Exhibit 99.2 Palm Communities (a Carve-Out of Principal Senior Living Group) Combined Carve-Out Financial Statements Nine Months Ended September 30, 2024

Palm Communities (a Carve-Out of Principal Senior Living Group) Financial Statements Nine Months Ended September 30, 2024

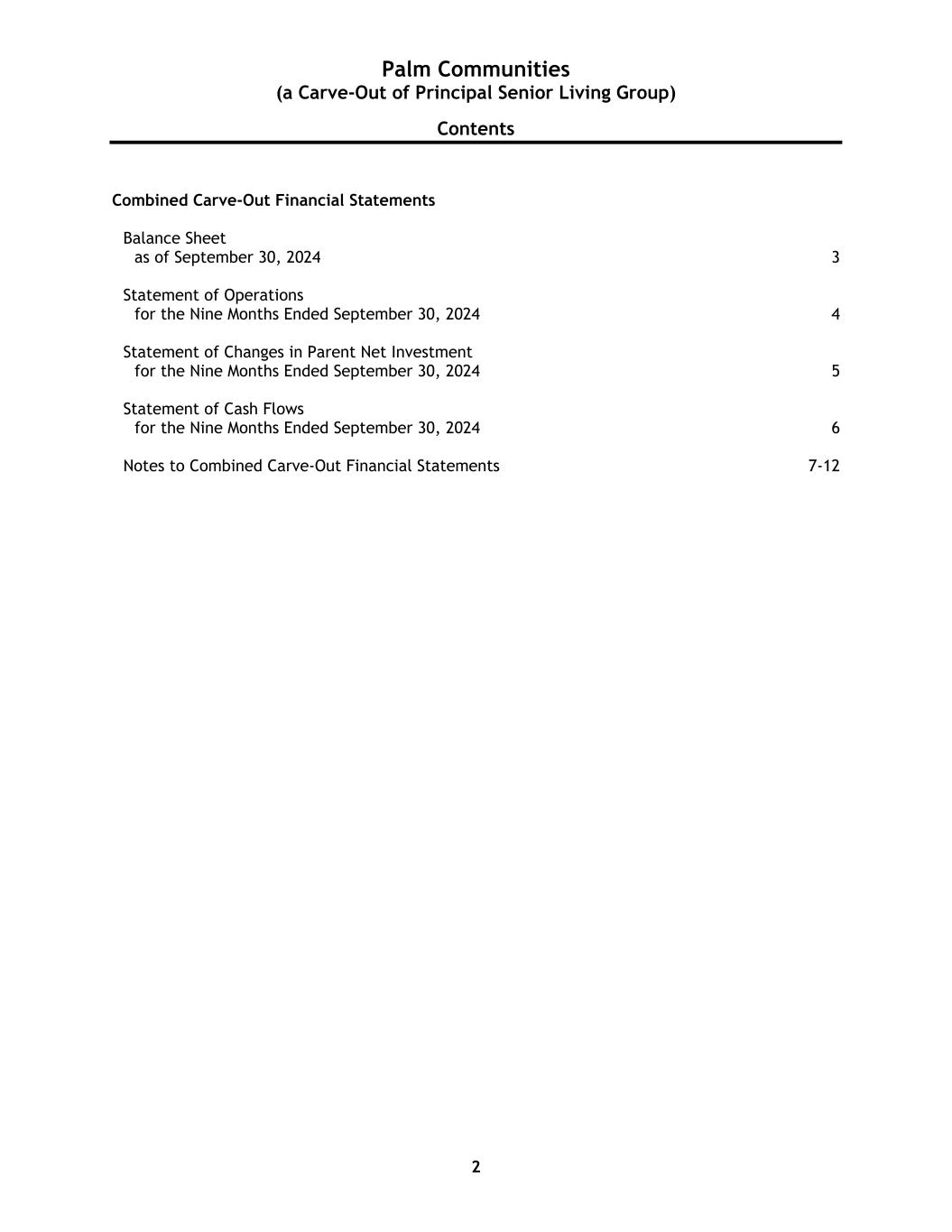

Palm Communities (a Carve-Out of Principal Senior Living Group) Contents 2 Combined Carve-Out Financial Statements Balance Sheet as of September 30, 2024 3 Statement of Operations for the Nine Months Ended September 30, 2024 4 Statement of Changes in Parent Net Investment for the Nine Months Ended September 30, 2024 5 Statement of Cash Flows for the Nine Months Ended September 30, 2024 6 Notes to Combined Carve-Out Financial Statements 7-12

