LETTER FROM THE PRESIDENT (Unaudited)

Dear Fellow Shareholders:

2008 by all accounts was the worst year for equity markets since the 1930’s. Unfortunately, all asset classes were effected without much shelter from the suffering market ride. After a year of extreme turmoil, domestically and worldwide, things appear to be stabilizing and looking up for the market. The turnaround is welcomed after a 46.20% decline in the S&P 500 from September 1, 2008 to the bottom on March 9, 2009.

We have seen historic moves by Congress to restore public confidence and boost the inter-locking economic trends. The U.S. Treasury and Federal Reserve have taken extraordinary actions to spur consumer spending in response to the unprecedented volatility in the Nation’s housing, corporate, mortgage and credit markets. While this may prove to be a painful process, it will ultimately result in greater financial stability and economic environment. Throughout these changes, we have worked hard to keep your interest paramount.

Amid this financial trouble, the portfolio managers of the Monteagle Funds have endeavored to capitalize on the opportunities created by investing in bargain investment grade bonds (in our fixed income fund) and high quality issues (in our equity funds). We believe that long-term investors will be rewarded for their faith in professional management and trusting patience.

I look forward to serving you as the new President. I encourage you to carefully review the information presented in this annual report and thank you for your continued confidence and support of the Monteagle Funds.

Sincerely,

Paul B. Ordonio, JD

President

Monteagle Funds

MONTEAGLE FIXED INCOME FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited)

How did the Fund perform?

For the year ended August 31, 2009, the Monteagle Fixed Income Fund (the “Fund”) had a total return of 6.80%. For the quarter ended August 31, 2009, the Fund had a total return of 2.26%; and for the six months ended August 31, 2009, the Fund had a total return of 4.35%. The Fund’s benchmark index (The Barclay’s Capital Intermediate Government/Credit Index) had relative returns of 6.81%, 2.86%, and 5.08% for the twelve, three, and six month periods, respectively. For the full year, the Fund equally performed with the benchmark index, but has underperformed over the second half of the year.

What is the fund’s investment approach?

The investment objective of the Monteagle Fixed Income Fund is total return. The Fund seeks to achieve its objective of total return through price appreciation, and interest income on the bonds and other securities held.

The Fund invests in investment grade intermediate term fixed income securities maintaining an average maturity of bonds and notes (on a dollar weighted basis) generally between 3 and 8 years. Securities purchased for the benefit of the fund are high quality; specifically at least rated Aa3 or higher by Moody’s Investors Service, Inc. or AA- or higher by Standard and Poor’s Ratings Group for municipal bonds and A3 or higher by Moody’s Investors Service, Inc. or A- or higher by Standard and Poor’s Ratings Group for corporate bonds. Under normal circumstances, the Fund will invest at least 80% of its assets in fixed income securities, including U.S. government securities, securities issued by agencies of the U.S government, mortgage-backed (and similar securities), taxable municipal bonds and corporate debt securities but no more than 70% in any one category.

The Fund’s portfolio is actively managed and based on an assessment of market conditions; the average maturity of the portfolio may be lengthened or shortened in an effort to maximize total return. Furthermore, the Fund’s portfolio holdings may vary across market sectors in order to maximize total return within the scope of permitted investments defined by the Fund’s prospectus. The Fund may achieve capital appreciation by owning bonds of longer duration (maturity) when interest rates are declining, and by owning bonds of shorter duration (maturity) when interest rates are rising; protecting against large capital depreciation. For this purpose, the Fund uses a proprietary “Bond Market Watch” model to evaluate macroeconomic indicators and, based on this evaluation, attempt to anticipate interest rate changes.

In addition, the Fund may achieve capital (price) appreciation if the credit quality of corporate and municipal bonds improves; making the associated scheduled interest payments more certain, thereby creating greater demand for such bonds. The Fund may also achieve increased interest income by purchasing bonds that have associated call options that are exercisable by the issuer of these securities. In exchange for issuing securities that gives the issuer the right to refund the par value prior to the stated maturity, the issuer must compensate potential buyers of these securities with higher interest payments. Based on management’s assessment of the value of the associated option inherent with these securities, the Fund may overweight its holdings of these securities, namely callable Government Agency bonds or mortgage-backed securities. These securities may be less sensitive to moderate increases or decreases in the general level of interest

MONTEAGLE FIXED INCOME FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued)

rates. Therefore, the associated capital appreciation or depreciation of these securities may also be limited; helping to preserve capital.

What influenced the Fund’s performance?

During the 12 months ended August 31, 2009, the Fund improved on the 4.94% return realized the previous year. Over the past year the major factors contributing to fund performance and lower interest rates were:

| | • | The virtual collapse of global financial markets in September of 2008 caused a crisis of historic proportions that froze the credit markets, increased the need for liquidity, and created a near panic not seen since the depression era of the 1930’s. |

| | • | Easing of monetary policy from 2.00% on September 1, 2008 to a target of 0 to 0.5% as of August 31, 2009 (significant decreases in Fed Funds rate by the Federal Reserve Bank as). |

| | • | The direct injection of liquidity by the Federal Reserve Bank through various government guarantee programs designed to keep the Capital markets and the banking system functioning. |

| | • | The eventual stabilization of the banking system and the improved liquidity of the capital markets, which provided the much needed credit market, a source of funding without government guarantees. |

The events of September and October of 2008 will remain some of the most memorable for generations to come. During a span of time of less than two weeks, our financial markets had to deal with the de-facto nationalization of Fannie Mae and Freddie Mac, the failure of Lehman Brothers, the acquisition of Merrill Lynch by Bank of America on the same weekend that Lehman filed for bankruptcy, and an emergency line of credit ($85 billion) extended to American Insurance Group (AIG) in an effort to prevent more failures within the banking system.

Another contributing factor to the disruption of the credit and cash markets was the closing of the oldest Money Market fund; the Prime Reserve Money Market fund after its Net Asset Value fell below $1.00. This event led to the largest ever withdrawal of capital from the once thought safest and most liquid investments – Money Markets (the unintended event of the Lehman Brothers failure). This is an example of the “systemic” risks present in our capital markets. As a result of these events and the continued lack of confidence and trust within our financial markets, the extension of credit between banks, companies, municipalities, and consumers, … etc, had come to a virtual standstill.

In October 2008 the Federal Reserve lowered the Federal funds rate by a full percentage point from 2% to 1% in two incremental monetary policy actions (one emergency action in conjunction with the banks of Canada, England, the European Central Bank, Sweden, and the Swiss National Bank and the other at their scheduled meeting on October). The Fund’s performance in the 1st quarter was positive in spite of the crisis at hand. The Fund outperformed the benchmark index primarily due to being underweight in the financial sector of the corporate bond market. Performance was also positively influenced by the fund’s positions in government agency guaranteed Mortgage-backed securities (“MBS”).

MONTEAGLE FIXED INCOME FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued)

By the end of December the Federal Reserve had lowered the Fed funds rate by another 0.75% and virtually maintained a target rate of 0 to 0.25% to continue injecting liquidity into the banking system. In the 2nd quarter, with short-term rates at close to zero, most bonds appreciated in value and the Fund’s performance was strong and outperformed the benchmark index once again. The Fund’s relative outperformance was partly attributable to slightly increasing the portfolio’s allocation to corporate bonds (that benefitted from a more stable environment for corporate credit) as well as agency guaranteed MBS, to provide both superior yield and credit quality in an increasingly challenging environment.

