FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of June, 2006

Commission File Number: 333-07654

ENDESA, S.A.

(Translation of Registrant's Name into English)

Ribera del Loira, 60

28042 Madrid, Spain

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information

contained in this Form, the Registrant is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

If “Yes” is marked, indicate below the file number assigned to the registrant

in connection with Rule 12g3-2(b): N/A

|

BOLONIA REAL ESTATE Constructing value Corporate Services and Technology |

|

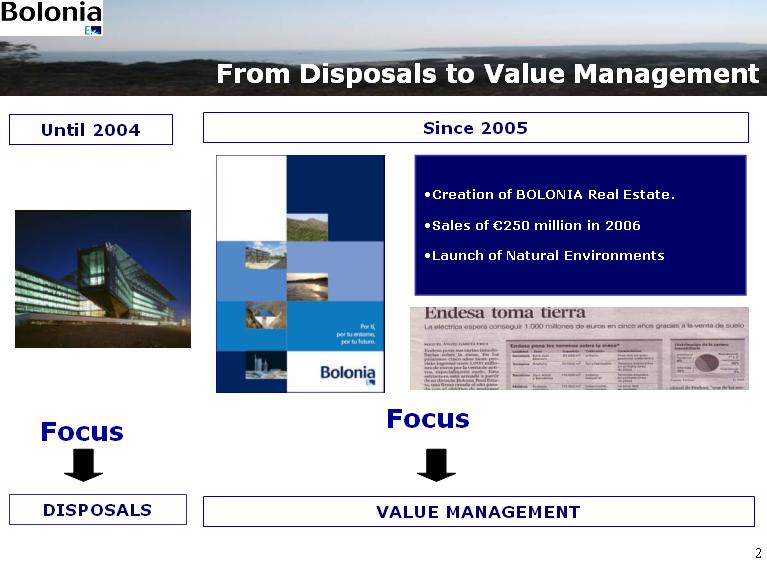

From Disposals to Value Management Until 2004 Since 2005 Creation of BOLONIA Real Estate. Sales of (euro)250 million in 2006 Launch of Natural Environments Focus Focus DISPOSALS VALUE MANAGEMENT |

|

Focus BOLONIA FOLLOWS ENDESA'S COMMITMENT TO ITS SUSTAINABILITY POLICY Commitment to Commitment to the development of the Social societies in which dimension we operate Environmental dimension Commitment to the environmental Economic dimension creation of value and protection profitability For you, your environments and your future |

|

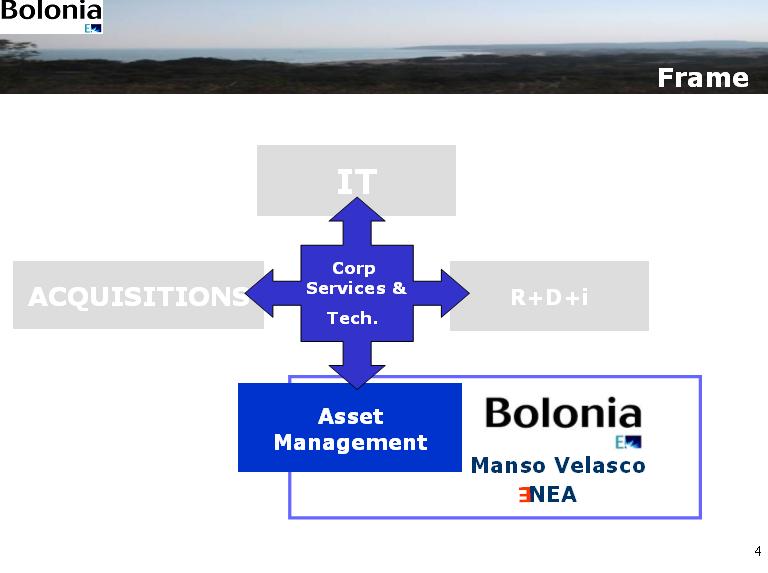

Frame IT ACQUISITIONS R+D+i Asset Management Corp Services & Tech. Manso Velasco NEA |

