UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES |

Investment Company Act file number 811-08327

Name of Fund: BlackRock Global Growth Fund, Inc.

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: Donald C. Burke, Chief Executive Officer, BlackRock

Global Growth Fund, Inc., 800 Scudders Mill Road, Plainsboro, NJ, 08536. Mailing address:

P.O. Box 9011, Princeton, NJ, 08543-9011

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 08/31/2008

Date of reporting period: 09/01/2007 – 02/29/2008

Item 1 – Report to Stockholders |

EQUITIES FIXED INCOME REAL ESTATE LIQUIDITY ALTERNATIVES BLACKROCK SOLUTIONS

| | BlackRock

Global Growth Fund, Inc.

SEMI-ANNUAL REPORT

FEBRUARY 29, 2008 | (UNAUDITED) |

NOT FDIC INSURED

MAY LOSE VALUE

NO BANK GUARANTEE |

| Table of Contents | | |

| |

|

| |

| | | Page |

| |

|

| |

| A Letter to Shareholders | | 3 |

| Semi-Annual Report: | | |

| Fund Summary | | 4 |

| About Fund Performance | | 6 |

| Disclosure of Expenses | | 6 |

| Portfolio Summary | | 7 |

| Financial Statements: | | |

| Schedule of Investments | | 8 |

| Statement of Assets and Liabilities | | 13 |

| Statement of Operations | | 14 |

| Statements of Changes in Net Assets | | 15 |

| Financial Highlights | | 16 |

| Notes to Financial Statements | | 21 |

| Proxy Results | | 26 |

| Officers and Directors | | 27 |

| Additional Information | | 28 |

| Mutual Fund Family | | 30 |

2 BLACKROCK GLOBAL GROWTH FUND, INC.

| | Dear Shareholder

Financial markets weathered intense bouts of volatility in 2007, only to enter 2008 with no relief. January and February

proved to be trying months for equities, but strong ones for some areas of the bond market, as fears of an economic

recession swelled. The Federal Reserve Board (the “Fed”), after cutting the target federal funds rate 100 basis points

(1%) between September 2007 and year-end, more than matched those cuts in January alone. Responding to a slow-

ing economy and continued fallout from chaos in the credit markets, the Fed cut interest rates 75 basis points in a rare

unscheduled session on January 22, and followed with a 50-basis-point cut at its regular meeting on January 30.

Another 75-basis-point cut on March 18 brought the target rate to 2.25% .

Reverberations from the U.S. subprime mortgage collapse, and the associated liquidity and credit crisis, continue to per-

meate global financial markets. The S&P 500 Index of U.S. stocks was down in February, marking the fourth consecutive

month of negative returns. International markets, while not unscathed, generally have outperformed their U.S. counter-

parts so far in 2008. Emerging markets, benefiting from stronger economic growth rates, have done particularly well.

In fixed income markets, fears related to the economic slowdown and related credit crisis have led to a prolonged flight

to quality. Investors have largely shunned bonds associated with the housing and credit markets in favor of higher-quali-

ty government issues. The yield on 10-year Treasury issues, which touched 5.30% in June 2007 (its highest level in five

years), fell to 4.04% by year-end and to 3.53% by the end of February, while prices correspondingly rose. After setting

a new-issuance record in 2007, supply in the municipal bond market has been on the decline for four consecutive

months (measured year over year). The market has struggled with concerns around the creditworthiness of monoline

bond insurers and the failure of auctions for auction rate securities, driving yields higher and prices lower across the

curve. By period-end, municipal bonds were trading at higher yields than their Treasury counterparts, a very unusual

occurrence by historical standards.

Against this backdrop, the major benchmark indexes posted mixed results for the current reporting period, generally

reflecting heightened investor risk aversion: |

| Total Returns as of February 29, 2008 | | 6-month | | 12-month |

| |

| |

|

| U.S. equities (S&P 500 Index) | | | – 8.79% | | | – 3.60% |

| |

|

| |

|

|

| Small cap U.S. equities (Russell 2000 Index) | | –12.91 | | –12.44 |

| |

| |

|

| International equities (MSCI Europe, Australasia, Far East Index) | | | – 4.71 | | | + 0.84 |

| |

|

| |

|

|

| Fixed income (Lehman Brothers U.S. Aggregate Bond Index) | | | + 5.67 | | | +7.30 |

| |

|

| |

|

|

| Tax-exempt fixed income (Lehman Brothers Municipal Bond Index) | | | – 0.60 | | | –1.17 |

| |

|

| |

|

|

| High yield bonds (Lehman Brothers U.S. Corporate High Yield 2% Issuer Cap Index) | | | – 1.39 | | | – 3.08 |

| |

|

| |

|

|

| | Past performance is no guarantee of future results. Index performance shown for illustrative purposes only. You cannot invest directly

in an index.

As you navigate today’s volatile markets, we encourage you to review your investment goals with your financial profes-

sional and to make portfolio changes, as needed. For more up-to-date commentary on the economy and financial

markets, we invite you to visit www.blackrock.com/funds. As always, we thank you for entrusting BlackRock with your

investment assets, and we look forward to continuing to serve you in the months and years ahead. |

THIS PAGE NOT PART OF YOUR FUND REPORT

3

Fund Summary (Unaudited)

Portfolio Management Commentary

How did the Fund perform?

•The Fund outperformed its benchmark, the MSCI World Index, for the

six months ended February 29, 2008. The Fund managed to post

positive total returns while the index registered negative returns amid

a challenging market backdrop.

What factors influenced performance?

•Stock markets were highly volatile during the period as the housing

collapse, credit market crisis and fears of an economic recession in

the U.S. prompted heightened investor risk aversion across global

financial markets.

•Security selection was the primary driver of the Fund’s outperformance

for the period. This was particularly true among U.S. stocks, as well as

within the financials, industrials and materials sectors. Investments in

Australia, Hong Kong, India and Brazil also contributed meaningfully

to returns for the period.

•Conversely, security selection in the information technology sector

and modest underweight positions in utilities and telecommunications

marginally detracted from Fund results.

Describe recent portfolio activity.

•During the six-month period, we modestly reduced the portfolio’s

exposure to the financials, information technology and consumer

discretionary sectors, while increasing investments in the industrials,

materials, healthcare and consumer staples sectors. |

•On a geographic basis, the most notable change was an increase in

exposure to the U.S., and decreased allocations in India, Hong Kong

and Australia.

Describe Fund positioning at period-end.

•Turbulent and uncertain conditions in the credit and financing markets

worldwide have clearly had a negative impact on global equity prices.

However, underlying fundamentals in many global regions and market

sectors may prove to be more resilient than such price action implies.

Given recent monetary and fiscal policy initiatives, we believe a pro-

longed threat to U.S. economic growth is unlikely. We continue to have a

constructive long-term secular view on many global markets (especially

the Asia-Pacific region), but remain cautious in our near-term outlook

as equity markets attempt to stabilize.

•On a sector basis, the portfolio ended the period with overweight expo-

sures to the industrials, materials and consumer staples sectors, and

underweight positions in the financials and consumer discretionary sec-

tors. Geographically, the portfolio was overweight in Australia, Hong Kong,

India and Brazil (notably, the latter two countries are not represented

in the MSCI World Index). The portfolio ended the period underweight

in the U.S., U.K., Japan and most of Western Europe. |

| Expense Example | | | | | | | | | | | | |

| |

| | | | | Actual | | | | | | Hypothetical** | | |

| | |

| |

| |

| |

| |

| |

|

| | | Beginning | | Ending | | | | Beginning | | Ending | | |

| | | Account Value | | Account Value | | Expenses Paid | | Account Value | | Account Value | | Expenses Paid |

| | | September 1, 2007 February 29, 2008 | | During the Period* | | September 1, 2007 February 29, 2008 | | During the Period* |

| |

| |

| |

| |

|

| Institutional | | $1,000 | | $1,040.70 | | $ 4.78 | | $1,000 | | $1,020.21 | | $ 4.73 |

| Investor A | | $1,000 | | $1,039.60 | | $ 6.20 | | $1,000 | | $1,018.82 | | $ 6.14 |

| Investor B | | $1,000 | | $1,035.10 | | $10.55 | | $1,000 | | $1,014.53 | | $10.45 |

| Investor C | | $1,000 | | $1,035.80 | | $10.10 | | $1,000 | | $1,014.98 | | $10.00 |

| Class R | | $1,000 | | $1,037.70 | | $ 7.77 | | $1,000 | | $1,017.27 | | $ 7.69 |

| |

| |

| |

| |

| |

| |

|

| * | For each class of the Fund, expenses are equal to the expense ratio for the class (.94% for Institutional, 1.22% for Investor A, 2.08% for Investor B, 1.99% for Investor C and 1.53% for Class R), multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). |

| |

| ** | Hypothetical 5% annual return before expenses is calculated by multiplying the number of days in the most recent fiscal half year divided by 365. See “Disclosure of Expenses” on page 6 for further information on how expenses were calculated. |

| |

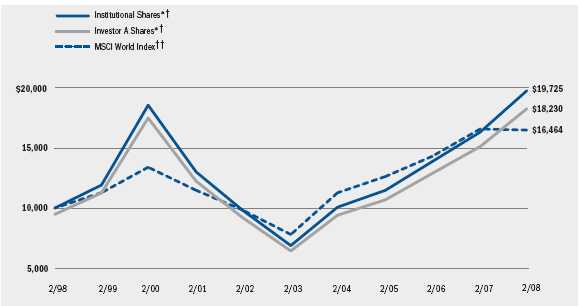

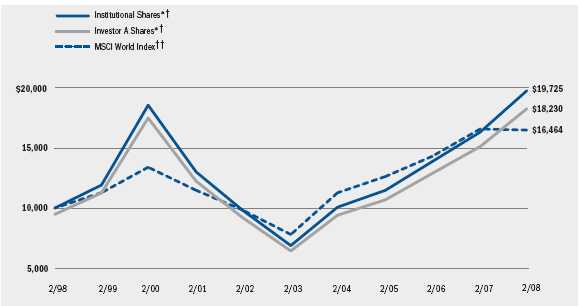

| | Total Return Based on a $10,000 Investment |

* Assuming maximum sales charge, if any, transaction costs and other operating expenses, including advisory fees.