After two quarters of outperformance, the second half of the year was characterized by the “reawakening” of credit issuance and the increased demand for higher yielding corporate bonds of lesser investment grade quality. For the six months ending 8/31/2009 the benchmark index returns for the lowest quality investment grade bonds (BBB/Baa) were 18.05%1; almost 5% more than the next highest credit sector rated single A. The Fund’s higher quality portfolio was negatively affected by not having any significant exposure to the lowest investment grade category of intermediate bonds.

What is the Fund’s Strategy?

The Fund will continue to invest in high quality intermediate term fixed income securities generally between 2 and 10 years in maturity. The Fund will continue to monitor economic conditions through the use of a proprietary model in an attempt to anticipate interest rate changes and lengthen or shorten the duration of the Fund’s portfolio of securities to maximize total return with minimal risk. The Fund will also actively manage portfolio holdings across market sectors in order to maximize total return within the scope of permitted investments defined by the Fund’s prospectus. While we have taken prudent steps to diversify the Fund’s assets by limiting exposure to the credit risk associated with any one specific issuer or market sector, those risks cannot be completely eliminated without affecting long-term fund performance. We remain vigilant and will act in your best interest to preserve the fund’s asset values.

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month-end, are available by calling 1-888-263-5593.

An investor should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other important information. To obtain a copy of the Fund’s prospectus please call 1-888-263-5593 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Fund is distributed by Matrix Capital Group, LLC.

The Discussion of Fund Performance seeks to describe some of the Sub-Adviser’s current opinions and views of the financial markets. Although the Sub-Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed.

| 1 | Barclay’s Capital – U.S. Credit Index Group (U.S. Intermediate credit - Baa) total return from 2/27/2009 to 8/31/2009 |

MONTEAGLE FIXED INCOME FUND

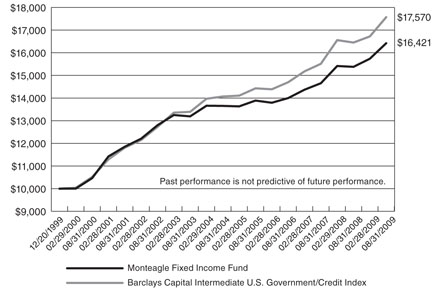

PERFORMANCE — August 31, 2009 (Unaudited)

Comparison of the Change in Value of a $10,000 Investment in Monteagle Fixed Income and the Barclays Capital Intermediate U.S. Government/Credit Index

Average Annual Total Returns (for periods ended August 31, 2009) |

| | | | |

| | | | |

| Monteagle Fixed Income Fund | 6.80% | 3.76% | 5.25% |

| Barclays Capital Intermediate U.S. Government/Credit Index | 6.81% | 4.54% | 5.98% |

| | | | |

| (a) | Represents the period from the commencement of operations (December 20, 1999) through August 31, 2009. |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost.

The above graph depicts the performance of the Monteagle Fixed Income Fund versus the Barclays Capital Intermediate U.S. Government/Credit Bond Index (formerly Lehman Brothers U.S. Intermediate Government/Credit Index). The Barclays Capital Intermediate U.S. Government/Credit Bond Index measures the performance of dollar denominated U.S. Treasuries, government-related (i.e. U.S. and foreign agencies, sovereign, supranational and local authority debt), and investment grade credit structures that have a remaining maturity of greater than or equal to one year and less than ten years. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track, and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the Barclays Capital Intermediate U.S. Government/Credit Bond Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the index; so too with the Monteagle Fixed Income Fund, which will not invest in certain securities comprising this index.

MONTEAGLE QUALITY GROWTH FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited)

How did the Fund perform?

For the twelve months ended August 31, 2009, the Fund reported a total return of -18.92 percent. The S&P 500 Index and the Russell 1000 Growth Index, the Fund’s two benchmarks, had total returns of -18.25 percent and -16.76 percent, respectively, for the same period. The Fund’s net asset value as of August 31, 2009 was $6.85 versus $8.46 as of August 31, 2008.

What is the Fund’s investment approach?

The Fund utilizes a growth style, investing in primarily domestic, high quality companies believed to have above-average sustainable and/or accelerating growth with an ability to exceed earnings expectations over time. The underlying belief is that high quality companies outperform over time with less risk. Various quality rankings and other metrics which demonstrate quality, including earnings consistency, are evaluated carefully before a stock is added to the portfolio. The Fund employs a proprietary screening process and bottom-up work to construct portfolios. However, portfolio constraints are established to ensure sufficient diversification by sector as well as by market capitalization. The underlying belief is that diversification provides for greater control of risk in the portfolio, while allowing freedom in individual stock selection. The screening process is designed to identify stocks with rising expectations, as the Fund looks to invest in securities whose growth potential is generally underestimated by the market. Holdings generally have a market capitalization of at least $2 billion, with about 65% to 75% of the portfolio in stocks of over $15 billion.

Compared to the S & P 500 Index, the portfolio will typically have a lower dividend yield, a higher price/earnings ratio and a higher expected earnings growth rate.

What influenced the Fund’s performance?

Over the course of the twelve months ending August 31, 2009, the equity market experienced a roller coaster ride that saw the period divided into two halves in stark contrast to each other. Negative pressures that had been weighing on equities since the latter half of 2007 intensified in late 2008 and culminated in a market drop of a magnitude not witnessed since the 1930s, during the dark days of the Great Depression. This current drop was triggered by a combination of failures within the U.S. financial system and the continued decline in economic activity, most notably related to employment and manufacturing. During this downturn, the U.S. government, along with governments around the world, acted aggressively to restore confidence in the financial system and to provide stimulus to the ailing economy. As investors gained renewed hope that the worst of the economic downturn was in the rearview mirror, there was a marked rotation back into risky assets. Stocks began a rally that has continued for six consecutive months through the end of August and has seen the S&P 500 advance by nearly 53% since marking a low on March 9, 2009.

Though the Fund held up relatively well compared to the benchmarks during the market downturn, this was unfortunately more than offset by the lag in relative performance during the market’s subsequent upswing. Consistent with past recoveries following major prolonged declines, leadership during the initial advance was decisively in favor of lower quality stocks, particularly those that had been the worst performing stocks during the market’s downturn. This presented a significant headwind given the Fund’s focus on high quality securities. Following the significant,

MONTEAGLE QUALITY GROWTH FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued)

uninterrupted advance over the past several months, we expect more volatility in the market moving forward. This should play favorably for the high quality holdings in the Monteagle Quality Growth Fund, as the stocks of large, high quality companies tend to perform better than the broader market during periods of greater volatility, especially following periods where they have lagged relative to lower quality peers.

Over the course of the fiscal year, portfolio holdings continued to exhibit greater success at meeting or exceeding consensus earnings expectations relative to both the style benchmark and the broad market. Though portfolio holdings that exceeded expectations performed well on an absolute basis, current earnings delivery was not a dominant factor in the broader market and did not benefit portfolio relative performance during the market’s recovery. Given the magnitude of the rebound to date, we are confident that investors will soon turn more discriminating and the market’s focus will return to companies exhibiting strong fundamentals, particularly superior earnings delivery.

During the first six months of the fiscal year just ended, the stock market experienced a dramatic market sell-off triggered by a combination of financial systems crisis and continued deterioration in both economic indicators and corporate earnings outlooks. Most notable among these negative factors was the bankruptcy of Lehman Brothers and the government rescue of insurance giant American International Group. As the credit markets deteriorated and equity markets plunged, governments around the world stepped in aggressively in an effort to restore confidence in the financial systems as well as in an effort to breathe life into the flagging global economy. Despite these efforts, the market as measured by either the S&P 500 or Russell 1000 Growth indices declined nearly 40% for the six months ending February 28, 2009. This was the most dramatic equity market decline in over seventy years. All ten economic sectors experienced significant declines during this six month period. Consumer Staples and Health Care, two traditionally defensive sectors, held up the best while the largest declines were delivered by stocks within the economically sensitive Financials, Energy, and Industrials sectors.

