- HFWA Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Heritage Financial (HFWA) 8-KRegulation FD Disclosure

Filed: 14 Feb 12, 12:00am

Brian L. Vance, President and CEO Donald J. Hinson, Senior Vice President & CFO Exhibit 99.1 Investor Presentation Investor Presentation 1 1 st st Quarter 2012 Quarter 2012 Heritage Financial Corporation Heritage Financial Corporation |

2 “Safe Harbor” statement under the Private Securities Litigation Reform Act of 1995: This presentation contains forward-looking statements that are subject to risks and uncertainties, including, but not limited to: the credit risks of lending activities, including changes in the level and trend of loan delinquencies and write-offs and changes in our allowance for loan losses and provision for loan losses that may be impacted by deterioration in the housing and commercial real estate markets; changes in general economic conditions, either nationally or in our market areas; changes in the levels of general interest rates, and the relative differences between short and long term interest rates, deposit interest rates, our net interest margin and funding sources; fluctuations in the demand for loans, the number of unsold homes and other properties and fluctuations in real estate values in our market areas; results of examinations of us by the Board of Governors of the Federal Reserve System (the “Federal Reserve Board”) and of our bank subsidiaries by the Federal Deposit Insurance Corporation (the “FDIC”), the Washington State Department of Financial Institutions, Division of Banks (the “Washington DFI”) or other regulatory authorities, including the possibility that any such regulatory authority may, among other things, require us to increase our reserve for loan losses, write-down assets, change our regulatory capital position or affect our ability to borrow funds or maintain or increase deposits, which could adversely affect our liquidity and earnings; legislative or regulatory changes that adversely affect our business including changes in regulatory policies and principles, including the interpretation of regulatory capital or other rules, the interpretation of regulatory capital or other rules including changes from the Dodd-Frank Wall Street Reform and Consumer Protection Act and regulations that have been or will be promulgated thereunder; our ability to control operating costs and expenses; the use of estimates in determining fair value of certain of our assets, which estimates may prove to be incorrect and result in significant declines in valuation; difficulties in reducing risk associated with the loans on our balance sheet; staffing fluctuations in response to product demand or the implementation of corporate strategies that affect our workforce and potential associated charges; computer systems on which we depend could fail or experience a security breach; our ability to retain key members of our senior management team; costs and effects of litigation, including settlements and judgments; our ability to implement our branch expansion strategy; our ability to implement our expansion strategy; our ability to successfully integrate any assets, liabilities, customers, systems, and management personnel we have acquired including the Cowlitz Bank and Pierce Commercial Bank transactions or may in the future acquire into our operations and our ability to realize related revenue synergies and cost savings within expected time frames and any goodwill charges related thereto; or may in the future acquire into our operations and our ability to realize related revenue synergies and cost savings within expected time frames and any goodwill charges related thereto; risks relating to acquiring assets or entering markets in which we have not previously operated and may not be familiar, changes in consumer spending, borrowing and savings habits; the availability of resources to address changes in laws, rules, or regulations or to respond to regulatory actions; adverse changes in the securities markets; inability of key third-party providers to perform their obligations to us; changes in accounting policies and practices, as may be adopted by the financial institution regulatory agencies or the Financial Accounting Standards Board, including additional guidance and interpretation on accounting issues and details of the implementation of new accounting methods; other economic, competitive, governmental, regulatory, and technological factors affecting our operations, pricing, products and services; and other risks detailed from time to time in our filings with the Securities and Exchange Commission. The Company cautions readers not to place undue reliance on any forward-looking statements. Moreover, you should treat these statements as speaking only as of the date they are made and based only on information then actually known to the Company. The Company does not undertake and specifically disclaims any obligation to revise any forward- looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements. These risks could cause our actual results for 2011 and beyond to differ materially from those expressed in any forward-looking statements by, or on behalf of, us, and could negatively affect the Company’s operating and stock price performance. Forward Looking Statement |

• Company & Economic Information • Recent Growth Initiatives • Financial Performance • Core Strategies 3 Overview |

Company and Economic Company and Economic Information Information 4 |

Financial Highlights Total Assets $1.37 billion Net Loans $1.00 billion Total Deposits $1.14 billion Tangible Common Equity $188.0 million Loan/Deposit Ratio 88.6% Coverage Ratio (1) 103.5% Core Deposit Ratio (2) 93.7% Net Interest Margin 5.18% (Q4’11) 5.41% (FY2011) Cost of Funds 0.58% (Q4’11) 0.71% (FY2011) PTPP ROAA (3) 1.91% (Q4’11) 1.75% (FY2011) (1) Allowance for loan loss/nonperforming loans (originated loans only) (2) All deposits less wholesale CDs and CDs over $250,000 (3) Pre-tax, pre-provision return on average assets Note: Numbers rounded for presentation purposes only Financial data as of December 31, 2011 unless otherwise indicated 5 Total assets: $1.20 billion Branches: 27 Total assets: $165.6 million Branches: 6 Corporate Structure |

