Letter from the President | 3 |

Management’s Discussion of Fund Performance | 4 |

Supplementary Portfolio Information | 31 |

| Financial Statements of the Monteagle Funds | |

| Schedule of Investments: | |

Fixed Income Fund | 36 |

Informed Investor Growth Fund | 40 |

Quality Growth Fund | 42 |

Select Value Fund | 46 |

Value Fund | 50 |

Statements of Assets and Liabilities | 53 |

Statements of Operations | 55 |

Statements of Changes in Net Assets | 57 |

Financial Highlights | 62 |

Notes to Financial Statements | 67 |

Report of Independent Registered Public Accounting Firm | 85 |

Other Information | 86 |

About Your Funds’ Expenses | 87 |

Trustees and Officers of the Trust | 90 |

LETTER FROM THE PRESIDENT (Unaudited) |

Dear Shareholders:

Enclosed is the Annual Report for the Monteagle Funds. I encourage you to carefully review the information presented in this Annual Report as it contains valuable information about your investment.

As you will notice in reviewing the Annual Report, despite the headwinds and market fluctuations, we continue to uncover opportunities in high quality, solid credit and attractive valuation areas.

As we reflect on this past fiscal year, we continue to see several headlines domestically and around the world during the period, such as slow economic recovery, sovereign debt and austerity moves, civil unrest, natural disasters, and commodity inflation, that had a dramatic effect on the markets in which the Monteagle Funds invest. Despite the volatility that these headlines have created in the day-to-day stock markets, we have often said that we view investing as a marathon, not a sprint. As a result, we remain optimistic as we expect that the effect of some of these events will be short-lived although others may take longer to work their way through the system. We believe that remaining disciplined with a longer-term focus will benefit patient investors.

In closing, we would like to thank you for your continued confidence and support of the Monteagle Funds.

Sincerely,

MONTEAGLE FUNDS

Paul B. Ordonio, JD

President

MONTEAGLE FIXED INCOME FUND A DISCUSSION OF FUND PERFORMANCE (Unaudited) |

How did the Fund Perform?

The Monteagle Fixed Income Fund (the “Fund”) benefitted from another year of positive returns. For the year ended August 31, 2012, the Fund had a total return of 3.48%. For the three and six month periods ended August 31, 2012, the Fund had total returns of 0.97% and 1.90%, respectively. The second half of the year had slightly more positive returns than the first half.

The Fund’s benchmark index, the Barclay’s Capital Intermediate U.S. Government/Credit Index (the “Barclay’s Index”) had relative returns of 4.04%, 1.24%, and 2.29% for the twelve, three, and six month periods, ended August 31, 2012, respectively.

What Influenced Fund Performance?

While we are marking the end of another fiscal year of solid performance, the driving factors influencing performance of the bond markets, and, as a result, the performance of the Fund, are very much the same ones we highlighted last year. The primary factors influencing lower and lower interest rates are reduced expectations of global economic growth and continued easing of monetary policy in most of the major global economies. Both factors contributed to positive performance of the Fund.

The beginning of the fiscal year started with better prospects for growth as measured by GDP (Gross Domestic Product). Economic releases showed improvement on a quarter-by-quarter basis toward the end of 2011 with Annualized GDP improving from approximately 2% in the 3rd quarter of 2011 to 3% in the 1st quarter of 2012. However, markets were disappointed as the balance of the year showed a slowing of growth, with preliminary GDP estimates for the 2nd quarter of 2012 coming in below 2%. Because of the lag in when data is collected and reported, we won’t know how the 2nd half of the year will evolve until the end of 2012 and into early 2013. However, expectations are not improving. With lower expectations for growth, the bond markets and the Fund have seen better second half performance than that displayed in the 1st half of the fiscal year.

Continued weakness and disappointment in the labor market has reinforced these less than optimistic expectations for renewed robust economic growth. This too has positively affected Fund performance. However, the entire year was not without some hope for improvement in the labor market. Beginning in December 2011, the economy added more than 200,000 nonfarm payrolls for three consecutive months. This certainly had a negative effect, at the time, on the bond markets and on the Fund itself, with the biggest declines occurring in March 2012. However, the trend did not continue and new job growth has been disappointing for much of the remainder of the year. Unemployment continues to be above 8% with under-employment (those unemployed, discouraged and not looking for work, and those working part-time out of necessity) closer to 15%.

The problems in Europe continue to have negative effects on the global economy, and undoubtedly have had a negative effect on our U.S. economy. It is well known that the problems in the European Union are not limited to Greece, which has had to restructure their debt and has adopted austerity measures that have kept the recession in that country in full force for approximately 5 years. We now know that the 3rd and 4th largest economies in the European Union are also in full recession.

MONTEAGLE FIXED INCOME FUND A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued) |

Both Italy and Spain are struggling with sovereign debt burdens that have led to historically high borrowing rates and forced both governments to implement austerity measures to reduce government deficits and attempt to regain the confidence of the capital markets. The resulting cuts in budgetary spending have contributed to their recessions. All indications are that the entire European Union is currently in recession. These problems have continued to lend support to the United States as a safe haven for investments. Both equities and bonds have benefited from the flow of capital from weaker European markets to our own. As such, this has enhanced the Fund’s performance.

In response to continued global economic weakness, interest rates in the strongest economies have responded accordingly. U.S. Treasury interest rates continue to decline. Over the last twelve months, longer maturity Treasury yields have declined significantly. 7, 10, and 30 year U.S. Treasury Note maturities have declined by 0.57%, 0.68%, and 0.92% respectively. Declining yields have a positive effect on bond prices and on performance. The shorter term maturity Treasury yields have remained approximately the same over the year.

The monetary policy pursued by the Federal Reserve Bank continues to support attempts to stimulate the U.S. economy and job growth by maintaining short-term rates (Fed Funds overnight lending rate) at historically low levels between 0.00% and 0.25%. This “zero interest rate policy” has contributed to a very low yielding environment, which in turn has resulted in an increased demand for higher yielding securities and a greater appetite for riskier asset classes. Additionally, the Quantitative Easing program put in place in September 2011 that was scheduled to end in June 2012, was extended through the end of 2012. The “Maturity Extension Program” (or “Operation Twist”) has had a direct impact on lowering longer term interest rates through purchases of U.S. Treasury Securities with maturities between 6 and 30 years while at the same time selling an equal amount of U.S. Treasury Securities of less than 6 years in maturity. While this program did not increase the money supply, it did succeed in lowering longer term interest rates, as mentioned above, and did stimulate demand for riskier asset classes. The increased demand led to higher asset prices for equities and high yield bonds.

Our responses to these events have primarily been a disciplined approach to a high quality portfolio profile. We remain committed to the Fund’s strategy of holding a well diversified portfolio of high quality bonds. We believe that the markets have rewarded our patience and prudence. However, we have made some changes over the last year.

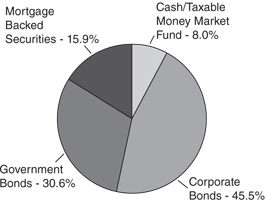

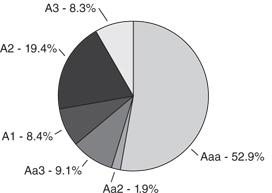

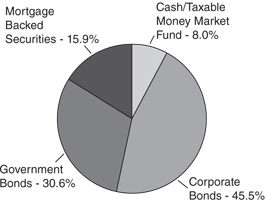

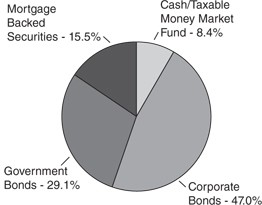

The principal variables affecting bond portfolio performance are overall duration and maturity structure of the portfolio, as well as, Market Sector allocation and credit quality. The first two charts below illustrate the market sector composition of the Fund’s Portfolio at the beginning and end of this past fiscal year.

