SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [_]

Check the appropriate box:

| [_] | | Preliminary Proxy Statement |

| [_] | | Confidential, for Use of the Commission Only (as permitted by Rule 14A-6(E)(2)) |

| [X] | | Definitive Proxy Statement |

| [_] | | Definitive Additional Materials |

| [_] | | Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12 |

BUCA, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [_] | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| [_] | | Fee paid previously with preliminary materials. |

| | [_] | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

1300 Nicollet Mall, Suite 5003

Minneapolis, Minnesota 55403

(612) 288-2382

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

MAY 6, 2003

VOTING METHOD

The accompanying proxy statement describes important issues affecting BUCA, Inc. If you are a shareholder of record, you have the right to vote your shares by telephone or by mail. You may also revoke your proxy at any time before the annual meeting. Please help us save time and postage costs by voting by telephone. Voting by telephone is available 24 hours a day and your vote will be confirmed and posted immediately. To vote:

| | a. | | On a touch-tone telephone, call toll-free 1-800-240-6326 24 hours a day, seven days a week. |

| | b. | | Enter the three-digit company number and seven-digit control number, which are located in the upper right hand corner of the proxy card, and the last four digits of the U.S. Social Security Number or Tax Identification Number for this account. If you do not have a U.S. Social Security Number or Tax Identification Number, please enter four zeros. |

| | c. | | Follow the simple recorded instructions. |

| | 2. | | BY MAIL (Do not mail the proxy card if you are voting by telephone.) |

| | a. | | Mark your selections on the proxy card. |

| | b. | | Date and sign your name exactly as it appears on your proxy card. |

| | c. | | Mail the proxy card in the enclosed postage-paid envelope. |

If your shares are held in the name of a bank, broker or other holder of record, you will receive instructions from the holder of record that you must follow in order for your shares to be voted.

Your vote is important. Thank you for voting.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TIME | 10:00 a.m., Central Daylight Time, on Tuesday, May 6, 2003. |

| | Minneapolis, Minnesota 55403 |

ITEMS OF BUSINESS | (1) To elect one director for a three-year term. |

| | (2) To amend our 1996 Stock Incentive Plan to increase the total |

| | | | number of shares reserved for issuance from 3,050,000 to |

| | (3) To ratify the appointment of Deloitte & Touche LLP as our |

| | (4) To act upon any other business that may properly come before |

RECORD DATE | You may vote if you are a shareholder of record at the close of business on March 27, 2003. |

ANNUAL REPORT | Our 2002 Annual Report has been included in this package. |

PROXY VOTING | It is important that your shares be represented and voted at the annual meeting. Please vote in one of these two ways: |

| | (1) Use the toll-free telephone number shown on the proxy card, |

| | (2) Mark, sign, date and promptly return the enclosed proxy card |

| | | | in the postage-paid envelope. |

| | You may revoke any proxy at any time prior to its exercise at the annual meeting. |

| | |

Greg A. Gadel

SECRETARY |

Approximate Date of Mailing of

Proxy Material: April 7, 2003

TABLE OF CONTENTS

BUCA, INC.

1300 Nicollet Mall, Suite 5003

Minneapolis, Minnesota 55403

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

May 6, 2003

The board of directors of BUCA, Inc. (the “company,” “we” or “us”) is soliciting the enclosed proxy for the 2003 Annual Meeting of Shareholders to be held at the Hyatt Hotel, 1300 Nicollet Mall, Minneapolis, Minnesota, on Tuesday, May 6, 2003, at 10:00 a.m., Central Daylight Time, and for any adjournment of the meeting. This proxy statement, a proxy card and our Annual Report to Shareholders for the fiscal year ended December 29, 2002 are being mailed on or about April 7, 2003 to shareholders of record on March 27, 2003.

GENERAL INFORMATION ABOUT THE MEETING AND VOTING

What is the purpose of the annual meeting?

At our annual meeting, shareholders will act upon the matters described in the accompanying notice of meeting, including the election of one director for a three-year term, the approval of amendments to our 1996 Stock Incentive Plan and the ratification of the appointment of our independent auditors. In addition, our management will report on the performance of the company during fiscal 2002 and respond to questions from shareholders.

Who may vote?

Only shareholders of record of our common stock at the close of business on the record date, March 27, 2003, are entitled to receive notice of the annual meeting and to vote the shares of common stock that they held on the record date at the meeting, or any postponement or adjournment of the meeting. Each share of common stock has one vote on each matter to be voted upon.

Who may attend the annual meeting?

All shareholders as of the record date, or their duly appointed proxies, may attend the meeting. Seating, however, is limited. Admission to the meeting is on a first-come, first-served basis and seating begins at approximately 9:30 a.m. Cameras and recording devices are not permitted at the meeting.

Please note that if you hold shares in “street name” (that is, through a bank, broker or other nominee), you will need to bring personal identification and a copy of a statement reflecting your stock ownership as of the record date and check in at the registration desk at the meeting.

What constitutes a quorum?

The presence at the meeting, in person or by proxy, of the holders of a majority of common stock outstanding on the record date will constitute a quorum, permitting the meeting to conduct its business. As of the record date, 16,654,519 shares of our common stock were outstanding. Proxies received but marked as abstentions will be included in the calculation of the number of shares considered to be present at the meeting for purposes of determining whether there is a quorum.

1

How may I vote?

You may vote by completing and properly signing the enclosed proxy card and returning it to the company in the envelope provided. If you are a registered shareholder (whose shares are owned in your name and not in “street name”) and attend the meeting, you may deliver your completed proxy card in person. In addition, registered shareholders may vote by telephone by following the instructions on the inside of the front cover of these materials. “Street name” shareholders who wish to vote at the meeting will need to obtain a proxy form from the institution that holds their shares.

May I vote confidentially?

Yes. Our policy is to treat all proxies, ballots and voting tabulations of a shareholder confidentially if the shareholder has requested confidentiality on the proxy card or ballot.

If you so request, your proxy will not be available for examination nor will your vote be disclosed prior to the tabulation of the final vote at the annual meeting except (1) to meet applicable legal requirements, (2) to allow the independent election inspectors to count and certify the results of the vote or (3) where there is a proxy solicitation in opposition to the board of directors, based upon an opposition proxy statement filed with the Securities and Exchange Commission (SEC). The independent election inspectors may at any time inform us whether or not a shareholder has voted.

May I change my vote?

Yes. Even after you have submitted your proxy, you may change your vote at any time before the proxy is exercised by filing with our Secretary either a notice of revocation or a duly executed proxy bearing a later date. The powers of the proxy holders will be suspended if you attend the meeting in person and so request, although attendance at the meeting will not by itself revoke a previously granted proxy.

How does the board recommend I vote?

Unless you give instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the board of directors. The board’s recommendation is set forth together with the description of each item in this proxy statement. In summary, the board of directors recommends a vote:

FOR election of the director nominee (see page 4),

FOR approval of amendments to our 1996 Stock Incentive Plan (see page 17), and

FOR ratification of the appointment of Deloitte & Touche LLP as our independent auditors (see page 22).

For any other matter that properly comes before the meeting, the proxy holders will vote as recommended by the board of directors or, if no recommendation is given, in their own discretion.

How many votes are required to approve each item?

The affirmative vote of the holders of a majority of the outstanding shares of our common stock entitled to vote and present in person or by proxy at the annual meeting will be required for approval of each proposal presented in this proxy statement. A properly executed proxy marked “WITHHOLD” or “ABSTAIN” with respect to any applicable matter will be counted for purposes of determining whether there is a quorum and will be considered present in person or by proxy and entitled to vote. Accordingly, a withholding or an abstention will have the effect of a negative vote. A shareholder (including a broker) who does not give authority to a proxy to vote, or who withholds authority to vote, on a proposal will not be considered present and entitled to vote on the proposal.

2

What if other matters are presented for determination at the annual meeting?

As of the date of this proxy statement, management knows of no matters that will be presented for determination at the meeting other than those referred to in this proxy statement. If any other matters properly come before the meeting calling for a vote of shareholders, proxies in the enclosed form returned to us will be voted in accordance with the recommendation of the board of directors, or, in the absence of such a recommendation, in accordance with the judgment of the proxy holders.

Who pays the expenses incurred in connection with the solicitation of proxies?

