Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ Filed by the Registrant | ☐ Filed by a Party other than the Registrant |

CHECK THE APPROPRIATE BOX: |

☐ Preliminary Proxy Statement

|

☐ Confidential, For Use of the Commission Only (as permitted by Rule14a-6(e)(2))

|

☑ Definitive Proxy Statement

|

☐ Definitive Additional Materials

|

☐ Soliciting Material Under Rule14a-12

|

Baxter International Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): | ||

☑ | No fee required.

| |

☐ | Fee computed on table below per Exchange Act Rules14a-6(i)(4) and0-11. | |

1) Title of each class of securities to which transaction applies: | ||

2) Aggregate number of securities to which transaction applies: | ||

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

4) Proposed maximum aggregate value of transaction: | ||

|

| 5) Total fee paid: | |

☐ | Fee paid previously with preliminary materials:

| |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |

1) Amount previously paid: | ||

2) Form, Schedule or Registration Statement No.: | ||

3) Filing Party: | ||

|

| 4) Date Filed: | |

Table of Contents

Table of Contents

|

Baxter International Inc. One Baxter Parkway Deerfield, Illinois 60015 | March 26, 2019 |  | ||

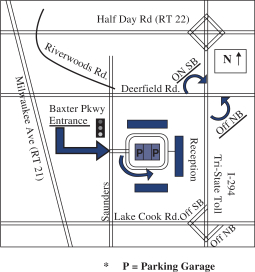

Dear Fellow Stockholder: It is my pleasure to invite you to attend Baxter’s Annual Meeting of Stockholders on Tuesday, May 7, 2019 at 9:00 a.m., Central Daylight Time, at our corporate headquarters located at One Baxter Parkway, Deerfield, Illinois 60015. Registration will begin at 8:00 a.m.

Baxter’s mission is unchanging and enduring: Save and Sustain Lives. It is a constant that defines our emphasis on medically necessary products as well as the commitment of our employees. What does change, in contrast, is how we bring this mission to life. For the past three years, we have been on a journey of transformation to deliver enhanced value for our stakeholders.

We continue investing to renew the pace of high-potential innovation across the company. This is an essential part of our commitment to patients, and equally essential to delivering increased value for our investors. Building on our recent progress, we intend to continue accelerating innovation through our internal research and development pipeline, business development, and by expanding into new adjacencies, from prevention through recovery. We are employing a highly disciplined business development strategy, assessing opportunities of varying scope and scale. We are focused on ensuring a complementary fit – whether through adjacencies or even new healthcare lines beyond our current core – as well as a return on investment in line with our current standards and expectations.

Simultaneously, we will maintain our tenacious focus on operational efficiency, which has been key to increasing our margins and cash flow over the past three years. Our focus on operational excellence has been a defining element of our ongoing transformation. Zero-based organization and spending initiatives have helped usher in a new era of efficiency, agility and spending discipline across all corners of the business.

An evolving culture has played a crucial role in Baxter’s broader transformation over the past three years. Our longtime mission to Save and Sustain Lives is being pursued with a new sense of dynamism and urgency, powered by levers like speed, simplicity, courage and collaboration. This charge will continue in order to maintain and accelerate our renewed trajectory.

Our 50,000 employees1 make it all possible. Our globe-spanning diversity is matched only by the commitments we share…including our passion for patients, our drive to innovate, and our belief in reaching beyond today’s goals and expectations. As much as any strategy, these traits will continue to form our future and the impact we deliver for our stakeholders.

As Baxter’s Chairman and CEO, it is gratifying to help channel this energy into meaningful results. We have already accomplished a great deal; but I am convinced that this is prologue for what is to come. There are so many opportunities within our reach to advance healthcare, refine our operations and deliver enhanced value for investors. Now it is time to deliver on the potential we have worked hard to create. Many thanks for your ongoing support and confidence as this journey continues.

We hope that you join us at the Annual Meeting of Stockholders to discuss our results and learn more about our strategic agenda. Details of the business to be conducted at the Annual Meeting are included in the attached Notice of Annual Meeting of Stockholders and Proxy Statement, which we encourage you to read carefully. If you plan to attend the Annual Meeting, please review the information on attendance provided on page 73 of the proxy statement.

Your vote is very important to us. Whether or not you plan to attend in person, I urge you to vote your shares as promptly as possible. You may vote your shares by Internet or by telephone. If you received a paper copy of the proxy card by mail, you may sign, date and return the proxy card in the enclosed envelope. If you attend the Annual Meeting, you may revoke your proxy and vote in person.

On behalf of the Board of Directors and our management team, thank you for your continued support of Baxter and your participation in this year’s Annual Meeting of Stockholders.

Very truly yours,

José (Joe) E. Almeida Chairman of the Board, President and Chief Executive Officer | ||||

| 1 | As of December 31, 2018. |

Table of Contents

|

Baxter International Inc. One Baxter Parkway Deerfield, Illinois 60015 | March 26, 2019 |  | ||

Dear Stockholder: It has been my privilege to serve as Baxter’s lead independent director during 2018. I also enjoyed meeting with several of our investors as part of our stockholder engagement program in late 2018 (as described on p.32 of the proxy statement). I look forward to continuing to engage in productive dialogue with our stockholders in 2019 and beyond.

Your Board plays a key advisory role in the mission and strategic direction of the company, and we are actively committed to our oversight responsibilities across all areas of the company. The Board includes diverse and independent directors with a wide range of skills and experiences that support Baxter’s strategy and help to position the company for long-term success in the complex and rapidly changing healthcare environment.

As a lead director, I liaise closely with the other independent directors to help ensure their input is incorporated into the Board meetings and work closely with Joe Almeida to develop the agenda topics. Additionally, I provide an independent channel for investors and other stakeholders to access the Board and Baxter generally. There were many developments in our Board and governance practices in 2018, including:

• Board Refreshment – We welcomed two new Board members: Patricia (Patty) Morrison and Amy Wendell. Their appointments were the result of our ongoing board refreshment activities, which included (for the first time) the use of a third party to help oversee our annual self-assessment process. Both Amy and Patty bring critical experience in the areas of information technology and cybersecurity and M&A, respectively, which complement Baxter’s strategies and potential transformation activities. Ms. Carole Shapazian and Mr. Munib Islam have announced their decisions to depart from the Board effective May 6th. We are grateful for their years of service and contributions to Baxter.

• Stockholder Engagement – We continued to build upon our year-round engagement program with stockholders to better understand their perspectives on a variety of relevant issues, including strategy, performance, governance, compensation, corporate responsibility and Board composition, refreshment and leadership.

• Governance Improvements – Consistent with feedback received from several investors and in light of the company’s increased focus on digital health, we amended our Committee charters in February 2019 to assign oversight responsibility for IT functions (includingnon-product related cybersecurity matters) to the Audit Committee. The Quality, Compliance & Technology Committee is now responsible for cybersecurity as it relates to Baxter products and services. Ms. Morrison has been added to the Audit Committee in light of her significant expertise in these areas.

I am confident that Baxter will continue to build on its growing momentum with the Board’s active involvement, valuable input and support. I am equally confident that we currently have the proper structures in place to help accomplish the company’s long term strategic goals.

