| OMB APPROVAL |

OMB Number: 3235-0570 Expires: September 30, 2007 Estimated average burden hours per response: 19.4 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08413

Evergreen Equity Trust

_____________________________________________________________

(Exact name of registrant as specified in charter)

200 Berkeley Street Boston, Massachusetts 02116

_____________________________________________________________

(Address of principal executive offices) (Zip code)

Michael H. Koonce, Esq. 200 Berkeley Street Boston, Massachusetts 02116

____________________________________________________________

(Name and address of agent for service)

Registrant's telephone number, including area code: (617) 210-3200

Date of fiscal year end: Registrant is making a semi-annual filing for seven of its series, Evergreen Disciplined Small-Mid Value Fund, Evergreen Disciplined Value Fund, Evergreen Equity Income Fund, Evergreen Fundamental Large Cap Fund, Evergreen Large Cap Value Fund, Evergreen Small Cap Value Fund and Evergreen Special Values Fund, for the six months ended January 31, 2006. These seven series have a July 31 fiscal year end.

Date of reporting period: January 31, 2006

Item 1 - Reports to Stockholders.

Evergreen Disciplined Small-Mid Value Fund

| table of contents | ||

| 1 | LETTER TO SHAREHOLDERS | |

| 4 | FUND AT A GLANCE | |

| 5 | ABOUT YOUR FUND’S EXPENSES | |

| 6 | FINANCIAL HIGHLIGHTS | |

| 8 | SCHEDULE OF INVESTMENTS | |

| 14 | STATEMENT OF ASSETS AND LIABILITIES | |

| 15 | STATEMENT OF OPERATIONS | |

| 16 | STATEMENT OF CHANGES IN NET ASSETS | |

| 17 | NOTES TO FINANCIAL STATEMENTS | |

| 22 | ADDITIONAL INFORMATION | |

| 24 | TRUSTEES AND OFFICERS |

This semiannual report must be preceded or accompanied by a prospectus of the Evergreen fund contained herein. The prospectus contains more complete information, including fees and expenses, and should be read carefully before investing or sending money.

The fund will file its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q will be available on the SEC’s Web site at http://www.sec.gov. In addition, the fund’s Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 800.SEC.0330.

A description of the fund’s proxy voting policies and procedures, as well as information regarding how the fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available by visiting our Web site at EvergreenInvestments.com or by visiting the SEC’s Web site at http://www.sec.gov. The fund’s proxy voting policies and procedures are also available without charge, upon request, by calling 800.343.2898.

| Mutual Funds: | ||||

| NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED |

Evergreen InvestmentsSM is a service mark of Evergreen Investment Management Company, LLC.

Copyright 2006, Evergreen Investment Management Company, LLC.

Evergreen Investment Management Company, LLC is a subsidiary of Wachovia Corporation

and is an affiliate of Wachovia Corporation's other Broker Dealer subsidiaries.

Evergreen mutual funds are distributed by Evergreen Investment Services, Inc.

200 Berkeley Street, Boston, MA 02116

LETTER TO SHAREHOLDERS

March 2006

Dennis H. Ferro

President and Chief Executive Officer

Dear Shareholder,

We are pleased to provide the semiannual report for the Evergreen Disciplined Small-Mid Value Fund, which covers the two-month period ended January 31, 2006.

The past months proved to be yet another challenging period for the equity markets. Uncertainty about the economy, monetary policy, and energy prices led to concerns about corporate profits and inflation. Geopolitical tensions continued and the Gulf region suffered enormous damage from the hurricanes. Not surprisingly, each of these issues converged at various times to increase market volatility. Fortunately, as the investment period progressed, the economy proved resilient and earnings continued to exceed expectations. By focusing on the solid fundamentals supporting growth, rather than the periodic bouts of volatility, Evergreen’s equity teams were able to provide our clients in these uncertain times with the disciplined approach necessary for the management of their long-term portfolios.

The investment period began with expectations for a moderation in U.S. economic growth. After all, the rapid pace of growth experienced during the recovery had transitioned to the more normalized Gross Domestic Product (“GDP”) levels typically associated with economic expansion. Energy prices continued to soar amid rising levels for employment, housing and production. The post-Katrina federal spending plans exacerbated pricing concerns and long-term interest rates began to rise. Despite these events, the U.S. consumer kept spending and businesses were investing some of their record cash balances, enabling the economy to overcome some extremely challenging obstacles in the waning months of 2005.

1

LETTER TO SHAREHOLDERS continued

Perhaps recognizing the strength in GDP and the attendant inflation fears, the Federal Reserve (“Fed”) maintained its “measured removal of policy accommodation” and continued to raise their target for the federal funds rate by 25 basis points at the conclusion of each policy meeting. Since rates had been low for such a lengthy period, Evergreen’s Investment Strategy Committee concluded that the central bank was simply attempting to remove stimulus, rather than restrict growth, for the U.S. economy. Fed Chairman Alan Greenspan remained very transparent in his public statements about the direction of monetary policy and long-term market interest rates responded, once again, by moving lower. Yet the extent of the yield curve’s flattening had many on Wall Street debating its meaning. Given our forecast for more moderate levels of growth in consumption and investment supporting a sustainable expansion, we viewed the yield curve’s message as confidence in the Fed’s ability to prevent long-term inflation. In addition, higher oil prices would likely serve to dampen output and we believed the absence of significant wage pressures would enable the Fed to continue on its measured path for monetary policy.

Low long-term market yields improved the relative attractiveness of equities during the investment period. The solid growth in GDP translated into better than expected profits, further supporting equities, especially during their late 2005 rally. Throughout it all, our equity analysts continued to identify companies with promising outlooks consistent with their investment styles. Positive earnings growth, solid balance sheets and strong cash flows attracted the most attention from our portfolio managers, while the improving trend for dividends enhanced the potential for total return in many of our equity portfolios.

2

LETTER TO SHAREHOLDERS continued

As always, we continue to recommend a fully diversified, long-term approach for equity investors.

Please visit our Web site, EvergreenInvestments.com, for more information about our funds and other investment products available to you. Thank you for your continued support of Evergreen Investments.

Sincerely,

Dennis H. Ferro

President and Chief Executive Officer

Evergreen Investment Company, Inc.

Special Notice to Shareholders:

Please visit our Web site at EvergreenInvestments.com for a statement from President and Chief Executive Officer, Dennis Ferro, addressing NASD actions involving Evergreen Investment Services, Inc. (EIS), Evergreen’s mutual fund distributor or statements from Dennis Ferro and Chairman of the Board of the Evergreen funds, Michael S. Scofield, addressing SEC actions involving the Evergreen funds.

3

FUND AT A GLANCE

as of January 31, 2006

MANAGEMENT TEAM

Investment Advisor:

• Evergreen Investment Management Company, LLC

Portfolio Manager:

• William E. Zieff

PERFORMANCE AND RETURNS

Portfolio inception date: 12/14/2005

| Class A | Class I | |||

| Class inception date | 12/14/2005 | 12/14/2005 | ||

| Nasdaq symbol | EDASX | EDISX | ||

| Cumulative return | ||||

| Since portfolio inception with sales charge | -1.79% | N/A | ||

| Since portfolio inception w/o sales charge | 4.20% | 4.20% | ||

| Maximum sales charge | 5.75% | N/A | ||

| Front-end | ||||

Past performance is no guarantee of future results. The performance quoted represents past performance and current performance may be lower or higher. The investment return and principal value of an investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance information current to the most recent month-end for Class I, please go to EvergreenInvestments.com/fundperformance. Class A shares are not available for sale to the public. The performance of each class may vary based on differences in loads, fees and expenses paid by the shareholders investing in each class. Performance includes the reinvestment of income dividends and capital gain distributions. Performance shown does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The fund incurs a 12b-1 fee of 0.30% for Class A. Class I does not pay a 12b-1 fee.

The advisor is waiving its advisory fee and reimbursing the fund for a portion of other expenses and a portion of the 12b-1 fee for Class A. Had the fees and expenses not been waived or reimbursed, returns would have been lower.

Class I shares are only offered in the following manner: (1) to investment advisory clients of Evergreen Investment Management Company, LLC (or its advisory affiliates) when purchased by such advisor(s) on behalf of its clients, (2) through arrangements entered into on behalf of the Evergreen funds with certain financial services firms, (3) to certain institutional investors and (4) to persons who owned Class Y shares in registered name in an Evergreen fund on or before December 31, 1994 or who owned shares of any SouthTrust fund in registered name as of March 18, 2005 or shares of Vestaur Securities Fund as of May 20, 2005.

Class I shares are only available to institutional shareholders with a minimum of $1 million investment, which may be waived in certain situations.

The fund’s investment objective is nonfundamental and may be changed without a vote of the fund’s shareholders.

Mid-cap securities may be subject to special risks associated with narrower product lines and limited financial resources than compared to their large-cap counterparts and, as a result, mid-cap securities may decline significantly in market downturns.