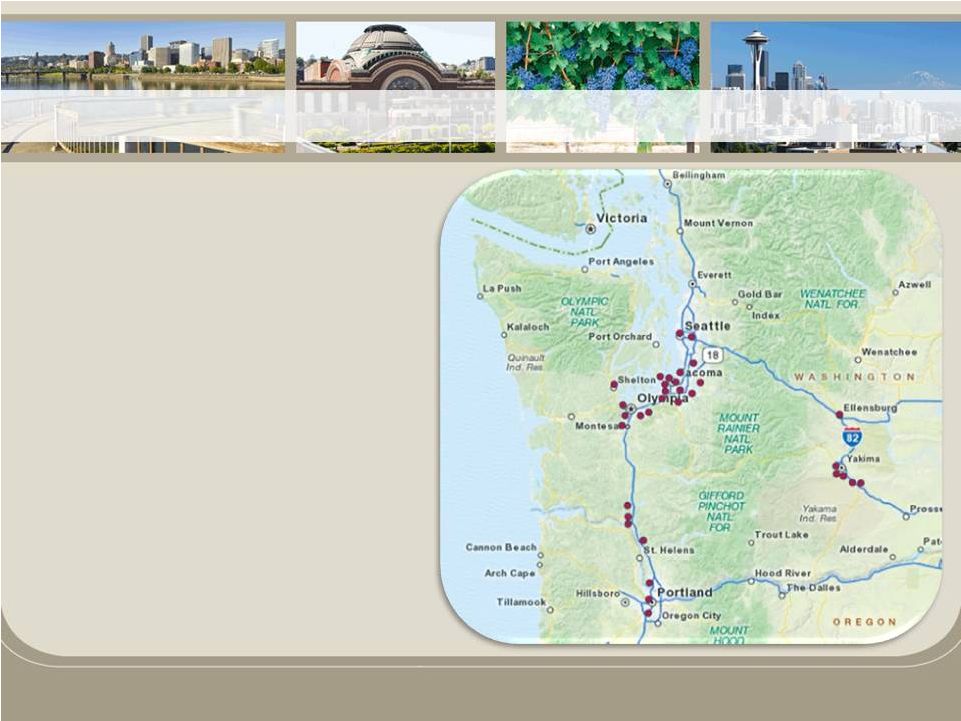

• 33 Branches – 27 Heritage Bank branches along I-5 corridor – 6 Central Valley Bank branches in Central WA 6 Our Market Area |

• We have not yet achieved measurable and sustainable economic growth in the Pacific Northwest • Our local economy will continue to struggle until unemployment and real estate values improve • However, we are beginning to see signs of improvement in some areas 7 Economic Outlook Economic Outlook |