Best regards,

Thomas T. Stallkamp Lead Director | ||||

Table of Contents

| Table of Contents |

i | |

| i | ||||||||||||||

| Notice of 2019 Annual Meeting of Stockholders and Proxy Statement | 1 | |||||||||||||

| 2 | ||||||||||||||

| Corporate Governance at Baxter International Inc. | 10 | |||||||||||||

Proposal 1 Election of Directors

|

|

10

|

| |||||||||||

| 11 | ||||||||||||||

| 17 | ||||||||||||||

| 20 | ||||||||||||||

| 20 | ||||||||||||||

| 22 | ||||||||||||||

| 23 | ||||||||||||||

| 24 | ||||||||||||||

| 27 | ||||||||||||||

| 29 | ||||||||||||||

Proposal 2 Advisory Vote to Approve Named |

|

29 |

| |||||||||||

| 30 | ||||||||||||||

| 30 | ||||||||||||||

| Summary | 30 | |||||||||||||

| 34 | ||||||||||||||

| 35 | ||||||||||||||

| 36 | ||||||||||||||

| 42 | ||||||||||||||

| 46 | ||||||||||||||

| Summary Compensation Table | 46 | |||||||||||||

investor.baxter.com

Table of Contents

| Notice of 2019 Annual Meeting of Stockholders and Proxy Statement |

1 | |

Notice of 2019 Annual Meeting of Stockholders and Proxy Statement

The 2019 Annual Meeting of Stockholders of Baxter International Inc. (the Annual Meeting) will be held at our corporate headquarters located at One Baxter Parkway, Deerfield, Illinois 60015, on Tuesday, May 7, 2019 at 9:00 a.m., Central Daylight Time, for the following purposes:

| To elect the 12 directors named in the attached proxy statement. | |

| To approve named executive officer compensation for 2018. | |

| To ratify the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm for Baxter International Inc. (Baxter or the company) in 2019. | |

| To vote on the two stockholder proposals as described in the proxy statement, if such proposals are properly presented at the Annual Meeting. | |

| To transact any other business that may properly come before the meeting. | |

The Board of Directors recommends that stockholders vote FOR Items 1, 2 and 3. The Board of Directors recommends that stockholders vote AGAINST each of the stockholder proposals referred to in Item 4. Stockholders of record at the close of business on March 14, 2019 will be entitled to vote at the meeting.

By order of the Board of Directors,

Ellen K. McIntosh Corporate Secretary

|

How Do I Vote?

| By Internet, following the instructions on the Notice of Internet Availability of Proxy Materials or the proxy card; | |||

| By telephone, using the telephone number printed on the proxy card; or | |||

| By mail (if you received your proxy materials by mail), using the enclosed proxy card and return envelope. | |||

Important Notice Regarding

the Availability of Proxy Materials for

the Annual Meeting of Stockholders

to be Held on May 7, 2019

The proxy statement relating to the

Annual Meeting and the

Annual Report to Stockholders for the year

ended December 31, 2018 are available at

http://materials.proxyvote.com/071813.

Proxy Statement

The accompanying proxy is solicited on behalf of the Board of Directors for use at the Annual Meeting to be held on Tuesday, May 7, 2019. On or about March 26, 2019, Baxter began mailing to stockholders of record a Notice of Internet Availability of Proxy Materials providing instructions on how to access proxy materials via the Internet and how to vote online (www.proxyvote.com). Stockholders who did not receive the Notice of Internet Availability of Proxy Materials as a result of a previous election will receive a paper or electronic copy of the proxy materials, which Baxter also began sending on or about March 26, 2019.

investor.baxter.com

Table of Contents

2 | Proxy Statement Highlights | |

To assist you in reviewing the proposals to be acted upon at the Annual Meeting, this section presents concise detail about eachnon-routine voting item. For more complete information, please review our Annual Report on Form10-K for the year ended December 31, 2018 and the complete proxy statement.

| 2019 Annual Meeting of Stockholders and Proxy Statement

| 2019 Annual Meeting of Stockholders and Proxy Statement

Table of Contents

| Proxy Statement Highlights |

3 | |

Name | Age | Director Since | Independent Y/N | Key Attributes and Skills | A | C | CG | QCT | ||||||||||||||||

José (Joe) E. Almeida Chairman, President and Chief Executive Officer, Baxter International Inc. | 56 | 2016 | N | ✓ Significant experience in the medical device industry ✓ Extensive experience leading and helping to transform global, multi-faceted corporations | ||||||||||||||||||||

Thomas F. Chen Senior Vice President and President of International Nutrition, Abbott Laboratories (retired) | 69 | 2012 | Y | ✓ Extensive international business experience in hospital products and pharmaceuticals ✓ Global perspective | ⬛ | ⬛ | ||||||||||||||||||

John D. Forsyth Chairman and CEO, Wellmark Blue Cross Blue Shield | 71 | 2003 | Y | ✓ Significant experience in the healthcare industry, including with leading payors ✓ Understanding of large, complex organizations, including healthcare payors | ⬛ | ⬛ | ||||||||||||||||||

James R. Gavin III, M.D., Ph.D. Chief Executive Officer and Chief Medical Officer Healing our Village, Inc. | 73 | 2003 | Y | ✓ Significant experience in the healthcare industry, including with leading healthcare providers ✓ Extensive scientific and medical expertise, including as a practicing endocrinologist | ⬛ | ⬛ | ||||||||||||||||||

Peter S. Hellman President and Chief Financial and Administrative Officer Nordson Corporation (retired) | 69 | 2005 | Y | ✓ Extensive financial and capital markets experience ✓ Significant experience leading global industrial companies, including a multi-billion dollar information technology business | ⬛ | ⬛ | ||||||||||||||||||

Michael F. Mahoney Chairman, President and CEO, Boston Scientific Corporation | 54 | 2015 | Y | ✓ Extensive experience leading global, medical products companies, including most recently as a Chairman and CEO | ⬛ | ⬛ | ||||||||||||||||||

| New | Patricia B. Morrison Executive Vice President, Customer Support Services & Chief Information Officer, Cardinal Health, Inc. (retired) | 59 | 2019 | Y | ✓ Significant experience in information technology and cybersecurity at global healthcare companies | ⬛ | ||||||||||||||||||

Stephen N. Oesterle, M.D. Healthcare Consultant, former Senior Vice President, Medicine and Technology, Medtronic plc | 68 | 2017 | Y | ✓ Significant experience in the medical products and healthcare industries ✓ Strong scientific and medical background, including as a practicing cardiologist | ⬛ | ⬛ | ||||||||||||||||||

Cathy R. Smith Executive Vice President and Chief Financial Officer, Target Corporation | 55 | 2017 | Y | ✓ Significant financial expertise and corporate leadership experience, including in response to cybersecurity incidents | ⬛ | |||||||||||||||||||

Thomas T. Stallkamp (Lead Director) Founder and Principal, Collaborative Management LLC | 72 | 2000 | Y | ✓ Extensive experience leading global corporations, including global manufacturers ✓ Significant business development and supply chain experience | ⬛ | ⬛ | ||||||||||||||||||

Albert P.L. Stroucken Chairman and Chief Executive Officer, Owens-Illinois Inc. (retired) | 71 | 2004 | Y | ✓ Extensive experience leading large, complex organizations ✓ Significant financial expertise | ⬛ | ⬛ | ||||||||||||||||||

| New | Amy A. Wendell Senior Advisor, Parella Weinberg Partners L.P., former Senior Vice President of Strategy and Business Development, Covidien | 58 | 2019 | Y | ✓ Extensive experience in business development and strategy in healthcare industry, including significant restructuring and integration experience | ⬛ | ||||||||||||||||||

Key

⬛ Committee Chairperson | A Audit Committee | CG Corporate Governance Committee | ||

⬛ Committee Member | C Compensation Committee | QCT Quality, Compliance and Technology Committee

|

investor.baxter.com

Table of Contents

4 | Proxy Statement Highlights | |

2018 Board and Governance Highlights

Board Refreshment Activities | See pages 18 and 32 |

• Heightened focus by the Board on refreshment and diversity led to the appointment of two new directors as described below • Two directors, Munib Islam and Carole Shapazian, have announced their departure from the Board, effective May 6th • Continued outreach to many of our large institutional investors. Thomas Stallkamp, the lead independent director, participated in several of these discussions. • Expanded the scope of the Board’s annual self-assessment review, as described below

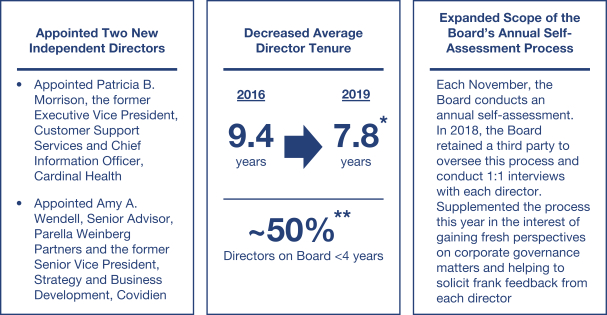

Appointed Two New Independent Directors Appointed Patricia B. Morrison, the former Executive Vice President, Customer Support Services and Chief Information Officer, Cardinal Health Appointed Amy A. Wendell, Senior Advisor, Parella Weinberg Partners and the former Senior Vice President, Strategy and Business Development, Covidien Decreased Average Director Tenure 2016 9.4 years 2019 7.8* years ~58%** Directors on Board <4 years Expanded Scope of the Board's Annual Self-Assessment Process Each November, the Board conducts an annual self-assessment. In 2018, the Board retained a third party to oversee this process and conduct 1:1 interviews with each director. Did so in the interest of getting fresh perspectives and helping to solicit frank feedback from each director