For the six months ending February 28, 2009, the Fund’s portfolio outperformed when compared to both the Russell 1000 Growth and the S&P 500. During this period of economic deceleration, historic market volatility, and heightened investor fear, the high quality bias of the portfolio factored favorably into relative performance. However, relative to our expectations the positive impact was somewhat muted by the rather broad-based nature of the sell-off in equities, as the primary goal of investors appeared to be getting out of stocks completely rather than a more typical rotation from riskier to less-risky stock exposure. Strong earnings delivery relative to expectations from holdings across the portfolio was also a positive factor during this period though again somewhat muted due to the “sink all ships” impact resulting from the mass exodus of investors from the equity markets. Stock selection was a positive factor in seven of the nine economic sectors represented in the portfolio. Relative contribution was particularly favorable in the Energy, Industrials, Consumer Discretionary, Materials, and Consumer Staples sectors. The positive impact of stock selection in these sectors was somewhat offset by the underperformance of holdings within the Financials sector of the portfolio.

During this period, stocks that contributed most positively to relative returns were Burger King (fast food restaurants, down 13%), C R Bard (medical products, down 14%), and Alberto Culver

MONTEAGLE QUALITY GROWTH FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued)

(beauty products, down 15%). Significant detractors from relative performance included financial holdings Bank of America (banking, down 87%), Prologis (industrial real estate, down 85%), and Janus Capital (asset management, down 84%).

The second half of the fiscal year started with a whimper as the stock market traded off meaningfully over the first nine days of March. However, initial hints of economic stabilization then triggered a sharp rebound in stock prices that not only carried throughout the month of March but also continued virtually uninterrupted over the following five month period. This steady advance was fueled not only by “less negative” economic readings but also by a return of confidence in the financial system and the favorable impact of aggressive cost-cutting on the part of corporations. Despite disappointing revenue trends, 1st and 2nd Quarter 2009 earnings reports came in broadly better than the street’s very pessimistic expectations. All told, the S&P 500 and Russell 1000 Growth indices advanced 53% and 48% respectively from the March 9th low to the end of August. Financials, by far the most beaten down sector during the previous six months, led stocks to the upside in the second half of the fiscal year. Information Technology and Industrials were the two next best performing sectors. Telecommunications, Health Care, and Consumer Staples, the defensive sectors that held up best during the downturn, lagged meaningfully during the market’s recovery.

For the six month period ending August 31, 2009, the Fund’s portfolio underperformed both the Russell 1000 Growth and the S&P 500. Historically, the Fund’s philosophy and investment process have not been favorable during periods punctuated by an increased appetite for risk, typically driven by macro factors and without regard to individual company fundamentals. Such an environment typically sees meaningful appreciation in lower quality stocks relative to high quality. During such periods, it has also been the case that positive estimate revision trends have been less likely to be a primary determinant of short term stock performance. This was exactly the case during the second half market rally as low quality stocks significantly outperformed high quality stocks such as those held in the Fund’s portfolio. Additionally, though portfolio holdings continued to exceed analysts’ expectations at a rate much higher than that of the broader market, the superior earnings delivery was not rewarded with superior relative performance. Due to these dynamics, stock selection was the primary factor behind relative underperformance. Though portfolio holdings within the Financials, Energy, and Materials sectors of the portfolio performed very well on a relative basis, this was more than offset by the underperformance of holdings in other sectors of the portfolio, particularly Consumer Discretionary and Health Care.

During this period, stocks that significantly contributed positively to returns were Bank of America (banking, up 350%), Janus Capital (asset management, up 190%), and Freeport McMoran (copper mining, up 107%). Significant negative contributors included Burger King (fast food restaurants, down 23%), GameStop (video game retailer, down 12%), and C R Bard (medical products, up 1%).

MONTEAGLE QUALITY GROWTH FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued)

What is the Fund’s Strategy?

The Fund will continue to focus on maintaining a diversified portfolio of high quality companies delivering sustainable above-market earnings growth as well as companies poised to experience meaningful acceleration in earnings growth relative to expectations. The Fund’s adviser believes the companies that can exceed expectations in the form of positive earnings surprises will be well rewarded over coming quarters.

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month-end, are available by calling 1-888-263-5593.

An investor should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other important information. To obtain a copy of the Fund’s prospectus please call 1-888-263-5593 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Fund is distributed by Matrix Capital Group, LLC.

The Discussion of Fund Performance seeks to describe some of the Sub-Adviser’s current opinions and views of the financial markets. Although the Sub-Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed.

MONTEAGLE QUALITY GROWTH FUND

PERFORMANCE — August 31, 2009 (Unaudited)

Comparison of the Change in Value of a $10,000 Investment in Monteagle Quality Growth Fund, the S&P 500 Index and the Russell 1000 Growth Index

Average Annual Total Returns (for periods ended August 31, 2009) |

| | | | |

| | | | |

| Monteagle Quality Growth Fund | (18.92)% | (0.22)% | (2.07)% |

| S&P 500 Index | (18.25)% | 0.49% | (0.79)% |

| Russell 1000 Growth Index | (16.76)% | 1.21% | (3.17)% |

| | | | |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost.

The above graph depicts the performance of the Monteagle Quality Growth Fund versus the S&P 500 Index and the Russell 1000 Growth Index. The S&P 500 Index by Standard and Poor’s Corp. is a capitalization-weighted index comprising 500 issues listed on various exchanges, representing the performance of the stock market generally. The Russell 1000 Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track, and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the S&P 500 Index and the Russell 1000 Growth Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the indices; so too with the Monteagle Quality Growth Fund, which will not invest in certain securities comprising these indices.

MONTEAGLE LARGE CAP GROWTH FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited)

How did the Fund perform?

For the year ending August 31, 2009, the Fund reported a total return of -27.87%. The S&P 500 index reported a return of -18.25%, and the Russell 1000 Growth index reported a return of -16.76% during the same time frame.

What is the Fund’s investment approach?

The Fund’s investment philosophy is that high quality, growing companies outperform broad market indices over full market cycles. Companies are identified using a strict application of a combined quantitative and qualitative strategy. The quantitative strategy screens the universe of larger capitalization companies (over $5 billion market capitalization) for stable, above market earnings growth, above market return on equity and attractive relative valuation. Companies meeting the quantitative criteria are then further analyzed for the characteristics of high quality companies, including superiority in management, products, distribution, access to markets and business plan implementation. The Fund holds between 25 and 35 securities and holdings are diversified to include no more than 2 times the S&P 500’s weighting for any particular sector. Holdings are generally equally weighted, and are trimmed back when a position size exceeds 6% of the total portfolio.

What influenced the Fund’s performance?

The calendar year that encompassed August 2008 to August 2009 was a story of two entirely different markets. The first part, lasting from September 2008 until late February 2009 was one of the worst periods in stock market history. The period was characterized by a massive deleveraging of all financial assets that in turn led to a selling panic from which no stocks were immune. The S&P 500 fell 41.8% during this six month time span, and the Fund was down 39.4%.

However starting in March the market staged a remarkable rally. Unfortunately the rally has been characterized by strong returns in companies with negative earnings and dismal financial outlooks. A perfect example is government bailout recipient AIG who has lost a record $88.7 billion in the trailing 12 month period, yet has risen an astounding 440% since the beginning of March 2009.

