SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [_]

Check the appropriate box:

| [_] | | Preliminary Proxy Statement |

| [_] | | Confidential, for Use of the Commission Only (as permitted by Rule 14A-6(E)(2)) |

| [X] | | Definitive Proxy Statement |

| [_] | | Definitive Additional Materials |

| [_] | | Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12 |

BUCA, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [_] | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| [_] | | Fee paid previously with preliminary materials. |

| | [_] | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

1300 Nicollet Mall, Suite 5003

Minneapolis, Minnesota 55403

(612) 288-2382

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

JUNE 4, 2002

VOTING METHOD

The accompanying proxy statement describes important issues affecting BUCA, Inc. If you are a shareholder of record, you have the right to vote your shares by telephone or by mail. You may also revoke your proxy any time before the Annual Meeting. Please help us save time and postage costs by voting by telephone. Voting by telephone is available 24 hours a day and your vote will be confirmed and posted immediately. To vote:

| | a. | | On a touch-tone telephone, call toll-free 1-800-240-6326 24 hours a day, seven days a week. |

| | b. | | Enter the 3-digit company number and 7-digit control number, which are located in the upper right hand corner of the proxy card. |

| | c. | | Follow the simple recorded instructions. |

| | 2. | | BY MAIL (Do not mail the proxy card if you are voting by telephone.) |

| | a. | | Mark your selections on the proxy card. |

| | b. | | Date and sign your name exactly as it appears on your proxy card. |

| | c. | | Mail the proxy card in the enclosed postage-paid envelope. |

If your shares are held in the name of a bank, broker or other holder of record, you will receive instructions from the holder of record that you must follow in order for your shares to be voted.

Your vote is important. Thank you for voting.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

| TIME . | 10:00 a.m., Central Daylight Time, on Tuesday, June 4, 2002. |

| | 1001 Marquette Avenue South |

| | Minneapolis, Minnesota 55403 |

| ITEMS OF BUSINESS | (1) To elect two directors for three-year terms and one director for a one-year term. |

| | (2) To amend our Amended and Restated Articles of Incorporation to increase the company’s aggregate number of authorized shares of capital stock from 25,000,000 to 35,000,000 and to increase the number of authorized shares of common stock of the company from 20,000,000 to 30,000,000. |

| | (3) To amend our 1996 Stock Incentive Plan to increase the total number of shares reserved for issuance from 2,300,000 to 3,050,000. |

| | (4) To approve the appointment of Deloitte & Touche LLP as our independent auditors. |

| | (5) To act upon any other business that may properly come before the meeting. |

| RECORD DATE | You may vote if you are a shareholder of record at the close of business on April 15, 2002. |

| ANNUAL REPORT | Our 2001 Annual Report has been included in this package. |

| PROXY VOTING | It is important that your shares be represented and voted at the Annual Meeting. Please vote in one of these two ways: |

| | (1) USE THE TOLL-FREE TELEPHONE NUMBER shown on the proxy card, |

| | (2)�� MARK, SIGN, DATE AND PROMPTLY RETURN the enclosed proxy card in the postage-paid envelope. |

| | You may revoke any proxy at any time prior to its exercise at the Annual Meeting. |

| | |

Greg A. Gadel

SECRETARY |

Approximate Date of Mailing of

Proxy Material: April 29, 2002

| | | Page

|

| | 1 |

| | 1 |

| | 1 |

| | 1 |

| | 1 |

| | 2 |

| | 2 |

| | 2 |

| | 2 |

| | 2 |

| | 3 |

| | 3 |

| | 3 |

|

| | 4 |

| | 4 |

| | 4 |

| | 5 |

| | 5 |

| | 5 |

| | 6 |

| | 6 |

| | 7 |

| | 9 |

| | 9 |

| | 9 |

| | 10 |

| | 11 |

| | 13 |

| | 13 |

| | 13 |

| | 13 |

| | 13 |

|

| | 14 |

|

| | 15 |

| | 15 |

| | 15 |

| | 15 |

| | 16 |

| | 16 |

| | 17 |

| | 17 |

| | 17 |

| | 18 |

|

| | 19 |

|

| | 19 |

| | 19 |

| | 20 |

| | 20 |

BUCA, INC.

1300 Nicollet Mall, Suite 5003

Minneapolis, Minnesota 55403

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

June 4, 2002

The board of directors of BUCA, Inc. (the “company,” “we” or “us”) is soliciting the enclosed proxy for the Annual Meeting of Shareholders to be held at the Hilton Hotel, 1001 Marquette Avenue South, Minneapolis, Minnesota, on Tuesday, June 4, 2002, at 10:00 a.m., Central Daylight Time, and for any adjournment of the meeting. This proxy statement, a proxy card and our Annual Report to Shareholders for the fiscal year ended December 30, 2001 are being mailed on or about April 29, 2002 to shareholders of record on April 15, 2002.

At our Annual Meeting, shareholders will act upon the matters described in the accompanying notice of meeting, including the election of two directors for three-year terms and one director for a one-year term, approval of amendments to our Amended and Restated Articles of Incorporation, approval of amendments to the 1996 Stock Incentive Plan, and appointment of our independent auditors. In addition, our management will report on the performance of the company during fiscal 2001 and respond to questions from shareholders.

Only shareholders of record of our common stock at the close of business on the record date, April 15, 2002, are entitled to receive notice of the Annual Meeting and to vote the shares of common stock that they held on the record date at the meeting, or any postponement or adjournment of the meeting. Each share of common stock has one vote on each matter to be voted upon.

All shareholders as of the record date, or their duly appointed proxies, may attend the meeting. Seating, however, is limited. Admission to the meeting is on a first-come, first-served basis and seating begins at approximately 9:30 a.m. Cameras and recording devices are not permitted at the meeting.

Please note that if you hold shares in “street name” (that is, through a bank, broker or other nominee), you will need to bring personal identification and a copy of a statement reflecting your stock ownership as of the record date and check in at the registration desk at the meeting.

The presence at the meeting, in person or by proxy, of the holders of a majority of common stock outstanding on the record date will constitute a quorum, permitting the meeting to conduct its business. As of the record date, 16,324,680 shares of our common stock were outstanding. Proxies received but marked as abstentions will be included in the calculation of the number of shares considered to be present at the meeting for purposes of determining whether there is a quorum.

1

You may vote by completing and properly signing the enclosed proxy card and returning it to the company in the envelope provided. If you are a registered shareholder (whose shares are owned in your name and not in “street name”) and attend the meeting, you may deliver your completed proxy card in person. In addition, registered shareholders may vote by telephone by following the instructions on the inside of the front cover of these materials. “Street name” shareholders who wish to vote at the meeting will need to obtain a proxy form from the institution that holds their shares.

Yes. Our policy is to treat all shareholder meeting proxies, ballots and voting tabulations of a shareholder confidentially if the shareholder has requested confidentiality on the proxy card or ballot.

If you so request, your proxy will not be available for examination nor will your vote be disclosed prior to the tabulation of the final vote at the Annual Meeting except (1) to meet applicable legal requirements, (2) to allow the independent election inspectors to count and certify the results of the vote or (3) where there is a proxy solicitation in opposition to the board of directors, based upon an opposition proxy statement filed with the Securities and Exchange Commission. The independent election inspectors may at any time inform us whether or not a shareholder has voted.

Yes. Even after you have submitted your proxy, you may change your vote at any time before the proxy is exercised by filing with our Secretary either a notice of revocation or a duly executed proxy bearing a later date. The powers of the proxy holders will be suspended if you attend the meeting in person and so request, although attendance at the meeting will not by itself revoke a previously granted proxy.

