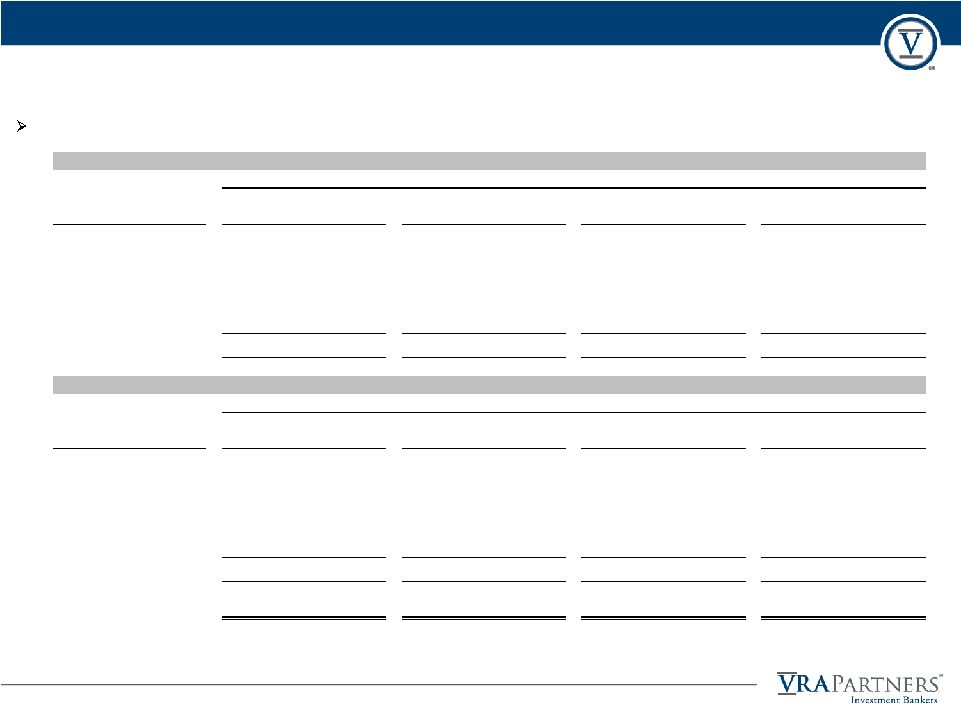

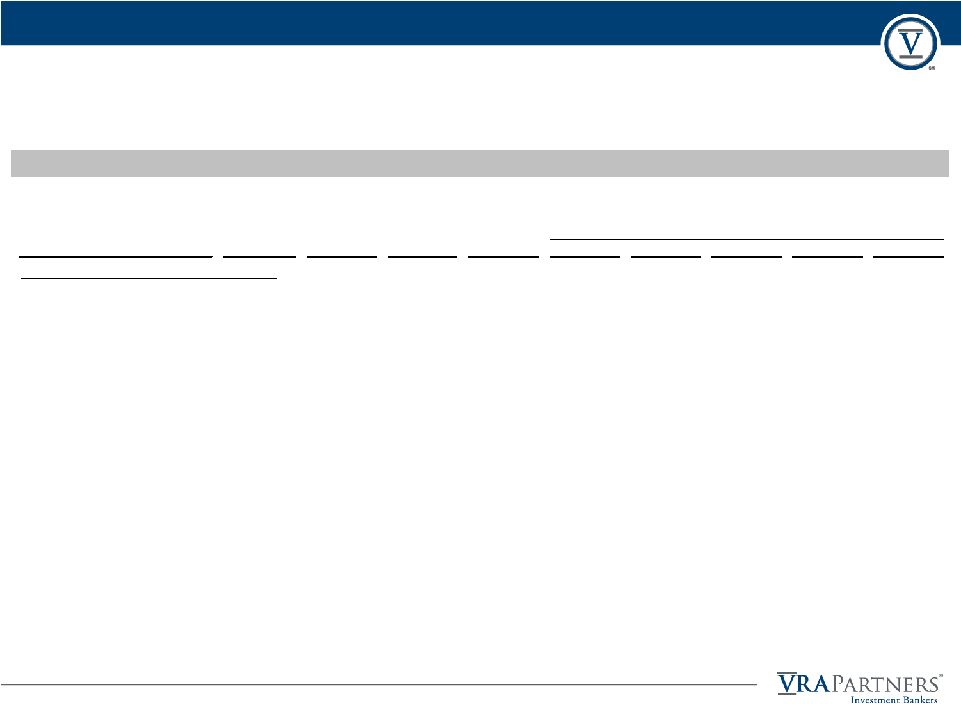

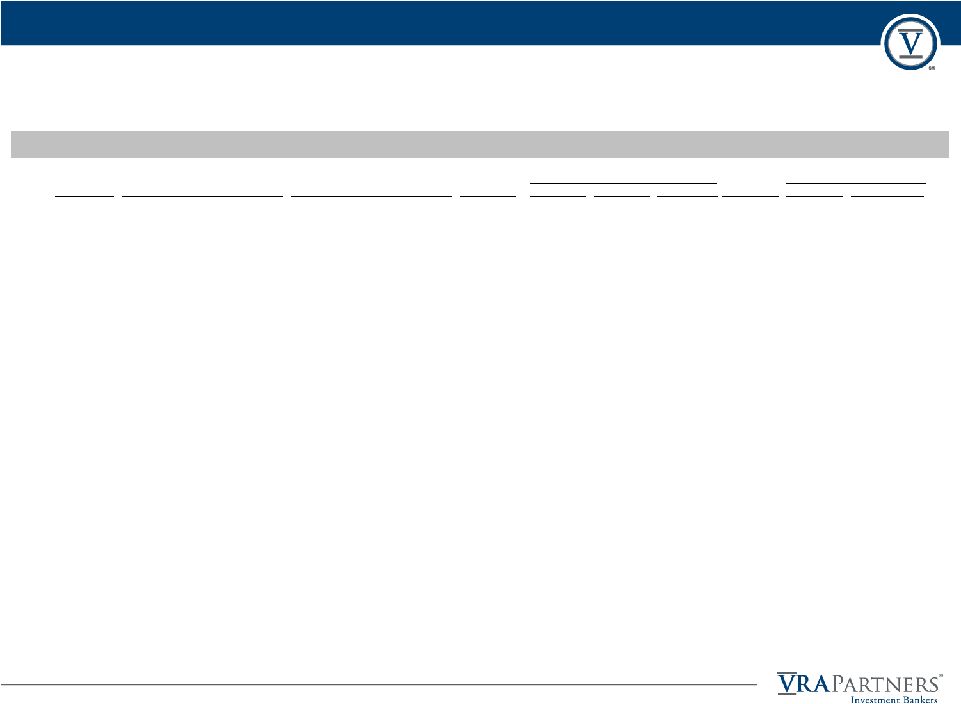

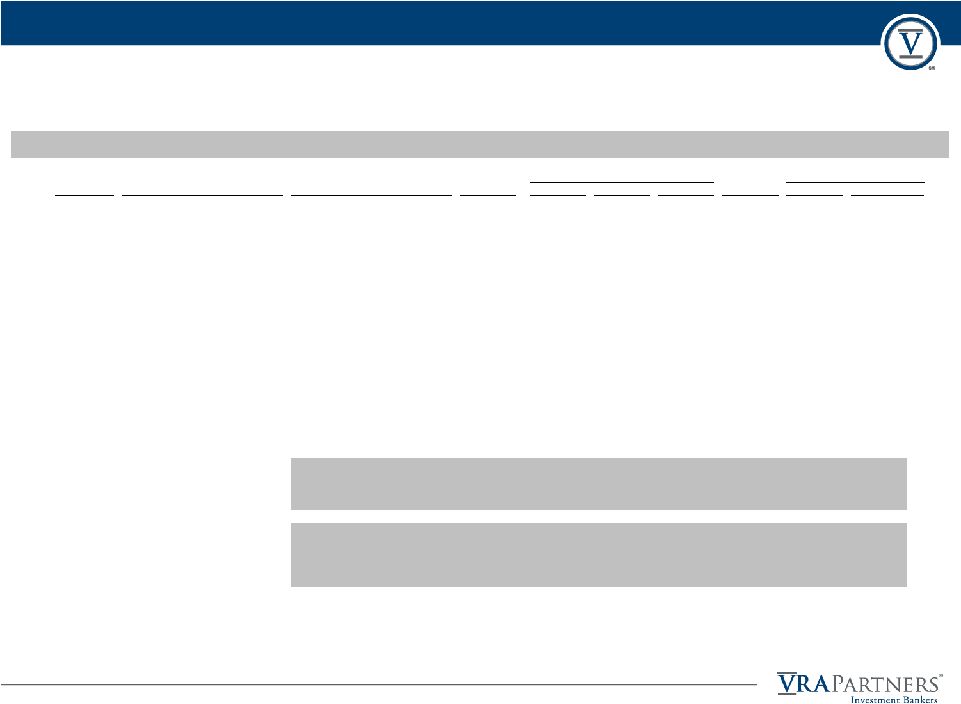

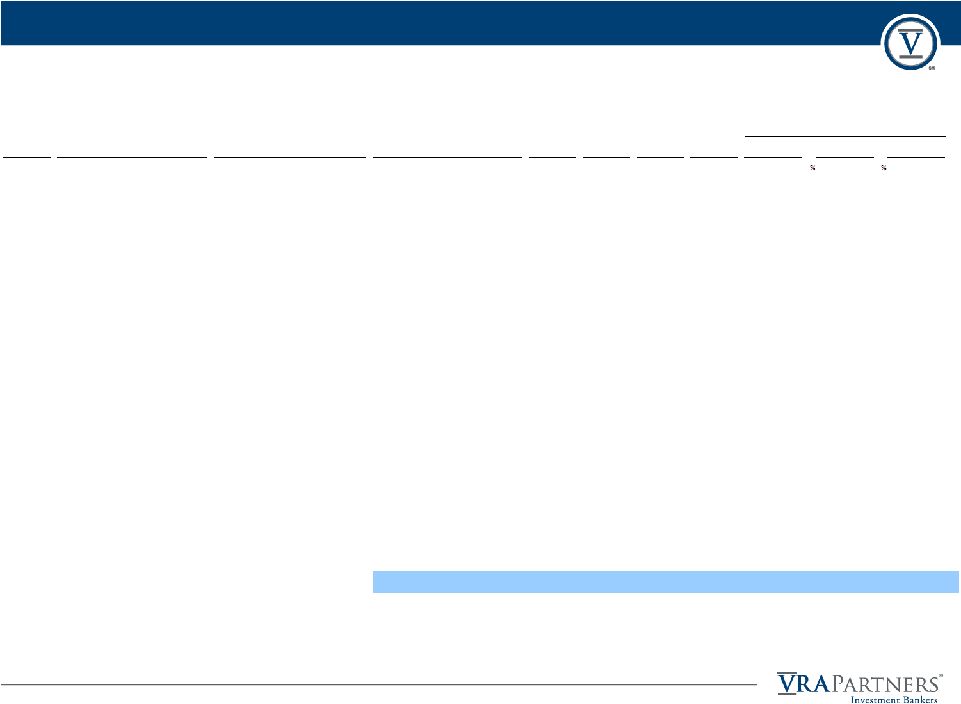

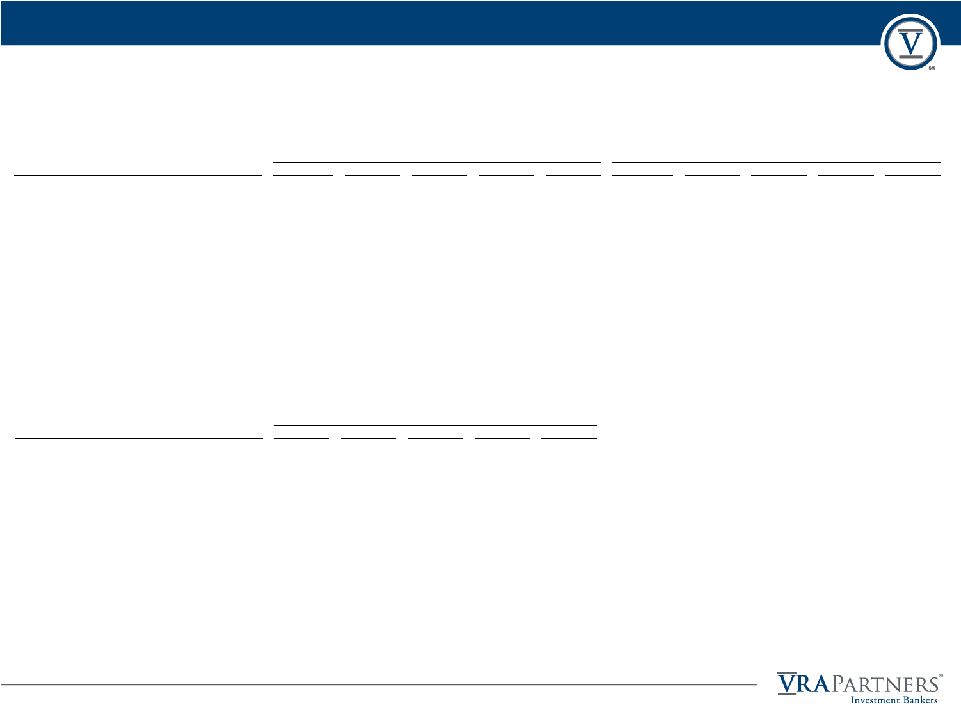

25 Premiums Paid Analysis Majority Shareholder Purchasing Remaining Shares Implied Implied Total Transaction Transaction Premium (%) Date Transaction Equity Percent Enterprise 1 Day Prior to 5 Days Prior to 30 Days Prior to Announced Target Primary Industry Acquiror Value Value Repurchased Value Announcement Announcement Announcement 03/25/09 Hearst-Argyle Television Inc. Broadcasting Hearst Broadcasting, Inc $75.9 $421.6 18.0% $1,205.6 115.3 * 150.0 * 157.2 * % 03/23/09 Cox Radio Inc. Broadcasting Cox Media Group, Inc. 65.2 302.0 21.6% 707.7 15.1 16.9 -25.8 * 02/27/09 Vita Food Products Inc. Packaged Foods and Meats Individual Investor (Company Director) 3.3 7.7 42.2% 7.7 250.0 * 250.0 * 400.0 * 02/26/09 OpenTV Corp. Application Software Kudelski SA 128.4 147.5 87.1% 46.3 35.0 27.4 