On a year-to-date basis (1/1/09 to 9/15/09) the companies with the worst earnings in the S&P 500 have performed the best from a stock price standpoint, while the companies with the strongest earnings have performed the worst.

This divergence between stock price and earnings performance is displayed in the following chart

| | Net Inc Reported T4Q ($M) | | | |

| Top 100* | $4,003 | 15.3x | 18.3x | 19.0% |

| Next 100 | $795 | 15.1x | 18.9x | 26.2% |

| Next 100 | $356 | 17.6x | 19.6x | 27.3% |

| Next 100 | $122 | 23.1x | 24.2x | 41.5% |

| Bottom 100 | $(3,198) | 26.1x | 22.5x | 59.0% |

MONTEAGLE LARGE CAP GROWTH FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued)

The 100 best companies in the S&P 500 by reported income, with an average income of $4 billion, are up 19% on average year-to-date. The 100 worst companies, with an average net loss of $3.2 billion, have gained nearly 60% year-to-date, or 40% ahead of the companies with the best reported income.

What is the Fund’s Strategy?

The Fund’s primary strategy has always been to focus on quality companies with the best long term growth prospects. This strategy has been successful in outperforming the stock market since our firm’s inception (1992), although there have been periods of underperformance.

Despite the poor relative performance of high quality companies in the past 2 years we continue to believe that their time is near. Simply put, a market that greatly rewards companies that are losing vast sums of money is not a market that has any long term sustainability. For example Ford Motor Company has seen its revenues decline by 33.5% over the previous 4 quarters, and has posted a loss of $5.3 billion over the same period. Yet in the recent rally Ford stock has gained 273% (since March 1st). On the other hand, a high quality firm like the biotechnology company Gilead (maker of antiviral drugs) has grown its revenues 27.5% on a reported income of $2.2 billion over the past 4 quarters, but during the recent rally the company’s stock is essentially flat. While we own Gilead, we would never own a company with a profitability profile as dismal as Ford’s, and we believe that the divergence in performance cannot persist.

While we are disappointed by the relative underperformance of quality stocks, we are not entirely discouraged. In the past, similar periods of strong performance by lower quality stocks have signaled the beginning of a new bull market. In the most recent example of 2003, our investment style lagged the S&P 500 and Russell Growth by more than 10% for that calendar year, not unlike this year. However as the rally matured our style outperformed the indices strongly in 2004 and 2005, outperforming the Russell Growth by a cumulative 17% those years, and the S&P 500 by 13%.

Another reason we believe the best times for quality companies lies ahead is current valuations. As can be seen in Chart 1 above, companies with the best net incomes are among the most reasonably priced at 15.3 times earnings, while the companies with the worst net income are highly priced at 26.1 times earnings. Moreover, when compared to their ten-year P/E averages, the high quality companies look relatively cheap, while the companies with net income losses look historically pricey. As stated before, we don’t think this can persist.

As always we will continue focus on investing in high quality companies with solid revenues and above market earnings growth. We are confident that, given the strong business positions of these companies and compelling historical valuations, strong stock price performance will follow.

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month-end, are available by calling 1-888-263-5593.

MONTEAGLE LARGE CAP GROWTH FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued)

An investor should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other important information. To obtain a copy of the Fund’s prospectus please call 1-888-263-5593 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Fund is distributed by Matrix Capital Group, LLC.

The Discussion of Fund Performance seeks to describe some of the Sub-Adviser’s current opinions and views of the financial markets. Although the Sub-Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed.

MONTEAGLE LARGE CAP GROWTH FUND

PERFORMANCE — August 31, 2009 (Unaudited)

Comparison of the Change in Value of a $10,000 Investment in Monteagle Large Cap Growth Fund and the S&P 500 Index

Average Annual Total Returns (for periods ended August 31, 2009) |

| | | | |

| | | | |

| Monteagle Large Cap Growth Fund | (27.87)% | (3.56)% | (7.89)% |

| S&P 500 Index | (18.25)% | 0.49% | (1.87)% |

| | | | |

| (a) | Represents the period from the commencement of operations (January 18, 2000) through August 31, 2009. |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost.

The above graph depicts the performance of the Monteagle Large Cap Growth Fund versus the S&P 500 Index. The S&P 500 Index by Standard and Poor’s Corp. is a capitalization-weighted index comprising 500 issues listed on various exchanges, representing the performance of the stock market generally. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track, and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the S&P 500 Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the index; so too with the Monteagle Large Cap Growth Fund, which will not invest in certain securities comprising this index.

MONTEAGLE SELECT VALUE FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited)

How did the Fund perform?

For the year ended August 31, 2009, the Monteagle Select Value Fund (“the Fund”) had a total return of -27.76%. The S&P 500 Index (“Index”) had a total return of -18.25% for the same period. The Fund’s net asset value per share as of August 31, 2009 is $8.30 versus $11.63 at August 31, 2008.

What is the Fund’s investment approach?

The Fund’s investment goal is long-term capital appreciation. The Fund uses a “value investing” style by investing under normal circumstances at least 80 percent of its assets in common stock of domestic companies believed to be under-priced relative to comparable securities determined by price-to-earnings ratios, cash flows or other measures. The Fund’s adviser predominately utilizes a reversion-to-the-mean strategy on stock selection in order to achieve its results rather than trying to time market fluctuations. The adviser limits the pool of stocks to consider for purchase to only those equities in the S&P 500 Index. In selecting stocks, the Fund’s adviser establishes valuation parameters by using relative ratios or target prices to evaluate companies on several levels. Additionally, the adviser will generally have the Fund hold between 40 and 60 equities and diversify its holdings across numerous industries, generally limiting issues in any one industry to five securities or unless more securities are needed for limiting specific dollar amounts per security or to over-weight a particular sector. The Fund seeks to maintain a minimum average weighted market capitalization of $5 billion.

Value stocks are broadly defined as equities which have a price-to-earnings ratio and a price-to-book ratio less than the relative market average with dividends tending to be higher than the relative market average. Also, value stocks tend to have a beta (a measure of the stocks price volatility relative to the overall market, i.e. the S&P 500) less than 1.0.

What influenced the Fund’s performance?

During the twelve months ended August 31, 2009, the Fund’s performance was affected by a global economic decline. The fear of an economic recession in the United States weighed on the markets as various domestic issues remained. The issues affecting the markets throughout the year are the domestic housing market decline, the uncertain stabilization of the financial markets, the lack of credit available for businesses and consumers and most significantly the continued increase in unemployment. During the period, the equity markets reached market lows that have not been seen for over twelve years basically removing a decades worth of growth from the markets. The Dow Jones Industrial Average began the year at its high point of 11,543.55 on August 29, 2008 declining to its low point of 6,547.05 on March 9, 2009 and recovering to the 9,496.20 level at August 31, 2009. The S&P 500 began the year at its high point of 1,282.83 on August 29, 2008 declining to its low point of 676.53 on March 9, 2009 and recovering to the 1020.62 level at August 31, 2009. During this period the Federal Open Markets Committee of the Federal Reserve continued lowering the Fed Funds rate to protect against a slowing economy and to generate liquidity for financial institutions dropping the target rate from 2.0% to 0.25%. These factors contributed to a market environment that proved difficult for the Fund given its focus of a “value style, reversion-to-the-mean” strategy which typically thrives in a growing economic

MONTEAGLE SELECT VALUE FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued)

environment. The Fund compares its performance to the S&P 500 Index. The Fund is affected by its asset allocation weighting to the ten sectors of the Index.

