UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-08411

(Investment Company Act file number)

The James Advantage Funds

(Exact name of registrant as specified in charter)

1349 Fairground Road

Xenia, Ohio 45385

(Address of principal executive offices) (Zip code)

Barry R. James

P.O. Box 8

Alpha, Ohio 45301

(Name and address of agent for service)

Registrant’s telephone number, including area code: (937) 426-7640

Date of fiscal year end: June 30

Date of reporting period: July 1, 2019 – June 30, 2020

Item 1. Reports to Stockholders.

TABLE OF CONTENTS

| Shareholder Letter | 1 |

| Growth of $10,000 or $50,000 Charts | 4 |

| Representation of Schedules of Investments | 7 |

| Disclosure of Fund Expenses | 8 |

| Schedule of Investments | |

| James Balanced: Golden Rainbow Fund | 9 |

| James Small Cap Fund | 14 |

| James Micro Cap Fund | 16 |

| James Aggressive Allocation Fund | 18 |

| Statements of Assets and Liabilities | 21 |

| Statements of Operations | 22 |

| Statements of Changes in Net Assets | 23 |

| Financial Highlights | |

| James Balanced: Golden Rainbow Fund - Retail Class | 28 |

| James Balanced: Golden Rainbow Fund - Institutional Class | 29 |

| James Small Cap Fund | 30 |

| James Micro Cap Fund | 31 |

| James Aggressive Allocation Fund | 32 |

| Notes to Financial Statements | 33 |

| Report of Independent Registered Public Accounting Firm | 40 |

| Additional Information | 41 |

| Liquidity Risk Management Program | 42 |

| Trustees & Officers | 43 |

| Privacy Policy | 45 |

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Funds’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website at www.jamesinvestment.com and you will be notified by mail each time a report is posted and provided with a website link to access the report.

You may, notwithstanding the availability of shareholder reports online, elect to receive all future shareholder reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Funds, you can call 1-800-995-2637 to let the Funds know you wish to continue receiving paper copies of your shareholder reports.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by enrolling at www.jamesinvestment.com.

| James Advantage Funds | Shareholder Letter |

June 30, 2020 (Unaudited)

LETTER TO THE SHAREHOLDERS

OF THE JAMES ADVANTAGE FUNDS

In 1966 Robert Kennedy delivered a speech in which he said “Like it or not, we live in interesting times. They are times of danger and uncertainty; but they are also the most creative of any time in the history of mankind.” It has been 54 years since he spoke those words, yet they are just as true now as they have ever been. Every part of life has been touched by the Coronavirus, COVID-19. With that being said, we sincerely hope you, your family and friends are in good health during these challenging times.

Both the stock and bond market saw wild price swings in February, March and April as the United States went into a lockdown phase. Almost as quickly as stocks declined, we saw a reversal in fortune, causing high levels of volatility. The markets seem to have traded less on fundamentals and more on whether consumers are staying at home or are back out spending in restaurants and department stores.

In our experience, when stocks decline, oftentimes large companies hold up better than smaller ones, as was the case during the recent downturn. As stocks have recovered, the advance has remained concentrated. Large cap stocks have led the way in 2020, significantly outperforming small cap stocks. The largest cap stocks did the best, with the Russell 1000® Index earning 7.48% for the fiscal year ended June 30, 2020, while the smaller stocks in the Russell 2000® Index were down by 6.62%. This spread of over 14% speaks to the issues that smaller stocks had during the period. Yet, the bigger dilemma may be how the large cap market indices are being driven by as few as 5 stocks. To be sure, the largest 5 companies now make up over 20% of the market value of the S&P 500® Index and are what have been driving those index returns. We do in fact own several of these names in some of our mutual funds, however owning such a concentrated position may increase the risk associated with investing. While we seek to continually improve results, we nonetheless remain committed to our time-tested risk management philosophy.

The Market Over the Past Year

The stock market was doing quite well in the later stages of 2019 and even into January of 2020. Consumer spending was high, unemployment was low, and the U.S. economy was making a steady advance. However, as we all know, the Coronavirus made its way from China to our shores only to push the market into turmoil. The Russell 1000® Index, a commonly used barometer of the stock market, rose 7.48% over the twelve months ended June 30, 2020. During that same period, the Russell 2000® Index declined by 6.62% and the Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index rose 7.12%.

Investment Goals and Objectives

Our research team uses our proprietary approach to try to identify securities we believe are undervalued. In our experience, these stocks typically hold up better in difficult markets and have the potential to trade higher as the market rallies. We do not drift from our style simply because the markets are embracing a current, but temporary, fad. We believe, supported by much academic research, value investing will outperform growth investing over the long run. Investors should realize, however, value investing does not always outperform growth and there are no assurances that value’s past outperformance will be repeated.

Investment Philosophy

James Investment Research, Inc. (“JIR” or the “Adviser”) does its own research using quantitative databases, statistical expertise and other elements to help measure risk levels and the potential impact on future stock and bond price movements. The Adviser employs a proprietary investment approach to select equity securities it believes are undervalued and more likely to appreciate. The Adviser focuses on company characteristics such as being overlooked by Wall Street, management commitment and value. The Adviser also assesses a number of fundamental factors such as earnings, earnings trends, price to earnings multiples, return on assets, other financial statement data as well as its own proprietary calculations. The Adviser evaluates over 3,500 companies of all capitalization ranges. For the James Micro Cap Fund and the James Small Cap Fund, the Adviser refines its approach by using a capitalization screen and evaluates thousands of companies within the appropriate capitalization range. For all funds, the Adviser normally will sell a security when the investment no longer meets the Adviser’s investment criteria. The Adviser’s Investment Committee has a great deal of investment experience, exceeding over 150 years in total with James. We believe our combination of quantitative modeling and hands-on management makes us unique and supports the James Advantage Funds. The James Aggressive Allocation Fund and the James Balanced: Golden Rainbow Fund invest not only in equities, but also in highly rated investment grade fixed income securities.

Fund Performance

It goes without saying, the major news story that has affected the markets has been the Coronavirus and the quarantine that followed. The shuttering of restaurants, malls, movie theaters and many other businesses caused millions of layoffs and furloughs. Since March of this year, over 20 million Americans have filed for unemployment insurance.

To combat these issues the Federal Government went on a spending spree issuing Paycheck Protection Program (PPP) loans, increasing payouts for unemployment and even sending stimulus checks to a good percentage of the population. As another backstop, the Federal Reserve Bank (the “Fed”) began buying corporate bonds, municipal bonds and exchange traded funds (“ETFs”) that hold those same types of securities. While these actions surpassed even what the Fed did back in the Financial Crisis of 2008, it looks as if these actions quelled fear in the markets and provided much needed liquidity to the bond market.

| Annual Report | June 30, 2020 | 1 |

| Shareholder Letter | James Advantage Funds |

June 30, 2020 (Unaudited)

Our flagship fund, the James Balanced: Golden Rainbow Fund, seeks to provide total return through a combination of growth and income and preservation of capital in declining markets. The Fund’s Retail Class shares fell 1.18% over the twelve months ended June 30, 2020.

The largest contributors to the James Balanced: Golden Rainbow Fund’s performance were the 10-year U.S. Treasury and our equity positions in Apple, Inc. and Microsoft Corp. High quality U.S. Treasury notes and bonds rallied as the Federal Reserve took drastic measures to push interest rates lower, by cutting the Fed Funds rate 50 basis points (one half of one percent) in early March, and again by an additional 100 basis points just one week later. The two stocks that added the most to the fund, Apple and Microsoft, are the two largest stocks in the market in terms of market capitalization. This once again reinforces the point that in this specific period, bigger was in fact better.

The largest detractors to the James Balanced: Golden Rainbow Fund’s performance were iShares® Russell 2000® ETF, United Rentals, Inc. and Pfizer, Inc. The iShares® Russell 2000® ETF represents an assortment of small cap stocks, meant to provide diversification while staying in smaller stocks. The shutdown in March had a strong effect on smaller stocks as fears of declining revenues caused some to sell. United Rentals, a construction equipment rental company, suffered when the quarantine went into effect. Builders and constructions companies simply stopped renting equipment as their businesses stopped as well. Pfizer, a large pharmaceutical corporation, lagged the market as well as many other health care stocks. The bulk of the damage to Pfizer’s stock price was in response to discussions in Washington centered on how to reduce drug costs for consumers.

The James Small Cap Fund fell 19.04% over the fiscal year. The top contributors to the James Small Cap Fund’s performance were Nova Measuring Instruments and Generac Holdings Inc. Nova manufactures and sells measurement equipment key to the production of semiconductors. Semiconductor sales increased as China and the United States came to an agreement on trade talks, which lead to higher sales for Nova. Generac makes commercial and residential generators. As more people began working from home, the need for backup power increased to prevent work stoppage. Generac was in a unique space to provide this product for homes and new office space.

Detractors to the performance of the James Small Cap Fund were Xenia Hotels & Resorts, Inc. and Skywest, Inc., a North American regional airline. The price of both of these stocks fell in response to the Coronavirus outbreak, as the travel and hotel industries were among those hardest hit during the virus pullback.

The James Micro Cap Fund declined 17.45% over the fiscal year. The James Micro Cap Fund focuses on companies with market capitalizations, at the time of purchase, no larger than the stocks in the Russell Microcap® Index, as well as exchange traded funds that invest primarily in such securities.

Due to the nature of micro cap stocks, many of the companies held by the fund are not household names. Companies like Nova Measuring Instruments, PC Connection, Inc. and Patrick Industries all contributed to the fund at a high level. PC Connection sells computers and related products. Once again, as more individuals began working from home, they purchased new computers or webcams allowing them to work remotely. Patrick Industries, who manufactures recreational vehicles, saw improved sales. Sales may have improved as fewer people flew or took traditional vacations, but rather took RVs to parks and remote destinations.

The largest detractors to the James Micro Cap Fund’s performance were OFG Bancorp and W&T Offshore, Inc. Small banks and oil drillers were two sectors that were negatively impacted by the Coronavirus shutdown. With such high levels of unemployment, mortgage and credit card payments are now in doubt. In an amazing reaction to so few people traveling and driving, the price of oil actually went negative for a period of 2 hours in April.

