UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-08371

| T. Rowe Price Real Estate Fund, Inc. |

|

| (Exact name of registrant as specified in charter) |

| |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Address of principal executive offices) |

| |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2012

Item 1. Report to Shareholders

| Real Estate Fund | December 31, 2012 |

The views and opinions in this report were current as of December 31, 2012. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors, and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of the fund’s future investment intent. The report is certified under the Sarbanes-Oxley Act, which requires mutual funds and other public companies to affirm that, to the best of their knowledge, the information in their financial reports is fairly and accurately stated in all material respects.

REPORTS ON THE WEB

Sign up for our E-mail Program, and you can begin to receive updated fund reports and prospectuses online rather than through the mail. Log in to your account at troweprice.com for more information.

Manager’s Letter

Fellow Shareholders

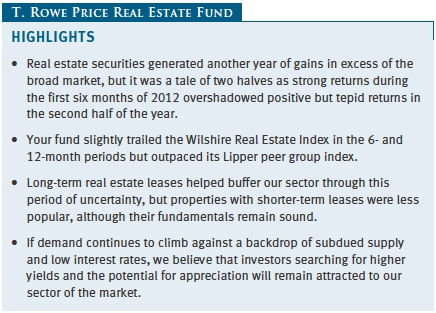

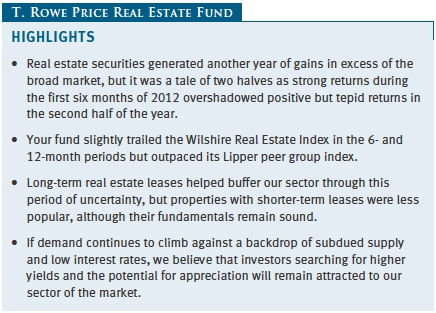

Real estate securities generated another year of gains in excess of the broad market, measured by the S&P 500 Index. It was a tale of two halves, however, as strong returns during the first six months of 2012 overshadowed positive but tepid returns in the second half of the year. Your fund participated in the strong annual performance with robust but mixed performance against its key benchmarks.

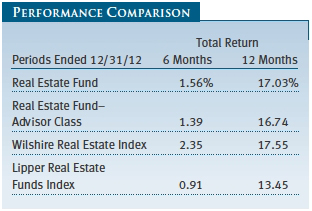

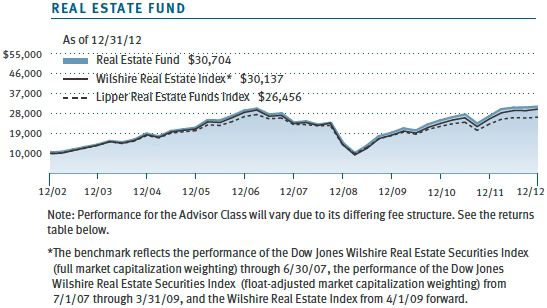

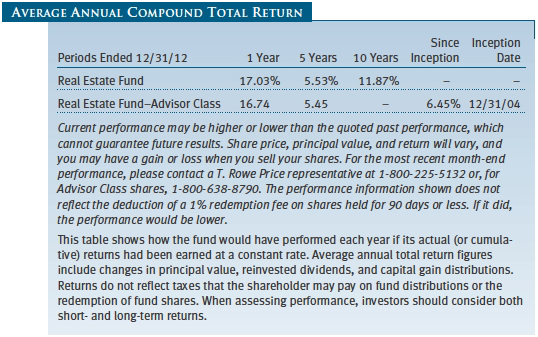

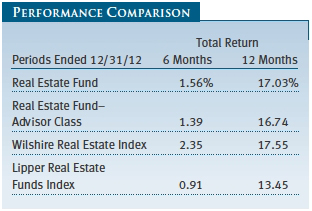

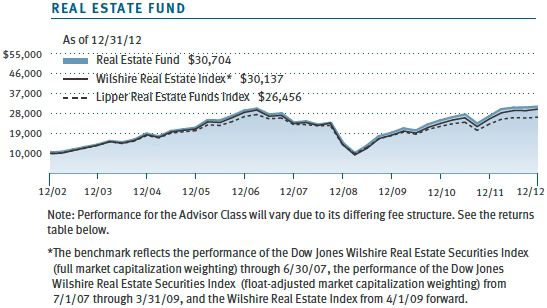

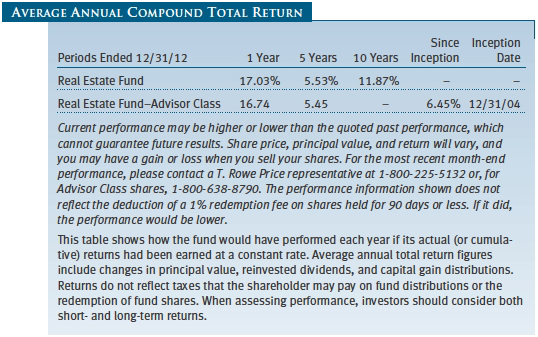

The Real Estate Fund returned 1.56% during the past six months and 17.03% for the year compared with 2.35% and 17.55%, respectively, for the Wilshire Real Estate Index. The Lipper Real Estate Funds Index generated respective returns of 0.91% and 13.45%. (The returns for the Advisor Class were lower, reflecting its different fee structure.)

DIVIDEND DISTRIBUTION

On December 12, 2012, your fund’s Board of Directors declared a fourth-quarter dividend of $0.14 per share to shareholders of record on that day. The dividend was paid on December 14. You should have received your check or statement reflecting this most recent distribution. This brings total dividends for the year to $0.46. Remember to use your Form 1099-DIV, not your year-end statement, for tax filing purposes. As reported on the 1099-DIV, a portion of the fund’s income distribution was reclassified. (Dividends were different for the Advisor Class.)

MARKET ENVIRONMENT AND STRATEGY

The U.S. economy continued to grind out a tepid recovery, as fall elections approached and optimism ebbed and flowed. U.S. businesses cautiously crept forward in a challenging environment, creating jobs at a positive yet restrained pace. European leaders managed to stave off a financial meltdown while maintaining the integrity of the eurozone, and China trudged toward a leadership transition. Interest rates remained low, and liquidity was available to established corporations and select individuals. Residential housing showed hints of recovery. The search for yield continued in a low-rate environment, and commercial real estate remained in favor thanks to its above-average income characteristics.

Following the fall elections, investor focus turned toward the looming fiscal cliff. After much talk about a need for change, the American people voted for what appeared to be the status quo. Democrats retained control of the presidency and Senate, while Republicans kept control of the House. Optimism about a “grand bargain” that would address budgetary imbalances was replaced with disappointment, as polarizing partisanship set the stage for another display of political brinkmanship. In the end, Congress found a detour around the fiscal cliff with an agreement to extend current tax rates for the overwhelming majority of taxpayers, although taxpayers at all income levels will be subject to a two-percentage-point increase in the employee portion of the Social Security tax. The second half of the budgetary equation, federal spending, will have to be addressed during the coming months.

