SCHEDULE 14A—INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

¨ Preliminary Proxy Statement | ¨ | CONFIDENTIAL FOR USE OF THE |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12 |

Heritage Financial Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held April 30, 2003

To Our Stockholders:

You are invited to attend the 2003 annual meeting of stockholders of Heritage Financial Corporation (Heritage) to be held at the Phoenix Inn, 417 Capitol Way N., Olympia, Washington, on April 30, 2003 at 10:30 a.m., Pacific Daylight Savings Time. At the annual meeting, you will be asked to:

| 1. | Elect three (3) persons to serve on the Board of Directors of Heritage until the annual meeting of stockholders in 2006. |

| 2. | Approve whatever other business as may properly be brought before the annual meeting or any Adjournment thereof. |

Stockholders of record at the close of business on March 11, 2003 are entitled to vote at the annual meeting or any adjournment of the annual meeting.

BY ORDER OF THE BOARD OF DIRECTORS

Edward D. Cameron

Secretary

Olympia, Washington

March 21, 2003

We urge you to complete, sign and return the enclosed proxy card as soon as possible, whether or not you plan to attend the annual meeting in person. If you do attend the annual meeting, you then may withdraw your proxy and vote in person. The proxy may be withdrawn at any time prior to voting.

201 5thAVENUE S.W.

OLYMPIA, WASHINGTON 98501

PROXY STATEMENT

Heritage is sending this proxy statement to you for the solicitation of proxies by the Board of Directors of Heritage to be voted at the annual meeting. This proxy statement and the enclosed proxy card are being mailed to stockholders on or about March 21, 2003.

INFORMATION ABOUT THE MEETING

When and Where is the Annual Meeting?

The annual meeting will be held at 10:30 a.m., Pacific Daylight Savings Time, on Wednesday, April 30, 2003 at the Phoenix Inn, 417 Capitol Way N., Olympia, Washington.

What Matters will be Voted on at the Annual Meeting?

At the annual meeting, you will be asked to:

| • | Elect three (3) persons to serve on the Board of Directors of Heritage until the annual meeting of stockholders in 2006; and |

| • | Approve whatever other business may properly come before the annual meeting or any adjournment thereof. |

Who is Entitled to Vote?

Only stockholders of record at the close of business on the record date, March 11, 2003, are entitled to receive notice of the annual meeting and to vote at the annual meeting. On March 11, 2003, there were 6,685,091 shares of Heritage common stock outstanding, held by approximately 1,300 holders of record. Each share of Heritage common stock is entitled to one vote on each matter considered at the meeting, including one vote for each director to be elected. Stockholders are not entitled to cumulate their votes in the election of directors.

What Constitutes a Quorum?

The presence at the annual meeting, in person or by proxy, of a majority of the outstanding shares eligible to vote at the annual meeting is required for a quorum to exist at the annual meeting. For this purpose, abstentions and broker non-votes are counted in determining the shares present at the annual meeting.

What Vote is Required to Elect the Directors?

The three nominees for election as directors who receive the greatest number of votes will be elected directors. Votes may be cast in favor of some or all of the nominees for election to the Board of Directors or withheld as to some or all of the nominees.

1

How Do I Vote?

If you complete and properly sign the accompanying proxy card and return it to Heritage, it will be voted as you direct. If you give no directions on your proxy, the shares represented by your proxy, if properly signed, will be voted FOR the nominees for directors listed in this proxy statement. If any other matters are properly presented at the annual meeting for consideration, the persons named in the proxy will have discretion to vote on those matters according to their best judgment. “Street name” stockholders who wish to vote at the annual meeting will need to obtain a proxy form from the institution that holds their shares.

Can I Change My Vote After I Return My Proxy Card?

Yes. Even after you have submitted your proxy, your proxy may be withdrawn at any time before it is voted by

| Ÿ | delivering written notice to Edward D. Cameron, Heritage’s Secretary, at 201 5th Avenue S.W., Olympia, Washington 98501, before 5:00 p.m. on April 29, 2003,or |

| Ÿ | completing a later dated proxy,or |

| Ÿ | attending the annual meeting and voting in person. |

Who Pays the Costs of Soliciting Proxies?

The enclosed proxy is solicited by the Board of Directors of Heritage. Heritage will bear the costs of soliciting proxies for the annual meeting. In addition to soliciting proxies by mail, Heritage’s directors, officers and employees may solicit proxies personally or by telephone or fax. No director, officer or employee of Heritage who solicits proxies will receive any compensation for their solicitation other than their regular compensation for the positions they hold. Heritage does not intend to pay any compensation to any other persons for the solicitation of proxies. However, it will reimburse brokerage houses and other custodians, nominees and fiduciaries for reasonable expenses to mail proxy materials for beneficial owners.

STOCK OWNERSHIP

Who are the Largest Owners of Heritage Stock?

The following table sets forth information concerning the number of shares of Heritage common stock held as of March 11, 2003 by the only stockholders who are known to management to be the beneficial owners of more than five percent (5%) of Heritage’s outstanding shares:

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership (1) | Percent of Class | ||

Donald V. Rhodes 201 Fifth Avenue, S.W. Olympia, WA 98501 | 412,487(2) | 6.06% | ||

U. S. Bank, National Association 800 Nicollet Mall Minneapolis, MN 55402 | 356,841(3) | 5.15% |

| (1) | Of common stock. |

| (2) | Includes 34,328 shares issuable upon exercise of options, which are exercisable at $3.58 per share, and 20,400 options, which are exercisable at $11.13 per share, and 20,400 options exercisable at $8.44 per share, 10,000 options exercisable at $9.75 per share and 4,000 options exercisable at $12.25 per share. Includes 14,065 vested shares in Heritage 401(k)/ ESOP. |

2

| (3) | Pursuant to a Schedule 13G filed by U. S. Bancorp, Inc. on behalf of its subsidiary U. S. Bank, National Association. U. S. Bank, National Association serves as the investment manager of the Heritage 401(k)/ESOP which has voting and dispositive power over 356,841 shares of Heritage Common Stock. Heritage shares held in the ESOP portion of the 401(k)/ESOP may be voted only in accordance with the written instructions of the plan participants, who are all employees or former employees of Heritage and its subsidiaries. |

How Much Stock Do Heritage’s Directors and Executive Officers Own?

The following table shows the beneficial ownership of Heritage common stock as of March 11, 2003 by:

| Ÿ | Each director and director nominee; |

| Ÿ | The chief executive officer and those persons who served as executive officers in 2002 and received salaries and bonuses totaling in excess of $100,000 during 2002; and |

| Ÿ | All directors and executive officers as a group. |

For purposes of this table and according to Rule 13d-3 under the Securities Exchange Act of 1934, a person is the beneficial owner of any shares if he or she has voting and/or investment power over those shares. The table includes shares owned by spouses, other immediate family members in trust, shares held in retirement accounts or funds for the benefit of the named individuals, and other forms of ownership, over which shares the persons named in the table possess voting and/or investment power.

