UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-08411

(Investment Company Act file number)

The James Advantage Funds

(Exact name of registrant as specified in charter)

1349 Fairground Road

Xenia, Ohio 45385

(Address of principal executive offices) (Zip code)

Barry R. James

P.O. Box 8

Alpha, Ohio 45301

(Name and address of agent for service)

Registrant’s telephone number, including area code: (937) 426-7640

Date of fiscal year end: June 30

Date of reporting period: July 1, 2016 – December 31, 2016

Item 1. Reports to Stockholders.

James Balanced: Golden Rainbow Fund

James Small Cap Fund

James Mid Cap Fund

James Micro Cap Fund

James Aggressive Allocation Fund

James Long-Short Fund

TABLE OF CONTENTS

| Shareholder Letter | 1 |

| Growth of $10,000 Charts | 4 |

| Representation of Schedules of Investments | 8 |

| Disclosure of Fund Expenses | 9 |

| Schedule of Investments | |

| James Balanced: Golden Rainbow Fund | 10 |

| James Small Cap Fund | 21 |

| James Mid Cap Fund | 24 |

| James Micro Cap Fund | 26 |

| James Aggressive Allocation Fund | 29 |

| James Long-Short Fund | 32 |

| Statements of Assets and Liabilities | 36 |

| Statements of Operations | 38 |

| Statements of Changes in Net Assets | 39 |

| Financial Highlights | |

| James Balanced: Golden Rainbow Fund - Retail Class | 46 |

| James Balanced: Golden Rainbow Fund - Institutional Class | 47 |

| James Small Cap Fund | 48 |

| James Mid Cap Fund | 49 |

| James Micro Cap Fund | 50 |

| James Aggressive Allocation Fund | 51 |

| James Long-Short Fund | 52 |

| Notes to Financial Statements | 53 |

| Additional Information | 61 |

| Privacy Policy | 62 |

December 31, 2016 (Unaudited)

LETTER TO THE SHAREHOLDERS

OF THE JAMES ADVANTAGE FUND

Worries about China, the Brexit, and then the presidential election – wow, what a year for stock volatility! Of course, the Federal Reserve’s cautious tightening of rates also was a factor. Given all the headline disruptions, it is incredible that stocks closed the year with decent gains. But they did, and all of the James Advantage Funds ended the year in positive territory, as well.

The Markets Over the Past Six Months

The S&P 500, a good gauge of the stock market, returned 7.82% over the last six months of 2016, but it returned 5.75% of that in the last two months of the year, following the presidential election. Small capitalization companies fared better, with the Russell 2000 Index returning 18.68% for the last six months and 14.24% since the election. Over the six month period, Financial Services, Technology and Industrial stocks led the advance (using the Russell 3000 Index), while Consumer Staples and Utilities lagged with negative returns. Since October 31st, Financial Services, Energy and Industrials led the way with Consumer Staples in last place, showing a negative return. The bond markets generally retreated, especially after the election. Fears of rising deficits and a more aggressive tightening agenda by the Federal Reserve helped push bond prices lower.

Investment Goals and Objectives

The Balanced: Golden Rainbow Fund seeks to provide total return through a combination of growth and income and preservation of capital in declining markets. The Fund will generally hold positions in common stocks that in the aggregate constitute between 35 percent and 55 percent of the net assets. Bonds held in the portfolio must be rated Baa2 by Mooody’s/ BBB by S&P or higher at the time of purchase.

The Aggressive Allocation Fund seeks to provide total return through a combination of growth and income, but preservation of capital in declining markets is a secondary objective. Potential investors should be aware that this Fund will likely have a higher level of volatility than the Balanced: Golden Rainbow Fund. The Balanced: Golden Rainbow Fund’s benchmark that we follow most closely is a blend of 25% S&P 500, 25% Russell 2000 Index and 50% Barclays Capital U.S. Intermediate Government /Credit Bond Index. The benchmark is the same for all share classes of the Balanced: Golden Rainbow Fund. The Aggressive Allocation Fund’s benchmark that we follow most closely is a blend of 65% Russell 3000 Index and 35% Barclays U.S. Aggregate Government/Credit Bond Index.

The Small Cap Fund, Mid Cap Fund, Long-Short Fund and Micro Cap Fund seek to provide long-term capital appreciation. These Funds hold only equity securities and cash/cash equivalents under most circumstances. The prospectus identifies the following benchmarks: the Russell 2000 Index for the Small Cap Fund, the S&P Mid Cap 400 Value Index for the Mid Cap Fund, the Russell Microcap Index for the Micro Cap Fund and the S&P 500 for the Long-Short Fund.

Investment Philosophy

James Investment Research, Inc., the Funds’ Adviser, adheres to a strategy of value investing. The Adviser’s research, along with much academic research, supports the view that value investing outperforms growth investing over the longer-run. While some growth stocks may have astronomical returns, many eventually succumb to too much optimism and speculative investing and produce sharply inferior results. The dot-com stocks in 2000 and real estate stocks in 2008 bear this out. James Investment Research, Inc. ranks stocks based on their value characteristics and chooses those ranked highly for inclusion in the James Advantage Funds’ portfolios. The short selection works in reverse manner, seeking to short securities that are expensive and show relatively poor earnings.

The Adviser to the Funds has no soft-dollar arrangements, and therefore does not purchase research from any broker/dealers.

An investor’s risk tolerance is a very personal characteristic. Risk tolerances change as a person’s life and circumstances change. Therefore we have additional styles. The Aggressive Allocation Fund generally takes on greater risk than the Balanced: Golden Rainbow Fund, but still has the ability to reduce that risk in anticipation of a major decline in stock prices. There is never a guarantee that the Adviser can make such calls correctly, so investors in the Aggressive Allocation Fund should have higher risk appetites than those in the Balanced: Golden Rainbow Fund.

A slightly different interpretation of preservation of capital is the Long-Short Fund. It may use bonds to diversify the portfolio, but it primarily uses short positions in stocks the Adviser believes to be over-valued. To that extent, it may hold short positions even though the Adviser is positive on the stock market.

The Micro Cap Fund and the Small Cap Fund invest in smaller capitalization companies, which have greater volatility and are generally believed to be riskier (which the September returns proved to be true). The Mid Cap, Small Cap, and Micro Cap Funds are niche products designed to meet the objectives of investors who want to establish diversified positions in these areas. As all-equity products, they are intrinsically riskier than the other products that hold bonds. Still, these portfolios will hold stocks that are ranked highly by the James models and pass a thorough review by its researchers and portfolio managers.

| Semi-Annual Report | December 31, 2016 | 1 |

| Shareholder Letter | James Advantage Funds |

December 31, 2016 (Unaudited)Strategy for Meeting Fund Objectives

The Funds’ Adviser believes that preservation of capital in down markets is the key to long-term success. The great economist, Peter Bernstein, may have summarized this idea best when he said “At the extremes, the market is not random walk. At the extremes the market is more likely to destroy fortunes than to create them. The stock market is a risky place.” Hence, the Balanced: Golden Rainbow Fund seeks to preserve capital by constructing a portfolio of both bonds and stocks. My experience as Associate Adjunct Professor at Wright State University leads me to the conclusion that most academic textbooks note that bonds are uncorrelated with stocks, thus providing income as well as diversification. Of course, Bernstein was correct when he noted that the wisdom of this approach is most obvious when the market is at extremes, such as in 2008 and 2000.

The Small Cap Fund, the Mid Cap Fund, the Long-Short Fund, and the Micro Cap Fund look for stocks the Adviser believes to be undervalued, using its proprietary research to screen a database of over 8,500 stocks. A deterioration in a stock’s fundamental value characteristics can lead the Adviser to trim or sell that position.

One change that is in process is to increase the performance of the Mid Cap Fund by adding more securities to the portfolio and also allowing the sector weights to vary according to the number of highly ranked securities in that sector. This will increase the amount of turnover in the Fund and also increase the potential for a capital gain distribution during the year in which these changes are initiated.

Fund Performance

The Balanced: Golden Rainbow Fund strived to meet its objectives of income and preservation of capital in this volatile environment by running a moderate allocation to stocks and replacing lower yielding U.S. Treasury securities with some corporate bonds with higher yields. The Fund’s portfolio managers also reduced holdings of longer-term bonds as inflation expectations embedded in Treasury Inflation-Protected securities increased over the period. Rising bond yields mean falling bond prices, so this move was also consistent with the Fund’s objective of preservation of capital. Over the six month period ended December 31, 2016, the retail shares of the Balanced: Golden Rainbow Fund returned 2.52% and the institutional share class returned 2.68%. The Fund’s benchmark that we follow most closely returned 5.53%. The Fund trailed its benchmark as its positions in Real Estate Investment Trusts (REITs) hurt performance: Annaly Capital* (0.1% of portfolio), Brandywine Realty Trust (0.2% of portfolio), Chimera Investment Corp (0.2% of portfolio), Government Properties Income (0.1% of portfolio) and LTC Properties Inc. (0.1% of portfolio). Performance was also hurt by holdings in Barrick Gold (0.3% of portfolio), Newmont Mining (1.0% of portfolio) and the Gold Trust SPDR (0.6% of portfolio).

The Balanced: Golden Rainbow Fund paid out a regular dividend every quarter. The Fund’s retail class shares paid 11.288 cents/share in September and 6.791 cents/share in December. The institutional class shares paid 12.854 cents/share in September and 8.372 cents/share in December. In addition, the Fund paid all shareholders a long-term capital gains distribution of 9.475 cents/share in December.

Over the six months ended December 31, 2016, the Small Cap Fund returned 16.80% while its benchmark, the Russell 2000 Index, returned 18.68%. The Fund’s return was pulled down by its investment in First Majestic Silver (0.8% of portfolio), Smith & Wesson (1.9% of portfolio) and Helen of Troy (3.7% of portfolio). The Fund also had about 3% of the portfolio in cash, which weighed down the return.

The Small Cap Fund paid an ordinary dividend of 16.988 cents/share in December. The Mid Cap Fund paid an ordinary dividend of 1.774 cents/share, a short-term capital gain of 11.181 cents per share and a long-term capital gain of $1.5716/share in December. These Funds do not seek to pay dividends as they do not have income as a primary objective, but will distribute income (and capital gains) when earned.

The Mid Cap Fund returned 6.57% for the period versus the S&P Mid Cap 400 Value Index, which returned 14.75%. The Fund carried about 5.5% of its assets in cash, which weighed on the performance. It also had losses in RR Donnelly (0.77% of portfolio) and Agnico Eagle Mines (1.10% of portfolio).

