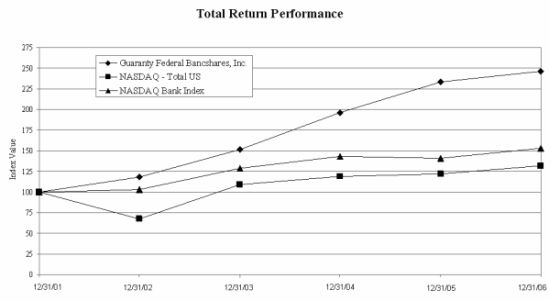

Set forth below is a stock performance graph comparing the cumulative total shareholder return on the Common Stock with (a) the cumulative total stockholder return on stocks included in The Nasdaq - Total U.S. Index and (b) the cumulative total stockholder return on stocks included in The Nasdaq Bank Index. All three investment comparisons assume the investment of $100 as of the close of business on December 31, 2001 and the hypothetical value of that investment as of the Company’s fiscal years ended December 31, 2002, 2003, 2004, 2005, and 2006, assuming that all dividends were reinvested. The graph reflects the historical performance of the Common Stock, and, as a result, may not be indicative of possible future performance of the Common Stock. The data used to compile this graph was obtained from NASDAQ.

I am very proud of the company we have become over the past few years. I am even more proud of the foundation we have built for future growth. Just four short years ago we were a thrift focused almost exclusively on retail residential lending. We have made strong progress in moving to a diversified financial institution that is delivering solid financial results and shareholder value. We are excited and optimistic about our future. I thank you, our shareholders, for your continued confidence and support, and I look forward to sharing our future progress with you.

The following tables include certain information concerning the financial position and results of operations of Guaranty Federal Bancshares, Inc. (including consolidated data from operations of subsidiaries) as of the dates indicated. Dollar amounts are expressed in thousands except per share data.

(1) In 2003, the Company determined to change its fiscal year end from June 30 to a calendar year end of December 31. As a result, the Company reported a six-month transition period ended December 31, 2003 in order to change to this new calendar year end.

Guaranty Federal Bancshares, Inc.

Selected Consolidated Financial and Other Data

Summary Statement of Income | | Years ended December 31, | |

| | | 2006 | | 2005 | | 2004 | |

| | | | | | | | |

| Interest income | | $ | 35,066 | | | 27,283 | | | 20,539 | |

| Interest expense | | | 17,386 | | | 11,860 | | | 8,446 | |

| Net interest income | | | 17,680 | | | 15,423 | | | 12,093 | |

| Provision for loan losses | | | 750 | | | 945 | | | 864 | |

| Net interest income after provision | | | | | | | | | | |

| for loan losses | | | 16,930 | | | 14,478 | | | 11,229 | |

| Noninterest income | | | 3,798 | | | 3,597 | | | 3,616 | |

| Noninterest expense | | | 10,177 | | | 8,670 | | | 8,248 | |

| Income before income taxes | | | 10,551 | | | 9,406 | | | 6,597 | |

| Provision for income taxes | | | 4,042 | | | 3,507 | | | 2,313 | |

| | | | | | | | | | | |

| Net income | | $ | 6,509 | | | 5,899 | | | 4,284 | |

| | | | | | | | | | | |

| Basic | | $ | 2.34 | | | 2.12 | | | 1.53 | |

| Diluted | | $ | 2.25 | | | 2.03 | | | 1.47 | |

| | | Six months ended | | Year ended | |

| | | December 31, | | June 30, | |

| | | 2003 | | 2002 | | 2003 | |

| | | | | (Unaudited) | | | |

| Interest income | | $ | 9,846 | | | 11,290 | | | 21,782 | |

| Interest expense | | | 4,491 | | | 6,086 | | | 11,445 | |

| Net interest income | | | 5,355 | | | 5,204 | | | 10,337 | |

| Provision for loan losses | | | 1,162 | | | 205 | | | 610 | |

| Net interest income after provision | | | | | | | | | | |

| for loan losses | | | 4,193 | | | 4,999 | | | 9,727 | |

| Noninterest income | | | 2,089 | | | 1,752 | | | 3,688 | |

| Noninterest expense | | | 3,994 | | | 4,060 | | | 8,179 | |

| Income before income taxes | | | 2,288 | | | 2,691 | | | 5,236 | |

| Provision for income taxes | | | 788 | | | 927 | | | 1,656 | |

| | | | | | | | | | | |

| Net income | | $ | 1,500 | | | 1,764 | | | 3,580 | |

| | | | | | | | | | | |

| Basic | | $ | 0.54 | | | 0.63 | | | 1.28 | |

| Diluted | | $ | 0.52 | | | 0.62 | | | 1.26 | |

Guaranty Federal Bancshares, Inc.

Management’s Discussion and Analysis of Financial Condition

And Results of Operations

GENERAL

Guaranty Federal Bancshares, Inc. (the “Company”) is a Delaware corporation organized on December 30, 1997 for the purpose of becoming the holding company of Guaranty Federal Savings Bank, a stock savings bank (the “Bank”). The Bank is a wholly-owned subsidiary of the Company.

In April 1995, Guaranty Federal Savings & Loan Association reorganized from a federally chartered mutual savings and loan association into a mutual holding company, Guaranty Federal Bancshares, M. H. C. (the “MHC”). Concurrent with the reorganization, the Bank was chartered. In December 1997, the Company completed the conversion and reorganization of the Bank and the former MHC by selling common stock to depositors of the Bank and a benefit plan of the Bank. In addition, all shares of common stock of the Bank held by public stockholders were exchanged for shares of common stock of the Company.

On June 27, 2003, the Bank converted to a state-chartered trust company with banking powers in Missouri, and the Company became a one-bank holding company. The name of the Bank was changed from Guaranty Federal Savings Bank to Guaranty Bank.

The primary activity of the Company is to oversee its investment in the Bank. The Company engages in few other activities, and the Company has no significant assets other than its investment in the Bank. For this reason, unless otherwise specified, references to the Company include the operations of the Bank. The Company’s principal business consists of attracting deposits from the general public and using such deposits to originate mortgage loans secured by one- to four-family residences, multi-family, construction and commercial real estate loans and consumer and business loans. The Company also uses these funds to purchase mortgage-backed securities, US government and agency obligations, and other permissible securities. When cash outflows exceed inflows, the Company uses borrowings and brokered deposits as additional financing sources.

The Company derives revenues principally from interest earned on loans and investments and, to a lesser extent, from fees charged for services. General economic conditions and policies of the financial institution regulatory agencies, including the Missouri Division of Finance and the Federal Deposit Insurance Corporation (“FDIC”) significantly influence the Company’s operations. Interest rates on competing investments and general market interest rates influence the Company’s cost of funds. Lending activities are affected by the interest rates at which such financing may be offered. The Company intends to focus on one- to four-family residential, consumer, and commercial real estate lending throughout southwestern Missouri.

The Company has two wholly-owned subsidiaries other than the Bank, its principal subsidiary: (i) Guaranty Statutory Trust I, a Delaware statutory trust (“Trust I”); and (ii) Guaranty Statutory Trust II, a Delaware statutory trust. These Trusts were formed in December 2005 for the exclusive purpose of issuing trust preferred securities to acquire junior subordinated debentures issued by the Company. The Company’s banking operation conducted through the Bank is the Company’s only reportable segment. See also the discussion contained in the section captioned “Segment Information” in Note 1 of the Notes to Consolidated Financial Statements in this report.

The discussion set forth below, and in any other portion of this report, may contain forward-looking statements. Such statements are based upon the information currently available to management of the Company and management’s perception thereof as of the date of this report. When used in this document, words such as “anticipates,” “estimates,” “believes,” “expects,” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. Such statements are subject to risks and uncertainties. Actual results of the Company’s operations could materially differ from those forward-looking comments. The differences could be caused by a number of factors or combination of factors including, but not limited to: changes in demand for banking services; changes in portfolio composition; changes in management strategy; increased competition from both bank and non-bank companies; changes in the general level of interest rates; and other factors set forth in reports and other documents filed by the Company with the Securities and Exchange Commission from time to time including the risk factors of the Company set forth in Item 1A. of the Company’s Form 10-K.

FINANCIAL CONDITION

From December 31, 2005 to December 31, 2006, the Company’s total assets increased $43,844,327 (9%) to $524,844,995, liabilities increased $41,037,233 (9%) to $479,945,752, and stockholders' equity increased $2,807,094 (7%) to $44,899,243. The ratio of stockholders’ equity to total assets decreased slightly to 8.6% during this period, compared to 8.8% as of December 31, 2005.

Guaranty Federal Bancshares, Inc.

Management’s Discussion and Analysis of Financial Condition

And Results of Operations

From December 31, 2005 to December 31, 2006, securities available-for-sale increased $1,149,174 (17%). The Company currently owns 36,600 shares of Federal Home Loan Mortgage Corporation (“FHLMC”) stock with an amortized cost of $35,847 in the securities available-for-sale category. As of December 31, 2006, the gross unrealized gain on the stock is $2,449,293, a decrease of $679,122 from the gross unrealized gain at December 31, 2005. This decrease is primarily due to the sale of 12,000 shares of the FHLMC stock in 2006. See also discussion under “Results of Operations - Comparison of Year Ended December 31, 2006 and December 31, 2005 - Non-Interest Income.”

