UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SOLICITATION/RECOMMENDATION STATEMENT UNDER

SECTION 14(d)(4) OF THE SECURITIES EXCHANGE ACT OF 1934

ENDESA, S.A.

(Name of Subject Company)

ENDESA, S.A.

(Name of Person Filing Statement) |

Ordinary shares, nominal value €1.20 each

American Depositary Shares, each representing the right to receive one ordinary share

(Title of Class of Securities)

00029274F1

(CUSIP Number of Class of Securities) |

Álvaro Pérez de Lema

Authorized Representative of Endesa, S.A.

410 Park Avenue, Suite 410

New York, NY 10022

(212) 750-7200

(Name, address and telephone number of person

authorized to receive notices and communications on

behalf of the person filing statement) |

With a Copy to:

Joseph B. Frumkin

Sergio J. Galvis

Richard A. Pollack

Angel L. Saad

Sullivan & Cromwell LLP

125 Broad Street

New York, NY 10004

(212) 558-4000 |

S Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

| IMPORTANT LEGAL INFORMATION |

This document has been made available to shareholders of Endesa, S.A. (the "Company" or "Endesa"). Investors are urged to read Endesa’s Solicitation/Recommendation Statement on Schedule 14D-9, which will be filed by the Company with the U.S. Securities and Exchange Commission (the "SEC”), as it contains important information. The Solicitation/Recommendation Statement and other public filings made from time to time by the Company with the SEC will be available without charge from the SEC's website at www.sec.gov and at the Company’s principal executive offices in Madrid, Spain.

Statements in this document other than factual or historical information are “forward-looking statements”. Forward-looking statements regarding Endesa’s anticipated financial and operating results and statistics are not guarantees of future performance and are subject to material risks, uncertainties, changes and other factors which may be beyond Endesa’s control or may be difficult to predict. No assurances can be given that the forward-looking statements in this document will be realized.

Forward-looking statements may include, but are not limited to, statements regarding: (1) estimated future earnings; (2) anticipated increases in wind and CCGTs generation and market share; (3) expected increases in demand for gas and gas sourcing; (4) management strategy and goals; (5) estimated cost reductions and increased efficiency; (6) anticipated developments affecting tariffs, pricing structures and other regulatory matters; (7) anticipated growth in Italy, France and elsewhere in Europe; (8) estimated capital expenditures and other investments; (9) expected asset disposals; (10) estimated increases in capacity and output and changes in capacity mix; (11) repowering of capacity; and (12) macroeconomic conditions.

The following important factors, in addition to those discussed elsewhere in this document, could cause actual financial and operating results and statistics to differ materially from those expressed in our forward-looking statements:

- Economic and Industry Conditions: Materially adverse changes in economic or industry conditions generally or in our markets; the effect of existing regulations and regulatory changes; tariff reductions; the impact of any fluctuations in interest rates; the impact of fluctuations in exchange rates; natural disasters; the impact of more stringent environmental regulations and the inherent environmental risks relating to our business operations; and the potential liabilities relating to our nuclear facilities.

- Transaction or Commercial Factors: Any delays in or failure to obtain necessary regulatory, antitrust and other approvals for our proposed acquisitions or asset disposals, or any conditions imposed in connection with such approvals; our ability to integrate acquired businesses successfully; the challenges inherent in diverting management's focus and resources from other strategic opportunities and from operational matters during the process of integrating acquired businesses; the outcome of any negotiations with partners and governments; any delays in or failure to obtain necessary regulatory approvals (including environmental) to construct new facilities or repower or enhance our existing facilities; shortages or changes in the price of equipment, materials or labor; opposition of political and ethnic groups; adverse changes in the political and regulatory environment in the countries where we and our related companies operate; adverse weather conditions, which may delay the completion of power plants or substations, or natural disasters, accidents or other unforeseen events; and the inability to obtain financing at rates that are satisfactory to us.

- Political/Governmental Factors: Political conditions in Latin America and changes in Spanish, European and foreign laws, regulations and taxes.

- Operating Factors: Technical difficulties; changes in operating conditions and costs; the ability to

| | | implement cost reduction plans; the ability to maintain a stable supply of coal, fuel and gas and the impact of fluctuations on fuel and gas prices; acquisitions or restructurings; and the ability to implement an international and diversification strategy successfully. |

| | Ÿ | Competitive Factors: the actions of competitors; changes in competition and pricing environments; and the entry of new competitors in our markets. |

Further information about the reasons why actual results and developments may differ materially from the expectations disclosed or implied by our forward-looking statements can be found under “Risk Factors” in our annual report on Form 20-F for the year ended December 31, 2005.

Except as may be required by applicable law, Endesa disclaims any obligation to revise or update any forward-looking statements in this document.