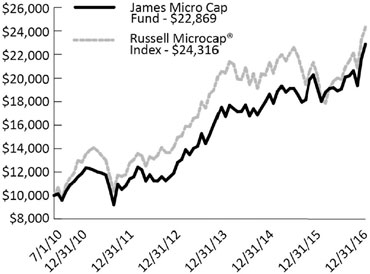

The Micro Cap Fund returned 20.09% for the six months ended December 31, 2016. Its benchmark, the Russell Microcap Index returned 22.43%. The Fund underperformed the benchmark in part as holdings fell in Richmont Mines (3.4% of portfolio) and Natural Health Trend (2.62% of portfolio).

The Long-Short Fund may employ a short-selling strategy. Over the six month period, the Fund’s portfolio managers established short positions on various occasions and ended the year with short positions totaling approximately 9% of net assets (long positions and cash less the short positions). Short positions are established according to the Adviser’s proprietary research and may vary from none at all to all short positions. Over this six month period, the Fund was generally net long, meaning the short positions were less than the long positions. The Fund returned 4.31% over the six months ended December 31, 2016 compared to 7.82% on the S&P 500 Index. The Fund held positions in Smith & Wesson (2.4% of net assets) and RR Donnelly (1.0% of net assets) that were a drag on performance, and also held high levels of cash (14.81% of net assets) which hurt performance.

December 31, 2016 (Unaudited)

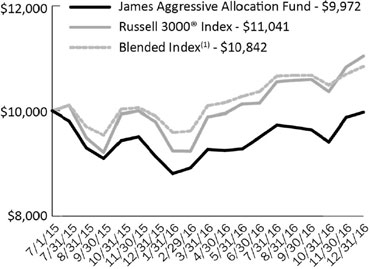

The Aggressive Allocation Fund commenced operations on July 1, 2015. It is similar to the Balanced: Golden Rainbow Fund in that its strategy requires it to hold both stocks and bonds. However, it is a much more aggressive Fund and generally will hold a higher allocation to stocks than the Balanced: Golden Rainbow Fund. Its benchmark that we follow most closely is 65% Russell 3000 Index and 35% Barclays U.S. Aggregate Government/Credit Bond Index. The Aggressive Allocation Fund paid an ordinary dividend of 8.861 cents per share in December. For the six months ended December 31, 2016, the Fund earned 4.94% while its benchmark blend earned 4.59%. The Funds outperformance was due, in part, to holdings in United Rentals (2.30% of assets), McDermott Intl (2.13% of assets) and Treasury Inflation Protected bonds (5.61% of assets).

Expectations for the Future

Some pundits have called the post-election rally a Hope Rally, as it is premised on the promise of a more favorable business climate in Washington and promises of lower taxes and less regulation. However, the Adviser believes it seems highly likely that tax rates, both individual and corporate, will be coming down. That should increase after tax earnings and lower Price/Earnings ratios. If these changes are substantial, the economy could benefit and additional increases in corporate earnings would result. While an expanding national debt will bother some, especially holders of debt, the markets may shrug that off as interest rates are still very low relative to a pre-2008 average. In that environment, the Adviser believes stocks should continue to perform well and may add to stock positions on corrections in that market. Conversely, sustained rallies in bonds will be difficult to achieve and a defensive strategy of shorter-term bonds will likely be best. If the President is not able to get his ideas concerning taxes and regulations passed into law, the Adviser believes current valuations will be much too high and a painful correction would probably occur. At this point, the markets are still embracing hope. Fund managers hope they are correct.

Thomas L. Mangan

Chief Financial Officer

Thomas Mangan is a registered representative of ALPS Distributors, Inc.

The statements and opinions expressed are those of the author, are as of the date of this report, are subject to change, and may not reflect the writer’s current views. All information is historical and not indicative of future results and subject to change. It should not be assumed that an investment in the securities mentioned will be profitable in the future. This information is not a recommendation to buy or sell.

You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing. You may obtain a current copy of the Fund’s prospectus by calling 1-800-995-2637.

Past performance is no guarantee of future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Price/Earnings ratio is a valuation of a company’s current share price compared to its per-share earnings.

Credit ratings apply the underlying holdings of the Fund, and not to the Fund itself. Moody's studies the financial condition of an entity to ascertain its creditworthiness. The credit ratings reflect the rating agency's opinion of the holdings financial condition and histories. The ratings shown are all considered investment grade and are listed by highest to lowest in percentage of what the Fund holds.

Soft dollar arrangements involve using client brokerage commissions to purchase research intended to help managers make investment decisions.

| * | Percentage of portfolio shown for each Fund consists of the average percentage held for the Fund during the six months ended December 31,2016. Holdings, as a percent of the portfolio, for each Fund as of December 31, 2016 are as follows: Balanced Golden Rainbow Fund: Annaly Capital (0.2%), Brandywine Realty Trust (0.2%), Chimera Investment Corp (0.3%), Government Properties Income (0.2%), LTC Properties Inc. (0.2%), Barrick Gold (0.1%), Newmont Mining (0.5%) and the Gold Trust SPDR (0.3%). Small Cap Fund: First Majestic Silver (0.1%), Smith & Wesson (0.7%) and Helen of Troy (2.4%). Mid Cap Fund: RR Donnelly (0.0%) and Agnico Eagle Mines (0.0%). Micro Cap Fund: Richmont Mines (0.0%) and Natural Health Trend (2.4%). Long-Short Fund: Smith & Wesson (1.0%) and RR Donnelly (0.0%). Aggressive Allocation Fund: United Rentals (2.8%0), McDermott Intl (2.5%) and Treasury Inflation Protected bonds (4.1%). Holdings are subject to change. |

| Semi-Annual Report | December 31, 2016 | 3 |

December 31, 2016 (Unaudited)

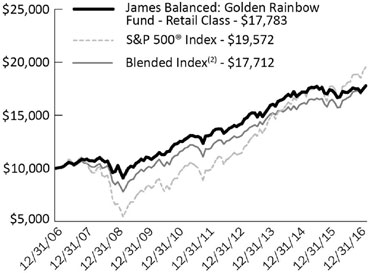

Comparison of the Change in Value of a $10,000 Investment in the James Balanced: Golden Rainbow Fund – Retail Class

James Balanced: Golden Rainbow Fund – Retail Class

Average Annual Total Returns

| | 1 Year | 5 Years | 10 Years | Since Inception(1) |

| James Balanced: Golden Rainbow – Retail Class | 4.17% | 6.25% | 5.93% | 7.85% |

S&P 500® Index | 11.96% | 14.66% | 6.95% | 9.45% |

Blended Index(2) | 9.45% | 8.28% | 5.88% | 8.01% |

Russell 2000® Index | 21.31% | 14.46% | 7.07% | 10.05% |

| Barclays Capital U.S. Intermediate Government/Credit Bond Index | 2.08% | 1.85% | 3.84% | 5.44% |

| (1) | Inception was July 1, 1991. |

| (2) | The Blended Index is comprised of a 25% weighting in the S&P 500® Index, a 25% weighting in the Russell 2000® Index and a 50% weighting in the Barclays Capital U.S. Intermediate Government/Credit Bond Index. |

| The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2016, was 0.97%. |

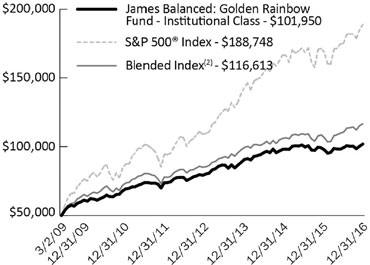

Comparison of the Change in Value of a $50,000 Investment in the James Balanced: Golden Rainbow Fund – Institutional Class

James Balanced: Golden Rainbow Fund – Institutional Class

Average Annual Total Returns

| | 1 Year | 5 Years | Since Inception(1) |

| James Balanced: Golden Rainbow – Institutional Class | 4.43% | 6.51% | 9.52% |

S&P 500® Index | 11.96% | 14.66% | 18.48% |

Blended Index(2) | 9.45% | 8.28% | 11.42% |

Russell 2000® Index | 21.31% | 14.46% | 19.79% |

| Barclays Capital U.S. Intermediate Government/ Credit Bond Index | 2.08% | 1.85% | 3.40% |

| (1) | Inception was March 2, 2009. |

(2) | The Blended Index is comprised of a 25% weighting in the S&P 500® Index, a 25% weighting in the Russell 2000® Index and a 50% weighting in the Barclays Capital U.S. Intermediate Government/Credit Bond Index. |

| The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2016, was 0.72%. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. These performance figures do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Please call 1-800-995-2637 for most recent month-end performance information.

The S&P 500® Index is an unmanaged index of 500 common stocks chosen for market size, liquidity and industry group representation.

The Russell 2000® Index is a widely recognized, unmanaged index comprised of the 2,000 smallest U.S. domiciled publicly-traded common stocks of the Russell 3000® Index, which represents approximately 8% of the total market capitalization of the Russell 3000® Index, an unmanaged index of the 3,000 largest U.S. domiciled publicly-traded common stocks by market capitalization.

The Barclays Capital U.S. Intermediate Government/Credit Bond Index measures the performance of U.S. Dollar denominated U.S. Treasuries, government-related and investment grade U.S. corporate securities that have a remaining maturity of greater than one year and less than ten years.

The S&P 500® Index, Russell 2000® Index, Barclays Capital U.S. Intermediate Government/Credit Bond Index and Blended Index are widely recognized unmanaged indices of security prices and are representative of a broader market and range of securities than is found in the Fund’s portfolio. The Index returns do not reflect the deduction of expenses, which have been deducted from a Fund’s returns. The Index returns assume reinvestment of all distributions and do not reflect the deduction of taxes and fees. Individuals cannot invest directly in any Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

| Growth of $10,000 or $50,000 Charts |

December 31, 2016 (Unaudited)

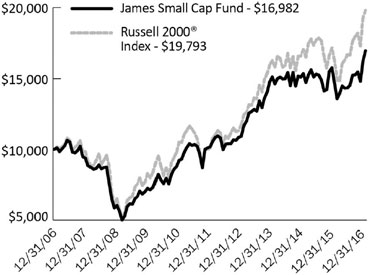

Comparison of the Change in Value of a $10,000 Investment in the James Small Cap Fund

James Small Cap Fund

Average Annual Total Returns

| | 1 Year | 5 Years | 10 Years | Since Inception(1) |

| James Small Cap Fund | 15.63% | 10.78% | 5.44% | 8.40% |

Russell 2000® Index | 21.31% | 14.46% | 7.07% | 9.15% |

(1) | Fund inception was October 2, 1998. |

| The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2016, was 1.51%. |

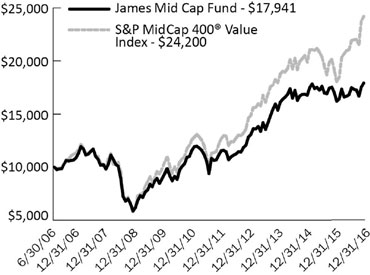

Comparison of the Change in Value of a $10,000 Investment in the James Mid Cap Fund

James Mid Cap Fund

Average Annual Total Returns

| | 1 Year | 5 Years | 10 Years | Since Inception(1) |

| James Mid Cap Fund | 5.33% | 10.89% | 5.43% | 5.72% |

S&P MidCap 400® Value Index | 26.53% | 16.07% | 8.48% | 8.78% |

| (1) | Fund inception was June 30, 2006. |

| The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2016, was 1.51%. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. These performance figures do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Please call 1-800-995-2637 for most recent month-end performance information.

