SCHEDULE 14A—INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

¨ Preliminary Proxy Statement | ¨ | CONFIDENTIAL FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12 |

Heritage Financial Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date filed: |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held April 27, 2006

To Our Stockholders:

You are invited to attend the 2006 annual meeting of stockholders of Heritage Financial Corporation (Heritage) to be held at the Phoenix Inn Suites, 417 Capitol Way N., Olympia, Washington, on April 27, 2006 at 10:30 a.m., Pacific Time. At the annual meeting, you will be asked to:

| 1. | Elect four (4) persons to serve on the Board of Directors of Heritage until the annual meeting of stockholders in 2009. |

| 2. | Approve the Heritage Financial Corporation Incentive Stock Option Plan of 2006, a copy of which is included as Exhibit A to the attached Proxy Statement. |

| 3. | Approve the Heritage Financial Corporation Director Nonqualified Stock Option Plan of 2006, a copy of which is included as Exhibit B to the attached Proxy Statement. |

| 4. | Approve the Heritage Financial Corporation Restricted Stock Plan of 2006, a copy of which is included as Exhibit C to the attached Proxy Statement. |

| 5. | Approve whatever other business as may properly be brought before the annual meeting or any adjournment thereof. |

Stockholders of record at the close of business on March 10, 2006 are entitled to vote at the annual meeting or any adjournment of the annual meeting.

BY ORDER OF THE BOARD OF DIRECTORS |

|

Edward D. Cameron |

Secretary |

Olympia, Washington

March 23, 2006

We urge you to complete, sign and return the enclosed proxy card as soon as possible, whether or not you plan to attend the annual meeting in person. If you do attend the annual meeting, you then may withdraw your proxy and vote in person. The proxy may be withdrawn at any time prior to voting.

201 5th Avenue S.W.

OLYMPIA, WASHINGTON 98501

PROXY STATEMENT

Heritage is sending this proxy statement to you for the solicitation of proxies by the Board of Directors of Heritage to be voted at the annual meeting. This proxy statement and the enclosed proxy card are being mailed to stockholders on or about March 23rd, 2006.

INFORMATION ABOUT THE MEETING

When and Where is the Annual Meeting?

The annual meeting will be held at 10:30 a.m., Pacific Time, on Thursday, April 27, 2006 at the Phoenix Inn Suites, 417 Capitol Way N., Olympia, Washington.

What Matters will be Voted on at the Annual Meeting?

At the annual meeting, you will be asked to:

| • | Elect four (4) persons to serve on the Board of Directors of Heritage until the annual meeting of stockholders in 2009; |

| • | Approve the Heritage Financial Corporation Incentive Stock Option Plan of 2006; |

| • | Approve the Heritage Financial Corporation Director Nonqualified Stock Option Plan of 2006; |

| • | Approve the Heritage Financial Corporation Restricted Stock Plan of 2006; and |

| • | Approve whatever other business may properly come before the annual meeting or any adjournment thereof. |

Who is Entitled to Vote?

Only stockholders of record at the close of business on the record date, March 10, 2006, are entitled to receive notice of the annual meeting and to vote at the annual meeting. On March 10, 2006, there were 6,340,361 shares of Heritage common stock outstanding, held by approximately 1,130 holders of record. Each share of Heritage common stock is entitled to one vote on each matter considered at the meeting, including one vote for each director to be elected. Stockholders are not entitled to cumulate their votes in the election of directors.

What Constitutes a Quorum?

The presence at the annual meeting, in person or by proxy, of a majority of the outstanding shares eligible to vote at the annual meeting is required for a quorum to exist at the annual meeting. For this purpose, abstentions and broker non-votes are counted in determining the shares present at the annual meeting.

1

What Vote is Required to Elect the Directors?

The four nominees for election as directors who receive a simple majority of votes cast will be elected directors. Votes may be cast in favor of some or all of the nominees for election to the Board of Directors or withheld as to some or all of the nominees.

What Vote is Required to Approve the Heritage Financial Corporation Incentive Stock Option Plan of 2006, the Heritage Financial Corporation Director Nonqualified Stock Option Plan of 2006 and the Heritage Financial Corporation Restricted Stock Plan of 2006?

The affirmative vote of a majority of Heritage’s outstanding stock is required to approve the Heritage Financial Corporation Incentive Stock Option Plan of 2006, the Heritage Financial Corporation Director Nonqualified Stock Option Plan of 2006 and the Heritage Financial Corporation Restricted Stock Plan of 2006.

How Do I Vote?

If you complete and properly sign the accompanying proxy card and return it to Heritage, it will be voted as you direct. If you give no directions on your proxy, the shares represented by your proxy, if properly signed, will be voted FOR the nominees for directors listed in this proxy statement. If any other matters are properly presented at the annual meeting for consideration, the persons named in the proxy will have discretion to vote on those matters according to their best judgment. “Street name” stockholders who wish to vote at the annual meeting will need to obtain a proxy form from the institution that holds their shares.

Can I Change My Vote After I Return My Proxy Card?

Yes. Even after you have submitted your proxy, your proxy may be withdrawn at any time before it is voted by

| • | delivering written notice to Edward D. Cameron, Heritage’s Secretary, at 201 5th Avenue S.W., Olympia, Washington 98501, before 5:00 p.m. on April 26, 2006,or |

| • | completing a later dated proxy,or |

| • | attending the annual meeting and voting in person. |

Who Pays the Costs of Soliciting Proxies?

The enclosed proxy is solicited by the Board of Directors of Heritage. Heritage will bear the costs of soliciting proxies for the annual meeting. In addition to soliciting proxies by mail, Heritage’s directors, officers and employees may solicit proxies personally or by telephone or fax. No director, officer or employee of Heritage who solicits proxies will receive any compensation for their solicitation other than their regular compensation for the positions they hold. Heritage does not intend to pay any compensation to any other persons for the solicitation of proxies. However, it will reimburse brokerage houses and other custodians, nominees and fiduciaries for reasonable expenses to mail proxy materials for beneficial owners.

2

STOCK OWNERSHIP

Who are the Largest Owners of Heritage Stock?

The following table sets forth information concerning the number of shares of Heritage common stock held as of March 10, 2006 by the only stockholders who are known to management to be the beneficial owners of more than five percent (5%) of Heritage’s outstanding shares:

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership (1) | Percent of Class | ||||

Donald V. Rhodes 201 Fifth Avenue, S.W. Olympia, WA 98501 | 438,164 | (2) | 6.91 | % |

| (1) | Of common stock. |

| (2) | Includes 7,140 options, which are exercisable at $10.60 per share, 14,280 options exercisable at $8.04 per share, 15,750 options exercisable at $9.29 per share, 12,600 options exercisable at $11.67 per share and 682 options exercisable at $20.49 per share. Includes 19,637 vested shares in the Heritage 401(k) ESOP. |

How Much Stock Do Heritage’s Directors and Executive Officers Own?

The following table shows the beneficial ownership of Heritage common stock as of March 10, 2006 by:

| • | Each director and director nominee; |

| • | The chief executive officer and those persons who served as executive officers in 2005 and received salaries and bonuses totaling in excess of $100,000 during 2005; and |

| • | All directors and executive officers as a group. |

For purposes of this table and according to Rule 13d-3 under the Securities Exchange Act of 1934, a person is the beneficial owner of any shares if he or she has voting and/or investment power over those shares. The table includes shares owned by spouses, other immediate family members in trust, shares held in retirement accounts or funds for the benefit of the named individuals, and other forms of ownership, over which shares the persons named in the table possess voting and/or investment power.

