| OMB APPROVAL |

OMB Number: 3235-0570 Expires: September 30, 2007 Estimated average burden hours per response: 19.4 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08413

Evergreen Equity Trust

_____________________________________________________________

(Exact name of registrant as specified in charter)

200 Berkeley Street Boston, Massachusetts 02116

_____________________________________________________________

(Address of principal executive offices) (Zip code)

Michael H. Koonce, Esq. 200 Berkeley Street Boston, Massachusetts 02116

____________________________________________________________

(Name and address of agent for service)

Registrant's telephone number, including area code: (617) 210-3200

Date of fiscal year end: Registrant is making a semi-annual filing for three of its series, Evergreen Market Index Growth Fund, Evergreen Market Index Value Fund and Evergreen Market Index Fund for the six months ended November 30, 2005. These three series have a May 31 fiscal year end.

Date of reporting period: November 30, 2005

Item 1 - Reports to Stockholders.

Evergreen Market Index Funds

This semiannual report must be preceded or accompanied by a prospectus of the Evergreen funds contained herein. The prospectus contains more complete information, including fees and expenses, and should be read carefully before investing or sending money.

The funds will file their complete schedules of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Each fund's Form N-Q will be available on the SEC’s Web site at http://www.sec.gov. In addition, the funds' Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 800.SEC.0330.

A description of each fund's proxy voting policies and procedures, as well as information regarding how each fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available by visiting our Web site at EvergreenInvestments.com or by visiting the SEC’s Web site at http://www.sec.gov. Each fund's proxy voting policies and procedures are also available without charge, upon request, by calling 800.343.2898.

| Mutual Funds: | | | | |

| NOT FDIC INSURED | | MAY LOSE VALUE | | NOT BANK GUARANTEED |

Evergreen InvestmentsSM is a service mark of Evergreen Investment Management Company, LLC.

Copyright 2006, Evergreen Investment Management Company, LLC.

Evergreen mutual funds are distributed by Evergreen Investment Services, Inc.

200 Berkeley Street, Boston, MA 02116

LETTER TO SHAREHOLDERS

JANUARY 2006

Dear Shareholder,

We are pleased to provide the semiannual report for the Evergreen Market Index Funds, which covers the six-month period ended November 30, 2005.

After experiencing volatile trading in the early months of 2005, we anticipated the return of a fundamentally-driven equity market. Relative to historical averages, corporate earnings were still solid and long-term interest rates remained attractive. The uncertainty related to monetary policy and energy prices, though, continued to weigh heavily on investor sentiment, which was further pressured by the devastating hurricanes in the Gulf region. The economy proved resilient, the Federal Reserve (Fed) maintained its policy stance, and corporate profits continued to exceed expectations. Even with surging energy prices and concerns about increased federal spending in the aftermath of the hurricanes, investors bid-up stocks based on their strong long-term return potential. Throughout it all, Evergreen’s equity management teams strictly adhered to the market fundamentals when making investment decisions, providing our clients with a disciplined approach for their long-term portfolios.

The investment period began with expectations for a moderation in U.S. economic growth. After all, the rapid pace of growth experienced during the recovery had transitioned to the more normalized Gross Domestic Product (GDP) levels typically associated with economic expansion. Yet energy prices continued to soar amid rising levels for employment, housing and production. The post-Katrina federal spending plans exacerbated these concerns resulting from rising energy prices and long-term interest rates began to crawl higher. Despite this, the U.S. consumer kept spending and businesses were investing some of their record cash balances, enabling the economy to overcome some extremely challenging obstacles.

Recognizing the strength in GDP and the attendant inflation fears, the Fed maintained its “measured removal of policy accommodation” throughout this timeframe. Since rates had been low for such a lengthy period, Evergreen’s Investment Strategy Committee concluded that the central bank was simply attempting to remove stimulus, rather than restrict growth, for the U.S. economy. Fed Chairman Alan Greenspan remained very transparent in his public statements about the direction of monetary policy and long-term market interest rates responded, once again, by moving lower.

The lower long-term market yields improved the relative attractiveness of equities as the period progressed. The solid growth in GDP translated into better than forecasted profit growth, further supporting equities, especially during their November rally. The gradual easing of oil prices as well as the market’s expectation of an end to Fed tightening supported this trend. During this time, our equity analysts continued to search for companies with promising outlooks consistent with their investment styles. Positive earnings, solid balance sheets and strong cash flows attracted the most attention from our portfolio managers, while the trend for dividends improved. Interestingly, after several years of underperforming, large caps and growth indexes made up some ground relative to small caps and value indexes, respectively, in the waning weeks of the investment period.

We continue to recommend a fully diversified, long-term approach for equity investors.

Please visit our Web site, EvergreenInvestments.com, for more information about our funds and other investment products available to you. Thank you for your continued support of Evergreen Investments.

Sincerely,

Dennis H. Ferro

President and Chief Executive Officer

Evergreen Investment Company, Inc.

Special Notice to Shareholders:

Please visit our Web site at EvergreenInvestments.com for a statement from President and Chief Executive Officer, Dennis Ferro, addressing NASD actions involving Evergreen Investment Services, Inc. (EIS), Evergreen’s mutual fund distributor or statements from Dennis Ferro and Chairman of the Board of the Evergreen funds, Michael S. Scofield, addressing SEC actions involving the Evergreen funds.

Market Index Fund

FUND AT A GLANCE

as of November 30, 2005

MANAGEMENT TEAM

Investment Advisor:

Evergreen Investment Management Company, LLC

Portfolio Manager:

William E. Zieff

CURRENT INVESTMENT STYLE

Source: Morningstar, Inc.

Morningstar’s style box is based on a portfolio date as of 9/30/2005.

The Equity style box placement is based on 10 growth and valuation measures for each fund holding and the median size of the companies in which the fund invests.

The advisor is waiving its advisory fee and reimbursing the fund for other expenses. Had the fee not been waived and expenses not reimbursed, returns would have been lower.

PERFORMANCE AND RETURNS

Portfolio inception date: 10/15/2002

| | | Class I |

| Class inception date | | 10/15/2002 |

| 6-month return | | 5.87% |

| Average annual return | | |

| 1-year | | 8.41% |

| Since portfolio inception | | 13.83% |

Past performance is no guarantee of future results. The performance quoted represents past performance and current performance may be lower or higher. The investment return and principal value of an investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. Performance includes the reinvestment of income dividends and capital gain distributions.

LONG-TERM GROWTH

Comparison of a $100,000,000 investment in the Evergreen Market Index Fund Class I shares, versus a similar investment in the Standard & Poor's 500 Index (S&P 500) and the Consumer Price Index (CPI).

The S&P 500 is an unmanaged market index and does not include transaction costs associated with buying and selling securities, any mutual fund expenses or any taxes. The CPI is a commonly used measure of inflation and does not represent an investment return. It is not possible to invest directly in an index.

The fund is only offered to certain pension plans having at least $100 million. Class I shares are sold without a front-end or deferred sales charge. The minimum initial investment for the fund is $100 million, which may be waived in certain situations. There is no minimum amount required for subsequent purchases.

The fund's investment objective is nonfundamental and may be changed without the vote of the fund's shareholders.

“Standard & Poor’s,” “S&P,” “S&P 500,” “Standard & Poor’s 500” and “500” are trademarks of The McGraw-Hill Companies, Inc. and have been licensed for use by Evergreen Investments. The product is not sponsored, endorsed, sold or promoted by Standard & Poor’s and Standard & Poor’s makes no representation regarding the advisability of investing in the product.

All data is as of November 30, 2005, and subject to change.

Market Index Growth Fund

FUND AT A GLANCE

as of November 30, 2005

MANAGEMENT TEAM

Investment Advisor:

Evergreen Investment Management Company, LLC

Portfolio Manager:

William E. Zieff

CURRENT INVESTMENT STYLE

Source: Morningstar, Inc.

Morningstar’s style box is based on a portfolio date as of 9/30/2005.

The Equity style box placement is based on 10 growth and valuation measures for each fund holding and the median size of the companies in which the fund invests.

The advisor is waiving its advisory fee and reimbursing the fund for other expenses. Had the fee not been waived and expenses not reimbursed, returns would have been lower.

PERFORMANCE AND RETURNS

Portfolio inception date: 10/15/2002

| | | Class I |

| Class inception date | | 10/15/2002 |

| 6-month return | | 7.01% |

| Average annual return | | |

| 1-year | | 9.66% |

| Since portfolio inception | | 11.85% |

Past performance is no guarantee of future results. The performance quoted represents past performance and current performance may be lower or higher. The investment return and principal value of an investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. Performance includes the reinvestment of income dividends and capital gain distributions.

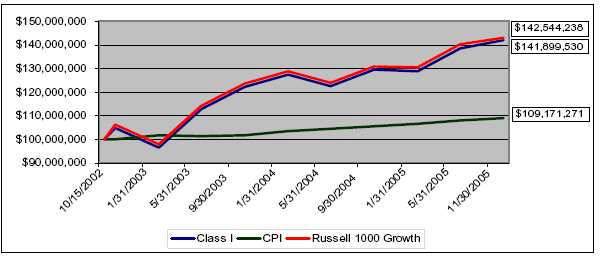

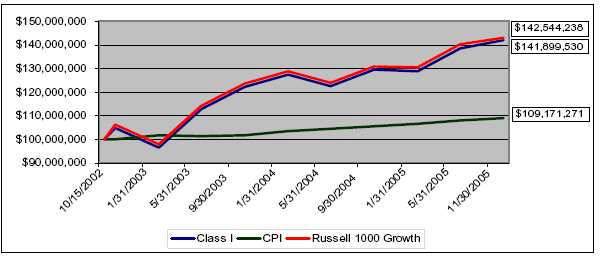

LONG-TERM GROWTH

Comparison of a $100,000,000 investment in the Evergreen Market Index Growth Fund Class I shares, versus a similar investment in the Russell 1000 Growth Index (Russell 1000 Growth) and the Consumer Price Index (CPI).

The Russell 1000 Growth is an unmanaged market index and does not include transaction costs associated with buying and selling securities, any mutual fund expenses or any taxes. The CPI is a commonly used measure of inflation and does not represent an investment return. It is not possible to invest directly in an index.

