UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-08411 | |

James Advantage Funds

(Exact name of registrant as specified in charter)

| 1349 Fairground Road Xenia, Ohio | 45385 |

| (Address of principal executive offices) | (Zip code) |

R. Brian Culpepper

P.O. Box 8 Alpha, Ohio 45301

(Name and address of agent for service)

| Registrant's telephone number, including area code: | (937) 426-7640 | |

| Date of fiscal year end: | June 30 | |

| | | |

| Date of reporting period: | June 30, 2023 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Annual Report

June 30, 2023

James Balanced: Golden Rainbow Fund

James Small Cap Fund

James Micro Cap Fund

James Aggressive Allocation Fund

TABLE OF CONTENTS

| Shareholder Letter | 1 |

| Growth of $10,000 or $50,000 Charts | 4 |

| Representation of Schedules of Investments | 8 |

| Schedule of Investments | |

| James Balanced: Golden Rainbow Fund | 9 |

| James Small Cap Fund | 14 |

| James Micro Cap Fund | 17 |

| James Aggressive Allocation Fund | 19 |

| Statements of Assets and Liabilities | 23 |

| Statements of Operations | 24 |

| Statements of Changes in Net Assets | 25 |

| Financial Highlights | |

| James Balanced: Golden Rainbow Fund – Retail Class | 29 |

| James Balanced: Golden Rainbow Fund – Institutional Class | 30 |

| James Small Cap Fund | 31 |

| James Micro Cap Fund | 32 |

| James Aggressive Allocation Fund | 33 |

| Notes to Financial Statements | 34 |

| Report of Independent Registered Public Accounting Firm | 42 |

| Disclosure of Fund Expenses | 43 |

| Additional Information | 44 |

| Disclosure Regarding Approval of Fund Advisory Agreements | 45 |

| Liquidity Risk Management Program | 48 |

| Trustees and Officers | 49 |

| Privacy Policy | 52 |

| James Advantage Funds | Shareholder Letter |

| | June 30, 2023 (Unaudited) |

| | |

LETTER TO THE SHAREHOLDERS

OF THE JAMES ADVANTAGE FUNDS

A mere fifteen months ago, the Federal Reserve (“Fed”) initiated a series of interest rate hikes, raising rates by a significant 500 basis points (5.0%) from their historically low level of 0.25%. Federal Reserve Chairman, Jerome Powell, and his team are diligently working towards achieving a soft landing, aiming to reduce inflation without pushing the U.S. economy into a full-blown recession. Throughout much of 2022, this outcome seemed improbable to many. However, at the mid-year point of 2023, the prospect of such a soft landing no longer appears as farfetched.

Despite prevailing economic pessimism this past year, stock returns have been surprisingly robust.

The first calendar quarter of 2023 saw several banks requiring bailouts to avoid defaulting on deposits, which raised concerns about a potential U.S. government debt default due to the ‘debt ceiling’ mandate.

The Market Over the Past Year

After a difficult 2022, the stock market had a strong first six months of 2023, with the S&P 500 Index up 16.9%. The 12 month total return for the fiscal year ended June 30, 2023, was not much different as we witnessed the S&P 500 advance 19.6%. Smaller stocks, represented by the Russell 2000 Index, also did well, however they trailed their large counterparts, showing a total return of 12.3%.

The rally for the first half of 2023 was driven by a number of factors, including: the Federal Reserve began to slow down the pace of rate hikes and even ’skipped’ a move; investors saw lower Consumer Price Index (“CPI”) and Personal Consumption Expenditures (“PCE”) numbers, which reduced concerns about inflation; the U.S. economy continued to grow, albeit at a slower pace; and strong corporate earnings. However, there were some headwinds in the second quarter of 2023, including: the war in Ukraine weighed on investor sentiment; inflation remained elevated; and the Fed signaled it would continue to raise interest rates.

Despite these headwinds, the stock market held up well in the second quarter, suggesting investors are confident in the long-term health of the economy.

Fixed income over the 12 months ended June 30, 2023 was essentially flat, as measured by the Bloomberg Intermediate Government/Credit Index. The 1-year total return was -0.10%. This is quite an improvement from the strong sell off we witnessed for the Index the previous year.

Investment Philosophy

James Investment Research, Inc.’s (“JIR” or the “Adviser”) research team uses a proprietary approach to try to identify securities they believe are undervalued. In their experience, these stocks typically hold up better in difficult markets and have the potential to trade higher as the market rallies. JIR believes, supported by much academic research, value investing will outperform growth investing over the long run. Investors should realize; however, value investing does not always outperform growth and there are no assurances that value’s past outperformance will be repeated. This is why JIR uses a multi-factor approach that includes both valuation, earnings and momentum.

JIR does its own research using quantitative databases, statistical expertise, and other elements to seek to measure risk levels and the potential impact on future stock and bond price movements. The Adviser employs a proprietary investment approach to select equity securities it believes are undervalued and more likely to appreciate. The Adviser focuses on company characteristics such as being overlooked by Wall Street, management commitment, and value. The Adviser also assesses several fundamental factors such as earnings, earnings trends, price to earnings multiples, return on assets, other financial statement data, as well as its own proprietary calculations. The Adviser evaluates over 3,000 companies of all capitalization ranges. For the James Micro Cap Fund and the James Small Cap Fund, the Adviser refines its approach by using a capitalization screen and evaluates thousands of companies within the appropriate capitalization range. For all funds, the Adviser normally will sell a security when the investment no longer meets the Adviser’s investment criteria. The Adviser’s Investment Committee has a great deal of investment experience, in excess of 150 years in total with James. We utilize a combination of quantitative modeling and hands-on management to help support the James Advantage Funds.

The James Aggressive Allocation Fund and the James Balanced: Golden Rainbow Fund invest not only in equities, but also in investment grade fixed income securities.

Fund Performance

Our flagship fund, the James Balanced: Golden Rainbow Fund, seeks to provide total return through a combination of growth and income and preservation of capital in declining markets. The Fund’s Retail Class shares advanced by 6.41% over the twelve months ended June 30, 2023. During the same twelve month period, the benchmark blend of 25% VettaFi US Equity Large/Mid-Cap 1000 Total Return Index, 25% VettaFi US Equity Small-Cap 2000 Total Return Index and 50% Bloomberg U.S. Intermediate Government/Credit Bond Index increased by 7.87%.

The largest contributors to the James Balanced: Golden Rainbow Fund’s performance were NVIDIA, Microsoft and Apple, some of the largest stocks by market capitalization. NVIDIA had an impressive 179.3% return due in part to strong sales of their graphics cards. Momentum behind the stock increased substantially as they are a leader in the AI, Artificial Intelligence, market. Microsoft, the technology and software giant, increased 33.9% for the year. It’s Windows line of business continued to have strong sales as users stuck with the product and continued to move more into ‘the cloud’. Apple Inc., the provider of computers, tablets and cell phones also contributed nicely to the Fund with a return of 42.7%. Large cap tech stocks led the market recovery, and as the largest stock in the market, Apple led the way.

The largest detractors to the James Balanced: Golden Rainbow Fund’s performance during the period were U.S. Treasury 2.75% Due 2-15-28, U.S. Treasury 3.125% 5-15-48, and Pfizer Inc. Treasury notes fell in value as the Federal Reserve pushed up interest rates. This specific issue declined 3.7% from June 30, 2022 to June 30, 2023. Pfizer, the multinational pharmaceutical company, dropped 5.7% from its peak in the previous year. Pfizer may have lagged because it had done so well in previous years due to sales of its Covid vaccine.

| Annual Report | June 30, 2023 | 1 |

| James Advantage Funds | Shareholder Letter |

| | June 30, 2023 (Unaudited) |

| | |

The James Small Cap Fund, which seeks to provide long-term capital appreciation, increased in value by 15.83% over the fiscal year, beating its benchmark, the VettaFi US Equity Small Cap 2000 Total Return Index, which was up 11.36%. The top contributors to the James Small Cap Fund’s performance were Super Micro Computer, Inc. (“SMCI”), Encore Wire Corp., and Deckers Outdoor. SMCI develops and sells computer servers, motherboards and other computer hardware and accessories. The stock advanced 517.2% for the past twelve months, spurred on by the recent euphoria associated with artificial intelligence, which SMCI provides for cloud gaming. Encore Wire Corp. manufactures copper wire and cable. The stock’s price rose 79.0% as commodities increased in value, especially copper wire used to manufacture new homes. Deckers, the parent company for Uggs, Teva, and Hoka shoes rallied 106.6% as strong customer demand boosted sales.

Detractors to the performance of the James Small Cap Fund were Helen of Troy, TTEC Holdings, and Concentrix Corporation. Helen of Troy, who makes hair dryers, cosmetics, water filters, and other beauty products, fell 45.5% over the reporting period. Slowing demand may have hurt sales as consumers looked to cheaper off named brands. TTEC, which provides business process outsourcing, fell 45.9% due to negative earnings estimate revisions. Concentrix Corp, a former spin off from Synnex Corp, is an American based company specializing in customer engagement and business performance. While they are U.S. based, close to 85% of their revenues come from outside of the U.S. The fear of a global recession caused international sales to fall short of estimates over the past year.

The James Micro Cap Fund, which seeks to provide long-term capital appreciation, was up 15.66% while its benchmark, the VettaFi US Equity Micro-Cap Total Return Index, was up 4.25% over the fiscal year. The James Micro Cap Fund focuses on companies with market capitalizations, at the time of purchase, no larger than the stocks in the VettaFi US Equity Micro-Cap Total Return Index, as well as exchange traded funds (“ETFs”) that invest primarily in such securities.

Due to the nature of micro cap stocks, many of the companies held by the Fund are not household names. Companies like Insight Enterprises, Enova International, and Federal Agricultural Mortgage Corp. all contributed to Fund performance during the period at a high level. Insight Enterprises Inc., which offers information technology hardware, software, and related services advanced 69.6% for the fiscal year. Insight was yet another company that was propelled due to their launch of generative AI services. Enova International operates as a financial services company who offers loans and financing online to small businesses. Enova outperformed the finance sector by adding 84.3% to its stock price this year by working with much of the underserved market. Earnings continued to increase at a robust pace while other financial stocks were mired in fears of bank runs. Federal Agricultural Mortgage Corp., also known as Farmer Mac, is a federally chartered institution who provides mortgages for agricultural real estate. With farming issues in Europe due to the Russian invasion of Ukraine, farming elsewhere has become even more important. Strong demand for domestic farmers boosted the stock price 52.2% this year.