| Shares Beneficially Owned at March 10, 2006 | |||||

Name | Number | Percent of Outstanding Common Stock | |||

D. Michael Broadhead (1) | 76,075 | 1.20 | % | ||

Lynn M. Brunton (2) | 134,061 | 2.11 | % | ||

Edward D. Cameron (3) | 28,973 | * | |||

Brian S. Charneski (4) | 30,240 | * | |||

Gary B. Christensen (5) | 33,103 | * | |||

John A. Clees (6) | 86,433 | 1.36 | % | ||

Kimberly T. Ellwanger | 2,625 | * | |||

Peter N. Fluetsch (7) | 27,930 | * | |||

Daryl D. Jensen (8) | 172,667 | 2.72 | % | ||

Jeffrey S. Lyon (9) | 16,638 | * | |||

Gregory D. Patjens (10) | 48,452 | * | |||

Donald V. Rhodes (11) | 438,164 | 6.91 | % | ||

James P. Senna (12) | 85,575 | 1.35 | % | ||

Brian L. Vance (13) | 190,997 | 3.01 | % | ||

Philip S. Weigand (14) | 135,087 | 2.13 | % | ||

Directors, nominees and executive officers as a group (15 persons) (15) | 1,507,020 | 23.77 | % | ||

| * | Represents less than 1.0% of Heritage’s outstanding common stock. |

3

| (1) | Includes 2,415 shares issuable upon exercise of options, which are exercisable at $8.57 per share, 7,245 options exercisable at $9.67 per share, 7,245 options exercisable at $11.67 per share, 7,245 options exercisable at $20.36 per share, 3,780 options exercisable at $20.10 per share and 1,890 options exercisable at $20.49 per share. Includes 4,982 vested shares in the Heritage 401(k) ESOP. |

| (2) | Includes 1,575 shares issuable upon exercise of options, which are exercisable at $20.36 per share, 1,050 options exercisable at $20.10 per share and 525 options exercisable at $20.49 per share. |

| (3) | Includes 1,050 shares issuable upon exercise of options, which are exercisable at $9.29 per share, 4,253 options exercisable at $11.67 per share, 1,260 options exercisable at $20.49 per share, 2,520 options exercisable at $20.10 per share and 4,725 options exercisable at $20.36 per share. Includes 3,825 vested shares in the Heritage 401(k) ESOP. |

| (4) | Includes 1,260 shares issuable upon exercise of options, which are exercisable at $7.62 per share, 1,260 options exercisable at $9.67 per share, 1,575 options exercisable at $11.67 per share, 1,575 options exercisable at $20.36 per share, 1,050 options exercisable at $20.10 per share and 525 options exercisable at $20.49 per share. |

| (5) | Includes 105 shares issuable upon the exercise of options, which are exercisable at $8.57 per share, 210 options exercisable at $7.35 per share, 315 options exercisable at $9.67 per share, 473 options exercisable at $11.67 per share, 473 options exercisable at $20.36, 315 options exercisable at $20.10 per share and 157 options exercisable at $20.49 per share. |

| (6) | Mr. Clees has no options available for exercise within 60 days of the record date. |

| (7) | Includes 1,575 shares issuable upon exercise of options, which are exercisable at $20.36 per share, 525 options exercisable at $20.49 per share and 1,050 options exercisable at $20.10 per share. |

| (8) | Includes 2,048 shares issuable upon the exercise of options, which are exercisable at $11.67 per share, 2,048 options exercisable at $20.36 per share, 682 options exercisable at $20.49 per share and 1,365 options exercisable at $20.10 per share. |

| (9) | Includes 1,260 shares issuable upon the exercise of options at $9.67 per share, 1,575 options exercisable at $20.36 per share, 525 options exercisable at $20.49 per share, 1,050 options exercisable at $20.10 and 1,575 options exercisable at $11.67 per share. |

| (10) | Includes 4,830 shares issuable upon exercise of options, which are exercisable at $8.04 per share, 2,415 options exercisable at $8.33 per share, 4,253 options exercisable at $11.67 per share, 4,725 options exercisable at $20.36 per share, 1,260 options exercisable at $20.49 per share, 2,520 options exercisable at $20.10 per share and 7,245 options exercisable at $9.29 per share. Includes 4,509 vested shares in the Heritage 401(k) ESOP. |

| (11) | Includes 7,140 shares issuable upon exercise of options, which are exercisable at $10.60 per share, 14,280 options exercisable at $8.04 per share, 15,750 options exercisable at $9.29 per share, 12,600 options exercisable at $11.67 per share and 682 options exercisable at $20.49 per share. Includes 19,637 vested shares in the Heritage 401(k) ESOP. |

| (12) | Includes 420 options, which are exercisable at $8.09 per share, 840 options exercisable at $7.44 per share, 1,260 options exercisable at $9.67 per share, 1,575 options exercisable at $11.67 per share, 1,575 options exercisable at $20.36 per share, 1,050 options exercisable at $20.10 per share and 525 options exercisable at $20.49 per share. |

| (13) | Includes 3,780 shares issuable upon exercise of options, which are exercisable at $8.04 per share, 8,400 options exercisable at $9.29 per share, 15,750 options which are exercisable at $11.67 per share, 22,050 options exercisable at $20.36 per share, 8,400 options exercisable at $20.10 per share and 5,250 options exercisable at $20.49 per share. Includes 11,930 vested shares in the Heritage 401(k) ESOP. |

| (14) | Includes 1,575 shares issuable upon exercise of options, which are exercisable at $11.67 per share, 1,260 shares exercisable at $7.44 per share, 840 shares exercisable at $8.09 per share, 1,260 shares exercisable at $9.67 per share, 1,575 options exercisable at $20.36 per share, 1,050 options exercisable at $20.10 per share and 525 options exercisable at $20.49 per share. |

| (15) | Includes 228,009 shares issuable upon exercise of options. Includes 44,883 vested shares in the Heritage 401(k) ESOP. |

4

EXECUTIVE OFFICERS

The following table provides information about the executive officers of Heritage. All officers are appointed by the Board of Directors and serve at the pleasure of the Board for an unspecified term.

Name | Age | Position | Has Served Heritage, Heritage Bank or Central Valley Bank Since | |||

Donald V. Rhodes (1) | 70 | Chairman and Chief Executive Officer of Heritage; Chairman of Heritage Bank; Chairman and Chief Executive Officer of Central Valley Bank | 1986 | |||

Brian L. Vance (2) | 51 | President of Heritage and President and Chief Executive Officer of Heritage Bank | 1996 | |||

Gregory D. Patjens (3) | 56 | Executive Vice President, Heritage Bank | 1999 | |||

Edward D. Cameron (4) | 65 | Senior Vice President, Treasurer and Corporate Secretary of Heritage and Senior Vice President, Treasurer and Corporate Secretary of Heritage Bank | 1999 | |||

D. Michael Broadhead (5) | 61 | President—Central Valley Bank | 1986 |

| (1) | For background information on Mr. Rhodes, see page 6 of the proxy statement. |

| (2) | For background information on Mr. Vance, see page 6 of the proxy statement. |

| (3) | Mr. Patjens joined Heritage Bank on March 16, 1999. Mr. Patjens was employed for over 25 years with Key Bank and its predecessor, Puget Sound National Bank in positions with responsibilities for a variety of administrative and bank operations functions. Prior to leaving Key Bank, Mr. Patjens was Senior Vice President for Key Services, National Client Services. |

| (4) | Mr. Cameron became the Senior Vice President, Treasurer and Corporate Secretary of Heritage in January of 2003. Mr. Cameron was named Corporate Secretary of Heritage in June 2002. Prior to that he was Vice President and Treasurer of Heritage. Mr. Cameron was the Senior Vice President and Treasurer of Heritage Bank in August 1999. Prior to that since April 1999, Mr. Cameron was Vice President, Investment Manager at Heritage Bank. Prior to that, he had over 25 years of banking experience, most recently as Senior Vice President, Investment Manager at Security Pacific Bank. |

| (5) | Mr. Broadhead joined Central Valley Bank in 1986 and has been President of Central Valley Bank since 1990. Heritage acquired Central Valley Bank in March 1999. |

ELECTION OF DIRECTORS

Heritage’s Articles of Incorporation call for the Board of Directors to fix the exact number of directors from time to time within a range of no fewer than five nor more than 25 persons. The Board of Directors has fixed the number of directors at 11 persons.

Directors are divided into three classes with each class having three year terms that expire in successive years. Approximately one third of the members of the Board of Directors are elected by the stockholders annually. The directors whose terms will expire at the 2006 annual meeting are Lynn M. Brunton, Gary B. Christensen, John A. Clees and Philip S. Weigand. All with the exception of Ms. Brunton have been nominated by the Nominating Committee of the Board of Directors for reelection at the 2006 annual meeting. Ms. Brunton has indicated her decision to retire at the expiration of her term. If elected, directors Christensen, Clees and Weigand will hold office until the annual meeting of stockholders in the year 2009.

5

In addition, the Nominating Committee of the Board nominated Ms. Kimberly T. Ellwanger for election to the Board. If elected Ms. Ellwanger will hold office until the annual meeting of stockholders in the year 2009.

