As the result of investment decisions in the ordinary course of business, MCM has periodically invested client account assets including Fund assets in shares of Goldman Sachs Group, Inc. (“GSG”), the parent company of Goldman and various affiliates, including at times during 2007 and prior years. MCM client accounts’ holdings in GSG’s stock have at times made those accounts in the aggregate among the largest investors in GSG. MCM expects that it may (or may not) continue to view investment in GSG’s common stock as an investment opportunity for its clients including the Funds, and may buy (or sell) shares of GSG’s common stock for client accounts from time to time as the result of investment decisions made in the ordinary course of MCM’s investment management process. MCM has informed the Board that decisions to buy or sell shares of GSG’s stock for client accounts including the Funds will not be made as a result of the Transaction or because of the ownership by Goldman or its affiliates of interests in Marsico Parent Companies, but will reflect MCM’s independent investment decisions in the ordinary course of business which MCM believes to be in the best interests of its clients.

Also as the result of investment decisions in the ordinary course of business, MCM has from time to time purchased securities for clients in syndicated offerings underwritten by dealers that included Goldman. MCM expects that it will continue this practice in the future. MCM has informed the Board that decisions to purchase securities from underwriting syndicates that include Goldman will not be made as a result of the Transaction or because of the ownership by Goldman or its affiliates of interests in Marsico Parent Companies, but will reflect MCM’s independent investment decisions in the ordinary course of business which MCM believes to be in the best interests of its clients.

Each Fund’s New Investment Advisory and Management Agreement is identical to its Current Investment Advisory and Management Agreement in all material respects. Both the Current and New Investment Advisory and Management Agreements provide that, subject to the supervision of the Funds’ Board of Trustees, MCM will provide the Funds with continuing investment management services. MCM, as the investment adviser, manages the investment operations of the Funds and the composition of each Fund’s portfolio, including the purchase, retention and disposition thereof, in accordance with each Fund’s investment goals and policies. In so doing, MCM agrees to provide supervision of the Funds’ investments and to determine from time to time what investments or securities will be purchased, retained, sold or loaned by each Fund, and what portion of the assets will be invested or held uninvested in cash; act in conformity with the Funds’ Trust Instrument, By-Laws and Registration Statement (including the Prospectus), and with the instructions and directions of the Board of the Trust; conform and comply with the requirements of the 1940 Act and all other applicable federal and state laws and regulations; maintain all books and records required to be maintained under the 1940 Act by an investment adviser to a registered investment company; render to the Board such periodic and special reports that the Board may reasonably request; and provide to the custodian of the Funds on each business day information relating to all transactions concerning the Funds’ assets.

Further, MCM determines the securities to be purchased or sold by the Funds and places orders pursuant to its determinations with or through such brokers, dealers, or alternative trading systems (including electronic communications networks) (individually, a “broker” and collectively, “brokers”) in conformity with the brokerage policy described in the Funds’ Registration Statement and Prospectus or as the Board may direct from time to time.

In selecting a broker to execute each particular transaction, MCM takes a variety of factors into consideration, which may include, without limitation: the best execution available based on considerations including the net price and other factors; the commissions or spreads charged; the reliability, expertise, integrity and financial condition of the broker; the size of the order and difficulty in executing it; the possible availability of broker capital to assist in execution; block trading capability, the use of brokerage credits to reduce non-distribution-related administrative service expenses as contemplated in a Board-approved commission recapture program; and the value of the expected provision by the broker of client commission benefits such as research and brokerage services that may benefit the Fund or other clients of MCM.