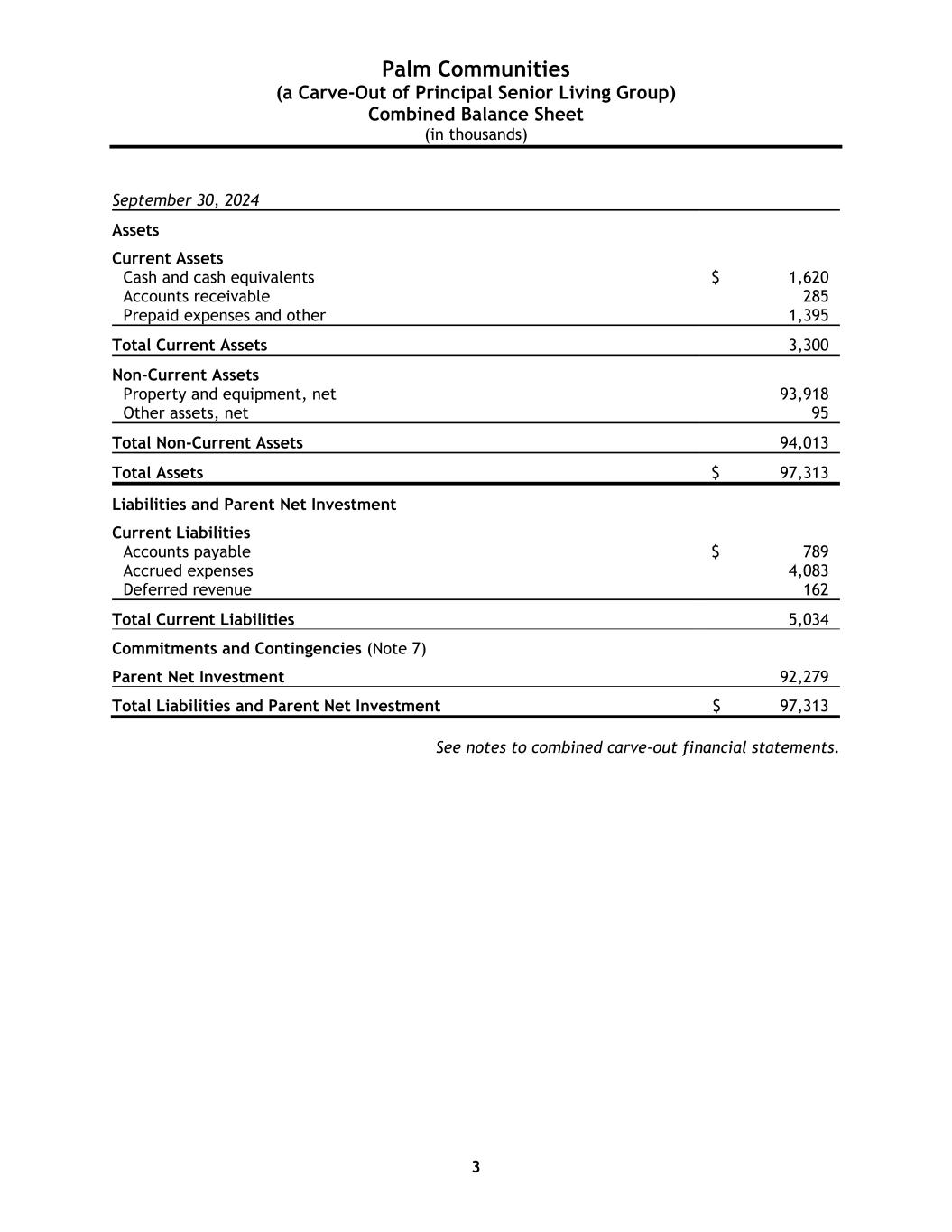

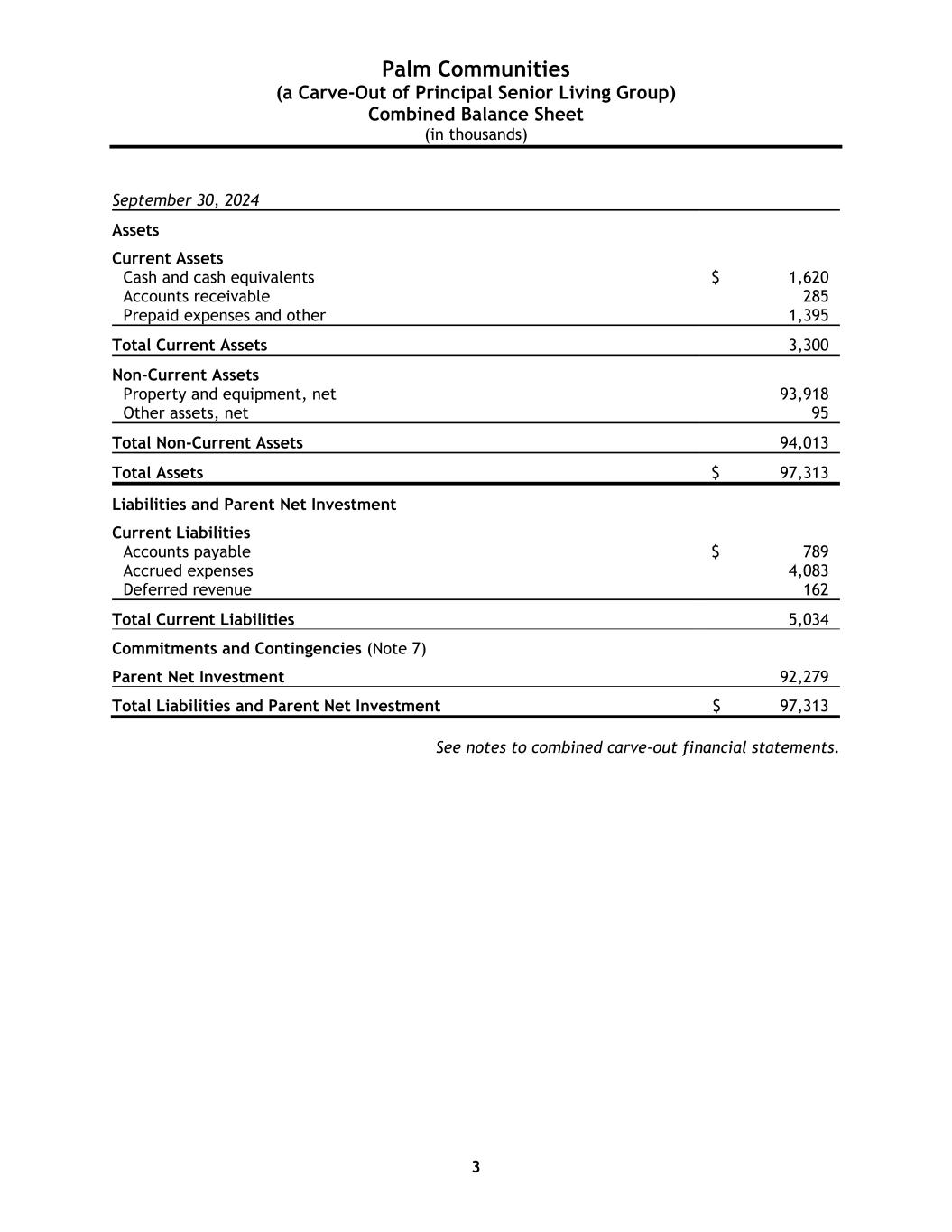

Palm Communities (a Carve-Out of Principal Senior Living Group) Combined Balance Sheet (in thousands) 3 September 30, 2024 Assets Current Assets Cash and cash equivalents $ 1,620 Accounts receivable 285 Prepaid expenses and other 1,395 Total Current Assets 3,300 Non-Current Assets Property and equipment, net 93,918 Other assets, net 95 Total Non-Current Assets 94,013 Total Assets $ 97,313 Liabilities and Parent Net Investment Current Liabilities Accounts payable $ 789 Accrued expenses 4,083 Deferred revenue 162 Total Current Liabilities 5,034 Commitments and Contingencies (Note 7) Parent Net Investment 92,279 Total Liabilities and Parent Net Investment $ 97,313 See notes to combined carve-out financial statements.