From December 31, 2005 to December 31, 2006, securities held-to-maturity decreased $181,699 (19%) to $763,025 due to repayments received during the period. Stock of the Federal Home Loan Bank of Des Moines (“FHLB”) was increased by $403,900 (8%) to $5,382,700 due to the purchase of stock necessary to meet FHLB borrowing requirements. The Bank is required to own stock in the FHLB equal to 0.12% of assets plus 4.45% of advances.

From December 31, 2005 to December 31, 2006, net loans receivable increased by $43,829,093 (10%) to $477,264,522. During this period, permanent loans secured by both owner and non-owner occupied one to four unit residential real estate decreased $14,794,803 (15%), consumer installment loans decreased $555,769 (2%), multi-family permanent loans decreased $3,264,365 (6%), construction loans increased $13,577,073 (19%), permanent loans secured by commercial real estate increased $32,916,866 (27%) and other commercial loans increased $16,305,287 (25%). During this period the Company continued to increase its emphasis on commercial lending, while selling the majority of conforming single family loan production on the secondary market. Loans sold on the secondary market are sold servicing released, whereby the third party who purchases the loan provides the servicing. In addition, during the year ended December 31, 2006, the Bank sold its mortgage servicing rights to a third party. As a result, loans serviced for others decreased $98,158,769 (86%).

From December 31, 2005 to December 31, 2006, loans past due 90 days or more increased $1,291,937 to $2,013,477 (0.4% of net loans). As of December 31, 2006, management considers loans totaling $3,016,448 as impaired with a related allowance for loan losses of $298,311. One to four family homes collateralize the majority of the impaired loans. The Bank recognizes interest income on impaired loans as payments are received. Management believes the loss allowances recorded for these loans are sufficient to liquidate the collateral without further loss.

From December 31, 2005 to December 31, 2006, the allowance for loan losses increased $383,823 to $5,783,477. In addition to the provision for loan loss of $750,000 recorded by the Company during the year ended December 31, 2006, loan charge-offs exceeded recoveries by $366,177 for the twelve months ended December 31, 2006. The allowance for loan losses as of December 31, 2006 and December 31, 2005 was 1.2% and 1.2% of net loans outstanding, respectively. As of December 31, 2006, the allowance for loan losses was 192% of impaired loans versus 117% as of December 31, 2005.

As of December 31, 2006, foreclosed assets held for sale consisted of one single family residence and two building lots.

From December 31, 2005 to December 31, 2006, premises and equipment increased $415,011 (6%) to $7,867,809. This increase is primarily due the addition of a new branch located in Springfield, Missouri, and new equipment.

From December 31, 2005 to December 31, 2006, deposits increased $32,170,685 (10%) to $352,229,636. During this period, core deposit accounts decreased by $1,259,419 (1%) to 37% of total deposits and certificates of deposit increased by $33,430,104 (18%) to $223,236,422. Included in the certificates of deposit total is $29,146,308 in deposits placed by brokers, a decrease from $57,269,088 as of December 31, 2005.

From December 31, 2005 to December 31, 2006, the Company’s borrowings from the Federal Home Loan Bank (“FHLB”) increased $8,000,000 to $108,000,000, which satisfies the Company’s requirement to comply with the FHLB advances limitation of 35% of total assets.

Guaranty Federal Bancshares, Inc.

Management’s Discussion and Analysis of Financial Condition

And Results of Operations

As of December 31, 2006 and 2005, the Company had $15,465,000 of junior subordinated debentures that were comprised of $5,155,000 issued to Guaranty Statutory Trust I and $10,310,000 issued to Guaranty Statutory Trust II. On December 15, 2005, the Company completed an offering of $15 million of trust preferred securities (”Trust Securities”). The Company formed Guaranty Statutory Trust I and Guaranty Statutory Trust II as wholly-owned subsidiaries and Delaware statutory trusts for the purpose of issuing the Trust Securities. The proceeds of the sale of Trust Securities issued by Guaranty Statutory Trust I, together with the proceeds of the Trust’s sale of its common securities issued to the Company, were used by the Trust to purchase 30-year junior subordinated deferrable interest debentures from the Company in the principal amount of $5,155,000 (“Trust I Debentures”). The proceeds of the sale of Trust Securities issued by Guaranty Statutory Trust II, together with the proceeds of the Trust’s sale of its common securities issued to the Company, were used by the Trust to purchase 30-year junior subordinated deferrable interest debentures from the Company in the principal amount of $10,310,000 (“Trust II Debentures”, and collectively with the Trust I Debentures, the “Debentures”). Both the Trust I Debentures and the Trust II Debentures were issued pursuant to the terms of Indentures dated December 15, 2005 by and between the Company and Wilmington Trust Company, as trustee. The Trust I Debentures bear interest at a fixed rate of 6.92%, payable quarterly. The Trust II Debentures bear interest at a fixed rate of 6.47% for 5 years, payable quarterly, after issuance and thereafter at a floating rate equal to the three month LIBOR plus 1.45%. The interest payments by the Company to the Trusts will be used to pay the dividends payable by the Trusts to the holders of the Trust Securities.

The Debentures mature on February 23, 2036. Subject to prior approval by the Federal Reserve Board, the Debentures and the Trust Securities are each callable by the Company or the Trusts, respectively and as applicable, at its option after five years from issuance, and sooner in the case of a special redemption at a special redemption price ranging up to 103.2% of the principal amount thereof, and upon the occurrence of certain events, such as a change in the regulatory capital treatment of the Trust Securities, either Trust being deemed an investment company or the occurrence of certain adverse tax events. In addition, the Company and the Trusts may defer interest and dividend payments, respectively, for up to five consecutive years without resulting in a default. An event of default may occur if the Company declares bankruptcy, fails to make the required payments within 30 days or breaches certain covenants under the Debentures. The Debentures are subordinated to the prior payment of any other indebtedness of the Company.

The Company invested the proceeds of the sale of the Trust Securities in its banking subsidiary, where the funds were used primarily to restructure the investment portfolio, fund loan growth and repay FHLB advances.

Stockholders’ equity (including unrealized appreciation on securities available-for-sale, net of tax) increased $2,807,094 (7%) to $44,899,243 as of December 31, 2006. Net income for the period ended December 31, 2006 exceeded cash dividends paid or declared by $4,649,668. The Company repurchased 125,066 shares as treasury stock at a cost of $3,593,081, at an average price of $28.73 per share. As of December 31, 2006, 163,477 shares remain to be repurchased under the repurchase plan announced July 25, 2006. The decrease in unrealized appreciation on securities available-for-sale, net of tax, decreased stockholders’ equity by $437,377. Stockholders’ equity also increased as a result of exercises of stock options to purchase the Company’s Common Stock and the release of shares of the Company’s Common Stock held by the Bank sponsored Employee Stock Ownership Plan. On a per share basis, stockholders’ equity increased $1.13 (7%) from $15.17 as of December 31, 2005 to $16.30 as of December 31, 2006.

Guaranty Federal Bancshares, Inc.

Management’s Discussion and Analysis of Financial Condition

And Results of Operations

AVERAGE BALANCES, INTEREST AND AVERAGE YIELDS

The following table shows the balances as of December 31, 2006 of various categories of interest-earning assets and interest-bearing liabilities and the corresponding yields and costs, and, for the periods indicated: (1) the average balances of various categories of interest-earning assets and interest-bearing liabilities, (2) the total interest earned or paid thereon, and (3) the resulting weighted average yields and costs. In addition, the table shows the Company’s rate spreads and net yields. Average balances are based on daily balances. Tax-free income is not material; accordingly, interest income and related average yields have not been calculated on a tax equivalent basis. Average loan balances include non-accrual loans. Dollar amounts are expressed in thousands.

| | | As of | | Year Ended | | Year Ended | | Year Ended | |

| | | December 31, 2006 | | December 31, 2006 | | December 31, 2005 | | December 31, 2004 | |

| | | Balance | | Yield / Cost | | Average Balance | | Interest | | Yield / Cost | | Average Balance | | Interest | | Yield / Cost | | Average Balance | | Interest | | Yield / Cost | |

ASSETS | | | | | | | | | | | | | | | | | | | | | | | |

| Interest-earning: | | | | | | | | | | | | | | | | | | | | | | | |

| Loans | | $ | 480,269 | | | 7.78 | % | $ | 452,348 | | $ | 34,362 | | | 7.60 | % | $ | 419,552 | | $ | 26,553 | | | 6.33 | % | $ | 366,696 | | $ | 19,990 | | | 5.45 | % |

| Investment securities | | | 6,184 | | | 5.04 | % | | 7,262 | | | 451 | | | 6.21 | % | | 9,905 | | | 432 | | | 4.36 | % | | 10,076 | | | 289 | | | 2.87 | % |

| Other assets | | | 12,064 | | | 4.17 | % | | 9,843 | | | 253 | | | 2.57 | % | | 11,681 | | | 299 | | | 2.56 | % | | 14,508 | | | 260 | | | 1.79 | % |

| Total interest-earning | | | 498,517 | | | 7.66 | % | | 469,452 | | | 35,066 | | | 7.47 | % | | 441,138 | | | 27,284 | | | 6.18 | % | | 391,280 | | | 20,539 | | | 5.25 | % |

| Noninterest-earning | | | 26,328 | | | | | | 20,914 | | | | | | | | | 20,205 | | | | | | | | | 20,812 | | | | | | | |

| | | $ | 524,845 | | | | | $ | 490,366 | | | | | | | | $ | 461,343 | | | | | | | | $ | 412,092 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