For the quarter ended November 30, 2008, the Monteagle Select Value Fund (“Fund”) under-performed the S&P 500 Index (“Index”). The Fund experienced a -35.74% return versus a -29.64% return for the Index. The Fund continued to be heavily invested in equities which represent 86.1% of the assets with cash and money funds representing 13.9% of the assets. The large cash/money fund position was maintained as a type of defensive positions in expectation of further market declines, anticipated dividend distributions and the potential for liquidations by investors.

Many serious economic issues remained within the markets and economy. The financial sector continued to face significant challenges within the credit markets and the effects were beginning to spill over into the other sectors of the economy. The economic sectors of the S&P 500 that declined the most during the quarter were the Financial (-37.22%), Material (-30.91%), Information Technology (-27.21%), Consumer Discretion (-27.17%) and the Industrial (-25.09%) sectors. The Fund’s performance was negatively impacted by its holdings in these sectors during this quarter. The major indices were expected to remain volatile for the balance of 2008 and into 2009 as expectations of continued write-down of assets take place in the financial sector. Negative pressure on corporate earnings will increase as the individual consumer becomes more defensive in their spending habits. These challenges generated opportunities to average-into the holdings of the Fund under the Fund’s investment strategy.

As of the end of the quarter, the portfolio holdings were invested in all sectors of the Index except the Utility sector, with the largest allocations in the Information Technology (16.4%), Consumer Discretionary (15.8%), Cash and Money Markets (13.9%) and the Industrial (11.7%) sectors. The Fund’s portfolio performance was least negatively affected by stock picks in the Material sector (Bemis Co. down 3.09%), the Telecommunication sector (AT&T Corporation down 8.68%) and the Health Care sector (Schering-Plough down 13.35%). The Fund’s portfolio performance was most negatively affected by its stock picks in the Energy sector (Ashland Inc. down 74.89%), the Telecommunication sector (Sprint Nextel down 68.00%) and the Financial sector (CIT Group Inc. down 67.60%). During the quarter, five of the portfolio holdings were sold and a portion of the proceeds were reinvested in three new positions and eighteen existing securities. Additionally, as mentioned above, a short-term fixed income agency discount note matured during the quarter. The Fund continued to be allocated across all sectors of the Index, with the exception of the Utility sector. The Fund remained overweight in the Information Technology, Consumer Discretionary, Material, Energy and Industrial sectors as compared to the Index.

For the quarter ended February 28, 2009, the Monteagle Select Value Fund (“Fund”) out-performed the S&P 500 Index (“Index”). The Fund experienced a -16.55% return versus a -17.28% return for the Index. The Fund continued to be heavily invested in equities which represent 83.0% of the assets with cash and money funds representing 17.0% of the assets. The primary contributing factor increasing the percentage of cash and cash equivalents was the continued decline in the market value of the equity positions in the portfolio. Hence, in anticipation of further market declines, dividend distributions and potential liquidations by investors, a large cash/money fund position was maintained.

MONTEAGLE SELECT VALUE FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued)

Many serious economic issues remained within the markets and economy. The financial sector continued to face significant challenges within the credit markets and the US Government involvement. The negative economic outlook concerns spilled over into the other sectors of the economy. The economic sectors of the S&P 500 that declined the most during the quarter were the Financial (-39.78%), Industrial (-26.84%), Energy (-18.20%) and Materials (-15.33%) sectors. The Fund’s performance was negatively impacted by its holdings in these sectors during this quarter. The major indices were expected to remain volatile throughout 2009 as expectations of continued write-downs of assets take place in the financial sector takes place. Quarterly earnings reports by companies were expected to be indicative of a recession and generate negative pressure on corporate equity prices in the stock market. These challenges continued to generate opportunities to average-into the holdings of the Fund under the Fund’s investment strategy.

As of the end of the quarter, the portfolio holdings were invested in all sectors of the Index except the Utility sector, with the largest allocations in Information Technology (18.0%), the Cash and Money Markets (17.0%), Consumer Discretionary (15.5%), and the Health Care (11.7%) sectors. The Fund’s negative portfolio performance was reduced by its stock picks in the Financial sector (Morgan Stanley up 32.47%), the Consumer Direction sector (Kohl’s Corp up 7.59%), the Telecommunications sector (Sprint Nextel up 17.92%), and the Consumer Staples sector (Whole Food Markets up 14.84%). The Fund’s portfolio performance was most negatively affected by its stock picks in the Financial sector (Bank of America down 75.69%), the Consumer Discretionary sector (Newell Rubbermaid down 56.82%), the Materials sector (Dow Chemical down 61.40%), and the Industrial sector (General Electric. down 50.44%). During the quarter, none of the portfolio holdings were sold nor were there any new purchases. The Fund continued to be allocated across all sectors of the Index, with the exception of the Utility sector.

For the third quarter ended May 31, 2009, the Monteagle Select Value Fund (“Fund”) under-performed the S&P 500 Index (“Index”). The Fund experienced a 22.55% return versus a 25.80% return for the Index. The Fund continued to be heavily invested in equities which represent 93.9% of the assets with cash and money funds representing 6.1% of the assets. The primary contributing factor for the decrease in the percentage of cash and cash equivalents was the investment in new equity positions in the portfolio at five different times during the quarter in anticipation of the beginning of a market recovery during the second half of 2009.

Continued fear and concern of a recession remain within the markets and economy. The financial sector continued to face significant challenges within the credit markets and the US Government involvement. The negative economic outlook concerns were continuing to weigh heavily on all sectors of the economy as the markets seem to be waiting for improving signs in housing starts and improvements in employment. Inflation fears were beginning to rise due to the economic stimulus added by the Fed and Treasury. Even though these concerns were evident, the markets improved during the quarter as valuations of companies were deemed very low and offered good opportunity for stock picking. The economic sectors of the S&P 500 that improved the most during the quarter were the Financial (38.17%), Material (21.48%), Industrial (20.85%) and Consumer Discretion (17.28%) sectors. The Fund’s performance was positively impacted by its holdings in these sectors during this quarter. The major indices were expected to remain volatile throughout

MONTEAGLE SELECT VALUE FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued)

2009 as expectations of inflation and lower corporate earnings appear. The quarterly earnings reports by companies were expected to be indicative of a recession and generate negative pressure on corporate equity prices in the stock market. Again, these challenges generated opportunities to continue averaging-into the holdings of the Fund under the Fund’s investment strategy.

As of the end of the quarter, the portfolio holdings were invested in all sectors of the Index, with the largest allocations in Energy (19.4%), Information Technology (14.5%), Health Care (14.0%), and the Consumer Discretion (11.0%) sectors. The Fund’s positive portfolio performance was assisted by its stock picks in the Financial sector (CME Group up 76.3% and Morgan Stanley up 57.0%), the Consumer Direction sector (Starbucks Corp. up 57.3%), and the Consumer Staples sector (Whole Food Markets up 55.3%). The Fund’s portfolio performance was most negatively affected by its stock picks in the Financial sector (Bank of America down 18.7%) and the Materials sector (Alcoa Inc. down 11.4% and Allegheny Technology down 5.8%). During the quarter, many of the portfolio holdings were sold and many new equities were purchased to realign the portfolio in anticipation of a market recovery. The Fund continued to be allocated across all sectors of the Index.

For the fourth quarter ended August 31, 2009, the Monteagle Select Value Fund (“Fund”) under-performed the S&P 500 Index (“Index”) even though achieving a positive return. The Fund experienced a 9.93% return versus an 11.65% return for the Index. The portfolio continued to be heavily invested in equities which represent 95.2% of the assets with cash, money funds and accrued income representing 4.8% of the assets.