* Calculated after giving effect to Mses. Morrison’s and Wendell’s appointments and the previously announced departures of Mr. Islam and Ms. Shapazian from the Board, effective May 6, 2019 **Calculated as of March 26, 2019, after giving effect to the upcoming departures of Mr. Islam and Ms. Shapazian from the Board

| ||

Governance Practices

| See page 32 | |

• Continued to augment Baxter’s stockholder engagement program, with continued involvement from members of the Board and senior management. In 2018, Thomas Stallkamp, as lead independent director, participated in several of these discussions. • Since the 2018 annual meeting, the company has approached stockholders holding over 50% of the company’s outstanding shares to engage in discussions. The company will continue having these conversations with interested investors. • Topics discussed with stockholders included company strategy and performance, corporate governance matters (including Board composition and refreshment), board leadership structure, executive compensation and corporate responsibility initiatives (including company culture and diversity). • Consistent with feedback shared by several stockholders in these discussions and in light of the company’s increased focus on digital health, amended the Audit and Quality, Compliance & Technology Committee charters in February 2019 to assign oversight responsibility for IT functions (includingnon-product related cybersecurity matters) to the Audit Committee. The Quality, Compliance & Technology Committee is now responsible for cybersecurity as it relates to Baxter products and services.

|

| 2019 Annual Meeting of Stockholders and Proxy Statement

| 2019 Annual Meeting of Stockholders and Proxy Statement

Table of Contents

| Proxy Statement Highlights |

5 | |

Board Qualifications, Experiences and Backgrounds

The following chart sets forth the varied qualifications, experiences and backgrounds of the director nominees in the aggregate. Each chevron represents a director nominee who possesses the specific attribute or experience. See “Corporate Governance at Baxter International Inc.—Nominees for Election as Directors” and “—Board of Directors—Director Qualifications” for additional information.

|

Advisory Vote to Approve Named Executive Officer Compensation

What am I voting on? You are asked to cast anon-binding advisory vote to approve Baxter’s compensation programs as described in the “Executive Compensation—Compensation Discussion and Analysis” section of the proxy statement. | |||||

What is the Board’s recommendation? The Board recommends a voteFOR this proposal. The Board and the Compensation Committee believe that Baxter’s executive compensation programs appropriately align executives’ interests with Baxter’s strategies and long-term objectives, including Baxter’s ongoing pursuit of top quartile financial performance. See “—Performance Highlights” below for additional information regarding 2018 financial and operational highlights.

| ||||||

investor.baxter.com

Table of Contents

6 | Proxy Statement Highlights | |

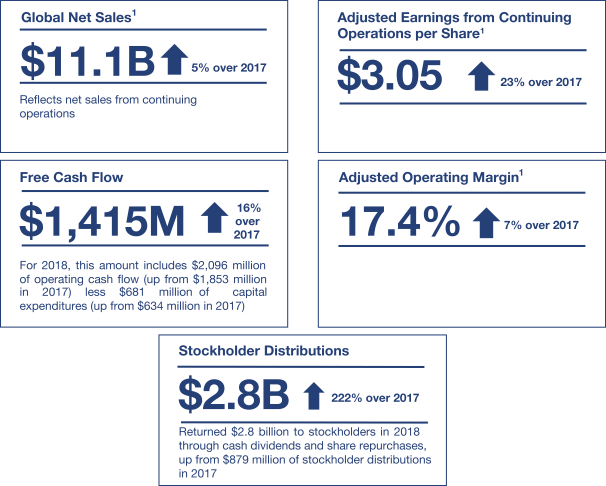

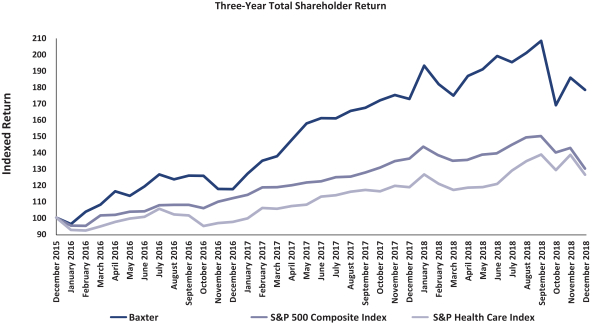

Performance Highlights

Development or Highlight | Further Information | |

Strong financial results and stockholder returns for 2018 | See pages 30, 36 and 39 |

| 1 | For purposes of calculating performance under the company’s 2018 annual incentive plan, net sales were calculated at budgeted exchange rates (as of January 1, 2018) and were adjusted to exclude results associated with sales of the company’s newly acquired RECOTHROM and PREVELEAK products. Adjusted earnings from continuing operations per share and adjusted operating margin were further adjusted (for purposes of performance calculations under the company’s 2018 annual and long-term incentive plans) to exclude the results associated with RECOTHROM and PREVELEAK. We refer to these measures as used in the proxy statement as adjusted net sales, further adjusted earnings per share or further adjusted EPS and further adjusted operating margin, respectively. These amounts totaled $11.6 billion in adjusted net sales, $3.01 in further adjusted EPS and 17.2% in further adjusted operating margin. See “Executive Compensation—Compensation Discussion and Analysis—Structure of Compensation Program—Financial Targets” and “—Performance Over the Long Term—Performance Against Adjusted Operating Margin Target” for a reconciliation of the amounts listed in the graphics above along with further adjusted amounts (as described in this paragraph) to the applicable measures calculated in accordance with U.S. generally accepted accounting principles (GAAP). |

| 2019 Annual Meeting of Stockholders and Proxy Statement

| 2019 Annual Meeting of Stockholders and Proxy Statement

Table of Contents

| Proxy Statement Highlights |

7 | |

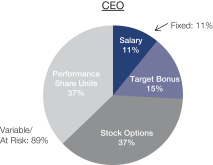

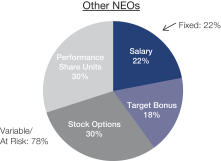

Compensation Design for 2018

| See page 35 | |

Base Salary

| ||

• Provides a base level of competitive compensation • Used to attract and retain executive talent | ||

Annual Incentive Program

| ||

• Motivates and rewards executives for company and individual performance against annually established financial targets and individual objectives • Financial targets and relative weightings for 2018 included: • Adjusted earnings per share (50%) • Net sales (30%) • Free cash flow (20%) | ||

Long-Term Incentive Program (LTI)

| ||

Performance Share Units (PSUs) (50%)

• Motivates and rewards executives for company performance against financial targets and incorporates an assessment of the executive’s past performance and future potential. All PSU awards are subject to a three-year vesting period • PSUs recognize that a portion of an executive’s equity awards should becompletely “at-risk” • Financial objectives for 2018 PSU awards included: • Adjusted operating margin (50%)—based on company performance as compared to the applicable annual financial target, in each case subject to completion of the three-year vesting period across all three tranches of awards • Three-year total shareholder return (formerly known as growth in shareholder value) (TSR) (50%)—based on company performance as compared to an indexed industry benchmark over a three-year period

| ||

Stock Options (50%)

• Motivates and rewards an executive’s contributions to helping to achieve the company’s long-term objectives and increasing stockholder value • Stock options recognize that it is in the best interests of the company to provide equity that will vest as long as the executive continues to serve at Baxter and are valued, at least in part, on the company’s performance during that period

The company did not issue any restricted stock units (RSUs) to any executive officers in 2018, consistent with the structure of its executive compensation program generally.

| ||

investor.baxter.com

Table of Contents

8 | Proxy Statement Highlights | |

|

Independent Board Chairman

What am I voting on? If properly presented, you will be asked to vote on a stockholder proposal that asks the Board to amend the company’s governing documents to require the Chairman of the Board, whenever possible, to be an independent member of the Board. | |||||

What is the Board’s recommendation? The Board of Directors recommends a voteAGAINSTthe stockholder proposal.

