UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SOLICITATION/RECOMMENDATION STATEMENT UNDER

SECTION 14(d)(4) OF THE SECURITIES EXCHANGE ACT OF 1934

ENDESA, S.A.

(Name of Subject Company)

ENDESA, S.A.

(Name of Person Filing Statement) |

Ordinary shares, nominal value €1.20 each

American Depositary Shares, each representing the right to receive one ordinary share

(Title of Class of Securities)

00029274F1

(CUSIP Number of Class of Securities) |

Álvaro Pérez de Lema

Authorized Representative of Endesa, S.A.

410 Park Avenue, Suite 410

New York, NY 10022

(212) 750-7200

(Name, address and telephone number of person

authorized to receive notices and communications on

behalf of the person filing statement) |

With a Copy to:

Joseph B. Frumkin

Sergio J. Galvis

Richard A. Pollack

Angel L. Saad

Sullivan & Cromwell LLP

125 Broad Street

New York, NY 10004

(212) 558-4000 |

S Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

| IMPORTANT LEGAL INFORMATION |

This document has been made available to shareholders of Endesa, S.A. (the "Company" or "Endesa"). Investors are urged to read Endesa’s Solicitation/Recommendation Statement on Schedule 14D-9, which will be filed by the Company with the U.S. Securities and Exchange Commission (the "SEC”), as it contains important information. The Solicitation/Recommendation Statement and other public filings made from time to time by the Company with the SEC will be available without charge from the SEC's website at www.sec.gov and at the Company’s principal executive offices in Madrid, Spain.

Statements in this document other than factual or historical information are “forward-looking statements”. Forward-looking statements regarding Endesa’s anticipated financial and operating results and statistics are not guarantees of future performance and are subject to material risks, uncertainties, changes and other factors which may be beyond Endesa’s control or may be difficult to predict. No assurances can be given that the forward-looking statements in this document will be realized.

Forward-looking statements may include, but are not limited to, statements regarding: (1) estimated future earnings; (2) anticipated increases in wind and CCGTs generation and market share; (3) expected increases in demand for gas and gas sourcing; (4) management strategy and goals; (5) estimated cost reductions and increased efficiency; (6) anticipated developments affecting tariffs, pricing structures and other regulatory matters; (7) anticipated growth in Italy, France and elsewhere in Europe; (8) estimated capital expenditures and other investments; (9) expected asset disposals; (10) estimated increases in capacity and output and changes in capacity mix; (11) repowering of capacity; and (12) macroeconomic conditions.

The following important factors, in addition to those discussed elsewhere in this document, could cause actual financial and operating results and statistics to differ materially from those expressed in our forward-looking statements:

- Economic and Industry Conditions: Materially adverse changes in economic or industry conditions generally or in our markets; the effect of existing regulations and regulatory changes; tariff reductions; the impact of any fluctuations in interest rates; the impact of fluctuations in exchange rates; natural disasters; the impact of more stringent environmental regulations and the inherent environmental risks relating to our business operations; and the potential liabilities relating to our nuclear facilities.

- Transaction or Commercial Factors: Any delays in or failure to obtain necessary regulatory, antitrust and other approvals for our proposed acquisitions or asset disposals, or any conditions imposed in connection with such approvals; our ability to integrate acquired businesses successfully; the challenges inherent in diverting management's focus and resources from other strategic opportunities and from operational matters during the process of integrating acquired businesses; the outcome of any negotiations with partners and governments; any delays in or failure to obtain necessary regulatory approvals (including environmental) to construct new facilities or repower or enhance our existing facilities; shortages or changes in the price of equipment, materials or labor; opposition of political and ethnic groups; adverse changes in the political and regulatory environment in the countries where we and our related companies operate; adverse weather conditions, which may delay the completion of power plants or substations, or natural disasters, accidents or other unforeseen events; and the inability to obtain financing at rates that are satisfactory to us.

- Political/Governmental Factors: Political conditions in Latin America and changes in Spanish, European and foreign laws, regulations and taxes.

- Operating Factors: Technical difficulties; changes in operating conditions and costs; the ability to

| | | implement cost reduction plans; the ability to maintain a stable supply of coal, fuel and gas and theimpact of fluctuations on fuel and gas prices; acquisitions or restructurings; and the ability toimplement an international and diversification strategy successfully. |

| | Ÿ | Competitive Factors: the actions of competitors; changes in competition and pricing environments; and the entry of new competitors in our markets. |

Further information about the reasons why actual results and developments may differ materially from the expectations disclosed or implied by our forward-looking statements can be found under “Risk Factors” in our annual report on Form 20-F for the year ended December 31, 2005.

Except as may be required by applicable law, Endesa disclaims any obligation to revise or update any forward-looking statements in this document.

Endesa Europe Jesus Olmos Clavijo General Manager Europe Valencia, 25 June 2007

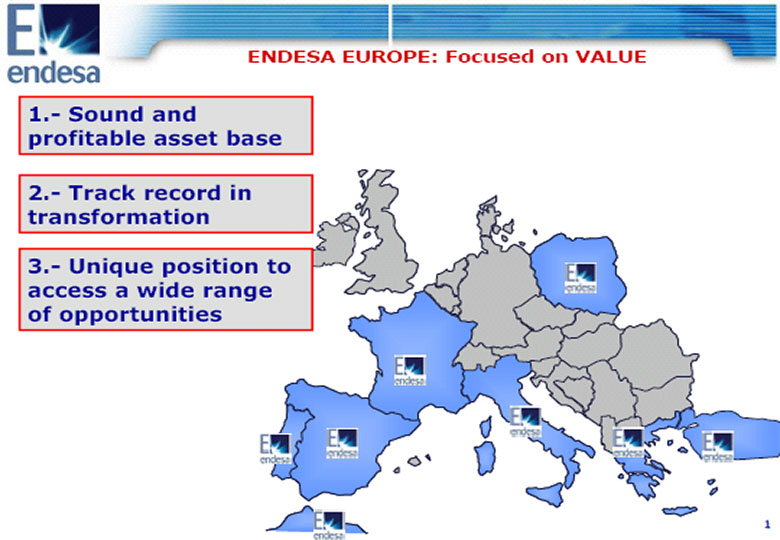

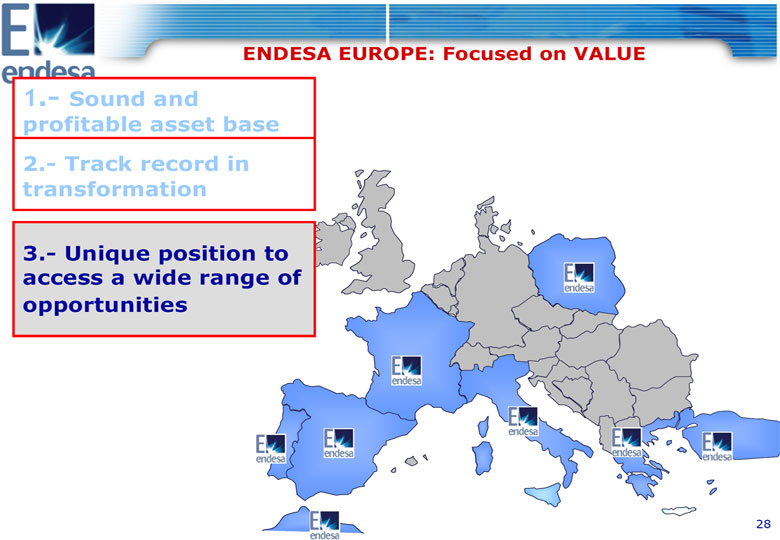

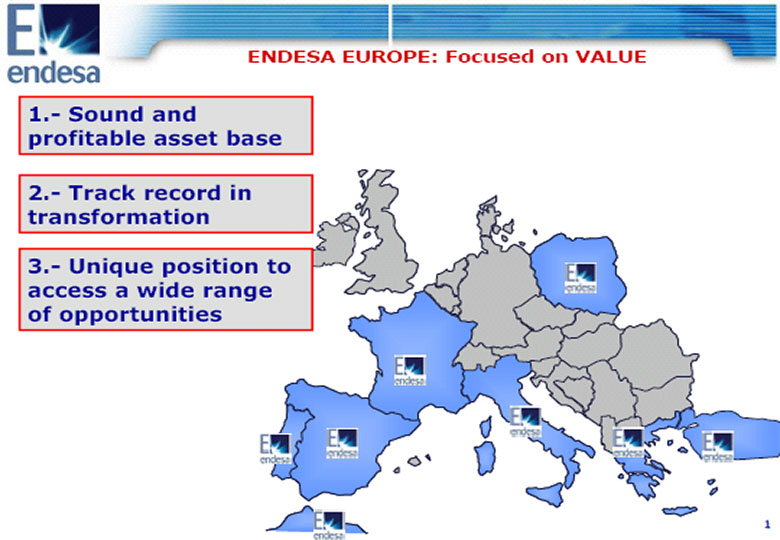

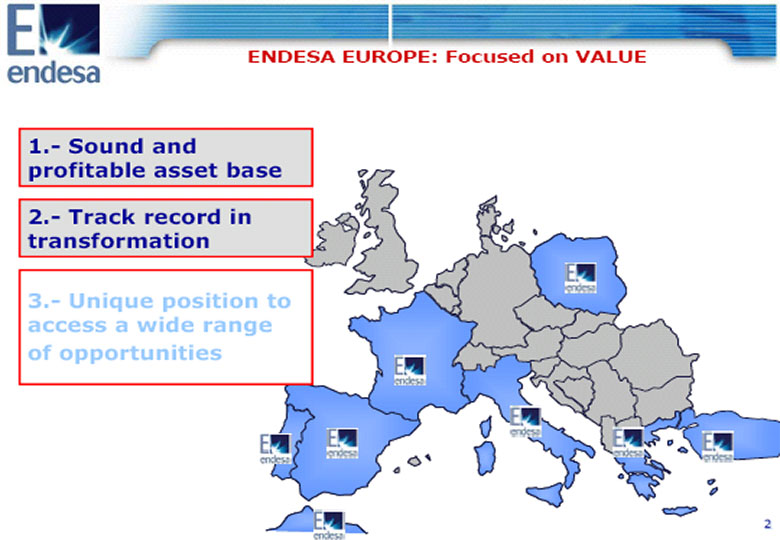

ENDESA EUROPE: Focused on VALUE 1.- Sound and profitable asset base 2.- Track record in transformation 3.- Unique position to access a wide range of opportunities 1

ENDESA EUROPE: Focused on VALUE 1.- Sound and profitable asset base 2.- Track record in transformation 3.- Unique position to access a wide range of opportunities 2

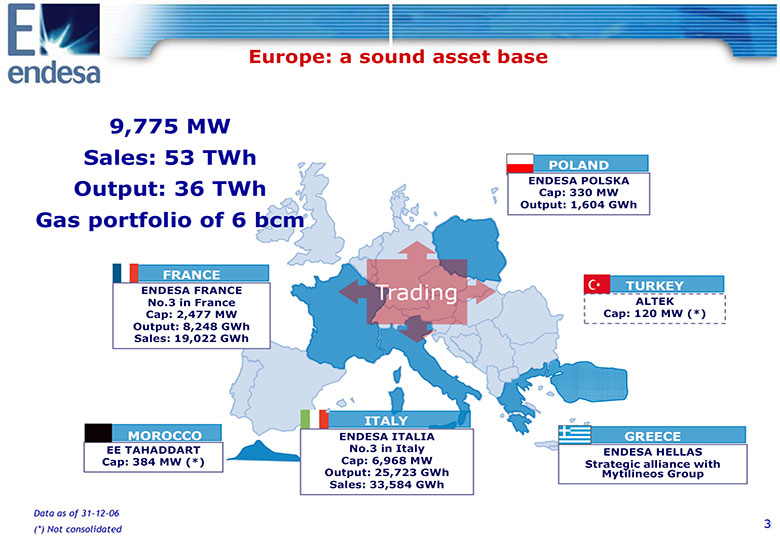

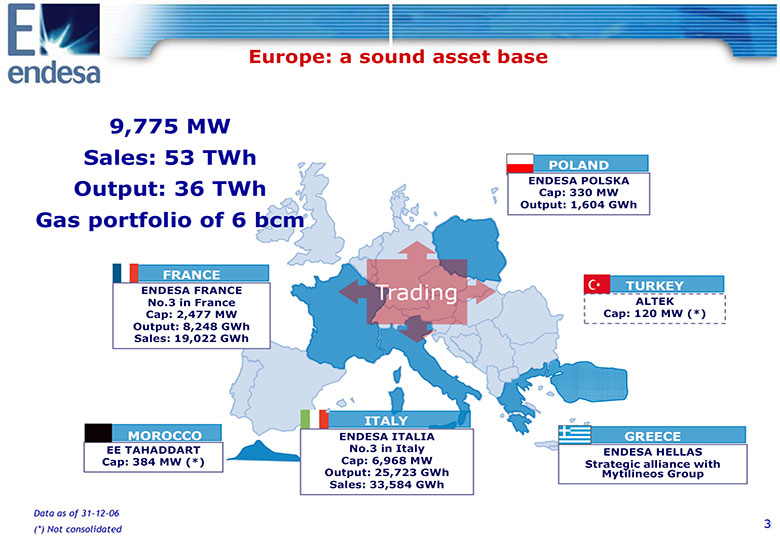

Europe: a sound asset base 9,775 MW Sales: 53 TWh POLAND ENDESA POLSKA Output: 36 TWh Cap: 330 MW Output: 1,604 GWh Gas portfolio of 6 bcm FRANCE ENDESA FRANCE Trading TURKEY No.3 in France ALTEK Cap: 2,477 MW Cap: 120 MW (*) Output: 8,248 GWh Sales: 19,022 GWh ITALY MOROCCO ENDESA ITALIA GREECE EE TAHADDART No.3 in Italy ENDESA HELLAS Cap: 384 MW (*) Cap: 6,968 MW Output: 25,723 GWh Strategic alliance withMytilineos Group Sales: 33,584 GWh Data as of 31-12-06 3(*) Not consolidated Which is complemented and optimised with its Trading business 2006 (TWh) 3

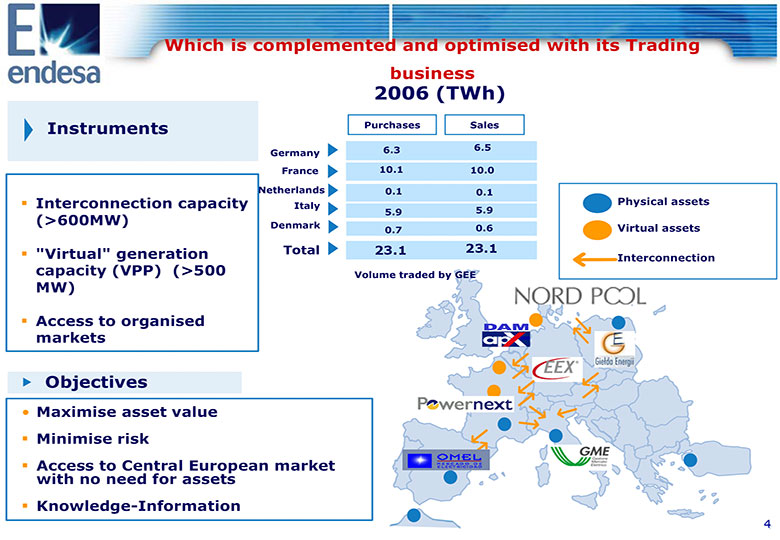

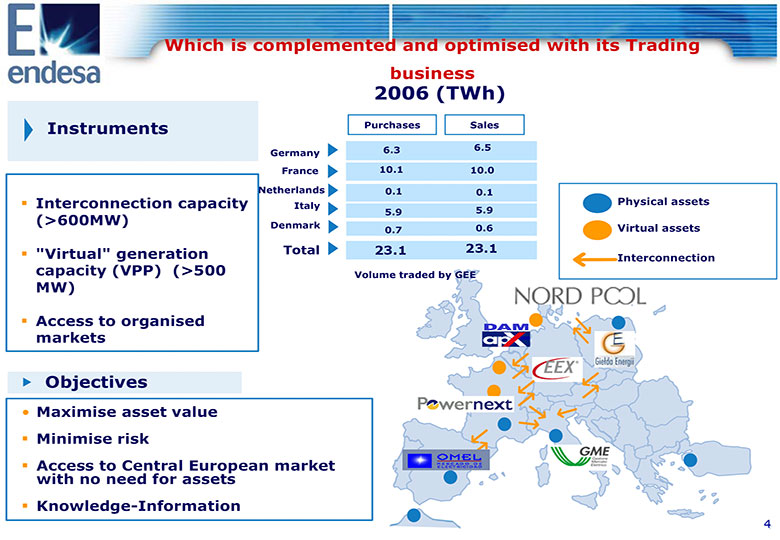

Instruments Purchases Sales 6.3 6.5 Germany France 10.1 10.0 Netherlands 0.1 0.1 Interconnection capacity Italy Physical assets 5.9 5.9 (>600MW) Denmark 0.7 0.6 Virtual assets "Virtual" generation Total 23.1 23.1 Interconnection capacity (VPP) (>500 Volume traded by GEE MW) Access to organised markets Objectives o Maximise asset value Minimise risk Access to Central European market with no need for assets Knowledge-Information 4

