FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of June, 2006

Commission File Number: 333-07654

ENDESA, S.A.

(Translation of Registrant's Name into English)

Ribera del Loira, 60

28042 Madrid, Spain

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information

contained in this Form, the Registrant is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

If “Yes” is marked, indicate below the file number assigned to the registrant

in connection with Rule 12g3-2(b): N/A

Regulatory framework for non-mainland generation - Investor Relations Days Palma de Mallorca, June 2006

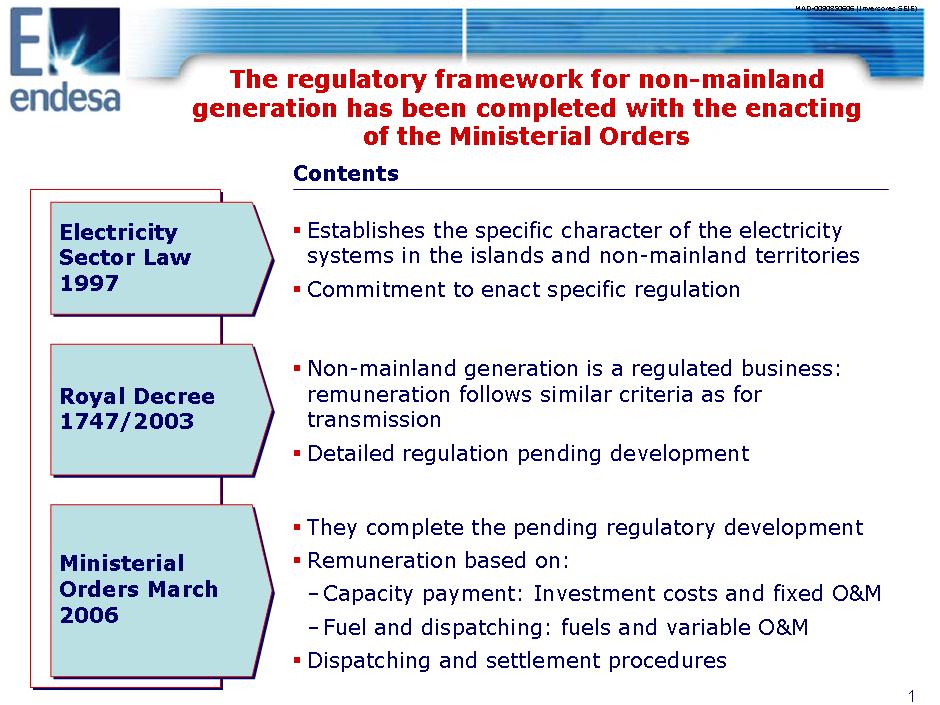

The regulatory framework for non-mainland generation has been completed with the enacting of the Ministerial Orders Contents Electricity Sector Law 1997 Establishes the specific character of the electricity systems in the islands and non-mainland territories Commitment to enact specific regulation Royal Decree 1747/2003 Non-mainland generation is a regulated business: remuneration follows similar criteria as for transmission Detailed regulation pending developmentMinisterial Orders March 2006 They complete the pending regulatory development Remuneration based on: Capacity payment: Investment costs and fixed O&M Fuel and dispatching: fuels and variable O&M Dispatching and settlement procedures