Under the Current and New Investment Advisory and Management Agreements, MCM agrees to pay the salaries and expenses of all of its personnel and all expenses incurred by it arising out of its duties under such Agreement. In return for the services provided by MCM as the investment adviser to the Funds, and the expenses it assumes under the Current Investment Advisory and Management Agreements, each Fund pays MCM an investment advisory fee. Under the Current and New Investment Advisory and Management Agreements, the advisory fee for each Fund other than the Focus Fund and the Growth Fund payable to MCM is 0.85% per year of that Fund’s average daily net assets. The advisory fee for the Focus Fund and the Growth Fund payable to MCM is 0.85% per year of that Fund’s average daily net assets up to $3 billion, and 0.75% per year of average daily net assets exceeding $3 billion. By separate written agreement (“Expense Limitation Agreement”), which has been approved by the Board of Trustees, MCM has voluntarily agreed to temporarily limit the total expenses of each Fund (excluding interest, taxes, acquired fund expenses, litigation, brokerage and extraordinary expenses) so that total expenses paid by the Focus Fund, the Growth Fund, the 21st Century Fund, the International Fund, the Flexible Capital Fund and the Global Fund do not exceed 1.60%, 1.50%, 1.50%, 1.60% 0.75% and 0.75% of their respective average daily net assets. The Expense Limitation Agreement remains in effect until December 31, 2007. To the extent that the total operating expenses accrued by a Fund during a month are less than the expense limitation set forth above, the Expense Limitation Agreement provides that MCM may recoup any previously waived amount from a Fund subject to certain conditions.

During the fiscal year ended September 30, 2006, the fees paid to MCM under the Current Investment Advisory and Management Agreement amounted to $35,162,884 from the Focus Fund, and $20,132,147 from the Growth Fund, $4,802,010 from the 21st Century Fund and $3,585,790 from the International Opportunities Fund.2 The Flexible Capital Fund and the Global Fund commenced operations on December 29, 2006 and June 29, 2007, respectively.

Under each Current Investment Advisory and Management Agreement, MCM is permitted to provide investment advisory services to other clients.

Each Agreement may be terminated at any time, without payment of penalty, on 60 days’ written notice by the Board or by vote of holders of a majority of the outstanding voting securities of each Fund, or by MCM upon 90 days’ written notice. Each Agreement automatically terminates in the event of its assignment (as defined in the 1940 Act).

____________________

| 2 | | During the fiscal year ended September 30, 2006, MCM recovered previously waived fees of $101,374, from the International Opportunities Fund, pursuant to the Expense Limitation Agreement with the Fund. This fee reimbursement is not included in the $3,585,790 assessed for advisory services to that Fund. |

12

Each Current and New Investment Advisory and Management Agreement provides that MCM is not liable for any error of judgment, mistake of law, or any loss suffered by the Funds or Fund shareholders, in connection with matters to which the Agreements relate, except a loss resulting from willful misfeasance, bad faith or gross negligence on the part of MCM in the performance of its duties or from reckless disregard by MCM of its obligations and duties under the Agreements.

MCM has acted as the investment manager for the Funds since the Focus Fund and Growth Fund commenced operations on December 31, 1997, the 21st Century Fund commenced operations on February 1, 2000, the International Opportunities Fund commenced operations on June 30, 2000, the Flexible Capital Fund commenced operations on December 29, 2006, and the Global Fund commenced operations on June 29, 2007. The Current Investment Advisory and Management Agreements for each of the Focus Fund, Growth Fund, 21st Century Fund and International Opportunities Fund are dated January 2, 2001, as amended November 11, 2004, and were last approved by the Board of Trustees at an in-person meeting held on November 8, 2006 and by shareholders, in accordance with the requirements of the 1940 Act, on November 9, 2000. They continue in effect until December 31, 2007. The Current Investment Advisory and Management Agreement for the Flexible Capital Fund is dated December 19, 2006 and was initially approved by the Board of Trustees at an in-person meeting held on November 8, 2006 and by the initial sole shareholder on December 20, 2006. It continues in effect until December 28, 2008. The Current Investment Advisory and Management Agreement for the Global Fund is dated June 25, 2007 and was initially approved by the Board of Trustees at an in-person meeting held on February 7, 2007 and by the initial sole shareholder on June 25, 2007. It continues in effect until June 28, 2009.