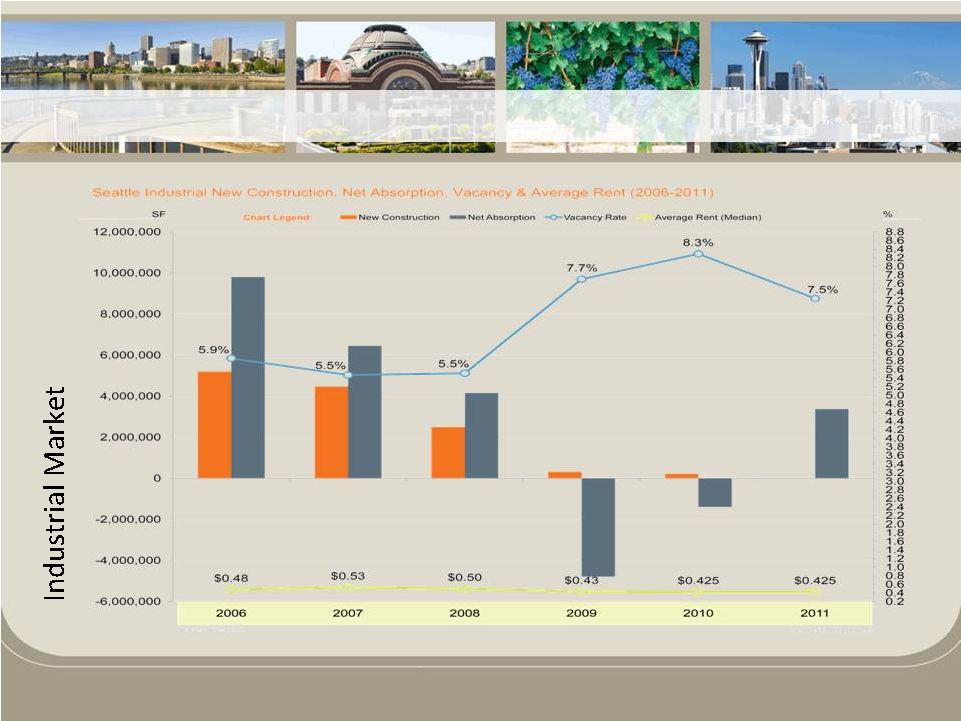

Source: Kidder Mathews Q4 Industrial Report 8 Economic Information |

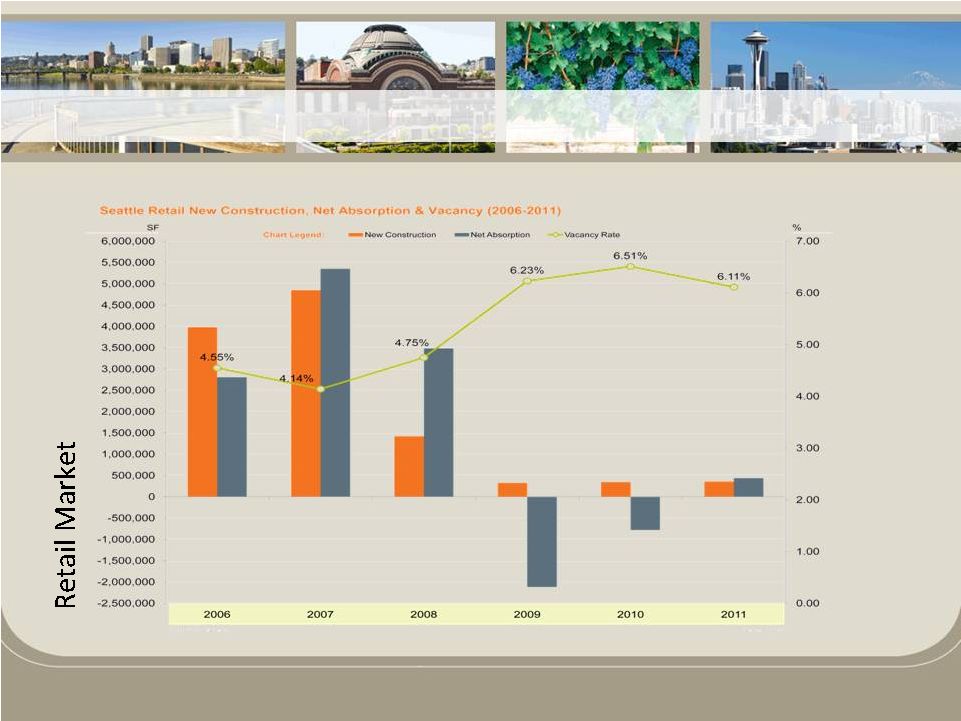

Source: Kidder Mathews Q4 Industrial Report 9 Economic Information |

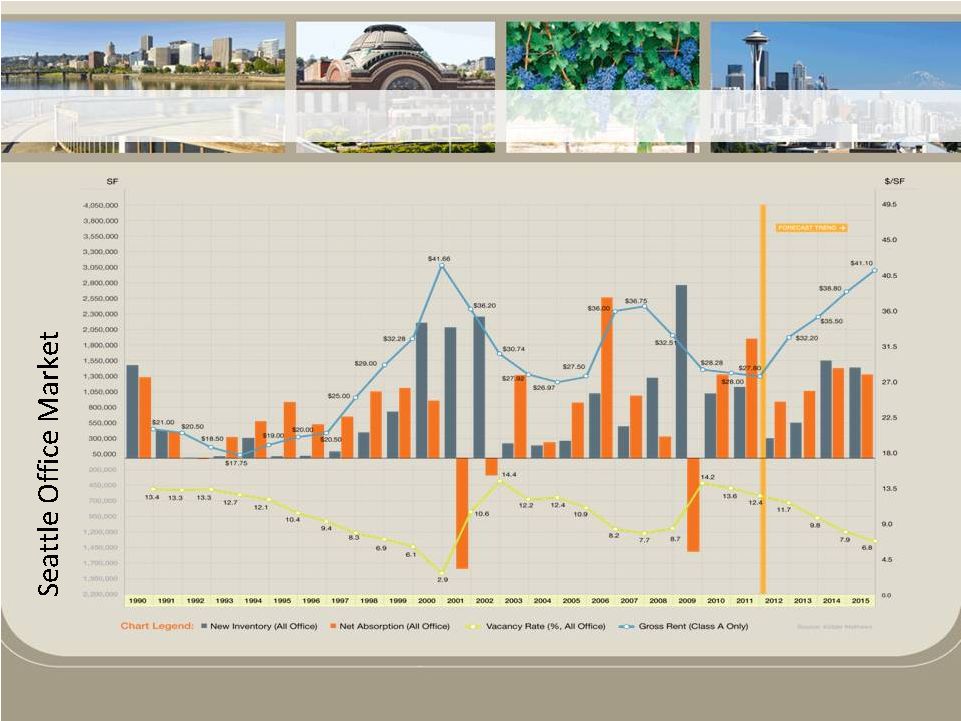

Source: Kidder Mathews Q4 Industrial Report 10 Economic Information |

Source: Kidder Mathews Q4 Industrial Report 11 Economic Information |

According to PwC and ULI “Emerging Trends in Real Estate 2012” survey, Seattle ranks as follows for investment opportunities among all metro