UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________

FORM 8-K/A

_________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED):

May 12, 2005

Metaphor Corp.

(EXACT NAME OF REGISTRANT SPECIFIED IN CHARTER)

Nevada | 000-13858 | 86-0214815 |

(STATE OR OTHER JURISDICTION OF INCORPORATION) | (COMMISSION FILE NUMBER) | (IRS EMPLOYER IDENTIFICATION NO.) |

| | |

| | |

580 Second Street, Suite 102 Encinitas, CA (Address of principal executive offices) | 92024 (Zip Code) |

Registrant’s telephone number, including area code: 760-230-2300

________

(Former name or former address, if changed since last report)

________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

£ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

£ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

£ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

£ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement

On May 12, 2005, the Registrant initially entered into a Sale and Purchase Agreement (the “CMN Agreement”) with 8 Holdings LLC, a Colorado limited liability company (“8 Holdings”), Hong Kong Huicong International Group Limited, a British Virgin Islands company (the “CMN Shareholder”), China Media Network International Inc., a British Virgin Islands company (together with its predecessors, “CMN”), and certain key members of management of CMN, which was subsequently superseded by an amended CMN Agreement, dated May 27, 2005, pursuant to which the Registrant is to acquire all of the issued and outstanding shares of stock of CMN (the “Transaction”). As a result of the Transaction, CMN will become a wholly-owned subsidiary of the Registrant. The Registrant is not aware of any arrangements which may at a subsequent date result in a change in control.

A copy of the CMN Agreement was filed with the Current Report on Form 8-K filed on May 24, 2005 and an amended version was filed on a Current Report on Form 8-K filed on August 1, 2005. A more detailed discussion of the Transaction is located in the section entitled “The Proposed Transactions” on page 25 of this Current Report on Form 8-K/A.

OVERVIEW

Introduction

Metaphor Corp. (“we,”“us,” or the “Company”), was originally incorporated in the State of Delaware in 1967 and re-incorporated in the State of Nevada in December 2004. As of January 14, 2003, we ceased all business operations. Since that time it has been our goal to restructure our business by seeking a candidate for merger, share exchange or other corporate transaction.

We have agreed to acquire China Media Network International Inc., a British Virgin Islands company (together with its predecessors, “CMN”).

We decided to pursue the proposed acquisition because we believe that the Chinese television market opportunity, in combination with the strategy and management team at CMN, is very attractive. With approximately 1.2 billion television viewers, China has the world’s largest television audience. According to ZenithOptimedia, China’s television advertising market grew from 1997 to 2003 at a compound annual growth rate of 14.3%, far outpacing the rest of Asia-Pacific, excluding Japan, which grew at 2.6%. In contrast, Japan had negative 1.4% growth during the same period, while North America grew by 4.1% and Europe by 5.4%. According to ZenithOptimedia, the Chinese television advertising market is expected to reach $4.5 billion by 2007, a compound annual growth rate of 10.0% from 2003.

The Chinese television market is currently undergoing significant regulatory reform (see “Business-Regulatory Policies and Foreign Investment”). Many of the services that previously had been controlled entirely by state-owned enterprises are being opened up to commercial competition by private domestic and foreign companies. Foreign operating companies and investors have been allowed to participate to varying degrees in different aspects of the Chinese media industry.

We believe that the liberalization of the regulations governing China’s television industry creates significant opportunities for companies that can improve the efficiencies of broadcasters and meet the needs of television advertisers, particularly in regions of the country where the media market is least developed.

CMN is a media company that provides a variety of services to television stations throughout China, including selling advertising time, recommending and negotiating the purchase of programming content, and raising consumer awareness of programming through promotional campaigns. CMN believes that by working with a number of television stations in its partnership network, it is able to secure better pricing on the sale of advertising airtime and the purchase of other services, make more informed programming recommendations and offer a more compelling product to advertisers than the stations can provide on a stand-alone basis.

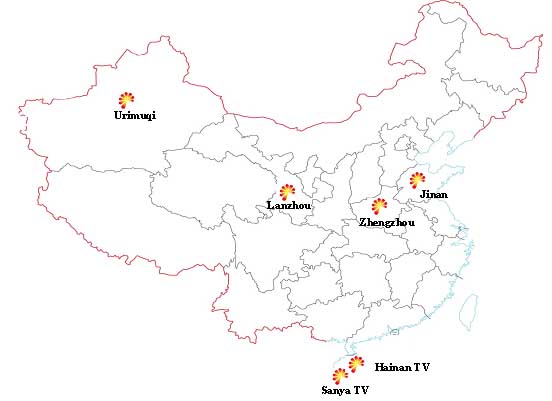

We believe that CMN is a leading provider of outsourced advertising sales services to television stations in China. CMN is currently working with five city and one provincial television station and 16 of their affiliated channels. According to the stations with which CMN works, the markets in which these channels are broadcast have a combined population in excess of 44 million people. In 2004, CMN sold advertising airtime on the channels it represented to more than 875 advertisers, including Coca-Cola, Pepsi, Colgate-Palmolive, Motorola, Unilever, KFC, Intel, Nokia, Procter and Gamble, L’Oreal and Ford.

History of the CMN Business

CMN first started its business in June 2000 by entering into multi-year contractual arrangements with city and provincial television stations, through which CMN obtained exclusive rights to advertising air-time on a number of the stations’ channels in exchange for paying an annual fixed fee. As of August 18, 2005, CMN has built a partnership network covering six television stations, which includes five city and one provincial level television station, and 16 channels affiliated with such television stations in China. CMN intends to continue to grow its business by entering into agreements with an additional eight television stations by the end of 2006.

CMN classifies its six exclusive long-term agreements with television stations into two categories: the contractual model and the joint venture model. Under the contractual model, CMN enters into exclusive long term agreements with television stations and pays fixed fees in exchange for the rights to the advertising airtime for selected channels broadcast by the television stations. Under the joint venture model, CMN forms new joint venture companies with the television stations. The joint venture companies enter into exclusive long term agreements with the television stations and pay fixed fees in exchange for the exclusive rights to the advertising airtime for selected channels broadcast by the television stations. The agreements of the joint venture companies generally have longer terms. CMN is party to the following agreements and participations:

| · | In June 2000, CMN entered into a two-year exclusive contractual agreement with Zhengzhou TV (ZZTV), to sell advertising time on ZZTV’s news and Shangdu (business/metropolitan) channels. This agreement was subsequently amended several times to extend the term. In the most recent December 2004 amendment, CMN extended this agreement on amended terms through December 2007. |

| · | In January 2002, CMN entered into a four-year exclusive contractual agreement with JiNan TV (JNTV), to sell advertising time on JNTV’s news and metropolitan channels. This agreement expires in December 2005. CMN is currently re-negotiating this contract with JNTV. |

| · | In December 2002, CMN entered into a six-year exclusive contractual agreement with Urumqi TV (UTV), to sell advertising time on all six channels operated by UTV. In November 2004, the agreement with UTV was extended to December 2012. |

| · | In April 2003, CMN entered into a five-year exclusive contractual agreement with Lanzhou TV (LTV), to sell advertising time on LTV’s public channel. This agreement expires in December 2008. |

| · | In January 2004, CMN entered into a 15-year exclusive joint venture agreement with LTV to sell advertising time on LTV’s entertainment and sports channel, and its general news channel. This agreement was subsequently replaced by a new agreement with a separate company that CMN formed in March 2004 with LTV. The agreement expires in December 2018. |

| · | In April 2005, CMN entered into a 10-year exclusive contractual agreement with Sanya TV (STV), to sell advertising time on STV’s news channel, and its travel and lifestyle channel. This agreement expires in April 2015. |

| · | In June 2005, CMN entered into a 10-year exclusive joint venture agreement with Hainan TV (HTV), to sell advertising time on HTV’s public channel. This agreement was subsequently replaced by a new agreement with a separate company that CMN formed with HTV. This agreement expires in June 2015. However, the agreement may be extended for an additional twenty-year term, provided that CMN does not breach any of its obligations under the agreement. |