While the New Investment Advisory and Management Agreements, as a contractual matter, would not be required to be renewed again for two years following their effectiveness, MCM and the Board have agreed that the New Investment Advisory and Management Agreements shall be subject to an annual review by the Board and shall continue from year-to-year thereafter, provided that they are specifically approved annually by (i) the vote of a majority of the Board of Trustees; or (ii) a vote of a “majority” (as defined by the 1940 Act) of each Fund’s outstanding voting securities, provided that in either event the continuance is also approved by a majority of the Board who are not “interested persons” of the Funds or MCM.

In the event the shareholders of one ore more Funds do not approve the New Investment Advisory and Management Agreements, the Board would consider what action would be appropriate, including the re-solicitation of shareholders. In the interim, the Current Investment Advisory and Management Agreements would remain in full force and effect, and MCM may consider various alternatives that may or may not be available including possible termination of the Transaction.

13

Information About the Investment Adviser

MCM was organized in September 1997 by Thomas F. Marsico as a registered investment adviser and is a Delaware limited liability company. In addition to advising the Funds, MCM provides investment services to other mutual funds, variable insurance funds, corporate retirement plans and other institutions, separately managed wrap accounts, and private accounts and, as of June 30, 2007, had approximately $94 billion under management. Thomas F. Marsico is the founder, Chief Executive Officer, and Chief Investment Officer of MCM. Mr. Marsico also serves as President and as a Trustee of the Trust.

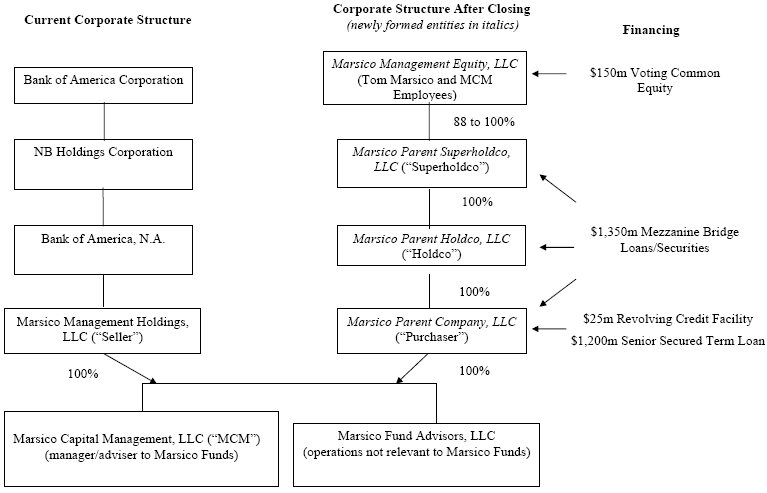

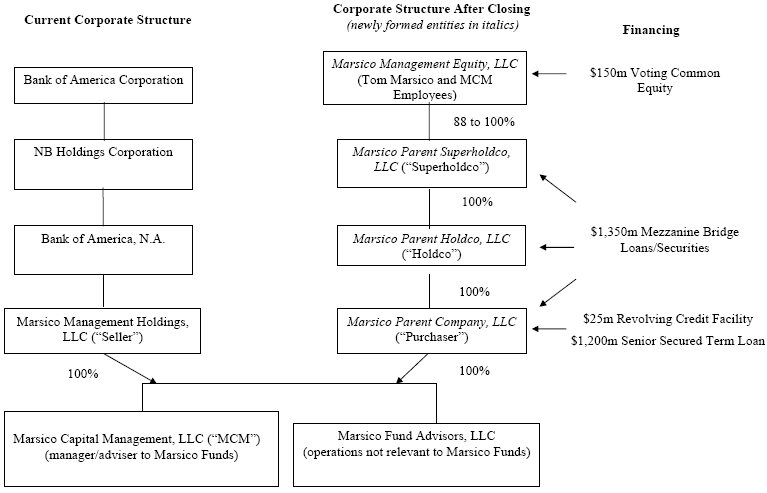

MCM is an indirect, wholly-owned subsidiary of Bank of America Corporation (“BofA”), a Delaware corporation that is a bank holding company and a financial holding company headquartered in Charlotte, North Carolina and is located at 101 N. Tryon Street, Charlotte, North Carolina 28246.

