Exhibit 10.1

Memorandum of Understanding

This Memorandum of Understanding (“MOU”) is made by and between First Colombia Gold Corp. (“FCGD”) and GMRV (“GMRV”), a branch of 4uX, LLC, a private company whose manager is Alan Gilda,

Whereas, GMRV owns and controls the Nile Mine Project (“Project”) which is further described in Exhibit A,

Whereas FCGD seeks to explore and earn-in a fifty percent participating interest in the project,

Therefore, FCGD and GMRV agree to enter into this MOU and in good faith implement its contemplated terms into a definitive agreement within 180 days of the effective date of this MOU,

| 1. | Duration : This agreement will be for 180 days from the date of the effective date and may be extended only upon the written authorization of FCGD and GMRV. |

| 2. | Authority : Alan Gilda warrants that he has the authority to bind GMRV and any other interests in the Project to the terms of this MOU and contemplated definitive agreement. |

| 3. | Terms and Conditions : FCGD and GMRV agree that FCGD shall earn a fifty percent participating interest in the Project by : |

| (a.) | Paying within180 days of the signing of this MOU $2,500 which will be payable in cash or the issuance of restricted shares of FCGD at the market bid price, or the equivalent in restricted preferred shares of FCGD, subject to an subscription agreement signed by GMRV acceptable to FCGD. |

| (b.) | FCGD agrees to an initial work commitment of $5,000 in 2013, and upon mutual agreement of an exploration plan for 2014, an increased work commitment of at least $10,000 is expected for 2014. |

| (c.) | FCGD agrees that work commitment will include the consulting services that will be provided by GMRV. |

| (d.) | The parties in good faith agree to enter into a definitive agreement with a duration of 10 years, with a work commitment for this period of $250,000 and annual minimum advance royalty payments of $5,000 per year in cash,common shares, or preferred shares, at FCGD’s option, for FCGD to earn a 50% interest in the project. Should a mutually agreed upon definitive agreement not be agreed on and implemented within the effective date of this agreement, the payment referred to above in section (a) shall be non-refundable. |

| 4. | Effective Date : May 01, 2013. |

| 5. | FCGD will be responsible for all property maintenance fees, estimated not to exceed $ 500.00 annually at the current BLM Maintenance Fee rate. |

For FCGD :

/s/ Piero Sutti-Keyser

Piero Sutti-Keyser, CEO,CGD

For GMRV :

/s/ Alan Gilda

Alan Gilda, Manager.GMRV

For Alan Gilda :

/s/ Alan Gilda

Alan Gilda, An Individual

Exhibit A

Project description :

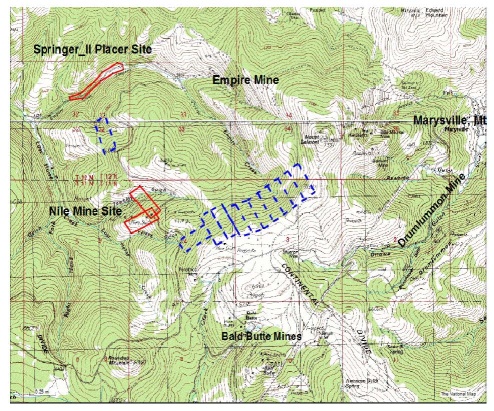

The Nile Mine Project consists of two unpatented lode claims covering the over 1,000 feet of the unpatented section of Nile and South Nile Veins and the Nile Cross-Cut located in Section 4, T11N, R6W. The Nile Mine reported production of ore running 0.08-4.64opt gold, 3-7opt silver, 21-65% lead, and 1-5% copper (L.S. Ropes, Towsley Mines Report 2/15/1919) .

The Springer_II Placer consists of one unpatented placer claim covering three tailing ponds and nearly 0.3 miles of old dredge piles in Section 32, T12N, R6W. The mill tailings are from the Empire Mill located further up the drainage. The mill processed ore from the Empire Mine which included the M&L, E-W, Smithville, Puritan, Empire, and Whipperwill Gold Veins. A total of five tailings ponds were identified by the State of Montana, of which three are located on the Springer II. A brief sampling program in 1996-1997 identified about 13,000 cy of tailings running 0.01 to 0.029opt gold, 0.55-0.86opt silver, 0.47-0.59% copper, and 0.99-1.47% lead.