Palm Communities (a Carve-Out of Principal Senior Living Group) Combined Statement of Operations (in thousands) 4 Nine months ended September 30, 2024 Revenues Resident revenues $ 26,122 Total Revenues 26,122 Operating Expenses Operating expense 19,551 General and administrative expense 2,091 Depreciation and amortization expense 2,438 Total Operating Expenses 24,080 Operating Income 2,042 Interest expense and amortization of loan costs (4,800) Other expense (174) Net Loss $ (2,932) See notes to combined carve-out financial statements.

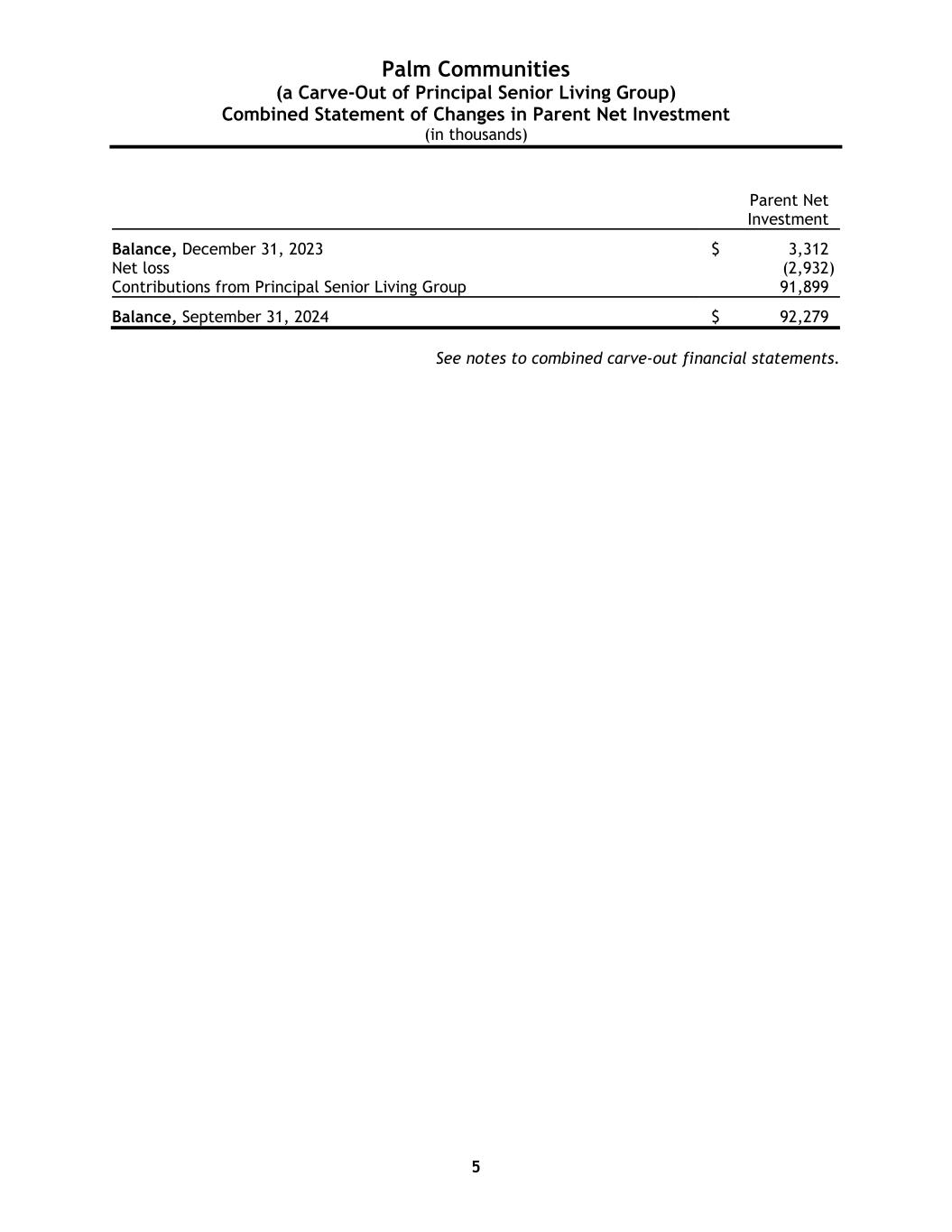

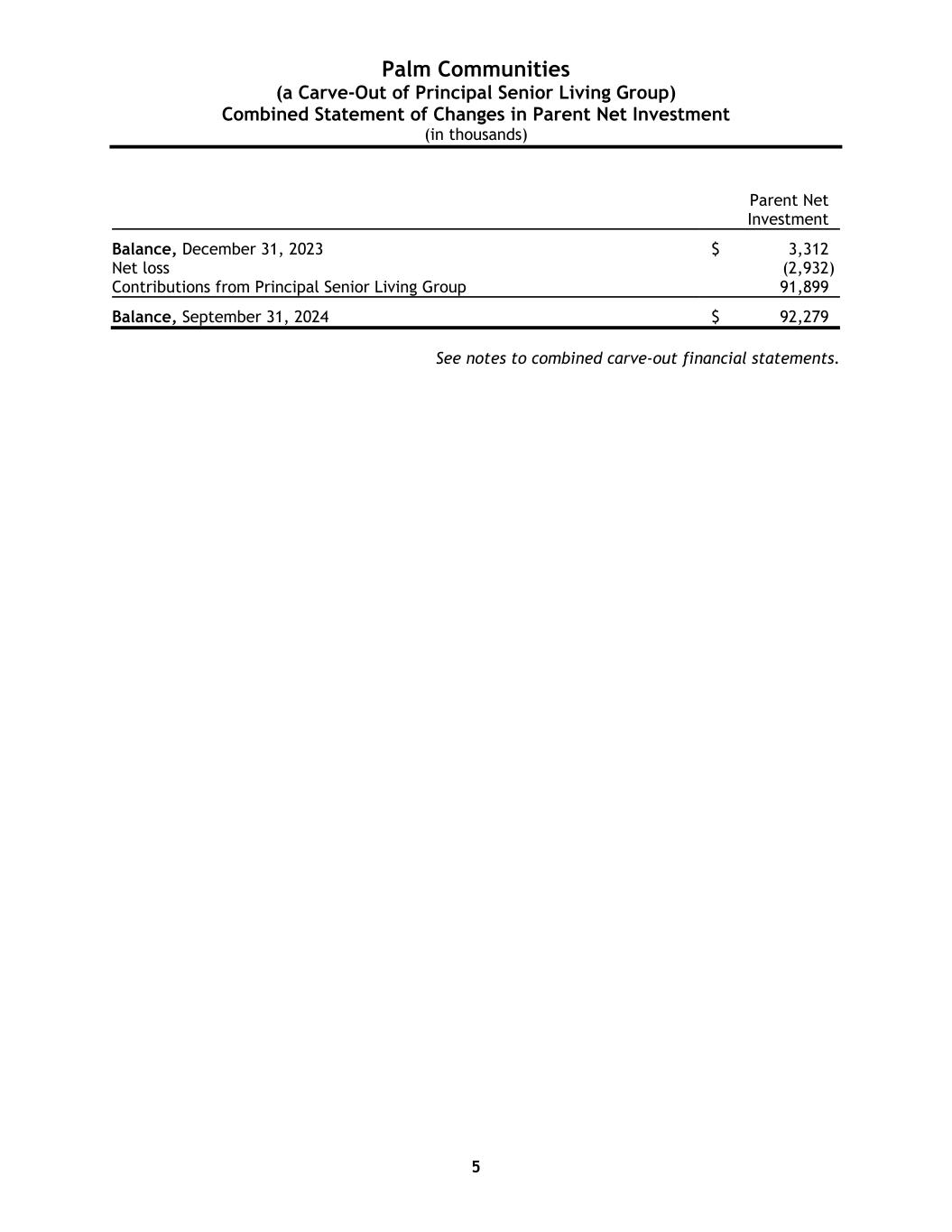

Palm Communities (a Carve-Out of Principal Senior Living Group) Combined Statement of Changes in Parent Net Investment (in thousands) 5 Parent Net Investment Balance, December 31, 2023 $ 3,312 Net loss (2,932) Contributions from Principal Senior Living Group 91,899 Balance, September 31, 2024 $ 92,279 See notes to combined carve-out financial statements.

Palm Communities (a Carve-Out of Principal Senior Living Group) Combined Statement of Cash Flows (in thousands) 6 Nine months ended September 30, 2024 Cash Flows from Operating Activities Net loss $ (2,932) Depreciation and amortization 2,438 Amortization of deferred loan costs 233 Changes in: Accounts receivable (121) Prepaid expenses and other (554) Accounts payable (1,294) Accrued expenses and other 1,229 Other (958) Net Cash Used in Operating Activities (1,959) Cash Flows from Investing Activities Capital expenditures (317) Net Cash Used in Investing Activities (317) Cash Flows from Financing Activities Principal payments on notes payable (90,026) Contributions from Principal Senior Living Group 91,899 Other financing costs (190) Net Cash Provided by Financing Activities 1,683 Net Increase in Cash and Cash Equivalents and Restricted Cash (593) Cash and Cash Equivalents and Restricted Cash, beginning of year 2,213 Cash and Cash Equivalents and Restricted Cash, end of year $ 1,620 Supplemental Disclosures of Cash Flow Information Cash paid during the period for: Interest $ 4,722 See notes to combined carve-out financial statements.