|

Bolonia's Targets Bolonia is created to oversee Endesa's real estate assets 5Assets which do not affect the business Creating value through managing real estate assets which do not affect the business Create value for Endesa's real estate assets which are currently undergoing urban management processes. Potential Value (euro)1 billion Short/Medium Term Long term Accelerate the value capture of assets which offer a longer maturity period and urban development. Assets in the portfolio |

|

A company with an excellent track record in the sustainable management of the environment and land. FOCUS Mission o Creating maximum value for Endesa optimising risk and profitability. o Provide Endesa with resources (land+cash-flow) which strengthen the company's core business. o Design and carry out urban projects strengthening social responsibility strategy. o Preserve and protect environments/land strengthening Endesa's environmental image. |

|

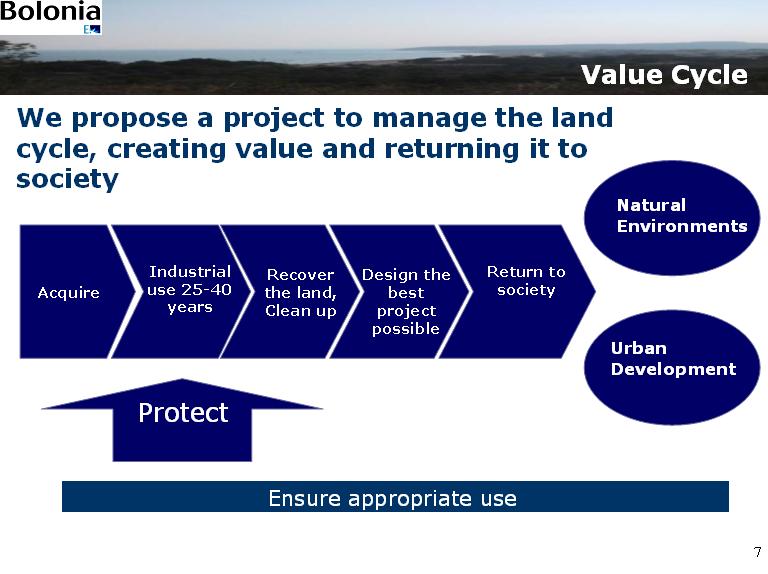

Value Cycle We propose a project to manage the land cycle, creating value and returning it to society Acquire Industrial use 25-40 years Recover the land, Clean up Design the best project possible Return to society Natural Environments Urban Development Protect Ensure appropriate use |