The fund is only offered to certain pension plans having at least $100 million. Class I shares are sold without a front-end or deferred sales charge. The minimum initial investment for the fund is $100 million, which may be waived in certain situations. There is no minimum amount required for subsequent purchases.

The fund's investment objective is nonfundamental and may be changed without the vote of the fund's shareholders.

“Russell 1000 Growth Index” is a trademark and service mark of Frank Russell Company (FRC) and has been licensed for use by Evergreen Investments. The product is not sponsored, endorsed, sold or promoted by FRC and FRC makes no representation regarding the advisability of investing in the product.

All data is as of November 30, 2005, and subject to change.

Market Index Value Fund

FUND AT A GLANCE

as of November 30, 2005

MANAGEMENT TEAM

Investment Advisor:

Evergreen Investment Management Company, LLC

Portfolio Manager:

William E. Zieff

CURRENT INVESTMENT STYLE

Source: Morningstar, Inc.

Morningstar’s style box is based on a portfolio date as of 9/30/2005.

The Equity style box placement is based on 10 growth and valuation measures for each fund holding and the median size of the companies in which the fund invests.

The advisor is waiving its advisory fee and reimbursing the fund for other expenses. Had the fee not been waived and expenses not reimbursed, returns would have been lower.

PERFORMANCE AND RETURNS

Portfolio inception date: 10/15/2002

| | | Class I |

| Class inception date | | 10/15/2002 |

| 6-month return | | 5.66% |

| Average annual return | | |

| 1-year | | 10.00% |

| Since portfolio inception | | 17.02% |

Past performance is no guarantee of future results. The performance quoted represents past performance and current performance may be lower or higher. The investment return and principal value of an investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. Performance includes the reinvestment of income dividends and capital gain distributions.

LONG-TERM GROWTH

Comparison of a $100,000,000 investment in the Evergreen Market Index Value Fund Class I shares, versus a similar investment in the Russell 1000 Value Index (Russell 1000 Value) and the Consumer Price Index (CPI).

The Russell 1000 Value is an unmanaged market index and does not include transaction costs associated with buying and selling securities, any mutual fund expenses or any taxes. The CPI is a commonly used measure of inflation and does not represent an investment return. It is not possible to invest directly in an index.

The fund is only offered to certain pension plans having at least $100 million. Class I shares are sold without a front-end or deferred sales charge. The minimum initial investment for the fund is $100 million, which may be waived in certain situations. There is no minimum amount required for subsequent purchases.

The fund's investment objective is nonfundamental and may be changed without the vote of the fund's shareholders.

Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

“Russell 1000 Value Index” is a trademark and service mark of Frank Russell Company (FRC) and has been licensed for use by Evergreen Investments. The product is not sponsored, endorsed, sold or promoted by FRC and FRC makes no representation regarding the advisability of investing in the product.

All data is as of November 30, 2005, and subject to change.

Market Index Fund

ABOUT YOUR FUND’S EXPENSES

The Example below is intended to describe the fees and expenses borne by shareholders and the impact of those costs on your investment.

Example

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads), redemption fees and exchange fees; and (2) ongoing costs, including management fees, distribution (12b-1) fees and other fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from June 1, 2005 to November 30, 2005.

The example illustrates your fund’s costs in two ways:

• Actual expenses

The section in the table under the heading “Actual” provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the appropriate column for your share class, in the column entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

• Hypothetical example for comparison purposes

The section in the table under the heading “Hypothetical (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the section in the table under the heading “Hypothetical (5% return before expenses)” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning | | Ending | | Expenses |

| | | Account | | Account | | Paid During |

| | | Value | | Value | | Period* |

| | | 6/1/2005 | | 11/30/2005 | | |

| Actual | | | | | | |

| Class I | | $1,000.00 | | $1,058.65 | | $0.15 |

| Hypothetical | | | | | | |

| (5% return before expenses) | | | | | | |

| Class I | | $1,000.00 | | $1,024.92 | | $0.15 |

*Expenses are equal to the Fund's annualized expense ratio (0.03% for Class I), multiplied by the average account value over the period, multiplied by 183 / 365 days.

Market Index Growth Fund

ABOUT YOUR FUND’S EXPENSES

The Example below is intended to describe the fees and expenses borne by shareholders and the impact of those costs on your investment.

Example

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads), redemption fees and exchange fees; and (2) ongoing costs, including management fees, distribution (12b-1) fees and other fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from June 1, 2005 to November 30, 2005.

The example illustrates your fund’s costs in two ways:

• Actual expenses

The section in the table under the heading “Actual” provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the appropriate column for your share class, in the column entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

• Hypothetical example for comparison purposes

The section in the table under the heading “Hypothetical (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the section in the table under the heading “Hypothetical (5% return before expenses)” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning | | Ending | | Expenses |

| | | Account | | Account | | Paid During |

| | | Value | | Value | | Period* |

| | | 6/1/2005 | | 11/30/2005 | | |

| Actual | | | | | | |

| Class I | | $1,000.00 | | $1,070.05 | | $0.16 |

| Hypothetical | | | | | | |

| (5% return before expenses) | | | | | | |

| Class I | | $1,000.00 | | $1,024.92 | | $0.15 |

*Expenses are equal to the Fund's annualized expense ratio (0.03% for Class I), multiplied by the average account value over the period, multiplied by 183 / 365 days.

Market Index Value Fund

ABOUT YOUR FUND’S EXPENSES

The Example below is intended to describe the fees and expenses borne by shareholders and the impact of those costs on your investment.

Example

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads), redemption fees and exchange fees; and (2) ongoing costs, including management fees, distribution (12b-1) fees and other fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from June 1, 2005 to November 30, 2005.

The example illustrates your fund’s costs in two ways:

• Actual expenses

The section in the table under the heading “Actual” provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the appropriate column for your share class, in the column entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

• Hypothetical example for comparison purposes

The section in the table under the heading “Hypothetical (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the section in the table under the heading “Hypothetical (5% return before expenses)” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning | | Ending | | Expenses |

| | | Account | | Account | | Paid During |

| | | Value | | Value | | Period* |

| | | 6/1/2005 | | 11/30/2005 | | |

| Actual | | | | | | |

| Class I | | $1,000.00 | | $1,056.64 | | $0.15 |

| Hypothetical | | | | | | |

| (5% return before expenses) | | | | | | |

| Class I | | $1,000.00 | | $1,024.92 | | $0.15 |

*Expenses are equal to the Fund's annualized expense ratio (0.03% for Class I), multiplied by the average account value over the period, multiplied by 183 / 365 days.

Market Index Fund

FINANCIAL HIGHLIGHTS - CLASS I

(For a share outstanding throughout each period)

| | | | | | | | | |

| | | Six Months Ended | | Year Ended May 31, |

| | November 30, 2005 | |

|

| | | (unaudited) | | 2005 | | 2004 | | 20031 |

|

| Net asset value, beginning of period | | $13.81 | | $12.97 | | $11.02 | | $10.00 |

|

| Income from investment operations | | | | | | | | |

| Net investment income (loss) | | 0.19 | | 0.30 | | 0.18 | | 0.12 |

| Net realized and unrealized gains or losses on | | | | | | | | |

| investments | | 0.62 | | 0.76 | | 1.83 | | 0.94 |

| |

|

| Total from investment operations | | 0.81 | | 1.06 | | 2.01 | | 1.06 |

|

| Distributions to shareholders from | | | | | | | | |

| Net investment income | | 0 | | (0.20) | | (0.06) | | (0.04) |

| Net realized gains | | 0 | | (0.02) | | 0 | | 0 |

| |

|

| Total distributions to shareholders | | 0 | | (0.22) | | (0.06) | | (0.04) |

|

| Net asset value, end of period | | $14.62 | | $13.81 | | $12.97 | | $11.02 |

|

| Total return | | 5.87% | | 8.24% | | 18.25% | | 10.63% |

|

| Ratios and supplemental data | | | | | | | | |

| Net assets, end of period (thousands) | | $663,499 | | $722,863 | | $716,998 | | $477,477 |

| Ratios to average net assets | | | | | | | | |

| Expenses including waivers/reimbursements but | | | | | | |

| excluding expense reductions | | 0.03%2 | | 0.03% | | 0.02% | | 0.02%2 |

| Expenses excluding waivers/reimbursements | | | | | | | | |

| and expense reductions | | 0.46%2 | | 0.47% | | 0.45% | | 0.47%2 |

| Net investment income (loss) | | 1.93%2 | | 2.08% | | 1.70% | | 1.84%2 |

| Portfolio turnover rate | | 3% | | 6% | | 2% | | 3% |

|

| 1 For the period from October 15, 2002 (commencement of operations), to May 31, 2003. |

| 2 Annualized |

See Combined Notes to Financial Statements

Market Index Growth Fund

FINANCIAL HIGHLIGHTS - CLASS I

(For a share outstanding throughout each period)

| | | | | | | | | | | |

| | | | | Six Months Ended | | Year Ended May 31, |

| | | | November 30, 2005 | |

|

| | | | | (unaudited) | | 2005 | | 2004 | | 20031 |

|

| Net asset value, beginning of period | | $12.99 | | $12.77 | | $10.86 | | $10.00 |

|

| Income from investment operations | | | | | | | | |

| Net investment income (loss) | | 0.07 | | 0.15 | | 0.12 | | 0.072 |

| Net realized and unrealized gains or losses on | | | | | | | | |

| | | investments | | 0.84 | | 0.27 | | 1.83 | | 0.81 |

| |

|

| Total from investment operations | | 0.91 | | 0.42 | | 1.95 | | 0.88 |

|

| Distributions to shareholders from | | | | | | | | |

| Net investment income | | 0 | | (0.12) | | (0.04) | | (0.02) |

| Net realized gains | | 0 | | (0.08) | | 0 | | 0 |

| |

|

| Total distributions to shareholders | | 0 | | (0.20) | | (0.04) | | (0.02) |

|

| Net asset value, end of period | | $13.90 | | $12.99 | | $12.77 | | $10.86 |

|

| Total return | | 7.01% | | 3.28% | | 17.97% | | 8.83% |

|

| Ratios and supplemental data | | | | | | | | |

| Net assets, end of period (thousands) | | $914,694 | | $854,566 | | $678,560 | | $529,545 |