Where can I find more information? Concise supporting information is presented below. | ||||||

|

See “Stockholder Proposals—Proposal 4—Independent Board Chairman” for additional information. | |||||

Items to consider when evaluating this proposal: |

• Existing Governance Structure: The company’s existing governance structure allows the Board flexibility to make changes in the company’s leadership structure in accordance with the best interests of the company and its stockholders • Consistent Communication and Coordination Through Transformation: Having Mr. Almeida serve as Chief Executive Officer and Chairman allows consistent communication and coordination throughout the company and effective and efficient implementation of corporate strategy • Established Independent Oversight: The existing leadership structure and corporate governance practices provide strong independent oversight of the Board, including the regular evaluation and review of the leadership structure by the Board. In 2018, the Board augmented this review process through the use of a third party to oversee its annual self-assessment process. This process resulted in the appointment of two new independent directors, Patricia Morrison and Amy Wendell, to the Board • Strong Lead Director:The responsibilities of the lead director are significant and include functioning as the primary liaison between the independent directors and the Chief Executive Officer and Chairman. Additionally, Mr. Stallkamp, who has served in the role since 2014, has helped oversee the company and Board through significant milestones and periods of transition, including the July 2015spin-off of Baxalta Incorporated (Baxalta) and the recruitment and appointment of Joe Almeida as Chief Executive Officer and Chairman beginning January 1, 2016 |

| 2019 Annual Meeting of Stockholders and Proxy Statement

| 2019 Annual Meeting of Stockholders and Proxy Statement

Table of Contents

| Proxy Statement Highlights |

9 | |

|

Right to Act by Written Consent

What am I voting on? If properly presented, you will be asked to vote on a stockholder proposal that asks the Board to undertake such steps as may be necessary to permit stockholders to act by written consent. | |||||

What is the Board’s recommendation? The Board of Directors recommends a voteAGAINSTthe stockholder proposal.

Where can I find more information? Concise supporting information is presented below. | ||||||

|

See “Stockholder Proposals—Proposal 5—Right to Act by Written Consent” for additional information. | |||||

Items to consider when evaluating this proposal: |

• Baxter Stockholders Have the Right to Call a Special Meeting: The company’s organizational documents allow holders of 25% of the outstanding shares of the company’s common stock to call a special meeting. This is approximatelyone-half of the percentage that would be required to act by written consent under the proposal • Minority Stockholders May be Left Out of the Written Consent Process: The proposal does not include a requirement that all stockholders be given prior notice and an opportunity to be heard. Furthermore, stockholders holding a mere majority of the company’s outstanding voting shares could adopt an action by written consent that is binding on the company and the company’s stockholders. In contrast, holders of just 25% of the outstanding shares of the company’s common stock are already permitted to call a special meeting which requires prior notice and gives all stockholders the opportunity to participate in the process • The Quality, Compliance & Technology Committee Provides Strong Oversight Over Product and Safety Matters: The Quality, Compliance & Technology Committee is responsible for the oversight of risk management in the areas of product quality and safety at Baxter. It has overseen a significant reduction in product recalls and the elimination of multiple Warning Letters since 2015 • Committed to Maintaining Strong Corporate Governance Practices and Protecting Stockholder Rights: This commitment is evidenced by, among other things, Baxter’s proxy access bylaw, the ability of stockholders to call a special meeting, the complete declassification of the Board, majority voting standard for directors, the removal of super-majority voting provisions from Baxter’s organizational documents and Board composition and refreshment efforts |

investor.baxter.com

Table of Contents

10 | Corporate Governance at Baxter International Inc. | |

Corporate Governance at Baxter International Inc.

|

The Board currently consists of 14 members. Mr. Munib Islam’s resignation and Ms. Carole Shapazian’s retirement from the Board will become effective on May 6, 2019, the day prior to the Annual Meeting. After giving effect to these departures, the Board has nominated all of the remaining directors for reelection as directors for a term of one year.

The Board of Directors recommends a voteFOR the election of each of the director nominees named below under “—Nominees for Election as Directors.” | |||

Baxter’s Bylaws require each director to be elected by the majority of the votes cast with respect to that director in uncontested elections; that is, the number of shares voted “for” a director must exceed 50% of the number of votes cast with respect to that director. Abstentions will not be considered votes cast. In a contested election (a situation in which the number of nominees exceeds the number of directors to be elected), the standard for election of directors will be a plurality of the shares represented in person or by proxy and entitled to vote on the election of directors. If a nominee who is serving as a director is not elected at an annual meeting of stockholders, under Delaware law the director would continue to serve on the Board as a “holdover director.” However, under the company’s Bylaws, any incumbent director who fails to be reelected at an annual meeting must offer his or her resignation to the Board. The Corporate Governance Committee would then make a recommendation to the Board whether to accept or reject the resignation, or whether other action should be taken. In accordance with the Bylaws, the Board would act on the Corporate Governance Committee’s recommendation and publicly disclose its decision and the rationale behind it within 90 days from the date that the election results are certified. The director who offers his or her resignation would not participate in the Board’s decision.

All of the nominees have indicated their willingness to serve if elected, but if any should be unable or unwilling to stand for election, proxies may be voted for a substitute nominee designated by the Board. No nominations for directors were received from stockholders (including as a result of any proxy access nominations), and no other candidates are eligible for election as directors at the Annual Meeting. Accordingly, there is no director election contest and each director nominee must receive a majority of the votes cast with respect to that director in order to be reelected to the Board. Unless proxy cards are marked otherwise, the individuals named as proxies intend to vote the shares represented by proxy in favor of all of the Board’s nominees.

Set forth below under “—Nominees for Election as Directors” is information concerning the nominees for election.

| 2019 Annual Meeting of Stockholders and Proxy Statement

| 2019 Annual Meeting of Stockholders and Proxy Statement

Table of Contents

| Corporate Governance at Baxter International Inc. |

11 | |

Nominees for Election as Directors

José (Joe) E. Almeida

Chairman of the Board, President and CEO Age 56 Director since 2016

Biography Mr. Almeida was appointed Chairman of the Board, President and Chief Executive Officer effective January 1, 2016. He began serving as an executive officer of the company in October 2015. He served as Senior Advisor with The Carlyle Group, a multinational private equity, alternative asset management and financial services corporation, from May 2015 to October 2015. Previously, he served as the Chairman, President and Chief Executive Officer of Covidien plc (Covidien), a global health care products company, from March 2012 through January 2015, prior to the acquisition of Covidien by Medtronic plc (Medtronic), and President and Chief Executive Officer of Covidien from July 2011 to March 2012. Mr. Almeida is a member of the Board of Directors of Walgreens Boots Alliance, Inc. and Ortho-Clinical Diagnostics, Inc., a Carlyle Group company. Mr. Almeida served on the board of directors of State Street Corporation from October 2013 to November 2015, Analog Devices, Inc. from December 2014 to November 2015 and EMC Corporation from January 2015 to November 2015. He previously served as director and chairman of the board for The Advanced Medical Technology Association (AdvaMed).

Key Attributes, Experience and Skills Substantial knowledge of the medical device industry and extensive experience leading, operating and transforming global corporations as a result of his roles as Chairman and Chief Executive Officer at Baxter and Covidien and in other senior management roles at other medical device companies.

|

Thomas F. Chen

Independent Director Age 69 Director since 2012

Committees: Corporate Governance and Quality, Compliance and Technology

Biography Mr. Chen served as Senior Vice President and President of International Nutrition of Abbott Laboratories (Abbott), a global health care company, before retiring in 2010. During his22-year career at Abbott, Mr. Chen served in a number of roles with expanding responsibilities, primarily in Pacific/Asia/Africa where he oversaw expansion into emerging markets. Prior to Abbott, he held several management positions at American Cyanamid Company, which later merged with PfizerInc. Mr. Chen currently serves as a director of Stericycle, Inc. and an advisor to Cooperation Fund, a partnership between Goldman Sachs and the sovereign fund, China Investment Cooperation, to bolster U.S. manufacturers’ market presence in China. Mr. Chen previously served as a director of Cyanotech Corporation.