Shares Beneficially Owned at March 11, 2003 | |||||

Name | Number | Percent of Outstanding Common Stock | |||

D. Michael Broadhead (1) | 66,066 | * |

| ||

Lynn M. Brunton (2) | 113,099 | 1.66 | % | ||

Edward D. Cameron (3) | 13,458 | * |

| ||

Brian Charneski (4) | 21,400 | * |

| ||

Peter Fluetsch (5) | 22,200 | * |

| ||

Daryl D. Jensen (6) | 159,745 | 2.35 | % | ||

Melvin R. Lewis (7) | 50,678 | * |

| ||

Jeffrey Lyon (8) | 11,446 | * |

| ||

H. Edward Odegard (9) | 104,161 | 1.53 | % | ||

Gregory D. Patjens (10) | 29,639 | * |

| ||

Donald V. Rhodes (11) | 412,487 | 6.06 | % | ||

James P. Senna (12) | 77,100 | 1.13 | % | ||

Brian L. Vance (13) | 129,922 | 1.91 | % | ||

Philip S. Weigand (14) | 123,128 | 1.81 | % | ||

Directors and executive officers as a group (14 persons) (15) | 1,334,529 | 19.60 | % | ||

| * | Represents less than 1.0% of Heritage’s outstanding common stock. |

| (1) | Includes 2,300 shares issuable upon exercise of options, which are exercisable at $7.72 per share, 6,900 options exercisable at $9.00 per share, 4,600 options exercisable at $10.15 and 2,300 options exercisable at $12.25. Includes 3,727 vested shares in the Heritage 401(k)/ESOP. |

| (2) | Includes 800 shares issuable upon exercise of options, which are exercisable at $10.15 per share, 400 options exercisable at $8.50 per share, 800 options exercisable at $7.81 per share and 500 options exercisable at $12.25 per share. |

| (3) | Includes 1,200 shares issuable upon exercise of options, which are exercisable at $8.56 per share, 1,350 options exercisable at $12.25 per share, 2,700 options exercisable at $8.44 per share and 2,000 options exercisable at $9.75 per share. Includes 1,608 vested shares in the Heritage 401(k)/ESOP. |

3

| (4) | Includes 1,200 shares issuable upon exercise of options, which are exercisable at $8.00 per share, 800 options exercisable at $10.15 per share and 500 options exercisable at $12.25 per share. |

| (5) | Includes 1,200 shares issuable upon the exercise of options, which are exercisable at $7.81 per share, 800 options exercisable at $10.15 per share and 500 options exercisable at $12.25 per share. |

| (6) | Includes 1,200 shares issuable upon exercise of options, which are exercisable at $7.81 per share, 300 options exercisable at $7.72 per share, 1,200 options exercisable at $8.50 per share, 300 options exercisable at $9.00 per share, 1,000 options exercisable at $10.15 per share and 650 options exercisable at $12.25 per share. |

| (7) | Includes 1,200 shares issuable upon exercise of options, which are exercisable at $7.81 per share, 300 options exercisable at $7.72 per share, 1,200 options exercisable at $8.50 per share, 300 options exercisable at $9.00 per share, 1,000 options exercisable at $10.15 per share and 650 options exercisable at $12.25 per share. |

| (8) | Includes 800 shares issuable upon the exercise of options, which are exercisable at $10.15 per share, and 500 options exercisable at $12.25 per share. |

| (9) | Includes 400 shares issuable upon the exercise of options at $10.15 per share, 400 options exercisable at $7.81 per share and 500 options exercisable at $12.25 per share. |

| (10) | Includes 4,600 shares issuable upon exercise of options, which are exercisable at $9.75 per share, 6,900 options exercisable at $8.44 per share, 6,900 options exercisable at $8.75 per share and 1,350 options exercisable at $12.25 per share. Includes 889 vested shares in the Heritage 401(k) ESOP. |

| (11) | Includes 34,328 shares issuable upon exercise of options, which are exercisable at $3.58 per share, and 20,400 options, which are exercisable at $11.13 per share, and 20,400 options exercisable at $8.44 per share, 10,000 options exercisable at $9.75 per share and 4,000 options exercisable at $12.25 per share. Includes 14,065 vested shares in the Heritage 401(k)/ ESOP. |

| (12) | Includes 1,200 options, which are exercisable at $8.50 per share, 1,200 options exercisable at $7.81 per share, 800 options exercisable at $10.15 per share and 500 options exercisable at $12.25 per share. |

| (13) | Includes 17,165 shares issuable upon exercise of options, which are exercisable at $3.58 per share, 10,800 options exercisable at $11.13 per share, 10,800 options which are exercisable at $8.44 per share 8,000 options exercisable at $9.75 per share and 5,000 options exercisable at $12.25 per share. Includes 7,382 vested shares in the Heritage 401(k) / ESOP. |

| (14) | Includes 4,576 shares issuable upon exercise of options, which are exercisable at $3.58 per share, 1,200 options exercisable at $8.50 per share, 1,200 options exercisable at $7.81 per share, 800 options exercisable at $10.15 per share and 500 options exercisable at $12.25 per share. |

| (15) | Includes 215,369 shares issuable upon exercise of options. Includes 27,671 vested shares in the Heritage 401(k)/ESOP. |

4

EXECUTIVE OFFICERS

The following table provides information about the executive officers of Heritage. All officers are appointed by the Board of Directors and serve at the pleasure of the Board for an unspecified term.

Name | Age | Position | Has Served Heritage, Heritage Bank or Central Valley Bank Since | |||

Donald V. Rhodes (1) | 67 | Chairman, President and Chief Executive Officer of Heritage; Chairman and Chief Executive Officer of Heritage Bank; Chairman and Chief Executive Officer of Central Valley Bank | 1986 | |||

Brian L. Vance (2) | 48 | Executive Vice President of Heritage and President and Chief Operating Officer of Heritage Bank | 1996 | |||

Gregory D. Patjens (3) | 53 | Executive Vice President, Heritage Bank | 1999 | |||

Edward D. Cameron (4) | 62 | Senior Vice President, Treasurer and Corporate Secretary of Heritage and Senior Vice President, Treasurer and Corporate Secretary of Heritage Bank | 1999 | |||

D. Michael Broadhead (5) | 58 | President—Central Valley Bank, N.A. | 1986 |

| (1) | For background information on Mr. Rhodes, see page 7 of the proxy statement. |

| (2) | Mr. Vance has been employed by Heritage Bank since 1996. Prior to joining Heritage Bank, Mr. Vance was employed for over 20 years with West One Bank, a bank with offices in Idaho and Washington. Prior to leaving West One, he was Senior Vice President and Regional Manager of Banking Operations for the south Puget Sound region. On August 17, 1998, the Board of Directors of Heritage Bank approved the appointment of Mr. Vance as President and Chief Operating Officer of Heritage Bank to be effective as of October 1, 1998. Prior to that, Mr. Vance was named Executive Vice President of Heritage Bank. In January of 2003, Mr. Vance was named Executive Vice President of Heritage. |

| (3) | Mr. Patjens joined Heritage Bank on March 16, 1999. Mr. Patjens was employed for over 25 years with Key Bank and its predecessor, Puget Sound National Bank in positions with responsibilities for a variety of administrative and bank operations functions. Prior to leaving Key Bank, Mr. Patjens was Senior Vice President for Key Services, National Client Services. |

| (4) | Mr. Cameron became the Senior Vice President, Treasurer and Corporate Secretary of Heritage in January of 2003. Mr. Cameron was named Corporate Secretary of Heritage in June 2002. Prior to that he was Vice President and Treasurer of Heritage. Mr. Cameron was the Senior Vice President and Treasurer of Heritage Bank in August, 1999. Prior to that, Mr. Cameron was Vice President, Investment Manager at Heritage Bank since April 1999. Prior to that, he had over 25 years of banking experience, most recently as Senior Vice President, Investment Manager at Security Pacific Bank. |

| (5) | Mr. Broadhead joined Central Valley Bank in 1986 and has been President of Central Valley Bank since 1990. Heritage acquired Central Valley Bank in March 1999. |

ELECTION OF DIRECTORS

Heritage’s Articles of Incorporation call for the Board of Directors to fix the exact number of directors from time to time within a range of no fewer than 5 nor more than 25 persons. The Board of Directors has fixed the number of directors at 11 persons.