Mid, Small and Micro Cap investing involve greater risk not associated with investing in more established companies, such as greater price volatility, business risk, less liquidity and increased competitive threat.

The Mid Cap Fund invests in stocks of mid-cap companies which tend to be more volatile and can be less liquid than stocks of large-cap companies. Diversification does not guarantee a profit or protect against loss. Current and future portfolio holdings are subject to risk.

The Russell 2000® Index is a widely recognized, unmanaged index comprised of the 2,000 smallest U.S. domiciled publicly-traded common stocks of the Russell 3000® Index, which represents approximately 8% of the total market capitalization of the Russell 3000® Index, an unmanaged index of the 3,000 largest U.S. domiciled publicly-traded common stocks by market capitalization.

The S&P MidCap 400® Value Index is a recognized, unmanaged index of mid cap stocks considered to be value stocks using Standard and

Poor’s methodology.

The Russell 2000® Index and S&P MidCap Value 400® Index are widely recognized unmanaged indices of security prices and are representative of a broader market and range of securities than is found in the Fund’s portfolio. The Index returns do not reflect the deduction of expenses, which have been deducted from a Fund’s returns. The Index returns assume reinvestment of all distributions and do not reflect the deduction of taxes and fees. Individuals cannot invest directly in any Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

| Semi-Annual Report | December 31, 2016 | 5 |

December 31, 2016 (Unaudited)

Comparison of the Change in Value of a $10,000 Investment in the James Micro Cap Fund

James Micro Cap Fund

Average Annual Total Returns

| | 1 Year | 5 Year | Since

Inception(1) |

| James Micro Cap Fund | 19.62% | 16.13% | 13.57% |

Russell Microcap® Index | 20.37% | 15.59% | 14.65% |

| (1) | Fund inception was July 1, 2010. |

| The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2016, was 1.51%. |

Comparison of the Change in Value of a $10,000 Investment in the James Aggressive Allocation Fund

James Aggressive Allocation Fund

Cumulative Annual Total Returns

| | 1 Year | Since Inception(1) |

| James Aggressive Allocation Fund | 9.09% | -0.19% |

Russell 3000® Index | 12.74% | 6.82% |

Blended Index(2) | 9.44% | 5.53% |

| (1) | Fund inception was July 1, 2015. |

| (2) | The Blended Index is comprised of a 35% weighting in the Barclays U.S. Aggregate Government/Credit Bond Index and a 65% weighting in the Russell 3000® Index. |

| The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2016, was 1.01%. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. These performance figures do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Please call 1-800-995-2637 for most recent month-end performance information.

Mid, Small and Micro Cap investing involve greater risk not associated with investing in more established companies, such as greater price volatility, business risk, less liquidity and increased competitive threat.

The Russell Microcap® Index measures the performance of the microcap segment of the U.S. equity market. It makes up less than 3% of the U.S. equity market. It includes 1,000 of the smallest securities in the small cap Russell 2000® Index, plus the next smallest eligible securities by market cap.

The Russell 3000® Index is a stock market index of U.S. stocks. The index measures the performance of 3,000 publicly held U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market.

The Barclays U.S. Aggregate Government/Credit Bond Index (an unmanaged index generally representative of dollar denominated U.S. Treasuries, government related and investment grade U.S. corporate securities that have a remaining maturity greater than one year).

The Russell Microcap® Index and the Blended Index are widely recognized unmanaged indices of security prices and are representative of a broader market and range of securities than is found in the Fund’s portfolio. The Index returns do not reflect the deduction of expenses, which have been deducted from a Fund’s returns. The Index returns assume reinvestment of all distributions and do not reflect the deduction of taxes and fees. Individuals cannot invest directly in any Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

| Growth of $10,000 or $50,000 Charts |

December 31, 2016 (Unaudited)

Comparison of the Change in Value of a $10,000 Investment in the James Long-Short Fund

James Long-Short Fund

Average Annual Total Returns

| | 1 Year | 5 Years | Since Inception(1) |

| James Long-Short Fund | 2.19% | 7.18% | 5.66% |

S&P 500® Index | 11.96% | 14.66% | 12.31% |

| (1) | Fund inception was May 23, 2011. |

| The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2016, was 2.53%. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. These performance figures do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Please call 1-800-995-2637 for most recent month-end performance information.

Short selling incurs significant additional risk; theoretically, stocks sold short have unlimited upside risk potential. In addition, this strategy depends on the Adviser’s ability to correctly identify undervalued and overvalued stocks, and that the stock markets are reasonable and efficient. Periods of extreme volatility may harm the performance of this product. The Long-Short Fund may have a high portfolio turnover rate. A high portfolio turnover rate can result in increased brokerage commission costs and may expose taxable shareholders to potentially larger current tax liability.

The S&P 500® Index is an unmanaged index of 500 common stocks chosen for market size, liquidity and industry group representation.

The S&P 500® Index is a widely recognized unmanaged index of security prices and are representative of a broader market and range of securities than is found in the Fund’s portfolio. The Index return does not reflect the deduction of expenses, which have been deducted from a Fund’s returns. The Index return assumes reinvestment of all distributions and does not reflect the deduction of taxes and fees. Individuals cannot invest directly in any Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

| Semi-Annual Report | December 31, 2016 | 7 |

December 31, 2016 (Unaudited)

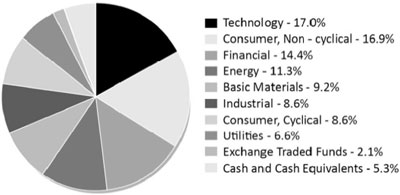

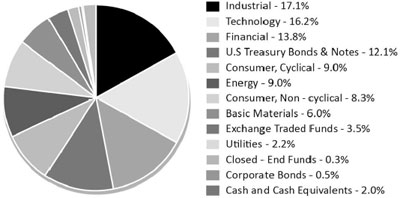

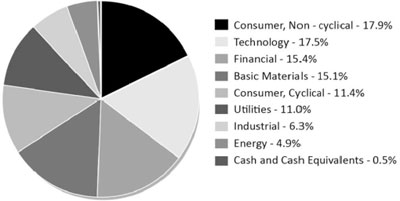

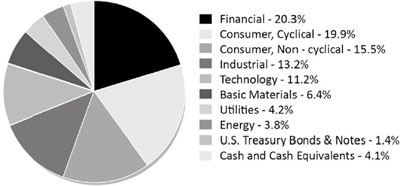

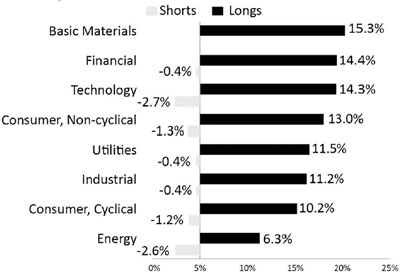

The illustrations below provide the industry sectors for the James Balanced: Golden Rainbow Fund, James Small Cap Fund, James Mid Cap Fund, James Micro Cap Fund, James Aggressive Allocation Fund and James Long-Short Fund.

James Balanced: Golden Rainbow Fund - Industry Sector Allocation

(% of Net Assets)*

James Mid Cap Fund - Industry Sector Allocation

(% of Net Assets)*

James Aggressive Allocation Fund - Industry Sector Allocation

(% of Net Assets)*

James Small Cap Fund - Industry Sector Allocation

(% of Net Assets)*

James Micro Cap Fund - Industry Sector Allocation

(% of Net Assets)*

James Long-Short Fund - Industry Sector Allocation

(% of Net Assets)*

(Cash and Cash Equivalents and Other Assets in Excess of Liabilities

not included)

| * | Holdings are subject to change, and may not reflect the current or future position of the portfolio. |

| Disclosure of Fund Expenses |

December 31, 2016 (Unaudited)

Example. As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including reinvested dividends or other distributions, and redemption fees; and (2) ongoing costs, including management fees, distribution (12b-1) fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period July 1, 2016 through December 31, 2016.

Actual Expenses. The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expense Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line of the table below provides information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that expenses shown in the table are meant to highlight and help you compare ongoing costs only. The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

| | Net Expense Ratio Annualized December 31, 2016(a) | Beginning Account Value July 1, 2016 | Ending Account Value December 31, 2016 | Expense Paid During Period(b) |

| James Balanced: Golden Rainbow Fund | | | | |

| Retail Class Actual | 0.96% | $1,000.00 | $1,025.20 | $4.90 |

| Retail Class Hypothetical (5% return before expenses) | 0.96% | $1,000.00 | $1,020.37 | $4.89 |

| | | | | |

| Institutional Class Actual | 0.71% | $1,000.00 | $1,026.80 | $3.63 |

| Institutional Class Hypothetical (5% return before expenses) | 0.71% | $1,000.00 | $1,021.63 | $3.62 |

| | | | | |

| James Small Cap Fund | | | | |

| Actual | 1.50% | $1,000.00 | $1,168.00 | $8.20 |

| Hypothetical (5% return before expenses) | 1.50% | $1,000.00 | $1,017.64 | $7.63 |

| | | | | |

| James Mid Cap Fund | | | | |

| Actual | 1.50% | $1,000.00 | $1,065.70 | $7.81 |

| Hypothetical (5% return before expenses) | 1.50% | $1,000.00 | $1,017.64 | $7.63 |

| | | | | |

| James Micro Cap Fund | | | | |

| Actual | 1.50% | $1,000.00 | $1,200.90 | $8.32 |

| Hypothetical (5% return before expenses) | 1.50% | $1,000.00 | $1,017.64 | $7.63 |

| | | | | |

| James Aggressive Allocation Fund | | | | |

| Actual | 0.98% | $1,000.00 | $1,049.40 | $5.06 |

| Hypothetical (5% return before expenses) | 0.98% | $1,000.00 | $1,020.27 | $4.99 |

| | | | | |

| James Long‐Short Fund | | | | |

| Actual | 1.56%(c) | $1,000.00 | $1,043.10 | $8.03 |

| Hypothetical (5% return before expenses) | 1.56%(c) | $1,000.00 | $1,017.34 | $7.93 |