| Ratios to average net assets | | | | | | | | |

| | | Expenses including waivers/reimbursements but | | | | | | |

| | | excluding expense reductions | | 0.03%3 | | 0.03% | | 0.02% | | 0.02%3 |

| | | Expenses excluding waivers/reimbursements | | | | | | | | |

| | | and expense reductions | | 0.46%3 | | 0.47% | | 0.45% | | 0.47%3 |

| | | Net investment income (loss) | | 1.03%3 | | 1.45% | | 1.03% | | 1.16%3 |

| Portfolio turnover rate | | 20% | | 15% | | 9% | | 2% |

|

| 1 For the period from October 15, 2002 (commencement of operations), to May 31, 2003. |

| 2 Net investment income (loss) per share is based on average shares outstanding during the period. |

| 3 Annualized |

See Combined Notes to Financial Statements

Market Index Value Fund

FINANCIAL HIGHLIGHTS - CLASS I

(For a share outstanding throughout each period)

| | | | | | | | | | | |

| | | Six Months Ended | | Year Ended May 31, |

| | November 30, 2005 | |

|

| | | (unaudited) | | 2005 | | 2004 | | 20031 |

|

| Net asset value, beginning of period | | $14.83 | | $13.23 | | $11.14 | | | | $10.00 |

|

| Income from investment operations | | | | | | | | | | | | |

| Net investment income (loss) | | | | 0.21 | | 0.35 | | 0.28 | | | | 0.15 |

| Net realized and unrealized gains or losses on | | | | | | | | | | | | |

| investments | | | | 0.63 | | 1.69 | | 1.91 | | | | 1.03 |

| |

|

| Total from investment operations | | | | 0.84 | | 2.04 | | 2.19 | | | | 1.18 |

|

| Distributions to shareholders from | | | | | | | | | | | | |

| Net investment income | | | | 0 | | (0.28) | | (0.10) | | | | (0.04) |

| Net realized gains | | | | 0 | | (0.16) | | 0 | | | | 0 |

| |

|

| Total distributions to shareholders | | | | 0 | | (0.44) | | (0.10) | | | | (0.04) |

|

| Net asset value, end of period | | $15.67 | | $14.83 | | $13.23 | | | | $11.14 |

|

| Total return | | 5.66% | | 15.51% | | 19.73% | | | | 11.85% |

|

| Ratios and supplemental data | | | | | | | | | | | | |

| Net assets, end of period (thousands) | | $865,151 | | $818,284 | | $708,489 | | | | $544,427 |

| Ratios to average net assets | | | | | | | | | | | | |

| Expenses including waivers/reimbursements but | | | | | | | | | | |

| excluding expense reductions | | 0.03%2 | | 0.03% | | 0.02% | | | | 0.02%2 |

| Expenses excluding waivers/reimbursements | | | | | | | | | | |

| and expense reductions | | 0.46%2 | | 0.46% | | 0.45% | | | | 0.47%2 |

| Net investment income (loss) | | 2.79%2 | | 2.54% | | 2.41% | | | | 2.67%2 |

| Portfolio turnover rate | | | | 20% | | 16% | | 10% | | | | 5% |

|

| 1 For the period from October 15, 2002 (commencement of operations), to May 31, 2003. |

| 2 Annualized |

See Combined Notes to Financial Statements

SCHEDULE OF INVESTMENTS

Market Index Fund

November 30, 2005 (unaudited)

| | | | | Shares | | Value |

|

| COMMON STOCKS 99.1% | | | | | | |

| CONSUMER DISCRETIONARY 10.8% | | | | |

| Auto Components 0.2% | | | | | | |

| Cooper Tire & Rubber Co. | | | | 3,565 | | $ 52,441 |

| Dana Corp. | | | | 8,754 | | 61,015 |

| Goodyear Tire & Rubber Co. * | | | | 10,250 | | 175,583 |

| Johnson Controls, Inc. | | | | 11,208 | | 778,396 |

| Visteon Corp. | | | | 7,491 | | 50,639 |

| |

|

| | | | | | | 1,118,074 |

| |

|

| Automobiles 0.4% | | | | | | |

| Ford Motor Co. | | | | 107,871 | | 876,991 |

| General Motors Corp. | | | | 32,919 | | 720,926 |

| Harley-Davidson, Inc. | | | | 15,974 | | 860,360 |

| |

|

| | | | | | | 2,458,277 |

| |

|

| Distributors 0.1% | | | | | | |

| Genuine Parts Co. | | | | 10,133 | | 448,993 |

| |

|

| Diversified Consumer Services 0.1% | | | | |

| Apollo Group, Inc., Class A * | | | | 8,513 | | 606,126 |

| H&R Block, Inc. | | | | 18,899 | | 461,891 |

| |

|

| | | | | | | 1,068,017 |

| |

|

| Hotels, Restaurants & Leisure 1.5% | | | | |

| Carnival Corp. | | | | 25,124 | | 1,369,007 |

| Darden Restaurants, Inc. | | | | 7,820 | | 279,800 |

| Harrah's Entertainment, Inc. | | | | 10,688 | | 727,746 |

| Hilton Hotels Corp. | | | | 19,072 | | 418,058 |

| International Game Technology | | | | 19,855 | | 582,744 |

| Marriott International, Inc., Class A | | | | 9,966 | | 643,903 |

| McDonald's Corp. | | | | 72,769 | | 2,463,231 |

| Starbucks Corp. * | | | | 44,734 | | 1,362,150 |

| Starwood Hotels & Resorts Worldwide, Inc., Class B | | 12,672 | | 766,656 |

| Wendy's International, Inc. | | | | 6,725 | | 341,495 |

| Yum! Brands, Inc. | | | | 16,615 | | 810,646 |

| |

|

| | | | | | | 9,765,436 |

| |

|

| Household Durables 0.7% | | | | | | |

| Black & Decker Corp. | | | | 4,684 | | 411,302 |

| Centex Corp. | | | | 7,471 | | 536,791 |

| D.R. Horton, Inc. | | | | 15,846 | | 561,582 |

| Fortune Brands, Inc. | | | | 8,498 | | 662,504 |

| KB Home | | | | 4,515 | | 315,012 |

| Leggett & Platt, Inc. | | | | 10,978 | | 257,763 |

| Lennar Corp., Class A | | | | 7,792 | | 449,443 |

| Maytag Corp. | | | | 4,649 | | 82,659 |

| Newell Rubbermaid, Inc. | | | | 16,026 | | 369,720 |

| Pulte Homes, Inc. | | | | 12,488 | | 519,876 |

| Snap-On, Inc. | | | | 3,366 | | 125,787 |

| Stanley Works | | | | 4,226 | | 202,848 |

| Whirlpool Corp. | | | | 3,888 | | 318,233 |

| |

|

| | | | | | | 4,813,520 |

| |

|

See Combined Notes to Financial Statements

SCHEDULE OF INVESTMENTS continued

Market Index Fund

November 30, 2005 (unaudited)

| Internet & Catalog Retail 0.6% | | | | | | |

| Amazon.com, Inc. * | | 17,854 | | $ | | 865,205 |

| eBay, Inc. * | | 64,627 | | | | 2,895,936 |

| |

|

| | | | | | | 3,761,141 |

| |

|

| Leisure Equipment & Products 0.2% | | | | | | |

| Brunswick Corp. | | 5,663 | | | | 222,499 |

| Eastman Kodak Co. | | 16,719 | | | | 400,755 |

| Hasbro, Inc. | | 10,420 | | | | 212,776 |

| Mattel, Inc. | | 23,501 | | | | 391,292 |

| |

|

| | | | | | | 1,227,322 |

| |

|

| Media 3.3% | | | | | | |

| Clear Channel Communications, Inc. | | 31,589 | | | | 1,028,538 |

| Comcast Corp., Class A * | | 127,833 | | | | 3,374,791 |

| Dow Jones & Co., Inc. | | 3,425 | | | | 116,827 |

| Gannett Co., Inc. | | 14,205 | | | | 875,312 |

| Interpublic Group of Cos. * | | 24,618 | | | | 229,440 |

| Knight Ridder, Inc. | | 4,040 | | | | 244,016 |

| McGraw-Hill Companies, Inc. | | 21,760 | | | | 1,154,368 |

| Meredith Corp. | | 2,440 | | | | 124,440 |

| New York Times Co., Class A | | 8,457 | | | | 232,567 |

| News Corp., Class A | | 142,602 | | | | 2,111,936 |

| Omnicom Group, Inc. | | 10,601 | | | | 896,420 |

| Time Warner, Inc. | | 273,259 | | | | 4,913,197 |

| Tribune Co. | | 15,435 | | | | 493,457 |

| Univision Communications, Inc., Class A * | | 13,401 | | | | 405,112 |

| Viacom, Inc., Class B | | 92,284 | | | | 3,082,286 |

| Walt Disney Co. | | 117,015 | | | | 2,917,184 |

| |

|

| | | | | | | 22,199,891 |

| |

|

| Multi-line Retail 1.1% | | | | | | |

| Big Lots, Inc. * | | 6,627 | | | | 81,446 |

| Dillard's, Inc., Class A | | 3,747 | | | | 78,575 |

| Dollar General Corp. | | 18,686 | | | | 353,352 |

| Family Dollar Stores, Inc. | | 9,017 | | | | 202,973 |

| Federated Department Stores, Inc. | | 15,435 | | | | 994,477 |

| J.C. Penney Co., Inc. | | 14,577 | | | | 764,855 |

| Kohl's Corp. * | | 20,064 | | | | 922,944 |

| Nordstrom, Inc. | | 12,889 | | | | 475,346 |

| Sears Holdings Corp. * | | 5,950 | | | | 684,369 |

| Target Corp. | | 51,499 | | | | 2,755,712 |

| |

|

| | | | | | | 7,314,049 |

| |

|

| Specialty Retail 2.2% | | | | | | |

| AutoNation, Inc. * | | 10,497 | | | | 217,498 |

| AutoZone, Inc. * | | 3,237 | | | | 288,287 |

| Bed Bath & Beyond, Inc. * | | 17,216 | | | | 734,434 |

| Best Buy Co., Inc. | | 23,565 | | | | 1,136,776 |

| Circuit City Stores, Inc. | | 9,576 | | | | 200,426 |

| Gap, Inc. | | 33,733 | | | | 586,279 |

| Home Depot, Inc. | | 124,594 | | | | 5,205,537 |

| Limited Brands, Inc. | | 20,324 | | | | 452,209 |

| Lowe's Companies, Inc. | | 45,386 | | | | 3,062,647 |

| Office Depot, Inc. * | | 18,416 | | | | 546,587 |

| OfficeMax, Inc. | | 4,117 | | | | 120,134 |

See Combined Notes to Financial Statements

SCHEDULE OF INVESTMENTS continued

Market Index Fund

November 30, 2005 (unaudited)