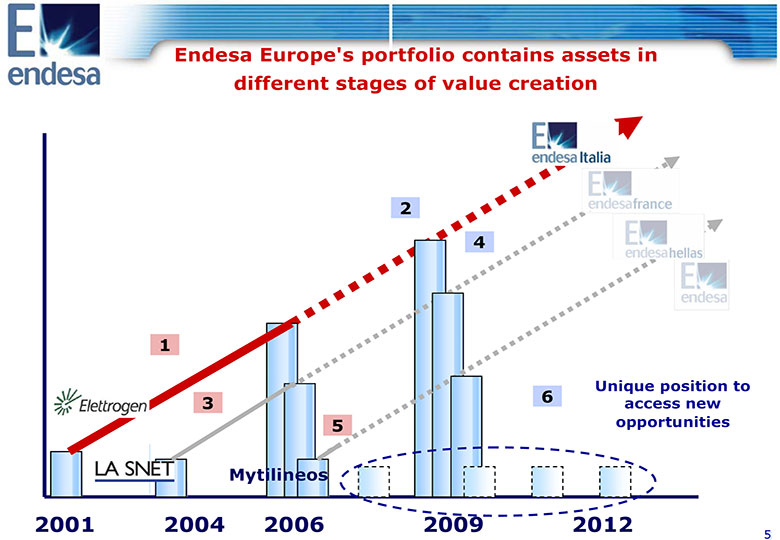

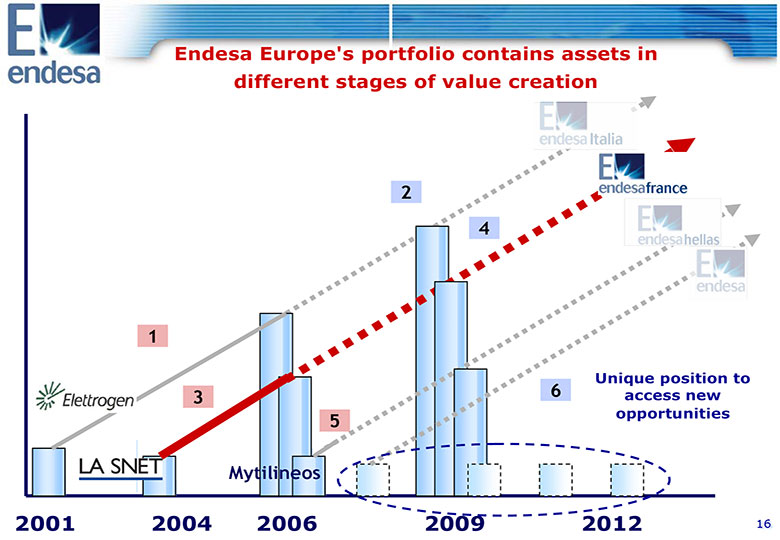

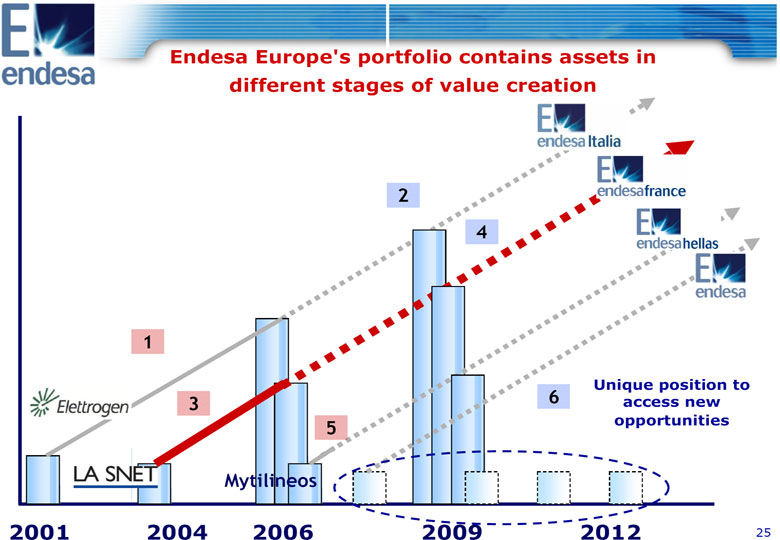

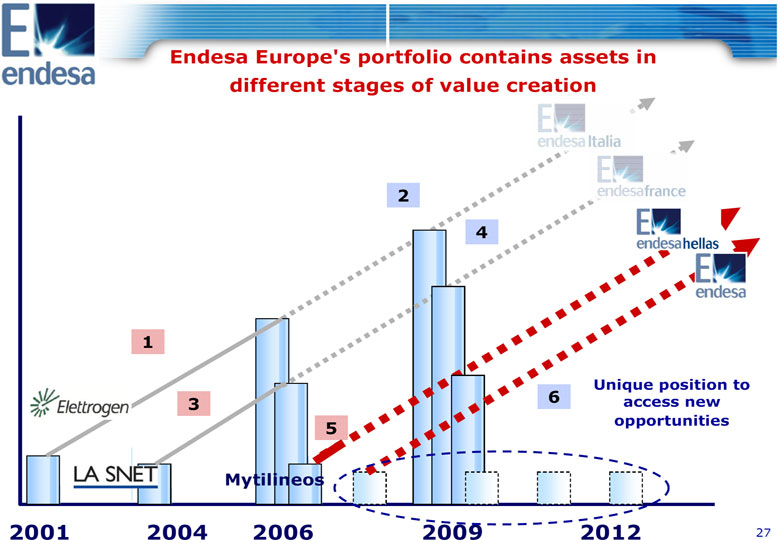

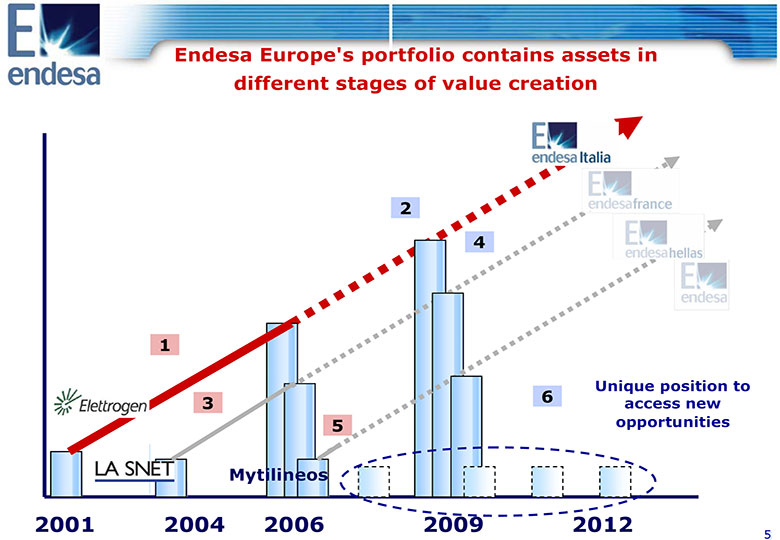

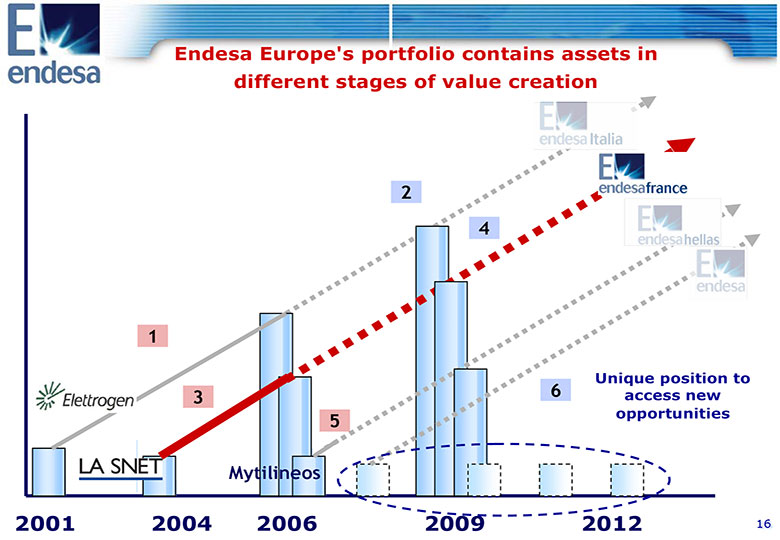

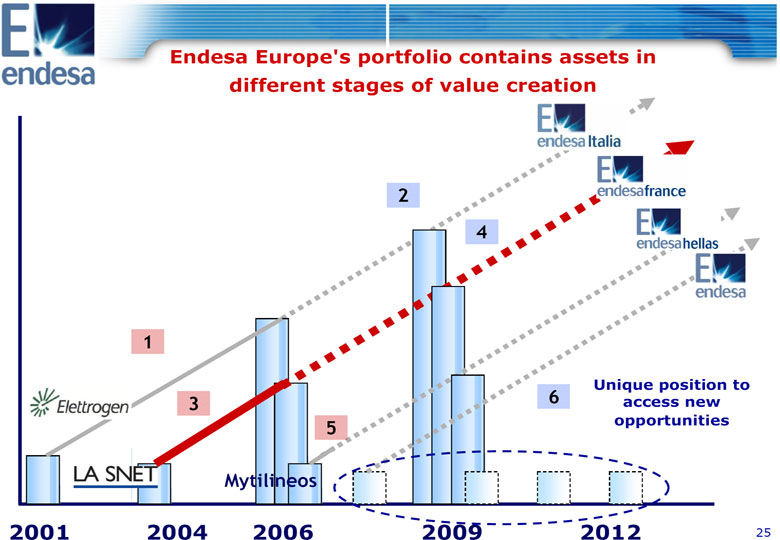

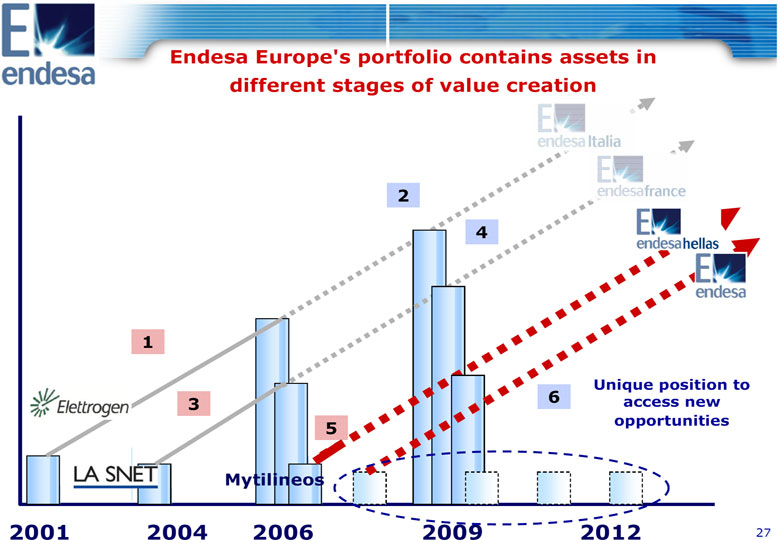

4 Endesa Europe's portfolio contains assets in different stages of value creation 2 4 1 Unique position to 3 6 access new 5 opportunities Mytilineos 2001 2004 2006 2009 2012 5

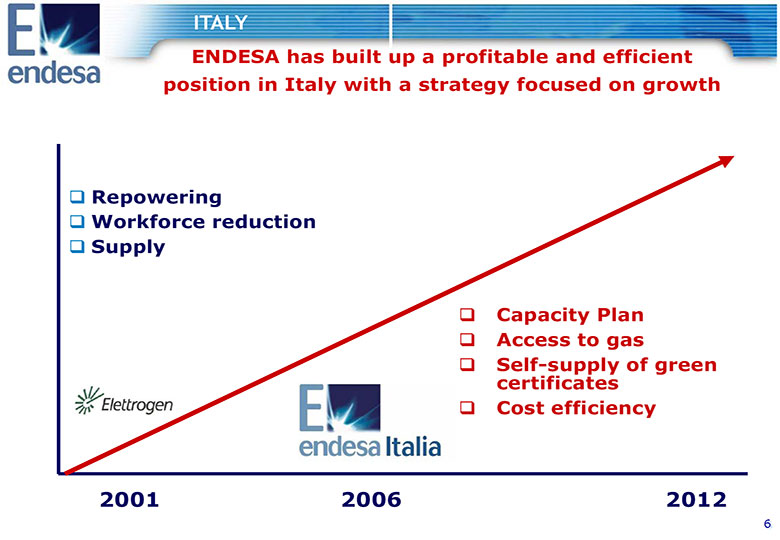

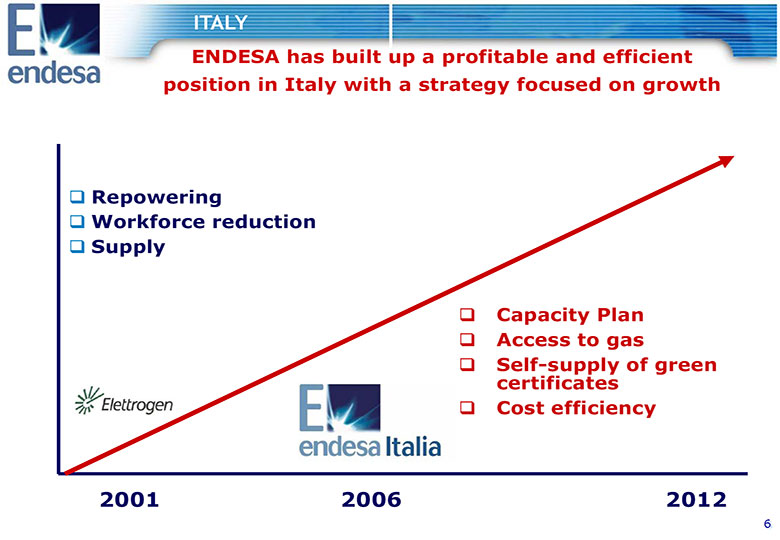

ITALY ENDESA has built up a profitable and efficient position in Italy with a strategy focused on growth Repowering Workforce reduction Supply Capacity Plan Access to gas Self-supply of green certificates Cost efficiency 2001 2006 2012 6

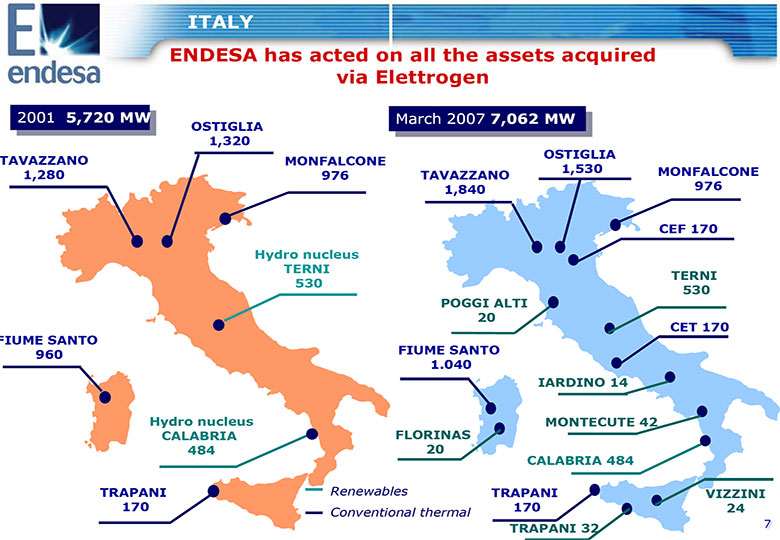

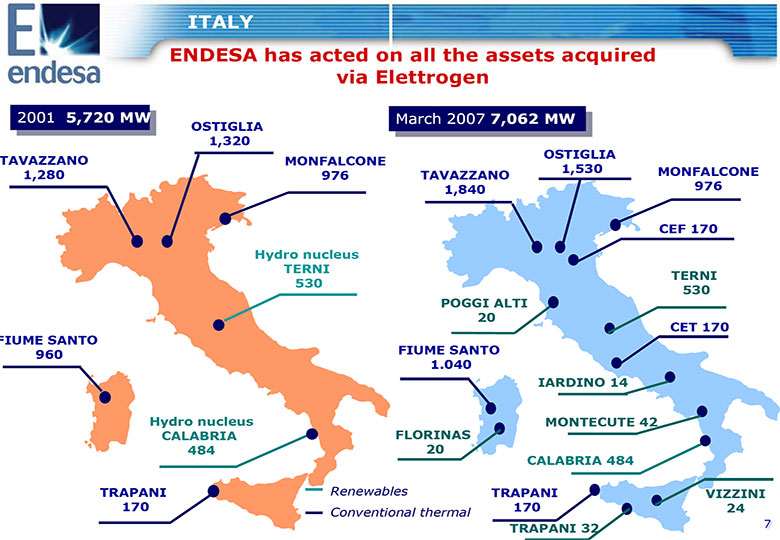

ITALY ENDESA has acted on all the assets acquired via Elettrogen 20012001 5,720 MW 5,720 MW March 2007 7,062 MW OSTIGLIA March 2007 7,062 MW 1,320 OSTIGLIA TAVAZZANO MONFALCONE 1,530 MONFALCONE 1,280 976 TAVAZZANO 1,840 976 CEF 170 Hydro nucleus TERNI TERNI 530 530 POGGI ALTI 20 CET 170 FIUME SANTO 960 FIUME SANTO 1.040 IARDINO 14 Hydro nucleus MONTECUTE 42 CALABRIA FLORINAS 484 20 CALABRIA 484 TRAPANI Renewables TRAPANI VIZZINI 170 Conventional thermal 170 24 TRAPANI 32 7