We will pay expenses in connection with the solicitation of proxies. Proxies are being solicited principally by mail and by telephone. In addition, our directors, officers and regular employees may solicit proxies personally, by telephone, fax or special letter.

How do I get additional copies of the Annual Report?

Our Annual Report for the fiscal year ended December 29, 2002, including financial statements, has been included in this package. For additional copies, please contact Greg A. Gadel, our Chief Financial Officer, at (612) 288-2382 or mail your request to Mr. Gadel at 1300 Nicollet Mall, Suite 5003, Minneapolis, Minnesota 55403.

3

ITEM ONE—ELECTION OF DIRECTORS

Director Nominee

Proxies solicited by the board of directors will, unless otherwise directed, be voted for the election of one nominee, John P. Whaley, to serve as Class I director for a three-year term expiring at the annual shareholders’ meeting in 2006 or until his successor is elected and qualified. Mr. Whaley is currently serving as a director of the company.

The nominee has consented to serve again. If for any reason the nominee becomes unavailable for election, the board of directors may designate a substitute nominee, in which event the shares represented by proxies returned to us will be voted for the substitute nominee, unless an instruction to the contrary is indicated on the proxy.

OUR BOARD OF DIRECTORS RECOMMENDS THAT OUR SHAREHOLDERS VOTE FOR ELECTING THE NOMINEE.

General Information About the Board of Directors

Our Amended and Restated Articles of Incorporation provide that the board of directors be divided into three classes of as nearly equal size as possible. Our board is divided into three classes with staggered three-year terms. Mr. Whaley is a Class I director whose term expires at the annual shareholders’ meeting in 2003. Mr. Mihajlov and Mr. Zepf are Class II directors whose terms expire at the annual shareholders’ meeting in 2004. Mr. Micatrotto and Mr. Roberts are Class III directors whose terms expire at the annual shareholders’ meeting in 2005.

At each annual meeting of shareholders, the successors to directors whose terms then expire will be elected to serve for a full term of three years. If the number of directors is changed, any increase or decrease shall be apportioned among the classes so as to maintain the number of directors in each class as nearly equal as possible. A nominee elected to fill a vacancy in a class will hold office for a term that will coincide with the remaining term of that class. This classification of the board may delay or prevent changes in our control or in our management.

Pursuant to the terms of Mr. Micatrotto’s employment agreement, the board is required to use its best efforts to cause Mr. Micatrotto to continue to be elected to the board as long as he is our Chief Executive Officer.

Following is information regarding the nominee and directors, including information furnished by them as to their principal occupations. All of the present directors were elected to the board of directors by our shareholders. See page 8 for a table showing the number of shares of our common stock beneficially owned by each director as of March 31, 2003.

Joseph P. Micatrotto, 51, joined BUCA in 1996 as our President, Chief Executive Officer and as a director and in July 1999 became Chairman of the Board. Mr. Micatrotto’s 29-year career in restaurant management includes being CEO of Panda Management Company, Inc., where he led the company’s expansion and president and CEO of Chi-Chi’s Mexican Restaurant, Inc., where he was instrumental in its national growth. Mr. Micatrotto is active on various boards and industry groups including the National Restaurant Association and The Oceanaire, Inc.

Philip A. Roberts, 64, co-founded BUCA in 1993. He has been a director since 1993 and served as Chairman of our board of directors until July 1999. Mr. Roberts is also a principal of Parasole Restaurant Holdings, Inc., which he co-founded in 1986. Mr. Roberts has been involved in the restaurant industry since 1977, when he co-founded with Mr. Mihajlov the first of several privately held restaurant companies, which later merged to form Parasole. Mr. Roberts is also a director of The Oceanaire, Inc.

4

Peter J. Mihajlov, 63, co-founded BUCA in 1993 and has served as a director since 1993. Mr. Mihajlov is also a principal of Parasole, which he co-founded in 1986. Mr. Mihajlov has been in the restaurant industry since 1977, when he and Mr. Roberts co-founded the first of several privately held restaurant companies, which later merged to form Parasole. Prior to that, Mr. Mihajlov served in a variety of marketing and business management positions within The Pillsbury Company over the course of 17 years. Mr. Mihajlov is also a director of The Oceanaire, Inc.

John P. Whaley, 50, has served as a director of BUCA since 1996. He is a partner of Norwest Equity Partners and Norwest Venture Partners and has been a partner or officer of these and affiliated private equity investment funds since 1977. Mr. Whaley is also a director of several privately held companies.

Paul J. Zepf, 38, has served as a director of BUCA since 1998. He is currently a managing director of Lazard Frères & Co. LLC. Previously, he was a managing director of Centre Partners Management L.L.C., and a managing director of Corporate Advisors, L.P., where he had been employed since 1989. Mr. Zepf is also a director of The Oceanaire, Inc.

Director Compensation

Our directors are reimbursed for certain reasonable expenses incurred in attending board meetings. Directors who are also our employees receive no remuneration for services as members of the board of directors or any board committee. Directors who are not employed by us have received grants of stock options from time to time. In fiscal 2002, each non-employee director received payment of $1,000 for attending each board meeting and payment of $500 per quarter.

Board Committees

Compensation Committee

The compensation committee of the board, comprised of Messrs. Roberts, Whaley and Zepf, is responsible for (1) reviewing and establishing the compensation structure for our officers, including salaries, participation in incentive compensation and benefit plans, stock option plans and other forms of compensation and (2) administering our 1996 Stock Incentive Plan, 2000 Stock Incentive Plan, Stock Option Plan for Non-employee Directors, Employee Stock Purchase Plan and Key Employee Share Option Plan. The compensation committee met six times during fiscal 2002.

Audit Committee

The audit committee of the board, comprised of Messrs. Mihajlov, Whaley and Zepf, is responsible for appointing our independent auditors, analyzing the reports and recommendations of the auditors and reviewing internal audit procedures and controls. The audit committee met four times during fiscal 2002.

All members of the audit committee are “independent” as that term is defined in the applicable listing standards of the NASDAQ Stock Market, Section 301 of the Sarbanes-Oxley Act of 2002 and the SEC rules adopted pursuant to the Sarbanes-Oxley Act. The responsibilities of the audit committee are set forth in the Audit Committee Charter, adopted by our audit committee on April 25, 2000, and amended and restated on March 30, 2001. A copy of our Audit Committee Charter was included as Exhibit A to our 2001 proxy statement. Our board of directors intends to amend our Audit Committee Charter, if necessary, to comply with the Sarbanes-Oxley Act and any final rules or regulations promulgated by the SEC or the NASDAQ Stock Market in response to the mandates of the Sarbanes-Oxley Act.

Board Meetings During Fiscal 2002

The board of directors met eight times during fiscal 2002. The SEC rules require disclosure of those directors who attended fewer than 75% of the aggregate total of meetings of the board and board committees on

5

which the director served during the last fiscal year. No director attended fewer than 75% of the aggregate total of these meetings.

Compensation Committee Interlocks and Insider Participation

The compensation committee is responsible for establishing and administering the company’s policies involving the compensation of executive officers. During fiscal 2002, the members of the compensation committee were Philip A. Roberts, John P. Whaley and Paul J. Zepf.

During the period prior to April 1998, Mr. Roberts served as an officer of the company and several of its subsidiaries. During fiscal 2002, we paid Roberts Consulting LLC, an entity controlled by Mr. Roberts, a total of $131,000 for consulting services provided to the company. We also paid Steven Roberts, son of Mr. Roberts, and Steven Harris Architects, an entity controlled by Steven Roberts, a total of $164,000 for their architectural services.

In fiscal 2002, Mr. Micatrotto, our director and Chairman, President and Chief Executive Officer, served on the board of The Oceanaire, Inc. Oceanaire did not have a compensation committee. During fiscal 2002, Mr. Roberts, our director and a member of our compensation committee, and Mr. Mihajlov, our director, served as non-employee executive officers of Oceanaire through a management agreement between Oceanaire and Parasole Restaurant Holdings, Inc., where Messrs. Roberts and Mihajlov are principal shareholders. Messrs. Roberts and Mihajlov also served as Oceanaire’s directors in fiscal 2002.

Certain Transactions

Agreement with Roberts Consulting LLC. In January 2000, we entered into an agreement with Roberts Consulting LLC. Our director, Philip Roberts, controls Roberts Consulting. Under the agreement, we pay Roberts Consulting certain fees for consulting services and assistance with new restaurant openings. During fiscal 2002, we paid Roberts Consulting a total of $131,000 for its consulting services.