The largest detractors to the James Micro Cap Fund’s performance during the period were SIGA Technologies Inc., Vanda Pharmaceuticals, and Vital Energy, Inc. SIGA Technologies Inc. operates as a pharmaceutical company. The company focuses on an antiviral drug to treat smallpox and other viruses. In 2022, the stock increased sharply in price as it was thought to be a leader in the fight again Monkey Pox. The diminishing news of Monkey Pox caused the price to drop in the wake of the run up. Vanda Pharmaceuticals declined in price 38.4% during the period as sales lagged while many of their partnerships with larger companies focused on alternative drugs to combat Covid, rather than on the sleeping disorder medications Vanda has been promoting. Vital Energy, Inc. is a company that explores and develops oil and gas in the Permian Basin. Lower oil and gas prices hurt recent revenues while the cost of keeping employees remained high. The stock fell 34.5% over the past fiscal year.

Finally, the James Aggressive Allocation Fund advanced 15.02% over the fiscal year, while its benchmark of 65% VettaFi US Equity 3000 Total Return Index and 35% Bloomberg US Aggregate Government/Credit Bond Index was up 11.96%. The Fund seeks to provide total return through a combination of growth and income. Preservation of capital in declining markets is a secondary objective. The Adviser expects the Fund will usually run higher equity levels than the James Balanced: Golden Rainbow Fund.

Over the 12 months ended June 30, 2023, the stocks that contributed the most to the Fund’s outperformance were NVIDIA Corp, Cadence Design Systems, and Enova International. NVIDIA had an impressive 179.3% return due in part to strong sales of their graphics cards. Momentum behind the stock increased substantially as they are a leader in the AI, Artificial Intelligence, market. Cadence Design Systems provides software design and consulting services in the technology area. Cadence has been increasing sales at a decent rate, especially in the international scene. Sales in China are believed to be a specific source of potential revenue that have helped the stock price. Enova International outperformed the finance sector by adding 84.3% to its stock price this year by working with much of the underserved market. Earnings continued to increase at a robust pace while other financial stocks were mired in fears of bank runs.

Primary detractors to the Fund’s performance during the period were SVB Financial, Lam Research Corp., and the Invesco Optimum Yield Diversified Commodity ETF. SVB Financial suffered as management purchased long-dated bonds in an effort to increase yield. Rising interest rates unfortunately caused those bonds to lose money, hampering the firm’s ability to pay out interest to those with savings at the bank. Even though the stock was sold in December of 2022, the decline in price caused this stock to be the largest detractor to the Fund. Lam Research dropped 25.7% because it was unable to ship parts needed to make semiconductors in the second half of 2022, due to backlogs in the supply chain. The Invesco Optimum Yield Diversified Commodity EFT declined 14.5% as commodities began to decline in price due to the forward-looking possibility of a recession and therefore lower futures prices.

Please see the following charts throughout the remainder of the Annual Report for longer-term comparisons for each Fund.

Expectations for the Future (as of June 30, 2023)

Despite the signs of late cycle growth and the odds of a recession around the corner, we believe there are reasons for optimism about the current state of the economy. The labor market has remained resilient, with consistent job gains and steady wage increases, although some cracks are beginning to show. While there has been an uptick in initial jobless claims and a reduction in the average weekly hours worked per employee, these levels have not reached the thresholds associated with recessions.

| 2 | www.jamesinvestment.com |

| James Advantage Funds | Shareholder Letter |

| | June 30, 2023 (Unaudited) |

| | |

Furthermore, consumer spending has remained positive, supported by a strong labor market, and increased wages, even in the face of higher prices. The housing market has also shown signs of stabilization, with growth in housing starts and permits, despite supply shortages and higher mortgage rates. Although the manufacturing sector has contracted for several months, the service sector continues to expand, albeit at a slower pace.

Overall, while there are challenges and potential risks on the horizon, in our view, the current state of the economy suggests a cautious approach rather than an impending downturn.

The equity market has shown resilience since October 2022, despite slow, yet persistent, economic growth and continually lower-than-expected inflation. This robustness in the stock rally is justified as fears of an imminent recession were premature. The concentration of the rally is also reasonable given the defensive nature of owning mega cap technology stocks with robust balance sheets and the potential for growth from emerging secular trends, such as Artificial Intelligence.

We advise maintaining vigilance in monitoring inflation, particularly rent and wage inflation, which are the main factors influencing the Fed’s concern with core inflation. Additionally, we believe it’s essential to keep an eye on initial jobless claims, as they provide an early indicator of potential labor market issues – a level of 300,000 claims is seen as a signal of recession.

As the economy experiences only modest growth and core inflation persists, many bond investors like the Funds, find themselves in a state of cautious observation, uncertain whether interest rates will continue to stay elevated for an extended period. We will continue to monitor this situation as things develop in the second half of 2023.

Brian Culpepper

President & CEO

James Investment Research, Inc.

The views of the author and information discussed in this commentary are as of the date of publication, are subject to change, and may not reflect the writer’s current views. The views expressed represent an assessment of market conditions at a specific point in time, are opinions only, and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the Funds or any securities or any sectors mentioned in this letter. The subject matter contained in this letter has been derived from several sources believed to be reliable and accurate at the time of compilation. Neither James Investment Research, Inc. nor the Funds accept any liability for losses either direct or consequential caused by the use of this information. Diversification cannot guarantee gain or prevent loss.

You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of a Fund before investing. The Funds’ prospectuses contain this and other information. You may obtain a current copy of a Fund’s prospectus by calling 1-800-995-2637 and should be read carefully before investing.

Past performance is no guarantee of future results. The investment return and principal value of an investment in any Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Funds’ current performance may be lower or higher than the performance data quoted. Investors may obtain performance information current to the last month-end at www.jamesinvestment.com.

Risks: Investing involves risk, including loss of principal. The value of the fund’s shares, when redeemed, may be worth more or less than their original cost. There is no guarantee that any investment strategy will achieve its objectives, generate profits or avoid losses. Small and Micro Cap investing involve greater risk not associated with investing in more established companies, such as greater price volatility, business risk, less liquidity and increased competitive threat.

Holdings shown represent an average weight in the Fund for the time period June 30, 2022 to June 30, 2023.

Large Cap refers to a company with a market capitalization value of more than $10 billion.

Small capitalization companies are defined as those companies with market capitalizations at the time of purchase no larger than the stocks in the VettaFi US Equity Small-Cap 2000 Total Return Index , including ETFs that invest primarily in such securities.

Micro capitalization companies are defined as those companies with market capitalizations at the time of purchase no larger than the stocks in the VettaFi US Equity Micro-Cap Total Return Index, including ETFs that invest primarily in such securities.

Growth stocks are those of a company whose stock tends to increase in capital value rather than yield high income.

Value stocks are considered to be a security trading at a lower price than what the company’s performance may otherwise indicate.

Price/Earnings ratio is a valuation of a company’s current share price compared to its per-share earnings.

Price earnings multiple is a measure of how expensive a stock is.

Reurn on assets is an indicator of how profitable a company is relative to its total assets.

Indices are not actively managed and do not reflect any deduction for fees, expenses or taxes. An investor may not invest directly in an index.

The James Advantage Funds are distributed by Ultimus Fund Distributors, LLC, Member FINRA. Ultimus is not affiliated with James Investment Research, Inc.

| Annual Report | June 30, 2023 | 3 |

| James Advantage Funds | Growth of $10,000 or $50,000 Charts |

| | June 30, 2023 (Unaudited) |

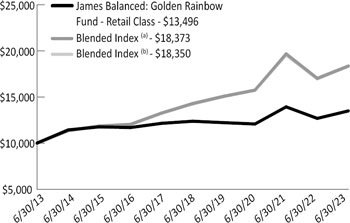

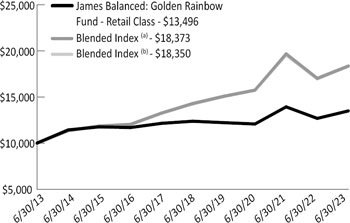

| Comparison of the Change in Value of a $10,000 Investment in | | Comparison of the Change in Value of a $50,000 Investment in |

| the James Balanced: Golden Rainbow Fund – Retail Class | | the James Balanced: Golden Rainbow Fund – Institutional Class |

| | | |

| |  |

Average Annual Total Returns

(for the periods ended June 30, 2023)

| | | | | Since |

| | 1 Year | 5 Years | 10 Years | Inception^ |

| James Balanced: Golden Rainbow – Retail Class | 6.41% | 1.75% | 3.04% | 6.60% |

| Blended Index (a) | 7.87% | 5.14% | 6.27% | N/A* |

| VettaFi U.S. Equity Large/ Mid-Cap 1000 Total Return Index | 19.32% | 11.82% | 12.56% | N/A* |

| VettaFi U.S. Equity Small-Cap 2000 Total Return Index | 11.36% | 3.98% | 8.29% | N/A* |

| Bloomberg U.S. Intermediate Government/Credit Bond Index | -0.10% | 1.23% | 1.41% | 6.30% |

| Blended Index (b) | 8.10% | 5.18% | 6.26% | 7.63% |

| Russell 1000® Index | 19.36% | 11.92% | 12.64% | 10.30% |

| Russell 2000® Index | 12.31% | 4.21% | 8.26% | 9.34% |

| | | | | |

| (a) | The Blended Index is comprised of a 25% weighting in the VettaFi U.S. Equity Large/Mid-Cap 1000 Total Return Index, a 25% weighting in the VettaFi U.S. Equity Small-Cap 2000 Total Return Index and a 50% weighting in the Bloomberg U.S. Intermediate Government/Credit Bond Index. Effective May 30, 2023 the Fund Changed its primary benchmark to the Blended Index(a). |

| (b) | The Blended Index is comprised of a 25% weighting in the Russell 1000® Index, a 25% weighting in the Russell 2000® Index and a 50% weighting in the Bloomberg U.S. Intermediate Government/Credit Bond Index. |

| ^ | Fund and Class inception was July 1, 1991. |

| * | Inception date of the VettaFi U.S. Equity Large Cap/Mid-Cap 1000 Total Return Index and VettaFi U.S. Equity Small-Cap 2000 Total Return Index was December 17, 1999. |

| The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2022 was 1.21%. |

Average Annual Total Returns

(for the periods ended June 30, 2023)

| | | | | Since |

| | 1 Year | 5 Years | 10 Years | Inception^ |

| James Balanced: Golden Rainbow - Institutional Class | 6.64% | 2.00% | 3.30% | 6.09% |

| Blended Index (a) | 7.87% | 5.14% | 6.27% | 9.15% |

| VettaFi U.S. Equity Large/ Mid-Cap 1000 Total Return Index | 19.32% | 11.82% | 12.56% | 15.90% |

| VettaFi U.S. Equity Small-Cap 2000 Total Return Index | 11.36% | 3.98% | 8.29% | 14.73% |

| Bloomberg U.S. Intermediate Government/Credit Bond Index | -0.10% | 1.23% | 1.41% | 2.36% |

| Blended Index (b) | 8.10% | 5.18% | 6.26% | 8.88% |

| Russell 1000® Index | 19.36% | 11.92% | 12.64% | 16.03% |

| Russell 2000® Index | 12.31% | 4.21% | 8.26% | 13.63% |

| | | | | |

| (a) | The Blended Index is comprised of a 25% weighting in the VettaFi U.S. Equity Large/Mid-Cap 1000 Total Return Index, a 25% weighting in the VettaFi U.S. Equity Small-Cap 2000 Total Return Index and a 50% weighting in the Bloomberg U.S. Intermediate Government/Credit Bond Index. Effective May 30, 2023 the Fund Changed its primary benchmark to the Blended Index(a). |

| (b) | The Blended Index is comprised of a 25% weighting in the Russell 1000® Index, a 25% weighting in the Russell 2000® Index and a 50% weighting in the Bloomberg U.S. Intermediate Government/Credit Bond Index. |

| ^ | Class inception was March 2, 2009. |

| The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2022 was 0.96%. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. These performance figures do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Please call 1-800-995-2637 for most recent month-end performance information.

| 4 | www.jamesinvestment.com |

| James Advantage Funds | Growth of $10,000 or $50,000 Charts |

| | June 30, 2023 (Unaudited) |

| | |

VettaFi U.S. Equity Large/Mid-Cap 1000 Total Return Index is an index comprised of 1,000 of the largest U.S. stocks.