Unless you give instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the board of directors. The board’s recommendation is set forth together with the description of each item in this proxy statement. In summary, the board of directors recommends a vote:

FOR election of the director nominees (see page 4),

FOR approval of amendment to our Amended and Restated Articles of Incorporation (see page 14),

FOR approval of amendments to our 1996 Stock Incentive Plan (see page 15), and

FOR approval of the appointment of Deloitte & Touche LLP as our independent auditors (see page 19).

For any other matter that properly comes before the meeting, the proxy holders will vote as recommended by the board of directors or, if no recommendation is given, in their own discretion.

The affirmative vote of the holders of a majority of the outstanding shares of our common stock entitled to vote and present in person or by proxy at the Annual Meeting will be required for approval of each proposal presented in this proxy statement. A properly executed proxy marked “ABSTAIN” with respect to any matter will be counted for purposes of determining whether there is a quorum and will be considered present in person or by proxy and entitled to vote. Accordingly, an abstention will have the effect of a negative vote. A shareholder

2

(including a broker) who does not give authority to a proxy to vote, or who withholds authority to vote, on a proposal will not be considered present and entitled to vote on the proposal.

As of the date of this proxy statement, management knows of no matters that will be presented for determination at the meeting other than those referred to in this proxy statement. If any other matters properly come before the meeting calling for a vote of shareholders, proxies in the enclosed form returned to us will be voted in accordance with the recommendation of the board of directors, or, in the absence of such a recommendation, in accordance with the judgment of the proxy holders.

We will pay expenses in connection with the solicitation of proxies. Proxies are being solicited principally by mail and by telephone. In addition, our directors, officers and regular employees may solicit proxies personally, by telephone, fax or special letter.

Our Annual Report for the fiscal year ended December 30, 2001, including financial statements, has been included in this package. For additional copies, please contact Greg A. Gadel, our Chief Financial Officer, at (612) 288-2382 or mail your request to Mr. Gadel at our address listed above.

3

Proxies solicited by the board of directors will, unless otherwise directed, be voted for the election of (1) two nominees, Joseph P. Micatrotto and Philip A. Roberts, to serve as Class III directors for three-year terms expiring in 2005 or until their successors are elected and (2) one nominee, John P. Whaley, to serve as Class I director for a one-year term expiring in 2003 or until his successor is elected. All three nominees are currently serving as directors of the company.

Each of the nominees has consented to serve again. If for any reason any of the nominees becomes unavailable for election, the board of directors may designate a substitute nominee, in which event the shares represented by proxies returned to us will be voted for the substitute nominee, unless an instruction to the contrary is indicated on the proxy.

OUR BOARD OF DIRECTORS RECOMMENDS THAT OUR SHAREHOLDERS VOTE FOR ELECTING THE NOMINEES.

Our Amended and Restated Articles of Incorporation provide that the board of directors be divided into three classes of as nearly equal size as possible. Our board is divided into three classes with staggered three-year terms. Mr. Micatrotto, Mr. Roberts and Mr. Whaley are Class III directors whose terms expire at the annual shareholders’ meeting in 2002. Mr. Mihajlov and Mr. Zepf are Class II directors whose terms expire at the annual shareholders’ meeting in 2004. Mr. Hays and Mr. Yarnell, formerly Class I directors whose terms expire at the annual shareholders’ meeting in 2003, resigned from their positions as directors effective as of December 31, 2001. As a result of Messr. Hays and Yarnell’s resignations, our board, pursuant to authority granted under our Amended and Restated Articles of Incorporation, has decided to reduce the size of the board from seven members to five members.

At each annual meeting of shareholders, the successors to directors whose terms then expire will be elected to serve for a full term of three years. If the number of directors is changed, any increase or decrease shall be apportioned among the classes so as to maintain the number of directors in each class as nearly equal as possible. A nominee elected to fill a vacancy in a class will hold office for a term that will coincide with the remaining term of that class. This classification of the board may delay or prevent changes in our control or in our management. As a result of the reduction in board size, the board has decided to nominate Mr. Whaley, currently a Class III director, to serve as a Class I director for a one-year term that coincides with the remaining term of Class I directors. This reclassification enables the board to maintain the number of directors in each class as nearly equal as possible.

Pursuant to the terms of Mr. Micatrotto’s employment agreement, the board is required to use its best efforts to cause Mr. Micatrotto to continue to be elected to the board as long as he is our Chief Executive Officer.

Following is information regarding the nominees and directors, including information furnished by them as to their principal occupations. All of the present directors were elected to the board of directors by our shareholders. See page 7 for a table showing the number of shares of our common stock beneficially owned by each director as of April 9, 2002.

Joseph P. Micatrotto, 50, joined BUCA in 1996 as our President and Chief Executive Officer and as a director and in July 1999 became Chairman of the Board. Mr. Micatrotto’s 28-year career in restaurant management includes being CEO of Panda Management Company, Inc., where he led the company’s expansion, and president and CEO of Chi-Chi’s Mexican Restaurant, Inc., where he was instrumental in its national growth. Mr. Micatrotto is active on various boards and industry groups including the National Restaurant Association.

4

Philip A. Roberts, 62, co-founded BUCA in 1993. He has been a director since 1993 and served as Chairman of our board of directors until July 1999. Mr. Roberts is also a principal of Parasole Restaurant Holdings, Inc., which he co-founded in 1986. Mr. Roberts has been involved in the restaurant industry since 1977, when he co-founded with Mr. Mihajlov the first of several privately-held restaurant companies, which later merged to form Parasole.

Peter J. Mihajlov, 62, co-founded BUCA in 1993 and has served as a director since 1993. Mr. Mihajlov is also a principal of Parasole, which he co-founded in 1986. Mr. Mihajlov has been in the restaurant industry since 1977, when he and Mr. Roberts co-founded the first of several privately-held restaurant companies, which later merged to form Parasole. Prior to that, Mr. Mihajlov served in a variety of marketing and business management positions within The Pillsbury Company over the course of 17 years.

John P. Whaley, 49, has served as a director of BUCA since 1996. He is a partner of Norwest Equity Partners and Norwest Venture Partners, and has been a partner or officer of these and affiliated private equity investment funds since 1977. Mr. Whaley is also a director of several privately held companies.

Paul Zepf, 37, has served as a director of BUCA since 1998. He is currently a Managing Director of Lazard Frères & Co. LLC. Previously, he was a managing director of Centre Partners Management L.L.C., a managing director of Corporate Advisors, L.P., where he had been employed since 1989, and a director of Nationwide Credit, Inc.

Our directors are reimbursed for certain reasonable expenses incurred in attending board meetings. In fiscal 2001, directors who are also our employees received no remuneration for services as members of the board of directors or any board committee. Directors who are not employed by us have received grants of stock options from time to time. In 2002, our board of directors approved payment of $1,000 to each non-employee director for attending each board meeting in person and payment of $500 to each non-employee director per quarter.

Compensation Committee

The compensation committee of the board, comprised of Messrs. Roberts, Whaley and Zepf, is responsible for (1) reviewing and establishing the compensation structure for our officers, including salaries, participation in incentive compensation and benefit plans, stock option plans and other forms of compensation, and (2) administering our 1996 Stock Incentive Plan, 2000 Stock Incentive Plan, Stock Option Plan for Non-employee Directors, Employee Stock Purchase Plan and Key Employee Share Option Plan. The compensation committee met four times during fiscal 2001.

Audit Committee

The audit committee of the board, comprised of Messrs. Mihajlov, Whaley and Zepf, is responsible for recommending to the board our independent auditors, analyzing the reports and recommendations of the auditors and reviewing internal audit procedures and controls. The audit committee met four times during fiscal 2001.

All members of the audit committee are “independent” as that term is defined in the applicable listing standards of The Nasdaq Stock Market. The responsibilities of the audit committee are set forth in the Audit Committee Charter, adopted by our audit committee on April 25, 2000, and amended and restated on March 30, 2001. A copy of our Audit Committee Charter was included as Exhibit A to last year’s proxy statement.