LIABILITIES AND STOCKHOLDERS' EQUITY | |

| Interest-bearing: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Savings accounts | | $ | 14,316 | | | 2.67 | % | $ | 14,830 | | | 365 | | | 2.46 | % | $ | 14,931 | | | 201 | | | 1.35 | % | $ | 16,607 | | | 140 | | | 0.84 | % |

| Transaction accounts | | | 87,782 | | | 2.55 | % | | 78,238 | | | 1,710 | | | 2.19 | % | | 84,776 | | | 1,300 | | | 1.53 | % | | 80,001 | | | 793 | | | 0.99 | % |

| Certificates of deposit | | | 223,236 | | | 4.86 | % | | 195,772 | | | 8,448 | | | 4.32 | % | | 178,301 | | | 5,788 | | | 3.25 | % | | 139,264 | | | 3,986 | | | 2.86 | % |

| FHLB advances | | | 108,000 | | | 5.35 | % | | 110,810 | | | 5,722 | | | 5.16 | % | | 111,104 | | | 4,494 | | | 4.04 | % | | 111,169 | | | 3,519 | | | 3.17 | % |

| Subordinated debentures | | | 15,465 | | | 6.62 | % | | 15,465 | | | 1,028 | | | 6.65 | % | | 701 | | | 47 | | | 6.70 | % | | - | | | - | | | | |

| Other borrowed funds | | | 1,703 | | | 2.75 | % | | 3,947 | | | 114 | | | 2.89 | % | | 1,395 | | | 31 | | | 2.22 | % | | 987 | | | 7 | | | 0.71 | % |

| Total interest-bearing | | | 450,502 | | | 4.51 | % | | 419,062 | | | 17,387 | | | 4.15 | % | | 391,208 | | | 11,861 | | | 3.03 | % | | 348,029 | | | 8,446 | | | 2.43 | % |

| Noninterest-bearing | | | 29,444 | | | | | | 26,898 | | | | | | | | | 28,374 | | | | | | | | | 24,173 | | | | | | | |

| Total liabilities | | | 479,946 | | | | | | 445,960 | | | | | | | | | 419,582 | | | | | | | | | 372,202 | | | | | | | |

| Stockholders' equity | | | 44,899 | | | | | | 44,406 | | | | | | | | | 41,761 | | | | | | | | | 39,891 | | | | | | | |

| | | $ | 524,845 | | | | | $ | 490,366 | | | | | | | | $ | 461,343 | | | | | | | | $ | 412,092 | | | | | | | |

| Net earning balance | | $ | 48,015 | | | | | $ | 50,390 | | | | | | | | $ | 49,930 | | | | | | | | $ | 43,252 | | | | | | | |

| Earning yield less costing rate | | | | | | 3.15 | % | | | | | | | | 3.32 | % | | | | | | | | 3.15 | % | | | | | | | | 2.82 | % |

| Net interest income, and net yield spread on interest-earning assets | | | | | | | | | | | $ | 17,679 | | | 3.77 | % | | | | $ | 15,423 | | | 3.50 | % | | | | $ | 12,094 | | | 3.09 | % |

| Ratio of interest-earning assets to | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| interest-bearing liabilities | | | 111 | % | | | | | 112 | % | | | | | | | | 113 | % | | | | | | | | 112 | % | | | | | | |

Guaranty Federal Bancshares, Inc.

Management’s Discussion and Analysis of Financial Condition

And Results of Operations

The following table sets forth information regarding changes in interest income and interest expense for the periods indicated resulting from changes in average balances and average rates shown in the previous table. For each category of interest-earning assets and interest-bearing liabilities information is provided with respect to changes attributable to: (i) changes in balance (change in balance multiplied by the old rate), (ii) changes in interest rates (change in rate multiplied by the old balance); and (iii) the combined effect of changes in balance and interest rates (change in balance multiplied by change in rate). Dollar amounts are expressed in thousands.

| | | Year ended | | Year ended | |

| | | December 31, 2006 versus December 31, 2005 | | December 31, 2005 versus December 31, 2004 | |

| | | Average Balance | | Interest Rate | | Rate & Balance | | Total | | Average Balance | | Interest Rate | | Rate & Balance | | Total | |

| Interest income: | | | | | | | | | | | | | | | | | |

| Loans | | $ | 2,075 | | | 5,318 | | | 416 | | | 7,809 | | $ | 2,881 | | | 3,218 | | | 464 | | | 6,563 | |

| Investment securitites | | | (115 | ) | | 183 | | | (49 | ) | | 19 | | | (5 | ) | | 150 | | | (2 | ) | | 143 | |

| Other assets | | | (47 | ) | | 1 | | | - | | | (46 | ) | | (50 | ) | | 111 | | | (22 | ) | | 39 | |

| Net change in interest income | | | 1,913 | | | 5,502 | | | 367 | | | 7,782 | | | 2,826 | | | 3,479 | | | 440 | | | 6,745 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest expense: | | | | | | | | | | | | | | | | | | | | | | | | | |

| Savings accounts | | | (2 | ) | | 167 | | | (1 | ) | | 164 | | | (14 | ) | | 84 | | | (9 | ) | | 61 | |

| Transaction accounts | | | (100 | ) | | 553 | | | (43 | ) | | 410 | | | 47 | | | 433 | | | 26 | | | 506 | |

| Certificates of deposit | | | 567 | | | 1,907 | | | 187 | | | 2,661 | | | 1,117 | | | 535 | | | 150 | | | 1,802 | |

| Advances | | | (12 | ) | | 1,243 | | | (3 | ) | | 1,228 | | | (2 | ) | | 977 | | | (1 | ) | | 974 | |

| Subordinated debentures | | | 990 | | | - | | | (9 | ) | | 981 | | | 47 | | | - | | | - | | | 47 | |

| Other borrowed funds | | | 57 | | | 9 | | | 17 | | | 83 | | | 3 | | | 15 | | | 6 | | | 24 | |

| Net change in interest expense | | | 1,500 | | | 3,879 | | | 148 | | | 5,527 | | | 1,198 | | | 2,044 | | | 172 | | | 3,414 | |

| Change in net interest income | | $ | 413 | | | 1,623 | | | 219 | | | 2,255 | | $ | 1,628 | | | 1,435 | | | 268 | | | 3,331 | |

RESULTS OF OPERATIONS - COMPARISON OF YEAR ENDED DECEMBER 31, 2006 AND DECEMBER 31, 2005

| | | Prime | | Ten-Year Treasury | | One-Year Treasury | |

| December 31, 2006 | | | 7.96 | % | | 4.80 | % | | 4.94 | % |

| December 31, 2005 | | | 6.19 | % | | 4.29 | % | | 3.62 | % |

| Change in rates | | | 1.77 | % | | 0.51 | % | | 1.32 | % |

Interest Rates. The Bank charges borrowers and pays depositors interest rates that are largely a function of the general level of interest rates. The above table sets forth the weekly average interest rates for the 52 weeks ending December 31, 2006 and December 31, 2005 as reported by the Federal Reserve. The Bank typically indexes its adjustable rate commercial loans to prime and its adjustable rate mortgage loans to the one-year treasury rate. The ten-year treasury rate is a proxy for 30-year fixed rate home mortgage loans.

Rates trended upward during 2005 as the Federal Reserve Open Market Committee increased the discount rates 25 basis points after eight consecutive meetings from January 2005 to December 2005. As of year-end 2005 the prime rate was 7.25%.This trend continued in 2006 as the Federal Reserve Open Market Committee increased the discount rates 25 basis points after four consecutive meetings from January 2006 to June 2006. As of year-end 2006 the prime rate was 8.25%.

Guaranty Federal Bancshares, Inc.

Management’s Discussion and Analysis of Financial Condition

And Results of Operations

Interest Income. Total interest income increased $7,782,911 (29%) as the average balance of interest-earning assets increased $28,314,000 (6%). In addition, the yield on average interest earning assets increased 129 basis points to 7.47%.

Interest on loans increased $7,809,604 (29%) and the average loan receivable balance increased $32,796,000 (8%) while the average yield increased 127 basis points to 7.60%. The increase in loan yield is the result of the combination of new loans at higher rates, a reduction in prepayments, and an increase of interest rates on adjustable rate loans.

Interest Expense. Total interest expense increased $5,526,189 (47%) as the average balance of interest-bearing liabilities increased $27,854,000 (7%). In addition, the average cost of interest-bearing liabilities increased 112 basis points to 4.15%.

Interest expense on deposits increased $3,235,130 (44%) as the average balance of interest bearing deposits increased $10,832,000 (4%) and the average interest rate paid to depositors increased 102 basis points to 3.64%. The average balance of interest bearing core deposit accounts decreased $6,639,000 (7%) and the average balance of certificates of deposit increased $17,471,000 (10%).