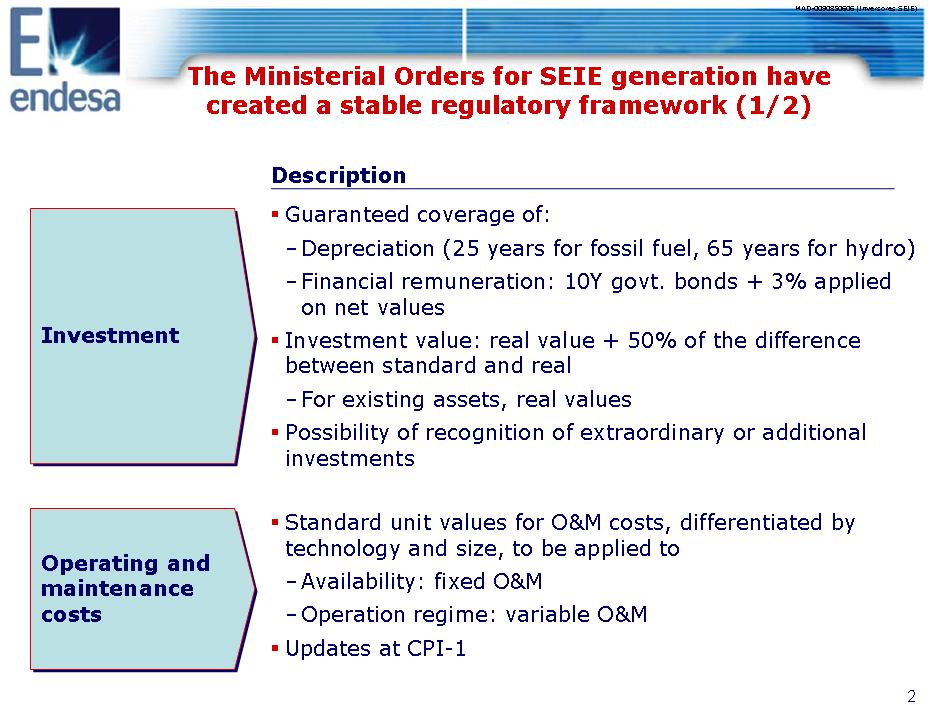

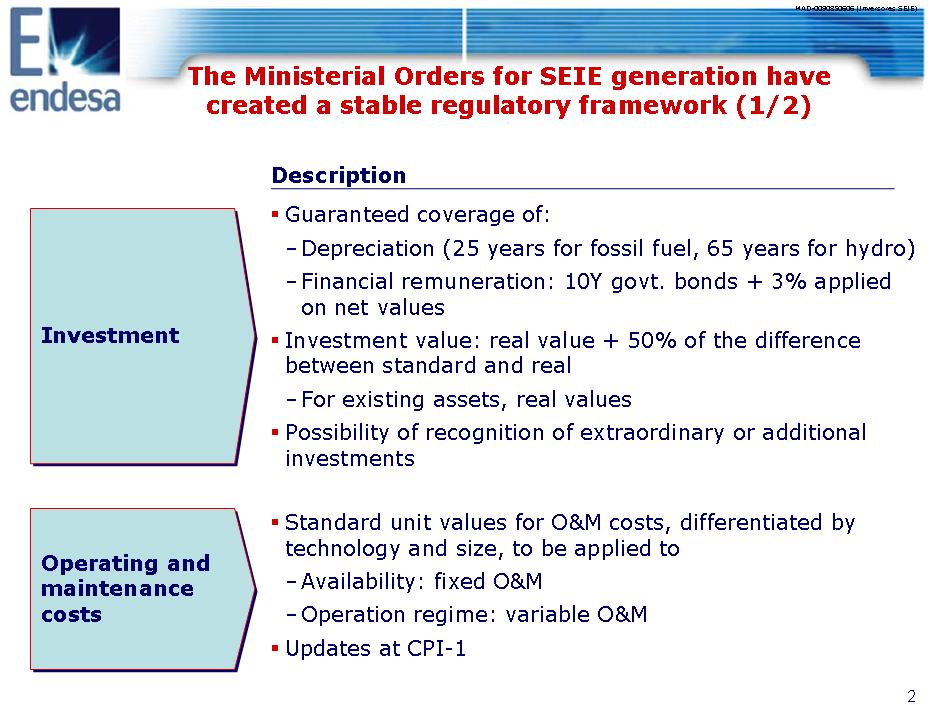

The Ministerial Orders for SEIE generation have created a stable regulatory framework (1/2) Description Investment Guaranteed coverage of: Depreciation (25 years for fossil fuel, 65 years for hydro) Financial remuneration: 10Y govt. bonds + 3% applied on net values Investment value: real value + 50% of the difference between standard and real