Agreement with Steven Roberts. Steven Roberts, son of our director, Philip Roberts, from time to time performs architectural services for us under a letter agreement. The amount paid by us to Mr. Roberts and Steven Harris Architects, an entity controlled by Mr. Steven Roberts, for these services in fiscal 2002 was $164,000. We believe the terms of the letter agreement are at least as favorable as we could obtain from unrelated parties.

Payments to Joseph Micatrotto, Jr. Joseph Micatrotto, Jr., son of our Chairman, President and Chief Executive Officer, Joseph P. Micatrotto, is a Paisano Partner. During fiscal 2002, we paid him a salary of $53,600 and a bonus of $29,703.

Agreement with Joseph P. Micatrotto. On February 6, 2001, our board of directors approved a $150,000 unsecured loan to Joseph P. Micatrotto, a director of the company and the company’s Chairman, President and Chief Executive Officer. The note bore interest at the rate of 8% per annum. The loan was made on March 15, 2001 and on February 12, 2002, the principal of and interest on the loan was forgiven by our board of directors.

Grant of Options under Our Key Employee Share Option Plan to Executive Officers. In January 2002, we established a Key Employee Share Option Plan that (1) allows our Compensation Committee to award special compensation to key employees in the form of outright awards of options to purchase mutual fund shares; and (2) allows key employees to exchange future base and/or bonus compensation for options to purchase mutual fund shares. The mutual fund shares under our Key Employee Share Option Plan do not include BUCA stock. The awards are subject to investment gain or loss.

During fiscal 2002, our Compensation Committee made outright awards of options under our Key Employee Share Option Plan to our executive officers as follows (the value of each award is based on the asset

6

value of the mutual fund shares less the exercise price on the date of the option grants): Mr. Micatrotto: $652,500; Mr. Gadel: $93,750; Mr. Kohaut: $93,750; Mr. Schmiesing (former executive officer): $93,750; and Jennifer Percival (former executive officer): $93,750. The net value of the outright awards vest as follows:

| | Ÿ | | Mr. Micatrotto: $65,250 in 2002; $130,500 in 2003; $163,125 in 2004; $195,750 in 2005 and $97,875 in 2006; |

| | Ÿ | | Mr. Gadel: $9,375 in 2002; $18,750 in 2003; $23,438 in 2004; $28,125 in 2005 and $14,063 in 2006; |

| | Ÿ | | Mr. Kohaut: $9,375 in 2002; $18,750 in 2003; $23,438 in 2004; $28,125 in 2005 and $14,063 in 2006; |

| | Ÿ | | Mr. Schmiesing: $9,375 in 2002; $18,750 in 2003; $23,438 in 2004; $28,125 in 2005 and $14,063 in 2006; and |

| | Ÿ | | Ms. Percival: $9,375 in 2002; $18,750 in 2003; $23,438 in 2004; $28,125 in 2005 and $14,063 in 2006. |

During fiscal 2002, Mr. Gadel, Mr. Schmiesing, and Ms. Percival also elected to exchange bonus compensation for options under our Key Employee Share Option Plan as follows: Mr. Gadel deferred bonus in the amount of $15,000 in exchange for options to purchase mutual fund shares valued at $20,000 on the date of grant with an exercise price of $5,000 (25% of the value of the mutual fund shares on the date of grant); Mr. Schmiesing deferred bonus in the amount of $12,500 in exchange for options to purchase mutual fund shares valued at $16,667 on the date of grant with an exercise price of $4,167 (25% of the value of the mutual fund shares on the date of grant); and Ms. Percival deferred bonus in the amount of $2,500 in exchange for options to purchase mutual fund shares valued at $3,333 on the date of grant with an exercise price of $833 (25% of the value of the mutual fund shares on the date of grant). All of the options granted in exchange for bonus compensation vested on the date of the option grants.

Mr. Schmiesing resigned in November 2002. In connection with the termination of his employment, the Compensation Committee accelerated the vesting of the unvested portion of the options granted to Mr. Schmiesing under the Key Employee Share Option Plan and in December 2002, Mr. Schmiesing exercised all of the options granted to him under the Key Employee Share Option Plan and realized a net gain of $95,607.

7

Stock Ownership of Directors, Officers and Principal Shareholders

The following table sets forth information regarding the beneficial ownership of our common stock as of March 31, 2003 by:

| | Ÿ | | each shareholder known by us to beneficially own more than five percent of our common stock, |

| | Ÿ | | each of our directors (including our director nominee), |

| | Ÿ | | our current and former executive officers named in the Summary Compensation Table on page 10, and |

| | Ÿ | | all of our directors and executive officers (including one former executive officer) as a group. |

Except as otherwise noted below, each of the shareholders identified in the table has sole voting and investment power with respect to the shares of common stock beneficially owned by the person.

| | | Shares Beneficially Owned(1)

| |

Name of Beneficial Owner

| | Number

| | Percent

| |

State of Wisconsin Investment Board.(2) | | 2,405,600 | | 14.4 | % |

T. Rowe Price Associates, Inc.(3) | | 1,042,500 | | 6.3 | % |

WEDGE Capital Management L.L. P.(4) | | 1,006,575 | | 6.0 | % |

Dimensional Fund Advisors Inc.(5) | | 978,341 | | 5.9 | % |

Lord, Abbett & Co.(6) | | 970,971 | | 5.8 | % |

Philip A. Roberts(7) | | 190,792 | | 1.1 | % |

Peter J. Mihajlov(8) | | 175,194 | | 1.1 | % |

John P. Whaley(9) | | 1,264,568 | | 7.6 | % |

Paul J. Zepf(10) | | 28,707 | | * | |

Joseph P. Micatrotto(11) | | 332,867 | | 2.0 | % |

Greg A. Gadel(12) | | 146,003 | | * | |

Joseph J. Kohaut(13) | | 50,626 | | * | |

Lane G. Schmiesing (former executive officer)(14) | | 93,267 | | * | |

All directors and executive officers as a group

(8 persons) | | 2,282,024 | | 13.2 | % |

| (1) | | Beneficial ownership is determined in accordance with the rules of the SEC that generally attribute beneficial ownership of securities to persons who possess sole or shared voting power and/or investment power with respect to those securities and includes shares of common stock issuable pursuant to the exercise of stock options that are immediately exercisable or exercisable within 60 days. Unless otherwise indicated, the persons or entities identified in this table have sole voting and investment power with respect to all shares shown as beneficially owned by them. Percentage ownership calculations are based on 16,654,519 shares of common stock outstanding as of March 31, 2003. |

| (2) | | Based on a Schedule 13G filed with the SEC on February 11, 2003. The address for State of Wisconsin Investment Board is P.O. Box 7842, Madison, Wisconsin 53707. |

| (3) | | Based on a Schedule 13G filed with the SEC on January 27, 2003. These securities are owned by various individual and institutional investors that T. Rowe Price Associates, Inc. serves as investment adviser with power to direct investments and/or sole power to vote the securities. For purposes of the reporting requirements of the Securities Exchange Act of 1934, T. Rowe Price Associates is deemed to be a beneficial owner of the securities; however, T. Rowe Price Associates expressly disclaims that it is, in fact, the beneficial owner of the securities. T. Rowe Price Associates, Inc. has sole voting power with respect to 224,600 shares of common stock. The address for T. Rowe Price Associates, Inc. is 100 E. Pratt Street, Baltimore, Maryland 21202. |