|

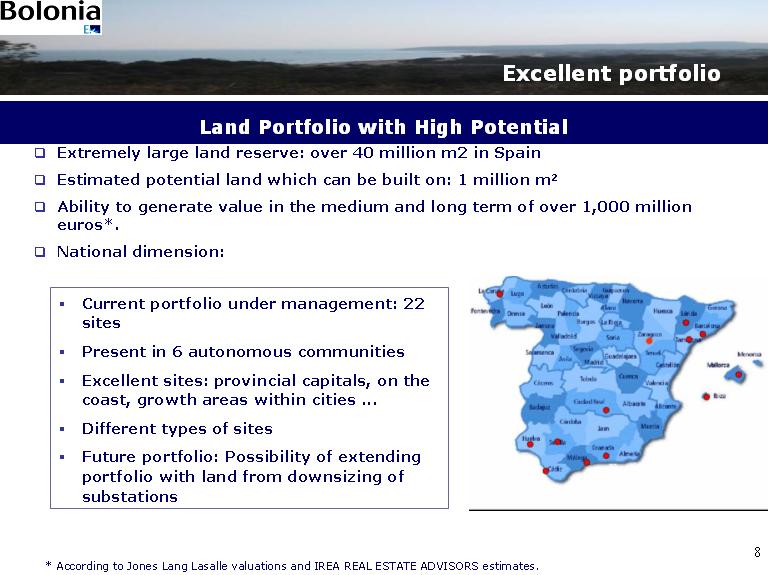

Excellent portfolio Land Portfolio with High Potential o Extremely large land reserve: over 40 million m2 in Spain o Estimated potential land which can be built on: 1 million m2 o Ability to generate value in the medium and long term of over 1,000 million euros*. o National dimension: o Current portfolio under management: 22 sites o Present in 6 autonomous communities o Excellent sites: provincial capitals, on the coast, growth areas within cities ... o Different types of sites o Future portfolio: Possibility of extending portfolio with land from downsizing of substations * According to Jones Lang Lasalle valuations and IREA REAL ESTATE ADVISORS estimates. |

|

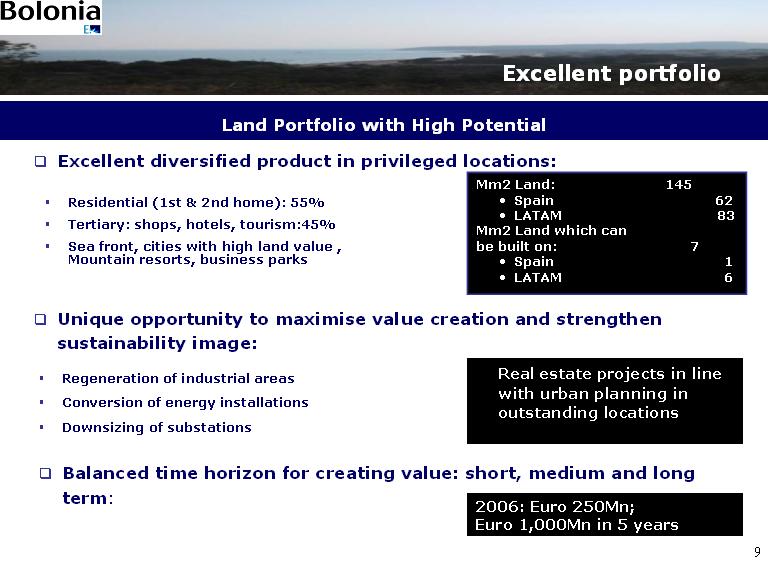

Excellent portfolio Land Portfolio with High Potential o Excellent diversified product in privileged locations: o Residential (1st & 2nd home): 55% o Tertiary: shops, hotels, tourism:45% o Sea front, cities with high land value , Mountain resorts, business parks Mm2 Land: 145 Spain 62 LATAM 83 Mm2 Land which can be built on: 7 Spain 1 LATAM 6 o Unique opportunity to maximise value creation and strengthen sustainability image: o Regeneration of industrial areas o Conversion of energy installations o Downsizing of substations Real estate projects in line with urban planning in outstanding locations o Balanced time horizon for creating value: short, medium and long term: 2006: Euro 250Mn; Euro 1,000Mn in 5 years |

|

We have the best proven ability in land mangement Proven ability o Civil Engineering o Land moving o Civil works, Large constructions o Conservation; Land recovery o Sale of assets o Urban developments |