CERTAIN TRANSACTIONS

CMN has entered into various financing arrangements with the CMN Shareholder and 8 Holdings to fund the ongoing costs of its business operations.

| · | In May 2005, 8 Holdings and the CMN Shareholder each made a loan of $362,472 to CMN. We have agreed to repay such loans out of the proceeds of a private placement we intend to conduct which will comprise the sale of shares of our Common Stock, $.001 par value per share (“Common Stock”), and may include the issuance of warrants to purchase our Common Stock (“Financing”). |

| · | As part of the restructuring of the CMN subsidiaries, in June 2005, the CMN Shareholder and Beijing Hehui Chuang Shi Advertising Col, Ltd. (“Beijing Hehui”), an entity controlled by CMN Management, funded an increase in the registered capital of Beijing China Media Network Information Technology Co., Ltd (“CMN Info”), a subsidiary of CMN, in the amount of $2.3 million. In August 2005, CMN Info intends allocate down $304,298 of such registered capital to fund certain contractual obligations of the CMN Subsidiaries. We have agreed to reimburse the full $2.3 million within 20 days after the closing of the Transaction. |

| · | In July 2005, the CMN Shareholder loaned additional funds in the aggregate amount of $304,298 to CMN. We have agreed to repay such loan out of the proceeds of the Financing. |

| · | In August 2005 the Company will transfer $450,000 to CMN to fund CMN’s operations. |

| · | As of the closing of the Transaction, it is expected that CMN will owe RMB 30 million (approximately $3.62 million) in the aggregate to the CMN Shareholder. As a condition to closing the CMN Agreement, we have agreed to enter into a five year term loan agreement to repay the CMN Shareholder such amounts owed. |

RISK FACTORS

THE FOLLOWING MATTERS, AMONG OTHERS, MAY HAVE A MATERIAL ADVERSE EFFECT ON OUR BUSINESS, FINANCIAL CONDITION, LIQUIDITY, RESULTS OF OPERATIONS OR PROSPECTS, FINANCIAL OR OTHERWISE. REFERENCE TO THIS CAUTIONARY STATEMENT IN THE CONTEXT OF A FORWARD-LOOKING STATEMENT OR STATEMENTS SHALL BE DEEMED TO BE A STATEMENT THAT ANY ONE OR MORE OF THE FOLLOWING FACTORS MAY CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE IN SUCH FORWARD-LOOKING STATEMENT OR STATEMENTS.

RISKS RELATED TO OUR BUSINESS

The closing of the Transaction under the CMN Agreement requires that we have at least $10 million in cash which we intend to raise through the Financing.

We are obligated under the CMN Agreement to have at least $10 million in cash in our bank account (net of a required payment of $3.785 million to the CMN Shareholder pursuant to the terms of the CMN Agreement) on or prior to closing of the Transaction, which we intend to raise through the Financing. Since the securities will be sold in the Financing pursuant to an exemption from registration, we are limited to selling to accredited investors. Currently, we are seeking financing from institutional and accredited investors with the expectation that we will be able to sell securities to secure the additional funds. Although we expect to be successful in these efforts, there is no guarantee that we will have sufficient investor interest, or that we will be able to sell the shares at a price that will generate adequate net proceeds. If we are unable to achieve this cash balance in the time period required under the CMN Agreement, the Transaction will not close, which will have a serious negative impact on our current business plan and future growth.

The restructuring of CMN may not be approved by the relevant Chinese governmental authorities, in which case it may be difficult, if not impossible, to complete the Transaction.

Prior to the closing of Transaction, CMN will restructure (the “Restructuring”) the corporate organization of its operating subsidiaries in the People’s Republic of China (“PRC”) engaged in the television advertising business (the "CMN Subsidiaries"). The Restructuring is subject to the approval of the PRC regulatory authorities at several levels. To date, CMN has received from the Beijing Municipal Administrative Bureau for Industry and Commerce (“BMAB”) the approval of the business license of CMN Info, which upon completion of the Restructuring will be the direct subsidiary in China of CMN.

The Restructuring is contingent upon the following additional approvals of applicable PRC regulatory authorities:

| · | As part of the regulatory process, the BMAB may initiate an inquiry in order to determine whether the business operations of Beijing China Media Network Dian Guang Ke Ji Co., Ltd. (“CMN DG”), which is the direct subsidiary of CMN Info, are within the scope of those industries restricting foreign investment. CMN may be required to submit a statement with respect to the business operations of CMN DG to complete the applicable business license change registration procedures; and |

| · | The ownership structure of CMN and its affiliated companies will have to be approved by the PRC State Administration of Foreign Exchange (“SAFE”), which is the primary regulator of the foreign exchange laws in China. |

There can be no assurance that CMN will not have to seek further approvals from the foregoing governmental agencies or any other agency or that any such licenses and approvals will be granted on a timely basis, if at all. If the Restructuring is not approved by the relevant governmental authorities, it may be difficult, if not impossible, to complete the Transaction.

Foreign investment in the advertising industry in China is subject to a number of restrictions, and the structure of CMN could be deemed in violation of such restrictions either before or after the completion of the Transaction.

Chinese regulations currently limit foreign ownership of Chinese advertising companies to 70% and require foreign owners to have at least two years of direct operations in the advertising industry outside of China. After December 10, 2005, foreign investors will be allowed to acquire 100% of Chinese advertising companies, provided the foreign investors have at least three years of direct operations in the advertising industry outside of China. The State Administration for Industry and Commerce (“SAIC”), which is the primary regulator of the advertising industry, has orally informed our Chinese counsel, Jun He Law Offices, that the type of structure which CMN has before and after the Restructuring (and our structure after the Transaction) will not constitute a violation of applicable laws in the advertising industry. This conclusion is based on SAIC’s interpretation of certain of its rules that there is no restriction on the proportion of investment contribution by a foreign-invested PRC enterprise investing in the advertising industry or a requirement for previous operational experience. In our case, CMN, although a foreign company, is the direct investor in CMN Info, which does not itself operate an advertising business. In turn, CMN Info, which is a foreign-invested entity, is the direct investor in CMN DG, which also does not itself operate an advertising business. At the lower level of CMN’s corporate structure, CMN DG, which is a domestic Chinese company, is the investor in various advertising companies.

The written rules and policies applicable to foreign investment in the advertising industry in China are not, however, clear in this regard, and the SAIC may change its interpretation at any time without warning to us or CMN, even if the Restructuring and the Transaction receive appropriate governmental approvals. If the SAIC were to take the position that our corporate structure does involve foreign investment into the advertising industry, we could be deemed to be in violation of Chinese law because we may own more than 70% of various CMN operating companies before December 10, 2005 and neither our company nor CMN has the requisite overseas advertising experience. In that case, we could also be deemed to have violated Chinese law as a result of CMN’s structure prior to the Restructuring.