Endesa: A Global Outlook Rafael Miranda Endesa CEO President of Eurelectric Valencia, June 25th, 2007

1 Industry Environment 2 Endesa: a global energy company

1 Industry Environment

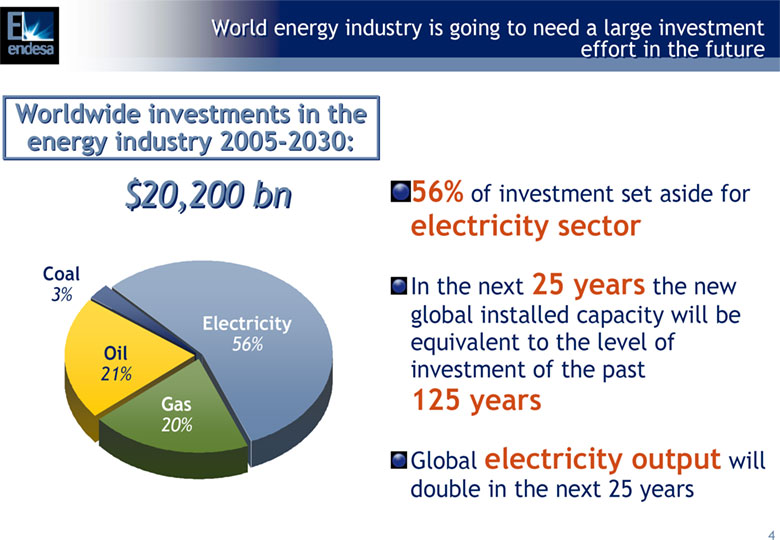

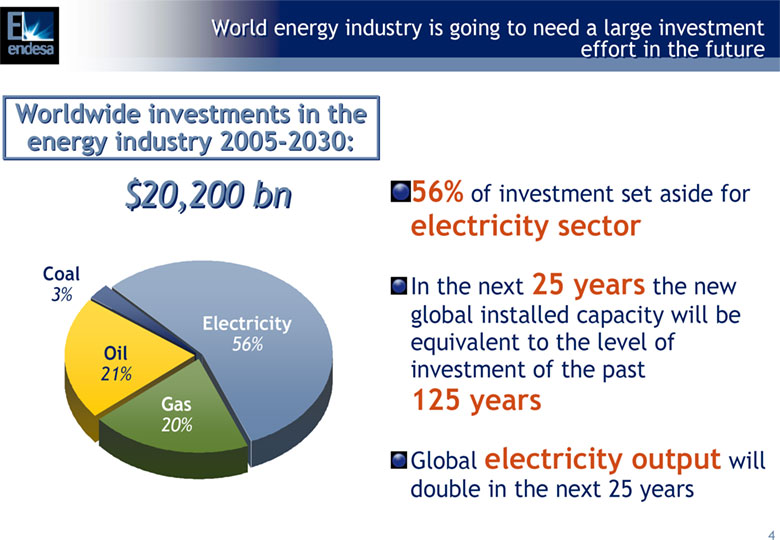

World energy industry is going to need a large investment effort in the future Worldwide investments in the energy industry 2005-2030: $20,200 bn 56% of investment set aside for electricity sector Coal 3% In the next 25 years the new Electricity global installed capacity will be 56% equivalent to the level of Oil 21% investment of the past Gas 125 years 20% Global electricity output will double in the next 25 years 4

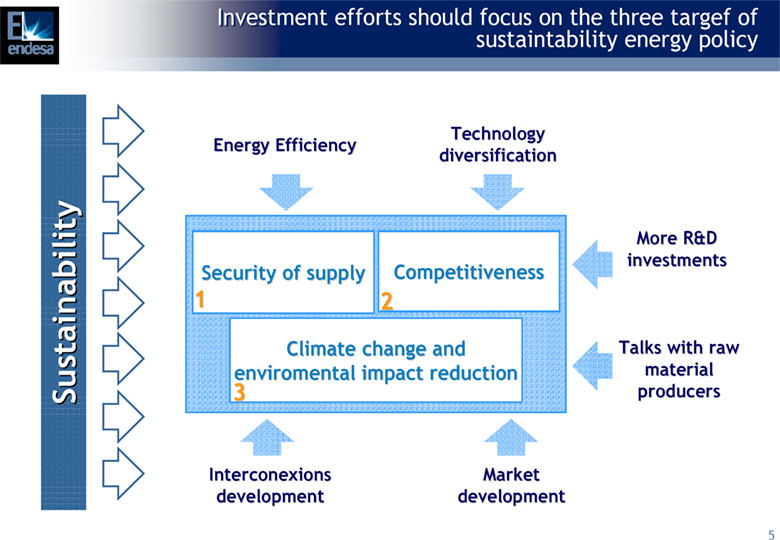

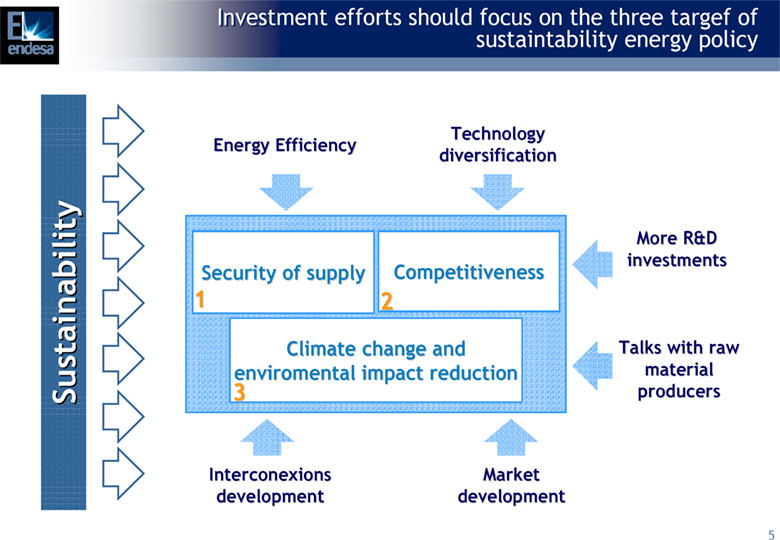

Investment efforts should focus on the three targef of sustaintability energy policy Technology Energy Efficiency diversification More R&D investments Security of supply Competitiveness 1 2 Climate change and Talks with raw enviromental impact reduction material Sustainability 3 producers Interconexions Market development development 5