|

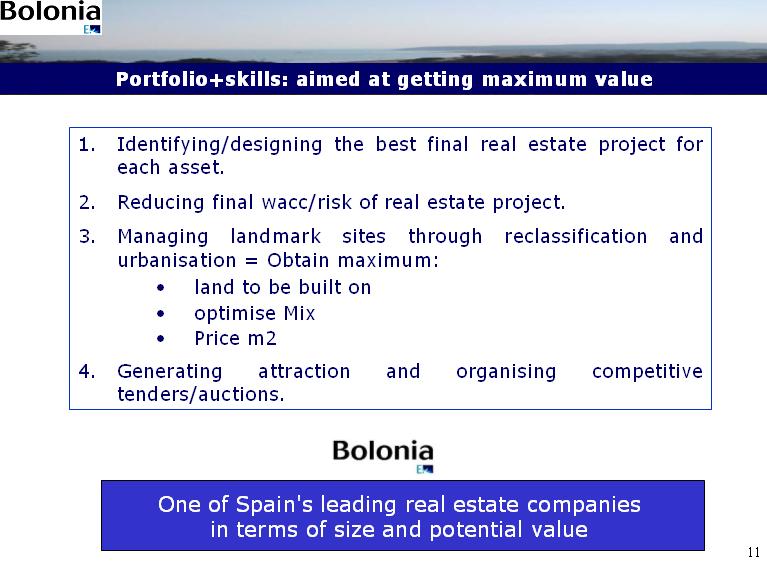

Portfolio+skills: aimed at getting maximum value 1. Identifying/designing the best final real estate project for each asset. 2. Reducing final wacc/risk of real estate project. 3. Managing landmark sites through reclassification and urbanisation = Obtain maximum: o land to be built on o optimise Mix o Price m2 4. Generating attraction and organising competitive tenders/auctions. 11One of Spain's leading real estate companies in terms of size and potential value |

|

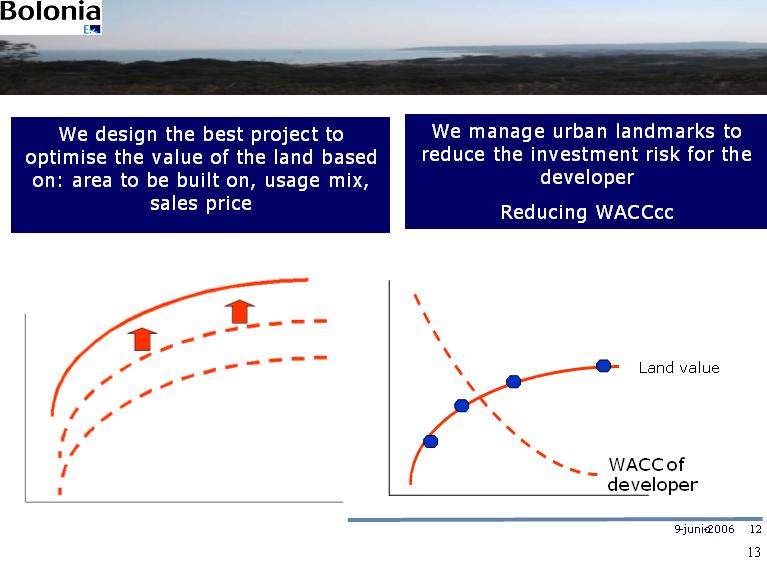

we design the best project (euro)/mn 2 Two drivers to maximise value We manage urban landmarks and reduce risk Book value Land value Managing Land value Construction Promoting final Initial Status Quo Land Final Status Quo value 12 |

|

We manage urban landmarks to reduce the investment risk for the developer Reducing WACCcc We design the best project to optimise the value of the land based on: area to be built on, usage mix, sales price WACC of developer Land value 9-junio-2006 12 |