The U.S. Federal Reserve did its part to support the economy by keeping the fed funds target rate in the 0.00% to 0.25% range. The central bank is continuing to purchase $40 billion of agency mortgage-backed securities every month. In addition, the Fed announced that it will purchase $45 billion worth of Treasury securities monthly starting in 2013 and that it plans to keep short-term rates low as long as the national unemployment rate remains above 6.5% and inflation is contained below 2.5%.

Long-term real estate leases helped buffer our sector through this period of uncertainty, adding to the attraction of income-producing real estate. However, properties with shorter-term leases, such as hotels and apartments, were less popular with investors, though their actual fundamentals remained largely unchanged. Apartment investments were under pressure throughout the year, in part due to investor anxiety that a housing recovery could translate into trouble for apartment demand. We believe that a housing recovery would ultimately be better for the prospects of apartments since it would bolster overall economic growth, which in turn creates jobs and leads to household formations. Among these emerging households, we’ve learned that not everyone can own a place to live and, therefore, there could be increased demand for rental housing. Additionally, a recovery in housing prices should help maintain proper pricing dynamics in the balance between rent-or-buy decisions. Inflation remains in check, yet many analysts fear that loose monetary policy will ultimately lead to escalating inflation, in which case shorter-term leases should be viewed favorably where there is pricing power.

As the economy recovered, so did demand for industrial properties. This subsector enjoyed strong returns over both halves of the year as businesses geared up for a recovery. Optimism surrounding consumer spending led to gains in retail properties for the year, but these gains were markedly stronger in the first half than in the second half. Still, shopping center operators were heartened by the pickup in leasing of space to smaller businesses, which have been noticeably weaker than big-box national retailers. Office investments began the year with a strong start but began to falter in the latter half of 2012 as uncertainty affected corporate expansion plans. The nature of office decisions tends to involve long-term commitments to substantial outlays of cash, and executives seemed increasingly reluctant to commit as the fiscal cliff deadline drew nearer without resolution.

PORTFOLIO REVIEW

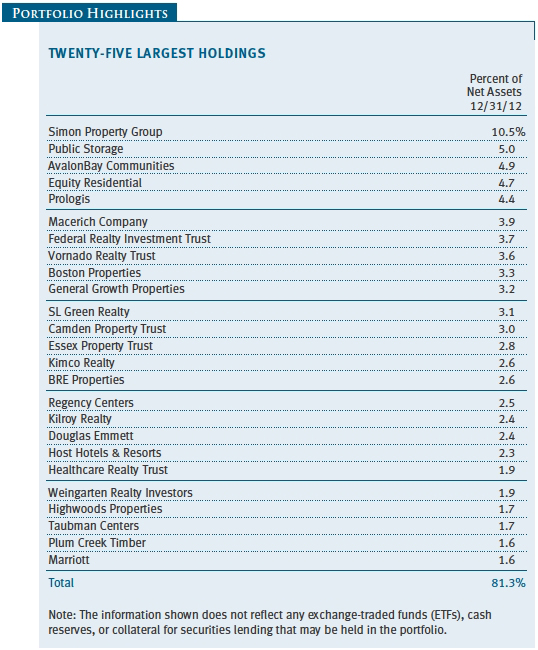

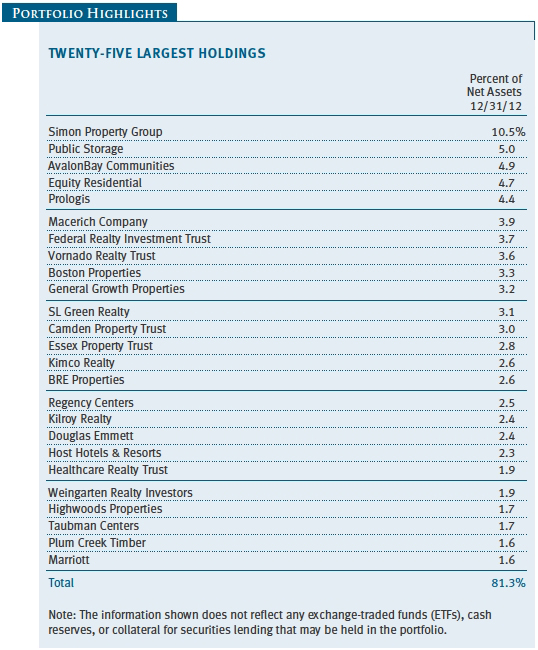

Several years ago, we recorded noteworthy gains from our investment in apartment owner Archstone Communities, which went private. We eagerly awaited the company’s return to the public market, as we admired the assets and thought very highly of the management team. While Archstone was in the process of preparing for a public offering, it was announced that AvalonBay Communities and Equity Residential would instead acquire Archstone’s assets. We were disappointed to miss the opportunity to again invest alongside Archstone’s executive team, but we were pleased to add thousands of well-located apartments to our existing portfolio, and we increased our holdings in AvalonBay Communities and Equity Residential. (Please refer to our portfolio of investments for a complete list of holdings and the amount each represents in the portfolio.)

We established a new position in American Campus Communities. ACC describes itself as the largest owner, manager, and developer of high-quality student housing communities in the U.S., and we agree. The company places an emphasis on assets within close walking distance to key campus locations. ACC has established a strong track record of performance for shareholders, and we welcomed the opportunity to take a stake in this successful franchise.

Despite hesitancy in the nation’s economic recovery, regional malls in primary metropolitan areas have been posting resilient results for several uninterrupted years. As the recovery has continued to unfold and broaden, many middle markets have now been bolstered, including those with dominant malls controlled by CBL & Associates Properties. CBL’s stock returned more than 40% in 2012, and we trimmed some of our position on that strength. Meanwhile, with many prior distractions resolved, the management team at General Growth Properties seems well positioned to focus intently on improving the operating fundamentals that should drive stock performance, and we added to our position. Among other retail venues, local shopping centers continued to benefit from recovering fundamentals, and we added to our position in Weingarten Realty Investors.

While we were not pleased with the volatility in lodging stocks caused by economic uncertainty, we did take the opportunity to add shares of Pebblebrook Hotel Trust. Pebblebrook focuses on investing in upscale hotels located in urban markets in major gateway cities. We believe the company is in an excellent position to exhibit industry-beating growth in revenue-per-available-room as business travel continues to build in an economic expansion.

OUTLOOK

It would be better for investors if policymakers were able to resolve the budgetary issues confronting the nation with a long-term feasible program on tax reform and spending reductions. So far, they have been unable or unwilling to do so. We have no control over the macroeconomic or political environment, but we remain optimistic that we can navigate whatever roiling waters we face as we implement our investment strategy in the months ahead.

The overall level of new commercial real estate supply continues to be limited. Therefore, we expect any economic recovery to benefit our existing portfolio properties. Due to the duration of leases, the durability of the assets, and the lead times required for new supply, real estate cycles tend to be long, which is why it is worth repeating that we think the ongoing recovery cycle will remain in place in the coming months. Many of our portfolio companies remain focused on disposing of their weaker assets and redeploying the proceeds into stronger assets. If demand continues to climb against a backdrop of subdued supply and low interest rates, we believe that investors searching for higher yields and the potential for appreciation will remain attracted to our sector of the market.

We would like to thank you for your continued support and confidence.