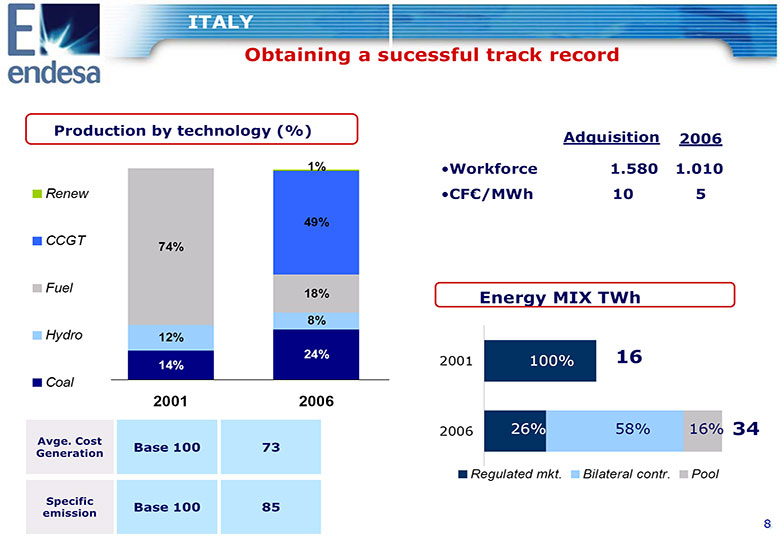

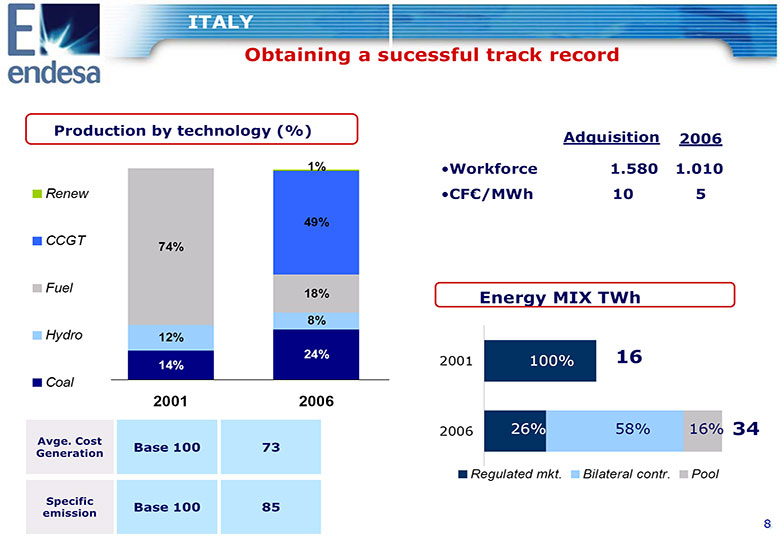

ITALY Obtaining a sucessful track record Production by technology (%) Adquisition 2006 1% oWorkforce 1.580 1.010 Renew oCF(euro)/MWh 10 5 49% CCGT 74% Fuel 18% Energy MIX TWh 8% Hydro 12% 24% 16 14% 2001 100% Coal 2001 2006 2006 26% 58% 16% 34 Avge. Cost Base 100 73 Generation Regulated mkt. Bilateral contr. Pool Specific Base 100 85 emission 8

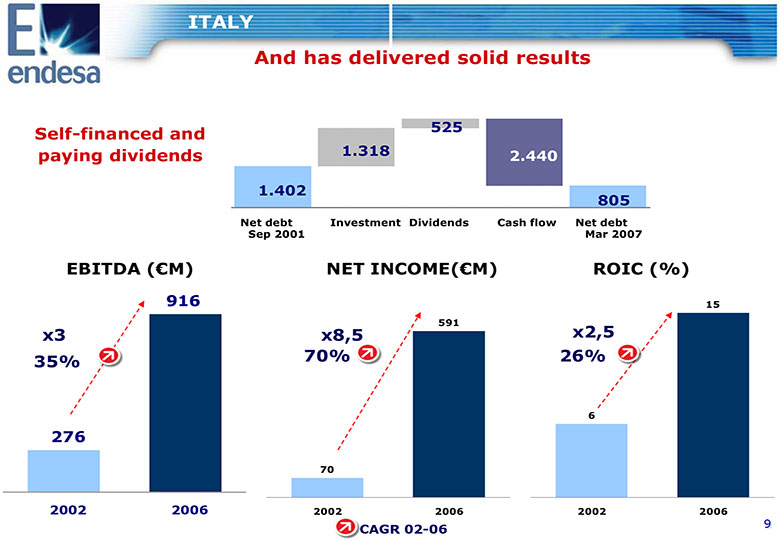

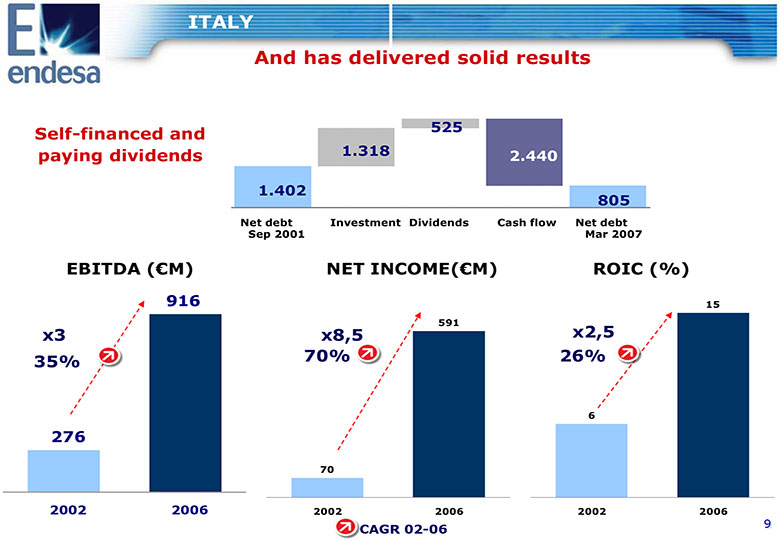

ITALY And has delivered solid results Self-financed and 525 paying dividends1.318 2.440 1.402 805 Net debt Investment Dividends Cash flow Net debt Sep 2001Mar 2007 EBITDA ((euro)M) NET INCOME((euro)M) ROIC (%) 916 15 591 x2,5 x3 x8,5 35% 70% 26% 6 276 70 2002 2006 2002 2006 2002 2006 CAGR 02-06 9

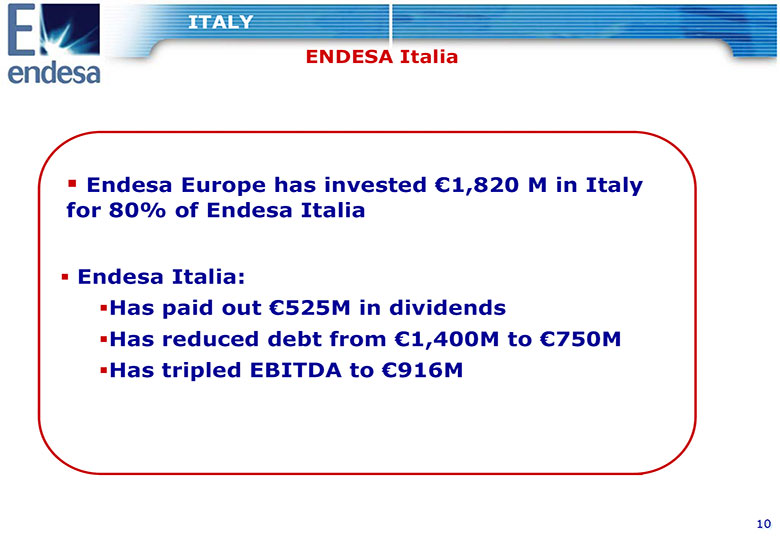

ITALY ENDESA Italia Endesa Europe has invested (euro)1,820 M in Italy for 80% of Endesa Italia Endesa Italia: Has paid out (euro)525M in dividends Has reduced debt from (euro)1,400M to (euro)750M Has tripled EBITDA to (euro)916M 10

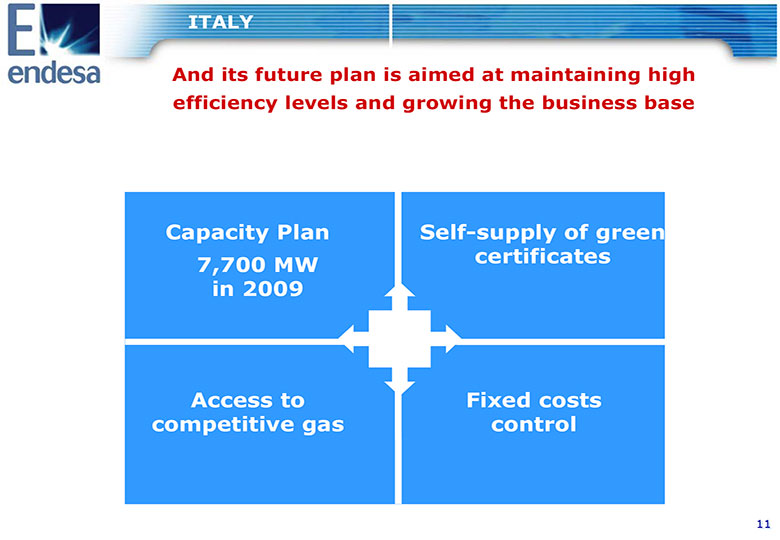

ITALY And its future plan is aimed at maintaining high efficiency levels and growing the business base Capacity Plan Self-supply of green 7,700 MW certificates in 2009 Access to Fixed costs competitive gas control 11

ITALY Capacity Plan 1 Scandale 2 Tavazzano 9 o CCGT 800 MW o CCGT400 MW o Under construction o Work begins July 2007 3 o On-stream 2008 2 o On-stream 2009 4 3 Monfalcone 3 & 4 1 4 Fiume Santo 5 o Repowering 800 MW o Coal plant 410 MW o On-stream 2011 o On-stream 2012 12

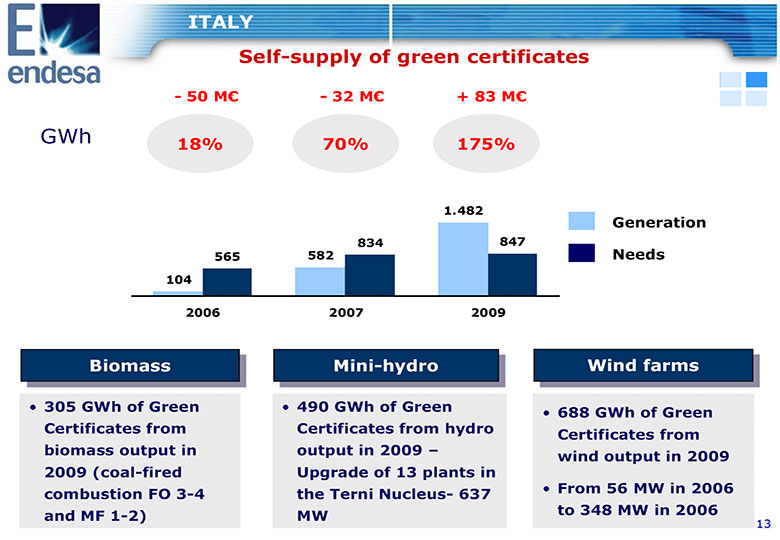

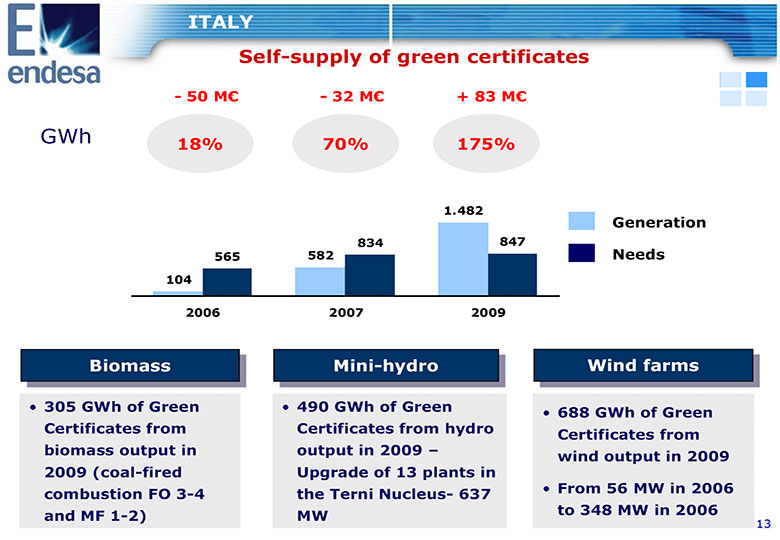

ITALY Self-supply of green certificates - 50 M(euro) - 32 M(euro) + 83 M(euro) GWh 18% 70% 175% 1.482 Generation 834 847 565 582 Needs 104 2006 2007 2009 Biomass Biomass Mini-hydro Mini-hydro Wind farms Wind farms o 305 GWh of Green o 490 GWh of Green o 688 GWh of Green Certificates from Certificates from hydro Certificates from biomass output in output in 2009 - wind output in 2009 2009 (coal-fired Upgrade of 13 plants in combustion FO 3-4 the Terni Nucleus- 637 o From 56 MW in 2006 and MF 1-2) MW to 348 MW in 2006 13

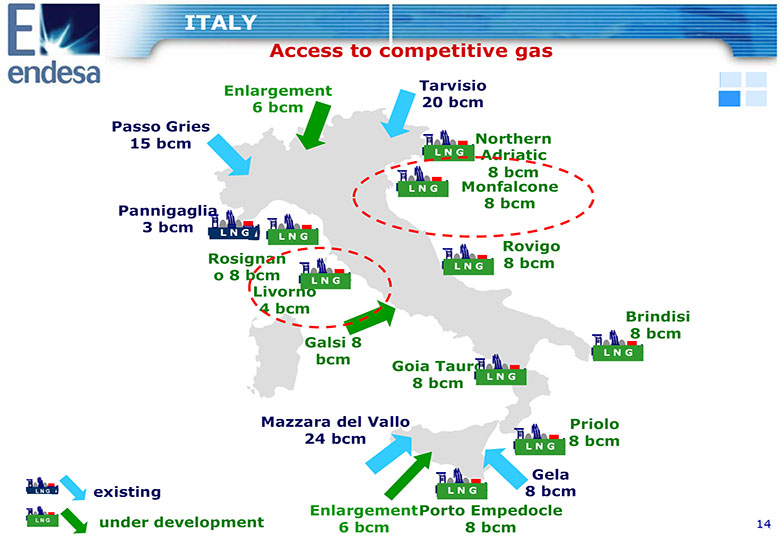

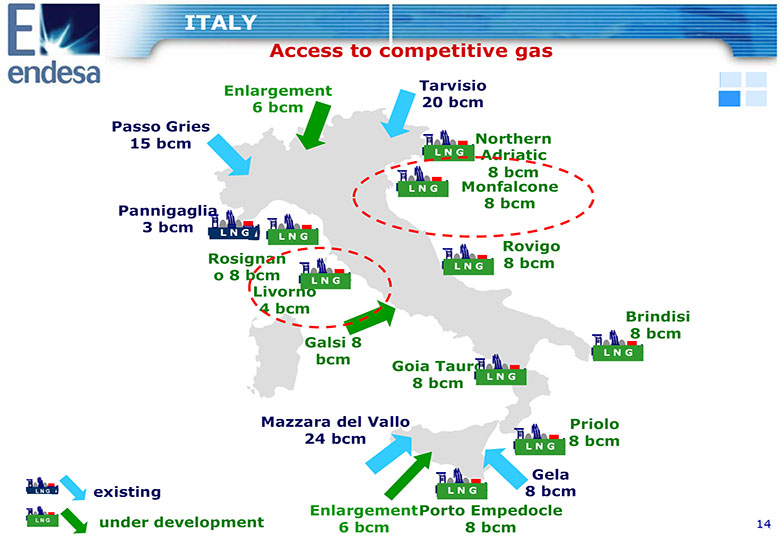

ITALY Access to competitive gas Enlargement Tarvisio 6 bcm 20 bcm Passo Gries 15 bcm Northern L N G Adriatic 8 bcm L N G Monfalcone 8 bcm Pannigaglia 3 bcm L N G L N G Rovigo Rosignan 8 bcm L N G o 8 bcm L N G Livorno 4 bcm Brindisi 8 bcm Galsi 8 bcm L N G Goia Tauro 8 bcm L N G Mazzara del Vallo Priolo 24 bcm 8 bcm L N G Gela L N G existing L N G 8 bcm EnlargementPorto Empedocle L N G under development 6 bcm 8 bcm 14