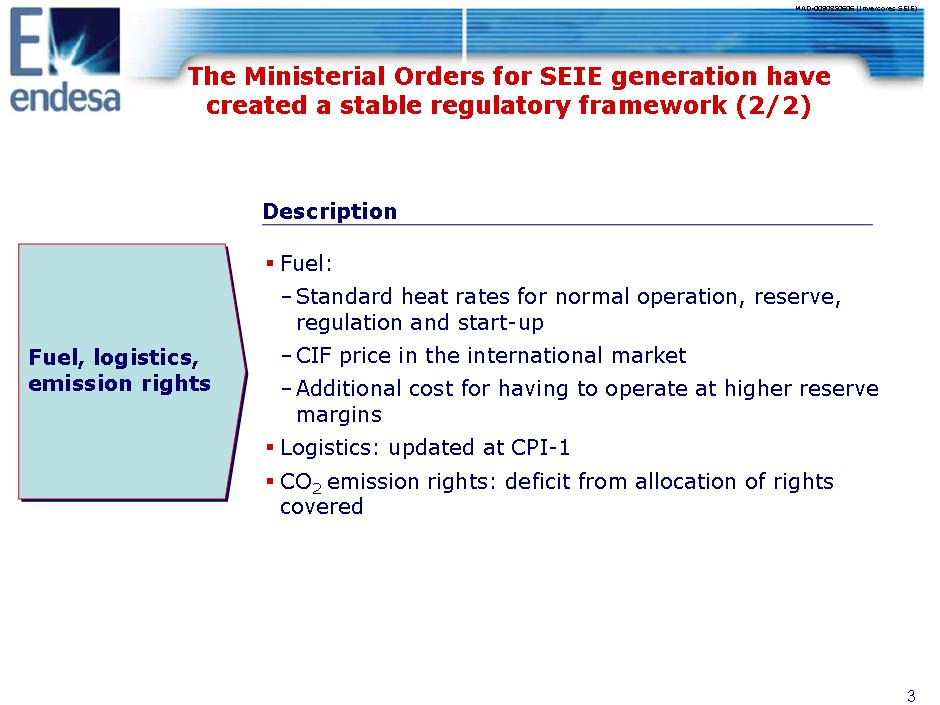

The Ministerial Orders for SEIE generation have created a stable regulatory framework (2/2) Description Fuel, logistics, emission rights Fuel: Standard heat rates for normal operation, reserve, regulation and start-up CIF price in the international market Additional cost for having to operate at higher reserve margins Logistics: updated at CPI-1 CO2 emission rights: deficit from allocation of rights covered

