To whom it may concern

November 6, 2009

Chuo Mitsui Trust Holdings, Inc.

(Securities Code: 8309 TSE, OSE, NSE)

The Sumitomo Trust and Banking Co., Ltd.

(Securities Code: 8403 TSE, OSE)

Conclusion of a Basic Agreement on the Management Integration of Chuo Mitsui Trust Group and The Sumitomo Trust and Banking Group

Creating “The Trust Bank” with a Combination of Expertise and Comprehensive Capability

Chuo Mitsui Trust Holdings, Inc. (“CMTH”; President: Kazuo Tanabe) and The Sumitomo Trust and Banking Co., Ltd. (“STB”; President: Hitoshi Tsunekage) today reached a basic agreement on the management integration of their two groups, subject to the approval of their shareholders and relevant authorities, in order to better achieve the objectives described below.

1. Objectives of Management Integration

The financial crisis that started in 2008 has led to major structural changes in the global economy and society and has made clients face more advanced and complex issues in managing their assets.

Japan’s low birthrate and aging society, as well as the maturing of the economy, make it a pressing challenge to facilitate the flow of Japan’s abundant personal financial assets, pensions and other funds to promising fields and to realize sustainable economic growth.

CMTH and STB Groups, both featuring high levels of expertise and broad scope of businesses, believe that they are entering an era where they should give full play to their strengths in order to address these social and economic challenges related to assets.

Based on their shared understanding of the management environment, CMTH and STB have agreed to form “The Trust Bank”, a new trust bank group that, with the combination of their expertise and comprehensive capability, can provide its clients with better and swifter comprehensive solutions than ever before. To create the new trust bank group, CMTH and STB Groups plan to combine their personnel, know-how and other managerial resources and to fuse both groups’ strengths such as CMTH Group’s agility and STB Group’s diversity.

The new trust bank group, which “takes pride as Japan’s leading trust bank group which boasts the largest scale and the highest status by combining banking, asset management and administration and real estate businesses”, will emphasize maintaining a strong relationship of trust with its clients and, as it moves onto the global stage, will aim to achieve the following goals:

| · | From clients’ perspective: |

to be a trusted partner that swiftly provides comprehensive solutions by making full use of its high levels of expertise and comprehensive capability.

| · | From society’s perspective: |

to be a company operating a trust business with strong social and public traits, that engages in sound management based on a high degree of self-discipline and greatly contributes to society by proactively promoting corporate social responsibility activities.

| · | From shareholders’ perspective: |

to be a financial institution with a new business model creating distinct, high value-added services by combining banking, asset management and administration and real estate businesses.

| · | From employees’ perspective: |

to be a workplace where the diversity and creativity of its employees are more fully used to add value to the organization and where employees can have pride and be highly motivated in fulfilling their missions.

CMTH and STB Groups will promote their management integration under the spirit of mutual trust and equality.

2. Post-integration Vision

Through the integration, the new trust bank group will be able to further strengthen its high levels of expertise as a trust bank developed over the past decades by CMTH and STB Groups. At the same time, CMTH and STB believe that the new trust bank group will possess the status and capabilities as one of Japan’s leading financial institutions, in addition to its leading role in the trust bank sector.

(1) Reinforcing and combining client bases and branch networks

CMTH and STB Groups have a limited overlap between their client bases and possess broad business relationships with their corporate clients, including those of Mitsui Group and Sumitomo Group.

The new trust bank group will be better able to offer products and services to a broad base of individual clients through the creation of a balanced branch network throughout Japan, with a focus on the Tokyo metropolitan area, as well as the Kansai and Chubu areas.

By leveraging the overseas networks of CMTH and STB Groups, the new trust bank group will be able to offer global financial services to its clients in Japan and overseas.

(2) Strengthening high levels of expertise and expanding operations

Assets under management, including corporate pension funds and investment trusts, will total approximately 58 trillion yen through the integration. The new trust bank group will become Japan’s largest asset management group, and will be able to provide its clients, ranging from individual to institutional investors, with an array of global asset management services.

In addition, the new trust bank group will become one of Japan’s top three banks in terms of sales of investment trusts and annuity insurance to individual clients, with a combined balance of approximately 4 trillion yen. As a result, the new trust bank group will become one of Japan’s leading asset management consulting groups, promoting the shift of personal financial assets “from savings to investments”.

Assets under custody will total over 181 trillion yen, the largest balance in Japan, and the new trust bank group will also be one of Japan’s leading firms in trust-bank-related businesses such as real estate and stock transfer agency services.