VettaFi U.S. Equity Small-Cap 2000 Total Return Index is an index that is comprised of the 1001st through the 3000th largest U.S. Stocks.

The Bloomberg U.S. Intermediate Government/Credit Bond Index measures the performance of U.S. Dollar denominated U.S. Treasures government-related and investment grade U.S. corporate securities that have a remaining maturity of greater than one year and less than ten years.

The Russell 1000® Index is an index of approximately 1,000 of the largest companies in the U.S. Equity Market. Russell 1000® Index is a subset of the Russell 3000® Index. It represents the top companies by market capitalization.

The Russell 2000® Index is a widely recognized, unmanaged index comprised of the 2,000 smallest U.S. domiciled publicly-traded common stocks of the Russell 3000® Index, which represents approximately 8% of the total market capitalization of the Russell 3000® Index, an unmanaged index of the 3,000 largest U.S. domiciled publicly-traded common stocks by market capitalization.

The VettaFi U.S. Equity Large/Mid-Cap 1000 Total Return Index, VettaFi U.S. Equity Small-Cap 2000 Total Return Index, Bloomberg U.S. Intermediate Government/Credit Bond Index, Russell 1000® Index, Russell 2000® Index and Blended Index are widely recognized unmanaged indices of security prices and are representative of a broader market and range of securities than is found in the Fund’s portfolio. The Index returns do not reflect the deduction of expenses, which have been deducted from a Fund’s returns. The Index returns assume reinvestment of all distributions and do not reflect the deduction of taxes and fees. Individuals cannot invest directly in any Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

| Annual Report | June 30, 2023 | 5 |

| James Advantage Funds | Growth of $10,000 or $50,000 Charts |

| | June 30, 2023 (Unaudited) |

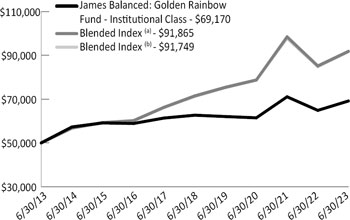

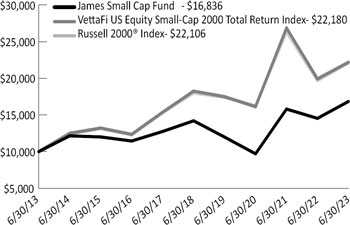

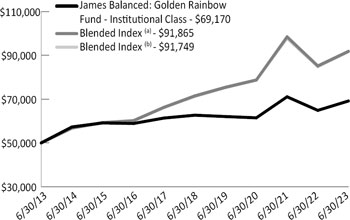

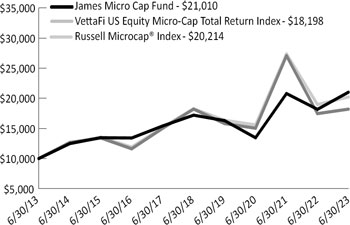

| Comparison of the Change in Value of a $10,000 Investment in | | Comparison of the Change in Value of a $10,000 Investment in |

| the James Small Cap Fund | | the James Micro Cap Fund |

| | | |

| |  |

Average Annual Total Returns

(for the periods ended June 30, 2023)

| | | | | Since |

| | 1 Year | 5 Years | 10 Years | Inception^ |

| James Small Cap Fund | 15.83% | 3.47% | 5.35% | 7.13% |

VettaFi U.S. Equity Small-Cap

2000 Total Return Index(a) | 11.36% | 3.98% | 8.29% | N/A* |

| Russell 2000® Index | 12.31% | 4.21% | 8.26% | 8.48% |

| | | | | |

| (a) | Effective May 30, 2023 the Fund changed its primary benchmark to VettaFi U.S. Equity Small-Cap 2000 Total Return Index. |

| ^ | Fund inception was October 2, 1998. |

| * | Inception date of the VettaFi U.S. Equit Small-Cap 2000 Total Return Index was December 17, 1999. |

| The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2022 was 1.56%. |

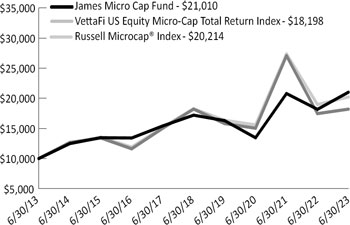

Average Annual Total Returns

(for the periods ended June 30, 2023)

| | | | | Since |

| | 1 Year | 5 Years | 10 Years | Inception^ |

| James Micro Cap Fund | 15.66% | 4.09% | 7.71% | 8.78% |

VettaFi U.S. Equity Micro-Cap

Total Return Index(a) | 4.25% | -0.01% | 6.17% | N/A* |

| Russell Microcap® Index | 6.63% | 2.07% | 7.29% | 9.81% |

| | | | | |

| (a) | Effective May 30, 2023 the Fund changed its primary benchmark to VettaFi U.S. Equity Micro-Cap Total Return Index. |

| ^ | Fund inception was July 1, 2010. |

| * | Inception date of the VettaFi U.S. Equity Micro-Cap Total Return Index was December 16, 2011. |

| The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2022 was 1.51%. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. These performance figures do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Please call 1-800-995-2637 for most recent month-end performance information..

Small and Micro Cap investing involve greater risk not associated with investing in more established companies, such as greater price volatility, business risk, less liquidity and increased competitive threat.

VettaFi U.S. Equity Small-Cap 2000 Total Return Index is an index that is comprised of the 1001st through the 3000th largest U.S. Stocks.

VettaFi U.S. Equity Micro-Cap Total Return Index is an index that is comprised of the lower half of the VettaFi U.S. Equity Small-Cap 2000 Index plus U.S. Stocks ranked too low for inclusion.

The Russell Microcap® Index measures the performance of the microcap segment of the U.S. equity market. It makes up less than 3% of the U.S. equity market. It includes 1,000 of the smallest securities in the small cap Russell 2000® Index, plus the next smallest eligible securities by market cap.

The Russell 2000® Index is a widely recognized, unmanaged index comprised of the 2,000 smallest U.S. domiciled publicly-traded common stocks of the Russell 3000® Index, which represents approximately 8% of the total market capitalization of the Russell 3000® Index, an unmanaged index of the 3,000 largest U.S. domiciled publicly-traded common stocks by market capitalization.

The VettaFi U.S. Equity Small-Cap 2000 Total Return Index, VettaFi U.S. Equity Micro Cap Total Return Index, Russell 2000® Index and Russell Microcap® Index are widely recognized unmanaged indices of security prices and are representative of a broader market and range of securities than is found in the Fund’s portfolio. The Index returns do not reflect the deduction of expenses, which have been deducted from a Fund’s returns. The Index returns assume reinvestment of all distributions and do not reflect the deduction of taxes and fees. Individuals cannot invest directly in any Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

| 6 | www.jamesinvestment.com |

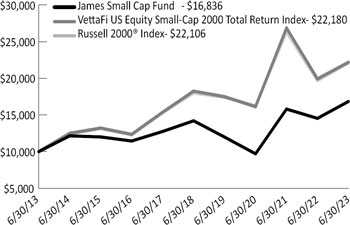

| James Advantage Funds | Growth of $10,000 or $50,000 Charts |

| | June 30, 2023 (Unaudited) |

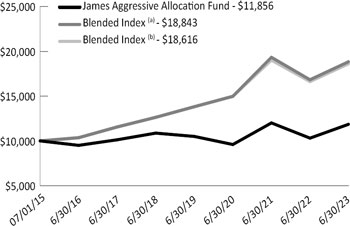

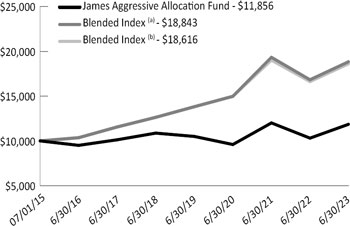

| Comparison of the Change in Value of a $10,000 Investment in | |

| the James Aggressive Allocation Fund | |

| | |

| |

Average Annual Total Returns

(for the periods ended June 30, 2023)

| | | | Since |

| | 1 Year | 5 Years | Inception^ |

| James Aggressive Allocation Fund | 15.02% | 1.75% | 2.15% |

| Blended Index (a) | 11.96% | 8.33% | 8.24% |

| VettaFi U.S. Equity 3000 Total Return Index | 18.89% | 11.83% | 11.63% |

| Blended Index (b) | 12.00% | 8.05% | 8.08% |

| Bloomberg U.S. Aggregate Government/Credit Bond Index | -0.70% | 1.03% | 1.38% |

| Russell 3000® Index | 18.95% | 11.39% | 11.37% |

| | | | |

| (a) | The Blended Index is comprised of a 65% weighting in the VettaFi U.S. Equity 3000 Total Return Index, and a 35% weighting in the Bloomberg U.S. Aggregate Government/Credit Bond Index. Effective May 30, 2023 the Fund Changed its primary benchmark to the Blended Index(a). |

| (b) | The Blended Index is comprised of a 65% weighting in the Russell 3000® Index, and a 35% weighting in the Bloomberg U.S. Aggregate Government/Credit Bond Index. |

| ^ | Fund inception was July 1, 2015. |

| The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2022 was 1.04%. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. These performance figures do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Please call 1-800-995-2637 for most recent month-end performance information.

