UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant | ☐ | Filed by a Party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Under Rule 14a-12 | |

Baxter International Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

| PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): | |||

| ☑ | No fee required. | ||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | ||

| 1) Title of each class of securities to which transaction applies: | |||

| 2) Aggregate number of securities to which transaction applies: | |||

| 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| 4) Proposed maximum aggregate value of transaction: | |||

| 5) Total fee paid: | |||

| ☐ | Fee paid previously with preliminary materials: | ||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | ||

| 1) Amount previously paid: | |||

| 2) Form, Schedule or Registration Statement No.: | |||

| 3) Filing Party: | |||

| 4) Date Filed: | |||

| Notice of 2016 | ||

| Annual Meeting | ||

| of Stockholders | ||

| and Proxy Statement | ||

| May 3, 2016 Baxter International Inc. Headquarters One Baxter Parkway Deerfield, Illinois 60015 | ||

| | ||

|  |

| Baxter International Inc. | |

| One Baxter Parkway | |

| Deerfield, Illinois 60015 | March24, 2016 |

Dear Stockholder:

You are invited to attend Baxter’s Annual Meeting of Stockholders on Tuesday, May 3, 2016 at 9:00 a.m., Central Daylight Time, at our corporate headquarters located at One Baxter Parkway, Deerfield, Illinois. Registration will begin at 8:00 a.m.

Details of the business to be conducted at the Annual Meeting are included in the attached Notice of Annual Meeting of Stockholders and Proxy Statement. If you plan to attend the Annual Meeting, please review the information on attendance provided on page 72 of the Proxy Statement.

In accordance with Securities and Exchange Commission rules, Baxter has elected to deliver its proxy materials over the Internet to most stockholders, which allows stockholders to receive information on a more timely basis, while lowering the company’s printing and mailing costs and reducing the environmental impact of the Annual Meeting.

Your vote is very important. Whether or not you plan to attend in person, I urge you to vote your shares as promptly as possible. You may vote your shares by Internet or by telephone. If you received a paper copy of the proxy card by mail, you may sign, date and return the proxy card in the enclosed envelope. If you attend the Annual Meeting, you may revoke your proxy and vote in person.

Very truly yours,

José E. Almeida

Chairman of the Board

and Chief Executive Officer

| 2 |

| Table of Contents |

| | 2016 Annual Meeting of Stockholders and Proxy Statement |

| 3 |

| Notice of Annual Meeting of Stockholders |

The 2016 Annual Meeting of Stockholders of Baxter International Inc. (the Annual Meeting) will be held at our corporate headquarters located at One Baxter Parkway, Deerfield, Illinois60015, on Tuesday, May 3, 2016 at 9:00 a.m., Central Daylight Time, for the following purposes:

| ❶ | To elect the four directors named in the attached Proxy Statement. Subject to approval of “Proposal 4—Proposed Charter Amendment to Declassify Board” and the subsequent validation of the related amendment to Baxter’s Certificate of Incorporation by the Delaware Court of Chancery (as described in such proposal), the specified directorswill be elected to hold office for a term of one year. Otherwise elected directorswill hold office for a term of three years. | |

| ❷ | To approve named executive officer compensation for 2015. | |

| ❸ | To ratify the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm for Baxter in 2016. | |

| ❹ | To approve amendments to Baxter’s Certificate of Incorporation to eliminate the classified board structure and provide for the annual election of directors. | |

| ❺ | To vote on a stockholder proposal as described in the Proxy Statement, if such proposal is properly presented at the Annual Meeting. | |

| ❻ | To transact any other business that may properly come before the meeting. | |

The Board of Directors recommends that stockholders vote FOR Items 1, 2, 3, and 4. The Board of Directors recommends that stockholders vote AGAINST the stockholder proposal referred to in Item 5.Stockholders of record at the close of business on March 9, 2016 will be entitled to vote at the meeting.

By order of the Board of Directors,

David P. Scharf

Corporate Secretary

How Do I Vote?

| By Internet, following the instructions on the Notice of Internet Availability of Proxy Materials or the proxy card; | |

| By telephone, using the telephone number printed on the proxy card; or | |

| By mail (if you received your proxy materials by mail), using the enclosed proxy card and return envelope. |

| Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting Of Stockholders tobe Held On May 3, 2016 |

This Proxy Statement relating to the 2016 Annual Meeting of Stockholders and the Annual Report to Stockholders for the year ended December 31, 2015 are available athttp://materials.proxyvote.com/071813.

Proxy Statement

The accompanying proxy is solicited on behalf of the Board of Directors for use at the Annual Meeting of Stockholders to be held on Tuesday, May 3, 2016. On or about March 24, 2016, Baxter began mailing to stockholdersof record a Notice of Internet Availability of Proxy Materials providing instructions on how to access proxy materials via the Internet and how to vote online (www.proxyvote.com). Stockholders who did not receive the Notice of Internet Availability of Proxy Materials as a result of a previous election will receive a paper or electronic copy of the proxy materials, which Baxter also began sending on or about March 24, 2016.

| investor.baxter.com |

| 4 |

| Proxy Statement Highlights |

To assist you in reviewing the proposals to be acted upon at the Annual Meeting, this section presents concise detail about each non-routine voting item. For more complete information, please review our Annual Report on Form 10-K and the complete Proxy Statement.

PROPOSAL 1 | Electionof Directors What am I voting on? What is the Board’s recommendation? Where can I find more information? | ||||

| See also “Proposal 1—Election of Directors” for additional information. | ||||

| Name | Director | Baxter Committees | |||||||||||||||

| Primary Occupation | Age | Since | Key Attributes and Skills | A | C | CG | PP | ||||||||||

Thomas F. Chen (I) | 66 | 2012 | ● | Extensive international business experience | ■ | ■ | |||||||||||

| ● | Global perspective | ||||||||||||||||

| John D. Forsyth (I) Chairman and CEO, Wellmark Blue Cross Blue Shield | 68 | 2003 | ● | Extensive experience in the healthcare industry | ■ | ■ | |||||||||||

| ● | Understanding of large, complex organizations | ||||||||||||||||

| Michael F. Mahoney (I) President and CEO, Boston Scientific Corporation | 51 | 2015 | ● | Significant knowledge of the global medical products business | ■ | ■ | |||||||||||

| ● | Extensive experience leading global, multi-faceted corporations | ||||||||||||||||

| Carole J. Shapazian (I) Executive Vice President of Maytag Corporation (retired) | 72 | 2003 | ● | Significant experience with, and insight into, global supply and service operations, manufacturing and distribution practices | ■ | ■ | |||||||||||

| Key | ||||||

| (I)Independent director | ■ Committee Chairperson | AAudit Committee | CGCorporate Governance Committee | |||

| ■ Committee Member | CCompensation Committee | PPPublic Policy Committee |

| | 2016 Annual Meeting of Stockholders and Proxy Statement |

| Proxy Statement Highlights | 5 |

Board Qualifications, Experiences and Backgrounds

The following chart sets forth the varied qualifications, experiences and backgrounds of the Board. See “Corporate Governance at Baxter International Inc.—Board of Directors—Director Qualifications” and “—Director Nominations” for additional information.

| International |  | |

| M&A/Transactional |  | |

| Manufacturing |  | |

| Healthcare Marketing/Delivery |  | |

| Other Sector Leadership |  | |

| Scientific/R&D |  | |

| Diversity |  |

Key growth priority and |

Critical skill to enhance |

Expertise required to effectively |

Industry leaders ready to bring |

Key growth priority and integral |

Diversity of ethnicity or gender |

| Creation of two independent boards in connection with the spin-off of Baxalta Incorporated | Addition of two new independent directors, Munib Islam and Michael F. Mahoney, to the Board | Appointment of a new Chairman of the Board and CEO, José E. Almeida | Approved declassification of the Baxter Board | Adoption of a 3% /3 year / greater of 2 and 20% proxy access Bylaw | ||||