Following the Transaction, as described above under “Information Concerning the Transaction,” Mr. Marsico and other members of management of MCM and certain of their family members, through another company, would own at least 88% of the common equity interests of Superholdco (and indirectly of MCM). The remaining 12% of the common equity interests of Superholdco, would be subject to warrants held by certain other parties who purchased Mezzanine Securities as described above. The common equity interests in Superholdco that holders of Mezzanine Securities would acquire by exercising the warrants will not be voting interests, and Mezzanine Securities do not provide their holders with board seats or supervisory rights relating to MCM.

Set forth in Exhibit C is certain information with respect to the executive officers and directors of MCM.

Set forth in Exhibit D is certain information with respect to the other registered investment companies sub-advised by MCM that have investment objectives similar to the Funds. The services that MCM provides to these investment companies as a sub-adviser are far more limited in scope than the services that MCM provides to the Funds as their manager and principal investment adviser. A principal investment manager other than MCM typically charges management fees to these investment companies that include both sub-advisory fees paid to MCM and additional management fees paid to the principal manager.

As of July 24, 2007, employees of MCM and their family members hold in the aggregate 47.28% of the shares of the Flexible Capital Fund and 27.62% of the shares of the Global Fund. These employees intend to vote those shares in favor of the New Investment Advisory and Management Agreements with regard to these Funds, which vote, in the case of the Flexible Capital Fund, may be sufficient to result in approval of the Agreement without the necessity of any other shareholders voting in favor of the proposal.

14

| PROPOSAL 2 - ALL FUNDS |

| |

| TRANSACT OTHER PROPER BUSINESS |

| |

Other Matters to Come Before the Special Meeting

The purpose of this proposal is to authorize the Trust and the Board to transact such other business as may properly come before the Special Meeting (including any adjournments and postponements thereof). The Board does not intend to present any other business at the Special Meeting. If, however, any other matters are properly brought before the Special Meeting, the persons named in the accompanying Proxy Card will vote thereon in accordance with their judgment.

Proposals of Shareholders

The Trust does not hold annual shareholder meetings. Any shareholder proposal intended to be presented at any future meeting of shareholders must be received by the Trust at its principal office a reasonable time before the solicitation of proxies for such meeting in order for such proposal to be considered for inclusion in the Proxy Statement relating to such meeting.

Shareholders who wish to communicate with the Board about business matters relating to the Trust that are appropriate for the Board’s consideration should send communications to the attention of the Secretary of the Trust, 1200 17th Street, Suite 1600, Denver, CO 80202. Appropriate communications will be directed to the Trustee or Trustees indicated in the communication or, if no Trustee or Trustees are indicated, to the Board or its designee.

15

GENERAL INFORMATION ABOUT THE FUNDS

Administrator and Distributor

UMB Fund Services, Inc., 803 W. Michigan Street, Suite A, Milwaukee, WI 53233 serves as the Funds’ administrator. UMB Distribution Services, LLC, located at the same address, serves as the Funds’ distributor.

Custodian

State Street Bank and Trust Company, located at 225 Franklin Street, Boston MA 02110, acts as the custodian of each Fund’s assets.

Transfer Agent

UMB Fund Services, Inc. acts as transfer agent for shares of the Funds.