areas in the Nation: Source: Urban Land Institute, in conjunction with Price Waterhouse Cooper, conducted an annual survey of commercial real estate metrics and trends. 12 Economic Outlook • #1 in Retail Real Estate • #1 in Industrial Real Estate • #2 in Office Real Estate • #3 in Apartment Real Estate • #7 in Hotel Real Estate |

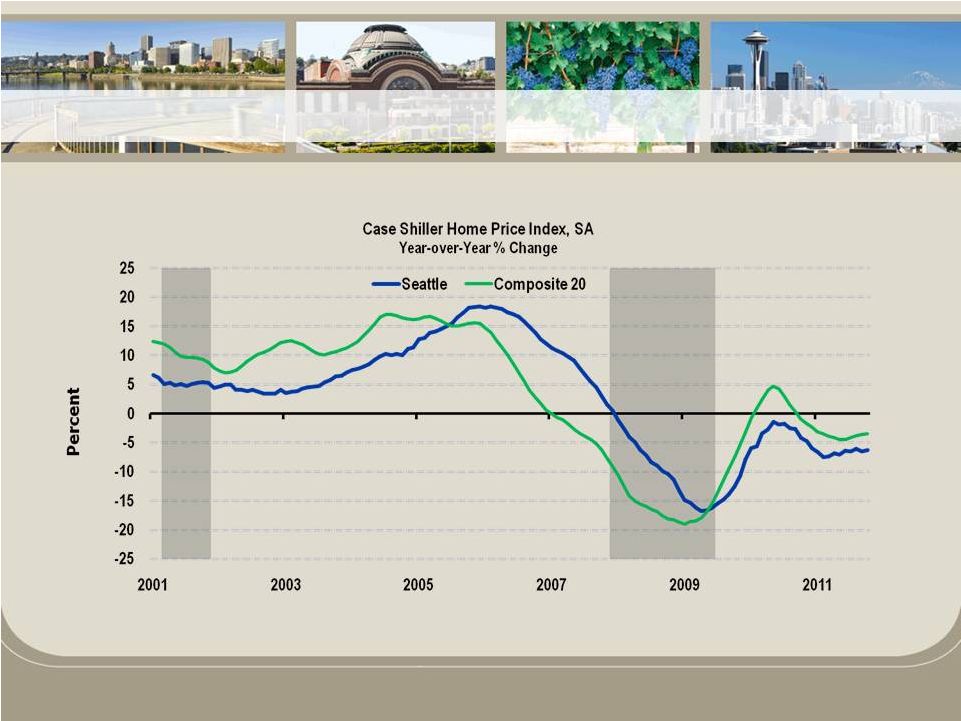

Single-family home prices continue to decline Oct 2011: U.S. is down 3.4%; SEA is down 6.2% Source: S&P/Case-Shiller; data through October 2011 13 Economic Information |

