UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 1, 2013

First Colombia Gold Corp.

(Exact name of registrant as specified in its charter)

| Nevada | 000-51203 | 98-0425310 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

Paseo de Bernardez #59, Fracc.Lomas de Bernardez, Guadalupe 98610,Zac. Mexico | __________ |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: 1-888-224-6561

Carrera 49 No.51-11 Suite 402,Copacabana,Antioquia,Colombia (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 1.01 Entry into a Material Definitive Agreement.

Memorandum of Understanding to Earn-Interest in the Nile Mine Project

On May 1, 2013, First Colombia Gold Corp. (the “Company”) with GMRV, a branch of 4uX, LLC, a private Montana company (“GMRV”) entered into a Memorandum of Understanding (“MOU”) to enter into a Definitive Agreement within 180 days for the Company to earn a fifty percent interest in the Nile Mine project. The Company has not entered into a final and definitive agreement at this time.

Land Status

The project is owned/controlled by GMRV and private interests. First Colombia signed a Memorandum of Understanding (“MOU”) on the project effective May 1, 2013 containing the following terms and conditions for the Company to earn a 50% interest in the project:

Paying within180 days of the signing of this MOU $2,500 which will be payable in cash or the issuance of restricted shares of First Colombia at the market bid price, or the equivalent in restricted preferred shares of First Colombia, subject to an subscription agreement signed by GMRV acceptable to First Colombia. First Colombia has agreed to an initial work commitment of $5,000 in 2013, and upon mutual agreement of an exploration plan for 2014, an increased work commitment of at least $10,000 for 2014.

First Colombia agrees that work commitment will include the consulting services that will be provided by GMRV. The parties in good faith agree to enter into a definitive agreement with duration of 10 years, with a work commitment for this period of $250,000 and annual minimum advance royalty payments of $5,000 per year in cash, common shares, or preferred shares, at First Colombia’s option, for First Colombia to earn a 50% interest in the project. Should a mutually agreed upon definitive agreement not be agreed on and implemented within the effective date of this agreement, the payment referred to above shall be non-refundable.

The effective Date: May 1, 2013. First Colombia will be responsible for all property maintenance fees, estimated not to exceed $ 500.00 annually at the current BLM Maintenance Fee rate.

The foregoing description of the MOU does not purport to be complete and is qualified in its entirety by reference to the MOU, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Description of Property

If you are not familiar with the mineral exploration terms used in this Current Report on Form 8-K, please refer to the definitions of these terms under the caption “Glossary” in our 10k filings for 2012 and 2011.

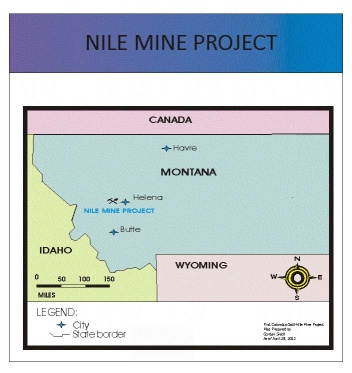

Location

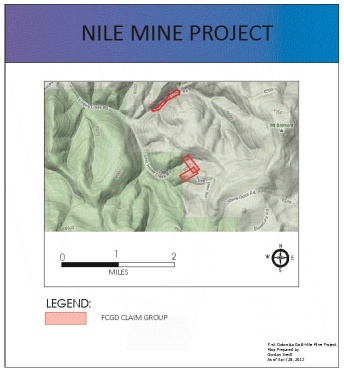

The project is located in Marysville Mining District in the Marysville area, and is comprised of the Nile Mine and nearby Springer II Placermining claim, comprising approximately fifty-five acres.

The Nile Mine Project consists of two unpatented lode claims covering the over 1,000 feet of the unpatented section of Nile and South Nile Veins and the Nile Cross-Cut located in Section 4, T11N, R6W.

The Springer_II Placer consists of one unpatented placer claim covering three tailing ponds and nearly 0.3 miles of old dredge piles in Section 32, T12N, R6W. The mill tailings are from the Empire Mill located further up the drainage.

History

The placer property contains evidence of production from a former gold-silver mill. Prior sampling identified about 13,000 cubic yards of mill tailings containing gold, silver, and copper values. The Company has not verified prior sampling results. The lead-silver-gold mine reported intermittent production from 1890's through 1940's.

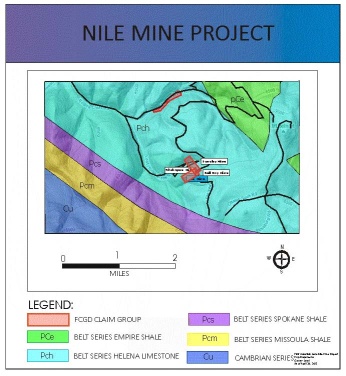

Regional Geology

The Company is currently reviewing regional and project geology.

Project Infrastructure, Access and Power

There is evidence and historical information that indicates some level of production from the Nile Mine but the Company hasn’t completed a thorough review of this data.

Reserves

There are no established reserves on the project.

Permitting

In Montana an Exploration License or POO (Plan of Operation) may be required depending on the extent of planned surface disturbance or water discharge form exploration and development activities, and such permits can typically require bonding.

Proposed Exploration Plan

Several phases of exploration work will be necessary to move forward this project. Each successive phase of work is contingent upon the results of previous phases. The first phase will require geological mapping and sampling

The second phase of work will involve re-establishing underground access, channel sampling, rehabilitation of underground workings, surface soil sampling, and geologic mapping.

Our most immediate 2013 work will be conducting mapping, geological mapping, and surface sampling, and preparing a budget for rehabilitation and access to underground areas, and preparing the required permits. We have retained GMRV to provide consulting and field support to these planned activities.

Our current cash on hand is insufficient to complete any of the activities set forth in our planned exploration program. We have postponed the commencement of any exploration and development program until such time that we are able to secure sufficient financing. We can provide no assurance that we will be successful in securing sufficient financing. Provided we are able to secure sufficient financing, we anticipate that we will incur the following costs for the next twelve months:

This exploration plan may change or be terminated depending on the results from each stage of exploration.

Item 7.01 Regulation FD Disclosure.

Press Release

The information in this Item 7.01 of this Current Report is furnished pursuant to Item 7.01 and shall not be deemed "filed" for any purpose, including for the purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that Section. The information in this Current Report on Form 8-K shall not be deemed incorporated by reference into any filing under the Securities Act or the Exchange Act regardless of any general incorporation language in such filing.

On May 6, 2013, the Company made a press release announcing its entering into a Memorandum of Understanding with GMRV, as discussed above. The text of the press release is attached hereto as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. The following exhibits are filed herewith.

| Exhibit No. | | Description |

| | | |

| 10.1 | | |

| | | |

| 99.1 | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: May 3, 2013

| First Colombia Gold Corp. |

| |

| |

| | |

| By: | | |

| Name: | | Piero Sutti-Keyser |

| Title: | | Chief Executive Officer |