Finally, the James Aggressive Allocation Fund declined 8.60% over the fiscal year. The fund seeks to provide total return through a combination of growth and income. Preservation of capital in declining markets is a secondary objective. It is expected the fund will usually run higher equity levels than the James Balanced: Golden Rainbow Fund.

Much like the James Balanced: Golden Rainbow Fund, the James Aggressive Allocation Fund’s holdings in Apple, Inc., Microsoft Corp. and U.S. Treasury issues were the fund’s top performers during the period, for the same reasons noted above.

The primary detractors to the performance of the James Aggressive Allocation Fund were Chimera Investment Corp. and AFLAC, Inc. Once again both stocks were hit in the wave of declining prices during the quarantine shutdown. Chimera, which deals heavily with mortgages was impacted on fears of defaulting loans. The price of the stock of AFLAC, the insurance company with the duck in its commercials, fell as fewer people were working, causing fewer workers to need workers compensation type insurance plans.

Please see the following charts throughout the remainder of the Annual Report for longer term comparisons for all our funds.

| James Advantage Funds | Shareholder Letter |

June 30, 2020 (Unaudited)

Expectations for the Future

There has been a massive disconnect between the recent movement of the stock market and the U.S. economy. Unemployment is running at some of the highest levels we have ever seen and Gross Domestic Product (GDP) appears to be falling, all the while stock prices have been advancing since late March 2020.

Much of this rally is due to the massive actions taken by the Fed. Initially, the Fed announced it would be purchasing Municipal Bonds and Corporate Bonds, which shortly after turned into the Fed purchasing ETFs that hold municipals and corporates. Since the Fed’s announcement, stocks and riskier bonds have made a steady advance.

How much further can this advance go? This has yet to be seen. As of the date of this letter, many recent unemployment benefits are set to expire at the end of July, which could hinder the consumer. At the same time, there is a general belief that such employment benefits may be extended or that there may even be another round of stimulus payments. At this point it is all speculation. Any help the government can give may be viewed as a positive for stocks.

The bond market has settled down since the beginning of the period of market volatility seen in response to the COVID-19 outbreak and appears to be in what some have dubbed as a ‘trading range’. The 10-year Treasury note and 30-year Treasury bonds provided diversification to portfolios in the period of market downturn following the COVID-19 outbreak and have managed to hold most of their gains. A slight pullback in prices might be expected in response to the increased level of government spending following the COVID-19 outbreak, which could be viewed as inflationary. While many states have opened and we look to be in the early phases of recovery, it is very possible a second wave of the virus could occur. If so, this would lead JIR to increase our investments in the bond market. There is speculation that defaults may be on the rise, and if accurate, higher quality issues should escape such a fate.

Barry R. James, CFA, CIC

President

James Investment Research, Inc.

The views of the author and information discussed in this commentary are as of the date of publication, are subject to change, and may not reflect the writer’s current views. The views expressed represent an assessment of market conditions at a specific point in time, are opinions only, and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the Funds or any securities or any sectors mentioned in this letter. The subject matter contained in this letter has been derived from several sources believed to be reliable and accurate at the time of compilation. Neither James Investment Research, Inc. nor the Funds accept any liability for losses either direct or consequential caused by the use of this information. Diversification cannot guarantee gain or prevent loss.

You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of a Fund before investing. The Funds’ prospectuses contain this and other information. You may obtain a current copy of a Fund’s prospectus by calling 1-800-995-2637. Investors may obtain performance information current to the last month-end at wwwjamesinvestment.com.

Past performance is no guarantee of future results. The investment return and principal value of an investment in any Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Barry R. James is a registered representative of ALPS Distributors, Inc.

CFA® is a trademark owned by the CFA Institute.

Price to earnings multiple is a measure of how expensive a stock is.

Return on assets is an indicator of how profitable a company is relative to its total assets.

Indices are not actively managed and do not reflect any deduction for fees, expenses or taxes. An investor may not invest directly in an index.

Diversification does not eliminate the risk of experiencing investment loss.

| Annual Report | June 30, 2020 | 3 |

| Growth of $10,000 or $50,000 Charts | James Advantage Funds |

June 30, 2020 (Unaudited)

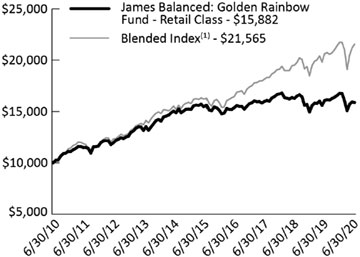

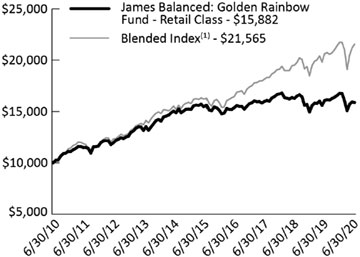

Comparison of the Change in Value of a $10, 000 Investment in the James Balanced: Golden Rainbow Fund – Retail Class

James Balanced: Golden Rainbow Fund – Retail Class Average Annual Total Returns

| | 1 Year | 5 Years | 10 Years | Since Inception(2) |

| James Balanced: Golden Rainbow – Retail Class | -1.18% | 0.52% | 4.73% | 6.90% |

| Blended Index(1) | 4.56% | 5.86% | 7.99% | 7.86% |

| Russell 1000® Index | 7.48% | 10.47% | 13.97% | 9.92% |

| Russell 2000® Index | -6.62% | 4.29% | 10.50% | 9.19% |

| Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index | 7.12% | 3.46% | 3.13% | 5.30% |

| (1) | The Blended Index is comprised of a 25% weighting in the Russell 1000® Index, a 25% weighting in the Russell 2000® Index and a 50% weighting in the Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index. |

| (2) | Fund and Class inception was July 1, 1991. |

| The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2019, was 1.08%. |

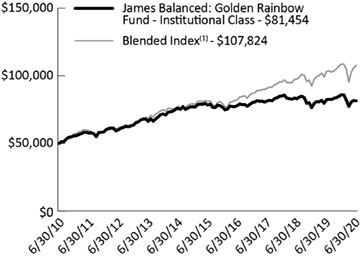

Comparison of the Change in Value of a $50,000 Investment in the James Balanced: Golden Rainbow Fund – Institutional Class

James Balanced: Golden Rainbow Fund – Institutional Class Average Annual Total Returns

| | 1 Year | 5 Years | 10 Years | Since Inception(2) |

| James Balanced: Golden Rainbow – Institutional Class | -0.93% | 0.78% | 5.00% | 6.65% |

| Blended Index(1) | 4.56% | 5.86% | 7.99% | 9.87% |

| Russell 1000® Index | 7.48% | 10.47% | 13.97% | 16.55% |

| Russell 2000® Index | -6.62% | 4.29% | 10.50% | 14.39% |

| Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index | 7.12% | 3.46% | 3.13% | 3.68% |

| (1) | The Blended Index is comprised of a 25% weighting in the Russell 1000® Index, a 25% weighting in the Russell 2000® Index and a 50% weighting in the Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index. |

| (2) | Class inception was March 2, 2009. |

| The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2019, was 0.83%. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. These performance figures do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Please call 1-800-995-2637 for most recent month-end performance information.

The Russell 1000® Index is an index of approximately 1,000 of the largest companies in the U.S. equity market. The Russell 1000® Index is a subset of the Russell 3000® Index. It represents the top companies by market capitalization.

The Russell 2000® Index is a widely recognized, unmanaged index comprised of the 2,000 smallest U.S. domiciled publicly-traded common stocks of the Russell 3000® Index, which represents approximately 8% of the total market capitalization of the Russell 3000® Index, an unmanaged index of the 3,000 largest U.S. domiciled publicly-traded common stocks by market capitalization.

The Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index measures the performance of U.S. Dollar denominated U.S. Treasuries, government-related and investment grade U.S. corporate securities that have a remaining maturity of greater than one year and less than ten years.

The Russell 1000® Index, Russell 2000® Index, Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index and Blended Index are widely recognized unmanaged indices of security prices and are representative of a broader market and range of securities than is found in the Fund’s portfolio. The Index returns do not reflect the deduction of expenses, which have been deducted from a Fund’s returns. The Index returns assume reinvestment of all distributions and do not reflect the deduction of taxes and fees. Individuals cannot invest directly in any Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

| James Advantage Funds | Growth of $10,000 or $50,000 Charts |

June 30, 2020 (Unaudited)

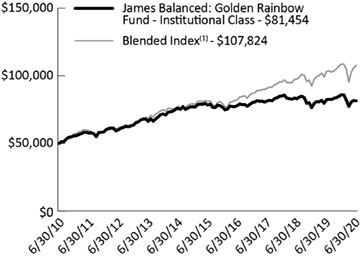

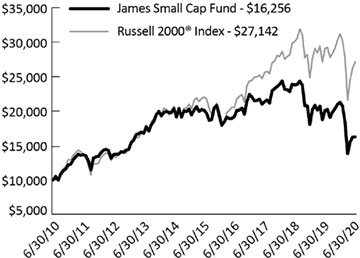

Comparison of the Change in Value of a $10,000 Investment in the James Small Cap Fund

James Small Cap Fund

Average Annual Total Returns

| | 1 Year | 5 Years | 10 Years | Since Inception(1) |

| James Small Cap Fund | -19.04% | -4.17% | 4.98% | 5.44% |

| Russell 2000® Index | -6.62% | 4.29% | 10.50% | 8.16% |

| (1) | Fund inception was October 2, 1998. |

| The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2019, was 1.54%. |

Comparison of the Change in Value of a $10,000 Investment in the James Micro Cap Fund

James Micro Cap Fund

Average Annual Total Returns

| | 1 Year | 5 Years | Since Inception(1) |

| James Micro Cap Fund | -17.45%* | -0.02% | 6.69% |

| Russell Microcap® Index | -4.77% | 2.86% | 10.03% |

| (1) | Fund inception was July 1, 2010. |

| The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2019, was 1.57%. |

| * | Excludes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value and total return for shareholder transactions reported to the market may differ from the net asset value for financial reporting purposes. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. These performance figures do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Please call 1-800-995-2637 for most recent month-end performance information.