Directors are divided into three classes with each class having three year terms that expire in successive years. Approximately one third of the members of the Board of Directors are elected by the stockholders

5

annually. The directors whose terms will expire at the 2003 annual meeting are Lynn M. Brunton, Melvin R. Lewis and Philip S. Weigand, all of whom have been nominated by the Nominating Committee of the Board of Directors for reelection at the 2003 annual meeting. If elected, directors Brunton, Lewis and Weigand will hold office until the annual meeting of stockholders in the year 2006.

Each nominee has indicated that he is able and willing to serve on the Board of Directors. If any nominee becomes unable to serve, the shares represented by all properly completed proxies will be voted for the election of the substitute recommended by the Board of Directors. At this time, the Board of Directors knows of no reason why any nominee might be unavailable to serve.

Information about the nominees for election at the annual meeting as well as information about those directors continuing in office after the annual meeting is as follows:

Nominees for Election at this Annual Meeting for a Term Expiring in 2006

Lynn M. Brunton, Director Since 1990. Ms. Brunton, 65, is presently a community volunteer and serves as a member of the St. Peter Hospital Community Board and is actively involved in several local community organizations. Ms. Brunton is also a director of Panorama City Corporation, a large retirement community located in Lacey, Washington.

Melvin R. Lewis, Director Since 1999. Mr. Lewis, 71, is a Broker and former President of the firm Terril, Lewis, Wilke Insurance. Since 1993, Mr. Lewis has served as a director of Central Valley Bank and, until March 5, 1999 was a director of Washington Independent Bancshares, Inc., the holding company for Central Valley Bank. On March 5, 1999, Heritage acquired Washington Independent Bancshares, Inc., and Central Valley Bank then became a subsidiary of Heritage. Mr. Lewis became a director of Heritage on March 25, 1999 to fulfill the requirements of the acquisition agreement between Heritage and Washington Independent Bancshares, Inc.

Philip S. Weigand, Director Since 1985. Mr. Weigand, 65, is a retired Lieutenant Colonel of the U.S. Marine Corps with 20 years of active service. Since 1988, Mr. Weigand has been a real estate agent with Virgil Adams Real Estate, located in Olympia, Washington.

The Board of Directors recommends a vote FOR the election of Ms. Brunton and Messrs. Lewis and Weigand.

Incumbent Directors whose terms expire in 2004

James P. Senna, Director since 1976. Mr. Senna, 68, retired at the end of 1998 as the President and Chief Executive Officer of Shee Atika, Inc. (an Alaska Native Corporation), Sitka, Alaska where he served in those capacities since 1987.

Peter Fluetsch, Director since 1999. Mr. Fluetsch, 65, is the President and Chief Executive Officer of Sunset Air, Inc. in Lacey, Washington, a heating and air conditioning contractor that he founded in 1976.

Brian Charneski, Director since 2000. Mr. Charneski, 41, is the President of L&E Bottling Company located in Olympia, Washington. He also serves as Chairman and CEO of Snack Time Foods, headquartered in Tumwater, Washington. Mr. Charneski is a director of Columbia Beverage Company headquartered in Tumwater, Washington.

Brian L. Vance. Mr. Vance, 48, currently serves as President and Chief Operating Officer of Heritage Bank. Prior to joining Heritage Bank in 1996, Mr. Vance was employed for over 20 years with West One Bank, a bank with offices in Idaho and Washington. Prior to leaving West One Bank, Mr. Vance served as the Senior Vice-President and Regional Manager of Banking Operations for the south Puget Sound region.

6

Incumbent Directors Whose Terms Expire in 2005

Donald V. Rhodes, Director Since 1989. Mr. Rhodes, 67 currently serves as Chairman, President and Chief Executive Officer of Heritage; Chairman and Chief Executive Officer of Heritage Bank; and since 1986, Chairman and Chief Executive Officer of Central Valley Bank, a subsidiary of Heritage which was acquired on March 5, 1999. Mr. Rhodes joined Heritage Bank in 1989 as President and Chief Executive Officer and was elected Chairman in 1990.

Daryl D. Jensen, Director Since 1985. Mr. Jensen, 64, was the President of Sunset Life Insurance Company of America from 1973 until his retirement in 1999. Currently, Mr. Jensen is Vice President of Western Institutional Review Board, located in Olympia, WA. He serves as a director of Sunset Life Insurance Company and Kansas City Life Insurance Company. Mr. Jensen is also a director of Generations Bank, located in Missouri, and a director of Panorama City Corporation, a large retirement community located in Lacey, Washington. Mr. Jensen has served as a director of Central Valley Bank since 1989.

H. Edward Odegard, Director Since 1987. Mr. Odegard, 71, has been a private investor since 1993. Prior to that time, he was the co-owner and manager of the Valley Athletic Club, Tumwater, Washington.

Jeffrey Lyon, Director since 2000. Mr. Lyon, 50, is the President/CEO of Insignia Kidder Mathews, headquartered in Seattle, Washington. Mr. Lyon is a member of the Real Estate Advisory Board of Washington State University and has over 30 years of experience in the commercial real estate industry in the Puget Sound area.

INFORMATION ABOUT THE BOARD OF DIRECTORS AND ITS COMMITTEES

How Often Did the Board Meet During 2002?

During the year ended December 31, 2002, the Board of Directors of Heritage held 12 meetings. No director of Heritage attended fewer than 75% of the total meetings of the Board and committees on which a director served during this period.

What Committees Has the Board Established?

The Board of Directors of Heritage has an Executive Committee, an Audit and Finance Committee, a Personnel and Compensation Committee, and a Nominating Committee.

Audit and Finance Committee. The Audit and Finance Committee:

| • | Is responsible for the selection and retention of Heritage’s independent auditors; |

| • | Reviews the plan, scope and audit results of the internal auditors and the independent auditors; |

| • | Reviews the reports of bank regulatory authorities; and |

| • | Reviews the annual and other reports to the Securities and Exchange Commission and the annual report to Heritage’s stockholders. |

| • | Reviews the work of the outside audit firm hired to perform the Company’s internal audit function. |

The Audit and Finance Committee consists of directors Jensen (chairman of the committee), Weigand, Charneski, Lyon and Fluetsch. Additionally, John Clees, a former member of the Heritage Board of Directors and an accountant with the firm of RSM McGladrey acts as a non-voting consultant to the Audit and Finance Committee. None of the members of the Audit and Finance Committee are officers or employees of Heritage or

7

any Heritage subsidiary. There were 6 meetings of the Audit and Finance Committee during the year ended December 31, 2002.

Personnel and Compensation Committee. The Personnel and Compensation Committee reviews and recommends compensation arrangements for all officers. The members of the Personnel and Compensation Committee are directors Fluetsch (chairman of the committee), Jensen and Brunton. Additionally, John Clees, a former member of the Heritage Board of Directors and an accountant with the firm of RSM McGladrey acts as a non-voting consultant to the Personnel and Compensation Committee. None of the members of the Committee are officers or employees of Heritage or any subsidiary of Heritage. There were 4 meetings of the Personnel and Compensation Committee during the year ended December 31, 2002.

Nominating Committee. The Nominating Committee reviews and recommends nominees to serve as directors and officers of Heritage. The members of the Nominating Committee are directors Jensen (chairman of the committee), Brunton and Fluetsch. There was 1 meeting of the Nominating Committee during the year ended December 31, 2002.