In addition, China may also enact laws which reverse recently enacted laws and prohibit or further restrict foreign ownership in the advertising industry or severely limit the ways in which companies in such industries may operate. Furthermore, many of the rules and regulations that we may face may not be explicitly communicated, and there may be uncertainties regarding proper interpretations of current and future laws and regulations in China. All of these factors could severely impair the operations of our Chinese operating companies. If we are found to be in violation of any existing or future Chinese laws or regulations, or fail to obtain or maintain any of the required permits or approvals, the relevant Chinese regulatory authorities, including the SAIC, would have broad discretion in dealing with such violations, including authority to:

| · | revoke the business and operating licenses of our operating companies; |

| · | discontinue or restrict the operations of our operating companies; |

| · | impose conditions or requirements with which we may not be able to comply; |

| · | require us to restructure the relevant ownership structure; or |

| · | unwind the Restructuring and/or the Transaction. |

The imposition of any of these penalties would result in a material and adverse effect on our ability to conduct our business following the Transaction.

The Chinese government has recently strengthened the regulation of investments made by Chinese residents in offshore companies and reinvestments in China made by these offshore companies. We may not be able to obtain the requisite approvals in connection with the Restructuring, the Transaction or in any future transaction.

The State Development and Reform Commission and the SAFE have recently adopted new regulations that will require registration with, and approval from, Chinese government authorities in connection with direct or indirect offshore investment activities by Chinese residents. The SAFE regulations retroactively require registration of investments in non-Chinese companies previously made by Chinese residents. In particular, the SAFE regulations require Chinese residents to file with SAFE information about offshore companies in which they have directly or indirectly invested and to make follow-up filings in connection with certain material transactions involving such offshore companies, such as mergers, acquisitions, capital increases and decreases, external equity investments or equity transfers. In addition, Chinese residents must obtain approval from SAFE before they transfer domestic assets or equity interests in exchange for equity or other property rights in an offshore company. A newly established enterprise in China which receives foreign investments is also now required to provide detailed information about its controlling shareholders and to certify whether it is directly or indirectly controlled by a domestic entity or resident.

In the event that a Chinese shareholder with a direct or indirect stake in an offshore parent company fails to make the required SAFE registration, the Chinese subsidiaries of such offshore parent company may be prohibited from making distributions of profit to the offshore parent and from paying the offshore parent proceeds from any reduction in capital, share transfer or liquidation in respect of the Chinese subsidiaries. Further, failure to comply with the various SAFE registration requirements described above can result in liability under Chinese law for foreign exchange evasion.

These regulations may have a significant impact on our present and future structuring and investment. Following our inquiries with SAFE, we have been informed that internal implementing guidelines have yet to be issued so that details about the application and filing process can be clarified. We intend to take all necessary measures for ensuring that all required applications and filings will be duly made and all other requirements will be met. We further intend to structure and execute our future offshore acquisitions in a manner consistent with the new regulations and any other relevant legislation. However, because it is presently uncertain how the SAFE regulations, and any future legislation concerning offshore or cross-border transactions, will be interpreted and implemented by the relevant government authorities, we cannot provide any assurances that we will be able to comply with, qualify under, or obtain any approvals required by the regulations or other legislation. Our inability to secure required approvals or registrations may prevent the completion of the Restructuring and the Transaction. The SAFE regulations could also subject us to legal sanctions, restrict our ability to pay dividends from any Chinese subsidiaries to our offshore holding company, and restrict our overseas or cross-border investment activities or affect our ownership structure if we fail to fully comply with them.

If existing laws and regulations in China or the way they are interpreted change, we might be unable to operate our business following the Transaction.

There is substantial uncertainty regarding the interpretation, application and future direction of existing laws and regulations related to foreign investment in the advertising industry in China. For example, under current Chinese regulations, radio and television stations are not permitted to rent their channels to foreign entities or to cooperate with foreign entities in joint ventures or cooperative projects to manage radio or television channels. While we do not believe that these regulations would be applicable to CMN’s business (or our business following the Transaction), it is possible that the relevant governmental authorities could have a different interpretation, which could severely impact our business. Moreover, if the current laws and regulations in China change, we may not be able to operate our business as we expect to conduct it, which could adversely impact our operations and financial condition.

CMN derives its revenues solely from the sale of advertising time, and advertising is particularly sensitive to changes in economic conditions.

CMN’s results of operations rely solely on advertising revenue, and demand for advertising is affected by prevailing general economic conditions. Adverse economic conditions generally, and any downturns in the economy in the PRC, are likely to negatively impact the advertising industry, causing advertisers to reduce the money they spend on purchasing advertising time. Any such declines in the level of business activity of CMN’s advertising customers may also have a material adverse effect on CMN’s revenues and results of operations. Although recently there has been significant growth in the PRC economy, there can be no assurance that this trend will continue or that any such improvement in general economic conditions will generate increased advertising revenue. Global and local downturns in the general economic environment may cause CMN’s advertising customers to reduce the amounts they spend on advertising, which could result in a decrease in demand for advertising airtime with the television stations with which CMN works. This could adversely affect CMN’s business, financial condition, results of operations and cash flow.

CMN suffered net losses in the first quarter ended March 31, 2005, and may experience future losses as it continues to implement its growth plan.

CMN had net losses of $1.06 million for the first quarter ended March 31, 2005 and expects to continue to incur net losses at least through 2007. These net losses for the first quarter ended March 31, 2005 were primarily attributable to the reduction in revenue for ZZTV and JNTV, which was mainly driven by a drop in the overall program ratings, and increased costs of revenue relating to the costs of advertising airtime and ratings data. As CMN continues to enter into contractual relationships with new television stations to implement its growth plan, it will incur additional costs and expenses, which may increase net loss in the future, if revenues do not increase.

CMN’s quarterly operating results are difficult to predict and may fluctuate significantly from period to period in the future.

CMN’s quarterly operating results are difficult to predict and may fluctuate significantly from period to period based on a variety of factors, including seasonality of consumer spending, corresponding advertising trends in the PRC and the ratings that the television channels with which CMN works receive. In addition, advertising spending generally tends to decrease during January and February each year due to the Chinese Lunar New Year holiday. As a result, you may not be able to rely on period to period comparisons of CMN’s operating results as an indication of future performance. Factors that are likely to cause CMN’s operating results to fluctuate, such as the seasonality of advertising spending in China, a deterioration of economic conditions in China and potential changes to the regulation of the advertising industry in China, are discussed elsewhere in this Current Report on Form 8-K/A. Ratings received for daily programming on a television station are a significant factor in the amount of revenues CMN generates on a quarterly basis. The impact of ratings on revenues is not immediately reflected in CMN’s financials. There may be a two to three month time lag after ratings are obtained before CMN sees an impact on its revenues. If CMN’s revenues for a particular quarter are lower than expected, CMN may be unable to reduce its operating expenses for that quarter by a corresponding amount due to the fixed nature of these expenses, which would harm its operating results for that quarter relative to operating results from other quarters.

CMN’s operating results are dependent on the importance of television as an advertising medium.

CMN generates all of its revenues from the sale of advertising airtime on the television channels with which it works. In the advertising market, television competes with various other advertising media, such as print, radio, the internet and outdoor advertising. In the PRC, television constitutes the single largest component of all advertising spending. There can be no assurances that the television advertising market will maintain its current position among advertising media or that changes in the regulatory environment will not favor other advertising media or other television broadcasters. Increases in competition arising from the development of new forms of advertising media could have an adverse effect on CMN’s maintaining and developing its advertising revenues and, as a result, on its results of operations and cash flows.