Small and Micro Cap investing involve greater risk not associated with investing in more established companies, such as greater price volatility, business risk, less liquidity and increased competitive threat.

The Russell Microcap® Index measures the performance of the microcap segment of the U.S. equity market. It makes up less than 3% of the U.S. equity market. It includes 1,000 of the smallest securities in the small cap Russell 2000® Index, plus the next smallest eligible securities by market cap.

The Russell 2000® Index is a widely recognized, unmanaged index comprised of the 2,000 smallest U.S. domiciled publicly-traded common stocks of the Russell 3000® Index, which represents approximately 8% of the total market capitalization of the Russell 3000® Index, an unmanaged index of the 3,000 largest U.S. domiciled publicly-traded common stocks by market capitalization.

The Russell 2000® Index and Russell Microcap® Index are widely recognized unmanaged indices of security prices and are representative of a broader market and range of securities than is found in the Fund’s portfolio. The Index returns do not reflect the deduction of expenses, which have been deducted from a Fund’s returns. The Index returns assume reinvestment of all distributions and do not reflect the deduction of taxes and fees. Individuals cannot invest directly in any Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

| Annual Report | June 30, 2020 | 5 |

| Growth of $10,000 or $50,000 Charts | James Advantage Funds |

June 30, 2020 (Unaudited)

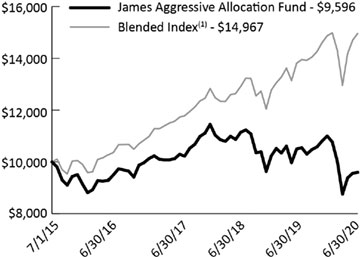

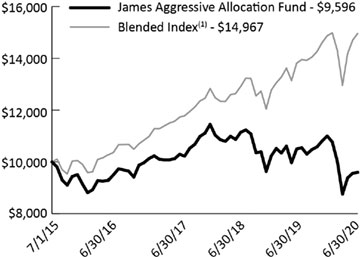

Comparison of the Change in Value of a $10,000 Investment in the James Aggressive Allocation Fund

James Aggressive Allocation Fund

Average Annual Total Returns

| | 1 Year | Since Inception(2) |

| James Aggressive Allocation Fund | -8.60% | -0.82% |

| Blended Index(1) | 8.35% | 8.40% |

| Russell 3000® Index | 6.53% | 9.89% |

| Bloomberg Barclays U.S. Aggregate Government/Credit Bond Index | 10.02% | 4.83% |

| (1) | The Blended Index is comprised of a 65% weighting in the Russell 3000® Index and a 35% weighting in the Bloomberg Barclays U.S. Aggregate Government/Credit Bond Index. |

| (2) | Fund inception was July 1, 2015. |

| The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2019, was 1.03%. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. These performance figures do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Please call 1-800-995-2637 for most recent month-end performance information.

The Russell 3000® Index is a stock market index of U.S. stocks. The Index measures the performance of 3,000 publicly held U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market.

The Bloomberg Barclays U.S. Aggregate Government/Credit Bond Index is an unmanaged index generally representative of U.S. Dollar denominated U.S. Treasuries, government related and investment grade U.S. corporate securities, that have a remaining maturity greater than one year.

The Russell 3000® Index, Bloomberg Barclays U.S. Aggregate Government/Credit Bond Index and the Blended Index are widely recognized unmanaged indices of security prices and are representative of a broader market and range of securities than is found in the Fund’s portfolio. The Index returns do not reflect the deduction of expenses, which have been deducted from a Fund’s returns. The Index returns assume reinvestment of all distributions and do not reflect the deduction of taxes and fees. Individuals cannot invest directly in any Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

| James Advantage Funds | Representation of Schedules of Investments |

June 30, 2020 (Unaudited)

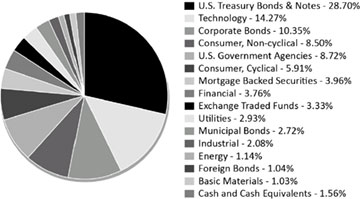

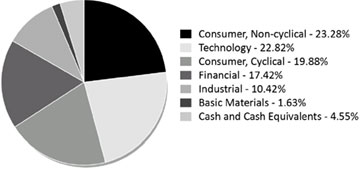

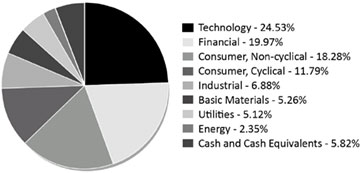

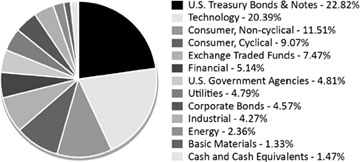

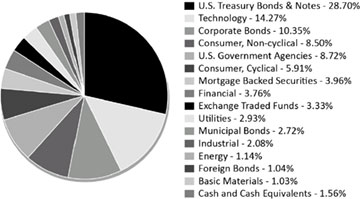

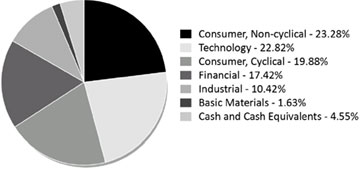

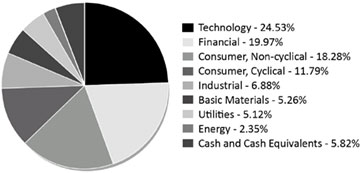

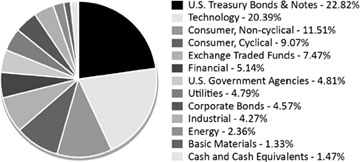

The illustrations below provide the industry sectors for the James Balanced: Golden Rainbow Fund, James Small Cap Fund, James Micro Cap Fund and James Aggressive Allocation Fund.

James Balanced: Golden Rainbow Fund - Industry Sector Allocation

(% of Net Assets)*

James Micro Cap Fund - Industry Sector Allocation

(% of Net Assets)*

James Small Cap Fund -Industry Sector Allocation

(% of Net Assets)*

James Aggressive Allocation Fund - Industry Sector Allocation

(% of Net Assets)*

| * | Holdings are subject to change, and may not reflect the current or future position of the portfolio. |

| Annual Report | June 30, 2020 | 7 |

| Disclosure of Fund Expenses | James Advantage Funds |

June 30, 2020 (Unaudited)

Example. As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including reinvested dividends or other distributions, and redemption fees; and (2) ongoing costs, including management fees, distribution (12b-1) fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period January 1, 2020 through June 30, 2020.

Actual Expenses. The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expense Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line of the table below provides information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that expenses shown in the table are meant to highlight and help you compare ongoing costs only. The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

| | Net Expense

Ratio

Annualized

June 30, 2020(a) | Beginning

Account Value

January 1, 2020 | Ending

Account Value

June 30, 2020 | Expense

Paid During

Period(b) |

| James Balanced: Golden Rainbow Fund | | | | |

| Retail Class Actual | 1.13% | $ 1,000.00 | $947.30 | $5.47 |

| Retail Class Hypothetical (5% return before expenses) | 1.13% | $ 1,000.00 | $1,019.24 | $5.67 |

| Institutional Class Actual | 0.88% | $ 1,000.00 | $948.90 | $4.26 |

| Institutional Class Hypothetical (5% return before expenses) | 0.88% | $ 1,000.00 | $1,020.49 | $4.42 |

| James Small Cap Fund | | | | |

| Actual | 1.50% | $ 1,000.00 | $764.50 | $6.58 |

| Hypothetical (5% return before expenses) | 1.50% | $ 1,000.00 | $1,017.40 | $7.52 |

| James Micro Cap Fund | | | | |

| Actual | 1.50% | $ 1,000.00 | $769.60 | $6.60 |

| Hypothetical (5% return before expenses) | 1.50% | $ 1,000.00 | $1,017.40 | $7.52 |

| James Aggressive Allocation Fund | | | | |

| Actual | 0.98% | $ 1,000.00 | $872.40 | $4.56 |

| Hypothetical (5% return before expenses) | 0.98% | $ 1,000.00 | $1,019.99 | $4.92 |

| (a) | Annualized, based on the Fund's most recent fiscal half year expenses. |

| (b) | Expenses are equal to the Fund's annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (182), divided by 366. |