† The Fund invests primarily in equity securities with a particular emphasis on companies that have exhibited above-average growth rates in earnings.

††This unmanaged market capitalization-weighted index is comprised of a representative sampling of large-, medium- and small-capitalization companies in 22 countries, including the United States.

Past performance is not indicative of future results.

| Performance Summary for the Period Ended February 29, 2008 | | | | | | | | | | | | | |

| |

| |

| |

| |

| |

|

| |

|

| |

| | | | | | | | | Average Annual Total Returns* | | | | | |

| | | | |

| |

| |

| |

|

| |

|

| | | | | 1 Year | | 5 Years | | | 10 Years |

| | | | |

| |

| |

|

|

| | | 6-Month | | w/o sales | | w/sales | | w/o sales | | w/sales | | w/o sales | | w/sales |

| | | Total Returns | | charge | | charge | | charge | | charge | | charge | | charge |

| |

| |

| |

| |

| |

| |

| |

|

| Institutional | | +4.07% | | +21.07% | | — | | +23.42% | | — | | + 7.03% | | — |

| Investor A | | +3.96 | | +20.79 | | +14.45% | | +23.12 | | +21.80% | | + 6.76 | | +6.19% |

| Investor B | | +3.51 | | +19.72 | | +15.22 | | +22.13 | | +21.95 | | + 6.10 | | +6.10 |

| Investor C | | +3.58 | | +19.81 | | +18.81 | | +22.15 | | +22.15 | | + 5.92 | | +5.92 |

| Class R | | +3.77 | | +20.26 | | — | | +23.03 | | — | | + 6.59 | | — |

| MSCI World Index | | –6.14 | | – 0.53 | | — | | +16.10 | | — | | + 5.11 | | — |

| |

| |

| |

| |

| |

| |

|

| |

|

| * | Assuming maximum sales charges. See “About Fund Performance” on page 6 for a detailed description of share classes, including any related sales charges and fees. Past performance is not indicative of future results. |

| |

| BLACKROCK GLOBAL GROWTH FUND, INC. |

About Fund Performance

•Institutional Sharesare not subject to any sales charge. Institutional

Shares bear no ongoing distribution or service fees and are available only

to eligible investors.

•Investor A Sharesincur a maximum initial sales charge (front-end load)

of 5.25% and a service fee of 0.25% per year (but no distribution fee).

•Investor B Sharesare subject to a maximum contingent deferred sales

charge of 4.50% declining to 0% after six years. In addition, Investor B

Shares are subject to a distribution fee of 0.75% per year and a service

fee of 0.25% per year. These shares automatically convert to Investor A

Shares after approximately eight years. (There is no initial sales charge

for automatic share conversions.) All returns for periods greater than

eight years reflect this conversion.

•Investor C Sharesare subject to a distribution fee of 0.75% per year and

a service fee of 0.25% per year. In addition, Investor C Shares are subject

to a 1% contingent deferred sales charge if redeemed within one year

of purchase.

•Class R Sharesdo not incur a maximum initial sales charge (front-end

load) or deferred sales charge. These shares are subject to a distribution

fee of 0.25% per year and a service fee of 0.25% per year. Class R

Shares are available only to certain retirement plans. Prior to inception,

Class R Share performance results are those of Institutional Shares

(which have no distribution or service fees) restated to reflect the Class

R Share fees. |

Performance information reflects past performance and does not guar-

antee future results. Current performance may be lower or higher than the

performance data quoted. Refer to www.blackrock.com/funds to obtain

performance data current to the most recent month-end. Performance

results do not reflect the deduction of taxes that a shareholder would

pay on fund distributions or the redemption of fund shares. Figures

shown in the performance tables on page 5 assume reinvestment of

all dividends and capital gain distributions, if any, at net asset value on

the ex-dividend date. Investment return and principal value of shares

will fluctuate so that shares, when redeemed, may be worth more or

less than their original cost. Dividends paid to each class of shares will

vary because of the different levels of service, distribution and transfer

agency fees applicable to each class, which are deducted from the

income available to be paid to shareholders. |

| | Disclosure of Expenses

Shareholders of this Fund may incur the following charges: (a) expenses

related to transactions, including sales charges, redemption fees and

exchange fees; and (b) operating expenses including advisory fees, distri-

bution fees including 12b-1 fees, and other Fund expenses. The expense

example on page 4 (which is based on a hypothetical investment of

$1,000 invested on September 1, 2007 and held through February 29,

2008) is intended to assist shareholders both in calculating expenses

based on an investment in the Fund and in comparing these expenses

with similar costs of investing in other mutual funds.

The table provides information about actual account values and actual

expenses. In order to estimate the expenses a shareholder paid during the

period covered by this report, shareholders can divide their account value

by $1,000 and then multiply the result by the number corresponding

to their share class under the heading entitled “Expenses Paid During

the Period.” |

The table also provides information about hypothetical account values

and hypothetical expenses based on the Fund’s actual expense ratio and

an assumed rate of return of 5% per year before expenses. In order to

assist shareholders in comparing the ongoing expenses of investing in this

Fund and other funds, compare the 5% hypothetical example with the 5%

hypothetical examples that appear in other funds’ shareholder reports.

The expenses shown in the table are intended to highlight shareholders’

ongoing costs only and do not reflect any transactional expenses, such

as sales charges, redemption fees or exchange fees. Therefore, the hypo-

thetical table is useful in comparing ongoing expenses only, and will not

help shareholders determine the relative total expenses of owning differ-

ent funds. If these transactional expenses were included, shareholder

expenses would have been higher. |

6 BLACKROCK GLOBAL GROWTH FUND, INC.

Portfolio Summary (Unaudited)

Fund Profile as of February 29, 2008

| | | Percent of |

| Ten Largest Holdings | | Net Assets |

| |

|

| The Procter & Gamble Co. | | 2.0% |

| Deere & Co. | | 1.6 |

| Google Inc. Class A | | 1.6 |

| Microsoft Corp. | | 1.6 |

| Monsanto Co. | | 1.6 |

| Veolia Environnement SA | | 1.4 |

| Nestle SA Registered Shares | | 1.4 |

| FTI Consulting, Inc. | | 1.2 |

| Altria Group, Inc. | | 1.2 |

| CVS/Caremark Corp. | | 1.2 |

| |

|

| |

| |

| |

| | | Percent of |

| Five Largest Industries | | Net Assets |

| |

|

| Metals & Mining | | 7.0% |

| Chemicals | | 5.8 |

| Commercial Banks | | 5.6 |

| Oil, Gas & Consumable Fuels | | 5.3 |

| Electrical Equipment | | 4.3 |

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report which may combine industry sub-classifications for reporting ease.

| | | Percent of |

| | | Long-Term |

| Geographic Allocation | | Investments |

| |

|

| United States | | 38.7% |

| Australia | | 10.6 |

| India | | 6.7 |

| Hong Kong | | 6.5 |

| Canada | | 5.7 |

| Switzerland | | 5.0 |

| Brazil | | 4.5 |

| United Kingdom | | 3.8 |

| France | | 3.5 |

| Japan | | 3.4 |

| Germany | | 2.5 |

| South Africa | | 1.8 |

| China | | 1.7 |

| Israel | | 1.0 |

| Singapore | | 0.9 |

| Italy | | 0.7 |

| Mexico | | 0.6 |

| South Korea | | 0.5 |

| Spain | | 0.5 |

| Greece | | 0.4 |

| Netherlands | | 0.4 |

| Bermuda | | 0.3 |

| Norway | | 0.2 |

| Cayman Islands | | 0.1 |

| BLACKROCK GLOBAL GROWTH FUND, INC. |

Schedule of Investments as of February 29, 2008 (Unaudited)