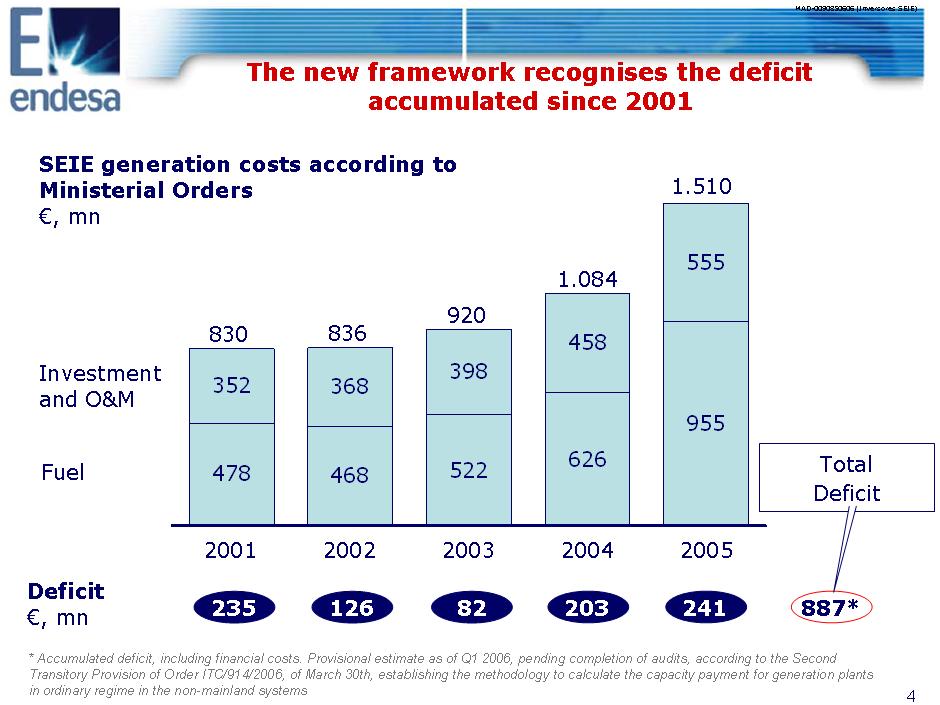

The new framework recognises the deficit accumulated since 2001 SEIE generation costs according to Ministerial Orders €, mn Investment and O&M Fuel 830 836 920 1.084 1.510 478 352 468 368 522 398 626 458 955 555 235 126 82 203 241 887* Total Deficit * Accumulated deficit, including financial costs. Provisional estimate as of Q1 2006, pending completion of audits, according to the Second Transitory Provision of Order ITC/914/2006, of March 30th, establishing the methodology to calculate the capacity payment for generation plants in ordinary regime in the non-mainland systems

The total amount of the SEIE deficit pending payment is €887mn SEIE deficit* €, mn 133 M€ deficit 2001-02 334 M€ deficit 2001-04 177 M€ deficit 2005 199 M€ deficit 2001-04 * Accumulated deficit, including financial costs. Provisional estimate as of Q1 2006, pending completion of audits, according to the Second Transitory Provision of Order ITC/914/2006, of March 30th, establishing the methodology to calculate the capacity payment for generation plants in ordinary regime in the non-mainland systems Deficit booked in Q1 2006 Deficit booked Total deficit pending payment 2001-2005 243 644 887 31 M€ financial costs 212 M€ revenues deficit 44 M€ deficit 2005