| RadioShack Corp. | | | | 7,817 | | $ | | 178,306 |

| Sherwin-Williams Co. | | | | 6,627 | | | | 290,528 |

| Staples, Inc. | | | | 42,778 | | | | 988,172 |

| Tiffany & Co. | | | | 8,291 | | | | 337,444 |

| TJX Companies, Inc. | | | | 27,123 | | | | 607,826 |

| |

|

| | | | | | | | | 14,953,090 |

| |

|

| Textiles, Apparel & Luxury Goods 0.4% | | | | | | |

| Coach, Inc. * | | | | 22,127 | | | | 761,832 |

| Jones Apparel Group, Inc. | | | | 6,892 | | | | 198,214 |

| Liz Claiborne, Inc. | | | | 6,247 | | | | 217,895 |

| NIKE, Inc., Class B | | | | 11,119 | | | | 948,451 |

| Reebok International, Ltd. | | | | 3,060 | | | | 176,195 |

| VF Corp. | | | | 5,200 | | | | 294,580 |

| |

|

| | | | | | | | | 2,597,167 |

| |

|

| CONSUMER STAPLES 9.4% | | | | | | | | |

| Beverages 2.2% | | | | | | | | |

| Anheuser-Busch Companies, Inc. | | | | 45,218 | | | | 1,977,835 |

| Brown-Forman Corp., Class B | | | | 4,830 | | | | 332,594 |

| Coca-Cola Co. | | | | 120,872 | | | | 5,160,026 |

| Coca-Cola Enterprises, Inc. | | | | 17,546 | | | | 337,234 |

| Constellation Brands, Inc., Class A * | | | | 11,408 | | | | 269,457 |

| Molson Coors Brewing Co., Class B | | | | 3,330 | | | | 221,745 |

| Pepsi Bottling Group, Inc. | | | | 8,082 | | | | 238,419 |

| PepsiCo, Inc. | | | | 97,205 | | | | 5,754,536 |

| |

|

| | | | | | | | | 14,291,846 |

| |

|

| Food & Staples Retailing 2.4% | | | | | | | | |

| Albertsons, Inc. | | | | 21,446 | | | | 503,981 |

| Costco Wholesale Corp. | | | | 27,895 | | | | 1,394,192 |

| CVS Corp. | | | | 47,321 | | | | 1,278,613 |

| Kroger Co. * | | | | 42,145 | | | | 820,142 |

| Safeway, Inc. | | | | 26,120 | | | | 607,290 |

| SUPERVALU, Inc. | | | | 7,911 | | | | 258,848 |

| SYSCO Corp. | | | | 36,851 | | | | 1,191,024 |

| Wal-Mart Stores, Inc. | | | | 145,393 | | | | 7,060,284 |

| Walgreen Co. | | | | 59,516 | | | | 2,718,691 |

| |

|

| | | | | | | | | 15,833,065 |

| |

|

| Food Products 1.0% | | | | | | | | |

| Archer-Daniels-Midland Co. | | | | 37,869 | | | | 892,572 |

| Campbell Soup Co. | | | | 10,767 | | | | 325,271 |

| ConAgra Foods, Inc. | | | | 30,148 | | | | 648,182 |

| General Mills, Inc. | | | | 21,307 | | | | 1,012,722 |

| H.J. Heinz Co. | | | | 19,842 | | | | 688,914 |

| Kellogg Co. | | | | 14,912 | | | | 657,172 |

| McCormick & Co., Inc. | | | | 7,794 | | | | 243,329 |

| Sara Lee Corp. | | | | 45,671 | | | | 824,818 |

| The Hershey Co. | | | | 10,686 | | | | 579,395 |

| Tyson Foods, Inc., Class A | | | | 14,632 | | | | 246,257 |

| Wm. Wrigley Jr. Co. | | | | 10,465 | | | | 717,794 |

| |

|

| | | | | | | | | 6,836,426 |

| |

|

| Household Products 2.3% | | | | | | | | |

| Clorox Co. | | | | 8,832 | | | | 479,401 |

See Combined Notes to Financial Statements

SCHEDULE OF INVESTMENTS continued

Market Index Fund

November 30, 2005 (unaudited)

| Colgate-Palmolive Co. | | | | 30,237 | | $ | | 1,648,521 |

| Kimberly-Clark Corp. | | | | 27,726 | | | | 1,635,280 |

| Procter & Gamble Co. | | | | 199,981 | | | | 11,436,913 |

| |

|

| | | | | | | | | 15,200,115 |

| |

|

| Personal Products 0.1% | | | | | | | | |

| Alberto-Culver Co. | | | | 4,389 | | | | 190,833 |

| Avon Products, Inc. | | | | 27,405 | | | | 749,527 |

| |

|

| | | | | | | | | 940,360 |

| |

|

| Tobacco 1.4% | | | | | | | | |

| Altria Group, Inc. | | | | 120,815 | | | | 8,794,124 |

| Reynolds American, Inc. | | | | 4,976 | | | | 442,964 |

| UST, Inc. | | | | 9,568 | | | | 369,133 |

| |

|

| | | | | | | | | 9,606,221 |

| |

|

| ENERGY 9.2% | | | | | | | | |

| Energy Equipment & Services 1.7% | | | | | | |

| Baker Hughes, Inc. | | | | 19,832 | | | | 1,137,365 |

| BJ Services Co. | | | | 18,764 | | | | 687,701 |

| Halliburton Co. | | | | 29,590 | | | | 1,883,404 |

| Nabors Industries, Ltd. * | | | | 9,166 | | | | 641,712 |

| National Oilwell Varco, Inc. * | | | | 10,094 | | | | 611,898 |

| Noble Corp. | | | | 7,958 | | | | 573,533 |

| Rowan Companies, Inc. | | | | 6,340 | | | | 227,479 |

| Schlumberger, Ltd. | | | | 34,247 | | | | 3,278,465 |

| Transocean, Inc. * | | | | 19,139 | | | | 1,221,834 |

| Weatherford International, Ltd. * | | | | 9,591 | | | | 666,670 |

| |

|

| | | | | | | | | 10,930,061 |

| |

|

| Oil, Gas & Consumable Fuels 7.5% | | | | | | |

| Amerada Hess Corp. | | | | 4,650 | | | | 569,718 |

| Anadarko Petroleum Corp. | | | | 13,758 | | | | 1,246,612 |

| Apache Corp. | | | | 19,143 | | | | 1,249,655 |

| Burlington Resources, Inc. | | | | 22,182 | | | | 1,602,650 |

| Chevron Corp. | | | | 131,090 | | | | 7,512,768 |

| ConocoPhillips | | | | 81,030 | | | | 4,903,125 |

| Devon Energy Corp. | | | | 26,383 | | | | 1,588,257 |

| El Paso Corp. | | | | 38,381 | | | | 421,807 |

| EOG Resources, Inc. | | | | 13,977 | | | | 1,002,850 |

| Exxon Mobil Corp. | | | | 367,038 | | | | 21,299,215 |

| Kerr-McGee Corp. | | | | 6,716 | | | | 580,598 |

| Kinder Morgan, Inc. | | | | 5,562 | | | | 503,917 |

| Marathon Oil Corp. | | | | 21,307 | | | | 1,263,292 |

| Murphy Oil Corp. | | | | 9,555 | | | | 472,590 |

| Occidental Petroleum Corp. | | | | 23,273 | | | | 1,845,549 |

| Sunoco, Inc. | | | | 7,951 | | | | 613,817 |

| Valero Energy Corp. | | | | 17,790 | | | | 1,711,398 |

| Williams Cos. | | | | 33,308 | | | | 716,122 |

| XTO Energy, Inc. | | | | 21,031 | | | | 855,752 |

| |

|

| | | | | | | | | 49,959,692 |

| |

|

| FINANCIALS 21.0% | | | | | | | | |

| Capital Markets 3.2% | | | | | | | | |

| Ameriprise Financial, Inc. | | | | 14,447 | | | | 607,496 |

See Combined Notes to Financial Statements

SCHEDULE OF INVESTMENTS continued

Market Index Fund

November 30, 2005 (unaudited)