The Company’s borrowings from the FHLB increased to $108,000,000, which remains in compliance with the FHLB limitation of advances to 35% of assets. The average cost of those advances increased 112 basis points to 5.16%. As a result, interest expense on these advances increased $1,227,976 (27%). As of December 31, 2006 FHLB advances are 20% of total assets, compared to 21% of total assets as of December 31, 2005.

Net Interest Income. The Company’s net interest income increased $2,256,722 (15%). During the year ended December 31, 2006, the average balance of interest-earning assets exceeded the average balance of interest-bearing liabilities by $50,390,000, resulting in an increase in the average net earning balance of $460,000 (1%). In addition, the Company’s spread between the average yield on interest-earning assets and the average cost of interest-bearing liabilities increased by 17 basis points from 3.15% to 3.32%.

Provision for Loan Losses. Provisions for loan losses are charged or credited to earnings to bring the total allowance for loan losses to a level considered adequate by the Company to provide for potential loan losses in the existing loan portfolio. When making its assessment, the Company considers prior loss experience, volume and type of lending, local banking trends and past due loans in the Company’s loan portfolio. In addition, the Company considers general economic conditions and other factors related to collectibility of the Company’s loan portfolio.

During the year ended December 31, 2006, the Company experienced loan charge-offs, in excess of recoveries, of $366,177 and, based on a review as discussed above, elected to record a provision for loan loss of $750,000 to increase the allowance for loan losses to $5,783,477 as of December 31, 2006. The provision for loan losses recorded by the Company during year ended December 31, 2005 was $945,000. Management of the Company anticipates the need to continue increasing the loan loss allowance in the future through charges to provision for loan losses based on the anticipated growth in its loan portfolio and the shift in the Company’s emphasis from primarily single-family loans to a mix of single-family and commercial loans.

Non-Interest Income. Non-interest income increased $200,789 (6%). The gain on sale of loans of $692,276 for 2006, compared to $623,252 for 2005, was the result of mortgage banking activities related to the sale of single-family conforming residential loans in the secondary market. The Bank attempts to minimize its risk of price changes by committing to sell loans while the loans are in the origination process. The gain on sale of investments for the year ended December 31, 2006 was $750,869, compared to $743,335 for year ended December 31, 2005. In 2006, this gain was attributed to the sale of 12,000 shares of FHLMC stock. During 2006 the Bank sold its mortgage loan servicing rights to a third party, which resulted in a profit on the sale of $89,441. In addition the Bank had income from tax credits purchased of $191,678 during 2006. Deposit service charges decreased $241,709 (15%) due to decreases in insufficient funds and overdraft charges on the Bank’s checking accounts. In addition, late charges and other fees decreased $30,021 (11%) primarily due to a decrease in prepayment penalties collected during the year ended December 31, 2006.

Guaranty Federal Bancshares, Inc.

Management’s Discussion and Analysis of Financial Condition

And Results of Operations

Non-Interest Expense. Non-interest expense increased $1,507,193 (17%). This increase was primarily due to increases in salaries and employee benefits of $1,226,893 (25%) and occupancy expense of $155,211 (11%). The increase in compensation was due to normal salary and benefits increases for the Bank’s employees, along with an increase in the number of employees. The staff increased from 125 full-time equivalent employees as of December 31, 2005 to 146 full-time equivalent employees as of December 31, 2006. In 2006, the Company opened a new full-service branch in Springfield, Missouri. In addition advertising expense increased $173,038 (75%). This increase was primarily due to the Bank’s decision to increase its exposure through the use of several different advertising mediums. Data processing expense decreased $160,222 (36%). This decrease was primarily due to the Bank’s decision to terminate its relationship with a third-party vendor that provided data processing services. This conversion was completed in January of 2006.

Income Taxes. The increase in income tax expense is a direct result of the increase in the Company’s taxable income for the period ended December 31, 2006 as compared to the period ended December 31, 2005.

Cash Dividends Paid. The Company paid dividends of $0.165 per share on April 14, 2006, to stockholders’ of record as of March 30, 2006, and $0.165 per share on July 15, 2006 to stockholders’ of record as of July 1, 2006, and $0.17 per share on October 14, 2006, to stockholders’ of record as of October 1, 2006. The Company declared a cash dividend of $0.17 per share on December 21, 2006, which was paid on January 19, 2007, to stockholders of record on January 5, 2007.

RESULTS OF OPERATIONS - COMPARISON OF YEAR ENDED DECEMBER 31, 2005 AND DECEMBER 31, 2004

| | | Prime | | Ten-Year Treasury | | One-Year Treasury | |

| December 31, 2005 | | | 6.19 | % | | 4.29 | % | | 3.62 | % |

| December 31, 2004 | | | 4.34 | % | | 4.27 | % | | 1.88 | % |

| Change in rates | | | 1.85 | % | | 0.02 | % | | 1.74 | % |

Interest Rates. The Bank charges borrowers and pays depositors interest rates that are largely a function of the general level of interest rates. The above table sets forth the weekly average interest rates for the 52 weeks ending December 31, 2005 and December 31, 2004 as reported by the Federal Reserve. The Bank typically indexes its adjustable rate commercial loans to prime and its adjustable rate mortgage loans to the one-year treasury rate. The ten-year treasury rate is a proxy for 30-year fixed rate home mortgage loans.

Rates trended upward during 2004 as the Federal Reserve Open Market Committee increased the discount rates 25 basis points after five consecutive meetings from June to December 2004. As of year-end 2004, the prime rate was 5.25% up from 4.00% where it was quoted from June 2003 to June 2004. This trend continued in 2005 as the Federal Reserve Open Market Committee increased the discount rates 25 basis points after eight consecutive meetings from January 2005 to December 2005. As of year-end 2005 the prime rate was 7.25%.

Interest Income. Total interest income increased $6,744,135 (33%) as the average balance of interest-earning assets increased $49,858,000 (12%). In addition, the yield on average interest earning assets increased 93 basis points to 6.18%.

Interest on loans increased $6,562,743 (33%) and the average loan receivable balance increased $52,856,000 (14%) while the average yield increased 88 basis points to 6.33%. The increase in loan yield is the result of the combination of new loans at higher rates, a reduction in prepayments, and an increase of interest rates on adjustable rate loans.

Guaranty Federal Bancshares, Inc.

Management’s Discussion and Analysis of Financial Condition

And Results of Operations

Interest Expense. Total interest expense increased $3,414,774 (40%) as the average balance of interest-bearing liabilities increased $43,179,000 (12%). In addition, the average cost of interest-bearing liabilities increased 60 basis points to 3.03%.

Interest expense on deposits increased $2,368,909 (48%) as the average balance of interest bearing deposits increased $42,136,000 (18%) and the average interest rate paid to depositors increased 54 basis points to 2.62%. The average balance of interest bearing core deposit accounts increased $3,099,000 (3%) and the average balance of certificates of deposit increased $39,037,000 (28%).

In compliance with the FHLB limitation of advances to 35% of assets, the Company’s borrowings from the FHLB remained the same at $100,000,000. The average cost of those advances increased 87 basis points to 4.04%. As a result, interest expense on these advances increased $974,604 (28%). As of December 31, 2005, FHLB advances are 21% of total assets, compared to 23% of total assets as of December 31, 2004.

Net Interest Income. The Company’s net interest income increased $3,329,361 (28%). During the year ended December 31, 2005, the average balance of interest-earning assets exceeded the average balance of interest-bearing liabilities by $49,930,000, resulting in an increase in the average net earning balance of $49,858,000 (12%). In addition, the Company’s spread between the average yield on interest-earning assets and the average cost of interest-bearing liabilities increased by 33 basis points from 2.82% to 3.15%.

Provision for Loan Losses. Provisions for loan losses are charged or credited to earnings to bring the total allowance for loan losses to a level considered adequate by the Company to provide for potential loan losses in the existing loan portfolio. When making its assessment, the Company considers prior loss experience, volume and type of lending, local banking trends and past due loans in the Company’s loan portfolio. In addition, the Company considers general economic conditions and other factors related to collectibility of the Company’s loan portfolio.

During year ended December 31, 2005, the Company experienced loan charge-offs in excess of recoveries of $82,000 and, based on a review as discussed above, elected to record a provision for loan loss of $945,000 to increase the allowance for loan losses to $5,399,654 as of December 31, 2005. The provision for loan losses recorded by the Company during year ended December 31, 2004 was $863,830. Management of the Company anticipates the need to continue increasing the loan loss allowance in the future through charges to provision for loan losses based on the anticipated growth in its loan portfolio and the shift in the Company’s emphasis from primarily single-family loans to a mix of single-family and commercial loans.

Non-Interest Income. Non-interest income decreased $19,115 (1%). The gain on sale of loans of $623,252 for 2005, compared to $484,920 for 2004, was the result of mortgage banking activities related to the sale of single-family conforming residential loans in the secondary market. The Bank attempts to minimize its risk of price changes by committing to sell loans while the loans are in the origination process. The gain on sale of investments for year ended December 31, 2005 was $743,335, compared to $742,608 for year ended December 31, 2004. In 2005, this gain was primarily attributed to the gain of $1,210,672, arising from the sale of 19,400 shares of FHLMC stock, which was offset by the loss of $526,000 incurred with the sale of all of its shares of Fannie Mae preferred. Deposit service charges decreased $234,396 (12%) due to decreases in insufficient funds and overdraft charges on the Bank’s checking accounts. In addition, late charges and other fees decreased $89,239 (25%) primarily due to a decrease in prepayment penalties collected during the year ended December 31, 2005.