Each nominee has indicated that he/she is able and willing to serve on the Board of Directors. If any nominee becomes unable to serve, the shares represented by all properly completed proxies will be voted for the election of the substitute recommended by the Board of Directors. At this time, the Board of Directors knows of no reason why any nominee might be unavailable to serve.

Information about the nominees for election at the annual meeting as well as information about those directors continuing in office after the annual meeting is as follows:

Nominees for Election at This Annual Meeting for a Term Expiring in 2009

Gary B. Christensen, Director Since 2005. Mr. Christensen, 57, is the owner of R.E. Powell Distributing a fuel, lubricant and propane distributorship headquartered in Yakima, Washington. In 2004 R.E. Powell Distributing was named one of five inductees into the University of Washington sponsored “Leadership Circle” at the 6th Annual UW Minority Business of the Year Awards dinner. Mr. Christensen serves as a director for Central Valley Bank and serves on the Board of Directors for Yakima County Economic Development.

John A. Clees, Director Since 2005. Mr. Clees, 58, is Tax Services Director at the consulting and accounting firm of RSM McGladrey in Olympia, Washington. Mr. Clees previously served on Heritage’s Board of Directors from 1990 to 2000 and served as a non-voting consultant to Heritage’s audit committee from 2000 until June 2005. Prior to this, Mr. Clees was the President of Clees Miles CPA Group, Olympia, Washington from 1995 until the Group was sold to RSM McGladrey. Prior to that time, he was the managing partner of Gattis, Clees and Company, an accounting firm with offices in Seattle and Olympia, Washington.

Kimberly T. Ellwanger. Ms. Ellwanger, 47, was Senior Director of Corporate Affairs and Associate General Counsel at Microsoft Corporation of Redmond, Washington from 1991 until she retired in October of 1999. Prior to that Ms. Ellwanger was a Partner at Perkins Coie in Seattle, Washington where she practiced business and tax law from 1985 to 1991. She has been involved in numerous civic and professional activities including such organizations as The Community Foundation of South Puget Sound where she currently serves as Board Chair. She also previously served as Chair of both the Washington Council on International Trade and the Dean’s Advisory Committee of the University of Washington Law School. Ms. Ellwanger graduated with high honors from the University of Washington School of Law and graduated Phi Beta Kappa from Vassar College with an honors degree in economics.

Philip S. Weigand, Director Since 1985. Mr. Weigand, 68, is a retired Lieutenant Colonel of the U.S. Marine Corps with 20 years of active service. Since 1988, Mr. Weigand has been a real estate agent with Virgil Adams Real Estate, located in Olympia, Washington. He is also a member of the Board of Trustees, St. Martins University in Lacey, Washington.

The Board of Directors recommends a vote FOR the election of Ms. Ellwanger and Messrs. Christensen, Clees and Weigand.

Incumbent Directors Whose Terms Expire in 2007.

Brian S. Charneski, Director since 2000. Mr. Charneski, 44, is the President of L&E Bottling Company located in Olympia, Washington. He also serves as Chairman and CEO of Snack Time Foods, headquartered in Tumwater, Washington. Mr. Charneski is a director of Columbia Beverage Company headquartered in Tumwater, Washington, L&E Bottling Company and ET Financial Services, Inc.

Peter N. Fluetsch, Director since 1999. Mr. Fluetsch, 68, is the Chief Executive Officer of Sunset Air, Inc. in Lacey, Washington, a heating and air conditioning contractor that he founded in 1976.

James P. Senna, Director since 1976. Mr. Senna, 71, is a retiree.

6

Brian L. Vance, Director since 2003. Mr. Vance, 51, currently serves as President and Chief Executive Officer of Heritage Bank and President of Heritage. Mr. Vance has been employed by Heritage Bank since 1996. Prior to joining Heritage Bank, Mr. Vance was employed for over 20 years with West One Bank, a bank with offices in Idaho and Washington. Prior to leaving West One, he was Senior Vice President and Regional Manager of Banking Operations for the south Puget Sound region. On March 24, 2003, Mr. Vance was named President and Chief Executive Officer of Heritage Bank. On August 17, 1998, the Board of Directors of Heritage Bank approved the appointment of Mr. Vance as President and Chief Operating Officer of Heritage Bank to be effective as of October 1, 1998. Prior to that, Mr. Vance was named Executive Vice President of Heritage Bank.

Incumbent Directors Whose Terms Expire in 2008.

Daryl D. Jensen, Director Since 1985. Mr. Jensen, 67, was the President of Sunset Life Insurance Company of America from 1973 until his retirement in 1999. Currently, Mr. Jensen is Vice President of Western Institutional Review Board, located in Olympia, WA. He serves as a director of Sunset Life Insurance Company and Kansas City Life Insurance Company. Mr. Jensen is also a director of Generations Bank, located in Missouri, and a director of Panorama City Corporation, a large retirement community located in Lacey, Washington. Mr. Jensen has served as a director of Central Valley Bank since 1989.

Jeffrey S. Lyon, Director since 2000. Mr. Lyon, 53, is the Chairman and Chief Executive Officer of GVA Kidder Mathews, headquartered in Seattle, Washington. Mr. Lyon serves as a director for GVA Worldwide and a director for Kidder Mathews-Segner Inc. Mr. Lyon is a member of the Real Estate Advisory Board of Washington State University, a member of the Business Advisory Board for the Milgard School of Business at the University of Washington, Tacoma and is also Chairman of the Tacoma-Pierce County Economic Development Board. Mr. Lyon has over 32 years of experience in the commercial real estate industry in the Puget Sound area.

Donald V. Rhodes, Director Since 1989. Mr. Rhodes, 70, currently serves as Chairman and Chief Executive Officer of Heritage; Chairman of Heritage Bank; and since 1986, Chairman and Chief Executive Officer of Central Valley Bank, a subsidiary of Heritage which was acquired on March 5, 1999. Mr. Rhodes joined Heritage Bank in 1989 as President and Chief Executive Officer and was elected Chairman in 1990.

INFORMATION ABOUT THE BOARD OF DIRECTORS AND ITS COMMITTEES

How Often Did the Board Meet During 2005?

During the year ended December 31, 2005, the Board of Directors of Heritage held 12 meetings. No director of Heritage attended fewer than 75% of the total meetings of the Board and committees on which a director served during this period. It is Heritage’s policy that its directors attend the annual meeting of stockholders. At the 2005 annual meeting, ten Heritage directors were in attendance.

What Committees Has the Board Established?

The Board of Directors of Heritage has an Executive Committee, an Audit and Finance Committee, a Personnel and Compensation Committee and a Nominating Committee.

Audit and Finance Committee. The Audit and Finance Committee:

| • | Reviews and approves the selection of Heritage’s independent auditors; |

| • | Reviews the plan, scope and audit results of the internal auditors and the independent auditors; |

| • | Reviews the reports of bank regulatory authorities; and |

| • | Reviews the annual and other reports to the Securities and Exchange Commission and the annual report to Heritage’s stockholders. |

7

The Audit and Finance Committee consists of directors Jensen (chair), Charneski, Christensen, Clees, Fluetsch, Lyon and Weigand. None of the members of the Audit and Finance Committee are officers or employees of Heritage or any Heritage subsidiary. Our Board has determined that all members of the Audit and Finance Committee are considered “independent” under the NASDAQ’s listing standards. There were five meetings of the Audit and Finance Committee during the year ended December 31, 2005.

Personnel and Compensation Committee. The Personnel and Compensation Committee reviews and recommends compensation arrangements for all officers. The members of the Personnel and Compensation Committee are directors Fluetsch (chair), Brunton, Clees and Jensen. None of the members of the Committee are officers or employees of Heritage or any subsidiary of Heritage. Our Board has determined that all members of the Personnel and Compensation Committee are considered “independent” under the NASDAQ’s listing standards. There were two meetings of the Personnel and Compensation Committee during the year ended December 31, 2005.