| (Percentages shown are based on Net Assets) |

| Common Stocks | | Shares | | Value |

| |

| |

|

| Africa | | | | |

| |

| |

|

| South Africa — 1.8% | | | | |

| Commercial Banks — 0.2% | | | | |

| Standard Bank Group Ltd. | | 105,779 | | $ 1,320,162 |

| |

| |

|

| Construction Materials — 0.2% | | | | |

| Pretoria Portland Cement Co. Ltd. | | 361,734 | | 1,964,136 |

| |

| |

|

| Industrial Conglomerates — 0.2% | | | | |

| Barloworld Ltd. | | 130,900 | | 1,576,207 |

| |

| |

|

| Media — 0.2% | | | | |

| Naspers Ltd. | | 66,700 | | 1,262,405 |

| |

| |

|

| Metals & Mining — 0.5% | | | | |

| Impala Platinum Holdings Ltd. | | 86,400 | | 3,575,297 |

| |

| |

|

| Wireless Telecommunication Services — 0.5% | | | | |

| MTN Group Ltd. | | 242,500 | | 3,797,378 |

| |

| |

|

| Total Common Stocks in Africa — 1.8% | | | | 13,495,585 |

| |

| |

|

| |

| Europe | | | | |

| |

| |

|

| France — 3.3% | | | | |

| Electric Utilities — 0.5% | | | | |

| Electricite de France SA | | 43,300 | | 4,038,567 |

| |

| |

|

| Electrical Equipment — 1.0% | | | | |

| Alstom | | 23,600 | | 4,959,737 |

| Areva SA | | 2,600 | | 2,754,008 |

| | | | |

|

| | | | | 7,713,745 |

| |

| |

|

| Machinery ��� 0.4% | | | | |

| Vallourec SA | | 15,500 | | 3,216,818 |

| |

| |

|

| Multi-Utilities — 1.4% | | | | |

| Veolia Environnement SA | | 117,025 | | 10,412,075 |

| |

| |

|

| Total Common Stocks in France | | | | 25,381,205 |

| |

| |

|

| Germany — 2.4% | | | | |

| Automobiles — 0.4% | | | | |

| Porsche Automobil Holding SE | | | | |

| (Preference Shares) | | 1,900 | | 3,256,548 |

| |

| |

|

| Chemicals — 0.7% | | | | |

| Wacker Chemie AG | | 24,800 | | 5,290,626 |

| |

| |

|

| Diversified Financial Services — 0.8% | | | | |

| Deutsche Boerse AG | | 35,200 | | 5,579,360 |

| |

| |

|

| Industrial Conglomerates — 0.5% | | | | |

| Siemens AG | | 29,800 | | 3,837,031 |

| |

| |

|

| Total Common Stocks in Germany | | | | 17,963,565 |

| |

| |

|

| Greece — 0.4% | | | | |

| Diversified Financial Services — 0.4% | | | | |

| Hellenic Exchanges SA | | 118,700 | | 2,861,304 |

| |

| |

|

| Total Common Stocks in Greece | | | | 2,861,304 |

| |

| |

|

| Italy — 0.7% | | | | |

| Commercial Banks — 0.7% | | | | |

| Unicredit SpA | | 678,700 | | 4,991,013 |

| |

| |

|

| Total Common Stocks in Italy | | | | 4,991,013 |

| |

| |

|

| Netherlands — 0.4% | | | | |

| Food & Staples Retailing — 0.4% | | | | |

| X 5 Retail Group NV (a)(d) | | 87,700 | | 2,867,790 |

| |

| |

|

| Total Common Stocks in the Netherlands | | | | 2,867,790 |

| |

| |

|

| Common Stocks | | Shares | | Value |

| |

| |

|

| |

| Europe (continued) | | | | |

| |

| |

|

| |

| Norway — 0.2% | | | | |

| Electrical Equipment — 0.2% | | | | |

| Renewable Energy Corp. AS (a) | | 67,000 | | $ 1,638,670 |

| |

| |

|

| Total Common Stocks in Norway | | | | 1,638,670 |

| |

| |

|

| Spain — 0.4% | | | | |

| Diversified Financial Services — 0.4% | | | | |

| Bolsas y Mercados Espanoles | | 64,800 | | 3,241,139 |

| |

| |

|

| Total Common Stocks in Spain | | | | 3,241,139 |

| |

| |

|

| Switzerland — 4.8% | | | | |

| Commercial Services & Supplies — 0.5% | | | | |

| SGS SA | | 2,900 | | 3,895,083 |

| |

| |

|

| Electrical Equipment — 0.5% | | | | |

| ABB Ltd. | | 161,800 | | 4,031,135 |

| |

| |

|

| Food Products — 1.4% | | | | |

| Nestle SA Registered Shares | | 21,650 | | 10,333,293 |

| |

| |

|

| Life Sciences Tools & Services — 1.2% | | | | |

| Lonza Group AG Registered Shares | | 68,700 | | 9,050,888 |

| |

| |

|

| Oil, Gas & Consumable Fuels — 0.4% | | | | |

| Petroplus Holdings AG (a) | | 50,600 | | 3,359,065 |

| |

| |

|

| Textiles, Apparel & Luxury Goods — 0.8% | | | | |

| The Swatch Group Ltd. Registered Shares | | 102,500 | | 5,838,440 |

| |

| |

|

| Total Common Stocks in Switzerland | | | | 36,507,904 |

| |

| |

|

| United Kingdom — 3.7% | | | | |

| Beverages — 1.1% | | | | |

| Diageo Plc | | 424,800 | | 8,680,719 |

| |

| |

|

| Commercial Banks — 1.1% | | | | |

| Standard Chartered Plc | | 241,000 | | 7,939,999 |

| |

| |

|

| Commercial Services & Supplies — 0.5% | | | | |

| Intertek Group Plc | | 209,400 | | 3,714,468 |

| |

| |

|

| Food & Staples Retailing — 0.5% | | | | |

| Tesco Plc | | 471,000 | | 3,722,015 |

| |

| |

|

| Metals & Mining — 0.5% | | | | |

| Rio Tinto Plc Registered Shares | | 33,000 | | 3,712,742 |

| |

| |

|

| Total Common Stocks in the United Kingdom | | | | 27,769,943 |

| |

| |

|

| Total Common Stocks in Europe — 16.3% | | | | 123,222,533 |

| |

| |

|

| |

| |

| Latin America | | | | |

| |

| |

|

| |

| Brazil — 4.4% | | | | |

| Beverages — 0.7% | | | | |

| Cia de Bebidas das Americas | | | | |

| (Preference Shares) (d)(e) | | 63,700 | | 5,190,276 |

| |

| |

|

| Commercial Banks — 0.7% | | | | |

| Banco Bradesco SA (d) | | 166,000 | | 5,210,740 |

| |

| |

|

| Diversified Financial Services — 0.4% | | | | |

| Bovespa Holding SA | | 188,100 | | 3,003,193 |

| |

| |

|

| Media — 0.4% | | | | |

| NET Servicos de Comunicacao SA | | | | |

| (Preference Shares) (a) | | 294,203 | | 3,237,607 |

| |

| |

|

| Metals & Mining — 0.6% | | | | |

| Companhia Vale do Rio Doce | | | | |

| (Common Shares) (d) | | 117,800 | | 4,104,152 |

| |

| |

|

| Multiline Retail — 0.4% | | | | |

| Lojas Renner SA | | 161,400 | | 3,203,949 |

| See Notes to Financial Statements. |

8 BLACKROCK GLOBAL GROWTH FUND, INC.

Schedule of Investments (continued)

(Percentages shown are based on Net Assets)

