Washington, D.C. 20549

The Annual report to Shareholders for the period ended August 31, 2015 pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “1940 Act”), as amended (17 CFR 270.30e-1) is filed herewith.

Letter from the President | 3 |

A Discussion of Fund Performance | 4 |

Supplementary Portfolio Information | 34 |

Financial Statements of the Monteagle Funds | |

Schedules of Investments: | |

Fixed Income Fund | 40 |

Informed Investor Growth Fund | 44 |

Quality Growth Fund | 46 |

Select Value Fund | 50 |

Value Fund | 53 |

The Texas Fund | 56 |

Statements of Assets and Liabilities | 62 |

Statements of Operations | 64 |

Statements of Changes in Net Assets | 66 |

Financial Highlights | 72 |

Notes to Financial Statements | 79 |

Report of Independent Registered Public Accounting Firm | 99 |

Other Information | 100 |

About Your Funds’ Expenses | 101 |

Trustees and Officers of the Trust | 104 |

Compensation of Trustees and Officers | 106 |

LETTER FROM THE PRESIDENT (Unaudited) |

Dear Shareholders:

Enclosed is the Annual Report for the Monteagle Funds. I encourage you to carefully review the information presented in this Annual Report as it contains valuable information about your investment.

As you will notice in reviewing the Annual Report, we continue to uncover opportunities in high quality, solid credit and attractive valuation areas.

As we reflect on this past fiscal year, we continue to see several headlines during the period, such as continued slow economic recovery, civil unrest, an uncertain domestic political environment, arguments over federal monetary policy, that all had a dramatic effect on the markets in which the Monteagle Funds invest. Despite the volatility that these headlines have created in the day-to-day stock markets, we have often said that we view investing as a marathon, not a sprint. As a result, we remain optimistic as we expect that the effect of some of these events will be short-lived although others may take longer to work their way through the system. We believe that remaining disciplined with a longer-term focus will benefit patient investors.

In closing, we would like to thank you for your continued confidence and support of the Monteagle Funds.

Sincerely,

MONTEAGLE FUNDS

Paul B. Ordonio, JD

President

MONTEAGLE FIXED INCOME FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited) |

How did the Fund Perform?

The Monteagle Fixed Income Fund (the “Fund”) had positive performance during the year. For the year ended August 31, 2015, the Fund had a total return of 0.72%. For the three, and six month periods ending August 31, 2015, the Fund had total returns of -0.54% and -0.42% respectively. The returns were primarily driven by deteriorating credit market conditions, rising short-term interest rates and modestly declining longer term interest rates over the fiscal year.

The Fund’s benchmark index (The Barclay’s Capital Intermediate Government/Credit Index) had relative returns of 1.47%, -0.33%, and 0.14% for the twelve, three, and six month periods, ending August 31, 2015, respectively.

What Influenced Fund Performance?

This past fiscal year ending August 2015, can best be described as volatile. Price volatility for fixed income securities is usually negatively correlated to uncertainty. In other words, as uncertainty increases, prices decrease (bond yields increase) and vice versa. However, within the context of uncertainty, various types of risk did impact Fund performance differently. This past year was characterized by increased uncertainty about inflation risk and its impact on real economic growth, as well as, uncertainty surrounding credit conditions for corporations and sovereign nations that also had a direct impact on fund performance.

Notwithstanding the much anticipated change in monetary policy actions by the Federal Reserve Bank (U.S. Central Bank – “the Fed”), longer term interest rates decreased while shorter term interest rates increased to reflect those changes to monetary policy. The chart below illustrates how interest rates on U.S. Treasury securities have changed over the fiscal year. The chart shows the progression of rates on a quarterly basis throughout the year.

U.S.

Treasury

Note | August

2014

Rates | November

2014

Rates | February

2015

Rates | May

2015

Rates | August

2015

Rates |

2 Year | 0.48 | 0.47 | 0.63 | 0.61 | 0.74 |

3 Year | 0.94 | 0.88 | 1.01 | 0.94 | 1.07 |

5 Year | 1.63 | 1.47 | 1.50 | 1.49 | 1.54 |

7 Year | 2.05 | 1.89 | 1.82 | 1.86 | 1.94 |

10 Year | 2.35 | 2.18 | 2.00 | 2.12 | 2.21 |

30 Year | 3.09 | 2.62 | 2.38 | 2.63 | 2.64 |

The movement in interest rates is usually an indication of the market’s expectation for growth, and with growth, we can also expect a certain amount of inflation. Additionally, monetary policy affected by the Federal Reserve Board (through the Fed funds overnight lending rate) does have an impact on the market structure of interest rates. The above chart illustrates how the bond market has responded to the end of asset purchases known as QE (quantitative easing) in October 2014 and the subsequent guidance provided by the Federal Reserve Board throughout the year that the Fed funds rate would most likely move from the 0 – 0.25% range in the 2nd half of 2015.

MONTEAGLE FIXED INCOME FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued) |

We can see that interest rates on the shorter end of the Treasury curve have increased slightly over the year, while rates on the longer end of the Treasury curve have declined. These movements in interest rates have had a mixed effect on performance. For those securities within the portfolio that have maturities of less than five years, relative performance has been slightly diminished. For those securities within the portfolio that have maturities greater than five years, the relative performance has been enhanced. Overall, portfolio performance has benefitted from the movement of interest rates over the last fiscal year.

In addition to monetary policy, portfolio performance has also been affected by economic growth, both, in the United States and globally. The U.S. economic growth rate as measured by the Real Gross Domestic Product (GDP) over the last year has been volatile. The 3rd quarter 2014 annualized rate of growth was 5.00%, but was followed by weaker estimates of growth. For the 4th quarter of 2014 it was 2.20%, 1st quarter of 2015, -0.20%, and the latest estimate of 2nd quarter 2015 growth, 3.70%. Some other major economies have had weaker readings of growth. The Eurozone’s last reading showed GDP year over year growth as of the 2nd quarter of 2015 of just 1.2%. Other Eurozone member nations such as Italy, France, Spain, and Germany had growth rates of 0.5%, 1.0%, 3.1%, and 1.6% respectively. Emerging market economies such as the so called BRICS (Brazil, Russia, India, China, and South Africa) are also struggling overall. Brazil and Russia are in recession with GDP year over year readings (as of 2nd quarter 2015) of -2.6% and -4.6% respectively. South Africa is still exhibiting positive growth at 1.2% year over year. India and China are still showing significant growth both above 7%, but at a slowing pace. As the market contemplates whether potential economic growth will accelerate or not, longer term interest rates will adjust higher or lower depending on what impact growth would have on labor markets, consumption, and inflation. This past year weaker growth rates have favored bonds of longer maturities. As previously mentioned, declining longer term interest rates had an overall positive affect on the portfolio’s performance.

Along with economic growth, the market has paid close attention to the health of the labor market. Improvement in labor statistics has positive implications for economic growth and direct implications for Federal Reserve monetary policy. During the course of this past fiscal year the economy created approximately 240,000 jobs per month. The unemployment rate has declined from 6.2% to 5.3% and the under-employment rate1 from 12.0% to 10.4%. However, while improvements in some statistics have provided some impetus for economic growth, there are other measurements that are not necessarily as strong and give an uncertain picture of future economic growth expectations.

With unemployment at 5.3% and approaching what historically would be considered the natural rate of unemployment, why has our economy failed to produce higher growth rates? The health of our Labor market can no longer be defined by the unemployment rate alone. We need to acknowledge that we still have a sizeable number of people that are working part-time who wish to be working full-time. The underemployment rate is still 10.4%. We also have the lowest labor

1 | (Total unemployed, plus all persons marginally attached to the labor force, plus total employed part time for economic reasons, as a percent of the civilian labor force plus all persons marginally attached to the labor force) |

MONTEAGLE FIXED INCOME FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued) |

participation rate since 1977. Wage growth is less than spectacular at 2.2% year over year. The average number of weekly hours worked is pretty stagnate at 34.6. So, while our economy has added jobs at a fairly decent pace since the recession ended, they are not high paying jobs and wage inflation is benign.

We believe that altogether the labor markets have had a modest negative impact on the Fund’s performance, primarily as it has affected the outlook for future monetary policy and increased short-term interest rates.