12.5 02/09/09 Galaxy Nutritional Foods Inc. Packaged Foods and Meats Mill Road Capital; Galaxy Partners 4.6 9.7 46.9% 6.8 111.8 * 80.0 * 44.0 01/27/09 NET2S Group Internet Software and Services BT Group plc 2.4 110.3 2.2% 109.7 85.6 * 85.6 * 58.3 01/15/09 Hiland Holdings GP LP Oil and Gas Storage and Transportation Individual Investor (Company Director) 27.1 69.1 39.2% 451.1 21.2 -14.0 * 29.6 12/09/08 Global Med Technologies Inc. Application Software Victory Park Capital Advisors, LLC 32.0 37.4 85.6% 45.4 25.0 57.1 * 22.2 08/07/08 Confirmit ASA Application Software Sebastian Holdings Inc. 5.5 90.4 6.1% 81.5 0.4 0.9 28.6 07/30/08 Zones Inc. Technology Distributors Individual Investor (Company CEO) 45.3 92.6 48.9% 97.9 15.9 -6.7 * -10.6 * 07/21/08 Genentech Inc. Biotechnology Roche Holdings, Inc. 46,722.4 100,115.3 46.7% 99,217.7 16.1 26.0 27.1 06/26/08 Five Star Products Inc. Distributors National Patent Development Corp. 1.7 6.7 24.9% 37.0 33.3 33.3 14.3 04/25/08 Tarrant Apparel Group Apparel, Accessories and Luxury Goods Company