| Common Stocks | | Shares | | Value |

| |

| |

|

| Latin America (continued) | | | | |

| |

| |

|

| Brazil (concluded) | | | | |

| Oil, Gas & Consumable Fuels — 1.2% | | | | |

| Petroleo Brasileiro SA (d) | | 76,400 | | $ 8,964,776 |

| |

| |

|

| Total Common Stocks in Brazil | | | | 32,914,693 |

| |

| |

|

| Mexico — 0.6% | | | | |

| Wireless Telecommunication Services — 0.6% | | | | |

| America Movil, SA de CV (d) | | 77,000 | | 4,655,420 |

| |

| |

|

| Total Common Stocks in Mexico | | | | 4,655,420 |

| |

| |

|

| Total Common Stocks in Latin America — 5.0% | | | | 37,570,113 |

| |

| |

|

| |

| Middle East | | | | |

| |

| |

|

| Israel — 1.0% | | | | |

| Pharmaceuticals — 1.0% | | | | |

| Teva Pharmaceutical Industries Ltd. (d) | | 152,400 | | 7,478,268 |

| |

| |

|

| Total Common Stocks in the Middle East — 1.0% | | | | 7,478,268 |

| |

| |

|

| |

| North America | | | | |

| |

| |

|

| Bermuda — 0.3% | | | | |

| Energy Equipment & Services — 0.3% | | | | |

| SeaDrill Ltd. (a) | | 86,500 | | 2,227,967 |

| |

| |

|

| Total Common Stocks in Bermuda | | | | 2,227,967 |

| |

| |

|

| Canada — 5.5% | | | | |

| Chemicals — 1.6% | | | | |

| Potash Corp. of Saskatchewan, Inc. | | 25,700 | | 4,083,730 |

| Potash Corp. of Saskatchewan, Inc. | | 48,100 | | 7,647,130 |

| | | | |

|

| | | | | 11,730,860 |

| |

| |

|

| Commercial Banks — 1.0% | | | | |

| Bank of Nova Scotia | | 58,800 | | 2,855,019 |

| Royal Bank of Canada | | 84,900 | | 4,260,311 |

| | | | |

|

| | | | | 7,115,330 |

| |

| |

|

| Diversified Financial Services — 0.3% | | | | |

| TSX Group, Inc. | | 45,300 | | 2,037,982 |

| |

| |

|

| Energy Equipment & Services — 0.3% | | | | |

| Ensign Resource Service Group | | 118,800 | | 2,211,243 |

| |

| |

|

| Food & Staples Retailing — 0.7% | | | | |

| Shoppers Drug Mart Corp. | | 110,400 | | 5,643,103 |

| |

| |

|

| Metals & Mining — 1.3% | | | | |

| Barrick Gold Corp. | | 167,800 | | 8,717,210 |

| Teck Cominco Ltd. Class B | | 35,400 | | 1,412,403 |

| | | | |

|

| | | | | 10,129,613 |

| |

| |

|

| Oil, Gas & Consumable Fuels — 0.3% | | | | |

| Cameco Corp. | | 65,200 | | 2,553,680 |

| |

| |

|

| Total Common Stocks in Canada | | | | 41,421,811 |

| |

| |

|

| Cayman Islands — 0.1% | | | | |

| Internet Software & Services — 0.1% | | | | |

| Alibaba.com Ltd. (a) | | 406,100 | | 984,289 |

| |

| |

|

| Total Common Stocks in the Cayman Islands | | | | 984,289 |

| |

| |

|

| Common Stocks | | Shares | | Value |

| |

| |

|

| |

| North America (continued) | | | | |

| |

| |

|

| |

| United States — 37.5% | | | | |

| Aerospace & Defense — 0.5% | | | | |

| Precision Castparts Corp. | | 36,200 | | $ 3,996,118 |

| |

| |

|

| Beverages — 2.1% | | | | |

| The Coca-Cola Co. | | 124,100 | | 7,254,886 |

| PepsiCo, Inc. | | 121,900 | | 8,479,364 |

| | | | |

|

| | | | | 15,734,250 |

| |

| |

|

| Capital Markets — 0.8% | | | | |

| Lehman Brothers Holdings, Inc. | | 30,900 | | 1,575,590 |

| Northern Trust Corp. | | 63,600 | | 4,301,268 |

| | | | |

|

| | | | | 5,876,858 |

| |

| |

|

| Chemicals — 1.6% | | | | |

| Monsanto Co. | | 102,000 | | 11,799,360 |

| |

| |

|

| Commercial Services & Supplies — 1.2% | | | | |

| FTI Consulting, Inc. (a) | | 147,900 | | 9,391,650 |

| |

| |

|

| Communications Equipment — 1.0% | | | | |

| Cisco Systems, Inc. (a) | | 322,200 | | 7,852,014 |

| |

| |

|

| Computers & Peripherals — 1.8% | | | | |

| Apple, Inc. (a) | | 34,500 | | 4,313,190 |

| EMC Corp. (a) | | 256,900 | | 3,992,226 |

| Hewlett-Packard Co. | | 110,100 | | 5,259,477 |

| | | | |

|

| | | | | 13,564,893 |

| |

| |

|

| Construction & Engineering — 1.0% | | | | |

| Jacobs Engineering Group, Inc. (a) | | 92,300 | | 7,410,767 |

| |

| |

|

| Diversified Financial Services — 0.2% | | | | |

| JPMorgan Chase & Co. | | 41,500 | | 1,686,975 |

| |

| |

|

| Electrical Equipment — 1.7% | | | | |

| General Cable Corp. (a) | | 84,500 | | 5,215,340 |

| Roper Industries, Inc. | | 129,800 | | 7,320,720 |

| | | | |

|

| | | | | 12,536,060 |

| |

| |

|

| Energy Equipment & Services — 1.9% | | | | |

| Core Laboratories NV (a) | | 37,500 | | 4,560,000 |

| National Oilwell Varco, Inc. (a) | | 62,800 | | 3,912,440 |

| Schlumberger Ltd. | | 65,500 | | 5,662,475 |

| | | | |

|

| | | | | 14,134,915 |

| |

| |

|

| Food & Staples Retailing — 1.8% | | | | |

| CVS/Caremark Corp. | | 225,800 | | 9,117,804 |

| Wal-Mart Stores, Inc. | | 89,400 | | 4,433,346 |

| | | | |

|

| | | | | 13,551,150 |

| |

| |

|

| Food Products — 0.8% | | | | |

| Bunge Ltd. | | 53,900 | | 5,974,276 |

| |

| |

|

| Health Care Equipment & Supplies — 1.4% | | | | |

| Hologic, Inc. (a) | | 102,400 | | 6,175,744 |

| Intuitive Surgical, Inc. (a) | | 14,900 | | 4,200,608 |

| | | | |

|

| | | | | 10,376,352 |

| |

| |

|

| Health Care Providers & Services — 0.9% | | | | |

| Aetna, Inc. | | 131,100 | | 6,502,560 |

| |

| |

|

| Hotels, Restaurants & Leisure — 1.2% | | | | |

| McDonald's Corp. | | 164,800 | | 8,917,328 |

| |

| |

|

| Household Products — 2.0% | | | | |

| The Procter & Gamble Co. | | 223,300 | | 14,777,994 |

| |

| |

|

| IT Services — 0.5% | | | | |

| MasterCard, Inc. Class A | | 21,500 | | 4,085,000 |

| |

| |

|

| See Notes to Financial Statements. |

| BLACKROCK GLOBAL GROWTH FUND, INC. |

Schedule of Investments (continued)

(Percentages shown are based on Net Assets)