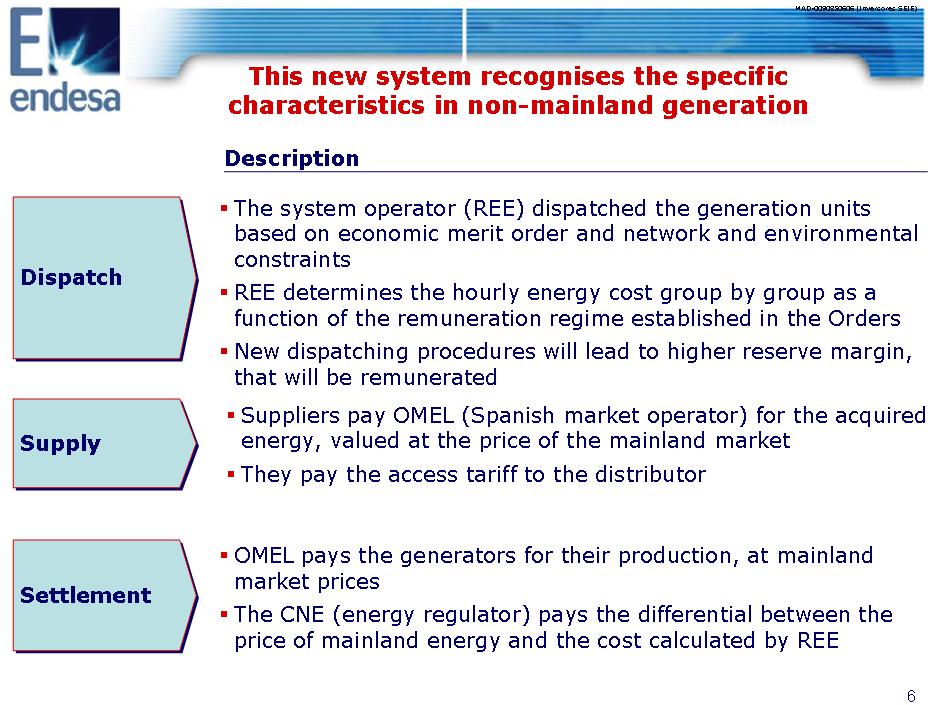

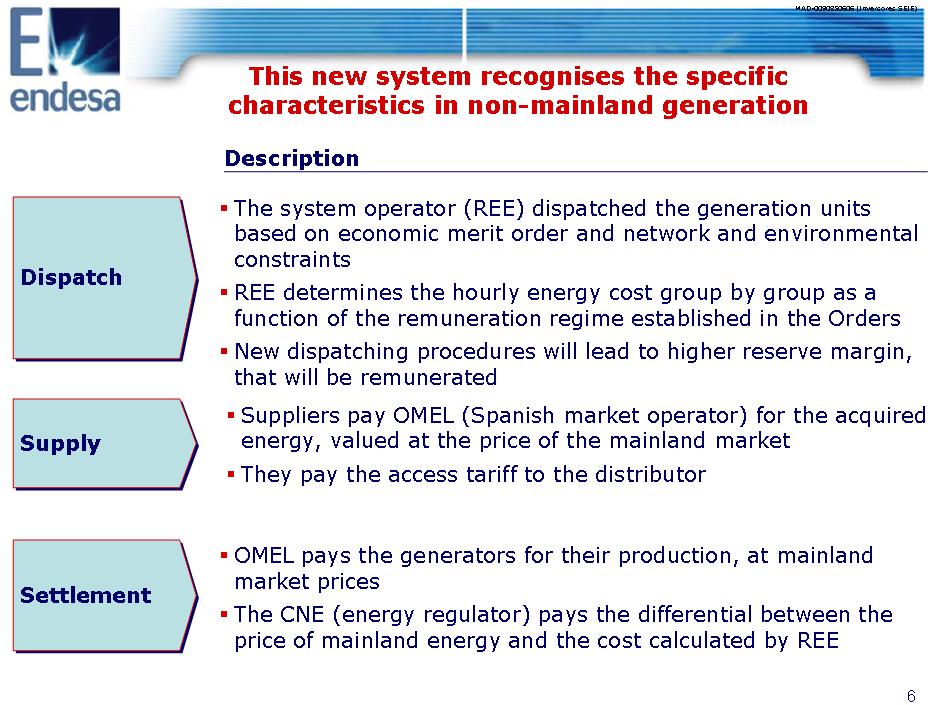

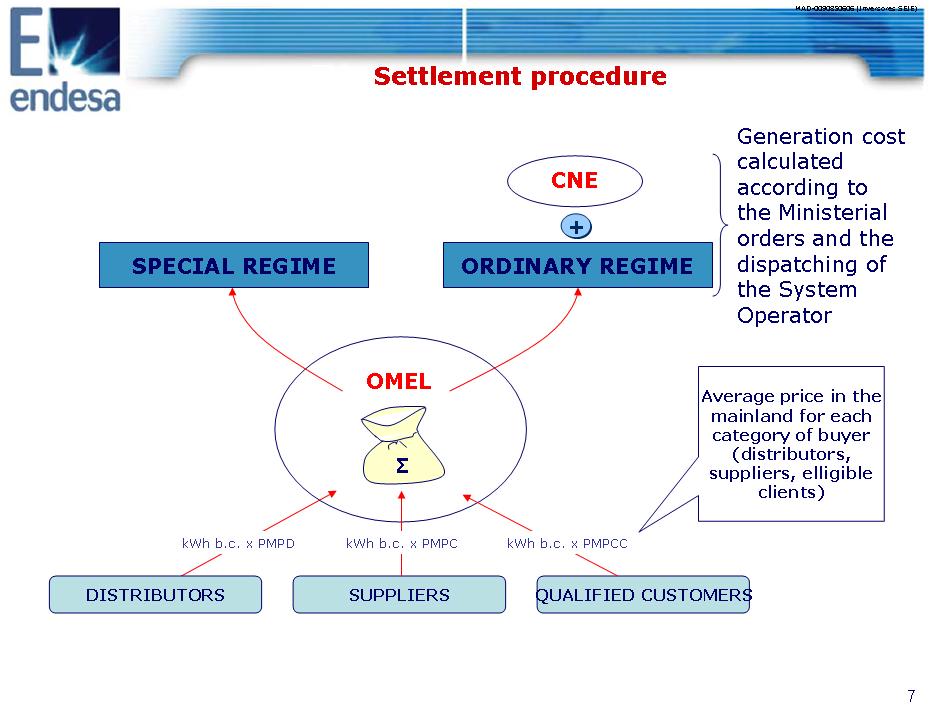

This new system recognises the specific characteristics in non-mainland generation Description Dispatch The system operator (REE) dispatched the generation units based on economic merit order and network and environmental constraints REE determines the hourly energy cost group by group as a function of the remuneration regime established in the Orders New dispatching procedures will lead to higher reserve margin, that will be remunerated Supply Suppliers pay OMEL (Spanish market operator) for the acquired energy, valued at the price of the mainland market They pay the access tariff to the distributor Settlement OMEL pays the generators for their production, at mainland market prices The CNE (energy regulator) pays the differential between the price of mainland energy and the cost calculated by REE