8

| (4) | | Based on a Schedule 13G filed with the SEC on January 28, 2003. The address for WEDGE Capital Management L.L.P. is 301 South College Street, Suite 2920, Charlotte, North Carolina 28202-6002. |

| (5) | | Based on a Schedule 13G filed with the SEC on February 10, 2003. Dimensional Fund Advisors Inc. (Dimensional), an investment advisor registered under Section 203 of the Investment Advisors Act of 1940, furnishes investment advice to four investment companies registered under the Investment Company Act of 1940 and serves as investment manager to certain other commingled group trusts and separate accounts. These investment companies, trusts and accounts are the “funds.” In its role as investment advisor or manager, Dimensional possesses voting and/or investment power over the securities of the company that are owned by the funds and may be deemed to be the beneficial owner of the shares of the company held by the funds. However, all securities reported in the schedule are owned by the funds. Dimensional disclaims beneficial ownership of such securities. The address for Dimensional Fund Advisors Inc. is 1299 Ocean Avenue, 11th Floor, Santa Monica, California 90401. |

| (6) | | Based on a Schedule 13G filed with the SEC on January 30, 2003. The address for Lord, Abbett is 90 Hudson Street, Jersey City, New Jersey 07302. |

| (7) | | Includes (1) 69,333 shares owned by the Roberts Family Limited Partnership II; (2) 90,462 shares owned by Mr. Roberts’ wife; (3) options for the purchase of 21,333 shares of common stock exercisable within 60 days granted to Mr. Roberts; and (4) options for the purchase of 1,165 shares of common stock exercisable within 60 days granted to Mr. Robert’s wife. |

| (8) | | Consists of (1) 4,166 shares owned by the Mihajlov Family Limited Partnership; (2) 64,166 shares owned by Mr. Mihajlov’s wife; (3) 98,862 shares held by Peter J. Mihajlov Trust; and (4) options for the purchase of 8,000 shares of common stock exercisable within 60 days granted to Mr. Mihajlov. |

| (9) | | Includes (1) options for the purchase of 10,665 shares of common stock exercisable within 60 days granted to Mr. Whaley; (2) 14,565 shares of common stock held by Whaley Family LP; (3) 413,232 shares of common stock beneficially owned by Norwest Equity Partners V, L.P. Mr. Whaley is a managing administrative partner of Itasca Partners V, LLP, the general partner of Norwest Equity Partners V, L.P. By virtue of his position with Itasca Partners V, LLP, Mr. Whaley may be deemed to beneficially own the securities held by Norwest Equity Partners V, L.P. Mr. Whaley disclaims beneficial ownership of such securities, except to his indirect pecuniary interest therein; (4) 273,000 shares of common stock beneficially owned by Norwest Equity Partners, VI, LP. Mr. Whaley is the managing administrative partner of Itasca LBO Partners VI, LLP, the general partner of Norwest Equity Partners VI, LP. By virtue of his position with Itasca LBO Partners VI, LLP, Mr. Whaley may be deemed to beneficially own the securities held by Norwest Equity Partners VI, LP. Mr. Whaley disclaims beneficial ownership of such securities, except to the extent of his indirect pecuniary interest therein; and (5) 546,000 shares of common stock beneficially owned by Norwest Equity Partners, VII, LP. Mr. Whaley is the managing administrative partner of Itasca LBO Partners VII, LLP, the general partner of Norwest Equity Partners VII, LP. By virtue of his position with Itasca LBO Partners VII, LLP, Mr. Whaley may be deemed to beneficially own the securities held by Norwest Equity Partners VII, LP. Mr. Whaley disclaims beneficial ownership of such securities, except to the extent of his indirect pecuniary interest therein. |

| (10) | | Includes options for the purchase of 5,833 shares of common stock exercisable within 60 days granted to Mr. Zepf. Mr. Zepf disclaims beneficial ownership of shares of common stock issuable pursuant to the exercise of these stock options. The options are beneficially owned by Centre Partners Management LLC. |

| (11) | | Includes (1) options for the purchase of 324,997 shares of common stock exercisable within 60 days granted to Mr. Micatrotto; and (2) 570 shares owned by Mr. Micatrotto’s wife. |

| (12) | | Includes (1) options for the purchase of 120,336 shares of common stock exercisable within 60 days granted to Mr. Gadel; (2) 5,000 shares owned by Mr. Gadel’s wife; and (3) 10,750 shares owned by Morrison Family Trust. |

| (13) | | Includes options for the purchase of 44,567 shares of common stock exercisable within 60 days granted to Mr. Kohaut. |

| (14) | | Consists of options for the purchase of 93,267 shares of common stock exercisable within 60 days granted to Mr. Schmiesing. |

9

Executive Compensation

Summary Compensation Table. The following table contains information concerning compensation for fiscal 2002, fiscal 2001 and fiscal 2000 earned by our current executive officers and one former executive officer.

Summary Compensation Table

| | | | | Annual Compensation

| | | Long-Term Compensation Awards

| | | |

Name and Principal Position

| | Year

| | Salary ($)

| | Bonus ($)

| | | Other Annual Compensation ($)

| | | Securities Underlying Options (#)

| | All Other Compensation

| |

|

Joseph P. Micatrotto Chairman, President and Chief Executive Officer | | 2002 2001 2000 | | $ | 400,000 376,848 322,796 | | | — — — | | | $ | 134,806 | (1)(2) | | — 80,000 190,000 | | $ | 153,485 4,274 5,032 | (3)(4) (3) (3) |

|

Greg A. Gadel Executive Vice President and Chief Financial Officer | | 2002 2001 2000 | | | 199,615 177,996 153,483 | | $ | 50,000 — — | (5) | | | 9,375 | (1) | | 25,000 70,000 42,000 | | | | |

|

Joseph J. Kohaut(6) Chief Operations Officer | | 2002 2001 2000 | | | 179,616 143,501 71,055 | | | 60,000 43,852 93,553 | | | | 9,375 | (1) | | 25,000 30,000 37,000 | | | | |

|

Lane G. Schmiesing (former executive officer)(7) Senior Vice President of Marketing | | 2002 2001 2000 | | | 145,769 137,189 116,022 | | | 25,000 — — | (5) | | | 149,804 | (8) | | 12,000 15,000 32,000 | | | | |

| (1) | | Includes the vested portion of the value of outright awards of options less the exercise price to purchase mutual fund shares under our Key Employee Share Option Plan granted by our Compensation Committee in fiscal 2002 to our executive officers. The net value of the outright awards (based on the asset value of the mutual fund shares less the exercise price) on the date of the option grants was as follows: Mr. Micatrotto: $652,500; Mr. Gadel: $93,750 and Mr. Kohaut: $93,750. The awards are subject to investment gain or loss. The net value of the outright awards vest as follows: |

| | Ÿ | | Mr. Micatrotto: $65,250 in 2002; $130,500 in 2003; $163,125 in 2004; $195,750 in 2005; and $97,875 in 2006; |

| | Ÿ | | Mr. Gadel: $9,375 in 2002; $18,750 in 2003; $23,438 in 2004; $28,125 in 2005; and $14,063 in 2006; and |

| | Ÿ | | Mr. Kohaut: $9,375 in 2002; $18,750 in 2003; $23,438 in 2004; $28,125 in 2005; and $14,063 in 2006. |

| (2) | | Includes a housing and car allowance of $69,546. |

| (3) | | Includes the estimated dollar value of the benefit to Mr. Micatrotto of the split-dollar and variable life insurance premium payments made by BUCA during each covered fiscal year as follows: Fiscal 2002: $3,485; Fiscal 2001: $4,274 and Fiscal 2000: $5,032. |

| (4) | | Includes a loan in the amount of $150,000 granted in February 2001 and forgiven by BUCA in February 2002. |

| (5) | | Includes the following bonuses that our executive officers elected to exchange for options to purchase mutual fund shares under our Key Employee Share Option Plan: Mr. Gadel: $15,000 and Mr. Schmiesing: $12,500. |

| (6) | | Mr. Kohaut became Senior Vice President of Operations in March 2001 and Chief Operations Officer in January 2003. |

| (7) | | Mr. Schmiesing became Senior Vice President of Marketing in March 2001 and resigned in November 2002. |

10

| (8) | | Includes a car allowance of $9,900 and, upon termination of employment, net gain realized in the amount of $93,750 upon exercise of the options granted to Mr. Schmiesing under our Key Employee Share Option Plan, and a lump sum payment of $46,154. See “Certain Transactions—Grant of Options under Our Key Employee Share Option Plan to Executive Officers” for a discussion of the options granted to Mr. Schmiesing under our Key Employee Share Option Plan. |

Stock Option Grants Table. The following table sets forth certain information concerning all stock options granted during fiscal 2002 to the named executive officers. We did not grant any stock appreciation rights or restricted stock awards during fiscal 2002.