Respectfully submitted,

David M. Lee

President of the fund and chairman of its Investment Advisory Committee

January 18, 2013

The committee chairman has day-to-day responsibility for managing the portfolio and works with committee members in developing and executing the fund’s investment program.

RISKS OF INVESTING

The fund’s share price can fall because of weakness in the stock market, a particular industry, or specific holdings. Stock markets can decline for many reasons, including adverse political or economic developments, changes in investor psychology, or heavy institutional selling. The prospects for an industry or company may deteriorate because of a variety of factors, including disappointing earnings or changes in the competitive environment. In addition, the investment manager’s assessment of companies held in a fund may prove incorrect, resulting in losses or poor performance even in rising markets.

Funds that invest only in specific industries will experience greater volatility than funds investing in a broad range of industries. Due to its concentration in the real estate industry, the fund’s share price could be more volatile than that of a fund with a broader investment mandate. Trends perceived to be unfavorable to real estate, such as changes in the tax laws or rising interest rates, could cause a decline in share prices.

GLOSSARY

Lipper indexes: Fund benchmarks that consist of a small number of the largest mutual funds in a particular category as tracked by Lipper Inc.

Price/earnings ratio (or multiple): A valuation measure calculated by dividing the price of a stock by its current or projected earnings per share. This ratio gives investors an idea of how much they are paying for current or future earnings power.

Real estate investment trusts (REITs): Publicly traded companies that own, develop, and operate apartment complexes, hotels, office buildings, and other commercial properties.

Wilshire Real Estate Index: A float-adjusted, market capitalization-weighted index composed of publicly traded REITs and real estate operating companies.

Performance and Expenses

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

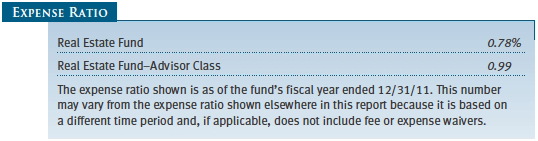

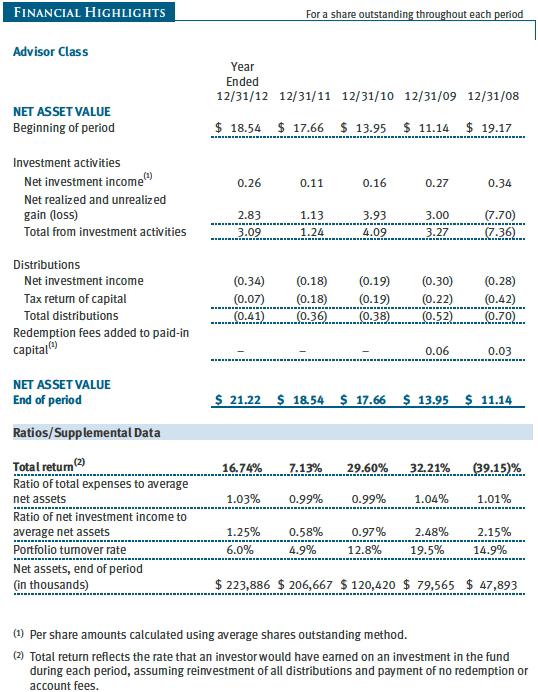

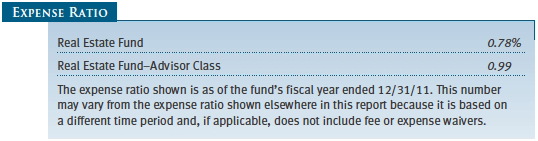

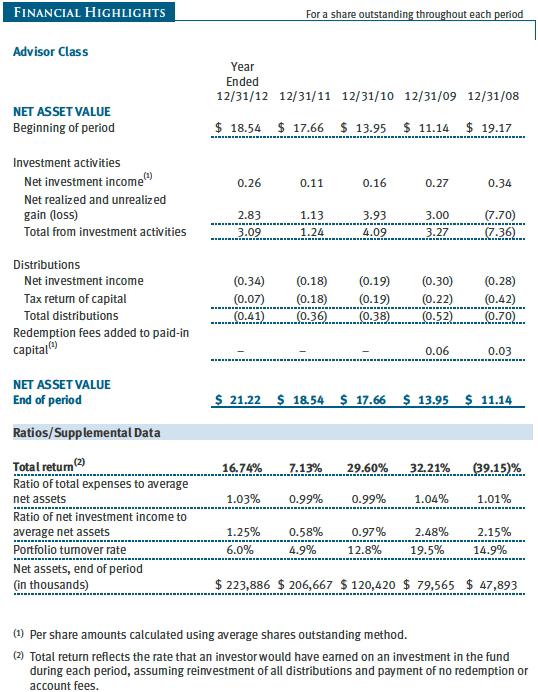

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees or sales loads, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Please note that the fund has two share classes: The original share class (Investor Class) charges no distribution and service (12b-1) fee, and the Advisor Class shares are offered only through unaffiliated brokers and other financial intermediaries and charge a 0.25% 12b-1 fee. Each share class is presented separately in the table.

Actual Expenses

The first line of the following table (Actual) provides information about actual account values and expenses based on the fund’s actual returns. You may use the information on this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (Hypothetical) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Note: T. Rowe Price charges an annual account service fee of $20, generally for accounts with less than $10,000. The fee is waived for any investor whose T. Rowe Price mutual fund accounts total $50,000 or more; accounts electing to receive electronic delivery of account statements, transaction confirmations, prospectuses, and shareholder reports; or accounts of an investor who is a T. Rowe Price Preferred Services, Personal Services, or Enhanced Personal Services client (enrollment in these programs generally requires T. Rowe Price assets of at least $100,000). This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