Nominating Committee. Heritage’s Board has established a Nominating Committee which reviews and recommends nominees to serve as directors and officers of Heritage. Heritage’s Nominating Committee consists of directors Jensen (chair), Brunton, Clees and Fluetsch. None of the members of the Nominating Committee are officers or employees of Heritage or any Heritage subsidiary. Our Board has determined that all members of the Nominating Committee are considered “independent” under the NASDAQ’s listing standards. The Nominating Committee provides oversight on a broad range of issues surrounding the composition and operation of the Board of Directors of Heritage Financial Corporation. The Nominating Committee has a Charter which is available on Heritage’s website at www.hf-wa.com. There was one meeting of the Nominating Committee during the year ended December 31, 2005.

The Nominating Committee’s Charter has established general criteria for considering director candidates. The Nominating Committee will consider the following criteria in selecting nominees:

| • | Ability to represent all Heritage stockholders; |

| • | Expected period of time available for service; |

| • | Independence; |

| • | Current knowledge and contacts in Heritage’s market area; |

| • | Ability to work effectively with the Board group; and |

| • | Ability to commit adequate time to serve as a Heritage director. |

How Can a Stockholder Nominate Someone for the Board?

According to Heritage’s Articles of Incorporation, any stockholder nominations of candidates for election to the Board of Directors at the 2007 annual meeting must be made in writing to Heritage’s chairman not fewer than 14 days nor more than 50 days prior to the date of the annual meeting. If fewer than 21 days notice of the annual meeting is given to stockholders, stockholder nominations must be mailed or delivered to Heritage’s chairman by the close of business on the seventh day after the day the notice of the annual meeting is mailed. Stockholder nominations must contain the following information if known to the nominating stockholder:

| • | The name and address of each proposed nominee; |

| • | The principal occupation of each proposed nominee; |

| • | The total number of shares of Heritage common stock that will be voted for each shareholder proposed nominee; |

| • | The name and address of the nominating stockholder; and |

| • | The number of shares of Heritage common stock owned by the nominating stockholder. |

8

Heritage’s Nominating Committee, in its discretion, may disregard any nominations that do not comply with the above-listed requirements. Upon the Nominating Committee’s instructions, the vote teller may disregard all votes cast for a nominee if the nomination does not comply with the above-listed requirements.

How Can Stockholders Communicate with the Board of Directors?

Heritage has implemented a stockholder communication process to facilitate communication with its Board of Directors. All stockholder communications to the Board of Directors should be forwarded to the attention of Edward D. Cameron, Secretary, Heritage Financial Corporation, 201 Fifth Avenue S.W., Olympia, Washington 98501. E-mail address: ecameron@heritagebankwa.com.

How are Directors Compensated?

During the year ended December 31, 2005, Heritage’s non-officer directors received a monthly retainer of $1,000 and a monthly fee of $625 for each Board meeting attended. Non-officer directors also received $150 for each committee meeting attended, other than the Audit and Finance Committee, with the Chair of the committee receiving $200 per meeting attended. Non-officer directors of the Audit and Finance Committee received $500 for each meeting attended with the Chair of the committee receiving $1,000 per meeting. Directors who are officers or employees of Heritage or its subsidiaries receive no additional compensation for service as directors or members of Board committees. In 2005, the Directors (with the exception of Director Vance) were each granted Non-Qualified Stock Options to purchase 1,575 shares at a strike price of $20.49. In addition, Directors Jensen and Christensen each received Non-Qualified Stock Options to purchase 473 shares at a strike price of $20.49 for their service as Directors of Central Valley Bank.

AUDIT AND FINANCE COMMITTEE REPORT

Report of the Audit and Finance Committee

This report of Heritage’s Audit and Finance Committee describes the manner in which the committee reviews Heritage’s financial reporting process.

What are the Responsibilities of the Audit and Finance Committee?

The committee monitors Heritage’s internal financial controls and its financial reporting process. The committee:

| • | Reviews and discusses the audited financial statements with management. |

| • | Reviews and discusses reports filed with the Securities and Exchange Commission. |

| • | Discusses with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees). |

| • | Receives written disclosures as required by Independent Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and discusses with the independent auditors the auditors’ independence. |

| • | Recommends to the Board of Directors whether the audited financial statements should be included in Heritage’s annual report on Form 10-K. |

Who are the Members of Heritage’s Audit and Finance Committee?

Heritage’s Audit and Finance Committee consists of directors Daryl D. Jensen (chair), Brian S. Charneski, Gary B. Christensen, John A. Clees, Peter N. Fluetsch, Jeffrey S. Lyon and Philip S. Weigand. None of the members of the Audit and Finance Committee are officers or employees of Heritage or any Heritage subsidiary.

9

Our board has determined that all members of the Audit and Finance Committee are considered “independent” under the requirements of the Securities and Exchange Commission and the NASDAQ’s listing standards, and further, our board of directors has determined that Mr. Jensen meets the definition of an audit committee financial expert, as set forth in Item 401(h)(2) of Regulation S-K.

Audit and Finance Committee Report

The Audit and Finance Committee of the Heritage Board of Directors is composed of seven independent directors and operates under a written charter adopted by the Board of Directors. The committee is responsible for the selection of Heritage’s independent auditors.

Management is responsible for Heritage’s internal controls and the financial reporting process. The independent auditors are responsible for performing an independent audit of Heritage’s consolidated financial statements in accordance with auditing standards generally accepted in the United States of America and for issuing a report thereon. The Audit and Finance Committee’s responsibility is to monitor and oversee these processes.

In this context, the Audit and Finance Committee has met and held discussions with management and the independent auditors. Management represented to the Audit and Finance Committee that Heritage’s consolidated financial statements were prepared in accordance with auditing principles generally accepted in the United States of America, and the Audit and Finance Committee has reviewed and discussed the consolidated financial statements with management and the independent auditors. The Audit and Finance Committee discussed with the independent auditors matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees).

Heritage’s independent auditors also provided to the Audit and Finance Committee the written disclosures required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and the Audit and Finance Committee discussed with the independent auditors that firm’s independence.

Based on the Audit and Finance Committee’s discussion with management and the independent auditors and the Audit and Finance Committee’s review of the representation of management and the report of the independent auditors to the Audit and Finance Committee, the Audit and Finance Committee recommended that the Board of Directors include the audited consolidated financial statements in Heritage’s annual report on Form 10-K for the year ended December 31, 2005 filed with the Securities and Exchange Commission.

Respectfully submitted: | Daryl D. Jensen, Chair of the Committee and designated audit committee financial expert Brian S. Charneski, Member Gary B. Christensen, Member John A. Clees, Member Peter N. Fluetsch, Member Jeffrey S. Lyon, Member Philip S. Weigand, Member |

10

EXECUTIVE COMPENSATION

Report of the Personnel and Compensation Committee

This report of Heritage’s Personnel and Compensation Committee describes in general terms the process the committee undertakes and the factors it considers to determine the appropriate compensation for Heritage’s officers.

What Are The Responsibilities of the Personnel and Compensation Committee?

The committee establishes and monitors compensation programs for executive officers of Heritage and its subsidiaries. The committee:

| • | reviews and approves individual officer salaries, bonus plan allocations, and stock option grants and other equity-based awards; and |

| • | establishes the compensation and evaluates the performance of the chief executive officer, while the chief executive officer evaluates the performance of the other executive officers and recommends individual compensation levels for approval by the committee. |

None of the members of the committee are officers or employees of Heritage or any Heritage subsidiary.

What is Heritage’s Philosophy of Executive Officer Compensation?

The committee’s compensation philosophy is intended to reflect and support the goals and strategies that Heritage has established. Currently, Heritage’s strategic focus is on expanding our commercial banking relationships. The key elements of this strategy are geographic and product expansion, loan portfolio diversification, development of relationship banking and maintenance of asset quality. The committee believes these goals, which are intended to create long-term stockholder value, must be supported by a compensation program that:

| • | attracts and retains highly qualified executives; |

| • | provides levels of compensation that are competitive with those offered by other financial institutions; |

| • | motivates executives to enhance long-term stockholder value by helping them to build their own ownership in Heritage; and |

| • | integrates Heritage’s long-term strategic planning and measurement processes. |

Heritage’s compensation program includes competitive salary and benefits, opportunities for employee ownership of Heritage stock through participation in an employee stock ownership plan and, for certain employees, an annual incentive cash bonus based upon attainment of company and individual performance goals and opportunities for stock ownership of Heritage stock through stock option and restricted stock programs.