Management 12.7 26.0 49.0% 44.1 28.8 30.8 26.9 03/05/08 Atari, Inc. Home Entertainment Software Infogrames Entertainment SA 11.0 22.6 48.6% 31.2 0.0 0.0 29.2 03/05/08 Nationwide Financial Services, Inc. Life and Health Insurance Nationwide 2,863.0 7,659.0 37.4% 9,550.7 28.3 18.0 19.0 02/28/08 GS AgriFuels Corporation Industrial Machinery GreenShift Corporation 1.5 14.5 10.0% 54.3 9.9 19.1 25.0 11/15/07 Atlantic Coast Entertainment Holdings Casinos and Gaming Icahn Enterprises, L.P. 12.3 211.2 5.8% 202.6 20.3 NA 22.1 10/22/07 Waste Industries USA Inc. Environmental and Facilities Services Mgmt, Macquaire and Goldman Sachs 268.8 538.4 49.9% 702.3 40.2 42.3 32.8 10/03/07 Suntron Corp. Electronic Manufacturing Services Blum Capital, Thayer Capital Partners 3.2 31.8 10.2% 51.9 -5.0 * 5.5 5.5 09/07/07 Emerson Radio Corp. Consumer Electronics Grande Holdings Ltd. 7.3 106.1 6.8% 87.7 50.5 50.5 52.2 08/08/07 Digital Angel Corp. Electronic Equipment Manufacturers Applied Digital Solutions Inc. 32.5 72.5 44.8% 85.0 22.1 22.1 16.8 07/17/07 Alfa