The board of directors met eight times during fiscal 2001. The Securities and Exchange Commission rules require disclosure of those directors who attended fewer than 75% of the aggregate total of meetings of the board

5

and board committees on which the director served during the last fiscal year. No director attended fewer than 75% of the aggregate total of these meetings.

The compensation committee is responsible for establishing and administering the company’s policies involving the compensation of executive officers. During fiscal 2001, the members of the compensation committee were Philip A. Roberts, John P. Whaley, Don W. Hays and Paul Zepf. On December 31, 2001, Mr. Hays resigned from his position as a director and as a member of all of our board committees to which he belonged.

During the period prior to April 1998, Messrs. Roberts and Hays served as officers of the company and several of its subsidiaries. During fiscal 2001, we paid Roberts Consulting LLC, an entity controlled by Mr. Roberts, a total of $91,000 for consulting services provided to the company. We also paid Steven Roberts, son of Mr. Roberts, and an entity controlled by Steven Roberts, a total of $297,000 for their architectural services.

Agreement with Roberts Consulting LLC. In January 2000, we entered into an agreement with Roberts Consulting LLC. Roberts Consulting is controlled by our director, Philip Roberts. Under the agreement we pay Roberts Consulting $6,500 for each new restaurant opening in 2001 and $8,500 for each restaurant opening in 2002 in exchange for consulting services and assistance with new restaurant openings. During fiscal 2001, we paid Roberts Consulting a total of $91,000 for its consulting services.

Agreement with Steven Roberts. Steven Roberts, son of our director, Philip Roberts, from time to time performs architectural services for us under a letter agreement. The amount paid by us to Mr. Roberts and Steven Harris Architects, an entity controlled by Mr. Roberts, for these services in fiscal 2001 was $297,000. We believe the terms of the letter agreement are at least as favorable as we could obtain from unrelated parties.

Agreement with Joseph P. Micatrotto. On February 6, 2001, our board of directors approved a $150,000 unsecured loan to Joseph P. Micatrotto, a director of the company and the company’s Chairman, President and Chief Executive Officer. The note bears interest at the rate of 8% per annum. The loan was made on March 15, 2001 and on February 12, 2002, the principal of and interest on the loan was forgiven by our board of directors.

Payments to John Mihajlov. John Mihajlov, son of our director, Peter Mihajlov, was a Regional Vice President of the company. John Mihajlov resigned from his position as a Regional Vice President of the company in January 2002. During fiscal 2001, we paid him a salary of $78,588 and a bonus of $64,105.

Payments to Joseph Micatrotto, Jr. Joseph Micatrotto, Jr., son of our Chairman, President and Chief Executive Officer, Joseph P. Micatrotto, is a Paisano Partner. During fiscal 2001, we paid him a salary of $51,237 and a bonus of $25,250.

6

The following table sets forth information regarding the beneficial ownership of our common stock as of April 9, 2002 by:

| | Ÿ | | each shareholder known by us to beneficially own more than five percent of our common stock, |

| | Ÿ | | each of our directors and director nominees, |

| | Ÿ | | the executive officers named in the Summary Compensation Table on page 9, and |

| | Ÿ | | all of our directors and executive officers as a group. |

Except as otherwise noted below, each of the shareholders identified in the table has sole voting and investment power with respect to the shares of common stock beneficially owned by the person.

| | | Shares Beneficially Owned(1)

| |

Name of Beneficial Owner

| | Number

| | Percent

| |

Lord, Abbett & Co.(2) | | 1,281,658 | | 7.8 | % |

T. Rowe Price Associates, Inc.(3) | | 1,196,000 | | 7.3 | % |

Wasatch Advisors, Inc.(4) | | 1,317,137 | | 8.0 | % |

Philip A. Roberts(5) | | 210,471 | | 1.3 | % |

Peter J. Mihajlov(6) | | 277,694 | | 1.7 | % |

John P. Whaley(7) | | 445,568 | | 2.7 | % |

Paul Zepf (8) | | 2,874 | | * | |

Joseph P. Micatrotto(9) | | 301,663 | | 1.8 | % |

Greg A. Gadel(10) | | 71,836 | | * | |

Lane G. Schmiesing(11) | | 30,342 | | * | |

Joseph J. Kohaut(12) | | 25,551 | | * | |

Jennifer Percival(13) | | 7,019 | | * | |

All directors and executive officers as a group (9 persons). | | 1,373,018 | | 8.1 | % |

(1) | | Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission that generally attribute beneficial ownership of securities to persons who possess sole or shared voting power and/or investment power with respect to those securities and includes shares of common stock issuable pursuant to the exercise of stock options that are immediately exercisable or exercisable within 60 days. Unless otherwise indicated, the persons or entities identified in this table have sole voting and investment power with respect to all shares shown as beneficially owned by them. Percentage ownership calculations are based on 16,383,343 shares of common stock outstanding. |

(2) | | Based on a Schedule 13G filed with the Securities and Exchange Commission on January 28, 2002. The address for Lord, Abbett is 90 Hudson Street, Jersey City, New Jersey 07302. |

(3) | | Based on a Schedule 13G filed with the Securities and Exchange Commission on February 4, 2002. These securities are owned by various individual and institutional investors which T. Rowe Price Associates, Inc. serves as investment adviser with power to direct investments and/or sole power to vote the securities. For purposes of the reporting requirements of the Securities Exchange Act of 1934, T. Rowe Price Associates is deemed to be a beneficial owner of the securities; however, T. Rowe Price Associates expressly disclaims that it is, in fact, the beneficial owner of the securities. T. Rowe Price Associates, Inc. has sole voting power with respect to 353,700 shares of common stock. The address for T. Rowe Price Associates, Inc. is 100 E. Pratt Street, Baltimore, Maryland 21202. |

7

(4) | | Based on a Schedule 13G filed with the Securities and Exchange Commission on February 15, 2002. The address for Wasatch Advisors, Inc. is 150 Social Hall Avenue, Salt Lake City, Utah 84111. |

(5) | | Includes (1) 69,333 shares owned by the Roberts Family Limited Partnership II; (2) 110,462 shares owned by Mr. Roberts’ wife; (3) options for the purchase of 21,333 shares of common stock exercisable within 60 days granted to Mr. Roberts; and (4) options for the purchase of 844 shares of common stock exercisable within 60 days granted to Mr. Robert’s wife. The address for Mr. Roberts is 1300 Nicollet Mall, Suite 5003, Minneapolis, Minnesota 55403. |

(6) | | Includes (1) 91,666 shares owned by the Mihajlov Family Limited Partnership; (2) 69,166 shares owned by Mr. Mihajlov’s wife; (3) 9,560 shares held by Peter J. Mihajlov Trust; and (4) options for the purchase of 8,000 shares of common stock exercisable within 60 days granted to Mr. Mihajlov. The address for Mr. Mihajlov is 3001 Hennepin Avenue South, Suite 301A, Minneapolis, Minnesota 55408. |

(7) | | Consists of (1) options for the purchase of 10,665 shares of common stock exercisable within 60 days granted to Mr. Whaley; (2) 14,565 shares of common stock held by Whaley Family LP; and (3) 413,232 shares of common stock beneficially owned by Norwest Equity Partners V, L.P. Mr. Whaley is a managing administrative partner of Itasca Partners V, LLP, the general partner of Norwest Equity Partners V, L.P. All voting and investment power with respect to the shares is held by the managing partners and managing administrative partner of Itasca Partners V, LLP. Mr. Whaley disclaims beneficial ownership of the 413,232 shares of common stock owned by Norwest Equity Partners V, L.P. except to his pecuniary interest therein. The address for Mr. Whaley is 3600 IDS Center, 80 South 8th Street, Minneapolis, Minnesota 55402. |