See Page 16 See Page 16 |  See Page 17 See Page 17 |  See Page 20 See Page 20 |  See Page 62 See Page 62 |  See Page17 See Page17 | ||||

| investor.baxter.com |

| 6 | Proxy Statement Highlights |

PROPOSAL 2 | Advisory Vote to Approve Named Executive Officer Compensation What am I voting on? What is the Board’s recommendation? Where can I find more information? | ||||

| See “Proposal 2—Advisory Vote to Approved Named Executive Officer Compensation” for additional information. | ||||

Corporate Developments and Performance Highlights

| Development or Highlight | Further Information | |||

| Completion of the Baxalta spin-off | See page 27 |

| ● | Spin-off permits Baxter management to focus onstand-alone medical products business | ||

| ● | Also enables Baxter to more effectively commercialize product offerings and to help drive innovation across the Hospital Products and Renal franchises | ||

| ● | Provides flexibility to pursue growth and investment strategies in revenue acceleration, improved profitability and enhanced returns | ||

| ● | Based on company estimates, the combined total shareholder return of Baxter and Baxalta totaled approximately 7.5% in 2015, as compared to 1.4% for the S&P 500 Composite Index and 7.0% for the S&P 500 Health Care Index. See “Executive Compensation—Compensation Discussion and Analysis—Summary—2015 Results” for additional information |

| Strong financial results and stockholder return for 2015 | See page 27 |

| ● | As discussed below, Baxter had $10.0 billion of net sales in 2015 | ||

| ● | Adjusted earnings from continuing operations per diluted share of $1.38 increased 8% in 2015. See “Executive Compensation—Compensation Discussion and Analysis—Structure of Compensation Program—Pay-for-Performance—Financial Targets” for a reconciliation of adjusted earningsfrom continuing operations per diluted share to the closest measuredetermined in accordance with U.S. generally accepted accounting principles (GAAP) | ||

| ● | Returned $910M to stockholders in 2015 through cash dividends, in addition to the value of the shares distributed in the Baxalta spin-off |

| 2015 Global Net Sales | Adjusted Earningsfrom Continuing Operations per Diluted Share | |||||||

| $10.0B | Reflects net sales from continuing operations | $1.38 |  8% over 2014 8% over 2014 | |||||

| | 2016 Annual Meeting of Stockholders and Proxy Statement |

| Proxy Statement Highlights | 7 |

| Compensation Design for 2015 and 2016 | See page 31 | ||

●For 2015, long-term compensation consisted of 50% restricted stock units (RSUs) and 50% stock options given the business separation and challenges in establishing appropriate long-term metricsto adequately reflect performance through the spin-off ●Cash bonus plan for 2015 was based on adjusted earnings per share (EPS) and adjusted sales, with separate targets established for each half of the year. Targets for first half of 2015 were based on total Baxter results (including Baxalta) and for second half of 2015, solely on Baxter results (after giving effect to the spin-off) ●For 2015, Mr. Parkinson’s annual base salary, as Chief Executive Officer, totaled $1,535,000 and he received a cash bonus award of $3,637,491 and long-term equity incentive awards with a grant date fair value of $11,466,401 ●In connection with the appointment of Mr. Almeida as CEO and Chairman in October 2015, Mr. Almeida was awarded an annual base salary of $1,300,000 and a target annual cash bonus equal to 135% of his salary beginning in 2016 (or $1,755,000). He also received a long-term equity grantwith a grant date fair value of $7,714,087, consisting of 50% stock options and 50% performance share units (PSUs) as an acceleration of his 2016 annual equity grant ●For 2016, cash bonus awards are based on adjusted EPS, adjusted sales and adjusted free cash flow, consistent with the company’s increased rigor around theprioritization of capital expenditures ●For 2016, equity incentive awards consist of 50% PSUs and 50% stock options for the company’s executive officers. 2016 PSU awardsare based on three-year growth in shareholder return (GSV) and annual operating margin targets, consistent with the company’s increased focus on improving profit margins | |||

| Stockholder Engagement | See page29 | ||

●Baxter sponsorsan active stockholder engagement program, with involvement from members of the Board, including the independent lead director (lead director) and members of the Corporate Governance and Compensation Committees ●In 2015, the company completed a corporate governance outreach to top investors and covered topics including Board composition and refreshment, succession planning (including the appointment of Mr. José Almeida as the company’s Chairman and Chief Executive Officer), Board leadership structure, the company’s new proxy access bylawamendment andBaxter’s executive compensation program |

| investor.baxter.com |

| 8 | Proxy Statement Highlights |

PROPOSAL 4 | Proposed Charter Amendment to Declassify Board What am I voting on? What is the Board’s recommendation? Where can I find more information? | ||||

| | |||||

| See “Proposal 4–Proposed Charter Amendment to Declassify Board” for additional information. | ||||

| Charter Amendment | See page 62 | ||

●The Charter Amendment provides for the gradual declassification of the Board between 2016 and 2018 ●If approved, Baxter will seekvalidation of the CharterAmendment with the Delaware Court of Chancery ●If approved and subsequentlyvalidated, director nominees elected under “Proposal 1—Election of Directors” will be elected for a one-year term; otherwise, they will be elected for a three-year term |

PROPOSAL 5 | Independent Board Chairman What am I voting on? What is the Board’s recommendation? Where can I find more information? | ||||

| See “Proposal 5–Independent Board Chairman” for additional information. | ||||

| Items to consider when evaluating this proposal: | |

●Under the current framework, the Board can respond to or consider strategic concerns and the qualifications of a particular CEO when deciding whether to separate or keep the roles combined ●The Board has a history of separating the roles when it deems it appropriate (in connection with the Baxalta spin-off) ●The decision to keep the roles combined was made in light of Mr. Almeida’s significant leadership and industry experience (including as Chairman and CEO of Covidien plc) and the presence of a strong lead director in Mr. Stallkamp |

| | 2016 Annual Meeting of Stockholders and Proxy Statement |

| 9 |

| Corporate Governance at Baxter International Inc. |

Baxter’s Bylaws require each director to be elected by the majority of the votes cast with respect to such director in uncontested elections; that is, the number of shares voted “for” a director must exceed 50% of the number of votes cast with respect to that director. Abstentions will not be considered votes cast. In a contested election (a situation in which the number of nominees exceeds the number of directors to be elected), the standard for election of directors will be a plurality of the shares represented in person or by proxy at any such meeting and entitled to vote on the election of directors. If a nominee who is serving as a director is not elected at an annual meeting of stockholders, under Delaware law the director would continue to serve on the Board as a “holdover director.” However, under the Bylaws, any incumbent director who fails to be elected must offer his or her resignation to the Board. The Corporate Governance Committee would then make a recommendation to the Board whether to accept or reject the resignation, or whether other action should be taken. In accordance with the Bylaws, the Board would act on the Corporate Governance Committee’s recommendation and publicly disclose its decision and the rationale behind it within 90 days from the date that the election results are certified. The director who offers his or her resignation would not participate in the Board’s decision.

All of the nominees have indicated their willingness to serve if elected, but if any should be unable or unwilling to stand for election, proxies may be voted for a substitute nominee designated by the Board. No nominations for directors were received from stockholders, and no other candidates are eligible for election as directors at the Annual Meeting. Accordingly, there is no director election contest and each director nominee must receive a majority of the votes cast with respect to such director in order to be reelected to the Board. Unless proxy cards are marked otherwise, the individuals named as proxies intend to vote the shares represented by proxy in favor of all of the Board’s nominees.