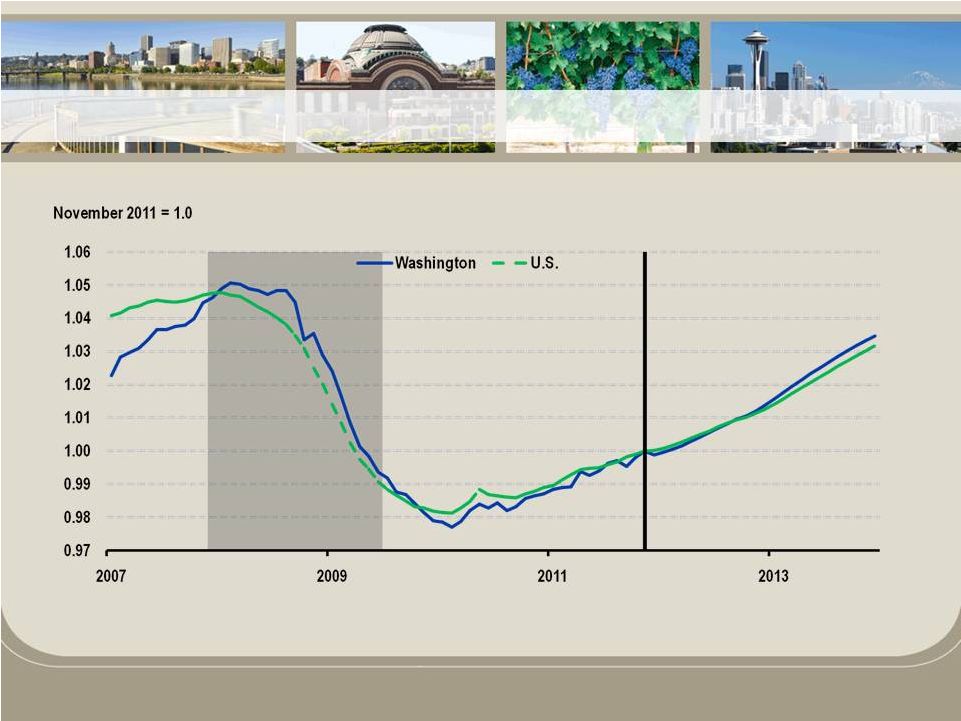

WA employment peaked 1 month after U.S. (Feb. 2008 vs. Jan. 2008) Both WA and the U.S. reached a trough in Feb. 2010 Both WA and the U.S. won’t reach their previous peak until after 2013 WA employment will recover slightly faster than the U.S. 14 Economic Information Source: WA State Economic and Revenue Forecast Council; November 2011 forecast |

Excludes the military’s new refueling tanker Source: Boeing; data through December 2011 Boeing has over 7 years of commercial orders on its books 15 Economic Information |

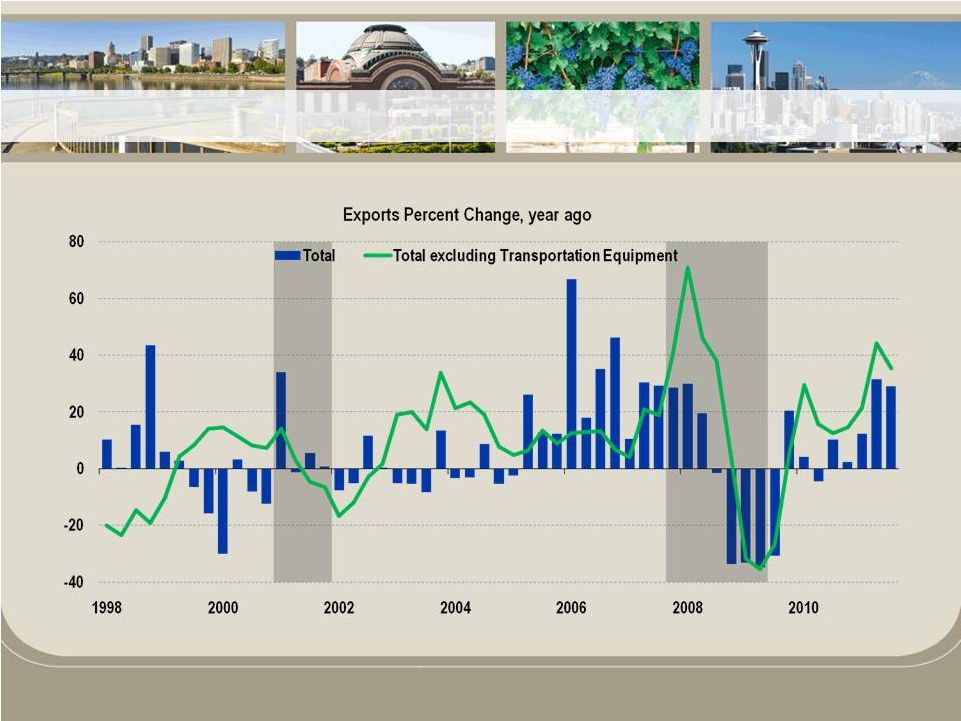

Total exports were up 29% y/y in Q3 Source: Wiser Trade Data; through Q3 2011 WA export growth is strong, and will help state outperform in the recovery 16 Economic Information |

Recent Growth Initiatives Recent Growth Initiatives 17 |

• Organic Growth • FDIC Assisted Transactions • Open Bank M&A Activity 18 Growth Strategies |

• Core deposits showing strong growth – Non-maturity deposits (total deposits less CDs) • Increased $73.1 million, or 10.0%, during 2011 • Non-maturity deposits increased to 71.0% of total deposits • Demand deposits increased $36.4 million, or 18.7%, during 2011 • Demand deposits increased to 20.4% of total deposits 19 Organic Growth |

• Deposits at acquired branches reporting steady growth since acquisition – Former Cowlitz Bank branches (acquired in July 2010) increased deposits by 19.5% during 2011 20 Organic Growth |

• 2011 Lender Recruitment – During 2011 we hired 7 new Lenders and a Market Executive • 3 lenders in King County (Seattle/Bellevue/Kent) • 2 lenders in Pierce County (Tacoma) • 1 lender in Thurston County (Olympia) • 1 lender in Portland, OR • 1 Market Executive for Vancouver, WA / OR 21 Organic Growth |