With approximately 61 trillion yen of total employable funds, the new trust bank group will be one of Japan’s core financial intermediaries and will be better able to smoothly provide credit and to support sustainable economic growth by appropriately meeting the financing needs of its individual and corporate clients.

The new trust bank group, through the integration, will aim to optimally allocate its expanded management resources in order to offer superior products and services across its business fields.

(3) Streamlining effects

Efficiencies in systems and administration, enhanced redeployment of personnel, reorganization of branch networks and other streamlining effects will be pursued through the integration of the three trust banks in the new trust bank group.

3. Outline of the Basic Agreement

(1) Conclusion of the Basic Agreement

CMTH and STB have concluded a basic agreement as to the following matters regarding their management integration.

(2) Management Integration Overview

The management integration will be accomplished through a holding company structure. From the perspective of expediting the management integration, the new trust bank group will utilize CMTH, which is currently the holding company of Chuo Mitsui Trust Group, as its holding company.

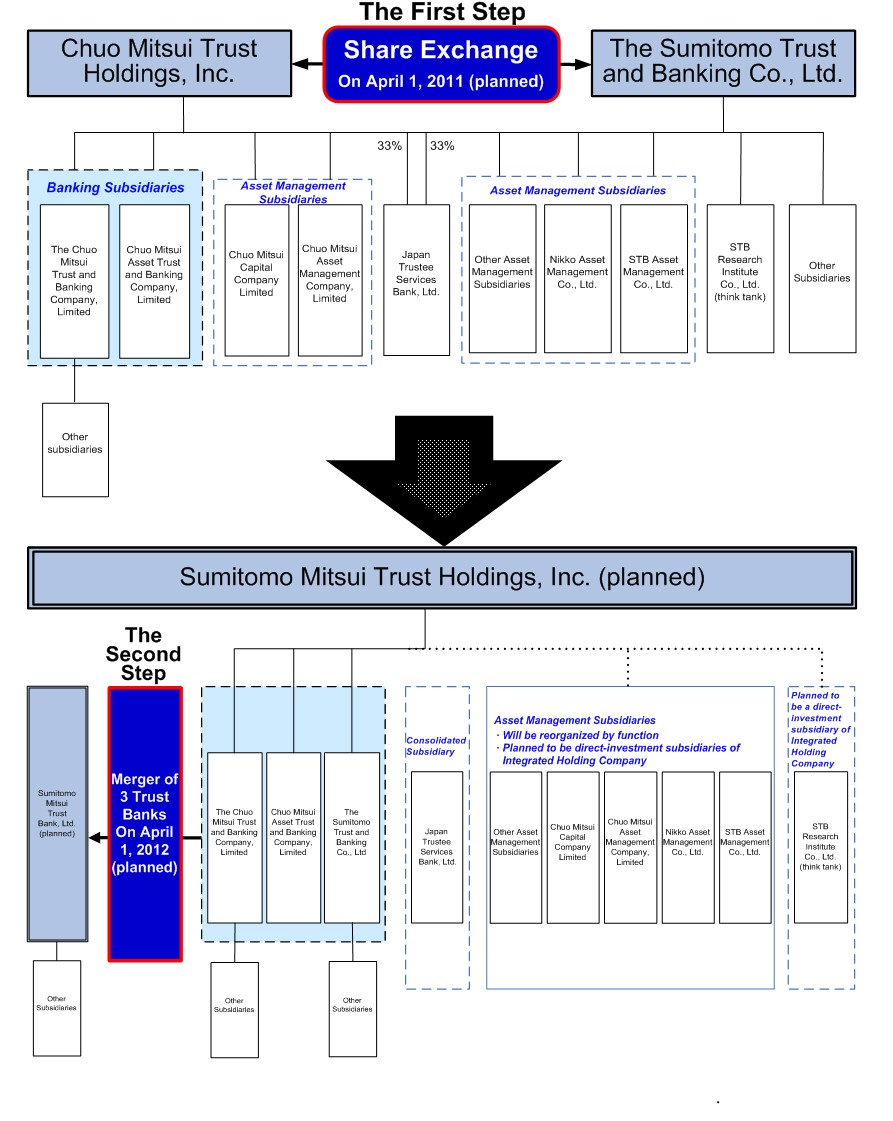

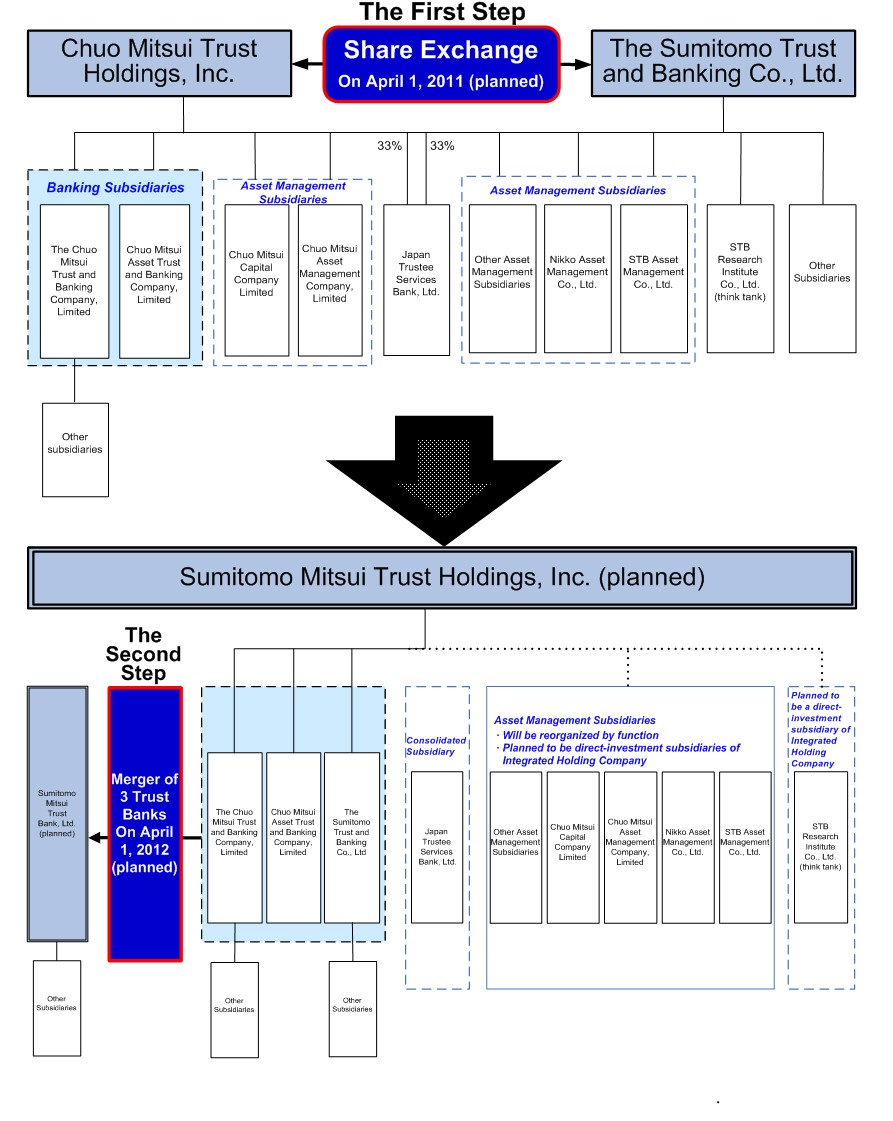

On April 1, 2011, CMTH and STB plan to conduct the management integration through a share exchange between CMTH and STB and to position CMTH, planned to be renamed Sumitomo Mitsui Trust Holdings, Inc., as a new holding company (“Integrated Holding Company”). (The First Step)

On April 1, 2012, Integrated Holding Company will plan to merge the three trust banks operating beneath it, which are STB, The Chuo Mitsui Trust and Banking Company, Limited and Chuo Mitsui Asset Trust and Banking Company, Limited, into a single trust

bank (“Combined Trust Bank”) in order to further improve their expertise and comprehensive capability. (The Second Step)

From the perspective of creating a management structure appropriate for Japan’s largest asset management group, Integrated Holding Company will explore ways to reorganize its asset management subsidiaries by function and thus to directly oversee their management.

Other group companies of Integrated Holding Company will also be examined for possible reorganization in light of the objectives of the management integration.