Set forth below under “—Nominees for Election as Directors (Term Expires 2016)” and “—Directors Continuing in Office” is information concerning the nominees for election as well as the current directors in each class continuing after the Annual Meeting.

| investor.baxter.com |

| 10 | Corporate Governance at Baxter International Inc. |

| Nominees for Election as Directors (Term Expires 2016) | |||||

|  | ||||

Thomas F. Chen Independent Director Biography Key Attributes, Experience and Skills | John D. Forsyth Independent Director Biography Key Attributes, Experience and Skills | ||||

| | 2016 Annual Meeting of Stockholders and Proxy Statement |

| Corporate Governance at Baxter International Inc. | 11 |

|  | ||||

Michael F. Mahoney Independent Director Biography Key Attributes, Experience and Skills | Carole J. Shapazian Independent Director Biography Key Attributes, Experience and Skills | ||||

| investor.baxter.com |

| 12 | Corporate Governance at Baxter International Inc. |

| Continuing Directors (Term Expires 2017) | |||||

|  | ||||

José E. Almeida Chairman of the Board and CEO Biography Key Attributes, Experience and Skills | Munib Islam Independent Director Biography Key Attributes, Experience and Skills | ||||

| | 2016 Annual Meeting of Stockholders and Proxy Statement |

| Corporate Governance at Baxter International Inc. | 13 |

|  | ||||

Thomas T. Stallkamp Independent Lead Director Biography Key Attributes, Experience and Skills | Albert P.L. Stroucken Independent Director Biography Key Attributes, Experience and Skills | ||||

| investor.baxter.com |

| 14 | Corporate Governance at Baxter International Inc. |

Continuing Directors (Term Expires 2018)

|  | ||||

Uma Chowdhry, Ph.D. Independent Director Biography Key Attributes, Experience and Skills | James R. Gavin III, M.D., Ph.D. Independent Director Biography Key Attributes, Experience and Skills | ||||

| | 2016 Annual Meeting of Stockholders and Proxy Statement |

| Corporate Governance at Baxter International Inc. | 15 |

|  | ||||

Peter S. Hellman Independent Director Biography Key Attributes, Experience and Skills | K.J. Storm Independent Director Biography Key Attributes, Experience and Skills | ||||

| investor.baxter.com |

| 16 | Corporate Governance at Baxter International Inc. |

The Board currently consists of12 members. The Board has determined that each of the following11 current directors satisfies Baxter’s independence standards and the listing standards of the New York Stock Exchange (NYSE) for independence: Thomas F. Chen, Uma Chowdhry, Ph.D., John D. Forsyth, James R. Gavin III, M.D., Ph.D., Peter S. Hellman, Munib Islam, Michael F. Mahoney, Carole J. Shapazian, Thomas T. Stallkamp, K. J. Storm and Albert P.L. Stroucken. The Board had previously determined that Dr. Wayne Hockmeyer, Mr. Blake Devitt and Ms. Gail Fosler, former Baxter directors, were also independent in accordance with NYSE listing standards.Please refer to “— Director Independence” below for a discussion of Baxter’s independence standards.

During 2015, the Board oversaw the creation and seeding of two separate, public company boards in anticipation of the Baxalta spin-off. The Board consisted of 13 members prior to the spin-off and ten members immediately thereafter. Dr. Hockmeyer, Mr. Devitt and Ms. Fosler resigned from the Board on June 30, 2015 in connection with their appointment to the Baxalta board of directors. Additionally, Dr. James Gavin and Messrs. John Forsyth and Albert Stroucken began serving as directors on both the Baxter and Baxalta boardsat that time. In 2015, the Board held 12 meetings. Each director attended at least 75% of the total number of board meetings and meetings of the committees on which he or she served. Baxter’s Corporate Governance Guidelines set forth the company’s expectation that directors attend each annual meeting of stockholders. In 2015, ten of the company’s directors then in officeattended the 2015 Annual Meeting held on May 5, 2015, and three directors did not attend due to personal or family medical reasons.

Director Independence

Baxter’s Corporate Governance Guidelines require that the Board be composed of a majority of directors who meet the criteria for “independence” established by the rules of the NYSE. To be considered independent, the Board must affirmatively determine that a director does not have any direct or indirect material relationship with Baxter (either directly or as a partner, stockholder or officer of an organization that has a relationship with Baxter), and solely with regard to Compensation Committee members, consider all relevant factors that could impair the ability of such Compensation Committee members to make independent judgments about executive compensation.

In making its independence determinations, the Board considers transactions, relationships and arrangements between Baxter and entities with which directors are associated as executive officers, employees, directors and trustees. When these transactions, relationships and arrangements exist, they are in the ordinary course of business and are of a type customary for a global diversified company such as Baxter. More specifically, with respect to each of the three most recent fiscal years, the Board evaluated for Dr. Gavin the annual amount of payments to Emory University and determined that the amount of payments in each fiscal year was below two percent of the consolidated gross revenues of Emory University during for that year.

| | 2016 Annual Meeting of Stockholders and Proxy Statement |

| Corporate Governance at Baxter International Inc. | 17 |

Director Qualifications

As discussed below in “—Nomination of Directors,” directors are selected on the basis of the specific criteria set forth in Baxter’s Corporate Governance Guidelines. The experience, expertise and knowledge represented by the Board as a collective body allow the Board to lead Baxter in a manner that serves its stockholders’ interests appropriately. Key attributes, experience and skills for each of the company’s current directors are included in “—Nominees for Election as Directors (Term Expires in 2016)” and “—Directors continuing in Office.” Set forth below is a summary of the Board’s collective qualifications, experiences and backgrounds.

| International |  | |

| M&A/Transactional |  | |

| Manufacturing |  | |

| Healthcare Marketing/Delivery |  | |

| Other Sector Leadership |  | |

| Scientific/R&D |  | |

| Diversity |  |

Key growth priority and |

Critical skill to enhance |

Expertise required to effectively |

Industry leaders ready to bring |

Key growth priority and integral |

Diversity of ethnicity or gender |

Nomination of Directors

It is the policy of the Corporate Governance Committee to consider candidates for director recommended by stockholders, members of the Board and management (including by virtue of the Third Point Support Agreement (as discussed below)). Additionally in December 2015, the Board adopted a new proxy access bylaw that permits eligible stockholders to nominate candidates for election to the Board, for inclusion in the company’s proxy statement, beginning with the 2017 Annual Meeting.

From time to time, the Corporate Governance Committee also considers directors recommended by independent search firms retained by the Board to help identify and evaluate potential director nominees or by stockholders. In 2015, the Corporate Governance Committee retained a search firm to assist in its ongoing search for two additional directors, in light of the Baxalta spin-off, the corresponding reduction to the Board size and the company’s emergence as a stand-alone medical products company. These search efforts included the completion of the Corporate Governance Committee’s standing practices regarding director recruitment and evaluation (as discussed below). The search also reflected input from Third Point in accordance with the terms of the related Support Agreement, dated as of September 29, 2015 (Third Point Support Agreement), by and among Baxter, Third Point and certain Third Point affiliates. The culmination of these activities resulted in the appointment of Messrs. Islam and Mahoney to the Board in September 2015 and October 2015, respectively.

The Corporate Governance Committee evaluates all candidates for director (other than proxy access nominees) in the same manner regardless of the source of the recommendation. Stockholder recommendations for candidates for director should include the information required by Baxter’s Bylaws and be sent to the Corporate Governance Committee, c/o Corporate Secretary, Baxter International Inc., One Baxter Parkway, Deerfield, Illinois 60015.

| investor.baxter.com |

| 18 | Corporate Governance at Baxter International Inc. |

Baxter’s Corporate Governance Guidelines provide that (as described below), director nominees selected by the Corporate Governance Committee must:

| ● | possess fundamental qualities of intelligence, honesty, perceptiveness, good judgment, maturity, high ethics and standards, integrity, fairness and responsibility; |

| ● | have a genuine interest in the company and recognition that as a member of the Board, each director is accountable to all stockholders of the company, not to any particular interest group; |

| ● | have a background that demonstrates an understanding of business and financial affairs and the complexities of a large, multifaceted, global business, governmental or educational organization; |

| ● | be or have been in a senior position in a complex organization such as a corporation, university or major unit of government or a large not-for-profit institution; |

| ● | have no conflict of interest or legal impediment that would interfere with the duty of loyalty owed to the company and its stockholders; |

| ● | have the ability and be willing to spend the time required to function effectively as a director; |

| ● | be compatible and able to work well with other directors and executives in a team effort with a view to a long-term relationship with the company as a director; and |

| ● | have independent opinions and be willing to state them in a constructive manner; |

The Corporate Governance Guidelines also provide that directors are selected on the basis of talent and experience. Diversity of background, including diversity of gender, race, ethnic or geographic origin, age and experience (including in business, government and education as well as healthcare, science and technology), is a relevant factor in the selection process. This factor is relevant as a diverse Board is likely to be a well-balanced Board with varying perspectives and a breadth of experience that will positively contribute to robust discussion at Board meetings. A nominee’s ability to meet the independence criteria established by the NYSE is also a factor in the nominee selection process. If a vacancy occurs or is expected to occur, the Board initiates a process to identify potential candidates. Once a candidate has been identified, the Corporate Governance Committee and the independent search firm will engage in a process that includes a thorough investigation of the candidate, an examination of his or her business background and education, research on the individual’s accomplishments and qualifications, in-person interviews and reference checking. If this process generates a positive indication,the leaddirector, the members of the Corporate Governance Committee and the Chairman of the Board will meet separately with the candidate and then confer with each otherregarding the candidate. If the individual was positively received, the Corporate Governance Committee will then recommend the individual to the full Board for further meetings and evaluation and ultimately election. If the full Board agrees, the Chairman of the Board is then authorized to extend an offer to the individual candidate to join the Board or nominate the candidate for election at the next Annual Meeting.