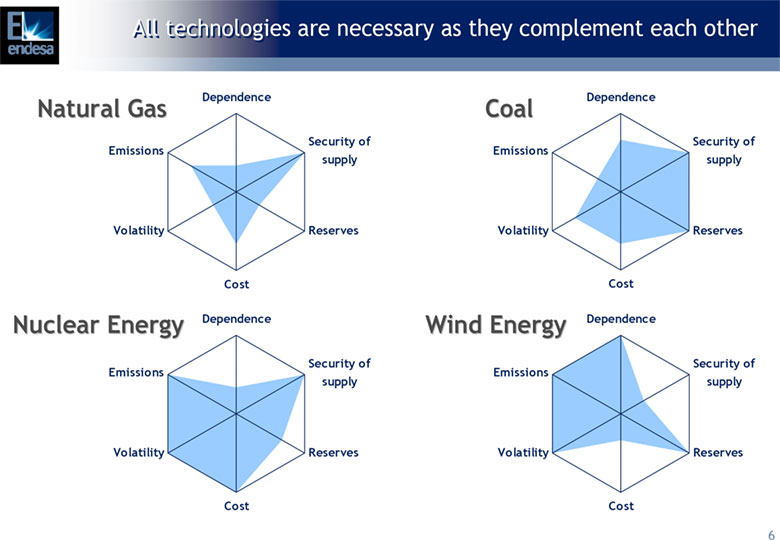

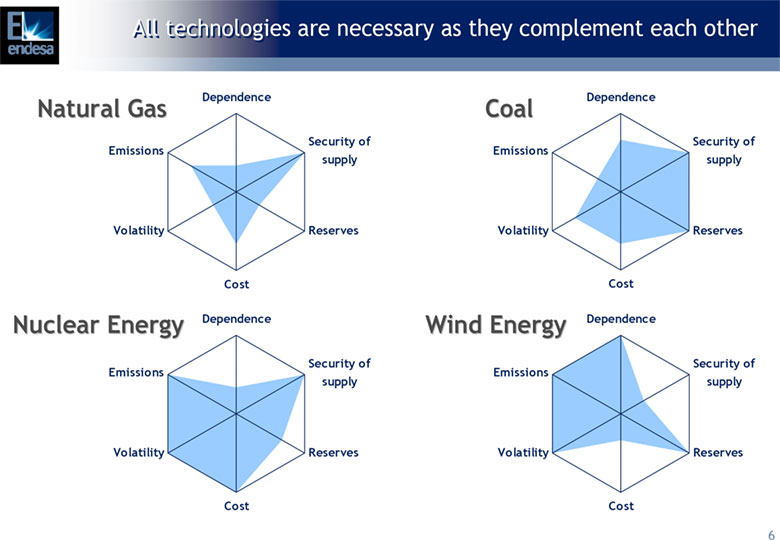

All technologies are necessary as they complement each other Natural Gas Dependence Coal Dependence Security of Security of Emissions Emissions supply supply Volatility Reserves Volatility Reserves Cost Cost Nuclear Energy Dependence Wind Energy Dependence Security of Security of Emissions Emissions supply supply Volatility Reserves Volatility Reserves Cost Cost 6