CMN’s advertising revenues depend on the technical reach of television stations within its partnership network, the pricing of advertising time, television viewing levels, changes in audience preferences, shifts in population, technological developments relating to media and broadcasting, competition from other broadcasters and other media operators, and seasonal trends in the advertising markets in China in which we operate. There can be no assurance that CMN will be able to continue to respond successfully to such developments. Any decline in the appeal of television generally or of the television channels with which CMN works, specifically, whether as a result of the growth in popularity of other forms of media or a decline in the attractiveness of television as an advertising medium, could have a material adverse effect on CMN’s results of operations and cash flows.

CMN’s profitability is highly dependent on the program ratings received by the channel with which it works.

In general, viewer interest in programming offered on a television channel determines the audience ratings a channel receives. Ratings are a significant factor in the amount of revenues CMN generates as ratings impact the pricing that CMN can charge to its advertisers. Because television stations generally make the final decision as to which programs they will broadcast, if the television stations choose poor quality programming, or due to competitive forces are unable to secure popular programs, their channel ratings could be negatively affected. The failure by the television stations to achieve good ratings for their programs could have a material adverse affect on the profitability of CMN.

If CMN fails to generate sufficient annual advertisement income to cover the annual charges paid to the television stations, CMN will suffer a loss.

In each of CMN’s agreements, CMN is required to pay annual charges for the entirety of the advertising airtime to the television station. Further, an escalation clause in some of the agreements provides for an increase between 5% and 15% in the annual charges every year, commencing after the first year of the term of the agreement. Under certain agreements CMN is also required to pay a deposit to the television station to cover the annual charges. If for any reason there is a slow down in sales or if CMN fails to generate new business to cover the annual charges paid to the television stations, CMN will suffer a loss that could have a negative effect on CMN’s financial condition and results of operations.

Loss of contractual agreements or significant increases in fees to be paid under the contracts may adversely affect CMN’s profits.

CMN’s revenue is derived from the sale of advertising airtime on selected channels broadcast by the six televisions stations in its partnership network. CMN’s contractual agreements expire between 2005 and 2018. These contracts are not automatically renewable. CMN’s agreement with JNTV which generated approximately 38% of its revenue for the year ended 2004 is due to expire in December 2005. CMN is currently negotiating to extend or enter into a new agreement with JNTV. CMN cannot guarantee that the television stations will renew the agreements, or that if renewed, the terms of the agreements will be favorable to CMN. CMN faces the risk that the renewal terms will substantially increase the annual fixed charges to be paid to the television stations. Further, the television stations are permitted to terminate the agreements prior to expiration although they would be required to pay CMN a termination fee. Any failure to renew the JNTV agreement or the other CMN agreements, the termination of any agreements prior to expiration, or a significant increase in fixed charges payable under the renewal terms could significantly adversely affect CMN’s profits and have a material adverse effect on its operations.

The television advertising arrangements entered into by CMN’s Subsidiaries and their predecessors in the past may be treated as breaches of the relevant PRC laws and regulations.

Prior to April 2003, the agreements entered into by the CMN Subsidiaries, and their predecessors, and each of ZZTV, JNTV, UTV and LTV specified a purchase and sub-sale arrangement. Before and after 2003, some predecessor companies of the CMN Subsidiaries and some CMN Subsidiaries entered into agreements with other local advertising companies authorizing such local advertising operators to solicit advertisers for certain portions of advertising airtime and collecting fixed amounts from the local operators. Such arrangement may be considered to be in breach of (i) the Reply to Question Concerning Whether Buy-Out and Assignment with Consideration of Advertising Media Constitute Illegal Business Operation issued by the SAIC on February 9, 1999 and (ii) the Reply to Questions Concerning the Contracting or Buy-Out of Advertising Media by Advertising Companies as a Fully Authorized Agent to Engage in Advertising Business in a Territory other than their own Territory issued by the SAIC on January 4, 1999 (the “Replies”) which prohibit the sub-sale of advertising time-slots. The CMN Subsidiaries could be fined up to $36,000 and the business or operating licenses of the CMN Subsidiaries could be revoked pursuant to Article 71 of the Company Registration Administration Regulations. Prior to January 1, 2005, the CMN Subsidiaries’ gross profits derived from such arrangements could be confiscated pursuant to Article 21 of the then applicable Implementation Rules of Advertising Administrative Regulations due to the activities of the CMN Subsidiaries and their predecessor companies. After January 1, 2005, however, it is unlikely that the SAIC will impose confiscation of such profits, although the relevant risk still exists because the CMN Subsidiaries are governed by different local branches of SAIC which may have different practices. The aggregate gross profit generated from such arrangements of all CMN Subsidiaries, as applicable, for the years ended December 31, 2003 and 2004 and for the three months ended March 31, 2005 are approximately $529,000, $475,000 and $63,000 respectively.

If the CMN Subsidiaries are unable to operate under the current contractual agreements that they have entered into with relevant provincial and city Television stations, they may have to enter into alternate arrangements with such Television stations which could be less favorable to the CMN Subsidiaries.

The CMN Subsidiaries have entered into new arrangements with the television stations which CMN believes comply with the Replies. These new contracts continue to require the payment of annual committed sums to the television stations. Consequently in the performance of these new contracts, the CMN Subsidiaries solicit and bill advertisers or advertising agencies for the airtime used directly. In the event that these amended agreements do not comply with the Replies, CMN’s Subsidiaries will have to enter into alternate arrangements to provide their services to their respective local television stations, which could result in their having to accept less favorable terms in such arrangements. In addition, CMN may be subject to certain fines and penalties in such instances.

The revision of agreements entered into between the CMN Subsidiaries and other local advertising operators may still be deemed as in violation of Replies, which may adversely impact the CMN Subsidiaries’ capacity to develop advertising clients.

The CMN Subsidiaries intend to enter into new agency agreements with other local advertising companies pursuant to which such local advertising companies act as the agents of the CMN Subsidiaries to develop advertising clients and collect agency fees and/or performance awards. Although CMN believes that these agreements comply with the Replies, there can be no guarantee that the SAIC will not determine otherwise. In the event that this arrangement does not comply with the Replies, the CMN Subsidiaries may be subject to penalties, confiscation of profits arising therefrom and revocation of businesses or operating licenses as mentioned above, and the CMN Subsidiaries will have to develop their business by themselves without any assistance of other advertising operators, which may adversely affect their capacity to pursue potential advertisers.

The expansion of CMN’s business into new markets is costly and such expansion may not enhance CMN’s financial condition.

CMN’s growth strategy is to build a nationwide partnership network of television stations in the PRC by identifying television stations in new cities and provinces, and entering into agreements with these stations. In particular, CMN intends to continue to grow its business by entering into agreements with an additional eight television stations by the end of 2006. CMN’s ability to execute its growth plan depends on the co-operation and willingness of additional television station broadcasters to do business with CMN. CMN may be unable to successfully identify or form such relationships with new television stations, or do so on terms acceptable to it. Even if it is able to identify a potential partner, the resources expended to enter into an agreement with the station may be significant and may require significant attention from management. In addition, if CMN does enter new markets, there can be no assurance that CMN will be able to adequately manage its growth. If CMN’s market research is not accurate and/or the economic benefit of entering into these arrangements is not realized, CMN will have increased operating expenses, but may not generate increased revenues as anticipated, which could have a material and adverse effect on CMN’s operating results.

CMN’s success is highly dependent upon the continuing service of certain key members of the management team CMN will form upon completion of the Transaction.