• Q4 2011 Loan Growth – Originated loans • Increased $35 million, or 4.4% – Net loans (including acquired portfolios) • Increased $20.2 million, or 2.0% • 2011 Loan Growth – Originated loans • Increased $95.9 million, or 12.9% 22 Organic Loan Growth |

• FDIC Acquisitions – Successfully completed two FDIC acquisitions – Continue to participate in FDIC bidding process – Expect less than five closures in WA/OR in 2012 • Open Bank – Opportunistically review deals 23 Acquisitions |

Financial Performance Financial Performance 24 |

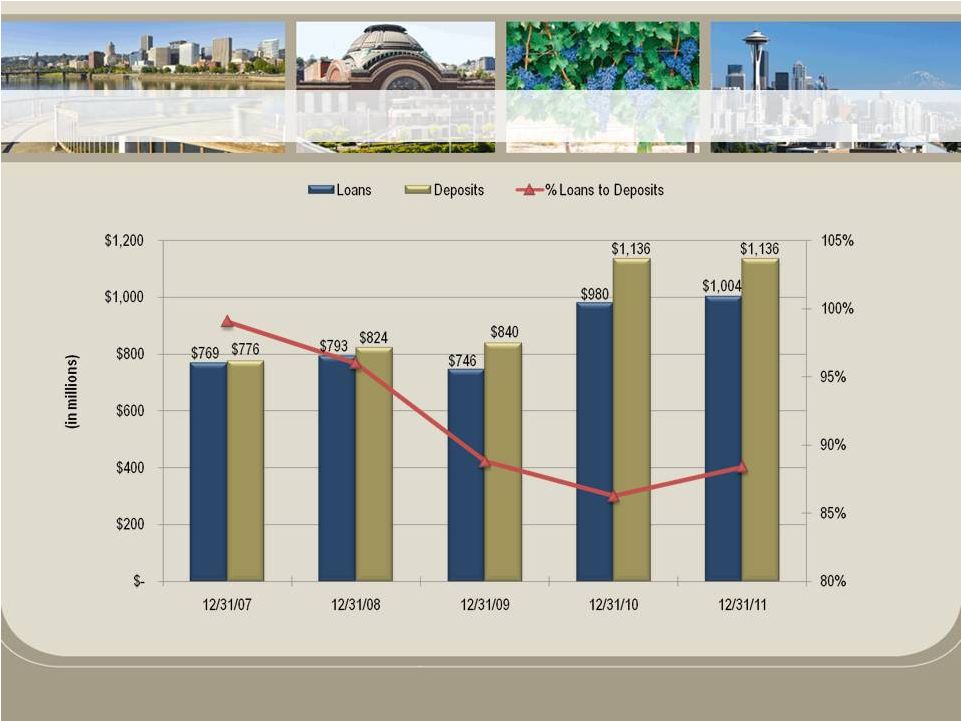

25 Loan and Deposit Growth |

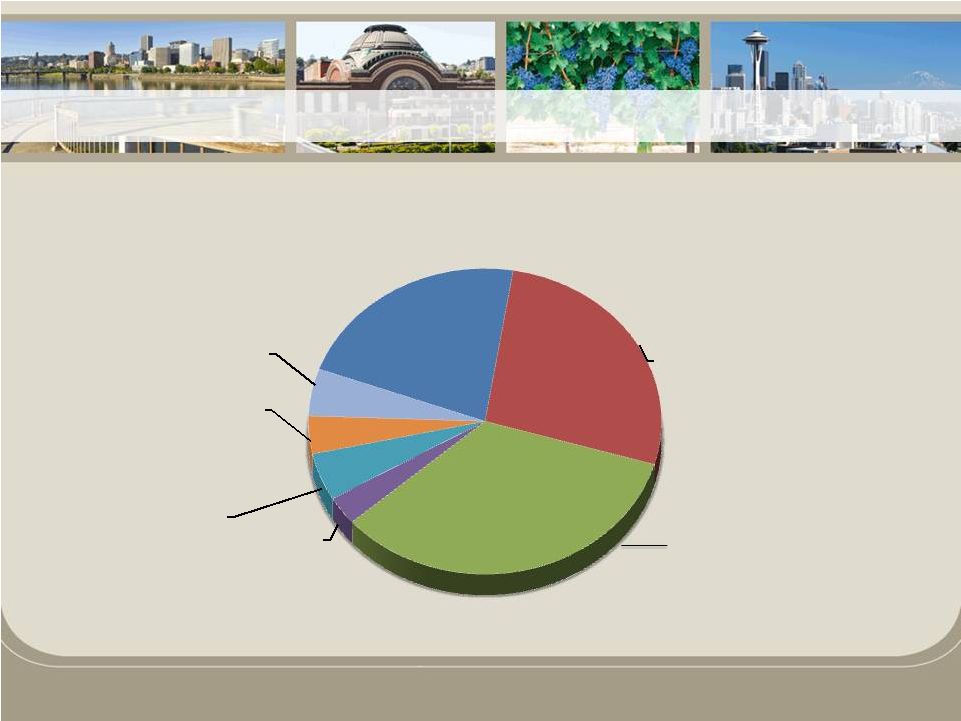