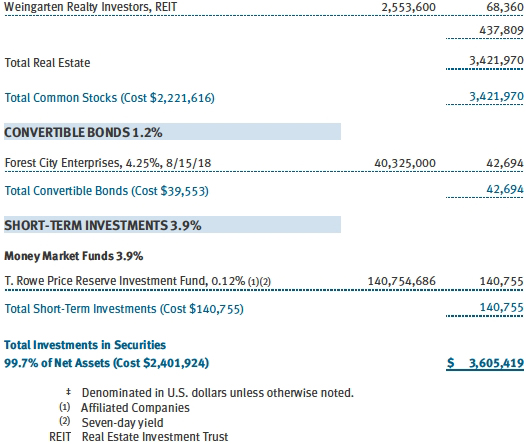

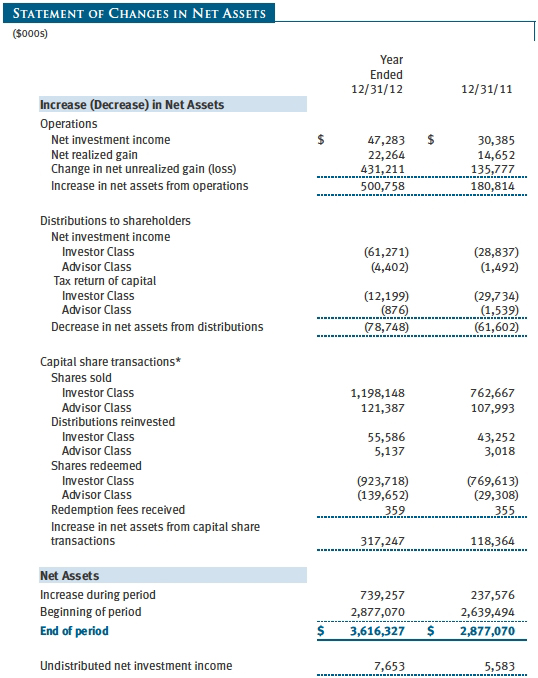

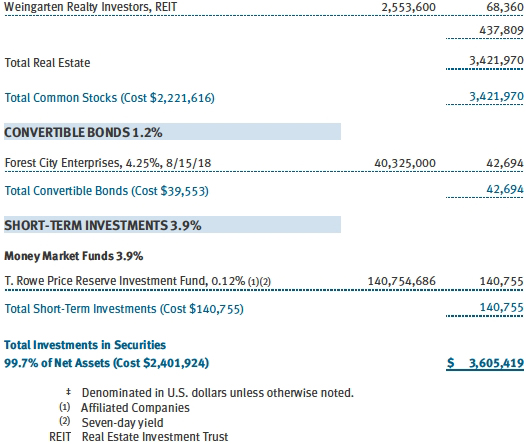

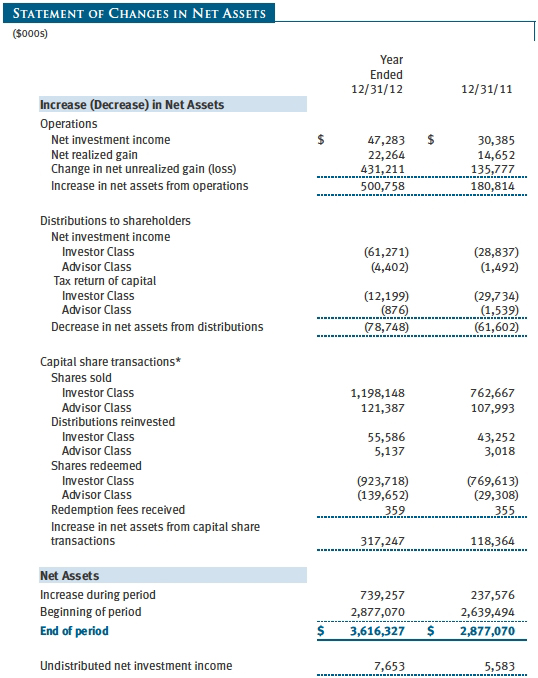

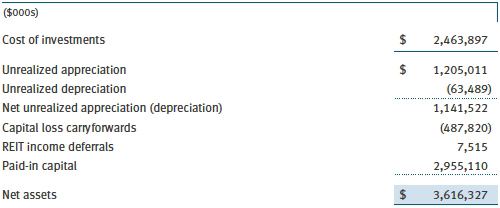

The accompanying notes are an integral part of these financial statements.

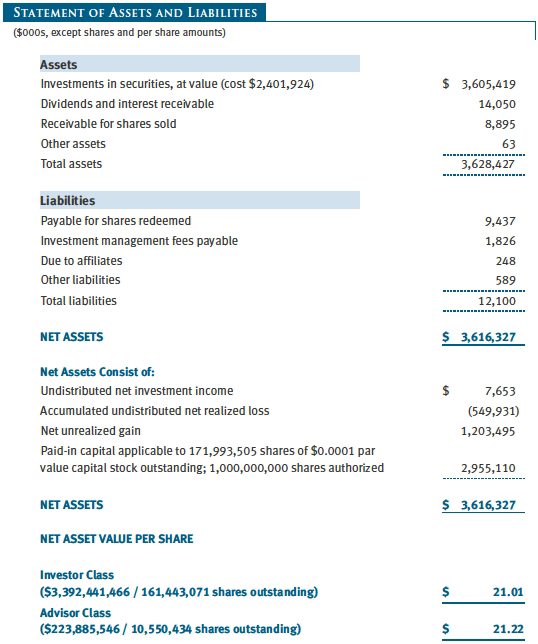

The accompanying notes are an integral part of these financial statements.