Key Attributes, Experience and Skills Extensive international business experience in pharmaceuticals, hospital products and nutritionals through his22-year career at Abbott, with a distinct global perspective resulting from his focus on emerging markets, particularly in China, India and other Asia Pacific regions. |

investor.baxter.com

Table of Contents

12 | Corporate Governance at Baxter International Inc. | |

John D. Forsyth

Independent Director Age 71 Director since 2003

Committees: Compensation and Corporate Governance

Biography Mr. Forsyth has been Chairman of Wellmark Blue Cross Blue Shield, a healthcare insurance provider for residents of Iowa and South Dakota, since 2000 and Chief Executive Officer since 1996. Prior to that, he spent 26 years at the University of Michigan, holding various positions, including President and Chief Executive Officer of the University of Michigan Health System. Mr. Forsyth currently serves as a director of the National Institute of Healthcare Management and previously served as a director of Baxalta, until its merger with Shire plc (Shire).

Key Attributes, Experience and Skills Extensive experience in the healthcare industry and with healthcare payors. An understanding of the challenges associated with leading and operating within large, complex organizations as current Chairman and Chief Executive Officer of Wellmark Blue Cross Blue Shield and given his 26 years of management experience in the University of Michigan Health System.

|

James R. Gavin III, M.D., Ph.D.

Independent Director Age 73 Director since 2003

Committees: Corporate Governance and Quality, Compliance and Technology

Biography Dr. Gavin is Chief Medical Officer of Healing Our Village, Inc., a healthcare corporation that specializes in targeted advocacy, training, education, disease management and outreach for healthcare professionals and minority communities, having previously served as Executive Vice President for Clinical Affairs at Healing Our Village from 2005 to 2007. Dr. Gavin is also Clinical Professor of Medicine and Senior Advisor of Health Affairs at Emory University, a position he has held since 2005, and Clinical Professor of Medicine at Indiana University School of Medicine in Indianapolis, a position he has held since 2008. From 2002 to 2005, Dr. Gavin was President of the Morehouse School of Medicine and from 1991 to 2002 he served as Senior Science Officer at Howard Hughes Medical Institute, anon-profit medical research organization. He previously served as a director of Amylin Pharmaceuticals, Inc. and Baxalta, until its merger with Shire.

Key Attributes, Experience and Skills Extensive experience with, and medical and scientific expertise and knowledge of, the healthcare industry and its providers as a result of the positions he has held at Emory and Indiana Universities, the Morehouse School of Medicine and Howard Hughes Medical Institute as well as significant leadership experience as Chief Executive Officer and Chief Medical Officer of Healing Our Village, Inc. |

| 2019 Annual Meeting of Stockholders and Proxy Statement

| 2019 Annual Meeting of Stockholders and Proxy Statement

Table of Contents

| Corporate Governance at Baxter International Inc. |

13 | |

Peter S. Hellman

Independent Director Age 69 Director since 2005

Committees: Audit and Compensation

Biography From 2000 until his retirement in 2008, Mr. Hellman held various positions at Nordson Corporation, a manufacturer of systems that apply adhesives, sealants and coatings during manufacturing operations, the most recent of which was President and Chief Financial and Administrative Officer. From 1989 to 1999, Mr. Hellman held various positions with TRW Inc., the most recent of which was President and Chief Operating Officer. Mr. Hellman currently serves as a director of The Goodyear Tire & Rubber Company and Owens-Illinois, Inc. Mr. Hellman previously served as a director of Qwest Communications International Inc.

Key Attributes, Experience and Skills Significant experience leading global industrial companies and a multi-billion dollar information technology business and overseeing global supply operations, manufacturing and distribution practices. Extensive financial, capital markets and operational expertise and experience leading complex corporations with a considerable global presence as a result of the various senior positions held at Nordson Corporation and TRW Inc. as well as extensive experience serving on public company boards, including as the audit committee chair of The Goodyear Tire & Rubber Company and Owens-Illinois, Inc. |

Michael F. Mahoney

Independent Director Age 54 Director since 2015

Committees: Compensation and Quality, Compliance and Technology

Biography Mr. Mahoney is Chairman, President and Chief Executive Officer of Boston Scientific Corporation (Boston Scientific), a global developer, manufacturer and marketer of medical devices. He has served in that role since 2016. Between 2012 and 2016, he served as President and Chief Executive Officer of Boston Scientific. He first joined Boston Scientific in 2011, with a24-year track record of building medical device, capital equipment and healthcare IT businesses. Prior to joining Boston Scientific, Mr. Mahoney served as Worldwide Chairman of Johnson & Johnson Medical Devices and Diagnostics Division and as Worldwide Group Chairman of Johnson & Johnson’s DePuy Orthopedics and NeuroScience Business. He serves as a director of AdvaMed.

Key Attributes, Experience and Skills Significant knowledge of the global medical products business and extensive experience leading and operating within global, multi-faceted medical products companies as a result of his roles at Boston Scientific and Johnson & Johnson. These experiences includes significant merger and acquisition activity. |

investor.baxter.com

Table of Contents

14 | Corporate Governance at Baxter International Inc. | |

Patricia B. Morrison

Independent Director Age 59 Director since 2019

Committees: Audit

Biography From 2009 to 2018, Ms. Morrison served as Executive Vice President, Customer Support Services and Chief Information Officer (CIO), of Cardinal Health Inc. (Cardinal), a global, integrated healthcare services and products company. At Cardinal, she led global information technology (IT) operations, which included the transformation of multiple business segments, acquisition integration and digital strategy. Prior to Cardinal, Ms. Morrison served as CIO of both Motorola, Inc. and Office Depot, Inc. and held senior-level IT positions at General Electric Company, PepsiCo, Inc., The Procter & Gamble Company, and The Quaker Oats Company. She currently serves as a director of Aramark Corporation and Splunk Inc.

Key Attributes, Experience and Skills Extensive experience of across diverse global industries overseeing strategic, operational and financial aspects of information technology including cybersecurity, global IT master planning and digital transformation. Most recently, this experience included work in the medical products industry while at Cardinal.

|

Stephen N. Oesterle, M.D.

Independent Director Age 68 Director since 2017

Committees: Corporate Governance and Quality, Compliance and Technology

Biography Dr. Oesterle is a consultant and provides advisory services to private equity and operating companies in the healthcare industry. From 2002 to 2015, he served as a member of the Executive Committee of Medtronic (Medtronic), a global medical technology, services and solutions company, and as Senior Vice President, Medicine and Technology of Medtronic. Previously, he served as an Associate Professor of Medicine and Director of Invasive Cardiology Services at each of Massachusetts General Hospital (1998 to 2002), Stanford University Medical Center (1992 to 1998) and Georgetown University Medical Center (1991 to 1992). He served as a director of HeartWare International, Inc. (HeartWare) from January 2016 to November 2016, prior to Medtronic’s acquisition of HeartWare. He served as a director of REVA Medical, Inc. (REVA) from February 2018 through March 2019.

Key Attributes, Experience and Skills Extensive experience in the medical products and healthcare industries with a strong scientific and medical background. Substantial knowledge of the medical device industry and extensive medical and leadership experience as a result of his role as Senior Vice President, Medicine and Technology at Medtronic and as a director at HeartWare and REVA as well as positions held at Harvard Medical School, Stanford University Medical Center and other leading hospitals.

|

| 2019 Annual Meeting of Stockholders and Proxy Statement

| 2019 Annual Meeting of Stockholders and Proxy Statement

Table of Contents

| Corporate Governance at Baxter International Inc. |

15 | |

Cathy R. Smith

Independent Director Age 55 Director since 2017

Committee: Audit

Biography Ms. Smith is Executive Vice President and Chief Financial Officer at Target Corporation (Target), a retailer. As previously disclosed by Target, Ms. Smith has announced her intention to retire from Target effective May 1, 2020. She will continue serving as Target’s Chief Financial Officer until her successor has been appointed, after which time she has agreed to provide strategic advisory services through her retirement date. Prior to joining Target in 2015, Ms. Smith served as Executive Vice President and Chief Financial Officer at Express Scripts Holding Company, (Express Scripts), an independent pharmacy benefits management company, from 2014 to 2015 and as Executive Vice President, Strategy and Chief Financial Officer at Walmart International (Walmart), a division of Walmart Stores Inc., a discount retailer, from 2010 to 2014.