Uncertainty remained within the markets and economy as the financial crisis improved as the specter of inflation became ever more mindful. The financial sector continued with its challenges in the credit markets dealing with the US Government involvement through the Toxic Asset Relief Program (TARP) and the expectation of an unwinding of the government’s involvement of support. The economic outlook concerns were beginning to show signs of easing but the outlook continued to weigh on all sectors of the economy. The markets continued to wait for improved signs in housing starts and improvements in employment. Inflation became the focus of the markets as the monetary system seeks to deal with the huge amounts of economic stimulus added by the Fed and Treasury. Even though these concerns were evident, the equity markets continued their improvement during the quarter as reports of company earnings were showing signs of general improvement; however, top-line revenue growth will be the focus in coming quarters. Positive signs of revenue growth will be a positive barometer for signaling an economic recovery. The economic sectors of the S&P 500 that improved the most during the quarter were the Financials (up over 19%), Information Technology (up over 15%) and Consumer Discretionary (up over 13%) sectors. The Fund’s performance was positively impacted by its holdings in these sectors during this quarter; however, the Fund’s performance was negatively impacted by an overweight position in the Energy sector which performed basically flat during the period. The major indices are expected to remain volatile throughout 2009 as concern over unemployment continues and the expectation of inflation remains. These challenges generated opportunities for continued averaging-into the holdings of the Fund under the Fund’s investment strategy.

MONTEAGLE SELECT VALUE FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued)

As of the end of the quarter, the portfolio holdings continued to be invested in all sectors of the Index, with the largest allocations in Energy (20.9%), Industrials (14.9%), Health Care (13.2%), and Materials (10.9%) sectors. The Fund’s positive portfolio performance was assisted by its stock picks in the Financial sector (Bank of America up 40.6%), the Consumer Staples sector (Whole Food Markets up 37.9%), the Information Technology sector (Cognizant Technology up 28.9%) and the Materials sector (Ashland Inc. up 28.7%). The Fund’s portfolio performance was most negatively affected by certain stock picks in the Energy sector (Hess Corporation down 20.1%, Tesoro Petroleum down 12.2% and Baker Hughes down 11.9%) and the Information Technology sector (MEMC Electronic down 14.5%). During the quarter, several of the portfolio holdings were reduced decreasing exposure to the Information Technology and Consumer Discretionary sectors while increasing exposure to the Industrials sector to realign the portfolio in anticipation of a market recovery. Also, investment was made in the majority of the holdings to dollar-cost-average into existing positions. The Fund continues to be allocated across all sectors of the Index.

What is the Fund’s strategy?

The Fund will continue to concentrate on equities contained in the S&P 500 Index which generally consist of large name brand corporations with good fundamentals and broad product diversification. The Fund’s adviser will continue to be disciplined in the use of its predominate strategy of reversion-to-the-mean by applying its “value investing” approach valuation model; thereby, allowing the market’s volatility to identify those securities that become under-valued and are poised to be the next performers in the market. Sector allocation in the Fund’s portfolio will primarily be determined by which companies are available for purchase under the reversion-to-the-mean selection criteria. It is anticipated that the Fund may hold higher levels of cash during extended periods of market uncertainty and will selectively invest the cash into equities identified by the primary investment strategy as opportunities present themselves or for dollar-cost-averaging into currently held positions. This strategy is executed with a long-term outlook and will have periods of under-performance and out-performance versus its Index. Therefore, the Fund’s daily performance can and will vary dependant upon current market conditions.

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month-end, are available by calling 1-888-263-5593.

An investor should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other important information. To obtain a copy of the Fund’s prospectus please call 1-888-263-5593 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Fund is distributed by Matrix Capital Group, LLC.

The Discussion of Fund Performance seeks to describe some of the Sub-Adviser’s current opinions and views of the financial markets. Although the Sub-Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed.

MONTEAGLE SELECT VALUE FUND

PERFORMANCE — August 31, 2009 (Unaudited)

Comparison of the Change in Value of a $10,000 Investment in Monteagle Select Value Fund and the S&P 500 Index

Average Annual Total Returns (for periods ended August 31, 2009) |

| | | | |

| | | | |

| Monteagle Select Value Fund | (27.76)% | (3.43)% | 1.90% |

| S&P 500 Index | (18.25)% | 0.49% | (0.79)% |

| | | | |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost.

The above graph depicts the performance of the Monteagle Select Value Fund versus the S&P 500 Index. The S&P 500 Index by Standard and Poor’s Corp. is a capitalization-weighted index comprising 500 issues listed on various exchanges, representing the performance of the stock market generally. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track, and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the S&P 500 Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the index; so too with the Monteagle Select Value Fund, which will not invest in certain securities comprising this index.

MONTEAGLE VALUE FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited)

How did the Fund Perform?

For the year ended August 31, 2009, the Fund reported a total return of -25.19%. The S&P 500 Index and the Russell 2000 Value Index had returns of – 18.25% and -20.68%, respectively, for the same time period. The Fund’s net asset value per share as of August 31, 2009 was $12.34 versus $16.67 at August 31, 2008.

What is the Fund’s investment approach?

The Fund’s investment goal is to achieve long term growth of capital through investing in undervalued companies. The Fund determines value usually based on price-to-earnings ratios, but also reviews historical price to book value ratios, dividend yield and balance sheet quality in determining whether prospective investments are truly undervalued. The Fund’s advisor also makes industry determinations based on interest rate cycles. The Fund typically holds 30 to 40 equities. The Fund seeks to maintain a minimum average market capitalization of $5 billion. The current average market capitalization exceeds $39 billion. The current price to earnings ratio is 12.6 times 2010 earnings and currently yields 2.2 percent. The S&P 500 currently trades at 14.9 times 2010 earnings and yields 2.5%.

What influenced the Fund’s performance?

During the year ending August 31, 2009, the Fund underperformed the market due to falling commodity prices as a result of deflationary pressures brought upon the economy from weakness in housing prices and the related financial crisis caused by the failure of five large financial companies. Emergency measures by the U.S. Federal Reserve and the U.S. Treasury Department providing significant monetary growth and government stimulus funding has stemmed the deflationary forces caused by the worst housing recession the U.S. has ever experienced. Recessionary forces have affected all asset classes including energy and other raw materials. The quick response by the world central bankers has for the time being resulted in a significant market rebound since the March 9, 2009 lows.

Commercial lending has resumed as a result of these measures and normal interest rate relationships have been resumed. The U.S. housing market and labor markets remain very weak but recent data suggest the declines have lessened and that stabilization is being forecasted over the next twelve to eighteen months. Short-term interest rates remain low and Fed policy statements suggest interest rates to remain low for the next six months.

Subsequently, the stock market has rebounded well over 50% since March 9, 2009. History suggests the market is due for a respite and that investors who have record levels of cash on the sidelines are waiting for a correction before investing. Patient investors who chose to ride the financial storm out have been rewarded.

With significantly low short-term interest rates, the Fund remains in the economically sensitive issues. Prior to the market’s sell-off over the past twelve months, many of the Fund’s holdings had been repurchasing shares or reducing debt. More recently some of the Fund’s holdings have been active in issuing long term financing taking advantage of the lower interest rates.

MONTEAGLE VALUE FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued)

What is the Fund’s current strategy?

The Fund continues to have significant exposure to the energy sector and has avoided many of the companies that obtained financing through the Government TARP plan. Under more normal economic conditions the Fund believes the long-term prospects for its holdings should benefit as the overall economy improves. The Fund believes the current monetary and fiscal policy should continue to weaken all major currencies and that inflationary forces will be predominant for the overall market. Interest rates will ultimately rise as a result.