Smaller capitalization stock investing may offer the potential for greater long-term results; however, it is also generally associated with greater price volatility due to the higher risk of failure.

Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

Performance results are extremely short term, and may not provide an adequate basis for evaluating a fund’s performance over varying market conditions or economic cycles. Unusual investment returns may be a result of a fund’s recent inception, existing market and economic conditions and the increased potential of a small number of stocks affecting fund performance due to the smaller asset size. Most mutual funds are intended to be long-term investments.

All data is as of January 31, 2006, and subject to change.

4

ABOUT YOUR FUND’S EXPENSES

The Example below is intended to describe the fees and expenses borne by shareholders and the impact of those costs on your investment.

Example

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads), redemption fees and exchange fees; and (2) ongoing costs, including management fees, distribution (12b-1) fees and other fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The actual expense Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from December 14, 2005 to January 31, 2006. The hypothetical expense Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from August 1, 2005 to January 31, 2006.

The example illustrates your fund’s costs in two ways:

• Actual expenses

The section in the table under the heading “Actual” provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the appropriate column for your share class, in the column entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

• Hypothetical example for comparison purposes

The section in the table under the heading “Hypothetical (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the section in the table under the heading “Hypothetical (5% return before expenses)” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Ending | ||||||

| Beginning | Account | Expenses | ||||

| Account | Value | Paid During | ||||

| Value | 1/31/2006 | Period | ||||

| Actual | ||||||

| Class A | $ 1,000.00 | $ 1,042.00 | $1.37* | |||

| Class I | $ 1,000.00 | $ 1,042.00 | $1.24* | |||

| Hypothetical | ||||||

| (5% return | ||||||

| before expenses) | ||||||

| Class A | $ 1,000.00 | $ 1,020.06 | $5.19** | |||

| Class I | $ 1,000.00 | $ 1,020.57 | $4.69** | |||

* For each class of the Fund, expenses are equal to the annualized expense ratio of each class (1.02% for Class A and 0.92% for Class I), multiplied by the average account value over the period, multiplied by 48 / 365 days.

**For each class of the Fund, expenses are equal to the annualized expense ratio of each class (1.02% for Class A and 0.92% for Class I), multiplied by the average account value over the period, multiplied by 184 / 365 days.

5

FINANCIAL HIGHLIGHTS

(For a share outstanding throughout the period)

| Period Ended | ||||

| January 31, 2006 | ||||

| CLASS A | (unaudited)1 | |||

| Net asset value, beginning of period | $10.00 | |||

| Income from investment operations | ||||

| Net investment income (loss) | 0.02 | |||

| Net realized and unrealized gains or losses on investments | 0.40 | |||

| Total from investment operations | 0.42 | |||

| Net asset value, end of period | $10.42 | |||

| Total return2 | 4.20% | |||

| Ratios and supplemental data | ||||

| Net assets, end of period (thousands) | $ | 1 | ||

| Ratios to average net assets | ||||

| Expenses including waivers/reimbursements but excluding expense reductions | 1.02%3 | |||

| Expenses excluding waivers/reimbursements and expense reductions | 3.01%3 | |||

| Net investment income (loss) | 1.35%3 | |||

| Portfolio turnover rate | 4% | |||

1 For the period from December 14, 2005 (commencement of operations), to January 31, 2006.

2 Excluding applicable sales charges

3 Annualized

See Notes to Financial Statements

6

FINANCIAL HIGHLIGHTS

(For a share outstanding throughout the period)

| Period Ended | ||

| January 31, 2006 | ||

| CLASS I | (unaudited)1 | |

| Net asset value, beginning of period | $10.00 | |

| Income from investment operations | ||

| Net investment income (loss) | 0.02 | |

| Net realized and unrealized gains or losses on investments | 0.40 | |

| Total from investment operations | 0.42 | |

| Net asset value, end of period | $10.42 | |

| Total return | 4.20% | |

| Ratios and supplemental data | ||

| Net assets, end of period (thousands) | $5,217 | |

| Ratios to average net assets | ||

| Expenses including waivers/reimbursements but excluding expense reductions | 0.92%2 | |

| Expenses excluding waivers/reimbursements and expense reductions | 2.91%2 | |

| Net investment income (loss) | 1.47%2 | |

| Portfolio turnover rate | 4% | |

1 For the period from December 14, 2005 (commencement of operations), to January 31, 2006.

2 Annualized

See Notes to Financial Statements

7

SCHEDULE OF INVESTMENTS

January 31, 2006 (unaudited)

| Shares | Value | |||||||

| COMMON STOCKS 95.4% | ||||||||

| CONSUMER DISCRETIONARY 9.7% | ||||||||

| Auto Components 1.3% | ||||||||

| Goodyear Tire & Rubber Co. * | 2,875 | $ | 44,965 | |||||

| Modine Manufacturing Co. | 886 | 24,011 | ||||||

| 68,976 | ||||||||

| Hotels, Restaurants & Leisure 1.3% | ||||||||

| Domino’s Pizza, Inc. | 1,220 | 30,390 | ||||||

| IHOP Corp. | 815 | 40,074 | ||||||

| 70,464 | ||||||||

| Household Durables 0.6% | ||||||||

| Furniture Brands International, Inc. | 1,287 | 30,965 | ||||||

| Media 0.8% | ||||||||

| Catalina Marketing Corp. | 706 | 15,779 | ||||||

| Emmis Communications Corp. | 1,464 | 26,045 | ||||||

| 41,824 | ||||||||

| Multi-line Retail 0.8% | ||||||||

| Dillard’s, Inc., Class A | 1,526 | 39,523 | ||||||

| Specialty Retail 2.6% | ||||||||

| Barnes & Noble, Inc. | 901 | 38,220 | ||||||

| Gymboree Corp. | 1,379 | 33,979 | ||||||

| Payless ShoeSource, Inc. * | 1,732 | 42,192 | ||||||

| The Sports Authority, Inc. | 656 | 24,088 | ||||||

| 138,479 | ||||||||

| Textiles, Apparel & Luxury Goods 2.3% | ||||||||

| Kellwood Co. | 1,867 | 45,200 | ||||||

| Movado Group, Inc. | 1,087 | 20,534 | ||||||

| Skechers USA, Inc. | 1,418 | 27,438 | ||||||

| Steven Madden, Ltd. | 845 | 25,713 | ||||||

| 118,885 | ||||||||

| CONSUMER STAPLES 3.6% | ||||||||

| Food & Staples Retailing 1.5% | ||||||||

| Casey’s General Stores, Inc. | 2,292 | 58,331 | ||||||

| Longs Drug Stores Corp. | 618 | 21,624 | ||||||

| 79,955 | ||||||||

| Food Products 1.3% | ||||||||

| Del Monte Foods Co. * | 1,585 | 16,944 | ||||||

| Hain Celestial Group, Inc. | 1,308 | 30,490 | ||||||

| Pilgrim’s Pride Corp. | 836 | 20,348 | ||||||

| 67,782 | ||||||||

See Notes to Financial Statements

8

SCHEDULE OF INVESTMENTS continued

January 31, 2006 (unaudited)

| Shares | Value | |||||||||

| COMMON STOCKS continued | ||||||||||

| CONSUMER STAPLES continued | ||||||||||

| Household Products 0.8% | ||||||||||

| Energizer Holdings, Inc. * | 738 | $ | 39,933 | |||||||

| ENERGY 3.8% | ||||||||||

| Energy Equipment & Services 2.9% | ||||||||||

| Global Industries, Ltd. * | 2,363 | 33,082 | ||||||||

| Helmerich & Payne, Inc. | 773 | 60,572 | ||||||||

| Veritas DGC, Inc. * | 1,282 | 57,767 | ||||||||

| 151,421 | ||||||||||

| Oil, Gas & Consumable Fuels 0.9% | ||||||||||

| USEC, Inc. | 3,076 | 47,032 | ||||||||

| FINANCIALS 31.9% | ||||||||||

| Capital Markets 2.5% | ||||||||||

| Knight Capital Group, Inc. * | 2,591 | 29,512 | ||||||||

| Piper Jaffray Cos. * | 935 | 41,916 | ||||||||

| Raymond James Financial, Inc. | 1,325 | 56,392 | ||||||||

| 127,820 | ||||||||||

| Commercial Banks 2.4% | ||||||||||

| Commerce Bancshares, Inc. | 1,372 | 69,354 | ||||||||

| Community Trust Bancorp, Inc. | 1,154 | 40,598 | ||||||||

| Irwin Financial Corp. | 804 | 17,222 | ||||||||

| 127,174 | ||||||||||

| Consumer Finance 1.1% | ||||||||||

| Advanta Corp., Class B | 702 | 24,296 | ||||||||

| CompuCredit Corp. | 828 | 33,253 | ||||||||

| 57,549 | ||||||||||

| Insurance 5.8% | ||||||||||

| American Physicians Capital, Inc. * | 254 | 12,421 | ||||||||

| LandAmerica Financial Group, Inc. | 906 | 59,778 | ||||||||

| Phoenix Companies, Inc. | 2,377 | 35,869 | ||||||||

| Safety Insurance Group, Inc. | 575 | 23,057 | ||||||||

| Stewart Information Services Corp. * | 1,114 | 59,543 | ||||||||

| UICI | 1,581 | 57,754 | ||||||||

| Universal American Financial Group, Inc. | 1,478 | 55,602 | ||||||||

| 304,024 | ||||||||||

| Real Estate 10.0% | ||||||||||

| American Home Mortgage Investment Corp. | 1,357 | 38,810 | ||||||||

| Anthracite Capital, Inc. | 3,606 | 40,459 | ||||||||

| Capital Trust, Inc. | 489 | 15,159 | ||||||||

| Commercial Net Lease Realty, Inc. REIT | 3,125 | 71,656 | ||||||||

| Fieldstone Investment Corp. REIT | 2,853 | 35,549 | ||||||||

| Health Care Property Investors, Inc. REIT | 2,339 | 64,907 | ||||||||

See Notes to Financial Statements

9

SCHEDULE OF INVESTMENTS continued

January 31, 2006 (unaudited)