(8) | | The address for Mr. Zepf is 30 Rockefeller Plaza, 50th Floor, New York, New York 10020. |

(9) | | Consists of options for the purchase of 301,663 shares of common stock exercisable within 60 days granted to Mr. Micatrotto. The address for Mr. Micatrotto is 1300 Nicollet, Suite 5003, Minneapolis, Minnesota 55403. |

(10) | | Includes options for the purchase of 69,070 shares of common stock exercisable within 60 days granted to Mr. Gadel. The address for Mr. Gadel is 1300 Nicollet, Suite 5003, Minneapolis, Minnesota 55403. |

(11) | | Includes options for the purchase of 29,333 shares of common stock exercisable within 60 days granted to Mr. Schmiesing. The address for Mr. Schmiesing is 1300 Nicollet, Suite 5003, Minneapolis, Minnesota 55403. |

(12) | | Includes options for the purchase of 23,867 shares of common stock exercisable within 60 days granted to Mr. Kohaut. The address for Mr. Kohaut is 1300 Nicollet, Suite 5003, Minneapolis, Minnesota 55403. |

(13) | | Includes options for the purchase of 6,833 shares of common stock exercisable within 60 days granted to Ms. Percival. The address for Ms. Percival is 1300 Nicollet, Suite 5003, Minneapolis, Minnesota 55403. |

8

Summary Compensation Table. The following table contains information concerning compensation for fiscal 2001, fiscal 2000 and fiscal 1999 earned by our executive officers.

| | | | | Annual Compensation

| | Long-Term Compensation Awards

|

Name and

Principal Position

| | Year

| | Salary ($)

| | Bonus ($)

| | Securities Underlying Options (#)

|

Joseph P. Micatrotto Chairman, President and Chief Executive Officer | | 2001 2000 1999 | | 376,848 322,796 309,615 | | — — 100,000 | | 80,000 190,000 126,666 |

Greg A. Gadel Executive Vice President and Chief Financial Officer | | 2001 2000 1999 | | 177,996 153,483 143,544 | | — — 70,000 | | 70,000 42,000 20,000 |

Lane G. Schmiesing Senior Vice President of Marketing(1) | | 2001 2000 1999 | | 137,199 116,022 107,796 | | — — 37,800 | | 15,000 32,000 10,000 |

Joseph J. Kohaut Senior Vice President of Operations(2) | | 2001 2000 1999 | | 143,501 71,055 71,781 | | 43,852 93,553 92,839 | | 30,000 37,000 7,500 |

Jennifer Percival Senior Vice President of Family Resources(3) | | 2001 2000 1999 | | 134,602 118,687 114,129 | | — — 36,000 | | 15,000 10,000 7,500 |

(1) | | Mr. Schmiesing became Senior Vice President of Marketing in March 2001. |

(2) | | Mr. Kohaut became Senior Vice President of Operations in March 2001. |

(3) | | Ms. Percival became Senior Vice President of Family Resources in September 2001. |

Stock Option Grants Table. The following table sets forth certain information concerning all stock options granted during fiscal 2001 to the named executive officers. We did not grant any stock appreciation rights or restricted stock awards during fiscal 2001.

Name

| | Number of Shares Underlying Options Granted

| | | Percent of Total Options Granted to Employees in 2001

| | | Option Term

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation For Option Term (2)

|

| | | | Exercise or Base Price ($/Share) (1)

| | Expiration Date

| | 5% ($)

| | 10% ($)

|

| Joseph P. Micatrotto | | 50,000 | (3) | | 9.9 | % | | $ | 17.00 | | 2011 | | $ | 534,560 | | $ | 1,354,681 |

| | | 30,000 | (4) | | 5.9 | % | | | 13.15 | | 2011 | | | 248,099 | | | 628,731 |

| Greg A. Gadel | | 40,000 | (5) | | 7.9 | % | | | 17.00 | | 2011 | | | 427,648 | | | 1,083,745 |

| | | 30,000 | (6) | | 5.9 | % | | | 13.15 | | 2011 | | | 248,099 | | | 628,731 |

| Lane G. Schmiesing | | 15,000 | (7) | | 3.0 | % | | | 13.15 | | 2011 | | | 124,049 | | | 314,366 |

| Joseph J. Kohaut | | 30,000 | (8) | | 5.9 | % | | | 13.15 | | 2011 | | | 248,099 | | | 628,731 |

| Jennifer Percival | | 15,000 | (9) | | 3.0 | % | | | 13.15 | | 2011 | | | 124,049 | | | 314,366 |

(1) | | The exercise price may be paid in cash, in shares of common stock valued at fair market value on the exercise date, or in a combination of cash and shares. |

9

(2) | | The hypothetical potential appreciation shown in these columns reflects the required calculations at annual assumed appreciation rates of 5% and 10%, as set by the Securities and Exchange Commission, and therefore is not intended to represent either historical appreciation or anticipated future appreciation of the common stock. |

(3) | | Options for the purchase of 50,000 shares vested on January 1, 2002. |

(4) | | Options for the purchase of 30,000 shares will vest on December 31, 2002. |

(5) | | Options for the purchase of 40,000 shares vested on January 1, 2002. |

(6) | | Options for the purchase of 30,000 shares will vest on December 31, 2002. |

(7) | | Options for the purchase of 15,000 shares will vest on the following dates: 3,000 shares on December 17, 2002; 3,000 shares on December 17, 2003; 3,000 shares on December 17, 2004; 3,000 shares on December 17, 2005; and 3,000 shares on December 17, 2006. |

(8) | | Options for the purchase of 30,000 shares will vest on the following dates: 6,000 shares on December 17, 2002; 6,000 shares on December 17, 2003; 6,000 shares on December 17, 2004; 6,000 shares on December 17, 2005; and 6,000 shares on December 17, 2006. |

(9) | | Options for the purchase of 15,000 shares will vest on the following dates: 3,000 shares on December 17, 2002; 3,000 shares on December 17, 2003; 3,000 shares on December 17, 2004; 3,000 shares on December 17, 2005; and 3,000 shares on December 17, 2006. |

Fiscal Year-End Option Value Table. The following table sets forth certain information concerning options exercised by named executive officers in fiscal 2001 and unexercised stock options held by the named executive officers as of fiscal 2001 year-end.

Fiscal Year-End Option Value Table

| | | | | | | Number of Shares Underlying Unexercised Options at December 30, 2001

| | Value of In-the-Money Options at December 30, 2001 (1)

|

Name

| | Number of Shares Acquired on Exercise

| | Value Realized

| | Unexercisable

| | Exercisable

| | Unexercisable

| | Exercisable

|

| Joseph P. Micatrotto | | 93,333 | | $ | 1,168,247 | | 196,667 | | 301,666 | | 697,106 | | 1,512,934 |

| Greg A. Gadel | | 23,666 | | | 262,623 | | 89,802 | | 55,401 | | 408,029 | | 60,230 |

| Lane G. Schmiesing | | 8,533 | | | 132,182 | | 55,934 | | 25,333 | | 238,744 | | 143,091 |

| Joseph J. Kohaut | | 3,866 | | | 64,503 | | 76,568 | | 20,399 | | 282,686 | | 113,995 |

| Jennifer Percival | | 1,500 | | | 17,415 | | 34,167 | | 6,833 | | 132,948 | | 39,087 |

(1) | | Based on a closing sale price of our common stock of $15.60 per share at December 28, 2001, the last trading day of our 2001 fiscal year. |