(3) Management Integration Through a Holding Company Structure (The First Step)

CMTH and STB will move ahead with the first stage of conducting the management integration through a holding company structure, based on the following basic policies.

| · | Target date for the management integration |

April 1, 2011.

| · | Integration ratio (share exchange ratio) |

The integration ratio (share exchange ratio) will be determined by CMTH and STB based on their discussions, each considering the valuation and advice of their financial advisors.

| · | Stock listing of Integrated Holding Company |

Integrated Holding Company is planned to be listed on the Tokyo Stock Exchange, the Osaka Securities Exchange and the Nagoya Stock Exchange.

| · | Name of Integrated Holding Company |

The planned English name is “Sumitomo Mitsui Trust Holdings, Inc.” (tentative).

| · | Headquarters location of Integrated Holding Company |

The planned headquarters location of Integrated Holding Company is an office building now under construction in Chiyoda-ku, Tokyo, which is being jointly developed by STB and other companies. STB’s current Tokyo headquarters in Chiyoda-ku, Tokyo is expected to be used as the headquarters of Integrated Holding Company until the new building is ready.

| · | Representative directors of Integrated Holding Company |

Integrated Holding Company’s chairman is expected to come from STB Group and its president is expected to come from CMTH Group.

| · | Directors of Integrated Holding Company |

At the time of the integration, the number of directors of Integrated Holding Company from CMTH Group and STB Group is planned to be equal.

| · | Governance and organizational system of Integrated Holding Company |

CMTH and STB will confer with one another to reach a decision on appropriate governance and organizational systems for the new trust bank group.

(4) Merging the Three Trust Banks Under Integrated Holding Company (The Second Step)

CMTH and STB will move ahead with the second step of merging the three trust banks under Integrated Holding Company, based on the following basic policies.

| · | Target date for the merger of the three trust banks |

April 1, 2012.

| · | Name of Combined Trust Bank |

The planned English name is “Sumitomo Mitsui Trust Bank, Ltd.” (tentative).

| · | Surviving company for Combined Trust Bank |

STB is planned to be the surviving company.

| · | Headquarters location of Combined Trust Bank |

The planned headquarters location of Combined Trust Bank is an office building now under construction in Chiyoda-ku,

Tokyo, which is being jointly developed by STB and other companies.

| · | Representative directors of Combined Trust Bank |

Combined Trust Bank’s chairman is expected to come from CMTH Group and its president is expected to come from STB Group.

| · | Directors of Combined Trust Bank |

At the time of the merger, the number of directors of Combined Trust Bank from CMTH Group and STB Group is planned to be equal.

4. Integration Promotion Committee

In order to facilitate the smooth and swift integration of the two groups, directors from CMTH and STB Groups today launched “Integration Promotion Committee”, headed by the presidents of CMTH and STB.

5. Business Alliance

CMTH and STB Groups plan to quickly examine the possibilities for forming business alliances with each other.

6. Other Details

Further details to be disclosed that have yet to be determined will be announced when formal decisions are reached.

End of Announcement

【For further inquiries about this announcement】 | | |

| | | |

| Chuo Mitsui Trust Holdings, Inc. | IR Group, General Planning Department | TEL: +81-3-5232-8828 |

| | | |

The Sumitomo Trust and Banking Co., Ltd. | IR Office, Financial Management Department | TEL: +81-3-3286-8354 |

| Outline of Management Integration (Planned) | 【Reference】 |

【Subsidiaries & Affiliates】

| | | CMTH Group | | STB Group |

《Domestic》 | | | | |

| Holding Company | | Chuo Mitsui Trust Holdings, Inc. | | |

| | | | | |

| Trust Bank | | The Chuo Mitsui Trust and Banking Company, Limited Chuo Mitsui Asset Trust and Banking Company, Limited | | The Sumitomo Trust and Banking Co., Ltd. |

| | | | | |

| Asset Management | | Chuo Mitsui Asset Management Company, Limited Chuo Mitsui Capital Company Limited Mitsui & Co., Logistics Partners Ltd. | | STB Asset Management Co., Ltd. Nikko Asset Management Co., Ltd. STB Investment Corporation STB Real Estate Investment Management Co., Ltd. Top REIT Asset Management Co., Ltd. |

| | | | | |

| Highly Specialized Trust Bank focusing on Custody Business | | Japan Trustee Services Bank, Ltd. | | Japan Trustee Services Bank, Ltd. |

| | | | | |

| Research Institute | | | | STB Research Institute Co., Ltd. |

| | | | | |

| Real Estate | | Chuo Mitsui Realty Company, Limited | | Sumishin Realty Company Limited |

| | | | | |

| Securities Transfer Services | | Tokyo Securities Transfer Agent Co., Ltd. Japan Stockholders Data Service Company, Limited | | Japan TA Solution, Ltd. |

| | | | | |

| Pension Operations | | | | Japan Pension Operation Service, Ltd. |

| | | | | |

| Financial Services | | Chuo Mitsui Finance Service Co., Ltd. | | First Credit Corporation Life Housing Loan, Ltd. BUSINEXT CORPORATION |

| | | | | |

| Card Services | | Chuo Mitsui Card Co., Ltd. | | Sumishin Card Company, Limited Sumishin Life Card Company, Limited |