| James Balanced: Golden Rainbow Fund | Schedule of Investments |

June 30, 2020

| Shares or Principal Amount | | Value |

| COMMON STOCKS-39.62% | | |

| | | Basic Materials-1.03% | | |

| | 21,770 | | | Avery Dennison Corp. | | $ | 2,483,739 | |

| | 26,145 | | | Celanese Corp. | | | 2,257,359 | |

| | 33,060 | | | Innospec, Inc. | | | 2,553,885 | |

| | | | | | | | 7,294,983 | |

| | | | | | | | | |

| | | | | Consumer, Cyclical-5.91% | | | | |

| | 11,610 | | | Alibaba Group Holding, Ltd., Sponsored ADR* | | | 2,504,277 | |

| | 51,320 | | | Best Buy Co., Inc. | | | 4,478,696 | |

| | 59,940 | | | CVS Health Corp. | | | 3,894,302 | |

| | 16,930 | | | Home Depot, Inc. | | | 4,241,134 | |

| | 72,445 | | | Insight Enterprises, Inc.* | | | 3,564,294 | |

| | 40,000 | | | McDonald's Corp. | | | 7,378,800 | |

| | 37,540 | | | Target Corp. | | | 4,502,172 | |

| | 77,785 | | | Walmart, Inc. | | | 9,317,087 | |

| | 16,135 | | | Walt Disney Co. | | | 1,799,214 | |

| | | | | | | | 41,679,976 | |

| | | | | | | | | |

| | | | | Consumer, Non-cyclical-8.50% | | | | |

| | 17,145 | | | Anthem, Inc. | | | 4,508,792 | |

| | 85,000 | | | AstraZeneca PLC, ADR | | | 4,495,650 | |

| | 6,220 | | | Costco Wholesale Corp. | | | 1,885,966 | |

| | 33,955 | | | Eli Lilly & Co. | | | 5,574,732 | |

| | 21,750 | | | FTI Consulting, Inc.* | | | 2,491,463 | |

| | 25,400 | | | Helen of Troy, Ltd.* | | | 4,789,424 | |

| | 43,170 | | | Johnson & Johnson | | | 6,070,997 | |

| | 7,059 | | | Kimberly-Clark Corp. | | | 997,790 | |

| | 122,105 | | | Kroger Co. | | | 4,133,254 | |

| | 62,700 | | | Medtronic PLC | | | 5,749,590 | |

| | 26,520 | | | National HealthCare Corp. | | | 1,682,429 | |

| | 212,000 | | | Pfizer, Inc. | | | 6,932,400 | |

| | 61,000 | | | Procter & Gamble Co. | | | 7,293,770 | |

| | 11,280 | | | UnitedHealth Group, Inc. | | | 3,327,036 | |

| | | | | | | | 59,933,293 | |

| | | | | | | | | |

| | | | | Energy-1.14% | | | | |

| | 34,185 | | | Chevron Corp. | | | 3,050,328 | |

| | 15,000 | | | Pioneer Natural Resources Co. | | | 1,465,500 | |

| | 53,000 | | | TOTAL SA, ADR | | | 2,038,380 | |

| | 25,780 | | | Valero Energy Corp. | | | 1,516,380 | |

| | | | | | | | 8,070,588 | |

| | | | | | | | | |

| | | | | Financial-3.76% | | | | |

| | 57,795 | | | Allstate Corp. | | | 5,605,537 | |

| | 6,095 | | | Goldman Sachs Group, Inc. | | | 1,204,494 | |

| | 93,070 | | | JPMorgan Chase & Co. | | | 8,754,164 | |

| | 29,534 | | | LPL Financial Holdings, Inc. | | | 2,315,466 | |

| | 32,630 | | | Nelnet, Inc., Class A | | | 1,557,756 | |

| | 41,605 | | | PNC Financial Services Group, Inc. | | | 4,377,262 | |

| | 14,000 | | | Public Storage, REIT | | | 2,686,460 | |

| | | | | | | | 26,501,139 | |

See Notes to Financial Statements.

| Annual Report | June 30, 2020 | 9 |

| Schedule of Investments | James Balanced: Golden Rainbow Fund |

June 30, 2020

| Shares or Principal Amount | | Value |

| | | | | Industrial-2.08% | | | | |

| | 14,852 | | | Caterpillar, Inc. | | $ | 1,878,778 | |

| | 27,300 | | | Eaton Corp. PLC | | | 2,388,204 | |

| | 36,811 | | | Generac Holdings, Inc.* | | | 4,488,365 | |

| | 25,000 | | | Raytheon Technologies Corp. | | | 1,540,500 | |

| | 39,834 | | | Republic Services, Inc. | | | 3,268,380 | |

| | 6,500 | | | Union Pacific Corp. | | | 1,098,955 | |

| | | | | | | | 14,663,182 | |

| | | | | | | | | |

| | | | | Technology-14.27% | | | | |

| | 7,411 | | | Alphabet, Inc., Class A* | | | 10,509,169 | |

| | 26,160 | | | Amgen, Inc. | | | 6,170,098 | |

| | 45,000 | | | Apple, Inc. | | | 16,416,000 | |

| | 24,450 | | | Cabot Microelectronics Corp. | | | 3,411,753 | |

| | 30,000 | | | Ciena Corp.* | | | 1,624,800 | |

| | 164,310 | | | Cisco Systems, Inc. | | | 7,663,418 | |

| | 26,400 | | | Crown Castle International Corp., REIT | | | 4,418,040 | |

| | 29,728 | | | Integer Holdings Corp.* | | | 2,171,630 | |

| | 149,220 | | | Intel Corp. | | | 8,927,833 | |

| | 22,152 | | | Leidos Holdings, Inc. | | | 2,074,978 | |

| | 17,300 | | | Lockheed Martin Corp. | | | 6,313,116 | |

| | 28,544 | | | Micron Technology, Inc.* | | | 1,470,587 | |

| | 89,325 | | | Microsoft Corp. | | | 18,178,531 | |

| | 12,890 | | | Motorola Solutions, Inc. | | | 1,806,276 | |

| | 3,930 | | | NetEase, Inc., ADR | | | 1,687,463 | |

| | 7,040 | | | Northrop Grumman Corp. | | | 2,164,378 | |

| | 16,555 | | | SYNNEX Corp. | | | 1,982,792 | |

| | 19,225 | | | Visa, Inc., Class A | | | 3,713,693 | |

| | | | | | | | 100,704,555 | |

| | | | | | | | | |

| | | | | Utilities-2.93% | | | | |

| | 70,783 | | | American Electric Power Co., Inc. | | | 5,637,158 | |

| | 45,163 | | | AT&T, Inc. | | | 1,365,277 | |

| | 28,710 | | | Entergy Corp. | | | 2,693,285 | |

| | 55,233 | | | FirstEnergy Corp. | | | 2,141,936 | |

| | 160,055 | | | Verizon Communications, Inc. | | | 8,823,832 | |

| | | | | | | | 20,661,488 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | |

| (Cost $230,759,943) | | | 279,509,204 | |

| Shares or Principal Amount | | | Value | |

| EXCHANGE TRADED FUNDS-3.33% | | | | |

| | 457,836 | | | iShares® Gold Trust* | | | 7,778,634 | |

| | 5,000 | | | iShares® Intermediate-Term Credit Bond ETF | | | 301,900 | |

| | 45,830 | | | iShares® Russell 2000® ETF | | | 6,561,939 | |

| | 50,710 | | | iShares® Russell 2000 Value ETF | | | 4,942,197 | |

| | 30,469 | | | iShares® Silver Trust ETF* | | | 518,278 | |

| | 20,000 | | | SPDR® Bloomberg Barclays Convertible Securities ETF | | | 1,210,000 | |

| | 12,974 | | | SPDR® Gold Shares ETF* | | | 2,171,458 | |

| | | | | | | | | |

| TOTAL EXCHANGE TRADED FUNDS | | | | |

| (Cost $22,518,574) | | | 23,484,406 | |

See Notes to Financial Statements.

| 10 | www.jamesinvestment.com |

| James Balanced: Golden Rainbow Fund | Schedule of Investments |

June 30, 2020

| Shares or Principal Amount | | Value |

| CORPORATE BONDS-10.35% | | |

| | | Consumer, Cyclical-2.35% | | |

| $ | 5,000,000 | | | eBay, Inc., 2.600%, 7/15/22 | | $ | 5,169,617 | |

| | 5,000,000 | | | Home Depot, Inc., 2.700%, 4/1/23 | | | 5,280,256 | |

| | 785,000 | | | McDonald's Corp., 5.700%, 2/1/39 | | | 1,088,681 | |

| | 2,000,000 | | | Starbucks Corp., 2.550%, 11/15/30 | | | 2,097,358 | |

| | 2,000,000 | | | Walmart, Inc., 5.250%, 9/1/35 | | | 2,915,685 | |

| | | | | | | | 16,551,597 | |

| | | | | Consumer, Non-cyclical-0.71% | | | | |

| | 3,000,000 | | | Hershey Co., 4.125%, 12/1/20 | | | 3,045,272 | |

| | 1,950,000 | | | Keurig Dr Pepper, Inc., 2.530%, 11/15/21 | | | 1,996,939 | |

| | | | | | | | 5,042,211 | |

| | | | | Financial-2.50% | | | | |

| | 8,100,000 | | | Berkshire Hathaway, Inc., 3.750%, 8/15/21 | | | 8,401,884 | |

| | 1,000,000 | | | Citigroup, Inc., 2.650%, 10/26/20 | | | 1,006,979 | |

| | 2,000,000 | | | Citigroup, Inc., 3.875%, 3/26/25 | | | 2,178,426 | |

| | 5,000,000 | | | Wells Fargo & Co., 2.500%, 3/4/21 | | | 5,069,858 | |

| | 1,000,000 | | | Wells Fargo & Co., 2.000%, 5/15/25 | | | 1,007,729 | |

| | | | | | | | 17,664,876 | |

| | | | | Industrial-0.75% | | | | |

| | 1,000,000 | | | Caterpillar, Inc., 8.250%, 12/15/38 | | | 1,785,985 | |

| | 1,000,000 | | | General Electric Co., 2.700%, 10/9/22 | | | 1,039,090 | |

| | 2,000,000 | | | General Electric Co., 6.875%, 1/10/39 | | | 2,458,127 | |

| | | | | | | | 5,283,202 | |

| | | | | Technology-4.04% | | | | |

| | 2,500,000 | | | Activision Blizzard, Inc., 2.300%, 9/15/21 | | | 2,548,143 | |

| | 2,500,000 | | | Apple, Inc., 2.050%, 9/11/26 | | | 2,671,129 | |

| | 5,000,000 | | | Intel Corp., 3.300%, 10/1/21 | | | 5,187,375 | |

| | 5,000,000 | | | Intel Corp., 2.875%, 5/11/24 | | | 5,416,542 | |

| | 3,700,000 | | | Microsoft Corp., 5.200%, 6/1/39 | | | 5,426,344 | |

| | 1,000,000 | | | Oracle Corp., 3.875%, 7/15/20 | | | 1,001,293 | |

| | 5,000,000 | | | Oracle Corp., 2.500%, 5/15/22 | | | 5,170,063 | |

| | 1,000,000 | | | PayPal Holdings, Inc., 2.650%, 10/1/26 | | | 1,086,731 | |

| | | | | | | | 28,507,620 | |

| TOTAL CORPORATE BONDS | | | | |

| (Cost $66,837,831) | | | 73,049,506 | |

| | | | | | | | | |

| Shares or Principal Amount | | | Value | |

| MUNICIPAL BONDS - 2.72% | | | | |

| | | | | Hawaii-1.41% | | | | |

| | 9,000,000 | | | City and County of Honolulu General Obligation Unlimited Bonds, Series B, 5.000%, 11/1/25 | | | 9,929,070 | |

| | | | | | | | | |

| | | | | Ohio-1.31% | | | | |

| | 7,450,000 | | | Beavercreek City School District General Obligation Unlimited Bonds, 3.250%, 12/1/36 | | | 7,839,262 | |

| | 1,000,000 | | | Ohio State University General Recipients Revenue Bonds, Series C, 4.910%, 6/1/40 | | | 1,425,000 | |

| | | | | | | | 9,264,262 | |

| TOTAL MUNICIPAL BONDS | | | | |

| (Cost $17,890,970) | | | 19,193,332 | |

See Notes to Financial Statements.