How are Directors Compensated?

During the year ended December 31, 2002, Heritage’s non-officer directors received a monthly retainer of $500 and a monthly fee of $500 for each Board meeting attended. Non-officer directors also received $150 for each committee meeting attended, other than the Audit and Finance Committee, with the Chairman of the committee receiving $200 per meeting attended. Non-officer directors of the Audit and Finance Committee received $500 for each meeting attended with the Chairman of the committee receiving $550 per meeting. Directors who are officers or employees of Heritage or its subsidiaries receive no additional compensation for service as directors or members of Board committees.

Under Heritage’s 1994 Stock Option Plan, directors Brunton, Clees, Jensen, Odegard, Senna and Weigand each were granted a non-qualified stock option in January 1994 to purchase 10,298 shares of Heritage common stock at an exercise price of $1.94 per share (as adjusted for the mutual holding company conversion). Under Heritage’s 1997 stock option plan, directors Brunton, Clees, Jensen, Odegard, Senna and Weigand each were granted a non-qualified stock option in January 1997 to purchase 6,863 shares of Heritage common stock at an exercise price of $3.58 per share (as adjusted for the mutual holding company conversion). Under Heritage’s 1998 Stock Option and Restricted Stock Award Plan, in April 1999, directors Brunton, Clees, Odegard, Senna, and Weigand each were granted a non-qualified stock option to purchase 1,200 shares of Heritage common stock at an exercise price of $8.50 per share. Also, in 1999, directors Jensen and Lewis each were granted a non-qualified stock option to purchase 1,500 shares of Heritage common stock: 1,200 in April 1999 at an exercise price of $8.50 per share as directors of Heritage and 300 in March, 1999 at an exercise price of $9.00 per share as directors of Central Valley Bank. Under Heritage’s 1998 Stock Option and Restricted Stock Award Plan, in April 2000, directors Brunton, Clees, Fluetsch, Odegard, Senna, and Weigand each were granted a non-qualified stock option to purchase 1,200 shares of Heritage stock at an exercise price of $7.81 per share. Also, in 2000, directors Jensen and Lewis each were granted a non-qualified stock option to purchase 1,500 shares of Heritage common stock: 1,200 in April 2000 at an exercise price of $7.81 per share and 300 in March 2000 at an exercise price of $7.72 per share as directors of Central Valley Bank. On May 18, 2000, Director Charneski was granted a non-qualified stock option to purchase 1,200 shares of Heritage stock at an exercise price of $8.00 per share. On March 27, 2001, under Heritage’s 1998 Stock Option and Restricted Stock Award Plan, directors Brunton, Charneski, Fluetsch, Lyon, Odegard, Senna, and Weigand were granted a non-qualified stock option to purchase 1,200 shares of Heritage common stock at an exercise price of $10.15 per share. Also in March 2001, directors Jensen and Lewis were granted a non-qualified stock option to purchase 1,500 shares of Heritage common stock at an exercise price of $10.15 per share, 1,200 as a director of Heritage and 300 shares as a director of Central Valley Bank. In February 2002, directors Brunton, Charneski, Fluetsch, Lyon, Odegard, Senna, and Weigand were granted a non-qualified stock option to purchase 1,500 shares of Heritage common stock at an exercise price of $12.25 per share. 6,009 of those options were granted under Heritage’s 1998 Stock Option and

8

Restricted Stock Award Plan and 4,491 options were granted under the Heritage Non-Qualified Stock Option Plan of 2002. Also in February 2002, directors Jensen and Lewis were granted a non-qualified stock option to purchase 1,950 shares of Heritage common stock at an exercise price of $12.25 per share, 1,500 as a director of Heritage and 450 shares as a director of Central Valley Bank. 2,232 of those options were granted under Heritage’s 1998 Stock Option and Restricted Stock Award Plan and 1,668 options were granted under the Heritage Non-Qualified Stock Option Plan of 2002. All director options vest and become exercisable in annual one-third increments beginning one year after the date of grant. The options are exercisable for a period of five years after they vest.

How Can a Stockholder Nominate Someone for the Board?

According to Heritage’s Articles of Incorporation, any stockholder nominations of candidates for election to the Board of Directors at the 2004 annual meeting must be made in writing to Heritage’s chairman not fewer than 14 days nor more than 50 days prior to the date of the annual meeting. If fewer than 21 days notice of the annual meeting is given to stockholders, stockholder nominations must be mailed or delivered to Heritage’s chairman by the close of business on the seventh day after the day the notice of the annual meeting is mailed. Stockholder nominations must contain the following information if known to the nominating stockholder:

| • | The name and address of each proposed nominee; |

| • | The principal occupation of each proposed nominee; |

| • | The total number of shares of Heritage common stock that will be voted for each proposed nominee; |

| • | The name and address of the nominating stockholder; and |

| • | The number of shares of Heritage common stock owned by the nominating stockholder. |

Heritage’s Nominating Committee, in its discretion, may disregard any nominations that do not comply with the above-listed requirements. Upon the Nominating Committee’s instructions, the vote teller may disregard all votes cast for a nominee if the nomination does not comply with the above-listed requirements.

AUDIT AND FINANCE COMMITTEE REPORT

Report of the Audit and Finance Committee

This report of Heritage’s Audit and Finance Committee describes the manner in which the committee reviews Heritage’s financial reporting process.

What are the Responsibilities of the Audit and Finance Committee?

The committee monitors Heritage’s internal financial controls and its financial reporting process. The committee:

| • | Reviews and discusses the audited financial statements with management and the independent auditors. |

| • | Discusses with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees). |

| • | Receives written disclosures as required by Independent Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and discusses with the independent auditors the auditors’ independence. |

| • | Recommends to the Board of Directors whether the audited financial statements should be included in Heritage’s annual report on Form 10-K. |

9

Audit and Finance Committee Report

The Audit and Finance Committee of the Heritage Board of Directors is composed of five independent directors and one consultant and operates under a written charter adopted by the Board of Directors. The committee is responsible for the selection and retention of Heritage’s independent auditors.

Management is responsible for Heritage’s internal controls and the financial reporting process. The independent auditors are responsible for performing an independent audit of Heritage’s consolidated financial statements in accordance with auditing standards generally accepted in the United States of America and for issuing a report thereon. The Audit and Finance Committee’s responsibility is to monitor and oversee these processes.

In this context, the Audit and Finance Committee has met and held discussions with management and the independent auditors. Management represented to the Audit and Finance Committee that Heritage’s consolidated financial statements were prepared in accordance with auditing principles generally accepted in the United States of America, and the Audit and Finance Committee has reviewed and discussed the consolidated financial statements with management and the independent auditors. The Audit and Finance Committee discussed with the independent auditors matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees).

Heritage’s independent auditors also provided to the Audit and Finance Committee the written disclosures required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and the Audit and Finance Committee discussed with the independent auditors that firm’s independence.

Based on the Audit and Finance Committee’s discussion with management and the independent auditors and the Audit and Finance Committee’s review of the representation of management and the report of the independent auditors to the Audit and Finance Committee, the Audit and Finance Committee recommended that the Board of Directors include the audited consolidated financial statements in Heritage’s annual report on Form 10-K for the year ended December 31, 2002 filed with the Securities and Exchange Commission.

Respectfully submitted by: | Daryl D. Jensen, Chairman of the Committee Philip S. Weigand, Member Brian Charneski, Member Jeffrey Lyon, Member Peter Fluetsch, Member |

10

EXECUTIVE COMPENSATION

Report of the Personnel and Compensation Committee

This report of Heritage’s Personnel and Compensation Committee describes in general terms the process the committee undertakes and the factors it considers to determine the appropriate compensation for Heritage’s officers.

