FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of June, 2006

Commission File Number: 333-07654

ENDESA, S.A.

(Translation of Registrant's Name into English)

Ribera del Loira, 60

28042 Madrid, Spain

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information

contained in this Form, the Registrant is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

If “Yes” is marked, indicate below the file number assigned to the registrant

in connection with Rule 12g3-2(b): N/A

|

8 June 2006 Analysts Meeting (Majorca 2006) Rafael Miranda CEO |

|

Business vision . Competitiveness . Asset portfolio . Risk management (balance) . Fuel supply . Operational efficiency . Customers . Versus the regulatory risk . Consolidated improvement in quality of supply . Added-value products and services . Regulation . Deregulated business subject to market forces . Regulated business with sufficient profitability for efficient management . Environment . More environmentally efficient production and consumption . CO2 |

|

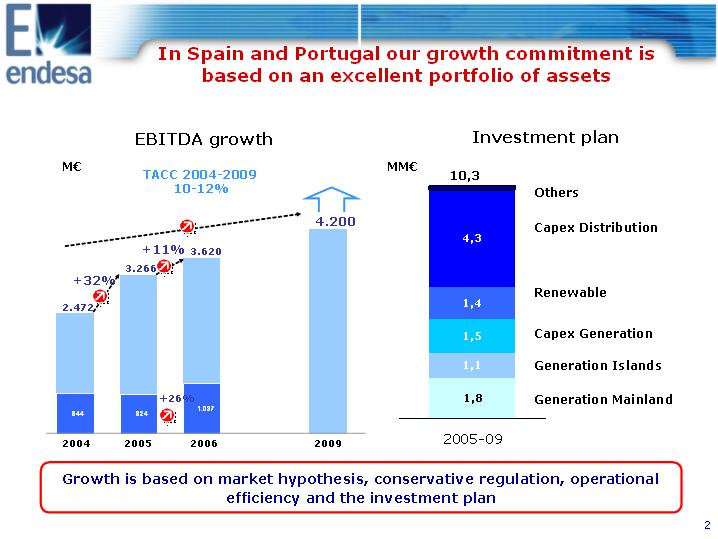

In Spain and Portugal our growth commitment is based on an excellent portfolio of assets M(euro) 844 TACC 2004-2009 EBITDA growth 824 1.037 +26% 4.200 MM(euro) 10,3 Investment plan Generation Mainland Capex Generation Renewable Generation Islands Capex Distribution 1,1 1,5 1,4 4,3 1,8 Others10-12% 3.266 3.620 +32% +11% 2004 2005 2006 2009 2005-09 Growth is based on market hypothesis, conservative regulation, operational efficiency and the investment plan |

|

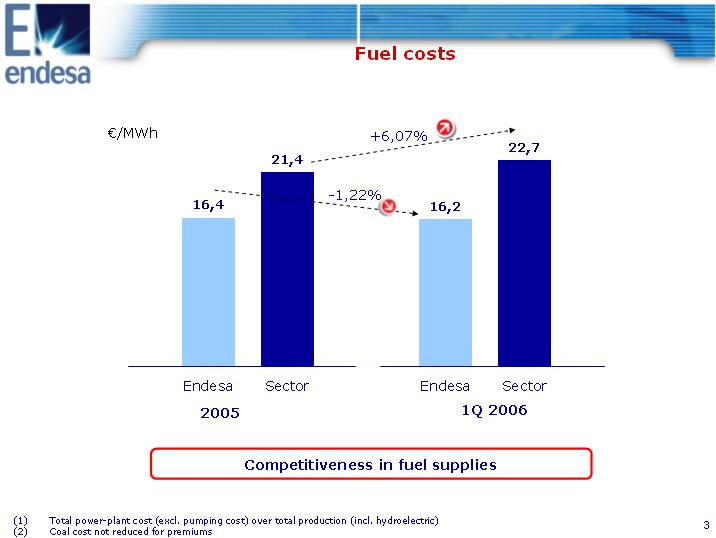

Fuel costs (euro)/MWh +6,07% 22,7 21,4 16,4 16,2 -1,22% Endesa Sector Endesa Sector 2005 1Q 2006 Competitiveness in fuel supplies (1) Total power-plant cost (excl. pumping cost) over total production (incl. hydroelectric) (2) Coal cost not reduced for premiums |