| Annual Report | June 30, 2020 | 11 |

| Schedule of Investments | James Balanced: Golden Rainbow Fund |

June 30, 2020

| Shares or Principal Amount | | Value |

| U.S. GOVERNMENT AGENCIES-8.72% | | | | |

| | | | | Federal Agricultural Mortgage Corp.-1.42% | | | | |

| $ | 10,000,000 | | | 3M US L + 0.08%, 1/3/22(a) | | $ | 10,005,505 | |

| | | | | | | | | |

| | | | | Federal Farm Credit Banks Funding Corp.-1.63% | | | | |

| | 5,000,000 | | | 0.930%, 11/26/25 | | | 5,000,881 | |

| | 5,725,000 | | | 2.750%, 11/6/26 | | | 6,491,979 | |

| | | | | | | | 11,492,860 | |

| | | | | Federal Home Loan Banks-3.49% | | | | |

| | 10,000,000 | | | 2.875%, 6/13/25 | | | 11,145,861 | |

| | 5,000,000 | | | 2.420%, 9/17/27 | | | 5,014,459 | |

| | 1,000,000 | | | 2.500%, 9/11/29 | | | 1,002,804 | |

| | 5,000,000 | | | 4.080%, 5/25/33 | | | 5,470,105 | |

| | 2,000,000 | | | 2.200%, 4/23/35 | | | 1,984,086 | |

| | | | | | | | 24,617,315 | |

| | | | | Tennessee Valley Authority-2.18% | | | | |

| | 10,000,000 | | | 5.250%, 9/15/39 | | | 15,425,876 | |

| | | | | | | | | |

| TOTAL U.S. GOVERNMENT AGENCIES | | | | |

| (Cost $56,909,925) | | | 61,541,556 | |

| Shares or Principal Amount | | | Value | |

| MORTGAGE BACKED SECURITIES-3.96% | | | | |

| | | | | Fannie Mae Pool-3.54% | | | | |

| | 6,930,923 | | | 3.500%, 9/1/33 | | | 7,416,194 | |

| | 16,689,418 | | | 2.500%, 1/1/57 | | | 17,521,743 | |

| | | | | | | | 24,937,937 | |

| | | | | Fannie Mae REMICS-0.42% | | | | |

| | 2,874,035 | | | 3.500%, 5/25/47 | | | 2,989,606 | |

| | | | | | | | | |

| TOTAL MORTGAGE BACKED SECURITIES | | | | |

| (Cost $26,018,837) | | | 27,927,543 | |

| Shares or Principal Amount | | | Value | |

| U.S. TREASURY BONDS & NOTES-28.70% | | | | |

| | | | | U.S. Treasury Bonds-20.27% | | | | |

| $ | 20,000,000 | | | 2.625%, 11/15/20 | | | 20,182,031 | |

| | 30,000,000 | | | 2.000%, 8/15/25 | | | 32,571,094 | |

| | 35,000,000 | | | 2.750%, 2/15/28 | | | 40,825,586 | |

| | 20,000,000 | | | 2.625%, 2/15/29 | | | 23,434,375 | |

| | 15,000,000 | | | 1.625%, 8/15/29 | | | 16,364,062 | |

| | 8,000,000 | | | 2.250%, 8/15/49 | | | 9,616,250 | |

| | | | | | | | 142,993,398 | |

| | | | | U.S. Treasury Notes-5.77% | | | | |

| | 40,000,000 | | | 2.375%, 4/15/21 | | | 40,696,875 | |

| | | | | | | | | |

| | | | | United States Treasury Inflation Indexed Bonds-2.66% | | | | |

| | 18,067,525 | | | 0.625%, 4/15/23 | | | 18,804,531 | |

| | | | | | | | | |

| TOTAL U.S. TREASURY BONDS & NOTES | | | | |

| (Cost $188,478,032) | | | 202,494,804 | |

See Notes to Financial Statements.

| 12 | www.jamesinvestment.com |

| James Balanced: Golden Rainbow Fund | Schedule of Investments |

June 30, 2020

| Shares or Principal Amount | | Value |

| FOREIGN BONDS-1.04% | | |

| | | Singapore Government Bond-1.04% | | | | |

| SGD 10,000,000 | | 2.250%, 6/1/21 | | $ | 7,303,380 | |

| | | | | | | |

| TOTAL FOREIGN BONDS | | | | |

| (Cost $7,447,905) | | | 7,303,380 | |

| Shares or Principal Amount | | | Value | |

| SHORT TERM INVESTMENTS-0.74% | | | | |

| | | Mutual Fund-0.74% | | | | |

| 5,198,872 | | First American Treasury Obligations Fund, Class X, 7-Day Yield 0.086% | | | 5,198,872 | |

| | | | | | | |

| TOTAL SHORT TERM INVESTMENTS | | | | |

| (Cost $5,198,872) | | | 5,198,872 | |

| | | | | | | |

| TOTAL INVESTMENT SECURITIES-99.18% | | | | |

| (Cost $622,060,889) | | | 699,702,603 | |

| OTHER ASSETS IN EXCESS OF LIABILITIES-0.82% | | | 5,785,058 | |

| NET ASSETS-100.00% | | $ | 705,487,661 | |

For Fund compliance purposes, the Fund's industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. Those definitions may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

| * | Non-income producing security. |

| (a) | Floating or variable rate security. The reference rate is described below. The rate in effect as of June 30, 2020 is based on the reference rate plus the displayed spread as of the security’s last reset date. |

Investment Abbreviations:

LIBOR - London Interbank Offered Rate

Reference Rates:

3M US L - 3 Month LIBOR as of June 30, 2020 was 0.30%

SGD - Singapore Dollar

See Notes to Financial Statements.

| Annual Report | June 30, 2020 | 13 |

| Schedule of Investments | James Small Cap Fund |

June 30, 2020

| Shares | | | | Value |

| COMMON STOCKS-94.18% | | |

| | | Basic Materials-5.26% | | |

| | 24,030 | | | Boise Cascade Co. | | $ | 903,768 | |

| | 16,000 | | | Cleveland-Cliffs, Inc. | | | 88,320 | |

| | 3,900 | | | Innospec, Inc. | | | 301,275 | |

| | 13,120 | | | Schnitzer Steel Industries, Inc., Class A | | | 231,437 | |

| | | | | | | | 1,524,800 | |

| | | | | | | | | |

| | | | | Consumer, Cyclical-11.79% | | | | |

| | 2,770 | | | Deckers Outdoor Corp.* | | | 544,000 | |

| | 21,650 | | | Gray Television, Inc.* | | | 302,018 | |

| | 19,890 | | | Insight Enterprises, Inc.* | | | 978,588 | |

| | 20,000 | | | MDC Holdings, Inc. | | | 714,000 | |

| | 3,800 | | | Meritage Homes Corp.* | | | 289,256 | |

| | 9,680 | | | Patrick Industries, Inc. | | | 592,900 | |

| | | | | | | | 3,420,762 | |

| | | | | | | | | |

| | | | | Consumer, Non-cyclical-18.28% | | | | |

| | 4,570 | | | FTI Consulting, Inc.* | | | 523,494 | |

| | 2,545 | | | Helen of Troy, Ltd.* | | | 479,885 | |

| | 24,198 | | | Hillenbrand, Inc. | | | 655,040 | |

| | 21,275 | | | Ingles Markets, Inc., Class A | | | 916,314 | |

| | 13,050 | | | National HealthCare Corp. | | | 827,892 | |

| | 29,440 | | | Tivity Health, Inc.* | | | 333,555 | |

| | 5,000 | | | TriNet Group, Inc.* | | | 304,700 | |

| | 15,000 | | | TrueBlue, Inc.* | | | 229,050 | |

| | 19,470 | | | Village Super Market, Inc., Class A | | | 539,708 | |

| | 9,855 | | | Weis Markets, Inc. | | | 493,933 | |

| | | | | | | | 5,303,571 | |

| | | | | | | | | |

| | | | | Energy-2.35% | | | | |

| | 51,100 | | | Frontline, Ltd. | | | 356,678 | |

| | 2,500 | | | HollyFrontier Corp. | | | 73,000 | |

| | 39,365 | | | WPX Energy, Inc.* | | | 251,149 | |

| | | | | | | | 680,827 | |

| | | | | | | | | |

| | | | | Financial-19.97% | | | | |

| | 36,580 | | | American Equity Investment Life Holding Co. | | | 903,892 | |

| | 3,870 | | | American Financial Group, Inc. | | | 245,590 | |

| | 8,300 | | | Assured Guaranty, Ltd. | | | 202,603 | |

| | 32,325 | | | Chimera Investment Corp., REIT | | | 310,643 | |

| | 3,720 | | | Evercore, Inc., Class A | | | 219,182 | |

| | 77,700 | | | First BanCorp | | | 434,343 | |

| | 165,655 | | | Genworth Financial, Inc., Class A* | | | 382,663 | |

| | 55,410 | | | Ladder Capital Corp., REIT | | | 448,821 | |

| | 2,400 | | | LGI Homes, Inc.* | | | 211,272 | |

| | 16,875 | | | Piper Sandler Cos. | | | 998,325 | |

| | 31,700 | | | Radian Group, Inc. | | | 491,667 | |

| | 40,575 | | | TPG Specialty Lending, Inc. | | | 669,082 | |

| | 29,280 | | | Xenia Hotels & Resorts, Inc., REIT | | | 273,182 | |

| | | | | | | | 5,791,265 | |

| | | | | | | | | |

| | | | | Industrial-6.88% | | | | |

| | 18,955 | | | Encore Wire Corp. | | | 925,383 | |

See Notes to Financial Statements.