VettaFi U.S. Equity 3000 Total Return Index is an index comprised of 3,000 of the largest U.S. stocks.

The Bloomberg U.S. Aggregate Government/Credit Bond Index is an unmanaged index generally representative of U.S. Dollar denominated U.S. Treasuries, government related and investment grade U.S. corporate securities, that have a remaining maturity greater than one year.

The Russell 3000® Index is a stock market index of U.S. stocks. The Index measures the performance of 3,000 publicly held U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market.

The VettaFi U.S. Equity 3000 Total Return Index, Bloomberg U.S. Aggregate Government/Credit Bond Index, Russell 3000® Index and the Blended Index are widely recognized unmanaged indices of security prices and are representative of a broader market and range of securities than is found in the Fund’s portfolio. The Index returns do not reflect the deduction of expenses, which have been deducted from a Fund’s returns. The Index returns assume reinvestment of all distributions and do not reflect the deduction of taxes and fees. Individuals cannot invest directly in any Index; however, an individual can invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

| Annual Report | June 30, 2023 | 7 |

| James Advantage Funds | Representation of Schedules of Investments |

| | June 30, 2023 (Unaudited) |

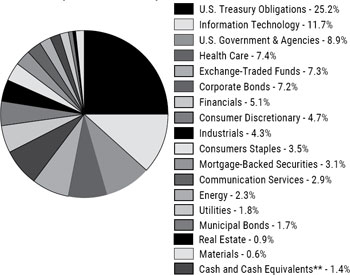

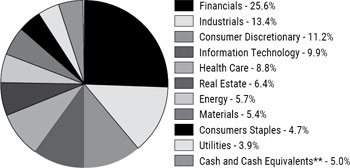

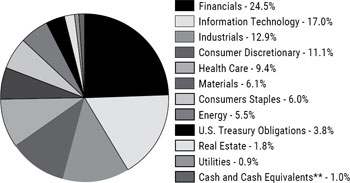

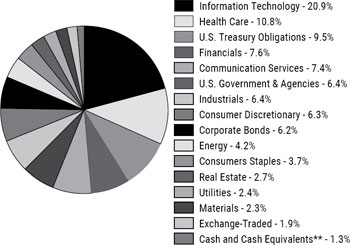

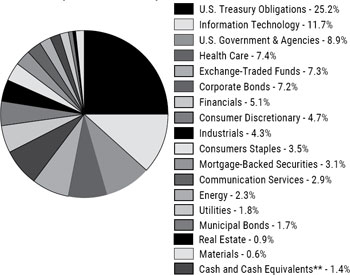

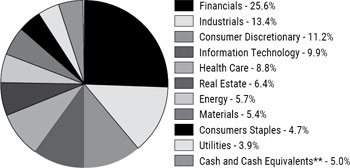

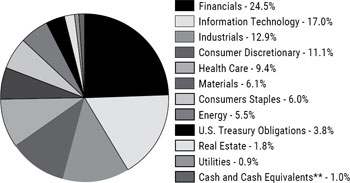

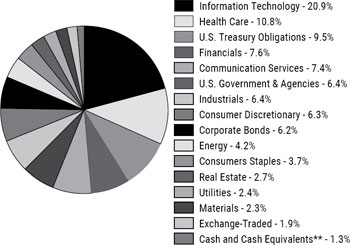

The illustrations below provide the industry sectors for the James Balanced: Golden Rainbow Fund, James Small Cap Fund, James Micro Cap Fund and James Aggressive Allocation Fund.

| James Balanced: Golden Rainbow Fund - Industry Sector | | James Small Cap Fund - Industry Sector Allocation |

| Allocation (% of Net Assets)* | | (% of Net Assets)* |

| | | |

| |  |

| | | |

| James Micro Cap Fund - Industry Sector Allocation | | James Aggressive Allocation Fund - Industry Sector Allocation |

| (% of Net Assets)* | | (% of Net Assets)* |

| | | |

| |  |

| | | |

| * | Holdings are subject to change, and may not reflect the current or future position of the portfolio. |

| ** | Cash and Cash Equivalent percentage include the net of other assets and liabilities, which are contained on the Statement of Assets and Liabilities. |

| 8 | www.jamesinvestment.com |

| James Balanced: Golden Rainbow Fund | Schedule of Investments |

| | June 30, 2023 |

| | | Shares | | | Value | |

| COMMON STOCKS - 45.2% | | | | | | | | |

| Communication Services - 2.9% | | | | | | | | |

| Alphabet, Inc. - Class A (a) | | | 72,807 | | | $ | 8,714,998 | |

| Meta Platforms, Inc. - Class A (a) | | | 5,560 | | | | 1,595,609 | |

| T-Mobile US, Inc. (a) | | | 15,000 | | | | 2,083,500 | |

| | | | | | | | 12,394,107 | |

| Consumer Discretionary - 4.7% | | | | | | | | |

| Amazon.com, Inc. (a) | | | 31,310 | | | | 4,081,572 | |

| Capri Holdings Ltd. (a) | | | 7,000 | | | | 251,230 | |

| Home Depot, Inc. (The) | | | 16,000 | | | | 4,970,240 | |

| M/I Homes, Inc. (a) | | | 20,189 | | | | 1,760,279 | |

| McDonald’s Corporation | | | 23,800 | | | | 7,102,158 | |

| Oxford Industries, Inc. | | | 9,000 | | | | 885,780 | |

| TJX Companies, Inc. (The) | | | 15,000 | | | | 1,271,850 | |

| | | | | | | | 20,323,109 | |

| Consumer Staples - 3.5% | | | | | | | | |

| Nestlé S.A. - ADR | | | 16,300 | | | | 1,961,705 | |

| PepsiCo, Inc. | | | 6,050 | | | | 1,120,581 | |

| Procter & Gamble Company (The) | | | 31,100 | | | | 4,719,114 | |

| Sysco Corporation | | | 35,125 | | | | 2,606,275 | |

| Walmart, Inc. | | | 30,000 | | | | 4,715,400 | |

| | | | | | | | 15,123,075 | |

| Energy - 2.3% | | | | | | | | |

| Chevron Corporation | | | 37,320 | | | | 5,872,301 | |

| ConocoPhillips | | | 11,615 | | | | 1,203,430 | |

| Exxon Mobil Corporation | | | 11,375 | | | | 1,219,969 | |

| Matador Resources Company | | | 5,575 | | | | 291,684 | |

| Pioneer Natural Resources Company | | | 1,821 | | | | 377,275 | |

| Valero Energy Corporation | | | 10,032 | | | | 1,176,754 | |

| | | | | | | | 10,141,413 | |

| Financials - 5.1% | | | | | | | | |

| Arthur J. Gallagher & Company | | | 12,488 | | | | 2,741,990 | |

| Berkshire Hathaway, Inc. - Class B (a) | | | 7,007 | | | | 2,389,387 | |

| BlackRock, Inc. | | | 2,519 | | | | 1,740,982 | |

| Charles Schwab Corporation (The) | | | 17,985 | | | | 1,019,390 | |

| Enova International, Inc. (a) | | | 63,000 | | | | 3,346,560 | |

| Goldman Sachs Group, Inc. (The) | | | 4,115 | | | | 1,327,252 | |

| JPMorgan Chase & Company | | | 30,926 | | | | 4,497,877 | |

| LPL Financial Holdings, Inc. | | | 10,000 | | | | 2,174,301 | |

| Nelnet, Inc. - Class A | | | 17,630 | | | | 1,700,942 | |

| Regions Financial Corporation | | | 50,350 | | | | 897,237 | |

| | | | | | | | 21,835,918 | |

| Health Care - 7.4% | | | | | | | | |

| Abbott Laboratories | | | 19,650 | | | | 2,142,243 | |

| AbbVie, Inc. | | | 14,792 | | | | 1,992,926 | |

| AstraZeneca plc - ADR | | | 60,273 | | | | 4,313,739 | |

| Danaher Corporation | | | 9,000 | | | | 2,160,000 | |

| Elevance Health, Inc. | | | 3,467 | | | | 1,540,353 | |

| Eli Lilly & Company | | | 15,000 | | | | 7,034,699 | |

| Johnson & Johnson | | | 14,030 | | | | 2,322,246 | |

| Pfizer, Inc. | | | 40,000 | | | | 1,467,200 | |

| Thermo Fisher Scientific, Inc. | | | 6,000 | | | | 3,130,500 | |

| UnitedHealth Group, Inc. | | | 12,258 | | | | 5,891,686 | |

| | | | | | | | 31,995,592 | |

See Notes to Financial Statements.

| Annual Report | June 30, 2023 | 9 |

| James Balanced: Golden Rainbow Fund | Schedule of Investments |

| | June 30, 2023 |

| | | Shares | | | Value | |

| Industrials - 4.3% | | | | | | | | |

| ABB Ltd. - ADR | | | 31,656 | | | $ | 1,242,498 | |

| Caterpillar, Inc. | | | 10,762 | | | | 2,647,990 | |

| Deere & Company | | | 8,500 | | | | 3,444,115 | |

| Eaton Corporation plc | | | 19,768 | | | | 3,975,345 | |

| Encore Wire Corporation | | | 2,742 | | | | 509,820 | |

| Lockheed Martin Corporation | | | 2,220 | | | | 1,022,044 | |

| Northrop Grumman Corporation | | | 4,830 | | | | 2,201,514 | |

| Union Pacific Corporation | | | 8,562 | | | | 1,751,956 | |

| United Rentals, Inc. | | | 4,000 | | | | 1,781,480 | |

| | | | | | | | 18,576,762 | |

| Information Technology - 11.7% | | | | | | | | |

| Accenture plc - Class A | | | 7,000 | | | | 2,160,060 | |

| Apple, Inc. | | | 54,000 | | | | 10,474,380 | |

| ASML Holding N.V. | | | 3,597 | | | | 2,606,926 | |

| Broadcom, Inc. | | | 1,600 | | | | 1,387,888 | |

| Insight Enterprises, Inc. (a) | | | 25,000 | | | | 3,658,500 | |

| Jabil, Inc. | | | 26,500 | | | | 2,860,145 | |

| Mastercard, Inc. - Class A | | | 9,000 | | | | 3,539,700 | |

| Microsoft Corporation | | | 44,954 | | | | 15,308,635 | |

| Nova Ltd. (a) | | | 20,812 | | | | 2,441,248 | |

| NVIDIA Corporation | | | 15,000 | | | | 6,345,299 | |

| | | | | | | | 50,782,781 | |

| Materials - 0.6% | | | | | | | | |

| Avery Dennison Corporation | | | 8,000 | | | | 1,374,400 | |

| Linde plc | | | 1,757 | | | | 669,558 | |

| Nucor Corporation | | | 3,698 | | | | 606,398 | |

| | | | | | | | 2,650,356 | |

| Real Estate - 0.9% | | | | | | | | |

| American Tower Corporation | | | 5,050 | | | | 979,397 | |

| CBRE Group, Inc. - Class A (a) | | | 14,100 | | | | 1,138,011 | |

| Prologis, Inc. | | | 16,000 | | | | 1,962,080 | |

| | | | | | | | 4,079,488 | |

| Utilities - 1.8% | | | | | | | | |

| Ameren Corporation | | | 10,422 | | | | 851,165 | |

| American Electric Power Company, Inc. | | | 28,200 | | | | 2,374,440 | |

| Iberdrola S.A. - ADR | | | 20,100 | | | | 1,050,627 | |

| NextEra Energy, Inc. | | | 19,600 | | | | 1,454,320 | |

| Sempra Energy | | | 13,400 | | | | 1,950,906 | |

| | | | | | | | 7,681,458 | |

| | | | | | | | | |

| Total Common Stocks | | | | | | | | |

| (Cost $124,973,143) | | | | | | $ | 195,584,059 | |

| | | | | | | | | |

See Notes to Financial Statements.