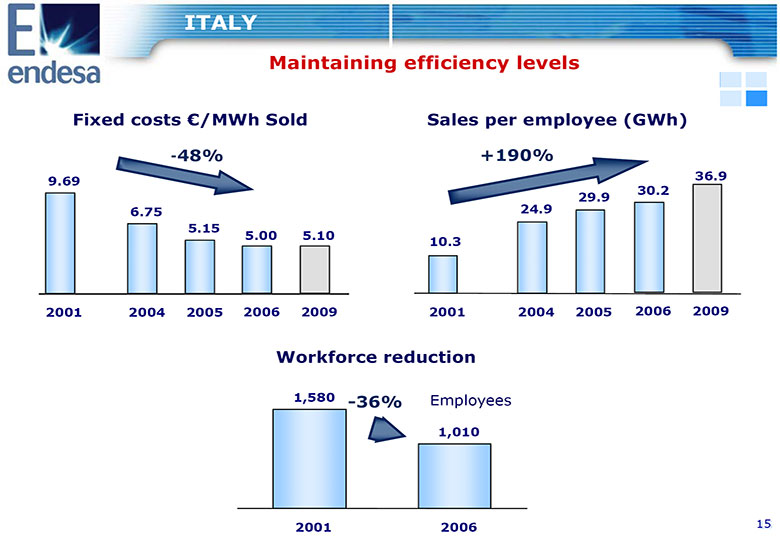

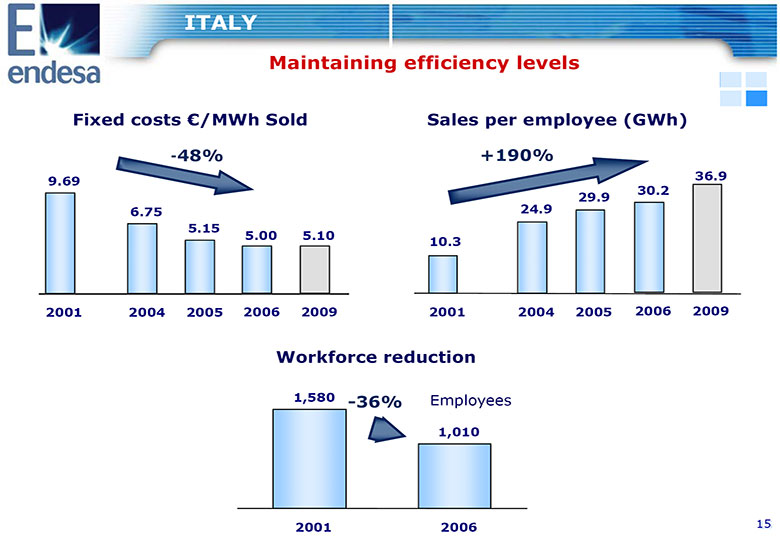

ITALY Maintaining efficiency levels Fixed costs (euro)/MWh Sold Sales per employee (GWh) -48% +190% 9.69 36.9 30.2 29.9 6.75 24.9 5.15 5.00 5.10 10.3 2001 2004 2005 2006 2009 2001 2004 2005 2006 2009 Workforce reduction 1,580 -36% Employees 1,010 2001 2006 15

Endesa Europe's portfolio contains assets in different stages of value creation 2 4 1 Unique position to 3 6 access new 5 opportunities Mytilineos 2001 2004 2006 2009 2012 16

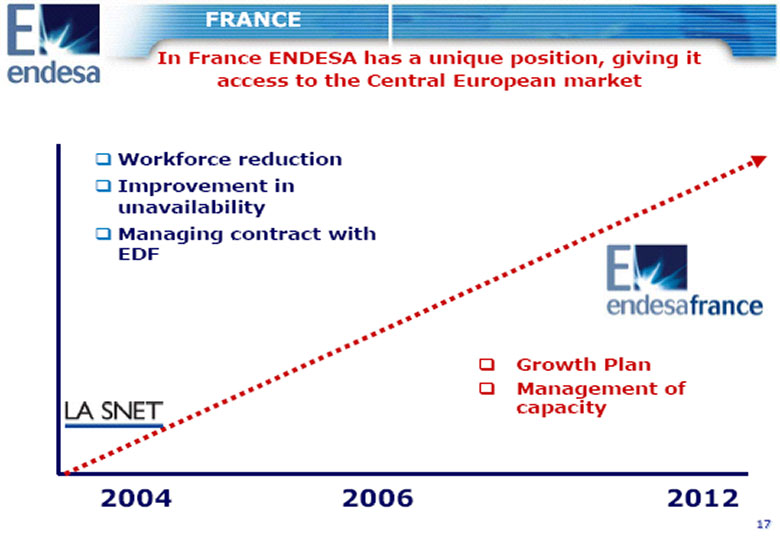

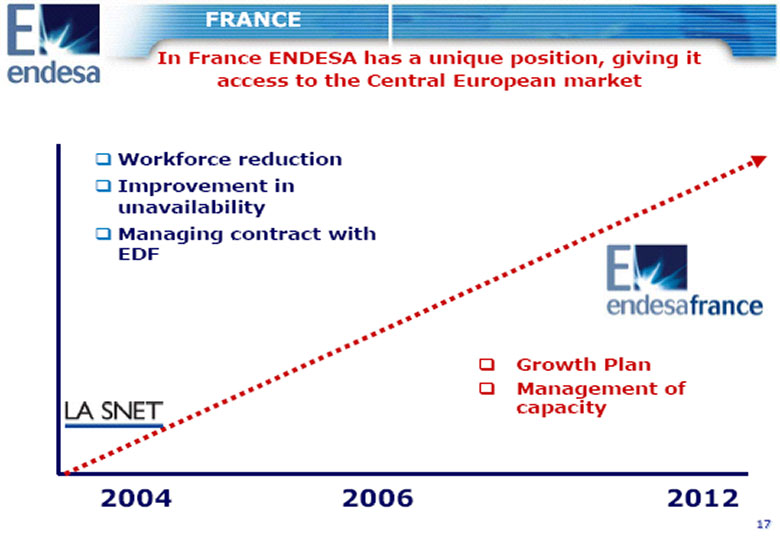

FRANCE In France ENDESA has a unique position, giving it access to the Central European market Workforce reduction Improvement in unavailability Managing contract with EDF Growth Plan Management of capacity 2004 2006 2012 17

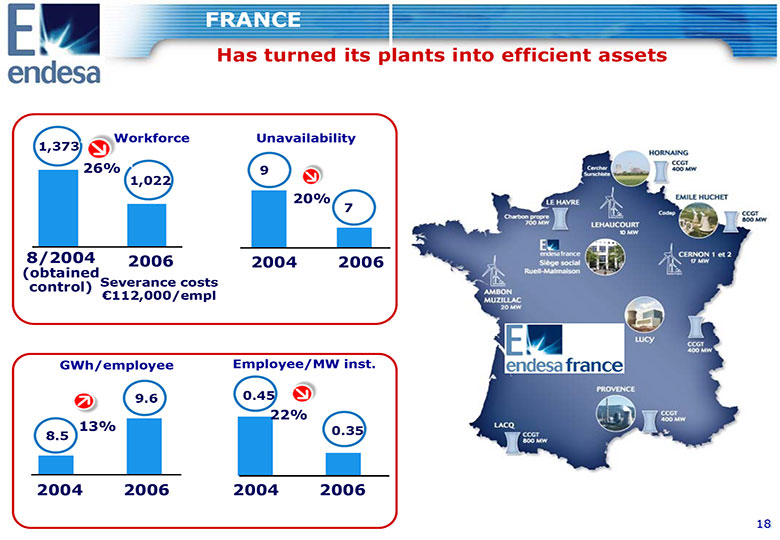

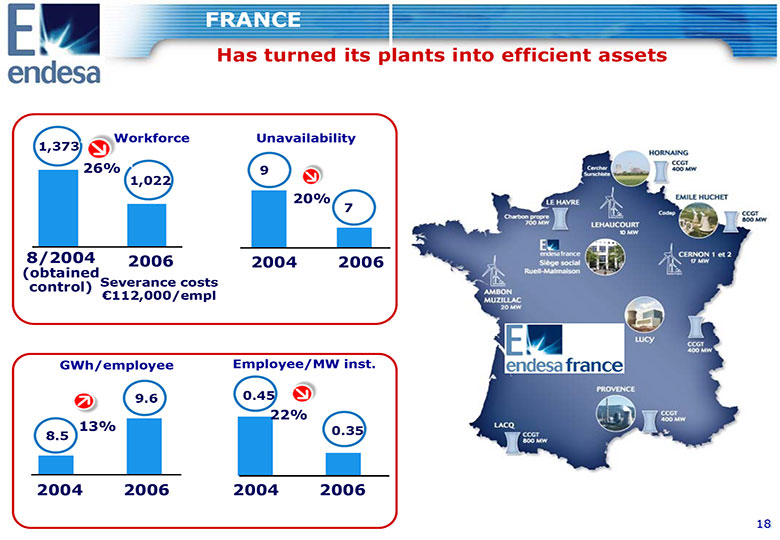

FRANCE Has turned its plants into efficient assets Workforce Unavailability 1,373 26% 9 1,022 20% 7 8/2004 2006 2004 2006 (obtained control) Severance costs (euro)112,000/empl GWh/employee Employee/MW inst. 9.6 0.45 22% 13% 0.35 8.5 2004 2006 2004 2006 18

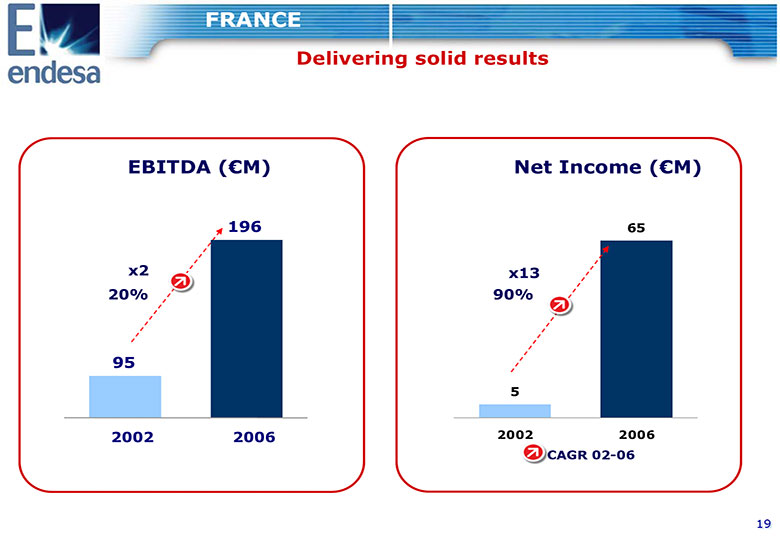

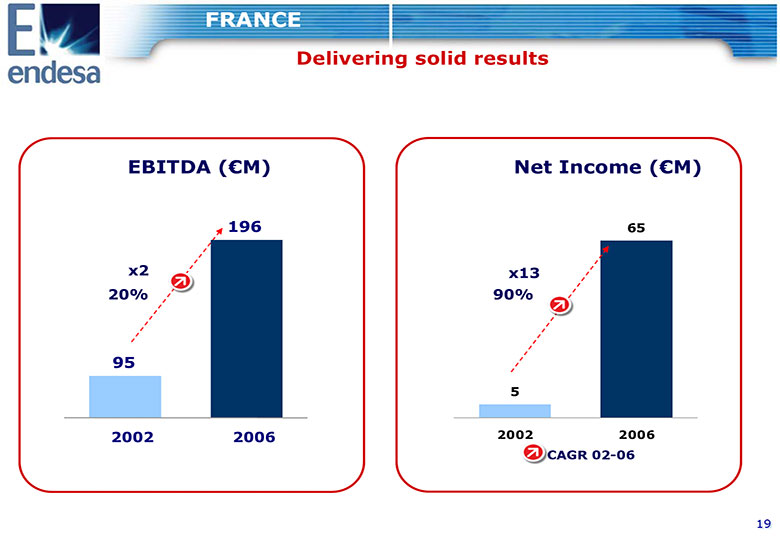

FRANCE Delivering solid results EBITDA ((euro)M) Net Income ((euro)M) 196 65 x2 x13 20% 90% 95 5 2002 2006 2002 2006 CAGR 02-06 19

FRANCE ENDESA France Endesa Europe has invested (euro)573M in France for the 65% of Endesa France Endesa France: Has paid out (euro)130M in dividends Has a net cash position of (euro) 350 M Has doubled EBITDA since 2002 to (euro)196M 20

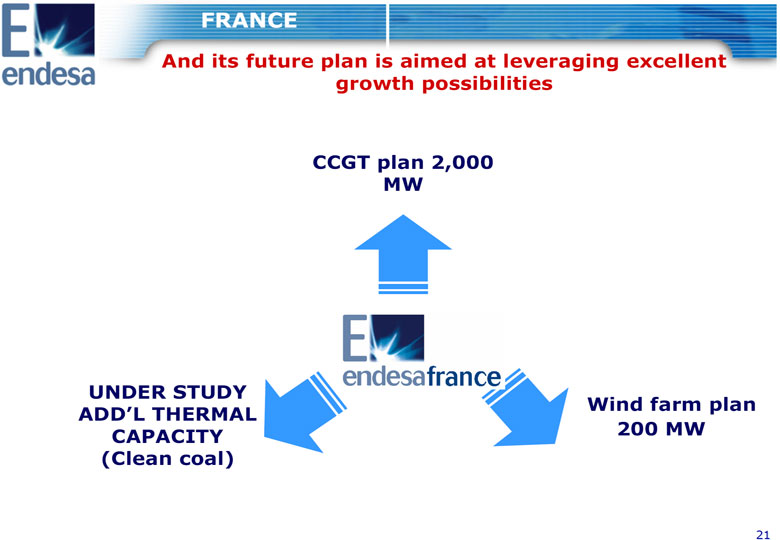

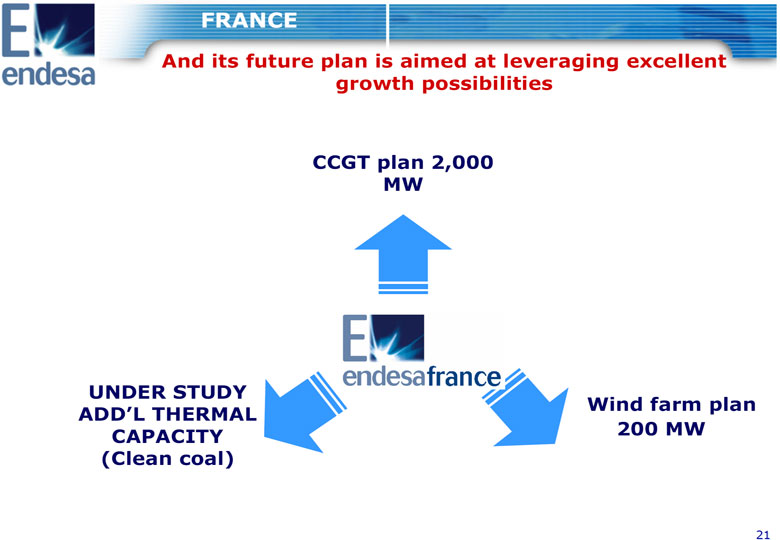

FRANCE And its future plan is aimed at leveraging excellent growth possibilities CCGT plan 2,000 MW (Clean coal) UNDER STUDY ADD’L THERMAL CAPACITY Wind farm plan 200 MW 21