| 14 | www.jamesinvestment.com |

| James Small Cap Fund | Schedule of Investments |

June 30, 2020

| Shares | Value | |

| | | | | Industrial (continued) | | | | |

| | 6,580 | | | Generac Holdings, Inc.* | | $ | 802,299 | |

| | 6,000 | | | MasTec, Inc.* | | | 269,220 | |

| | | | | | | | 1,996,902 | |

| | | | | | | | | |

| | | | | Technology-24.53% | | | | |

| | 13,200 | | | Avnet, Inc. | | | 368,082 | |

| | 4,465 | | | Cabot Microelectronics Corp. | | | 623,046 | |

| | 9,683 | | | Deluxe Corp. | | | 227,938 | |

| | 92,560 | | | Innoviva, Inc.* | | | 1,293,989 | |

| | 15,190 | | | Integer Holdings Corp.* | | | 1,109,630 | |

| | 32,945 | | | Nova Measuring Instruments, Ltd.* | | | 1,587,620 | |

| | 21,060 | | | Sykes Enterprises, Inc.* | | | 582,520 | |

| | 5,035 | | | SYNNEX Corp. | | | 603,042 | |

| | 47,010 | | | Vishay Intertechnology, Inc. | | | 717,843 | |

| | | | | | | | 7,113,710 | |

| | | | | | | | | |

| | | | | Utilities-5.12% | | | | |

| | 5,085 | | | IDACORP, Inc. | | | 444,276 | |

| | 13,875 | | | PNM Resources, Inc. | | | 533,355 | |

| | 12,135 | | | Portland General Electric Co. | | | 507,364 | |

| | | | | | | | 1,484,995 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | |

| (Cost $27,024,708) | | | 27,316,832 | |

| Shares | | | Value | |

| SHORT TERM INVESTMENTS-5.77% | | | | |

| | | | | Mutual Fund-5.77% | | | | |

| | 1,674,913 | | | First American Treasury Obligations Fund, Class X, 7-Day Yield 0.086% | | | 1,674,913 | |

| | | | | | | | | |

| TOTAL SHORT TERM INVESTMENTS | | | | |

| (Cost $1,674,913) | | | 1,674,913 | |

| | | | | | | | | |

| TOTAL INVESTMENT SECURITIES-99.95% | | | | |

| (Cost $28,699,621) | | | 28,991,745 | |

| OTHER ASSETS IN EXCESS OF LIABILITIES-0.05% | | | 14,239 | |

| NET ASSETS-100.00% | | $ | 29,005,984 | |

For Fund compliance purposes, the Fund's industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. Those definitions may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

| * | Non-income producing security. |

See Notes to Financial Statements.

| Annual Report | June 30, 2020 | 15 |

| Schedule of Investments | James Micro Cap Fund |

June 30, 2020

| Shares | | | | Value |

| COMMON STOCKS-95.45% | | |

| | | Basic Materials-1.63% | | |

| | 18,045 | | | Schnitzer Steel Industries, Inc., Class A | | $ | 318,314 | |

| | | | | | | | 318,314 | |

| | | | | | | | | |

| | | | | Consumer, Cyclical-19.88% | | | | |

| | 16,230 | | | Century Communities, Inc.* | | | 497,612 | |

| | 30,210 | | | Haverty Furniture Cos., Inc. | | | 483,360 | |

| | 6,240 | | | Insight Enterprises, Inc.* | | | 307,008 | |

| | 31,660 | | | M/I Homes, Inc.* | | | 1,090,370 | |

| | 24,726 | | | Patrick Industries, Inc. | | | 1,514,468 | |

| | | | | | | | 3,892,818 | |

| | | | | | | | | |

| | | | | Consumer, Non-cyclical-23.28% | | | | |

| | 6,405 | | | BioSpecifics Technologies Corp.* | | | 392,498 | |

| | 19,230 | | | Ingles Markets, Inc., Class A | | | 828,236 | |

| | 6,557 | | | John B Sanfilippo & Son, Inc. | | | 559,509 | |

| | 48,010 | | | Kamada, Ltd.* | | | 372,558 | |

| | 33,200 | | | Lantheus Holdings, Inc.* | | | 474,760 | |

| | 7,050 | | | National HealthCare Corp. | | | 447,252 | |

| | 11,475 | | | PetIQ, Inc.* | | | 399,789 | |

| | 6,030 | | | Semler Scientific, Inc.* | | | 277,380 | |

| | 27,445 | | | TrueBlue, Inc.* | | | 419,085 | |

| | 14,030 | | | Village Super Market, Inc., Class A | | | 388,912 | |

| | | | | | | | 4,559,979 | |

| | | | | | | | | |

| | | | | Financial-17.42% | | | | |

| | 57,215 | | | Ares Commercial Real Estate Corp., REIT | | | 521,801 | |

| | 48,590 | | | Enova International, Inc.* | | | 722,533 | |

| | 9,320 | | | Federal Agricultural Mortgage Corp., Class C | | | 596,573 | |

| | 34,030 | | | OFG Bancorp | | | 454,981 | |

| | 10,830 | | | Piper Sandler Cos. | | | 640,703 | |

| | 26,675 | | | Universal Insurance Holdings, Inc. | | | 473,481 | |

| | | | | | | | 3,410,072 | |

| | | | | | | | | |

| | | | | Industrial-10.42% | | | | |

| | 13,035 | | | ArcBest Corp. | | | 345,558 | |

| | 27,900 | | | CAI International, Inc.* | | | 464,814 | |

| | 7,145 | | | NACCO Industries, Inc., Class A | | | 166,479 | |

| | 21,680 | | | Vectrus, Inc.* | | | 1,065,138 | |

| | | | | | | | 2,041,989 | |

| | | | | | | | | |

| | | | | Technology-22.82% | | | | |

| | 102,175 | | | ACCO Brands Corp. | | | 725,442 | |

| | 24,730 | | | Innoviva, Inc.* | | | 345,725 | |

| | 5,270 | | | Integer Holdings Corp.* | | | 384,974 | |

| | 28,615 | | | Nova Measuring Instruments, Ltd.* | | | 1,378,957 | |

| | 30,368 | | | PC Connection, Inc. | | | 1,407,860 | |

| | 19,495 | | | Vanda Pharmaceuticals, Inc.* | | | 223,023 | |

| | | | | | | | 4,465,981 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | |

| (Cost $16,682,162) | | | 18,689,153 | |

See Notes to Financial Statements.

| 16 | www.jamesinvestment.com |

| James Micro Cap Fund | Schedule of Investments |

June 30, 2020

| Shares | | | | Value |

| SHORT TERM INVESTMENTS-15.23% | | | | |

| | | Mutual Fund-15.23% | | | | |

| 2,982,224 | | First American Treasury Obligations Fund, Class X, 7-Day Yield 0.086% | | $ | 2,982,224 | |

| | | | | | | |

| TOTAL SHORT TERM INVESTMENTS | | | | |

| (Cost $2,982,224) | | | 2,982,224 | |

| | | | | | | |

| TOTAL INVESTMENT SECURITIES-110.68% | | | | |

| (Cost $19,664,386) | | | 21,671,377 | |

| OTHER LIABILITIES IN EXCESS OF OTHER ASSETS-(10.68)% | | | (2,090,913 | ) |

| NET ASSETS-100.00% | | $ | 19,580,464 | |

For Fund compliance purposes, the Fund's industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. Those definitions may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

| * | Non-income producing security. |

See Notes to Financial Statements.

| Annual Report | June 30, 2020 | 17 |

| Schedule of Investments | James Aggressive Allocation Fund |

June 30, 2020

| Shares or Principal Amount | | Value |

| COMMON STOCKS-58.86% | | |

| | | Basic Materials-1.33% | | |

| | 4,475 | | | Newmont Mining Corp. | | $ | 276,287 | |

| | | | | | | | 276,287 | |

| | | | | | | | | |

| | | | | Consumer, Cyclical-9.07% | | | | |

| | 980 | | | Alibaba Group Holding, Ltd., Sponsored ADR* | | | 211,386 | |

| | 2,095 | | | Best Buy Co., Inc. | | | 182,831 | |

| | 3,220 | | | CVS Health Corp. | | | 209,203 | |

| | 16,550 | | | Gray Television, Inc.* | | | 230,873 | |

| | 1,000 | | | Home Depot, Inc. | | | 250,510 | |

| | 2,250 | | | Target Corp. | | | 269,843 | |

| | 2,950 | | | Walmart, Inc. | | | 353,351 | |

| | 1,600 | | | Walt Disney Co. | | | 178,416 | |

| | | | | | | | 1,886,413 | |

| | | | | | | | | |

| | | | | Consumer, Non-cyclical-11.51% | | | | |

| | 775 | | | Anthem, Inc. | | | 203,809 | |

| | 2,700 | | | FTI Consulting, Inc.* | | | 309,285 | |

| | 1,475 | | | Helen of Troy, Ltd.* | | | 278,126 | |

| | 1,295 | | | Johnson & Johnson | | | 182,116 | |

| | 9,300 | | | Kroger Co. | | | 314,805 | |

| | 3,125 | | | Medtronic PLC | | | 286,563 | |

| | 2,750 | | | National HealthCare Corp. | | | 174,460 | |

| | 3,220 | | | Pfizer, Inc. | | | 105,294 | |

| | 1,690 | | | Procter & Gamble Co. | | | 202,073 | |

| | 7,750 | | | TrueBlue, Inc.* | | | 118,343 | |

| | 1,595 | | | Zoetis, Inc. | | | 218,579 | |

| | | | | | | | 2,393,453 | |

| | | | | | | | | |

| | | | | Energy-2.36% | | | | |

| | 2,350 | | | Chevron Corp. | | | 209,690 | |

| | 5,550 | | | EOG Resources, Inc. | | | 281,163 | |

| | | | | | | | 490,853 | |

| | | | | | | | | |

| | | | | Financial-5.14% | | | | |

| | 2,155 | | | Allstate Corp. | | | 209,013 | |

| | 23,000 | | | Annaly Capital Management, Inc., REIT | | | 150,880 | |

| | 4,350 | | | CBRE Group, Inc., Class A* | | | 196,707 | |

| | 1,150 | | | Goldman Sachs Group, Inc. | | | 227,263 | |

| | 2,000 | | | JPMorgan Chase & Co. | | | 188,120 | |

| | 1,250 | | | LPL Financial Holdings, Inc. | | | 98,000 | |

| | | | | | | | 1,069,983 | |

| | | | | | | | | |

| | | | | Industrial-4.27% | | | | |

| | 3,475 | | | AGCO Corp. | | | 192,723 | |

| | 4,650 | | | Magna International, Inc. | | | 207,065 | |

| | 3,500 | | | MasTec, Inc.* | | | 157,045 | |

| | 2,225 | | | United Rentals, Inc.* | | | 331,614 | |

| | | | | | | | 888,447 | |

| | | | | | | | | |

| | | | | Technology-20.39% | | | | |

| | 75 | | | Alphabet, Inc., Class A* | | | 106,354 | |

| | 1,575 | | | Amgen, Inc. | | | 371,479 | |

See Notes to Financial Statements.