|

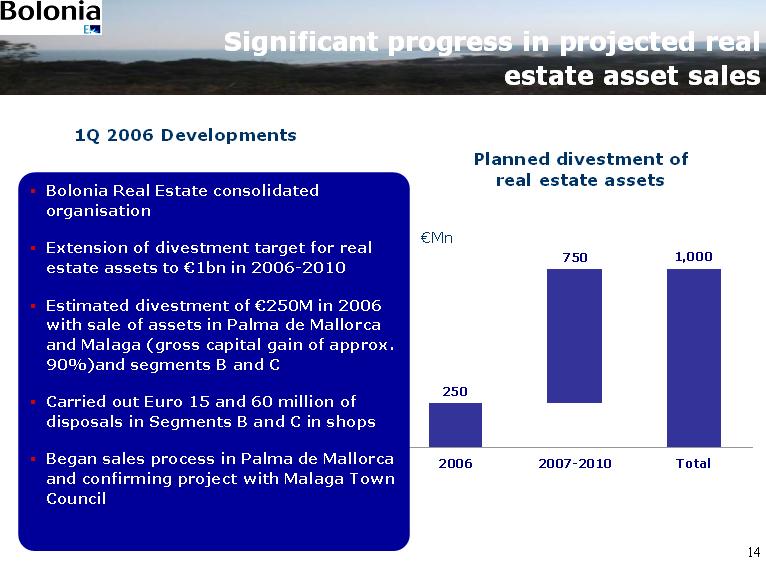

Significant progress in projected real estate asset sales 1Q 2006 Developments Planned divestment of real estate assets (euro)Mn o Bolonia Real Estate consolidated organisation o Extension of divestment target for real 750 1,000 estate assets to (euro)1bn in 2006-2010 o Estimated divestment of (euro)250M in 2006 with sale of assets in Palma de Mallorca and Malaga (gross capital gain of approx. 90%)and segments B and C 250 o Carried out Euro 15 and 60 million of disposals in Segments B and C in shops o Began sales process in Palma de Mallorca and confirming project with Malaga Town Council 2006 2007-2010 Total |

|

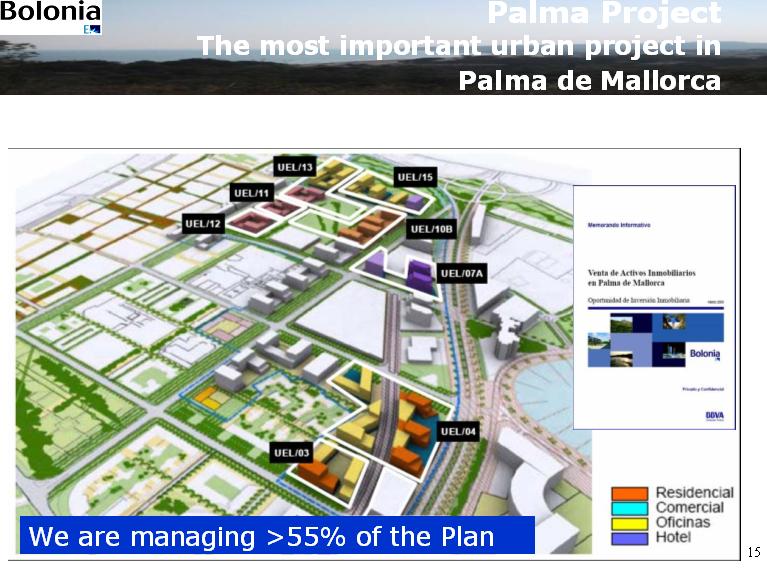

Palma Project The most important urban project in Palma de Mallorca We are managing >55% of the Plan |