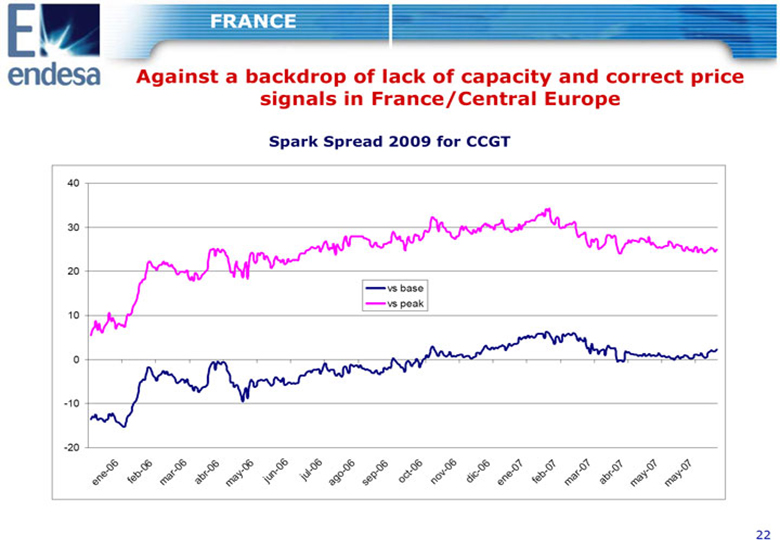

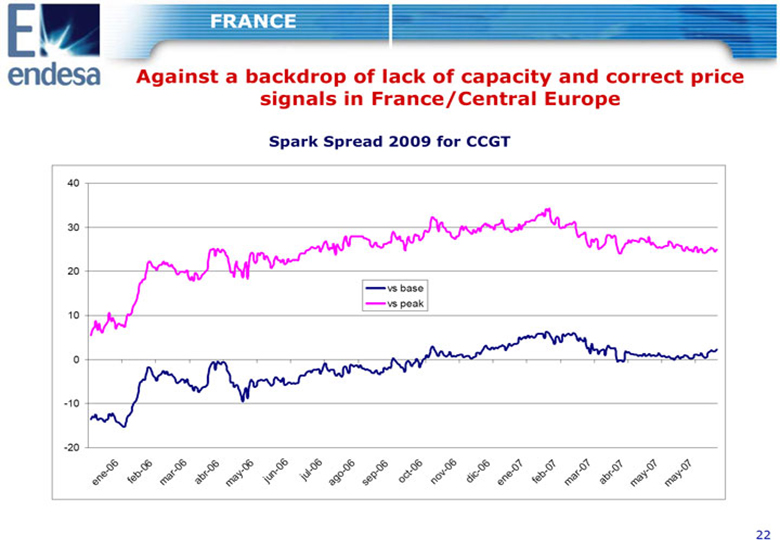

- -20 -10 0 10 20 30 40 ene- 06 feb- (0)6 mar- 06 ab r - 06 may- (0)6 j un -06 FRANCE j ul - 06 ag o- (0)6 sep- 06 oct -(0)6 vs peak vs base nov - 06 dic -06 Spark Spread 2009 for CCGT ene - 07 feb-07 mar- 07 abr signals in France/Central Europe - 07 may-07 may- (0)7 Against a backdrop of lack of capacity and correct price 22

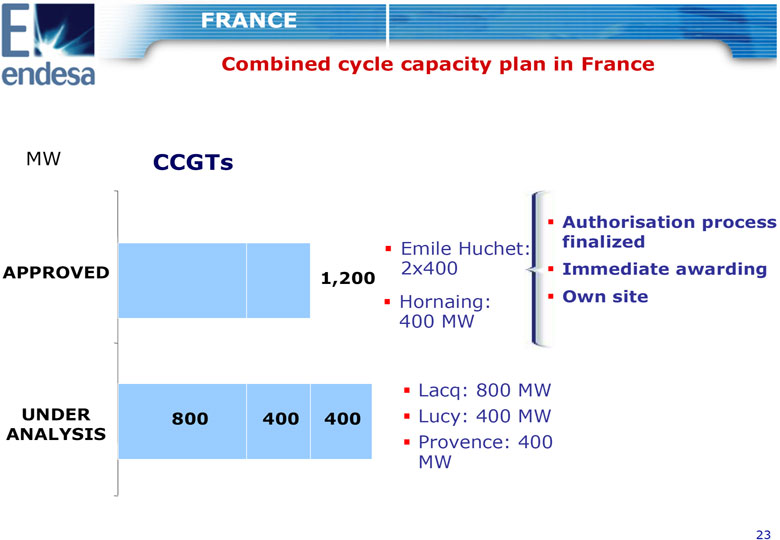

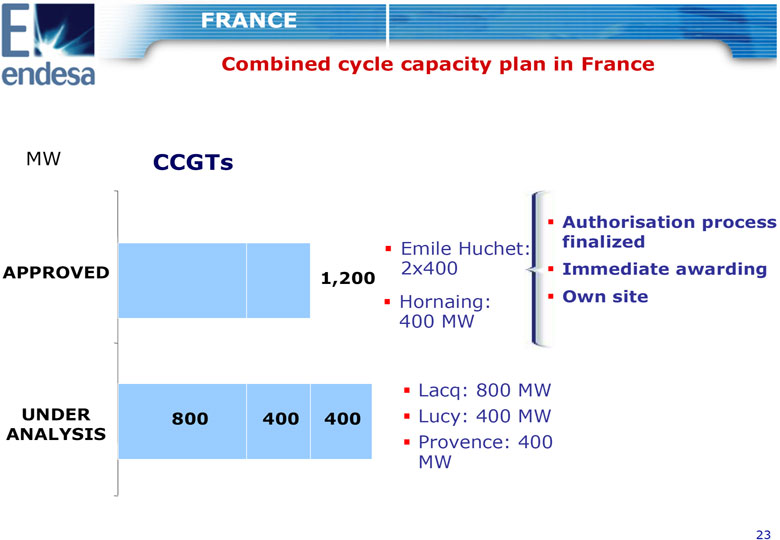

FRANCE Combined cycle capacity plan in France MW CCGTs Authorisation process Emile Huchet: finalized APPROVED 2x400 Immediate awarding 1,200 Hornaing: Own site 400 MW Lacq: 800 MW UNDER ANALYSIS 800 400 400 Lucy: 400 MW Provence: 400 MW 23

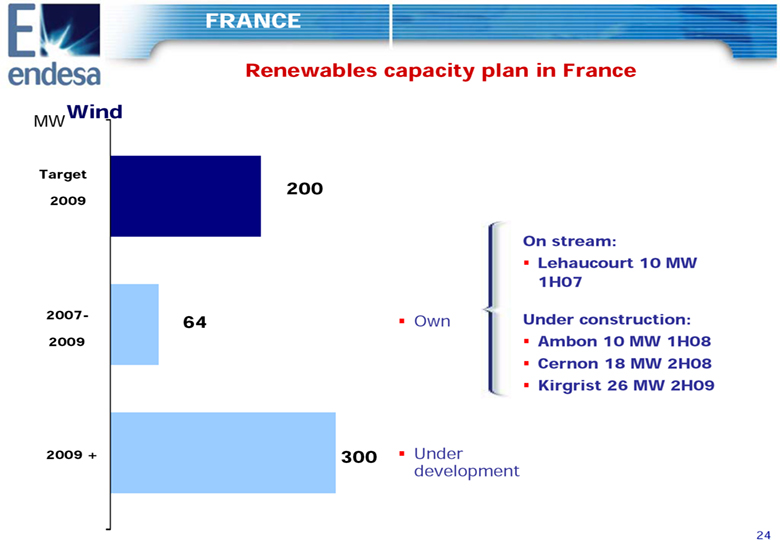

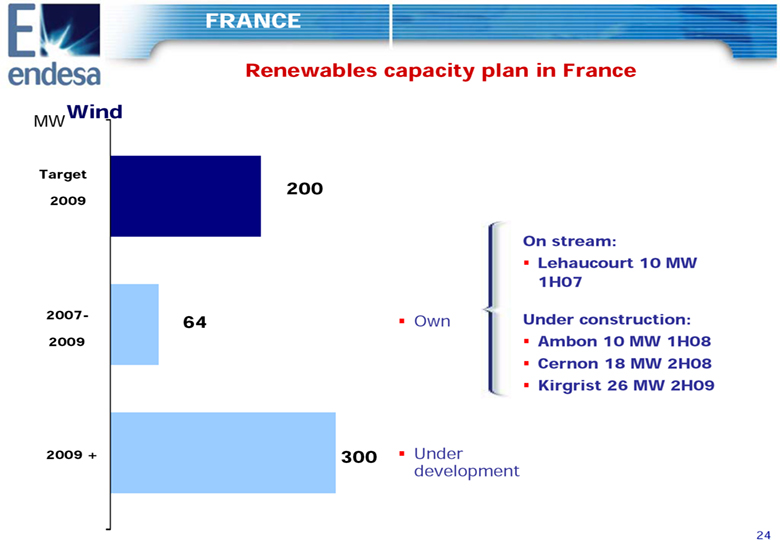

FRANCE Renewables capacity plan in France Wind MW Target 200 2009 On stream: Lehaucourt 10 MW 1H07 2007- 64 Own Under construction: 2009 Ambon 10 MW 1H08 Cernon 18 MW 2H08 Kirgrist 26 MW 2H09 2009 + 300 Under development 24

Endesa Europe's portfolio contains assets in different stages of value creation 2 4 1 Unique position to 3 6 access new 5 opportunities Mytilineos 2001 2004 2006 2009 2012 25

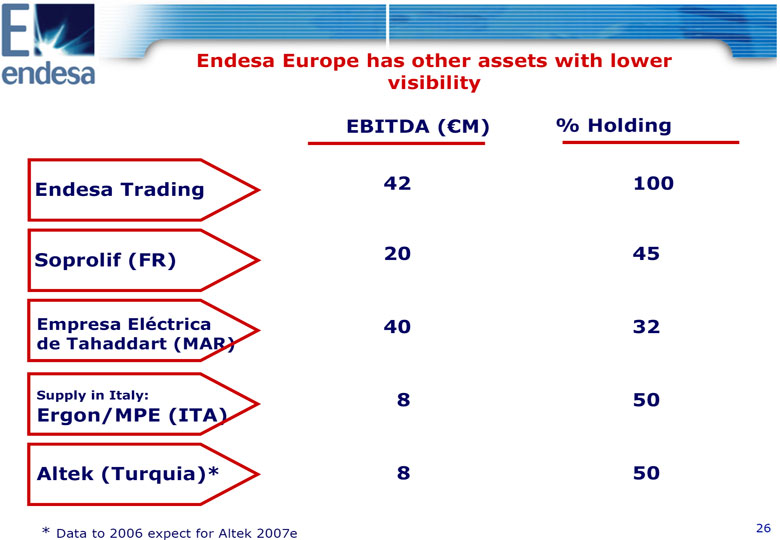

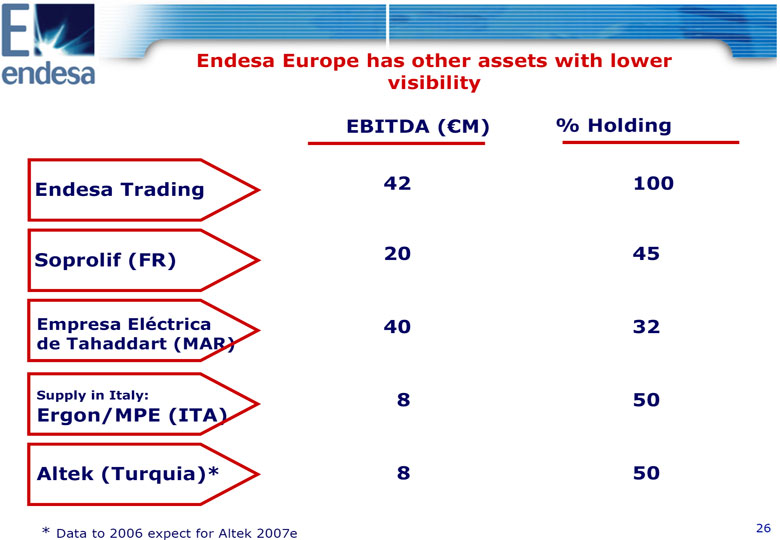

Endesa Europe has other assets with lower visibility EBITDA ((euro)M) % Holding Endesa Trading 42 100 Soprolif (FR) 20 45 Empresa Electrica 40 32 de Tahaddart (MAR) Supply in Italy: 8 50 Ergon/MPE (ITA) Altek (Turquia)* 8 50 * Data to 2006 expect for Altek 2007e 26

Endesa Europe's portfolio contains assets in different stages of value creation 2 4 1 Unique position to Elettrogen 3 6 access new 5 opportunities LA SNET Mytilineos 2001 2004 2006 2009 2012 27

ENDESA EUROPE: Focused on VALUE 1.- Sound and profitable asset base 2.- Track record in transformation 3.- Unique position to access a wide range of opportunities 28

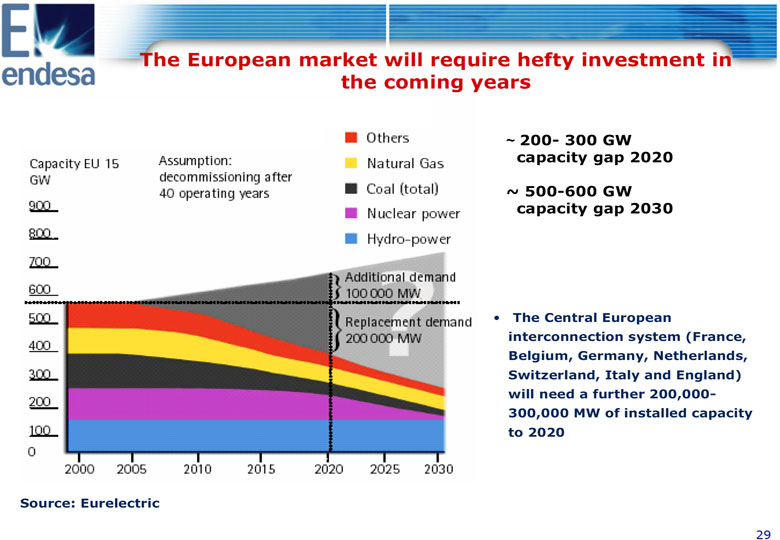

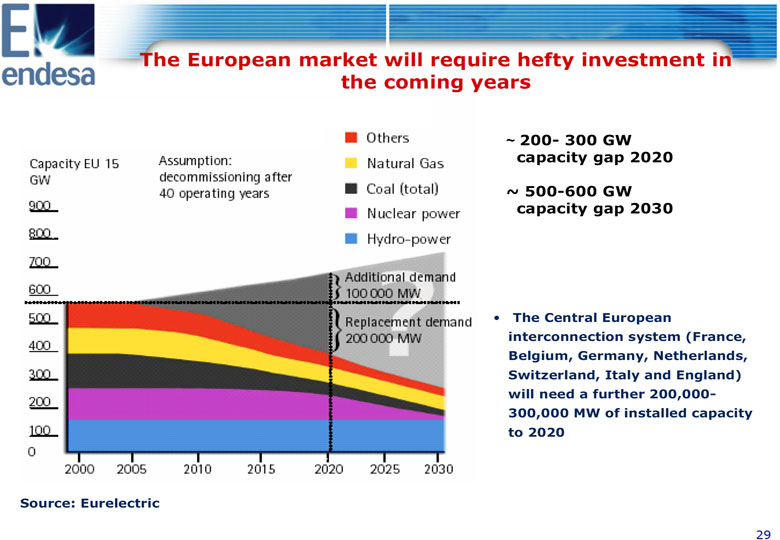

The European market will require hefty investment in the coming years ~ 200- 300 GW capacity gap 2020 ~ 500-600 GW capacity gap 2030 o The Central European interconnection system (France, Belgium, Germany, Netherlands, Switzerland, Italy and England) will need a further 200,000-300,000 MW of installed capacity to 2020 Source: Eurelectric 29