Key Attributes, Experience and Skills Significant financial expertise and corporate leadership experience as a result of her senior positions held at Target, Express Scripts and Walmart. This experience includes work helping to oversee cybersecurity incident response.

|

Thomas T. Stallkamp

Lead Independent Director Age 72 Director since 2000

Lead Director since 2014 Committees: Audit and Compensation

Biography Mr. Stallkamp is the current lead independent director and has been elected annually as such by the other independent directors since May 2014. Mr. Stallkamp is the founder and principal of Collaborative Management LLC, a private supply chain consulting firm. From 2004 to 2010, Mr. Stallkamp was an Industrial Partner in Ripplewood Holdings L.L.C., a New York private equity group. From 2003 to 2004, Mr. Stallkamp served as Chairman of MSX International, Inc. (MSX), a global provider of technology-driven engineering, business and specialized staffing services, and from 2000 to 2003, he served as Vice-Chairman and Chief Executive Officer of MSX. From 1980 to 1999, Mr. Stallkamp held various positions with DaimlerChrysler Corporation and its predecessor Chrysler Corporation, the most recent of which was Vice Chairman and President. Mr. Stallkamp serves as a director of BorgWarner Inc.

Key Attributes, Experience and Skills Extensive experience leading complex, global organizations, including global manufacturers, through his senior management roles at DaimlerChrysler Corporation and its predecessor Chrysler Corporation and MSX. Significant financial and business development expertise with Ripplewood Holdings L.L.C. and supply chain expertise as founder and principal of Collaborative Management LLC. |

investor.baxter.com

Table of Contents

16 | Corporate Governance at Baxter International Inc. | |

Albert P.L. Stroucken

Independent Director Age 71 Director since 2004

Committees: Audit and Corporate Governance

Biography Mr. Stroucken served as Executive Chairman of the Board of Owens-Illinois, Inc. (Owens-Illinois), a glass packaging company, from January 1 to June 30, 2016, having served as Chairman, President and Chief Executive Officer from 2006 until 2015. From 1998 to 2006, Mr. Stroucken served as President and Chief Executive Officer of H.B. Fuller Company, a manufacturer of adhesives, sealants, coatings, paints and other specialty chemicals. Mr. Stroucken served as Chairman of H.B. Fuller Company from 1999 to 2006. From 1997 to 1998, he was General Manager of the Inorganics Division of Bayer AG. From 1992 to 1997, Mr. Stroucken was Executive Vice President and President of the Industrial Chemicals Division of Bayer Corporation. Mr. Stroucken previously served as a director of Baxalta and as a director of Shire until its recent acquisition by Takeda Pharmaceutical Company Ltd.

Key Attributes, Experience and Skills Substantial experience leading and operating large, complex corporations and significant financial expertise through his leadership roles with Owens-Illinois, Inc. and H.B. Fuller Company as well as through positions at Bayer Corporation.

|

Amy A. Wendell

Independent Director Age 58 Director since 2019

Committees: Quality, Compliance and Technology

Biography Ms. Wendell is Senior Advisor at Perella Weinberg Partners L.P., consulting on strategy, corporate finance and investing practices in the healthcare industry, which she joined in 2016. She previously served as Senior Vice President of strategy and business development at Covidien from 2006 to 2015, where she led the company’s strategy and portfolio management initiatives and managed business development activities. From 1986 to 2015, Ms. Wendell held prior roles of increasing responsibility at Covidien (including its predecessors, Tyco International plc and Kendall Healthcare Products Company), from engineering to product management and business development. She serves as a director of Hologic, Inc. and Axogen, Inc.

Key Attributes, Experience and Skills Extensive expertise in the healthcare section in the areas of global business development and licensing, portfolio management, mergers and acquisitions, resource allocation, and identifying new market opportunities, as a result of her roles at Covidien and its predecessors. She has significant restructuring and integration experience as well. |

| 2019 Annual Meeting of Stockholders and Proxy Statement

| 2019 Annual Meeting of Stockholders and Proxy Statement

Table of Contents

| Corporate Governance at Baxter International Inc. |

17 | |

As of March 26, 2019, the Board consists of 14 members. As previously announced, Mr. Munib Islam will be resigning from the Board effective May 6, 2019. Ms. Carole Shapazian will be retiring from the Board effective on the same date. In connection with these departures, the size of the Board will be reduced from 14 to 12 members.

The Board has determined that each of the following current directors satisfies Baxter’s independence standards and the listing standards of the New York Stock Exchange (NYSE) for independence: Thomas F. Chen, John D. Forsyth, James R. Gavin III, M.D., Ph.D., Peter S. Hellman, Munib Islam, Michael F. Mahoney, Patricia B. Morrison, Stephen N. Oesterle, M.D., Carole J. Shapazian, Cathy R. Smith, Thomas T. Stallkamp, Albert P.L. Stroucken and Amy A. Wendell. Please refer to “—Director Independence” below for a discussion of Baxter’s independence standards.

Mmes. Morrison and Wendell joined the Board in February 2019. In 2018, the Board held eight meetings. Each director attended at least 75% of the total number of Board meetings and meetings of the committees on which he or she served in 2018. Baxter’s Corporate Governance Guidelines set forth the company’s expectation that directors attend each annual meeting of stockholders. In 2018, all of the directors then in office participated in the 2018 annual meeting in person or by teleconference.

The Board has a mix of relatively new and longer-tenured directors. This mix provides the Board with the benefit of new perspectives from shorter-tenured directors. It also helps to maintain the continuity of the Board and the Board’s familiarity with, and knowledge of, the Baxter organization. In connection with the recent appointments of Mmes. Morrison and Wendell to the Board and the upcoming departures of Mr. Islam and Ms. Shapazian from the Board, the average Board tenure will decrease from 8.3 years (immediately prior to these appointments) to 7.8 years.

Director Independence

Baxter’s Corporate Governance Guidelines require that the Board be composed of a majority of directors who meet the criteria for “independence” established by the rules of the NYSE. To be considered independent, the Board must affirmatively determine that a director does not have any direct or indirect material relationship with Baxter (either directly or as a partner, stockholder or officer of an organization that has a relationship with Baxter), and solely with regard to Compensation Committee members, consider all relevant factors that could impair his or her ability to make independent judgments about executive compensation.

In making its independence determinations, the Board considers transactions, relationships and arrangements between Baxter and entities with which directors are associated as partner, stockholder or officer. When these transactions, relationships and arrangements have existed, they have generally been in the ordinary course of business and of a type customary for a global diversified company such as Baxter.

investor.baxter.com

Table of Contents

18 | Corporate Governance at Baxter International Inc. | |

Director Qualifications

As discussed below in “—Nomination of Directors,” directors are selected on the basis of the specific criteria set forth in Baxter’s Corporate Governance Guidelines. The experience, expertise and knowledge represented by the Board as a collective body allow the Board to lead Baxter in a manner that serves its stockholders’ interests appropriately. Key attributes, experience and skills for each of the company’s director nominees are included above under “—Nominees for Election as Directors”. Set forth below is a summary of the collective qualifications, experiences and backgrounds of the director nominees in the aggregate. Each chevron represents a director nominee who possesses the specific attribute or experience.

Nomination of Directors

It is the policy of the Corporate Governance Committee to consider candidates for director recommended by stockholders, members of the Board and management.

Each year, the Corporate Governance Committee oversees a robust review of the structure and composition of the Board and each committee. This review or self-evaluation is conducted to help assess how the Board and each committee functions in light of the company’s strategic objectives, the company’s Corporate Governance Guidelines and each committee charter. It also helps to identify any potential gaps or areas that the Board would like to augment by appointing new directors, rotating existing directors off the Board or refreshing committee assignments.