Beginning with the 2017 Annual Meeting, eligible stockholders can nominate candidates for election to the Board through the proxy access provisions of Baxter’s Bylaws, as amended on December 18, 2015. Subject to compliance with the related requirements (including with respect to the nominating stockholders, the nominee and the manner in which the nominee was nominated), the nominees will be included in the related proxy statement as a stockholder nominee. The proxy access provision provides that stockholders can nominate up to two individuals or 20% of the Board, whichever is greater, for election at an annual stockholders meeting (beginning with the 2017 Annual Meeting); provided that the nominating stockholder (or group of up to 20 stockholders) has held at least 3% of Baxter’s outstanding shares for at least three years.

Communicating with the Board of Directors

Stockholders and other interested parties may contact any of Baxter’s directors, including the lead director or the non-management directors as a group, by writing a letter to Baxter Director c/o Corporate Secretary, Baxter International Inc., One Baxter Parkway, Deerfield, Illinois 60015, or by sending an e-mail to boardofdirectors@baxter.com. Baxter’s Corporate Secretary will forward communications directly to the lead director, unless a different director is specified.

See “Executive Compensation—Compensation Discussion and Analysis—Summary—Stockholder Engagement” for a discussion of the company’s stockholder outreach efforts.

| | 2016 Annual Meeting of Stockholders and Proxy Statement |

| Corporate Governance at Baxter International Inc. | 19 |

Other Corporate Governance Information

Corporate Governance Guidelines

Baxter’s Board of Directors has long adhered to corporate governance principles designed to ensure effective corporate governance. Since 1995, the Board of Directors has had in place a set of corporate governance guidelines reflecting these principles. Baxter’s current Corporate Governance Guidelines, most recently adopted in February 2016, cover topics including director qualification standards, director responsibilities (including those of the lead director), director access to management and independent advisors, director compensation, director orientation and continuing education, succession planning and the annual evaluations of the Board and its committees. Baxter’s Corporate Governance Guidelines are available on Baxter’s website at www.baxter.com under “About Baxter—About Us—Governance, Ethics & Compliance—Guidelines.”

Code of Conduct

Baxter has adopted a Code of Conduct that applies to all members of the Board of Directors and all employees of the company, including the Chief Executive Officer, Chief Financial Officer, Controller and other senior financial officers. Any amendment to, or waiver from, a provision of the Code of Conduct that applies to Baxter’s Chief Executive Officer, Chief Financial Officer, Controller or persons performing similar functions will be disclosed on Baxter’s website, at www.baxter.com under “About Baxter—About Us—Governance, Ethics & Compliance.” The Code of Conduct is available on Baxter’s website at www.baxter.com under “About Baxter—About Us—Governance, Ethics & Compliance—Code of Conduct.”

Board’s Oversight of Risk

Baxter’s risk management activities include the identification and assessment of the key risks facing the company among the universe of business risks (strategic, operational, financial and regulatory/compliance). These risks are identified across the organization and come from multiple businesses, regions and functions. The Board reviews these risks on an annual basis after they have been identified and assessed by management and regularly reviews the initiatives put in place to mitigate the effects of these risks. These reviews include updates throughout the year from the businesses, regions and functions from which the key risks arise. Depending on the risk, the update may be presented to the full Board or if appropriate to a committee. For example, the Audit Committee reviews the financial risk assessment process and findings of the internal auditors while the Public Policy Committee and the Audit Committee jointly receive an update from the ethics and compliance function at least annually. Some risks are reviewed by the Board as well as a committee. For example, quality updates are provided at least annually to the full Board although more frequently provided to the Public Policy Committee. The oversight of risk within the organization is an evolving process requiring the company to continually identify opportunities to further embed systematic enterprise risk management into ongoing business processes across the organization. The Board actively encourages management to continue to drive this evolution.

In March 2015, in advance of the Baxalta spin-off, the Board conducted its annual enterprise risk management review and evaluated key risks across the organization and assigned responsible owners for each risk applicable to Baxter (after the spin-off) to a Baxter representative and those applicable to Baxalta (after the spin-off) to a Baxalta representative.

In addition to the Board’s role in enterprise risk management, various committees of the Board are also expressly tasked by their charters to be responsible for the oversight of certain risks. More specifically, the Audit Committee is charged with oversight of the process by which management assesses and manages risk as well as the company’s major financial risk exposures and the steps taken to monitor and control these exposures, while the Public Policy Committee is charged with oversight of Baxter’s quality and regulatory programs as well as review of strategic issues and corporate actions relating to current and emerging political issues, corporate citizenship and public policy.

Certain Relationships and Related Person Transactions

The Board recognizes that related person transactions present a heightened risk of conflicts of interest. Accordingly, pursuant to Baxter’s Corporate Governance Guidelines, the Corporate Governance Committee has been charged with reviewing related person transactions regardless of whether the transactions are reportable pursuant to applicable rules of the Securities and Exchange Commission (SEC). For purposes of this policy, a “related person transaction” is any transaction in which the company was or is to be a participant and in which any related person has a direct or indirect material interest other than transactions that involve less than $50,000 when aggregated with all similar transactions. For any related person transaction to be consummated or to continue, the

| investor.baxter.com |

| 20 | Corporate Governance at Baxter International Inc. |

Corporate Governance Committee must approve or ratify the transaction. The Corporate Governance Committee will approve or ratify a transaction if it determines that such transaction is in Baxter’s best interest. Related person transactions are reviewed as they arise and are reported to the Corporate Governance Committee. The Corporate Governance Committee also reviews materials prepared by the Corporate Secretary (including information identified in questionnaires distributed annually to the company’s directors, executive officers and controller) to determine whether any related person transactions have occurred that have not been reported. It is Baxter’s policy to disclose all related person transactions in the company’s applicable filings to the extent required by the applicable rules and regulations of the SEC.

Upon his hiring in 2011, Dr. Marcus Schabacker received a loan from the company to assist in his relocation. In June 2015, prior to his becoming the company’s Corporate Vice President and Chief Scientific Officer, Dr. Schabacker repaid the then outstanding loan balance of $386,161 (and all accrued interest thereon) in full.

Board Leadership Structure; Lead Director

Mr. Almeida has served as Chairman of the Board and Chief Executive Officer since January 1, 2016. Mr. Robert Parkinson retired from that role effective as of December 31, 2015. Thomas T. Stallkamp serves as the lead director and has served in such capacity since May 2014.

The Board regularly reviews the leadership structure of the company, including whether the position of Chairman should be held by an independent director. In connection with Mr. Almeida’s appointment, the Board determined that it was in Baxter stockholders’ best interests to keep the Chairman and Chief Executive Officer roles combined. The Board reached this decision in light of Mr. Almeida’s significant industry and leadership experience, including as Chairman and Chief Executive Officer of Covidien. They also believed that Mr. Almeida would serve as an effective bridge between the Board and management as he works with management to establish Baxter’s new strategic framework and refresh its long-range plans. See “Stockholder Proposals—Proposal 5—Independent Board Chairman—Board of Directors’ Statement Opposing the Stockholder Proposal” for additional information regarding the Board’s determination to keep the roles combined in connection with Mr. Almeida’s appointment and to make these determinations on a case by case basis.

