Item 1. Reports to Stockholders

Annual report

Multi-asset mutual fund

Delaware Strategic Allocation Fund

March 31, 2021

Beginning on or about June 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your Fund’s shareholder reports will no longer be sent to you by mail, unless you specifically request them from the Fund or from your financial intermediary, such as a broker/dealer, bank, or insurance company. Instead, you will be notified by mail each time a report is posted on the website and provided with a link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you do not need to take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by signing up at delawarefunds.com/edelivery. If you own these shares through a financial intermediary, you may contact your financial intermediary. You may elect to receive paper copies of all future shareholder reports free of charge. You can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by contacting us at 800 523-1918. If you own these shares through a financial intermediary, you may contact your financial intermediary to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held with the Delaware Funds® by Macquarie or your financial intermediary. |

Carefully consider the Fund’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Fund’s prospectus and its summary prospectus, which may be obtained by visiting delawarefunds.com/literature or calling 800 523-1918. Investors should read the prospectus and the summary prospectus carefully before investing.

You can obtain shareholder reports and prospectuses online instead of in the mail.

Visit delawarefunds.com/edelivery.

Table of Contents

Experience Delaware Funds® by Macquarie

Macquarie Investment Management (MIM) is a global asset manager with offices in the United States, Europe, Asia, and Australia. As active managers, we prioritize autonomy and accountability at the investment team level in pursuit of opportunities that matter for clients. Delaware Funds is one of the longest-standing mutual fund families, with more than 80 years in existence.

If you are interested in learning more about creating an investment plan, contact your financial advisor.

You can learn more about Delaware Funds or obtain a prospectus for Delaware Strategic Allocation Fund at delawarefunds.com/literature.

Manage your account online

| ● | Check your account balance and transactions |

| ● | View statements and tax forms |

| ● | Make purchases and redemptions |

Visit delawarefunds.com/account-access.

Macquarie Asset Management (MAM) offers a diverse range of products including securities investment management, infrastructure and real asset management, and fund and equity-based structured products. MIM is the marketing name for certain companies comprising the asset management division of Macquarie Group. This includes the following investment advisers: Macquarie Investment Management Business Trust (MIMBT), Macquarie Funds Management Hong Kong Limited, Macquarie Investment Management Austria Kapitalanlage AG, Macquarie Investment Management Global Limited, Macquarie Investment Management Europe Limited, and Macquarie Investment Management Europe S.A.

The Fund is distributed by Delaware Distributors, L.P. (DDLP), an affiliate of MIMBT and Macquarie Group Limited.

Other than Macquarie Bank Limited (MBL), none of the entities noted are authorized deposit-taking institutions for the purposes of the Banking Act 1959 (Commonwealth of Australia). The obligations of these entities do not represent deposits or other liabilities of MBL. MBL does not guarantee or otherwise provide assurance in respect of the obligations of these entities, unless noted otherwise.

The Fund is governed by US laws and regulations.

Table of contents

Unless otherwise noted, views expressed herein are current as of March 31, 2021, and subject to change for events occurring after such date.

The Fund is not FDIC insured and is not guaranteed. It is possible to lose the principal amount invested.

Advisory services provided by Delaware Management Company, a series of MIMBT, a US registered investment advisor.

All third-party marks cited are the property of their respective owners.

© 2021 Macquarie Management Holdings, Inc.

Table of Contents

| Portfolio management review | |

| Delaware Strategic Allocation Fund | March 31, 2021 (Unaudited) |

| Performance preview (for the year ended March 31, 2021) | | | | | |

| Delaware Strategic Allocation Fund (Institutional Class shares) | | 1-year return | | +35.54 | % |

| Delaware Strategic Allocation Fund (Class A shares) | | 1-year return | | +35.37 | % |

| Bloomberg Barclays US Aggregate Index (benchmark) | | 1-year return | | +0.71 | % |

| S&P 500® Index (benchmark) | | 1-year return | | +56.35 | % |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Strategic Allocation Fund, please see the table on page 5. Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. Both Institutional Class shares and Class A shares reflect the reinvestment of all distributions.

Please see page 8 for a description of the indices. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Investment objective

The Fund seeks capital appreciation with current income as a secondary objective.

Market review

The fiscal year ended March 31, 2021, was mixed from a performance perspective, with risk assets in positive territory overall, albeit with heightened volatility. Just weeks before the period began, in mid-January 2020, the COVID-19 pandemic emerged in China. As reported cases around the globe increased significantly, it soon became clear that the virus would not be contained and, beginning in February, financial markets plunged worldwide. Then just weeks into the fiscal period, governments and central banks worldwide began providing unprecedented levels of fiscal and monetary support, setting the stage for a remarkable rebound in financial markets.

Contrasting themes marked the latter half of the fiscal year as equities recovered and pushed toward all-time highs despite virus cases increasing in the United States, Europe, and Asia. Investors focused instead on the improving economic data, the abundant liquidity provided by central banks, and the prospect of additional fiscal stimulus. Optimism faded in September as a resurgence in coronavirus cases, political uncertainty about the US presidential election, and continued US-China tensions concerned investors.