| Common Stocks | | Shares | | Value |

| |

| |

|

| North America (concluded) | | | | |

| |

| |

|

| United States (concluded) | | | | |

| Industrial Conglomerates — 1.0% | | | | |

| General Electric Co. | | 216,100 | | $ 7,161,554 |

| |

| |

|

| Internet & Catalog Retail — 0.7% | | | | |

| Amazon.com, Inc. (a) | | 86,400 | | 5,570,208 |

| |

| |

|

| Internet Software & Services — 1.9% | | | | |

| Google Inc. Class A (a) | | 25,500 | | 12,015,090 |

| Mercadolibre, Inc. (a) | | 62,900 | | 2,273,835 |

| | | | |

|

| | | | | 14,288,925 |

| |

| |

|

| Life Sciences Tools & Services — 1.4% | | | | |

| Thermo Fisher Scientific, Inc. (a) | | 125,200 | | 7,002,436 |

| Waters Corp. (a) | | 66,300 | | 3,952,143 |

| | | | |

|

| | | | | 10,954,579 |

| |

| |

|

| Machinery — 2.6% | | | | |

| Deere & Co. | | 141,800 | | 12,082,778 |

| Joy Global, Inc. | | 117,500 | | 7,798,475 |

| | | | |

|

| | | | | 19,881,253 |

| |

| |

|

| Metals & Mining — 1.0% | | | | |

| Freeport-McMoRan Copper & Gold, Inc. Class B | | 78,000 | | 7,867,080 |

| |

| |

|

| Oil, Gas & Consumable Fuels — 0.7% | | | | |

| Consol Energy, Inc. | | 72,800 | | 5,531,344 |

| |

| |

|

| Pharmaceuticals — 1.3% | | | | |

| Johnson & Johnson | | 94,700 | | 5,867,612 |

| Merck & Co., Inc. | | 82,500 | | 3,654,750 |

| | | | |

|

| | | | | 9,522,362 |

| |

| |

|

| Semiconductors & Semiconductor | | | | |

| Equipment — 0.3% | | | | |

| Nvidia Corp. (a) | | 122,300 | | 2,615,997 |

| |

| |

|

| Software — 2.0% | | | | |

| Microsoft Corp. | | 438,100 | | 11,925,082 |

| Oracle Corp. (a) | | 173,900 | | 3,269,320 |

| | | | |

|

| | | | | 15,194,402 |

| |

| |

|

| Thrifts & Mortgage Finance — 0.2% | | | | |

| Fannie Mae | | 55,600 | | 1,537,340 |

| |

| |

|

| Tobacco — 1.2% | | | | |

| Altria Group, Inc. | | 125,400 | | 9,171,756 |

| |

| |

|

| Wireless Telecommunication Services — 0.8% | | | | |

| SBA Communications Corp. Class A (a) | | 188,700 | | 5,859,135 |

| |

| |

|

| Total Common Stocks in the United States | | | | 283,324,455 |

| |

| |

|

| Total Common Stocks in North America — 43.4% | | | | 327,958,522 |

| |

| |

|

| |

| Pacific Basin | | | | |

| |

| |

|

| Australia — 10.3% | | | | |

| Biotechnology — 0.8% | | | | |

| CSL Ltd. | | 190,200 | | 6,379,199 |

| |

| |

|

| Capital Markets — 0.6% | | | | |

| Australian Wealth Management Ltd. | | 1,033,700 | | 1,644,046 |

| Perpetual Trustees Australia Ltd. | | 55,600 | | 2,822,543 |

| | | | |

|

| | | | | 4,466,589 |

| |

| |

|

| Common Stocks | | Shares | | Value |

| |

| |

|

| |

| Pacific Basin (continued) | | | | |

| |

| |

|

| |

| Australia (concluded) | | | | |

| Chemicals — 1.2% | | | | |

| Incitec Pivot Ltd. | | 29,400 | | $ 3,993,174 |

| Nufarm Ltd. | | 145,700 | | 2,165,065 |

| Orica Ltd. | | 105,300 | | 2,787,821 |

| | | | |

|

| | | | | 8,946,060 |

| |

| |

|

| Commercial Banks — 0.3% | | | | |

| Westpac Banking Corp. | | 122,400 | | 2,617,969 |

| |

| |

|

| Commercial Services & Supplies — 0.2% | | | | |

| Seek Ltd. | | 272,900 | | 1,638,279 |

| |

| |

|

| Construction & Engineering — 1.2% | | | | |

| Boart Longyear Group (a) | | 1,350,900 | | 2,530,502 |

| Leighton Holdings Ltd. | | 151,100 | | 6,334,264 |

| | | | |

|

| | | | | 8,864,766 |

| |

| |

|

| Diversified Financial Services — 0.6% | | | | |

| Australian Stock Exchange Ltd. | | 107,600 | | 4,136,965 |

| |

| |

|

| Energy Equipment & Services — 0.6% | | | | |

| WorleyParsons Ltd. | | 120,422 | | 4,122,059 |

| |

| |

|

| Health Care Equipment & Supplies — 0.5% | | | | |

| Cochlear Ltd. | | 77,800 | | 3,878,763 |

| |

| |

|

| Insurance — 0.3% | | | | |

| QBE Insurance Group Ltd. | | 107,100 | | 2,215,228 |

| |

| |

|

| Metals & Mining — 1.9% | | | | |

| BHP Billiton Ltd. | | 209,000 | | 7,562,197 |

| Lihir Gold Ltd. (a) | | 1,138,717 | | 4,409,948 |

| Zinifex Ltd. | | 220,500 | | 2,218,508 |

| | | | |

|

| | | | | 14,190,653 |

| |

| |

|

| Oil, Gas & Consumable Fuels — 1.3% | | | | |

| Origin Energy Ltd. | | 340,100 | | 2,771,927 |

| Paladin Resources Ltd. (a)(e) | | 291,700 | | 1,628,958 |

| Woodside Petroleum Ltd. | | 105,000 | | 5,490,606 |

| | | | |

|

| | | | | 9,891,491 |

| |

| |

|

| Transportation Infrastructure — 0.8% | | | | |

| Macquarie Infrastructure Group | | 1,392,300 | | 3,735,110 |

| Transurban Group | | 442,400 | | 2,633,320 |

| | | | |

|

| | | | | 6,368,430 |

| |

| |

|

| Total Common Stocks in Australia | | | | 77,716,451 |

| |

| |

|

| China — 1.7% | | | | |

| Electrical Equipment — 0.2% | | | | |

| Suntech Power Holdings Co. Ltd. (a)(d) | | 39,900 | | 1,483,083 |

| |

| |

|

| Machinery — 0.3% | | | | |

| China Infrastructure Machinery Holdings Ltd. | | 1,200,000 | | 1,874,545 |

| |

| |

|

| Media — 0.4% | | | | |

| Focus Media Holding Ltd. (a)(d)(e) | | 62,800 | | 3,163,236 |

| |

| |

|

| Metals & Mining — 0.2% | | | | |

| China Molybdenum Co. Ltd. (a) | | 1,240,500 | | 1,738,048 |

| |

| |

|

| Oil, Gas & Consumable Fuels — 0.6% | | | | |

| China Shenhua Energy Co. Ltd. Class H | | 955,200 | | 4,865,412 |

| |

| |

|

| Total Common Stocks in China | | | | 13,124,324 |

| |

| |

|

| | See Notes to Financial Statements. |

10 BLACKROCK GLOBAL GROWTH FUND, INC.

Schedule of Investments (continued)

(Percentages shown are based on Net Assets)

| Common Stocks | | Shares | | Value |

| |

| |

|

| |

| Pacific Basin (continued) | | | | |

| |

| |

|

| |

| Hong Kong — 6.3% | | | | |

| Chemicals — 0.4% | | | | |

| Sinofert Holdings Ltd. | | 3,352,000 | | $ 3,344,274 |

| |

| |

|

| Commercial Banks — 0.5% | | | | |

| Hang Seng Bank Ltd. | | 191,800 | | 3,630,423 |

| |

| |

|

| Communications Equipment — 0.4% | | | | |

| ZTE Corp. | | 496,700 | | 2,702,286 |

| |

| |

|

| Distributors — 0.6% | | | | |

| China Resources Enterprise, Ltd. | | 1,201,900 | | 4,266,944 |

| |

| |

|

| Diversified Financial Services — 0.7% | | | | |

| Hong Kong Exchanges and Clearing Ltd. | | 259,700 | | 4,933,540 |

| |

| |

|

| Electric Utilities — 0.5% | | | | |

| Cheung Kong Infrastructure Holdings Ltd. | | 992,700 | | 3,920,100 |

| |

| |

|

| Food Products — 0.8% | | | | |

| Chaoda Modern Agriculture Holdings Ltd. | | 3,353,832 | | 3,780,438 |

| China Mengniu Dairy Co., Ltd. | | 963,500 | | 2,598,873 |

| | | | |

|

| | | | | 6,379,311 |

| |

| |

|

| Industrial Conglomerates — 0.4% | | | | |

| NWS Holdings Ltd. | | 1,092,700 | | 3,177,054 |

| |

| |

|

| Real Estate Management & Development — 0.3% | | | | |

| Sun Hung Kai Properties Ltd. | | 136,600 | | 2,380,454 |

| |

| |

|

| Specialty Retail — 0.3% | | | | |

| Esprit Holdings Ltd. | | 186,000 | | 2,337,467 |

| |

| |

|

| Transportation Infrastructure — 0.8% | | | | |

| COSCO Pacific Ltd. | | 693,000 | | 1,494,727 |

| China Merchants Holdings International Co., Ltd. | | 417,100 | | 2,238,845 |

| Hopewell Holdings Ltd. | | 465,300 | | 2,132,493 |

| | | | |

|

| | | | | 5,866,065 |

| |

| |

|

| Wireless Telecommunication Services — 0.6% | | | | |

| China Mobile Ltd. | | 322,400 | | 4,827,339 |

| |

| |

|

| Total Common Stocks in Hong Kong | | | | 47,765,257 |

| |

| |

|

| India — 6.6% | | | | |

| Automobiles — 0.3% | | | | |

| Tata Motors Ltd. | | 114,900 | | 1,980,663 |

| |

| |

|

| Commercial Banks — 1.1% | | | | |

| HDFC Bank Ltd. | | 137,700 | | 4,932,409 |

| State Bank of India Ltd. | | 60,000 | | 3,125,706 |

| | | | |

|

| | | | | 8,058,115 |

| |

| |

|

| Construction & Engineering — 1.2% | | | | |

| Jaiprakash Associates Ltd. | | 441,700 | | 2,855,097 |

| Larsen & Toubro Ltd. | | 67,500 | | 5,857,555 |

| | | | |

|

| | | | | 8,712,652 |

| |

| |

|

| Electrical Equipment — 0.7% | | | | |

| Bharat Heavy Electricals Ltd. | | 59,400 | | 3,336,276 |

| Suzlon Energy Ltd. | | 264,100 | | 1,833,066 |

| | | | |

|

| | | | | 5,169,342 |

| |

| |

|

| Common Stocks | | Shares | | Value |

| |

| |

|

| Pacific Basin (continued) | | | | |

| |

| |

|

| Industrial Conglomerates — 0.2% | | | | |

| Siemens India Ltd. | | 90,000 | | $ 1,813,386 |

| |

| |

|

| Media — 0.2% | | | | |

| Zee Telefilms Ltd. | | 216,500 | | 1,290,978 |

| |

| |

|

| Metals & Mining — 1.0% | | | | |

| Hindalco Industries Ltd. | | 526,100 | | 2,620,635 |

| Sterlite Industries India Ltd. (a) | | 244,200 | | 5,023,147 |

| | | | |

|

| | | | | 7,643,782 |

| |

| |

|

| Oil, Gas & Consumable Fuels — 0.7% | | | | |

| Reliance Industries Ltd. | | 84,200 | | 5,133,399 |

| |

| |

|

| Pharmaceuticals — 0.2% | | | | |

| Sun Pharmaceuticals Industries Ltd. | | 62,000 | | 1,876,218 |

| |

| |

|

| Transportation Infrastructure — 0.3% | | | | |

| Mundra Port and Special Economic Zone Ltd. (a) | | 121,800 | | 2,239,215 |

| |

| |

|

| Wireless Telecommunication Services — 0.7% | | | | |

| Bharti Tele-Ventures Ltd. (a) | | 144,900 | | 2,953,437 |

| Reliance Communication Ventures Ltd. | | 178,400 | | 2,527,111 |

| | | | |

|

| | | | | 5,480,548 |

| |

| |

|

| Total Common Stocks in India | | | | 49,398,298 |

| |

| |

|

| Japan — 3.2% | | | | |

| Chemicals — 0.3% | | | | |

| JSR Corp. | | 94,300 | | 2,069,663 |

| |

| |

|

| Office Electronics — 0.5% | | | | |

| Canon, Inc. | | 87,500 | | 3,922,212 |

| |

| |

|

| Road & Rail — 0.3% | | | | |

| East Japan Railway Co. | | 291 | | 2,335,671 |

| |

| |

|

| Software — 0.8% | | | | |

| Nintendo Co., Ltd. | | 12,500 | | 6,223,696 |

| |

| |

|

| Trading Companies & Distributors — 1.0% | | | | |

| Mitsubishi Corp. | | 125,000 | | 3,813,810 |

| Mitsui & Co., Ltd. | | 177,700 | | 3,864,519 |

| | | | |

|

| | | | | 7,678,329 |

| |

| |

|

| Wireless Telecommunication Services — 0.3% | | | | |

| NTT DoCoMo, Inc. | | 1,675 | | 2,453,992 |

| |

| |

|

| Total Common Stocks in Japan | | | | 24,683,563 |

| |

| |

|

| Singapore — 0.8% | | | | |

| Food Products — 0.4% | | | | |

| Wilmar International Ltd. | | 1,027,000 | | 3,179,304 |

| |

| |

|

| Industrial Conglomerates — 0.4% | | | | |

| Keppel Corp. Ltd. | | 435,600 | | 3,282,306 |

| |

| |

|

| Total Common Stocks in Singapore | | | | 6,461,610 |

| |

| |

|

| See Notes to Financial Statements. |

| BLACKROCK GLOBAL GROWTH FUND, INC. |

Schedule of Investments (concluded)