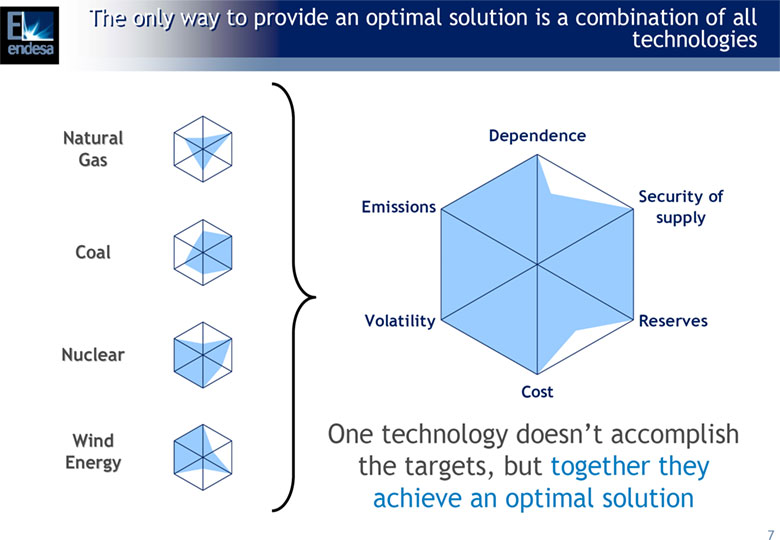

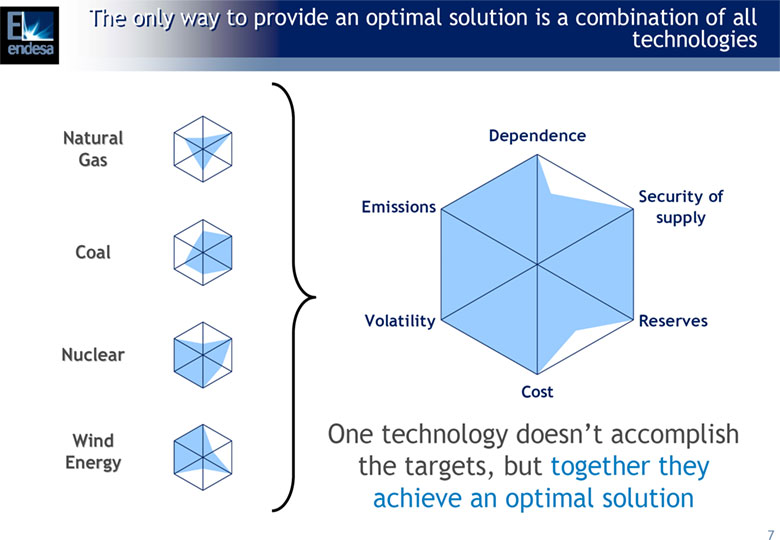

The only way to provide an optimal solution is a combination of all technologies Natural Dependence Gas Security of Emissions supply Coal Volatility Reserves Nuclear Cost Wind One technology doesn't accomplish Energy the targets, but together they achieve an optimal solution 7

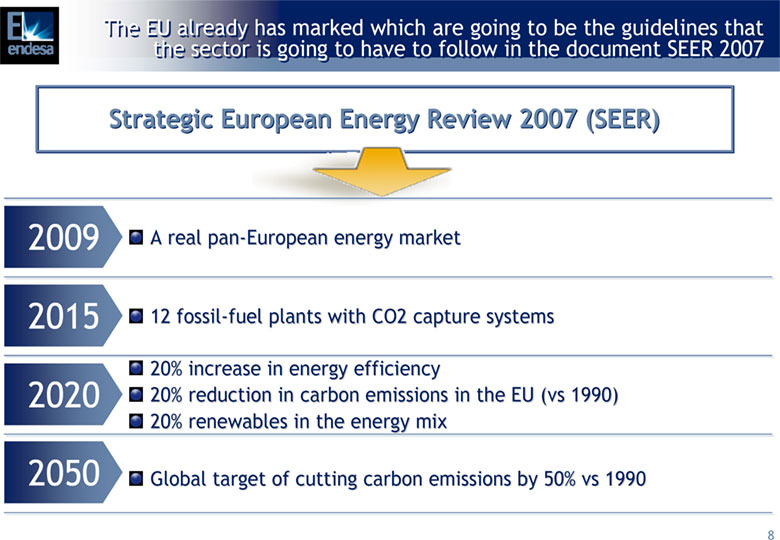

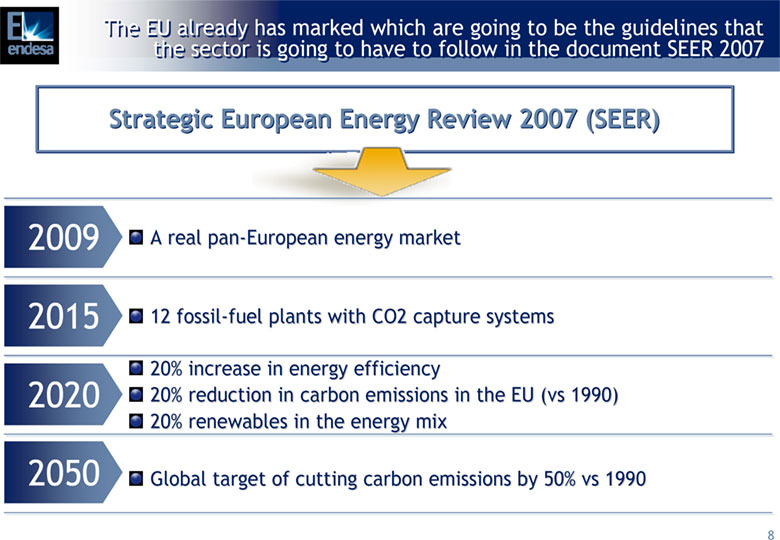

The EU already has marked which are going to be the guidelines that the sector is going to have to follow in the document SEER 2007 Strategic European Energy Review 2007 (SEER) 2009 A real pan-European energy market 2015 12 fossil-fuel plants with CO2 capture systems 20% increase in energy efficiency 2020 20% reduction in carbon emissions in the EU (vs 1990) 20% renewables in the energy mix 2050 Global target of cutting carbon emissions by 50% vs 1990 8