Corp. Property and Casualty Insurance Alfa Mutual Insurance Company 832.6 1,767.5 47.1% 2,071.3 44.4 44.6 29.5 05/14/07 Spear & Jackson Inc. Household Appliances United Pacific Industries Ltd. 4.3 11.2 38.3% 4.0 78.2 * 70.5 * 81.5 * 04/22/07 Optical Communication Products Inc. Communications Equipment Oplink Communications Inc. 78.7 187.8 41.9% 70.9 19.6 20.4 21.3 02/23/07 Refac Optical Group Specialty Stores Palisade Capital Management LLC 10.7 106.7 10.0% 106.7 50.4 56.3 52.3 02/22/07 Great American Financial Resources Life and Health Insurance American Financial Group Inc. 245.8 1,170.5 21.0% 1,203.3 13.2 15.0 11.8 01/24/07 21st Century Insurance Group Property and Casualty Insurance American International Group, Inc. 806.6 1,935.2 41.7% 2,009.7 34.6 31.2 24.9 12/20/06 Crested Corp. Diversified Metals and Mining US Energy Corp. 12.4 42.8 29.0% 52.6 14.2 13.2 7.8 10/06/06 NetRatings Inc. Internet Software and Services The Nielsen Company B.V. 328.3 757.1 43.4% 610.3 44.0 47.6 41.6 04/27/06 Erie Family Life Insurance Co. Life and