MONTEAGLE FIXED INCOME FUND A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued) |

Comparative Market Sector Weights

(as a percentage of market values plus accrued interest)

Monteagle Fixed Income Fund

August 31, 2011 | August 31, 2012 |

|  |

| | • | During the course of the year we slightly increased the Fund’s market allocation to corporate bonds while decreasing the allocation to Government Agency securities. The decision to increase the allocation to corporate bonds relative to government bonds in general contributed positively to relative performance as the corporate sector outperformed the intermediate government/credit index and government bonds over the last year. |

| |

| U.S. Treasury: Intermediate | 2.78% |

| U.S. Agency Intermediate | 2.02% |

| Intermediate Corporate | 7.42% |

| Invest. Grade: Industrial — Intermediate | 6.43% |

| Invest. Grade: Financial Institutions — Intermediate | 9.09% |

| U.S. MBS: Agency Fixed Rate MBS | 3.71% |

| | • | Duration was slightly increased over last year. As of August 31, 2012 the Fund’s portfolio duration was 4.3 years compared to 4.1 years at 2011 fiscal year end. Maturity was relatively unchanged at 4.8 years versus 4.7 years at 2011 fiscal year end. When compared to the Barclay’s Index’s duration and weighted average maturity of 3.9 and 4.3, the Fund’s portfolio is slightly longer in both measures. This actually had a positive benefit to Fund performance in the 2nd half of the year as longer term rates declined over that period of time. The portfolio’s securities are fairly distributed across maturity ranges. 32.7% of the securities mature in less than 3 years, 31.7% in 3 to 7 years, and 35.6% in 7 to 10 years. |

MONTEAGLE FIXED INCOME FUND A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued) |

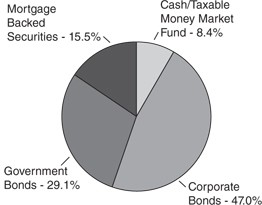

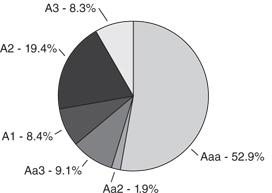

Comparative Credit Quality

(as a percentage of market values plus accrued interest, excluding cash)

Monteagle Fixed Income Fund

Moody’s Ratings August 31, 2011 | Moody’s Ratings August 31, 2012 |

|  |

| | • | The preceding charts represent the credit quality distribution of the Fund’s securities holdings (not including cash or money market securities) at the beginning and end of this past fiscal year. In our distribution comparison above, we have only included the ratings provided by Moody’s (and not S&P which rates U.S. Government obligations AA+) for consistency of the relative analysis. The Barclay’s Index still maintains ratings of AAA on U.S. Government obligations. |

| | • | The overall credit quality of the portfolio marginally decreased over the course of the year. Our overweighting of corporate bonds and underweighting of government bonds has lowered quality slightly, but credit quality remains excellent with overall ratings of AA-/AA or Aa3/Aa2. |

| | • | We would also note that at the end of this fiscal year the fund’s portfolio contained investment grade securities rated below A3/A-. While we are restricted from investing in securities rated below A3/A- at time of purchase, we do have the discretion of holding securities rated Baa/BBB should the rating be the result of a downgrade. It is our opinion that the Fund’s holdings of such securities do not materially affect the overall credit quality of the Fund’s portfolio and do not represent significant credit risk to portfolio value. The following table specifically identifies the securities held by the Fund at the end of the fiscal year that were downgraded below A3/A during the fiscal year ended August 31, 2012. |

MONTEAGLE FIXED INCOME FUND A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued) |

| | | |

| Amgen, Inc., 4.85%, due 11/18/14 | Baa1 | A+ | 0.82% |

| Amgen, Inc., 4.50%, due 03/15/20 | Baa1 | A+ | 0.86% |

| Bank of America Corp 4.875%, due 01/15/13 | Baa2 | A- | 1.53% |

| Morgan Stanley, 3.45%, due 11/2/15 | Baa1 | A- | 1.52% |

| Pitney Bowes, Inc., 5.75%, due 09/15/17 | Baa1 | BBB+ | 0.83% |

| Total | | | 5.56% |

| | • | The following table provides a summary illustration of how investment grade bonds of varying credit quality have performed over the past year. These are returns of bonds in the Barclay’s Index. The relative performance of credit is indicative of the risk/reward nature of these bonds. We can see that for the full year lesser quality bonds had a significant performance advantage over higher quality. In this respect, the performance of the Fund did not benefit from the higher returns associated with Baa rated bonds. It is quite clear from the following table that the continued zero rate monetary policy of the Federal Reserve Open Market Committee has increased the demand for higher yielding, lower quality fixed income securities. |

| | | |

| Aaa | 2.68% | 2.30% | 1.24% |

| Aa | 3.81% | 1.66% | 0.55% |

| A | 7.34% | 2.08% | 1.33% |

| Baa | 8.04% | 3.95% | 3.10% |

| Total | 4.04% | 3.96% | 2.82% |

| | • | For the year, trading was primarily driven by the replacement of Agency bonds with the purchase of corporate bonds and slightly longer dated Treasury bonds. The Fund also tactically traded 10 year Treasuries, adding and removing positions at times we felt yields were falling and rising respectively. This strategy resulted in gains and benefited the Fund. |

MONTEAGLE FIXED INCOME FUND A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued) |

What is the Fund’s Strategy?

The Fund will continue to invest in high quality, intermediate-term, fixed income securities generally between 2 and 10 years in maturity. The Fund will continue to monitor economic conditions through the use of a proprietary model in an attempt to anticipate interest rate changes and lengthen or shorten the duration of the Fund’s portfolio of securities to maximize total return with minimal risk. The Fund will also actively manage portfolio holdings across market sectors in order to maximize total return within the scope of permitted investments defined by the Fund’s prospectus. While we have taken prudent steps to diversify the Fund’s assets by limiting exposure to the credit and interest rate risk associated with any one specific issuer, market sector, or maturity range, those risks cannot be completely eliminated without affecting long-term Fund performance. We remain vigilant and will act in your best interest to preserve the Fund’s asset values.

Fund performance shown represents the performance of the Fund’s Class I shares. For complete performance information, please refer to the Average Annual Total Return table in the following performance report. Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month-end, are available by calling 1-888-263-5593.

An investor should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other important information. To obtain a copy of the Fund’s prospectus please call 1-888-263-5593 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Fund is distributed by Matrix Capital Group, Inc.

Management’s Discussion of Fund Performance seeks to describe some of the Sub-Adviser’s current opinions and views of the financial markets. Although the Sub-Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed.

MONTEAGLE FIXED INCOME FUND PERFORMANCE — August 31, 2012 (Unaudited) |

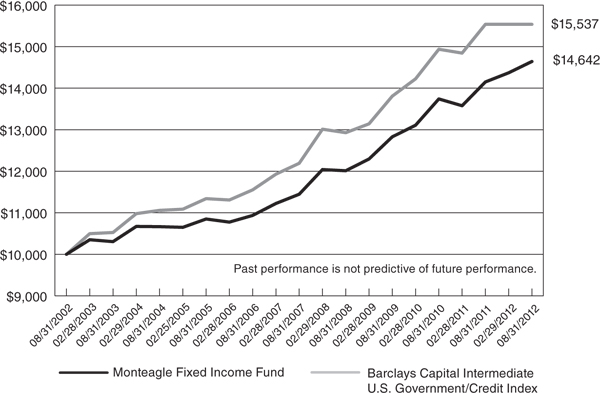

Comparison of the Change in Value of a $10,000 Investment in Monteagle Fixed Income Fund

and the Barclays Capital Intermediate U.S. Government/Credit Index

Average Annual Total Return (for the periods ended August 31, 2012) |

| | | | |

| Monteagle Fixed Income Fund | 3.48% | 5.05% | 3.89% |

| Barclays Capital Intermediate U.S. Government/Credit Index | 4.04% | 5.80% | 4.92% |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost.