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month-end, are available by calling 1-888-263-5593.

An investor should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other important information. To obtain a copy of the Fund’s prospectus please call 1-888-263-5593 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Fund is distributed by Matrix Capital Group, LLC.

The Discussion of Fund Performance seeks to describe some of the Sub-Adviser’s current opinions and views of the financial markets. Although the Sub-Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed.

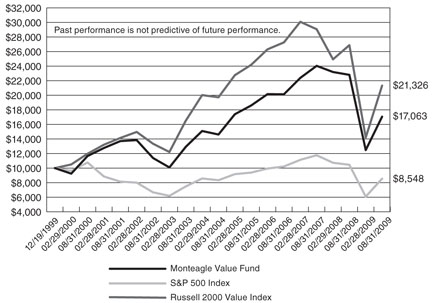

MONTEAGLE VALUE FUND

PERFORMANCE — August 31, 2009 (Unaudited)

Comparison of the Change in Value of a $10,000 Investment in Monteagle Value Fund, the S&P 500 Index and the Russell 2000 Value Index

Average Annual Total Returns (for periods ended August 31, 2009) |

| | | | |

| | | | |

| Monteagle Value Fund | (25.19)% | 3.15% | 5.66% |

| S&P 500 Index | (18.25)% | 0.49% | (1.60)% |

| Russell 2000 Value Index | (20.68)% | 1.57% | 8.12% |

| | | | |

| (a) | Represents the period from the commencement of operations (December 19, 1999) through August 31, 2009. |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost.

The above graph depicts the performance of the Monteagle Value Fund versus the S&P 500 Index and the Russell 2000 Value Index. The S&P 500 Index by Standard and Poor’s Corp. is a capitalization-weighted index comprising 500 issues listed on various exchanges, representing the performance of the stock market generally. The Russell 2000 Value Index measures the performance of small-cap value segment of the U.S. equity universe. It includes those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track, and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the S&P 500 Index and the Russell 2000 Value Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the indices; so too with the Monteagle Value Fund, which will not invest in certain securities comprising these indices.

MONTEAGLE INFORMED INVESTOR GROWTH FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited)

How did the Fund perform?

For the twelve months ending August 31, 2009, the Fund reported a total return of +46.15% vs. -18.25% for the S&P 500 with dividends and -16.76% for the Russell 1000 Growth Index. Since inception from April 3, 2008 to August 31, 2009, the Fund had an annualized total return of +19.75% vs. -16.72% for the S&P 500 with dividends and - -13.77% for the Russell 1000 Growth Index.

What is the Fund’s Investment Approach?

The Fund’s primary investment approach is best characterized as growth equity-based, in which senior corporate management, or large outside investors are significant common stock owners or buyers, and/or, where the company itself is repurchasing its own shares on the open market. The Fund’s goal is to invest in these common stocks with demonstrated informed investor interest and ownership, as well as, solid earnings fundamentals. The Fund’s investment strategy begins with a careful detailed identification of Informed Investor ownership or buying interest. No stock is considered for research analysis unless it first meets this inviolable first-screen requirement. Stocks that do qualify are then analyzed for the quality and magnitude of past earnings growth, and more importantly, for the projected future stability of that past growth rate. Finally, the Fund’s strategy is to minimize losses within the broader framework of this basic philosophy.

What influenced the Fund’s performance?

In an effort to moderate the Fund’s volatility during the market turbulence of this past year, cash was used as a strategic asset. It had been determined, over the course of this year, that only a limited number of companies met the Informed Investors criteria for investment purposes. This, coupled with chaotic market conditions and a rapid decline in major indexes, led to a decision to utilize a portion of the Fund’s assets in ETFs (Exchange-Traded Funds) for an extended period of time. It was this asset allocation decision that enhanced the Fund’s performance during this past year ending August 31, 2009.

What is the Fund’s Strategy?

As of August 31, 2009, the portfolio manager sees some stability returning to the market and some companies to meet the investment criteria described above. In light of some uncertainty in the marketplace, the portfolio manager continues to utilize cash and ETFs to protect the Fund. The number of equity securities in the portfolio is expected to increase over time.

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month-end, are available by calling 1-888-263-5593.

An investor should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other important information. To obtain a copy of the Fund’s prospectus please call 1-888-263-5593 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Fund is distributed by Matrix Capital Group, LLC.

MONTEAGLE INFORMED INVESTOR GROWTH FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued)

The Discussion of Fund Performance seeks to describe some of the Sub-Adviser’s current opinions and views of the financial markets. Although the Sub-Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed.

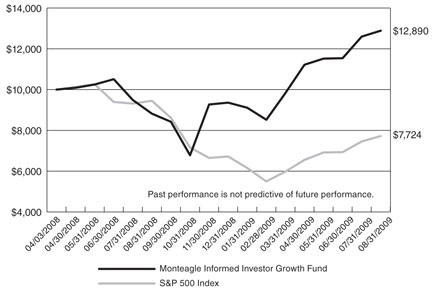

MONTEAGLE INFORMED INVESTOR GROWTH FUND

PERFORMANCE — August 31, 2009 (Unaudited)

Comparison of the Change in Value of a $10,000 Investment in Monteagle Informed Investor Growth Fund and the S&P 500 Index

Average Annual Total Returns (for periods ended August 31, 2009) |

| | | |

| Monteagle Informed Investor Growth Fund | 46.15% | 19.75% |

| S&P 500 Index | (18.25)% | (16.72)% |

| | | |

| (a) | Represents the period from the commencement of operations (April 3, 2008) through August 31, 2009. |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost.

The above graph depicts the performance of the Monteagle Informed Investor Growth Fund versus the S&P 500 Index. The S&P 500 Index by Standard and Poor’s Corp. is a capitalization-weighted index comprising 500 issues listed on various exchanges, representing the performance of the stock market generally. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track, and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the S&P 500 Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the index; so too with the Monteagle Informed Investor Growth Fund, which will not invest in certain securities comprising this index.

MONTEAGLE FIXED INCOME FUND

SUPPLEMENTARY PORTFOLIO INFORMATION — August 31, 2009 (Unaudited)

FUND PROFILE:

| Top Ten Long-Term Portfolio Holdings | (% of Net Assets) |

| FNMA, Pool 386008, 4.52%, due 04/01/2013 | 3.59% |

| GNMA, Series 2003-81 PB, 6.00%, due 03/20/2029 | 3.22% |

| U.S. Treasury Note, 3.625%, due 08/15/2019 | 3.17% |

| FHLMC, Series 3290 PD, 5.50%, due 03/15/2035 | 2.48% |

| U.S. Treasury Note, 3.75%, due 11/15/2018 | 2.40% |

| FHLMC, Series 2841 BY, 5.00%, due 08/15/2019 | 2.06% |

| Johnson & Johnson, 5.15%, due 07/15/2018 | 2.03% |

| General Dynamics Corp., 5.25%, due 02/01/2014 | 1.95% |

| FNMA, 5.55%, due 02/16/2017 | 1.90% |

| Estee Lauder Cos., 7.75%, due 11/01/13 | 1.76% |

| Sector Allocation | (% of Net Assets) |

| Corporate Bonds | 42.02% |

| U.S. Government and Agency Obligations | 30.30% |

| Mortgage-Backed Securities | 23.57% |

| Money Market Funds | 2.51% |

| Municipal Obligations | 0.72% |

| Other Assets in Excess of Liabilities | |

| | |

MONTEAGLE QUALITY GROWTH FUND

SUPPLEMENTARY PORTFOLIO INFORMATION — August 31, 2009 (Unaudited)