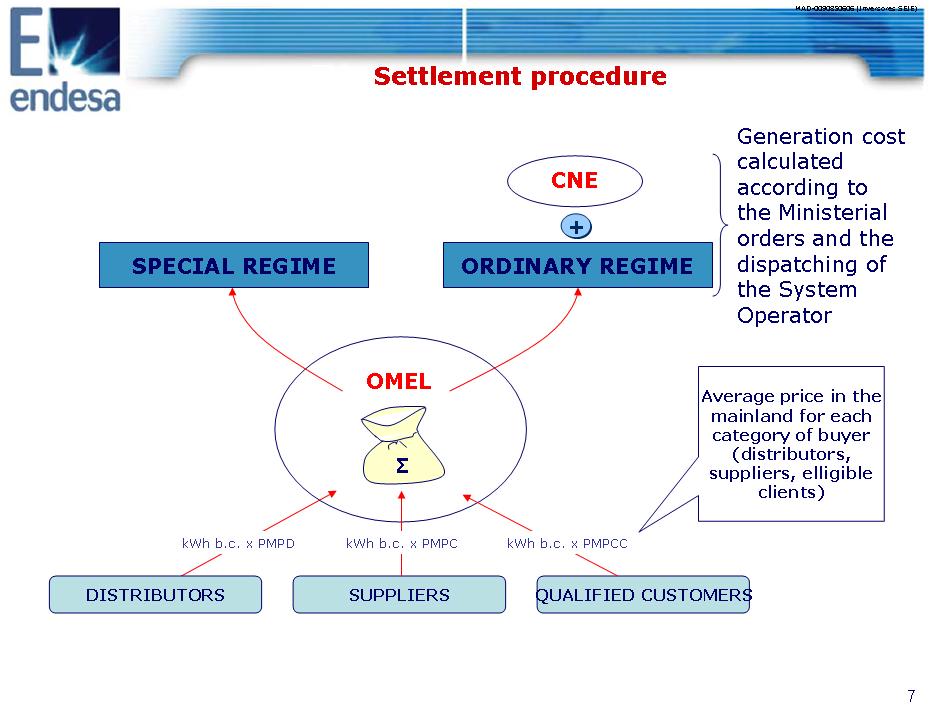

Settlement procedure Generation cost calculated according to the Ministerial orders and the dispatching of the System Operator CNE SPECIAL REGIME ORDINARY REGIME OMEL Σ Average price in the mainland for each category of buyer (distributors, suppliers, elligible clients) kWh b.c. x PMPD kWh b.c. x PMPC kWh b.c. x PMPCC DISTRIBUTORS SUPPLIERS QUALIFIED CUSTOMERS