Employment Agreements. We entered into an employment agreement with Joseph P. Micatrotto on July 22, 1996, which was subsequently amended and restated in February 1999 and further amended in September 2000. Under the terms of the agreement, Mr. Micatrotto is currently serving as our Chairman, President and Chief Executive Officer for a term expiring on December 31, 2004. The agreement provides that Mr. Micatrotto’s annual salary will be $375,000 for the year ended December 31, 2001, $400,000 for the year ended December 31, 2002, $425,000 for the year ended December 31, 2003, and $450,000 for the year ended December 31, 2004. Mr. Micatrotto is eligible to receive a yearly bonus based upon certain performance criteria established by the board. In connection with the amendment of Mr. Micatrotto’s employment agreement in February 1999, Mr. Micatrotto received options to purchase 126,666 shares of our common stock at an exercise price of $11.25 per share, 6,666 of which vested on each of December 31, 1999, 2000 and 2001 and 53,334 of which vest on each of December 31, 2002 and 2003. We also have agreed to reimburse Mr. Micatrotto’s reasonable and necessary business expenses. Mr. Micatrotto is entitled to the following termination benefits:

| | Ÿ | | If Mr. Micatrotto is terminated by us for cause or if Mr. Micatrotto terminates his employment, he will receive no additional compensation or termination benefits. |

10

| | Ÿ | | If Mr. Micatrotto is terminated because of death or physical or mental disability, he or his estate will be entitled to a termination payment of two years’ base salary then in effect, payable in 24 equal monthly installments. |

| | Ÿ | | If Mr. Micatrotto terminates his employment upon 30 days’ prior written notice following a change in control of the company, because his duties are substantially reduced or negatively altered without his prior written consent, or if Mr. Micatrotto’s employment is terminated by us without cause following a change in control or within 180 days prior to a change in control and the termination is related to the change in control, he will be entitled to a termination payment of 18 months’ base salary then in effect, payable in 18 monthly installments. If Mr. Micatrotto terminates employment as a result of a change in control, but his duties have not been substantially reduced or negatively altered, he will be entitled to a termination payment of 12 months’ base salary then in effect, payable in 12 monthly installments. |

| | Ÿ | | If Mr. Micatrotto is terminated by us without cause and not associated with a change in control, he will be entitled to a termination payment of 18 months’ base salary then in effect, payable in 18 monthly installments. |

The agreement also contains fringe benefits, confidentiality and non-competition provisions.

On April 1, 1997, we entered into a letter agreement with Greg A. Gadel under which Mr. Gadel will be entitled one year’s base compensation in effect at the time of termination if his employment is terminated as a result of a change in control of BUCA or if he terminates his employment following a change in control if his duties are substantially reduced or negatively altered.

Philip A. Roberts, John P. Whaley and Paul Zepf are members of the Compensation Committee (the “Committee”) of the Board of Directors. For fiscal year ended 2001, all decisions concerning executive compensation were made by the Committee. The Committee is responsible for setting and administering the policies governing annual compensation of the executive officers of the company. The Committee reviews and approves the President and Chief Executive Officer’s recommendations regarding the performance and compensation levels for executive officers, other than himself.

Overview

The goals of the company’s executive officer compensation policies are to attract, retain and reward executive officers who contribute to the company’s success, to align executive officer compensation with the company’s performance and to motivate executive officers to achieve the company’s business objectives. The company uses salary, bonus compensation and option grants to attain these goals. The Committee reviews compensation surveys and other data to enable the Committee to compare the company’s compensation package with that of similarly-sized restaurant companies.

Salary

Base salaries of executive officers are reviewed annually, and if deemed appropriate, adjustments are made based on individual executive officer performance, scope of responsibilities and levels paid by similarly-sized restaurant companies. In determining the salaries of the executive officers, the Committee considered information provided by the company’s President and Chief Executive Officer and salary data from industry surveys, and may from time to time consider salary surveys and similar data prepared by an executive recruitment consulting firm.

The President and Chief Executive Officer is responsible for evaluating the performance of all other executive officers and recommends salary adjustments which are reviewed and approved by the Committee. In

11

addition to considering the performance of individual executive officers and information concerning competitive salaries, significant weight is placed on the financial performance of the company in considering salary adjustments.

Bonus Compensation

Cash bonuses for each executive officer are determined annually by the Committee. At the beginning of each year, the Committee chooses five of the following six performance targets upon which to base bonus compensation for that year: (1) number of new restaurant openings, (2) number of operating weeks, (3) restaurant operating profit, (4) total sales, (5) general and administrative expenses and (6) comparable restaurant sales. These are the same targets used in determining the President and Chief Executive Officer’s cash bonus. Performance against the established goals is determined annually by the Committee and based on such determination, the Committee approves payment of appropriate bonuses.

Stock Options

The company strongly believes that equity ownership by executive officers provides incentives to build shareholder value and align the interests of executive officers with the shareholders. The size of an initial option grant to an executive officer has generally been determined with reference to similarly-sized restaurant companies, the responsibilities and future contributions of the executive officer, as well as recruitment and retention considerations. In fiscal 2001, the President and Chief Executive Officer recommended to the Committee and the Board of Directors, and the Committee and the Board of Directors approved, stock option grants under the 1996 Stock Incentive Plan to the executive officers.

Compensation of Chief Executive Officer

The company and Mr. Micatrotto, our President and Chief Executive Officer, entered into an employment agreement upon Mr. Micatrotto’s hire in 1996. Prior to the company’s initial public offering in April 1999, Mr. Micatrotto’s employment agreement was amended and restated. Mr. Micatrotto’s employment agreement was further amended in September 2000. See “Executive Compensation—Employment Agreements” for a general discussion of the agreement. As amended, the agreement set Mr. Micatrotto’s base compensation for 2001 at $375,000. In addition, the bonus policy for Mr. Micatrotto is based upon meeting certain company performance targets specified in the agreement. The performance targets for fiscal 2001 were not met and therefore, no bonus was paid to Mr. Micatrotto. The Committee also approved the grant of options to Mr. Micatrotto covering an aggregate of 80,000 shares of common stock under the 1996 Stock Incentive Plan.

Deductibility of Executive Compensation

Internal Revenue Code Section 162(m) limits the deductibility of compensation over $1 million paid by a company to an executive officer. The Committee currently does not have a policy with respect to Section 162(m) because it is unlikely that such limit will apply to compensation paid by the company to any of the company’s executive officers for at least the current year.

COMPENSATION COMMITTEE

Philip A. Roberts

John P. Whaley

Paul Zepf

12

The role of the company’s Audit Committee, which is composed of three independent non-employee directors, is one of oversight of the company’s management and the company’s outside auditors in regard to the company’s financial reporting and the company’s controls respecting accounting and financial reporting. In performing its oversight function, the Audit Committee relied upon advice and information received in its discussions with the company’s management and independent auditors.

The Audit Committee has (1) reviewed and discussed the company’s audited financial statements for the year ended and December 30, 2001 with the company’s management; (2) discussed with the company’s independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61 regarding communication with audit committees (Codification of Statements on Auditing Standards, AU sec. 380); (3) received the written disclosures and the letter from the company’s independent accountants required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees); and (4) discussed with the company’s independent accountants the independent accountants’ independence.

Based on the review and discussions with management and the company’s independent auditors referred to above, the Audit Committee recommended to the board of directors that the audited financial statements be included in the company’s Annual Report on Form 10-K for the fiscal year ended December 30, 2001 for filing with the Securities and Exchange Commission.

AUDIT COMMITTEE

Peter J. Mihajlov

John P. Whaley

Paul Zepf

The aggregate fees billed for the audit of the company’s annual consolidated financial statements for fiscal 2001 and for the review of the company’s interim consolidated financial statements for each quarter in fiscal 2001 were $65,000.

Deloitte & Touche LLP did not bill any amounts to the company for financial information systems design and implementation during fiscal 2001.

The company also paid its principal accountant $214,325 for all other services for fiscal 2001. These fees related primarily to (1) preparation and review of the company’s tax returns; (2) consulting related to tax planning; and (3) acquisition of restaurant assets.