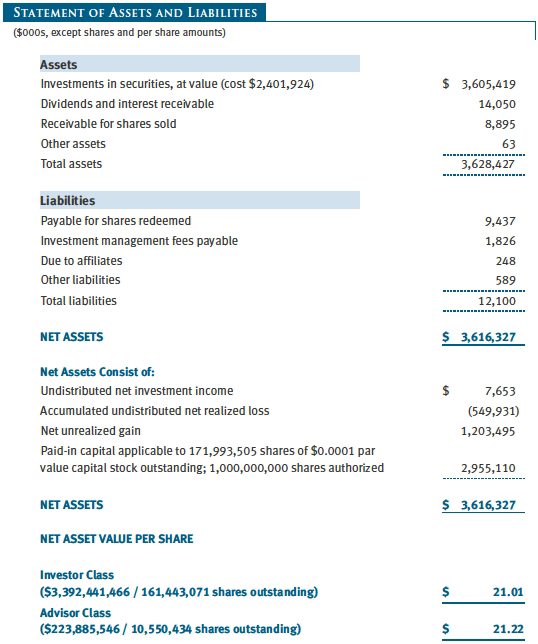

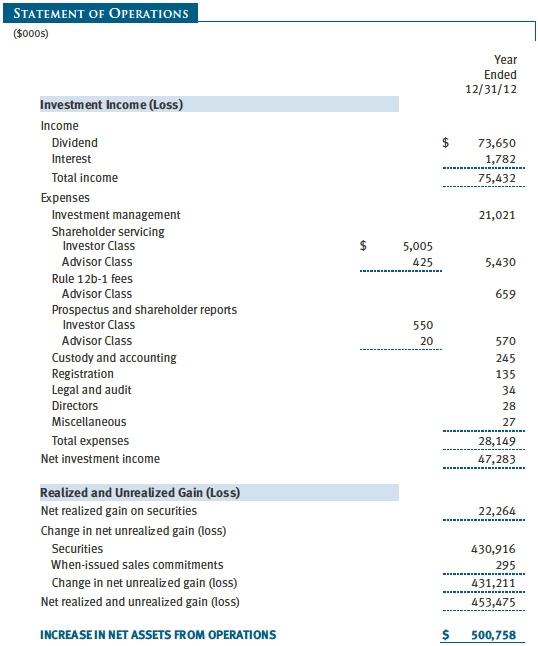

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

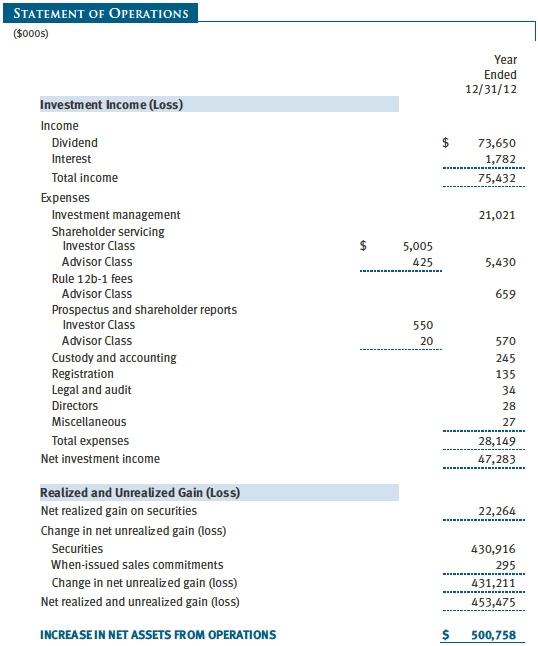

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

| Notes to Financial Statements |

T. Rowe Price Real Estate Fund, Inc. (the fund), is registered under the Investment Company Act of 1940 (the 1940 Act) as a diversified, open-end management investment company. The fund seeks to provide long-term growth through a combination of capital appreciation and current income. The fund has two classes of shares: the Real Estate Fund original share class, referred to in this report as the Investor Class, offered since October 31, 1997, and the Real Estate Fund–Advisor Class (Advisor Class), offered since December 31, 2004. Advisor Class shares are sold only through unaffiliated brokers and other unaffiliated financial intermediaries that are compensated by the class for distribution, shareholder servicing, and/or certain administrative services under a Board-approved Rule 12b-1 plan. Each class has exclusive voting rights on matters related solely to that class; separate voting rights on matters that relate to both classes; and, in all other respects, the same rights and obligations as the other class.

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (GAAP), which require the use of estimates made by management. Management believes that estimates and valuations are appropriate; however, actual results may differ from those estimates, and the valuations reflected in the accompanying financial statements may differ from the value ultimately realized upon sale or maturity.

Investment Transactions, Investment Income, and Distributions Income and expenses are recorded on the accrual basis. Premiums and discounts on debt securities are amortized for financial reporting purposes. Dividends received from mutual fund investments are reflected as dividend income; capital gain distributions are reflected as realized gain/loss. Dividend income and capital gain distributions are recorded on the ex-dividend date. Income tax-related interest and penalties, if incurred, would be recorded as income tax expense. Investment transactions are accounted for on the trade date. Realized gains and losses are reported on the identified cost basis. Distributions to shareholders are recorded on the ex-dividend date. Income distributions are declared and paid by each class quarterly. Capital gain distributions, if any, are generally declared and paid by the fund annually.

Class Accounting The Advisor Class pays distribution, shareholder servicing, and/or certain administrative expenses in the form of Rule 12b-1 fees, in an amount not exceeding 0.25% of the class’s average daily net assets. Shareholder servicing, prospectus, and shareholder report expenses incurred by each class are charged directly to the class to which they relate. Expenses common to both classes, investment income, and realized and unrealized gains and losses are allocated to the classes based upon the relative daily net assets of each class.

Rebates and Credits Subject to best execution, the fund may direct certain security trades to brokers who have agreed to rebate a portion of the related brokerage commission to the fund in cash. Commission rebates are reflected as realized gain on securities in the accompanying financial statements and totaled $33,000 for the year ended December 31, 2012. Additionally, the fund earns credits on temporarily uninvested cash balances held at the custodian, which reduce the fund’s custody charges. Custody expense in the accompanying financial statements is presented before reduction for credits.

Redemption Fees A 1% fee is assessed on redemptions of fund shares held for 90 days or less to deter short-term trading and to protect the interests of long-term shareholders. Redemption fees are withheld from proceeds that shareholders receive from the sale or exchange of fund shares. The fees are paid to the fund and are recorded as an increase to paid-in capital. The fees may cause the redemption price per share to differ from the net asset value per share.

New Accounting Pronouncements In December 2011, the FASB issued amended guidance to enhance disclosure for offsetting assets and liabilities. The guidance is effective for fiscal years and interim periods beginning on or after January 1, 2013. Adoption will have no effect on the fund’s net assets or results of operations.

NOTE 2 - VALUATION

The fund’s financial instruments are reported at fair value as defined by GAAP. The fund determines the values of its assets and liabilities and computes each class’s net asset value per share at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day that the NYSE is open for business.

Valuation Methods Equity securities listed or regularly traded on a securities exchange or in the over-the-counter (OTC) market are valued at the last quoted sale price or, for certain markets, the official closing price at the time the valuations are made, except for OTC Bulletin Board securities, which are valued at the mean of the latest bid and asked prices. A security that is listed or traded on more than one exchange is valued at the quotation on the exchange determined to be the primary market for such security. Listed securities not traded on a particular day are valued at the mean of the latest bid and asked prices for domestic securities and the last quoted sale price for international securities.

Debt securities are generally traded in the OTC market. Securities with remaining maturities of one year or more at the time of acquisition are valued at prices furnished by dealers who make markets in such securities or by an independent pricing service, which considers the yield or price of bonds of comparable quality, coupon, maturity, and type, as well as prices quoted by dealers who make markets in such securities. Securities with remaining maturities of less than one year at the time of acquisition generally use amortized cost in local currency to approximate fair value. However, if amortized cost is deemed not to reflect fair value or the fund holds a significant amount of such securities with remaining maturities of more than 60 days, the securities are valued at prices furnished by dealers who make markets in such securities or by an independent pricing service.

Investments in mutual funds are valued at the mutual fund’s closing net asset value per share on the day of valuation.

Other investments, including restricted securities and private placements, and those financial instruments for which the above valuation procedures are inappropriate or are deemed not to reflect fair value, are stated at fair value as determined in good faith by the T. Rowe Price Valuation Committee, established by the fund’s Board of Directors (the Board). Subject to oversight by the Board, the Valuation Committee develops pricing-related policies and procedures and approves all fair-value determinations. The Valuation Committee regularly makes good faith judgments, using a wide variety of sources and information, to establish and adjust valuations of certain securities as events occur and circumstances warrant. For instance, in determining the fair value of private-equity instruments, the Valuation Committee considers a variety of factors, including the company’s business prospects, its financial performance, strategic events impacting the company, relevant valuations of similar companies, new rounds of financing, and any negotiated transactions of significant size between other investors in the company. Because any fair-value determination involves a significant amount of judgment, there is a degree of subjectivity inherent in such pricing decisions.

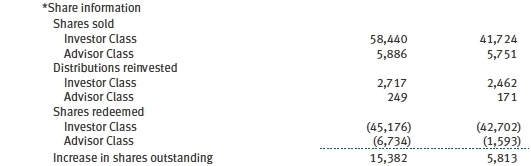

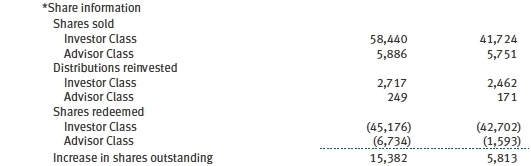

Valuation Inputs Various inputs are used to determine the value of the fund’s financial instruments. These inputs are summarized in the three broad levels listed below:

Level 1 – quoted prices in active markets for identical financial instruments

Level 2 – observable inputs other than Level 1 quoted prices (including, but not limited to, quoted prices for similar financial instruments, interest rates, prepayment speeds, and credit risk)

Level 3 – unobservable inputs

Observable inputs are those based on market data obtained from sources independent of the fund, and unobservable inputs reflect the fund’s own assumptions based on the best information available. The input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level. The following table summarizes the fund’s financial instruments, based on the inputs used to determine their values on December 31, 2012:

NOTE 3 - OTHER INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fund engages in the following practices to manage exposure to certain risks and/or to enhance performance. The investment objective, policies, program, and risk factors of the fund are described more fully in the fund’s prospectus and Statement of Additional Information.