Non-Interest Expense. Non-interest expense increased $421,630 (5%). This increase was primarily due to increases in salaries and employee benefits of $313,328 (7%) and occupancy expense of $78,298 (6%). The increase in compensation was due to normal salary and benefits increases for the Bank’s employees, along with an increase in the number of employees. The staff increased from 115 full-time equivalent employees as of December 31, 2004 to 125 full-time equivalent employees as of December 31, 2005. In August 2005, the Company opened a new full-service branch in Nixa, Missouri. In addition, the full-service branch located on West Kearney was in operation for the entire year of 2005.

Guaranty Federal Bancshares, Inc.

Management’s Discussion and Analysis of Financial Condition

And Results of Operations

Income Taxes. The increase in income tax expense is a direct result of the increase in the Company’s taxable income for the period ended December 31, 2005 as compared to the period ended December 31, 2004.

Cash Dividends Paid. The Company paid dividends of $0.16 per share on April 14, 2005, to stockholders’ of record as of March 30, 2005, and $0.16 per share on July 15, 2005 to stockholders’ of record as of July 1, 2005, and $0.165 per share on October 14, 2005, to stockholders’ of record as of October 1, 2005. The Company declared a cash dividend of $0.165 per share on December 22, 2005, which was paid on January 20, 2006, to stockholders of record on January 6, 2006.

ASSET / LIABILITY MANAGEMENT

The goal of the Bank’s asset/liability policy is to manage interest rate risk so as to maximize net interest income over time in changing interest rate environments. Management monitors the Bank’s net interest spreads (the difference between yields received on assets and paid on liabilities) and, although constrained by market conditions, economic conditions, and prudent underwriting standards, it offers deposit rates and loan rates that maximize net interest income. Management also attempts to fund the Bank’s assets with liabilities of a comparable duration to minimize the impact of changing interest rates on the Bank’s net interest income. This matching is especially difficult because the residential mortgage loans that comprise a significant portion of the Bank’s assets give the borrower the right to prepay at any time. These borrowers act in their economic self-interest and refinance higher rate loans when rates are low. Since the relative spread between financial assets and liabilities is constantly changing, the Bank’s current net interest income may not be an indication of future net interest income.

As a part of its asset and liability management strategy, the Bank implemented an adjustable rate mortgage loan (“ARM”) program beginning in the early 1980s. Throughout the past several years, the Bank has continued to emphasize the origination of adjustable-rate, one- to four-family residential loans and adjustable-rate or relatively short-term commercial real estate, construction, commercial business, home equity and consumer loans, while originating fixed-rate, one- to four-family residential loans primarily for immediate resale in the secondary market.

The Bank is also managing interest rate risk by the origination of construction loans. As of December 31, 2006, such loans, net of loans in process, constitute 17% of the Bank’s loan portfolio. In general, these loans have higher yields, shorter maturities, and greater interest rate sensitivity than other real estate loans.

The Bank constantly monitors its deposits in an effort to decrease their interest rate sensitivity. Rates of interest paid on deposits at the Bank are priced competitively in order to meet the Bank’s asset/liability management objectives and spread requirements. As of December 31, 2006 and December 31, 2005, the Bank’s savings accounts, checking accounts, and money market deposit accounts totaled $128,993,214 or 37% of its total deposits and $130,252,633 or 41% of total deposits, respectively. The weighted average rate paid on these accounts increased 87 basis points from 1.12% on December 31, 2005 to 1.99% on December 31, 2006. The Bank believes, based on historical experience, that a substantial portion of such accounts represents non-interest rate sensitive, core deposits. During the year ending December 31, 2007, the FHLB has the option to call $9.0 million of advances with a weighted average rate of 5.55% and a remaining life of 1.7 years.

Guaranty Federal Bancshares, Inc.

Management’s Discussion and Analysis of Financial Condition

And Results of Operations

INTEREST RATE SENSITIVITY ANALYSIS

The following table sets forth as of December 31, 2006, management’s estimates of the projected changes in net portfolio value (“NPV”) in the event of 100, 200, and 300 basis point (“bp”) instantaneous and permanent increases and decreases in market interest rates. Dollar amounts are expressed in thousands.

| BP Change | | Estimated Net Portfolio Value | | NPV as % of PV of Assets | |

| in Rates | | $ Amount | | $ Change | | % Change | | NPV Ratio | | Change | |

| +300 | | | 41,364 | | | (1,646 | ) | | -3 | % | | 9.55 | % | | -3.61 | % |

| +200 | | | 42,650 | | | (360 | ) | | -1 | % | | 9.60 | % | | -3.56 | % |

| +100 | | | 43,321 | | | 311 | | | 1 | % | | 9.53 | % | | -3.63 | % |

| NC | | | 43,010 | | | | | | | | | 9.25 | % | | | |

| -100 | | | 41,982 | | | (1,028 | ) | | -2 | % | | 8.85 | % | | -4.31 | % |

| -200 | | | 40,409 | | | (2,601 | ) | | -5 | % | | 8.38 | % | | -4.78 | % |

| -300 | | | 38,284 | | | (4,726 | ) | | -8 | % | | 7.81 | % | | -5.35 | % |

Computations of prospective effects of hypothetical interest rate changes are based on an internally generated model using actual maturity and repricing schedules for the Bank’s loans and deposits, and are based on numerous assumptions, including relative levels of market interest rates, loan repayments and deposit run-offs, and should not be relied upon as indicative of actual results. Further, the computations do not contemplate any actions the Bank may undertake in response to changes in interest rates.

Management cannot predict future interest rates or their effect on the Bank’s NPV in the future. Certain shortcomings are inherent in the method of analysis presented in the computation of NPV. For example, although certain assets and liabilities may have similar maturities or periods to repricing, they may react in differing degrees to changes in market interest rates. Additionally, certain assets, such as adjustable-rate loans, which represent the Bank’s primary loan product, have an initial fixed rate period typically from one to five years and over the remaining life of the asset changes in the interest rate are restricted. In addition, the proportion of adjustable-rate loans in the Bank’s loan portfolio could decrease in future periods due to refinancing activity if market interest rates remain constant or decrease in the future. Further, in the event of a change in interest rates, prepayment and early withdrawal levels could deviate significantly from those assumed in the table. Finally, the ability of many borrowers to service their adjustable-rate debt may decrease in the event of an interest rate increase.

The Bank’s Board of Directors is responsible for reviewing the Bank’s asset and liability policies. The Bank’s management is responsible for administering the policies and determinations of the Board of Directors with respect to the Bank’s asset and liability goals and strategies. Management expects that the Bank’s asset and liability policies and strategies will continue as described above so long as competitive and regulatory conditions in the financial institution industry and market interest rates continue as they have in recent years.

LIQUIDITY AND CAPITAL RESOURCES

The Company’s principal sources of funds for investments and operations are net income from operations, deposits from its primary market area, FHLB advances, principal and interest payments on loans and mortgage-backed securities, proceeds from maturing investment securities, and the issuance of subordinated debentures. The Company considers deposits and FHLB advances as its primary sources of funds.

The Company’s most liquid assets are cash and cash equivalents, which are cash on hand, amounts due from financial institutions, and certificates of deposit with other financial institutions that have an original maturity of three months or less. The levels of such assets are dependent on the Bank’s operating, financing, and investment activities at any given time. The Company’s cash and cash equivalents totaled $14,880,601 as of December 31, 2006 and $20,506,478 as of December 31, 2005, representing a decrease of $5,625,877. The variations in levels of cash and cash equivalents are influenced by deposit flows and anticipated future deposit flows, which are subject to, and influenced by, many factors.

Guaranty Federal Bancshares, Inc.

Management’s Discussion and Analysis of Financial Condition

And Results of Operations

In addition to the capital necessary to meet the Company’s conditional commitments discussed under the caption “Off-Balance Sheet Arrangements” below, the Bank also has $173,499,700 in certificates of deposit that are scheduled to mature in one year or less. Management anticipates that the majority of these certificates will renew in the normal course of operations. Based on existing collateral as well as the FHLB’s limitation of advances to 35% of assets, the Bank has the ability to borrow an additional $40,645,000 from the FHLB, as of December 31, 2006. The Bank plans to maintain its FHLB borrowings to a level that will provide a borrowing capacity sufficient to provide for contingencies.

The Company’s regulatory capital position of $57,820,000 is 11.0% of total assets as of December 31, 2006. The Company has an excess of $38,205,000, $38,589,000, and $26,790,000 of required regulatory levels of tangible, core, and risk-based capital, respectively. Under current regulatory guidelines, the Bank is classified as well capitalized. See also additional information provided under the caption “Regulatory Matters” in Note 1 of the Notes to Consolidated Financial Statements.

During the year ended December 31, 2006, the Company declared dividends of $0.67 per share and paid dividends of $0.665 per share, compared to dividends declared of $0.65 per share and paid of $0.645 per share during the year ended December 31, 2005. The Board of Directors of the Company meets regularly to consider the level and the timing of dividend payments. Dividends declared but unpaid at December 31, 2006 ($0.17 per share), were paid to shareholders on January 19, 2007.