| 18 | www.jamesinvestment.com |

| James Aggressive Allocation Fund | Schedule of Investments |

June 30, 2020

| Shares or Principal Amount | | Value |

| | | | | Technology (continued) | | | | |

| | 1,500 | | | Apple, Inc. | | $ | 547,200 | |

| | 1,550 | | | Arrow Electronics, Inc.* | | | 106,469 | |

| | 1,925 | | | Cabot Microelectronics Corp. | | | 268,614 | |

| | 5,000 | | | Cisco Systems, Inc. | | | 233,200 | |

| | 5,875 | | | Intel Corp. | | | 351,501 | |

| | 1,610 | | | International Business Machines Corp. | | | 194,440 | |

| | 1,425 | | | KLA Corp. | | | 277,134 | |

| | 950 | | | Lockheed Martin Corp. | | | 346,674 | |

| | 3,650 | | | Logitech International SA | | | 238,053 | |

| | 2,525 | | | Microsoft Corp. | | | 513,863 | |

| | 1,675 | | | Motorola Solutions, Inc. | | | 234,718 | |

| | 725 | | | Northrop Grumman Corp. | | | 222,894 | |

| | 1,175 | | | Visa, Inc., Class A | | | 226,975 | |

| | | | | | | | 4,239,568 | |

| | | | | | | | | |

| | | | | Utilities-4.79% | | | | |

| | 6,875 | | | AT&T, Inc. | | | 207,831 | |

| | 2,250 | | | Entergy Corp. | | | 211,072 | |

| | 4,200 | | | FirstEnergy Corp. | | | 162,876 | |

| | 6,155 | | | NRG Energy, Inc. | | | 200,407 | |

| | 3,875 | | | Verizon Communications, Inc. | | | 213,629 | |

| | | | | | | | 995,815 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | |

| (Cost $11,417,158) | | | 12,240,819 | |

| Shares or Principal Amount | | | Value | |

| EXCHANGE TRADED FUNDS-7.47% | | | | |

| | 4,310 | | | ARK Genomic Revolution ETF* | | | 224,809 | |

| | 2,500 | | | Communication Services Select Sector SPDR® Fund | | | 135,100 | |

| | 16,125 | | | iShares® Gold Trust* | | | 273,964 | |

| | 5,600 | | | iShares® MSCI Emerging Markets ETF | | | 223,944 | |

| | 7,170 | | | SPDR® Bloomberg Barclays Convertible Securities ETF | | | 433,785 | |

| | 2,500 | | | Technology Select Sector SPDR® Fund | | | 261,225 | |

| | | | | | | | | |

| TOTAL EXCHANGE TRADED FUNDS | | | | |

| (Cost $1,493,024) | | | 1,552,827 | |

| Shares or Principal Amount | | | Value | |

| CORPORATE BONDS-4.57% | | | | |

| | | | | Consumer, Cyclical-2.52% | | | | |

| $ | 500,000 | | | Starbucks Corp., 2.550%, 11/15/30 | | | 524,340 | |

| | | | | | | | | |

| | | | | Financial-1.80% | | | | |

| | 250,000 | | | Citigroup, Inc., 3.875%, 3/26/25 | | | 272,303 | |

| | 100,000 | | | Wells Fargo & Co., 2.000%, 5/15/25 | | | 100,773 | |

| | | | | | | | 373,076 | |

| | | | | Industrial-0.25% | | | | |

| | 50,000 | | | General Electric Co., 2.700%, 10/9/22 | | | 51,954 | |

| | | | | | | | | |

| TOTAL CORPORATE BONDS | | | | |

| (Cost $913,631) | | | 949,370 | |

See Notes to Financial Statements.

| Annual Report | June 30, 2020 | 19 |

| Schedule of Investments | James Aggressive Allocation Fund |

June 30, 2020

| Shares or Principal Amount | | Value |

| U.S. GOVERNMENT AGENCIES-4.81% | | | | |

| | | Federal Farm Credit Banks Funding Corp.-4.81% | | | | |

| $ | 500,000 | | 0.950%, 11/5/25 | | $ | 500,018 | |

| 500,000 | | 0.930%, 11/26/25 | | | 500,088 | |

| | | | | | 1,000,106 | |

| TOTAL U.S. GOVERNMENT AGENCIES | | | | |

| (Cost $1,000,000) | | | 1,000,106 | |

| Shares or Principal Amount | | | Value | |

| U.S. TREASURY BONDS & NOTES-22.82% | | | | |

| | | U.S. Treasury Bonds-13.93% | | | | |

| $ | 1,000,000 | | 2.625%, 11/15/20 | | | 1,009,102 | |

| 1,200,000 | | 2.625%, 2/15/29 | | | 1,406,063 | |

| 400,000 | | 2.250%, 8/15/49 | | | 480,812 | |

| | | | | | 2,895,977 | |

| | | U.S. Treasury Notes-7.08% | | | | |

| 950,000 | | 1.375%, 9/15/20 | | | 952,342 | |

| 500,000 | | 1.125%, 2/28/25 | | | 520,039 | |

| | | | | | 1,472,381 | |

| | | United States Treasury Inflation Indexed Bonds-1.81% | | | | |

| 369,792 | | 0.625%, 7/15/21 | | | 376,588 | |

| | | | | | | |

| TOTAL U.S. TREASURY BONDS & NOTES | | | | |

| (Cost $4,514,458) | | | 4,744,946 | |

| Shares or Principal Amount | | | Value | |

| SHORT TERM INVESTMENTS-1.34% | | | | |

| | | Mutual Fund-1.34% | | | | |

| | 279,417 | | First American Treasury Obligations Fund, Class X, 7-Day Yield 0.086% | | | 279,417 | |

| | | | | | | |

| TOTAL SHORT TERM INVESTMENTS | | | | |

| (Cost $279,417) | | | 279,417 | |

| | | | | | | |

| TOTAL INVESTMENT SECURITIES-99.87% | | | | |

| (Cost $19,617,688) | | | 20,767,485 | |

| OTHER ASSETS IN EXCESS OF LIABILITIES-0.13% | | | 27,533 | |

| NET ASSETS-100.00% | | $ | 20,795,018 | |

For Fund compliance purposes, the Fund's industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. Those definitions may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

| * | Non-income producing security. |

See Notes to Financial Statements.

| 20 | www.jamesinvestment.com |

| James Advantage Funds | Statements of Assets and Liabilities |

June 30, 2020

| | | James Balanced: Golden Rainbow Fund | | | James Small Cap Fund | | | James Micro Cap Fund | | | James Aggressive Allocation Fund | |

| ASSETS: | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Investment securities: | | | | | | | | | | | | | | | | |

| At cost | | $ | 622,060,889 | | | $ | 28,699,621 | | | $ | 19,664,386 | | | $ | 19,617,688 | |

| At value | | $ | 699,702,603 | | | $ | 28,991,745 | | | $ | 21,671,377 | | | $ | 20,767,485 | |

| Dividends and interest receivable | | | 2,506,002 | | | | 51,000 | | | | 23,009 | | | | 43,988 | |

| Receivable for securities sold | | | 6,135,385 | | | | – | | | | – | | | | – | |

| Receivable for capital shares sold | | | 27,729 | | | | 228 | | | | 481 | | | | – | |

| Other assets | | | 34,079 | | | | – | | | | – | | | | – | |

| Total Assets | | | 708,405,798 | | | | 29,042,973 | | | | 21,694,867 | | | | 20,811,473 | |

| | | | | | | | | | | | | | | | | |

| LIABILITIES: | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Payable for capital shares redeemed | | | 1,159,717 | | | | 1,509 | | | | – | | | | 402 | |

| Payable for securities purchased | | | 1,073,605 | | | | – | | | | 2,090,721 | | | | – | |

| Accrued expenses: | | | | | | | | | | | | | | | | |

| Management fees | | | 425,562 | | | | 29,487 | | | | 23,682 | | | | 16,053 | |

| 12b-1 distribution and service fees | | | 110,684 | | | | 5,993 | | | | – | | | | – | |

| Trustee fees | | | 1,211 | | | | – | | | | – | | | | – | |

| Other payables | | | 147,358 | | | | – | | | | – | | | | – | |

| Total Liabilities | | | 2,918,137 | | | | 36,989 | | | | 2,114,403 | | | | 16,455 | |

| Net Assets | | $ | 705,487,661 | | | $ | 29,005,984 | | | $ | 19,580,464 | | | $ | 20,795,018 | |

| | | | | | | | | | | | | | | | | |

| NET ASSETS CONSIST OF: | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Paid-in capital | | $ | 635,543,624 | | | $ | 35,601,554 | | | $ | 19,899,515 | | | $ | 22,401,874 | |

| Total Distributable Earnings | | | 69,944,037 | | | | (6,595,570 | ) | | | (319,051 | ) | | | (1,606,856 | ) |