For 2018, the Board engaged a third party to help oversee this self-evaluation process. This third party, an outside law firm with significant experience advising the boards of directors of other S&P 500 companies, conducted aone-on-one interview with each

| 2019 Annual Meeting of Stockholders and Proxy Statement

| 2019 Annual Meeting of Stockholders and Proxy Statement

Table of Contents

| Corporate Governance at Baxter International Inc. |

19 | |

director. A representative from the law firm summarized those findings during presentations to the full Board and each committee in November 2018. The Board took this feedback into account when conducting its annual self-assessment process. The Board anticipates engaging a third party every few years or as circumstances otherwise warrant to help conduct theseself-assessments.

In connection with the annual self-assessment process (as described above), the Board retained a third-party search firm to help conduct a search for two new directors. The search firm was charged with seeking out candidates with significant information technology and cybersecurity experience in light of the company’s increased focus on digital health. They were also asked to pursue candidates with significant merger and acquisition activity (including integration) experience. Additionally, the Board charged the search firm to seek out a diverse slate, with a particular focus on recruiting female candidates.

With input from members of the Corporate Governance Committee, the search firm identified Mses. Morrison and Wendell. These efforts ultimately resulted in the Corporate Governance Committee recommending that the Board appoint both Mses. Morrison and Wendell. They joined the Board in February 2019.

The Corporate Governance Committee evaluates all candidates for director in the same manner regardless of the source of the recommendation. Stockholder recommendations for candidates for director should include the same information required by Baxter’s Bylaws for stockholder director nominees and be sent to the Corporate Governance Committee, c/o Corporate Secretary, Baxter International Inc., One Baxter Parkway, Deerfield, Illinois 60015.

Baxter’s Corporate Governance Guidelines provide that (as described below), director nominees selected by the Corporate Governance Committee must:

| • | possess fundamental qualities of intelligence, honesty, perceptiveness, good judgment, maturity, high ethics and standards, integrity, fairness and responsibility; |

| • | have a genuine interest in the company and recognition that as a member of the Board, each director is accountable to all stockholders of the company, not to any particular interest group; |

| • | have a background that demonstrates an understanding of business and financial affairs and the complexities of a large, multifaceted, global business, governmental or educational organization; |

| • | be or have been in a senior position in a complex organization such as a corporation, university or major unit of government or a largenot-for-profit institution; |

| • | have no conflict of interest or legal impediment that would interfere with the duty of loyalty owed to the company and its stockholders; |

| • | have the ability and be willing to spend the time required to function effectively as a director; |

| • | be compatible and able to work well with other directors and executives in a team effort with a view to a long-term relationship with the company as a director; and |

| • | have independent opinions and be willing to state them in a constructive manner. |

In 2018, the Board adopted certain amendments to its Corporate Governance Guidelines, which included the adoption of a mandatory retirement age of 75, subject to certain exceptions (such as, during a CEO succession or during a material merger, acquisition or disposition).

A nominee’s ability to meet the independence criteria established by the NYSE is a factor in the nominee selection process. The Corporate Governance Guidelines provide that directors are selected on the basis of talent and experience. Diversity of background, including diversity of gender, race, ethnic or geographic origin, age and experience (including in business, government and education as well as healthcare, science and technology), is a relevant factor in the selection process. This factor is relevant as a diverse Board is likely to be a well-balanced Board with varying perspectives and a breadth of experience that will positively contribute to robust discussion at Board meetings. A diverse board is also more reflective of Baxter’s global customer base. The Board’s focus on diversity matters helped to inform the recently completed director search and the appointments of both Mses. Morrison and Wendell to the Board.

As discussed above, the Board conducts an annual self-evaluation to help identify potential gaps or areas that the Board may look to augment in light of the company’s strategies. Ms. Morrison’s diverse corporate leadership experience across multiple industries, coupled with her extensive experience in cybersecurity, global IT planning and digital transformations and her focus in digital health, helps support Baxter’s pursuit of top quartile performance in its growth through innovation goal. Her contributions to the Board are expected to help the company maintain its position within the top quartile of industry leading performance. Ms. Wendell’s

investor.baxter.com

Table of Contents

20 | Corporate Governance at Baxter International Inc. | |

comprehensive experience in business development strategy, corporate finance and portfolio management initiatives (including integration and restructuring activities) in the healthcare industry helps support the company’s goal to deliver sustainabletop-quartile performance for its stockholders and grow through innovation (both organic and inorganic). Mses. Morrison and Wendell also further enhance the diversity of the Board’s membership. The Board’s thoughtful approach to Board composition has resulted in a balance of skillsets and backgrounds that align with the company’s strategic initiatives and are core to the Baxter business, enabling the Board to more effectively oversee the company’s ongoing transformation efforts.

If a vacancy occurs or is expected to occur on the Board (and the Board desires to fill the position), the Board initiates a process to identify potential candidates, if that process has not already been launched. Once a candidate has been identified, the Corporate Governance Committee (on behalf of the Board) and the independent search firm will engage in a process that includes a thorough investigation of the candidate, an examination of his or her business background and education, research on the individual’s accomplishments and qualifications,in-person interviews and reference checking. If this process generates a positive indication, the lead director, members of the Corporate Governance Committee and the Chairman of the Board will meet separately with the candidate and then confer with each other regarding the candidate. After consideration of these background screens and interviews (possibly with multiple candidates), the Corporate Governance Committee may then recommend an individual to the full Board for further evaluation and ultimately election. If the full Board agrees, the Chairman of the Board is then authorized to extend an offer to the individual candidate to join the Board at that time or nominate the candidate for election at the next annual meeting of stockholders.

In addition to making recommendations to the Board, eligible stockholders are able to nominate a candidate for election to the Board through the proxy access provisions of Baxter’s Bylaws. Subject to compliance with the related requirements (including with respect to the nominating stockholders and the nominee), the nominee will be included in the proxy statement as a stockholder nominee. The proxy access provision provides that a group of up to 20 stockholders that have held at least 3% of Baxter’s outstanding shares for at least three years can nominate up to two individuals or 20% of the Board, whichever is greater, for election at an annual stockholders’ meeting. No stockholders submitted any proxy access nominees for consideration at the Annual Meeting.

Communicating with the Board of Directors

Stockholders and other interested parties may contact any of Baxter’s directors, including the lead director or thenon-management directors as a group, by writing a letter to Baxter Board of Directors c/o Corporate Secretary, Baxter International Inc., One Baxter Parkway, Deerfield, Illinois 60015, or by sending ane-mail to boardofdirectors@baxter.com. Baxter’s Corporate Secretary will forward communications directly to the lead director, unless a different director is specified.

See “Executive Compensation—Compensation Discussion and Analysis—Summary—Stockholder Engagement” for a discussion of the company’s stockholder outreach efforts.

Other Corporate Governance Information

Corporate Governance Guidelines

Baxter’s Board of Directors has long adhered to corporate governance principles designed to ensure effective corporate governance. Since 1995, the Board of Directors has had in place a set of corporate governance guidelines reflecting these principles. Baxter’s current Corporate Governance Guidelines, most recently revised in February 2018, cover topics including director qualification standards, mandatory retirement age, director responsibilities (including those of the lead director), director access to management and independent advisors, director compensation, director orientation and continuing education, succession planning and the annual evaluations of the Board and its committees. Baxter’s Corporate Governance Guidelines are available on Baxter’s website at www.baxter.com under “Our Story—Our Governance—Corporate Governance Matters—Corporate Governance Guidelines.”

Code of Conduct

Baxter has adopted a Code of Conduct that applies to all members of the Board and all employees of the company, including the Chief Executive Officer, Chief Financial Officer, Controller and other senior financial officers. Any amendment to, or waiver from, a provision of the Code of Conduct that applies to Baxter’s Chief Executive Officer, Chief Financial Officer, Controller or persons performing similar functions will be disclosed on Baxter’s website, at www.baxter.com under “Our Story—Our Governance—Corporate Governance Matters.” The Code of Conduct is available on Baxter’s website at www.baxter.com under “Our Story—Our Governance—Corporate Governance Matters—Code of Conduct.”

| 2019 Annual Meeting of Stockholders and Proxy Statement

| 2019 Annual Meeting of Stockholders and Proxy Statement

Table of Contents

| Corporate Governance at Baxter International Inc. |

21 | |

Board’s Oversight of Risk

Baxter’s risk management activities include the identification and assessment of the key risks facing the company among the universe of business risks (strategic, operational, financial, regulatory/compliance, cybersecurity, etc). These risks are identified across the organization and come from multiple businesses, regions and functions. The Board and, as appropriate, its committees review these risks on at least an annual basis after they have been identified and assessed by management (including by the company’s Risk Committee, as discussed below) and regularly review the initiatives put in place to mitigate the effects of these risks.