The above graph depicts the performance of the Monteagle Fixed Income Fund versus the Barclays Capital Intermediate U.S. Government/Credit Index (formerly Lehman Brothers U.S. Intermediate Government/Credit Index). The Barclays Capital Intermediate U.S. Government/Credit Index measures the performance of dollar denominated U.S. Treasuries, government-related (i.e. U.S. and foreign agencies, sovereign, supranational and local authority debt), and investment grade credit structures that have a remaining maturity of greater than or equal to one year and less than ten years. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track, and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the Barclays Capital Intermediate U.S. Government/Credit Bond Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the index; so too with the Monteagle Fixed Income Fund, which will not invest in certain securities comprising this index.

MONTEAGLE INFORMED INVESTOR GROWTH FUND A DISCUSSION OF FUND PERFORMANCE (Unaudited) |

The Monteagle Informed Investor Growth Fund (the “Fund”) returned a positive, though disappointing, 14.81% for the fiscal-year ending August 31, 2012. The S&P 500 Index (“S&P 500”), the Fund’s benchmark, rose 18.00%

The Fund’s fiscal-year portfolio performance was negatively affected by the recurring bouts of monetary crisis within the Eurozone. These periodic crisis episodes fell hardest on global financial institutions, which carried a sector weighting of approximately 14% in the S&P 500. But because of the perceived threat it represented to world collapse and the presumed crashing end to life as known on this planet, the drama-packed markets targeted all growth stocks. This exposed the Fund, with its normal growth stock portfolio weighting in excess of 90%, and the S&P 500 and its 30% weighting in growth stocks, to a brutally sharp sell-off. For a time, Jurassic Park loomed large indeed. However, almost on cue, the Euro Band-Aid relief squad periodically was rushed to the rescue, and what was once viewed as the road to ruin magically became the Yellow Brick Road.

But only for a brief period of time; the “remedies” had a shelf-life of seemingly 10 minutes before the outlook reversed as new and, of course, more threatening rumors of disaster surfaced in Euro land — the land-locked Titanic.

In late spring, of this year, the market bungee-jumped. The S&P 500 suffered an ominous 15 losses in 22 trading days. It was one of the weakest months of May in market history, with only five up days for the S&P 500. This happened only once previously in 86 years. For most investors, buying when there was blood in the streets suddenly seemed less compelling when that blood-letting happened to be their own.

The fiscal-year ended with the market shifting to cruise control for much of the month of August. During that month, the S&P 500 formed one of the tightest 8-day closing ranges since 1928, with a high-to-low range of less than 0.35%, and the second-tightest 17-day trading range in 40 years.

FUND MANAGEMENT AND STRATEGY

The Fund invests primarily in medium capitalization stocks of well-managed, financially sound companies, offering under-valued earnings and cash flow growth opportunities. These are companies, in which, management or large outside investors are significant common stock owners or buyers, or where the company itself is repurchasing its own shares on the open market. This investment discipline is now recognized as The Informed Investor Strategy.

Quite simply, these companies qualify for research analysis only if they meet at least one of these four first-screen tests:

| | 1. | The company’s officers and directors are buying its common stock on the open market. |

| | 2. | A major outside investor (minimum 5% shares outstanding owned) has filed a Form 13-D purchase disclosure on the company’s stock. |

| | 3. | The company has announced its intent to repurchase its common stock on the open market. |

| | 4. | A significant percentage of the company’s stock is owned by family/management. |

The buy disciplines are matched by a series of five sell disciplines. They are:

| | 1. | Begin selling if a stock drops a minimum of 8% from an average cost basis. |

MONTEAGLE INFORMED INVESTOR GROWTH FUND A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued) |

| | 2. | Begin selling when a holding-high loss-limit is triggered (stock falls a minimum of 14% from its portfolio holding-high price). |

| | 3. | Begin selling on preliminary indications of a stock breakdown in a company’s financials. |

| | 4. | Begin selling when informed investors’ stock transaction signals turn bearish. |

| | 5. | Sell partial positions of a portfolio stock after sharp price run-ups. |

The Fund profited from its two dominating sector allocations: Information Technology and Consumer Discretionary. At year-end, these two sectors accounted for approximately 50% of the Fund’s equity portfolio weightings. Information Technology was led by Apple (AAPL) which returned 38.1% during the year.

Major new securities bought in the first fiscal quarter and their performance during the quarter were Solarwinds (SWI) 32.8% and Ulta Salon Cosmetics and Fragrances (ULTA) 1.4% - - both of which are still held in the portfolio.

In the second quarter, major equity positions added to the Fund along with their performance during the quarter included Apple (AAPL) 60.0%, Continental Resources (CLR) -55.2%, Cummins, Inc. (CMI) -5.7%, Fastenal (FAST) 32.5%, B/E Aerospace (BEAV) -3.8%, Ca, Inc. (CA) 4.6%, McDonalds (MCD) -5.7%, Parametric Technology (PMTC) -3.7%, Qualcom (QCOM) 4.3%, Select Comfort (SCSS) 36.0%, Tractor Supply (TSCO) 14.6% and Valspar (VAL) 19.4%. All except Apple were later sold in response to stop-loss sell triggers occurring in a volatile market.

In the third quarter, positions added and their performance during the quarter were Align Technologies (ALGN) -15.5%, MasterCard (MA) -21.2%, Monster Beverage (MNST) 31.3%, Questcor Pharmaceuticals (QCOR) 8.2%, Seagate Technologies (STX) -63.0% and Ebay (EBAY) -6.2%. Out of these, ALGN, QCOR and EBAY remained in the portfolio at August 31, 2012.

Beginning in the fourth quarter, positions purchased and their performance during the quarter were Mellanox Technologies (MLNX) -20.4%, TJX Company (TJX) 5.7%, Western Digital (WDC) 8.4%, Lumber Liquidators (LL) 33.0% and Michael Kors (KORS) 3.5% All of these positions remained in the portfolio at August 31, 2012.

On a full fiscal-year time basis, the portfolio performance was positively impacted most by these three largest-weighted sectors: Information Technology (+21%), Healthcare (+19%) and Consumer Discretionary (+11%). It was negatively impacted, on a relative performance basis, by the three largest-weighted lagging sectors: Materials (-12%), Energy (+3%) and Utilities (+5%).

Measured on a total return basis, for the full fiscal year, the top-ten portfolio equity holdings contributing most to the Fund’s performance were: HANS (Hanson), LL (Lumber Liquidators), WNR (Western Refining), ESRX (Express Scripts), ROST (Ross Stores), ALXN (Alexion Pharmaceuticals), DLTR (Dollar Tree), EBAY (Ebay), SCSS (Select Comfort) and AAPL (Apple)

The ten portfolio equity holdings contributing the least to the Fund’s performance for the full fiscal-year were: SAVE (Spirit Airlines), CTRX (Catamaran Group), LQDT (Liquidity Services), STX (Seagate), SPRD (Spreadtrum), TKR (Timken), PMTC (Parametric Technology), NTES (Netease), CVI (CVR Energy) and AMZN (Amazon).

MONTEAGLE INFORMED INVESTOR GROWTH FUND A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued) |

All of the top-performing portfolio stocks, except Hanson, Dollar Tree and Select Comfort, continued to be held at fiscal year-end. None of the top-ten poor performing stocks were held at fiscal-year end.

Significant sector weightings in the Fund that differed significantly from the sector weightings of the S&P 500:

| First Quarter: | Sector | Fund | S&P 500 |

| | Financials | 24.1% | 14.1% |

| | Consumer Discretionary | 20.0% | 10.8% |

| | Information Technology | 18.5% | 19.0% |

| | | | |

| Second Quarter: | Sector | Fund | S&P 500 |

| | Information Technology | 25.3% | 20.9% |

| | Consumer Discretionary | 24.0% | 11.1% |

| | Industrials | 15.9% | 10.5% |

| | | | |

| Third Quarter: | Sector | Fund | S&P 500 |

| | Consumer Discretionary | 20.9% | 10.8% |

| | Healthcare | 20.1% | 11.9% |

| | | | |

| Fourth Quarter: | Sector | Fund | S&P 500 |

| | Financials | 27.6% | 14.2% |

| | Information Technology | 20.4% | 17.6% |

At fiscal year-end, the Monteagle Informed Investors Growth Fund was 88.5% invested and the remaining 11.5% was in cash. Management believes that the Fund’s portfolio seemed, at that time, best situated relative to the then-current market outlook.