| (a) | Annualized, based on the Fund's most recent fiscal half year expenses. |

| (b) | Expenses are equal to the Fund's annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (184), divided by 365. |

| (c) | Dividend and interest expense on securities sold short and interest expense totaled 0.06% (annualized) of average net assets for the six months ended December 31, 2016. Total annual operating expense of 1.56% includes the 0.06% of dividend and interest expense. |

| Schedule of Investments | James Balanced: Golden Rainbow Fund |

| December 31, 2016 (Unaudited) | |

| Shares or Principal Amount | | Value | |

| COMMON STOCKS-52.1% | |

| | | | Basic Materials-5.7% | | | |

| | 12,188 | | AEP Industries, Inc. | | $ | 1,415,027 | |

| | 323,670 | | Avery Dennison Corp. | | | 22,728,107 | |

| | 314,370 | | Barrick Gold Corp. | | | 5,023,633 | |

| | 553,420 | | Celanese Corp., Series A | | | 43,576,291 | |

| | 98,720 | | Ciner Resources LP | | | 2,870,778 | |

| | 447,690 | | Cooper Tire & Rubber Co. | | | 17,392,756 | |

| | 76,830 | | Dow Chemical Co. | | | 4,396,213 | |

| | 75,330 | | Enviva Partners LP | | | 2,018,844 | |

| | 22,670 | | First Majestic Silver Corp.* | | | 172,972 | |

| | 1,150,260 | | Goodyear Tire & Rubber Co. | | | 35,508,526 | |

| | 58,910 | | Hecla Mining Co. | | | 308,688 | |

| | 329,655 | | Innospec, Inc. | | | 22,581,367 | |

| | 21,500 | | International Paper Co. | | | 1,140,790 | |

| | 172,610 | | Lydall, Inc.* | | | 10,675,928 | |

| | 192,445 | | Neenah Paper, Inc. | | | 16,396,314 | |

| | 637,820 | | Newmont Mining Corp. | | | 21,730,527 | |

| | 16,610 | | Pan American Silver Corp. | | | 250,313 | |

| | 170,990 | | Universal Forest Products, Inc. | | | 17,471,758 | |

| | 86,000 | | Westlake Chemical Corp. | | | 4,815,140 | |

| | | | | 230,473,972 | |

| | | | | | |

| | | | Consumer, Cyclical-6.6% | | | | |

| | 642,220 | | Alaska Air Group, Inc. | | | 56,984,181 | |

| | 7,910 | | Asbury Automotive Group, Inc.* | | | 488,047 | |

| | 165,260 | | Avianca Holdings SA, Sponsored ADR | | | 1,593,106 | |

| | 590,000 | | Best Buy Co., Inc. | | | 25,175,300 | |

| | 371,875 | | Big Lots, Inc. | | | 18,671,844 | |

| | 456,765 | | Cato Corp., Class A | | | 13,739,491 | |

| | 112,210 | | Century Communities, Inc.* | | | 2,356,410 | |

| | 115,610 | | Flexsteel Industries, Inc. | | | 7,129,669 | |

| | 448,050 | | Foot Locker, Inc. | | | 31,762,264 | |

| | 707,670 | | Ford Motor Co. | | | 8,584,037 | |

| | 314,125 | | Hawaiian Holdings, Inc.* | | | 17,905,125 | |

| | 25,110 | | Hibbett Sports, Inc.* | | | 936,603 | |

| | 14,850 | | Insight Enterprises, Inc.* | | | 600,534 | |

| | 120,350 | | Lennar Corp., Class A | | | 5,166,625 | |

| | 95,080 | | M/I Homes, Inc.* | | | 2,394,114 | |

| | 102,690 | | Meritage Homes Corp.* | | | 3,573,612 | |

| | 89,740 | | Modine Manufacturing Co.* | | | 1,337,126 | |

| | 122,770 | | Patrick Industries, Inc.* | | | 9,367,351 | |

| | 86,720 | | PetMed Express, Inc. | | | 2,000,630 | |

| | 746,725 | | Southwest Airlines Co. | | | 37,216,774 | |

| | 32,000 | | Tata Motors, Ltd., Sponsored ADR | | | 1,100,480 | |

| | 43,890 | | Tower International, Inc. | | | 1,244,282 | |

| | 66,405 | | Wabash National Corp.* | | | 1,050,527 | |

| | 234,005 | | Wal-Mart Stores, Inc. | | | 16,174,426 | |

| | 32,200 | | Wesco Aircraft Holdings, Inc.* | | | 481,390 | |

| | | | | 267,033,948 | |

| | | | | | |

| | | | Consumer, Non-cyclical-8.1% | | | | |

| | 71,030 | | Aetna, Inc. | | | 8,808,430 | |

| | 71,935 | | Anthem, Inc. | | | 10,342,095 | |

| | 24,530 | | Barrett Business Services, Inc. | | | 1,572,373 | |

| See Notes to Financial Statements. | |

| James Balanced: Golden Rainbow Fund | Schedule of Investments |

December 31, 2016 (Unaudited)