Loan Portfolio Financial data as of December 31, 2011 26 CRE Owner Occupied 22% CRE Non- Owner Occupied 27% Commercial & Industrial 34% Residential Construction 3% Commercial Construction 5% Residential Real Estate 4% Consumer 5% Diversified Loan Portfolio |

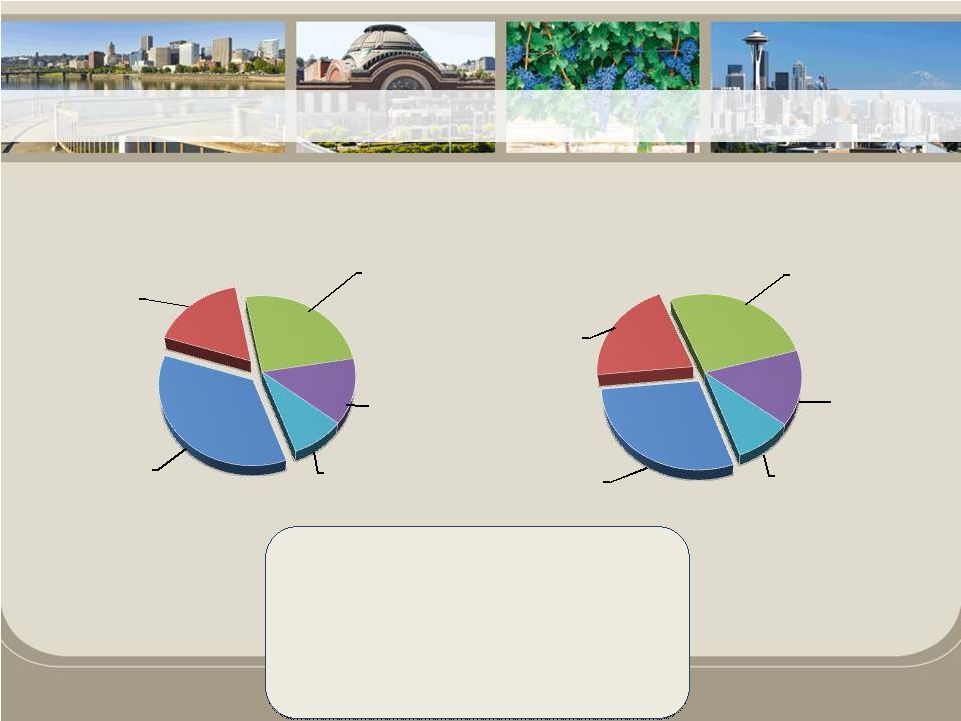

December 31, 2010 December 31, 2011 Deposit Composition 27 Attractive Deposit Base CDs 36% Non- Interest Bearing Demand 17% Interest Checking (NOW) 25% Money Market 13% Savings 9% CDs 29% Non- Interest Bearing Demand 20% Interest Checking (NOW) 27% Money Market 15% Savings 9% Financial Data as of December 31, 2011 – Total Deposits $1.1 billion – Total Non-Maturity Deposits – Non-Maturity Deposits / Total Dep. – Non-Int. Bearing Dep. / Total Dep. 20.4% – Cost of Int. Bear. Deposits 0.71% – Cost of Deposits 0.58% $806 million 71.0% |