VOTING INFORMATION

This Proxy Statement is furnished in connection with a solicitation of proxies by the Board of Trustees to be used at the Special Meeting. This Proxy Statement, along with a Notice of the Special Meeting, Questions & Answers statement and Proxy Card, is first being mailed to shareholders of the Trust on or about August 17, 2007. Only shareholders of record as of the close of business on the Record Date, July 26, 2007, will be entitled to notice of, and to vote at, the Special Meeting (including any adjournments or postponements thereof). If the enclosed form of Proxy Card is properly executed and returned in time to be voted at the Special Meeting, the proxies named therein will vote the shares represented by the proxy in accordance with the instructions marked thereon. Unmarked but properly executed Proxy Cards will be voted FOR the proposals. A proxy may be revoked at any time before or at the Special Meeting by delivering to the Funds a subsequently dated Proxy Card (by written proxy or through one of the appropriate websites), by calling the toll-free number listed on the Proxy Card, by providing other written notice of revocation to the Funds, or by attending and voting at the Special Meeting. Unless revoked, all valid and executed proxies will be voted in accordance with the specifications thereon or, in the absence of such specifications, FOR the approval of the investment advisory and management agreements.

Quorum and Voting Requirement

The presence at the Special Meeting, in person or by proxy, of the holders of one-third (1/3) of the outstanding shares of each Fund entitled to be cast shall be necessary and sufficient to constitute a quorum for the transaction of business.

The votes of each Fund of the Trust will be counted separately with respect to the approval of each Fund’s Investment Advisory and Management Agreement. The Proposal requires the affirmative vote of a “majority of the outstanding shares” of each Fund. The term “majority of outstanding shares,” as defined by the 1940 Act and as used in this Proxy Statement with respect to each Fund, means: the affirmative vote of the lesser of (1) 67% of the voting securities of the Fund present at the Special Meeting if more than 50% of the outstanding shares of the Fund are present in person or by proxy or (2) more than 50% of the outstanding shares of the Fund.

16

PROXY SOLICITATION

The cost of preparing, printing and mailing the enclosed proxy, accompanying notice and Proxy Statement and all other costs incurred in connection with the solicitation of proxies, including any additional solicitation made by electronic means, letter, telephone, or fax, will be borne by MCM. MCM has also undertaken to pay the costs of holding the Special Meeting as well as certain other costs associated with the Transaction, including the related fees and expenses of legal counsel to the Funds. In addition to proxy solicitation efforts by Broadridge Financial Solutions, Inc. as discussed below, certain officers and representatives of the Trust, officers and employees of the Adviser, or other service providers to the Trust, and certain financial services firms and their representatives, who will receive no extra compensation for their services, may solicit proxies by mail, electronically, or by telephone, fax or personally.

Broadridge Financial Solutions, Inc. has been engaged to assist in the solicitation of proxies. As the Special Meeting date approaches, certain shareholders of the Funds may receive a letter or telephone call from a representative of Broadridge if their votes have not yet been received. Authorization to permit Broadridge to execute proxies may be obtained by various means including telephonic or electronically transmitted instructions from shareholders of the Funds. Proxies that are obtained telephonically or by any other appropriate means will be recorded in accordance with the procedures set forth below. These procedures have been reasonably designed to ensure that the identity of the shareholder casting the vote is accurately determined and that the voting instructions of the shareholder are accurately determined.

In all cases where a telephonic proxy is solicited, the Broadridge representative is required to ask for each shareholder’s full name and complete mailing address on the account to confirm that the shareholder has received the Proxy Statement and Proxy Card and that they were mailed to the correct address. If the information solicited agrees with the information provided to Broadridge, the Broadridge representative has the responsibility to explain the process, read the proposals listed on the Proxy Card, and ask for the shareholder’s instructions on such proposals. The Broadridge representative, although he or she is permitted to answer questions about the process, is not permitted to recommend to the shareholder how to vote, other than to read any recommendation set forth in the Proxy Statement. The Broadridge representative will record the shareholder’s instructions on the card. Within 72 hours, the shareholder will be sent by mail a confirmation of his or her vote and the shareholder will be asked to call immediately if his or her instructions are not correctly reflected in the confirmation.