Fiscal 2002 Stock Option Grants Table

| | | | Option Term

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation For Option Term(2)

|

Name

| | Number of Shares Underlying Options Granted

| | | Percent of Total Options Granted to Employees in 2002

| | | Exercise or Base Price ($/Share) (1)

| | Expiration Date

| | 5% ($)

| | 10% ($)

|

Joseph P. Micatrotto | | — | | | | | | | | | | | | | | | |

Greg A. Gadel | | 25,000 | (3) | | 3.0 | % | | $ | 6.49 | | 2012 | | $ | 102,038 | | $ | 258,585 |

Joseph J. Kohaut | | 25,000 | (3) | | 3.0 | % | | | 6.49 | | 2012 | | | 102,038 | | | 258,585 |

Lane G. Schmiesing (former executive officer) | | 12,000 | (4) | | 1.4 | % | | | 6.49 | | 2012 | | | 48,978 | | | 124,121 |

| (1) | | The exercise price may be paid in cash, in shares of common stock valued at fair market value on the exercise date, or in a combination of cash and shares. |

| (2) | | The hypothetical potential appreciation shown in these columns reflects the required calculations at annual assumed appreciation rates of 5% and 10%, as set by the SEC, and therefore is not intended to represent either historical appreciation or anticipated future appreciation of the common stock. |

| (3) | | Options for the purchase of 25,000 shares will vest on December 31, 2003. |

| (4) | | Options for the purchase of 12,000 shares vested upon termination of employment in November 2002. |

Fiscal Year-End Option Value Table. The following table sets forth certain information concerning options exercised by named executive officers in fiscal 2002 and unexercised stock options held by the named executive officers as of fiscal 2002 year-end.

Aggregated Option Exercises in Fiscal 2002 and

Fiscal Year-End Option Value Table

Name

| | Number of Shares Acquired on Exercise

| | Value Realized

| | Number of Shares Underlying Unexercised Options at December 29, 2002

| | Value of In-the-Money Options at December 29, 2002(1)

|

| | | | Exercisable

| | | Unexercisable

| | Exercisable

| | Unexercisable

|

Joseph P. Micatrotto | | 100,000 | | $ | 1,262,500 | | 324,997 | | | 73,334 | | $ | — | | $ | — |

Greg A. Gadel | | 10,467 | | | 121,214 | | 120,336 | | | 49,867 | | | 27,468 | | | 37,463 |

Joseph J. Kohaut | | 7,000 | | | 88,690 | | 44,567 | | | 77,400 | | | 14,924 | | | 37,082 |

Lane G. Schmiesing (former executive officer) | | — | | | — | | 93,267 | (2) | | — | | $ | 37,350 | | | — |

| (1) | | Based on a closing sale price of our common stock of $7.94 per share at December 27, 2002, the last trading day of our 2002 fiscal year. |

| (2) | | We accelerated the vesting of all of Mr. Schmiesing’s outstanding unvested options in connection with his termination of employment. |

11

Employment Agreements. We entered into an employment agreement with Joseph P. Micatrotto on July 22, 1996, which was subsequently amended and restated in February 1999 and further amended in September 2000, December 2002 and March 2003. Under the terms of the amended agreement, Mr. Micatrotto is currently serving as our Chairman, President and Chief Executive Officer for a term expiring on December 31, 2005. The agreement provides that Mr. Micatrotto’s annual salary will be $400,000 for the year ended December 31, 2002, $500,000 for the year ended December 31, 2003, $525,000 for the year ended December 31, 2004 and $550,000 for the year ended December 31, 2005. Mr. Micatrotto is eligible to receive a yearly bonus based upon certain performance criteria established by the board. In connection with the amendment of Mr. Micatrotto’s employment agreement in February 1999, Mr. Micatrotto received options to purchase 126,666 shares of our common stock at an exercise price of $11.25 per share, 6,666 of which vested on each of December 31, 1999, 2000 and 2001, 53,334 of which vested on December 31, 2002 and the remaining 53,334 will vest on December 31, 2003. We also have agreed to reimburse Mr. Micatrotto’s reasonable and necessary business expenses. Mr. Micatrotto is entitled to the following termination benefits:

| | Ÿ | | If Mr. Micatrotto is terminated by us for cause or if Mr. Micatrotto terminates his employment, he will receive no additional compensation or termination benefits. |

| | Ÿ | | If Mr. Micatrotto is terminated because of death or physical or mental disability, he or his estate will be entitled to a termination payment of two years’ base salary then in effect, payable in 24 equal monthly installments. |

| | Ÿ | | If Mr. Micatrotto terminates his employment upon 30 days’ prior written notice following a change in control of the company, because his duties are substantially reduced or negatively altered without his prior written consent, or if Mr. Micatrotto’s employment is terminated by us without cause following a change in control or within 180 days prior to a change in control and the termination is related to the change in control, he will be entitled to a termination payment of 2 years’ base salary then in effect, payable in 24 monthly installments. If Mr. Micatrotto terminates employment as a result of a change in control, but his duties have not been substantially reduced or negatively altered, he will be entitled to a termination payment of 12 months’ base salary then in effect, payable in 12 monthly installments. |

| | Ÿ | | If Mr. Micatrotto is terminated by us without cause and not associated with a change in control, he will be entitled to a termination payment of 18 months’ base salary then in effect, payable in 18 monthly installments. |

The agreement also contains fringe benefits, confidentiality and non-competition provisions.

We entered into an employment agreement with Greg A. Gadel in December 2002. Under the terms of the agreement, Mr. Gadel is currently serving as our Executive Vice President, Chief Financial Officer, Secretary and Treasurer for a term expiring on December 31, 2005. The agreement provides that Mr. Gadel’s annual salary for the year ended December 31, 2002 will be $200,000. The board of directors will establish Mr. Gadel’s base salary for each subsequent calendar year in an amount not less than the base salary in effect for the prior year. Mr. Gadel is eligible to receive a yearly bonus based upon certain performance criteria established by the board. We also have agreed to reimburse Mr. Gadel’s reasonable and necessary business expenses. Mr. Gadel is entitled to the following termination benefits:

| | Ÿ | | If Mr. Gadel is terminated by us for cause or if Mr. Gadel terminates his employment, he will receive no additional compensation or termination benefits. |

| | Ÿ | | If Mr. Gadel is terminated because of death or physical or mental disability, he or his estate will be entitled to a termination payment of 18 months’ base salary then in effect, payable in 18 equal monthly installments. |

| | Ÿ | | If Mr. Gadel terminates his employment upon 30 days’ prior written notice following a change in control of the company, because his duties are substantially reduced or negatively altered without his prior written consent, or if Mr. Gadel’s employment is terminated by us without cause following a change in control or within 180 days prior to a change in control and the termination is related to the |

12

| | change in control, he will be entitled to a termination payment of 18 months’ base salary then in effect, payable in 18 monthly installments. If Mr. Gadel terminates employment as a result of a change in control, but his duties have not been substantially reduced or negatively altered, he will be entitled to a termination payment of 12 months’ base salary then in effect, payable in 12 monthly installments. |

| | Ÿ | | If Mr. Gadel is terminated by us without cause and not associated with a change in control, he will be entitled to a termination payment of 18 months’ base salary then in effect, payable in 18 monthly installments. |

The agreement also contains fringe benefits, confidentiality and non-competition provisions.

We entered into an employment agreement with Joseph J. Kohaut in December 2002. Under the terms of the agreement, Mr. Kohaut is currently serving as our Chief Operations Officer for a term expiring on December 31, 2005. The agreement provides that Mr. Kohaut’s annual salary for the year ended December 31, 2002 will be $180,000. The board of directors will establish Mr. Kohaut’s base salary for each subsequent calendar year in an amount not less than the base salary in effect for the prior year. Mr. Kohaut is eligible to receive a yearly bonus based upon certain performance criteria established by the board. We also have agreed to reimburse Mr. Kohaut’s reasonable and necessary business expenses. Mr. Kohaut is entitled to the following termination benefits:

| | Ÿ | | If Mr. Kohaut is terminated by us for cause or if Mr. Kohaut terminates his employment, he will receive no additional compensation or termination benefits. |

| | Ÿ | | If Mr. Kohaut is terminated because of death or physical or mental disability, he or his estate will be entitled to a termination payment of 18 months’ base salary then in effect, payable in 18 equal monthly installments. |

| | Ÿ | | If Mr. Kohaut terminates his employment upon 30 days’ prior written notice following a change in control of the company, because his duties are substantially reduced or negatively altered without his prior written consent, or if Mr. Kohaut’s employment is terminated by us without cause following a change in control or within 180 days prior to a change in control and the termination is related to the change in control, he will be entitled to a termination payment of 18 months’ base salary then in effect, payable in 18 monthly installments. If Mr. Kohaut terminates employment as a result of a change in control, but his duties have not been substantially reduced or negatively altered, he will be entitled to a termination payment of 12 months’ base salary then in effect, payable in 12 monthly installments. |

| | Ÿ | | If Mr. Kohaut is terminated by us without cause and not associated with a change in control, he will be entitled to a termination payment of 18 months’ base salary then in effect, payable in 18 monthly installments. |

The agreement also contains fringe benefits, confidentiality and non-competition provisions.