| 10 | www.jamesinvestment.com |

| James Balanced: Golden Rainbow Fund | Schedule of Investments |

| | June 30, 2023 |

| | | Shares | | | Value | |

| EXCHANGE-TRADED FUNDS - 7.3% | | | | | | | | |

| Consumer Discretionary Select Sector SPDR® | | | 17,300 | | | $ | 2,937,713 | |

| Invesco S&P SmallCap 600 Revenue ETF | | | 30,000 | | | | 3,402,300 | |

| iShares 5-10 Year Investment Grade Corporate Bond ETF | | | 25,000 | | | | 1,264,250 | |

| iShares Floating Rate Bond ETF | | | 20,000 | | | | 1,016,400 | |

| iShares Gold Trust (a) | | | 209,455 | | | | 7,622,067 | |

| iShares MSCI EAFE ETF | | | 28,050 | | | | 2,033,625 | |

| iShares Russell 2000 ETF | | | 30,000 | | | | 5,618,100 | |

| Technology Select Sector SPDR® Fund | | | 10,553 | | | | 1,834,745 | |

| Vanguard Small-Cap Value ETF | | | 36,000 | | | | 5,954,400 | |

| Total Exchange-Traded Funds | | | | | | | | |

| (Cost $27,303,212) | | | | | | $ | 31,683,600 | |

| | | | | | | | | |

| | | Par Value | | | Value | |

| CORPORATE BONDS - 7.2% | | | | | | | | |

| Communication Services - 0.2% | | | | | | | | |

| AT&T, Inc., 2.950%, due 07/15/26 | | $ | 1,000,000 | | | $ | 940,457 | |

| | | | | | | | | |

| Consumer Discretionary - 0.2% | | | | | | | | |

| Ross Stores, Inc., 4.700%, due 04/15/27 | | | 1,000,000 | | | | 977,105 | |

| | | | | | | | | |

| Consumer Staples - 0.5% | | | | | | | | |

| Walmart, Inc., 5.250%, due 09/01/35 | | | 2,000,000 | | | | 2,132,456 | |

| | | | | | | | | |

| Energy - 0.2% | | | | | | | | |

| BP Capital Markets America, Inc., 4.234%, due 11/06/28 | | | 1,000,000 | | | | 969,432 | |

| | | | | | | | | |

| Financials - 2.6% | | | | | | | | |

| Bank of America Corporation, | | | | | | | | |

| 1.250%, due 09/24/26 | | | 2,000,000 | | | | 1,739,547 | |

| 5.000%, due 06/22/27 | | | 1,000,000 | | | | 969,007 | |

| Bank of Montreal, | | | | | | | | |

| 2.000%, due 12/22/26 | | | 2,500,000 | | | | 2,159,693 | |

| Citigroup Global Markets Holdings, Inc., | | | | | | | | |

| 3.000%, due 03/28/24 | | | 2,500,000 | | | | 2,433,047 | |

| Citigroup, Inc., 3.875%, due 03/26/25 | | | 2,000,000 | | | | 1,931,411 | |

| Goldman Sachs Group, Inc. (The), 3.500%, due 04/01/25 | | | 1,000,000 | | | | 960,590 | |

| Royal Bank of Canada, 5.500%, due 02/14/25 | | | 1,000,000 | | | | 970,684 | |

| | | | | | | | 11,163,979 | |

| Health Care - 0.9% | | | | | | | | |

| Johnson & Johnson, 1.300%, due 09/01/30 | | | 5,000,000 | | | | 4,106,704 | |

| | | | | | | | | |

| Industrials - 0.3% | | | | | | | | |

| Caterpillar, Inc., 8.250%, due 12/15/38 | | | 1,000,000 | | | | 1,300,054 | |

| | | | | | | | | |

| Information Technology - 2.3% | | | | | | | | |

| Apple, Inc., 2.050%, due 09/11/26 | | | 2,500,000 | | | | 2,303,718 | |

| Automatic Data Processing, Inc., 1.250%, due 09/01/30 | | | 2,000,000 | | | | 1,621,479 | |

| | | | | | | | | |

See Notes to Financial Statements.

| Annual Report | June 30, 2023 | 11 |

| James Balanced: Golden Rainbow Fund | Schedule of Investments |

| | June 30, 2023 |

| | | Par Value | | | Value | |

| Information Technology - 2.3% (continued) | | | | | | | | |

| Intel Corporation, 2.875%, due 05/11/24 | | $ | 5,000,000 | | | $ | 4,887,424 | |

| PayPal Holdings, Inc., 2.650%, due 10/01/26 | | | 1,000,000 | | | | 929,150 | |

| | | | | | | | 9,741,771 | |

| | | | | | | | | |

| Total Corporate Bonds | | | | | | | | |

| (Cost $33,929,374) | | | | | | $ | 31,331,958 | |

| | | | | | | | | |

| | | Par Value | | | Value | |

| MORTGAGE-BACKED SECURITIES - 3.1% | | | | | | | | |

| Federal National Mortgage Association - 3.1% | | | | | | | | |

| 3.500%, due 09/01/33 | | $ | 3,234,368 | | | $ | 3,060,772 | |

| 3.500%, due 05/25/47 | | | 285,099 | | | | 264,209 | |

| 2.500%, due 01/01/57 | | | 11,681,613 | | | | 9,908,378 | |

| Total Mortgage-Backed Securities | | | | | | | | |

| (Cost $14,810,799) | | | | | | $ | 13,233,359 | |

| | | | | | | | | |

| | | Par Value | | | Value | |

| MUNICIPAL BONDS - 1.7% | | | | | | | | |

| Ohio - 1.7% | | | | | | | | |

| Beavercreek Ohio City School District, 3.250%, due 12/01/36 (Cost $7,407,770) | | $ | 7,450,000 | | | $ | 7,209,882 | |

| | | | | | | | | |

| | | Par Value | | | Value | |

| U.S. GOVERNMENT & AGENCIES - 8.9% | | | | | | | | |

| Federal Farm Credit Bank - 2.8% | | | | | | | | |

| 4.670%, due 07/26/23 | | $ | 5,000,000 | | | $ | 4,997,565 | |

| 0.670%, due 08/04/25 | | | 2,000,000 | | | | 1,821,652 | |

| 2.750%, due 11/06/26 | | | 5,725,000 | | | | 5,393,580 | |

| | | | | | | | 12,212,797 | |

| Federal Home Loan Bank - 5.4% | | | | | | | | |

| 3.650%, due 07/19/24 | | | 1,000,000 | | | | 980,801 | |

| 5.800%, due 09/27/24 | | | 1,000,000 | | | | 996,762 | |

| 3.000%, due 12/30/24 | | | 1,000,000 | | | | 963,142 | |

| 3.125%, due 04/29/25 | | | 2,500,000 | | | | 2,410,602 | |

| 2.875%, due 06/13/25 | | | 10,000,000 | | | | 9,602,207 | |

| 4.050%, due 07/28/25 | | | 2,000,000 | | | | 1,953,986 | |

| 0.580%, due 09/11/25 | | | 2,000,000 | | | | 1,820,766 | |

| 1.020%, due 09/17/26 | | | 2,500,000 | | | | 2,233,685 | |

| 0.850%, due 10/15/27 | | | 2,500,000 | | | | 2,162,674 | |

| | | | | | | | | |

| Federal Home Loan Mortgage Corporation - 0.7% | | | | | | | 23,124,625 | |

| 3.125%, due 06/28/24 | | | 2,000,000 | | | | 1,948,332 | |

| 5.750%, due 03/20/26 | | | 1,000,000 | | | | 994,394 | |

| | | | | | | | 2,942,726 | |

| Total U.S. Government & Agencies | | | | | | | | |

| (Cost $40,335,727) | | | | | | $ | 38,280,148 | |

| | | | | | | | | |

See Notes to Financial Statements.

| 12 | www.jamesinvestment.com |

| James Balanced: Golden Rainbow Fund | Schedule of Investments |

| | June 30, 2023 |

| | | Par Value | | | Value | |

| U.S. TREASURY OBLIGATIONS - 25.2% | | | | | | | | |

| U.S. Treasury Bills (b) - 0.5% | | | | | | | | |

| 4.792%, due 09/07/23 | | $ | 2,000,000 | | | $ | 1,981,172 | |

| | | | | | | | | |

| U.S. Treasury Bonds - 4.0% | | | | | | | | |

| 3.125%, due 05/15/48 | | | 20,000,000 | | | | 17,252,344 | |

| | | | | | | | | |

| U.S. Treasury Notes - 20.7% | | | | | | | | |

| 0.250%, due 03/15/24 | | | 15,000,000 | | | | 14,470,313 | |

| 2.000%, due 06/30/24 | | | 2,000,000 | | | | 1,934,063 | |

| 4.500%, due 11/30/24 | | | 30,000,000 | | | | 29,681,249 | |

| 2.375%, due 05/15/27 | | | 15,000,000 | | | | 13,967,578 | |

| 3.125%, due 11/15/28 | | | 30,000,000 | | | | 28,578,515 | |

| 4.125%, due 11/15/32 | | | 1,000,000 | | | | 1,021,875 | |

| | | | | | | | 89,653,593 | |

| Total U.S. Treasury Obligations | | | | | | | | |

| (Cost $111,893,388) | | | | | | $ | 108,887,109 | |

| | | | | | | | | |

| | | Shares | | | Value | |

| MONEY MARKET FUNDS - 1.4% | | | | | | | | |

| First American Treasury Obligations Fund - Class X, 5.03% (c) (Cost $6,065,140) | | | 6,065,140 | | | $ | 6,065,140 | |

| | | | | | | | | |

| Total Investments at Value - 100.0% | | | | | | | | |

| (Cost $366,718,553) | | | | | | $ | 432,275,255 | |

| Liabilities in Excess of Other Assets - (0.0%) (d) | | | | | | | (22,919 | ) |

| Net Assets - 100.0% | | | | | | $ | 432,252,336 | |

| | | | | | | | | |

| (a) | Non-income producing security. |

| (b) | The rate shown is the annualized yield at time of purchase. |

| (c) | The rate shown is the 7-day effective yield as of June 30, 2023. |

| (d) | Percentage rounds to less than 0.1%. |

ADR- American Depositary Receipt.