The Audit Committee has considered whether, and has determined that, the provision of services described under “All Other Fees” was compatible with maintaining the independence of Deloitte & Touche LLP as the company’s principal accountants.

13

OUR AMENDED AND RESTATED ARTICLES OF INCORPORATION

Our current Amended and Restated Articles of Incorporation authorizes the company to issue 25,000,000 shares of capital stock, par value $.01 per share, of which, 20,000,000 are designated as common shares and 5,000,000 are undesignated. Our board of directors has proposed to amend our Amended and Restated Articles of Incorporation to increase the company’s aggregate number of authorized shares of capital stock from 25,000,000 shares to 35,000,000 and to increase the number of authorized shares of common stock from 20,000,000 to 30,000,000. Specifically, if the proposal is approved, Article III(a) of the Amended and Restated Articles of Incorporation of the company will be amended to read as follows:

“(a) General. The aggregate number of shares of stock which the Corporation is authorized to issue is 35,000,000 shares, par value $.01 per share, of which, 30,000,000 are designated as common shares (the “Common Stock”), and 5,000,000 are undesignated (the “Undesignated Capital Stock”). The shares of Common Stock and Undesignated Capital Stock are referred to herein collectively as the “capital stock”.”

As of April 9, 2002, there were 16,386,343 shares of common stock issued and outstanding. Of the remaining authorized but unissued shares of common stock, approximately 2,341,276 shares are reserved for issuance under the company’s option plans, employee stock purchase plan and other option agreements. As a result, the company only has a limited number of authorized but unissued common shares available for issuance for other corporate purposes.

Our board of directors believes it desirable to increase the authorized number of shares of common stock in order to provide the company with adequate flexibility in corporate planning and strategies. Subject to limitations prescribed by applicable laws or the rules of the Nasdaq Stock Market, authorized but unissued shares common stock and undesignated capital stock are available for issuance in the discretion of our board of directors, from time to time, for any proper corporate purpose, without further action of our shareholders. If this proposal is approved, the company will have more financial flexibility and be able to issue shares of common stock, without the expense and delay of holding a special meeting of shareholders, in connection with future opportunities for expanding the business through investments or acquisitions, equity financing, management incentive, employee benefit plans, stock dividends or splits, stock options, other stock-based compensation, and for other purposes.

At the date of this proxy statement, except as described under the company’s option plans, employee stock purchase plan and other option agreements, our board of directors has not authorized the issuance of any additional shares of common stock and we currently have no agreements or commitments, including any acquisition proposals, with respect to the sale or issuance of any shares of our capital stock. The issuance of additional shares could have the effect of diluting per share earnings and the book value of existing shares. The proposal to increase the authorized number of shares of our capital stock may be considered as having the effect of discouraging attempts to take over control of the company. Under certain circumstances, our board of directors could create impediments to, or delay persons seeking to effect, a takeover or transfer of control of the company by causing the remaining authorized shares to be issued to a holder or holders who side with the board of directors in opposing a takeover bid that our board of directors determines is not in the best interests of the company and our shareholders. Such an issuance would diminish the voting power of existing shareholders who favor a change in control, and the ability to issue the shares could discourage an attempt to acquire control of the company. While it may be deemed to have potential anti-takeover effects, our board of directors is proposing to increase the authorized shares of our capital stock and common stock primarily for the reasons described in the prior paragraph. The proposal is not prompted by any specific efforts or takeover threat currently known or perceived by management or the board.

OUR BOARD OF DIRECTORS RECOMMENDS THAT OUR SHAREHOLDERS VOTE TO APPROVE THE AMENDMENTS TO OUR AMENDED AND RESTATED ARTICLES OF INCORPORATION.

14

On October 1, 1996, our shareholders approved the 1996 Stock Incentive Plan of BUCA, Inc. and Affiliated Companies. The purpose of the plan is to motivate our key personnel to produce a superior return for our shareholders by facilitating their ownership of our common stock and by rewarding them for achieving a high level of corporate financial performance. The plan is also intended to facilitate recruiting and retaining key personnel of outstanding ability by providing an attractive capital accumulation opportunity. As of April 9, 2002, options to purchase 2,220,487 shares of common stock had been issued under the plan, 736,068 shares had been issued under the plan and 79,513 shares were available for future grants.

In addition to the 1996 Stock Incentive Plan, our board of directors adopted a 2000 Stock Incentive Plan on April 25, 2000. The plan will remain in effect until all stock subject to it has been distributed, until all awards have expired or lapsed, or until April 25, 2010. We have reserved 300,000 shares of our common stock for awards under the plan. All of our employees, other than our officers and directors, are eligible to receive awards under the plan.

In fiscal 2000, our board of directors and shareholders approved amendments to our 1996 Stock Incentive Plan to increase the total number of shares reserved for issuance to 1,800,000 and to allow shares issued under the plan, but reacquired by the company, to be available for future awards under the plan. In fiscal 2001, our board of directors and shareholders approved another amendment to our 1996 Stock Incentive Plan to increase the total number of shares reserved for issuance to 2,300,000. To enable the company to continue to make awards under the plan, our board of directors has approved another amendment to the plan to increase the number of shares reserved for issuance by 750,000, increasing the total number of shares reserved under the plan to 3,050,000, subject to shareholder approval. We are asking shareholders to approve the amendment to the plan at the Annual Meeting to accommodate the increase in the number of employees participating in the plan and to enable the company to continue to offer employees the opportunity to realize stock appreciation in the company.

There are currently 2,300,000 shares of our common stock available for awards under the plan. This number of shares under the plan is subject to adjustment for future stock splits, stock dividends, and similar changes in the capitalization of our company. The plan will remain in effect until all stock subject to it has been distributed or until all awards have expired or lapsed. In addition, our board of directors may terminate the plan at any time, subject to the conditions stated in the plan.

The plan is not subject to the Employee Retirement Income Security Act of 1974 and is not a “qualified plan” under Section 401(a) of the Internal Revenue Code of 1986.

The 1996 Stock Incentive Plan is administered by a committee of members of our board of directors. The committee has the authority, subject to the terms of the plan, to adopt, revise, and waive rules relating to the plan. The committee is also responsible for determining when and to whom awards will be granted, the form of each award, the amount of each award, and any other terms of an award, consistent with the plan.

Members of the committee are designated by our board of directors and serve on the committee for an indefinite term, at the discretion of the board. The Compensation Committee of our board of directors currently serves as the committee that administers the plan. The committee may delegate its responsibilities under the plan to members of our management, or to others, with respect to the grants of awards to employees who are not deemed to be executive officers of our company under relevant federal securities laws.

15

All employees of the company and its “affiliates,” as defined in the plan, are eligible to receive awards under the plan. As of December 30, 2001, we had approximately 4,100 employees. Awards other than incentive stock options may be granted by the committee to individuals or entities that are not our employees, but who provide services to our company or its affiliates as consultants or independent contractors. The selection of those to whom awards under the plan are made is within the sole discretion of the committee.

The types of awards that may be granted under the plan include incentive and non-statutory stock options, restricted stock, stock appreciation rights, performance shares, and other stock-based awards. The following is a brief description of the material characteristics of each type of award.

Incentive and Non-Statutory Stock Options. Both incentive stock options and non-statutory stock options may be granted under the plan. The exercise price of an option is determined by the committee and set forth in an option agreement. The exercise price for non-qualified stock options may be less than, equal to or greater than the fair market value of our common stock on the date the option is granted. Stock options may be granted and exercised at such times as the committee may determine, which is reflected in the exercise schedule set forth in an option agreement. Unless federal tax laws are modified:

| | Ÿ | | no incentive stock option may be granted more than 10 years after October 1, 1996, which was the effective date of the plan; |

| | Ÿ | | an incentive stock option may not be exercised more than 10 years after the date it was granted; and |

| | Ÿ | | the aggregate fair market value of shares of our common stock underlying incentive stock options held by any participant under the plan, and under any other plan of our company or of our affiliates, that first become exercisable in any calendar year may not exceed $100,000. |

Additional restrictions apply to incentive stock options granted to persons who beneficially own 10% or more of the outstanding shares of our common stock.