| | | | | |

| Leasing | | | | STB Leasing & Financial Group Co., Ltd. Sumishin Matsushita Financial Services Co., Ltd.※1 STB Leasing Co., Ltd.※1 |

| | | | | |

| Consulting | | | | STB Wealth Partners Co., Limited |

| | | | | |

| Internet Bank | | | | SBI Sumishin Net Bank, Ltd. |

| | | | | |

| I T | | Chuo Mitsui Information Technology Co., Ltd. Japan Trustee Information Systems, Ltd. | | Sumishin Information Service Company Limited Japan Trustee Information Systems, Ltd. |

| | | | | |

| Loan Guarantees | | Chuo Mitsui Guarantee Co., Ltd. | | Sumishin Guaranty Company Limited |

| | | | | |

| Administrative Agency | | Chuo Mitsui Business Co., Ltd. Chuo Mitsui Loan Business Company, Limited | | Sumishin Business Service Company, Limited |

| | | | | |

| Training and Human Resources | | Chuo Mitsui Create Company, Limited | | HR One Corporation STB Business Partners Co., Ltd. |

| | | | | |

| Real Estate Management | | CMTB Facilities Company, Limited | | The Sumishin Shinko Company Limited |

| | | | | |

| Equity Investment and Management | | CMTB Equity Investments Co., Ltd. | | |

《Overseas》

| United States | | Chuo Mitsui Investments, Inc. | | Sumitomo Trust and Banking Co. (U.S.A.) |

| | | | | |

| Luxembourg | | | | Sumitomo Trust and Banking (Luxembourg) S.A. |

| | | | | |

| United Kingdom | | Chuo Mitsui Trust International Ltd. | | |

| | | | | |

| Singapore | | Chuo Mitsui Investments, Singapore Pte. Ltd. | | |

| | | | | |

| China | | Chuo Mitsui Investments Hong Kong Limited | | The Sumitomo Trust Finance (H.K.) Limited STB Consulting (China) Co., Ltd. |

| Note 1: | Non-bolded companies are equity method affiliates. |

| Note 2: | Financing-related subsidiaries are excluded. |

| ※1 | Sumishin Matsushita Financial Services Co., Ltd. and STB Leasing Co., Ltd. are scheduled to merge on April 1, 2010 to become “Sumishin Panasonic Financial Services Co., Ltd.” (planned). |

【Reference】Principal Combined Figures of CMTH Group and STB Group (As of March 31, 2009)

(Includes CMTH and STB estimates)

<Status in Japan’s financial sector>

| ● | Assets under Management※1 | Approx. 58 trillion yen | (No.1 among Japanese Bank and Securities Company Groups) |

| | | | |

| ● | Assets under Custody※2 | Approx. 181 trillion yen | (No.1 among Japanese Bank Groups) |

| | | | |

| ● | Total Employable Funds※3 | Approx. 61 trillion yen | (No.4 among Japanese Bank Groups) |

| | | | |

| ● | Balance of Investment Trust, Annuity Insurance and Other Sales※4 | Approx. 4 trillion yen | (No.3 among Japanese Banks) |

| | | | |

| ※1 | Combined balances of assets under management by Chuo Mitsui Asset Trust and Banking Company, Limited, Chuo Mitsui Asset Management Company, Limited, The Sumitomo Trust and Banking Co., Ltd., STB Asset Management Co., Ltd. and Nikko Asset Management Co., Ltd. |

| ※2 | Balance of trust accounts of Japan Trustee Services Bank, Ltd. |

| ※3 | Combined balances of The Chuo Mitsui Trust and Banking Company, Limited, Chuo Mitsui Asset Trust and Banking Company, Limited and The Sumitomo Trust and Banking Co., Ltd. (all non-consolidated). |

| ※4 | Combined balances of sales to individuals by The Chuo Mitsui Trust and Banking Company, Limited and The Sumitomo Trust and Banking Co., Ltd. (both non-consolidated). |