Fund performance shown represents the performance of the Fund’s Class I shares. For complete performance information, please refer to the Average Annual Total Return table in the following performance report. Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month-end, are available by calling 1-888-263-5593.

An investor should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other important information. To obtain a copy of the Fund’s prospectus please call 1-888-263-5593 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Fund is distributed by Matrix Capital Group, Inc.

Management’s Discussion of Fund Performance seeks to describe some of the Sub-Adviser’s current opinions and views of the financial markets. Although the Sub-Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed.

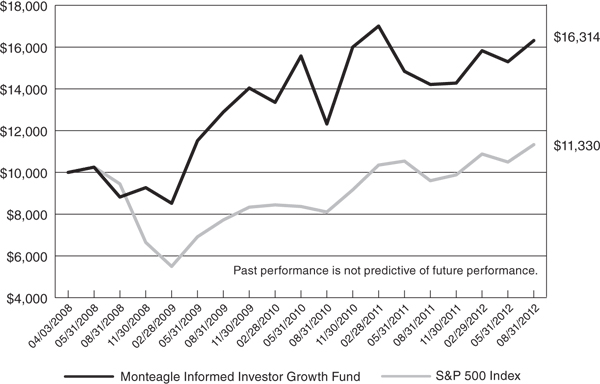

MONTEAGLE INFORMED INVESTOR GROWTH FUND PERFORMANCE — August 31, 2012 (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment

in Monteagle Informed Investor Growth Fund and the S&P 500 Index

Average Annual Total Return (for the periods ended August 31, 2012) |

| | | |

| Monteagle Informed Investor Growth Fund | 14.81% | 11.74% |

| S&P 500 Index | 18.00% | 2.87% |

| (a) | Represents the period from the commencement of operations (April 3, 2008) through August 31, 2012. |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost.

The above graph depicts the performance of the Monteagle Informed Investor Growth Fund versus the S&P 500 Index. The S&P 500 Index by Standard and Poor’s Corp. is a capitalization-weighted index comprising 500 issues listed on various exchanges, representing the performance of the stock market generally. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track, and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the S&P 500 Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the index; so too with the Monteagle Informed Investor Growth Fund, which will not invest in certain securities comprising this index.

MONTEAGLE QUALITY GROWTH FUND A DISCUSSION OF FUND PERFORMANCE (Unaudited) |

How did the Fund perform?

For the twelve months ended August 31, 2012, the Monteagle Quality Growth Fund (the “Fund”) reported a total return of 14.26%. The S&P 500 Index (“S&P 500”) and the Russell 1000 Growth Index (“Russell 1000”), the Fund’s two benchmarks, had total returns of 18.00% and 17.37%, respectively, for the same period. The Fund’s net asset value as of August 31, 2012 was $9.95 versus $8.71 as of August 31, 2011.

What is the Fund’s investment approach?

The Fund utilizes a growth style, investing in primarily domestic, high quality companies believed to have above-average sustainable and/or accelerating growth with an ability to exceed earnings expectations over time. The underlying belief is that high quality companies outperform over time with less risk. Various quality rankings and other metrics which demonstrate quality, including earnings consistency, are evaluated carefully before a stock is added to the portfolio. The Fund employs a proprietary screening process and bottom-up work to construct portfolios. However, portfolio constraints are established to ensure sufficient diversification by sector, as well as by market capitalization. The underlying belief is that diversification provides for greater control of risk in the portfolio, while allowing freedom in individual stock selection. The screening process is designed to identify stocks with rising expectations, as the Fund looks to invest in securities whose growth potential is generally underestimated by the market. Holdings generally have a market capitalization of at least $2 billion, with about 65% to 75% of the portfolio in stocks of over $15 billion.

Compared to the S&P 500, the portfolio will typically have a lower dividend yield, a higher price/earnings ratio and a higher expected earnings growth rate.

What influenced the Fund’s performance?

Despite fits and starts along the way, the market once again rewarded equity investors with strong mid-teens returns for the fiscal year ended August 31, 2012. In a repeat of the prior two fiscal years, investors see-sawed between continued concerns regarding the possible deterioration of the European Union with the accompanying potential for renewed global economic deterioration and excitement regarding a growing probability of yet another round of monetary easing on the part of central banks around the globe. At the end of day, the expected liquidity benefits from further monetary actions won out as evident in the solid advance in a broad range of risk assets including domestic equities. While corporate earnings results over the past twelve months did witness the moderation in growth that we expected entering the fiscal year, the overall level of growth was still enough to present an additional factor supporting higher stock prices in the just completed period.

While the Fund delivered respectable performance over the twelve month period, we were disappointed that the strong fundamentals and attractive valuations of portfolio holdings were not more fully rewarded. In particular, portfolio holdings continued to exhibit greater success at meeting or exceeding consensus earnings expectations relative to both the style benchmark and the broad market. While macro-economic headlines have been the primary factor in what has been very much a “risk-on, risk-off” environment over the past several quarters, we remain

MONTEAGLE QUALITY GROWTH FUND A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued) |

confident that in the long run underlying fundamentals drive stock prices and that strong earnings surprises and positive estimate revision trends will become more of a differentiating factor in stock performance as the current corporate earnings cycle matures. Earnings growth rates have already begun to decelerate following incredibly strong growth over the course of 2010 and 2011. Growth rates in 2012 have remained respectably in the high-single-digit to low-double-digit range but expectations for the coming quarters call for a continued moderation in corporate earnings growth. Based on history, this slowdown in profits growth suggests high quality stocks should be increasingly well-positioned for outperformance relative to low quality. Because of greater consistency in earnings delivery, strong balance sheets, and diversified business operations, large cap high quality growth companies tend to act particularly well on a relative basis in periods of slowing profit growth. Based on historical valuations, large cap high quality stocks remain substantially undervalued relative to smaller cap and lower quality stocks and we would expect to see this valuation discrepancy close.

During the first six months of the fiscal year just ended, the market rallied off of a calendar year 2011 low set in the first week of October to deliver a low-teens return over the full period ended February 29, 2012. A frequent event since the market rallied off of cycle lows back in early 2009, it was once again easing action on the part of a central bank that served as the catalyst for upside in stock prices. This time around it was the European Central Bank (the ECB) that launched a round of liquidity injection with a program dubbed “LTRO”, which stands for Long Term Refinancing Operation and essentially involved the central bank lending money at a very low interest rate to euro zone banks for a period of three years. This new injection of liquidity had the effect of lowering sovereign bond yields, reducing fears of default, and spurring investors back into risky assets. Against this backdrop, higher beta and lower quality issues outpaced higher quality stocks. While all ten economic sectors delivered positive returns, economically-sensitive or “cyclical” sectors led the way with Information Technology (up 21.0%), Industrials (up 16.1%), and Consumer Discretion (up 13.6%), the top performing sectors in the Russell 1000. Traditionally defensive, the Utilities, Telecommunications, and Consumer Staples sectors were the laggards (up 0.2%, 6.8%, and 7.0%, respectively).

For the period, the Fund’s portfolio delivered a solid double-digit absolute return that came in a bit below the benchmarks on a relative basis. Sector allocation was a neutral factor, as a beneficial underweight in the lagging Health Care sector was offset by an overweight in the also-lagging Energy sector. Overall, stock selection was a negative factor with four sectors contributing positively and six sectors contributing negatively to relative performance. Stock selection was notably favorable within the Consumer Discretionary, Industrials, and Telecommunications sectors of the portfolio. Stock selection was notably negative within the Energy, Health Care, and Information Technology sectors. Of note, the Fund’s preference for high quality stocks was a headwind across sectors in a period meaningfully favoring higher beta, low quality securities.

During this period, stocks that contributed most positively to relative returns were W.W. Grainger (distributor of industrial supplies, up 36%), Cummins (manufacturer of heavy-duty engines, up 31%) and Walt Disney (media & theme parks, up 25%). Significant detractors from relative

MONTEAGLE QUALITY GROWTH FUND A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued) |

performance included Carbo Ceramics (supplier of oil & gas drilling consumables, down 42%), Peabody Energy (coal producer, down 27%) and Freeport McMoran (copper & gold mining, down 10%).