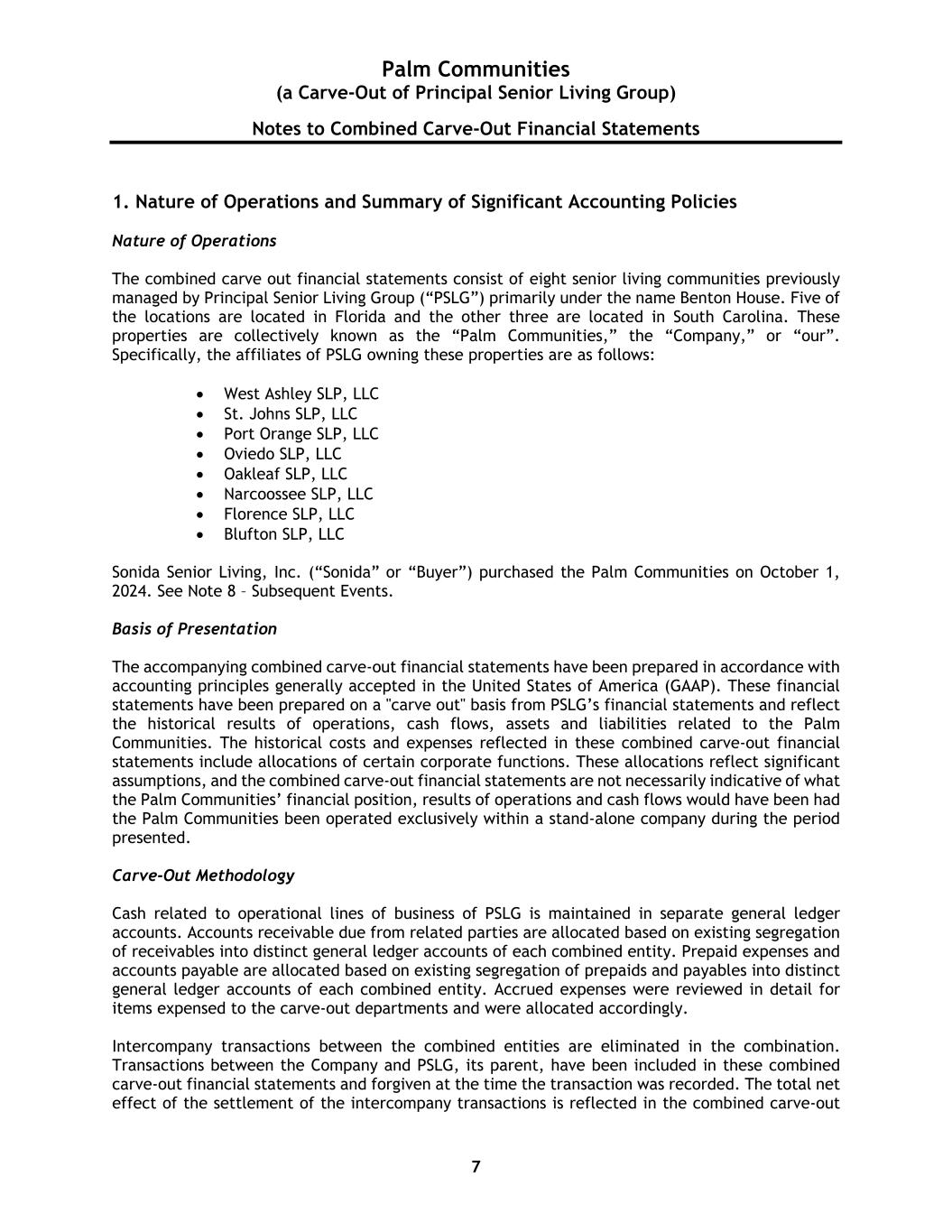

Palm Communities (a Carve-Out of Principal Senior Living Group) Notes to Combined Carve-Out Financial Statements 7 1. Nature of Operations and Summary of Significant Accounting Policies Nature of Operations The combined carve out financial statements consist of eight senior living communities previously managed by Principal Senior Living Group (“PSLG”) primarily under the name Benton House. Five of the locations are located in Florida and the other three are located in South Carolina. These properties are collectively known as the “Palm Communities,” the “Company,” or “our”. Specifically, the affiliates of PSLG owning these properties are as follows: • West Ashley SLP, LLC • St. Johns SLP, LLC • Port Orange SLP, LLC • Oviedo SLP, LLC • Oakleaf SLP, LLC • Narcoossee SLP, LLC • Florence SLP, LLC • Blufton SLP, LLC Sonida Senior Living, Inc. (“Sonida” or “Buyer”) purchased the Palm Communities on October 1, 2024. See Note 8 – Subsequent Events. Basis of Presentation The accompanying combined carve-out financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (GAAP). These financial statements have been prepared on a "carve out" basis from PSLG’s financial statements and reflect the historical results of operations, cash flows, assets and liabilities related to the Palm Communities. The historical costs and expenses reflected in these combined carve-out financial statements include allocations of certain corporate functions. These allocations reflect significant assumptions, and the combined carve-out financial statements are not necessarily indicative of what the Palm Communities’ financial position, results of operations and cash flows would have been had the Palm Communities been operated exclusively within a stand-alone company during the period presented. Carve-Out Methodology Cash related to operational lines of business of PSLG is maintained in separate general ledger accounts. Accounts receivable due from related parties are allocated based on existing segregation of receivables into distinct general ledger accounts of each combined entity. Prepaid expenses and accounts payable are allocated based on existing segregation of prepaids and payables into distinct general ledger accounts of each combined entity. Accrued expenses were reviewed in detail for items expensed to the carve-out departments and were allocated accordingly. Intercompany transactions between the combined entities are eliminated in the combination. Transactions between the Company and PSLG, its parent, have been included in these combined carve-out financial statements and forgiven at the time the transaction was recorded. The total net effect of the settlement of the intercompany transactions is reflected in the combined carve-out

Palm Communities (a Carve-Out of Principal Senior Living Group) Notes to Combined Carve-Out Financial Statements 8 statement of cash flows as a financing activity and in the combined carve-out balance sheet as a parent net investment. The components of the net transfers to and from PSLG are as follows (in thousands): September 30, 2024 Cash pooling and general financing activities $ 92,279 Net Contributions from Principal Senior Living Group Investment $ 92,279 PSLG segregates financial transactions by operating departments for most statement of operations activity. Revenues for the carved-out entities were recorded in respective general ledger accounts as were the related expenses. General overhead expenses were allocated based either on a proportionate share of leased square footage, personnel costs or by a more exact method if detailed information was available. Use of Estimates The preparation of combined carve-out financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the combined financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Cash and Cash Equivalents and Restricted Cash The Company considers all liquid investments with original maturities of three months or less to be cash equivalents. The Company has deposits in banks that exceed the Federal Deposit Insurance Corporation insurance limits. Management believes that credit risk related to these deposits is minimal. Restricted cash consists of reserve accounts for debt service required by certain loan agreements. Accounts Receivable Accounts receivable are stated at the amount billed to residents. Ordinarily, accounts receivable are due within one month after the fee revenues are recognized. The Company provides an allowance for credit losses, if any, which is based upon a review of outstanding receivables, historical collection information and existing economic conditions. Accounts that are past due more than 60 days, are reviewed monthly to determine if they are collectible. Accounts deemed uncollectible are written off and charged against the allowance for credit losses. There were no allowances for credit losses as of September 30, 2024. Accrued Expense Accrued expenses primarily consist of accrued insurance expense of $2.1 million, accrued payroll expense of $1.0 million, accrued real estate taxes of $0.9 million, and other accrued expenses of $0.1 million as of September 30, 2024.