Competition in the industry for executive-level personnel is strong, and recruiting, training, and keeping qualified key personnel with both technical and market expertise are important factors in our ongoing success and survival. The proposed Board of Directors and certain members of our management team have limited experience in the PRC advertising and media industries. Further certain members of our management team will not be located in the PRC on a full-time basis. Therefore, we will rely heavily on the services of Mr. Wu Xian, who will become our President, and Mr. Qizhi Shen, who will become our Chief Operating Officer upon completion of the Transaction. Each of these persons has previous experience in these industries, and specifically, with CMN and its subsidiaries in operating this business. Messrs. Wu and Shen have entered into employment agreements with CMN that are contingent upon completion of the Transaction and will be employed on a full-time basis. Should Messrs. Wu or Shen leave, we may lose both an important internal asset, and the television stations with which we work may not want to extend or re-negotiate existing agreements.

After the closing of the Transaction, we will have all new executive officers who have not worked together for a long period of time, which may make it difficult for you to evaluate their effectiveness and ability to address challenges.

Our management team will consist of all new executive officers after the closing of the Transaction. Although Messrs. Wu and Shen have worked together for CMN, our proposed chief executive officer and chief financial officer have worked together and with Messrs. Wu and Shen for a relatively short period of time in anticipation of the closing of the Transaction. As a result of these circumstances, it may be difficult to evaluate the effectiveness of our executive officers and their ability to address future challenges to our business.

We may need to raise additional capital and may not be able to obtain it, which could adversely affect our liquidity and financial position.

CMN believes that its current cash and cash equivalents, cash flow from operations and the proceeds from the Financing, will be sufficient to meet its anticipated cash needs including for working capital and capital expenditure, for the next 12 to 15 months. CMN may, however, require additional cash resources for the implementation and continuation of its growth plans and for other future developments. In the future we may seek to raise additional funds through public or private financing, which may include the sale of equity or debt securities, including securities convertible into, or exchangeable for, our Common Stock or obtain a credit facility. There is no guarantee that we will be able to enter into agreements to obtain such financing, or if such financing is available, that the terms will be favorable to us. The issuance, conversion or exchange of equity or debt securities could result in dilution to our stockholders. The incurrence of indebtedness would result in increased debt service obligations and could result in operating and financing covenants that would restrict our operations and liquidity. Further, if we are unable to repay such debt obligations when due we would be in default under our debt documents, which could trigger severe penalties. If we are unable to raise capital on terms favorable to us when needed, our business growth strategy may slow, which could severely limit our ability to increase revenue and could have a material adverse effect on our liquidity and financial condition.

Internal controls of the CMN’s Subsidiaries may be non-existent or inadequate under US regulatory standards.

The CMN Subsidiaries comprised one business segment of their previous parent company. Due to the corporate structure of their previous parent, many of the administrative, accounting, legal and other functions requiring the establishment and enforcement of internal control systems were maintained and carried out by the parent for all of its subsidiaries’ businesses. Accordingly, CMN’s Subsidiaries may not have previously established any of their own internal controls, or if so, such controls may be inadequate under US securities law standards. The process to establish internal controls and train personnel to adhere to such controls may be time-consuming and costly.

Our new management team has limited experience operating a U.S. public company.

The members of our new management team are currently making efforts to familiarize themselves with the relevant securities laws, rules and regulations and market practice to operate a U.S. public company. The process to master relevant knowledge and skills to operate the Company may be lengthy. As a result, the disclosure controls and procedures, and internal controls over financial reporting may initially be deficient, which could result in delays in filing reports required by the Securities and Exchange Commission.

CMN has not complied with all applicable PRC labor laws.

There are certain laws, rules and regulations in the PRC governing employment matters and which, among other things, require an employer to set up and make contributions to social insurances and other public funds on behalf of its employees. CMN has advised us that it has failed to make timely contributions to certain of these social insurances and funds. As a result of CMN’s failure to make such timely contributions, PRC authorities may impose a penalty and/or, in certain instances, CMN may be required to compensate the employee for the failure to make such contributions. In addition, there are also rules and regulations in the PRC governing certain terms of the employment relationship between a company and its respective employees. Upon a review of CMN’s standard labor contract, internal rules and employee manual, our PRC counsel has advised us that CMN’s practices were not uniformly consistent with the applicable rules and regulations, which could result in CMN being obligated to pay certain amounts of compensation to the relevant employees if they so claim.

RISKS RELATED TO OUR INDUSTRY

Advertising is subject to extensive government content regulations in the PRC, which could adversely affect CMN’s business.

As a company in the business of selling television advertising airtime, CMN’s subsidiaries are subject to the regulatory requirements of the PRC. The Advertising Law is the major law in the PRC governing the conduct of advertising activities in the PRC. The Advertising Law prohibits the dissemination of false, deceptive, misleading and unfair advertising, as well as advertising that harms the public interest or is contrary to the PRC government’s social, cultural or political policy. SAIC as primary regulator of the advertising industry, has enforcement powers to impose civil penalties, consumer redress, injunctive relief and other remedies upon advertisers and other companies engaged in advertising activities. The SAIC, as well as other administrative authorities, can also impose restrictions on all advertisements within a certain sector or industry. For example, within the television industry in August 2004, the State Administration of Radio, Film and Television (“SARFT”) passed regulations forbidding certain healthcare advertisements from being aired. In addition, applicable PRC regulations require that all advertisements relating to pharmaceuticals, medical instruments, agrochemicals and veterinary pharmaceuticals be submitted to the relevant administrative authorities for content approval prior to dissemination. There is no guarantee that in the future new regulations may prohibit or otherwise restrict the advertising of products or services in other sectors. Advertisers, advertising agencies and companies that engage in advertising activities are liable for the accuracy of the content of advertisements and they have to ensure that the advertised products, activities and services are in full compliance with applicable law.

If CMN is found to be in breach of these requirements, CMN could be subject to liability and penalties under the Advertising Law. These penalties include fines, confiscation of profits derived from such activities, orders to cease the dissemination of the advertisement and orders to publish an advertisement correcting the misleading information. If the case is very serious, the SAIC may revoke the advertising business license of the offending party. Any such enforcement action by the SAIC whether or not it is ultimately successful could distract management’s attention and have a material adverse effect on CMN’s business and financial condition or results of operations.

CMN’s business operations may be affected by legislative or regulatory changes in China.

Relevant Chinese government authorities are currently considering adopting new regulations that may influence various aspects of the advertising and media industry and we cannot predict the timing and effects of any new regulations. Because laws and regulations governing the advertising and media industry in China change frequently we also cannot predict the ultimate cost of complying with these requirements, or the impact of these requirements on our business. Changes in laws and regulations governing the content of advertising, business licensing or otherwise affecting the advertising and media industry in China may materially and adversely affect our results of operations, business or prospects.

Reductions in the amount of daily programming time offered by the television stations within CMN’s partnership network, may have a negative impact on the amount of effective advertising airtime CMN is able to sell.

In January 2004, Rule No. 17 “Provisional Administrative Rules on Broadcast of Advertisements via Radio and Television” issued by SARFT went into effect. Rule No. 17 implements more detailed regulations on the amount of advertising airtime available for television stations based on the amount of such television station’s daily programming time, and puts further restrictions on the type of advertisements that can be shown during specified hours of the day and the frequency that certain advertisements can be shown during the course of a day. CMN’s revenues are directly impacted by the effective amount of airtime available for sale by the television stations in its partnership network. Due to Rule No. 17, certain television stations’ daily hours of programming have been reduced. There can be no assurance that there will not be other rules enacted which are similar to Rule No. 17 and have the effect of further limiting advertising airtime that can be sold. Rule No. 17 and any other similar rules could have a negative impact on the amount of revenue that CMN generates.