| Bank of New York Co. | | | | 45,314 | | $ | | 1,468,174 |

| Bear Stearns Cos. | | | | 6,548 | | | | 726,763 |

| Charles Schwab Corp. | | | | 60,498 | | | | 922,594 |

| E*TRADE Financial Corp. * | | | | 23,675 | | | | 462,136 |

| Federated Investors, Inc., Class B | | | | 4,931 | | | | 180,179 |

| Franklin Resources, Inc. | | | | 8,642 | | | | 802,669 |

| Goldman Sachs Group, Inc. | | | | 27,068 | | | | 3,490,689 |

| Janus Capital Group, Inc. | | | | 12,975 | | | | 248,731 |

| Lehman Brothers Holdings, Inc. | | | | 15,842 | | | | 1,996,092 |

| Mellon Financial Corp. | | | | 24,342 | | | | 818,865 |

| Merrill Lynch & Co., Inc. | | | | 53,925 | | | | 3,581,698 |

| Morgan Stanley | | | | 63,226 | | | | 3,542,553 |

| Northern Trust Corp. | | | | 10,805 | | | | 569,315 |

| State Street Corp. | | | | 19,262 | | | | 1,111,225 |

| T. Rowe Price Group, Inc. | | | | 7,555 | | | | 543,582 |

| |

|

| | | | | | | | | 21,072,761 |

| |

|

| Commercial Banks 5.7% | | | | | | | | |

| AmSouth Bancorp, Inc. | | | | 20,400 | | | | 542,436 |

| Bank of America Corp. | | | | 233,894 | | | | 10,733,396 |

| BB&T Corp. | | | | 31,872 | | | | 1,356,154 |

| Comerica, Inc. | | | | 9,737 | | | | 561,533 |

| Compass Bancshares, Inc. | | | | 7,239 | | | | 350,802 |

| Fifth Third Bancorp | | | | 32,374 | | | | 1,303,701 |

| First Horizon National Corp. | | | | 7,283 | | | | 283,454 |

| Huntington Bancshares, Inc. | | | | 13,437 | | | | 321,950 |

| KeyCorp | | | | 23,827 | | | | 790,103 |

| M&T Bank Corp. | | | | 4,703 | | | | 508,959 |

| Marshall & Ilsley Corp. | | | | 12,061 | | | | 518,382 |

| National City Corp. | | | | 33,104 | | | | 1,122,557 |

| North Fork Bancorp, Inc. | | | | 27,849 | | | | 751,923 |

| PNC Financial Services Group, Inc. | | | | 16,926 | | | | 1,079,371 |

| Regions Financial Corp. | | | | 26,807 | | | | 903,128 |

| SunTrust Banks, Inc. | | | | 21,104 | | | | 1,535,105 |

| Synovus Financial Corp. | | | | 18,149 | | | | 510,894 |

| U.S. Bancorp | | | | 106,393 | | | | 3,221,580 |

| Wachovia Corp. ° | | | | 91,821 | | | | 4,903,241 |

| Wells Fargo & Co. | | | | 98,265 | | | | 6,175,955 |

| Zions Bancorp | | | | 5,244 | | | | 396,604 |

| |

|

| | | | | | | | | 37,871,228 |

| |

|

| Consumer Finance 1.3% | | | | | | | | |

| American Express Co. | | | | 72,236 | | | | 3,714,375 |

| Capital One Financial Corp. | | | | 16,806 | | | | 1,395,907 |

| MBNA Corp. | | | | 73,222 | | | | 1,960,153 |

| SLM Corp. | | | | 24,306 | | | | 1,277,280 |

| |

|

| | | | | | | | | 8,347,715 |

| |

|

| Diversified Financial Services 3.7% | | | | | | |

| CIT Group, Inc. | | | | 11,742 | | | | 581,229 |

| Citigroup, Inc. | | | | 300,964 | | | | 14,611,802 |

| JPMorgan Chase & Co. | | | | 204,492 | | | | 7,821,819 |

| Moody's Corp. | | | | 14,714 | | | | 885,047 |

| Principal Financial Group, Inc. | | | | 16,282 | | | | 825,009 |

| |

|

| | | | | | | | | 24,724,906 |

| |

|

See Combined Notes to Financial Statements

SCHEDULE OF INVESTMENTS continued

Market Index Fund

November 30, 2005 (unaudited)

| Insurance 4.8% | | | | | | |

| ACE, Ltd. | | 18,452 | | $ | | 1,024,086 |

| AFLAC, Inc. | | 29,205 | | | | 1,401,840 |

| Allstate Corp. | | 38,233 | | | | 2,144,871 |

| Ambac Financial Group, Inc. | | 6,227 | | | | 477,549 |

| American International Group, Inc. | | 151,066 | | | | 10,142,571 |

| AON Corp. | | 18,542 | | | | 675,114 |

| Chubb Corp. | | 11,546 | | | | 1,118,115 |

| Cincinnati Financial Corp. | | 10,175 | | | | 453,093 |

| Hartford Financial Services Group, Inc. | | 17,434 | | | | 1,523,209 |

| Jefferson-Pilot Corp. | | 7,845 | | | | 435,790 |

| Lincoln National Corp. | | 10,041 | | | | 521,931 |

| Loews Corp. | | 7,891 | | | | 762,113 |

| Marsh & McLennan Cos. | | 31,160 | | | | 962,532 |

| MBIA, Inc. | | 7,803 | | | | 482,069 |

| MetLife, Inc. | | 44,037 | | | | 2,265,263 |

| Progressive Corp. | | 11,480 | | | | 1,411,925 |

| Prudential Financial, Inc. | | 29,863 | | | | 2,311,396 |

| SAFECO Corp. | | 7,281 | | | | 409,556 |

| St. Paul Travelers Companies, Inc. | | 39,321 | | | | 1,829,606 |

| Torchmark Corp. | | 6,073 | | | | 328,671 |

| UnumProvident Corp. | | 17,341 | | | | 381,502 |

| XL Capital, Ltd., Class A | | 8,173 | | | | 542,524 |

| |

|

| | | | | | | 31,605,326 |

| |

|

| Real Estate 0.7% | | | | | | |

| Apartment Investment & Management Co., Class A REIT | | 5,560 | | | | 215,339 |

| Archstone-Smith Trust REIT | | 12,327 | | | | 515,392 |

| Equity Office Properties Trust REIT | | 23,900 | | | | 745,202 |

| Equity Residential REIT | | 16,715 | | | | 681,303 |

| Plum Creek Timber Co., Inc. REIT | | 10,709 | | | | 417,223 |

| Prologis REIT | | 14,380 | | | | 652,277 |

| Public Storage, Inc. REIT | | 4,811 | | | | 339,656 |

| Simon Property Group, Inc. REIT | | 10,658 | | | | 823,970 |

| Vornado Realty Trust REIT | | 6,863 | | | | 585,757 |

| |

|

| | | | | | | 4,976,119 |

| |

|

| Thrifts & Mortgage Finance 1.6% | | | | | | |

| Countrywide Financial Corp. | | 34,613 | | | | 1,204,879 |

| Fannie Mae | | 56,344 | | | | 2,707,329 |

| Freddie Mac | | 40,225 | | | | 2,512,051 |

| Golden West Financial Corp. | | 14,875 | | | | 963,751 |

| MGIC Investment Corp. | | 5,416 | | | | 352,582 |

| Sovereign Bancorp, Inc. | | 21,054 | | | | 460,241 |

| Washington Mutual, Inc. | | 58,070 | | | | 2,391,903 |

| |

|

| | | | | | | 10,592,736 |

| |

|

| HEALTH CARE 12.7% | | | | | | |

| Biotechnology 1.6% | | | | | | |

| Amgen, Inc. * | | 71,823 | | | | 5,812,636 |

| Applera Corp. - Applied Biosystems Group | | 11,371 | | | | 313,612 |

| Biogen Idec, Inc. * | | 19,695 | | | | 843,143 |

| Chiron Corp. * | | 6,343 | | | | 280,995 |

| Genzyme Corp. * | | 14,942 | | | | 1,110,788 |

| Gilead Sciences, Inc. * | | 26,541 | | | | 1,345,363 |

See Combined Notes to Financial Statements

SCHEDULE OF INVESTMENTS continued

Market Index Fund

November 30, 2005 (unaudited)

| MedImmune, Inc. * | | | | 14,340 | | $ | | 514,950 |

| |

|

| | | | | | | | | 10,221,487 |

| |

|

| Health Care Equipment & Supplies 2.1% | | | | | | |

| Bausch & Lomb, Inc. | | | | 3,130 | | | | 254,344 |

| Baxter International, Inc. | | | | 36,238 | | | | 1,409,296 |

| Becton, Dickinson & Co. | | | | 14,550 | | | | 847,247 |

| Biomet, Inc. | | | | 14,528 | | | | 517,487 |

| Boston Scientific Corp. * | | | | 34,377 | | | | 910,303 |

| C.R. Bard, Inc. | | | | 6,129 | | | | 397,588 |

| Fisher Scientific International, Inc. * | | | | 7,097 | | | | 457,615 |

| Guidant Corp. | | | | 19,212 | | | | 1,184,996 |

| Hospira, Inc. * | | | | 9,307 | | | | 410,904 |

| Medtronic, Inc. | | | | 70,499 | | | | 3,917,629 |

| Millipore Corp. * | | | | 3,001 | | | | 191,644 |

| PerkinElmer, Inc. | | | | 7,582 | | | | 172,945 |

| St. Jude Medical, Inc. * | | | | 21,224 | | | | 1,013,870 |

| Stryker Corp. | | | | 16,912 | | | | 732,290 |

| Thermo Electron Corp. * | | | | 9,408 | | | | 290,237 |

| Waters Corp. * | | | | 6,695 | | | | 262,645 |

| Zimmer Holdings, Inc. * | | | | 14,399 | | | | 902,385 |

| |

|

| | | | | | | | | 13,873,425 |

| |

|

| Health Care Providers & Services 3.0% | | | | | | |

| Aetna, Inc. | | | | 16,879 | | | | 1,561,139 |

| AmerisourceBergen Corp. | | | | 6,042 | | | | 485,475 |

| Cardinal Health, Inc. | | | | 24,847 | | | | 1,588,966 |

| Caremark Rx, Inc. * | | | | 26,195 | | | | 1,346,161 |

| CIGNA Corp. | | | | 7,484 | | | | 842,100 |

| Coventry Health Care, Inc. * | | | | 9,376 | | | | 558,528 |

| Express Scripts, Inc. * | | | | 8,652 | | | | 730,748 |

| HCA, Inc. | | | | 24,636 | | | | 1,256,189 |

| Health Management Associates, Inc. | | | | 14,390 | | | | 337,014 |

| Humana, Inc. * | | | | 9,455 | | | | 433,323 |

| IMS Health, Inc. | | | | 13,143 | | | | 321,346 |

| Laboratory Corporation of America Holdings * | | 7,866 | | | | 408,167 |

| Manor Care, Inc. | | | | 4,604 | | | | 181,536 |

| McKesson Corp. | | | | 17,950 | | | | 902,885 |

| Medco Health Solutions, Inc. * | | | | 17,719 | | | | 950,624 |

| Patterson Companies, Inc. * | | | | 8,029 | | | | 280,533 |

| Quest Diagnostics, Inc. | | | | 9,689 | | | | 485,322 |

| Tenet Healthcare Corp. * | | | | 27,276 | | | | 213,298 |

| UnitedHealth Group, Inc. | | | | 73,530 | | | | 4,401,506 |

| WellPoint, Inc. * | | | | 35,720 | | | | 2,744,367 |

| |

|

| | | | | | | | | 20,029,227 |

| |

|

| Pharmaceuticals 6.0% | | | | | | | | |

| Abbott Laboratories | | | | 90,487 | | | | 3,412,265 |

| Allergan, Inc. | | | | 7,613 | | | | 761,300 |

| Bristol-Myers Squibb Co. | | | | 113,856 | | | | 2,458,151 |

| Eli Lilly & Co. | | | | 66,002 | | | | 3,333,101 |

| Forest Laboratories, Inc. * | | | | 19,786 | | | | 773,039 |

| Johnson & Johnson | | | | 173,165 | | | | 10,692,939 |

| King Pharmaceuticals, Inc. * | | | | 14,072 | | | | 221,353 |

| Merck & Co., Inc. | | | | 127,811 | | | | 3,757,643 |

| Mylan Laboratories, Inc. | | | | 12,725 | | | | 265,825 |

See Combined Notes to Financial Statements

SCHEDULE OF INVESTMENTS continued

Market Index Fund

November 30, 2005 (unaudited)