While muted compared to the first six months, stock market performance remained positive in the second half of the fiscal year, with both the S&P 500 and Russell 1000 experiencing low single digit advances. Midway through this six month period, the market did experience a bump in the road with the S&P 500 declining nine percent from its spring highs. In a repeat of the prior summer, renewed concerns related to Europe and deterioration in economic data both in the U.S. and abroad led to the market pullback. However, unlike the prior summer, when the sell-off in the S&P 500 reached a much more severe 20% decline at its worst point, this most recent sell-off was rather subdued and orderly. While corporate earnings delivery over this six month period was stronger than many investors feared, economic readings related to employment and manufacturing backslid from the improved levels of early 2012. Thus it was once again indications of forthcoming new monetary easing actions on the part of our U.S. Federal Reserve and central banks abroad, most notably the ECB, aimed at combating the weak global economy that triggered a recovery in stock prices during the months of July and August. For the full six month period, defensive sectors led relative to cyclical, as the extremely low interest rates available in the bond market acted as an additional catalyst behind a rotation into yield-oriented stocks. Consumer Staples (up 9.4%), Health Care (up 9.0%), and Telecommunications (up 7.1%) were the best performing sectors in the Russell 1000. Lingering concerns related to slowing global economic demand was evident in the lagging returns delivered by the Industrials (down 4.4%), Materials (down 1.1%) and Energy (up 0.8%) sectors.

For the six month period ended August 31, 2012, the Fund’s portfolio lagged slightly compared to the Russell 1000 and S&P 500. While the portfolio remained meaningfully overweighted in high quality stocks (stocks with a Standard & Poors Earnings Quality rating of B+ or better), the benefit of this high quality profile was muted by a directional weighting in favor of economic sectors and individual holdings positioned to benefit from continued steady-but-slow global economic improvement. As such, the portfolio did not benefit from this period’s rotation into Consumer Staples and Health Care, two sectors where we have yet to identify meaningfully attractive fundamental earnings growth candidates relative to high quality stocks in other economic sectors and thus have been consistently underweight over the past several quarters. While sector allocation was a negative factor during this period, overall stock selection within the Fund was positive, particularly in the Information Technology and Materials sectors of the portfolio. Strong contributions from holdings in these sectors were partially offset by negative relative contribution from holdings in the Consumer Discretion and Energy sectors of the portfolio.

During this period, stocks that contributed most positively to returns were eBay (online retail and payment solutions, up 33%), Hain Celestial (organic foods, up 68%), and Walt Disney (media & theme parks, up 18%). Significant negative contributors included Tempur Pedic (high-end bedding, down 41%), Cummins (heavy-duty engines, down 19%) and Occidental Petroleum (oil & gas exploration, production, and marketing, down 18%).

MONTEAGLE QUALITY GROWTH FUND A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued) |

What is the Fund’s Strategy?

The Fund will continue to focus on maintaining a diversified portfolio of high quality companies delivering sustainable above-market earnings growth as well as companies poised to experience meaningful acceleration in earnings growth relative to expectations. The Fund’s Sub-Adviser believes the companies that can exceed expectations in the form of positive earnings surprises will be well rewarded over coming quarters.

Fund performance shown represents the performance of the Fund’s Class I shares. For complete performance information, please refer to the Average Annual Total Return table in the following performance report. Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month-end, are available by calling 1-888-263-5593.

An investor should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other important information. To obtain a copy of the Fund’s prospectus please call 1-888-263-5593 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Fund is distributed by Matrix Capital Group, Inc.

Management’s Discussion of Fund Performance seeks to describe some of the Sub-Adviser’s current opinions and views of the financial markets. Although the Sub-Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed.

MONTEAGLE QUALITY GROWTH FUND PERFORMANCE — August 31, 2012 (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment in Monteagle Quality Growth Fund,

the S&P 500 Index and the Russell 1000 Growth Index

Average Annual Total Return (for the periods ended August 31, 2012) |

| | | | |

| Monteagle Quality Growth Fund | 14.26% | 2.47% | 4.66% |

| S&P 500 Index | 18.00% | 1.28% | 6.50% |

| Russell 1000 Growth Index | 17.37% | 3.68% | 7.01% |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost.

The above graph depicts the performance of the Monteagle Quality Growth Fund versus the S&P 500 Index and the Russell 1000 Growth Index. The S&P 500 Index by Standard and Poor’s Corp. is a capitalization-weighted index comprising 500 issues listed on various exchanges, representing the performance of the stock market generally. The Russell 1000 Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track, and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the S&P 500 Index and the Russell 1000 Growth Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the indices; so too with the Monteagle Quality Growth Fund, which will not invest in certain securities comprising these indices.

MONTEAGLE SELECT VALUE FUND A DISCUSSION OF FUND PERFORMANCE (Unaudited) |

How did the Fund perform?

For the year ended August 31, 2012, the Monteagle Select Value Fund (the “Fund”) had a total return of 9.01%. The S&P 500 Index (“S&P 500” or “Index”) had a total return of 18.00% for the same period. The Fund’s net asset value per share as of August 31, 2012 was $10.95 versus $10.16 on August 31, 2011.

What is the Fund’s investment approach?

The Fund’s investment goal is long-term capital appreciation. The Fund uses a “value investing” style by investing under normal circumstances at least 80 percent of its assets in common stock of domestic companies believed to be under-priced relative to comparable securities determined by price-to-earnings ratios, cash flows or other measures. The Fund’s adviser predominately utilizes a reversion-to-the-mean strategy on stock selection in order to achieve its results rather than trying to time market fluctuations. The adviser limits the pool of stocks to consider for purchase to only those equities in the S&P 500. In selecting stocks, the Fund’s adviser establishes valuation parameters by using relative ratios or target prices to evaluate companies on several levels. Additionally, the adviser will generally have the Fund hold between 40 and 60 equities and diversify its holdings across numerous industries, generally limiting issues in any one industry to five securities unless more securities are needed for limiting specific dollar amounts per security or to over-weight a particular sector. The Fund seeks to maintain a minimum average weighted market capitalization of $5 billion.

Value stocks are broadly defined as equities which have a price-to-earnings ratio and a price-to-book ratio less than the relative market average with dividends tending to be higher than the relative market average. Also, value stocks tend to have a beta (a measure of the stocks price volatility relative to the overall market, i.e. the S&P 500) less than 1.0.

What influenced the Fund’s performance?

During the twelve months ended August 31, 2012, the Fund’s performance was affected by various economic concerns both domestically and globally. The fear of the fiscal cliff and the presidential election provide considerable uncertainty in the market. The issues that have continued to affect the markets throughout the year are the uncertain stabilization of the domestic financial markets, the fear of the European economies and the prolonged higher level of U.S. unemployment. During the period, the equity markets reached market highs that have not been seen since May 2008 prior to the height of the recession. Following these highs, the U.S. credit rating was lowered which resulted in a significant downturn in the early weeks of August 2011. The S&P 500 yielded attractive returns during the first calendar quarter of the year only to subsequently fall back to this level in early June 2012. The Dow Jones Industrial Average (the “Dow”) began the period at approximately 11,600 on August 31, 2011 briefly falling to the low of 10,655 on October 3, 2011 to then increase to its high of 13,279.32 on May 1, 2012. The Dow concluded on August 31, 2012 near its high for the period at 13,090.84. The S&P 500 trended similarly, beginning the period at just over 1,200 on August 31, 2011, falling just below 1,100 in early October, to then increase to its high point of 1,419.04 on April 2, 2012. The S&P 500 also concluded on August 31, 2012 near its high for the period at 1,406.58. During this period the Federal Open Markets Committee of

MONTEAGLE SELECT VALUE FUND A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued) |

the Federal Reserve continued to maintain the Fed Funds rate at the range of 0% to 0.25%, where it has remained since December 2008. These factors contributed to a mixed market environment that proved difficult for the Fund given its focus of a “value style, reversion-to-the-mean” strategy which typically thrives in a growing economic environment. The Fund compares its performance to the S&P 500. The Fund is affected by its asset allocation weighting to the ten sectors of the Index.