CMN’s activities could be deemed to involve the operation of television channels which could subject it to various restrictions and penalties.

In July 2005, SARFT implemented a new rule prohibiting foreign parties from, among other things, conducting domestic channel operations. In addition, television stations are not permitted to rent their channels to foreign entities or to cooperate with foreign entities in joint ventures or cooperate projects to manage or control radio or television channels. In the event local television stations rely on, or through cooperative arrangements conduct, channel operations with foreign parties, such activities will be terminated and penalties may be imposed. SARFT will not only review underlying contracts governing such relationships, but will review daily operations in order to ensure that channel operation is being implemented by a domestic entity in lieu of a foreign one. There can be no assurance that SARFT will not review CMN’s operations or that it will render a conclusion favorable to CMN with regard to channel operations.

Outsourcing the sale of television airtime is a new and evolving business, and remains subject to potential change.

Traditionally, television stations in China have used internal sales forces to sell their advertising airtime. There is currently a trend toward outsourcing this function in an effort to improve operating efficiencies. CMN’s ability to continue to generate revenue depends upon the demand for CMN’s services by television stations. An economic downturn, or a slowdown or reversal of the tendency to rely on outsourcing could have a material adverse effect on CMN’s business, results of operations and financial condition.

The television stations CMN does business with face competition from local broadcasters and national broadcasters for audience ratings.

The television stations in CMN’s partnership network directly compete for audience ratings with approximately 25 television broadcasters and their respective channels in various regional markets in China, which include the capital cities of the Henan, Shandong, Xinjiang and Gansu provinces and in Hainan province. The television stations in CMN’s partnership network also compete with CCTV, a national broadcaster, that is the only station mandated by the government to have some of its channels carried on cable systems, resulting in its dominating market share in China. Further, the government can dictate that the best programming be allotted to CCTV television channels, which could negatively affect ratings for other television broadcasters. Although we believe that the television stations with which CMN works within the capital cities of the Henan, Shandong, Xinjiang and Gansu provinces, and in Hainan province in China carry content that generally appeals to local viewers, they do not have extensive coverage like CCTV. Reductions in audience ratings, caused by competition or other factors, could have a negative impact on the advertising revenue that CMN generates.

If CMN does not compete successfully against new and existing competitors, it may lose market share, and its profitability may be adversely affected.

CMN directly competes with other companies that sell television advertising time, including, but not limited to, other television broadcasters and certain programming companies. Recently, there has been an increase in the number of independent programming companies that sell advertising airtime on the programs that they distribute to broadcasters. Although as part of its business growth strategy, CMN may seek to partner with certain of these programming companies, there is no guarantee that these companies would be willing to enter into such arrangements with CMN on terms acceptable to them, if at all, and if they choose not to partner with CMN they may remain as CMN’s competitors.

CMN also may face competition in the future from new entrants in this sector of the advertising industry. Increased competition could reduce CMN’s operating margins and profitability and result in a loss of market share. Some of CMN’s competitors may have significantly greater financial, marketing or other resources than does CMN. Moreover, increased competition would provide advertisers with a wider range of advertising service alternatives, which could lead to lower prices and decreased revenues, gross margins and profits.

RISKS ASSOCIATED WITH DOING BUSINESS IN GREATER CHINA

Currently, all of CMN’s subsidiaries’ assets are located in China and all of its revenue is derived from operations in China and is denominated in Renminbi. Accordingly, the financial condition and results of operations are subject to a significant degree to economic, political and legal developments in China.

Political and economic policies of the PRC government could affect our business.

The economy of China differs from the economies of most developed countries belonging to the Organization for Economic Cooperation and Development in a number of respects, including:

| · | level of governmental involvement; |

| · | level of capital reinvestment; |

| · | control of capital reinvestment; |

| · | control of foreign exchange; and |

| · | allocation of resources. |

Before its adoption of reform and open-door policies beginning in 1978, China was primarily a planned economy. Since that time, the PRC government has been reforming China’s economic system and in recent years has also begun reforming the government structure. These reforms have resulted in significant economic growth and social progress. Although the PRC government still owns a significant portion of the productive assets in the PRC, economic reform policies since the late 1970’s have emphasized autonomy of enterprises and the utilization of market mechanisms. Although we believe that these reforms will have a positive effect on CMN’s overall and long-term development, we cannot predict whether certain changes to China’s political, economic and social conditions, laws, regulations and policies will have any material adverse effect on current or future business, financial condition or results of operations.

Deterioration of China’s political relations with the United States, Europe or other Asian nations could make Chinese businesses less attractive as investments to Western investors.

The relationship between the United States and the China is subject to sudden fluctuation and periodic tension. Changes in political conditions in China and changes in the state of foreign relations are difficult to predict and could adversely affect our operations or cause potential target businesses or services to become less attractive. This could lead to a decline in our profitability. Any weakening of relations between the United States, Europe or other Asian nations and China could have a material adverse effect on CMN’s operations.

Restrictions on foreign currency exchange may limit our ability to obtain foreign currency or to utilize our revenues effectively.

Currently, the Renminbi is not a freely convertible currency. As CMN receives substantially all of its revenues in Renminbi, restrictions on foreign currency exchange may affect us because a portion of CMN’s Renminbi revenues may need to be converted primarily into US dollars to meet foreign currency obligations, including payment of any dividends.

The principal regulation governing foreign currency exchange in China is the Foreign Currency Administration Rules (1996), as amended. Under the Rules, we may undertake current account foreign exchange transactions without prior approval from SAFE. Current account transactions refer to international revenue and expenditures that occur on a current basis, such as trade and service related foreign exchange transactions, and the declaration and payment of dividends. Foreign exchange for current account transactions can be obtained by procuring commercial documents evidencing such transactions, provided that the transactions must be processed through PRC banks licensed to engage in foreign exchange.

For foreign exchange capital account transactions, however, prior approval of the SAFE must be obtained. Capital account transactions refer to international revenue and expenditures resulting in increases or reductions in debt and equity, such as direct investment, various types of loans and investments in securities.

We cannot assure you that sufficient amounts of foreign currency will always be available to enable us to meet our foreign currency obligations, whether to pay foreign currency denominated indebtedness, or to remit revenues out of the PRC. Also, the CMN Subsidiaries may not be able to obtain sufficient foreign currency to pay dividends to us or to satisfy their foreign exchange requirements. Since foreign exchange transactions under the capital account are still subject to limitations and require approval from the SAFE, this could affect our ability to obtain foreign exchange through debt or equity financing, including by means of loans or capital contributions from us to our subsidiaries. These limitations on the free flow of funds between us and the CMN Subsidiaries may restrict our ability to act in response to changing market conditions. We also cannot assure you that the PRC governmental authorities will not impose further restrictions on the convertibility of Renminbi.

The ability of the CMN Subsidiaries to make dividend payments to us may be restricted by or limited by certain laws and regulations.

The CMN Subsidiaries are required, where applicable, to allocate a portion of their net profit to certain funds before distributing dividends, including at least 10% of their net profit to certain reserve funds until the balance of such fund has reached 50% of their registered capital, and an additional 5% to 10% of their net profits to a statutory common welfare fund. These reserves can only be used for specific purposes and are not distributable as dividends. The net profit available for distribution from the CMN Subsidiaries is determined in accordance with generally accepted accounting principles in China, which may materially differ from a determination performed in accordance with U.S. GAAP. As a result, we may not receive sufficient distributions or other payments from these entities to enable us to make dividend distributions to our shareholders in the future, even if our U.S. GAAP financial statements indicate that our operations have been profitable.