These reviews include updates throughout the year from the businesses, regions and functions from which the key risks arise. Over the course of the year, each of the key risks and related mitigation strategies is reviewed with the Board or one or more committees of the Board, as applicable. For example, the Audit Committee reviews the financial risk assessment process and findings of the internal auditors while the Quality, Compliance and Technology Committee and the Audit Committee jointly receive an update from the ethics and compliance function at least annually. After giving effect to the recent amendments to the Audit and Quality, Compliance and Technology Committee charters, the Audit Committee has assumed oversight responsibility for the company’s information technology (IT) functions, includingnon-product related cybersecurity matters. The Quality, Compliance and Technology Committee is now responsible for overseeing product or service based IT matters, including cybersecurity. The Audit Committee has, however, maintained responsibility for the oversight of any cybersecurity incident, including ones related to Baxter products and services. Both committees will receive updates from company management on these topics throughout the year. Additionally, the full Board will receive at least one update on IT and cybersecurity matters each year. Other risks are also reviewed by the Board as well as a Board committee. For example, quality updates are provided to the full Board throughout the year during the review of business and technology strategies of related global business units, capital expenditures or business development activities. The Quality, Compliance and Technology Committee receives a quality update as part of each regularly scheduled meeting. Through its risk oversight activities, the company identifies opportunities to further embed systematic enterprise risk management into its business processes. The Board actively encourages management to continue to identify enterprise risk and develop appropriate mitigation strategies.

In addition to the Board’s role in enterprise risk management, various committees of the Board are also expressly tasked by their charters to be responsible for the oversight of certain risks. More specifically and in addition to the IT and cybersecurity matters described above, the Audit Committee is charged with oversight of the process by which management assesses and manages risk as well as the company’s major financial risk exposures and the steps taken to monitor and control these exposures, while the Quality, Compliance and Technology Committee is charged with oversight of Baxter’s quality, compliance and innovation strategy programs (including with respect to product cybersecurity and IT matters) as well as review of strategic issues and corporate actions relating to current and emerging political issues, corporate citizenship and public policy.

In 2017, Baxter formed the Risk Committee which is comprised of functional and business leaders. The committee meets approximately three times per year and engages in meaningful discussions about the company’s enterprise risk management program. The Risk Committee helps to drive accountability across the organization, define the company’s risk tolerances and evaluate the sufficiency of the company’s mitigation plans. Throughout the year, the Board receives updates about the Risk Committee’s activities and assessments from the head of Corporate Audit.

Certain Relationships and Related Person Transactions

The Board recognizes that related person transactions present a heightened risk of conflicts of interest. Accordingly, pursuant to Baxter’s Corporate Governance Guidelines, the Corporate Governance Committee has been charged with reviewing related person transactions regardless of whether the transactions are reportable pursuant to applicable rules of the SEC. For purposes of this policy, a “related person transaction” is any transaction in which the company was, is or is to be a participant and in which any related person has a direct or indirect material interest other than transactions that involve less than $50,000 when aggregated with all similar transactions. For any related person transaction to be consummated or to continue, the Corporate Governance Committee must approve or ratify the transaction. The Corporate Governance Committee will approve or ratify a transaction if it determines that such transaction is in Baxter’s best interest. Related person transactions are reviewed as they arise and are reported to the Corporate Governance Committee. The Corporate Governance Committee also reviews materials prepared by the Corporate Secretary (including information identified in questionnaires distributed annually to the company’s directors, executive officers and controller and in the company’s annual search of certain of its IT systems) to determine whether any related person transactions have occurred that have not been reported.

investor.baxter.com

Table of Contents

22 | Corporate Governance at Baxter International Inc. | |

Board Leadership Structure; Lead Director

Mr. Almeida has served as Chairman of the Board and Chief Executive Officer since January 1, 2016. Thomas T. Stallkamp currently serves as the lead director and has been elected annually to such position since May 2014. That annual election is made solely by the independent directors, instead of by the full Board.

The Board regularly reviews the leadership structure of the company, including whether the position of Chairman should be held by an independent director. In connection with Mr. Almeida’s appointment, the Board determined that it was in Baxter stockholders’ best interests to keep the Chairman and Chief Executive Officer roles combined. The Board reached this decision in light of Mr. Almeida’s significant industry and leadership experience, including as Chairman and Chief Executive Officer of Covidien. The Board also believed that Mr. Almeida would effectively connect the Board and Baxter management as he worked with management to establish Baxter’s new strategic framework and refresh its long range plan. As Chairman of the Board, he has developed a process through which each component of this strategic framework is reviewed with the Board on a regular basis.

As Chairman of the Board and pursuant to Baxter’s Bylaws, Mr. Almeida presides at all Board and stockholder meetings, serves as the primary spokesperson for Baxter and acts as a liaison between the Board and the stockholders. As Chief Executive Officer and pursuant to Baxter’s Bylaws, Mr. Almeida supervises the business of the company, subject to the direction of the Board.

As lead director and pursuant to Baxter’s Corporate Governance Guidelines, Mr. Stallkamp (or in his absence, another independent director) has the following responsibilities and authority:

| • | presiding at all executive sessions of the Board; |

| • | acting as the principal liaison between the independent directors and the Chairman; |

| • | approving meeting agendas for the Board; |

| • | approving meeting schedules to assure that there is sufficient time for discussion of all agenda items; |

| • | working with the Chairman to facilitate timely and appropriate information flow to the Board; and |

| • | ability to call meetings of the independent directors. |

In 2018, executive sessions of the Board occurred as part of every regularly scheduled meeting of the Board and covered critical issues facing the company, including matters related to the company’s product portfolio and inventory levels, capital allocation strategies and potential and ongoing business development opportunities. The lead director, together with the chairpersons of the Compensation and Corporate Governance Committees, lead thenon-employee directors in the annual review and approval of compensation for the Chief Executive Officer. Mr. Stallkamp serves as the contact person for interested parties to communicate directly with the independent members of the Board and has engaged with Baxter stockholders on selected topics, including corporate governance matters.

Each May, the Corporate Governance Committee recommends a lead director for approval. Mr. Stallkamp has served in this role since May 2014 and was most recently elected in May 2018.

As discussed above, the Board has determined that the combined Chief Executive Officer—Chairman structure currently serves the best interests of the company and its stockholders at this time in light of Mr. Almeida’s significant industry and leadership experience and the strong role played by the lead director in accordance with Baxter’s Corporate Governance Guidelines. The Board made this determination in advance of extending an offer to Mr. Almeida to serve as Baxter’s Chairman and Chief Executive Officer.

Executive Sessions

As discussed above, independent directors of the Board met in executive session without management at every regularly scheduled meeting during 2018 in accordance with Baxter’s Corporate Governance Guidelines. Mr. Stallkamp, as lead director, led these executive sessions. Additionally, the Audit Committee is required by its charter to regularly hold separate sessions during committee meetings with each of the internal auditor, the independent registered public accounting firm and management. The Compensation, Corporate Governance and Quality, Compliance and Technology Committees generally meet in executive session at each meeting.

| 2019 Annual Meeting of Stockholders and Proxy Statement

| 2019 Annual Meeting of Stockholders and Proxy Statement

Table of Contents

| Corporate Governance at Baxter International Inc. |

23 | |

The standing committees of the Board of Directors consist of the Audit Committee, the Compensation Committee, the Corporate Governance Committee and the Quality, Compliance and Technology Committee.

Each committee consists solely of independent directors and is governed by a written charter. All standing committee charters are available on Baxter’s website at www.baxter.com under “Our Story—Our Governance—Board Committees & Charters.”

Audit Committee