For the first quarter ended November 30, 2011, the portfolio holdings of the Fund under-performed the Index. The investments of the Fund experienced a -0.35% return versus a return for the Index of 2.90%. For the trailing 12-month period ended November 30, 2011, the portfolio holdings of the Fund under-performed the Index with the investments of the Fund experiencing a -0.01% return versus a 7.83% return for the Index, a difference of 784 basis points. Please review the Performance Analysis section of this report for additional performance information. The portfolio continued to be heavily invested in equities which represented 94.6% of the assets with cash and money funds representing 5.4% of the assets at November 30, 2011.

The broad sectors of the Index that improved the most on average during the first quarter were Utilities (+3.30%), Information Technology (3.21%), and Consumer Staples (2.94%) sectors while the Financials (-7.48%), Materials (-5.44%) and Telecommunication Services (-0.80%) sectors were the lowest performing within the Index. The portfolio performance was led by its holdings in Consumer Staples, Healthcare and Industrials sectors during this quarter; the lower performing sectors in the portfolio were Telecommunications, Information Technology and Financials. The equity markets still have yet to return to levels prior to the financial crisis, although appreciation from the lows has occurred. The first quarter included significant volatility in the equity market, concluding slightly higher than it began.

As of the end of the first quarter, the portfolio holdings continued to be diversified across many sectors of the Index with less exposure to the Utility, Telecommunication Services and Energy sectors. The largest sector allocations are Financials (19.7%), Healthcare (14.4%) and Information Technology (14.1%). The Fund’s positive portfolio performance was primarily attributed to its top performing stock picks of Intel Corp. (+23.75%), Dean Foods Co. (+17.59%), and Kohl’s Corp. (+16.10%). The Fund’s portfolio performance was most negatively affected by MEMC Electronic Materials (-40.26%), Bank of America Corp. (-33.41%) and Sprint Nextel (-28.19%). During the quarter, no disposals or purchases were made as with the relatively flat trading in the general market there were no securities that achieved their target price. As of the end of the quarter, cash represented 5.4% of the assets.

For the second quarter ended February 29, 2012, the portfolio holdings of the Fund outperformed the Index. The investments of the Fund experienced a 10.47% return versus a return for the Index of 10.11%, a difference of 36 basis points. For the trailing 12-month period ended February 29, 2012, the portfolio holdings of the Fund underperformed the Index with the investments of the Fund experiencing a -4.65% return versus a 5.12% return for the Index. Please review the Performance Analysis section of this report for additional performance information. The portfolio continued to be heavily invested in equities which represented 92.9% of the assets with cash and money funds representing 7.1% of the assets at February 29, 2012.

MONTEAGLE SELECT VALUE FUND A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued) |

The broad sectors of the Index that improved the most on average during the second quarter were the Financial (24.45%), Information Technology (20.34%), and Industrial (18.14%) sectors while the Utilities (4.71%), Consumer Staples (8.06%) and Telecommunication Services (9.51%) sectors were the lowest performing within the Index. The portfolio performance was led by its holdings in the Financials, Consumer Staples, and Information Technology sectors during this quarter; the lower performing sectors in the portfolio were Telecommunications, Utilities and Healthcare. The equity markets still have yet to return to levels prior to the financial crisis, although significant appreciation from the lows has occurred. The second quarter witnessed notable improvement in the equity market, with the S&P 500 concluding at its highest level since June 2008.

As of the end of the second quarter, the portfolio holdings continued to be diversified across many sectors of the Index with less exposure to the Utility, Telecommunication Services and Energy sectors. The largest sector allocations were Financials (21.4%), Consumer Discretionary (13.7%) and Healthcare (13.0%). The Fund’s positive portfolio performance was primarily attributed to its top performing stock picks of Whirlpool Corp (+54.04%), Bank of America Corp. (+46.51%), and Genworth Financial, Inc. (+37.94%). The Fund’s portfolio performance was most negatively affected by RadioShack Corp. (-38.24%), Hewlett-Packard Co. (-9.45%) and Best Buy Co. (-8.82%). During the quarter, two disposals were made in order to remove securities that had achieved their target price and leave room for new securities with more appreciation potential. The cash balance continues to remain relatively higher in order to allow cash to average into the equity market and/or find additional securities with positive appreciation potential. As of the end of the quarter, cash represented 7.1% of the assets.

For the third quarter ended May 31, 2012, the portfolio holdings of the Fund underperformed the Index. The investments of the Fund experienced a -9.21% return versus a return for the Index of -3.53%. For the trailing 12-month period ended May 31, 2012, the portfolio holdings of the Fund underperformed the Index with the investments of the Fund experiencing a -13.87% return versus a -0.41% return for the Index. Please review the Performance Analysis section of this report for additional performance information. The portfolio continued to be heavily invested in equities which represented 93.5% of the assets with cash and money funds representing 6.5% of the assets at May 31, 2012.

The broad sectors of the Index that improved the most on average during the third quarter were the Telecommunication Services (9.14%), Consumer Services (3.89%), and Utilities (3.42%) sectors while the Energy (-12.76%), Materials (-7.59%) and Industrials (-5.04%) sectors were the lowest performing within the Index. The portfolio performance was led by its holdings in the Telecommunication Services, Utilities, and Consumer Staples sectors during this quarter; the lower performing sectors in the portfolio were Financials, Information Technology and Materials. The equity markets still have yet to return to levels prior to the financial crisis, although significant appreciation from the lows has occurred. The third quarter experienced volatility in the equity market, with the S&P 500 gaining almost 4% to subsequently fall over 7%, concluding just above 1,300.

MONTEAGLE SELECT VALUE FUND A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued) |

As of the end of the third quarter, the portfolio holdings continued to be diversified across many sectors of the Index with less exposure to the Utility, Telecommunication Services and Consumer Staples sectors. The largest sector allocations are Financials (20.1%), Information Technology (14.9%), and Consumer Discretionary (13.6%). The Fund’s positive portfolio performance was primarily attributed to its top performing stock picks of ConocoPhillips (+32.29%), AT&T Corp. (+11.70%), and Wal-Mart Stores (+11.41%). The Fund’s portfolio performance was most negatively affected by MEMC Electronics (-57.51%), Genworth Financial (-42.35%) and First Solar, Inc. (-39.58%). During the quarter, two disposals were made in order to remove securities that had achieved their target price and leave room for new securities with more appreciation potential. Four securities were purchased in order to reinvest the cash. The cash balance continued to remain a little elevated in order to allow cash to average into the equity market and/or find additional securities with positive appreciation potential. As of the end of the quarter, cash represented 6.5% of the assets.

For the fourth quarter ended August 31, 2012, the portfolio holdings of the Fund outperformed the S&P 500. The investments of the Fund experienced a 9.07% return versus a return for the Index of 7.94%. For the trailing 12-month period ended August 31, 2012, the portfolio holdings of the Fund underperformed the Index with the investments of the Fund experiencing a 9.01% return versus an 18.00% return for the Index. Please review the Performance Analysis section of this report for additional performance information. The portfolio continued to be heavily invested in equities which represented 93.7% of the assets with cash and money funds representing 6.3% of the assets at August 31, 2012.

The broad sectors of the Index that improved the most on average during the fourth quarter were the Telecommunication Services (11.88%), Energy (11.13%), and Financials (9.29%) sectors while the Utilities (2.71%), Industrials (5.13%) and Materials (5.87%) sectors were the lowest performing within the Index. The portfolio performance was led by its holdings in the Telecommunication Services and Information Technology sectors during this quarter; the lower performing sectors in the portfolio were Utilities, Materials and Healthcare. The equity markets still have yet to return to levels prior to the financial crisis, although significant appreciation from the lows has occurred. The fourth quarter experienced positive appreciation in the equity market, with the S&P 500 ending just above 1,400, near the high of the year.