When-Issued Securities The fund may enter into when-issued purchases and/or sales commitments, pursuant to which it agrees to purchase or sell, respectively, the underlying security for a fixed unit price, with payment and delivery at a scheduled future date generally beyond the customary settlement period for such securities. When-issued refers to securities that have not yet been issued but will be issued in the future and may include new securities or securities obtained through a corporate action on a current holding. The fund normally purchases when-issued securities with the intention of taking possession but may enter into a separate agreement to sell the securities before the settlement date. Until settlement, the fund maintains cash reserves and liquid assets sufficient to settle its when-issued commitments. Amounts realized on when-issued transactions are included with realized gain/loss on securities in the accompanying financial statements.

Other Purchases and sales of portfolio securities other than short-term securities aggregated $550,908,000 and $197,785,000, respectively, for the year ended December 31, 2012.

NOTE 4 - FEDERAL INCOME TAXES

No provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its taxable income and gains. Distributions determined in accordance with federal income tax regulations may differ in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences.

The fund files U.S. federal, state, and local tax returns as required. The fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after the filing of the tax return but which can be extended to six years in certain circumstances. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

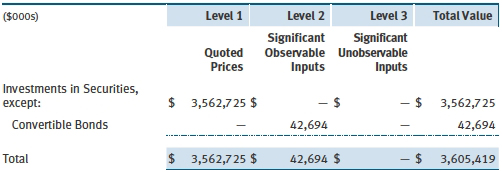

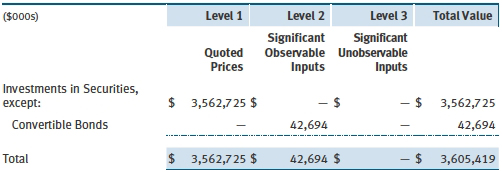

Reclassifications to paid-in capital relate primarily to an overdistribution of taxable income not deemed a return of capital for tax purposes. Reclassifications between income and gain relate primarily to the character of dividends received from real estate investment trusts (REITs). For the year ended December 31, 2012, the following reclassifications were recorded to reflect tax character (there was no impact on results of operations or net assets):

Distributions during the years ended December 31, 2012 and December 31, 2011, were characterized for tax purposes as follows:

At December 31, 2012, the tax-basis cost of investments and components of net assets were as follows:

The difference between book-basis and tax-basis net unrealized appreciation (depreciation) is attributable to the deferral of losses from wash sales for tax purposes. The fund intends to retain realized gains to the extent of available capital loss carryforwards. As a result of the Regulated Investment Company Modernization Act of 2010, net capital losses realized on or after January 1, 2011 (effective date) may be carried forward indefinitely to offset future realized capital gains; however, post-effective losses must be used before pre-effective capital loss carryforwards with expiration dates. Accordingly, it is possible that all or a portion of the fund’s pre-effective capital loss carryforwards could expire unused. During the year ended December 31, 2012, the fund utilized $21,890,000 of capital loss carryforwards. The fund’s available capital loss carryforwards as of December 31, 2012, expire as follows: $44,598,000 in fiscal 2016, $367,971,000 in fiscal 2017, and $75,251,000 in fiscal 2018. Certain dividends declared by REITs in December and paid the following January are recognized for tax purposes in the subsequent year (REIT income deferrals) but, for financial reporting purposes, are included in the fund’s dividend income on ex-date.

NOTE 5 - RELATED PARTY TRANSACTIONS

The fund is managed by T. Rowe Price Associates, Inc. (Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. (Price Group). The investment management agreement between the fund and Price Associates provides for an annual investment management fee, which is computed daily and paid monthly. The fee consists of an individual fund fee, equal to 0.30% of the fund’s average daily net assets, and a group fee. The group fee rate is calculated based on the combined net assets of certain mutual funds sponsored by Price Associates (the group) applied to a graduated fee schedule, with rates ranging from 0.48% for the first $1 billion of assets to 0.28% for assets in excess of $300 billion. The fund’s group fee is determined by applying the group fee rate to the fund’s average daily net assets. At December 31, 2012, the effective annual group fee rate was 0.30%.

In addition, the fund has entered into service agreements with Price Associates and two wholly owned subsidiaries of Price Associates (collectively, Price). Price Associates computes the daily share prices and provides certain other administrative services to the fund. T. Rowe Price Services, Inc., provides shareholder and administrative services in its capacity as the fund’s transfer and dividend disbursing agent. T. Rowe Price Retirement Plan Services, Inc., provides subaccounting and recordkeeping services for certain retirement accounts invested in the Investor Class. For the year ended December 31, 2012, expenses incurred pursuant to these service agreements were $168,000 for Price Associates; $1,158,000 for T. Rowe Price Services, Inc.; and $479,000 for T. Rowe Price Retirement Plan Services, Inc. The total amount payable at period-end pursuant to these service agreements is reflected as Due to Affiliates in the accompanying financial statements.

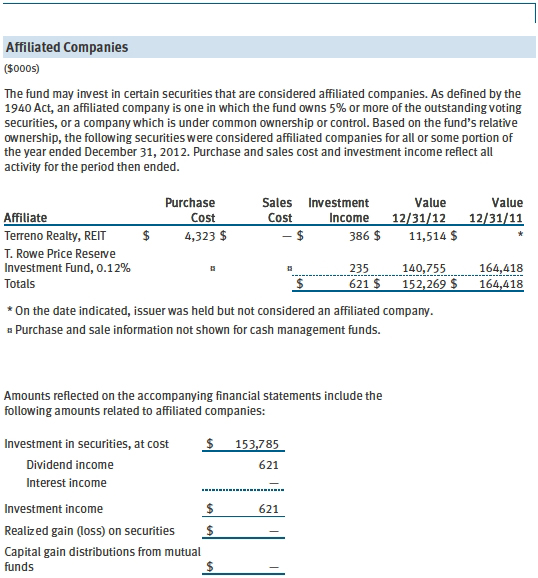

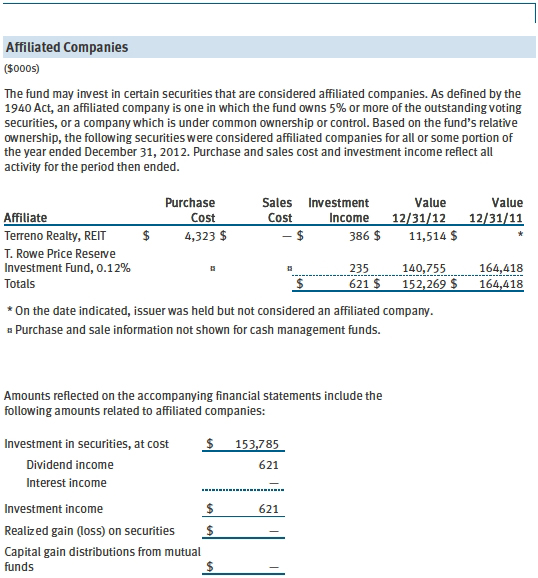

The fund may invest in the T. Rowe Price Reserve Investment Fund and the T. Rowe Price Government Reserve Investment Fund (collectively, the T. Rowe Price Reserve Investment Funds), open-end management investment companies managed by Price Associates and considered affiliates of the fund. The T. Rowe Price Reserve Investment Funds are offered as cash management options to mutual funds, trusts, and other accounts managed by Price Associates and/or its affiliates and are not available for direct purchase by members of the public. The T. Rowe Price Reserve Investment Funds pay no investment management fees.