| Shares | Value | |||||

| COMMON STOCKS continued | ||||||

| FINANCIALS continued | ||||||

| Real Estate continued | ||||||

| HRPT Properties Trust REIT | 2,563 | $ | 27,501 | |||

| IMPAC Mortgage Holdings, Inc. | 2,397 | 20,950 | ||||

| LTC Properties, Inc. | 1,377 | 31,079 | ||||

| Nationwide Health Properties, Inc. | 2,947 | 67,398 | ||||

| NovaStar Financial, Inc. | 1,041 | 32,781 | ||||

| Rayonier, Inc. REIT | 1,733 | 74,086 | ||||

| 520,335 | ||||||

| Thrifts & Mortgage Finance 10.1% | ||||||

| Anchor Bancorp Wisconsin, Inc. | 1,601 | 49,839 | ||||

| Downey Financial Corp. | 637 | 41,711 | ||||

| FirstFed Financial Corp. | 1,063 | 66,650 | ||||

| Fremont General Corp. | 2,796 | 68,502 | ||||

| IndyMac Bancorp, Inc. | 1,684 | 68,808 | ||||

| MAF Bancorp, Inc. | 1,473 | 63,324 | ||||

| PMI Group, Inc. | 1,830 | 79,111 | ||||

| Radian Group, Inc. | 1,389 | 79,493 | ||||

| WSFS Financial Corp. | 169 | 10,672 | ||||

| 528,110 | ||||||

| HEALTH CARE 6.2% | ||||||

| Biotechnology 1.1% | ||||||

| Applera Corp. - Celera Genomics Group * | 4,627 | 54,414 | ||||

| Health Care Equipment & Supplies 1.6% | ||||||

| Bausch & Lomb, Inc. | 560 | 37,828 | ||||

| Varian, Inc. | 1,204 | 46,197 | ||||

| 84,025 | ||||||

| Health Care Providers & Services 1.2% | ||||||

| Health Net, Inc. * | 1,023 | 50,505 | ||||

| Per-Se Technologies, Inc. * | 563 | 14,002 | ||||

| 64,507 | ||||||

| Pharmaceuticals 2.3% | ||||||

| Alpharma, Inc. | 1,751 | 58,571 | ||||

| King Pharmaceuticals, Inc. * | 3,277 | 61,444 | ||||

| 120,015 | ||||||

| INDUSTRIALS 9.9% | ||||||

| Commercial Services & Supplies 1.2% | ||||||

| CBIZ, Inc. | 3,709 | 22,217 | ||||

| Spherion Corp. * | 3,633 | 40,689 | ||||

| 62,906 | ||||||

See Notes to Financial Statements

10

SCHEDULE OF INVESTMENTS continued

January 31, 2006 (unaudited)

| Shares | Value | |||||||||

| COMMON STOCKS continued | ||||||||||

| INDUSTRIALS continued | ||||||||||

| Construction & Engineering 0.7% | ||||||||||

| EMCOR Group, Inc. | 417 | $ | 34,202 | |||||||

| Electrical Equipment 0.9% | ||||||||||

| LSI Industries, Inc. | 676 | 9,755 | ||||||||

| Woodward Governor Co. | 373 | 34,894 | ||||||||

| 44,649 | ||||||||||

| Industrial Conglomerates 1.1% | ||||||||||

| Teleflex, Inc. | 954 | 60,169 | ||||||||

| Machinery 3.6% | ||||||||||

| Harsco Corp. | 378 | 29,945 | ||||||||

| Mueller Industries, Inc. | 1,421 | 41,252 | ||||||||

| SPX Corp. | 1,509 | 71,994 | ||||||||

| Valmont Industries, Inc. | 1,093 | 43,775 | ||||||||

| 186,966 | ||||||||||

| Road & Rail 1.6% | ||||||||||

| Laidlaw International, Inc. | 3,113 | 84,674 | ||||||||

| Trading Companies & Distributors 0.8% | ||||||||||

| GATX Corp. | 1,030 | 40,901 | ||||||||

| INFORMATION TECHNOLOGY 11.2% | ||||||||||

| Communications Equipment 2.6% | ||||||||||

| Belden CDT, Inc. * | 1,788 | 48,455 | ||||||||

| Ciena Corp. * | 10,444 | 41,776 | ||||||||

| Sycamore Networks, Inc. | 9,414 | 46,599 | ||||||||

| 136,830 | ||||||||||

| Computers & Peripherals 1.4% | ||||||||||

| Adaptec, Inc. * | 3,913 | 21,287 | ||||||||

| Brocade Communications Systems, Inc. * | 5,980 | 27,508 | ||||||||

| Intergraph Corp. * | 660 | 25,218 | ||||||||

| 74,013 | ||||||||||

| Electronic Equipment & Instruments 2.5% | ||||||||||

| Agilysys, Inc. | 1,198 | 25,398 | ||||||||

| Newport Corp. | 1,946 | 33,024 | ||||||||

| Tech Data Corp. * | 1,076 | 44,363 | ||||||||

| Technitrol, Inc. * | 1,286 | 26,183 | ||||||||

| 128,968 | ||||||||||

| Internet Software & Services 0.4% | ||||||||||

| SonicWALL, Inc. * | 2,863 | 23,591 | ||||||||

| IT Services 0.5% | ||||||||||

| Ceridian Corp. * | 1,037 | 25,593 | ||||||||

See Notes to Financial Statements

11

SCHEDULE OF INVESTMENTS continued

January 31, 2006 (unaudited)

| Shares | Value | |||||||||

| COMMON STOCKS continued | ||||||||||

| INFORMATION TECHNOLOGY continued | ||||||||||

| Semiconductors & Semiconductor Equipment 1.6% | ||||||||||

| Conexant Systems, Inc. * | 7,905 | $ | 26,561 | |||||||

| Intersil Corp. | 1,066 | 30,978 | ||||||||

| Zoran Corp. * | 1,308 | 25,650 | ||||||||

| 83,189 | ||||||||||

| Software 2.2% | ||||||||||

| BEA Systems, Inc. * | 3,498 | 36,274 | ||||||||

| Fair Isaac Corp. | 564 | 24,997 | ||||||||

| Lawson Software, Inc. | 3,387 | 24,928 | ||||||||

| NetIQ Corp. | 2,024 | 26,595 | ||||||||

| 112,794 | ||||||||||

| MATERIALS 7.5% | ||||||||||

| Chemicals 3.2% | ||||||||||

| H.B. Fuller Co. | 1,233 | 46,595 | ||||||||

| Lubrizol Corp. | 1,405 | 64,265 | ||||||||

| Scotts Miracle-Gro Co., Class A | 1,117 | 55,291 | ||||||||

| 166,151 | ||||||||||

| Construction Materials 0.5% | ||||||||||

| Texas Industries, Inc. | 527 | 28,358 | ||||||||

| Containers & Packaging 2.8% | ||||||||||

| Sealed Air Corp. * | 915 | 50,572 | ||||||||

| Smurfit-Stone Container Corp. * | 3,291 | 42,092 | ||||||||

| Sonoco Products Co. | 1,657 | 51,317 | ||||||||

| 143,981 | ||||||||||

| Metals & Mining 1.0% | ||||||||||

| Carpenter Technology Corp. | 561 | 50,804 | ||||||||

| TELECOMMUNICATION SERVICES 1.9% | ||||||||||

| Diversified Telecommunication Services 1.9% | ||||||||||

| CenturyTel, Inc. | 1,095 | 36,463 | ||||||||

| PanAmSat Holding Corp. | 1,741 | 43,055 | ||||||||

| Time Warner Telecom, Inc. * | 1,725 | 18,630 | ||||||||

| 98,148 | ||||||||||

| UTILITIES 9.7% | ||||||||||

| Electric Utilities 1.0% | ||||||||||

| Pepco Holdings, Inc. | 2,232 | 51,358 | ||||||||

| Gas Utilities 4.1% | ||||||||||

| Energen Corp. | 1,320 | 51,506 | ||||||||

| Laclede Group, Inc. | 1,526 | 49,778 | ||||||||

| National Fuel Gas Co. | 1,471 | 48,396 | ||||||||

| New Jersey Resources Corp. | 1,472 | 66,903 | ||||||||

| 216,583 | ||||||||||

See Notes to Financial Statements

12

SCHEDULE OF INVESTMENTS continued

January 31, 2006 (unaudited)