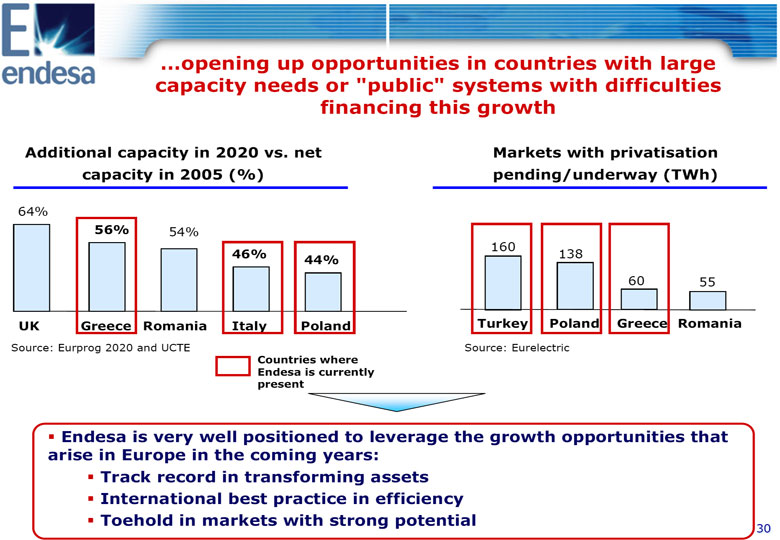

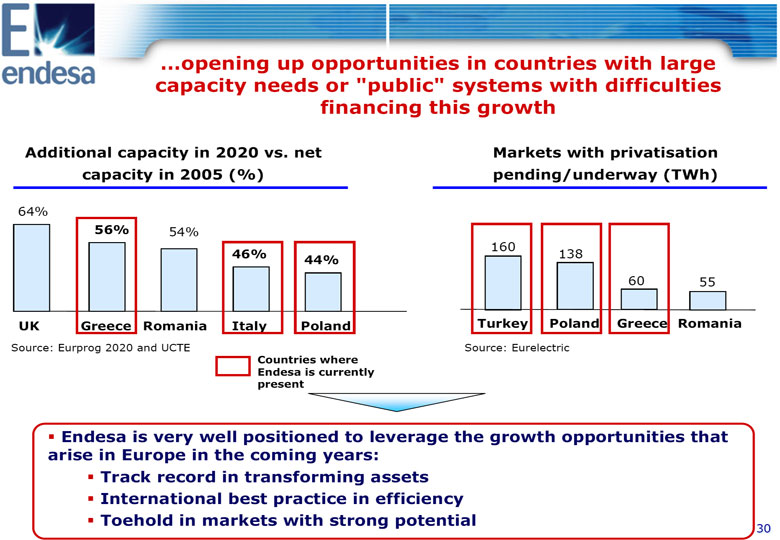

....opening up opportunities in countries with large capacity needs or "public" systems with difficulties financing this growth Additional capacity in 2020 vs. net Markets with privatisation capacity in 2005 (%) pending/underway (TWh) 64% 56% 54% 160 46% 44% 138 60 55 UK Greece Romania Italy Poland Turkey Poland Greece Romania Source: Eurprog 2020 and UCTE Source: Eurelectric Countries where Endesa is currently present Endesa is very well positioned to leverage the growth opportunities that arise in Europe in the coming years: Track record in transforming assets International best practice in efficiency Toehold in markets with strong potential 30

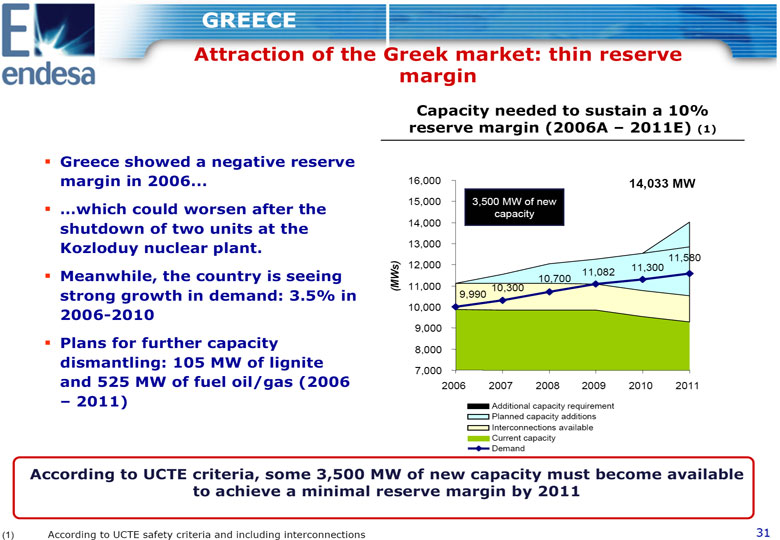

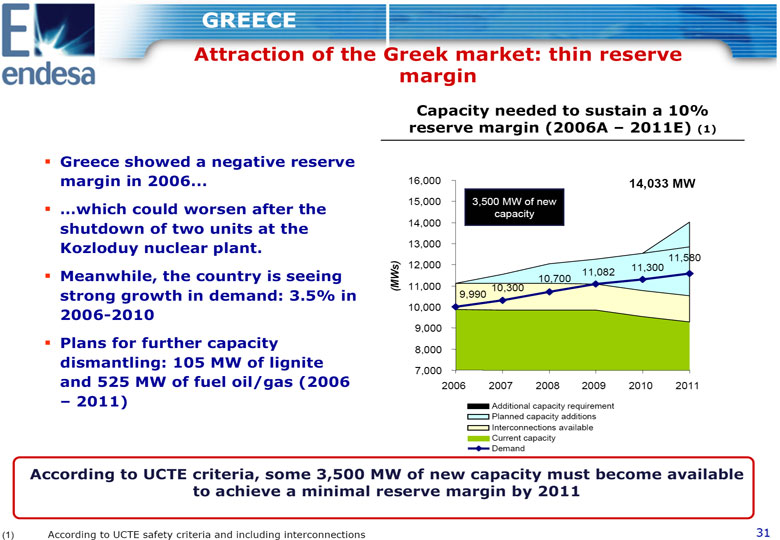

GREECE Attraction of the Greek market: thin reserve margin Capacity needed to sustain a 10% reserve margin (2006A - 2011E) (1) Greece showed a negative reserve margin in 2006... 16,000 14,033 MW 15,000 3,500 MW of new ...which could worsen after the capacity shutdown of two units at the 14,000 Kozloduy nuclear plant. 13,000 11,580 12,000 11,300 Meanwhile, the country is seeing 11,082 10,700 1,250 MW (MWs) 11,000 10,300 strong growth in demand: 3.5% in 9,990 2006-2010 10,000 9,000 Plans for further capacity 8,000 dismantling: 105 MW of lignite 7,000 and 525 MW of fuel oil/gas (2006 2006 2007 2008 2009 2010 2011 - 2011) Additional capacity requirement Planned capacity additions Interconnections available Current capacity Demand According to UCTE criteria, some 3,500 MW of new capacity must become available to achieve a minimal reserve margin by 2011 (1) According to UCTE safety criteria and including interconnections 31

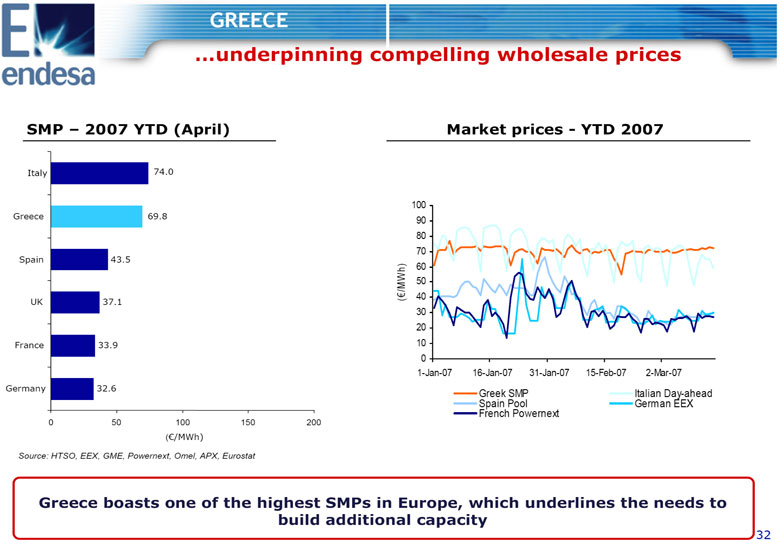

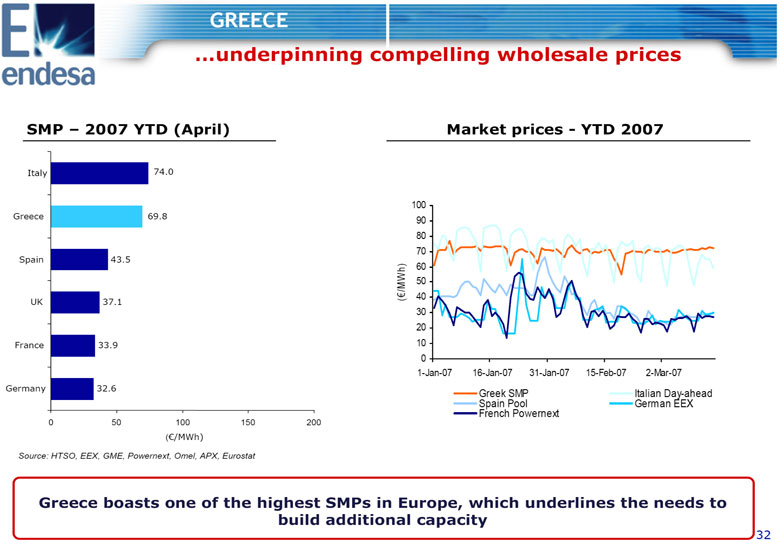

GREECE ...underpinning compelling wholesale prices SMP - 2007 YTD (April) Market prices - YTD 2007 Italy 74.0 100 Greece 69.8 90 80 70 Spain 43.5 60 50 ((euro)/M W h) 40 UK 37.1 30 20 France 33.9 10 0 1-Jan-07 16-Jan-07 31-Jan-07 15-Feb-07 2-Mar-07 Germany 32.6 Greek SMP Italian Day-ahead Spain Pool German EEX French Powernext 0 50 100 150 200 ((euro)/MWh) Source: HTSO, EEX, GME, Powernext, Omel, APX, Eurostat Greece boasts one of the highest SMPs in Europe, which underlines the needs to build additional capacity 32

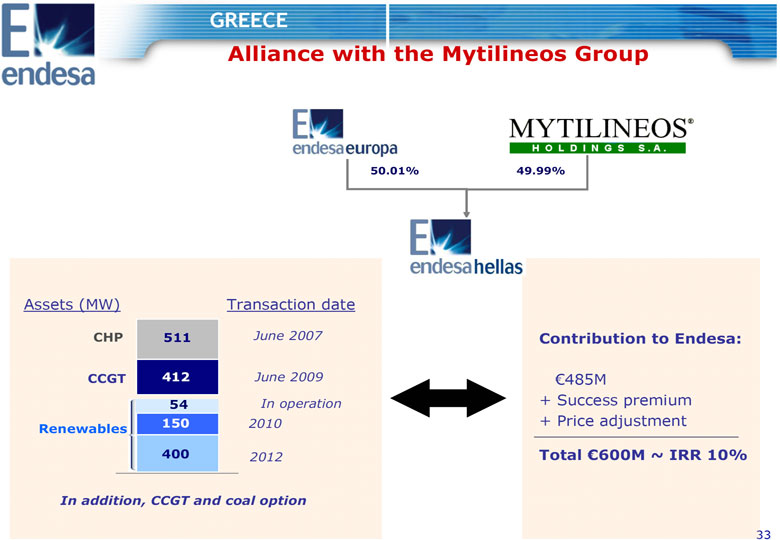

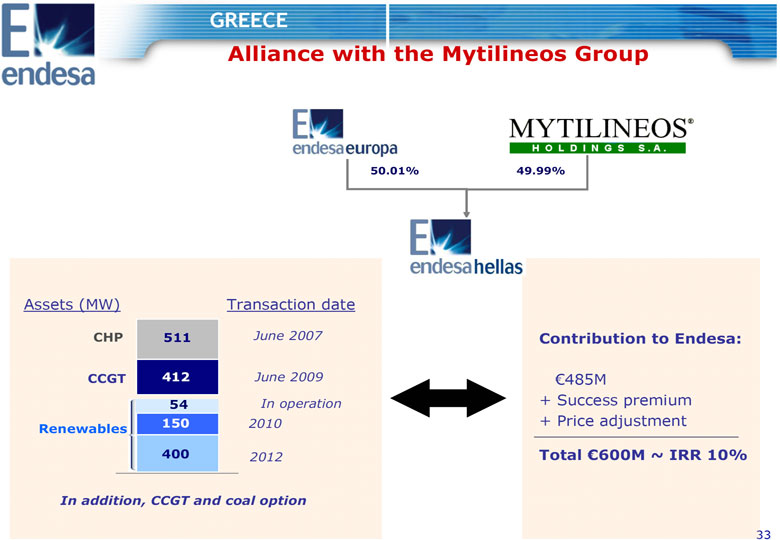

GREECE Alliance with the Mytilineos Group 50.01% 49.99% NEWCO Assets (MW) Transaction date CHP 511 June 2007 Contribution to Endesa: CCGT 412 June 2009 (euro)485M 54 In operation + Success premium 150 2010 + Price adjustment Renewables 400 2012 Total (euro)600M ~ IRR 10% In addition, CCGT and coal option 33

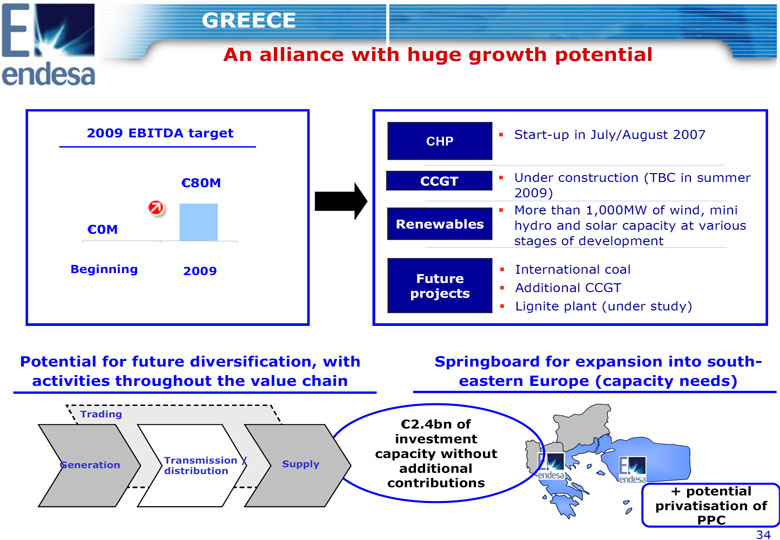

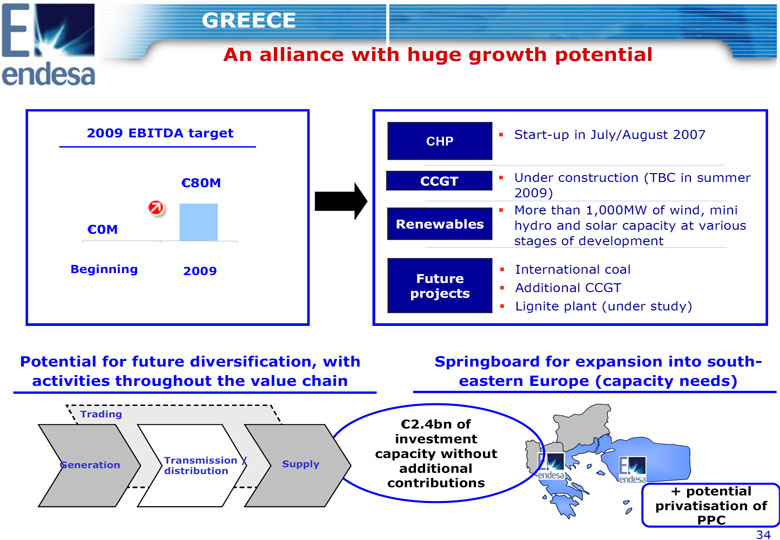

GREECE An alliance with huge growth potential 2009 EBITDA target Start-up in July/August 2007 CHP (euro)80M CCGT Under construction (TBC in summer 2009) More than 1,000MW of wind, mini (euro)0M Renewables hydro and solar capacity at various stages of development Beginning 2009 International coal Future projects Additional CCGT Lignite plant (under study) Potential for future diversification, with Springboard for expansion into south-activities throughout the value chain eastern Europe (capacity needs) Trading (euro)2.4bn of investment capacity without Generation Transmission / Supply distribution additional contributions + potential privatisation of PPC 34