|

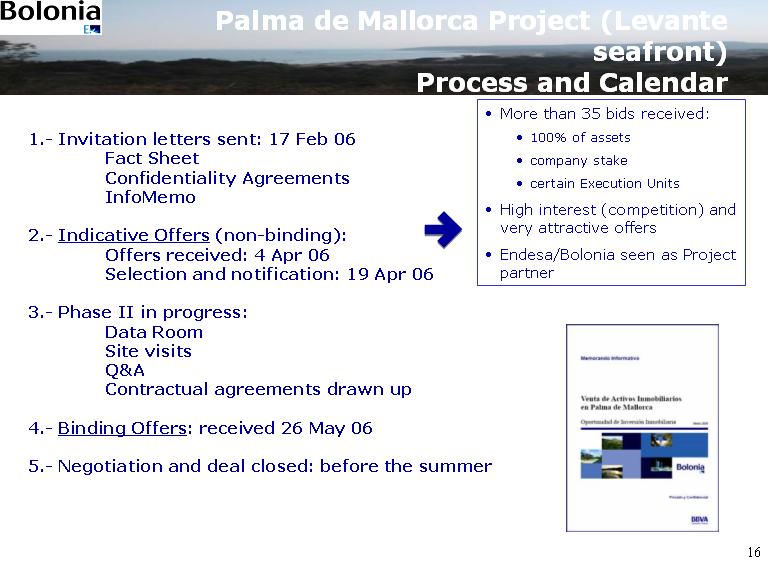

Palma de Mallorca Project (Levante seafront) Process and Calendar 1.-Invitation letters sent: 17 Feb 06 Fact Sheet Confidentiality Agreements InfoMemo 2.-Indicative Offers (non-binding): Offers received: 4 Apr 06 Selection and notification: 19 Apr 06 3.-Phase II in progress: o More than 35 bids received: o 100% of assets ocompany stake o certain Execution Units o High interest (competition) and very attractive offers o Endesa/Bolonia seen as Project partner Data Room Site visits Q&A Contractual agreements drawn up 4.-Binding Offers: received 26 May 06 5.-Negotiation and deal closed: before the summer |

|

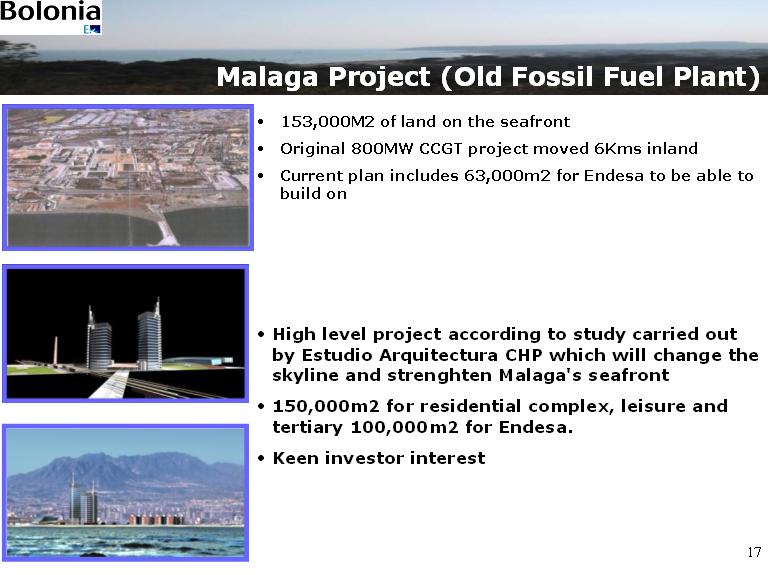

Malaga Project (Old Fossil Fuel Plant) o 153,000M2 of land on the seafront o Original 800MW CCGT project moved 6Kms inland o Current plan includes 63,000m2 for Endesa to be able to build on o High level project according to study carried out by Estudio Arquitectura CHP which will change the skyline and strenghten Malaga's seafront o 150,000m2 for residential complex, leisure and tertiary 100,000m2 for Endesa. o Keen investor interest |

|

An unique initiative aimed at giving Real Value: ENDESA's natural spaces. ENDESA's excellent conservationist track record. Endesa has a unique and unrivalled portfolio of natural surroundings/spaces. Ways of creating value: Protection aimed at partial and sustainable real estate development Reforestation and forest development Coal drains Unique sites for renewables (solar /wind) Rental/loan to investigation foundations Entornos Naturales 18 |

|

Excellent Excellent management management abilities abilities + Unique Unique asset asset Portfolio Portfolio Bolonia Constructing value Per m2 land and per asset One of Spain's leading real estate companies |

|

40 M m2 of Diversified Assets which allow Sustainable Development and Value Creation LAND FOR BUILDING NATURAL ENVIRONMENTS Altafulla Sevilla Empalme Malaga Fossil Fuel Plant Malaga San Rafael Son Molinas Central III San Juan de Dios Sant Adria San Roque Sant Just Enea Tapihue MIXED Bolonia Guejar Sierra As Pontes Mine Dilar Durcal Gavet PuertoLlano Land Espot Huinay |

|

Altafulla (Tarragona) ALTAFULLA Size (Sqm) Land to be built on (Sqm) 227,452 90,000 |