During the year ended December 31, 2005, the Company purchased 146,542 shares of common stock at an average price of $24.31 to place in the treasury account. During the year ended December 31, 2006, the Company purchased 125,066 shares of common stock at an average price of $28.73 to place in the treasury account. The Company intends to monitor the common stock price and, with regulatory approval, may from time to time initiate further stock repurchases in order to improve the Company’s long-term earnings per share while at the same time maintaining an adequate level of stockholders’ equity. The Company has a repurchase plan which was announced on July 25, 2006, and as of December 31, 2006, a total of 163,477 shares of the Company’s common stock may be purchased under this plan.

On December 15, 2005, the Company issued $15 million of trust preferred securities (”Trust Securities”) in a private placement. The proceeds of the sale of Trust Securities issued by Guaranty Statutory Trust I and Guaranty Statutory Trust II, together with the proceeds of the Trust’s sale of their common securities issued to the Company, were used by the Trusts to purchase 30-year junior subordinated deferrable interest debentures from the Company in the principal amount of $5,155,000 (“Trust I Debentures”) and $10,310,000 (“Trust II Debentures”), respectively. The Trust I Debentures bear interest at a fixed rate of 6.92%, payable quarterly. The Trust II Debentures bear interest at a fixed rate of 6.47% for 5 years, payable quarterly, after issuance and thereafter at a floating rate equal to the three month LIBOR plus 1.45%. The Company invested the proceeds of the sale of the Trust Securities in its banking subsidiary, where the funds were used primarily to restructure the investment portfolio, fund loan growth and repay FHLB advances.

OFF-BALANCE SHEET ARRANGEMENTS

Various commitments and contingent liabilities arise in the normal course of business, which are not required to be recorded on the balance sheet. The most significant of these are loan commitments, lines of credit and standby letters of credit. Commitments to extend credit are agreements to lend to a customer as long as there is no violation of any condition established in the contract. As of December 31, 2006 and 2005, the Bank had outstanding commitments to originate loans of approximately $3,991,000 and $2,285,000, respectively. Lines of credit are agreements to lend to a customer as long as there is no violation of any condition established in the contract. As of December 31, 2006 and 2005, unused lines of credit to borrowers aggregated approximately $64,370,000 and $77,725,000 for commercial lines and $19,790,000 and $18,180,000 for open-end consumer lines. Since a portion of the loan commitment and line of credit may expire without being drawn upon, the total unused commitments and lines do not necessarily represent future cash requirements.

Guaranty Federal Bancshares, Inc.

Management’s Discussion and Analysis of Financial Condition

And Results of Operations

Standby letters of credit are irrevocable conditional commitments issued by the Bank to guarantee the performance of a customer to a third party. The credit risk involved in issuing standby letters of credit is essentially the same as that involved in extending loans to customers. The Bank had total outstanding standby letters of credit amounting to $9,182,000 and $9,731,000 as of December 31, 2006 and 2005, respectively. Forward commitments to sell mortgage loans are obligations to deliver loans at a specified price on or before a specified date. As of December 31, 2006 and 2005, the Bank had no outstanding forward commitments.

In connection with the Company’s issuance of the Trust Securities and pursuant to two guarantee agreements by and between the Company and Wilmington Trust Company, the Company issued a limited, irrevocable guarantee of the obligations of each Trust under the Trust Securities whereby the Company has guaranteed any and all payment obligations of the Trusts related to the Trust Securities including distributions on, and the liquidation or redemption price of, the Trust Securities to the extent each Trust does not have funds available.

AGGREGATE CONTRACTUAL OBLIGATIONS

The following table summarizes the Company’s fixed and determinable contractual obligations by payment date as of December 31, 2006. Dollar amounts are expressed in thousands.

| Payments Due By Period | |

| | | | | | | | | | | | |

| | | | | One Year | | One to | | Three to | | More than | |

| Contractual Obligations | | Total | | or less | | Three Years | | Five Years | | Five Years | |

| | | | | | | | | | | | |

| Deposits without stated maturity | | $ | 128,993 | | | 128,993 | | | - | | | - | | | - | |

| Time and brokered certificates of deposit | | | 223,236 | | | 173,500 | | | 43,483 | | | 5,353 | | | 900 | |

| Short-term borrowings | | | 1,703 | | | 1,703 | | | - | | | - | | | - | |

| Federal Home Loan Bank advances | | | 108,000 | | | 85,414 | | | 14,036 | | | 3,000 | | | 5,550 | |

| Subordinated debentures | | | 15,465 | | | - | | | - | | | - | | | 15,465 | |

| Operating leases | | | 443 | | | 108 | | | 178 | | | 115 | | | 42 | |

| Purchase obligations | | | - | | | - | | | - | | | - | | | - | |

| Other long term obligations | | | 110,984 | | | 110,984 | | | - | | | - | | | - | |

| Total | | $ | 588,825 | | | 338,077 | | | 69,716 | | | 8,468 | | | 21,957 | |

IMPACT OF INFLATION AND CHANGING PRICES

The Company prepared the consolidated financial statements and related data presented herein in accordance with accounting principles generally accepted in the United States of America which require the measurement of financial position and operating results in terms of historical dollars, without considering changes in the relative purchasing power of money over time due to inflation.

Unlike most companies, the assets and liabilities of a financial institution are primarily monetary in nature. As a result, interest rates have a more significant impact on a financial institution’s performance than the effects of general levels of inflation. Interest rates do not necessarily move in the same direction or in the same magnitude as the price of goods and services, since such prices are affected by inflation. In the current interest rate environment, liquidity and the maturity structure of the Bank’s assets and liabilities are critical to the maintenance of acceptable performance levels.

Guaranty Federal Bancshares, Inc.

Management’s Discussion and Analysis of Financial Condition

And Results of Operations

CRITICAL ACCOUNTING POLICIES

Management’s Discussion and Analysis of Financial Condition and Results of Operations is based upon the Company’s consolidated financial statements and the notes thereto, which have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these financial statements requires management to make estimates and judgments that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reported periods. On an on-going basis, management evaluates its estimates and judgments.

Management bases its estimates and judgments on historical experience and on various other factors that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. There can be no assurance that actual results will not differ from those estimates. If actual results are different than management’s judgements and estimates, the Company’s financial results could change, and such change could be material to the Company.

Material estimates and judgments that are particularly susceptible to significant change relate to the determination of the allowance for loan losses. In connection with the determination of the allowance for loan losses, management obtains independent appraisals for significant properties.

The Company has identified the accounting policies for the allowance for loan losses and related significant estimates and judgments as critical to its business operations and the understanding of its results of operations. For a detailed discussion on the application of these significant estimates and judgments and our accounting policies, also see Note 1 of the notes to consolidated financial statements in this report.

IMPACT OF NEW ACCOUNTING PRONOUNCEMENTS

In July 2006, the Financial Accounting Standards Board (FASB) issued FASB Interpretation No. 48 (FIN 48), Accounting for Uncertainty in Income Taxes - an Interpretation of SFAS No. 109 - Accounting for Income Taxes. This interpretation addresses accounting for tax uncertainties that arise when a position that an entity takes on its tax return may be different from the position that the taxing authority may take, and provides guidance about the accounting for tax benefits associated with uncertain tax positions, classification of a liability recognized for those positions, and interim reporting considerations. This Interpretation requires that the Company recognize in its financial statements, the impact of a tax position, if that position is more likely than not of being sustained on audit. The provisions of FIN 48 are effective as of the beginning of the Company's 2007 fiscal year, with the cumulative effect of the change in accounting principle recorded as an adjustment to retained earnings. The Company is evaluating the requirements of the exposure draft to determine the impact, if any, on the financial condition or the results of operation of the Company.

In March 2006, the FASB issued Statement of Financial Accounting Standards (SFAS) No. 156, Accounting for Servicing of Financial Assets. SFAS No. 156 amends SFAS No. 140, Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities, and specifies the accounting for certain servicing assets and liabilities, such as those common to mortgage servicing activities. SFAS No. 156 requires an entity to separately recognize servicing assets and servicing liabilities and to initially measure these servicing assets and servicing liabilities at fair value at inception. It also permits an entity with a separately recognized servicing asset or servicing liability to choose either the amortization method or fair value method for subsequent measurement. Adoption of SFAS No. 156 is required for transactions occurring in fiscal years beginning after September 15, 2006, with early adoption permitted. The Company does not believe the adoption of this standard will have a material impact on the consolidated financial condition or results of operations of the Company.

In September 2006, the FASB issued SFAS No. 157, Fair Value Measurements. This Statement defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles and expands disclosure related to the use of fair value measures in financial statements. This Statement applies under other accounting pronouncements that require or permit fair value measurements, and does not expand the use of fair value measures in financial statements, but standardizes its definition and guidance in generally accepted accounting principles. SFAS No. 157 emphasizes that fair value is a market-based measurement based on an exchange transaction between market participants in which an entity sells an asset or transfers a liability. SFAS No. 157 also establishes a fair value hierarchy from observable market data as the highest level to fair value based on an entity's own fair value assumptions as the lowest level. The Statement is to be effective for financial statements issued for fiscal years beginning after November 15, 2007, with early adoption permitted. The Company is evaluating this Statement to determine the impact, if any, on certain of its financial assets and liabilities.

Guaranty Federal Bancshares, Inc.