| Shares | Value | |||||||

| COMMON STOCKS continued | ||||||||

| UTILITIES continued | ||||||||

| Multi-Utilities 4.6% | ||||||||

| Alliant Energy Corp. | 2,261 | $ | 67,062 | |||||

| CenterPoint Energy, Inc. | 4,858 | 62,085 | ||||||

| TECO Energy, Inc. | 2,803 | 47,875 | ||||||

| WPS Resources Corp. | 1,134 | 63,595 | ||||||

| 240,617 | ||||||||

| Total Common Stocks (cost $4,783,249) | 4,978,657 | |||||||

| EXCHANGE TRADED FUNDS 3.1% | ||||||||

| iShares Russell 2000 Value Index Fund | 1,175 | 83,484 | ||||||

| iShares Russell Midcap Value Index Fund | 620 | 80,352 | ||||||

| Total Exchange Traded Funds (cost $157,629) | 163,836 | |||||||

| SHORT-TERM INVESTMENTS 0.7% | ||||||||

| MUTUAL FUND SHARES 0.7% | ||||||||

| Evergreen Institutional Money Market Fund ø (cost $35,759) | 35,759 | 35,759 | ||||||

| Total Investments (cost $4,976,637) 99.2% | 5,178,252 | |||||||

| Other Assets and Liabilities 0.8% | 40,027 | |||||||

| Net Assets 100.0% | $ | 5,218,279 | ||||||

| * | Non-income producing security | |

| ø | Evergreen Investment Management Company, LLC is the investment advisor to both the Fund and the money market | |

| fund. | ||

| Summary of Abbreviations | ||

| REIT | Real Estate Investment Trust | |

| The following table shows the percent of total long-term investments by sector as of January 31, 2006: | |||

| Financials | 33.5% | ||

| Information Technology | 11.7% | ||

| Industrials | 10.3% | ||

| Consumer Discretionary | 10.2% | ||

| Utilities | 10.2% | ||

| Materials | 7.8% | ||

| Health Care | 6.5% | ||

| Energy | 4.0% | ||

| Consumer Staples | 3.8% | ||

| Telecommunication Services | 2.0% | ||

| 100.0% | |||

See Notes to Financial Statements

13

STATEMENT OF ASSETS AND LIABILITIES

January 31, 2006 (unaudited)

| Assets | ||||

| Investments in securities, at value (cost $4,940,878) | $ | 5,142,493 | ||

| Investments in affiliated money market fund, at value (cost $35,759) | 35,759 | |||

| Total investments | 5,178,252 | |||

| Receivable for securities sold | 49,141 | |||

| Dividends receivable | 4,272 | |||

| Receivable from investment advisor | 175 | |||

| Total assets | 5,231,840 | |||

| Liabilities | ||||

| Due to related parties | 17 | |||

| Accrued expenses and other liabilities | 13,544 | |||

| Total liabilities | 13,561 | |||

| Net assets | $ | 5,218,279 | ||

| Net assets represented by | ||||

| Paid-in capital | $ | 5,009,500 | ||

| Undistributed net investment income | 9,763 | |||

| Accumulated net realized losses on investments | (2,599) | |||

| Net unrealized gains on investments | 201,615 | |||

| Total net assets | $ | 5,218,279 | ||

| Net assets consists of | ||||

| Class A | $ | 1,042 | ||

| Class I | 5,217,237 | |||

| Total net assets | $ | 5,218,279 | ||

| Shares outstanding (unlimited number of shares authorized) | ||||

| Class A | 100 | |||

| Class I | 500,822 | |||

| Net asset value per share | ||||

| Class A | $ | 10.42 | ||

| Class A — Offering price (based on sales charge of 5.75%) | $ | 11.06 | ||

| Class I | $ | 10.42 | ||

See Notes to Financial Statements

14

STATEMENT OF OPERATIONS

Period Ended January 31, 2006 (unaudited) (a)

| Investment income | ||||

| Dividends | $ | 13,645 | ||

| Interest | 2,111 | |||

| Income from affiliate | 125 | |||

| Total investment income | 15,881 | |||

| Expenses | ||||

| Advisory fee | 4,655 | |||

| Administrative services fee | 661 | |||

| Transfer agent fees | 11 | |||

| Trustees’ fees and expenses | 53 | |||

| Printing and postage expenses | 4,444 | |||

| Custodian and accounting fees | 416 | |||

| Registration and filing fees | 5,368 | |||

| Professional fees | 3,593 | |||

| Other | 146 | |||

| Total expenses | 19,347 | |||

| Less: Expense reductions | (8) | |||

| Fee waivers and expense reimbursements | (13,221) | |||

| Net expenses | 6,118 | |||

| Net investment income | 9,763 | |||

| Net realized and unrealized gains or losses on investments | ||||

| Net realized losses on investments | (2,599) | |||

| Net change in unrealized gains or losses on investments | 201,615 | |||

| Net realized and unrealized gains or losses on investments | 199,016 | |||

| Net increase in net assets resulting from operations | $ | 208,779 | ||

(a) For the period from December 14, 2005 (commencement of operations), to January 31, 2006.

See Notes to Financial Statements

15

STATEMENT OF CHANGES IN NET ASSETS

| Period Ended | ||||

| January 31, 2006 | ||||

| (unaudited) (a) | ||||

| Operations | ||||

| Net investment income | $ | 9,763 | ||

| Net realized losses on investments | (2,599) | |||

| Net change in unrealized gains or losses on investments | 201,615 | |||

| Net increase in net assets resulting from operations | 208,779 | |||

| Shares | ||||

| Capital share transactions | ||||

| Proceeds from shares sold | ||||

| Class A | 100 | 1,000 | ||

| Class I | 500,822 | 5,008,500 | ||

| Net increase in net assets resulting from capital share transactions | 5,009,500 | |||

| Total increase in net assets | 5,218,279 | |||

| Net assets | ||||

| Beginning of period | 0 | |||

| End of period | $ | 5,218,279 | ||

| Undistributed net investment income | $ | 9,763 | ||

(a) For the period from December 14, 2005 (commencement of operations), to January 31, 2006.

See Notes to Financial Statements

16

NOTES TO FINANCIAL STATEMENTS (unaudited)

1. ORGANIZATION

Evergreen Disciplined Small-Mid Value Fund (the “Fund”) is a diversified series of Evergreen Equity Trust (the “Trust”), a Delaware statutory trust organized on September 18, 1997. The Trust is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”).

The Fund offers Class A and Institutional (“Class I”) shares. Class A shares are sold with a front-end sales charge. However, Class A share investments of $1 million or more are not subject to a front-end sales charge but will be subject to a contingent deferred sales charge of 1.00% upon redemption within one year. Class A shares are currently not available for sale to the public. Class I shares are sold without a front-end sales charge or contingent deferred sales charge. Class A shares pay an ongoing distribution fee.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The policies are in conformity with generally accepted accounting principles in the United States of America, which require management to make estimates and assumptions that affect amounts reported herein. Actual results could differ from these estimates.

a. Valuation of investments

Listed equity securities are usually valued at the last sales price or official closing price on the national securities exchange where the securities are principally traded.

Short-term securities with remaining maturities of 60 days or less at the time of purchase are valued at amortized cost, which approximates market value.

Investments in other mutual funds are valued at net asset value. Securities for which market quotations are not readily available or not reflective of current market value are valued at fair value as determined by the investment advisor in good faith, according to procedures approved by the Board of Trustees.

b. Repurchase agreements

Securities pledged as collateral for repurchase agreements are held by the custodian bank or in a segregated account in the Fund’s name until the agreements mature. Collateral for certain tri-party repurchase agreements is held at the counterparty’s custodian in a segregated account for the benefit of the Fund and the counterparty. Each agreement requires that the market value of the collateral be sufficient to cover payments of interest and principal. However, in the event of default or bankruptcy by the other party to the agreement, retention of the collateral may be subject to legal proceedings. The Fund will only enter into repurchase agreements with banks and other financial institutions, which are deemed by the investment advisor to be creditworthy pursuant to guidelines established by the Board of Trustees.