| Shares or Principal Amount | | Value | |

| | | | Consumer, Non-cyclical (continued) | | | | |

| | 56,260 | | Cardtronics PLC, Class A* | | $ | 3,070,108 | |

| | 307,039 | | Convergys Corp. | | | 7,540,878 | |

| | 200,000 | | Dr Pepper Snapple Group, Inc. | | | 18,134,000 | |

| | 272,022 | | DST Systems, Inc. | | | 29,147,157 | |

| | 20,590 | | Farmer Brothers Co.* | | | 755,653 | |

| | 129,650 | | Grand Canyon Education, Inc.* | | | 7,578,042 | |

| | 116,531 | | Helen of Troy, Ltd.* | | | 9,841,043 | |

| | 338,830 | | Ingles Markets, Inc., Class A | | | 16,297,723 | |

| | 76,500 | | Ingredion, Inc. | | | 9,559,440 | |

| | 142,055 | | John B Sanfilippo & Son, Inc. | | | 9,999,251 | |

| | 773,480 | | Kroger Co. | | | 26,692,795 | |

| | 145,358 | | ManpowerGroup, Inc. | | | 12,917,965 | |

| | 31,620 | | Medifast, Inc. | | | 1,316,341 | |

| | 674,260 | | Merck & Co., Inc. | | | 39,693,686 | |

| | 68,431 | | National HealthCare Corp. | | | 5,186,385 | |

| | 218,710 | | Natural Health Trends Corp. | | | 5,434,944 | |

| | 600,000 | | Newell Brands, Inc. | | | 26,790,000 | |

| | 181,465 | | Nutrisystem, Inc. | | | 6,287,762 | |

| | 454,550 | | Omega Protein Corp.* | | | 11,386,478 | |

| | 777,530 | | Pfizer, Inc. | | | 25,254,174 | |

| | 104,514 | | Sanderson Farms, Inc. | | | 9,849,399 | |

| | 69,960 | | Superior Uniform Group, Inc. | | | 1,372,615 | |

| | 366,992 | | Toro Co. | | | 20,533,202 | |

| | | | | 325,361,939 | |

| | | | | | |

| | | | Energy-2.5% | | | | |

| | 187,500 | | BP PLC, Sponsored ADR | | | 7,008,750 | |

| | 33,430 | | Canadian Solar, Inc.* | | | 407,177 | |

| | 355,020 | | Diamond Offshore Drilling, Inc.* | | | 6,283,854 | |

| | 30,018 | | Matrix Service Co.* | | | 681,409 | |

| | 1,985,900 | | McDermott International, Inc.* | | | 14,675,801 | |

| | 9,670 | | Rowan Cos., PLC, Class A* | | | 182,666 | |

| | 34,770 | | SolarEdge Technologies, Inc.* | | | 431,148 | |

| | 136,580 | | Star Gas Partners LP | | | 1,469,601 | |

| | 374,950 | | Tesoro Corp. | | | 32,789,378 | |

| | 444,710 | | Valero Energy Corp. | | | 30,382,587 | |

| | 104,435 | | World Fuel Services Corp. | | | 4,794,611 | |

| | | | | 99,106,982 | |

| | | | | | |

| | | | Financial-9.4% | | | | |

| | 48,300 | | Aaron's, Inc. | | | 1,545,117 | |

| | 116,293 | | American Financial Group, Inc. | | | 10,247,739 | |

| | 1,039,470 | | AmTrust Financial Services, Inc. | | | 28,460,689 | |

| | 809,372 | | Annaly Capital Management, Inc., REIT | | | 8,069,439 | |

| | 67,100 | | Ares Commercial Real Estate Corp., REIT | | | 921,283 | |

| | 281,736 | | Argo Group International Holdings, Ltd. | | | 18,566,402 | |

| | 185,630 | | Ashford Hospitality Trust, Inc., REIT | | | 1,440,489 | |

| | 100,000 | | Bank of Montreal | | | 7,192,000 | |

| | 449,972 | | Brandywine Realty Trust, REIT | | | 7,429,038 | |

| | 77,000 | | Capital One Financial Corp. | | | 6,717,480 | |

| | 752,426 | | Chimera Investment Corp., REIT | | | 12,806,291 | |

| | 60,300 | | CorEnergy Infrastructure Trust, Inc., REIT | | | 2,103,264 | |

| | 143,615 | | Dynex Capital, Inc., REIT | | | 979,454 | |

| | 94,990 | | ePlus, Inc.* | | | 10,942,848 | |

| See Notes to Financial Statements. | |

| Semi-Annual Report | December 31, 2016 | 11 |

| Schedule of Investments | James Balanced: Golden Rainbow Fund |

| December 31, 2016 (Unaudited) |

| Shares or Principal Amount | | Value | |

| | | | Financial (continued) | | | | |

| | 813,010 | | Fifth Third Bancorp | | $ | 21,926,880 | |

| | 13,500 | | First Interstate BancSystem, Inc., Class A | | | 574,425 | |

| | 30,320 | | Franklin Financial Network, Inc.* | | | 1,268,892 | |

| | 60,000 | | Franklin Resources, Inc. | | | 2,374,800 | |

| | 47,225 | | Getty Realty Corp., REIT | | | 1,203,765 | |

| | 466,046 | | Government Properties Income Trust, REIT | | | 8,885,167 | |

| | 45,420 | | Hanmi Financial Corp. | | | 1,585,158 | |

| | 13,465 | | Hanover Insurance Group, Inc. | | | 1,225,450 | |

| | 504,470 | | JPMorgan Chase & Co. | | | 43,530,716 | |

| | 1,032,600 | | KeyCorp | | | 18,865,602 | |

| | 37,385 | | LendingTree, Inc.* | | | 3,788,970 | |

| | 147,696 | | LTC Properties, Inc., REIT | | | 6,938,758 | |

| | 133,150 | | MainSource Financial Group, Inc. | | | 4,580,360 | |

| | 27,210 | | Meta Financial Group, Inc. | | | 2,799,909 | |

| | 31,250 | | MutualFirst Financial, Inc. | | | 1,034,375 | |

| | 46,120 | | National Storage Affiliates Trust, REIT | | | 1,017,868 | |

| | 377,630 | | Nelnet, Inc., Class A | | | 19,164,723 | |

| | 105,180 | | Old National Bancorp | | | 1,909,017 | |

| | 85,930 | | People's Utah Bancorp | | | 2,307,221 | |

| | 125,000 | | Principal Financial Group, Inc. | | | 7,232,500 | |

| | 141,710 | | Prospect Capital Corp. | | | 1,183,279 | |

| | 210,000 | | Regions Financial Corp. | | | 3,015,600 | |

| | 29,970 | | Sunstone Hotel Investors, Inc., REIT | | | 457,043 | |

| | 78,850 | | TCF Financial Corp. | | | 1,544,672 | |

| | 233,270 | | Torchmark Corp. | | | 17,205,995 | |

| | 505,424 | | Travelers Cos., Inc. | | | 61,874,006 | |

| | 15,000 | | United Overseas Bank, Ltd., Sponsored ADR | | | 422,100 | |

| | 475,000 | | Unum Group | | | 20,866,750 | |

| | 30,320 | | Whitestone, REIT | | | 436,002 | |

| | | | | 376,641,536 | |

| | | | | | |

| | | | Industrial-6.1% | | | | |

| | 75,593 | | Aegion Corp.* | | | 1,791,554 | |

| | 80,000 | | AGCO Corp. | | | 4,628,800 | |

| | 64,760 | | Air Transport Services Group, Inc.* | | | 1,033,570 | |

| | 17,733 | | Alamo Group, Inc. | | | 1,349,481 | |

| | 315,210 | | American Axle & Manufacturing Holdings, Inc.* | | | 6,083,553 | |

| | 185,075 | | American Outdoor Brands Corp.* | | | 3,901,381 | |

| | 201,330 | | American Railcar Industries, Inc. | | | 9,118,236 | |

| | 115,390 | | American Woodmark Corp.* | | | 8,683,097 | |

| | 37,350 | | Argan, Inc. | | | 2,635,042 | |

| | 106,090 | | Ceco Environmental Corp. | | | 1,479,955 | |

| | 224,430 | | Costamare, Inc. | | | 1,256,808 | |

| | 200,740 | | Covenant Transportation Group, Inc., Class A* | | | 3,882,312 | |

| | 138,922 | | Crown Holdings, Inc.* | | | 7,303,130 | |

| | 214,755 | | Culp, Inc. | | | 7,978,148 | |

| | 177,500 | | Deere & Co. | | | 18,289,600 | |

| | 173,425 | | DHT Holdings, Inc. | | | 717,980 | |

| | 77,400 | | FedEx Corp. | | | 14,411,880 | |

| | 632,700 | | Frontline, Ltd. | | | 4,498,497 | |

| | 265,005 | | Gener8 Maritime, Inc.* | | | 1,187,222 | |

| | 5,800 | | Gibraltar Industries, Inc.* | | | 241,570 | |

| | 271,920 | | Global Brass & Copper Holdings, Inc. | | | 9,326,856 | |

| | 118,700 | | Hollysys Automation Technologies, Ltd. | | | 2,174,584 | |

| See Notes to Financial Statements. | |

| James Balanced: Golden Rainbow Fund | Schedule of Investments |

| | December 31, 2016 (Unaudited) |

| Shares or Principal Amount | | Value | |

| | | | Industrial (continued) | | | | |

| | 51,230 | | Huntington Ingalls Industries, Inc. | | $ | 9,436,054 | |

| | 35,110 | | Insteel Industries, Inc. | | | 1,251,320 | |

| | 1,092,890 | | Magna International, Inc. | | | 47,431,426 | |

| | 38,830 | | NACCO Industries, Inc., Class A | | | 3,516,057 | |

| | 54,080 | | Republic Services, Inc. | | | 3,085,264 | |

| | 32,400 | | Ryder System, Inc. | | | 2,411,856 | |

| | 488,550 | | Ship Finance International, Ltd. | | | 7,254,968 | |

| | 266,910 | | Sonoco Products Co. | | | 14,066,157 | |

| | 43,029 | | Sturm Ruger & Co., Inc. | | | 2,267,628 | |

| | 35,635 | | Superior Industries International, Inc. | | | 938,982 | |

| | 267,430 | | Teekay Tankers, Ltd., Class A | | | 604,392 | |

| | 12,380 | | Tenneco, Inc.* | | | 773,379 | |

| | 25,000 | | Trinity Industries, Inc. | | | 694,000 | |

| | 84,320 | | Unifi, Inc.* | | | 2,751,362 | |

| | 347,680 | | United Rentals, Inc.* | | | 36,708,054 | |

| | | | | 245,164,155 | |

| | | | | | |

| | | | Technology-8.3% | | | | |

| | 652,527 | | ACCO Brands Corp.* | | | 8,515,477 | |

| | 306,400 | | Arrow Electronics, Inc.* | | | 21,846,320 | |

| | 255,210 | | Avnet, Inc. | | | 12,150,548 | |

| | 31,000 | | Broadcom, Ltd. | | | 5,479,870 | |

| | 47,940 | | Cabot Microelectronics Corp. | | | 3,028,370 | |

| | 363,070 | | Cisco Systems, Inc. | | | 10,971,975 | |

| | 437,810 | | Corning, Inc. | | | 10,625,649 | |

| | 28,995 | | CSG Systems International, Inc. | | | 1,403,358 | |

| | 986,375 | | Deluxe Corp. | | | 70,634,314 | |

| | 74,880 | | Digi International, Inc.* | | | 1,029,600 | |

| | 54,670 | | Eastman Kodak Co.* | | | 847,385 | |

| | 366,269 | | Ebix, Inc. | | | 20,895,646 | |

| | 29,500 | | Engility Holdings, Inc.* | | | 994,150 | |

| | 20,000 | | General Dynamics Corp. | | | 3,453,200 | |

| | 257,740 | | Hackett Group, Inc. | | | 4,551,688 | |

| | 461,500 | | Intel Corp. | | | 16,738,605 | |

| | 22,120 | | International Business Machines Corp. | | | 3,671,699 | |

| | 68,460 | | Leidos Holdings, Inc. | | | 3,501,044 | |

| | 109,930 | | Lockheed Martin Corp. | | | 27,475,904 | |

| | 34,880 | | Nanometrics, Inc.* | | | 874,093 | |

| | 51,240 | | NeuStar, Inc., Class A* | | | 1,711,416 | |

| | 171,220 | | Northrop Grumman Corp. | | | 39,822,348 | |

| | 321,655 | | Orbotech, Ltd.* | | | 10,746,494 | |

| | 131,710 | | PC Connection, Inc. | | | 3,699,734 | |

| | 249,650 | | SYNNEX Corp. | | | 30,212,643 | |

| | 31,030 | | Triumph Group, Inc. | | | 822,295 | |

| | 107,760 | | Unisys Corp.* | | | 1,611,012 | |

| | 228,330 | | WESCO International, Inc.* | | | 15,195,362 | |

| | | | | 332,510,199 | |

| | | | | | |

| | | | Utilities-5.4% | | | | |

| | 225,520 | | American Electric Power Co., Inc. | | | 14,198,739 | |

| | 1,637,700 | | AT&T, Inc. | | | 69,651,381 | |

| | 93,965 | | Avista Corp. | | | 3,757,660 | |

| | 418,554 | | BT Group PLC, Sponsored ADR | | | 9,639,299 | |

| | 339,850 | | CenterPoint Energy, Inc. | | | 8,373,904 | |

| See Notes to Financial Statements. | |

| Semi-Annual Report | December 31, 2016 | 13 |

| Schedule of Investments | James Balanced: Golden Rainbow Fund |

December 31, 2016 (Unaudited)

| Shares or Principal Amount | | Value | |

| | | | Utilities (continued) | | | | |

| | 89,620 | | DTE Energy Co. | | $ | 8,828,466 | |

| | 65,000 | | Edison International | | | 4,679,350 | |

| | 107,480 | | IDACORP, Inc. | | | 8,657,514 | |

| | 26,080 | | Otter Tail Corp. | | | 1,064,064 | |

| | 97,210 | | Pinnacle West Capital Corp. | | | 7,585,296 | |

| | 176,175 | | PNM Resources, Inc. | | | 6,042,803 | |

| | 365,620 | | Portland General Electric Co. | | | 15,842,315 | |

| | 317,120 | | Public Service Enterprise Group, Inc. | | | 13,915,226 | |

| | 44,670 | | SJW Group | | | 2,500,627 | |

| | 73,067 | | Spark Energy, Inc., Class A | | | 2,213,930 | |

| | 14,650 | | Spire, Inc. | | | 945,658 | |

| | 265,510 | | UGI Corp. | | | 12,234,701 | |

| | 300,720 | | Verizon Communications, Inc. | | | 16,052,434 | |

| | 883,480 | | Vonage Holdings Corp.* | | | 6,051,838 | |

| | 75,170 | | Westar Energy, Inc. | | | 4,235,830 | |

| | | | | 216,471,035 | |

| | | | | | |

| TOTAL COMMON STOCKS (Cost $1,619,622,462) | | | 2,092,763,766 | |

| | | | | | |

| CLOSED-END FUNDS-0.0%(a) | |

| | 131,000 | | BlackRock Resources & Commodities Strategy Trust | | | 1,083,370 | |

| | | | | | | | |

| TOTAL CLOSED-END FUNDS (Cost $929,275) | | | 1,083,370 | |

| | | | | | |

| EXCHANGE TRADED FUNDS-1.0% | |

| | 107,910 | | iShares® MSCI All Peru Capped ETF | | | 3,539,448 | |

| | 109,760 | | iShares® MSCI Canada ETF | | | 2,870,224 | |

| | 94,410 | | iShares® MSCI Chile Capped ETF | | | 3,532,822 | |

| | 55,590 | | iShares® MSCI Philippines ETF | | | 1,802,228 | |

| | 7,000 | | iShares® National AMT-Free Municipal Bond ETF | | | 757,260 | |

| | 704,760 | | iShares® Silver Trust ETF* | | | 10,648,924 | |

| | 119,610 | | SPDR® Gold Shares ETF* | | | 13,110,452 | |

| | 106,112 | | VanEck Vectors Indonesia Index ETF | | | 2,252,758 | |

| | | | | | | | |

| TOTAL EXCHANGE TRADED FUNDS (Cost $37,960,825) | | | 38,514,116 | |

| | | | | | |

| CORPORATE BONDS-7.0% | |

| | | | Basic Materials-0.0%(a) | | | | |

| $ | 1,500,000 | | E.I. du Pont de Nemours & Co., 5.750%, 3/15/19 | | | 1,625,242 | |

| | | | | | | | |

| | | | Communications-0.2% | | | | |

| | 8,000,000 | | Alphabet, Inc., 3.625%, 5/19/21 | | | 8,476,440 | |

| | | | | | | | |

| | | | Consumer, Cyclical-0.5% | | | | |

| | 5,000,000 | | eBay, Inc., 2.600%, 7/15/22 | | | 4,841,080 | |

| | 5,000,000 | | Home Depot, Inc., 2.700%, 4/1/23 | | | 4,984,255 | |

| | 5,000,000 | | Home Depot, Inc., 5.950%, 4/1/41 | | | 6,345,350 | |

| | 785,000 | | McDonald's Corp., 5.700%, 2/1/39 | | | 903,326 | |

| | 2,000,000 | | Wal-Mart Stores, Inc., 5.250%, 9/1/35 | | | 2,388,348 | |

| | | | | | | 19,462,359 | |

See Notes to Financial Statements.