The purchase price for common stock purchased upon the exercise of stock options may be payable in cash, in our common stock having a fair market value on the date the option is exercised equal to the option price of the stock being purchased, or a combination of cash and stock, as provided in the option agreement. In addition, the committee may permit recipients of stock options to simultaneously exercise options and sell the common stock purchased upon exercise and to use the sale proceeds to pay the purchase price.

Restricted Stock and Other Stock-Based Awards. The committee is authorized to grant, either alone or in combination with other types of awards, restricted stock and other stock-based awards. Restricted stock may contain such restrictions, including provisions requiring forfeiture and imposing restrictions on stock transfer, as the committee may determine and set forth in the option agreement.

The committee may provide that, unless forfeited, a recipient of an award of restricted stock will have all rights of a company shareholder, including voting and dividend rights.

Stock Appreciation Rights and Performance Awards. The recipient of a stock appreciation right receives all or a portion of the amount by which the fair market value of a specified number of shares, as of the date the right is exercised, exceeds a price specified by the committee at the time the right is granted, as set forth in the recipient’s agreement. The price specified by the committee must be at least 100% of the fair market value of our common stock on the date the right is granted.

Performance awards entitle the recipient to payment in amounts determined by the committee, and set forth in the recipient’s agreement, based upon the achievement of specified performance targets during a specified term.

16

Payments for stock appreciation rights and performance awards may be paid in cash, shares of our common stock, or a combination of cash and shares, as determined by the committee.

The committee may provide in the applicable agreement for the lapse of restrictions on restricted stock or other awards, accelerated vesting of stock options, stock appreciation rights, and other awards, or acceleration of the term with respect to which the achievement of performance targets for performance awards is determined in the following circumstances:

| | Ÿ | | a change in control of the company; |

| | Ÿ | | other fundamental changes in the corporate structure of the company; |

| | Ÿ | | death, disability, or qualified retirement; or |

| | Ÿ | | such other events as the committee may determine. |

Adjustments, Modifications, Termination

The plan gives the committee discretion to adjust the kind and number of shares available for awards or subject to outstanding awards, the exercise price of outstanding stock options, and performance targets for, and payments under, outstanding performance awards upon mergers, recapitalizations, stock dividends, stock splits, or similar changes affecting us. Adjustments in performance targets and payments on performance shares are also permitted upon the occurrence of such other events as may be specified by the committee.

The plan also gives our board of directors the right to terminate, suspend, or modify the plan. Amendments to the plan are subject to shareholder approval, however, if needed to comply with Rule 16b-3 under the Securities Exchange Act or federal tax laws relating to incentive stock options.

Under the plan, the committee may generally cancel outstanding stock options and stock appreciation rights in exchange for cash payments to the recipients upon dissolutions, liquidations, mergers, statutory share exchanges, or similar events involving us.

Federal Tax Considerations

Incentive Stock Options. Option recipients do not realize taxable income, and we are not entitled to any related deduction, when we grant recipients an incentive stock option. The Internal Revenue Code requires that recipients satisfy the following employment and holding period requirements to obtain the tax benefits given to incentive stock options:

| | Ÿ | | unless they die or become disabled, they must remain employed by us or a subsidiary during the entire period starting on the date the option was granted and ending three months before the date the option was exercised. |

| | Ÿ | | unless they die, they must hold the shares they receive upon exercise of the option for the longer of (1) two years from the date the option was granted, or (2) one year from the date the option was exercised. |

If the recipient satisfies the statutory employment and holding period conditions, then they will not realize taxable income upon the exercise of the option, and we will not be entitled to any related deduction. Upon disposition of the shares after expiration of the statutory holding periods, any gain or loss they realize will be a capital gain or loss, and we will not be entitled to any related deduction.

Except in connection with the recipient’s death, if a recipient exercises an incentive stock option and then disposes of the shares before the expiration of the statutory holding periods (a “disqualifying disposition”), he or

17

she will realize ordinary income in the year of disposition equal to the lesser of (1) the total gain realized on disposition, or (2) the difference between the exercise price and the fair market value of the shares on the date of exercise. We will be entitled to a deduction at the same time and in the same amount as the recipient realizes ordinary income. Any gain they realize on the disposition in excess of the amount treated as ordinary income, or any loss they realize on the disposition, will be capital gain or loss.

If recipients pay the exercise price with shares of stock that the recipient originally acquired upon the exercise of an incentive stock option and the statutory holding periods for those shares have not been met, they will be treated as having made a disqualifying disposition of those shares. The tax consequences of such a disqualifying disposition will be as described above.

The foregoing discussion applies only for regular tax purposes. For alternative minimum tax purposes, an incentive stock option will be treated as if it were a non-statutory stock option, the tax consequences of which are discussed below.

Non-Statutory Stock Options. Option recipients do not realize taxable income, and we are not entitled to any related deduction, when we grant recipients a non-statutory stock option. When they exercise a non-statutory stock option, they will realize ordinary income, and we will be entitled to a related deduction, equal to the excess of the fair market value of the shares on the date of exercise over the option price. Upon disposition of the shares, any additional gain or loss they realize will be taxed as a capital gain or loss.

Restricted Stock. Unless recipients file an election to be taxed under Section 83(b) of the Internal Revenue Code, the following federal tax consequences will apply:

| | Ÿ | | they will not realize income upon the grant of the restricted stock; |

| | Ÿ | | they will realize ordinary income, and we will be entitled to a related deduction, when the restrictions on their stock have been removed or have expired; and |

| | Ÿ | | the amount of their ordinary income and our deduction will be the fair market value of the stock on the date the restrictions are removed or expire. |

If recipients elect to be taxed under Section 83(b), then the tax consequences to them and us will be determined as of the date of the grant of the restricted stock, rather than as of the date of the removal or expiration of the restrictions.

When they dispose of restricted stock, the difference between the amount they receive upon disposition and the fair market value of the shares on the date they realized ordinary income will be taxed as a capital gain or loss.

Stock Appreciation Rights and Performance Awards. Recipients will not realize income upon the award of a stock appreciation right or performance shares. They will realize ordinary income, and we will be entitled to a related deduction, when cash or shares of common stock are delivered to them upon exercise of a stock appreciation right or in payment of a performance shares award. The amount of ordinary income and deduction will be the amount of cash, plus the fair market value of the shares on the date they receive them. Upon a subsequent disposition of any shares received, any additional gain or loss they realize will be taxed as capital gain or loss.

Following approval of the increase in the number of shares available under the plan, we intend to amend our registration statement covering the plan to include the additional shares.

OUR BOARD OF DIRECTORS RECOMMENDS THAT OUR SHAREHOLDERS VOTE TO APPROVE THE AMENDMENT TO THE 1996 STOCK INCENTIVE PLAN OF BUCA, INC. AND AFFILIATED COMPANIES.

18

Proxies solicited by the board of directors will, unless otherwise directed, be voted to approve the appointment by the board of directors of Deloitte & Touche LLP as our independent auditors for the fiscal year ending December 29, 2002. We have employed Deloitte & Touche LLP in this capacity since 1997.

A representative from Deloitte & Touche LLP will be at the Annual Meeting and will have the opportunity to make a statement if such representative so desires and will be available to respond to questions during the meeting.