17

NOTES TO FINANCIAL STATEMENTS (unaudited) continued

c. Security transactions and investment income

Security transactions are recorded on trade date. Realized gains and losses are computed using the specific cost of the security sold. Interest income is recorded on the accrual basis and includes accretion of discounts and amortization of premiums. Dividend income is recorded on the ex-dividend date.

d. Federal taxes

The Fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income, including any net capital gains. Accordingly, no provision for federal taxes is required.

e. Distributions

Distributions to shareholders from net investment income and net realized gains, if any, are recorded on the ex-dividend date. Such distributions are determined in conformity with income tax regulations, which may differ from generally accepted accounting principles.

f. Class allocations

Income, common expenses and realized and unrealized gains and losses are allocated to the classes based on the relative net assets of each class. Distribution fees, if any, are calculated daily at the class level based on the appropriate net assets of each class and the specific expense rates applicable to each class.

3. ADVISORY FEE AND OTHER TRANSACTIONS WITH AFFILIATES

Evergreen Investment Management Company, LLC (“EIMC”), an indirect, wholly-owned subsidiary of Wachovia Corporation (“Wachovia”), is the investment advisor to the Fund and is paid an annual fee starting at 0.70% and declining to 0.65% as average daily net assets increase.

From time to time, EIMC may voluntarily or contractually waive its fee and/or reimburse expenses in order to limit operating expenses. During the period ended January 31, 2006, EIMC waived its advisory fee in the amount of $4,655 and reimbursed other expenses in the amount of $8,566.

Evergreen Investment Services, Inc. (“EIS”), an indirect, wholly-owned subsidiary of Wachovia, is the administrator to the Fund. As administrator, EIS provides the Fund with facilities, equipment and personnel and is paid an annual rate determined by applying percentage rates to the aggregate average daily net assets of the Evergreen funds (excluding money market funds), starting at 0.10% and declining to 0.05% as the aggregate average daily net assets of the Evergreen funds (excluding money market funds) increase.

Evergreen Service Company, LLC (“ESC”), an indirect, wholly-owned subsidiary of Wachovia, is the transfer and dividend disbursing agent for the Fund. ESC receives account fees that vary based on the type of account held by the shareholders in the Fund.

18

NOTES TO FINANCIAL STATEMENTS (unaudited) continued

4. DISTRIBUTION PLAN

EIS also serves as distributor of the Fund’s shares. The Fund has adopted a Distribution Plan, as allowed by Rule 12b-1 of the 1940 Act, for Class A shares. Under the Distribution Plan, distribution fees are paid at an annual rate of 0.30% of the average daily net assets for Class A shares.

5. SECURITIES TRANSACTIONS

Cost of purchases and proceeds from sales of investment securities (excluding short-term securities) were $5,192,773 and $214,129, respectively, for the period ended January 31, 2006.

On January 31, 2006, the aggregate cost of securities for federal income tax purposes was $4,976,637. The gross unrealized appreciation and depreciation on securities based on tax cost was $282,422 and $80,807, respectively, with a net unrealized appreciation of $201,615.

6. INTERFUND LENDING

Pursuant to an Exemptive Order issued by the SEC, the Fund may participate in an interfund lending program with certain funds in the Evergreen fund family. This program allows the Fund to borrow from, or lend money to, other participating funds. During the period ended January 31, 2006, the Fund did not participate in the interfund lending program.

7. EXPENSE REDUCTIONS

Through expense offset arrangements with ESC and the Fund’s custodian, a portion of fund expenses has been reduced.

8. DEFERRED TRUSTEES’ FEES

Each Trustee of the Fund may defer any or all compensation related to performance of their duties as Trustees. The Trustees’ deferred balances are allocated to deferral accounts, which are included in the accrued expenses for the Fund. The investment performance of the deferral accounts is based on the investment performance of certain Evergreen funds. Any gains earned or losses incurred in the deferral accounts are reported in the Fund’s Trustees’ fees and expenses. At the election of the Trustees, the deferral account will be paid either in one lump sum or in quarterly installments for up to ten years.

9. CONCENTRATION OF RISK

The Fund may invest a substantial portion of its assets in an industry or sector and, therefore, may be more affected by changes in that industry or sector than would be a comparable mutual fund that is not heavily weighted in any industry or sector.

10. REGULATORY MATTERS AND LEGAL PROCEEDINGS

Since September 2003, governmental and self-regulatory authorities have instituted numerous ongoing investigations of various practices in the mutual fund industry, including investigations relating to revenue sharing, market-timing, late trading and record retention, among other things.

19

NOTES TO FINANCIAL STATEMENTS (unaudited) continued

The investigations cover investment advisors, distributors and transfer agents to mutual funds, as well as other firms. EIMC, EIS and ESC (collectively, “Evergreen”) have received subpoenas and other requests for documents and testimony relating to these investigations, are endeavoring to comply with those requests, and are cooperating with the investigations. Evergreen is continuing its own internal review of policies, practices, procedures and personnel, and is taking remedial action where appropriate.

In connection with one of these investigations, on July 28, 2004, the staff of the Securities and Exchange Commission (“SEC”) informed Evergreen that the staff intends to recommend to the SEC that it institute an enforcement action against Evergreen. The SEC staff’s proposed allegations relate to (i) an arrangement pursuant to which a broker at one of EIMC’s affiliated broker-dealers had been authorized, apparently by an EIMC officer (no longer with EIMC), to engage in short-term trading, on behalf of a client, in Evergreen Mid Cap Growth Fund (formerly Evergreen Emerging Growth Fund and prior to that, known as Evergreen Small Company Growth Fund) during the period from December 2000 through April 2003, in excess of the limitations set forth in the fund’s prospectus, (ii) short-term trading from September 2001 through January 2003, by a former Evergreen portfolio manager, of Evergreen Precious Metals Fund, a fund he managed at the time, (iii) the sufficiency of systems for monitoring exchanges and enforcing exchange limitations as stated in the fund’s prospectuses, and (iv) the adequacy of e-mail retention practices. In connection with the activity in Evergreen Mid Cap Growth Fund, EIMC reimbursed the fund $378,905, plus an additional $25,242, representing what EIMC calculated at that time to be the client’s net gain and the fees earned by EIMC and the expenses incurred by this fund on the client’s account. In connection with the activity in Evergreen Precious Metals Fund, EIMC reimbursed the fund $70,878, plus an additional $3,075, representing what EIMC calculated at that time to be the portfolio manager’s net gain and the fees earned by EIMC and expenses incurred by the fund on the portfolio manager’s account. Evergreen is currently engaged in discussions with the staff of the SEC concerning its recommendation.

The staff of the National Association of Securities Dealers (“NASD”) had notified EIS that it has made a preliminary determination to recommend that disciplinary action be brought against EIS for certain violations of the NASD’s rules. The recommendation relates principally to allegations that EIS (i) arranged for fund portfolio trades to be directed to broker-dealers (including Wachovia Securities, LLC, an affiliate of EIS) that sold Evergreen fund shares during the period of January 2001 to December 2003 and (ii) provided non-cash compensation by sponsoring offsite meetings attended by Wachovia Securities, LLC brokers during that period. EIS is cooperating with the NASD staff in its review of these matters.

Any resolution of these matters with regulatory authorities may include, but not be limited to, sanctions, penalties or injunctions regarding Evergreen, restitution to mutual fund shareholders and/or other financial penalties and structural changes in the governance or management of Evergreen’s mutual fund business. Any penalties or restitution will be paid by Evergreen and not by the Evergreen funds.

20

NOTES TO FINANCIAL STATEMENTS (unaudited) continued

In addition, the Evergreen funds and EIMC and certain of its affiliates are involved in various legal actions, including private litigation and class action lawsuits. EIMC does not expect that any of such legal actions currently pending or threatened will have a material adverse impact on the financial position or operations of any of the Evergreen funds or on EIMC’s ability to provide services to the Evergreen funds.

Although Evergreen believes that neither the foregoing investigations nor any pending or threatened legal actions will have a material adverse impact on the Evergreen funds, there can be no assurance that these matters and any publicity surrounding or resulting from them will not result in reduced sales or increased redemptions of Evergreen fund shares, which could increase Evergreen fund transaction costs or operating expenses, or have other adverse consequences on the Evergreen funds.

21

ADDITIONAL INFORMATION (unaudited)

INFORMATION ABOUT THE REVIEW AND APPROVAL OF THE FUND’S INVESTMENT ADVISORY AGREEMENT

The Fund’s Board of Trustees considered the investment advisory agreement between the Fund and EIMC at meetings held in June of 2005. At the meeting, the Trustees, including a majority of the Trustees who are not interested persons (as that term is defined in the 1940 Act) of the Fund or of EIMC, approved the investment advisory agreement.

The Board of Trustees meets with representatives of Evergreen during the course of the year, and, in considering the advisory and administrative arrangements for the Fund, the Trustees took into account information provided in those meetings.