See Notes to Financial Statements.

| Annual Report | June 30, 2023 | 13 |

| James Small Cap Fund | Schedule of Investments |

| | June 30, 2023 |

| | | Shares | | | Value | |

| COMMON STOCKS - 95.0% | | | | | | | | |

| Consumer Discretionary - 11.2% | | | | | | | | |

| Brinker International, Inc. (a) | | | 19,400 | | | $ | 710,040 | |

| Deckers Outdoor Corporation (a) | | | 2,160 | | | | 1,139,745 | |

| Marriott Vacations Worldwide Corporation | | | 2,670 | | | | 327,662 | |

| Oxford Industries, Inc. | | | 1,933 | | | | 190,246 | |

| Patrick Industries, Inc. | | | 6,190 | | | | 495,200 | |

| Winmark Corporation | | | 2,310 | | | | 768,006 | |

| YETI Holdings, Inc. (a) | | | 6,670 | | | | 259,063 | |

| | | | | | | | 3,889,962 | |

| Consumer Staples - 4.7% | | | | | | | | |

| Andersons, Inc. (The) | | | 5,993 | | | | 276,577 | |

| Coca-Cola Consolidated, Inc. | | | 960 | | | | 610,579 | |

| Ingles Markets, Inc. - Class A | | | 6,841 | | | | 565,409 | |

| SpartanNash Company | | | 7,663 | | | | 172,494 | |

| | | | | | | | 1,625,059 | |

| Energy - 5.7% | | | | | | | | |

| Callon Petroleum Company (a) | | | 5,900 | | | | 206,913 | |

| HF Sinclair Corporation | | | 12,160 | | | | 542,458 | |

| Magnolia Oil & Gas Corporation - Class A | | | 19,100 | | | | 399,190 | |

| Matador Resources Company | | | 6,600 | | | | 345,312 | |

| PDC Energy, Inc. | | | 6,800 | | | | 483,752 | |

| | | | | | | | 1,977,625 | |

| Financials - 25.6% | | | | | | | | |

| American Equity Investment Life Holding Company | | | 16,015 | | | | 834,541 | |

| American Financial Group, Inc. | | | 2,630 | | | | 312,313 | |

| Assured Guaranty Ltd. | | | 10,300 | | | | 574,740 | |

| Axos Financial, Inc. (a) | | | 6,132 | | | | 241,846 | |

| Bancorp, Inc. (The) (a) | | | 7,299 | | | | 238,312 | |

| Cadence Bank | | | 11,000 | | | | 216,040 | |

| Enova International, Inc. (a) | | | 17,830 | | | | 947,130 | |

| Evercore, Inc. - Class A | | | 6,730 | | | | 831,761 | |

| EZCORP, Inc. - Class A (a) | | | 33,000 | | | | 276,540 | |

| First BanCorporation | | | 47,750 | | | | 583,506 | |

| Glacier Bancorp, Inc. | | | 7,455 | | | | 232,372 | |

| Houlihan Lokey, Inc. | | | 6,300 | | | | 619,353 | |

| LPL Financial Holdings, Inc. | | | 1,958 | | | | 425,728 | |

| MGIC Investment Corporation | | | 37,900 | | | | 598,441 | |

| Piper Sandler Companies | | | 6,085 | | | | 786,547 | |

| Radian Group, Inc. | | | 31,700 | | | | 801,376 | |

| SouthState Corporation | | | 5,620 | | | | 369,796 | |

| | | | | | | | 8,890,342 | |

| Health Care - 8.8% | | | | | | | | |

| AMN Healthcare Services, Inc. (a) | | | 3,900 | | | | 425,567 | |

| Corcept Therapeutics, Inc. (a) | | | 18,033 | | | | 401,234 | |

| Dynavax Technologies Corporation (a) | | | 40,978 | | | | 529,436 | |

| Innoviva, Inc. (a) | | | 35,600 | | | | 453,188 | |

| Integer Holdings Corporation (a) | | | 4,878 | | | | 432,240 | |

| National HealthCare Corporation | | | 3,545 | | | | 219,152 | |

| Option Care Helath, Inc. (a) | | | 10,500 | | | | 341,145 | |

| Varex Imaging Corporation (a) | | | 11,600 | | | | 273,412 | |

| | | | | | | | 3,075,374 | |

See Notes to Financial Statements.

| 14 | www.jamesinvestment.com |

| James Small Cap Fund | Schedule of Investments |

| | June 30, 2023 |

| | | Shares | | | Value | |

| Industrials - 13.4% | | | | | | | | |

| Allegiant Travel Company (a) | | | 2,400 | | | $ | 303,072 | |

| Boise Cascade Company | | | 6,830 | | | | 617,091 | |

| Encore Wire Corporation | | | 6,285 | | | | 1,168,570 | |

| FTI Consulting, Inc. (a) | | | 5,420 | | | | 1,030,884 | |

| Generac Holdings, Inc. (a) | | | 2,892 | | | | 431,284 | |

| Hillenbrand, Inc. | | | 13,136 | | | | 673,614 | |

| WESCO International, Inc. | | | 2,500 | | | | 447,650 | |

| | | | | | | | 4,672,165 | |

| Information Technology - 9.9% | | | | | | | | |

| Avnet, Inc. | | | 8,250 | | | | 416,213 | |

| Concentrix Corporation | | | 2,500 | | | | 201,875 | |

| Insight Enterprises, Inc. (a) | | | 4,297 | | | | 628,823 | |

| Nova Ltd. (a) | | | 3,000 | | | | 351,900 | |

| PC Connection, Inc. | | | 17,500 | | | | 789,250 | |

| Progress Software Corporation | | | 4,000 | | | | 232,400 | |

| Super Micro Computer, Inc. (a) | | | 2,949 | | | | 735,038 | |

| TD SYNNEX Corporation | | | 1,100 | | | | 103,400 | |

| | | | | | | | 3,458,899 | |

| Materials - 5.4% | | | | | | | | |

| Cleveland-Cliffs, Inc. (a) | | | 24,575 | | | | 411,877 | |

| Innospec, Inc. | | | 5,286 | | | | 530,926 | |

| Schnitzer Steel Industries, Inc. - Class A | | | 13,820 | | | | 414,462 | |

| Warrior Met Coal, Inc | | | 13,785 | | | | 536,925 | |

| | | | | | | | 1,894,190 | |

| Real Estate - 6.4% | | | | | | | | |

| Agree Realty Corporation | | | 6,505 | | | | 425,362 | |

| Healthcare Realty Trust, Inc. | | | 8,000 | | | | 150,880 | |

| LXP Industrial Trust | | | 58,560 | | | | 570,960 | |

| Physicians Realty Trust | | | 21,000 | | | | 293,790 | |

| Sabra Health Care REIT, Inc. | | | 10,000 | | | | 117,700 | |

| STAG Industrial, Inc. | | | 6,000 | | | | 215,280 | |

| Terreno Realty Corporation | | | 4,200 | | | | 252,420 | |

| Xenia Hotel & Resorts, Inc. | | | 16,940 | | | | 208,531 | |

| | | | | | | | 2,234,923 | |

| Utilities - 3.9% | | | | | | | | |

| IDACORP, Inc. | | | 3,753 | | | | 385,058 | |

| Otter Tail Corporation | | | 5,935 | | | | 468,628 | |

| Portland General Electric Company | | | 10,455 | | | | 489,607 | |

| | | | | | | | 1,343,293 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $23,234,369) | | | | | | $ | 33,061,832 | |

| | | | | | | | | |

See Notes to Financial Statements.

| Annual Report | June 30, 2023 | 15 |

| James Small Cap Fund | Schedule of Investments |

| | June 30, 2023 |

| | | Shares | | | Value | |

| MONEY MARKET FUNDS - 5.1% | | | | | | | | |

| First American Treasury Obligations Fund - Class X, 5.03% (b) (Cost $1,777,278) | | | 1,777,278 | | | $ | 1,777,278 | |

| | | | | | | | | |

| Total Investments at Value - 100.1% | | | | | | | | |

| (Cost $25,011,647) | | | | | | $ | 34,839,110 | |

| Liabilities in Excess of Other Assets - (0.1%) | | | | | | | (52,196 | ) |

| Net Assets - 100.0% | | | | | | $ | 34,786,914 | |

| | | | | | | | | |

| (a) | Non-income producing security. |

| (b) | The rate shown is the 7-day effective yield as of June 30, 2023. |

See Notes to Financial Statements.

| 16 | www.jamesinvestment.com |

| James Micro Cap Fund | Schedule of Investments |

| | June 30, 2023 |

| | | Shares | | | Value | |

| COMMON STOCKS - 95.2% | | | | | | | | |

| Consumer Discretionary - 11.1% | | | | | | | | |

| Century Communities, Inc. | | | 4,662 | | | $ | 357,202 | |

| Haverty Furniture Companies, Inc. | | | 21,134 | | | | 638,670 | |

| M/I Homes, Inc. (a) | | | 4,742 | | | | 413,455 | |

| MarineMax, Inc. (a) | | | 5,750 | | | | 196,420 | |

| Patrick Industries, Inc. | | | 4,044 | | | | 323,520 | |

| Shoe Carnival, Inc. | | | 12,950 | | | | 304,066 | |

| Standard Motor Products, Inc. | | | 5,625 | | | | 211,050 | |

| Zumiez, Inc. (a) | | | 4,568 | | | | 76,103 | |

| | | | | | | | 2,520,486 | |

| Consumer Staples - 6.0% | | | | | | | | |

| Central Garden & Pet Company - Class A (a) | | | 13,108 | | | | 477,918 | |

| Ingles Markets, Inc. - Class A | | | 10,714 | | | | 885,512 | |

| | | | | | | | 1,363,430 | |

| Energy - 5.5% | | | | | | | | |

| Civitas Resources, Inc. | | | 7,254 | | | | 503,210 | |

| Dorian LPG Ltd. | | | 19,032 | | | | 488,171 | |

| Vital Energy, Inc. (a) | | | 5,814 | | | | 262,502 | |

| | | | | | | | 1,253,883 | |

| Financials - 24.5% | | | | | | | | |

| Bancorp, Inc. (The) (a) | | | 6,900 | | | | 225,285 | |

| Donnelley Financial Solutions, Inc. (a) | | | 20,288 | | | | 923,712 | |

| Enova International, Inc. (a) | | | 17,016 | | | | 903,890 | |

| Federal Agricultural Mortgage Corporation - Class C | | | 6,912 | | | | 993,531 | |