Another important variable that has, and will continue to impact portfolio performance, is expected inflation. Inflation measurements for much of the year have been well below the Fed’s implicit long-range target for price stability of 2%. The last reading of the CPI (Consumer Price Index) during the fiscal year, measured only 0.2% year over year, while the core CPI (less food and energy) increased 1.8%. While the trend for inflation has decreased over the last year, much of the decrease to CPI is from volatile decline in energy prices. Furthermore, inflation expectations as measured by the difference in yields between U.S. Treasury Notes and U.S. Inflation Protected Treasury Securities (TIPS) are also well below the 2% long-range Fed target. For the 5-year Notes, the difference is 1.33% and for 10-year Notes, the difference is 1.64%. We don’t believe that inflation had a material impact on Fund’s performance over the year. Actually, declining inflation had more of a positive impact on the Fund’s performance due to marginally longer duration than the benchmark index.

Credit conditions in the corporate bond market have deteriorated over the year. The tables that follow clearly indicate that higher quality bonds outperformed those of lower quality within the investment grade spectrum of fixed income securities. The biggest contributing factor to the underperformance of credit has to do with collapsing commodity prices for the better part of the year. The most widely used commodity that has had an impact on inflation measures, as well as credit, is petroleum or oil. While declining oil prices are a positive contributor to net importers of oil, they are a major problem for net exporters. Energy prices declining can be partially attributable to weaker demand from China, but most of the declines come from increased global supply. So, countries such as Russia, Brazil, and Canada have seen substantial negative impacts from these declines. As mentioned previously, both Russia and Brazil are currently in economic recessions, while Canada’s year over year GDP growth is just 0.5%. All of these countries rely heavily on net energy exports. As a result, this sector of the fixed income and equity markets has seen asset values decline and risk premiums increase, especially for heavily indebted energy exploration companies.

Our responses to these events have primarily been a disciplined approach to a high quality portfolio profile. We remain committed to the fund’s strategy of holding a well-diversified portfolio of high quality bonds. We believe that the markets have rewarded our patience and prudence. However, we have made some changes over the last year.

MONTEAGLE FIXED INCOME FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued) |

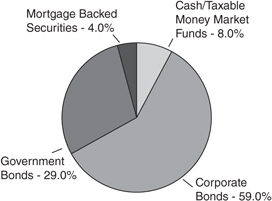

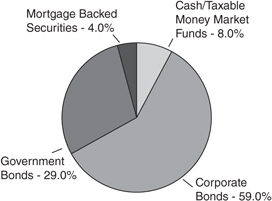

| | ● | During the course of the year we increased the Fund’s market allocation to Mortgage-Backed Securities while modestly increasing the Fund’s allocation to Government securities. We decreased the Fund’s allocation to investment grade intermediate corporate bonds to 51% from 59% of the portfolio. As can be seen from the following table, the Fund’s decision to increase the allocation to Mortgage-Backed securities, while decreasing exposure to corporate bonds did contribute positively to relative performance. |

Comparative Market Sector Weights

Monteagle Fixed Income Fund

August 31, 2014 | August 31, 2015 |

| | |

|  |

Index | Return for Period |

U.S. Treasury: Intermediate | 1.90% |

U.S. Agency Intermediate | 1.77% |

Intermediate Corporate | 0.76% |

Invest. Grade: Industrial — Intermediate | 0.25% |

Invest. Grade: Financial Institutions — Intermediate | 1.44% |

Fixed Rate Mortgage Backed Securities | 2.68% |

| | ● | Portfolio duration decreased slightly over last year. As of August 31, 2015 the Fund’s portfolio duration was 4.2 years (including cash) compared to the portfolio duration of 4.6 years at 2014 fiscal year end. Maturity decreased slightly from 5.0 years at 2014 fiscal year end to 4.83. When compared to the duration and weighted average maturity of 3.95 and 4.29, of the Barclay’s Intermediate Government/Credit index, the Fund’s portfolio is longer in both measures. We do not believe that the maturity structure of the Fund’s portfolio, relative to the benchmark index, had either positive or negative effects on relative performance. The following chart illustrates the performance of various maturity ranges within the Barclay’s Intermediate Government/Credit index. As we can see, bonds in the 3-7 year maturity range outperformed those having shorter |

MONTEAGLE FIXED INCOME FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued) |

and/or longer maturities. The portfolio’s securities mature in less than 10 years with the highest percentage maturing in the 3 to 5 year range (33.6%). 22.6% of the Fund’s assets mature in less than 3 years, 66.1%% in 3 to 7 years, and 11.3% in 7 to 10 years.

Intermediate U.S. Government/Credit (Returns, Unhedged) Maturity Sectors | 1 yr.

Total

Return | 6 month

Total

Return | 3 month

Total

Return |

All Maturities | 1.47% | 0.14% | -0.33% |

1 - 3 yrs. | 0.81% | 0.36% | -0.03% |

3 - 5 yrs. | 2.01% | 0.71% | -0.08% |

5 - 7 yrs. | 2.30% | 0.20% | -0.46% |

7 - 10 yrs. | 1.52% | -1.42% | -1.30% |

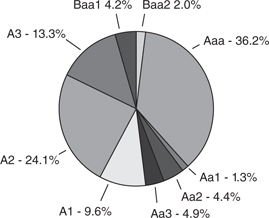

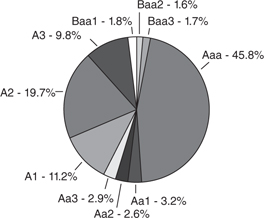

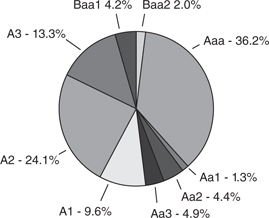

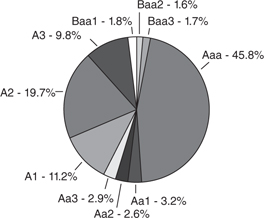

Comparative Credit Quality

Monteagle Fixed Income Fund

Moody’s Ratings August 29, 2014 | Moody’s Ratings August 31, 2015 |

| |

|  |

| | ● | The preceding charts represent the credit quality distribution of the fund’s securities holdings (not including cash or money market securities) at the beginning and end of this past fiscal year. For consistency of the relative analysis, in our distribution comparison above, we have only included the ratings provided by Moody’s (and not S&P, which rates U.S. Government obligations AA+). The Barclay’s benchmark index still maintains ratings of AAA on U.S. Government obligations. |

| | ● | The overall credit quality of the portfolio marginally increased over the course of the year. Our decreasing of corporate bonds and increasing of Mortgage-Backed securities, as well as Government bonds has increased quality slightly. Overall credit quality remains excellent with ratings of AA-/Aa3. |

MONTEAGLE FIXED INCOME FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued) |

| | ● | We would also note that at the end of this fiscal year, the Fund’s portfolio contained investment grade securities rated below A3/A-. While we are restricted from investing in securities rated below A3/A- at time of purchase, we do have the discretion of holding securities rated Baa/BBB should the rating be the result of a downgrade. It is our opinion that the securities in question do not materially affect the overall credit quality of the Fund’s portfolio and do not represent significant credit risk to portfolio value. The following table specifically identifies the securities in question. |

| MOODY

RTG | S&P

RTG | % of

Portfolio

Market Value |

AT&T, Inc., 5.80%, due 02/15/19 | Baa1 | BBB+ | 1.67% |

Allergan, Inc., 5.75%, due 04/01/16 | Baa3 | BBB-/*+ | 1.58% |

Becton Dickinson & Co, 3.125%, due 11/08/21 | Baa2 | BBB+ | 1.50% |

Total | | | 4.76% |

| | ● | The following table provides a summary illustration of how investment grade bonds of varying credit quality have performed over the past year. These are returns of bonds in the Barclay’s Intermediate U.S. Government/Credit index. The relative performance of credit is indicative of the risk/reward nature of these bonds. We can see that for the full year higher quality bonds had a performance advantage over those of lesser quality. As such, the performance of the Fund did benefit from the higher returns associated with Aaa and Aa rated bonds. |

| 1 yr.