The disinterested Trustees discussed the approval of the investment advisory agreement with representatives of EIMC and with legal counsel. In all of its deliberations with respect to the Fund and the investment advisory agreement, the Board of Trustees and the disinterested Trustees were advised by independent counsel to the disinterested Trustees and counsel to the Fund. In considering the investment advisory agreement, the Trustees did not identify any particular information or consideration that was all-important or controlling, and each Trustee attributed different weights to various factors. This summary describes the most important, but not necessarily all, of the factors considered by the Board and the disinterested Trustees.

The Trustees considered that EIMC and its affiliates would provide a comprehensive investment management service and implement an investment program for the Fund. The Trustees also considered that EIMC makes its personnel available to serve as officers of the Evergreen funds, and concluded that the reporting and management functions provided by EIMC with respect to the Evergreen funds overall were generally satisfactory. In considering approval of the Fund’s investment advisory agreement with EIMC the Trustees considered, among other factors, the portfolio management team’s investment approach, information regarding EIMC’s historical investment performance with respect to comparable investment products, the fees and expenses to be paid by the Fund to EIMC and its affiliates, and the projected fees and expenses that the Fund would pay after its launch. On the basis of these factors, they determined that the nature and scope of the services provided by EIMC were likely to be consistent with its duties under the investment advisory agreement and appropriate and consistent with the investment program and best interests of the Fund.

The Trustees considered whether growth in assets of the Fund might result in economies of scale and noted that the advisory fee for the Fund contemplated a breakpoint at $1 billion, which appeared reasonable to the Trustees in light of the information available to them and the fact that the Fund was in a start-up phase. The Trustees also reviewed fees paid to EIMC by other comparable investment companies and institutional accounts managed by EIMC. The Trustees also relied, in part, on comparisons of the Fund’s projected expenses to the expenses of funds with similar investment strategies. In their consideration of the fees to be paid by the Fund to EIMC, the Trustees considered information provided by EIMC regarding the profitability of the

22

ADDITIONAL INFORMATION (unaudited) continued

Envision product to EIMC, which the Trustees considered both without taking into account distribution expenses and taking into account distribution expenses, on the basis of which the Trustees determined that the likely profitability to EIMC from the Fund appeared reasonable.

In considering the investment advisory agreement, the Trustees took into account indirect bene-fits to EIMC, including, among others, the fact that growth in the assets within the Envision funds would result in additions to assets under management in the Fund, that EIMC benefits from soft-dollar research and brokerage services from transactions by the Evergreen funds, and that Wachovia Securities and its affiliates receive revenues from providing brokerage services to the Evergreen funds. The Trustees concluded that the arrangements to be put in place with respect to the Fund were comparable to those in place for the Evergreen funds generally and appeared reasonable in light of that consideration.

23

TRUSTEES AND OFFICERS

TRUSTEES1

| Charles A. Austin III | Investment Counselor, Anchor Capital Advisors, Inc. (investment advice); Director, The Andover | |

| Trustee | Companies (insurance); Trustee, Arthritis Foundation of New England; Former Director, The | |

| DOB: 10/23/1934 | Francis Ouimet Society; Former Trustee, Mentor Funds and Cash Resource Trust; Former | |

| Term of office since: 1991 | Investment Counselor, Appleton Partners, Inc. (investment advice); Former Director, Executive | |

| Vice President and Treasurer, State Street Research & Management Company (investment | ||

| Other directorships: None | advice) | |

| Shirley L. Fulton | Partner, Tin, Fulton, Greene & Owen, PLLC (law firm); Former Partner, Helms, Henderson & | |

| Trustee | Fulton, P.A. (law firm); Retired Senior Resident Superior Court Judge, 26th Judicial District, | |

| DOB: 1/10/1952 | Charlotte, NC | |

| Term of office since: 2004 | ||

| Other directorships: None | ||

| K. Dun Gifford | Chairman and President, Oldways Preservation and Exchange Trust (education); Trustee, | |

| Trustee | Treasurer and Chairman of the Finance Committee, Cambridge College; Former Trustee, Mentor | |

| DOB: 10/23/1938 | Funds and Cash Resource Trust | |

| Term of office since: 1974 | ||

| Other directorships: None | ||

| Dr. Leroy Keith, Jr. | Partner, Stonington Partners, Inc. (private equity fund); Trustee, Phoenix Funds Family; Director, | |

| Trustee | Diversapack Co.; Director, Obagi Medical Products Co.; Former Director, Lincoln Educational | |

| DOB: 2/14/1939 | Services; Former Trustee, Mentor Funds and Cash Resource Trust | |

| Term of office since: 1983 | ||

| Other directorships: Trustee, The | ||

| Phoenix Group of Mutual Funds | ||

| Gerald M. McDonnell | Manager of Commercial Operations, SMI Steel Co. – South Carolina (steel producer); Former | |

| Trustee | Sales and Marketing Manager, Nucor Steel Company; Former Trustee, Mentor Funds and Cash | |

| DOB: 7/14/1939 | Resource Trust | |

| Term of office since: 1988 | ||

| Other directorships: None | ||

| William Walt Pettit | Vice President, Kellam & Pettit, P.A. (law firm); Director, Superior Packaging Corp.; Director, | |

| Trustee | National Kidney Foundation of North Carolina, Inc.; Former Trustee, Mentor Funds and Cash | |

| DOB: 8/26/1955 | Resource Trust | |

| Term of office since: 1984 | ||

| Other directorships: None | ||

| David M. Richardson | President, Richardson, Runden LLC (executive recruitment business development/consulting | |

| Trustee | company); Consultant, Kennedy Information, Inc. (executive recruitment information and | |

| DOB: 9/19/1941 | research company); Consultant, AESC (The Association of Executive Search Consultants); | |

| Term of office since: 1982 | Director, J&M Cumming Paper Co. (paper merchandising); Former Trustee, NDI Technologies, LLP | |

| (communications); Former Trustee, Mentor Funds and Cash Resource Trust | ||

| Other directorships: None | ||

| Dr. Russell A. Salton III | President/CEO, AccessOne MedCard; Former Medical Director, Healthcare Resource Associates, | |

| Trustee | Inc.; Former Medical Director, U.S. Health Care/Aetna Health Services; Former Trustee, Mentor | |

| DOB: 6/2/1947 | Funds and Cash Resource Trust | |

| Term of office since: 1984 | ||

| Other directorships: None | ||

24

TRUSTEES AND OFFICERS continued

| Michael S. Scofield | Director and Chairman, Branded Media Corporation (multi-media branding company); Attorney, | |

| Trustee | Law Offices of Michael S. Scofield; Former Trustee, Mentor Funds and Cash Resource Trust | |

| DOB: 2/20/1943 | ||

| Term of office since: 1984 | ||

| Other directorships: None | ||

| Richard J. Shima | Independent Consultant; Trustee, Saint Joseph College (CT); Director, Hartford Hospital; Trustee, | |

| Trustee | Greater Hartford YMCA; Former Director, Trust Company of CT; Former Director, Enhance | |

| DOB: 8/11/1939 | Financial Services, Inc.; Former Director, Old State House Association; Former Trustee, Mentor | |

| Term of office since: 1993 | Funds and Cash Resource Trust | |

| Other directorships: None | ||

| Richard K. Wagoner, CFA2 | Member and Former President, North Carolina Securities Traders Association; Member, Financial | |

| Trustee | Analysts Society; Former Consultant to the Boards of Trustees of the Evergreen funds; Former | |

| DOB: 12/12/1937 | Trustee, Mentor Funds and Cash Resource Trust | |

| Term of office since: 1999 | ||

| Other directorships: None | ||

| OFFICERS | ||

| Dennis H. Ferro3 | Principal occupations: President and Chief Executive Officer, Evergreen Investment Company, | |

| President | Inc. and Executive Vice President, Wachovia Bank, N.A.; former Chief Investment Officer, | |

| DOB: 6/20/1945 | Evergreen Investment Company, Inc. | |

| Term of office since: 2003 | ||

| Jeremy DePalma4 | Principal occupations: Vice President, Evergreen Investment Services, Inc.; Former Assistant Vice | |

| Treasurer | President, Evergreen Investment Services, Inc. | |

| DOB: 2/5/1974 | ||

| Term of office since: 2005 | ||

| Michael H. Koonce4 | Principal occupations: Senior Vice President and General Counsel, Evergreen Investment | |

| Secretary | Services, Inc.; Senior Vice President and Assistant General Counsel, Wachovia Corporation | |

| DOB: 4/20/1960 | ||

| Term of office since: 2000 | ||

| James Angelos4 | Principal occupations: Chief Compliance Officer and Senior Vice President, Evergreen Funds; | |

| Chief Compliance Officer | Former Director of Compliance, Evergreen Investment Services, Inc. | |

| DOB: 9/2/1947 | ||

| Term of office since: 2004 | ||

1 Each Trustee serves until a successor is duly elected or qualified or until his/her death, resignation, retirement or removal from office. Each Trustee oversees 90 Evergreen funds. Correspondence for each Trustee may be sent to Evergreen Board of Trustees, P.O. Box 20083, Charlotte, NC 28202.