As Chairman of the Board and pursuant to Baxter’s Bylaws, Mr. Almeida presides at all Board and stockholder meetings, serves as the primary spokesperson for Baxter and acts as a liaison between the Board and the stockholders. As Chief Executive Officer and pursuant to Baxter’s Bylaws, Mr. Almeida supervises the business of the company, subject to the direction of the Board. As lead director and pursuant to Baxter’s Corporate Governance Guidelines, Mr. Stallkamp presides at all executive sessions of the Board, acts as the liaison between the independent directors and the Chairman of the Board, reviews meeting agendas for the Board and works with the Chairman to facilitate timely and appropriate information flow to the Board. In 2015, these executive sessions occurred as part of every regularly scheduled meeting of the Board and covered critical issues facing the company. The lead director, together with the chairpersons of the Compensation and Corporate Governance Committees, also leads the non-employee directors in the annual review and approval of compensation for the Chief Executive Officer.

Mr. Stallkamp also serves as the contact person for interested parties to communicate directly with the independent members of the Board. As part of our stockholder outreach, Mr. Stallkamp spoke with company stockholders on select matters, including corporate governance and executive compensation items.See “Executive Compensation—Compensation Discussion and Analysis—Summary—Stockholder Engagement.”

The Corporate Governance Committee recommends a lead director to the full Board for approval on an annual basis, with the expectation that once elected a lead director will serve for three consecutive years.

As discussed above, the Board has determined that this structure continues to serve the best interests of the company’s stockholders in light of the related requirements as set forth in Baxter’s Bylaws and Corporate Governance Guidelines and the skills and experience that Messrs. Almeida and Stallkamp bring to their respective roles. The Board made this determination in advance of extending an offer to Mr. Almeida to serve as Baxter’s Chairman and Chief Executive Officer, in accordance with the terms of his offer letter.

| | 2016 Annual Meeting of Stockholders and Proxy Statement |

| Corporate Governance at Baxter International Inc. | 21 |

Executive Sessions

As discussed above, independent directors of the Board met in executive session without management at every regularly scheduled meeting during 2015 in accordance with Baxter’s Corporate Governance Guidelines. Mr. Stallkamp, as lead director, led these executive sessions. Additionally, the Audit Committee is required by its charter toregularly hold separate sessionsduring committee meetings with each of the internal auditor, the independent registered public accounting firm and management. The Corporate Governance and Compensation Committees generally meet in executive session at each meeting.

The standing committees of the Board of Directors currently consist of the Audit Committee, the Compensation Committee, the Corporate Governance Committee and the Public Policy Committee. In July 2015, in connection with the spin-off of Baxalta, the Board of Directors dissolved the Finance and Science and Technology Committees. These changes were made in light of the company’s reduced size and emergence as a stand-alone medical products company. The responsibilities of the former Finance and Science and Technology Committees have been assumed by the Board and Audit Committee, as discussed below.

Each committee consists solely of independent directors and is governed by a written charter. All committee charters are available on Baxter’s website at www.baxter.com under “About Baxter—About Us—Governance, Ethics & Compliance—Committees and Charters.”

Audit Committee

The Audit Committee is currently composed of K. J. Storm (Chair), Peter S. Hellman, Munib Islam, Thomas T. Stallkamp and Albert P.L. Stroucken, each of whom is independent under the rules of the NYSE and Rule 10A-3 of the Securities Exchange Act of 1934, as amended (Exchange Act). The Board has determined that Messrs. Hellman, Stallkamp, Storm and Stroucken each qualify as an “audit committee financial expert” as defined by the rules of the SEC. The Audit Committee is primarily concerned with the integrity of Baxter’s financial statements, system of internal accounting controls, the internal and external audit process, and the process for monitoring compliance with laws and regulations. The Audit Committee’s duties include: (1) reviewing the adequacy and effectiveness of Baxter’s internal control over financial reporting with management and the external and internal auditors and reviewing with management Baxter’s disclosure controls and procedures; (2) retaining and evaluating the qualifications, independence and performance of the independent registered public accounting firm; (3) approving audit and permissible non-audit engagements to be undertaken by the independent registered public accounting firm; (4) reviewing the scope of the annual external and internal audits; (5) reviewing and discussing Baxter’s financial statements (audited and unaudited), as well as earnings press releases and related information, prior to their filing or release; (6) overseeing legal and regulatory compliance as it relates to financial matters; (7) holding separate executive sessions with the independent registered public accounting firm, the internal auditor and management; (8) discussing guidelines and policies governing the process by which Baxter assesses and manages risk; and (9) after the dissolution of the Finance Committee and the February 2016 amendment of the Audit Committee’s charter, approving certain financing matters, proposed corporate transactions and capital expenditures. The Audit Committee met 15 times in 2015. The Audit Committee Report appears on page 60.

Compensation Committee

The Compensation Committee is currently composed of John D. Forsyth (Chair), Peter S. Hellman, Michael F. Mahoney, Carole J. Shapazian and Thomas T. Stallkamp, each of whom is independent under the rules of the NYSE. The Compensation Committee exercises the authority of the Board relating to employee benefit and equity-based plans and the compensation of the company’s officers. The Compensation Committee’s duties include: (1) making recommendations for consideration by the Board, in executive session and in coordination with the Corporate Governance Committee, concerning the compensation of the Chief Executive Officer; (2) determining the compensation of the company’s officers (other than the Chief Executive Officer) and advising the Board of such determination; (3) making recommendations to the Board with respect to incentive compensation plans and equity-based plans and exercising the authority of the Board concerning benefit plans; (4) serving as the administration committee of the company’s equity-based plans; (5) making recommendations to the Board concerning director compensation; (6) reviewing the adequacy of the company’s stock ownership guidelines and periodically assessing compliance with these guidelines; and (7) overseeing the company’s compensation philosophy and strategy and periodically assessing the risk related to its compensation policies and practices. The Corporate Governance and Compensation Committees work together to establish a link between the Chief

| investor.baxter.com |

| 22 | Corporate Governance at Baxter International Inc. |

Executive Officer’s performance and decisions regarding his compensation. All compensation actions relating to the company’s Chief Executive Officer are subject to the approval of the independent directors of the Board. The Compensation Committee met eight times in 2015. The Compensation Committee Report appears on page 27.

The Compensation Committee has the sole and direct responsibility for the appointment, compensation and oversight of the work of any advisor retained by the Compensation Committee, and it has directly engaged George B. Paulin, Chairman and Chief Executive Officer of Frederic W. Cook & Co., Inc. (Cook & Co.), as itsindependent compensation consultant. Additionally, Aon Hewitt assists the Compensation Committee with the compilation of market data from time to time. Mr. Paulin reports directly and exclusively to the Compensation Committee and his firm provides no other services to Baxter except advising on executive and Board compensation matters. He provides analyses and recommendations that inform the Compensation Committee’s decisions, but he does not decide or approve any compensation actions. During 2015, he advised the Compensation Committee Chairman on setting agenda items for Compensation Committee meetings; reviewed management proposals presented to the Compensation Committee; assisted in the Compensation Committee’s assessment of Baxter’s compensation policies and practices (and those established for Baxalta prior tothe Baxalta spin-off); and conducted a review of the compensation of non-employee directors at Baxter’s peer companies. He also assisted in the identification of new peer companies for Baxter, in advance of the Baxalta spin-off. In accordance with the rules of the SEC and the NYSE regarding the independence of compensation consultants, Mr. Paulin provided the Compensation Committee information regarding any personal, financial, or business relationships between Cook & Co. and Baxter, its management or the members of the Compensation Committee that could impair its independence or present a conflict of interest. Based on its review of this information, the Compensation Committee determined that there were no relationships that impair the independence or create a conflict of interest between Baxter and Cook & Co. and the partners, consultants and employees who provide services to the Compensation Committee. In addition, the Compensation Committee annually reviews the substantive performance of Mr. Paulin and Cook & Co. as part of its engagement process.