What Are The Responsibilities of the Personnel and Compensation Committee?

The committee establishes and monitors compensation programs for executive officers of Heritage and its subsidiaries. The committee:

| • | reviews and approves individual officer salaries, bonus plan allocations, and stock option grants and other equity-based awards; and |

| • | establishes the compensation and evaluates the performance of the chief executive officer, while the chief executive officer evaluates the performance of the other executive officers and recommends individual compensation levels for approval by the committee. |

None of the members of the committee are officers or employees of Heritage or any Heritage subsidiary.

What is Heritage’s Philosophy of Executive Officer Compensation?

The committee’s compensation philosophy is intended to reflect and support the goals and strategies that Heritage has established. Currently, Heritage’s growth strategy is to broaden its products and services from traditional thrift products and services to those more closely related to commercial banking. The key elements of this strategy are geographic and product expansion, loan portfolio diversification, development of relationship banking and maintenance of asset quality. The committee believes these goals, which are intended to create long-term stockholder value, must be supported by a compensation program that:

| • | attracts and retains highly qualified executives; |

| • | provides levels of compensation that are competitive with those offered by other financial institutions; |

| • | motivates executives to enhance long-term stockholder value by helping them to build their own ownership in Heritage; and |

| • | integrates Heritage’s long-term strategic planning and measurement processes. |

Heritage’s compensation program includes competitive salary and benefits, opportunities for employee ownership of Heritage stock through participation in an employee stock ownership plan and, for certain employees, an annual incentive cash bonus based upon attainment of company and individual performance goals and opportunities for stock ownership of Heritage stock through stock option and restricted stock programs.

To determine compensation packages for individual executives, the committee considers various subjective and objective factors, including:

| • | individual job responsibilities and experience; |

| • | individual performance in terms of both qualitative and quantitative goals; |

| • | Heritage’s overall performance, as measured by attainment of strategic and budgeted financial goals and prior performance; and |

| • | industry surveys, prepared by an independent consulting firm, of compensation for comparable positions with similar institutions in the State of Washington, the Pacific Northwest and the United States. |

11

The components of Heritage’s compensation program are the following:

Base Salary. Salary levels of executive officers are designed to be competitive within the banking industry. To set competitive salary ranges, the committee periodically evaluates current salary levels of other financial institutions with size, lines of business, geographic dispersion and market place position similar to Heritage’s. Base salaries for Heritage’s executive officers other than the chief executive officer are based upon recommendations by the chief executive officer, taking into account the subjective and objective factors described above. The committee reviews and approves or disapproves those recommendations.

Annual Incentive Bonus. Executive officers have an annual incentive opportunity with cash bonus awards based on the overall performance of Heritage and on attainment of individual performance targets. The annual awards are determined by formulas established by the committee following each fiscal year and are based upon an assessment of Heritage’s performance (for the year ended December 31, 2002, primarily with respect to the Company’s return on average equity) as compared to both budgeted and previous fiscal year performance and upon an evaluation by the chief executive officer of an executive’s individual performance and contribution to Heritage’s overall performance. The committee then reviews and approves the bonus recommendations and presents them to the Board of Directors for approval.

Stock Option and Other Stock-Based Compensation. Equity-based compensation is intended to more closely align the financial interests of Heritage’s executives with long-term stockholder value, and to assist in the retention of executives who are key to the success of Heritage and its subsidiaries. Equity-based compensation generally has been in the form of incentive stock options and restricted stock awards pursuant to Heritage’s existing stock option plans. The committee determines from time to time which executives, if any, will receive stock options or awards and determines the number of shares subject to each option or award. Grants of stock options and awards are based on various subjective factors relating primarily to the responsibilities of individual executives, their expected future contributions to Heritage and prior option grants.

How Is Heritage’s Chief Executive Officer Compensated?

The base compensation for Heritage’s chairman, president and chief executive officer, Donald V. Rhodes, was determined by the committee with final approval by the Board based on the same criteria as the compensation for the other executive officers. In October 1997, Heritage entered into an employment agreement with Mr. Rhodes providing for an annual base salary of $174,000, which could be increased at the discretion of the Board of Directors or the committee. During the first quarter of 2002, Heritage entered into a new employment agreement with Mr. Rhodes, effective June 1, 2001, providing for an annual base salary of not less than $234,000 beginning on April 1, 2001. During the year ended December 31, 2002, the annual salary of Mr. Rhodes was $238,500. In addition to this, he received a performance bonus of $122,850. The chief executive officer’s bonus potential is based on achievement of certain targeted results of the Company (for 2002 with respect to the Company’s return on average equity) and is determined by the committee with final approval by the Board.

The committee believes that for the year ended December 31, 2002, the compensation for Mr. Rhodes, as well as for the other executive officers, was consistent with Heritage’s overall compensation philosophy and clearly related to the realization of Heritage’s goals and strategies for the period.

Respectfully submitted by: | Peter Fluetsch, Chairman of the Committee | |

Lynn M. Brunton, Member | ||

Daryl D. Jensen, Member |

12

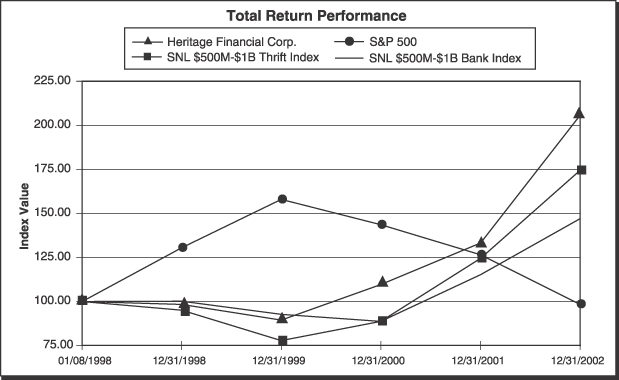

Stock Performance Graph

The chart shown below depicts total return to stockholders during the period beginning January 8, 1998, when Heritage first issued its shares publicly, and ending December 31, 2002. Total return includes appreciation or depreciation in market value of Heritage common stock as well as actual cash and stock dividends paid to stockholders. Indices shown below, for comparison purposes only, are the S&P 500(TM) stock index, which is a broad nationally recognized index of stock performance by publicly traded companies, and the SNL Securities thrift index, which is comprised of publicly-traded thrift institutions with assets of $500 million to $1 billion located throughout the United States. The chart assumes that the value of the investment in Heritage’s common stock and each of the two indices was $100 on January 8, 1998, and that all dividends were reinvested.

HERITAGE FINANCIAL CORPORATION

Period Ending | ||||||||||||

Index | 01/08/98 | 12/31/98 | 12/31/99 | 12/31/00 | 12/31/01 | 12/31/02 | ||||||

Heritage Financial Corp. | 100.00 | 98.39 | 89.41 | 109.61 | 133.30 | 205.72 | ||||||

S&P 500 | 100.00 | 130.43 | 157.88 | 143.50 | 126.45 | 98.37 | ||||||

SNL $500M-$1B Thrift Index | 100.00 | 95.12 | 77.76 | 88.73 | 124.49 | 174.41 | ||||||

SNL $500M-$1B Bank Index | 100.00 | 100.16 | 92.72 | 88.75 | 115.14 | 147.00 | ||||||

Heritage Financial Corp. index values are based on the IPO price of $10.00.