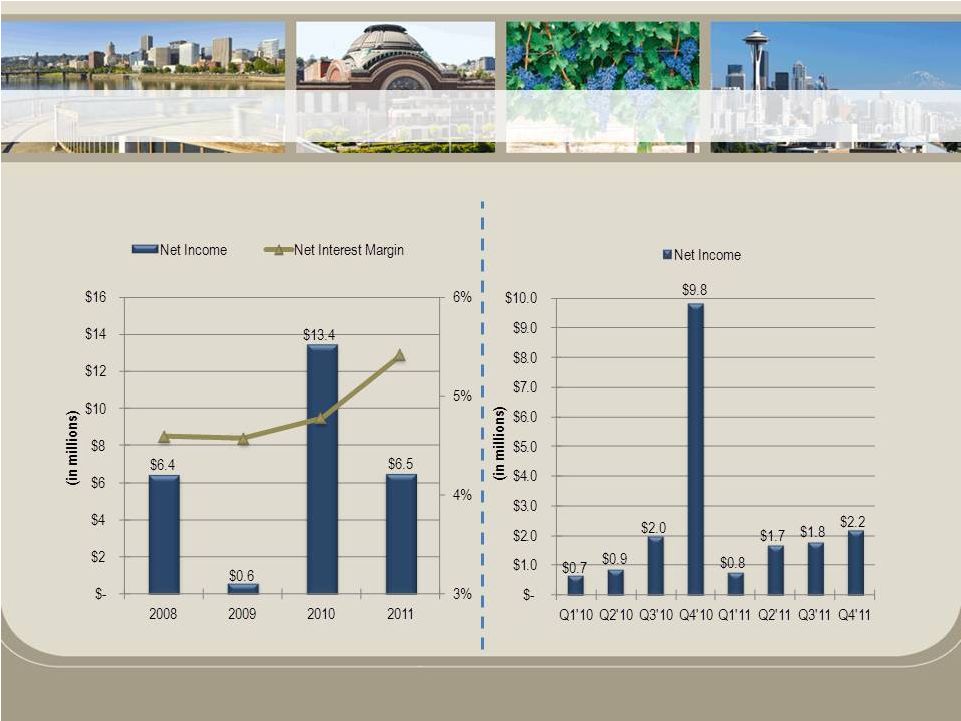

Annual Earnings Quarterly Earnings 28 Annual Earnings |

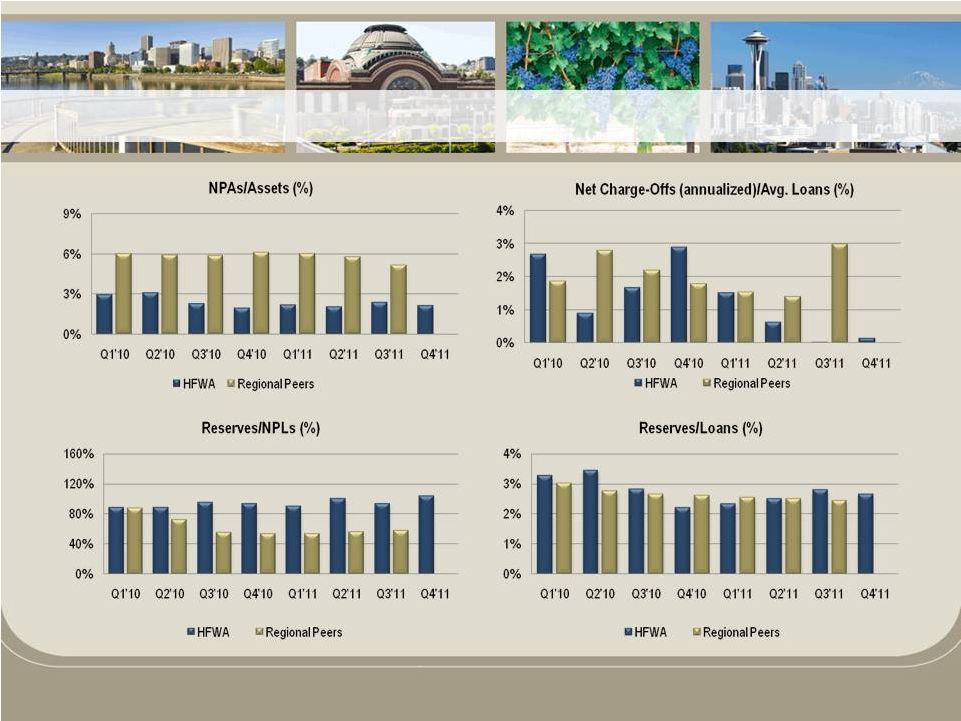

Peer Source: SNL Financial Regional Peer Group (12): Ticker Symbols – BANR, CACB, COLB, FFNW, HOME, NRIM, PCBK, PRWT, RVSB, TSBK, WBCO, WCBO 29 Credit Quality |

• Cash Dividends – Resumed quarterly cash dividend in Q2 2011 at $0.03 – Increased quarterly dividend to $0.05 for Q3 and Q4 2011 – Special dividend of $0.25 in Q4 2011 – Increased quarterly dividend to $0.06 for Q1 2012 • Stock Repurchases – Announced 5% repurchase program in Q3 2011 – During 2011, repurchased 201,205 shares (26% of repurchase program at an average price of $11.63) 30 Capital Management Strategies |

Core Strategies Core Strategies 31 |

32 Maintain Core Quality Loan Growth Fill in PNW Footprint Leverage Capital Core Strategies |

• Experienced management team supported by a strong Board of Directors • Disciplined approach to acquisitions • Well-positioned to take advantage of the right opportunities • Continuing focus on building long-term franchise value • Solid financial performance trends 33 Investment Value |

Thank You Thank You Questions? Questions? Heritage Financial Corporation Heritage Financial Corporation 34 |