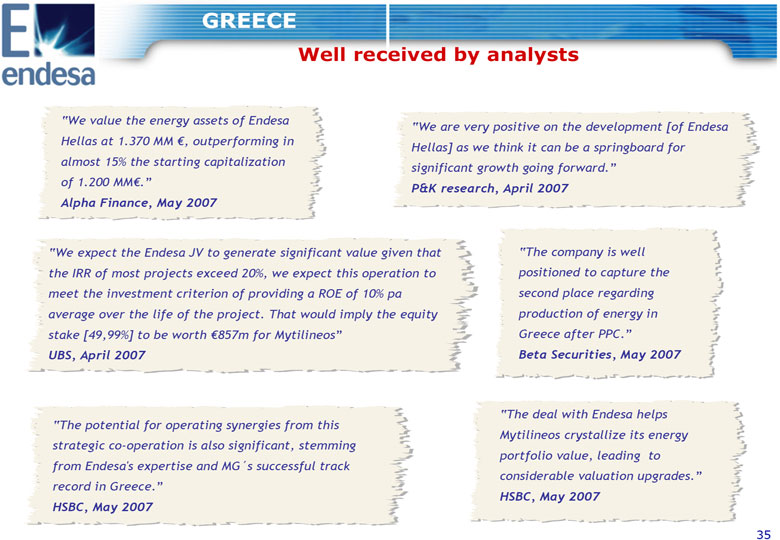

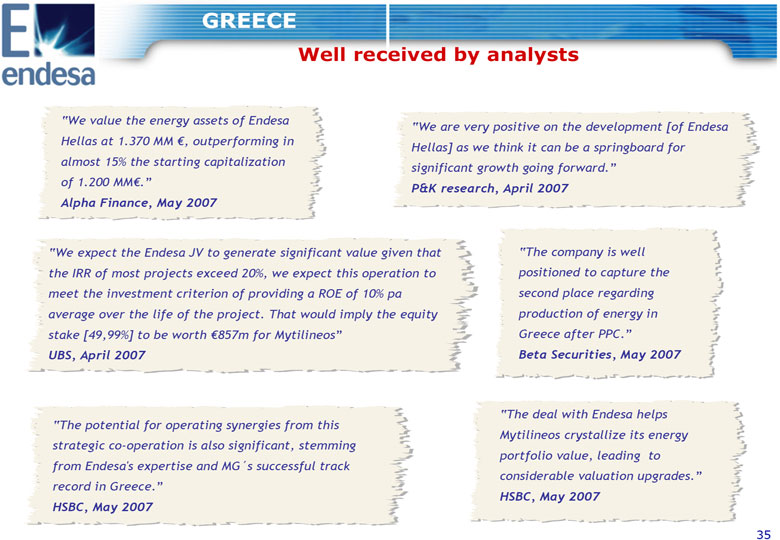

GREECE Well received by analysts "We value the energy assets of Endesa "We are very positive on the development [of Endesa Hellas at 1.370 MM (euro), outperforming in Hellas] as we think it can be a springboard for almost 15% the starting capitalization significant growth going forward." of 1.200 MM(euro)." P&K research, April 2007 Alpha Finance, May 2007 "We expect the Endesa JV to generate significant value given that "The company is well the IRR of most projects exceed 20%, we expect this operation to positioned to capture the meet the investment criterion of providing a ROE of 10% pa second place regarding average over the life of the project. That would imply the equity production of energy in stake [49,99%] to be worth (euro)857m for Mytilineos" Greece after PPC." UBS, April 2007 Beta Securities, May 2007 "The deal with Endesa helps "The potential for operating synergies from this Mytilineos crystallize its energy strategic co-operation is also significant, stemming portfolio value, leading to from Endesa's expertise and MG's successful track considerable valuation upgrades." record in Greece." HSBC, May 2007 HSBC, May 2007 35

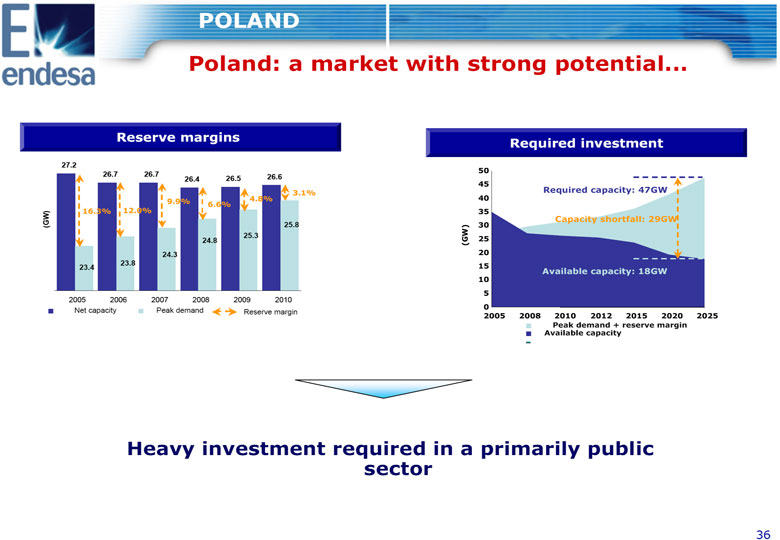

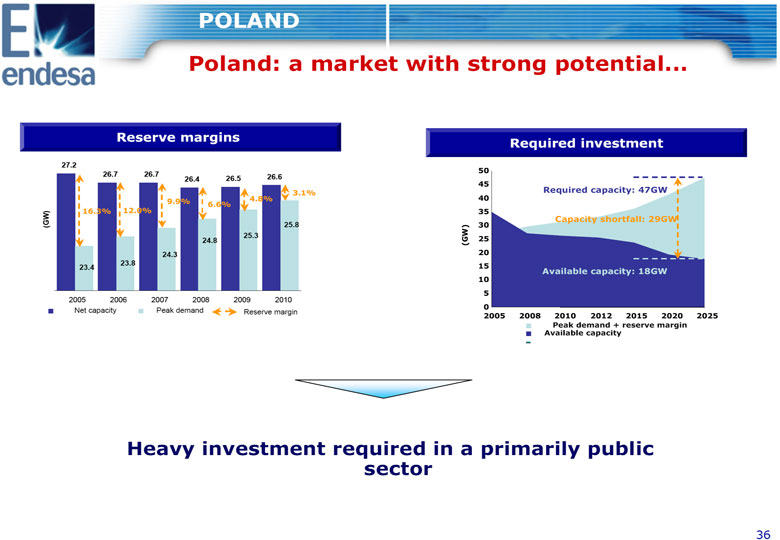

POLAND Poland: a market with strong potential... Reserve margins Required investment 27.2 50 26.7 26.7 26.6 26.426.5 45 3.1% Required capacity: 47GW 9.9% 4.8% 40 6.6% 16.3% 12.0% 35 Capacity shortfall: 29GW (GW) 25.8 30 25.3 25 24.8 (GW) 24.3 20 23.8 15 23.4 Available capacity: 18GW 10 5 2005 2006 2007 2008 2009 2010 0 Net capacity Peak demand Reserve margin 2005 2008 2010 2012 2015 2020 2025 Peak demand + reserve margin Available capacity Heavy investment required in a primarily public sector 36

POLAND ...where Endesa already has operations Ongoing efficiency improvement policy Byalistock Becoming profit-making and paying its first dividends Technical transformation underway to burn biomass in its boilers Poland's renewable targets are ambitious and require huge investment Renewables in both wind power and biomass over the coming years A number of the current facilities are old and their useful lives will end Repowering in the next few years Scope for private capital to fund the repowering of these units Poland boasts large coal reserves (hard coal and lignite) Greenfields "Room" for new plants The Polish government has mentioned the privatisation scheme often Privatisations (but not carried it out) The aim is to create four integrated utilities and possibly sell controlling interests in the two smallest ones 37

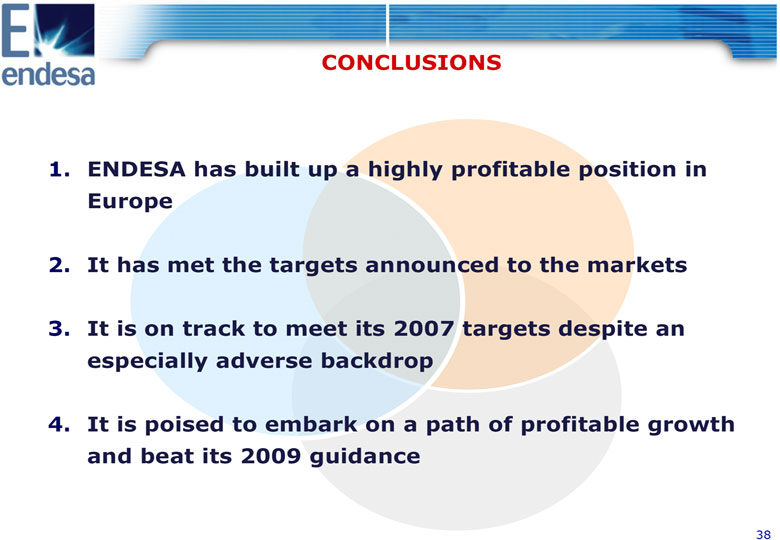

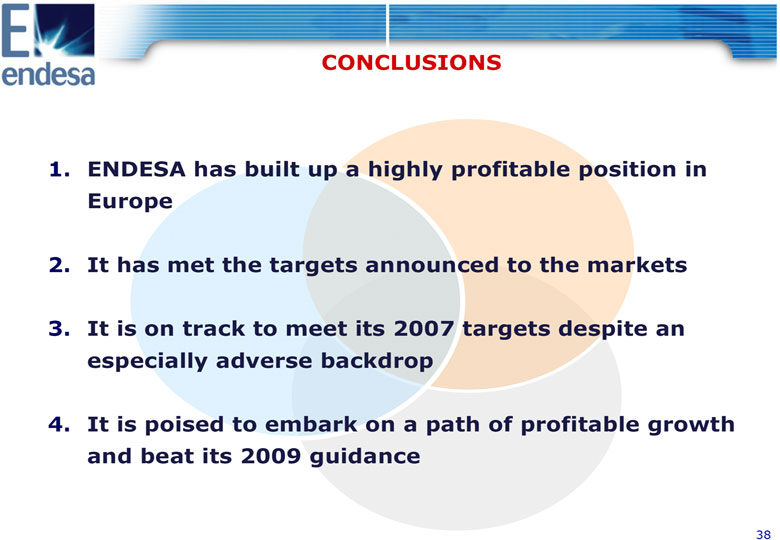

CONCLUSIONS 1. ENDESA has built up a highly profitable position in Europe 2. It has met the targets announced to the markets 3. It is on track to meet its 2007 targets despite an especially adverse backdrop 4. It is poised to embark on a path of profitable growth and beat its 2009 guidance 38

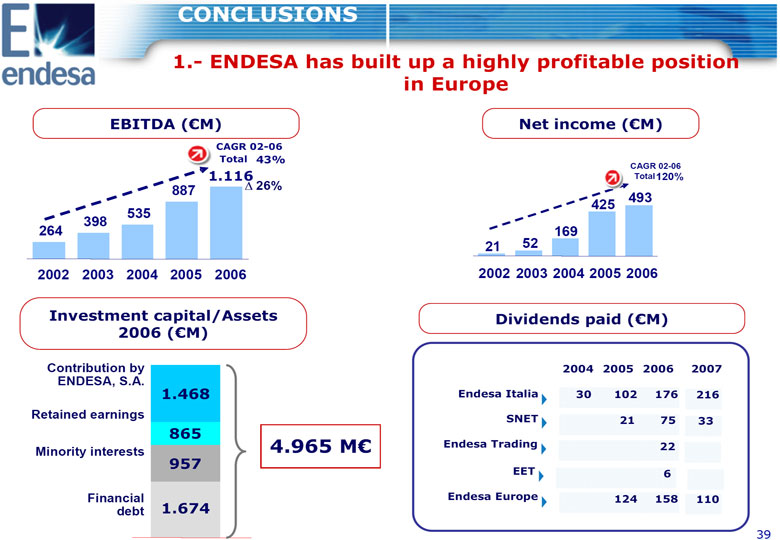

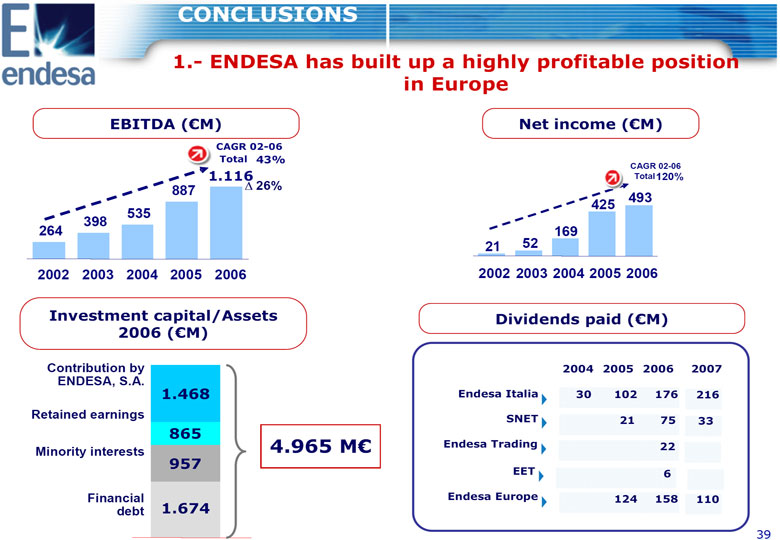

CONCLUSIONS 1.- ENDESA has built up a highly profitable position in Europe EBITDA ((euro)M) Net income ((euro)M) CAGR 02-06 Total 43% CAGR 02-06 1.116 Total120% 887 26% 493 425 535 398 264 169 21 52 2002 2003 2004 2005 2006 2002 2003 2004 2005 2006 Investment capital/Assets Dividends paid ((euro)M) 2006 ((euro)M) Contribution by 2004 2005 2006 2007 ENDESA, S.A. 1.468 Endesa Italia 30 102 176 216 Retained earnings SNET 21 75 33 865 4.965 M(euro) Endesa Trading 22 Minority interests 957 EET 6 Financial Endesa Europe 124 158 110 debt 1.674 39

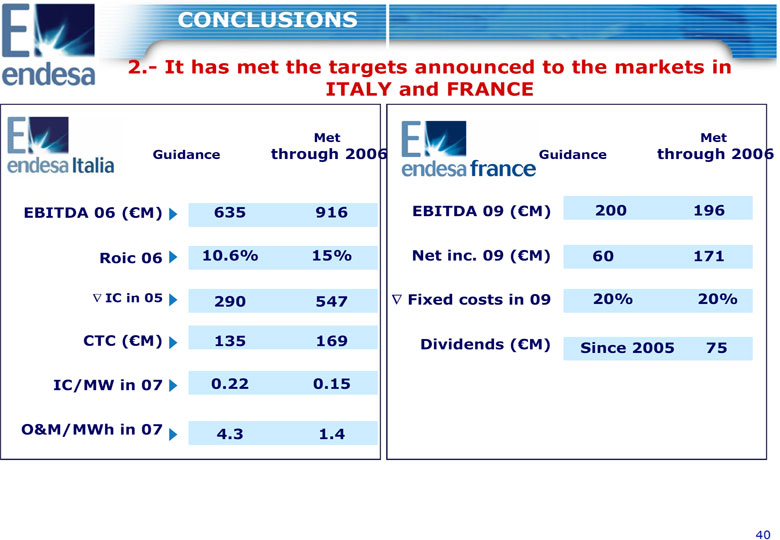

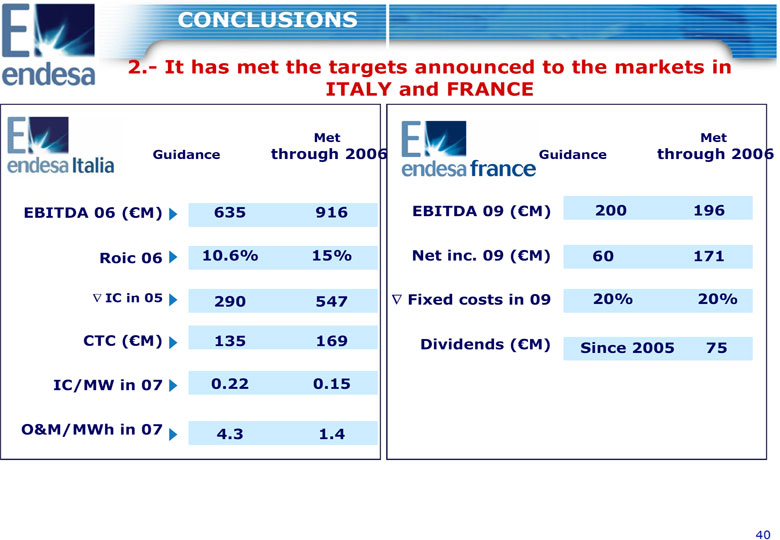

CONCLUSIONS 2.- It has met the targets announced to the markets in ITALY and FRANCE Met Met Guidance through 2006 Guidance through 2006 EBITDA 06 ((euro)M) 635 916 EBITDA 09 ((euro)M) 200 196 Roic 06 10.6% 15% Net inc. 09 ((euro)M) 60 171 IC in 05 290 547 Fixed costs in 09 20% 20% CTC ((euro)M) 135 169 Dividends ((euro)M) Since 2005 75 IC/MW in 07 0.22 0.15 O&M/MWh in 07 4.3 1.4 40