Corporate Governance Committee

The Corporate Governance Committee is currently composed of James R. Gavin III, M.D., Ph.D. (Chair), Thomas F. Chen, Uma Chowdhry, Ph.D., John D. Forsyth, Michael F. Mahoney and K. J. Storm, each of whom is independent under the rules of the NYSE. The Corporate Governance Committee assists and advises the Board on director nominations, corporate governance and general Board organization and planning matters. The Corporate Governance Committee’s duties include: (1) developing criteria for use in evaluating and selecting candidates for election or re-election to the Board and assisting the Board in identifying and attracting qualified director candidates; (2) selecting and recommending that the Board approve the director nominees for the next annual meeting and recommending persons to fill any vacancy on the Board; (3) determining Board committee structure and membership; (4) overseeing the succession planning process for management, including the Chief Executive Officer; (5) developing and implementing an annual process for evaluating the performance of the Chief Executive Officer; (6) developing and implementing an annual process for evaluating Board and committee performance; (7) overseeing the continuing education of the Board; and (8) reviewing at least annually the adequacy of Baxter’s Corporate Governance Guidelines. Additionally, in 2015, the Corporate Governance Committee assisted the Board in deciding to adopt and then finalize the December 2015 proxy access bylaw amendment in order to strike a balance between enhancing stockholder rights and acting in the best interest of all Baxter stockholders. The Corporate Governance Committee met seven times in 2015.

Public Policy Committee

The Public Policy Committee is currently composed of Carole J. Shapazian (Chair), Thomas F. Chen, Uma Chowdhry, Ph.D., James R. Gavin III, M.D., Ph.D. and Albert P.L. Stroucken. The Public Policy Committee assists the Board in fulfilling its oversight responsibilities with respect to legal, regulatory and other compliance matters, and advises the Board with respect to Baxter’s responsibilities as a global corporate citizen. The Public Policy Committee’s duties include: (1) reviewing Baxter’s compliance with laws and regulations administered by the U.S. Food and Drug Administration and similar agencies; (2) reviewing the safety and quality of Baxter’s products; (3) reviewing periodic reports on quality and compliance; (4) coordinating with the Audit Committee on quality and compliance issues; and (5) reviewing strategic issues and corporate actions relating to current and emerging political, corporate citizenship and public policy issues that may affect Baxter. The Public Policy Committee met three times in 2015.

| | 2016 Annual Meeting of Stockholders and Proxy Statement |

| Corporate Governance at Baxter International Inc. | 23 |

Non-employee directors are compensated for their service under Baxter’s non-employee director compensation plan with cash compensation and equity awards of stock options and RSUs. In July and November 2014 and May 2015, Cook & Co. reviewed this plan in its capacity as the Compensation Committee’s independent advisor. Cook & Co. recommended that the mix of equity and cash awards under the plan be positioned at the median range of Baxter’s new peer group (after the Baxalta spin-off). This new peer set, which was approved by the Compensation Committee in July 2014 for executive-level benchmarking for the company generally, is set forth below under “Compensation Discussion and Analysis—Structure of Compensation Program—Baxter’s New Peer Group and Use of Peer Group Data.” These recommendations, which were approved by the Compensation Committee and subsequently by all independent directors, increased the value of target annual equity awards to non-employee directors(from $165,000 to $175,000) and the cash retainer paid to the lead independent director and committee chairs, as described below.

Beginning in 2016, the Board anticipates that Mr. Islam will be paid solely in cash, in an amount equal to the cash compensation paid to all other non-employee directors (as described below under “—Cash Compensation”) and an amount equal to the target value of the RSUs and stock options awarded to all other non-employee directors (as described below under “—Stock Options” and “—Restricted Stock Units”); provided, thatthe target value shall only be paid at the end of the one-year vesting period to which all non-employee director equity awards are subject, assuming Mr. Islam is still a directorat that time.

Baxter’s director compensation program utilizes equity awards in order to further align the interests of directors with Baxter stockholders. Notwithstanding that Mr. Islam may receive solely cash awards beginning in 2017 with regard to his 2016 grants, he serves on the Board as a Third Point nominee in accordance with the terms of Third Point Support Agreement and as a senior Third Point executive. Third Point is the company’s largest stockholder as of the date of this Proxy Statement. See “Ownership of Our Stock—Security Ownership by Certain Beneficial Owners” for additional information regarding Third Point’s holdings.

Cash Compensation

Each non-employee director is paid a $65,000 annual cash retainer and a $2,000 fee for each Board and committee meeting attended. The fee for attending a Science and Technology Committee meeting, prior to its dissolution, was $3,000 as this committee held less frequent but longer meetings, often not coincident with Board meetings. Each non-employee director who acts as the Chair of any committee meeting receives an additional annual retainer of $15,000, except for the Chair of the Audit Committee who receives an additional retainer of $20,000 in light of the frequency of meetings held by this committee.These amounts were increased from $10,000 and $15,000, respectively, in 2015. Effective July 1, 2015, the lead director is paid an additional annual cash retainer of $50,000, an increase from $30,000. Non-employee directors are eligible to participate in a deferred compensation plan that allows for the deferral of all or any portion of cash payments until Board service ends and provides participants with a select subset of investment elections available to all eligible employees under Baxter’s tax-qualified Section 401(k) plan.2015 cash compensation for Messrs. Forsyth, Hellman, Hockmeyer, Stallkamp and Storm also includes payment for meetings of an ad hoc Board working group constituted to assist on strategic decisions related to the separation of Baxter and Baxalta. Working group meeting fees were $2,000 per meeting, consistent with Baxter’s standard meeting fees.

Stock Options

Except as described above with respect to Mr. Islam, each non-employee director is entitled to receive a grant of stock options annually on the date of each annual meeting. Under Baxter’s director compensation plan for 2015, each non-employee director on the Board in May 2015 received an annual stock option grant with a value of $60,000 as of the grant date, rounded to the nearest ten shares. The stock options become exercisable on the date of the next annual meeting, and may become exercisable earlier in the event of death, disability or a change in control of Baxter. Upon their appointment to the Board, Messrs. Islam and Mahoney received prorated stock option grants in September 2015 and October 2015, respectively.

Restricted Stock Units

Except as described above with respect to Mr. Islam, each non-employee director also receives an annual grant of RSUs on the date of each annual meeting. The number of RSUs for 2015 equaled the quotient of $115,000 divided by the closing sale price for a share of Baxter common stock on the date of the 2015 Annual Meeting, rounded to the nearest ten shares. Directors have the option of deferring the distribution of the shares of stock underlying such RSUs until termination from service as a director. The RSUs vest on the date of the next annual meeting and may vest earlier in the event of death, disability or a change in control of Baxter. Directors are credited with dividend equivalents on the shares underlying the RSUs (whether vested or unvested) and such dividend equivalents are reinvested in additional unvested RSUs. Directors have no other rights of a stockholder with respect to the shares underlying the RSUs prior to vesting. Upon their appointment to the Board, Messrs. Islam and Mahoney received prorated RSU grants in September 2015 and October 2015, respectively.

| investor.baxter.com |

| 24 | Corporate Governance at Baxter International Inc. |

Other Director Compensation

Directors are eligible to participate in the Baxter International Foundation matching gift program, under which Baxter’s foundation matches gifts made by employees and directors to eligible non-profit organizations. The maximum gift total for a non-employee director participant in the program is $20,000 in any calendaryear. Baxter periodically reimburses travel and entertainment expenses when significant others of directors are invited to attend a meeting of the Board. The Compensation Committee believes these types of events help to create a sense of collegiality among the Board that is helpful to the directors in fulfilling their responsibilities as members of the Board.

Baxter’s Stock Ownership Guidelines for Directors; Prohibitions on Trading

Baxter’s Corporate Governance Guidelines provide that after five years of Board service, each director is recommended to hold common stock equal to five times the annual cash retainer provided to directors. The Board has determined that Mr. Islam satisfies this guideline by virtue of Third Point’s ownership of Baxter common stock. Third Point beneficially owns approximately9.8% of Baxter’s outstanding common stock based on Amendment No. 2 to the Schedule 13D/A it filed on September 30, 2015. See “Ownership of Our Stock—Security Ownership by Certain Beneficial Owners” for a description of Third Point’s holdings.

