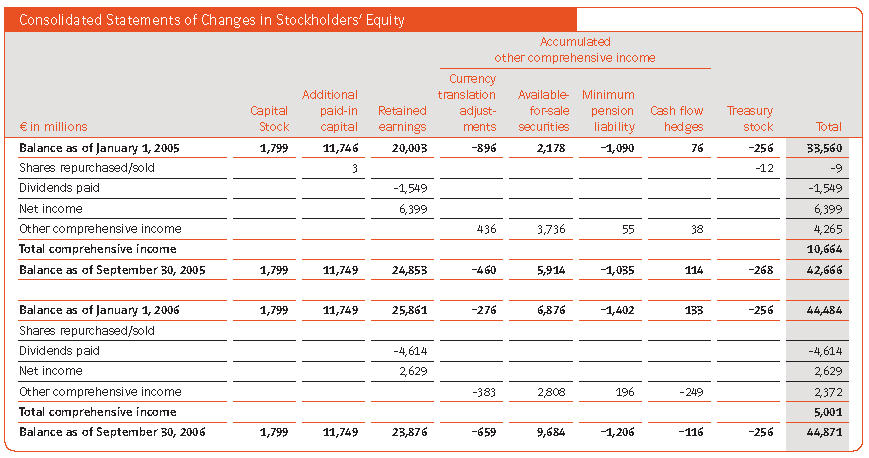

Consolidated Statements of Changes in Stockholders' Equity, Accumulated other comprehensive income, € in millions, Capital Stock, Additional paid-In capital, Retained earnings, Currency translation adjustrnents, Available-for-sale securities, Minimum pension liability, Cash flow hedges, Treasury Stock, Total, Balance as of January 1, 2005, 1,799, 11,746, 20,003, -896, 2,178, -1,090, 76, -256, 33,560, Shares repurchased/sold 3 -12 -9, Dividends paid -1,549,-1,549, Net income 6,399 6,399, Other comprehensive income 436, 3,736, 55, 38, , 4,265, Total comprehensive income 10,664, Balance as of September 30, 2005, 1,799, 11,749, 24,853, -460, 5,914, -1,035, 114, -268, 42,666, Balance as of January 1, 2006, 1,799, 11,749, 25,861, -276, 6,876, -1,402, 133, -256, 44,484, Shares repurchased/sold, Dividends paid -4,614, -4,614, Net income 2,629, 2,629, Other comprehensive income -383, 2,808, 196, -249, , 2,372, Total comprehensive income 5,001, Balance as of September 30, 2006, 1,799, 11,749, 23,876, -659, 9,684, -1,206, -116, -256, 44,871

Interim Report III/2006

30

Notes

Accounting Policies The accounting policies used to prepare the Interim Financial Statements for the nine months ended September 30, 2006, correspond to those used in the Consolidated Financial Statements for the year ended December 31, 2005, with the following exceptions.

On January 1, 2006, E.ON adopted Statement of Financial Accounting Standard (SFAS) No.123 (revised 2004), Share-Based Payment (SFAS 123R). SFAS 123R requires us to account for our stock appreciation rights (SAR) on the basis of their fair values and to recognize the corresponding expenses in our Statements of Income. Prior to adopting SFAS 123R, we accounted for SAR on the basis of intrinsic values and recognized the corresponding expenses in our Statements of Income, as provided by SFAS 123 in conjunction with FASB Interpretation 28, Accounting for Stock Appreciation Rights and Other Variable Stock Option or Award Plans. Pursuant to SFAS 123R we use a Monte Carlo simulation technique to calculate the fair value of SAR. The cumulative effect of initially applying SFAS 123R by using the modified version of prospective application as the transition method had no material effect on our results of operations. As a result, no further disclosure is provided.

New Accounting Pronouncement FASB Interpretation (FIN) No. 48, Accounting for Uncertainty in Income Taxes, was published in July 2006. FIN 48 applies to fiscal years that begin after December 15, 2006. We are currently evaluating the potential effects of applying FIN 48.

In September 2006, the FASB issued Statement of Financial Accounting Standards No.157, Fair Value Measurements (SFAS 157). This statement provides additional guidance for fair value measurements of assets and liabilities. It applies whenever other standards require assets or liabilities to be measured at fair value. It does not expand the use of fair value in any new circumstances. Under SFAS 157, fair value is the price in an orderly transaction between market participants to sell an asset or transfer a liability. A fair value | | measurement should be determined based on the assumptions that market participants would use in pricing the asset or liability. In accordance with this principle, this statement establishes a fair value hierarchy that gives highest priority to quoted prices on active markets. At the lowest rung of this hierarchy are unobservable data such as the reporting entity's own data.This statement is effective for fiscal years beginning after November 15, 2007. We are currently evaluating the effects of applying SFAS 157.

In September 2006, the FASB issued Statement of Financial Accounting Standards No.158, Employers' Accounting for Defined Benefit Pension and Other Postretirement Plans-an amendment of FASB Statements No. 87, 88,106and 132(R) (SFAS 158). This statement requires balance sheet recognition of the overfunded or underfunded status of pension and postretirement benefit plans. Under SFAS 158, actuarial gains and losses, prior service costs or credits, and any remaining transition assets or obligations that have not been recognized under previous accounting standards must be recognized in accumulated other comprehensive income, net of tax effects, until they are amortized as a component of net periodic benefit cost. SFAS 158 is effective for fiscal years ending after December 15, 2006. Based on our unfunded obligation as of December 31, 2005, the adoption of SFAS 158 would decrease total assets (excluding deferred taxes) by €337 million, increase provisions for pensions by €895 million, and reduce total shareowners' equity by €822 million. It would also result in a net increase of approximately €410 million in deferred taxes recorded in the Consolidated Balance Sheets. At this time, we anticipate that there will be at most very minimal additional valuation allowances on deferred tax assets at individual subsidiaries that will record higher deferred tax assets as a result of implementing the new standard. In this case, a valuation allowance of deferred tax assets would be offset against shareholders' equity and would not affect net income. The adoption of SFAS 158 will not affect our results of operations. We cannot rule out the possibility that changed actuarial assumptions and actual plan performance could have a significant impact on the actual amounts recorded.

In September 2006, the SEC staff issued Staff Accounting Bulletin No.108, Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements. SAB 108 was issued in order to elimi- |