| Pfizer, Inc. | | | | 429,056 | | $ | | 9,095,987 |

| Schering-Plough Corp. | | | | 85,944 | | | | 1,660,438 |

| Watson Pharmaceuticals, Inc. * | | | | 6,067 | | | | 202,395 |

| Wyeth | | | | 78,073 | | | | 3,244,714 |

| |

|

| | | | | | | | | 39,879,150 |

| |

|

| INDUSTRIALS 11.2% | | | | | | | | |

| Aerospace & Defense 2.2% | | | | | | | | |

| Boeing Co. | | | | 47,769 | | | | 3,257,368 |

| General Dynamics Corp. | | | | 11,702 | | | | 1,337,539 |

| Goodrich Corp. | | | | 7,077 | | | | 272,606 |

| Honeywell International, Inc. | | | | 49,780 | | | | 1,818,961 |

| L-3 Communications Holdings, Inc. | | | | 6,908 | | | | 514,646 |

| Lockheed Martin Corp. | | | | 21,184 | | | | 1,283,750 |

| Northrop Grumman Corp. | | | | 20,787 | | | | 1,192,550 |

| Raytheon Co. | | | | 26,274 | | | | 1,009,447 |

| Rockwell Collins, Inc. | | | | 10,285 | | | | 470,025 |

| United Technologies Corp. | | | | 59,654 | | | | 3,211,771 |

| |

|

| | | | | | | | | 14,368,663 |

| |

|

| Air Freight & Logistics 1.0% | | | | | | | | |

| FedEx Corp. | | | | 17,628 | | | | 1,720,846 |

| Ryder System, Inc. | | | | 3,738 | | | | 158,603 |

| United Parcel Service, Inc., Class B | | | | 64,457 | | | | 5,021,200 |

| |

|

| | | | | | | | | 6,900,649 |

| |

|

| Airlines 0.1% | | | | | | | | |

| Southwest Airlines Co. | | | | 40,330 | | | | 665,445 |

| |

|

| Building Products 0.2% | | | | | | | | |

| American Standard Companies, Inc. | | | | 10,677 | | | | 406,580 |

| Masco Corp. | | | | 25,055 | | | | 745,887 |

| |

|

| | | | | | | | | 1,152,467 |

| |

|

| Commercial Services & Supplies 0.7% | | | | | | |

| Allied Waste Industries, Inc. * | | | | 12,701 | | | | 106,815 |

| Avery Dennison Corp. | | | | 6,430 | | | | 378,020 |

| Cendant Corp. | | | | 60,909 | | | | 1,082,353 |

| Cintas Corp. | | | | 8,035 | | | | 359,325 |

| Equifax, Inc. | | | | 7,582 | | | | 290,391 |

| Monster Worldwide, Inc. * | | | | 7,090 | | | | 275,801 |

| Pitney Bowes, Inc. | | | | 13,322 | | | | 554,994 |

| R.R. Donnelley & Sons Co. | | | | 12,498 | | | | 427,432 |

| Robert Half International, Inc. | | | | 9,856 | | | | 377,091 |

| Waste Management, Inc. | | | | 32,721 | | | | 978,685 |

| |

|

| | | | | | | | | 4,830,907 |

| |

|

| Construction & Engineering 0.1% | | | | | | | | |

| Fluor Corp. | | | | 5,049 | | | | 374,131 |

| |

|

| Electrical Equipment 0.5% | | | | | | | | |

| American Power Conversion Corp. | | | | 9,955 | | | | 223,092 |

| Cooper Industries, Inc., Class A | | | | 5,392 | | | | 392,214 |

| Emerson Electric Co. | | | | 24,047 | | | | 1,818,194 |

| Rockwell Automation, Inc. | | | | 10,571 | | | | 596,521 |

| |

|

| | | | | | | | | 3,030,021 |

| |

|

See Combined Notes to Financial Statements

SCHEDULE OF INVESTMENTS continued

Market Index Fund

November 30, 2005 (unaudited)

| Industrial Conglomerates 4.4% | | | | | | |

| 3M Co. | | | | 44,537 | | $ | | 3,495,264 |

| General Electric Co. | | | | 617,100 | | | | 22,042,812 |

| Textron, Inc. | | | | 7,787 | | | | 614,394 |

| Tyco International, Ltd. | | | | 117,815 | | | | 3,360,084 |

| |

|

| | | | | | | | | 29,512,554 |

| |

|

| Machinery 1.4% | | | | | | | | |

| Caterpillar, Inc. | | | | 39,397 | | | | 2,276,359 |

| Cummins, Inc. | | | | 2,706 | | | | 240,834 |

| Danaher Corp. | | | | 13,833 | | | | 767,731 |

| Deere & Co. | | | | 14,040 | | | | 973,674 |

| Dover Corp. | | | | 11,788 | | | | 476,825 |

| Eaton Corp. | | | | 8,581 | | | | 546,781 |

| Illinois Tool Works, Inc. | | | | 12,153 | | | | 1,072,745 |

| Ingersoll-Rand Co., Ltd., Class A | | | | 19,636 | | | | 778,175 |

| ITT Industries, Inc. | | | | 5,397 | | | | 586,978 |

| Navistar International Corp. * | | | | 3,591 | | | | 101,877 |

| Paccar, Inc. | | | | 9,980 | | | | 717,163 |

| Pall Corp. | | | | 7,241 | | | | 201,010 |

| Parker Hannifin Corp. | | | | 6,967 | | | | 476,612 |

| |

|

| | | | | | | | | 9,216,764 |

| |

|

| Road & Rail 0.6% | | | | | | | | |

| Burlington Northern Santa Fe Corp. | | | | 21,739 | | | | 1,438,687 |

| CSX Corp. | | | | 12,630 | | | | 614,323 |

| Norfolk Southern Corp. | | | | 23,549 | | | | 1,041,808 |

| Union Pacific Corp. | | | | 15,355 | | | | 1,175,272 |

| |

|

| | | | | | | | | 4,270,090 |

| |

|

| Trading Companies & Distributors 0.0% | | | | | | |

| W.W. Grainger, Inc. | | | | 4,409 | | | | 309,644 |

| |

|

| INFORMATION TECHNOLOGY 15.4% | | | | | | |

| Communications Equipment 2.8% | | | | | | |

| ADC Telecommunications, Inc. * | | | | 6,782 | | | | 138,556 |

| Andrew Corp. * | | | | 9,457 | | | | 103,365 |

| Avaya, Inc. * | | | | 24,689 | | | | 294,293 |

| Ciena Corp. * | | | | 33,645 | | | | 100,598 |

| Cisco Systems, Inc. * | | | | 372,018 | | | | 6,525,196 |

| Comverse Technology, Inc. * | | | | 11,718 | | | | 307,129 |

| Corning, Inc. * | | | | 85,693 | | | | 1,735,283 |

| JDS Uniphase Corp. * | | | | 95,942 | | | | 246,571 |

| Lucent Technologies, Inc. * | | | | 258,746 | | | | 721,901 |

| Motorola, Inc. | | | | 143,730 | | | | 3,462,456 |

| QUALCOMM, Inc. | | | | 94,911 | | | | 4,315,603 |

| Scientific-Atlanta, Inc. | | | | 8,918 | | | | 377,410 |

| Tellabs, Inc. * | | | | 26,050 | | | | 267,273 |

| |

|

| | | | | | | | | 18,595,634 |

| |

|

| Computers & Peripherals 3.8% | | | | | | |

| Apple Computer, Inc. * | | | | 48,306 | | | | 3,276,113 |

| Dell, Inc. * | | | | 139,561 | | | | 4,209,160 |

| EMC Corp. * | | | | 140,329 | | | | 1,954,783 |

| Gateway, Inc. * | | | | 15,341 | | | | 46,637 |

See Combined Notes to Financial Statements

SCHEDULE OF INVESTMENTS continued

Market Index Fund

November 30, 2005 (unaudited)