Report of the Compensation Committee on Executive Compensation

Philip A. Roberts, John P. Whaley and Paul J. Zepf are members of the Compensation Committee (the “Committee”) of the Board of Directors. For fiscal year ended 2002, all decisions concerning executive compensation were made by the Committee. The Committee is responsible for setting and administering the policies governing annual compensation of the executive officers of the company. The Committee reviews and approves the President and Chief Executive Officer’s recommendations regarding the performance and compensation levels for executive officers, other than himself.

Overview

The goals of the company’s executive officer compensation policies are to attract, retain and reward executive officers who contribute to the company’s success, to align executive officer compensation with the

13

company’s performance and to motivate executive officers to achieve the company’s business objectives. The company uses salary, bonus compensation and option grants to attain these goals. The Committee reviews compensation surveys and other data to enable the Committee to compare the company’s compensation package with that of similarly-sized restaurant companies.

Salary

Base salaries of executive officers are reviewed annually, and if deemed appropriate, adjustments are made based on individual executive officer performance, scope of responsibilities and levels paid by similarly-sized restaurant companies. In determining the salaries of the executive officers, the Committee considered information provided by the company’s President and Chief Executive Officer and salary data from industry surveys, and may from time to time consider salary surveys and similar data prepared by an executive recruitment consulting firm.

The President and Chief Executive Officer is responsible for evaluating the performance of all other executive officers and recommends salary adjustments which are reviewed and approved by the Committee. In addition to considering the performance of individual executive officers and information concerning competitive salaries, significant weight is placed on the financial performance of the company in considering salary adjustments.

Bonus Compensation

The Committee determines cash bonuses for each executive officer annually. At the beginning of each year, the Committee chooses five of the following performance targets upon which to base bonus compensation for that year: (1) number of new restaurant openings, (2) number of operating weeks, (3) restaurant operating profit, (4) total sales, (5) general and administrative expenses, (6) comparable restaurant sales and (7) any other factors as determined by the board. These are similar to the targets used in determining the President and Chief Executive Officer’s cash bonus. Performance against the established goals is determined annually by the Committee and based on such determination, the Committee approves payment of appropriate bonuses.

Stock Options

The company strongly believes that equity ownership by executive officers provides incentives to build shareholder value and align the interests of executive officers with the shareholders. The size of an initial option grant to an executive officer has generally been determined with reference to similarly-sized restaurant companies, the responsibilities and future contributions of the executive officer, as well as recruitment and retention considerations. In fiscal 2002, the President and Chief Executive Officer recommended to the Committee and the Board of Directors, and the Committee and the Board of Directors approved, stock option grants under the 1996 Stock Incentive Plan to the executive officers.

Special Compensation

In January 2002, the company established a Key Employee Share Option Plan that, among other things, allows the Committee, in its discretion, to award special compensation to key employees in the form of outright awards of options to purchase mutual fund shares. The mutual fund shares under the Key Employee Share Option Plan do not include BUCA stock. During fiscal 2002, the Committee made outright awards of options under the Key Employee Share Option Plan to the company’s executive officers.

Compensation of Chief Executive Officer

The company and Mr. Micatrotto, President and Chief Executive Officer, entered into an employment agreement upon Mr. Micatrotto’s hire in 1996. Prior to the company’s initial public offering in April 1999, Mr. Micatrotto’s employment agreement was amended and restated. Mr. Micatrotto’s employment agreement

14

was further amended in September 2000, December 2002 and March 2003. See “Executive Compensation—Employment Agreements” for a general discussion of the agreement.

As amended, the agreement set Mr. Micatrotto’s base compensation for 2002 at $400,000. In addition, the bonus policy for Mr. Micatrotto is based upon meeting certain company performance targets specified in the agreement. The performance targets for fiscal 2002 were not met and therefore, no bonus was paid to Mr. Micatrotto.

During fiscal 2002, the Committee has made an outright award of option to purchase mutual fund shares under the company’s Key Employee Share Option Plan to Mr. Micatrotto. The value of the outright award was $652,500 and was based on the asset value of the mutual fund shares less the exercise price on the date of the option grant.

Deductibility of Executive Compensation

Internal Revenue Code Section 162(m) limits the deductibility of compensation over $1 million paid by a company to an executive officer. The Committee currently does not have a policy with respect to Section 162(m) because it is unlikely that such limit will apply to compensation paid by the company to any of the company’s executive officers for at least the current year.

COMPENSATION COMMITTEE

Philip A. Roberts

John P. Whaley

Paul J. Zepf

15

Report of the Audit Committee

The role of the company’s Audit Committee, which is composed of three independent non-employee directors, is one of oversight of the company’s management and the company’s outside auditors in regard to the company’s financial reporting and the company’s controls respecting accounting and financial reporting. In performing its oversight function, the Audit Committee relied upon advice and information received in its discussions with the company’s management and independent auditors.

The Audit Committee has (1) reviewed and discussed the company’s audited financial statements for the year ended and December 29, 2002 with the company’s management; (2) discussed with the company’s independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61 regarding communication with audit committees (Codification of Statements on Auditing Standards, AU sec. 380); and (3) received the written disclosures and the letter from the company’s independent accountants required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees); and (4) discussed with the company’s independent accountants the independent accountants’ independence.

Based on the review and discussions with management and the company’s independent auditors referred to above, the Audit Committee recommended to the board of directors that the audited financial statements be included in the company’s Annual Report on Form 10-K for the fiscal year ended December 29, 2002 for filing with the SEC.

AUDIT COMMITTEE

Peter J. Mihajlov

John P. Whaley

Paul J. Zepf

Independent Auditors’ Fees

The following table shows the aggregate fees billed to the Company by Deloitte & Touche, LLP for services rendered during the fiscal year ended December 29, 2002.

Description of Fees

| | 2002 Amount

|

Audit Fees(1) | | $93,400 |

Audit Related Fees(2) | | 15,250 |

Tax Fees(3) | | 84,494 |

Other Fees(4) | | 49,620 |

| (1) | | Includes fees for the audit of the December 29, 2002 and December 30, 2001 financial statements and reviews of the related quarterly financial statements. |

| (2) | | Includes fees for certain statutory audits and accounting and reporting assistance. |

| (3) | | Includes fees related to tax return preparation, state and federal tax planning and state sales tax matters. |

| (4) | | Includes fees related to the implementation of our Key Employee Share Option Plan. |

Auditor Independence

The Audit Committee has considered whether, and has determined that, the provision of services by Deloitte & Touche LLP described under “All Other Fees” was compatible with maintaining the independence of Deloitte & Touche LLP as the company’s principal accountants.

16

ITEM TWO—APPROVAL OF AMENDMENTS TO OUR 1996 STOCK INCENTIVE PLAN

Introduction

On October 1, 1996, our shareholders approved the 1996 Stock Incentive Plan of BUCA, Inc. and Affiliated Companies. The purpose of the plan is to motivate our key personnel to produce a superior return for our shareholders by facilitating their ownership of our common stock and by rewarding them for achieving a high level of corporate financial performance. The plan is also intended to facilitate recruiting and retaining key personnel of outstanding ability by providing an attractive capital accumulation opportunity. As of March 31, 2003, options to purchase 1,892,212 shares of common stock had been issued but not exercised under the plan, 971,597 shares had been issued under the plan and 186,191 shares were available for future grants.