<Status in Japan’s trust bank sector>

| ● | Balance of Trust Accounts※1 | Approx. 119 trillion yen | (No.1) | |

| | | | | |

| ● | Balance of Corporate Pension Funds※2 | Approx. 12 trillion yen | (No.1) | |

| | | | | |

| ● | Lead Manager for Corporate Pension Funds ※2 | 2,033 funds | (No.1) | |

| | | | | |

| ● | Real Estate Business-Related Revenue※3 | Approx. 25 billion yen | (No.1) | |

| | | | | |

| ● | Stock Transfer Agency Services / Corporate Clients※4 | 2,887 | (No.2) | |

| | | | | |

| ● | Number of Will Trusts※3 | 18,620 | (No.2) | |

| | | | | |

| ● | Lending Business / Total Loan Balance※3 | Approx. 20 trillion yen | (No.1) | |

| | | | | |

| | Balance of Loans to Individuals※3 | Approx. 5 trillion yen | (No.1) | |

| ※1 | Combined balances of The Chuo Mitsui Trust and Banking Company, Limited, Chuo Mitsui Asset Trust and Banking Company, Limited and The Sumitomo Trust and Banking Co., Ltd. (all non-consolidated). |

| ※2 | Combined balances of Chuo Mitsui Asset Trust and Banking Company, Limited and The Sumitomo Trust and Banking Co., Ltd. (both non-consolidated). |

| ※3 | Combined balances of The Chuo Mitsui Trust and Banking Company, Limited and The Sumitomo Trust and Banking Co., Ltd. (both non-consolidated). |

| ※4 | Combined balances of The Chuo Mitsui Trust and Banking Company, Limited, Tokyo Securities Transfer Agent Co., Ltd. and The Sumitomo Trust and Banking Co., Ltd. (all non-consolidated). |

<Specialist employees>※1

| ● | Securities Analysts | 765 | |

| | | | |

| ● | Asset Management Specialists※2 | 266 | |

| | | | |

| ● | Pension Actuaries | 57 | |

| | | | |

| ● | Real Estate Appraisers | 158 | |

| | | | |

| ● | Real Estate Transaction Specialists | 5,177 | |

| | | | |

| ● | Certified Skilled Worker of Financial Planning (First Guide) | 531 | |

| | | | |

| ● | Financial Consultants | 182 | |

| ※1 | Combined numbers of The Chuo Mitsui Trust and Banking Company, Limited, Chuo Mitsui Asset Trust and Banking Company, Limited and The Sumitomo Trust and Banking Co., Ltd. (all non-consolidated). |

| ※2 | Fund managers, portfolio managers, strategists and analysts. |

Corporate Data for the Two Companies (as of March 31, 2009)

| | Chuo Mitsui Trust Holdings, Inc. | The Sumitomo Trust and Banking Co., Ltd. |

| Date of Establishment | February 1, 2002 | July 28, 1925 |

| Registered Head Office | 33-1, Shiba 3-chome Minato-ku, Tokyo 105-8574 Japan | 5-33, Kitahama 4-chome Chuo-ku, Osaka, 540-8639 Japan |

| Name and title of Representative | President Kazuo Tanabe | President and CEO Hitoshi Tsunekage |

Capital Stock1 | 261,608 Million yen | 342,037 Million yen |

Number of Issued Shares1 | Common: 1,658,426,267 | Common: 1,675,128,546 Preferred: 109,000,000 |

| Total Net Assets (Consolidated) | 688,455 Million yen | 1,264,052 Million yen |

| Total Assets (Consolidated) | 15,086,445 Million yen | 21,330,132 Million yen |

| End of Fiscal Year | March | March |

Number of Employees2 | 8,828 (Consolidated) | 9,965 (Consolidated) |

| | <Common Stock> | <Common Stock> |

| | The Resolution and Collection Corporation | 30.20% | Japan Trustee Services Bank, Ltd. (Trust Account) | 6.51% |

Major Shareholders and Percentage of Total Shares Held1 | Japan Trustee Services Bank, Ltd. (Trust Account) | 6.40% | The Master Trust Bank of Japan, Ltd. (Trust Account) | 4.65% |

The Master Trust Bank of Japan, Ltd. (Trust Account) | 6.20% | The Bank of New York Mellon as Depositary Bank for Deposit Receipt Holders | 2.29% |

Japan Trustee Services Bank, Ltd. (Trust account 9) | 1.75% | Japan Trustee Services Bank, Ltd. (Trust account 9) | 1.43% |

Japan Trustee Services Bank, Ltd. (Trust account 4) | 1.10% | Northern Trust Co. (AVFC) Sub A/C American Clients | 1.39% |

| Goldman Sachs & Co. Regular Account | 1.03% | State Street Bank and Trust Company 505225 | 1.38% |

| State Street Bank and Trust Company 505225 | 1.02% | The Chase Manhattan Bank, N.A. London Secs Lending Omnibus Account | 1.32% |