|

Bolonia (Cadiz) BAHIA DE BOLONIA Size (Sqm) Land to be built on (Sqm) 1,920,835 104,018 |

|

Seville SEVILLA EMPALME Size (Sqm) Land to be built on (Sqm) 57,466 60,706 |

|

Sant Adria (Barcelona) SANT ADRIA Size (Sqm) Land to be built on (Sqm) 40,000 36,000 |

|

Sant Just Desvern (Barcelona) SANT JUST DESVERN Size (Sqm) Land to be built on (Sqm) 49,614 80,871 |

|

70mn m2 of Assets in LATAM ENEA Project: 1,031ha next to Santiago airport: 14.4% of project sold. |

|

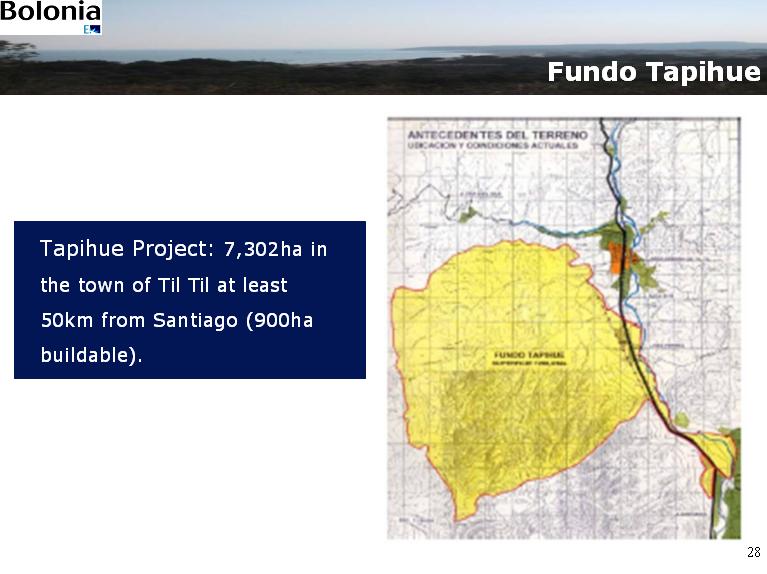

Fundo Tapihue Tapihue Project: 7,302ha in the town of Til Til at least 50km from Santiago (900ha buildable). |

|

Disclaimer o This presentation contains certain "forward-looking statements" regarding anticipated financial and operating results and statistics and other future events. These statements are not guarantees of future performance and are subject to material risks, uncertainties, changes and other factors which may be beyond Endesa's control or may be difficult to predict. o The principal assumptions underlying these forecasts and targets relate to economic, market and regulatory environment. In addition to other factors described under "Risk Factors" in our annual report on Form 20-F for the most recent fiscal year and in the Documento Registro de Acciones presently in force registered with the Comision Nacional de Valores, the following important factors could cause actual financial and operating results and statistics to differ materially from those expressed in our forward-looking statements: o Materially adverse changes in economic or industry conditions generally or in our markets; the effect of existing regulations and regulatory changes; tariff reductions; the impact of any fluctuations in interest rates; the impact of fluctuations in exchange rates; the impact of more stringent regulations and the inherent environmental risks relating to our business operations; any delays in or failure to obtain necessary regulatory, antitrust and other approvals, or any conditions imposed in connection with such approvals; opposition or actions of partners, competitors and political or ethnic groups; adverse changes in the political and regulatory environment; adverse weather conditions; natural disasters, accidents or other unforeseen eventsNo assurance can be given that the forward-looking statements in this document will be realized. o Except as may be required by applicable law, neither Endesa nor any of its affiliates intends to update these forward-looking statements. o For all of these forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. |

|

BOLONIA REAL ESTATE Constructing value Corporate Services and Technology |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | ENDESA, S.A. |

| | | |

Dated: June 8th , 2006 | | By: /s/ Álvaro Pérez de Lema |

| | | Name: Álvaro Pérez de Lema |

| | | Title: Manager of North America Investor Relations |