|

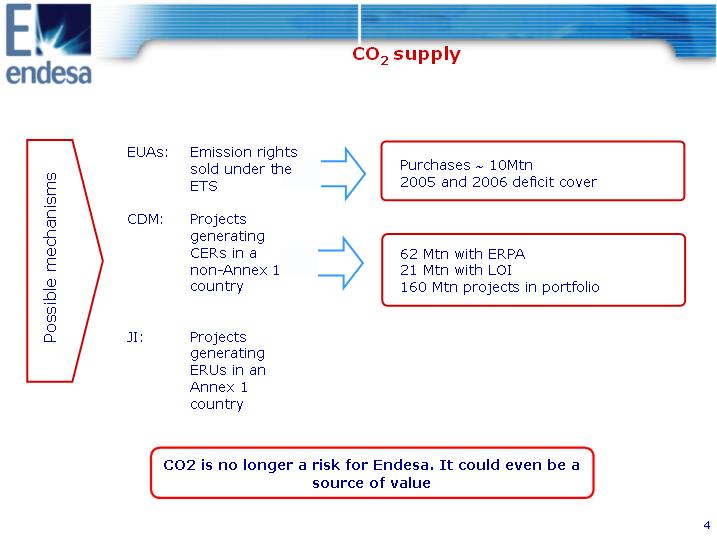

CO2 supply Possible mechanisms EUAs: Emission rights sold under the ETS CDM: Projects generating CERs in a non-Annex 1 country JI: Projects generating ERUs in an Annex 1 country Purchases ~ 10Mtn 2005 and 2006 deficit cover 62 Mtn with ERPA 21 Mtn with LOI 160 Mtn projects in portfolio CO2 is no longer a risk for Endesa. It could even be a source of value |

|

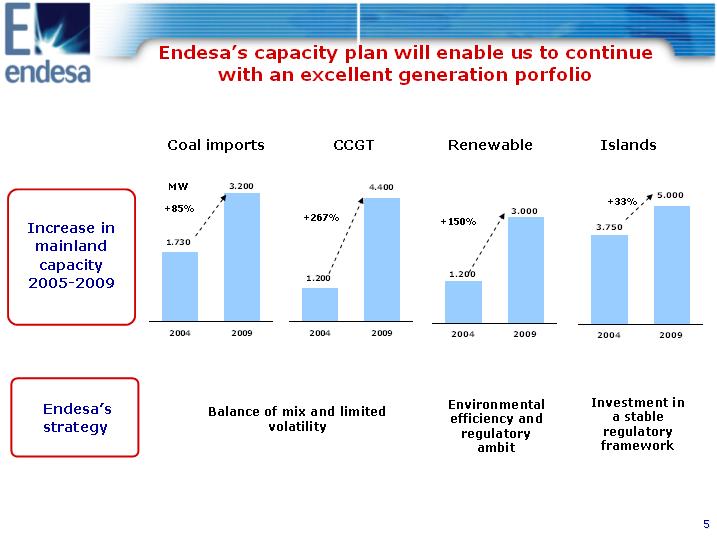

Endesa's capacity plan will enable us to continue with an excellent generation porfolio Coal imports CCGT Renewable Islands MW 3.200 4.400 5.000 +33% +85% 3.000 +267% +150% 3.750 Increase in mainland 1.730 capacity 1.200 1.200 2005-2009 2004 2009 2004 2009 2004 2009 2004 2009 Endesa's Environmental Investment in Balance of mix and limited efficiency and a stable strategy volatility regulatory regulatory ambit framework |

|

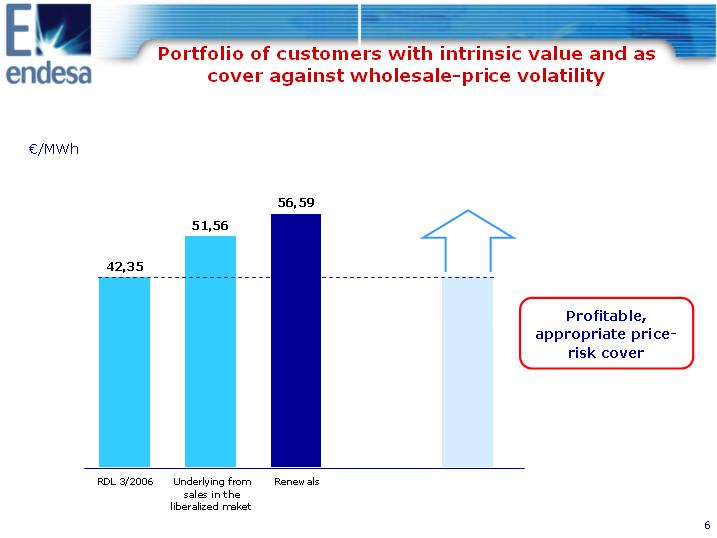

Portfolio of customers with intrinsic value and as cover against wholesale-price volatility (euro)/MWh 56,59 51,56 42,35 Profitable, appropriate price- risk cover RDL 3/2006 Underlying from Renewals sales in the liberalized maket |