Japan Trustee Services Bank, Ltd. (Re-trusted by Chuo Mitsui Asset Trust and Banking Company, Limited. Composite trust account held for Toyota Motor Corporation) | 0.91% | KUBOTA Corporation | 1.31% |

| Mitsui Life Insurance Company Limited | 0.82% | SSBT OD05 Omnibus Account China Treaty Clients | 1.17% |

| Tobu Railway Co., Ltd | 0.80% | State Street Bank and Trust Company | 0.99% |

| | | <First Series of Class 2 Preferred Stock> | |

| | | Sumitomo Corporation | 13.76% |

| | | Sumitomo Metal Industries, Ltd. | 9.17% |

| | | Sumitomo Realty & Development Co., Ltd. | 9.17% |

| | | Idemitsu Kosan, Co., Ltd. | 4.59% |

| | | ITOCHU Corporation | 4.59% |

| | | Keio Corporation | 4.59% |

| | | Sumitomo Chemical Company, Limited | 4.59% |

| | | Sumitomo Metal Mining Co., Ltd. | 4.59% |

| | | Tokyu Corporation | 4.59% |

| | | Toyo Seikan Kaisha, Ltd. | 4.59% |

| | | NEC Corporation | 4.59% |

| | | Marubeni Corporation | 4.59% |

| | | Daido Life Insurance Company | 4.59% |

| | | Mitsui Sumitomo Insurance Company Limited | 4.59% |

| | | | Mitsui Life Insurance Company Limited | 4.59% |

| 1 | As of September 30, 2009. |

| 2 | Number of employees includes permanent staff and overseas local hires, and excludes short-term contractors and temporary employees. |

| Relationships Between the Two Companies | Capital Relationships | Not applicable |

| Personnel Relationships | Not applicable |

| Business Relationships | Not applicable |

| Related-Party Relationships | Not applicable |

Business Results for the Past Three Fiscal Years [Consolidated]

| | Chuo Mitsui Trust Holdings, Inc. | The Sumitomo Trust and Banking Co., Ltd. |

| Fiscal Year ended March 31, | 2007 | 2008 | 2009 | 2007 | 2008 | 2009 |

| Ordinary Income (billions of yen) | 447.1 | 459.1 | 413.0 | 853.3 | 1,095.6 | 1,062.1 |

| Ordinary Profit (billions of yen) | 159.9 | 125.3 | (116.9) | 170.1 | 136.9 | 29.6 |

| Net Income (billions of yen) | 112.7 | 71.8 | (92.0) | 103.8 | 82.3 | 7.9 |

BIS Capital Adequacy Ratio1 | 12.13% | 13.84% | 12.05% | 11.36% | 11.84% | 12.09% |

| | Tier I Capital Ratio1 | 8.90% | 10.82% | 8.74% | 6.44% | 7.33% | 7.63% |

| 1 | Chuo Mitsui Trust Holdings, Inc. uses a domestic standard and The Sumitomo Trust and Banking Co., Ltd. uses an international standard. |

Previous Fiscal Year

[Non-Consolidated, as of March 31, 2009]

| | The Chuo Mitsui Trust and Banking Company, Limited | Chuo Mitsui Asset Trust and Banking Company, Limited | The Sumitomo Trust and Banking Co., Ltd. | Combined Total |

| Date of Establishment | May 26, 1962 | December 28, 1995 | July 28, 1925 | ― |

| Registered Head Office | 33-1, Shiba 3-chome, Minato-ku, Tokyo 105-8574, Japan | 23-1, Shiba 3-chome, Minato-ku, Tokyo 105-8574, Japan | 5-33, Kitahama 4-chome, Chuo-ku, Osaka, 540-8639, Japan | ― |

| Name and Title of Representative | President Kazuo Tanabe | President Tadashi Kawai | President and CEO Hitoshi Tsunekage | ― |

| Capital Stock (millions of yen) | 399,697 | 11,000 | 287,537 | ― |

| Rating | A1 (Moody’s) A (S&P) | A1 (Moody’s) | Aa3 (Moody’s) A+ (S&P) | ― |

| Number of Branches | 67 | 1 | 55 | 123 |

| | Domestic branches | 67 | 1 | 51 | 119 |

| | Overseas branches | ― | ― | 4 | 4 |

| Number of Domestic Sub-branches and Overseas Representative Offices | 29 | 2 | 16 | 47 |

| | Domestic sub-branches | 25 | 2 | 12 | 39 |

| | Overseas representative offices | 4 | ― | 4 | 8 |

Number of Employees1 | 6,371 | 631 | 6,026 | 13,028 |

| Total Assets (billions of yen) | 14,502.5 | 145.9 | 20,735.8 | 35,384.3 |

| Deposits (billions of yen) | 8,953.9 | 0.1 | 11,906.0 | 20,860.1 |

Loans and Bills Discounted2 (billions of yen) | 9,191.1 | ― | 11,857.8 | 21,048.9 |