| Report of Independent Registered Public Accounting Firm |

To the Board of Directors and Shareholders of

T. Rowe Price Real Estate Fund, Inc.

In our opinion, the accompanying statement of assets and liabilities, including the portfolio of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of T. Rowe Price Real Estate Fund, Inc. (the “Fund”) at December 31, 2012, and the results of its operations, the changes in its net assets and the financial highlights for each of the periods indicated therein, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2012 by correspondence with the custodian, and confirmation of the underlying funds by correspondence with the transfer agent, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Baltimore, Maryland

February 15, 2013

| Tax Information (Unaudited) for the Tax Year Ended 12/31/12 |

We are providing this information as required by the Internal Revenue Code. The amounts shown may differ from those elsewhere in this report because of differences between tax and financial reporting requirements.

The fund’s distributions to shareholders included $91,000 from short-term capital gains.

For taxable non-corporate shareholders, $3,257,000 of the fund’s income represents qualified dividend income subject to the 15% rate category.

For corporate shareholders, $3,257,000 of the fund’s income qualifies for the dividends-received deduction.

| Information on Proxy Voting Policies, Procedures, and Records |

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information, which you may request by calling 1-800-225-5132 or by accessing the SEC’s website, sec.gov. The description of our proxy voting policies and procedures is also available on our website, troweprice.com. To access it, click on the words “Our Company” at the top of our corporate homepage. Then, when the next page appears, click on the words “Proxy Voting Policies” on the left side of the page.

Each fund’s most recent annual proxy voting record is available on our website and through the SEC’s website. To access it through our website, follow the directions above, then click on the words “Proxy Voting Records” on the right side of the Proxy Voting Policies page.

| How to Obtain Quarterly Portfolio Holdings |

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q is available electronically on the SEC’s website (sec.gov); hard copies may be reviewed and copied at the SEC’s Public Reference Room, 100 F St. N.E., Washington, DC 20549. For more information on the Public Reference Room, call 1-800-SEC-0330.

| About the Fund’s Directors and Officers |

Your fund is overseen by a Board of Directors (Board) that meets regularly to review a wide variety of matters affecting the fund, including performance, investment programs, compliance matters, advisory fees and expenses, service providers, and other business affairs. The Board elects the fund’s officers, who are listed in the final table. At least 75% of the Board’s members are independent of T. Rowe Price Associates, Inc. (T. Rowe Price), and its affiliates; “inside” or “interested” directors are employees or officers of T. Rowe Price. The business address of each director and officer is 100 East Pratt Street, Baltimore, Maryland 21202. The Statement of Additional Information includes additional information about the fund directors and is available without charge by calling a T. Rowe Price representative at 1-800-638-5660.

| Independent Directors |

| |

| Name | | |

| (Year of Birth) | | |

| Year Elected* | | |

| [Number of T. Rowe Price | | Principal Occupation(s) and Directorships of Public Companies and |

| Portfolios Overseen] | | Other Investment Companies During the Past Five Years |

| | | |

| William R. Brody, M.D., Ph.D. | | President and Trustee, Salk Institute for Biological Studies (2009 |

| (1944) | | to present); Director, Novartis, Inc. (2009 to present); Director, IBM |

| 2009 | | (2007 to present); President and Trustee, Johns Hopkins University |

| [142] | | (1996 to 2009); Chairman of Executive Committee and Trustee, |

| | Johns Hopkins Health System (1996 to 2009) |

| | | |

| Anthony W. Deering | | Chairman, Exeter Capital, LLC, a private investment firm (2004 |

| (1945) | | to present); Director, Under Armour (2008 to present); Director, |

| 2001 | | Vornado Real Estate Investment Trust (2004 to present); Director |

| [142] | | and Member of the Advisory Board, Deutsche Bank North America |

| | (2004 to present); Director, Mercantile Bankshares (2002 to 2007) |

| | | |

| Donald W. Dick, Jr. | | Principal, EuroCapital Partners, LLC, an acquisition and management |

| (1943) | | advisory firm (1995 to present) |

| 1997 | | |

| [142] | | |

| | | |

| Robert J. Gerrard, Jr. | | Chairman of Compensation Committee and Director, Syniverse |

| (1952) | | Holdings, Inc. (2008 to 2011); Executive Vice President and General |

| 2012 | | Counsel, Scripps Networks, LLC (1997 to 2009); Advisory Board |

| [90] | | Member, Pipeline Crisis/Winning Strategies (1997 to present) |

| | | |

| Karen N. Horn | | Senior Managing Director, Brock Capital Group, an advisory and |

| (1943) | | investment banking firm (2004 to present); Director, Eli Lilly and |

| 2003 | | Company (1987 to present); Director, Simon Property Group (2004 |

| [142] | | to present); Director, Norfolk Southern (2008 to present); Director, |

| | Fannie Mae (2006 to 2008) |

| | | |

| Theo C. Rodgers | | President, A&R Development Corporation (1977 to present) |

| (1941) | | |

| 2005 | | |

| [142] | | |

| | | |

| Cecilia E. Rouse, Ph.D. | | Professor and Researcher, Princeton University (1992 to present); |

| (1963) | | Director, MDRC (2011 to present); Member, National Academy of |

| 2012 | | Education (2010 to present); Research Associate, National Bureau |

| [90] | | of Economic Research’s Labor Studies Program (1998 to 2009 |

| | and 2011 to present); Member, President’s Council of Economic |

| | Advisors (2009 to 2011); Member, The MacArthur Foundation |

| | Network on the Transition to Adulthood and Public Policy (2000 to |

| | 2008); Member, National Advisory Committee for the Robert Wood |

| | Johnson Foundation’s Scholars in Health Policy Research Program |

| | (2008); Director and Member, National Economic Association |

| | (2006 to 2008); Member, Association of Public Policy Analysis and |

| | Management Policy Council (2006 to 2008); Member, Hamilton |

| | Project’s Advisory Board at The Brookings Institute (2006 to 2008); |

| | Chair of Committee on the Status of Minority Groups in the Economic |

| | Profession, American Economic Association (2006 to 2008) |

| | | |

| John G. Schreiber | | Owner/President, Centaur Capital Partners, Inc., a real estate |