Total Return | 6 month

Total Return | 3 month

Total Return |

Aaa | 1.87% | 0.54% | 0.05% |

Aa | 1.63% | 0.04% | -0.34% |

A | 1.37% | -0.30% | -0.62% |

Baa | -0.19% | -1.11% | -1.65% |

Total | 1.47% | 0.14% | -0.33% |

| | ● | For the year, trading was primarily driven by repositioning the Fund’s portfolio to reduce credit exposure and increase allocations to Mortgage-Backed and Government securities. We did realize on longer term gains by selling some of our more seasoned corporate bonds. In capturing some of the portfolio gains, we did sell bonds having higher coupons with shorter maturities and replaced with Mortgage-Backed and Government bonds having lower coupons. However, overall portfolio’s average coupon was slightly higher than at the end of 2014 fiscal year end; 3.26% versus 3.03%. |

MONTEAGLE FIXED INCOME FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued) |

What is the Fund’s Strategy?

The Fund will continue to invest in high quality intermediate term fixed income securities generally between 2 and 10 years in maturity. The Fund will continue to monitor economic conditions through the use of a proprietary model in an attempt to anticipate interest rate changes and lengthen or shorten the duration of the Fund’s portfolio of securities to maximize total return with minimal risk. The Fund will also actively manage portfolio holdings across market sectors in order to maximize total return within the scope of permitted investments defined by the Fund’s prospectus. While we have taken prudent steps to diversify the Fund’s assets by limiting exposure to the credit and interest rate risk associated with any one specific issuer, market sector, or maturity range, those risks cannot be completely eliminated without affecting long-term Fund performance. We remain vigilant and will act in your best interest to preserve the Fund’s asset values.

Fund performance shown represents the performance of the Fund’s Class I shares. For complete performance information, please refer to the Average Annual Total Return table in the following performance report. Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month-end, are available by calling 1-888-263-5593.

An investor should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other important information. To obtain a copy of the Fund’s prospectus please call 1-888-263-5593 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Fund is distributed by Matrix Capital Group, Inc.

Management’s Discussion of Fund Performance seeks to describe some of the Sub-Adviser’s current opinions and views of the financial markets. Although the Sub-Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed.

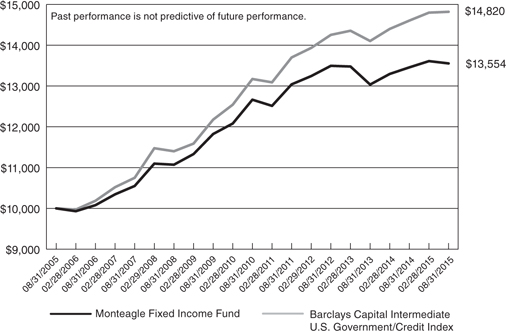

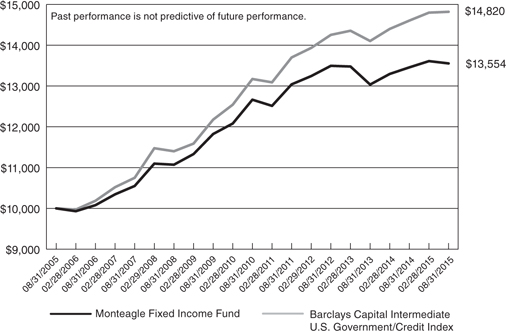

MONTEAGLE FIXED INCOME FUND

PERFORMANCE — August 31, 2015 (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment in Monteagle Fixed Income Fund

and the Barclays Capital Intermediate U.S. Government/Credit Index

Average Annual Total Return

(for the periods ended August 31, 2015) |

| | One Year | Five Years | Ten Years | |

Monteagle Fixed Income Fund | 0.72% | 1.37% | 3.09% | |

Barclays Capital Intermediate U.S. Government/Credit Index | 1.47% | 2.38% | 4.01% | |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost.

The above graph depicts the performance of the Monteagle Fixed Income Fund versus the Barclays Capital Intermediate U.S. Government/Credit Index (formerly Lehman Brothers U.S. Intermediate Government/Credit Index). The Barclays Capital Intermediate U.S. Government/Credit Index measures the performance of dollar denominated U.S. Treasuries, government-related (i.e. U.S. and foreign agencies, sovereign, supranational and local authority debt), and investment grade credit structures that have a remaining maturity of greater than or equal to one year and less than ten years. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track, and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the Barclays Capital Intermediate U.S. Government/Credit Bond Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the index; so too with the Monteagle Fixed Income Fund, which will not invest in certain securities comprising this index.

MONTEAGLE INFORMED INVESTORS GROWTH FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited) |

How did the Fund Perform?

The Monteagle Informed Investor Growth Fund (Fund) returned a slightly positive 0.24% for the fiscal year ending August 31, 2015. The S&P 500 Index (S&P), the Fund’s benchmark, rose 0.48%.

What is the Fund’s Investment Approach?

The Fund invests primarily in medium capitalization stocks (median, generally around $15 billion) of well-managed, financially sound companies, offering under-valued earnings growth rate, earnings yield and earnings surprise momentum, superior return on investment capital and cash flow growth opportunities. These are companies in which management or large and informed investors - - individuals and/or funds - - are significant common stock owners or buyers, or where the company itself is repurchasing its own shares on the open market. This investment discipline is widely recognized as The Informed Investor Strategy - - now marking its 60th year of institutional portfolio management success.

Summarizing, these companies qualify for intensive research analysis only if they meet at least one of these five first-screen qualifying selection tests:

| | 1. | The company’s officers and directors are buying its common stock on the open market. |

| | 2. | A major outside investor (minimum 5% shares outstanding owned) has filed a Form 13-D purchase disclosure on the company’s stock. |

| | 3. | The company has announced its intent to repurchase its common stock on the open market. |

| | 4. | A significant percentage of the company’s stock is owned by family/management. |

| | 5. | The current top performing equity mutual funds and/or equity-orientated hedge funds are accumulating the company’s common stock on the open market. |

The buy disciplines are matched by a series of five sell disciplines. They are:

| | 1. | Begin selling if a stock drops a minimum of 8% from an average-cost basis. |

| | 2. | Begin selling when a holding-high loss-limit is triggered. (Stock falls a minimum of 14% from its portfolio holding-high price.) |

| | 3. | Begin selling on preliminary, but confirmed, indications of a breakdown in a company’s financials. |

| | 4. | Possibly selling when informed investors stock transaction signals turn bearish. |

| | 5. | Sell partial positions of a portfolio stock after an unusually day-to-day sharp price run-up. |

MONTEAGLE INFORMED INVESTORS GROWTH FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued) |

What Influenced the Fund’s Performance?

The Fund returned a negative 2.9% for the first fiscal quarter ending November 30, 2014. The S&P 500 Index, the Fund’s benchmark, posted a return of +3.7%. The Fund’s investment return was influenced during its first fiscal quarter by negative performance in three sectors: Energy, Consumer Discretionary and Industrials.

| | o | Declining stocks in the Consumer Discretionary sector included Harman (HAR) -17.8%, Tesla (TSLA) -10.9% and Netflix (NFLX) -10.2%. |

| | o | The Energy sector held Continental Resource (CLR) which was the major problem stock, losing -15.1%. |

| | o | The Industrial sector was negatively impacted by losses in Spirit Airlines (SAVE) -15.6% and Trinity (TRN) down 18.1%. |

The Fund returned a positive 7.3% for the second fiscal quarter ending February 28, 2015. The S&P 500 Index, the Fund’s benchmark, posted a return of +2.3%. The Fund’s investment return was influenced during this time by positive performance in four sectors: Information Technology, Consumer Staples, Consumer Discretionary and Healthcare.

| | o | The Information Technology sector’s advancing stocks included Avago Technologies (AVGO) +36.6%, Electronic Arts (EA) +30.2%, and Skyworks Solutions (SWKS) +30.1%. |

| | o | The Consumer Staple sector’s advancing stock was Monster Beverage (MNST) +19.1%. |

| | o | The Consumer Discretionary sector included Domino’s Pizza (DPZ) +8.2% and Lowes (LOW) +7.4%. |

| | o | The Healthcare sector’s advancing stocks were Centene (CNC) +24.5% and Valeant Pharmaceutical (VRX) +22.7%. |

The Fund returned a positive 5.8% for the third fiscal quarter ending May 31, 2015. The S&P 500 Index, the Fund’s benchmark, posted a return of +0.6%. The Fund’s investment return was influenced during its third fiscal quarter by positive performance in two sectors: Health Care and Information Technology.