2 Mr. Wagoner is an “interested person” of the Fund because of his ownership of shares in Wachovia Corporation, the parent to the Fund’s investment advisor.

3 The address of the Officer is 401 S. Tryon Street, 20th Floor, Charlotte, NC 28288.

4 The address of the Officer is 200 Berkeley Street, Boston, MA 02116.

Additional information about the Fund’s Board of Trustees and Officers can be found in the Statement of Additional Information (SAI) and is available upon request without charge by calling 800.343.2898.

25

575707 3/2006

Evergreen Disciplined Value Fund

| table of contents | ||

| 1 | LETTER TO SHAREHOLDERS | |

| 4 | FUND AT A GLANCE | |

| 6 | ABOUT YOUR FUND’S EXPENSES | |

| 7 | FINANCIAL HIGHLIGHTS | |

| 11 | SCHEDULE OF INVESTMENTS | |

| 16 | STATEMENT OF ASSETS AND LIABILITIES | |

| 17 | STATEMENT OF OPERATIONS | |

| 18 | STATEMENTS OF CHANGES IN NET ASSETS | |

| 20 | NOTES TO FINANCIAL STATEMENTS | |

| 28 | TRUSTEES AND OFFICERS | |

This semiannual report must be preceded or accompanied by a prospectus of the Evergreen fund contained herein. The prospectus contains more complete information, including fees and expenses, and should be read carefully before investing or sending money.

The fund will file its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q will be available on the SEC’s Web site at http://www.sec.gov. In addition, the fund’s Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 800.SEC.0330.

A description of the fund’s proxy voting policies and procedures, as well as information regarding how the fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available by visiting our Web site at EvergreenInvestments.com or by visiting the SEC’s Web site at http://www.sec.gov. The fund’s proxy voting policies and procedures are also available without charge, upon request, by calling 800.343.2898.

| Mutual Funds: | ||||

| NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED |

Evergreen InvestmentsSM is a service mark of Evergreen Investment Management Company, LLC.

Copyright 2006, Evergreen Investment Management Company, LLC.

Evergreen Investment Management Company, LLC is a subsidiary of Wachovia Corporation

and is an affiliate of Wachovia Corporation's other Broker Dealer subsidiaries.

Evergreen mutual funds are distributed by Evergreen Investment Services, Inc.

200 Berkeley Street, Boston, MA 02116

LETTER TO SHAREHOLDERS

March 2006

Dennis H. Ferro

President and Chief Executive Officer

Dear Shareholder,

We are pleased to provide the semiannual report for the Evergreen Disciplined Value Fund, which covers the six-month period ended January 31, 2006.

The past six months proved to be yet another challenging period for the equity markets. Uncertainty about the economy, monetary policy, and energy prices led to concerns about corporate profits and inflation. Geopolitical tensions continued and the Gulf region suffered enormous damage from the hurricanes. Not surprisingly, each of these issues converged at various times to increase market volatility. Fortunately, as the investment period progressed, the economy proved resilient and earnings continued to exceed expectations. By focusing on the solid fundamentals supporting growth, rather than the periodic bouts of volatility, Evergreen’s equity teams were able to provide our clients in these uncertain times with the disciplined approach necessary for the management of their long-term portfolios.

The investment period began with expectations for a moderation in U.S. economic growth. After all, the rapid pace of growth experienced during the recovery had transitioned to the more normalized Gross Domestic Product (“GDP”) levels typically associated with economic expansion. Energy prices continued to soar amid rising levels for employment, housing and production. The post-Katrina federal spending plans exacerbated pricing concerns and long-term interest rates began to rise. Despite these events, the U.S. consumer kept spending and businesses were investing some of their record cash balances, enabling the economy to overcome some extremely challenging obstacles in the waning months of 2005.

1

LETTER TO SHAREHOLDERS continued

Perhaps recognizing the strength in GDP and the attendant inflation fears, the Federal Reserve (“Fed”) maintained its “measured removal of policy accommodation” and continued to raise their target for the federal funds rate by 25 basis points at the conclusion of each policy meeting. Since rates had been low for such a lengthy period, Evergreen’s Investment Strategy Committee concluded that the central bank was simply attempting to remove stimulus, rather than restrict growth, for the U.S. economy. Fed Chairman Alan Greenspan remained very transparent in his public statements about the direction of monetary policy and long-term market interest rates responded, once again, by moving lower. Yet the extent of the yield curve’s flattening had many on Wall Street debating its meaning. Given our forecast for more moderate levels of growth in consumption and investment supporting a sustainable expansion, we viewed the yield curve’s message as confidence in the Fed’s ability to prevent long-term inflation. In addition, higher oil prices would likely serve to dampen output and we believed the absence of significant wage pressures would enable the Fed to continue on its measured path for monetary policy.

Low long-term market yields improved the relative attractiveness of equities during the investment period. The solid growth in GDP translated into better than expected profits, further supporting equities, especially during their late 2005 rally. Throughout it all, our equity analysts continued to identify companies with promising outlooks consistent with their investment styles. Positive earnings growth, solid balance sheets and strong cash flows attracted the most attention from our portfolio managers, while the improving trend for dividends enhanced the potential for total return in many of our equity portfolios.

2

LETTER TO SHAREHOLDERS continued

As always, we continue to recommend a fully diversified, long-term approach for equity investors.

Please visit our Web site, EvergreenInvestments.com, for more information about our funds and other investment products available to you. Thank you for your continued support of Evergreen Investments.

Sincerely,

Dennis H. Ferro

President and Chief Executive Officer

Evergreen Investment Company, Inc.

Notice to Shareholders:

At meeting held on March 15-16, 2006, the Board of Trustees of the Fund approved a proposal to (i) reduce the advisory fees of the Fund and (ii) to reduce the Fund’s Rule 12b-1 fee for Class A shares from 0.30% to 0.25% . These changes are effective April 3, 2006.

The Fund’s prospectus has been revised to reflect these changes.

Special Notice to Shareholders:

Please visit our Web site at EvergreenInvestments.com for a statement from President and Chief Executive Officer, Dennis Ferro, addressing NASD actions involving Evergreen Investment Services, Inc. (EIS), Evergreen’s mutual fund distributor or statements from Dennis Ferro and Chairman of the Board of the Evergreen funds, Michael S. Scofield, addressing SEC actions involving the Evergreen funds.

3

FUND AT A GLANCE

as of January 31, 2006

MANAGEMENT TEAM

Investment Advisor:

• Evergreen Investment Management Company, LLC

Portfolio Manager:

• William E. Zieff

CURRENT INVESTMENT STYLE

Source: Morningstar, Inc.

Morningstar’s style box is based on a portfolio date as of 12/31/2005.

The Equity style box placement is based on 10 growth and valuation measures for each fund holding and the median size of the companies in which the fund invests.

PERFORMANCE AND RETURNS

Portfolio inception date: 5/8/1992

| Class A | Class B | Class C | Class I | |||||

| Class inception date | 3/18/2005 | 3/18/2005 | 3/18/2005 | 5/8/1992 | ||||

| Nasdaq symbol | EDSAX | EDSBX | EDSCX | EDSIX | ||||

| 6-month return with sales charge | -0.45% | 0.34% | 4.20% | N/A | ||||

| 6-month return w/o sales charge | 5.65% | 5.34% | 5.20% | 5.79% | ||||

| Average annual return* | ||||||||

| 1-year with sales charge | 7.35% | 8.46% | 12.12% | N/A | ||||

| 1-year w/o sales charge | 13.92% | 13.20% | 13.07% | 14.03% | ||||

| 5-year | 3.38% | 4.17% | 4.46% | 4.64% | ||||

| 10-year | 9.64% | 10.23% | 10.21% | 10.31% | ||||

| Maximum sales charge | 5.75% | 5.00% | 1.00% | N/A | ||||

| Front-end | CDSC | CDSC | ||||||

* Adjusted for maximum applicable sales charge, unless noted.

Past performance is no guarantee of future results. The performance quoted represents past performance and current performance may be lower or higher. The investment return and principal value of an investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance information current to the most recent month-end for Classes A, B, C or I, please go to EvergreenInvestments.com/fundperformance. The performance of each class may vary based on differences in loads, fees and expenses paid by the shareholders investing in each class. Performance includes the reinvestment of income dividends and capital gain distributions. Performance shown does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Historical performance shown for Classes A, B and C prior to their inception is based on the performance of Class I. Historical performance for Class I prior to 3/21/2005 is based on the fund’s predecessor fund, SouthTrust Value Fund. The historical returns for Classes A, B and C have not been adjusted to reflect the effect of each class’ 12b-1 fee. These fees are 0.25% for Class A and 1.00% for Classes B and C. Class I does not, and the fund’s predecessor fund did not, pay a 12b-1 fee. If these fees had been reflected, returns for Classes A, B and C would have been lower.