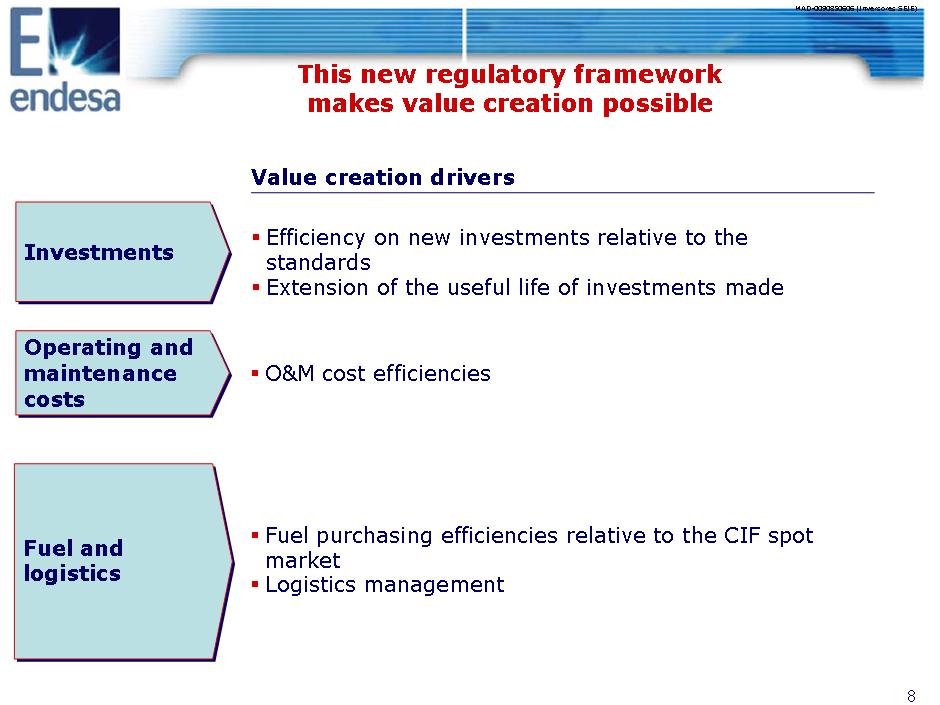

This new regulatory framework makes value creation possible Value creation drivers Investments Efficiency on new investments relative to the standards Extension of the useful life of investments made Operating and maintenance costs O&M cost efficiencies Fuel and logistics Fuel purchasing efficiencies relative to the CIF spot market Logistics management

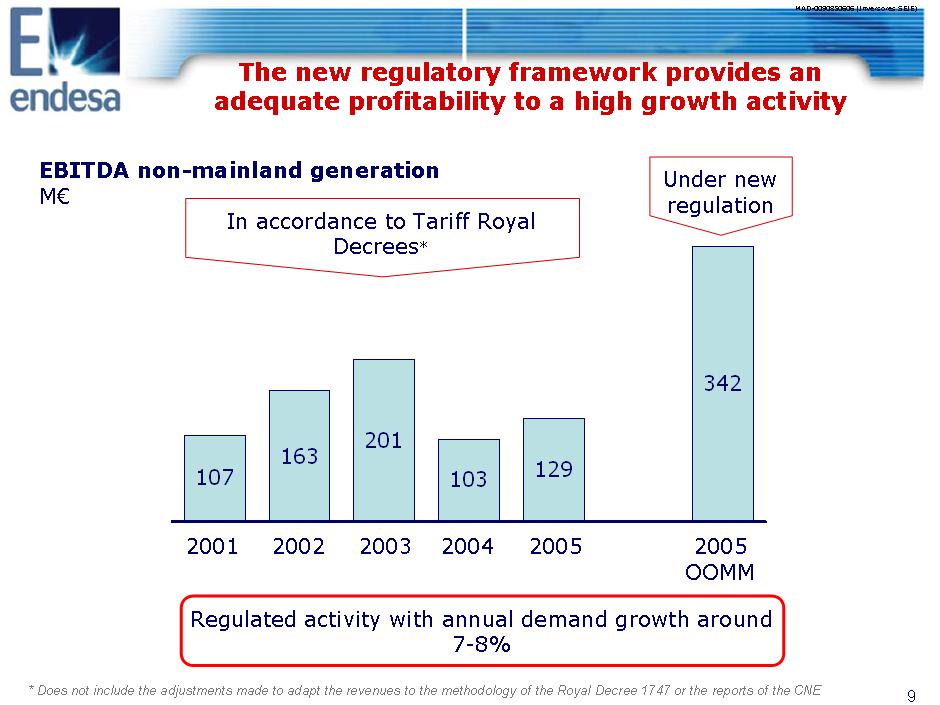

The new regulatory framework provides an adequate profitability to a high growth activity EBITDA non-mainland generation M€ In accordance to Tariff Royal Decrees* Under new regulation 2001 107 2002 163 2003 201 2004 103 2005 129 2005 OOMM 342 Regulated activity with annual demand growth around 7-8% * Does not include the adjustments made to adapt the revenues to the methodology of the Royal Decree 1747 or the reports of the CNE