Pursuant to Baxter’s securities trading policy, Baxter directors are prohibited from engaging in short-term trading activities and option transactions in Baxter stock. As a result, directors cannot enter into any “put” or “call” options or otherwise buy or sell derivatives on any Baxter stock.

| | 2016 Annual Meeting of Stockholders and Proxy Statement |

| Corporate Governance at Baxter International Inc. | 25 |

Director Compensation Table

The following table provides information on 2015 compensation for non-employee directors who served during 2015.

| Name | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2) | Option Awards ($)(3) | All Other Compensation ($)(4) | Total ($) | |||||||

| Thomas F. Chen | $107,000 | $114,923 | $52,977 | $8,813 | $283,713 | |||||||

| Uma Chowdhry, Ph.D. | 106,000 | 114,923 | 52,977 | 23,874 | 297,774 | |||||||

| John D. Forsyth | 138,000 | 114,923 | 52,977 | 2,790 | 308,690 | |||||||

| James R. Gavin, M.D., Ph.D. | 127,000 | 114,923 | 52,977 | 30,381 | 325,281 | |||||||

| Peter S. Hellman | 133,000 | 114,923 | 52,977 | 21,290 | 322,190 | |||||||

| Munib Islam(5) | 30,250 | 58,802 | 36,849 | 0 | 125,901 | |||||||

| Michael F. Mahoney(5) | 28,717 | 54,468 | 35,160 | 0 | 118,345 | |||||||

| Carole Shapazian | 123,000 | 114,923 | 52,977 | 22,790 | 313,690 | |||||||

| Thomas T. Stallkamp | 179,000 | 114,923 | 52,977 | 22,090 | 368,990 | |||||||

| K. J. Storm | 158,500 | 114,923 | 52,977 | 12,790 | 339,190 | |||||||

| Albert P.L. Stroucken | 131,000 | 114,923 | 52,977 | 2,790 | 301,690 | |||||||

| Blake E. Devitt(6) | 72,500 | 114,923 | 52,977 | 4,187 | 244,587 | |||||||

| Gail D. Fosler(6) | 56,500 | 114,923 | 52,977 | 2,687 | 227,087 | |||||||

| Wayne T. Hockmeyer, Ph.D.(6) | 65,000 | 114,923 | 52,977 | 2,687 | 235,587 |

| 1 | Consists of the amounts described above under “—Cash Compensation.” |

| 2 | The amounts shown in this column are valued based on the grant date fair value computed in accordance with FASB ASC Topic 718. For more information on how these amounts are calculated, please see Note 12 to the Consolidated Financial Statements included in the company’s Annual Report on Form 10-K for the year ended December 31, 2015. As of December 31, 2015, each current director (other than Messrs. Islam and Mahoney) had 3,097 unvested Baxter RSUs. Messrs. Islam and Mahoney had 1,790 and 1,530 unvested Baxter RSUs, respectively, as of December 31, 2015. Amounts for each of Dr. Hockmeyer, Mr. Devitt and Ms. Fosler represent 3,610 unvested Baxalta RSUs which were issued in exchange for 3,610 unvested Baxter RSUs in connection with the spin-off. See “—Adjustments to Certain Equity Awards in the Spin-Off” below for a description of the adjustments made to outstanding equity awards in connection with the Baxalta spin-off. Mr. Islam has disclaimed beneficial ownership of the RSUs granted to him in connection with his appointment, in light of his employment arrangement with Third Point. |

| 3 | The amounts shown in this column are valued based on the grant date fair value computed in accordance with FASB ASC Topic 718. For more information on how these amounts are calculated, please see Note 12 to the Consolidated Financial Statements included in the company’s Annual Report on Form 10-K for the year ended December 31, 2015. As of December 31, 2015, each director had the following number of Baxter and Baxalta stock options outstanding (Baxter/Baxalta): Mr. Chen (20,509/9,720); Dr. Chowdhry (20,509/9,720); Mr. Devitt (0/47,678); Mr. Forsyth (51,539/40,750); Ms. Fosler (25,090/37,678); Dr. Gavin (51,539/40,750); Mr. Hellman (51,539/40,750); Dr. Hockmeyer (33,310/45,898); Mr. Islam (6,290/0); Mr. Mahoney (5,390/0); Ms. Shapazian (35,879/25,090); Mr. Stallkamp (31,899/21,110); Mr. Storm (51,539/40,750); and Mr. Stroucken (51,539/40,750). See “—Adjustments to Certain Equity Awards in the Spin-Off” below for a description of the adjustments made to outstanding equity awards in connection with the Baxalta spin-off. Mr. Islam has disclaimed beneficial ownership of the Baxter stock options granted to him in connection with his appointment, in light of his employment arrangement with Third Point. |

| 4 | The amounts in this column include contributions made by Baxter’s charitable foundation for 2015 (paid as of March 1, 2016) on behalf of certain directors under the foundation’s matching gift program as follows: Dr. Chowdhry ($20,000); Dr. Gavin ($20,000); Mr. Hellman ($18,500); Ms. Shapazian ($20,000); and Mr. Stallkamp ($19,300). These donations are the only component of “All Other Compensation” that involved an amount equal to or greater than $10,000 for any director in 2015. All other amounts in this column represent dividend equivalent payments on RSUs held by the non-employee directors during 2015 (including any RSUs with deferred vesting pursuant to the deferred compensation plan). |

| 5 | Messrs. Islam and Mahoney were appointed to the Board in September 2015 and October 2015, respectively.Mr. Islam received a pro rata payment to reflect his service between September 29, 2015 and December 31, 2015. Mr. Mahoney received a pro rata payment to reflect his service between October 21, 2015 and December 31, 2015. |

| 6 | Dr. Hockmeyer, Mr. Devitt and Ms. Fosler resigned from the Board on June 30, 2015 in connection with their appointment to the Baxalta board of directors. |

| investor.baxter.com |

| 26 |

| Executive Compensation |

The Board encourages stockholders to carefully review the “Executive Compensation—Compensation Discussion and Analysis” section of this Proxy Statement, in connection with this advisory vote. The Compensation Discussion and Analysis section describes Baxter’s executive compensation program and the decisions made by the Compensation Committee and the Board with respect to the compensation of the company’s named executive officers for 2015.

The company has designed its executive compensation programs to attract, motivate, reward and retain the senior management talent required to achieve its corporate objectives and increase stockholder value. As discussed below in Compensation Discussion and Analysis, pay-for-performance is the most significant structural element of Baxter’s executive compensation program, where the majority of executive pay is at risk and subject to specific annual and long-term performance requirements.

In addition, Baxter has also adopted policies, like the stock ownership guidelines and the executive compensation recoupment policy, to help ensure long-term focus and appropriate levels of risk-taking by executive officers.

The Board believes that Baxter’s executive compensation program is designed to meet the objectives discussed in the Compensation Discussion and Analysis section. Accordingly, the Board recommends that stockholders vote in favor of the following resolution:

RESOLVED, that the stockholders of Baxter International Inc. approve the compensation paid to the company’s named executive officers as described in this Proxy Statement under “Executive Compensation,” including the Compensation Discussion and Analysis, the compensation tables and other narrative disclosure contained therein. |  |

This say-on-pay advisory vote is non-binding on the Board. Although the vote is non-binding, the Board and the Compensation Committee will review and thoughtfully consider the voting results when making future decisions concerning the compensation of the company’s named executive officers.

| | 2016 Annual Meeting of Stockholders and Proxy Statement |

| Executive Compensation | 27 |

The Compensation Committee is responsible for the oversight of Baxter’s compensation programs on behalf of the Board of Directors. In fulfilling its oversight responsibilities, the Compensation Committee has reviewed and discussed with management the Compensation Discussion and Analysis set forth in this Proxy Statement.

Based on the review and discussions referred to above, the Compensation Committee recommended to the Board of Directors that the following Compensation Discussion and Analysis be included in Baxter’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015 and this Proxy Statement, each of which will be filed with the SEC.

Compensation Committee

John D. Forsyth (Chair)

Peter S. Hellman

Michael F. Mahoney

Carole J. Shapazian

Thomas T. Stallkamp

Compensation Discussion and Analysis

This Compensation Discussion and Analysis discusses the 2015 compensation paid to Baxter’s executive officers who are identified as named executive officers below. The purpose of this discussion is to provide investors with an understanding of the company’s executive compensation policies and practices, and the decisions regarding the compensation for the named executive officers.