Management’s Discussion and Analysis of Financial Condition

And Results of Operations

In September 2006, the Securities and Exchange Commission issued Staff Accounting Bulletin (SAB) No. 108, Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements. SAB No. 108 was issued to provide guidance on how the effects of prior year uncorrected misstatements should be considered when quantifying misstatements in current year financial statements. SAB No. 108 requires an entity to quantify misstatements using both a balance sheet and an income statement approach and to evaluate whether either approach results in quantifying an error that is material in light of the relevant quantitative and qualitative factors. SAB No. 108 is effective for fiscal years ending after November 15, 2006. The adoption of this standard did not have a material impact on the consolidated financial condition or results of operations of the Company.

Guaranty Federal Bancshares, Inc.

Management’s Discussion and Analysis of Financial Condition

And Results of Operations

SUMMARY OF UNAUDITED QUARTERLY OPERATING RESULTS

| | | Year Ended December 31, 2006, Quarter ended | |

| | | Mar-06 | | Jun-06 | | Sep-06 | | Dec-06 | |

| Interest income | | $ | 8,077,915 | | | 8,386,269 | | | 9,054,605 | | | 9,547,529 | |

| Interest expense | | | 3,769,423 | | | 4,125,175 | | | 4,543,095 | | | 4,948,900 | |

| Net interest income | | | 4,308,492 | | | 4,261,094 | | | 4,511,510 | | | 4,598,629 | |

| Provision for loan losses | | | 225,000 | | | 225,000 | | | 150,000 | | | 150,000 | |

| Gain on sale of loans and investment securities | | | 317,997 | | | 336,889 | | | 349,425 | | | 438,834 | |

| Other noninterest income, net | | | 503,823 | | | 621,981 | | | 571,626 | | | 657,273 | |

| Noninterest expense | | | 2,367,394 | | | 2,543,500 | | | 2,630,195 | | | 2,635,605 | |

| Income before income taxes | | | 2,537,918 | | | 2,451,464 | | | 2,652,366 | | | 2,909,131 | |

| Provision for income taxes | | | 973,593 | | | 870,074 | | | 1,028,044 | | | 1,170,084 | |

| Net income | | $ | 1,564,325 | | | 1,581,390 | | | 1,624,322 | | | 1,739,047 | |

| Basic earnings per share | | $ | 0.56 | | | 0.56 | | | 0.58 | | | 0.63 | |

| Diluted earnings per share | | $ | 0.54 | | | 0.54 | | | 0.56 | | | 0.61 | |

| | | Year Ended December 31, 2005, Quarter ended | |

| | | Mar-05 | | Jun-05 | | Sep-05 | | Dec-05 | |

| Interest income | | $ | 5,900,919 | | | 6,560,914 | | | 7,091,488 | | | 7,730,086 | |

| Interest expense | | | 2,457,208 | | | 2,783,379 | | | 3,129,687 | | | 3,490,130 | |

| Net interest income | | | 3,443,711 | | | 3,777,535 | | | 3,961,801 | | | 4,239,956 | |

| Provision for loan losses | | | 225,000 | | | 240,000 | | | 240,000 | | | 240,000 | |

| Gain on sale of loans and investment securities | | | 337,736 | | | 304,288 | | | 390,684 | | | 333,879 | |

| Other noninterest income, net | | | 546,174 | | | 536,916 | | | 567,108 | | | 580,274 | |

| Noninterest expense | | | 2,180,393 | | | 2,065,697 | | | 2,157,256 | | | 2,266,155 | |

| Income before income taxes | | | 1,922,228 | | | 2,313,042 | | | 2,522,337 | | | 2,647,954 | |

| Provision for income taxes | | | 707,454 | | | 864,327 | | | 935,076 | | | 999,734 | |

| Net income | | $ | 1,214,774 | | | 1,448,715 | | | 1,587,261 | | | 1,648,220 | |

| Basic earnings per share | | $ | 0.43 | | | 0.53 | | | 0.57 | | | 0.59 | |

| Diluted earnings per share | | $ | 0.41 | | | 0.50 | | | 0.55 | | | 0.57 | |

Guaranty Federal Bancshares, Inc.

Consolidated Balance Sheets

December 31, 2006 and 2005

| | | December 31, | | December 31, | |

| | | 2006 | | 2005 | |

ASSETS | | | | | |

| Cash | | $ | 10,684,831 | | | 17,990,774 | |

| Interest-bearing deposits in other financial institutions | | | 4,195,770 | | | 2,515,704 | |

| Cash and cash equivalents | | | 14,880,601 | | | 20,506,478 | |

| Available-for-sale securities | | | 7,906,321 | | | 6,757,147 | |

| Held-to-maturity securities | | | 763,025 | | | 944,724 | |

| Stock in Federal Home Loan Bank, at cost | | | 5,382,700 | | | 4,978,800 | |

| Mortgage loans held for sale | | | 3,004,635 | | | 2,092,279 | |

| Loans receivable, net of allowance for loan losses of December 31, 2006 and 2005 - $5,783,477 and $5,399,654, respectively | | | 477,264,522 | | | 433,435,429 | |

| Accrued interest receivable: | | | | | | | |

| Loans | | | 2,830,811 | | | 2,040,872 | |

| Investments | | | 79,498 | | | 48,255 | |

| Prepaid expenses and other assets | | | 2,955,483 | | | 2,604,425 | |

| Foreclosed assets held for sale | | | 172,637 | | | 26,775 | |

| Premises and equipment | | | 7,867,809 | | | 7,452,798 | |

| Income taxes receivable | | | 774,469 | | | - | |

| Deferred income taxes | | | 962,484 | | | 112,686 | |

| | | $ | 524,844,995 | | | 481,000,668 | |

| | | | | | | | |

LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | | | |

| | | | | | | | |

| LIABILITIES | | | | | | | |

| Deposits | | $ | 352,229,636 | | | 320,058,951 | |

| Federal Home Loan Bank advances | | | 108,000,000 | | | 100,000,000 | |

| Securities sold under agreements to repurchase | | | 1,703,221 | | | 1,594,258 | |

| Subordinated debentures | | | 15,465,000 | | | 15,465,000 | |

| Advances from borrowers for taxes and insurance | | | 222,869 | | | 212,320 | |

| Accrued expenses and other liabilities | | | 441,890 | | | 288,587 | |

| Accrued interest payable | | | 1,414,946 | | | 508,164 | |

| Dividend payable | | | 468,190 | | | 459,074 | |

| Income taxes payable | | | - | | | 322,165 | |

| | | | 479,945,752 | | | 438,908,519 | |

| STOCKHOLDERS' EQUITY | | | | | | | |

| Common Stock: | | | | | | | |

| $0.10 par value; authorized 10,000,000 shares; issued; December 31, 2006 and 2005 - 6,653,527 and 6,571,348 shares, respectively | | | 665,353 | | | 657,135 | |

| Additional paid-in capital | | | 55,730,352 | | | 53,778,686 | |

| Unearned ESOP shares | | | (1,344,930 | ) | | (1,572,930 | ) |

| Retained earnings, substantially restricted | | | 41,183,006 | | | 36,533,338 | |

| Accumulated other comprehensive income | | | | | | | |

| Unrealized appreciation on available-for-sale securities, net of income taxes; December 31, 2006 and 2005 - $901,243, and $1,158,114, respectively | | | 1,534,548 | | | 1,971,925 | |

| | | | 97,768,329 | | | 91,368,154 | |

| Treasury stock, at cost; | | | | | | | |

| December 31, 2006 and 2005 - 3,764,367 and 3,639,301 shares, respectively | | | (52,869,086 | ) | | (49,276,005 | ) |

| | | | 44,899,243 | | | 42,092,149 | |

| | | $ | 524,844,995 | | | 481,000,668 | |

See Notes to Consolidated Financial Statements

Guaranty Federal Bancshares, Inc.

Consolidated Statements of Income

Years Ended December 31, 2006, 2005 and 2004

| | | 2006 | | 2005 | | 2004 | |

| | | | | | | | |

INTEREST INCOME | | | | | | | |

| Loans | | $ | 34,362,199 | | | 26,552,595 | | | 19,989,852 | |

| Investment securities | | | 450,919 | | | 431,863 | | | 289,335 | |

| Other | | | 253,200 | | | 298,949 | | | 260,085 | |

| | | | 35,066,318 | | | 27,283,407 | | | 20,539,272 | |

INTEREST EXPENSE | | | | | | | | | | |

| Deposits | | | 10,523,203 | | | 7,288,073 | | | 4,919,164 | |

| Federal Home Loan Bank advances | | | 5,721,973 | | | 4,493,997 | | | 3,519,393 | |

| Subordinated debentures | | | 1,027,526 | | | 47,683 | | | - | |

| Other | | | 113,891 | | | 30,651 | | | 7,073 | |

| | | | 17,386,593 | | | 11,860,404 | | | 8,445,630 | |

NET INTEREST INCOME | | | 17,679,725 | | | 15,423,003 | | | 12,093,642 | |

PROVISION FOR LOAN LOSSES | | | 750,000 | | | 945,000 | | | 863,830 | |

NET INTEREST INCOME AFTER PROVISION FOR LOAN LOSSES | | | 16,929,725 | | | 14,478,003 | | | 11,229,812 | |

NONINTEREST INCOME | | | | | | | | | | |

| Service charges | | | 1,401,724 | | | 1,643,433 | | | 1,877,829 | |

| Late charges and other fees | | | 234,339 | | | 264,360 | | | 353,689 | |

| Gain on sale of investment securities | | | 750,869 | | | 743,335 | | | 742,608 | |