To determine compensation packages for individual executives, the committee considers various subjective and objective factors, including:

| • | individual job responsibilities and experience; |

| • | individual performance in terms of both qualitative and quantitative goals; |

| • | Heritage’s overall performance, as measured by attainment of strategic and budgeted financial goals and prior performance; and |

| • | industry surveys, prepared by an independent consulting firm, of compensation for comparable positions with similar institutions in the State of Washington, the Pacific Northwest and the United States. |

11

The components of Heritage’s compensation program are the following:

Base Salary. Salary levels of executive officers are designed to be competitive within the banking industry. To set competitive salary ranges, the committee periodically evaluates current salary levels of other financial institutions with size, lines of business, geographic dispersion and market place position similar to Heritage’s. Base salaries for Heritage’s executive officers other than the chief executive officer are based upon recommendations by the chief executive officer, taking into account the subjective and objective factors described above. The committee reviews and approves or disapproves those recommendations.

Annual Incentive Bonus. Executive officers have an annual incentive opportunity with cash bonus awards based on the overall performance of Heritage and on attainment of individual performance targets. The annual awards are determined by formulas established by the committee following each fiscal year and are based upon an assessment of Heritage’s performance (for the year ended December 31, 2005, primarily with respect to Heritage Financial Corporation’s net income and return on average equity) as compared to both budgeted and previous fiscal year performance and upon an evaluation by the chief executive officer of an executive’s individual performance and contribution to Heritage’s overall performance. The committee then reviews and approves the bonus recommendations and presents them to the Board of Directors for approval.

Stock Option and Other Stock-Based Compensation. Equity-based compensation is intended to more closely align the financial interests of Heritage’s executives with long-term stockholder value, and to assist in the retention of executives who are key to the success of Heritage and its subsidiaries. Equity-based compensation generally has been in the form of incentive stock options and restricted stock awards pursuant to Heritage’s existing stock option plans. The committee determines from time to time which executives, if any, will receive stock options or awards and determines the number of shares subject to each option or award. Grants of stock options and awards are based on various subjective factors relating primarily to the responsibilities of individual executives, their expected future contributions to Heritage and prior option grants.

How Is Heritage’s Chief Executive Officer Compensated?

The base compensation for Heritage’s chairman, president and chief executive officer, Donald V. Rhodes, was determined by the committee with final approval by the Board based on the same criteria as the compensation for the other executive officers. During the first quarter of 2002, Heritage entered into a new employment agreement with Mr. Rhodes, effective June 1, 2001, providing for an annual base salary of not less than $234,000 beginning on April 1, 2001. The term of the agreement continued until June 30, 2004. Mr. Rhodes executed a new agreement on August 26, 2004 to be effective January 1, 2005 that provides for an annual base salary of $150,000 beginning on January 1, 2005. In addition to base salary, the agreement provides for Mr. Rhodes’ participation in employee benefit plans and other fringe benefits applicable to senior executives of Heritage Bank except that Mr. Rhodes will not be eligible to participate in the Management Incentive Plan or receive options other than director restricted options. The term of the agreement will continue until December 31, 2006. During the year ended December 31, 2005, the annual salary of Mr. Rhodes was $150,000.

The committee believes that for the year ended December 31, 2005, the compensation for Mr. Rhodes, as well as for the other executive officers, was consistent with Heritage’s overall compensation philosophy and clearly related to the realization of Heritage’s goals and strategies for the period.

Respectfully submitted by: | Peter N. Fluetsch, Chair of the Committee Lynn M. Brunton, Member John A. Clees, Member Daryl D. Jensen, Member |

12

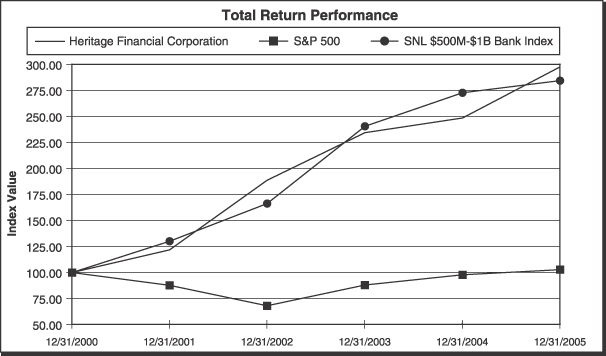

Stock Performance Graph

The chart shown below depicts total return to stockholders during the period beginning December 31, 2000 and ending December 31, 2005. Total return includes appreciation or depreciation in market value of Heritage common stock as well as actual cash and stock dividends paid to stockholders. Indices shown below, for comparison purposes only, are the S&P 500(TM) stock index, which is a broad nationally recognized index of stock performance by publicly traded companies and the SNL Securities Bank Index which is comprised of publicly traded commercial banks with assets of $500 million to $1 billion. The chart assumes that the value of the investment in Heritage’s common stock and each of the three indices was $100 on December 31, 2000, and that all dividends were reinvested.

HERITAGE FINANCIAL CORPORATION

| Period Ending | ||||||||||||

| Index | 12/31/00 | 12/31/01 | 12/31/02 | 12/31/03 | 12/31/04 | 12/31/05 | ||||||

Heritage Financial Corporation | 100.00 | 121.62 | 187.69 | 232.86 | 246.79 | 295.13 | ||||||

S&P 500 | 100.00 | 88.11 | 68.64 | 88.33 | 97.94 | 102.74 | ||||||

SNL $500M-$1B Bank Index | 100.00 | 129.74 | 165.63 | 238.84 | 270.66 | 282.26 | ||||||

SOURCE: SNL Financial LC, Charlottesville, VA

©2006

13

Summary Compensation Table

The following table shows the aggregate compensation for services rendered to Heritage or its subsidiaries in all capacities paid or accrued for the year ended December 31, 2005, compared to the same periods ended December 31, 2003 and 2004, to Heritage’s chief executive officer and each of the four other most highly compensated executive officers whose aggregate cash and cash equivalent forms of compensation exceeded $100,000 in 2005.

| Long-Term Compensation Awards | |||||||||||||||

| Annual Compensation | |||||||||||||||

| Restricted Stock Awards ($) | Securities Underlying Options (#) | All Other Compensation (1) | |||||||||||||

Name and Principal Position | Period | Salary | Bonus | ||||||||||||

Donald V. Rhodes Chairman and Chief Executive Officer Heritage Financial Corp. | 2005 2004 2003 | $ $ $ | 150,152 240,000 240,000 | $ $ $ | -0- 87,150 94,920 | -0- -0- -0- | 2,048 -0- | $ $ $ | 21,142 20,117 20,354 | ||||||

Brian L. Vance President and Chief Executive Officer Heritage Bank | 2005 2004 2003 | $ $ $ | 192,452 176,400 168,600 | $ $ $ | 84,649 56,697 54,100 | -0- -0- -0- | 15,750 12,000 21,000 | $ $ $ | 21,284 20,117 19,934 | ||||||

Gregory D. Patjens Executive Vice President Heritage Bank | 2005 2004 2003 | $ $ $ | 135,552 130,125 126,770 | $ $ $ | 26,156 23,707 21,729 | -0- -0- -0- | 3,780 3,600 4,500 | $ $ $ | 15,205 14,240 15,702 | ||||||

D. Michael Broadhead President Central Valley Bank | 2005 2004 2003 | $ $ $ | 136,112 130,830 126,390 | $ $ $ | 30,000 20,690 28,500 | -0- -0- -0- | 5,670 5,400 6,900 | $ $ $ | 16,176 15,804 15,645 | ||||||

Edward D. Cameron Senior Vice President, Secretary and Treasurer | 2005 2004 2003 | $ $ $ | 113,279 105,000 97,200 | $ $ $ | 25,604 20,076 19,069 | -0- -0- -0- | 3,780 3,600 4,500 | $ $ $ | 13,571 12,248 12,166 | ||||||

| (1) | Amounts in calendar 2005 represent for Messrs. Rhodes, Vance, Patjens, Broadhead and Cameron: (i) matching contributions under Heritage’s 401(k) ESOP in the amount of $6,300, $6,300, $3,750, $4,758 and $4,001, respectively; (ii) additional discretionary and non-discretionary contributions under Heritage’s 401(k) ESOP of approximately $14,286, $14,286, $10,834, $10,790 and $9,072, respectively; and (iii) life insurance premiums paid by Heritage for the benefit of each executive in the amount of $556, $698, $621, $627 and $498, respectively. |

Option Grants During 2005

In October 1998, the stockholders approved the adoption of the 1998 Stock Option and Restricted Stock Award Plan, providing for the award of incentive stock options to employees and nonqualified stock options to directors of Heritage Financial Corporation at the discretion of the Board of Directors. Under the plan, on the date of grant, the exercise price of the option must at least equal the market value per share of Heritage Financial Corporation’s common stock. The plan provides for the granting of options for up to 414,750 common shares and restricted stock awards of up to 69,413 shares. All awards made under the plan require vesting over a three year period beginning on the date of grant. Under the plan, the options must be exercised within five years of vesting. In 2005, 3,050 restricted stock awards were granted under the 1998 Stock Option and Restricted Stock Award Plan. There are 3,197 restricted stock awards available under the Plan that have not been awarded.