Our board of directors recently approved an amendment to the 1996 Stock Incentive Plan of BUCA, Inc. and Affiliated Companies, as amended, to increase the aggregate number of shares authorized for issuance under the plan from 3,050,000 to 3,450,000. The board took this action to accommodate the increase in the number of employees participating in the plan, to enable us to continue to make awards under the plan, to offer employees the opportunity to realize stock appreciation in the company and to facilitate the retention or recruitment of high-caliber individuals to key management positions. Our shareholders are being asked to approve this amendment at the annual meeting.

OUR BOARD OF DIRECTORS RECOMMENDS THAT OUR SHAREHOLDERS VOTE TO APPROVE THE AMENDMENTS TO THE 1996 STOCK INCENTIVE PLAN OF BUCA, INC. AND AFFILIATED COMPANIES.

Option Grants

All awards granted under our 1996 Stock Incentive Plan have been in the form of options to purchase shares of our common stock. The following table presents (a) the number of shares of common stock subject to options granted under our 1996 Stock Incentive Plan from its inception (net of cancelled options, but including exercised options) through March 31, 2003 to each individual and group indicated and (b) the weighted average exercise price payable per share under the options granted to each individual and group indicated. No associate of any director or officer has received options under the 1996 Stock Incentive Plan and, except as set forth below, no person has received five percent or more of the total options granted under the 1996 Stock Incentive Plan.

Name and Position

| | Number of Shares of Common Stock Subject to Granted Options

| | | Weighted Average Exercise Price of Granted Options

|

Joseph P. Micatrotto Chairman, President and Chief Executive Officer | | 668,186 | (1) | | $ | 9.42 |

|

Greg A. Gadel Executive Vice President and Chief Financial Officer | | 233,666 | (1) | | | 10.60 |

|

Joseph J. Kohaut Chief Operations Officer | | 138,833 | (1) | | | 9.95 |

|

All current directors who are not executive officers as a group | | 45,333 | | | | 10.20 |

|

John P. Whaley Director Nominee | | 10,665 | | | | 10.04 |

|

All employees, including all current officers who are not executive officers, as a group | | 1,483,002 | | | | 8.43 |

| (1) | | These individuals have received 5% or more of the total options granted under the 1996 Stock Incentive Plan. |

17

As of March 31, 2003, the fair market value of our common stock underlying options granted pursuant to our 1996 Stock Incentive Plan was $5.50 per share, based on the closing price of our common stock reported on the NASDAQ National Market on that date.

General Description of Our 1996 Stock Incentive Plan

There are currently 3,050,000 shares of our common stock available for awards under the plan. This number of shares under the plan is subject to adjustment for future stock splits, stock dividends and similar changes in the capitalization of our company. The plan will remain in effect until all stock subject to it has been distributed or until all awards have expired or lapsed. In addition, our board of directors may terminate the plan at any time, subject to the conditions stated in the plan.

The plan is not subject to the Employee Retirement Income Security Act of 1974 and is not a “qualified plan” under Section 401(a) of the Internal Revenue Code of 1986.

Plan Administration

A committee of members of our board of directors administers the 1996 Stock Incentive Plan. The committee has the authority, subject to the terms of the plan, to adopt, revise and waive rules relating to the plan. The committee is also responsible for determining when and to whom awards will be granted, the form of each award, the amount of each award and any other terms of an award, consistent with the plan.

Members of the committee are designated by our board of directors and serve on the committee for an indefinite term, at the discretion of the board. The Compensation Committee of our board of directors currently serves as the committee that administers the plan. The committee may delegate its responsibilities under the plan to members of our management, or to others, with respect to the grants of awards to employees who are not deemed to be executive officers of our company under relevant federal securities laws.

Eligibility

All employees of the company and its “affiliates,” as defined in the plan, are eligible to receive awards under the plan. As of December 29, 2002, we had approximately 7,000 employees. The committee may grant awards other than incentive stock options to individuals or entities that are not our employees, but who provide services to our company or its affiliates as consultants or independent contractors. The selection of those to whom awards under the plan are made is within the sole discretion of the committee.

Types of Awards Under the Plan

The types of awards that may be granted under the plan include incentive and non-statutory stock options, restricted stock, stock appreciation rights, performance shares and other stock-based awards. The following is a brief description of the material characteristics of each type of award.

Incentive and Non-Statutory Stock Options. Both incentive stock options and non-statutory stock options may be granted under the plan. The exercise price of an option is determined by the committee and set forth in an option agreement. The exercise price for non-qualified stock options may be less than, equal to or greater than the fair market value of our common stock on the date the option is granted. Stock options may be granted and exercised at such times as the committee may determine, which is reflected in the exercise schedule set forth in an option agreement. Unless federal tax laws are modified:

| | Ÿ | | no incentive stock option may be granted more than 10 years after October 1, 1996, which was the effective date of the plan; |

| | Ÿ | | an incentive stock option may not be exercised more than 10 years after the date it was granted; and |

| | Ÿ | | the aggregate fair market value of shares of our common stock underlying incentive stock options held by any participant under the plan and under any other plan of our company or of our affiliates, that first become exercisable in any calendar year may not exceed $100,000. |

18

Additional restrictions apply to incentive stock options granted to persons who beneficially own 10% or more of the outstanding shares of our common stock.

The purchase price for common stock purchased upon the exercise of stock options may be payable in cash, in our common stock having a fair market value on the date the option is exercised equal to the option price of the stock being purchased, or a combination of cash and stock, as provided in the option agreement. In addition, the committee may permit recipients of stock options to simultaneously exercise options and sell the common stock purchased upon exercise and to use the sale proceeds to pay the purchase price.

Restricted Stock and Other Stock-Based Awards. The committee is authorized to grant, either alone or in combination with other types of awards, restricted stock and other stock-based awards. Restricted stock may contain such restrictions, including provisions requiring forfeiture and imposing restrictions on stock transfer, as the committee may determine and set forth in the option agreement.

The committee may provide that, unless forfeited, a recipient of an award of restricted stock will have all rights of a company shareholder, including voting and dividend rights.

Stock Appreciation Rights and Performance Awards. The recipient of a stock appreciation right receives all or a portion of the amount by which the fair market value of a specified number of shares, as of the date the right is exercised, exceeds a price specified by the committee at the time the right is granted, as set forth in the recipient’s agreement. The price specified by the committee must be at least 100% of the fair market value of our common stock on the date the right is granted.

Performance awards entitle the recipient to payment in amounts determined by the committee, and set forth in the recipient’s agreement, based upon the achievement of specified performance targets during a specified term.

Payments for stock appreciation rights and performance awards may be paid in cash, shares of our common stock, or a combination of cash and shares, as determined by the committee.

Acceleration of Awards, Lapse of Restrictions, Forfeiture

The committee may provide in the applicable agreement for the lapse of restrictions on restricted stock or other awards, accelerated vesting of stock options, stock appreciation rights and other awards, or acceleration of the term with respect to which the achievement of performance targets for performance awards is determined in the following circumstances:

| | Ÿ | | a change in control of the company; |

| | Ÿ | | other fundamental changes in the corporate structure of the company; |

| | Ÿ | | death, disability, or qualified retirement; or |

| | Ÿ | | such other events as the committee may determine. |

Adjustments, Modifications, Termination

The plan gives the committee discretion to adjust the kind and number of shares available for awards or subject to outstanding awards, the exercise price of outstanding stock options and performance targets for, and payments under, outstanding performance awards upon mergers, recapitalizations, stock dividends, stock splits, or similar changes affecting us. Adjustments in performance targets and payments on performance shares are also permitted upon the occurrence of such other events as may be specified by the committee.

The plan also gives our board of directors the right to terminate, suspend, or modify the plan. Amendments to the plan are subject to shareholder approval, however, if needed to comply with Rule 16b-3 under the Securities Exchange Act or federal tax laws relating to incentive stock options.

19

Under the plan, the committee may generally cancel outstanding stock options and stock appreciation rights in exchange for cash payments to the recipients upon dissolutions, liquidations, mergers, statutory share exchanges, or similar events involving us.

Federal Tax Considerations

Incentive Stock Options. Option recipients do not realize taxable income, and we are not entitled to any related deduction, when we grant recipients an incentive stock option. The Internal Revenue Code requires that recipients satisfy the following employment and holding period requirements to obtain the tax benefits given to incentive stock options:

| | Ÿ | | unless they die or become disabled, they must remain employed by us or a subsidiary during the entire period starting on the date the option was granted and ending three months before the date the option was exercised. |

| | Ÿ | | unless they die, they must hold the shares they receive upon exercise of the option for the longer of (1) two years from the date the option was granted, or (2) one year from the date the option was exercised. |

If the recipient satisfies the statutory employment and holding period conditions, then they will not realize taxable income upon the exercise of the option, and we will not be entitled to any related deduction. Upon disposition of the shares after expiration of the statutory holding periods, any gain or loss they realize will be a capital gain or loss, and we will not be entitled to any related deduction.