Health Insurance Erie Indemnity Co. 75.2 302.4 24.9% 346.9 2.4 1.8 1.6 03/17/06 William Lyon Homes Homebuilding Individual Investor (Company CEO) 245.9 944.7 26.0% 1,858.4 44.3 50.8 27.4 10/07/05 Micro Therapeutics Inc. Healthcare Equipment ev3, Inc. 93.6 312.7 29.9% 309.7 9.8 15.2 7.6 09/06/05 7-Eleven Inc. Food Retail IYG Holding Company 1,182.3 4,330.6 27.3% 5,622.5 6.9 34.7 18.0 04/14/05 Rubicon Medical Corporation Semiconductor Equipment Boston Scientific Corporation 80.6 82.2 50.0% 113.8 -0.7 * 0.7 26.1 01/17/05 Unitedglobalcom Inc. Cable and Satellite Liberty Global Inc. 3,481.4 7,503.0 46.4% 11,508.8 -0.7 * 3.2 1.8 08/02/04 Cox Communications Inc. Broadband Communications Cox Enterprises, Inc. 8,531.9 22,452.4 38.0% 28,999.5 33.2 31.7 32.4 01/15/04 Phosphate Resource Partners LP Fertilizers and Agricultural Chemicals Mosaic Global Holdings Inc. 53.5 110.6 48.4% 684.6 2.7 12.1 24.0 Mean 23.5 % 24.0 % 24.8 % Median 22.1 26.7 25.0 $ in millions except per share data, * Excluded from mean NA – Not available NM – Not meaningful |