FUND PROFILE:

| Top Ten Long-Term Portfolio Holdings | (% of Net Assets) |

| Microsoft Corp. | 3.81% |

| International Business Machines Corp. | 3.07% |

| Wal-Mart Stores, Inc. | 2.72% |

| Apple, Inc. | 2.70% |

| Danaher Corp. | 2.53% |

| Cisco Systems, Inc. | 2.48% |

| QUALCOMM, Inc. | 2.47% |

| Hewlett-Packard Co. | 2.18% |

| Apache Corp. | 2.16% |

| CR Bard, Inc. | 2.12% |

| Top Ten Portfolio Industries | (% of Net Assets) |

| Computers | 9.47% |

| Retail | 8.30% |

| Software | 7.17% |

| Healthcare - Products | 7.07% |

| Telecommunications | 6.58% |

| Cosmetics & Personal Care | 4.02% |

| Miscellaneous Manufacturing | 4.01% |

| Pharmaceuticals | 3.99% |

| Oil & Gas | 3.88% |

| Diversified Financial Services | |

| | |

| Economic Sectors with Cash and Other Assets | (% of Net Assets) |

| Consumer, Non-cyclical | 27.06% |

| Technology | 19.84% |

| Industrials | 12.72% |

| Communications | 11.64% |

| Consumer, Cyclical | 9.40% |

| Financials | 6.30% |

| Energy | 6.13% |

| Basic Materials | 3.76% |

| Money Market Funds | 2.61% |

| Other Assets in Excess of Liabilities | |

| | |

MONTEAGLE LARGE CAP GROWTH FUND

SUPPLEMENTARY PORTFOLIO INFORMATION — August 31, 2009 (Unaudited)

FUND PROFILE:

| Top Ten Long-Term Portfolio Holdings | (% of Net Assets) |

| Apple, Inc. | 5.29% |

| Cognizant Technology Solutions Corp. | 4.35% |

| Google, Inc. | 4.29% |

| Oracle Corp. | 4.21% |

| Fluor Corp. | 4.17% |

| Visa, Inc. Class A | 4.11% |

| Gilead Sciences, Inc. | 3.99% |

| International Business Machines Corp. | 3.94% |

| Wal-Mart Stores, Inc. | 3.62% |

| Hewlett-Packard Co. | 3.51% |

| Top Ten Portfolio Industries | (% of Net Assets) |

| Computers | 17.09% |

| Retail | 9.67% |

| Internet | 9.22% |

| Banks | 7.42% |

| Biotechnology | 7.36% |

| Software | 7.14% |

| Pharmaceuticals | 6.95% |

| Engineering & Construction | 5.97% |

| Oil & Gas | 5.96% |

| Chemicals | |

| | |

| Economic Sectors with Cash and Other Assets | (% of Net Assets) |

| Technology | 24.24% |

| Consumer, Non-cyclical | 18.42% |

| Consumer, Cyclical | 12.65% |

| Financials | 12.63% |

| Industrials | 9.45% |

| Communications | 9.22% |

| Energy | 7.13% |

| Basic Materials | 4.37% |

| Other Assets in Excess of Liabilities | |

| | |

MONTEAGLE SELECT VALUE FUND

SUPPLEMENTARY PORTFOLIO INFORMATION — August 31, 2009 (Unaudited)

FUND PROFILE:

| Top Ten Long-Term Portfolio Holdings | (% of Net Assets) |

| Applied Materials, Inc. | 3.56% |

| Target Corp. | 3.46% |

| WellPoint, Inc. | 3.19% |

| UnitedHealth Group, Inc. | 2.75% |

| Pfizer, Inc. | 2.71% |

| PACCAR, Inc. | 2.59% |

| Transocean Ltd. | 2.20% |

| Morgan Stanley | 2.06% |

| United States Steel Corp. | 1.58% |

| Bank of America Corp. | 1.57% |

| Top Ten Portfolio Industries | (% of Net Assets) |

| Oil & Gas | 13.26% |

| Semiconductors | 7.22% |

| Banks | 6.35% |

| Retail | 6.07% |

| Healthcare - Services | 5.94% |

| Pharmaceuticals | 5.44% |

| Oil & Gas - Services | 4.96% |

| Mining | 4.06% |

| Chemicals | 3.06% |

| Diversified Financial Services | |

| | |

| Economic Sectors with Cash and Other Assets | (% of Net Assets) |

| Energy | 19.40% |

| Consumer, Non-cyclical | 15.96% |

| Industrials | 14.99% |

| Financials | 11.98% |

| Consumer, Cyclical | 10.12% |

| Basic Materials | 9.76% |

| Technology | 8.77% |

| Money Market Funds | 4.76% |

| Communications | 2.82% |

| Utilities | 1.36% |

| Other Assets in Excess of Liabilities | |

| | |

MONTEAGLE VALUE FUND

SUPPLEMENTARY PORTFOLIO INFORMATION — August 31, 2009 (Unaudited)

FUND PROFILE:

| Top Ten Long-Term Portfolio Holdings | (% of Net Assets) |

| Tidewater, Inc. | 6.64% |

| Barrick Gold Corp. | 6.36% |

| Goodrich Corp. | 6.06% |

| Halliburton Co. | 5.91% |

| Transocean Ltd. | 5.83% |

| Schering-Plough Corp. | 5.78% |

| Newmont Mining Corp. | 5.30% |

| Gap, Inc. | 4.90% |

| Eastman Chemical Co. | 3.82% |

| AT&T, Inc. | 3.82% |

| Top Ten Portfolio Industries | (% of Net Assets) |

| Mining | 13.60% |

| Pharmaceuticals | 11.08% |

| Transportation | 9.76% |

| Oil & Gas | 9.45% |

| Chemicals | 7.28% |

| Retail | 7.22% |

| Telecommunications | 6.55% |

| Aerospace & Defense | 6.06% |

| Oil & Gas - Services | 5.91% |

| Semiconductors | |

| | |

| Economic Sectors with Cash and Other Assets | (% of Net Assets) |

| Basic Materials | 20.88% |

| Industrials | 19.49% |

| Energy | 15.36% |

| Consumer, Non-cyclical | 11.08% |

| Communications | 8.34% |

| Technology | 7.42% |

| Consumer, Cyclical | 7.22% |

| Money Market Funds | 7.18% |

| Utilities | 2.90% |

| Other Assets in Excess of Liabilities | |

| | |

MONTEAGLE INFORMED INVESTOR GROWTH FUNDSUPPLEMENTARY PORTFOLIO INFORMATION — August 31, 2009 (Unaudited)

FUND PROFILE:

| Top Ten Long-Term Portfolio Holdings | (% of Net Assets) |

| ProShares Ultra QQQ | 9.87% |

| ProShares Ultra Russell 200 | 8.63% |

| ProShares Ultra S&P 500 | 6.79% |

| International Paper Co. | 5.08% |

| Sepracor, Inc. | 4.98% |

| Atwood Oceanics, Inc. | 4.88% |

| Priceline.com, Inc. | 4.73% |

| Western Digital Corp. | 4.64% |

| Eastman Chemical Co. | 4.52% |

| NGR Energy, Inc. | 4.27% |

| Top Ten Portfolio Industries | (% of Net Assets) |

| Internet | 9.75% |

| Computers | 9.48% |

| Forest Products & Paper | 7.05% |

| Packaging & Containers | 6.42% |

| Pharmaceuticals | 6.21% |

| Oil & Gas | 4.88% |

| Chemicals | 4.52% |