| Gain on sale of loans | | | 692,276 | | | 623,252 | | | 484,920 | |

| Loss on foreclosed assets | | | (46,833 | ) | | (1,617 | ) | | (3,157 | ) |

| Other income | | | 765,473 | | | 324,296 | | | 160,285 | |

| | | | 3,797,848 | | | 3,597,059 | | | 3,616,174 | |

NONINTERESTEXPENSE | | | | | | | | | | |

| Salaries and employee benefits | | | 6,111,762 | | | 4,884,869 | | | 4,571,541 | |

| Occupancy | | | 1,520,770 | | | 1,365,559 | | | 1,287,261 | |

| FDIC deposit insurance premiums | | | 39,661 | | | 39,796 | | | 36,038 | |

| Data processing | | | 280,189 | | | 440,411 | | | 399,891 | |

| Advertising | | | 403,292 | | | 230,254 | | | 287,594 | |

| Other expense | | | 1,821,020 | | | 1,708,612 | | | 1,665,544 | |

| | | | 10,176,694 | | | 8,669,501 | | | 8,247,871 | |

INCOME BEFORE INCOME TAXES | | | 10,550,879 | | | 9,405,561 | | | 6,598,115 | |

PROVISION FOR INCOME TAXES | | | 4,041,795 | | | 3,506,591 | | | 2,313,342 | |

NET INCOME | | $ | 6,509,084 | | | 5,898,970 | | | 4,284,773 | |

| | | | | | | | | | | |

BASIC EARNINGS PER SHARE | | $ | 2.34 | | | 2.12 | | | 1.53 | |

DILUTED EARNINGS PER SHARE | | $ | 2.25 | | | 2.03 | | | 1.47 | |

See Notes to Consolidated Financial Statements

Guaranty Federal Bancshares, Inc.

Consolidated Statements of Cash Flows

Years Ended December 31, 2006, 2005 and 2004

| | | 2006 | | 2005 | | 2004 | |

| | | | | | | | |

CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | | |

| Net income | | $ | 6,509,084 | | | 5,898,970 | | | 4,284,773 | |

| Items not requiring (providing) cash: | | | | | | | | | | |

| Deferred income taxes | | | (592,927 | ) | | (249,519 | ) | | (99,952 | ) |

| Depreciation | | | 814,150 | | | 759,931 | | | 670,096 | |

| Provision for loan losses | | | 750,000 | | | 945,000 | | | 863,830 | |

| Gain on sale of loans and investment securities | | | (1,443,145 | ) | | (1,366,587 | ) | | (1,227,528 | ) |

| (Gain) loss on sale of equipment and other assets | | | (89,911 | ) | | 3,055 | | | 11,517 | |

| (Gain) loss on sale of foreclosed assets | | | 46,833 | | | (1,323 | ) | | (1,724 | ) |

| Amortization of deferred income, premiums and discounts | | | 24,106 | | | (48,305 | ) | | 78,148 | |

| Stock award plan expense | | | 83,192 | | | 45,694 | | | 63,200 | |

| Origination of loans held for sale | | | (51,685,484 | ) | | (45,528,012 | ) | | (30,561,273 | ) |

| Proceeds from sale of loans held for sale | | | 51,465,404 | | | 47,649,521 | | | 28,723,721 | |

| Release of ESOP shares | | | 651,958 | | | 564,980 | | | 461,512 | |

| Changes in: | | | | | | | | | | |

| Accrued interest receivable | | | (821,182 | ) | | (519,112 | ) | | (264,287 | ) |

| Prepaid expenses and other assets | | | 400,043 | | | (628,141 | ) | | 80,912 | |

| Accrued expenses and other liabilities | | | 1,060,085 | | | 200,417 | | | 105,421 | |

| Income taxes payable | | | (790,942 | ) | | 89,638 | | | 7,484 | |

| Net cash provided by operating activities | | | 6,381,264 | | | 7,816,207 | | | 3,195,850 | |

| | | | | | | | | | | |

CASH FLOWS FROM INVESTING ACTIVITIES | | | | | | | | | | |

| Net increase in loans | | | (45,195,742 | ) | | (45,967,115 | ) | | (59,380,244 | ) |

| Principal payments on held-to-maturity securities | | | 186,219 | | | 358,395 | | | 574,920 | |

| Principal payments on available-for-sale securities | | | 175,145 | | | - | | | - | |

| Purchase of available-for-sale securities | | | (3,780,315 | ) | | (10,516,958 | ) | | (5,971,840 | ) |

| Purchase of premises and equipment | | | (719,094 | ) | | (1,032,777 | ) | | (1,300,977 | ) |

| Purchase of tax credit investments | | | (2,195,334 | ) | | - | | | - | |

| Proceeds from sale of originated mortgage servicing rights | | | 1,023,608 | | | - | | | - | |

| Proceeds from sale of premises and equipment | | | 470 | | | 5,860 | | | 6,500 | |

| Proceeds from sales of available-for-sale securities | | | 762,617 | | | 9,345,564 | | | 754,355 | |

| Proceeds from maturities of available-for-sale securities | | | 1,750,000 | | | 9,000,000 | | | 6,000,000 | |

| (Purchase) redemption of FHLB stock | | | (403,900 | ) | | 167,700 | | | 147,700 | |

| Proceeds from sale of foreclosed assets | | | 395,327 | | | 352,341 | | | 434,161 | |

| Net cash used in investing activities | | | (48,000,999 | ) | | (38,286,990 | ) | | (58,735,425 | ) |

See Notes to Consolidated Financial Statements

Guaranty Federal Bancshares, Inc.

Consolidated Statements of Cash Flows (continued)

Years Ended December 31, 2006, 2005 and 2004

| | | 2006 | | 2005 | | 2004 | |

| | | | | | | | |

CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | | |

| Stock options exercised | | | 1,147,042 | | | 1,031,400 | | | 751,274 | |

| Cash dividends paid | | | (1,850,300 | ) | | (1,794,557 | ) | | (1,767,337 | ) |

| Cash dividends received on RRP Stock | | | - | | | - | | | 217 | |

| Net increase (decrease) in demand deposits, NOW accounts and savings accounts | | | (1,259,419 | ) | | 2,901,337 | | | 10,307,199 | |

| Net increase in certificates of deposit and securities sold under agreements to repurchase | | | 33,539,067 | | | 21,100,110 | | | 49,475,420 | |

| Proceeds from FHLB advances | | | 1,901,242,000 | | | 1,322,664,000 | | | 201,614,000 | |

| Repayments of FHLB advances | | | (1,893,242,000 | ) | | (1,322,664,000 | ) | | (210,450,948 | ) |

| Proceeds from issuance of subordinated debentures | | | - | | | 15,465,000 | | | - | |

| Advances from borrowers for taxes and insurance | | | 10,549 | | | (59,476 | ) | | 12,529 | |

| Treasury stock purchased | | | (3,593,081 | ) | | (3,563,011 | ) | | (1,163,115 | ) |

| Net cash provided by financing activities | | | 35,993,858 | | | 35,080,803 | | | 48,779,239 | |

| | | | | | | | | | | |

INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | | | (5,625,877 | ) | | 4,610,020 | | | (6,760,336 | ) |

| | | | | | | | | | | |

CASH AND CASH EQUIVALENTS, BEGINNING OF YEAR | | | 20,506,478 | | | 15,896,458 | | | 22,656,794 | |

| | | | | | | | | | | |

CASH AND CASH EQUIVALENTS, END OF YEAR | | $ | 14,880,601 | | | 20,506,478 | | | 15,896,458 | |

| | | | | | | | | | | |

Supplemental Cash Flows Information | | | | | | | | | | |

| | | | | | | | | | | |

| Real estate acquired in settlement of loans | | $ | 588,022 | | | 299,643 | | | 466,670 | |

| | | | | | | | | | | |

| Interest paid | | $ | 16,479,811 | | | 11,713,756 | | | 8,445,630 | |

| | | | | | | | | | | |

| Income taxes paid | | $ | 4,041,795 | | | 3,506,591 | | | 2,313,342 | |

| | | | | | | | | | | |

| Dividend declared and unpaid | | $ | 468,190 | | | 459,074 | | | 450,868 | |

See Notes to Consolidated Financial Statements

Guaranty Federal Bancshares, Inc.

Consolidated Statements of Stockholders’ Equity

Years Ended December 31, 2006, 2005 and 2004

| | | Common Stock | | Additional Paid-In Capital | | Unearned ESOP Shares | | Treasury Stock | | Retained Earnings | | Accumulated Other Comprehensive Income | | Total | |

Balance, January 1, 2004 | | $ | 642,890 | | | 51,330,202 | | | (2,030,930 | ) | | (44,549,879 | ) | | 29,919,695 | | | 2,666,143 | | | 37,978,121 | |

| Comprehensive income | | | | | | | | | | | | | | | | | | | | | | |

| Net income | | | - | | | - | | | - | | | - | | | 4,284,773 | | | - | | | 4,284,773 | |