If a shareholder elects to vote by electronic proxy, the shareholder may access the Trust’s website at www.marsicofunds.com (if Shares were purchased directly from the Funds), or at the website listed on the Proxy Card (if Shares were purchased through a financial advisor or other intermediary). The shareholder will be prompted to provide the 12-digit control number provided on the proxy ballot. If this information has been correctly entered, the Shareholder will be provided with an online explanation of the process and a recitation of the proposals listed on the Proxy Card. The Shareholder will then have the opportunity to give his or her instructions on such proposals. Upon completion of voting, the shareholder may elect to receive an electronic confirmation of the vote by providing his or her email address.

17

If the shareholder wishes to participate in the Special Meeting, but does not wish to give his or her proxy telephonically or electronically, the shareholder may still submit the Proxy Card originally sent with the Proxy Statement or attend in person. Should the shareholder require additional information regarding the proxy or a replacement Proxy Card, the shareholder may contact the Marsico Funds toll-free at 888-860-8686. Any proxy given by a shareholder, whether in writing or by telephone, is revocable.

ADJOURNMENTS

In the event that sufficient votes to constitute a quorum or approve the proposal are not received, the persons named as proxies may propose one or more adjournments of the Special Meeting to permit further solicitation of proxies. Any such adjournment will require an affirmative vote by the holders of a majority of the shares of the respective Fund present in person or by proxy and entitled to vote at the Special Meeting. The persons named as proxies will vote in favor of such adjournment those proxies which they are entitled to vote in favor of such proposals and will vote against such adjournment those proxies to be voted against the proposals.

EFFECT OF ABSTENTIONS AND BROKER NON-VOTES

For purposes of determining the presence of a quorum for transacting business at the Special Meeting, abstentions and broker “non-votes” will be treated as shares that are present but which have not been voted. Broker non-votes are proxies received by the Funds from brokers or nominees when the broker or nominee has neither received instructions from the beneficial owner or other persons entitled to vote nor has discretionary power to vote on a particular matter itself. Accordingly, shareholders who purchased their shares through brokers or other financial intermediaries are urged to forward their voting instructions promptly.

Abstentions will have the effect of a “no” vote on the proposals. Broker non-votes will have the effect of a “no” vote on the proposals where a vote is determined on the basis of obtaining the affirmative vote of more than 50% of the outstanding shares of a Fund. Broker non-votes will not constitute “yes” or “no” votes and will be disregarded in determining the voting securities “present” if such vote is determined on the basis of the affirmative vote of 67% of the voting securities of each Fund present at the Special Meeting.

18

SHARE INFORMATION

Holders of record of shares of the Marsico Focus Fund, Marsico Growth Fund, Marsico 21st Century Fund, Marsico International Opportunities Fund, Marsico Flexible Capital Fund and Marsico Global Fund at the close of business on the Record Date will be entitled to one vote per share for that Fund on all business to be conducted at the Special Meeting. The number of shares outstanding as of the Record Date was 236,914,857.222 for the Marsico Focus Fund, 132,813,849.964 for the Marsico Growth Fund, 125,873,060.840 for the Marsico 21st Century Fund, 41,093,132.839 for the Marsico International Opportunities Fund, 2,341,161.723 for the Marsico Flexible Capital Fund and 1,941,554.424 for the Marsico Global Fund.

FUND SHARES OWNED BY CERTAIN BENEFICIAL OWNERS

For a list of persons or entities that owned beneficially or of record 5% or more of the outstanding shares of each of the Funds as of the Record Date, please refer to Exhibit E.

19

Appendix 1

REPURCHASE OFMARSICOCAPITALMANAGEMENT, LLC(“MCM”)

FROM BANK OFAMERICACORPORATION