Fluctuations in the value of the Chinese Renminbi relative to foreign currencies could affect CMN’s financial condition, results of operations and the price of our Common Stock.

CMN’s revenue, and a majority of CMN’s other costs of non-United States operations are denominated in Chinese Renminbi. The value of the Renminbi against the U.S. dollar and other currencies may fluctuate and is affected by, among other things, changes in China’s political and economic conditions. The Chinese government recently announced that it is pegging the exchange rate of the Chinese Renminbi against a number of currencies, rather than just the U.S. dollar. As our operations are only in China, any significant revaluation of the Chinese Renminbi may materially and adversely affect our cash flows, revenues and financial condition. For example, to the extent that we need to convert United States dollars into Chinese Renminbi for CMN’s operations, appreciation of this currency against the United States dollar could have a material adverse effect on our business, financial condition and results of operations. Conversely, if we decide to convert CMN’s Chinese Renminbi into United States dollars for other business purposes and the United States dollar appreciates against this currency, the United States dollar equivalent of the Chinese Renminbi we convert would be reduced.

The legal system in China has inherent uncertainties that may limit the legal protections available to you as an investor or to us in the event of any claims or disputes with third parties.

The legal system in China is based on written statutes. Prior court decisions may be cited for reference but have limited precedential value. Since 1979, the central government has promulgated laws and regulations dealing with economic matters such as foreign investment, corporate organization and governance, commerce, taxation and trade. As China’s foreign investment laws and regulations are relatively new and the legal system is still evolving, the interpretation of many laws, regulations and rules is not always uniform and enforcement of many laws, regulations and rules involve uncertainties, which may limit the remedies available in the event of any claims or disputes with third parties. In addition, any litigation in China may be protracted and result in substantial costs and diversion of resources and management attention.

CMN may be subject to, and may expend significant resources in defending against, government actions and civil suits based on the content of the advertisements aired on the television stations within its partnership network.

PRC advertising laws and regulations require advertisers, advertising operators and advertising distributors, including businesses such as CMN’s, to ensure that the content of the advertisements aired on the television stations with which it works are fair and accurate and are in full compliance with applicable law. Violation of these laws or regulations may result in penalties, including fines, confiscation of advertising fees, orders to cease dissemination of the advertisements and orders to publish an advertisement correcting the misleading information. In circumstances involving serious violations, the PRC government may revoke a violator’s license for advertising business operations. CMN is obligated under PRC laws and regulations to monitor the advertising content that is shown on the television stations within its partnership network for compliance with applicable law. CMN endeavors to comply, and encourages its advertising clients to comply, with the laws and regulations on content. However, we cannot assure you that each advertisement an advertising agency or client provides to CMN which a television station airs is in compliance with relevant PRC advertising laws and regulations. Moreover, civil claims may be filed against us for fraud, defamation, subversion, negligence, copyright or trademark infringement or other violations due to the nature of the information displayed on the television channels that are part of CMN’s television station partnership network.

You may experience difficulties in effecting service of legal process and enforcing judgments against us and our management.

Upon the closing of the Transaction, almost all of our operations and assets will be located in China. In addition, most of our executive officers will be non-U.S. residents and many of the assets of these persons are located outside of the United States. As a result, it may not be possible to effect service of process within the United States upon these executive officers, including with respect to matters arising under U.S. federal securities laws or applicable state securities laws. China does not have treaties with the United States or many other countries providing for the reciprocal recognition and enforcement of court judgments. As a result, recognition and enforcement in China, or elsewhere outside of the United States of judgments of a court of the United States or any other jurisdiction, including judgments against us or our directors and executive officers, may be difficult or impossible.

Upon the expiration of the tax exemption period for certain of CMN’s Subsidiaries in China, they will be subject to a 33% enterprise income tax rate which could have a negative effect on CMN’s net income.

PRC entities are subject to PRC enterprise income tax on their taxable income. Generally, this tax is assessed at the rate of 33%. The PRC state tax bureau is authorized to grant an exemption from enterprise income tax of up to two years to newly established domestic companies engaged in technology services and in the information industry, which includes advertising services. While some of the CMN Subsidiaries have qualified for tax exemptions in the years 2003 and 2004, currently, among all of the CMN Subsidiaries, only Urumqi China Media Network Communications Co. Ltd. (“URMQ CMN”) is within the exemption period. The tax exemption period for URMQ CMN expires at the end of 2005. Upon expiration of the tax exemption period, the taxes assessed could have a negative impact on CMN’s net income. Further, there is no guarantee that the effective enterprise income tax rate will not be higher in the future.

RISKS RELATED TO OUR COMMON STOCK

There has not been significant trading in our Common Stock.

Our Common Stock is quoted on the Over the Counter Bulletin Board. There is a significant risk that our stock price may fluctuate dramatically in the future in response to any of the following factors, some of which are beyond our control:

| · | variations in our quarterly operating results; |

| · | announcements that our revenue or income are below analysts’ expectations, or general economic slowdowns; |

| · | changes in market valuations of similar companies; |

| · | sales of large blocks of our Common Stock; |

| · | announcements by us or our competitors of significant contracts, acquisitions, strategic partnerships, joint ventures or capital commitments; or |

| · | fluctuations in stock market prices and volumes. |

FORWARD-LOOKING STATEMENTS

This Current Report on Form 8-K/A contains forward-looking statements that are based on CMN’s current expectations, assumptions, estimates and projections about CMN and its industry. All statements other than statements of historical fact in this Current Report on Form 8-K/A are forward-looking statements. These forward-looking statements can be identified by words or phrases such as “may”, “will”, “expect”, “anticipate’, “estimate”, “plan”, “believe”, “is/are likely to” or other similar expressions. The forward-looking statements included in this Current Report on Form 8-K/A relate to, among others:

| · | our goals and strategies; |

| · | our future business development, financial condition and results of operations; |

| · | projected revenues, profits, earnings and other estimated financial information; |

| · | our plans to expand CMN’s advertising network into new cities and regions; |

| · | competition in the PRC advertising industry; |

| · | the expected growth in the urban population, consumer spending, average income levels and advertising spending levels; and |

| · | PRC governmental policies and regulations relating to the advertising industry and regulations and policies promulgated by the State Administration of Foreign Exchange. |

These forward-looking statements involve various risks and uncertainties. Although we believe that our expectations expressed in these forward-looking statements are reasonable, we cannot assure you that our expectations will turn out to be correct. Our actual results could be materially different from or worse than our expectations. Important risks and factors that could cause our actual results to be materially different from our expectations are generally set forth in the “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, “Business” and other sections of this Current Report on Form 8-K/A.

This Current Report on Form 8-K/A also contains data relating to the advertising industry that includes projections based on a number of assumptions. The advertising market may not grow at the rates projected by market data, or at all. The failure of these markets to grow at the projected rates may have a material adverse effect on our business and the market price of our Common Stock. Furthermore, if any one or more of the assumptions underlying the market data turns out to be incorrect, actual results may differ from the projections based on these assumptions. You should not place undue reliance on these forward-looking statements.

The forward-looking statements made in this Current Report on form 8-K relate only to events or information as of the date on which the statements are made in this Current Report on Form 8-K/A. We undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date on which the statements are made or to reflect the occurrence of unanticipated events.