| (1946) | | investment company (1991 to present); Cofounder and Partner, |

| 2001 | | Blackstone Real Estate Advisors, L.P. (1992 to present); Director, |

| [142] | | General Growth Properties, Inc. (2010 to present) |

| | | |

| Mark R. Tercek | | President and Chief Executive Officer, The Nature Conservancy |

| (1957) | | (2008 to present); Managing Director, The Goldman Sachs Group, |

| 2009 | | Inc. (1984 to 2008) |

| [142] | | |

| |

| *Each independent director serves until retirement, resignation, or election of a successor. |

| |

| Inside Directors | | |

| |

| Name | | |

| (Year of Birth) | | |

| Year Elected* | | |

| [Number of T. Rowe Price | | Principal Occupation(s) and Directorships of Public Companies and |

| Portfolios Overseen] | | Other Investment Companies During the Past Five Years |

| | | |

| Edward C. Bernard | | Director and Vice President, T. Rowe Price; Vice Chairman of the |

| (1956) | | Board, Director, and Vice President, T. Rowe Price Group, Inc.; |

| 2006 | | Chairman of the Board, Director, and President, T. Rowe Price |

| [142] | | Investment Services, Inc.; Chairman of the Board and Director, |

| | T. Rowe Price Retirement Plan Services, Inc., T. Rowe Price Savings |

| | Bank, and T. Rowe Price Services, Inc.; Chairman of the Board, Chief |

| | Executive Officer, and Director, T. Rowe Price International; Chief |

| | Executive Officer, Chairman of the Board, Director, and President, |

| | T. Rowe Price Trust Company; Chairman of the Board, all funds |

| | | |

| Brian C. Rogers, CFA, CIC | | Chief Investment Officer, Director, and Vice President, T. Rowe Price; |

| (1955) | | Chairman of the Board, Chief Investment Officer, Director, and Vice |

| 2006 | | President, T. Rowe Price Group, Inc.; Vice President, T. Rowe Price |

| [75] | | Trust Company |

| |

| *Each inside director serves until retirement, resignation, or election of a successor. |

| Officers | | |

| |

| Name (Year of Birth) | | |

| Position Held With Real Estate Fund | Principal Occupation(s) |

| | |

| Anna M. Dopkin, CFA (1967) | | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | | Group, Inc., T. Rowe Price International, and |

| | T. Rowe Price Trust Company |

| | | |

| Joseph B. Fath, CPA (1971) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Group, Inc. |

| | | |

| Roger L. Fiery III, CPA (1959) | | Vice President, Price Hong Kong, Price |

| Vice President | | Singapore, T. Rowe Price, T. Rowe Price Group, |

| | Inc., T. Rowe Price International, and T. Rowe |

| | Price Trust Company |

| | | |

| John R. Gilner (1961) | | Chief Compliance Officer and Vice President, |

| Chief Compliance Officer | | T. Rowe Price; Vice President, T. Rowe Price |

| | Group, Inc., and T. Rowe Price Investment |

| | Services, Inc. |

| | | |

| Gregory S. Golczewski (1966) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Trust Company |

| | | |

| Gregory K. Hinkle, CPA (1958) | | Vice President, T. Rowe Price, T. Rowe Price |

| Treasurer | | Group, Inc., and T. Rowe Price Trust Company |

| | | |

| Thomas J. Huber, CFA (1966) | | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | | Group, Inc., and T. Rowe Price Trust Company |

| | | |

| Nina P. Jones, CPA (1980) | | Vice President, T. Rowe Price and T. Rowe |

| Vice President | | Price Group, Inc.; formerly student, Columbia |

| | Business School (to 2008) |

| | | |

| Michael M. Lasota (1982) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Group, Inc.; formerly student, University of |

| | Chicago, Graduate School of Business (to 2008) |

| | | |

| David M. Lee, CFA (1962) | | Vice President, T. Rowe Price and T. Rowe Price |

| President | | Group, Inc. |

| | | |

| Patricia B. Lippert (1953) | | Assistant Vice President, T. Rowe Price and |

| Secretary | | T. Rowe Price Investment Services, Inc. |

| | | |

| Philip A. Nestico (1976) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Group, Inc. |

| | | |

| David Oestreicher (1967) | | Director, Vice President, and Secretary, T. Rowe |

| Vice President | | Price Investment Services, Inc., T. Rowe Price |

| | Retirement Plan Services, Inc., T. Rowe Price |

| | Services, Inc., and T. Rowe Price Trust Company; |

| | Vice President and Secretary, T. Rowe Price, |

| | T. Rowe Price Group, Inc., and T. Rowe Price |

| | International; Vice President, Price Hong Kong |

| | and Price Singapore |

| | | |

| Theodore E. Robson, CFA (1965) | | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | | Group, Inc., and T. Rowe Price Trust Company |

| | | |

| Deborah D. Seidel (1962) | | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | | Group, Inc., T. Rowe Price Investment Services, |

| | | Inc., and T. Rowe Price Services, Inc. |

| | | |

| Julie L. Waples (1970) | | Vice President, T. Rowe Price |

| Vice President | | |

| |

| Unless otherwise noted, officers have been employees of T. Rowe Price or T. Rowe Price International for at least 5 years. |

Item 2. Code of Ethics.

The registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of this code of ethics is filed as an exhibit to this Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors/Trustees has determined that Mr. Anthony W. Deering qualifies as an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. Deering is considered independent for purposes of Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

(a) – (d) Aggregate fees billed for the last two fiscal years for professional services rendered to, or on behalf of, the registrant by the registrant’s principal accountant were as follows:

Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Audit-related fees include amounts reasonably related to the performance of the audit of the registrant’s financial statements and specifically include the issuance of a report on internal controls and, if applicable, agreed-upon procedures related to fund acquisitions. Tax fees include amounts related to services for tax compliance, tax planning, and tax advice. The nature of these services specifically includes the review of distribution calculations and the preparation of Federal, state, and excise tax returns. All other fees include the registrant’s pro-rata share of amounts for agreed-upon procedures in conjunction with service contract approvals by the registrant’s Board of Directors/Trustees.

(e)(1) The registrant’s audit committee has adopted a policy whereby audit and non-audit services performed by the registrant’s principal accountant for the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant require pre-approval in advance at regularly scheduled audit committee meetings. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by one audit committee member with ratification at the next scheduled audit committee meeting. Waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount is not permitted.

(2) No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $1,802,000 and $1,764,000, respectively.

(h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, these services were considered by the registrant’s audit committee in maintaining the principal accountant’s independence.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the registrant’s second fiscal quarter covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) The registrant’s code of ethics pursuant to Item 2 of Form N-CSR is attached.

(2) Separate certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(3) Written solicitation to repurchase securities issued by closed-end companies: not applicable.

(b) A certification by the registrant's principal executive officer and principal financial officer, pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(b) under the Investment Company Act of 1940, is attached.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

T. Rowe Price Real Estate Fund, Inc.

| | By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| |

| Date February 15, 2013 | | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| | By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| |

| Date February 15, 2013 | | |

| |

| |

| By | /s/ Gregory K. Hinkle |

| | Gregory K. Hinkle |

| | Principal Financial Officer |

| |

| Date February 15, 2013 | | |