| James Balanced: Golden Rainbow Fund | Schedule of Investments |

December 31, 2016 (Unaudited)

| Shares or Principal Amount | | Value | |

| | | | Consumer, Non-cyclical-1.2% | | | | |

| $ | 10,000,000 | | Coca-Cola Co., 3.200%, 11/1/23 | | $ | 10,315,010 | |

| | 3,000,000 | | Hershey Co., 4.125%, 12/1/20 | | | 3,217,926 | |

| | 5,475,000 | | Johnson & Johnson, 4.500%, 9/1/40 | | | 6,106,804 | |

| | 5,000,000 | | Merck & Co., Inc., 2.800%, 5/18/23 | | | 5,013,760 | |

| | 10,000,000 | | Merck & Co., Inc., 4.150%, 5/18/43 | | | 10,251,260 | |

| | 10,000,000 | | PepsiCo, Inc., 5.000%, 6/1/18 | | | 10,500,190 | |

| | | | | | | 45,404,950 | |

| | | | Energy-1.4% | | | | |

| | 5,000,000 | | Apache Corp., 3.250%, 4/15/22 | | | 5,073,530 | |

| | 5,000,000 | | BP Capital Markets PLC, 3.245%, 5/6/22 | | | 5,100,335 | |

| | 8,271,000 | | Chevron Corp., 3.326%, 11/17/25 | | | 8,417,992 | |

| | 10,000,000 | | Diamond Offshore Drilling, Inc., 5.875%, 5/1/19 | | | 10,372,500 | |

| | 2,000,000 | | Phillips 66, 4.300%, 4/1/22 | | | 2,145,274 | |

| | 5,050,000 | | Shell International Finance BV, 2.375%, 8/21/22 | | | 4,954,080 | |

| | 5,000,000 | | Shell International Finance BV, 6.375%, 12/15/38 | | | 6,437,510 | |

| | 2,625,000 | | Shell International Finance BV, 4.375%, 5/11/45 | | | 2,653,712 | |

| | 10,000,000 | | Statoil ASA, 2.250%, 11/8/19 | | | 10,078,100 | |

| | | | | | | 55,233,033 | |

| | | | Financial-1.8% | | | | |

| | 5,000,000 | | Aflac, Inc., 2.650%, 2/15/17 | | | 5,007,500 | |

| | 8,000,000 | | Aflac, Inc., 3.625%, 11/15/24 | | | 8,223,344 | |

| | 14,733,000 | | American Express Credit Corp., 1.125%, 6/5/17 | | | 14,730,436 | |

| | 5,000,000 | | Berkshire Hathaway, Inc., 3.750%, 8/15/21 | | | 5,290,360 | |

| | 5,000,000 | | Citigroup, Inc., 4.450%, 1/10/17 | | | 5,002,140 | |

| | 11,000,000 | | JPMorgan Chase & Co., 4.250%, 10/15/20 | | | 11,631,895 | |

| | 5,000,000 | | Morgan Stanley & Co., 4.750%, 3/22/17 | | | 5,037,645 | |

| | 6,000,000 | | PNC Bank Na, 2.950%, 2/23/25 | | | 5,883,882 | |

| | 1,775,000 | | PNC Bank NA, 1.950%, 3/4/19 | | | 1,776,228 | |

| | 5,000,000 | | UBS AG, 5.875%, 12/20/17 | | | 5,204,355 | |

| | 5,000,000 | | Wells Fargo & Co., 2.500%, 3/4/21 | | | 4,958,780 | |

| | | | | | | 72,746,565 | |

| | | | Industrial-0.5% | | | | |

| | 1,000,000 | | Caterpillar, Inc., 7.900%, 12/15/18 | | | 1,115,948 | |

| | 1,000,000 | | Caterpillar, Inc., 8.250%, 12/15/38 | | | 1,577,543 | |

| | 10,000,000 | | General Electric Capital Corp., 1.680%, 4/15/20(b) | | | 10,154,810 | |

| | 2,000,000 | | General Electric Capital Corp., 6.875%, 1/10/39 | | | 2,815,328 | |

| | 5,000,000 | | United Technologies Corp., 3.100%, 6/1/22 | | | 5,133,755 | |

| | | | | | | 20,797,384 | |

| | | | Technology-1.2% | | | | |

| | 3,419,000 | | Apple, Inc., 1.550%, 2/7/20 | | | 3,375,404 | |

| | 5,000,000 | | Intel Corp., 3.300%, 10/1/21 | | | 5,190,960 | |

| | 7,000,000 | | International Business Machines Corp., 1.875%, 8/1/22 | | | 6,702,955 | |

| | 3,700,000 | | Microsoft Corp., 5.200%, 6/1/39 | | | 4,330,643 | |

| | 10,000,000 | | Microsoft Corp., 3.500%, 11/15/42 | | | 9,111,190 | |

| | 7,266,000 | | Oracle Corp., 2.500%, 10/15/22 | | | 7,180,021 | |

| | 10,000,000 | | QUALCOMM, Inc., 4.650%, 5/20/35 | | | 10,555,160 | |

| | | | | | | 46,446,333 | |

| | | | Utilities-0.2% | | | | |

| | 5,000,000 | | Duke Energy Florida LLC, Series A, 5.800%, 9/15/17 | | | 5,156,115 | |

See Notes to Financial Statements.

Semi-Annual Report | December 31, 2016 | 15 |

| Schedule of Investments | James Balanced: Golden Rainbow Fund |

December 31, 2016 (Unaudited)

| Shares or Principal Amount | | Value | |

| | | | Utilities (continued) | | | | |

| | $4,600,000 | | San Diego Gas & Electric Co., 3.000%, 8/15/21 | | $ | 4,728,280 | |

| | | | | | | 9,884,395 | |

| TOTAL CORPORATE BONDS (Cost $279,355,729) | | | 280,076,701 | |

| | | | | | |

| MORTGAGE BACKED SECURITIES-0.4% | |

| | | | Federal National Mortgage Association-0.3% | | | | |

| $ | 11,654,519 | | 3.500%, 9/1/33 | | | 12,121,447 | |

| | 1,478,764 | | 4.500%, 9/1/40 | | | 1,554,495 | |

| | | | | | | 13,675,942 | |

| | | | Government National Mortgage Association-0.1% | | | | |

| | 3,230,472 | | 4.000%, 12/20/40 | | | 3,463,018 | |

| | | | | | | | |

| TOTAL MORTGAGE BACKED SECURITIES (Cost $16,739,655) | | | 17,138,960 | |

| | | | | | |

| U.S. GOVERNMENT AGENCIES-5.1% | |

| | | | Federal Farm Credit Banks-1.1% | | | | |

| | 10,000,000 | | 1.170%, 5/16/19 | | | 9,942,770 | |

| | 10,000,000 | | 2.350%, 5/2/24 | | | 9,641,920 | |

| | 5,725,000 | | 2.750%, 11/6/26 | | | 5,664,178 | |

| | 10,000,000 | | 2.800%, 6/2/28 | | | 9,730,170 | |

| | 10,000,000 | | 3.220%, 3/26/31 | | | 10,020,060 | |

| | | | | | | 44,999,098 | |

| | | | Federal Home Loan Banks-3.6% | | | | |

| | 25,000,000 | | 0.700%, 6/5/17 | | | 24,997,900 | |

| | 50,000,000 | | 1.000%, 8/28/18 | | | 49,698,300 | |

| | 11,250,000 | | 1.200%, 5/23/19 | | | 11,169,191 | |

| | 5,000,000 | | 1.600%, 10/22/20 | | | 4,822,295 | |

| | 10,000,000 | | 1.500%, 12/28/21(c) | | | 9,987,100 | |

| | 10,000,000 | | 2.050%, 6/9/23 | | | 9,778,940 | |

| | 10,000,000 | | 2.620%, 4/28/26 | | | 9,646,890 | |

| | 5,981,481 | | 3.000%, 4/18/31 | | | 5,890,862 | |

| | 19,000,000 | | 2.000%, 6/30/31(c) | | | 18,122,371 | |

| | | | | | | 144,113,849 | |

| | | | Federal Home Loan Mortgage Corporation-0.3% | | | | |

| | 5,000,000 | | 1.000%, 8/26/19(c) | | | 4,971,825 | |

| | 5,000,000 | | 1.000%, 12/30/21 | | | 4,999,325 | |

| | | | | | | 9,971,150 | |

| | | | United States Department of Housing and Urban Development-0.1% | | | | |

| | 5,000,000 | | 2.050%, 8/1/19 | | | 5,052,060 | |

| | | | | | | | |

| TOTAL U.S. GOVERNMENT AGENCIES (Cost $207,087,011) | | | 204,136,157 | |

| | | | | | |

| U.S. TREASURY BONDS & NOTES-25.7% | |

| | | | U.S. Treasury Bonds-2.8% | | | | |

| $ | 45,000,000 | | 1.625%, 5/15/26 | | | 41,896,575 | |

| | 40,000,000 | | 5.375%, 2/15/31 | | | 53,182,920 | |

| | 20,000,000 | | 2.500%, 2/15/46 | | | 17,728,300 | |

| | | | | | | 112,807,795 | |

See Notes to Financial Statements.