| | o | The Healthcare sector’s advancing stocks were Centene (CNC) +22.6, Biomarin (BMRN) +12.0% and Cigna (CI) +14.8%. |

| | o | The Information Technology sector held NXP Semiconductor (NXPI) +32.5%, Palo Alto (PANW) +19.2% and Avago (AVGO) +16.0%. |

The Fund returned a negative 9.0% for the fourth fiscal quarter ending August 31, 2015. The S&P 500 Index, the Fund’s benchmark, posted a return of – 5.9%. The Fund’s investment return was influenced during its third fiscal quarter by negative performance in two sectors: Health Care and Information Technology.

| | o | The Health Care Sector returned a negative 6.9% for the quarter. Declining stocks in the sector included: Mallinkrodt (MNK) -22.5% and Medivation (MDVN) -14.8% |

MONTEAGLE INFORMED INVESTORS GROWTH FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued) |

| | o | The Information Technology Sector returned a negative 7.5%. Declining stocks in the sector included: Intuit (INTU) -18.0% and Nxp Semiconductor (NXPI) -17.0%. |

The top five holdings that influenced the fund’s performance positively for the fiscal year were Avago Technologies (AVGO) +52.2%, Palo Alto Networks (PANW) +49.2%, Skechers (SKX) +49.2%, Electronic Arts (EA) +45.3 and Skyworks (SWKS) +43.9%. Four of the five stocks are in the Information Technology Sector.

The five equity holdings contributing the least to the Fund’s performance for the full fiscal-year were: Akorn (AKRX) -23.3%, Intuit (INTU) -21.4%, Illumina (ILMN) -21.0%, Old Dominion Freight (ODFL) -20.4% and Universal Health Services (UHS) -18.5. Three of the five stocks are in the Health Care Sector

The total performance return for the portfolio was aided by the results of the two ETF holdings: S&P 500 Trust Index (SPY), up 10.8%, and the Nasdaq Power Shares Trust (QQQ), up 9.9%. ETFs’ are used when we believe stock picks are limited due to market variations.

Also, as of the August 31, 2015 fiscal year-end, the Fund held 32% in cash. This holding was viewed as a neutral influence on performance during the fiscal year.

Finally, the Fund’s fiscal year ended with some continuing economic bright spots: a positive housing outlook, re-surging auto sales and low interest rates.

What is the Fund’s Strategy?

The current strategy of the Monteagle Informed Investors Growth Fund is bullish in outlook and the intention is to remain virtually fully invested in a select list of uniquely attractive growth stocks that fulfill the rigid Informed Investors growth stock criteria. Positions in cash and ETFs remain a secondary consideration, and are quite subordinate to stock selection priorities.

Fund performance shown represents the performance of the Fund’s Class I shares. For complete performance information, please refer to the Average Annual Total Return table in the following performance report. Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month-end are available by calling 1-888-263-5593.

An investor should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other important information. To obtain a copy of the Fund’s prospectus please call 1-888-263-5593 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Fund is distributed by Matrix Capital Group, Inc.

Management’s Discussion of Fund Performance seeks to describe some of the Sub-Adviser’s current opinions and views of the financial markets. Although the Sub-Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed.

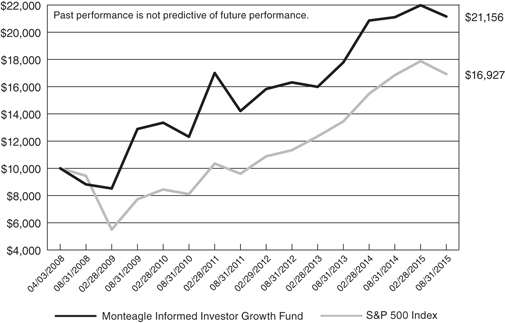

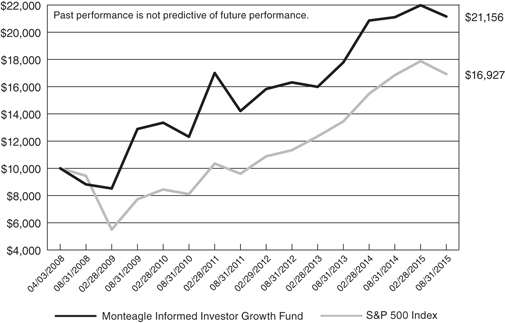

MONTEAGLE INFORMED INVESTOR GROWTH FUND

PERFORMANCE — August 31, 2015 (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment

in Monteagle Informed Investor Growth Fund and the S&P 500 Index

Average Annual Total Return

(for the periods ended August 31, 2015) |

| | One Year | Five Years | Since

Inception(a) | |

Monteagle Informed Investor Growth Fund | 0.24% | 11.42% | 10.64% | |

S&P 500 Index | 0.48% | 15.86% | 7.36% | |

(a) | Represents the period from the commencement of operations (April 3, 2008) through August 31, 2015. |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost.

The above graph depicts the performance of the Monteagle Informed Investor Growth Fund versus the S&P 500 Index. The S&P 500 Index by Standard and Poor’s Corp. is a capitalization-weighted index comprising 500 issues listed on various exchanges, representing the performance of the stock market generally. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track, and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the S&P 500 Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the index; so too with the Monteagle Informed Investor Growth Fund, which will not invest in certain securities comprising this index.

MONTEAGLE QUALITY GROWTH FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited) |

How did the Fund perform?

For the year ended August 31, 2015, the Monteagle Quality Growth Fund (the “Fund”) had a total return of 2.43%. The S&P 500 Index (“S&P 500”) and the Russell 1000 Growth Index (“Russell 1000”), the Fund’s two benchmarks, had total returns of 0.48% and 4.26%, respectively, for the same period. The Fund’s net asset value per share as of August 31, 2015 was $13.16 versus $12.99 as of August 31, 2014.

What is the Fund’s investment approach?

The Fund utilizes a growth style, investing in primarily domestic companies believed by the investment manager to be of high quality and to have above-average sustainable and/or accelerating growth with an ability to exceed earnings expectations over time. The underlying belief is that high quality companies outperform over time with less risk. Various quality rankings and other metrics which demonstrate quality, including earnings consistency, are evaluated carefully before a stock is added to the portfolio. The Fund employs a proprietary screening process and bottom-up work to construct portfolios. However, portfolio constraints are established to ensure sufficient diversification by sector as well as by market capitalization. The underlying belief is that diversification provides for greater control of risk in the portfolio, while allowing freedom in individual stock selection. The screening process is designed to identify stocks with rising expectations, as the Fund looks to invest in securities whose growth potential is, in the manager’s eyes, generally underestimated by the market. Holdings generally have a market capitalization of at least $2 billion, with about 65% to 85% of the portfolio in stocks of over $15 billion. Compared to the S&P 500, the portfolio may have a lower dividend yield, a higher price/earnings ratio and a higher expected earnings growth rate.

What influenced the Fund’s performance?

For the fiscal year ended August 31, 2015, domestic equity markets posted modest returns. Yet the year is best viewed as two distinct time periods. For the first eleven months of the fiscal year, stocks moved steadily higher on expectations of a gradually improving global economy and continued liquidity support from central banks. Through July 31, 2015, the S&P 500 gained 6.9%. Volatility rose dramatically in the final fifteen days of the year following an unexpected Chinese currency devaluation, confirming sluggish growth in China and calling into question the global economic recovery. During the month of August, the S&P 500 dropped 6.0%.

The Fund’s strategy to focus on high quality stocks suggests performance might be expected to lag a bit in periods when investors seek riskier, ultra-high growth stocks. Such has been the case in the six-plus years subsequent to the March 2009 market bottom. Investors have been fixated on central bank actions, expecting any market dip would be supported with additional liquidity injections from the U.S. Federal Reserve. Consistent with this trend, the Fund returned 9.6% through the first eleven months of the fiscal year, slightly behind the higher-risk Russell 1000 benchmark return of 11.0% but ahead of broader S&P 500 benchmark returns of 6.9%.

MONTEAGLE QUALITY GROWTH FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued) |

A focus on high quality stocks also suggests the Fund might hold up better during periods of market distress as fearful investors seek the safety of more conservative, blue chip stocks. Unfortunately, investors differentiated little between risk and safety in the August downturn. The higher-risk Russell 1000 benchmark declined 6.1% for the final month of the year, compared with 6.0% for the broader S&P 500 and 6.5% for the Fund.