|

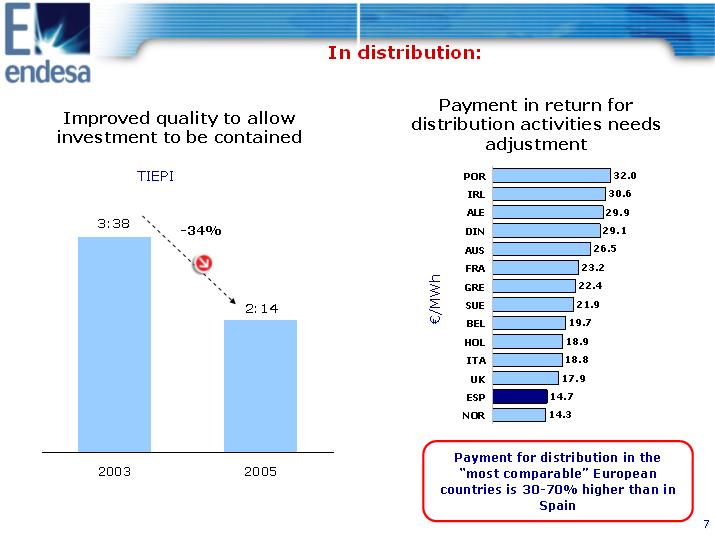

In distribution: Payment in return for distribution activities needs adjustment Improved quality to allow investment to be contained TIEPI 3:38 -34% 2:14 2003 2005 (euro)/MWh POR IRL ALE DIN AUS FRA GRE SUE BEL HOL ITA UK ESP NOR 32.0 30.6 29.9 29.1 26.5 23.2 22.4 21.9 19.7 18.9 18.8 17.9 14.7 14.3 Payment for distribution in the "most comparable" European countries is 30-70% higher than in Spain |

|

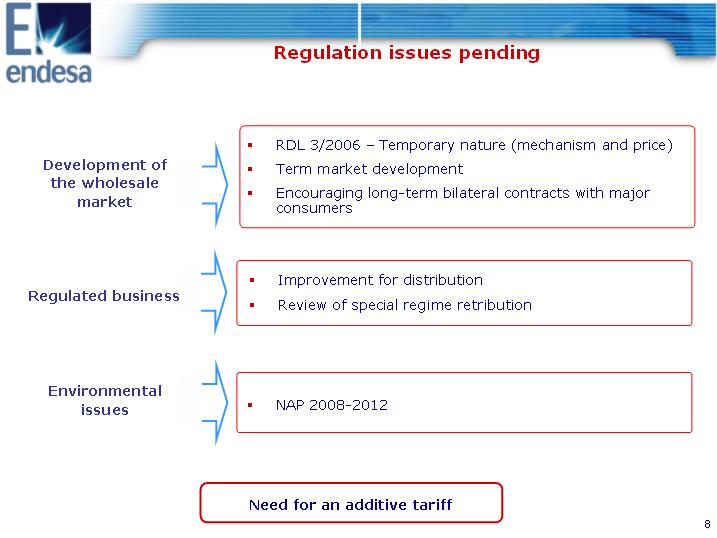

Regulation issues pending Development of the wholesale market Regulated business Environmental issues . RDL 3/2006 - Temporary nature (mechanism and price) . Term market development . Encouraging long-term bilateral contracts with major consumers . Improvement for distribution . Review of special regime retribution . NAP 2008-2012 Need for an additive tariff |

|

Topics to be pursued . Regulatory outlook in Spain . Energy and CO2 markets . Endesa's Supply Strategy . Bolonia Real Estate . Explanatory rules on Balearic Islands system . Non-mainland system: estimated impact of Ministerial Orders development |

|

Disclaimer This presentation contains certain "forward-looking statements" regarding anticipated financial and operating results and statistics and other future events. These statements are not guarantees of future performance and are subject to material risks, uncertainties, changes and other factors which may be beyond Endesa's control or may be difficult to predict. The principal assumptions underlying these forecasts and targets relate to economic, market and regulatory environment. In addition to other factors described under "Risk Factors" in our annual report on Form 20-F for the most recent fiscal year and in the Documento Registro de Acciones presently in force registered with the Comision Nacional de Valores, the following important factors could cause actual financial and operating results and statistics to differ materially from those expressed in our forward-looking statements: Materially adverse changes in economic or industry conditions generally or in our markets; the effect of existing regulations and regulatory changes; tariff reductions; the impact of any fluctuations in interest rates; the impact of fluctuations in exchange rates; the impact of more stringent regulations and the inherent environmental risks relating to our business operations; any delays in or failure to obtain necessary regulatory, antitrust and other approvals, or any conditions imposed in connection with such approvals; opposition or actions of partners, competitors and political or ethnic groups; adverse changes in the political and regulatory environment; adverse weather conditions; natural disasters, accidents or other unforeseen eventsNo assurance can be given that the forward- looking statements in this document will be realized. Except as may be required by applicable law, neither Endesa nor any of its affiliates intends to update these forward-looking statements. For all of these forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. |

|

8 June 2006 Analysts Meeting (Majorca 2006) Rafael Miranda CEO |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | |

| | ENDESA, S.A. |

|

|

|

| Dated: June 8th , 2006 | By: | /s/ Álvaro Pérez de Lema |

| |

Name: Álvaro Pérez de Lema |

| | Title: Manager of North America Investor Relations |