| James Balanced: Golden Rainbow Fund | Schedule of Investments |

December 31, 2016 (Unaudited)

| Shares or Principal Amount | | Value | |

| | | | U.S. Treasury Inflation Indexed Bonds-0.8% | | | | |

| $ | 30,000,000 | | 0.625%, 7/15/21 | | $ | 33,197,932 | |

| | | | | | | | |

| | | | U.S. Treasury Inflation Indexed Notes-1.7% | | | | |

| | 26,500,000 | | 1.625%, 1/15/18 | | | 31,374,395 | |

| | 35,000,000 | | 0.125%, 1/15/22 | | | 37,438,794 | |

| | | | | | | 68,813,189 | |

| | | | U.S. Treasury Notes-20.4% | | | | |

| | 40,000,000 | | 0.500%, 1/31/17 | | | 40,004,560 | |

| | 40,000,000 | | 0.500%, 2/28/17 | | | 40,003,680 | |

| | 105,000,000 | | 0.875%, 11/15/17 | | | 105,000,525 | |

| | 10,000,000 | | 0.750%, 2/28/18 | | | 9,975,780 | |

| | 155,000,000 | | 1.500%, 8/31/18 | | | 155,946,275 | |

| | 180,000,000 | | 2.750%, 2/15/19 | | | 185,605,920 | |

| | 50,000,000 | | 1.375%, 9/30/20 | | | 49,396,700 | |

| | 97,500,000 | | 2.625%, 11/15/20 | | | 100,697,707 | |

| | 15,000,000 | | 1.125%, 2/28/21 | | | 14,582,520 | |

| | 58,000,000 | | 2.125%, 5/15/25 | | | 56,778,404 | |

| | 60,000,000 | | 2.000%, 8/15/25 | | | 58,036,440 | |

| | | | | | | 816,028,511 | |

| TOTAL U.S. TREASURY BONDS & NOTES (Cost $1,033,012,319) | | | 1,030,847,427 | |

| | | | | | |

| FOREIGN BONDS-0.8% | |

| | | | Australia Government-0.2% | | | | |

| | AUD 10,000,000 | | 5.250%, 3/15/19 | | | 7,734,365 | |

| | | | | | | | |

| | | | Canadian Government-0.2% | | | | |

| | CAD 5,000,000 | | 3.750%, 6/1/19 | | | 3,985,141 | |

| | CAD 5,000,000 | | 3.500%, 6/1/20 | | | 4,039,884 | |

| | | | | | | 8,025,025 | |

| | | | New Zealand Government-0.2% | | | | |

| | NZD 15,000,000 | | 5.000%, 3/15/19 | | | 11,037,004 | |

| | | | | | | | |

| | | | Singapore Government-0.2% | | | | |

| | SGD 10,000,000 | | 2.250%, 6/1/21 | | | 7,033,746 | |

| | | | | | | | |

| TOTAL FOREIGN BONDS (Cost $37,771,528) | | | 33,830,140 | |

| | | | | | |

| MUNICIPAL BONDS-5.1% | |

| | | | California-0.0%(a) | | | | |

| | 1,000,000 | | Citrus Community College District General Obligation Unlimited Bonds, Series B, Prefunded 6/01/17 @ 100, 4.750%, 6/1/31(d) | | | 1,015,540 | |

| | | | | | | | |

| | | | Connecticut-0.2% | | | | |

| | 5,350,000 | | State of Connecticut, Series D, 5.000%, 11/1/25 | | | 5,969,316 | |

| | | | | | | | |

| | | | Florida-0.4% | | | | |

| | 10,775,000 | | Florida State Board of Education Capital Outlay General Obligation Bonds, Series C, 5.000%, 6/1/23 | | | 12,624,313 | |

| | 1,000,000 | | Florida State Board of Education Capital Outlay General Obligation Bonds, Series D, 5.000%, 6/1/38 | | | 1,056,830 | |

| | | | | | | 13,681,143 | |

See Notes to Financial Statements.

Semi-Annual Report | December 31, 2016 | 17 |

| Schedule of Investments | James Balanced: Golden Rainbow Fund |

December 31, 2016 (Unaudited)

| Shares or Principal Amount | | Value | |

| | | | Georgia-0.2% | | | | |

| $ | 3,000,000 | | State of Georgia General Obligation Unlimited Bonds, Series B, 4.500%, 1/1/29 | | $ | 3,140,130 | |

| | 5,000,000 | | State of Georgia General Obligation Unlimited Bonds, Series D, 5.000%, 2/1/25 | | | 5,863,000 | |

| | | | | | | 9,003,130 | |

| | | | Hawaii-0.3% | | | | |

| | 9,000,000 | | City and County of Honolulu General Obligation Unlimited Bonds, Series B, 5.000%, 11/1/25 | | | 10,428,480 | |

| | | | | | | | |

| | | | Illinois-0.0%(a) | | | | |

| | 1,000,000 | | Village of Bolingbrook General Obligation Unlimited Bonds, 5.000%, 1/1/37 | | | 1,023,380 | |

| | | | | | | | |

| | | | Maryland-0.1% | | | | |

| | 5,000,000 | | County of Montgomery General Obligation Unlimited Bonds, Series A, 3.000%, 11/1/29 | | | 4,989,300 | |

| | | | | | | | |

| | | | Massachusetts-0.0%(a) | | | | |

| | 1,000,000 | | Commonwealth of Massachusetts General Obligation Limited Bonds, Series C, Prefunded 8/1/17 @ 100, 5.250%, 8/1/22(d) | | | 1,024,360 | |

| | | | | | | | |

| | | | Michigan-0.0%(a) | | | | |

| | 1,000,000 | | Marysville Public School District General Obligation Unlimited Bonds (School Building & Site), Prefunded 5/1/17 @ 100, 5.000%, 5/1/32(d) | | | 1,013,110 | |

| | | | | | | | |

| | | | Ohio-1.6% | | | | |

| | 7,450,000 | | Beavercreek City School District General Obligation Unlimited Bonds, 3.250%, 12/1/36 | | | 7,205,193 | |

| | 6,395,000 | | City of Cincinnati General Obligation Unlimited Bonds, Series A, 3.000%, 12/1/27 | | | 6,468,287 | |

| | 5,450,000 | | City of Columbus General Obligation Various Purpose Limited Tax Bonds, Series B, 3.250%, 8/15/24 | | | 5,728,168 | |

| | 1,500,000 | | City of Newark General Obligation Limited Bonds, 1.750%, 5/16/17 | | | 1,502,520 | |

| | 5,000,000 | | County of Cuyahoga General Obligation Limited (Capital Improvement), Series A, 4.000%, 12/1/37 | | | 5,116,100 | |

| | 2,580,000 | | County of Trumbull OH General Obligation Limited Notes, Series B, 2.000%, 8/31/17 | | | 2,591,481 | |

| | | | Greenville City School District General Obligation Unlimited Bonds (School Improvement): | | | | |

| | 5,000,000 | | 5.000%, 1/1/46 | | | 5,540,750 | |

| | 11,000,000 | | 5.500%, 1/1/51 | | | 12,126,070 | |

| | 1,100,000 | | Miamisburg City School District General Obligation Unlimited Bonds (School Facilities Construction & Improvement), Prerefunded 12/1/18 @ 100, 5.000%, 12/1/33(d) | | | 1,176,560 | |

| | 500,000 | | Mount Healthy City School District General Obligation Unlimited Bonds (School Improvement), Prefunded 6/1/18 @ 100, 5.000%, 12/1/26(d) | | | 526,180 | |

| | 1,000,000 | | Ohio State University General Recipients Revenue Bonds, Series C, 4.910%, 6/1/40 | | | 1,140,510 | |

| | 105,000 | | Ohio State University Revenue Bonds, Series A, Prefunded 12/1/18 @ 100, 5.000%, 12/1/28(d) | | | 112,308 | |

| | 895,000 | | Ohio State University Revenue Bonds, Series A, Unrefunded Portion, 5.000%, 12/1/28 | | | 954,670 | |

| | 500,000 | | Springboro Community City School District General Obligation Unlimited Bonds, 5.250%, 12/1/23 | | | 579,185 | |

| | | | State of Ohio General Obligation Unlimited Bonds, Series A, Prefunded 3/1/18 @ 100: | | | | |

| | 365,000 | | 5.375%, 9/1/28(d) | | | 382,604 | |

| | 635,000 | | 5.375%, 9/1/28(d) | | | 666,001 | |

| | 3,475,000 | | State of Ohio General Obligation Unlimited Bonds, Series C, 5.000%, 9/1/19 | | | 3,787,541 | |

| | 6,900,000 | | State of Ohio General Obligation Unlimited Bonds, Series S, 5.000%, 5/1/28 | | | 8,262,819 | |

| | 1,000,000 | | Wright State University Revenue Bonds, 4.000%, 5/1/18 | | | 1,035,400 | |

| | | | | | | 64,902,347 | |

| | | | Pennsylvania-1.1% | | | | |

| | | | Commonwealth of Pennsylvania General Obligation Unlimited Bonds, First Series: | | | | |

| | 20,000,000 | | 5.000%, 6/1/24 | | | 22,534,600 | |

| | 12,005,000 | | 5.000%, 3/15/25 | | | 13,936,004 | |

| | 7,050,000 | | 5.000%, 9/15/26 | | | 8,260,556 | |

| | | | | | | 44,731,160 | |

See Notes to Financial Statements.

| James Balanced: Golden Rainbow Fund | Schedule of Investments |

December 31, 2016 (Unaudited)

| Shares or Principal Amount | | Value | |

| | | | Tennessee-0.1% | | | | |

| $ | 5,000,000 | | Metropolitan Government of Nashville & Davidson County TN General Obligation Unlimited Bonds, Series C, 4.000%, 7/1/24 | | $ | 5,585,350 | |

| | | | | | | | |

| | | | Texas-0.6% | | | | |

| | 1,000,000 | | Friendswood Independent School District General Obligation Unlimited Bonds (Schoolhouse), Prefunded 2/15/18 @ 100, 5.000%, 2/15/37(d) | | | 1,043,050 | |

| | 5,000,000 | | Houston Texas Independent School District General Obligation Limited Bonds, Series A, 5.000%, 2/15/28 | | | 5,967,800 | |

| | 1,000,000 | | Judson Independent School District General Obligation Unlimited Bonds (School Building), Prefunded 2/1/17 @ 100, 5.000%, 2/1/37(d) | | | 1,003,000 | |

| | 500,000 | | Lamar Consolidated Independent School District General Obligation Unlimited Bonds (Schoolhouse), Prefunded 2/15/17 @ 100, 5.000%, 2/15/38(d) | | | 502,335 | |

| | 5,335,000 | | Port of Houston Authority General Obligation Unlimited Bonds, Series D-1, 5.000%, 10/1/35 | | | 5,922,970 | |

| | 7,620,000 | | Referendum Transportation Community Mobility General Obligation Unlimited Bonds, Series A, 5.000%, 10/1/25 | | | 9,199,854 | |