Viewing the entire fiscal year, the portfolio outperformed the S&P 500 by 1.95%, or 195 basis points. Both sector allocation and stock selection contributed to the relative returns. An underweight position in Energy and overweight position in Consumer Discretionary provided most of the 279 basis points of performance attributable to sector allocation. The underlying reason was a collapse in energy prices, boosting cash available in consumers’ pockets to spend on other items. Stock selection benefits were widespread across the portfolio, contributing 57 basis points of relative performance.

Relative to the Russell 1000 Growth benchmark, the Fund underperformed by 183 basis points for the fiscal year. The portfolio’s high quality focus reduced performance by 24 basis points. Sector allocation contributed 51 basis points of positive performance, attributable to an underweight position in Energy and an overweight position in Consumer Staples. Stock selection against the higher-risk Russell 1000 was negative, reducing performance by 95 basis points. In particular, biotechnology stocks posted very strong returns. The portfolio has relatively few biotechnology holdings as most do not meet the Fund’s screens due to a low profitability.

During the fiscal year, individual stocks contributing most positively to relative returns were CVS Health (drug retail, up 30.6%), Nike (footwear, up 43.5%), Visa (electronic payments, up 35.2%), Home Depot (home improvement retail, up 27.1%), and Walt Disney (entertainment, up 15.4%). Individual stocks reducing performance the most were Stratasys (instruments, down 75.9%), Qualcomm (communications, down 23.6%), and Trimble Navigation (instruments, down 43.2%).

For the first quarter ending November 30, 2014, the portfolio returned 5.2% compared with 3.7% for the S&P 500 and 4.4% for the Russell 1000 Growth. The portfolio’s tilt toward consumer companies, away from Energy companies, was most obvious in the first quarter as crude oil prices fell markedly.

For the second quarter ending February 28, 2015, the portfolio gained 3.4% compared with 2.3% for the S&P 500 and 3.9% for the Russell 1000 Growth. Financial holdings performed well during the quarter as investors began to anticipate rising long term interest rates with the U.S. Federal Reserve backing away from its bond purchasing programs. Typically, financial stocks perform well with a steepening yield curve.

For the third quarter ending May 31, 2015, the portfolio slipped 0.1% while the S&P 500 Index rose 0.6% and the Russell 1000 Growth increased 0.8%. During the latter portion of the quarter, earnings estimate cuts began to spread beyond Energy companies to include areas exposed to the general business cycle or a rising U.S. dollar. Investors responded to negative estimate revisions by seeking ultra-high growth, but often unprofitable, companies. Biotechnology and internet companies fared particularly well. Both areas are underrepresented in the portfolio.

MONTEAGLE QUALITY GROWTH FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued) |

For the fourth quarter ending August 31, 2015, the portfolio declined 5.7% compared with a 5.9% decrease for the S&P 500 and a 4.6% reduction in the Russell 1000 Growth. Modest cash holdings and an underweight position in Energy provided little cushion. Investors made no distinction between conservative blue chip stocks and high-risk unprofitable companies with stretched balance sheets. In general, better performing companies sported higher P/E valuations.

Changes to the portfolio during the year reflect a heightened emphasis on quality in the expectation that stock market volatility may increase in a slowing global economy. New holdings added to the fund over the past year include American Express (payments), Biogen (biotechnology), Caterpillar (machinery), Chevron (integrated energy), Deckers Outdoors (footwear), Facebook (internet), FLIR Systems (instruments), Procter & Gamble (household products), Schlumberger (oil service), Time (publications), Union Pacific (railroad), UnitedHealth Group (managed care), and Wynn Resorts (casino).

Purchases were funded by the elimination of positions in American Express (payments), Baxalta (biotechnology), Danaher (industrial), East West Bancorp (banking), Family Dollar (retail), National Oilwell Varco (oil service), Precision Castparts (industrial), Ross Stores (retail), Schlumberger (oil service), Stratasys (instruments), and Wynn Resorts (casino).

What is the Fund’s Strategy?

The Fund will continue to focus on maintaining a diversified portfolio of high-quality companies delivering sustainable above-market earnings growth as well as companies poised to experience acceleration in earnings growth relative to expectations. The Fund’s adviser believes the companies that can exceed expectations in the form of positive earnings surprises will be well rewarded over coming quarters.

Fund performance shown represents the performance of the Fund’s Class I shares. For complete performance information, please refer to the Average Annual Total Return table in the following performance report. Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month-end, are available by calling 1-888-263-5593.

An investor should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other important information. To obtain a copy of the Fund’s prospectus please call 1-888-263-5593 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Fund is distributed by Matrix Capital Group, Inc.

Management’s Discussion of Fund Performance seeks to describe some of the Sub-Adviser’s current opinions and views of the financial markets. Although the Sub-Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed.

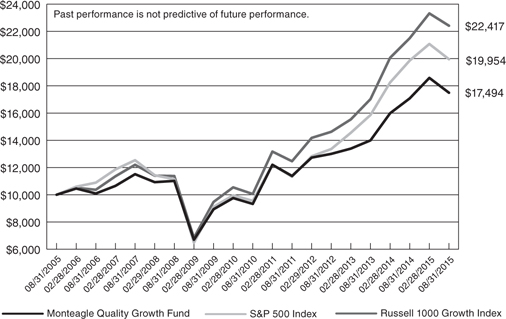

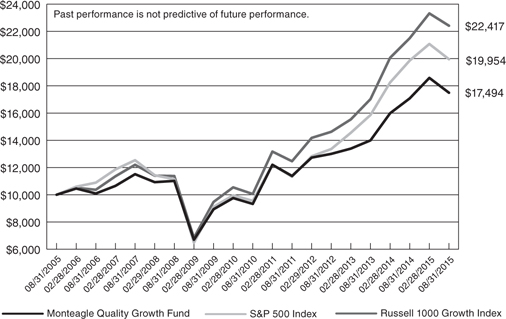

MONTEAGLE QUALITY GROWTH FUND

PERFORMANCE — August 31, 2015 (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment in Monteagle Quality Growth Fund,

the S&P 500 Index and the Russell 1000 Growth Index

Average Annual Total Return

(for the periods ended August 31, 2015) |

| | One Year | Five Years | Ten Years | |

Monteagle Quality Growth Fund | 2.43% | 13.41% | 5.75% | |

S&P 500 Index | 0.48% | 15.86% | 7.15% | |

Russell 1000 Growth Index | 4.26% | 17.39% | 8.40% | |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost.

The above graph depicts the performance of the Monteagle Quality Growth Fund versus the S&P 500 Index and the Russell 1000 Growth Index. The S&P 500 Index by Standard and Poor’s Corp. is a capitalization-weighted index comprising 500 issues listed on various exchanges, representing the performance of the stock market generally. The Russell 1000 Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track, and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the S&P 500 Index and the Russell 1000 Growth Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the indices; so too with the Monteagle Quality Growth Fund, which will not invest in certain securities comprising these indices.

MONTEAGLE SELECT VALUE FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited) |

How did the Fund perform?

For the year ended August 31, 2015, the Monteagle Select Value Fund (the “Fund”) had a return of -4.10%. The S&P 500 Index (“S&P 500” or “Index”) had a return of 0.48% for the same period. The Fund’s net asset value per share as of August 31, 2015 was $15.86 versus $18.66 on August 31, 2014. Despite the negative return, we still anticipate a large capital gain distribution occurring in December as a result of the high amount of realized gains recognized over the last year.

What is the Fund’s investment approach?

The Fund’s investment goal is long-term capital appreciation. The Fund uses a “value investing” style by investing, under normal circumstances, at least 80 percent of its assets in common stock of domestic companies believed to be under-priced relative to comparable securities determined by price-to-earnings ratios, cash flows or other measures. The Fund’s adviser predominately utilizes a reversion-to-the-mean strategy on stock selection in order to achieve its results rather than trying to time market fluctuations. The adviser limits the pool of stocks to consider for purchase to only those equities in the S&P 500. In selecting stocks, the Fund’s adviser establishes valuation parameters by using relative ratios or target prices to evaluate companies on several levels. Additionally, the adviser will generally have the Fund hold between 40 and 60 equities and diversify its holdings across numerous industries. The Fund seeks to maintain a minimum average weighted market capitalization of $5 billion.