| Hewlett-Packard Co. | | | | 166,778 | | $ | | 4,948,303 |

| International Business Machines Corp. | | | | 92,895 | | | | 8,258,366 |

| Lexmark International, Inc., Class A * | | | | 6,911 | | | | 329,102 |

| NCR Corp. * | | | | 10,816 | | | | 367,203 |

| Network Appliance, Inc. * | | | | 21,418 | | | | 623,692 |

| QLogic Corp. * | | | | 4,684 | | | | 154,853 |

| Sun Microsystems, Inc. * | | | | 198,507 | | | | 748,371 |

| |

|

| | | | | | | | | 24,916,583 |

| |

|

| Electronic Equipment & Instruments 0.3% | | | | | | | | |

| Agilent Technologies, Inc. * | | | | 28,767 | | | | 1,025,831 |

| Jabil Circuit, Inc. * | | | | 10,011 | | | | 331,564 |

| Molex, Inc. | | | | 8,436 | | | | 226,001 |

| Sanmina-SCI Corp. * | | | | 30,598 | | | | 126,676 |

| Solectron Corp. * | | | | 56,597 | | | | 203,183 |

| Symbol Technologies, Inc. | | | | 14,148 | | | | 161,712 |

| Tektronix, Inc. | | | | 4,919 | | | | 125,877 |

| |

|

| | | | | | | | | 2,200,844 |

| |

|

| Internet Software & Services 0.4% | | | | | | | | |

| Yahoo!, Inc. * | | | | 72,997 | | | | 2,936,669 |

| |

|

| IT Services 1.1% | | | | | | | | |

| Affiliated Computer Services, Inc., Class A * | | | | 7,312 | | | | 407,863 |

| Automatic Data Processing, Inc. | | | | 33,775 | | | | 1,587,425 |

| Computer Sciences Corp. * | | | | 10,757 | | | | 540,324 |

| Convergys Corp. * | | | | 8,153 | | | | 135,340 |

| Electronic Data Systems Corp. | | | | 30,209 | | | | 696,317 |

| First Data Corp. | | | | 44,914 | | | | 1,943,429 |

| Fiserv, Inc. * | | | | 10,951 | | | | 498,380 |

| Paychex, Inc. | | | | 19,387 | | | | 822,203 |

| Sabre Holdings Corp., Class A | | | | 7,633 | | | | 174,567 |

| Unisys Corp. * | | | | 19,824 | | | | 121,918 |

| |

|

| | | | | | | | | 6,927,766 |

| |

|

| Office Electronics 0.1% | | | | | | | | |

| Xerox Corp. * | | | | 55,854 | | | | 793,127 |

| |

|

| Semiconductors & Semiconductor Equipment 3.3% | | | | | | |

| Advanced Micro Devices, Inc. * | | | | 23,189 | | | | 607,088 |

| Altera Corp. * | | | | 21,688 | | | | 396,023 |

| Analog Devices, Inc. | | | | 21,679 | | | | 822,068 |

| Applied Materials, Inc. | | | | 94,449 | | | | 1,710,471 |

| Applied Micro Circuits Corp. * | | | | 17,782 | | | | 46,945 |

| Broadcom Corp., Class A * | | | | 16,456 | | | | 765,862 |

| Freescale Semiconductor, Inc., Class B * | | | | 23,582 | | | | 608,416 |

| Intel Corp. | | | | 354,689 | | | | 9,463,103 |

| KLA-Tencor Corp. | | | | 11,502 | | | | 588,787 |

| Linear Technology Corp. | | | | 17,859 | | | | 666,319 |

| LSI Logic Corp. * | | | | 22,745 | | | | 186,737 |

| Maxim Integrated Products, Inc. | | | | 19,088 | | | | 697,666 |

| Micron Technology, Inc. * | | | | 35,867 | | | | 511,463 |

| National Semiconductor Corp. | | | | 19,982 | | | | 517,134 |

| Novellus Systems, Inc. * | | | | 8,068 | | | | 199,038 |

| NVIDIA Corp. * | | | | 9,820 | | | | 355,189 |

| PMC-Sierra, Inc. * | | | | 10,609 | | | | 83,493 |

| Teradyne, Inc. * | | | | 11,453 | | | | 167,557 |

See Combined Notes to Financial Statements

SCHEDULE OF INVESTMENTS continued

Market Index Fund

November 30, 2005 (unaudited)

| Texas Instruments, Inc. | | | | 94,482 | | $ | | 3,068,775 |

| Xilinx, Inc. | | | | 20,345 | | | | 537,922 |

| |

|

| | | | | | | | | 22,000,056 |

| |

|

| Software 3.6% | | | | | | | | |

| Adobe Systems, Inc. | | | | 28,617 | | | | 933,200 |

| Autodesk, Inc. | | | | 13,296 | | | | 554,709 |

| BMC Software, Inc. * | | | | 12,687 | | | | 259,957 |

| Citrix Systems, Inc. * | | | | 9,918 | | | | 269,174 |

| Computer Associates International, Inc. | | 26,971 | | | | 768,943 |

| Compuware Corp. * | | | | 22,590 | | | | 208,506 |

| Electronic Arts, Inc. * | | | | 17,669 | | | | 995,825 |

| Intuit, Inc. * | | | | 10,551 | | | | 565,217 |

| Mercury Interactive Corp. * | | | | 5,041 | | | | 140,140 |

| Microsoft Corp. | | | | 536,308 | | | | 14,861,095 |

| Novell, Inc. * | | | | 22,237 | | | | 173,004 |

| Oracle Corp. * | | | | 219,538 | | | | 2,759,593 |

| Parametric Technology Corp. * | | 15,852 | | | | 92,734 |

| Siebel Systems, Inc. * | | | | 30,406 | | | | 319,263 |

| Symantec Corp. * | | | | 62,956 | | | | 1,112,432 |

| |

|

| | | | | | | | | 24,013,792 |

| |

|

| MATERIALS 3.0% | | | | | | | | |

| Chemicals 1.5% | | | | | | | | |

| Air Products & Chemicals, Inc. | | 12,905 | | | | 763,589 |

| Ashland, Inc. | | | | 4,319 | | | | 240,784 |

| Dow Chemical Co. | | | | 56,151 | | | | 2,540,833 |

| E.I. DuPont de Nemours & Co. | | 53,500 | | | | 2,287,125 |

| Eastman Chemical Co. | | | | 4,743 | | | | 262,430 |

| Ecolab, Inc. | | | | 10,719 | | | | 356,621 |

| Engelhard Corp. | | | | 6,993 | | | | 206,293 |

| Hercules, Inc. * | | | | 6,565 | | | | 77,204 |

| International Flavors & Fragrances, Inc. | | 4,753 | | | | 154,663 |

| Monsanto Co. | | | | 15,638 | | | | 1,145,796 |

| PPG Industries, Inc. | | | | 9,890 | | | | 600,620 |

| Praxair, Inc. | | | | 18,821 | | | | 978,692 |

| Rohm & Haas Co. | | | | 8,462 | | | | 370,636 |

| Sigma-Aldrich Corp. | | | | 3,929 | | | | 259,471 |

| |

|

| | | | | | | | | 10,244,757 |

| |

|

| Construction Materials 0.1% | | | | | | |

| Vulcan Materials Co. | | | | 5,955 | | | | 397,199 |

| |

|

| Containers & Packaging 0.2% | | | | | | |

| Ball Corp. | | | | 6,353 | | | | 261,871 |

| Bemis Co., Inc. | | | | 6,223 | | | | 171,444 |

| Pactiv Corp. * | | | | 8,718 | | | | 176,452 |

| Sealed Air Corp. * | | | | 4,824 | | | | 249,449 |

| Temple-Inland, Inc. | | | | 6,577 | | | | 275,379 |

| |

|

| | | | | | | | | 1,134,595 |

| |

|

| Metals & Mining 0.7% | | | | | | | | |

| Alcoa, Inc. | | | | 50,785 | | | | 1,392,017 |

| Allegheny Technologies, Inc. | | | | 4,897 | | | | 161,503 |

| Freeport-McMoRan Copper & Gold, Inc., Class B | | 10,324 | | | | 537,984 |

| Newmont Mining Corp. | | | | 25,975 | | | | 1,197,967 |

See Combined Notes to Financial Statements

SCHEDULE OF INVESTMENTS continued

Market Index Fund

November 30, 2005 (unaudited)

| NuCor Corp. | | | | 9,095 | | $ | | 610,092 |

| Phelps Dodge Corp. | | | | 5,644 | | | | 765,721 |

| United States Steel Corp. | | | | 6,651 | | | | 316,588 |

| |

|

| | | | | | | | | 4,981,872 |

| |

|

| Paper & Forest Products 0.5% | | | | | | | | |

| Georgia-Pacific Corp. | | | | 15,148 | | | | 716,349 |

| International Paper Co. | | | | 28,553 | | | | 900,276 |

| Louisiana-Pacific Corp. | | | | 6,453 | | | | 174,037 |

| MeadWestvaco Corp. | | | | 10,711 | | | | 299,801 |

| Weyerhaeuser Co. | | | | 14,260 | | | | 945,581 |

| |

|

| | | | | | | | | 3,036,044 |

| |

|

| TELECOMMUNICATION SERVICES 3.1% | | | | | | | | |

| Diversified Telecommunication Services 2.4% | | | | | | | | |

| Alltel Corp. | | | | 22,225 | | | | 1,485,297 |

| AT&T Inc. | | | | 228,720 | | | | 5,697,404 |

| BellSouth Corp. | | | | 106,666 | | | | 2,907,715 |

| CenturyTel, Inc. | | | | 7,565 | | | | 250,402 |

| Citizens Communications Co. | | | | 19,977 | | | | 260,700 |

| Qwest Communications International, Inc. * | | | | 88,777 | | | | 465,191 |

| Verizon Communications, Inc. | | | | 160,969 | | | | 5,147,789 |

| |

|

| | | | | | | | | 16,214,498 |

| |

|

| Wireless Telecommunication Services 0.7% | | | | | | | | |

| Sprint Nextel Corp. | | | | 170,739 | | | | 4,275,304 |

| |

|

| UTILITIES 3.3% | | | | | | | | |

| Electric Utilities 1.6% | | | | | | | | |

| Allegheny Energy, Inc. * | | | | 9,474 | | | | 263,661 |

| American Electric Power Co., Inc. | | | | 22,888 | | | | 836,328 |

| Cinergy Corp. | | | | 11,577 | | | | 475,583 |

| Edison International | | | | 18,966 | | | | 855,746 |

| Entergy Corp. | | | | 12,084 | | | | 845,880 |

| Exelon Corp. | | | | 39,035 | | | | 2,031,381 |

| FirstEnergy Corp. | | | | 19,201 | | | | 901,679 |

| FPL Group, Inc. | | | | 22,937 | | | | 972,299 |

| Pinnacle West Capital Corp. | | | | 5,749 | | | | 238,526 |

| PPL Corp. | | | | 22,092 | | | | 649,505 |

| Progress Energy, Inc. | | | | 14,625 | | | | 654,908 |

| Southern Co. | | | | 43,474 | | | | 1,508,983 |

| |

|

| | | | | | | | | 10,234,479 |

| |

|

| Gas Utilities 0.0% | | | | | | | | |

| Nicor, Inc. | | | | 2,570 | | | | 103,057 |

| Peoples Energy Corp. | | | | 2,220 | | | | 79,765 |

| |

|

| | | | | | | | | 182,822 |

| |

|

| Independent Power Producers & Energy Traders 0.6% | | | | | | |

| AES Corp. * | | | | 38,023 | | | | 599,623 |

| Calpine Corp. * | | | | 33,063 | | | | 16,862 |

| Constellation Energy Group, Inc. | | | | 10,361 | | | | 549,029 |

| Duke Energy Corp. | | | | 53,927 | | | | 1,448,479 |

| Dynegy, Inc., Class A * | | | | 16,675 | | | | 79,873 |

See Combined Notes to Financial Statements

SCHEDULE OF INVESTMENTS continued

Market Index Fund

November 30, 2005 (unaudited)