As of the end of the fourth quarter, the portfolio holdings continued to be diversified across many sectors of the Index with less exposure to the Utility, Telecommunication Services and Consumer Staples sectors. The largest sector allocations are Financials (18.7%), Information Technology (15.7%), and Consumer Discretionary (13.1%). The Fund’s positive portfolio performance was primarily attributed to its top performing stock picks of Sprint Nextel (+88.72%), MEMC Electronic Materials (+60.48%), and First Solar, Inc. (+59.16%). The Fund’s portfolio performance was most negatively affected by RadioShack (-47.63%), Hewlett Packard (-25.57%) and Cliffs Natural Resources (-13.11%). During the quarter, one disposal was made in order to remove a security that had achieved its target price and make room for new securities with more appreciation potential. One security was purchased in order to reinvest the cash. The cash balance continued to remain marginally in order to allow cash to average into the equity market and/or find additional securities with positive appreciation potential. As of the end of the quarter, cash represented 6.3% of the assets.

MONTEAGLE SELECT VALUE FUND A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued) |

For the year ended August 31, 2012, the Fund underperformed the Index. The investments of the Fund experienced a 9.01% return versus an 18.00% return for the Index. The broad sectors of the Fund that contributed the most on average to the performance were the Consumer Staples (+31.71%), Telecommunications Services (+28.84%), and Industrials (+21.56%) sectors while the Materials (-11.37%), Information Technology (-4.88%) and the Consumer Discretionary (-3.10%) sectors were the lowest performing on average within the Fund.

What is the Fund’s strategy?

The Fund will continue to concentrate on equities contained in the S&P 500 which generally consists of large name brand corporations with good fundamentals and broad product diversification. The Fund’s adviser will continue to be disciplined in the use of its predominate strategy of reversion-to-the-mean by applying its “value investing” approach valuation model; thereby, allowing the market’s volatility to identify those securities that become under-valued and are poised to be the next performers in the market. Sector allocation in the Fund’s portfolio will primarily be determined by which companies are available for purchase pursuant to the Fund’s strategy. It is anticipated that the Fund may hold higher levels of cash during extended periods of market uncertainty and will selectively invest the cash into equities identified by the primary investment strategy as opportunities present themselves or for dollar-cost-averaging into currently held positions. This strategy is executed with a long-term outlook and will have periods of under-performance and out-performance versus its Index. Therefore, the Fund’s daily performance can and will vary dependant upon current market conditions.

Fund performance shown represents the performance of the Fund’s Class I shares. For complete performance information, please refer to the Average Annual Total Return table in the following performance report. Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month-end, are available by calling 1-888-263-5593.

An investor should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other important information. To obtain a copy of the Fund’s prospectus please call 1-888-263-5593 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Fund is distributed by Matrix Capital Group, Inc.

Management’s Discussion of Fund Performance seeks to describe some of the Sub-Adviser’s current opinions and views of the financial markets. Although the Sub-Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed.

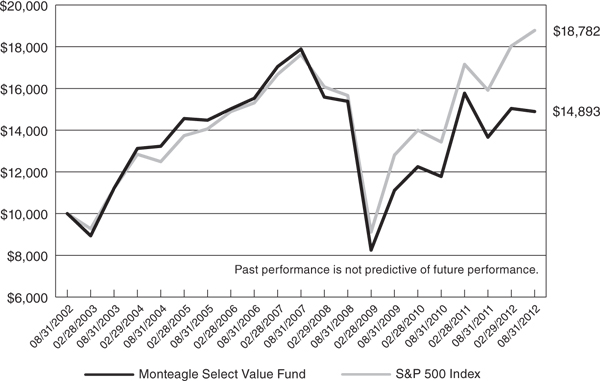

MONTEAGLE SELECT VALUE FUND PERFORMANCE — August 31, 2012 (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment

in Monteagle Select Value Fund and the S&P 500 Index

Average Annual Total Return (for the periods ended August 31, 2012) |

| | | | |

| Monteagle Select Value Fund | 9.01% | (3.60%) | 2.80% |

| S&P 500 Index | 18.00% | 1.28% | 6.50% |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost.

The above graph depicts the performance of the Monteagle Select Value Fund versus the S&P 500 Index. The S&P 500 Index by Standard and Poor’s Corp. is a capitalization-weighted index comprising 500 issues listed on various exchanges, representing the performance of the stock market generally. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track, and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the S&P 500 Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the index; so too with the Monteagle Select Value Fund, which will not invest in certain securities comprising this index.

MONTEAGLE VALUE FUND A DISCUSSION OF FUND PERFORMANCE (Unaudited) |

How did the Fund Perform?

For the year ended August 31, 2012, the Monteagle Value Fund (the “Fund”) reported a total return of 8.64%. The S&P 500 Index (“S&P 500”) had total returns of 18.00% for the same time period. The Fund’s net asset value per share as of August 31, 2012 was $13.31 versus $15.55 at August 31, 2011. The drop in NAV was due in part to a capital gain distribution of $3.02 per share paid in December 2011.

What is the Fund’s investment approach?

The Fund’s investment goal is to achieve maximum returns through investing in undervalued companies. The Fund determines value usually based on price-to-earnings ratios, but also reviews historical price to book value ratios, dividend yield and balance sheet quality in determining whether prospective investments are truly undervalued. The adviser will hold 35 to 45 equities. The Fund seeks to maintain a minimum average market capitalization of $5 billion. The current average market capitalization exceeds $40 billion. The current price earnings ratio is 12.1 times 2013 earnings and currently yields 2.7 percent. The S&P 500 currently trades at 13.4 times 2013 earnings and yields 1.9 percent.

Fund’s adviser also makes industry determinations based upon interest rate cycles. Historical relationships between short-term and long-term U.S. Treasury securities impact industry weightings as easier money promotes growth in inflation while tight money favors disinflation.

The Fund also makes investments for the long-term, holding the positions for three to five years unless extraordinary events occur such as mergers, acquisitions or deterioration of the industry or company.

What influenced the Fund’s performance?

During the year ended August 31, 2012, the Fund underperformed the S&P 500. We remain committed to our buy and hold investment strategy though many believe long term investment is no longer relevant. Our positions continue to focus on economically sensitive issues that usually benefit from improving economic conditions. Consequently, these positions have been whipsawed by the markets over the past twelve months. With short-term interest rates flat-lining just above zero, we believe that commodity prices will ultimately rise as a result of renewed economic activity. Worldwide financial trade winds have not been favorable to companies tied to international markets over the past twelve months. Budget issues pertaining to European debt woes have presented challenges to financial markets during this period. Waning Chinese economic growth has also been a contributing factor to weakening demand for raw materials reducing prices further contributing to our market underperformance.

During the past twelve months, the Federal Reserve transitioned from QE II to Operation Twist that moved its Federal Open Market Operation activity to swapping short-term Treasury Bills and Notes to longer term bonds. Money supply growth increased during the year approaching 10% which is very accommodative to financial markets. Additionally, the third year of $1.0 trillion budget deficits by the U.S. government has made John Maynard Keynes proud as the Fiscal stimulus theoretically lessens the severity of recessions. With the Fed and Treasury printing money, one would expect more robust economic growth. Yet, the high unemployment and weak

MONTEAGLE VALUE FUND A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued) |

housing numbers continue to suggest the economy is far from full recovery. Our positive stance may have been premature in the past but believe conditions continue to be favorable for rising stock prices.

We do believe that the market has been too focused on fiscal cliffs and proverbial cans being kicked down the road as policy makers extend debt terms and refinance bonds. During the year, the S&P downgraded U.S. Treasury bonds and the market responded by higher prices and lower yields. Usually, lower interest rates portends higher stock prices. Interest rates remain conducive to fostering economic growth, both in the U.S. as well as the rest of the world. We believe stock prices have not fully discounted the benefits to the favorable interest rate environment.