In April 2002, the stockholders approved the adoption of the Heritage Financial Corporation Incentive Stock Option Plan of 2002, the Heritage Financial Corporation Director Non-Qualified Stock Option Plan of 2002 and the Heritage Financial Corporation Restricted Stock Plan of 2002. These plans provided for the award of incentive stock options and restricted stock to employees and Non-Qualified stock options and restricted stock to

14

directors of Heritage Financial Corporation at the discretion of the Board of Directors. Under the plans, on the date of grant, the exercise price of the option must at least equal the market value per share of Heritage Financial Corporation’s common stock. The plan provides for the granting of incentive options for up to 451,500 common shares, Non-Qualified options for up to 73,500 common shares and restricted stock awards of up to 52,500 common shares. All awards are subject to a vesting schedule as determined by the Board of Directors. Under the plans, the options must be exercised within five years of vesting. In 2005, 114,517 options were granted under the Heritage Financial Corporation Incentive Stock Option Plan of 2002 and 20,007 options were awarded under the Heritage Financial Corporation Non-Qualified Stock Option Plan of 2002. Taking into account Heritage Financial Corporation’s five percent stock dividend to stockholders of record on September 30, 2005, distributed on October 14, 2005, there are 52,921 Incentive Stock Options available that have not been awarded, 16,193 Non-Qualified Stock Options available that have not been awarded and 52,500 restricted stock awards available that have not been awarded.

The following table summarizes options granted to each of the executives listed in the summary compensation table for the year ended December 31, 2005.

Name | Number of Securities Underlying Options Granted (#) | Percentage of total options granted to employees during year | Exercise Price ($/share) | Expiration Date | Grant Date Present Value ($) | |||||||||

Donald V. Rhodes | 2,048 | 0.18 | % | $ | 20.49 | (1 | ) | $ | 5,834 | |||||

Brian L. Vance | 15,750 | 1.36 | % | $ | 20.49 | (1 | ) | $ | 44,875 | |||||

Gregory D. Patjens | 3,780 | 0.33 | % | $ | 20.49 | (1 | ) | $ | 10,770 | |||||

D. Michael Broadhead | 5,670 | 0.49 | % | $ | 20.49 | (1 | ) | $ | 16,155 | |||||

Edward D. Cameron | 3,780 | 0.33 | % | $ | 20.49 | (1 | ) | $ | 10,770 | |||||

| (1) | One-third of the options granted vest on each of the first, second and third anniversary dates of the grants and each grant expires five years after it becomes vested. |

Option Exercises and Period End Option Values.

The following table summarizes option exercises during the year ended December 31, 2005 by each of the executives listed in the summary compensation table and the period end value of unexercised options granted:

Name | Shares Acquired On Exercise | Value Realized | Number of Securities Underlying Unexercised Options at December 31, 2005 (Exercisable/Unexercisable) | Value of Unexercised In-the-Money Options At December 31, 2005(1) (Exercisable/Unexercisable) | |||||

Donald V. Rhodes | 10,644 | $ | 218,149 | 49,770 / 2,048 | $731,160 /$8,018 | ||||

Brian L. Vance | -0- | $ | -0- | 46,830 / 31,500 | $467,217 /$127,576 | ||||

Gregory D. Patjens | 1,680 | $ | 35,287 | 25,568 / 7,875 | $338,674 /$32,023 | ||||

D. Michael Broadhead | 945 | $ | 23,134 | 24,570 / 11,865 | $280,043 /$48,247 | ||||

Edward D. Cameron | -0- | $ | -0- | 9,713 / 7,875 | $88,252 /$32,023 | ||||

| (1) | Values are calculated by subtracting the exercise price from the fair market value of the underlying stock. For purposes of this table, fair market value is deemed to be $24.41, the last sale price of Heritage’s common stock on the NASDAQ National Market on December 31, 2005. |

Other Employee Benefits and Proposed Changes in Those Benefits.

On October 1, 1999, Heritage combined its defined contribution retirement plan, its salary savings 401(k) Plan and its Employee Stock Ownership Plan (“ESOP”) into the ESOP and amended the ESOP to give it 401(k) features. The ESOP was renamed the Heritage Financial Corporation 401(k) ESOP (“KSOP”). On that date, account balances in each employee’s account in the defined contribution retirement plan and the 401(k) Plan were transferred to the KSOP, and each employee having account balances in those plans was given the ability to allocate up to 20% of those balances to purchase Heritage stock.

15

Under the KSOP, eligible employees have the right to defer a portion of their compensation to be contributed to the KSOP which is matched 50% by Heritage up to certain specified limits. Employees can elect whether to have their deferred compensation amount placed in a Heritage stock account to be invested in Heritage stock by the KSOP trustee (subject to availability) or in other available investment accounts and invested by the KSOP trustee in investments other than Heritage stock as directed by the participants. In addition to the matching contributions Heritage makes, Heritage makes a nondiscretionary 2% contribution and has the discretion to make additional contributions to the KSOP.

On December 31, 2005, the KSOP owned 403,361 shares of Heritage common stock, of which 337,787 shares were allocated to participants’ accounts and 65,574 shares were held in an unallocated account. Shares held in the suspense account are released to participant accounts on a pro rata basis as the KSOP’s loan payable to Heritage is repaid.

Executive Employment and Severance Agreements

In the first quarter of 2002, Donald V. Rhodes executed an employment agreement with Heritage and Heritage Bank effective June 1, 2001. The agreement with Mr. Rhodes provided for an annual base salary of not less than $234,000 beginning on April 1, 2001. In addition to base salary, the agreement provided for Mr. Rhodes’ participation in employee benefit plans and other fringe benefits applicable to senior executives of Heritage Bank. The term of the agreement continued until June 30, 2004. Mr. Rhodes was required to notify Heritage prior to 180 days before the end of the term of the employment agreement if Mr. Rhodes did not desire to seek to renew or renegotiate the employment agreement. Mr. Rhodes did provide timely notice that he wished to extend the term of his employment agreement until December 31, 2004 and Heritage Financial Corporation agreed to the extension. Mr. Rhodes executed a new agreement on August 26, 2004 to be effective January 1, 2005 that provides for an annual base salary of $150,000 beginning on January 1, 2005. In addition to base salary, the agreement provides for Mr. Rhodes’ participation in employee benefit plans and other fringe benefits applicable to senior executives of Heritage Bank except that Mr. Rhodes will not be eligible to participate in the Management Incentive Plan or receive options other than director restricted options. The term of the agreement will continue until December 31, 2006. If Employer terminates this Agreement for “Cause”, as defined in the agreement, effective before the end of the term hereof, Employer shall pay Executive upon the effective date of such termination only such salary earned and expenses reimbursable hereunder incurred through such termination date. Executive shall have no right to receive compensation or other benefits for any period after termination for Cause, and in the case of termination for Cause, Executive’s unvested stock options, if any, shall terminate immediately. If Employer terminates this Agreement without “Cause” or Executive terminates this Agreement for “Good Reason”, both as defined in the agreement, and either termination is effective before the end of the term hereof, Employer shall pay Executive all reimbursable expenses incurred through such termination date and, in addition, a severance benefit in an amount equal to the amount of his then-current base salary which would otherwise have been paid to Executive during the then-remaining term of the Agreement. In such event, all forfeiture provisions regarding restricted stock awards or vesting requirements regarding options shall lapse or be considered completed as of the effective date of termination. Notwithstanding the above, in the event Executive’s employment is terminated as a result of a sale or a merger of Heritage Financial Corporation (a “Transaction”), Executive will be compensated under the terms of this Agreement through the date of closing of the Transaction without provision for severance thereafter.