Value stocks are broadly defined as equities which have a price-to-earnings ratio and a price-to-book ratio less than the relative market average with dividends tending to be higher than the relative market average. Also, value stocks tend to have a beta (a measure of the stocks price volatility relative to the overall market, i.e. the S&P 500) less than 1.0.

What influenced the Fund’s performance?

During the twelve months ended August 31, 2015, the Fund’s performance was affected by the incredible volatility in the US equity market and the large concern of rising interest rates and its effect on the markets. Between the economic woes in China, revamping of quantitative easing by the ECB, US presidential candidates duking it out and record intraday equity movements in the US, there has been plenty of reading entertainment. The Federal Reserve continues to manage expectation regarding the timing of rising interest rates. Even major economists have been “head faked” by the timing. In early August, over 80% of economists believed the Fed would raise rates in September with the majority of the remainder believing October would be the first hike. Since that September meeting has already occurred at the time of this writing, it is obvious to report there was no move from the Fed. Despite unemployment falling in August to its lowest level since April of 2008 (5.1%), the FOMC statement stated the belief that “recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term.” The translation is the Fed is keeping their options open and wants to be very sure indicators will continue improving once they begin raising rates. At the time of this writing, traders in the futures market are putting about 30% odds on a December increase and 40% on January with the vast majority of the remainder being further in 2016. Essentially, this means no one knows and even the “professional” economists have differing views. During the

MONTEAGLE SELECT VALUE FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued) |

period, the US equity market saw the largest intraday decline of all time in late August when the Dow Jones Industrial Average fell 1,089 points when the market opened Monday, August 24th. While the market closed at less of a loss that day, this occurrence (hindsight) was in the middle of an almost 11% fall which triggered correction territory. This fall wiped out the gains for the year that the major equity indices had generated. To put this in context, during the last week of August, the S&P 500 completed six consecutive trading sessions with movements of 1% or more. This has happened only 21 other times for the S&P since 1950. With a rough quarter for stocks to end the Fund’s year, the focus on a “value style, reversion-to-the-mean” has led to lagging performance as of late. Moreover, the Fund’s performance was affected by its asset allocation weighting to the various sectors of the Index. However, longer term, the Fund has performed very attractively overall compared to the S&P 500 Index.

For the first quarter ended November 30, 2014, the portfolio holdings of the Fund underperformed the Index. The investments of the Fund experienced a 0.92% return versus a return for the Index of 3.72%. For the trailing 12-month period ended November 30, 2014, the portfolio holdings of the Fund underperformed the Index with the investments of the Fund experiencing a 13.52% return versus a 16.86% return for the Index. The portfolio held a slightly higher cash balance of 13.3% invested in cash and money funds while the equities represented 86.7% of the assets.

The broad sectors of the Index that improved the most on average during the first quarter were the Health Care (9.95%), Consumer Staples (9.30%), and Utilities (8.94%) sectors while the Energy (-10.94%), Materials (1.03%), and Telecommunication Services (3.22%) sectors were the lowest performing within the Index. The portfolio performance was led by its holdings in the Consumer Discretionary, Utilities and Consumer Staple sectors during this quarter. The lower performing sectors in the portfolio were Energy, Basic Materials and Industrial. The Index again closed near record highs, ending the quarter at 2,067.56, just five points off the all-time high close the day before. This followed a run-up of approximately 11.3% in the Index over a month and a half period.

As of the end of the first quarter, the portfolio holdings continued to be diversified across many sectors of the Index with less exposure to the Communications, Utility and Materials sectors. The largest sector allocations were Consumer Discretionary, Financial and Industrial. The Fund’s positive portfolio performance was primarily attributed to its top performing stock picks of Edwards Lifesciences Corp. (24.84%), Target Corp. (24.25%), and Whirlpool Corp. (22.28%). The Fund’s portfolio performance was most negatively affected by Transocean LTD. (-44.45%), Diamond Offshore Drilling, Inc. (-31.78%) and Abercrombie & Fitch Co. (-30.63%). During the quarter, five disposals were made in order to remove securities that achieved their target price and make room for new securities with more appreciation potential. Four purchases were made in November, purchasing three new names and averaging into one existing security. The elevated cash balance at the end of the quarter ended November 30, 2014 was to allow for payment of the large capital distribution in December. As of the end of the second quarter, cash represented 13.3% of the assets.

MONTEAGLE SELECT VALUE FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued) |

For the second quarter ended February 28, 2015, the portfolio holdings of the Fund outperformed the Index. The investments of the Fund experienced a 5.42% return versus a return for the Index of 2.31%. For the trailing 12-month period ended February 28, 2015, the portfolio holdings of the Fund outperformed the Index with the investments of the Fund experiencing a 17.90% return versus a 15.50% return for the Index. The portfolio held a cash balance of 10.68% invested in cash and money funds while the equities represented 89.32% of the assets.

The broad sectors of the Index that improved the most on average during the second quarter were the Consumer Discretionary (8.24%), Health Care (6.10%), and Materials (4.43%) sectors while the Energy (-5.72%), Telecommunication Services (-0.25%), and Utilities (0.56%) sectors were the lowest performing within the Index. The portfolio performance was led by its holdings in the Consumer Discretionary, Consumer Staple and Telecommunication Services sectors during this quarter. The lower performing sectors in the portfolio were Basic Materials, Utilities and Industrial. The Index again closed near record highs, ending the second quarter at 2,104.50 approximately eleven points off the all-time high close a few days before. This followed a run-up of approximately 6.04% in the Index in February.

As of the end of the second quarter, the portfolio holdings continued to be diversified across many sectors of the Index with less exposure to the Utility, Materials and Technology sectors. The largest sector allocations were Consumer Discretionary, Financial and Energy. The Fund’s positive portfolio performance was primarily attributed to its top performing stock picks of Kohl’s Corp. (24.58%), Tesoro Petroleum Corp. (20.34%), and Humana, Inc. (19.37%). The Fund’s portfolio performance was most negatively affected by United States Steel Corp. (-28.07%), Transocean LTD (-20.22%) and Freeport-McMoran (-17.95%). During the quarter, five disposals were made in order to remove securities that achieved their target price in order to make room for securities with more appreciation potential. Four purchases were made in February, purchasing three new names and averaging into one existing security. As of the end of the third quarter, cash represented 10.68% of the assets.

For the third quarter ended May 31, 2015, the portfolio holdings of the Fund outperformed the Index. The investments of the Fund experienced a 0.75% return versus a return for the Index of 0.64%. For the trailing 12-month period ended May 31, 2015, the portfolio holdings of the Fund outperformed the Index with the investments of the Fund experiencing a 13.07% return versus an 11.80% return for the Index. The portfolio held an elevated cash balance of 16.28% invested in cash and money funds while the equities represented 83.72% of the assets.

The broad sectors of the Index that improved the most on average during the third quarter were the Health Care (4.95%), Financials (2.50%), and Consumer Discretionary (2.31%) sectors while the Consumer Staples (-1.13%), Industrials (-0.59%), and the Utilities (-0.54%) sectors were the lowest performing within the Index. The Index again closed near record highs, ending the quarter at 2,107.39 approximately twenty-three points (1.1%) off the all-time high close about a week before. This followed a run-up of almost 2.5% in the Index in earlier May.

As of the end of the third quarter, the portfolio holdings continued to be diversified across many sectors of the Index with less exposure to the Utility, Materials and Consumer Staple sectors. The largest sector allocations are Financial, Energy and Consumer Discretionary. The Fund’s positive

MONTEAGLE SELECT VALUE FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued) |

portfolio performance was primarily attributed to its top performing stock picks of Humana (30.80%), Transocean LTD (22.72%), and Noble Corp. (9.58%). The Fund’s portfolio performance was most negatively affected by Abercrombie & Fitch Co. (-16.56%), C.H. Robinson Worldwide, Inc. (-16.49%) and Xerox Corp. (-15.83%). During the quarter, three disposals were made in order to remove securities that achieved their target price in order to make room for securities with more appreciation potential. One of these disposals, CVS Health Corp., was sold after achieving a return of approximately 250%. Five purchases were made in April, purchasing four new names and averaging into one existing security. As of the end of the quarter, cash represented 16.3% of the assets.