During the first six months of the year, the Fund performed in line with the market providing returns of 9.75% versus the S&P 500 of 13.31%. During this period, many of the positions believed to benefit from improving economic conditions performed in line with the market. Federal Reserve policy continued to maintain low short-term interest rates and accommodation at the discount window allowing banks and investment banks the ability to borrow. The financial system remains strong as corporate bond market has been very active as interest rate spreads have narrowed indicating that companies have accessed public markets for borrowing needs. During this period, the Fund’s weighting in chemicals, paper, mining and steel of 35% and healthcare of 12.2% impeded the returns of the Fund. Our 10.4% weighting in telecommunications helped our returns for the Fund during this period.

The Fund disposed of Eastman Kodak, AOL, Alcoa, Tidewater, Cubist Pharmaceuticals, Applied Materials, Shaw Industries, Pfizer, IPG, Marathon Petroleum, and Gap, Inc. The Fund reduced its holdings in Dupont and Newmont Mining. The Fund invested in International Paper, Solutia, Textron, Worthington Industries, Spreadtrum Communications, Chemtura, Kronos Worldwide, Nuvasive, and Sanmina-SCI. Also, ADPT. Co changed its name to Steel Excel, Inc.

During the six months ended August 31, 2012 the Fund experienced underperformance versus the S&P 500 during the quarter ended May 31, 2012. During this period the Fund returned -1.01% versus 4.14% for the S&P 500. Recent Federal Reserve policy continues to maintain low short-term interest rates and money supply is growing at 10% annually. Quantitative Easing I, II and most recent Operation Twist is allowing the rampant growth of the monetary base propping up the banking system. Money market yields continue to be low and the bond market has outperformed all stock indices during this period as money came out of stock mutual funds and into bond funds. The Fund continues to favor economically sensitive issues although the obvious policy changes at the Fed and other world central banks have quelled the commodity markets. Turmoil in the European financial markets has created questions about the Euro being a formidable reserve currency against the dollar. Middle Eastern investors have shifted out of the Euro into the dollar and the Euro has fallen in its exchange value by twenty percent against the dollar. Deflationary pressures have eliminated inflation from being any concern for central banking policy.

During the last six months our weightings in Industrials and Materials combined at nearly 40% has continued to contribute to our underperformance. Recent moves in telecommunications and health stocks actually helped performance for the Fund. During the six months, the Fund made no changes to its holdings.

MONTEAGLE VALUE FUND A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued) |

Since November 2011, Federal Reserve policy has been very accommodative maintaining record low short-term interest rates and growing money supply at 10% on an annual basis. Summer time turmoil in Europe pertaining to Credit issues in Greece, Spain and Portugal has presented financial challenges for banks in Europe and New York which has plagued the financial markets here and abroad. Additional weakness in the Chinese and South American markets indicates worldwide economic slow-down.

The Fund maintains its belief that economic conditions are indeed improving as monetary aggregates continue to anticipate economic growth for the foreseeable future. Recent declines in commodity prices should give the Fed ample reason to start another round of stimulus in the form of QE III recently announced after the Fund’s year end. The Fed has indicated it will keep purchasing $40 billion in mortgage backed bonds per month as long as it takes to see meaningful employment improvements.

The current market remains volatile due to the high frequency traders with very little regulatory scrutiny. Since January 2012, equity mutual funds have seen over $400 billion in liquidations, though the market remains resilient with positive returns. We still believe that low money market yields and low bond yields should lead investors back into stocks.

The current U.S. Treasury yield curve supports growing economic activity. The Federal Reserve has reiterated its willingness to do what is necessary to avert further deflationary pressures associated with job and housing weakness.

What is the Fund’s strategy?

The Fund continues to focus on consistency in earnings in its holdings. The Fund remains committed to economically sensitive issues including energy, materials and industrials. The Fund has a modest overweight in materials, telecommunications and industrials as the economic recovery continues to sputter and recent Fed policy statements indicated they were concerned that it would be willing to accept higher inflation as it fends off deflationary forces. The Fund is underweight energy, financials, utilities, health and technology sectors. The Fund believes that worldwide economic recovery has started though unemployment remains high and housing weak.

MONTEAGLE VALUE FUND A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued) |

The Fund’s industry weightings as of August 31, 2012 as compared to the S&P 500 were as follows:

| | |

| Industrials | 8.2% | 12.7% |

| Energy | 7.3% | 8.0% |

| Materials | 31.7% | 6.3% |

| Financials | 0.0% | 13.0% |

| Health | 13.5% | 12.3% |

| Technology | 11.2% | 15.8% |

| Telecom | 11.7% | 0.8% |

| Utilities | 5.3% | 4.3% |

| Consumer Discretion | 3.8% | 19.2% |

| Consumer Staples | 2.9% | 7.6% |

| Other Holdings | 4.4% | 0.0% |

Fund performance shown represents the performance of the Fund’s Class I shares. For complete performance information, please refer to the Average Annual Total Return table in the following performance report. Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month-end, are available by calling 1-888-263-5593.

An investor should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other important information. To obtain a copy of the Fund’s prospectus please call 1-888-263-5593 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Fund is distributed by Matrix Capital Group, Inc.

Management’s Discussion of Fund Performance seeks to describe some of the Sub-Adviser’s current opinions and views of the financial markets. Although the Sub-Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed.

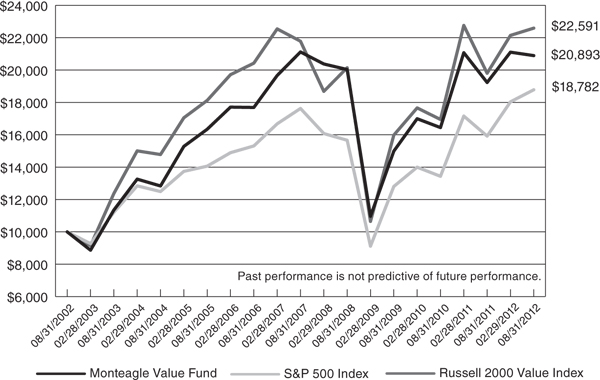

MONTEAGLE VALUE FUND PERFORMANCE — August 31, 2012 (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment

in Monteagle Value Fund, the S&P 500 Index and the Russell 2000 Value Index

Average Annual Total Return (for the periods ended August 31, 2012) |

| | | | |

| Monteagle Value Fund | 8.64% | (0.22%) | 7.65% |

| S&P 500 Index | 18.00% | 1.28% | 6.50% |

| Russell 2000 Value Index | 14.08% | 0.73% | 8.48% |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost.

The above graph depicts the performance of the Monteagle Value Fund versus the S&P 500 Index and the Russell 2000 Value Index. The S&P 500 Index by Standard and Poor’s Corp. is a capitalization-weighted index comprising 500 issues listed on various exchanges, representing the performance of the stock market generally. The Russell 2000 Value Index measures the performance of small-cap value segment of the U.S. equity universe. It includes those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track, and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the S&P 500 Index and the Russell 2000 Value Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the indices; so too with the Monteagle Value Fund, which will not invest in certain securities comprising these indices.

MONTEAGLE FIXED INCOME FUND SUPPLEMENTARY PORTFOLIO INFORMATION — August 31, 2012 (Unaudited) |

Top Ten Long-Term Portfolio Holdings | |

| U.S. Treasury Note, 2.00%, due 11/15/2021 | 5.84% |

| U.S. Treasury Note, 1.75%, due 05/15/2022 | 5.69% |

| U.S. Treasury Note, 1.625%, due 08/15/2022 | 5.60% |

| FNMA, Pool 386008, 4.52%, due 04/01/2013 | 3.08% |

| U.S. Treasury Note, 2.125%, due 08/15/2021 | 2.96% |

| FHLMC, Pool J19285, 2.50%, due 06/01/2027 | 2.18% |

| FHLMC, Series 3290 PD, 5.50%, due 03/15/2035 | 2.16% |

| Johnson & Johnson, 5.15%, due 07/15/2018 | 2.06% |

| FHLMC, Series 2841 BY, 5.00%, due 08/15/2019 | 1.79% |

| GlaxoSmithKline Capital, Inc., 5.65%, due 05/15/2018 | 1.71% |

| |

| Corporate Bonds | 47.33% |