13

Summary Compensation Table

The following table shows the aggregate compensation for services rendered to Heritage or its subsidiaries in all capacities paid or accrued for the year ended December 31, 2002, compared to the same periods ended December 31, 2001 and 2000, to Heritage’s chief executive officer and each of the three other most highly compensated executive officers whose aggregate cash and cash equivalent forms of compensation exceeded $100,000 in 2002.

Annual Compensation | Long-Term Compensation Awards | |||||||||||||||

Name and Principal Position | Period | Salary | Bonus | Restricted Stock Awards ($) | Securities Underlying Options (#) | All Other Compensation (1) | ||||||||||

Donald V. Rhodes | 2002 | $ | 238,500 | $ | 122,850 |

| 0 | 12,000 | $ | 21,222 | ||||||

Chairman, President and Chief Executive Officer Heritage Financial Corp. | 2001 2000 | $ $ | 231,750 225,000 | $ $ | 87,019 77,963 |

| 0 0 | 0 15,000 | $ $ | 18,261 17,874 | ||||||

Brian L. Vance | 2002 | $ | 156,750 | $ | 74,125 | $ | 61,250 | 15,000 | $ | 21,195 | ||||||

President and Chief Operating Officer Heritage Bank | 2001 2000 | $ $ | 147,000 138,000 | $ $ | 47,386 42,280 |

| 0 0 | 0 12,000 | $ $ | 18,205 16,474 | ||||||

Gregory D. Patjens | 2002 | $ | 121,800 | $ | 27,000 |

| 0 | 4,050 | $ | 16,272 | ||||||

Executive Vice President | 2001 | $ | 118,860 | $ | 27,082 |

| 0 | 0 | $ | 13,352 | ||||||

Heritage Bank | 2000 | $ | 112,740 | $ | 25,727 |

| 0 | 6,900 | $ | 5,226 | ||||||

D. Michael Broadhead | 2002 | $ | 122,700 | $ | 31,925 | $ | 30,625 | 6,900 | $ | 14,807 | ||||||

President | 2001 | $ | 118,600 | $ | 5,500 |

| 0 | 6,900 | $ | 14,243 | ||||||

Central Valley Bank | 2000 | $ | 113,300 | $ | 12,900 |

| 0 | 6,900 | $ | 13,405 | ||||||

Edward D. Cameron | 2002 | $ | 88,500 | $ | 28,175 | $ | 30,625 | 4,050 | $ | 15,374 | ||||||

Senior Vice President, | 2001 | $ | 82,051 | $ | 17,316 |

| 0 | 0 | $ | 14,243 | ||||||

Secretary and Treasurer | 2000 | $ | 76,200 | $ | 13,532 |

| 0 | 3,000 | $ | 13,405 | ||||||

| (1) | Amounts in calendar 2002 represent for Messrs. Rhodes, Vance, Patjens, Broadhead and Cameron: (i) matching contributions under Heritage’s 401(k)/ESOP in the amount of $5,500, $5,498, $4,484, $4,066 and $4,277, respectively; (ii) additional discretionary and non-discretionary contributions under Heritage’s 401(k)/ESOP of approximately $14,988, $14,988, $11,202, $10,157 and $10,684, respectively; and (iii) life insurance premiums paid by Heritage for the benefit of each executive in the amount of $734, $710, 586, $584 and $413, respectively. |

Option Grants During 2002

In October 1998, the stockholders approved the adoption of the 1998 Stock Option and Restricted Stock Award Plan, providing for the award of incentive stock options to employees and nonqualified stock options to directors of the Company at the discretion of the Board of Directors. Under the plan, on the date of grant, the exercise price of the option must at least equal the market value per share of the Company’s common stock. The plan provides for the granting of options for up to 395,000 common shares and restricted stock awards of up to 66,125 shares. All awards made under the plan require vesting over a three year period beginning on the date of grant. Under the plan, the options must be exercised within five years of vesting. In 2002, 70,449 options and 35,000 restricted stock awards were granted under the 1998 Stock Option and Restricted Stock Award Plan. There are 31,125 restricted stock awards available under the Plan that have not been awarded. Also during 2002, 12,321 options were granted under a previous Stock Option Plan that represented prior option grants that had been forfeited by the original recipients.

14

In April 2002, the stockholders approved the adoption of the Heritage Financial Corporation Incentive Stock Option Plan of 2002, the Heritage Financial Corporation Director Nonqualified Stock Option Plan of 2002 and the Heritage Financial Corporation Restricted Stock Plan of 2002. These plans provided for the award of incentive stock options to employees and nonqualified stock options and restricted stock to directors of the Company at the discretion of the Board of Directors. Under the plans, on the date of grant, the exercise price of the option must at least equal the market value per share of the Company’s common stock. The plan provides for the granting of incentive options for up to 430,000 common shares, nonqualified options for up to 70,000 common shares and restricted stock awards of up to 50,000 common shares. All awards are subject to a vesting schedule as determined by the Board of Directors. Under the plans, the options must be exercised within five years of vesting. In 2002, 59,016 options were granted under the Heritage Financial Corporation Incentive Stock Option Plan of 2002 and 7,314 options were awarded under the Heritage Financial Corporation Nonqualified Stock Option Plan of 2002. No restricted stock awards were granted under the Heritage Financial Corporation Restricted Stock Plan of 2002.

The following table summarizes options granted to each of the executives listed in the summary compensation table for the year ended December 31, 2002.

Name | Number of Securities Underlying Options Granted (#) | Percentage of Total Options to Employees During year | Exercise Price ($/share) | Expiration Date (1) | Grant Date Present Value ($) | ||||||||

Donald V. Rhodes | 12,000 | 6.52 | % | $ | 12.25 | 2/2008 | $ | 21,720 | |||||

Brian L. Vance | 15,000 | 8.15 | % |

| 12.25 | 2/2008 |

| 27,150 | |||||

Gregory D. Patjens | 4,050 | 2.20 | % |

| 12.25 | 2/2008 |

| 7,331 | |||||

D. Michael Broadhead | 6,900 | 3.75 | % |

| 12.25 | 2/2008 |

| 12,489 | |||||

Edward D. Cameron | 4,050 | 2.20 | % |

| 12.25 | 2/2008 |

| 7,331 | |||||

| (1) | One-third of the option grants vests on each of the first, second and third anniversary dates of the grants and each grant expires five years after it becomes vested. |

Option Exercises and Period End Option Values.

The following table summarizes option exercises during the year ended December 31, 2002 by each of the executives listed in the summary compensation table and the period end value of unexercised options granted to those periods:

Name | Shares Acquired On Exercise | Value Realized | Number of Securities Underlying Unexercised Options at December 31, 2002 (Exercisable/Unexercisable) | Value of Unexercised In-the-Money Options At December 31, 2002(1) (Exercisable/Unexercisable) | ||||||

Donald V. Rhodes | 0 |

| 0 | 85,128 / 17,000 | $ | 896,507 / $107,020 | ||||

Brian L. Vance | 8,582 | $ | 152,845 | 63,928 / 19,000 |

| 730,341 / 115,640 | ||||

Gregory D. Patjens | 0 |

| 0 | 18,400 / 6,350 |

| 164,243 / 41,056 | ||||

D. Michael Broadhead | 4,600 | $ | 78,108 | 9,200 / 13,800 |

| 78,407 / 96,807 | ||||

Edward D. Cameron | 0 |

| 0 | 5,900 / 5,050 |

| 52,519 / 30,578 | ||||

| (1) | Values are calculated by subtracting the exercise price from the fair market value of the underlying stock. For purposes of this table, fair market value is deemed to be $17.81, the last sale price of Heritage’s common stock on the Nasdaq National Market on December 31, 2002. |

Other Employee Benefits and Proposed Changes in Those Benefits.