(Percentages shown are based on Net Assets)

| Common Stocks | | Shares | | Value |

| |

| |

|

| Pacific Basin (concluded) | | | | |

| |

| |

|

| South Korea — 0.5% | | | | |

| Construction & Engineering — 0.5% | | | | |

| Doosan Heavy Industries and Construction Co. Ltd. | | 16,000 | | $ 2,311,064 |

| GS Engineering & Construction Corp. | | 9,900 | | 1,514,520 |

| |

| |

|

| Total Common Stocks in South Korea | | | | 3,825,584 |

| |

| |

|

| Total Common Stocks in the Pacific Basin — 29.4% | | | | 222,975,087 |

| |

| |

|

| Total Common Stocks (Cost — $625,801,812) — 96.9% | | | | 732,700,108 |

| |

| |

|

| | | Beneficial Interest | | |

| Short-Term Securities | | (000) | | Value |

| |

| |

|

| |

| BlackRock Liquidity Series, LLC | | | | |

| Cash Sweep Series, 3.76% (b)(c) | | $ 21,245 | | $ 21,245,455 |

| BlackRock Liquidity Series, LLC | | | | |

| Money Market Series, 3.54% (b)(c)(f) | | 9,621 | | 9,621,000 |

| |

| |

|

| Total Short-Term Securities | | | | |

| (Cost — $30,866,455) — 4.1% | | | | 30,866,455 |

| |

| |

|

| Total Investments (Cost — $656,668,267*) — 101.0% | | 763,566,563 |

| Liabilities in Excess of Other Assets — (1.0%) | | | | (7,411,077) |

| | | | |

|

| Net Assets — 100% | | | | $756,155,486 |

| | | | |

|

| * | The cost and unrealized appreciation (depreciation) of investments as of February 29, 2008, as computed for federal income tax purposes, were as follows: |

| |

| Aggregate cost | | $ 657,053,207 |

| | |

|

| Gross unrealized appreciation | | $ 137,058,190 |

| Gross unrealized depreciation | | (30,544,834) |

| | |

|

| Net unrealized appreciation | | $ 106,513,356 |

| | |

|

| (a) | Non-income producing security. |

| |

| (b) | Investments in companies considered to be an affiliate of the Fund, for purposes of Section 2(a)(3) of the Investment Company Act of 1940, were as follows: |

| |

| | | Net | | |

| | | Activity | | Interest |

| Affiliate | | (000) | | Income |

| |

| |

|

| |

| BlackRock Liquidity Series, LLC | | | | |

| Cash Sweep Series | | $3,546 | | $660,194 |

| BlackRock Liquidity Series, LLC | | | | |

| Money Market Series | | $6,708 | | $ 25,622 |

| |

| |

|

| (c) | Represents the current yield as of report date. |

| |

| (d) | Depositary receipts. |

| |

| (e) | Security, or a portion of security, is on loan. |

| |

| (f) | Security was purchased with the cash proceeds from securities loans. |

| |

- For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized

market indexes or ratings group indexes, and/or as defined by Fund management.This definition may not apply for purposes of this report which may combine industrysub-classifications for reporting ease.

| | See Notes to Financial Statements. |

12 BLACKROCK GLOBAL GROWTH FUND, INC.

| Statement of Assets and Liabilities | | |

| |

| As of February 29, 2008 (Unaudited) | | |

| |

|

| |

| Assets | | |

| |

|

| |

| Investments at value — unaffiliated (including securities loaned of $8,775,284) (identified cost — $625,801,812) | | $ 732,700,108 |

| Investments at value — affiliated (identified cost — $30,866,455) | | 30,866,455 |

| Foreign currency at value (cost — $1,099,080) | | 1,092,914 |

| Capital shares sold receivable | | 1,435,665 |

| Dividends receivable | | 1,300,593 |

| Investments sold receivable | | 1,835 |

| Securities lending income receivable | | 5,201 |

| Prepaid expenses | | 136,564 |

| | |

|

| Total assets | | 767,539,335 |

| |

|

| |

| |

| Liabilities | | |

| |

|

| |

| Collateral at value — securities loaned | | 9,621,000 |

| Deferred foreign capital gain tax | | 210,989 |

| Capital shares redeemed payable | | 630,578 |

| Investment advisory fees payable | | 448,731 |

| Other affiliates payable | | 181,318 |

| Service and distribution fees payable | | 182,740 |

| Directors payable | | 3,292 |

| Other accrued expenses and other liabilities payable | | 105,201 |

| | |

|

| Total liabilities | | 11,383,849 |

| |

|

| |

| |

| Net Assets | | |

| |

|

| |

| Net assets | | $ 756,155,486 |

| |

|

| |

| |

| Net Assets Consist of | | |

| |

|

| |

| Institutional Shares of Common Stock, $.10 par value, 100,000,000 shares authorized | | $ 1,553,186 |

| Investor A Shares of Common Stock, $.10 par value, 100,000,000 shares authorized | | 1,971,793 |

| Investor B Shares of Common Stock, $.10 par value, 300,000,000 shares authorized | | 262,279 |

| Investor C Shares of Common Stock, $.10 par value, 100,000,000 shares authorized | | 619,357 |

| Class R Shares of Common Stock, $.10 par value, 300,000,000 shares authorized | | 62,575 |

| Paid-in capital in excess of par | | 973,800,503 |

| Undistributed net investment income | | 1,186,301 |

| Accumulated net realized loss | | (330,021,923) |

| Net unrealized appreciation | | 106,721,415 |

| | |

|

| Net Assets | | $ 756,155,486 |

| |

|

| |

| |

| Net Asset Value | | |

| |

|

| |

| Institutional — Based on net assets of $267,503,704 and 15,531,864 shares outstanding | | $ 17.22 |

| | |

|

| Investor A — Based on net assets of $335,378,813 and 19,717,932 shares outstanding | | $ 17.01 |

| | |

|

| Investor B — Based on net assets of $42,522,632 and 2,622,789 shares outstanding | | $ 16.21 |

| | |

|

| Investor C — Based on net assets of $100,378,841 and 6,193,574 shares outstanding | | $ 16.21 |

| | |

|

| Class R — Based on net assets of $10,371,496 and 625,746 shares outstanding | | $ 16.57 |

| | |

|

| See Notes to Financial Statements. |

| BLACKROCK GLOBAL GROWTH FUND, INC. |

| Statement of Operations | | |

| |

| For the Six Months Ended February 29, 2008 (Unaudited) | | |

| |

|

| |

| Investment Income | | |

| |

|

| |

| Dividends (net of $166,613 foreign withholding tax) | | $ 5,980,474 |

| Interest from affiliates | | 660,194 |

| Securities lending | | 25,622 |

| | |

|

| Total income | | 6,666,290 |

| |

|

| |

| |

| Expenses | | |

| |

|

| |

| Investment advisory | | 3,067,100 |

| Service — Investor A | | 419,931 |

| Service and distribution — Investor B | | 243,627 |

| Service and distribution — Investor C | | 450,920 |

| Service and distribution — Class R | | 19,293 |

| Transfer agent — Institutional | | 141,073 |

| Transfer agent — Investor A | | 188,040 |

| Transfer agent — Investor B | | 55,670 |

| Transfer agent — Investor C | | 60,250 |

| Transfer agent — Class R | | 6,427 |

| Custodian | | 150,250 |

| Accounting services | | 128,562 |

| Printing | | 37,864 |

| Professional fees | | 37,611 |

| Registration | | 37,558 |

| Directors | | 18,065 |

| Miscellaneous | | 33,064 |

| | |

|

| Total expenses | | 5,095,305 |

| | |

|

| Net investment income | | 1,570,985 |

| |

|

| |

| |

| Realized and Unrealized Gain (Loss) | | |

| |

|

| |

| Net realized gain (loss) from: | | |

| Investments | | 39,355,488 |

| Options written | | 1,680,524 |

| Foreign currency | | (258,045) |

| | |

|

| | | 40,777,967 |

| | |

|

| Net change in unrealized appreciation/depreciation on: | | |

| Investments (including $915,318 deferred foreign capital gain credit) | | (26,381,553) |

| Foreign currency | | 14,497 |

| | |

|

| | | (26,367,056) |

| | |

|

| Total realized and unrealized gain | | 14,410,911 |

| | |

|

| Net Increase in Net Assets Resulting from Operations | | $ 15,981,896 |

| | |

|

| See Notes to Financial Statements. |

14 BLACKROCK GLOBAL GROWTH FUND, INC.

| Statements of Changes in Net Assets | | | | |

| |

| | | For the | | For the |

| | | Six Months Ended | | Year Ended |

| | | February 29, 2008 | | August 31, |

| Increase (Decrease) in Net Assets: | | (Unaudited) | | 2007 |

| |

| |

|

| Operations | | | | |

| |

| |

|

| Net investment income | | $ 1,570,985 | | $ 3,956,446 |

| Net realized gain | | 40,777,967 | | 76,592,338 |

| Net change in unrealized appreciation/depreciation | | (26,367,056) | | 66,010,249 |

| | |

| |

|

| Net increase in net assets resulting from operations | | 15,981,896 | | 146,559,033 |

| |

| |

|

| |

| Dividends to Shareholders from | | | | |

| |

| |

|

| Net investment income: | | | | |

| Institutional | | (2,410,109) | | (101,798) |

| Investor A | | (1,607,917) | | — |

| Class R | | (23,917) | | — |

| | |

| |

|

| Decrease in net assets resulting from dividends to shareholders | | (4,041,943) | | (101,798) |

| |

| |

|

| |

| Capital Share Transactions | | | | |

| |

| |

|

| Net increase in net assets derived from capital share transactions | | 48,554,894 | | 56,315,507 |

| |

| |

|

| |

| Redemption Fees | | | | |

| |

| |

|

| Redemption fees | | 94,093 | | 9,997 |

| |

| |

|

| |

| Net Assets | | | | |

| |

| |

|

| Total increase in net assets | | 60,588,940 | | 202,782,739 |

| Beginning of period | | 695,566,546 | | 492,783,807 |

| | |

| |

|

| End of period | | $ 756,155,486 | | $ 695,566,546 |

| | |

| |

|

| End of period undistributed net investment income | | $ 1,186,301 | | $ 3,657,259 |