2 Endesa: a global energy company

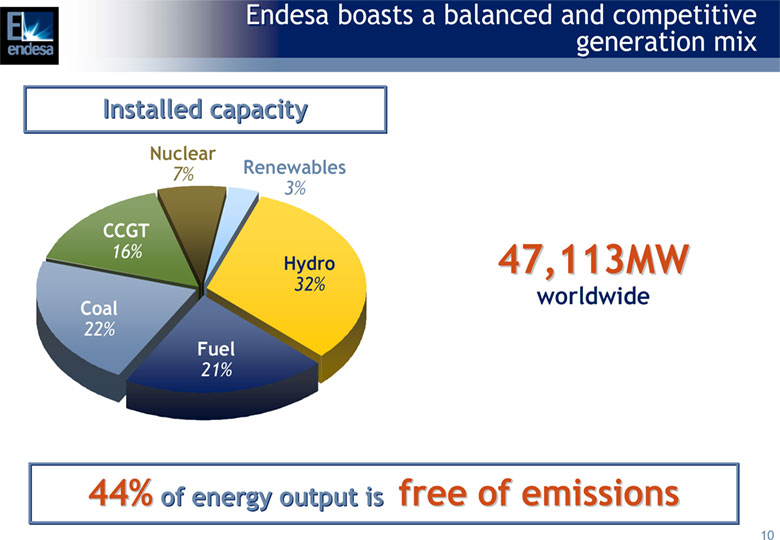

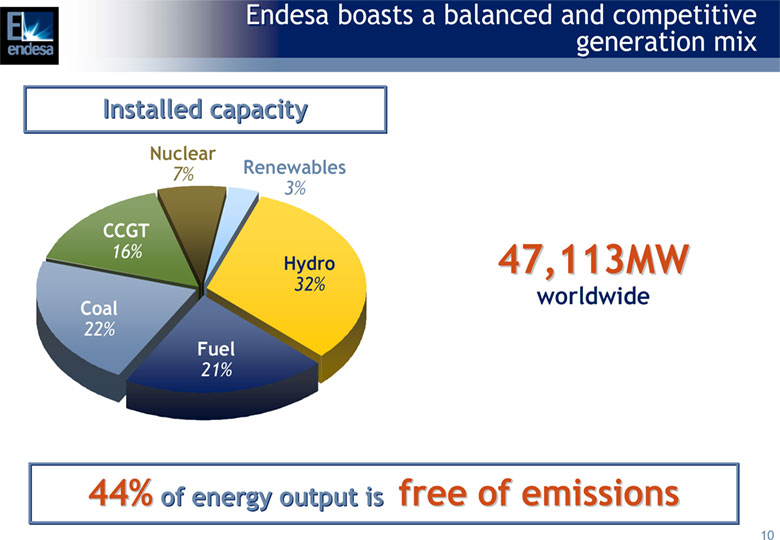

Endesa boasts a balanced and competitive generation mix Installed capacity Nuclear 7% Renewables 3% CCGT 16% Hydro 47,113MW 32% worldwide Coal 22% Fuel 21% 44% of energy output is free of emissions 10

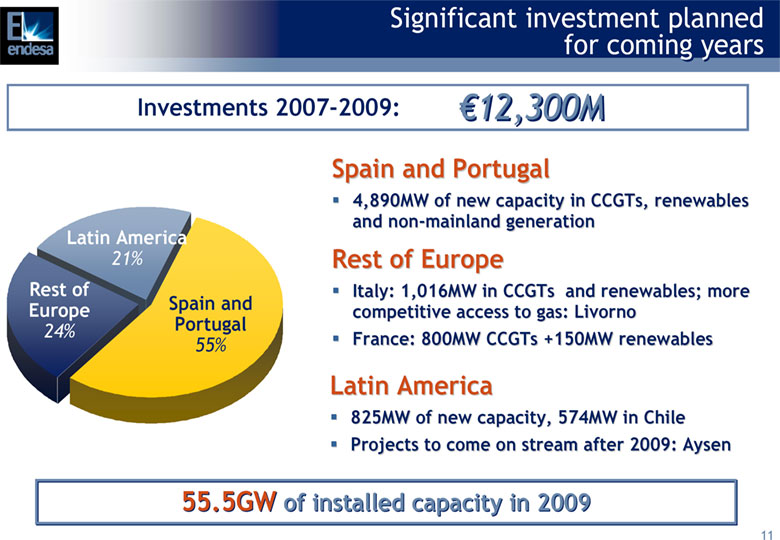

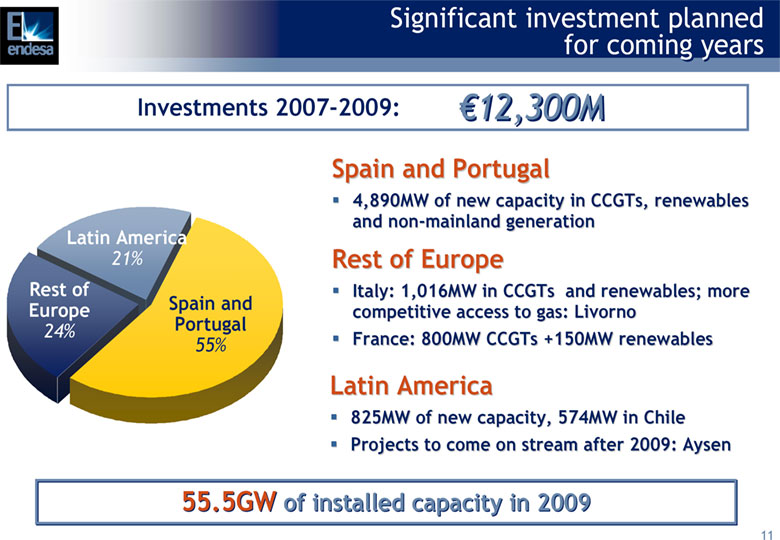

Significant investment planned for coming years Investments 2007-2009: (euro)12,300M Spain and Portugal 4,890MW of new capacity in CCGTs, renewables and non-mainland generation Latin America 21% Rest of Europe Rest of Italy: 1,016MW in CCGTs and renewables; more EuropeSpain and competitive access to gas: Livorno 24% Portugal 55% France: 800MW CCGTs +150MW renewables Latin America 825MW of new capacity, 574MW in Chile Projects to come on stream after 2009: Aysen 55.5GW of installed capacity in 2009 11