Except in connection with the recipient’s death, if a recipient exercises an incentive stock option and then disposes of the shares before the expiration of the statutory holding periods (a “disqualifying disposition”), he or she will realize ordinary income in the year of disposition equal to the lesser of (1) the total gain realized on disposition, or (2) the difference between the exercise price and the fair market value of the shares on the date of exercise. We will be entitled to a deduction at the same time and in the same amount as the recipient realizes ordinary income. Any gain they realize on the disposition in excess of the amount treated as ordinary income, or any loss they realize on the disposition, will be capital gain or loss.

If recipients pay the exercise price with shares of stock that the recipient originally acquired upon the exercise of an incentive stock option and the statutory holding periods for those shares have not been met, they will be treated as having made a disqualifying disposition of those shares. The tax consequences of such a disqualifying disposition will be as described above.

The foregoing discussion applies only for regular tax purposes. For alternative minimum tax purposes, an incentive stock option will be treated as if it were a non-statutory stock option, the tax consequences of which are discussed below.

Non-Statutory Stock Options. Option recipients do not realize taxable income, and we are not entitled to any related deduction, when we grant recipients a non-statutory stock option. When they exercise a non-statutory stock option, they will realize ordinary income, and we will be entitled to a related deduction, equal to the excess of the fair market value of the shares on the date of exercise over the option price. Upon disposition of the shares, any additional gain or loss they realize will be taxed as a capital gain or loss.

Restricted Stock. Unless recipients file an election to be taxed under Section 83(b) of the Internal Revenue Code, the following federal tax consequences will apply:

| | Ÿ | | they will not realize income upon the grant of the restricted stock; |

| | Ÿ | | they will realize ordinary income, and we will be entitled to a related deduction, when the restrictions on their stock have been removed or have expired; and |

| | Ÿ | | the amount of their ordinary income and our deduction will be the fair market value of the stock on the date the restrictions are removed or expire. |

20

If recipients elect to be taxed under Section 83(b), then the tax consequences to them and us will be determined as of the date of the grant of the restricted stock, rather than as of the date of the removal or expiration of the restrictions.

When they dispose of restricted stock, the difference between the amount they receive upon disposition and the fair market value of the shares on the date they realized ordinary income would be taxed as a capital gain or loss.

Stock Appreciation Rights and Performance Awards. Recipients will not realize income upon the award of a stock appreciation right or performance shares. They will realize ordinary income, and we will be entitled to a related deduction, when cash or shares of common stock are delivered to them upon exercise of a stock appreciation right or in payment of a performance shares award. The amount of ordinary income and deduction will be the amount of cash, plus the fair market value of the shares on the date they receive them. Upon a subsequent disposition of any shares received, any additional gain or loss they realize will be taxed as capital gain or loss.

Registration with the SEC

Following approval by the shareholders of the increase in the number of shares available under the plan, we intend to amend our registration statement covering the plan to include the additional shares.

Equity Compensation Plan Information

The following table provides information as of December 29, 2002 for our compensation plans under which equity securities may be issued:

| | | (a) | | | (b) | | (c) | |

Plan Category

| | Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights

| | | Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights

| | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column (a))

| |

Equity Compensation Plans Approved by Security Holders | | 1,895,543 | (1) | | $ | 9.85 | | 590,916 | (2) |

Equity Compensation Plans Not Approved by Security Holders | | 296,600 | | | | 13.04 | | 3,400 | |

Total | | 2,192,143 | | | | 10.28 | | 594,316 | |

| (1) | | Includes 1,892,212 shares of common stock subject to issued but unexercised options under our 1996 Stock Incentive Plan and 3,331 shares of common stock subject to issued but unexercised options under our Stock Option Plan for Non-Employee Directors. |

| (2) | | Includes 186,191 shares of common stock available for issuance under our 1996 Stock Incentive Plan and 404,725 shares of common stock available for issuance under our Employee Stock Purchase Plan. |

Equity Compensation Plans Not Approved By Security Holders

2000 Stock Incentive Plan

Our board of directors adopted a 2000 Stock Incentive Plan on April 25, 2000. The plan will remain in effect until all stock subject to it has been distributed, until all awards have expired or lapsed, or until April 25, 2010. We have reserved 300,000 shares of our common stock for awards under the plan. The 2000 Stock Incentive Plan contains similar terms as the 1996 Stock Incentive Plan described in Item Two, except that our officers and directors are not eligible to receive awards under the plan.

21

ITEM THREE—RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

Proxies solicited by the board of directors will, unless otherwise directed, be voted to ratify the appointment by the Audit Committee of Deloitte & Touche LLP as our independent auditors for the fiscal year ending December 28, 2003. We have employed Deloitte & Touche LLP in this capacity since 1997.

A representative from Deloitte & Touche LLP will be at the annual meeting and will have the opportunity to make a statement if such representative so desires and will be available to respond to questions during the meeting.

OUR BOARD OF DIRECTORS RECOMMENDS THAT OUR SHAREHOLDERS VOTE TO RATIFY THE APPOINTMENT OF DELOITTE & TOUCHE LLP AS OUR INDEPENDENT AUDITORS.

22

ADDITIONAL INFORMATION

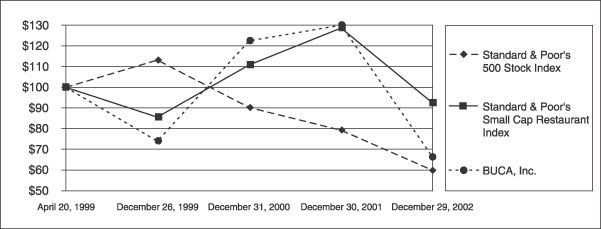

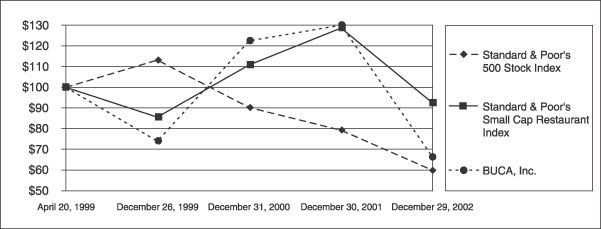

Comparison of Total Shareholder Return

The graph below compares the cumulative total shareholder return(1), assuming the reinvestment of all dividends on our common stock for the period beginning April 20, 1999(2), and ending on December 29, 2002.

| | | April 20, 1999

| | December 26, 1999

| | December 31, 2000

| | December 30, 2001

| | December 29, 2002

|

Standard & Poor’s 500 Stock Index | | $ | 100.00 | | $ | 113.10 | | $ | 90.15 | | $ | 79.28 | | $ | 59.78 |

Standard & Poor’s Small Cap Restaurant Index | | | 100.00 | | | 85.57 | | | 110.83 | | | 128.72 | | | 92.44 |

BUCA, Inc. | | | 100.00 | | | 73.96 | | | 122.40 | | | 130.00 | | | 66.17 |

| (1) | | Assumes that $100 was invested on April 20, 1999 in our common stock at the initial public offering price of $12 and at the closing sales price for each index, and that all dividends were reinvested. We have not declared dividends on our common stock. You should not consider shareholder returns over the indicated period to be indicative of future shareholder returns. |

| (2) | | The effective date of our initial public offering was April 20, 1999. For purposes of this presentation, we have assumed that our initial public offering price of $12 would have been the closing sales price on April 19, 1999, the day prior to commencement of trading. |

Section 16(a) Beneficial Ownership Reporting Compliance

The SEC rules require disclosure of those directors, officers and beneficial owners of more than 10% of the our common stock who fail to file on a timely basis reports required by Section 16(a) of the Securities Exchange Act of 1934 during the most recent fiscal year. Based solely on review of reports furnished to us and written representations that no other reports were required during the fiscal year ended December 29, 2002, all Section 16(a) filing requirements were met.

Shareholder Proposals