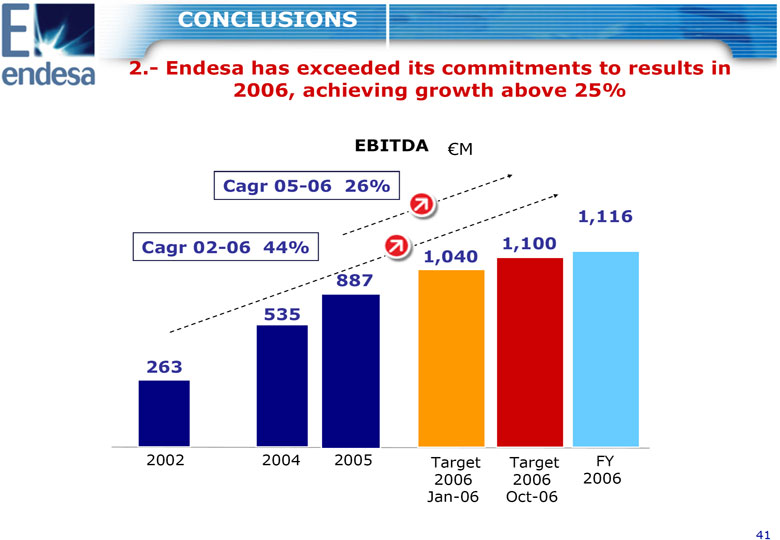

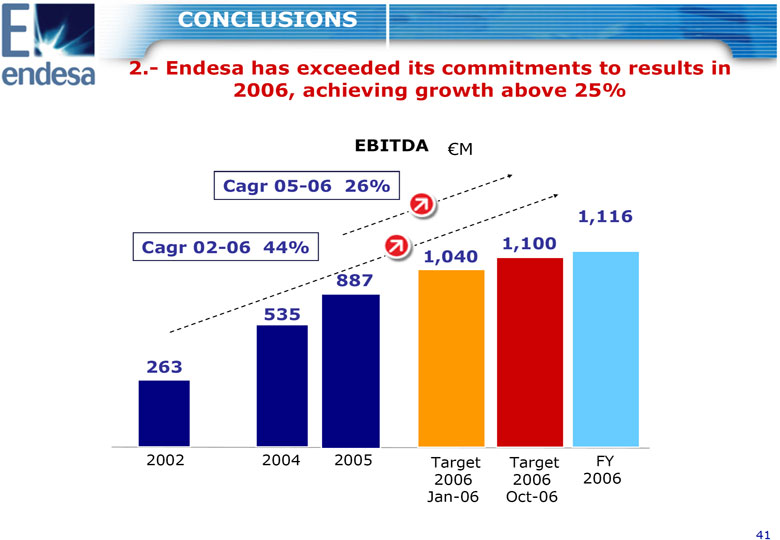

CONCLUSIONS 2.- Endesa has exceeded its commitments to results in 2006, achieving growth above 25% EBITDA (euro)M Cagr 05-06 26% 1,116 Cagr 02-06 44% 1,100 1,040 887 535 702 263 2002 2004 2005 Target Target FY 2006 2006 2006 Jan-06 Oct-06 41

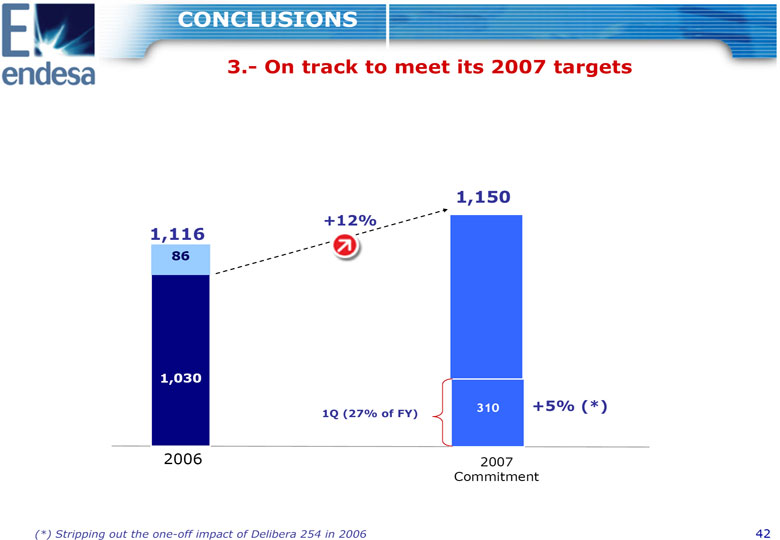

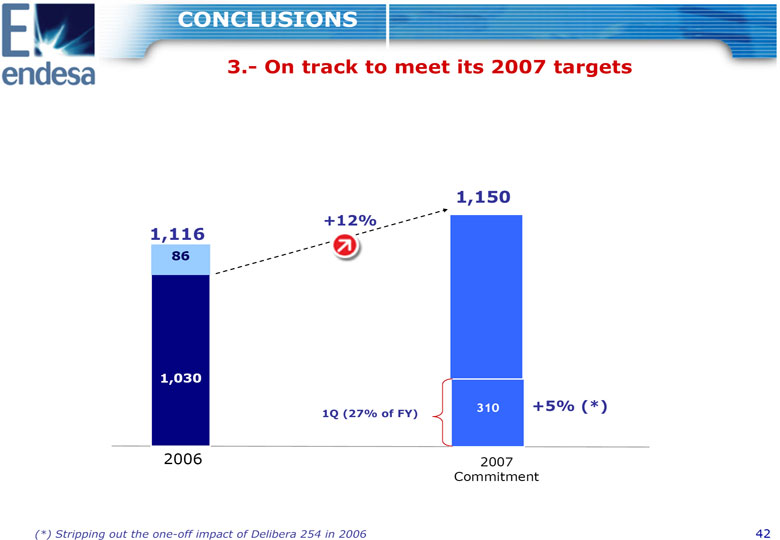

CONCLUSIONS 3.- On track to meet its 2007 targets 1,150 +12% 1,116 86 1,030 310 +5% (*) 1Q (27% of FY) 2006 2007 Commitment (*) Stripping out the one-off impact of Delibera 254 in 2006 42

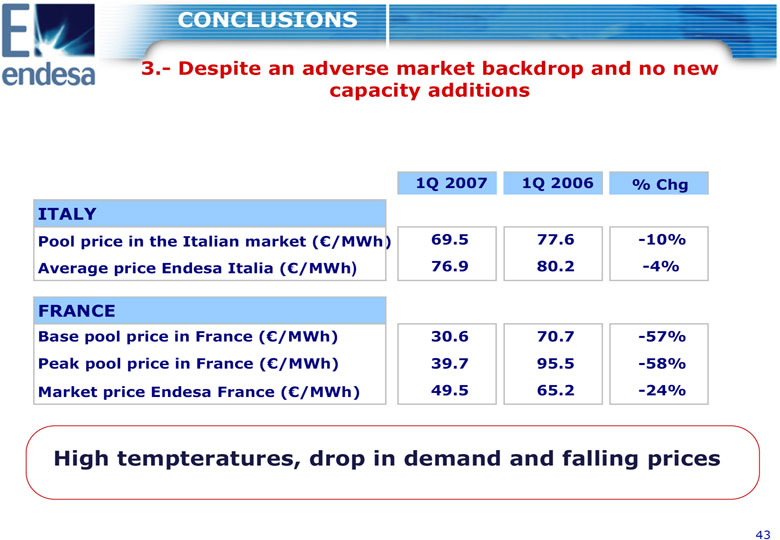

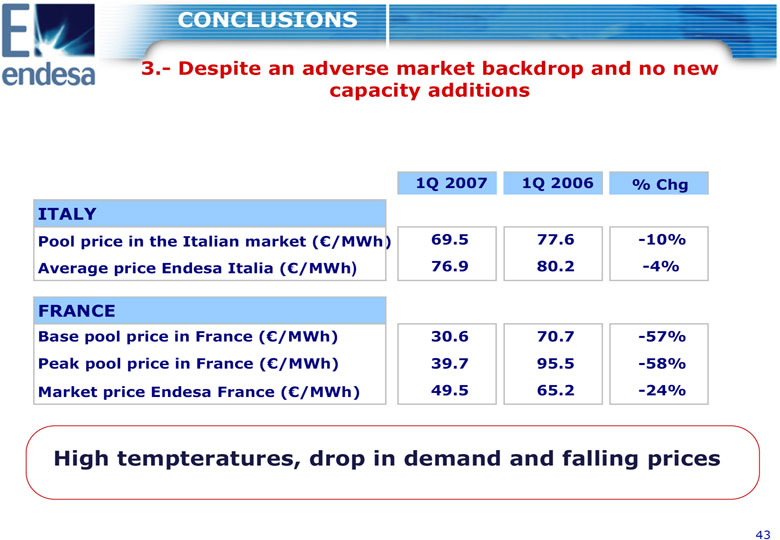

CONCLUSIONS 3.- Despite an adverse market backdrop and no new capacity additions 1Q 2007 1Q 2006 % Chg ITALY Pool price in the Italian market ((euro)/MWh) 69.5 77.6 -10% Average price Endesa Italia ((euro)/MWh) 76.9 80.2 -4% FRANCE Base pool price in France ((euro)/MWh) 30.6 70.7 -57% Peak pool price in France ((euro)/MWh) 39.7 95.5 -58% Market price Endesa France ((euro)/MWh) 49.5 65.2 - -24% High tempteratures, drop in demand and falling prices 43

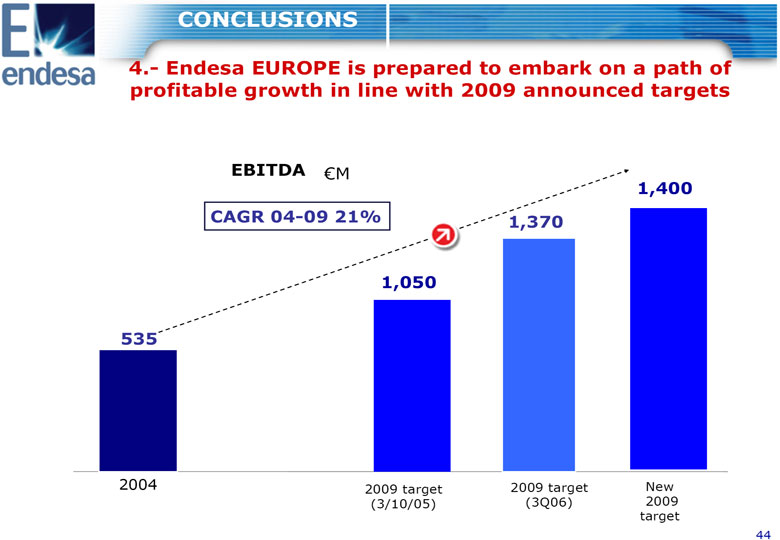

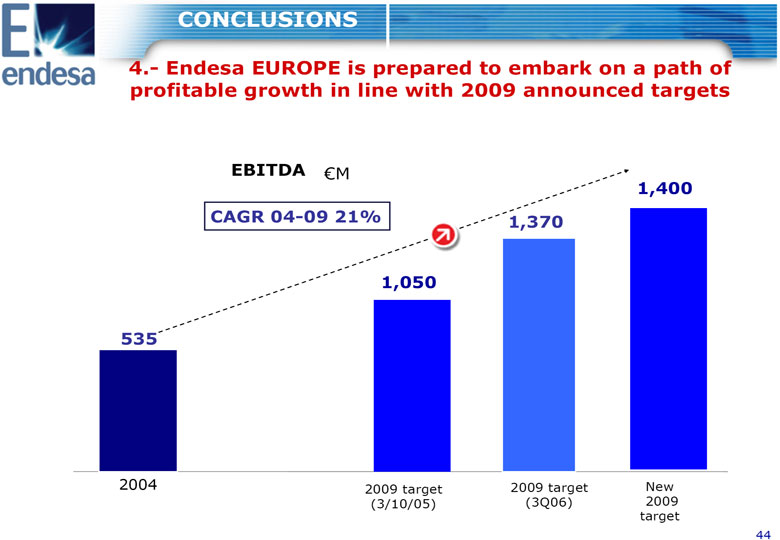

CONCLUSIONS 4.- Endesa EUROPE is prepared to embark on a path of profitable growth in line with 2009 announced targets EBITDA (euro)M 1,400 CAGR 04-09 21% 1,370 1,050 535 702 2004 2009 target 2009 target New (3/10/05) (3Q06) 2009 target 44

Legal information This document was made available to shareholders of Endesa, S.A.. In relation with the announced joint offer by ENEL SpA and Acciona, S.A., Endesa shareholders are urged to read the report of Endesa's board of directors when it is filed by the Company with the Comision Nacional del Mercado de Valores (the "CNMV"), as well as Endesa's Solicitation/Recommendation Statement on Schedule 14D-9 when it is filed by the Company with the U.S. Securities and Exchange Commission (the "SEC"), as it will contain important information. Such documents and other public filings made from time to time by Endesa with the CNMV or the SEC are available without charge from the Endesa's website at www.endesa.es, from the the CNMV's website at www.cnmv.es and from the SEC's website at www.sec.gov and at Endesa's principal executive offices in Madrid, Spain. This presentation contains certain "forward-looking" statements regarding anticipated financial and operating results and statistics and other future events. These statements are not guarantees of future performance and they are subject to material risks, uncertainties, changes and other factors that may be beyond ENDESA's control or may be difficult to predict. Forward-looking statements include, but are not limited to, information regarding: estimated future earnings; anticipated increases in wind and CCGTs generation and market share; expected increases in demand for gas and gas sourcing; management strategy and goals; estimated cost reductions; tariffs and pricing structure; estimated capital expenditures and other investments; estimated asset disposals; estimated increases in capacity and output and changes in capacity mix; repowering of capacity and macroeconomic conditions. For example, the investment plan for 2007-2009 included in this presentation are forward-looking statements and are based on certain assumptions which may or may not prove correct. The main assumptions on which these expectations and targets are based are related to the regulatory setting, exchange rates, divestments, increases in production and installed capacity in markets where ENDESA operates, increases in demand in these markets, assigning of production amongst different technologies, increases in costs associated with higher activity that do not exceed certain limits, electricity prices not below certain levels, the cost of CCGT plants, and the availability and cost of the gas, coal, fuel oil and emission rights necessary to run our business at the desired levels. In these statements we avail ourselves of the protection provided by the Private Securities Litigation Reform Act of 1995 of the United States of America with respect to forward-looking statements. The following important factors, in addition to those discussed elsewhere in this presentation, could cause actual financial and operating results and statistics to differ materially from those expressed in our forward-looking statements: Economic and industry conditions: significant adverse changes in the conditions of the industry, the general economy or our markets; the effect of the prevailing regulations or changes in them; tariff reductions; the impact of interest rate fluctuations; the impact of exchange rate fluctuations; natural disasters; the impact of more restrictive environmental regulations and the environmental risks inherent to our activity; potential liabilities relating to our nuclear facilities. Transaction or commercial factors: any delays in or failure to obtain necessary regulatory, antitrust and other approvals for our proposed acquisitions or asset disposals, or any conditions imposed in connection with such approvals; our ability to integrate acquired businesses successfully; the challenges inherent in diverting management's focus and resources from other strategic opportunities and from operational matters during the process of integrating acquired businesses; the outcome of any negotiations with partners and governments. Delays in or impossibility of obtaining the pertinent permits and rezoning orders in relation to real estate assets. Delays in or impossibility of obtaining regulatory authorisation, including that related to the environment, for the construction of new facilities, repowering or improvement of existing facilities; shortage of or changes in the price of equipment, material or labour; opposition of political or ethnic groups; adverse changes of a political or regulatory nature in the countries where we or our companies operate; adverse weather conditions, natural disasters, accidents or other unforeseen events, and the impossibility of obtaining financing at what we consider satisfactory interest rates. Political/governmental factors: political conditions in Latin America; changes in Spanish, European and foreign laws, regulations and taxes. Operating factors: technical problems; changes in operating conditions and costs; capacity to execute cost-reduction plans; capacity to maintain a stable supply of coal, fuel and gas and the impact of the price fluctuations of coal, fuel and gas; acquisitions or restructuring; capacity to successfully execute a strategy of internationalisation and diversification. Competitive factors: the actions of competitors; changes in competition and pricing environments; the entry of new competitors in our markets. Further details on the factors that may cause actual results and other developments to differ significantly from the expectations implied or explicitly contained in the presentation are given in the Risk Factors section of Form 20-F filed with the SEC and in the ENDESA Share Registration Statement filed with the Comision Nacional del Mercado de Valores (the Spanish securities regulator or the "CNMV" for its initials in Spanish).No assurance can be given that the forward-looking statements in this document will be realised. Except as may be required by applicable law, neither Endesa nor any of its affiliates intends to update these forward-looking statements. 45

Endesa Europe Jesus Olmos Clavijo General Manager Europe Valencia, 25 June 2007