For the fourth quarter ended August 31, 2015, the portfolio holdings of the Fund underperformed the Index. The investments of the Fund experienced a -10.54% return versus a return for the Index of -5.92%. For the trailing 3-year period ended August 31, 2015, the portfolio holdings of the Fund significantly outperformed the Index with the investments of the Fund experiencing a 19.35% annualized return versus a 14.31% annualized return for the Index. The cash balance of the portfolio at the end of the fourth quarter, which is also the Fund’s year-end, was 2.72%, invested in cash and money funds while the equities represented 97.28% of the assets.

The broad sectors of the Index that improved the most/fell the least on average during the fourth quarter were the Consumer Discretionary (0.42%), Utilities (-2.10%), and Information Technology (-2.11%) sectors while the Energy (-14.63%), Materials (-12.67%), and Industrials (-6.91%) sectors were the lowest performing within the Index. The Index experienced one of the largest all-time intra-day declines on record near the close of the quarter, falling approximately 9.55% in only four trading days. The last couple days of August ended with positive movement, yet the Index still closed over 11.6% off of highs earlier this calendar year. Perhaps a correction was in order as the first four months of the calendar quarter produced a run up of over 17.5%. Moreover, since this time the Index fell approximately 6.9% from the beginning of May until the end of August.

As of the end of the fourth quarter, the portfolio holdings continued to be diversified across many sectors of the Index with less exposure to the Consumer Staple and Materials sectors. The largest sector allocations are Energy, Consumer Discretionary and Financial. The Fund’s positive portfolio performance was primarily attributed to its top performing stock picks of Google, Inc. (18.80%), C.H. Robinson Worldwide (9.90%), and National Oilwell Varco, Inc. (8.51%). The Fund’s portfolio performance was most negatively affected by Denbury Resources, Inc. (-54.64%), Freeport-McMoRan, Inc. (-45.63%) and Allegheny Technology, Inc. (-40.24%). During the fourth quarter, seven disposals were made. Some of these were sold in order to remove securities that achieved their target price and make room for securities with more appreciation potential. Others were sold in order to realize losses to offset a portion of the large capital gains distribution for the Fund. These securities were sold under the procedural “out process” as determined by the holding period for the strategy. Subsequent to these disposals, thirteen securities were either averaged into or purchased for the first time to reinvest cash. As of the end of the fourth quarter, cash represented 2.7% of the assets.

MONTEAGLE SELECT VALUE FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued) |

What is the Fund’s strategy?

The Fund will continue to concentrate on equities contained in the S&P 500 which generally consists of large name brand corporations with good fundamentals and broad product diversification. The Fund’s adviser will continue to be disciplined in the use of its predominate strategy of reversion-to-the-mean by applying its “value investing” approach valuation model; thereby, allowing the market’s volatility to identify those securities that become under-valued and are poised to be the next performers in the market. Sector allocation in the Fund’s portfolio will primarily be determined by which companies are available for purchase pursuant to the Fund’s strategy. It is anticipated that the Fund may hold higher levels of cash during extended periods of market uncertainty and will selectively invest the cash into equities identified by the primary investment strategy as opportunities present themselves or for dollar-cost-averaging into currently held positions. This strategy is executed with a long-term outlook and will have periods of under-performance and out-performance versus its Index. Therefore, the Fund’s daily performance can and will vary dependant upon current market conditions.

Fund performance shown represents the performance of the Fund’s Class I shares. For complete performance information, please refer to the Average Annual Total Return table in the following performance report. Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month-end, are available by calling 1-888-263-5593.

An investor should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other important information. To obtain a copy of the Fund’s prospectus please call 1-888-263-5593 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Fund is distributed by Matrix Capital Group, Inc.

Management’s Discussion of Fund Performance seeks to describe some of the Sub-Adviser’s current opinions and views of the financial markets. Although the Sub-Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed.

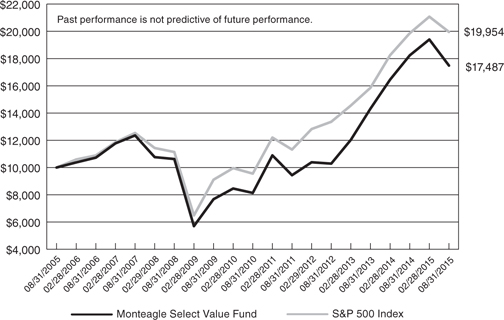

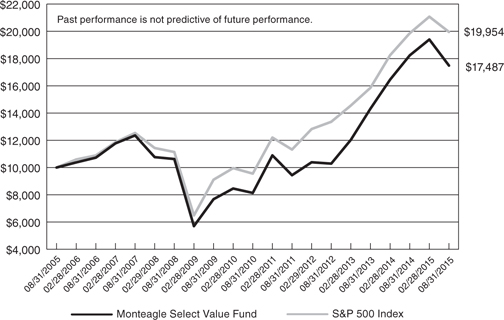

MONTEAGLE SELECT VALUE FUND

PERFORMANCE — August 31, 2015 (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment

in Monteagle Select Value Fund and the S&P 500 Index

Average Annual Total Return

(for the periods ended August 31, 2015) |

| | One Year | Five Years | Ten Years | |

Monteagle Select Value Fund | (4.10%) | 16.54% | 5.75% | |

S&P 500 Index | 0.48% | 15.86% | 8.38% | |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost.

The above graph depicts the performance of the Monteagle Select Value Fund versus the S&P 500 Index. The S&P 500 Index by Standard and Poor’s Corp. is a capitalization-weighted index comprising 500 issues listed on various exchanges, representing the performance of the stock market generally. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track, and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the S&P 500 Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the index; so too with the Monteagle Select Value Fund, which will not invest in certain securities comprising this index.

MONTEAGLE VALUE FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited) |

How did the Fund Perform?

For the year ended August 31, 2015, the Monteagle Value Fund (the “Fund”) reported a total return of -14.33%. The S&P 500 Index (“S&P 500”) had a total return of 0.48% for the same time period. The Fund’s net asset value per share as of August 31, 2015 was $13.36 versus $18.60 at August 31, 2014. The Fund paid capital gains distributions of $2.53 per share in December 2014.

What is the Fund’s investment approach?

The Fund’s investment goal is to achieve maximum returns through investing in undervalued companies. The Fund determines value usually based on price-to-earnings ratios, but also reviews historical price to book value ratios, dividend yield and balance sheet quality in determining whether prospective investments are truly undervalued. The Fund adviser will hold 40 to 50 equities. The Fund seeks to maintain a minimum average market capitalization of $5 billion. The current average market capitalization exceeds $49 billion. The current price earnings ratio is 14.3 times 2016 earnings and currently yields 3.2%. The S&P 500 currently trades at 15.5 times 2016 earnings and yields 2.1 percent.

The Fund also makes industry determinations based upon interest rate cycles. Historical relationships between short-term and long-term U.S. Treasury securities impact industry weightings as easier money promotes growth in inflation while tight money favors disinflation.

As a general rule, new investments are made based on historical quantitative valuation measures that the Fund deems as undervalued. Conversely, the positions which are sold usually reach quantitative valuation measures that the Fund deems fully or overvalued. Decisions to reduce or sell partial holdings are based on industry overweightings.

The Fund also makes investments for the long-term, holding the positions for three to five years unless there are extraordinary events such as mergers, acquisitions or deterioration of the industry or company.

What influenced the Fund’s performance?

During the year ended August 31, 2015, the Fund incurred its underperformance versus the S&P 500 as the overall economic activity posted anemic worldwide growth weakening the U.S. equity markets. The major indices including the S&P 500 and the Dow Jones Industrial Averages were dominated by the top five market capitalization companies that command higher price earnings ratios and little or no dividend yield. Value companies that have lower price earnings ratios and higher dividend yields underachieved for the twelve months as economic activity slowed. More recent corporations have projected lower or flat earnings growth for the immediate six months dampening overall equity prices. During the past twelve months, the Federal Reserve has inserted debate in the FOMC statements to the criteria being used to raise short-term interest rates. At the current juncture, the economy has not achieved its targeted 2% inflation rate. The government is reporting 5.1% unemployment although over 10 million workers have given up looking for jobs. The Great Inflation has certainly been put on hold as disinflationary forces have quelled any hopes of a robust economy anytime soon. The recent decline in U.S. Treasury yields continues to keep a lid on any rise in short-term interest rates.