| Merchants Bancorp | | | 25,704 | | | | 657,508 | |

| Nelnet, Inc. - Class A | | | 5,646 | | | | 544,726 | |

| OFG Bancorp | | | 25,456 | | | | 663,892 | |

| Piper Sandler Companies | | | 4,960 | | | | 641,130 | |

| | | | | | | | 5,553,674 | |

| Health Care - 9.4% | | | | | | | | |

| Eagle Pharmaceuticals, Inc. (a) | | | 1,650 | | | | 32,076 | |

| Innoviva, Inc. (a) | | | 40,082 | | | | 510,244 | |

| Integer Holdings Corporation (a) | | | 6,396 | | | | 566,749 | |

| iRadmed Corporation | | | 2,400 | | | | 114,576 | |

| iTeos Therapeutics, Inc. (a) | | | 3,964 | | | | 52,483 | |

| Kiniksa Pharmaceuticals Ltd. (a) | | | 6,909 | | | | 97,279 | |

| Selecta Biosciences, Inc. (a) | | | 94,737 | | | | 106,106 | |

| SIGA Technologies, Inc. | | | 52,400 | | | | 264,620 | |

| Utah Medical Products, Inc. | | | 4,200 | | | | 391,440 | |

| | | | | | | | 2,135,573 | |

| Industrials - 12.9% | | | | | | | | |

| ACCO Brands Corporation | | | 74,997 | | | | 390,734 | |

| ArcBest Corporation | | | 5,285 | | | | 522,158 | |

| Boise Cascade Company | | | 2,500 | | | | 225,875 | |

| CRA International, Inc. | | | 3,384 | | | | 345,169 | |

| Cross Country Healthcare, Inc. (a) | | | 4,213 | | | | 118,301 | |

| Genco Shipping & Trading Ltd. | | | 8,000 | | | | 112,240 | |

| Heidrick & Struggles International, Inc. | | | 3,400 | | | | 89,998 | |

| Heritage-Crystal Clean, Inc. (a) | | | 5,000 | | | | 188,950 | |

| Insteel Industries, Inc. | | | 3,500 | | | | 108,920 | |

| Kforce, Inc. | | | 2,400 | | | | 150,384 | |

| Shyft Group, Inc. (The) | | | 6,336 | | | | 139,772 | |

| | | | | | | | | |

See Notes to Financial Statements.

| Annual Report | June 30, 2023 | 17 |

| James Micro Cap Fund | Schedule of Investments |

| | June 30, 2023 |

| | | Shares | | | Value | |

| Industrials - 12.9% (continued) | | | | | | | | |

| Transcat, Inc. (a) | | | 2,200 | | | $ | 187,682 | |

| V2X, Inc. (a) | | | 6,950 | | | | 344,442 | |

| | | | | | | | 2,924,625 | |

| Information Technology - 17.0% | | | | | | | | |

| Cohu, Inc. (a) | | | 8,022 | | | | 333,394 | |

| ePlus, Inc. (a) | | | 4,600 | | | | 258,980 | |

| Insight Enterprises, Inc. (a) | | | 5,663 | | | | 828,723 | |

| Nova Ltd. (a) | | | 9,143 | | | | 1,072,475 | |

| PC Connection, Inc. | | | 12,184 | | | | 549,498 | |

| Photronics, Inc. (a) | | | 22,198 | | | | 572,486 | |

| Vishay Precision Group, Inc. (a) | | | 6,384 | | | | 237,166 | |

| | | | | | | | 3,852,722 | |

| Materials - 6.1% | | | | | | | | |

| Innospec, Inc. | | | 4,000 | | | | 401,760 | |

| Schnitzer Steel Industries, Inc. - Class A | | | 18,045 | | | | 541,170 | |

| United States Lime & Minerals, Inc. | | | 2,070 | | | | 432,402 | |

| | | | | | | | 1,375,332 | |

| Real Estate - 1.8% | | | | | | | | |

| PotlatchDeltic Corporation | | | 7,517 | | | | 397,273 | |

| | | | | | | | | |

| Utilities - 0.9% | | | | | | | | |

| Clearway Energy, Inc. - Class C | | | 7,332 | | | $ | 209,402 | |

| | | | | | | | | |

| Total Common Stocks | | | | | | | | |

| (Cost $14,202,374) | | | | | | | 21,586,400 | |

| | | | | | | | | |

| | | Par Value | | | Value | |

| U.S. TREASURY OBLIGATIONS - 3.8% | | | | | | | | |

| U.S. Treasury Bills (b) - 3.8% | | | | | | | | |

| 5.000%, due 01/25/24 (Cost $875,165) | | $ | 900,000 | | | $ | 874,146 | |

| | | | | | | | | |

| | | Shares | | | Value | |

| MONEY MARKET FUNDS - 1.1% | | | | | | | | |

| First American Treasury Obligations Fund - Class X, 5.03% (c) (Cost $245,399) | | | 245,399 | | | $ | 245,399 | |

| | | | | | | | | |

| Total Investments at Value - 100.1% | | | | | | | | |

| (Cost $15,322,938) | | | | | | $ | 22,705,945 | |

| Liabilities in Excess of Other Assets - (0.1%) | | | | | | | (25,310 | ) |

| Net Assets - 100.0% | | | | | | $ | 22,680,635 | |

| | | | | | | | | |

| (a) | Non-income producing security. |

| (b) | Rate shown is the annualized yield at the time of purchase. |

| (c) | The rate shown is the 7-day effective yield as of June 30, 2023. |

See Notes to Financial Statements.

| 18 | www.jamesinvestment.com |

| James Aggressive Allocation Fund | Schedule of Investments |

| | June 30, 2023 |

| | | Shares | | | Value | |

| COMMON STOCKS - 74.7% | | | | | | | | |

| Communication Services - 7.4% | | | | | | | | |

| Alphabet, Inc. - Class A (a) | | | 4,750 | | | $ | 568,575 | |

| Comcast Corporation - Class A | | | 6,645 | | | | 276,100 | |

| Meta Platforms, Inc. - Class A (a) | | | 1,000 | | | | 286,980 | |

| T-Mobile US, Inc. (a) | | | 2,300 | | | | 319,470 | |

| | | | | | | | 1,451,125 | |

| Consumer Discretionary - 6.3% | | | | | | | | |

| Best Buy Company, Inc. | | | 1,815 | | | | 148,739 | |

| Deckers Outdoor Corporation (a) | | | 590 | | | | 311,319 | |

| Home Depot, Inc. (The) | | | 700 | | | | 217,448 | |

| McDonald’s Corporation | | | 1,000 | | | | 298,410 | |

| Tractor Supply Company | | | 1,205 | | | | 266,426 | |

| | | | | | | | 1,242,342 | |

| Consumer Staples - 3.7% | | | | | | | | |

| PepsiCo, Inc. | | | 1,100 | | | | 203,742 | |

| Procter & Gamble Company (The) | | | 1,700 | | | | 257,958 | |

| Walmart, Inc. | | | 1,700 | | | | 267,206 | |

| | | | | | | | 728,906 | |

| Energy - 4.2% | | | | | | | | |

| Cheniere Energy, Inc. | | | 845 | | | | 128,744 | |

| Chevron Corporation | | | 2,000 | | | | 314,700 | |

| Matador Resources Company | | | 5,000 | | | | 261,600 | |

| Valero Energy Corporation | | | 1,000 | | | | 117,300 | |

| | | | | | | | 822,344 | |

| Financials - 7.6% | | | | | | | | |

| Bancorp, Inc. (The) (a) | | | 4,000 | | | | 130,600 | |

| BlackRock, Inc. | | | 500 | | | | 345,570 | |

| Enova International, Inc. (a) | | | 8,485 | | | | 450,723 | |

| Goldman Sachs Group, Inc. (The) | | | 855 | | | | 275,772 | |

| JPMorgan Chase & Company | | | 2,000 | | | | 290,880 | |

| | | | | | | | 1,493,545 | |

| Health Care - 10.8% | | | | | | | | |

| Abbott Laboratories | | | 2,625 | | | | 286,178 | |

| AbbVie, Inc. | | | 1,250 | | | | 168,413 | |

| AstraZeneca plc - ADR | | | 4,000 | | | | 286,279 | |

| Danaher Corporation | | | 825 | | | | 198,000 | |

| Eli Lilly & Company | | | 600 | | | | 281,388 | |

| Johnson & Johnson | | | 1,295 | | | | 214,348 | |

| Pfizer, Inc. | | | 3,220 | | | | 118,110 | |

| UnitedHealth Group, Inc. | | | 610 | | | | 293,190 | |

| Zoetis, Inc. | | | 1,595 | | | | 274,675 | |

| | | | | | | | 2,120,581 | |

| Industrials - 6.4% | | | | | | | | |

| ABB Ltd. - ADR | | | 3,500 | | | | 137,375 | |

| Caterpillar, Inc. | | | 800 | | | | 196,840 | |

| Deere & Company | | | 435 | | | | 176,258 | |

| Eaton Corporation plc | | | 1,175 | | | | 236,292 | |

| Generac Holdings, Inc. (a) | | | 1,000 | | | | 149,130 | |

| Lockheed Martin Corporation | | | 415 | | | | 191,058 | |

| Union Pacific Corporation | | | 850 | | | | 173,927 | |

| | | | | | | | 1,260,880 | |

See Notes to Financial Statements.