A firm commitment to deregulation and a pan-european single market Spain Rest of Europe Spain's leading supplier in deregulated electricity 11,000 supply points in Europe market with a market share of 56% Spain's second gas operator in deregulated market with a market share of 13% in the first quarter of 2007 12

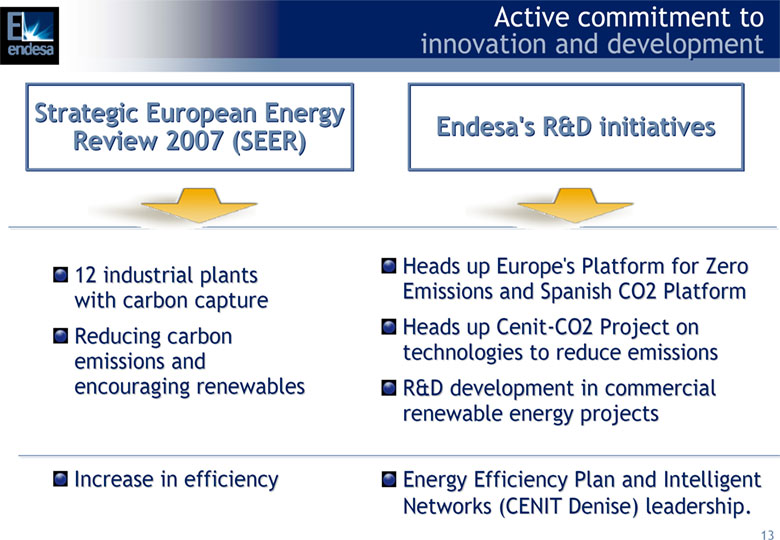

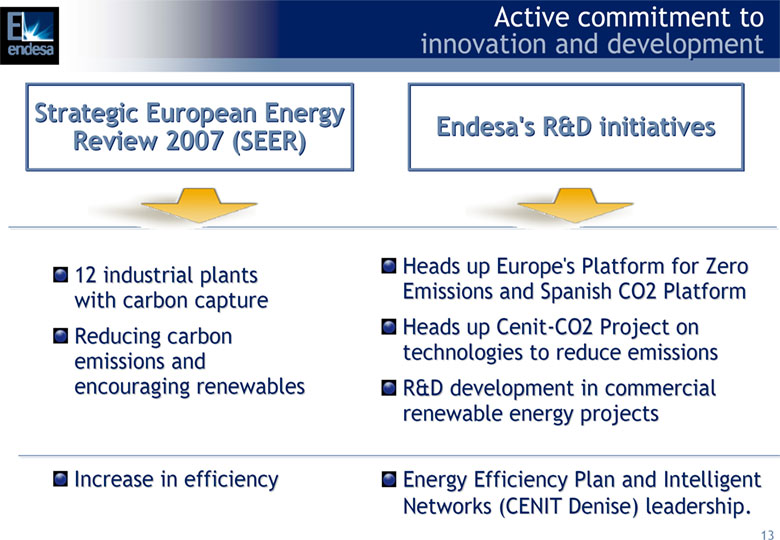

Active commitment to innovation and development Strategic European Energy Endesa's R&D initiatives Review 2007 (SEER) 12 industrial plants Heads up Europe's Platform for Zero with carbon capture Emissions and Spanish CO2 Platform Reducing carbon Heads up Cenit-CO2 Project on emissions and technologies to reduce emissions encouraging renewables R&D development in commercial renewable energy projects Increase in efficiency Energy Efficiency Plan and Intelligent Networks (CENIT Denise) leadership. 13

Strong leadership in sustainability Endesa Projects Climate Initiative Endorsing main initiatives Only company in the world with an Global initiative of this kind Roundtable on Endesa involved in over 40 CDM projects in Climate Change 2006 in Mexico, Brazil, Colombia, India and China UN Global Recognition by leading Compact benchmark indexes Combat Climate Change 14