MONTEAGLE VALUE FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued) |

During the first quarter ending November 30, 2014 the Fund underperformed the S&P 500 returning -2.94% versus 3.72% for the S&P 500. The much promoted “FANG portfolio” of Facebook, Amazon, NetFlix and Google dominated the Indices during the quarter while the industrial based companies underperformed. The commodity price declines continued to dominate overall stock prices causing energy companies to weaken in price. Top line revenue growth for economically sensitive industries including chemicals, paper and forest products, steel, automobiles, and housing stocks have contributed to the Fund’s underperformance.

During the first quarter, the Fund added to its positions in Transocean, Stepan Co., Exxon Mobil, Commercial Metals, Coach, Inc., Cliffs Natural Resources, Schneider Electric ADR, Wolseley PLC ADR, Sonoco Products, and Ford Motor. The Fund initiated a new position in Tidewater, Inc.

During the second quarter ending February 28, 2015, the Fund underperformed the S&P 500 returning 1.29% versus 2.31% for the S&P 500. Federal Reserve policy continued to maintain low short-term interest rates and money is growing at an 8% rate during the quarter.

The Fund continued to favor economically sensitive issues and believed that the economic recovery will bid commodity prices higher. The Fund favors industrials, energy and materials industries.

During the quarter, the Fund sold Bristol Myers Squibb, Duke Energy, International Paper, and Cliff Natural Resources. During the quarter, the Fund initiated positions in Yamana Gold and Barrick Resources.

During the third quarter ending May 31, 2015, the Fund slightly outperformed the S&P 500 returning -0.75% versus 0.64%. The overall market reached an intermediate high with the Dow Jones Industrial Average hitting 18,353 in late May. Federal Reserve policy continues to be dominated by debate on when it will raise interest rates. Yet, no change during the quarter.

The Fund continues to favor economically sensitive issues. Economic activity experienced improvement during the quarter and points to improving revenue and earnings growth for U.S. corporations.

During the quarter, the Fund did not make any changes in holdings.

During the fourth quarter ending August 31, 2015, the Fund underperformed versus the S&P 500, returning -12.20% versus -5.92% for the S&P 500. Over the past twelve months, the Fund underperformed the S&P 500 returning -14.33% versus 0.48%. The Fund’s quarterly performance was affected by declines in energy prices impacting the oil positions in the Fund. Fed policy continues to keep interest rates near zero as inflation rates are significantly lower than 2%.

During the quarter, the Fund sold its position in Cooper Tire and Rubber. The Fund made new purchases of General Electric, Fluor Corp., Rayonier, Inc., and Greif, Inc.

What is the Fund’s current strategy?

The Fund continues to focus on consistency in earnings in its holdings. The Fund remains committed to economically sensitive issues including energy, materials, and industrials. The Fund is overweight in materials, energy, telecommunications, and industrials as the economic recovery continues to sputter and recent Fed policy statements indicated they were concerned that it would

MONTEAGLE VALUE FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued) |

be willing to accept higher inflation as it fends off deflationary forces. The Fund is underweight financials, health, technology, consumer discretion, and consumer staples. The fund has increased its holdings into international ADR’s believing the worldwide recovery has begun.

Fund performance shown represents the performance of the Fund’s Class I shares. For complete performance information, please refer to the Average Annual Total Return table in the following performance report. Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month-end are available by calling 1-888-263-5593.

An investor should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other important information. To obtain a copy of the Fund’s prospectus please call 1-888-263-5593 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Fund is distributed by Matrix Capital Group, Inc.

Management’s Discussion of Fund Performance seeks to describe some of the Sub-Adviser’s current opinions and views of the financial markets. Although the Sub-Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed.

MONTEAGLE VALUE FUND

PERFORMANCE — August 31, 2015 (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment

in Monteagle Value Fund, the S&P 500 Index and the Russell 2000 Value Index

Average Annual Total Return

(for the periods ended August 31, 2015) |

| | One Year | Five Years | Ten Years | |

Monteagle Value Fund | (14.33%) | 9.80% | 4.85% | |

S&P 500 Index | 0.48% | 15.86% | 7.15% | |

Russell 2000 Value Index | (4.95%) | 13.23% | 5.70% | |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost.

The above graph depicts the performance of the Monteagle Value Fund versus the S&P 500 Index and the Russell 2000 Value Index. The S&P 500 Index by Standard and Poor’s Corp. is a capitalization-weighted index comprising 500 issues listed on various exchanges, representing the performance of the stock market generally. The Russell 2000 Value Index measures the performance of small-cap value segment of the U.S. equity universe. It includes those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track, and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the S&P 500 Index and the Russell 2000 Value Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the indices; so too with the Monteagle Value Fund, which will not invest in certain securities comprising these indices.

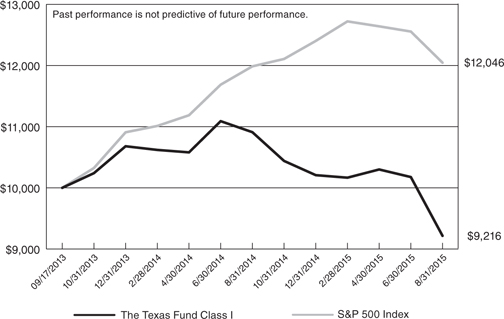

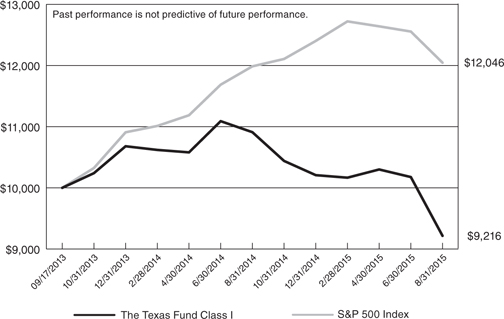

THE TEXAS FUND

A DISCUSSION OF FUND PERFORMANCE (Unaudited) |

How did the Fund perform?

The period from August 31, 2014 to August 31, 2015 proved to be a difficult market for Texas stocks when compared to the S&P 500 Index (“S&P 500”). The Texas Fund (the “Fund”) lost 15.53% over that time period while the S&P 500 was flat at 0.48%. The contributing factors were led by an extreme downturn in energy prices as well as a rising dollar. This market proved difficult for all investments with ties to commodity based economies. This effect on a geogrzaphic area like Texas is not only in energy stocks, but also sectors like banking and industrials as they are seen as strongly tied to energy. Energy investments particularly had very poor performance over this time period. As a point of reference, the Energy Select Sector SPDR®ETF, a popular large cap energy investment, lost 31.05% over the same time period. Another interesting comparison is how other commodity based economies like Australia and Canada performed over the same time period. The iShares MSCI Canada ETF lost 24.54% and the iShares MSCI Australia ETF lost 27.28%.

The Fund managed some of these risks due to continued underperformance of the energy, industrials, banking and other sectors through this time period in Texas. This was done through security selection, sector rebalances, and options strategies. These approaches allowed the Fund to reduce risk while maintaining the overall long-term investment strategy.

What is the Fund’s investment approach?

The Fund’s investment goal is long-term capital appreciation. The Fund invests in a broad market capitalization across the various sectors and sizes of the Texas economy keeping 80% or more of the Fund invested in: 1) companies headquartered in Texas, 2) organized under Texas state laws, or 3) derive 50% of revenues or profits or have 50% of their assets in Texas. The adviser limits the pool of stocks considered for purchase to only those equities with market capitalization greater than $1 billion. The adviser also limits the amount in any one sector to less than 25% of the overall portfolio of companies.

In selecting stocks, the Fund’s adviser ranks stocks in each sector with an A, B or C. An equal weighting is applied across the A ranking and B rankings for each sector with A’s weighted more heavily than B’s. C rankings are considered sells. Company rankings are determined by the Fund’s adviser after analyzing the financials, valuation, and growth prospects in comparison with their peers in the sector. The overall objective is to hold companies for a long-term period to allow the capture of their growth within the Texas economy.

Since there are a number of small and mid-cap companies in Texas and the fund advisers do not give specific preference large caps, the Fund tends to have an average market capitalization between $4 billion to $6 billion. The Fund also maintains investments across the spectrum of Texas companies from those considered to be value companies to those considered growth companies.

What influenced the Fund’s performance?