In 2002, Brian L. Vance executed an employment agreement with Heritage and Heritage Bank effective June 1, 2001. The agreement with Mr. Vance provides for an annual base salary of not less than $150,000 per year effective on April 1, 2001. In addition to the base salary, the agreement provides for Mr. Vance’s participation in employee benefit plans and other fringe benefits applicable to senior executives of Heritage Bank. The term of the agreement expired on June 30, 2004 and is currently subject to automatic one year renewal extensions unless prior notice otherwise is given. In the event that Mr. Vance is terminated by Heritage at any time for “cause” or by Mr. Vance without “good reason”, both as defined in the agreement, no termination benefit will be payable. If Mr. Vance is terminated without cause or he terminates the agreement for good reason,

16

a severance benefit will be payable in an amount equal to his then current annual base salary or the amount of such salary which would otherwise have been paid to Mr. Vance during the then remaining term of his agreement, whichever is greater.

The agreement with Mr. Vance also provides for the payment of a severance benefit to Mr. Vance in the event of his termination of employment without cause in some cases preceding and for any reason within one year after a change of control of Heritage or Heritage Bank. Under the terms of the agreement, Mr. Vance is entitled to receive two times his then current annual base salary following the termination or the amount due him until the end of the term of his agreement, whichever is greater. In those circumstances, Mr. Vance also is entitled to all benefits in his agreement, to be fully vested as to unvested options, and to have restrictions lapse on any restricted stock or other restricted securities.

For purposes of the agreements, “change in control” generally includes the acquisition by any person of 25% or more of the outstanding securities of Heritage; replacement of incumbent directors or election of newly elected directors constituting a majority of the Board of Heritage where the replacement or election has not been supported by the Board; dissolution, or sale of 50% or more in value of the assets, of either Heritage or Heritage Bank or any of their respective subsidiaries; or the merger of Heritage into any corporation, 25% or more of the outstanding common stock of which is owned by persons other than owners of the common stock of Heritage prior to such merger.

The employment agreement with Mr. Vance provides that in the event he receives an amount under the provisions of the agreements that results in imposition of a tax on the executive under the provisions of the Code Section 4999 (relating to golden Parachute payments), the employer is obligated to reimburse the executive for that amount, exclusive of any tax imposed by reason of receipt of reimbursement under the employment agreements.

The agreements restrict the right of Messrs. Rhodes and Vance to compete against Heritage or Heritage Bank in the State of Washington for a period of two years following termination of employment, except if employment is terminated by Heritage without cause or by Mr. Rhodes or Mr. Vance for good reason.

Effective on March 5, 1999, Central Valley Bank and D. Michael Broadhead entered into an employment agreement. The term of the agreement expired on December 31, 2002 and is currently subject to automatic one year renewal extensions unless prior notice otherwise is given. The agreement calls for Mr. Broadhead to serve as President of Central Valley Bank at a base annual salary of no less than $110,000 plus customary fringe benefits. Also, under the agreement, on December 31, 2005 (regardless of whether Mr. Broadhead is employed by Central Valley Bank at the time), Mr. Broadhead is eligible to receive a payment of $40,000 plus $10,000 for each full year of his service at Central Valley Bank or its successor—up to a $200,000 maximum payment. Mr. Broadhead’s estate is also entitled to a death benefit payment of no less than $100,000 nor more than $200,000 if he dies prior to the receipt of the December 31, 2005 service payment.

In the event Mr. Broadhead’s employment is terminated by Central Valley Bank at any time for “cause” or if Mr. Broadhead resigns without “good reason” and his resignation does not coincide with a change in control of Heritage, Mr. Broadhead will not be entitled to any severance benefit payable to him. The agreement does provide for the payment of a severance benefit to Mr. Broadhead (in addition to his service payment described above) in the event of his termination of employment in some cases preceding, and for any reason following by up to one year, a change in control of Heritage. Under the terms of the agreement, Mr. Broadhead is entitled to receive an amount of up to 36 months of his base salary in effect at the time if his employment is terminated without cause by Central Valley Bank from the time after a change in control transaction is announced up to one year following the completion of the change in control or if Mr. Broadhead resigns for any reason within a year after the change in control is completed.

The agreement restricts the right of Mr. Broadhead to compete against Heritage or Central Valley Bank in Yakima County, Washington for a period of up to three years unless Mr. Broadhead is terminated without cause or resigns for good reason.

17

PROPOSAL 2: APPROVAL OF THE HERITAGE FINANCIAL CORPORATION

INCENTIVE STOCK OPTION PLAN OF 2006

Background

In October 1994, Heritage Bank’s stockholders approved the adoption of the 1994 Stock Option and Restricted Stock Award Plan (“1994 Plan”), providing for the award of restricted stock to a key officer, incentive stock options to employees and non-qualified stock options to directors of Heritage Bank, all at the discretion of the Board of Directors. In October 1996, the stockholders of Heritage Bank approved the adoption of the Stock Option and Restricted Stock Award Plan (“1997 Plan”), which generally was similar to the 1994 Plan. The 1997 Plan did not affect options granted under the 1994 Plan.

In October 1998, Heritage’s stockholders approved the adoption of the 1998 Stock Option and Restricted Stock Award Plan (“1998 Plan”). By adopting the 1998 Plan, the Board of Directors of Heritage terminated the 1994 Plan and the 1997 Plan.

Under the 1998 Plan, Heritage reserved 414,750 shares of common stock for the issuance of stock options which could be either incentive stock options or nonqualified stock options and, as a part of a Management Recognition Plan, up to an additional 69,431 shares of common stock were reserved for award as restricted stock.

In April 2002, Heritage’s stockholders approved the adoption of the 2002 Stock Option and Restricted Stock Award Plan (“2002 Plan”). Under the 2002 Plan, Heritage reserved 451,500 shares of common stock for the issuance of stock options, 73,500 shares of common stock for the issuance of nonqualified stock options and up to an additional 52,500 shares of common stock were reserved for award as restricted stock.

The 2006 Incentive Stock Option Plan

Subject to stockholder approval, the Board of Directors has adopted a Heritage Financial Corporation Incentive Stock Option Plan of 2006 (“2006 Incentive Plan”). The Board of Directors recommends that stockholders approve the 2006 Incentive Plan. The Board believes that the 2006 Incentive Plan will benefit Heritage and its existing and any future subsidiaries by providing employees of, and persons offered employment by, Heritage and its subsidiaries with a proprietary interest in Heritage as an incentive to contribute to the success of Heritage and to reward employees for outstanding performance and attainment of targeted objectives. The purpose of the 2006 Incentive Plan is to promote Heritage’s success by aligning employee financial interests with long term stockholder value. A copy of the 2006 Incentive Plan is attached to this Proxy Statement as Exhibit A.

Description of the 2006 Incentive Stock Option Plan

The following is a summary of the principal provisions of the 2006 Incentive Plan and is subject to and qualified in its entirety by the express terms of the 2006 Incentive Plan.

Purpose

The purpose of the 2006 Incentive Plan is to:

| • | Enhance the long term profitability and stockholder value of Heritage by offering stock based incentives to employees of Heritage or its subsidiaries; |

| • | Attract and retain the best available personnel for positions of responsibility with Heritage and its subsidiaries; and |

| • | Encourage employees to acquire and maintain stock ownership in Heritage. |

18

Administration

The 2006 Incentive Plan presently is administered by Heritage’s Board of Directors. In addition to its authority to grant stock options, as described below, the Board of Directors is authorized to administer and interpret the 2006 Incentive Plan subject to its express provisions.

Shares Subject to the 2006 Incentive Stock Option Plan

Under the 2006 Incentive Plan, a maximum of 400,000 shares of common stock would be reserved for issuance upon the exercise of incentive stock options.

Limitations

The aggregate fair market value of all shares exercised by a participant for the first time in any calendar year shall not exceed $100,000.

Persons Who May Participate

Awards may be granted under the 2006 Incentive Plan to those employees of, and persons offered employment by, Heritage or its subsidiaries as the Board of Directors from time to time selects. If the 2006 Incentive Plan is approved by the stockholders at the annual meeting, there will be approximately 211 employees, including executive officers, eligible to participate in the 2006 Incentive Plan.