In 1999, Heritage combined its defined contribution retirement plan, its salary savings 401(k) Plan and its Employee Stock Ownership Plan (“ESOP”) into the ESOP and amended the ESOP to give it 401(k) features. The ESOP was renamed the Heritage Financial Corporation 401(k) ESOP (“KSOP”). All those plans were combined into the KSOP on October 1, 1999. On that date, account balances in each employee’s account in the defined contribution retirement plan and the 401(k) Plan were transferred to the KSOP, and each employee having account balances in those plans was given the ability to allocate up to 20% of those balances to purchase Heritage stock.

15

Under the KSOP, eligible employees have the right to defer a portion of their compensation to be contributed to the KSOP which is matched 50% by Heritage up to certain specified limits. Employees can elect whether to have their deferred compensation amount placed in a Heritage stock account to be invested in Heritage stock by the KSOP trustee (subject to availability) or in other available investment accounts and invested by the KSOP trustee in investments other than Heritage stock as directed by the participants. In addition to the matching contributions Heritage makes, Heritage has the discretion to make additional contributions to the KSOP.

On December 31, 2002, the KSOP owned 355,074 shares of Heritage common stock, of which 266,173 shares were allocated to participants’ accounts and 88,901 shares were held in a suspense account. Shares held in the suspense account are released to participant accounts on a pro rata basis as the KSOP’s loan payable to Heritage is repaid.

Executive Employment and Severance Agreements

Heritage and Heritage Bank entered into an employment agreement with Donald V. Rhodes, effective on October 1, 1997. The agreement with Mr. Rhodes provided for an annual base salary of $174,000, which could be increased at the discretion of the Board of Directors or by an authorized board committee. In addition to base salary, the agreement provided for Mr. Rhodes’s participation in employee benefit plans and other fringe benefits applicable to senior executives of Heritage Bank. The term of the agreement ran until Mr. Rhodes attained the age of 65 (March 14, 2001).

In the first quarter of 2002, Donald V. Rhodes executed an employment agreement with Heritage and Heritage Bank effective June 1, 2001. The agreement with Mr. Rhodes provides for an annual base salary of not less than $234,000 beginning on April 1, 2001. In addition to base salary, the agreement provides for Mr. Rhodes’ participation in employee benefit plans and other fringe benefits applicable to senior executives of Heritage Bank. The term of the agreement will continue until June 30, 2004. Mr. Rhodes must notify Heritage prior to 180 days before the end of the term of the employment agreement if Mr. Rhodes does not desire to seek to renew or renegotiate the employment agreement. If Mr. Rhodes does not provide this notice, Heritage will not be obligated to make any severance payments as described in the paragraph below. In the event the employment of Mr. Rhodes is terminated by Heritage at any time for “cause” or by Mr. Rhodes without “good reason”, both as defined in the agreement, no termination benefit will be payable. If Mr. Rhodes is terminated without cause or he terminates the agreement for good reason, a severance benefit will be payable in an amount equal to Mr. Rhodes’ then current base salary which would otherwise have been paid to him during the then remaining term of the agreement plus an amount equal to his then current base salary for one year.

The agreement with Mr. Rhodes also provides for the payment of a severance benefit to Mr. Rhodes in the event of his termination of employment at the end of the agreement if

| • | Mr. Rhodes is still employed by Heritage at that time, |

| • | Mr. Rhodes has provided notice that he desires to extend his employment agreement within 180 days before the end of the term of the agreement and |

| • | Heritage terminates Mr. Rhodes’ employment for any other reason whatsoever other than cause. |

Under the terms of the agreement, Mr. Rhodes is entitled to receive his then-current annual base salary as severance.

In 2002, Brian L. Vance executed an employment agreement with Heritage and Heritage Bank effective June 1, 2001. The agreement with Mr. Vance provides for an annual base salary of not less than $150,000 per year effective on April 1, 2001. In addition to the base salary, the agreement provides for Mr. Vance’s participation in employee benefit plans and other fringe benefits applicable to senior executives of Heritage

16

Bank. This agreement will continue until June 30, 2004, after which time the agreement will automatically renew for additional terms of one year each unless notice is given one year prior to the expiration date of any term that renewal will not be effected. In the event that Mr. Vance is terminated by Heritage at any time for “cause” or by Mr. Vance without “good reason”, both as defined in the agreement, no termination benefit will be payable. If Mr. Vance is terminated without cause or he terminates the agreement for good reason, a severance benefit will be payable in an amount equal to his then current annual base salary or the amount of such salary which would otherwise have been paid to Mr. Vance during the then remaining term of his agreement, whichever is greater.

The agreement with Mr. Vance also provides for the payment of a severance benefit to Mr. Vance in the event of his termination of employment without cause in some cases preceding and for any reason within one year after a change of control of Heritage or Heritage Bank. Under the terms of the agreement, Mr. Vance is entitled to receive two times his then current annual base salary following the termination or the amount due him until the end of the term of his agreement, whichever is greater. In those circumstances, Mr. Vance also is entitled to all benefits in his agreement, to be fully vested as to unvested options, and to have restrictions lapse on any restricted stock or other restricted securities.

For purposes of the agreements, “change in control” generally includes the acquisition by any person of 25% or more of the outstanding securities of Heritage; replacement of incumbent directors or election of newly elected directors constituting a majority of the Board of Heritage where the replacement or election has not been supported by the Board; dissolution, or sale of 50% or more in value of the assets, of either Heritage or Heritage Bank or any of their respective subsidiaries; or the merger of Heritage into any corporation, 25% or more of the outstanding common stock of which is owned by persons other than owners of the common stock of Heritage prior to such merger.

The employment agreements with Mr. Rhodes and Mr. Vance provide that in the event any of those executives receive an amount under the provisions of the agreements that results in imposition of a tax on the executive under the provisions of the Code Section 4999 (relating to golden Parachute payments), the employer is obligated to reimburse the executive for that amount, exclusive of any tax imposed by reason of receipt of reimbursement under the employment agreements.

The agreements also restrict the right of Messrs. Rhodes and Vance to compete against Heritage or Heritage Bank in the State of Washington for a period of two years following termination of employment, except if employment is terminated by Heritage without cause or by Mr. Rhodes or Mr. Vance for good reason.

Effective on March 5, 1999, Central Valley Bank and D. Michael Broadhead entered into an employment agreement. The term of the agreement expires on December 31, 2002 and is subject to automatic one year renewal extensions unless prior notice otherwise is given. The agreement calls for Mr. Broadhead to serve as President of Central Valley Bank at a base annual salary of no less than $110,000 plus customary fringe benefits. Also, under the agreement, on December 31, 2005 (regardless of whether Mr. Broadhead is employed by Central Valley Bank at the time), Mr. Broadhead is to receive a payment of $40,000 plus $10,000 for each full year of his service at Central Valley Bank or its successor—up to a $200,000 maximum payment. Mr. Broadhead’s estate is also entitled to a death benefit payment of no less than $100,000 nor more than $200,000 if he dies prior to the receipt of the December 31, 2005 service payment.