| Total Net Assets (billions of yen) | 571.8 | 44.8 | 863.1 | 1,479.8 |

Trust account3 (billions of yen) | 7,228.8 | 28,841.3 | 82,770.9 | 118,841.1 |

BIS Capital Adequacy Ratio4 | 11.27% | 27.55% | 13.03% | ― |

| | Tier I Capital Ratio4 | 7.92% | 27.55% | 8.49% | ― |

Assets Classified under the Financial Revitalization Law5 (billions of yen) | 139.1 | ― | 116.4 | 255.6 |

Non-Performing Loans ratio5 | 1.4% | ― | 0.9% | 1.1% |

| Gross Business Profit (before trust account write-offs) (billions of yen) | 193.4 | 35.3 | 334.3 | 563.0 |

| Net Business Profit before Credit Costs (billions of yen) | 93.2 | 19.5 | 201.0 | 313.8 |

| Net Income (billions of yen) | (90.3) | 10.3 | 38.9 | (41.0) |

1 Number of employees includes permanent staff and overseas local hires, and excludes short-term contractors and temporary employees.

2 Combined totals of banking and trust accounts.

3 Including the amount re-trusted to Japan Trustee Services Bank, Ltd.

4 The Chuo Mitsui Trust and Banking Company, Limited and Chuo Mitsui Asset Trust and Banking Company, Limited use a domestic standard and The Sumitomo Trust and Banking Co., Ltd. uses an international standard.

5 Combined totals of banking and principal guaranteed trust accounts.

Cautionary Statement Regarding Forward-Looking Statements

This announcement contains certain forward-looking statements that reflect the plans and expectations of Chuo Mitsui Trust Holdings, Inc. and The Sumitomo Trust and Banking Co., Ltd. in relation to, and the benefits resulting from, their proposed business combination and business alliance. These forward-looking statements may be identified by words such as ‘believes’, ‘expects’, ‘anticipates’, ‘projects’, ‘intends’, ‘should’, ‘seeks’, ‘estimates’, ‘future’ or similar expressions or by discussion of, among other things, strategy, goals, plans or intentions. Actual results may differ materially in the future from those reflected in forward-looking statements contained in this document, due to various factors including but not limited to:

| · | failure of the parties to agree on some or all of the terms of business combination; |

| · | failure to obtain a necessary shareholder approval; |

| · | inability to obtain some or all necessary regulatory approvals or to fulfill any other condition to the closing of the transaction; |

| · | changes in laws or accounting standards, or other changes in the business environment relevant to the parties; |

| · | challenges in executing our business strategies; |

| · | the effects of financial instability or other changes in general economic or industry conditions; and |

| · | other risks to consummation of the transaction. |

Additional Information and Where to Find It

Chuo Mitsui Trust Holdings, Inc. may file a registration statement on Form F-4 with the U.S. Securities and Exchange Commission (the “SEC”) in connection with its proposed business combination with The Sumitomo Trust and Banking Co., Ltd. The Form F-4, if filed, will contain a prospectus and other documents. If the Form F-4 is filed and declared effective, the prospectus contained in the Form F-4 is expected to be mailed to U.S. shareholders of The Sumitomo Trust and Banking Co., Ltd. prior to the shareholders’ meeting at which the proposed business combination will be voted upon. The Form F-4, if filed, and prospectus, as they may be amended from time to time, will contain important information about Chuo Mitsui Trust Holdings, Inc. and The Sumitomo Trust and Banking Co., Ltd., the business combination and related matters including the terms and conditions of the transaction. U.S. shareholders of The Sumitomo Trust and Banking Co., Ltd. are urged to read carefully the Form F-4, the prospectus and the other documents, as they may be amended from time to time, that have been or may be filed with the SEC in connection with the transaction before they make any decision at the shareholders meeting with respect to the business combination. The Form F-4, if filed, the prospectus and all other documents filed with the SEC in connection with the business combination will be available when filed, free of charge, on the SEC’s web site at www.sec.gov. In addition, the prospectus and all other documents filed with the SEC in connection with the business combination will be made available to U.S. shareholders of The Sumitomo Trust and Banking Co., Ltd., free of charge, by faxing a request to Chuo Mitsui Trust Holdings, Inc. at +81-3-5232-8716 or to The Sumitomo Trust and Banking Co., Ltd. at +81-3-3286-4654.