Type of Awards

Awards granted under the 2006 Incentive Plan will be incentive stock options (“ISOs”) intended to meet all of the requirements of an “Incentive Stock Option” as defined in §422 of the Internal Revenue Code.

Terms and Conditions of Awards

Each Award granted under the 2006 Incentive Plan must be evidenced by a written agreement duly executed on behalf of Heritage. Each agreement will comply with and be subject to the terms and conditions of the 2006 Incentive Plan. An agreement may also contain such other terms, provisions and conditions not inconsistent with the 2006 Incentive Plan as may be determined by the Board of Directors.

Stock Option Grants

The exercise price for each option granted under the 2006 Incentive Plan will be determined by the Board of Directors, but will not be less than 100% of the fair market value of Heritage’s common stock on the date of grant of an ISO. For any participant who immediately before the grant owns 10% or more of the total combined voting stock of Heritage, Heritage Bank, Central Valley Bank, or any other subsidiary of Heritage, the exercise price shall be 110% of the optioned stock’s then fair market value.

The exercise of an option must be paid in cash or already owned shares of Heritage common stock, or, if approved by the Board of Directors, delivery of an interest bearing promissory note, payable to Heritage or Heritage Bank or Central Valley Bank with interest, collateral, and under terms prescribed by Heritage Bank or Central Valley Bank, in payment of all or part of the exercise price.

The term of the outstanding options will be fixed by the Board of Directors. No ISO granted pursuant to the 2006 Incentive Plan will be exercisable after five years from the date of grant. Each option will be exercisable pursuant to a vesting schedule to be determined by the Board of Directors. An option will not be deemed to be granted until the option is vested.

19

The 2006 Incentive Plan provides that options generally will be exercisable for up to one year after termination of service as a result of a death or disability, and for up to three months after all other terminations except for terminations for “cause” as defined in the 2006 Incentive Plan, in which case an option will immediately terminate. The options will also immediately terminate if a participant competes with the Bank or any other subsidiary of Heritage, with competition being determined under the provisions of the Plan.

Transferability

No option under the 2006 Incentive Plan will be assignable or otherwise transferable, other than by will or the laws of descent and distribution, and, during the recipient’s lifetime, may be exercised only by the recipient of the option.

Amendment and Termination of the 2006 Incentive Stock Option Plan

The 2006 Incentive Plan may be modified, amended or terminated by the Board of Directors, except that stockholder approval is required for any amendment that:

| • | Increases the number of shares subject to the 2006 Incentive Plan (other than in connection with certain automatic adjustments such as stock splits or stock dividends); or |

| • | Changes the class of eligible employees to anything other than the employees defined in the Plan; or |

| • | Reduces the basis upon which the minimum option price is determined; or |

| • | Extends the period within which the options under the Plan may be granted; or |

| • | Provides for an option that is exercisable during a period of more than five years from the date it is granted. |

The Board of Directors may suspend or terminate the Plan at any time. No such suspension or termination shall affect options then in effect.

Adjustment of Shares

In the event of any changes in the outstanding stock of Heritage by reason of a merger, acquisition, stock dividends, stock splits or any other increase or decrease in the number of shares of Heritage’s common stock effected without receipt of consideration by Heritage, the Board of Directors subject to any required action by the stockholders, shall make proportional adjustments in:

| • | The maximum number of shares subject to the 2006 Incentive Plan: |

| • | The number of securities subject to any outstanding award; and |

| • | The per share price of such securities. |

The determination by the Board of Directors of the applicable adjustments is final.

Corporate Transactions

In the event that Heritage, Heritage Bank or Central Valley Bank has a change of control in which:

| • | An offeror other than Heritage purchases shares of the Common Stock of Heritage, Heritage Bank or Central Valley Bank pursuant to a tender or exchange offer for such shares; |

| • | Any person (as such term is used in Section 13(d) and 14(d)(2) of the Securities Exchange Act) other than Heritage is or becomes the beneficial owner, directly or indirectly, of securities of Heritage, Heritage Bank or Central Valley Bank representing 20% or more of the combined voting power of Heritage’s, Heritage Bank’s or Central Valley Bank’s then outstanding securities; |

20

| • | The membership of the Board of Directors of Heritage, Heritage Bank or Central Valley Bank changes as the result of a contested election, such that individuals who were directors at the beginning of any 24 month period (whether commencing before or after the date of adoption of this Plan) do not constitute a majority of the Board at the end of such period; or |

| • | Shareholders of Heritage, Heritage Bank or Central Valley Bank approve a merger, consolidation, sale, or disposition of all or substantially all of Heritage’s or the Bank’s assets or a plan of partial or complete liquidation. |

then immediately prior to the transaction, all options will become 100% vested, subject to the other terms of the Plan.

Federal Income Tax Consequences

The federal income tax consequences to Heritage and to any person granted an Award under the 2006 Incentive Plan under existing applicable provisions of the Code and regulations thereunder are generally as follows:

Upon exercise of an ISO during employment or within three months after the optionee’s termination of employment (or within 12 months thereafter in the case of permanent and total disability as defined within the Code), for federal tax purposes the optionee will recognize no income at the time of the exercise (although the optionee at that time will have income for alternative minimum income tax purposes as if the option were not an ISO) and no deduction will be allowed to Heritage for federal income tax purposes in connection with the grant or exercise of the option. If the acquired shares are sold or exchanged after the later of:

| • | One year after the date of exercise of the option; and |

| • | Two years after the date of grant of the option |

the difference between the amount realized by the optionee on that sale or exchange and the option price will be taxed to the optionee as a long term capital gain or loss. If the shares are disposed of before such holding period requirements are satisfied, then the optionee will recognize taxable ordinary income in the year of disposition in an amount equal to the excess, on the date of exercise of the option, of the fair market value of the shares received over the option price paid (or, generally, if less, the excess of the amount realized on the sale of the shares over the price), and the optionee will have capital gain or loss, long term or short term, as the case may be, in an amount equal to the difference between:

| • | The amount realized by the optionee upon that disposition of that share; and |

| • | The option price paid by the optionee (increased by the amount of ordinary income, if any, so recognized by the optionee on the transaction). |

If payment of the option exercise price is made entirely in cash, the tax basis of the shares will be equal to the amount that was paid for the stock, and the shares holding period will begin on the day after the exercise date. If the optionee uses already owned shares to exercise an option in whole or in part, the transaction will not be considered to be a taxable disposition of the already owned shares. The optionee’s tax basis of the already owned shares will be carried over to the equivalent number of shares received upon exercise; the tax basis of the additional shares received upon exercise will be the amount that was originally paid for the stock that was carried over, and the holding period for such additional shares will begin on the date after the exercise date.

Under §162 (m) of the Internal Revenue Code, certain compensation payments in excess of $1 million are subject to a limitation on deductibility for Heritage. The limitation on deductibility applies with respect to that portion of a compensation payment for a taxable year in excess of $1 million to either Heritage’s Chief Executive Officer or any one of the other four most highly compensated executive officers. Certain performance-based compensation is not subject to the limitation on the deductibility. Options can qualify for this performance-based exception, but only if they are granted at fair market value, the total number of shares that can be granted to an executive for any period as stated, and stockholder and Board of Directors approval is obtained. The 2006 Incentive Plan has been drafted to allow compliance with those performance-based criteria.

21

Accounting for Stock Options

Effective January 1, 2006, the Company adopted Statement of Financial Accounting Standards (SFAS) No. 123(R),Share-Based Payment. This Statement establishes standards for the accounting for transactions in which an entity exchanges its equity instruments for goods or services. Adoption of the Statement impacts the Company’s consolidated financial statements by requiring compensation expense to be recorded for the unvested portion of stock options, which have been granted or are subsequently granted.

Awards Under the 2006 Incentive Plan

Awards of options for the purchase of 100,350 shares have conditionally been made under the 2006 Incentive Plan. In the event the 2006 Incentive Plan is not approved by the stockholders of Heritage, those options already granted under the 2006 Incentive Plan shall be null and void. Since Awards under the 2006 Incentive Plan are discretionary, Heritage cannot currently determine a number of shares that will be subject to Awards in the future pursuant to the 2006 Incentive Plan.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” APPROVAL OF THE 2006 INCENTIVE PLAN.

PROPOSAL 3: APPROVAL OF THE HERITAGE FINANCIAL CORPORATION

DIRECTOR NONQUALIFIED STOCK OPTION PLAN OF 2006

Background