| | |

| |

|

| See Notes to Financial Statements. |

| BLACKROCK GLOBAL GROWTH FUND, INC. |

| Financial Highlights | | | | | | | | | | | | | | |

| |

| | | | | | | | | Institutional | | | | |

| For the Six |

| Months Ended |

| | | February 29, 2008 | | | | For the Year Ended August 31, | | |

| | | (Unaudited) | | | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 |

| |

| |

| |

| |

| |

| |

| |

|

| Per Share Operating Performance | | | | | | | | | | | | | | |

| |

| Net asset value, beginning of period | | $ 16.66 | | $ 12.71 | | $ 10.72 | | $ 8.56 | | $ 7.58 | | $ 7.00 |

| | |

| |

| |

| |

| |

| |

|

| Net investment income1 | | .06 | | | | .16 | | .09 | | .16 | | .09 | | .04 |

| Net realized and unrealized gain | | .632 | | | | 3.802 | | 2.072 | | 2.032 | | .892 | | .54 |

| | |

| |

| |

| |

| |

| |

| |

|

| Net increase from investment operations | | .69 | | | | 3.96 | | 2.16 | | 2.19 | | .98 | | .58 |

| | |

| |

| |

| |

| |

| |

| |

|

| Dividends from net investment income | | (.13) | | | | (.01) | | (.17) | | (.03) | | — | | — |

| | |

| |

| |

| |

| |

| |

| |

|

| Net asset value, end of period | | $ 17.22 | | $ 16.66 | | $ 12.71 | | $ 10.72 | | $ 8.56 | | $ 7.58 |

| |

| |

| |

| |

| |

| |

|

| |

| Total Investment Return3 | | | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| |

| |

|

| |

| Based on net asset value | | 4.07%4 | | | | 31.17% | | 20.41% | | 25.58% | | 12.93% | | 8.29% |

| |

| |

| |

| |

| |

| |

| |

|

| |

| Ratios to Average Net Assets | | | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| |

| |

|

| |

| Total expenses | | .94%5 | | | | 1.01% | | 1.12% | | 1.13% | | 1.13% | | 1.16% |

| | |

| |

| |

| |

| |

| |

| |

|

| Net investment income | | .68%5 | | | | 1.07% | | .71% | | 1.60% | | 1.05% | | .63% |

| |

| |

| |

| |

| |

| |

| |

|

| |

| Supplemental Data | | | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| |

| |

|

| |

| Net assets, end of period (000) | | $ 267,504 | | $ 284,754 | | $ 144,560 | | $ 114,007 | | $ 106,785 | | $ 133,096 |

| | |

| |

| |

| |

| |

| |

|

| Portfolio turnover | | 32% | | | | 91% | | 80% | | 109% | | 72% | | 121% |

| | |

| |

| |

| |

| |

| |

| |

|

| 1 | Based on average shares outstanding. |

| |

| 2 | Includes a redemption fee, which is less than $.01 per share. |

| |

| 3 | Total investment return excludes the effect of any sales charge. |

| |

| 4 | Aggregate total investment return. |

| |

| 5 | Annualized. |

| |

| See Notes to Financial Statements. |

16 BLACKROCK GLOBAL GROWTH FUND, INC.

| Financial Highlights (continued) | | | | | | | | | | | | | | | | |

| |

| | | | | | | | | Investor A | | | | | | |

| For the Six |

| Months Ended |

| | | February 29, 2008 | | | | For the Year Ended August 31, | | |

| | | (Unaudited) | | | | 2007 | | 2006 | | | | 2005 | | 2004 | | 2003 |

| Per Share Operating Performance | | | | | | | | | | | | | | | | |

| |

| Net asset value, beginning of period | | $ 16.44 | | $ 12.57 | | $ 10.60 | | $ 8.47 | | $ 7.51 | | $ 6.95 |

| | |

| |

| |

| |

| |

| |

|

| Net investment income1 | | .04 | | | | .11 | | .06 | | | | .13 | | .07 | | .03 |

| Net realized and unrealized gain | | .622 | | | | 3.762 | | 2.052 | | | | 2.002 | | .892 | | .53 |

| | |

| |

| |

| |

| |

| |

| |

| |

|

| Net increase from investment operations | | .66 | | | | 3.87 | | 2.11 | | | | 2.13 | | .96 | | .56 |

| | |

| |

| |

| |

| |

| |

| |

| |

|

| Dividends from net investment income | | (.09) | | | | — | | (.14) | | | | —3 | | — | | — |

| | |

| |

| |

| |

| |

| |

| |

| |

|

| Net asset value, end of period | | $ 17.01 | | $ 16.44 | | $ 12.57 | | $ 10.60 | | $ 8.47 | | $ 7.51 |

| |

| |

| |

| |

| |

| |

|

| |

| Total Investment Return4 | | | | | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

|

| |

| Based on net asset value | | 3.96%5 | | | | 30.79% | | 20.13% | | | | 25.17% | | 12.78% | | 8.06% |

| |

| |

| |

| |

| |

| |

| |

| |

|

| |

| Ratios to Average Net Assets | | | | | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

|

| |

| Total expenses | | 1.22%6 | | | | 1.30% | | 1.35% | | | | 1.38% | | 1.37% | | 1.42% |

| | |

| |

| |

| |

| |

| |

| |

| |

|

| Net investment income | | .42%6 | | | | .75% | | .53% | | | | 1.35% | | .87% | | .40% |

| |

| |

| |

| |

| |

| |

| |

| |

|

| |

| Supplemental Data | | | | | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

|

| |

| Net assets, end of period (000) | | $ 335,379 | | $ 288,912 | | $ 227,792 | | $ 93,408 | | $ 98,519 | | $ 110,092 |

| | |

| |

| |

| |

| |

| |

|

| Portfolio turnover | | 32% | | | | 91% | | 80% | | | | 109% | | 72% | | 121% |

| | |

| |

| |

| |

| |

| |

| |

| |

|

| 1 | Based on average shares outstanding. |

| |

| 2 | Includes a redemption fee, which is less than $.01 per share. |

| |

| 3 | Amount is less than ($.01) per share. |

| |

| 4 | Total investment return excludes the effects of sales charges. |

| |

| 5 | Aggregate total investment return. |

| |

| 6 | Annualized. |

| |

| See Notes to Financial Statements. |

| BLACKROCK GLOBAL GROWTH FUND, INC. |

| Financial Highlights (continued) | | | | | | | | | | | | | | |

| |

| | | | | | | | | Investor B | | | | |

| | |

| |

| |

| |

| |

| |

|

| For the Six |

| Months Ended |

| | | February 29, 2008 | | | | For the Year Ended August 31, | | |

| | | (Unaudited) | | | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 |

| Per Share Operating Performance | | | | | | | | | | | | | | |

| |

| Net asset value, beginning of period | | $ 15.66 | | $ 12.07 | | $ 10.17 | | $ 8.19 | | $ 7.32 | | $ 6.83 |

| | |

| |

| |

| |

| |

| |

|

| Net investment income (loss)1 | | (.04) | | | | (.01) | | (.06) | | .05 | | —2 | | (.03) |

| Net realized and unrealized gain | | .593 | | | | 3.603 | | 2.003 | | 1.933 | | .873 | | .52 |

| | |

| |

| |

| |

| |

| |

| |

|

| Net increase from investment operations | | .55 | | | | 3.59 | | 1.94 | | 1.98 | | .87 | | .49 |

| | |

| |

| |

| |

| |

| |

| |

|

| Dividends from net investment income | | — | | | | — | | (.04) | | — | | — | | — |

| | |

| |

| |

| |

| |

| |

| |

|

| Net asset value, end of period | | $ 16.21 | | $ 15.66 | | $ 12.07 | | $ 10.17 | | $ 8.19 | | $ 7.32 |

| |

| |

| |

| |

| |

| |

|

| |

| Total Investment Return4 | | | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| |

| |

|

| |

| Based on net asset value | | 3.51%5 | | | | 29.74% | | 19.18% | | 24.18% | | 11.89% | | 7.17% |

| |

| |

| |

| |

| |

| |

| |

|

| |

| Ratios to Average Net Assets | | | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| |

| |

|

| |

| Total expenses | | 2.08%6 | | | | 2.15% | | 2.18% | | 2.16% | | 2.16% | | 2.22% |

| | |

| |

| |

| |

| |

| |

| |

|

| Net investment income (loss) | | (.44%)6 | | | | (.10%) | | (.56%) | | .56% | | .05% | | (.43%) |

| |

| |

| |

| |

| |

| |

| |

|

| |

| Supplemental Data | | | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| |

| |

|

| |

| Net assets, end of period (000) | | $ 42,523 | | $ 47,186 | | $ 62,390 | | $ 212,353 | | $ 252,691 | | $ 327,483 |

| | |

| |

| |

| |

| |

| |

|

| Portfolio turnover | | 32% | | | | 91% | | 80% | | 109% | | 72% | | 121% |

| | |

| |

| |

| |

| |

| |

| |

|

| 1 | Based on average shares outstanding. |

| |

| 2 | Amount is less than $.01 per share. |

| |

| 3 | Includes a redemption fee, which is less than $.01 per share. |

| |

| 4 | Total investment return excludes the effects of sales charges. |

| |

| 5 | Aggregate total investment return. |

| |

| 6 | Annualized. |

| |

| See Notes to Financial Statements. |

18 BLACKROCK GLOBAL GROWTH FUND, INC.

| Financial Highlights (continued) | | | | | | | | | | | | | | |

| |

| | | | | | | | | Investor C | | | | |

| For the Six |

| Months Ended |

| | | February 29, 2008 | | | | For the Year Ended August 31, | | |

| | | (Unaudited) | | | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 |

| Per Share Operating Performance | | | | | | | | | | | | | | |

| |

| Net asset value, beginning of period | | $ 15.65 | | $ 12.06 | | $ 10.17 | | $ 8.19 | | $ 7.32 | | $ 6.83 |