| Net Assets | | $ | 705,487,661 | | | $ | 29,005,984 | | | $ | 19,580,464 | | | $ | 20,795,018 | |

| | | | | | | | | | | | | | | | | |

| PRICING OF RETAIL CLASS SHARES: | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net assets | | $ | 534,314,353 | | | | N/A | | | | N/A | | | | N/A | |

| Shares of beneficial interest outstanding (unlimited number of shares authorized, no par) | | | 26,602,787 | | | | N/A | | | | N/A | | | | N/A | |

| Net assets value, offering price and redemption price per share | | $ | 20.08 | | | | N/A | | | | N/A | | | | N/A | |

| | | | | | | | | | | | | | | | | |

| PRICING OF INSTITUTIONAL CLASS SHARES: | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net assets | | $ | 171,173,308 | | | | N/A | | | | N/A | | | | N/A | |

| Shares of beneficial interest outstanding (unlimited number of shares authorized, no par) | | | 8,635,350 | | | | N/A | | | | N/A | | | | N/A | |

| Net assets value, offering price and redemption price per share | | $ | 19.82 | | | | N/A | | | | N/A | | | | N/A | |

| | | | | | | | | | | | | | | | | |

| PRICING OF SHARES | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net assets | | | N/A | | | $ | 29,005,984 | | | $ | 19,580,464 | | | $ | 20,795,018 | |

| Shares of beneficial interest outstanding (unlimited number of shares authorized, no par) | | | N/A | | | | 1,543,120 | | | | 1,538,589 | | | | 2,253,054 | |

| Net assets value, offering price and redemption price per share | | | N/A | | | $ | 18.80 | | | $ | 12.73 | | | $ | 9.23 | |

See Notes to Financial Statements.

| Annual Report | June 30, 2020 | 21 |

| Statements of Operations | James Advantage Funds |

For the Year Ended June 30, 2020

| | | James Balanced: Golden Rainbow Fund | | | James Small Cap Fund | | | James Micro Cap Fund | | | James Aggressive Allocation Fund | |

| INVESTMENT INCOME: | | | | | | | | | | | | |

| Dividends (Net of withholding taxes of $29,611, $1,399, $1,266 and $1,797, respectively) | | $ | 9,371,679 | | | $ | 716,970 | | | $ | 443,972 | | | $ | 366,809 | |

| Interest | | | 11,264,004 | | | | – | | | | 5,176 | | | | 116,864 | |

| Total Investment Income | | | 20,635,683 | | | | 716,970 | | | | 449,148 | | | | 483,673 | |

| EXPENSES: | | | | | | | | | | | | | | | | |

| Management fees | | | 6,275,780 | | | | 449,755 | | | | 347,568 | | | | 215,446 | |

| 12b-1 distribution and service fees - Retail Class | | | 1,621,883 | | | | – | | | | – | | | | – | |

| 12b-1 distribution and service fees | | | – | | | | 91,531 | | | | – | | | | – | |

| Administration fee | | | 513,707 | | | | – | | | | – | | | | – | |

| Transfer agent fee | | | 163,341 | | | | – | | | | – | | | | – | |

| Custodian fees | | | 68,509 | | | | – | | | | – | | | | – | |

| Professional fees | | | 179,989 | | | | – | | | | – | | | | – | |

| Trustee fees | | | 197,002 | | | | 7,899 | | | | 5,098 | | | | 4,541 | |

| Registration fees | | | 46,623 | | | | – | | | | – | | | | – | |

| Shareholder report printing and mailing | | | 82,787 | | | | – | | | | – | | | | – | |

| Other expenses | | | 92,876 | | | | – | | | | – | | | | – | |

| Total Expenses | | | 9,242,497 | | | | 549,185 | | | | 352,666 | | | | 219,987 | |

| Net Investment Income | | | 11,393,186 | | | | 167,785 | | | | 96,482 | | | | 263,686 | |

| REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS: | | | | | | | | | | | | | | | | |

| Net realized gain/(loss) from: | | | | | | | | | | | | | | | | |

| Investments | | | 108,227 | | | | (4,498,039 | ) | | | (2,129,133 | ) | | | (2,408,560 | ) |

| Foreign currency transactions | | | (1,142 | ) | | | (24 | ) | | | – | | | | – | |

| Total realized gain/(loss) | | | 107,085 | | | | (4,498,063 | ) | | | (2,129,133 | ) | | | (2,408,560 | ) |

| Net change in unrealized appreciation/(depreciation) on investments | | | (17,921,747 | ) | | | (3,226,659 | ) | | | (2,592,497 | ) | | | 196,503 | |

| Net change in unrealized depreciation on foreign currency translation | | | (93 | ) | | | – | | | | – | | | | – | |

| Total change in unrealized appreciation/(depreciation) | | | (17,921,840 | ) | | | (3,226,659 | ) | | | (2,592,497 | ) | | | 196,503 | |

| Net Realized and Unrealized Loss on Investments | | | (17,814,755 | ) | | | (7,724,722 | ) | | | (4,721,630 | ) | | | (2,212,057 | ) |

| Net Decrease in Net Assets Resulting from Operations | | $ | (6,421,569 | ) | | $ | (7,556,937 | ) | | $ | (4,625,148 | ) | | $ | (1,948,371 | ) |

See Notes to Financial Statements.

| 22 | www.jamesinvestment.com |

| James Balanced: Golden Rainbow Fund | Statements of Changes in Net Assets |

| | | For the Year Ended June 30, 2020 | | | For the Year Ended June 30, 2019 | |

| FROM OPERATIONS: | | | | | | | | |

| | | | | | | | | |

| Net investment income | | $ | 11,393,186 | | | $ | 19,251,822 | |

| Net realized gain | | | 107,085 | | | | 63,697,199 | |

| Net change in unrealized depreciation | | | (17,921,840 | ) | | | (127,714,218 | ) |

| Net decrease in net assets resulting from operations | | | (6,421,569 | ) | | | (44,765,197 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| | | | | | | | | |

| Retail Class Shares: | | | | | | | | |

| From distributable earnings | | | (11,438,111 | ) | | | (103,981,188 | ) |

| Institutional Class Shares: | | | | | | | | |

| From distributable earnings | | | (4,402,203 | ) | | | (52,506,234 | ) |

| Decrease in net assets from distributions to shareholders | | | (15,840,314 | ) | | | (156,487,422 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| | | | | | | | | |

| Retail Class Shares: | | | | | | | | |

| Proceeds from shares sold | | | 27,111,849 | | | | 40,903,491 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | 11,140,768 | | | | 100,963,978 | |

| Payments for shares redeemed | | | (258,653,190 | ) | | | (755,368,263 | ) |

| Net Decrease in net assets from Retail Class capital share transactions | | | (220,400,573 | ) | | | (613,500,794 | ) |

| | | | | | | | | |

| Institutional Class Shares: | | | | | | | | |

| Proceeds from shares sold | | | 20,785,892 | | | | 61,904,385 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | 3,792,084 | | | | 43,120,244 | |

| Payments for shares redeemed | | | (152,450,448 | ) | | | (564,933,978 | ) |

| Net Decrease in net assets from Institutional Class capital share transactions | | | (127,872,472 | ) | | | (459,909,349 | ) |

| Total Decrease in Net Assets | | | (370,534,928 | ) | | | (1,274,662,762 | ) |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| | | | | | | | | |

| Beginning of year | | | 1,076,022,589 | | | | 2,350,685,351 | |

| End of year | | $ | 705,487,661 | | | $ | 1,076,022,589 | |

See Notes to Financial Statements.

| Annual Report | June 30, 2020 | 23 |

| Statements of Changes in Net Assets | James Balanced: Golden Rainbow Fund |

| | | For the Year Ended June 30, 2020 | | | For the Year Ended June 30, 2019 | |

| SUMMARY OF CAPITAL SHARE ACTIVITY: | | | | | | |

| | | | | | | |

| Retail Class Shares: | | | | | | | | |

| Shares sold | | | 1,306,726 | | | | 1,894,552 | |

| Shares issued in reinvestment of distributions to shareholders | | | 540,113 | | | | 5,033,571 | |

| Shares redeemed | | | (12,537,191 | ) | | | (34,580,038 | ) |

| Net Decrease in shares outstanding | | | (10,690,352 | ) | | | (27,651,915 | ) |

| Shares outstanding, beginning of year | | | 37,293,139 | | | | 64,945,054 | |

| Shares outstanding, end of year | | | 26,602,787 | | | | 37,293,139 | |

| | | | | | | | | |

| Institutional Class Shares: | | | | | | | | |

| Shares sold | | | 1,024,302 | | | | 2,902,339 | |

| Shares issued in reinvestment of distributions to shareholders | | | 186,405 | | | | 2,171,321 | |

| Shares redeemed | | | (7,468,833 | ) | | | (26,447,927 | ) |

| Net Decrease in shares outstanding | | | (6,258,126 | ) | | | (21,374,267 | ) |

| Shares outstanding, beginning of year | | | 14,893,476 | | | | 36,267,743 | |

| Shares outstanding, end of year | | | 8,635,350 | | | | 14,893,476 | |

See Notes to Financial Statements.

| 24 | www.jamesinvestment.com |

| James Small Cap Fund | Statements of Changes in Net Assets |

| | | For the Year Ended June 30, 2020 | | | For the Year Ended June 30, 2019 | |

| FROM OPERATIONS: | | | | | | | | |

| | | | | | | | | |

| Net investment income/(loss) | | $ | 167,785 | | | $ | (11,285 | ) |

| Net realized loss | | | (4,498,063 | ) | | | (2,557,416 | ) |

| Net change in unrealized depreciation | | | (3,226,659 | ) | | | (6,045,303 | ) |

| Net decrease in net assets resulting from operations | | | (7,556,937 | ) | | | (8,614,004 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| | | | | | | | | |

| From distributable earnings | | | – | | | | (3,818,168 | ) |

| Decrease in net assets from distributions to shareholders | | | – | | | | (3,818,168 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| | | | | | | | | |

| Proceeds from shares sold | | | 2,570,677 | | | | 6,554,991 | |