Summary

2015 Results

In March 2014, Baxter announced plans to create two separate, independent global healthcare companies – one focused on developing and marketing innovative biopharmaceuticals (Baxalta) and the other on life-saving medical products (Baxter). On July 1, 2015, the spin-off was completed, creating two, well-capitalized independent companies with strong balance sheets, investment grade profiles, and disciplined approaches to capital allocation. Baxter had positioned both businesses to be successful, profitable and sustainable independent companies, and this decision reflects the further evolution of Baxter’s multi-faceted strategies emphasizing a commitment to innovation and operational excellence. The two businesses had historically operated in distinct markets with corresponding and distinct underlying fundamentals, and each possesses unique and compelling growth prospects, investment requirements and risk profiles. Baxter believes that the separation has and will continue to result in other material benefits, including:

| ● | Greater management focus on the distinct business of medical products; |

| ● | Ability to more effectively commercialize new and existing product offerings; |

| ● | Ability to drive innovation across the franchises and allocate necessary resources to the areas presenting the highest growth potential; and |

| ● | Flexibility to pursue growth and investment strategies resulting in revenue acceleration, improved profitability and enhanced returns. |

Baxter’s financial results for 2015 reflect the company’s achievement of significant financial, operational and strategic objectives. The related highlights include:

| ● | the successful completion of the Baxalta spin-off, including the distribution of 80.5% of the outstanding shares of Baxalta common stock to Baxter stockholders (as further discussed below); |

| ● | the implementation of actions to rebase the company’s cost structure in light of the company’s emergence as a stand-alone medical products company; |

| ● | the launch of new products or next generation products in select markets, two new automated peritoneal dialysis systems (HOMECHOICE CLARIA with SHARESOURCE and AMIA with SHARESOURCE), Cefazolin injection in GALAXY container (2 g/100 mL), Baxter’s next-generation SIGMA SPECTRUM infusion pump and AK-98, Baxter’s new in-center hemodialysis system; and |

| ● | continued savings associated with the Gambro AB integration, the optimization of Baxter’s portfolio and the Baxalta spin-off. |

| investor.baxter.com |

| 28 | Executive Compensation |

Baxter’s global net sales totaled $10.0 billion in 2015, withadjusted earnings from continuing operation per diluted share of $1.38 (excluding special items). See footnote 1 to the table in “—Structure of Compensation Program—Financial Targets” for information regarding the adjustments made to adjusted earnings from continuing operations per diluted share.

As discussed in “—Structure of Compensation Program—Financial Targets” below, Baxter’s short-term cash compensation program for 2015 was based, in part, on the achievement of adjusted EPS and adjusted sales for the first and second half of 2015.

The company’s financial, operational and strategic performances (as discussed above) were all significant factors in the compensation decisions made for 2015. A comparison of the performance of Baxter’s common stock (after giving effect to the Baxalta spin-off) against certain of its peers provides another perspective on Baxter’s overall performance over the last five years and is an additional factor that the Compensation Committee (and with respect to Chief Executive Officer compensation, the Board) considered when making compensation decisions.

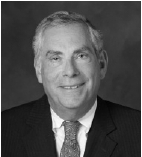

In 2015, Baxter delivered value to stockholders through $910 million in dividends. Additionally, on July 1, 2015, Baxter distributed 80.5% of the outstanding Baxalta shares to its stockholders in the Baxalta spin-off. Based on company estimatesand as set forth below, the combined total shareholder return for Baxter and Baxalta in 2015 totaled approximately 7.5%, as compared to 1.4% for the S&P 500 Composite Index and 7.0% for the S&P 500 Health Care Index over the same period.

The following graph compares the cumulative total shareholder return (including reinvested dividends) on Baxter common stock and, for the period between July 1, 2015 and December 31, 2015, on Baxter and Baxalta common stock with the Standard & Poor’s 500 Composite Index and the Standard & Poor’s 500 Health Care Index for 2015. Performance through June 30, 2015 reflects Baxter performance prior to adjusting for the Baxalta separation. Performance after June 30, 2015 represents the aggregate total shareholder return for Baxter (as adjusted for the Baxalta separation) and Baxalta.

| | 2016 Annual Meeting of Stockholders and Proxy Statement |

| Executive Compensation | 29 |

The second graph compares the change in the cumulative total shareholder return (including reinvested dividends) on Baxter common stock and, for the period between July 1, 2015 and December 31, 2015, on Baxter and Baxalta common stock with the same indices shown above between 2010 and 2015. Performance through June 30, 2015 reflects Baxter performance prior to adjusting for the Baxalta separation. Performance after June 30, 2015 represents the aggregate total shareholder return for Baxter (as adjusted for the Baxalta separation) and Baxalta.

2015 Say-on-Pay Vote

At the 2015 Annual Meeting, approximately 74% of the stockholders voting at the meeting approved the compensation paid to Baxter’s named executive officers in 2014.

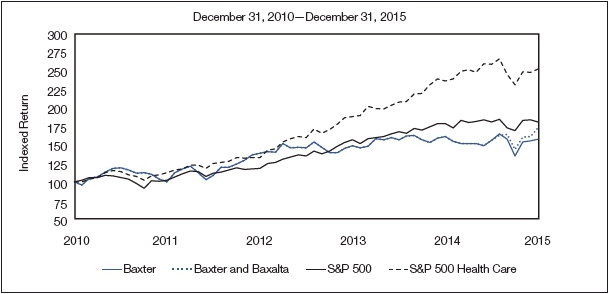

The Compensation Committee and management are committed to strengthening pay-for-performance alignment, as well as the overall design of the company’s executive compensation programs. In 2015 after the 2015 Annual Meeting, Baxter reached out to certain of its top stockholders to seek feedback on Baxter’s executive pay practicesand the 2015 say-on-pay vote. Several stockholders suggested that their “no” votes primarily reflected views on total shareholder return and related matters in 2014 andthese stockholders generally did not suggest fundamental changes in program design.See “—Structure of Compensation Program—Pay-for-Performance—CEO Alignment of Realizable Pay and Performance” for additional information regarding the alignment between company performance and realizable pay in 2015.

Stockholder Engagement

Baxter sponsors an active stockholder engagement program. As part of this program, the company is committed to engaging in constructive dialogue with its stockholders. Management is primarily responsible for stockholder communications and engagement, with involvement from the lead director, Corporate Governance and Compensation Committees. Management provides regular updates to the Board concerning stockholder feedback. The Board considers this feedback as well as the interests of all stakeholders when overseeing company strategy, formulating governance practices and designing or evaluating compensation programs, as discussed above.

During 2015, members of the Board and management met with stockholders and other stakeholders as part of its annual outreach program and a targeted corporate governance outreach, as well as at other times throughout the year. This outreach included discussions with representatives from Baxter’s top institutional investors, hedge funds, mutual funds and public pension funds (representing over 25% of our outstanding shares). We also engaged with proxy and other investor advisory firms that represented the interests of various stockholders. Topics included our strategy and performance, corporate governance matters such as Board composition and refreshment, succession planning (including the appointment of Mr. Almeida as the company’sChairman and Chief Executive Officer), Board leadership structure and the company’s recently adopted proxy access bylaw amendmentand Baxter’s executive compensation program. Management solicited feedback from stockholders on these subjects and provided a summary of responses to the Board. Directors who participated in the meetings also shared their perspectives on these meetings with the full Board.

| investor.baxter.com |

| 30 | Executive Compensation |

2015 Executive Compensation Awarded and Earned

For his service as Baxter’s Chairman and Chief Executive Officer in 2015, Mr. Parkinson has compensation reported in theSummary Compensation Table of $17,883,684. In reviewing the company’s programs (including the successful Baxalta separation and distribution) and the decisions made relative to Mr. Parkinson’s compensation, the Compensation Committee believes that Mr. Parkinsonwas fairly rewarded for leading the company through a period of substantial change and long-term investment for the future benefit of stockholders.