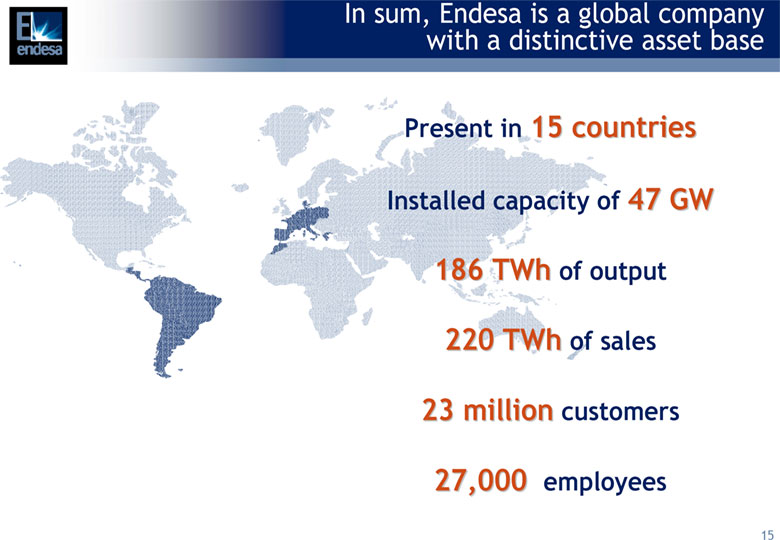

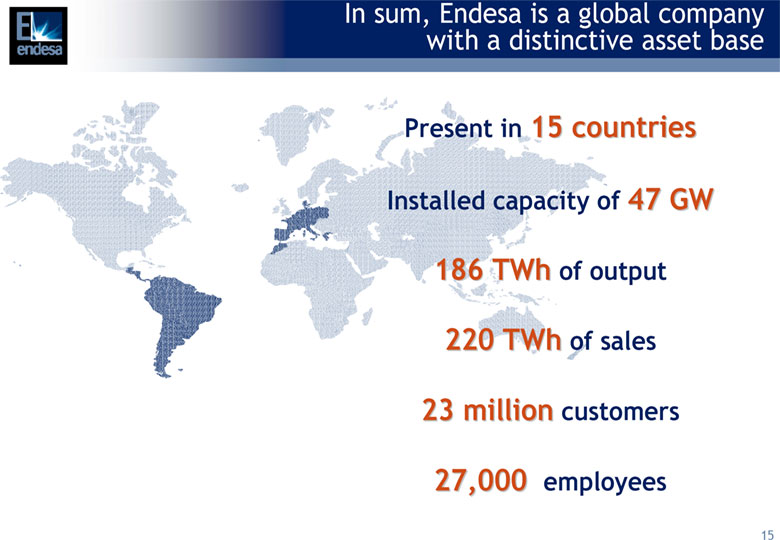

In sum, Endesa is a global company with a distinctive asset base Present in 15 countries Installed capacity of 47 GW 186 TWh of output 220 TWh of sales 23 million customers 27,000 employees 15

An indisputable leader in markets where it operates Priviledged position in Spain and Latin America Strategic presence in Europe High efficiency and quality standards Leader in sustainability and R&D 16

New future growth commitments New targets for 2009 EBITDA 8,500 (euro)4,425M shareholder ((euro)M) remuneration in 2005 and 2006 Net income ((euro)M) 3,075 Dividend commitment 9,900 45% of the (euro)9,900M 2005-2009 ((euro)M) committed Leverage ‹1.4x 17

Positive results in first quarter 2007 1T2007 Change LFL change ((euro)M) Sales 5,069 -4% 0% EBITDA 2,000 +3% +15% Net income 633 -40% +11% Affected by extraordinary earnings in 2006 In line with targets 18

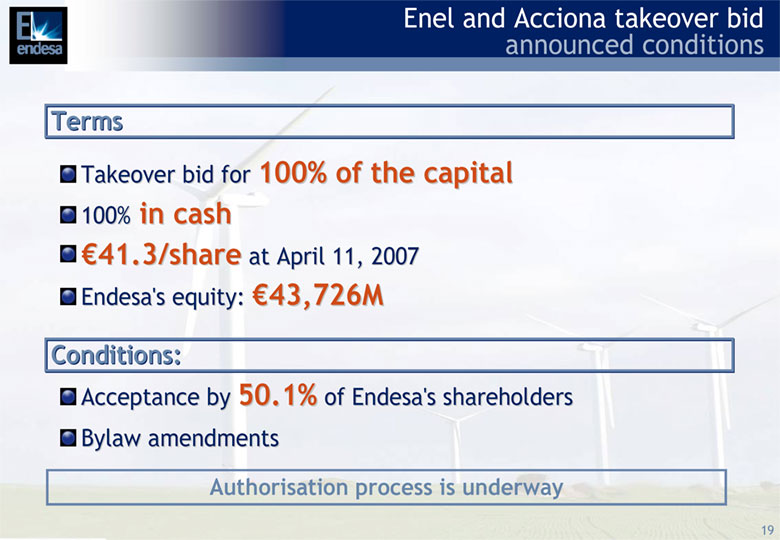

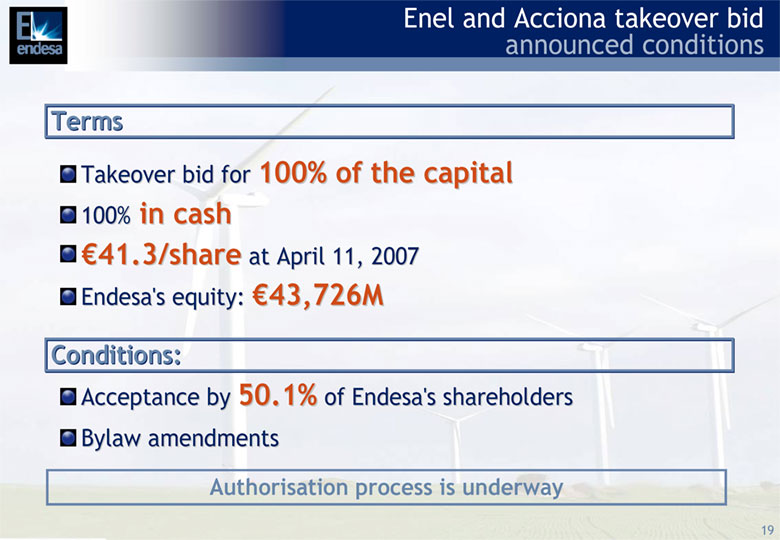

Enel and Acciona takeover bid announced conditions Terms Takeover bid for 100% of the capital 100% in cash (euro)41.3/share at April 11, 2007 Endesa's equity: (euro)43,726M Conditions: Acceptance by 50.1% of Endesa's shareholders Bylaw amendments Authorisation process is underway 19