| TXU Corp. | | 13,974 | | $ 1,434,152 |

| |

|

| | | | | 4,128,018 |

| |

|

| Multi- Utilities 1.1% | | | | |

| Ameren Corp. | | 11,862 | | 622,281 |

| CenterPoint Energy, Inc. | | 18,020 | | 238,224 |

| CMS Energy Corp. * | | 12,764 | | 178,441 |

| Consolidated Edison, Inc. | | 14,224 | | 647,761 |

| Dominion Resources, Inc. | | 19,838 | | 1,506,696 |

| DTE Energy Co. | | 10,352 | | 451,761 |

| KeySpan Corp. | | 10,145 | | 340,466 |

| NiSource, Inc. | | 15,862 | | 341,509 |

| PG&E Corp. | | 21,716 | | 798,715 |

| Public Service Enterprise Group, Inc. | | 13,914 | | 872,686 |

| Sempra Energy | | 14,911 | | 655,338 |

| TECO Energy, Inc. | | 12,100 | | 211,629 |

| Xcel Energy, Inc. | | 23,445 | | 433,967 |

| |

|

| | | | | 7,299,474 |

| |

|

| Total Common Stocks (cost $477,161,464) | | | | 657,661,711 |

| |

|

| | | Principal | | |

| SHORT-TERM INVESTMENTS 0.7% | | Amount | | Value |

| U.S. TREASURY OBLIGATIONS 0.1% | | | �� | |

| U.S. Treasury Bills, 3.98%, 02/09/2006 ƒ + | | $ 500,000 | | 496,223 |

| | | Shares | | Value |

| MUTUAL FUND SHARES 0.6% | | | | |

| Evergreen Institutional Money Market Fund ø | | 3,874,514 | | 3,874,514 |

| |

|

| Total Short-Term Investments (cost $4,370,737) | | | | 4,370,737 |

| |

|

| Total Investments (cost $481,532,201) 99.8% | | | | 662,032,448 |

| Other Assets and Liabilities 0.2% | | | | 1,466,928 |

| |

|

| Net Assets 100.0% | | | | $ 663,499,376 |

| |

|

| * | | Non-income producing security |

| ° | | Investment in non-controlled affiliate. The Fund owns shares of Wachovia Corporation with a cost basis of $3,113,610 |

| | | at November 30, 2005. The Fund earned $99,703 of income from Wachovia Corporation during the six months ended |

| | | November 30, 2005, which is included in income from affiliates. |

| ƒ | | All or a portion of this security was pledged to cover initial margin requirements for open futures contracts. |

| + | | Rate shown represents the yield to maturity at date of purchase. |

| ø | | Evergreen Investment Management Co mpany, LLC is the investment advisor to both the Fund and the money market |

| | | fund. |

| |

| Summary of Abbreviations |

| REIT | | Real Estate Investment Trust |

See Combined Notes to Financial Statements

SCHEDULE OF INVESTMENTS continued

Market Index Fund

November 30, 2005 (unaudited)

| The following table shows the percent of total long-term investments by sector as of November 30, 2005: |

| Financials | | 21.2% | |

| Information Technology | | 15.6% | |

| Health Care | | 12.8% | |

| Industrials | | 11.3% | |

| Consumer Discretionary | | 10.9% | |

| Consumer Staples | | 9.5% | |

| Energy | | 9.3% | |

| Utilities | | 3.3% | |

| Telecommunication Services | | 3.1% | |

| Materials | | 3.0% | |

| |

| |

| | | 100.0% | |

| |

| |

See Combined Notes to Financial Statements

SCHEDULE OF INVESTMENTS

Market Index Growth Fund

November 30, 2005 (unaudited)

| | | | | Shares | | | | Value |

|

| COMMON STOCKS 99.4% | | | | | | | | |

| CONSUMER DISCRETIONARY 14.6% | | | | | | |

| Auto Components 0.1% | | | | | | | | |

| Autoliv, Inc. | | | | 2,131 | | $ | | 93,253 |

| BorgWarner, Inc. | | | | 2,417 | | | | 145,020 |

| Gentex Corp. | | | | 22,025 | | | | 414,731 |

| Goodyear Tire & Rubber Co. * | | | | 10,571 | | | | 181,081 |

| Johnson Controls, Inc. | | | | 5,099 | | | | 354,125 |

| |

|

| | | | | | | | | 1,188,210 |

| |

|

| Automobiles 0.3% | | | | | | | | |

| Harley-Davidson, Inc. | | | | 40,202 | | | | 2,165,280 |

| |

|

| Diversified Consumer Services 0.5% | | | | | | |

| Apollo Group, Inc., Class A * | | | | 20,265 | | | | 1,442,868 |

| Career Education Corp. * | | | | 14,507 | | | | 541,111 |

| Education Management Corp. * | | | | 10,495 | | | | 354,206 |

| H&R Block, Inc. | | | | 46,677 | | | | 1,140,786 |

| ITT Educational Services, Inc. * | | | | 6,520 | | | | 400,132 |

| Laureate Education, Inc. * | | | | 6,307 | | | | 318,945 |

| ServiceMaster Co. | | | | 25,117 | | | | 299,144 |

| Weight Watchers International, Inc. * | | | | 5,450 | | | | 260,510 |

| |

|

| | | | | | | | | 4,757,702 |

| |

|

| Hotels, Restaurants & Leisure 2.0% | | | | | | |

| Applebee's International, Inc. | | | | 11,457 | | | | 262,594 |

| Boyd Gaming Corp. | | | | 5,965 | | | | 288,587 |

| Brinker International, Inc. | | | | 12,529 | | | | 497,151 |

| CBRL Group, Inc. | | | | 3,208 | | | | 118,664 |

| Cheesecake Factory, Inc. * | | | | 11,027 | | | | 404,029 |

| Choice Hotels International, Inc. | | | | 4,308 | | | | 156,079 |

| Darden Restaurants, Inc. | | | | 22,125 | | | | 791,633 |

| GTECH Holdings Corp. | | | | 17,666 | | | | 540,580 |

| Harrah's Entertainment, Inc. | | | | 16,100 | | | | 1,096,249 |

| Hilton Hotels Corp. | | | | 53,929 | | | | 1,182,124 |

| International Game Technology | | | | 48,550 | | | | 1,424,942 |

| International Speedway Corp., Class A | | 553 | | | | 30,177 |

| Las Vegas Sands Corp. * | | | | 3,351 | | | | 139,770 |

| Marriott International, Inc., Class A | | | | 24,837 | | | | 1,604,719 |

| MGM MIRAGE * | | | | 17,057 | | | | 650,042 |

| Outback Steakhouse, Inc. | | | | 8,307 | | | | 334,606 |

| Panera Bread Co., Class A * | | | | 3,812 | | | | 259,216 |

| Penn National Gaming, Inc. * | | | | 9,566 | | | | 317,304 |

| Scientific Games Corp., Class A * | | | | 8,494 | | | | 240,635 |

| Sonic Corp. * | | | | 8,524 | | | | 252,225 |

| Starbucks Corp. * | | | | 110,098 | | | | 3,352,484 |

| Starwood Hotels & Resorts Worldwide, Inc., Class B | | 18,771 | | | | 1,135,645 |

| Station Casinos, Inc. | | | | 7,863 | | | | 545,220 |

| Wendy's International, Inc. | | | | 8,376 | | | | 425,333 |

| Wynn Resorts, Ltd. * | | | | 6,744 | | | | 376,518 |

| Yum! Brands, Inc. | | | | 40,920 | | | | 1,996,487 |

| |

|

| | | | | | | | | 18,423,013 |

| |

|

See Combined Notes to Financial Statements

SCHEDULE OF INVESTMENTS continued

Market Index Growth Fund

November 30, 2005 (unaudited)

| Household Durables 1.0% | | | | | | |

| Beazer Homes USA, Inc. | | 2,476 | | $ | | 173,246 |

| Black & Decker Corp. | | 6,227 | | | | 546,793 |

| Centex Corp. | | 9,455 | | | | 679,342 |

| D.R. Horton, Inc. | | 27,964 | | | | 991,044 |

| Fortune Brands, Inc. | | 20,541 | | | | 1,601,376 |

| Harman International Industries, Inc. | | 9,512 | | | | 927,420 |

| Hovnanian Enterprises, Inc., Class A * | | 4,738 | | | | 236,142 |

| KB Home | | 9,496 | | | | 662,536 |

| Leggett & Platt, Inc. | | 7,391 | | | | 173,541 |

| Lennar Corp., Class A | | 10,904 | | | | 628,943 |

| M.D.C Holdings, Inc. | | 2,829 | | | | 192,740 |

| Mohawk Industries, Inc. * | | 1,707 | | | | 150,182 |

| Newell Rubbermaid, Inc. | | 6,959 | | | | 160,544 |

| NVR, Inc. * | | 761 | | | | 522,997 |

| Ryland Group, Inc. | | 5,276 | | | | 377,445 |

| Standard Pacific Corp. | | 1,216 | | | | 45,831 |

| Stanley Works | | 7,612 | | | | 365,376 |

| Tempur-Pedic International, Inc. * | | 6,072 | | | | 68,917 |

| Toll Brothers, Inc. * | | 14,974 | | | | 515,105 |

| |

|

| | | | | | | 9,019,520 |

| |

|

| Internet & Catalog Retail 1.1% | | | | | | |

| Amazon.com, Inc. * | | 43,115 | | | | 2,089,353 |

| eBay, Inc. * | | 153,834 | | | | 6,893,302 |

| Expedia, Inc. * | | 13,941 | | | | 345,597 |

| IAC/InterActiveCorp * | | 13,941 | | | | 384,911 |

| |

|

| | | | | | | 9,713,163 |

| |

|