| | 475,000 | | Tyler Independent School District General Obligation Unlimited Bonds, Prefunded 2/15/18 @ 100, 5.000%, 2/15/34(d) | | | 495,183 | |

| | 525,000 | | Tyler Independent School District General Obligation Unlimited Bonds, Unrefunded Portion, 5.000%, 2/15/34 | | | 546,919 | |

| | | | | | | 24,681,111 | |

| | | | Washington-0.3% | | | | |

| | 5,000,000 | | State of Washington General Obligation Unlimited Bonds, Series D, 4.000%, 2/1/37 | | | 5,192,950 | |

| | 5,845,000 | | State of Washington General Obligation Various Purpose Unlimited Bonds, Series D, 5.000%, 2/1/20 | | | 6,432,832 | |

| | | | | | | 11,625,782 | |

| | | | Wisconsin-0.2% | | | | |

| | 5,000,000 | | State of Wisconsin General Obligation Unlimited Bonds, Series C, Prefunded 5/1/21 @ 100, 5.000%, 5/1/25(d) | | | 5,660,100 | |

| | | | | | | | |

| TOTAL MUNICIPAL BONDS (Cost $205,387,212) | | | 205,333,609 | |

| | | | | | |

| SHORT TERM INVESTMENTS-2.2% | |

| | | | Mutual Funds-2.2% | | | | |

| | 89,441,746 | | First American Government Obligations Fund, Class Y, 7-Day Yield 0.156% | | | 89,441,746 | |

| | | | | | | | |

| TOTAL SHORT TERM INVESTMENTS (Cost $89,441,746) | | | 89,441,746 | |

| | | | | | |

| TOTAL INVESTMENT SECURITIES-99.4% (Cost $3,527,307,762) | | | 3,993,165,992 | |

| OTHER ASSETS IN EXCESS OF LIABILITIES-0.6% | | | 20,812,603 | |

| NET ASSETS-100.0% | | $ | 4,013,978,595 | |

For Fund compliance purposes, the Fund's industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. Those definitions may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

| * | Non-income producing security. |

| (a) | Less than 0.05% of Net Assets. |

| (b) | Floating or variable rate security. Interest rate disclosed is that which is in effect at December 31, 2016. |

| (c) | Step coupon. Coupon increases periodically based upon a predetermined schedule. Interest rate disclosed is that which is in effect as of December 31, 2016. |

See Notes to Financial Statements.

Semi-Annual Report | December 31, 2016 | 19 |

| Schedule of Investments | James Balanced: Golden Rainbow Fund |

December 31, 2016 (Unaudited)

| (d) | Prefunded Issues are bonds which are prerefunded and collateralized by U.S. Treasury securities held in escrow and used to pay principal and interest on tax exempt issues and to retire the bonds in full at the earliest refunding date. |

| AUD - Australian Dollar |

| CAD - Canadian Dollar |

| NZD - New Zealand Dollar |

| SGD - Singapore Dollar |

December 31, 2016 (Unaudited)

| Shares | | Value | |

| COMMON STOCKS-99.5% | |

| | | | Basic Materials-15.1% | | | |

| | 1,723 | | AEP Industries, Inc. | | $ | 200,040 | |

| | 13,875 | | Ciner Resources LP | | | 403,485 | |

| | 12,670 | | Cooper Tire & Rubber Co. | | | 492,229 | |

| | 11,880 | | Enviva Partners LP | | | 318,384 | |

| | 14,990 | | First Majestic Silver Corp.* | | | 114,374 | |

| | 34,230 | | Hecla Mining Co. | | | 179,365 | |

| | 34,860 | | Innospec, Inc. | | | 2,387,910 | |

| | 79,720 | | Lydall, Inc.* | | | 4,930,682 | |

| | 33,600 | | Neenah Paper, Inc. | | | 2,862,720 | |

| | 9,640 | | Pan American Silver Corp. | | | 145,275 | |

| | 5,940 | | Universal Forest Products, Inc. | | | 606,949 | |

| | | | | 12,641,413 | |

| | | | | | |

| | | | Consumer, Cyclical-11.4% | | | | |

| | 4,970 | | Asbury Automotive Group, Inc.* | | | 306,649 | |

| | 20,960 | | Avianca Holdings SA, Sponsored ADR | | | 202,054 | |

| | 15,430 | | Big Lots, Inc. | | | 774,740 | |

| | 20,340 | | Cato Corp., Class A | | | 611,827 | |

| | 15,160 | | Century Communities, Inc.* | | | 318,360 | |

| | 35,174 | | Flexsteel Industries, Inc. | | | 2,169,181 | |

| | 26,605 | | Hawaiian Holdings, Inc.* | | | 1,516,485 | |

| | 3,500 | | Hibbett Sports, Inc.* | | | 130,550 | |

| | 9,340 | | Insight Enterprises, Inc.* | | | 377,710 | |

| | 12,020 | | M/I Homes, Inc.* | | | 302,664 | |

| | 4,430 | | Meritage Homes Corp.* | | | 154,164 | |

| | 12,490 | | Modine Manufacturing Co.* | | | 186,101 | |

| | 23,020 | | Patrick Industries, Inc.* | | | 1,756,426 | |

| | 14,620 | | PetMed Express, Inc. | | | 337,283 | |

| | 6,110 | | Tower International, Inc. | | | 173,219 | |

| | 18,250 | | Wesco Aircraft Holdings, Inc.* | | | 272,838 | |

| | | | | 9,590,251 | |

| | | | | | |

| | | | Consumer, Non-cyclical-17.9% | | | | |

| | 3,110 | | Barrett Business Services, Inc. | | | 199,351 | |

| | 41,455 | | Cardtronics PLC, Class A* | | | 2,262,199 | |

| | 48,355 | | Convergys Corp. | | | 1,187,599 | |

| | 4,230 | | Farmer Brothers Co.* | | | 155,241 | |

| | 13,970 | | Grand Canyon Education, Inc.* | | | 816,546 | |

| | 23,630 | | Helen of Troy, Ltd.* | | | 1,995,554 | |

| | 13,565 | | Ingles Markets, Inc., Class A | | | 652,476 | |

| | 23,509 | | John B Sanfilippo & Son, Inc. | | | 1,654,799 | |

| | 4,000 | | Medifast, Inc. | | | 166,520 | |

| | 34,792 | | National HealthCare Corp. | | | 2,636,886 | |

| | 34,053 | | Natural Health Trends Corp. | | | 846,217 | |

| | 28,690 | | Omega Protein Corp.* | | | 718,684 | |

| | 11,055 | | Sanderson Farms, Inc. | | | 1,041,823 | |

| | 33,370 | | Superior Uniform Group, Inc. | | | 654,719 | |

| | | | | 14,988,614 | |

| | | | | | |

| | | | Energy-4.9% | | | | |

| | 4,660 | | Canadian Solar, Inc.* | | | 56,759 | |

| | 28,350 | | Diamond Offshore Drilling, Inc.* | | | 501,795 | |

See Notes to Financial Statements.

Semi-Annual Report | December 31, 2016 | 21 |

| Schedule of Investments | James Small Cap Fund |

December 31, 2016 (Unaudited)

| Shares | | Value | |

| | | | Energy (continued) | | | | |

| | 7,045 | | Matrix Service Co.* | | $ | 159,921 | |

| | 192,310 | | McDermott International, Inc.* | | | 1,421,171 | |

| | 6,130 | | Rowan Cos., PLC, Class A* | | | 115,796 | |

| | 4,850 | | SolarEdge Technologies, Inc.* | | | 60,140 | |

| | 136,433 | | Star Gas Partners LP | | | 1,468,019 | |

| | 7,905 | | World Fuel Services Corp. | | | 362,919 | |

| | | | | 4,146,520 | |

| | | | | | |

| | | | Financial-15.4% | | | | |

| | 27,380 | | Aaron's, Inc. | | | 875,886 | |

| | 42,831 | | Argo Group International Holdings, Ltd. | | | 2,822,563 | |

| | 14,180 | | Brandywine Realty Trust, REIT | | | 234,112 | |

| | 17,420 | | Chimera Investment Corp., REIT | | | 296,488 | |

| | 9,510 | | CorEnergy Infrastructure Trust, Inc., REIT | | | 331,709 | |

| | 16,296 | | ePlus, Inc.* | | | 1,877,299 | |

| | 6,300 | | Franklin Financial Network, Inc.* | | | 263,655 | |

| | 8,560 | | Government Properties Income Trust, REIT | | | 163,196 | |

| | 8,100 | | Hanmi Financial Corp. | | | 282,690 | |

| | 7,630 | | Hanover Insurance Group, Inc. | | | 694,406 | |

| | 8,820 | | LTC Properties, Inc., REIT | | | 414,364 | |

| | 32,501 | | MainSource Financial Group, Inc. | | | 1,118,034 | |

| | 3,910 | | Meta Financial Group, Inc. | | | 402,339 | |

| | 3,460 | | MutualFirst Financial, Inc. | | | 114,526 | |

| | 31,280 | | Old National Bancorp | | | 567,732 | |

| | 11,700 | | People's Utah Bancorp | | | 314,145 | |

| | 50,758 | | Premier Financial Bancorp, Inc. | | | 1,020,226 | |

| | 23,280 | | Prospect Capital Corp. | | | 194,388 | |

| | 19,000 | | Sunstone Hotel Investors, Inc., REIT | | | 289,750 | |

| | 30,240 | | TCF Financial Corp. | | | 592,402 | |

| | 4,920 | | Whitestone, REIT | | | 70,750 | |

| | | | | 12,940,660 | |

| | | | | | |

| | | | Industrial-6.3% | | | | |

| | 8,503 | | Aegion Corp.* | | | 201,521 | |

| | 9,450 | | Air Transport Services Group, Inc.* | | | 150,822 | |

| | 2,687 | | Alamo Group, Inc. | | | 204,481 | |

| | 25,980 | | American Outdoor Brands Corp.* | | | 547,658 | |

| | 7,040 | | American Railcar Industries, Inc. | | | 318,842 | |

| | 4,160 | | Argan, Inc. | | | 293,488 | |

| | 13,450 | | Ceco Environmental Corp. | | | 187,627 | |

| | 30,070 | | Costamare, Inc. | | | 168,392 | |

| | 30,010 | | Covenant Transportation Group, Inc., Class A* | | | 580,393 | |

| | 20,590 | | Frontline, Ltd. | | | 146,395 | |

| | 48,690 | | Gener8 Maritime, Inc.* | | | 218,131 | |

| | 19,600 | | Global Brass & Copper Holdings, Inc. | | | 672,280 | |

| | 13,390 | | Hollysys Automation Technologies, Ltd. | | | 245,305 | |

| | 4,450 | | Insteel Industries, Inc. | | | 158,598 | |