Sale and Purchase Agreement between the Company and 8 Holdings LLC

On April 7, 2005, we entered into a Sale and Purchase Agreement with 8 Holdings LLC (“S&P Agreement”). Pursuant to the terms of the S&P Agreement, we agreed to sell to 8 Holdings shares of our Common Stock reflecting a controlling interest in our company. As a condition to the closing of the S&P Agreement and as consideration for the purchase of the shares, 8 Holdings committed to assist us in completing a financing in the amount of at least $10,000,000 (net of a required payment of $3.785 million to the CMN Shareholder pursuant to the terms of the CMN Agreement) and consummating the acquisition of CMN. 8 Holdings has also agreed to satisfy all of our liabilities outstanding as of the closing, in an amount not to exceed $65,000. The closing of the transactions contemplated by the S&P Agreement is expected to occur immediately after or concurrently with the closing of the acquisition of CMN discussed below. On April 14, 2005, we filed a Current Report on Form 8-K reporting the S&P Agreement. A copy of the S&P Agreement was filed in a Quarterly Report on Form 10-QSB filed by us with the Securities and Exchange Commission on August 17, 2005.

Mark L. Baum, our current sole director and officer, has agreed to resign and to appoint Clive Ng and Harlan Kleiman to our Board of Directors as of the closing. Mr. Baum has also agreed to execute a “No Sale and Lock-Up Agreement” prohibiting him from disposing of the 465,241 shares of Common Stock he owns for a period of one year from the closing of the acquisition of CMN. We will also pay, out of the gross proceeds of the Financing, $90,000 to Mr. Baum, currently owed to him under a certain Promissory Note.

At the closing of the S&P Agreement, we will enter into a consulting agreement with Mr. Baum’s company, JMAX Corporation. JMAX will be retained as a consultant to provide advice concerning management, marketing, strategic planning and other matters in connection with the operation of a public reporting company. The consulting agreement is for a term of one year from the date of the closing. We will pay JMAX a consulting fee of $160,000.

Sale and Purchase Agreement between the Company, 8 Holdings, CMN, Hong Kong Huicong International Group Limited and certain members of CMN Management

On May 12, 2005, the Company entered into the CMN Agreement, which was subsequently superseded by an amended CMN Agreement, dated May 27, 2005. Pursuant to the terms of the Transaction, as contemplated in the CMN Agreement, we shall acquire all of the issued and outstanding shares of stock of CMN in exchange for the issuance of shares of Common Stock to the CMN Shareholder representing 28.68% of our issued and outstanding Common Stock and a cash payment in the amount of $3,785,000. Upon the completion of the Transaction, CMN will become our wholly-owned subsidiary.

The consummation of the Transaction will be subject to satisfaction of certain closing conditions, including among other things:

| · | CMN’s completion of the restructuring of its television advertising businesses, as more fully described in detail in the section below entitled “The Restructuring Transactions”; |

| · | Our completion and reasonable satisfaction with the legal and financial due diligence of CMN and its subsidiaries; |

| · | A cash balance in our bank account of at least $10 million as of the closing of the Transaction after payment of the $3,785,000 cash portion of the consideration to the CMN Shareholder; |

| · | We shall enter into a loan agreement for a term of five years pursuant to which we will repay, RMB 30 million (approximately $3,600,000), currently owed by the CMN Subsidiaries to the CMN Shareholder; and |

| · | CMN Management entering into employment agreements with us. |

The CMN Agreement provides for payment of a termination fee in the amount of $500,000 if we or the CMN Shareholder breach certain provisions resulting in a termination of the CMN Agreement. Also, upon the closing of the Transaction, there will be a change in the majority of our Board of Directors and in our management team. Mark L. Baum shall resign as Chief Executive Officer and sole director pursuant to the terms of the S&P Agreement and shall appoint Clive Ng and Harlan Kleiman as members of our Board of Directors. We anticipate having five members on our Board of Directors upon the closing of the Transaction, which would include Messrs. Clive Ng, Harlan Kleiman, Wu Xian, Bruce Maggin and John Notter.

At closing, we will execute a Voting Agreement with 8 Holdings, and the CMN Shareholder, which provides for the designation and voting by 8 Holdings and the CMN Shareholder of persons to serve on our Board of Directors. Pursuant to the Voting Agreement, during the two year period commencing on the date of the closing of the Transaction, 8 Holdings and the CMN Shareholder will be permitted to designate 4 and 1 person, respectively, for nomination at each annual meeting of our stockholders, and will be required to vote their shares of Common Stock for all such nominees.

Beijing China Media Network Advertising Co., Ltd. (“CMN Ad”) originally commenced business operations in June 2000 as a television advertising subsidiary of HC International, Inc., a listed company on the Growth Enterprises Market (GEM) in Hong Kong, by entering into a management agreement with ZZTV. It was formed as a separate entity in April 2004. A number of subsidiaries which engaged in the TV advertising businesses in Jinan, Urumqi, Lanzhou, Sanya and Hainan were subsequently established.

Among all the television advertising subsidiaries under CMN Ad, Zhengzhou China Media Network Advertising Communications Co., Ltd (“ZZ CMN”) commenced operations in June 2000 to carry out the advertising business in Zhengzhou. It was formed as a separate entity in March 2003. By paying a fixed fee to ZZTV station under a management agreement, ZZ CMN arranged for customers to place advertisements during allocated time slots in between programs for two of the channels operated by the television station. The business of Jinan China Media Network Communications Co., Ltd. (“JN CMN”) commenced in January 2002 to carry out the advertising business for two of the channels operated by JNTV station. It was formed as a separate entity in January 2003. Urumqi China Media Network Communications Co., Ltd. (“URMQ CMN”) was incorporated in April 2003 after entering into an advertising sales agreement with UTV station in January 2003. This company is currently owned 76% by CMN Ad and 24% by Mr. Li Guangyu, a minority investor. Lanzhou China Media Advertising Communications Co., Ltd. (“LZ CM”) is an advertising business company formed by CMN Ad and the Lanzhou TV station in February 2004. CMN Ad owns 51% of LZ CM and Lanzhou TV station owns the remaining 49%. Lanzhou China Media Network Advertising Communications Co., Ltd. (“LZ CMN”) was incorporated in April 2003. CMN Ad will own a 76% equity stake in this company upon the completion of the Restructuring and Mr. Li Guangyu, a minority investor, will own the remaining 24%. CMN Ad formed the Beijing China Media Network Advertising Co., Ltd. Sanya Branch (“Sanya Branch”) in May 2005. CMN Ad owns 100% of the Sanya Branch. Hainan Dian Guang China Media Network Communications Co., Ltd. (“HM CMN”) was formed in July 2005. CMN Ad owns 50% of this entity and Hainan Dian Guang Media Investments Holding Co., Ltd. owns the remaining 50%.

HC International, Inc. commenced its Restructuring activities in May 2005. Upon completion of the Restructuring, CMN Info will become the holding company of all the PRC domestic television advertising businesses.

According to the Company Law of the PRC, if a company, other than an investment company or holding company as specified by the State Council of the PRC, invests in other limited liability companies or companies limited by shares, the aggregate amount of such investments may not exceed 50% of the investing company’s net assets. As the original registered share capital of CMN Info was RMB 1.0 million ($120,802), the registered share capital of CMN Info was subsequently increased to RMB 20.0 million ($2.4 million) in order to avoid breaching such regulation after the completion of the Restructuring.

The RMB 19.0 million ($2.3 million) increase in the registered capital of CMN Info was satisfied by way of a cash injection, which was funded by the CMN Shareholder and Beijing Hehui, a company controlled by the CMN Management, in accordance with their respective shareholdings prior to the closing of the Transaction. Such cash injection will be reimbursed by us within 20 days after the closing of the Transaction.

The Restructuring Transaction