OUR BOARD OF DIRECTORS RECOMMENDS THAT OUR SHAREHOLDERS VOTE TO APPROVE THE APPOINTMENT OF DELOITTE & TOUCHE LLP AS INDEPENDENT AUDITORS.

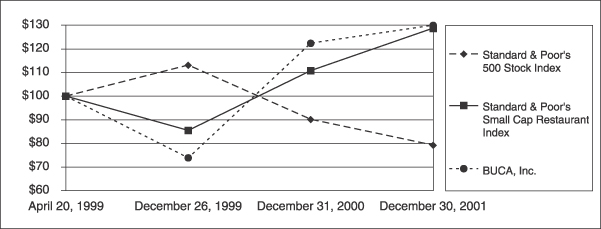

The graph below compares the cumulative total shareholder return(1), assuming the reinvestment of all dividends on our common stock for the period beginning April 20, 1999(2), and ending on December 30, 2001.

| | | April 20, 1999

| | December 26, 1999

| | December 31, 2000

| | December 30, 2001

|

| Standard & Poor’s 500 Stock Index | | $ | 100 | | $ | 113.10 | | $ | 90.15 | | $ | 79.28 |

| Standard & Poor’s Small Cap Restaurant Index | | $ | 100 | | $ | 85.57 | | $ | 110.83 | | $ | 128.72 |

| BUCA, Inc. | | $ | 100 | | $ | 73.96 | | $ | 122.40 | | $ | 130.00 |

(1) | | Assumes that $100 was invested on April 20, 1999, in our common stock at the initial public offering price of $12 and at the closing sales price for each index, and that all dividends were reinvested. We have not declared dividends on our common stock. You should not consider shareholder returns over the indicated period to be indicative of future shareholder returns. |

(2) | | The effective date of our initial public offering was April 20, 1999. For purposes of this presentation, we have assumed that our initial public offering price of $12 would have been the closing sales price on April 19, 1999, the day prior to commencement of trading. |

19

The SEC rules require disclosure of those directors, officers and beneficial owners of more than 10% of the our common stock who fail to file on a timely basis reports required by Section 16(a) of the Securities Exchange Act of 1934 during the most recent fiscal year. Based solely on review of reports furnished to us and written representations that no other reports were required during the fiscal year ended December 30, 2001, all Section 16(a) filing requirements were met, except as follows:

Don W. Hays, a former director of the company, inadvertently failed to timely file a Form 4 to report the sale of certain shares of common stock in May 2001. Mr. Hays also mistakenly reported on his Form 4 the sale of certain shares by himself in June 2001 when the sale was in fact made by Hays Family Limited Partnership of which Mr. Hays is a general partner. Philip A. Roberts, one of our directors, inadvertently failed to timely file Form 4s to report (1) the sale of certain shares of common stock in July 2001; (2) the acquisition of certain shares of common stock in December 2001 as a gift from his spouse, and (3) the acquisition of certain shares of common stock by his spouse in November 2000 as a result of distribution from an employee stock ownership trust. Mr. Roberts also mistakenly reported on his Form 4 disposition of certain shares of common stock by him and his spouse in March 2001 that did not in fact occur. Joseph P. Micatrotto, our chairman, president and chief executive officer, inadvertently failed to timely file a Form 4 to report the sale of certain shares of common stock in May 2001. Joseph J. Kohaut, our senior vice president of operations, inadvertently failed to report beneficial ownership of certain employee stock option on his initial Form 3 filed with the SEC. Each of the Form 3, Form 4s and amendments to Form 4s, as the case may be, was subsequently filed in 2002 to report the transactions or correct prior reports.

Shareholder proposals for consideration at our 2003 Annual Meeting must follow the procedures set forth in Rule 14a-8 under the Securities Exchange Act of 1934 and our By-laws. To be timely under Rule 14a-8, shareholder proposals must be received by our Secretary by December 30, 2002, in order to be included in the proxy statement. Under our By-laws, if a shareholder plans to propose an item of business to be considered at any annual meeting of shareholders, that shareholder is required to give notice of the proposal to our Secretary at least 90 days prior to the anniversary of the most recent annual meeting and to comply with certain other requirements. The proposals also must comply with all applicable statutes and regulations.

20

ANNUAL MEETING OF SHAREHOLDERS

Tuesday, June 4, 2002

10:00 a.m., Central Daylight Savings Time

Hilton Hotel

1001 Marquette Avenue South

Minneapolis, Minnesota 55403

|

Buca, Inc | | |

1300 Nicollet Mall, Minneapolis, Minnesota 55403 | | Proxy |

|

This proxy is solicited by the Board of Directors for use at the Annual Meeting

of Shareholders to be held on June 4, 2002 and at any adjournment thereof.

By signing this proxy, you revoke all prior proxies and appoint Joseph P. Micatrotto and Greg A. Gadel, and each of them, as Proxies, each with full power of substitution, to vote, as designated on the reverse side and below, at the Annual Meeting of Shareholders to be held on June 4, 2002, and at any adjournment thereof, all shares of Common Stock of BUCA, Inc. registered in your name at the close of business on April 15, 2002.

This proxy when properly executed will be voted as specified on the reverse side, but, if no direction is given, this proxy will be voted FORItems 1, 2, 3 and 4. Notwithstanding the foregoing, if this proxy is to be voted for any nominee named on the reverse side and such nominee is unwilling or unable to serve, this proxy will be voted for a substitute in the discretion of the Proxies. The Proxies are authorized to vote in their discretion upon such other matters as may properly come before the Annual Meeting or any adjournment thereof.

See reverse for voting instructions.

There are two ways to vote your Proxy

Your telephone vote authorizes the Named Proxies to vote your shares in the same manner as if you marked, signed and returned your proxy card.

VOTE BY PHONE — TOLL FREE — 1-800-240-6326 — QUICK *** EASY *** IMMEDIATE

| • | | Use any touch-tone telephone to vote your proxy 24 hours a day, 7 days a week, until 12 p.m. (ET) on June 3, 2002. |

| • | | You will be prompted to enter your 3-digit Company Number and your 7-digit Control Number which are located above. |

| • | | Follow the simple instructions the voice provides you. |

VOTE BY MAIL

Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to BUCA, Inc. c/o Shareowner ServicesSM, P.O. Box 64873, St. Paul, MN 55164-0873.

|

IF YOU VOTE BY PHONE, PLEASE DO NOT MAIL YOUR PROXY CARD. Please detach here ò ò |

|

|

The Board of Directors Recommends a Vote FOR Items 1, 2, 3 and 4. |

|

| 1. Election of Directors: | | 01 Joseph P. Micatrotto | | ¨ Vote FOR ¨ Vote WITHHELD |

| | | 02 Philip A. Roberts | | all nominees from all nominees |

| | | 03 John P. Whaley | | (except as marked) |

|

(Instructions: To withhold authority to vote for any indicated nominee, write the number(s) of the nominee(s) in the box provided to the right.) | | |

|

| 2. Approval of amendments to our Amended and Restated Articles of Incorporation as specified in our proxy statement. | | ¨ For | | ¨ Against | | ¨ Abstain |

|

| 3. Approval of amendments to our 1996 Stock Incentive Plan as specified in our proxy statement. | | ¨ For | | ¨ Against | | ¨ Abstain |

|

| 4. Ratification of the appointment of Deloitte & Touche LLP as independent auditors for the 2002 fiscal year. | | ¨ For | | ¨ Against | | ¨ Abstain |

|

Address Change? Mark Box ¨ Indicate changes below: | | Dated: , 2002 |

|

| | |

|

| | | Signature(s) in Box |

| | | Please sign exactly as your name(s) appear on proxy. Jointly owned shares will be voted as directed if one owner signs unless another owner instructs to the contrary, in which case the shares will not be voted. Trustees, administrators, etc., should include title and authority. Corporations should provide full name of corporation and title of authorized officer signing the proxy. |