| | |

| |

| |

| |

| |

| |

|

| Net investment income (loss)1 | | (.03) | | | | (.01) | | (.04) | | .05 | | —2 | | (.03) |

| Net realized and unrealized gain | | .593 | | | | 3.603 | | 1.983 | | 1.933 | | .873 | | .52 |

| | |

| |

| |

| |

| |

| |

| |

|

| Net increase from investment operations | | .56 | | | | 3.59 | | 1.94 | | 1.98 | | .87 | | .49 |

| | |

| |

| |

| |

| |

| |

| |

|

| Dividends from net investment income | | — | | | | — | | (.05) | | — | | — | | — |

| | |

| |

| |

| |

| |

| |

| |

|

| Net asset value, end of period | | $ 16.21 | | $ 15.65 | | $ 12.06 | | $ 10.17 | | $ 8.19 | | $ 7.32 |

| |

| |

| |

| |

| |

| |

|

| |

| Total Investment Return4 | | | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| |

| |

|

| |

| Based on net asset value | | 3.58%5 | | | | 29.77% | | 19.15% | | 24.18% | | 11.89% | | 7.17% |

| |

| |

| |

| |

| |

| |

| |

|

| |

| Ratios to Average Net Assets | | | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| |

| |

|

| |

| Total expenses | | 1.99%6 | | | | 2.10% | | 2.16% | | 2.18% | | 2.18% | | 2.24% |

| | |

| |

| |

| |

| |

| |

| |

|

| Net investment income (loss) | | (.36%)6 | | | | (.04%) | | (.36%) | | .55% | | .05% | | (.43%) |

| |

| |

| |

| |

| |

| |

| |

|

| |

| Supplemental Data | | | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| |

| |

|

| |

| Net assets, end of period (000) | | $ 100,379 | | $ 70,835 | | $ 56,567 | | $ 55,507 | | $ 60,771 | | $ 72,249 |

| | |

| |

| |

| |

| |

| |

|

| Portfolio turnover | | 32% | | | | 91% | | 80% | | 109% | | 72% | | 121% |

| | |

| |

| |

| |

| |

| |

| |

|

| 1 | Based on average shares outstanding. |

| |

| 2 | Amount is less than $.01 per share. |

| |

| 3 | Includes a redemption fee, which is less than $.01 per share. |

| |

| 4 | Total investment return excludes the effects of sales charges. |

| |

| 5 | Aggregate total investment return. |

| |

| 6 | Annualized. |

| |

| See Notes to Financial Statements. |

| BLACKROCK GLOBAL GROWTH FUND, INC. |

| Financial Highlights (concluded) | | | | | | | | | | | | | | | | |

| |

| | | | | | | | | Class R | | | | | | |

| | | For the Six | | | | | | | | | | | | | | For the Period |

| | | Months Ended | | | | | | For the Year Ended August 31, | | | | January 3, 20031 |

| | | February 29, 2008 | | | | | | | | | | | | to August 31, |

| | | (Unaudited) | | | | 2007 | | 2006 | | | | 2005 | | 2004 | | 2003 |

| Per Share Operating Performance | | | | | | | | | | | | | | | | |

| |

| Net asset value, beginning of period | | $ 16.04 | | $ 12.30 | | $ 10.42 | | $ 8.36 | | $ 7.39 | | $ 6.50 |

| | |

| |

| |

| |

| |

| |

|

| Net investment income2 | | .01 | | | | .06 | | .03 | | | | .06 | | .08 | | .06 |

| Net realized and unrealized gain | | .603 | | | | 3.683 | | 2.003 | | | | 2.013 | | .893 | | .83 |

| | |

| |

| |

| |

| |

| |

| |

| |

|

| Net increase from investment operations | | .61 | | | | 3.74 | | 2.03 | | | | 2.07 | | .97 | | .89 |

| | |

| |

| |

| |

| |

| |

| |

| |

|

| Dividends from net investment income | | (.08) | | | | — | | (.15) | | | | (.01) | | — | | — |

| | |

| |

| |

| |

| |

| |

| |

| |

|

| Net asset value, end of period | | $ 16.57 | | $ 16.04 | | $ 12.30 | | $ 10.42 | | $ 8.36 | | $ 7.39 |

| |

| |

| |

| |

| |

| |

|

| |

| Total Investment Return | | | | | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

|

| |

| Based on net asset value | | 3.77%4 | | | | 30.41% | | 19.78% | | | | 24.81% | | 13.13% | | 13.69%4 |

| |

| |

| |

| |

| |

| |

| |

| |

|

| |

| Ratios to Average Net Assets | | | | | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

|

| |

| Total expenses | | 1.53%5 | | | | 1.63% | | 1.62% | | | | 1.79% | | 1.56% | | 1.64%5 |

| | |

| |

| |

| |

| |

| |

| |

| |

|

| Net investment income | | .09%5 | | | | .44% | | .23% | | | | .99% | | 1.36% | | .66%5 |

| |

| |

| |

| |

| |

| |

| |

| |

|

| |

| Supplemental Data | | | | | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

|

| |

| Net assets, end of period (000) | | $ 10,371 | | $ 3,880 | | $ 1,475 | | $ 705 | | $ 166 | | —6 |

| | |

| |

| |

| |

| |

| |

|

| Portfolio turnover | | 32% | | | | 91% | | 80% | | | | 109% | | 72% | | 121% |

| | |

| |

| |

| |

| |

| |

| |

| |

|

| 1 | Commencement of operations. |

| |

| 2 | Based on average shares outstanding. |

| |

| 3 | Includes a redemption fee, which is less than $.01 per share. |

| |

| 4 | Aggregate total investment return. |

| |

| 5 | Annualized. |

| |

| 6 | Amount is less than $1,000. |

| |

| See Notes to Financial Statements. |

20 BLACKROCK GLOBAL GROWTH FUND, INC.

Notes to Financial Statements (Unaudited)

1. Significant Accounting Policies:

BlackRock Global Growth Fund, Inc. (the “Fund”) is registered under

the Investment Company Act of 1940, as amended (the “1940 Act”), as

a diversified, open-end management investment company. The Fund’s

financial statements are prepared in conformity with accounting princi-

ples generally accepted in the United States of America, which may

require the use of management accruals and estimates. Actual results

may differ from these estimates. The Fund offers multiple classes of

shares. Institutional Shares are sold without a sales charge and only

to certain eligible investors. Investor A Shares are generally sold with a

front-end sales charge. Investor B and Investor C Shares may be subject

to a contingent deferred sales charge. Class R Shares are sold only to

certain retirement plans. All classes of shares have identical voting, divi-

dend, liquidation and other rights and the same terms and conditions,

except that Investor A, Investor B, Investor C and Class R Shares bear

certain expenses related to the shareholder servicing of such shares,

and Investor B, Investor C and Class R Shares also bear certain expens-

es related to the distribution of such shares. Each class has exclusive

voting rights with respect to matters relating to its shareholder servicing

and distribution expenditures (except that Investor B shareholders may

vote on material changes to the Investor A distribution plan).

The following is a summary of significant accounting policies followed by

the Fund:

Valuation of Investments: Equity investments traded on a national secu-

rities exchange or the NASDAQ Global Market System are valued at

the last reported sale price that day or the NASDAQ official closing price,

if applicable. Equity investments traded on a national exchange for

which there were no sales on that day and equity investments traded

on over-the-counter (“OTC”) markets for which market quotations are

readily available are valued at the last available bid price. Short-term

securities may be valued at amortized cost.

In the event that application of these methods of valuation results in a

price for an investment which is deemed not to be representative of the

market value of such investment, the investment will be valued by, under

the direction of, or in accordance with, a method approved by the Board

of Directors (the “Board”) as reflecting fair value (“Fair Value Assets”).

When determining the price for Fair Value Assets, BlackRock Advisors,

LLC (the “Advisor”), an indirect, wholly owned subsidiary of BlackRock,

Inc., and/or sub-advisor seeks to determine the price that the Fund

might reasonably expect to receive from the current sale of that asset in

an arm’s-length transaction. Fair value determinations shall be based

upon all available factors that the Advisor and/or sub-advisor deems

relevant. The pricing of all Fair Value Assets is subsequently reported to

the Board or a committee thereof. |

Generally, trading in foreign securities is substantially completed each

day at various times prior to the close of business on the New York Stock

Exchange (“NYSE”). The values of such securities used in computing the

net assets of the Fund are determined as of such times. Foreign currency

exchange rates will be determined as of the close of business on the

NYSE. Occasionally, events affecting the values of such securities and

such exchange rates may occur between the times at which they are

determined and the close of business on the NYSE that may not be

reflected in the computation of the Fund’s net asset value. If events

(for example, a company announcement, market volatility or a natural

disaster) occur during such periods that are expected to materially affect

the value of such securities, those securities will be valued at their fair

value as determined in good faith by the Board or by the Advisor using

a pricing service and/or procedures approved by the Board.

Foreign Currency Transactions: Foreign currency amounts are trans-

lated into United States dollars on the following basis: (i) market value

of investment securities, assets and liabilities at the current rate of