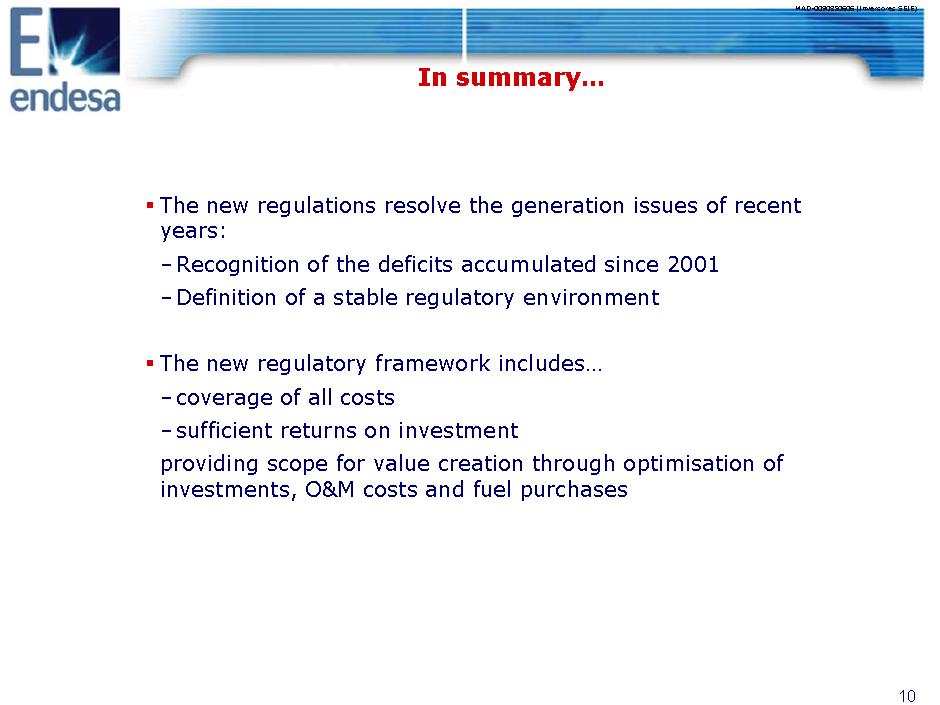

In summary… The new regulations resolve the generation issues of recent years: Recognition of the deficits accumulated since 2001 Definition of a stable regulatory environment The new regulatory framework includes… coverage of all costs sufficient returns on investment providing scope for value creation through optimisation of investments, O&M costs and fuel purchases

Disclaimer This presentation contains certain “forward-looking statements” regarding anticipated financial and operating results and statistics and other future events. These statements are not guarantees of future performance and are subject to material risks, uncertainties, changes and other factors which may be beyond Endesa’s control or may be difficult to predict. The principal assumptions underlying these forecasts and targets relate to economic, market and regulatory environment. In addition to other factors described under “Risk Factors” in our annual report on Form 20-F for the most recent fiscal year and in the Documento Registro de Acciones presently in force registered with the Comisión Nacional de Valores, the following important factors could cause actual financial and operating results and statistics to differ materially from those expressed in our forward-looking statements: Materially adverse changes in economic or industry conditions generally or in our markets; the effect of existing regulations and regulatory changes; tariff reductions; the impact of any fluctuations in interest rates; the impact of fluctuations in exchange rates; the impact of more stringent regulations and the inherent environmental risks relating to our business operations; any delays in or failure to obtain necessary regulatory, antitrust and other approvals, or any conditions imposed in connection with such approvals; opposition or actions of partners, competitors and political or ethnic groups; adverse changes in the political and regulatory environment; adverse weather conditions; natural disasters, accidents or other unforeseen eventsNo assurance can be given that the forward-looking statements in this document will be realized. Except as may be required by applicable law, neither Endesa nor any of its affiliates intends to update these forward-looking statements. For all of these forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

Regulatory framework for non-mainland generation - Investor Relations Days - Palma de Mallorca, June 2006

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | ENDESA, S.A. |

| | | |

Dated: June 9th , 2006 | | By: /s/ Álvaro Pérez de Lema |

| | | Name: Álvaro Pérez de Lema |

| | | Title: Manager of North America Investor Relations |