| Annual Report | June 30, 2023 | 19 |

| James Aggressive Allocation Fund | Schedule of Investments |

| | June 30, 2023 |

| | | Shares | | | Value | |

| Information Technology - 20.9% | | | | | | | | |

| Accenture plc - Class A | | | 465 | | | $ | 143,490 | |

| Apple, Inc. | | | 3,400 | | | | 659,498 | |

| ASML Holding N.V. | | | 550 | | | | 398,613 | |

| Broadcom, Inc. | | | 300 | | | | 260,229 | |

| Cadence Design Systems, Inc. (a) | | | 2,000 | | | | 469,040 | |

| Enphase Energy, Inc. (a) | | | 550 | | | | 92,114 | |

| Jabil, Inc. | | | 1,800 | | | | 194,274 | |

| Mastercard, Inc. - Class A | | | 735 | | | | 289,075 | |

| Microsoft Corporation | | | 1,730 | | | | 589,134 | |

| Nova Ltd. (a) | | | 2,515 | | | | 295,010 | |

| NVIDIA Corporation | | | 1,700 | | | | 719,133 | |

| | | | | | | | 4,109,610 | |

| Materials - 2.3% | | | | | | | | |

| CF Industries Holdings, Inc. | | | 500 | | | | 34,710 | |

| James Hardie Industries plc - ADR (a) | | | 6,800 | | | | 182,852 | |

| Linde plc | | | 332 | | | | 126,519 | |

| Nucor Corporation | | | 700 | | | | 114,786 | |

| | | | | | | | 458,867 | |

| Real Estate - 2.7% | | | | | | | | |

| Digital Realty Trust, Inc. | | | 1,500 | | | | 170,805 | |

| Prologis, Inc. | | | 2,905 | | | | 356,240 | |

| | | | | | | | 527,045 | |

| Utilities - 2.4% | | | | | | | | |

| American Water Works Company, Inc. | | | 750 | | | | 107,063 | |

| Iberdrola S.A. - ADR | | | 2,000 | | | | 104,540 | |

| NextEra Energy, Inc. | | | 2,380 | | | | 176,595 | |

| Sempra Energy | | | 610 | | | | 88,810 | |

| | | | | | | | 477,008 | |

| | | | | | | | | |

| Total Common Stocks | | | | | | | | |

| (Cost $10,919,458) | | | | | | $ | 14,692,253 | |

| | | | | | | | | |

| | | Shares | | | Value | |

| EXCHANGE-TRADED FUNDS - 1.9% | | | | | | | | |

| Invesco Optimum Yield Diversified Commodity Strategy No. K-1 ETF | | | 21,000 | | | $ | 285,705 | |

| SPDR® S&P Regional Banking ETF | | | 2,000 | | | | 81,660 | |

| Total Exchange-Traded Funds | | | | | | | | |

| (Cost $436,266) | | | | | | $ | 367,365 | |

| | | | | | | | | |

See Notes to Financial Statements.

| 20 | www.jamesinvestment.com |

| James Aggressive Allocation Fund | Schedule of Investments |

| | June 30, 2023 |

| | | Par Value | | | Value | |

| CORPORATE BONDS - 6.2% | | | | | | | | |

| Consumer Discretionary - 2.2% | | | | | | | | |

| Starbucks Corporation, 2.550%, due 11/15/30 | | $ | 500,000 | | | $ | 425,834 | |

| | | | | | | | | |

| Financials - 2.1% | | | | | | | | |

| Bank of Montreal, 2.000%, due 12/22/26 | | | 200,000 | | | | 172,775 | |

| Citigroup, Inc., 3.875%, due 03/26/25 | | | 250,000 | | | | 241,427 | |

| | | | | | | | 414,202 | |

| Health Care - 1.1% | | | | | | | | |

| AstraZeneca plc, 0.700%, due 04/08/26 | | | 250,000 | | | | 223,348 | |

| | | | | | | | | |

| Information Technology - 0.8% | | | | | | | | |

| Automatic Data Processing, Inc., 1.250%, due 09/01/30 | | | 200,000 | | | | 162,148 | |

| | | | | | | | | |

| Total Corporate Bonds | | | | | | | | |

| (Cost $1,403,722) | | | | | | $ | 1,225,532 | |

| | | | | | | | | |

| | | Par Value | | | Value | |

| U.S. GOVERNMENT & AGENCIES - 6.4% | | | | | | | | |

| Federal Farm Credit Bank - 2.3% | | | | | | | | |

| 0.670%, due 08/04/25 | | $ | 500,000 | | | $ | 455,413 | |

| | | | | | | | | |

| Federal Home Loan Bank - 0.5% | | | | | | | | |

| 3.650%, due 07/19/24 | | | 100,000 | | | | 98,080 | |

| | | | | | | | | |

| Federal Home Loan Mortgage Corporation - 1.3% | | | | | | | | |

| 3.125%, due 06/28/24 | | | 250,000 | | | | 243,542 | |

| | | | | | | | | |

| Federal National Mortgage Association - 2.3% | | | | | | | | |

| 0.560%, due 10/22/25 | | | 500,000 | | | | 453,416 | |

| | | | | | | | | |

| Total U.S. Government & Agencies | | | | | | | | |

| (Cost $1,350,000) | | | | | | $ | 1,250,451 | |

| | | | | | | | | |

| | | Par Value | | | Value | |

| U.S. TREASURY OBLIGATIONS - 9.5% | | | | | | | | |

| U.S. Treasury Bills (b) - 0.5% | | | | | | | | |

| U.S. Treasury Bills, 5.155%, due 08/10/23 | | $ | 100,000 | | | $ | 99,458 | |

| | | | | | | | | |

| U.S. Treasury Bonds - 3.2% | | | | | | | | |

| U.S. Treasury Bonds, 3.000%, due 08/15/48 | | | 750,000 | | | | 632,754 | |

| | | | | | | | | |

| U.S. Treasury Notes - 5.8% | | | | | | | | |

| U.S. Treasury Notes, | | | | | | | | |

| 0.250%, due 03/15/24 | | | 500,000 | | | | 482,344 | |

| 1.125%, due 02/28/25 | | | 400,000 | | | | 374,922 | |

| 2.625%, due 02/15/29 | | | 300,000 | | | | 277,980 | |

| | | | | | | | 1,135,246 | |

| | | | | | | | | |

| Total U.S. Treasury Obligations | | | | | | | | |

| (Cost $1,964,150) | | | | | | $ | 1,867,458 | |

| | | | | | | | | |

See Notes to Financial Statements.

| Annual Report | June 30, 2023 | 21 |

| James Aggressive Allocation Fund | Schedule of Investments |

| | June 30, 2023 |

| | | Shares | | | Value | |

| MONEY MARKET FUNDS - 1.5% | | | | | | | | |

| First American Treasury Obligations Fund - Class X, 5.03% (c) (Cost $297,695) | | | 297,695 | | | $ | 297,695 | |

| | | | | | | | | |

| Total Investments at Value - 100.2% | | | | | | | | |

| (Cost $16,371,291) | | | | | | $ | 19,700,754 | |

| Liabilities in Excess of Other Assets - (0.2%) | | | | | | | (46,176 | ) |

| Net Assets - 100.0% | | | | | | $ | 19,654,578 | |

| | | | | | | | | |

| (a) | Non-income producing security. |

| (b) | Rate shown is the annualized yield at the time of purchase. |

| (c) | The rate shown is the 7-day effective yield as of June 30, 2023. |

ADR- American Depositary Receipt.

See Notes to Financial Statements.

| James Advantage Funds | Statements of Assets and Liabilities |

| | June 30, 2023 |

| | | James Balanced: | | | | | | | | | | |

| | | Golden Rainbow | | | James Small | | | James Micro | | | James Aggressive | |

| | | Fund | | | Cap Fund | | | Cap Fund | | | Allocation Fund | |

| ASSETS | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Investment securities: | | | | | | | | | | | | | | | | |

| At cost | | $ | 366,718,553 | | | $ | 25,011,647 | | | $ | 15,322,938 | | | $ | 16,371,291 | |

| At value | | $ | 432,275,255 | | | $ | 34,839,110 | | | $ | 22,705,945 | | | $ | 19,700,754 | |

| Receivable for investment securities sold | | | — | | | | — | | | | — | | | | 50,745 | |

| Receivable for capital shares sold | | | 10,297 | | | | 141 | | | | — | | | | 150 | |

| Dividends and interest receivable | | | 954,024 | | | | 30,511 | | | | 10,711 | | | | 26,419 | |

| Tax reclaims receivable | | | 19,089 | | | | — | | | | — | | | | 1,319 | |

| Other assets | | | 44,345 | | | | 125 | | | | 85 | | | | — | |

| Total Assets | | | 433,303,010 | | | | 34,869,887 | | | | 22,716,741 | | | | 19,779,387 | |

| | | | | | | | | | | | | | | | | |

| LIABILITIES | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Payable for capital shares redeemed | | | 340,692 | | | | 2,871 | | | | 7,106 | | | | 100 | |

| Payable for investment securities purchased | | | — | | | | — | | | | — | | | | 107,498 | |

| Accrued expenses: | | | | | | | | | | | | | | | | |

| Management fees (Note 4) | | | 262,548 | | | | 35,032 | | | | 27,406 | | | | 15,564 | |

| Administration fees (Note 4) | | | 17,449 | | | | — | | | | — | | | | — | |

| 12b-1 distribution and service fees (Note 4) | | | 270,949 | | | | 42,843 | | | | — | | | | — | |

| Trustee fees (Note 4) | | | 12,200 | | | | 2,227 | | | | 1,594 | | | | 1,647 | |

| Other accrued expenses | | | 146,836 | | | | — | | | | — | | | | — | |

| Total Liabilities | | | 1,050,674 | | | | 82,973 | | | | 36,106 | | | | 124,809 | |

| Net Assets | | $ | 432,252,336 | | | $ | 34,786,914 | | | $ | 22,680,635 | | | $ | 19,654,578 | |

| | | | | | | | | | | | | | | | | |

| NET ASSETS CONSIST OF | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Paid-in capital | | $ | 364,858,688 | | | $ | 24,735,858 | | | $ | 15,654,280 | | | $ | 16,996,824 | |

| Distributable earnings | | | 67,393,648 | | | | 10,051,056 | | | | 7,026,355 | | | | 2,657,754 | |

| Net Assets | | $ | 432,252,336 | | | $ | 34,786,914 | | | $ | 22,680,635 | | | $ | 19,654,578 | |

| | | | | | | | | | | | | | | | | |

| PRICING OF RETAIL CLASS SHARES | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net assets | | $ | 338,462,985 | | | | N/A | | | | N/A | | | | N/A | |

| Shares of beneficial interest outstanding (unlimited number of shares authorized, no par) | | | 17,132,740 | | | | N/A | | | | N/A | | | | N/A | |

| Net assets value, offering price and redemption price per share | | $ | 19.76 | | | | N/A | | | | N/A | | | | N/A | |

| | | | | | | | | | | | | | | | | |

| PRICING OF INSTITUTIONAL CLASS SHARES | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net assets | | $ | 93,789,351 | | | | N/A | | | | N/A | | | | N/A | |

| Shares of beneficial interest outstanding (unlimited number of shares authorized, no par) | | | 4,830,960 | | | | N/A | | | | N/A | | | | N/A | |

| Net assets value, offering price and redemption price per share | | $ | 19.41 | | | | N/A | | | | N/A | | | | N/A | |

| | | | | | | | | | | | | | | | | |

| PRICING OF SHARES | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net assets | | | N/A | | | $ | 34,786,914 | | | $ | 22,680,635 | | | $ | 19,654,578 | |