In the event Mr. Broadhead’s employment is terminated by Central Valley Bank at any time for “cause” or if Mr. Broadhead resigns without “good reason” and his resignation does not coincide with a change in control of Heritage, Mr. Broadhead will not be entitled to any severance benefit payable to him. The agreement does provide for the payment of a severance benefit to Mr. Broadhead (in addition to his service payment described above) in the event of his termination of employment in some cases preceding, and for any reason following by up to one year, a change in control of Heritage. Under the terms of the agreement, Mr. Broadhead is entitled to receive an amount of up to 36 months of his base salary in effect at the time if his employment is terminated without cause by Central Valley Bank from the time after a change in control transaction is announced up to one year following the completion of the change in control or if Mr. Broadhead resigns for any reason within a year after the change in control is completed.

17

The agreement also restricts the right of Mr. Broadhead to compete against Heritage or Central Valley Bank in Yakima County, Washington for a period of up to three years unless Mr. Broadhead is terminated without cause or resigns for good reason.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires directors, executive officers and greater than 10% stockholders to file reports of their ownership and any changes in ownership of Heritage securities with the Securities and Exchange Commission. These directors, executive officers and greater than 10% stockholders are required by regulation to provide Heritage with a copy of any Section 16(a) reports they file. Based on Heritage’s review of copies of these reports received by it and written representations made to Heritage by these persons, Heritage believes that all Section 16(a) filing requirements applicable to its directors, executive officers and greater than 10% stockholders were complied with during the year ended December 31, 2002 with the exception of the following: Director Brian Vance exercised an option previously granted to him by Heritage and purchased pursuant to the option 8,582 shares of Heritage stock on April 10, 2002. The Form 4 reporting Mr. Vance’s increase in stock ownership was inadvertently not filed in 2002. Upon review of the stock ownership filings by its executive officers, directors and 10% or more stockholders, Heritage discovered that this filing had not been made and, as a result, a late Form 4 filing on this transaction was made by Mr. Vance on March 4, 2003. In November 2002, Executive Officer D. Michael Broadhead filed a Form 4 timely upon exercise of options. However, the Form 4 was coded improperly and an amended Form 4 was filed on March 11, 2003. Director Brian Charneski served as a trustee or director of three different entities that purchased a total of 4,900 shares of Heritage in August and September of 2001. Mr. Charneski misunderstood the need to file a Form 4 on these transactions and, as a result a late Form 4 filing on those transactions was made on March 12, 2003.

INTEREST OF MANAGEMENT IN CERTAIN TRANSACTIONS

During the year ended December 31, 2002, several directors and executive officers of Heritage and Heritage Bank and their associates, were customers of Heritage Bank or Central Valley Bank, and it is anticipated that these persons will continue to be customers of Heritage Bank or Central Valley Bank in the future. All transactions between Heritage Bank and Central Valley Bank and its executive officers and directors, and their associates, were made in the ordinary course of business on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other persons, and, in the opinion of management, did not involve more than the normal risk of repayment or present other unfavorable features.

RELATIONSHIP WITH INDEPENDENT PUBLIC ACCOUNTANTS

The firm of KPMG LLP performed the audit of the consolidated financial statements of Heritage and its subsidiaries for the year ended December 31, 2002. The Audit and Finance Committee has selected KPMG LLP to be retained as independent auditors of Heritage and its subsidiaries for the year ending December 31, 2003, subject to the terms of an engagement letter with that firm. Stockholders are not required to take action on this retention. Representatives of KPMG LLP will be present at the annual meeting. They will have the opportunity to present a statement if they desire to and will be available to respond to appropriate questions.

Fees Billed by KMPG During 2002

Audit fees, excluding audit related | $ | 92,627 | |

All other fees: | |||

Audit related fees (1) | $ | 11,500 | |

Other non-audit services (2) |

| 84,433 | |

$ | 95,933 | ||

| (1) | Audit related fees related to the review of a registration statement and FDICIA attestation. |

| (2) | Other non-audit fees consisted of advisory and tax compliance services. |

18

STOCKHOLDER PROPOSALS FOR THE 2004 ANNUAL MEETING

Stockholders interested in presenting a proposal for consideration at the annual meeting of stockholders in 2004 may do so by following the procedures prescribed in Rule 14a-8 under the Securities Exchange Act of 1934. To be eligible for inclusion, stockholder proposals must be received by Heritage no later than November 21, 2003.

OTHER MATTERS

The Board of Directors knows of no other matters to be brought before the annual meeting. If other matters are properly brought before the annual meeting, the persons appointed in the proxy intend to vote the shares represented by the proxy according to their best judgment.

We urge you to sign and return the enclosed proxy as soon as possible, whether or not you plan to attend the annual meeting in person. If you do attend the annual meeting, you then may withdraw your proxy and vote in person. The proxy may be withdrawn at any time prior to voting.

MISCELLANEOUS

Heritage’s annual report for the year ended December 31, 2002 has been mailed along with this proxy statement to all stockholders of record as of March 11, 2003. Any stockholder who has not received a copy of this annual report may obtain a copy by writing to Heritage. The annual report is not to be treated as part of the proxy solicitation material or having been incorporated by reference in this proxy statement.

A copy of Heritage’s Form 10-K that is to be filed with the Securities and Exchange Commission by March 30, 2003 will be provided to you without charge if you are a stockholder of Heritage as of March 11, 2003. Please make your written request to Edward D. Cameron, Secretary, Heritage Financial Corporation, 201 5th Avenue S.W., Olympia, Washington 98501.

19

HERITAGE FINANCIAL CORPORATION

PROXY FOR ANNUAL MEETING OF STOCKHOLDERS

April 30, 2003

THIS PROXY IS SOLICITED ON BEHALF OF THE

BOARD OF DIRECTORS OF

HERITAGE FINANCIAL CORPORATION

PLEASE SIGN AND RETURN IMMEDIATELY

The undersigned stockholder of HERITAGE FINANCIAL CORPORATION (“Heritage”) hereby nominates, constitutes and appoints Donald V. Rhodes and Daryl D. Jensen, and each of them, jointly and severally, as true and lawful agents and proxies, with full power of substitution, for me and in my name, place and stead, to act and vote all the common stock of Heritage standing in my name and on its books on March 11, 2003 at the Annual Meeting of Stockholders to be held at the Phoenix Inn, Olympia, Washington, on April 30, 2003 at 10:30 a.m., and at any adjournment thereof, with all the powers the undersigned would possess if personally present, as follows:

| 1. | ELECTION OF DIRECTORS: Election of three (3) directors to serve on the Board of Directors until 2006. |

¨ FOR all the nominees listed below. | ¨ WITHHOLD AUTHORITY TO VOTE | |

forall nominees listed below (in the manner described below). |

INSTRUCTIONS: To withhold authority to vote for any individual nominee, strike a line through the nominee’s name listed below.

Lynn M. Brunton | Melvin R. Lewis | Phillip S. Weigand |

| 2. | In their discretion, upon such other business as may properly come before the Annual Meeting or any adjournment thereof. |

(Continued and to be signed on the other side)

THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED AS SPECIFIED ABOVE. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED “FOR” THE PROPOSALS SET FORTH ABOVE.

Management knows of no other matters that may properly be, or which are likely to be, brought before the Annual Meeting. However, if any other matters are properly presented at the Annual Meeting, this Proxy will be voted according to the discretion of the named proxies.

The undersigned hereby acknowledges receipt of the Notice of the Annual Meeting of Stockholders for the April 30, 2003 Annual Meeting, and the accompanying documents forwarded therewith, and ratifies all lawful action taken by the above-named agents and proxies.

Date:

Signature

Signature, if held jointly

NOTE: Signature(s) should agree with name(s) on Heritage stock certificate(s). Executives, administrators, trustees and other fiduciaries, and persons signing on behalf of corporations, partnerships or other entities should so indicate when signing. All joint owners must sign.