Legal Information This document was made available to shareholders of Endesa, S.A.. In relation with the announced joint offer by ENEL SpA and Acciona, S.A., Endesa shareholders are urged to read the report of Endesa's board of directors when it is filed by the Company with the Comision Nacional del Mercado de Valores (the "CNMV"), as well as Endesa's Solicitation/Recommendation Statement on Schedule 14D-9 when it is filed by the Company with the U.S. Securities and Exchange Commission (the "SEC"), as it will contain important information. Such documents and other public filings made from time to time by Endesa with the CNMV or the SEC are available without charge from the Endesa's website at www.endesa.es, from the the CNMV's website at www.cnmv.es and from the SEC's website at www.sec.gov and at Endesa's principal executive offices in Madrid, Spain. This presentation contains certain "forward-looking" statements regarding anticipated financial and operating results and statistics and other future events. These statements are not guarantees of future performance and they are subject to material risks, uncertainties, changes and other factors that may be beyond ENDESA's control or may be difficult to predict. Forward-looking statements include, but are not limited to, information regarding: estimated future earnings; anticipated increases in wind and CCGTs generation and market share; expected increases in demand for gas and gas sourcing; management strategy and goals; estimated cost reductions; tariffs and pricing structure; estimated capital expenditures and other investments; estimated asset disposals; estimated increases in capacity and output and changes in capacity mix; repowering of capacity and macroeconomic conditions. For example, the investment plan for 2007-2009 included in this presentation are forward-looking statements and are based on certain assumptions which may or may not prove correct. The main assumptions on which these expectations and targets are based are related to the regulatory setting, exchange rates, divestments, increases in production and installed capacity in markets where ENDESA operates, increases in demand in these markets, assigning of production amongst different technologies, increases in costs associated with higher activity that do not exceed certain limits, electricity prices not below certain levels, the cost of CCGT plants, and the availability and cost of the gas, coal, fuel oil and emission rights necessary to run our business at the desired levels. In these statements we avail ourselves of the protection provided by the Private Securities Litigation Reform Act of 1995 of the United States of America with respect to forward-looking statements. The following important factors, in addition to those discussed elsewhere in this presentation, could cause actual financial and operating results and statistics to differ materially from those expressed in our forward-looking statements: Economic and industry conditions: significant adverse changes in the conditions of the industry, the general economy or our markets; the effect of the prevailing regulations or changes in them; tariff reductions; the impact of interest rate fluctuations; the impact of exchange rate fluctuations; natural disasters; the impact of more restrictive environmental regulations and the environmental risks inherent to our activity; potential liabilities relating to our nuclear facilities. Transaction or commercial factors: any delays in or failure to obtain necessary regulatory, antitrust and other approvals for our proposed acquisitions or asset disposals, or any conditions imposed in connection with such approvals; our ability to integrate acquired businesses successfully; the challenges inherent in diverting management's focus and resources from other strategic opportunities and from operational matters during the process of integrating acquired businesses; the outcome of any negotiations with partners and governments. Delays in or impossibility of obtaining the pertinent permits and rezoning orders in relation to real estate assets. Delays in or impossibility of obtaining regulatory authorisation, including that related to the environment, for the construction of new facilities, repowering or improvement of existing facilities; shortage of or changes in the price of equipment, material or labour; opposition of political or ethnic groups; adverse changes of a political or regulatory nature in the countries where we or our companies operate; adverse weather conditions, natural disasters, accidents or other unforeseen events, and the impossibility of obtaining financing at what we consider satisfactory interest rates. Political/governmental factors: political conditions in Latin America; changes in Spanish, European and foreign laws, regulations and taxes. Operating factors: technical problems; changes in operating conditions and costs; capacity to execute cost-reduction plans; capacity to maintain a stable supply of coal, fuel and gas and the impact of the price fluctuations of coal, fuel and gas; acquisitions or restructuring; capacity to successfully execute a strategy of internationalisation and diversification. Competitive factors: the actions of competitors; changes in competition and pricing environments; the entry of new competitors in our markets. Further details on the factors that may cause actual results and other developments to differ significantly from the expectations implied or explicitly contained in the presentation are given in the Risk Factors section of Form 20-F filed with the SEC and in the ENDESA Share Registration Statement filed with the Comision Nacional del Mercado de Valores (the Spanish securities regulator or the "CNMV" for its initials in Spanish).No assurance can be given that the forward-looking statements in this document will be realised. Except as may be required by applicable law, neither Endesa nor any of its affiliates intends to update these forward-looking statements. 20

Endesa: A Global Outlook Rafael Miranda Endesa CEO President of Eurelectric Valencia, June 25th, 2007