Returns reflect expense limits previously in effect, without which returns would have been lower.

4

FUND AT A GLANCE continued

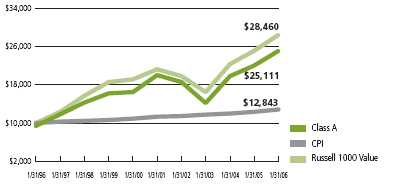

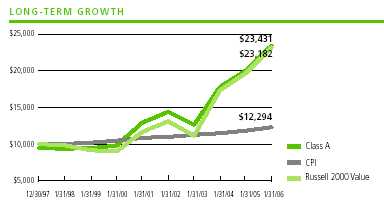

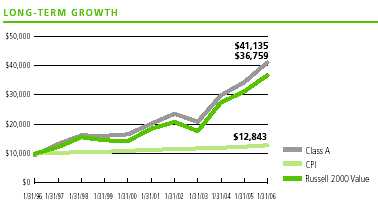

LONG-TERM GROWTH

Comparison of a $10,000 investment in the Evergreen Disciplined Value Fund Class A shares, versus a similar investment in the Russell 1000 Value Index (Russell 1000 Value) and the Consumer Price Index (CPI).

The Russell 1000 Value is an unmanaged market index and does not include transaction costs associated with buying and selling securities, any mutual fund expenses or any taxes. The CPI is a commonly used measure of inflation and does not represent an investment return. It is not possible to invest directly in an index.

Class I shares are only offered in the following manner: (1) to investment advisory clients of Evergreen Investment Management Company, LLC (or its advisory affiliates) when purchased by such advisor(s) on behalf of its clients, (2) through arrangements entered into on behalf of the Evergreen funds with certain financial services firms, (3) to certain institutional investors and (4) to persons who owned Class Y shares in registered name in an Evergreen fund on or before December 31, 1994 or who owned shares of any SouthTrust fund in registered name as of March 18, 2005 or shares of Vestaur Securities Fund as of May 20, 2005.

Class I shares are only available to institutional shareholders with a minimum of $1 million investment, which may be waived in certain situations.

The fund’s investment objective is nonfundamental and may be changed without a vote of the fund’s shareholders.

Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

All data is as of January 31, 2006, and subject to change.

5

ABOUT YOUR FUND’S EXPENSES

The Example below is intended to describe the fees and expenses borne by shareholders and the impact of those costs on your investment.

Example

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads), redemption fees and exchange fees; and (2) ongoing costs, including management fees, distribution (12b-1) fees and other fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from August 1, 2005 to January 31, 2006.

The example illustrates your fund’s costs in two ways:

• Actual expenses

The section in the table under the heading “Actual” provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the appropriate column for your share class, in the column entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

• Hypothetical example for comparison purposes

The section in the table under the heading “Hypothetical (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the section in the table under the heading “Hypothetical (5% return before expenses)” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning | Ending | |||||||

| Account | Account | Expenses | ||||||

| Value | Value | Paid During | ||||||

| 8/1/2005 | 1/31/2006 | Period* | ||||||

| Actual | ||||||||

| Class A | $ 1,000.00 | $ 1,056.52 | $ | 6.48 | ||||

| Class B | $ 1,000.00 | $ 1,053.43 | $ 10.20 | |||||

| Class C | $ 1,000.00 | $ 1,052.01 | $ 10.14 | |||||

| Class I | $ 1,000.00 | $ 1,057.90 | $ | 4.88 | ||||

| Hypothetical | ||||||||

| (5% return | ||||||||

| before expenses) | ||||||||

| Class A | $ 1,000.00 | $ 1,018.90 | $ | 6.36 | ||||

| Class B | $ 1,000.00 | $ 1,015.27 | $ 10.01 | |||||

| Class C | $ 1,000.00 | $ 1,015.32 | $ | 9.96 | ||||

| Class I | $ 1,000.00 | $ 1,020.47 | $ | 4.79 | ||||

* For each class of the Fund, expenses are equal to the annualized expense ratio of each class (1.25% for Class A, 1.97% for Class B, 1.96% for Class C and 0.94% for Class I), multiplied by the average account value over the period, multiplied by 184 / 365 days.

6

FINANCIAL HIGHLIGHTS

(For a share outstanding throughout each period)

| Six Months Ended | ||||||||

| January 31, 2006 | Year Ended | Year Ended | ||||||

| CLASS A | (unaudited) | July 31, 20051 | April 30, 20052 | |||||

| Net asset value, beginning of period | $15.82 | $16.96 | $17.35 | |||||

| Income from investment operations | ||||||||

| Net investment income (loss) | 0.093 | 0.05 | 0.01 | |||||

| Net realized and unrealized gains or losses on investments | 0.77 | 1.08 | (0.36) | |||||

| Total from investment operations | 0.86 | 1.13 | (0.35) | |||||

| Distributions to shareholders from | ||||||||

| Net investment income | (0.08) | (0.04) | (0.04) | |||||

| Net realized gains | (0.45) | (2.23) | 0 | |||||

| Total distributions to shareholders | (0.53) | (2.27) | (0.04) | |||||

| Net asset value, end of period | $16.15 | $15.82 | $16.96 | |||||

| Total return4 | 5.65% | 7.76% | (2.01%) | |||||

| Ratios and supplemental data | ||||||||

| Net assets, end of period (thousands) | $3,288 | $1,617 | $ | 1 | ||||

| Ratios to average net assets | ||||||||

| Expenses including waivers/reimbursements but excluding expense reductions | 1.25%5 | 1.26%5 | 1.11%5 | |||||

| Expenses excluding waivers/reimbursements and expense reductions | 1.25%5 | 1.26%5 | 1.11%5 | |||||

| Net investment income (loss) | 1.13%5 | 0.74%5 | 0.58%5 | |||||

| Portfolio turnover rate | 31% | 15% | 54% | |||||

1 For the three months ended July 31, 2005. The Fund changed its fiscal year end from April 30 to July 31, effective July 31, 2005.

2 For the period from March 18, 2005 (commencement of class operations), to April 30, 2005.

3 Net investment income (loss) per share is based on average shares outstanding during the period.

4 Excluding applicable sales charges

5 Annualized

See Notes to Financial Statements

7

FINANCIAL HIGHLIGHTS

(For a share outstanding throughout each period)

| Six Months Ended | ||||||||

| January 31, 2006 | Year Ended | Year Ended | ||||||

| CLASS B | (unaudited) | July 31, 20051 | April 30, 20052 | |||||

| Net asset value, beginning of period | $15.79 | $16.97 | $17.35 | |||||

| Income from investment operations | ||||||||

| Net investment income (loss) | 0.05 | 0.013 | 03 | |||||

| Net realized and unrealized gains or losses on investments | 0.77 | 1.06 | (0.34) | |||||

| Total from investment operations | 0.82 | 1.07 | (0.34) | |||||

| Distributions to shareholders from | ||||||||

| Net investment income | (0.06) | (0.02) | (0.04) | |||||

| Net realized gains | (0.45) | (2.23) | 0 | |||||

| Total distributions to shareholders | (0.51) | (2.25) | (0.04) | |||||

| Net asset value, end of period | $16.10 | $15.79 | $16.97 | |||||

| Total return4 | 5.34% | 7.35% | (1.97%) | |||||

| Ratios and supplemental data | ||||||||

| Net assets, end of period (thousands) | $2,001 | $ 121 | $ | 5 | ||||

| Ratios to average net assets | ||||||||

| Expenses including waivers/reimbursements but excluding expense reductions | 1.97%5 | 2.00%5 | 1.82%5 | |||||

| Expenses excluding waivers/reimbursements and expense reductions | 1.97%5 | 2.00%5 | 1.82%5 | |||||

| Net investment income (loss) | 0.47%5 | 0.16%5 | 0.10%5 | |||||

| Portfolio turnover rate | 31% | 15% | 54% | |||||

1 For the three months ended July 31, 2005. The Fund changed its fiscal year end from April 30 to July 31, effective July 31, 2005.

2 For the period from March 18, 2005 (commencement of class operations), to April 30, 2005.

3 Net investment income (loss) per share is based on average shares outstanding during the period.

4 Excluding applicable sales charges

5 Annualized

See Notes to Financial Statements

8

FINANCIAL HIGHLIGHTS

(For a share outstanding throughout each period)

| Six Months Ended | ||||||||

| January 31, 2006 | Year Ended | Year Ended | ||||||

| CLASS C | (unaudited) | July 31, 20051 | April 30, 20052 | |||||

| Net asset value, beginning of period | $15.79 | $16.97 | $17.35 | |||||

| Income from investment operations | ||||||||