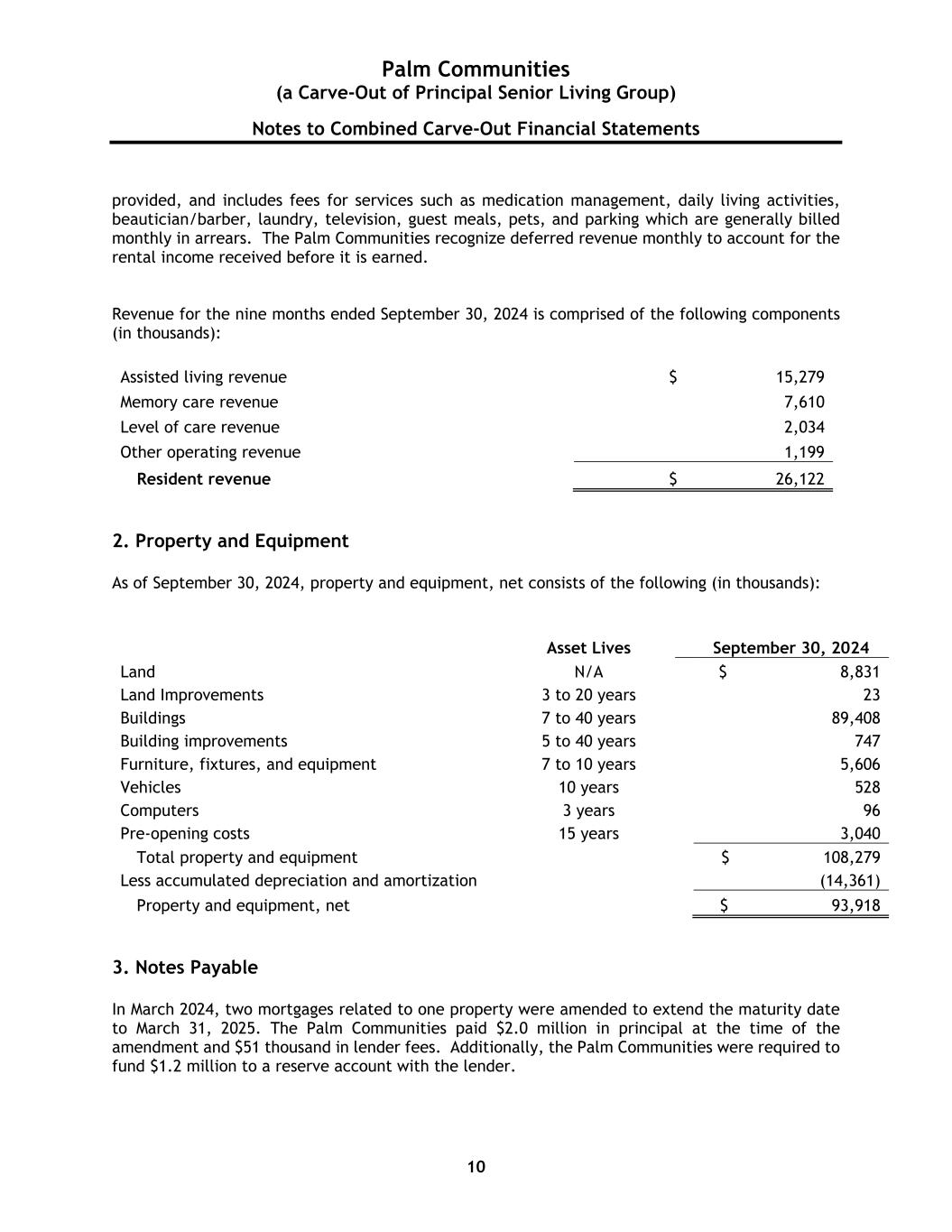

Palm Communities (a Carve-Out of Principal Senior Living Group) Notes to Combined Carve-Out Financial Statements 9 Property and Equipment, Net Property and equipment, net are stated at cost and depreciated on a straight-line basis over the estimated useful lives of the assets. Ordinary maintenance and repairs are recorded as expenses when incurred. Renovations and improvements, which improve and/or extend the useful life of the asset, are capitalized and depreciated over the estimated useful life of the renovations or improvements. See “Note 2–Property and Equipment, net.” Income Taxes PSLG treats the single-member LLCs included in the Company as disregarded entities under the provisions of the Internal Revenue Code (IRC). Therefore, all income or loss related to the Company is included in the federal income tax return of PSLG. PSLG is a multi-member LLC that has elected to be taxed as a partnership. All income and expense from the LLCs are passed through to the individual members. Revenue Recognition Revenues are recognized when control of the promised goods or services is transferred to our customers, in an amount that reflects the consideration we expect to be entitled to in exchange for those goods or services. The Company determines revenue recognition through the following steps: • Identification of the contract, or contracts, with a customer • Identification of the performance obligations in the contract • Determination of the transaction price • Allocation of the transaction price to the performance obligations in the contract • Recognition of revenue when, or as, we satisfy a performance obligation In determining the transaction price, we include variable consideration only to the extent that it is probable that a significant reversal in the amount of cumulative revenue recognized would not occur when the uncertainty associated with the variable consideration is resolved. The Company does not disclose the amount of variable consideration that is expected to be recognized in future periods as the consideration is allocated entirely to a wholly unsatisfied promise to transfer a distinct service that forms part of a single performance obligation, and the terms of the consideration relate specifically to the Company’s efforts to transfer the service. Resident revenue consists of fees for basic housing and certain support services and fees associated with additional housing and expanded support requirements such as assisted living care, memory care, and ancillary services. Basic housing and certain support services revenue is recorded when services are rendered, and amounts billed are due from residents in the period in which the rental and other services are provided. Residency agreements are generally short term in nature with durations of one year or less and are typically terminable by either party, under certain circumstances, upon providing 30 days’ notice, unless state law provides otherwise, with resident fees billed monthly in advance. Revenue for certain ancillary services is recognized as services are

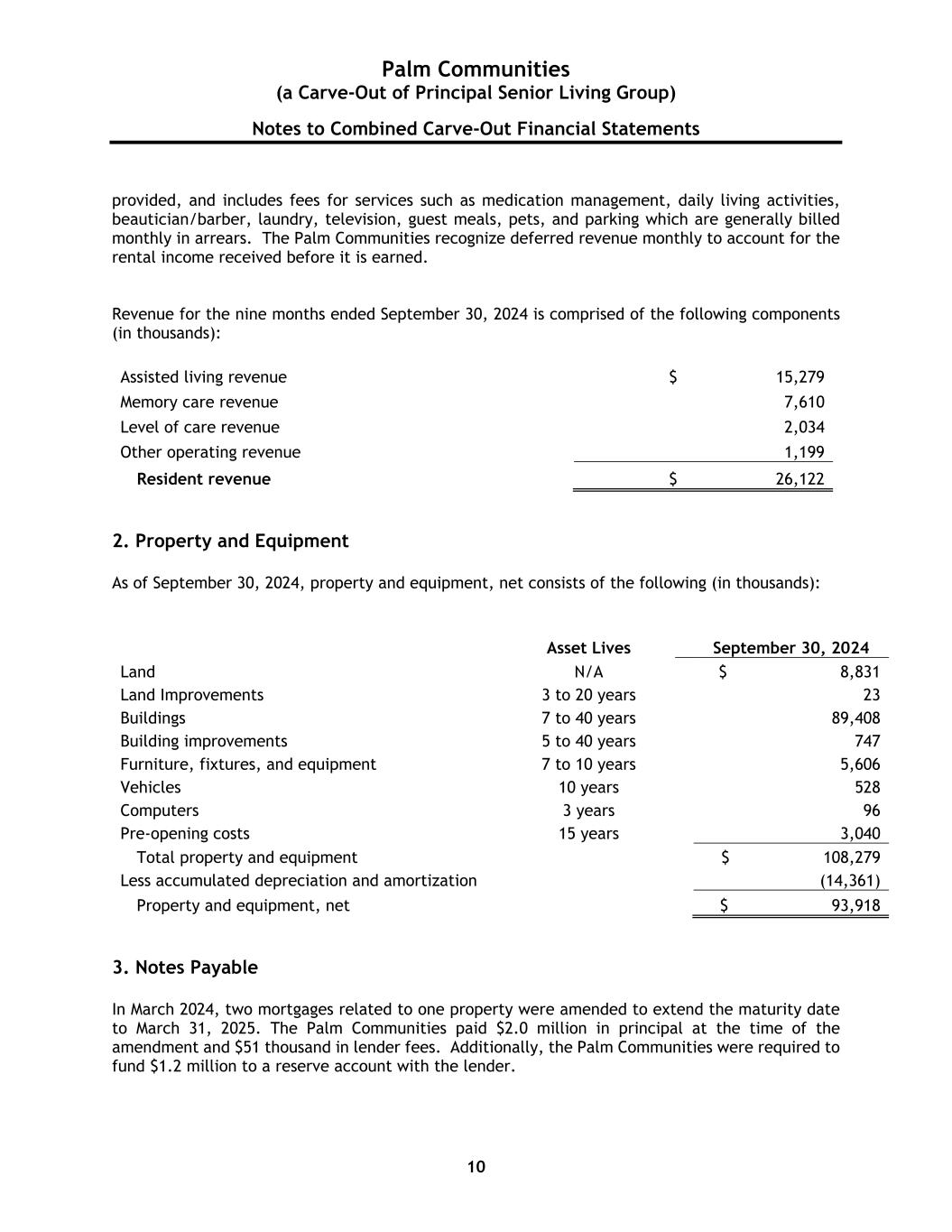

Palm Communities (a Carve-Out of Principal Senior Living Group) Notes to Combined Carve-Out Financial Statements 10 provided, and includes fees for services such as medication management, daily living activities, beautician/barber, laundry, television, guest meals, pets, and parking which are generally billed monthly in arrears. The Palm Communities recognize deferred revenue monthly to account for the rental income received before it is earned. Revenue for the nine months ended September 30, 2024 is comprised of the following components (in thousands): Assisted living revenue $ 15,279 Memory care revenue 7,610 Level of care revenue 2,034 Other operating revenue 1,199 Resident revenue $ 26,122 2. Property and Equipment As of September 30, 2024, property and equipment, net consists of the following (in thousands): Asset Lives September 30, 2024 Land N/A $ 8,831 Land Improvements 3 to 20 years 23 Buildings 7 to 40 years 89,408 Building improvements 5 to 40 years 747 Furniture, fixtures, and equipment 7 to 10 years 5,606 Vehicles 10 years 528 Computers 3 years 96 Pre-opening costs 15 years 3,040 Total property and equipment $ 108,279 Less accumulated depreciation and amortization (14,361) Property and equipment, net $ 93,918 3. Notes Payable In March 2024, two mortgages related to one property were amended to extend the maturity date to March 31, 2025. The Palm Communities paid $2.0 million in principal at the time of the amendment and $51 thousand in lender fees. Additionally, the Palm Communities were required to fund $1.2 million to a reserve account with the lender.

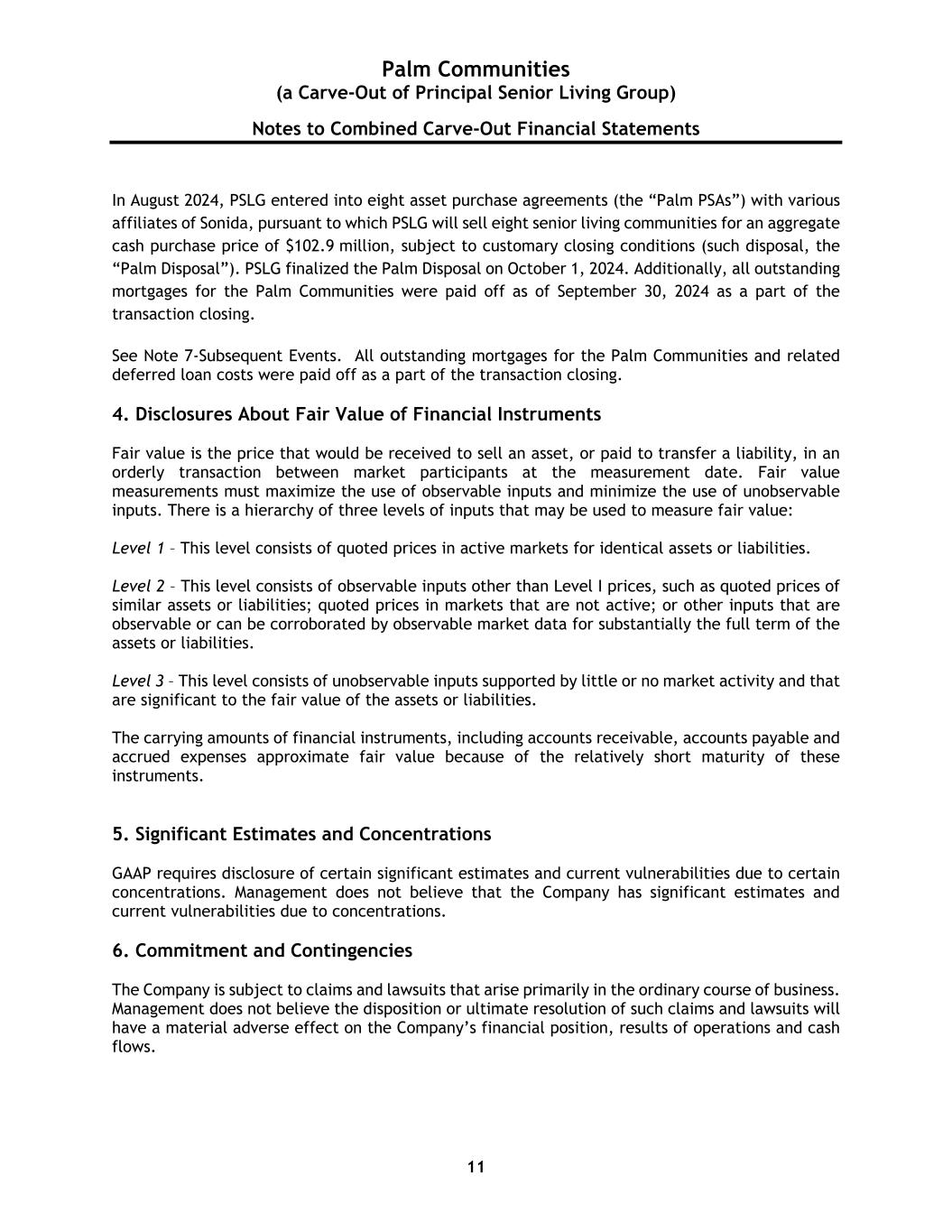

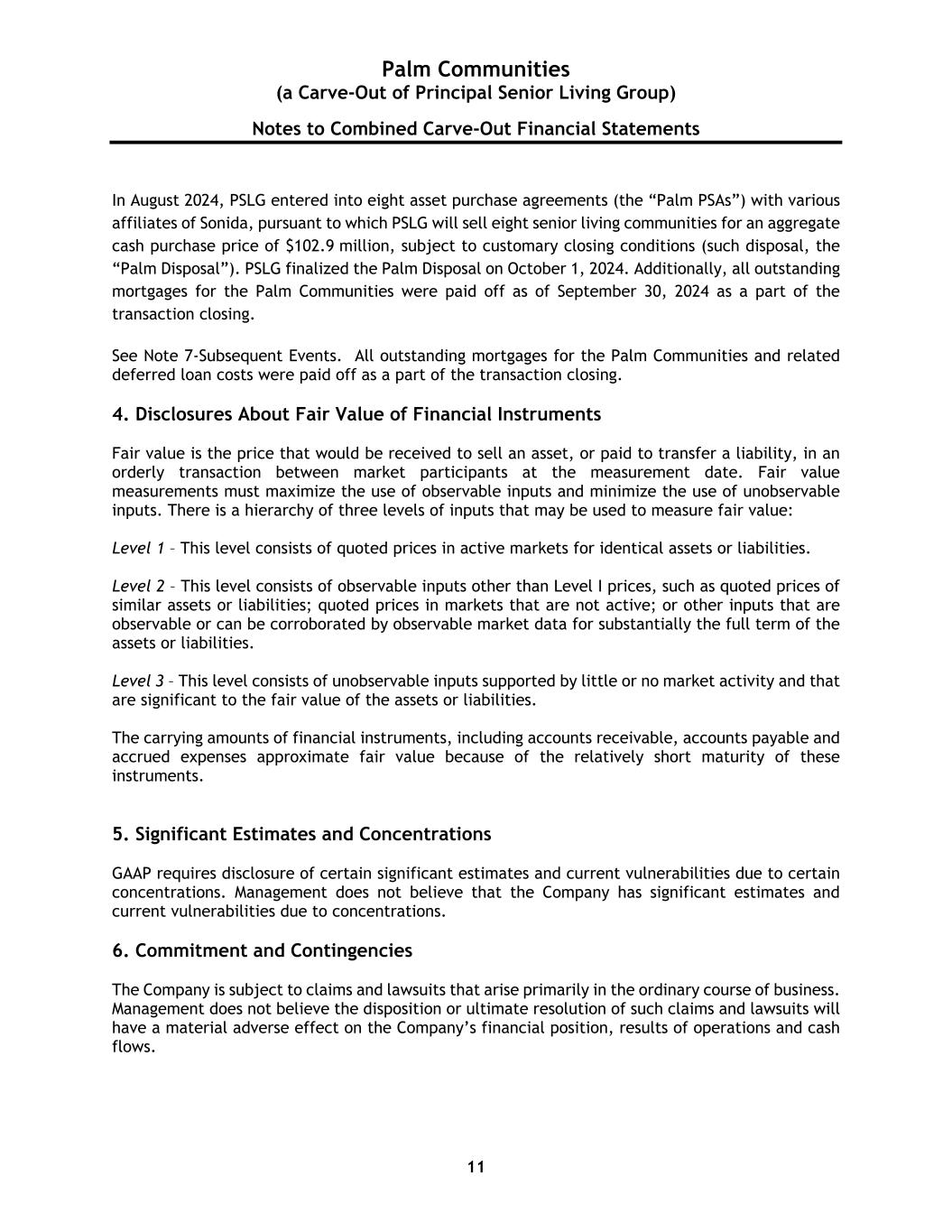

Palm Communities (a Carve-Out of Principal Senior Living Group) Notes to Combined Carve-Out Financial Statements 11 In August 2024, PSLG entered into eight asset purchase agreements (the “Palm PSAs”) with various affiliates of Sonida, pursuant to which PSLG will sell eight senior living communities for an aggregate cash purchase price of $102.9 million, subject to customary closing conditions (such disposal, the “Palm Disposal”). PSLG finalized the Palm Disposal on October 1, 2024. Additionally, all outstanding mortgages for the Palm Communities were paid off as of September 30, 2024 as a part of the transaction closing. See Note 7-Subsequent Events. All outstanding mortgages for the Palm Communities and related deferred loan costs were paid off as a part of the transaction closing. 4. Disclosures About Fair Value of Financial Instruments Fair value is the price that would be received to sell an asset, or paid to transfer a liability, in an orderly transaction between market participants at the measurement date. Fair value measurements must maximize the use of observable inputs and minimize the use of unobservable inputs. There is a hierarchy of three levels of inputs that may be used to measure fair value: Level 1 – This level consists of quoted prices in active markets for identical assets or liabilities. Level 2 – This level consists of observable inputs other than Level I prices, such as quoted prices of similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities. Level 3 – This level consists of unobservable inputs supported by little or no market activity and that are significant to the fair value of the assets or liabilities. The carrying amounts of financial instruments, including accounts receivable, accounts payable and accrued expenses approximate fair value because of the relatively short maturity of these instruments. 5. Significant Estimates and Concentrations GAAP requires disclosure of certain significant estimates and current vulnerabilities due to certain concentrations. Management does not believe that the Company has significant estimates and current vulnerabilities due to concentrations. 6. Commitment and Contingencies The Company is subject to claims and lawsuits that arise primarily in the ordinary course of business. Management does not believe the disposition or ultimate resolution of such claims and lawsuits will have a material adverse effect on the Company’s financial position, results of operations and cash flows.

Palm Communities (a Carve-Out of Principal Senior Living Group) Notes to Combined Carve-Out Financial Statements 12 7. Subsequent Events Management evaluates events occurring subsequent to the date of the combined carve-out financial statements in determining the accounting for and disclosure of transactions and events that affect the combined carve-out financial statements. Subsequent events have been evaluated through December 17, 2024, which is the date the combined carve-out financial statements were available to be issued. Per the Palm Disposal, the eight Palm Communities were transferred to Sonida effective October 1, 2024.