As 2020 drew to a close, even as COVID-19 cases were worsening globally, investors were buoyed by positive news on coronavirus vaccine development and clarity on the US election results. An unprecedented rally for risk assets resulted. Shortly after the election, two COVID-19 vaccines developed by Pfizer and Moderna, with higher-than-expected efficacy rates of about 95%, were granted Emergency Use Authorization by the Food and Drug Administration. The initial rollout of the vaccines was slow, however, and US case trends worsened. Some states added or reinstated restrictions as new cases and hospitalizations hit record highs daily. Holiday travel may have accelerated the spread.

In the first quarter of 2021, markets focused on key support themes. A stronger-than-expected US and European earnings season, the acceleration of the COVID-19 vaccine rollout globally, declining infection rates, and an ultra-accommodative monetary policy drove the markets. Against the positive economic backdrop, interest rates, which had slowly risen, increased their upward movement in the latter half of the quarter. As a result, markets sold off somewhat, and volatility

1

Table of Contents

Portfolio management review

Delaware Strategic Allocation Fund

picked up as a global bond market rout ensued with the 10-year US Treasury rate climbing above 1.7% on an intraday basis.

The question now, in our view, is no longer whether the economic glass is half full or half empty, but whether the stimulating monetary and fiscal policy may make the glass overflow.

Within the Fund

For the fiscal year ended March 31, 2021, Delaware Strategic Allocation Fund underperformed its primary benchmark, the S&P 500® Index, and outperformed its other benchmark, the Bloomberg Barclays US Aggregate Index. The Fund’s Institutional Class shares gained 35.54%. The Fund’s Class A shares advanced 35.37% at net asset value and 27.54% at maximum offer price. These figures reflect all distributions reinvested. During the same period, the S&P 500 Index gained 56.35% and the Bloomberg Barclays US Aggregate Index advanced 0.71%. For complete, annualized performance of Delaware Strategic Allocation Fund, please see the table on page 5.

At the overall portfolio level, overweights to structured finance, public corporates, and cash securities drove underperformance relative to the primary benchmark. Security selection in equities partially offset this.

The Fund seeks capital appreciation with current income as a secondary objective by investing in a combination of underlying securities representing a variety of asset classes and investment styles. The Fund will typically target about 60% of its net assets in equity securities and about 40% of its net assets in fixed income securities.

During the period, fixed income underperformed equities as rising interest rates negatively affected bond prices while equities continued to rally on hopes that the economy was recovering. As such, the Fund’s allocation to fixed income caused the largest drag on relative performance during the period. Within fixed income, an overweight to structured finance and US Treasurys drove underperformance.

The Fund continued to maintain a modestly conservative tilt toward international exposure relative to the benchmark. This international exposure also detracted, as it underperformed US equities during the period. Despite an accelerated rollout of vaccines for COVID-19 globally, many developed economies, including within Europe, were slow to implement vaccination programs and, with rising infection rates, government-imposed lockdowns continued to weigh across the region. As a result of the delayed normalization in some parts of the world, international equities lagged US equities for the period.

Another detractor from relative performance was the Fund’s exposure to US growth equities. Although they were up sharply throughout 2020, they lagged in the latter half of the investment period when investors took profits and reallocated to more cyclical stocks such as value equities. Rising interest rates negatively affected many growth companies, further hurting performance during the period.

At the sector level within the Fund’s corporate securities (equities, public corporates, and convertibles), underperformance was offset by investments in consumer staples and healthcare. Investments in the consumer staples sector made the largest contribution to relative performance during the period. Within the sector, exposure to household products, beverages, and food & staples retailing supported performance. The inelastic demand for these staples, along with recent stimulus checks sent to many US households, lifted the group higher.

The healthcare sector also contributed to relative performance. Exposure to biotechnology and healthcare equipment added to performance. During the period, as healthcare companies and governments raced to find a vaccine or other

2

Table of Contents

effective treatment for COVID-19, investors rotated into the space to take advantage of the sector’s defensive nature and the potential for a COVID-19 cure.

We periodically examine the contribution of derivatives to the Fund’s performance. Based on the available information, during the 12 months ended March 31, 2021, the Fund’s combination of futures, options, swaps, and currency positions had only a limited positive impact on performance.

Portfolio positioning

The Fund’s strategic policy weights reflect a commitment to seeking diversification across geographies and asset classes. As such, the Fund continued to maintain a modestly conservative tilt toward risk assets (equities) but adjusted the exposure during the period.

The most notable change was trimming exposure in fixed income and rotating into equities. As markets recovered from the initial decline induced by COVID-19, the Fund was able to take advantage of investments with what we viewed as attractive valuations. As such, the Fund decreased its exposure to investment grade fixed income and structure finance during the period.

Within equities, the Fund increased its international exposure. The increase reflects our base scenario of a broad global economic recovery in 2021 and 2022 and adds to the allocation of more cyclical market segments that have, in our estimation, attractive valuation levels relative to the US.

Outlook

We remain optimistic about the economic recovery. There are signs that new virus cases are declining globally even as many COVID-19-related challenges remain. Among them is the recent rise in global yields, which appear to be “normalizing” after the dramatic downturn at this point last year. We think this normalization is warranted by a vaccine-based recovery and the eventual tightening by central banks. With the economic recovery strengthening, we think the positive catalysts to an economic recovery may outweigh the risks to rising rates.

Rising real yields may provide a tailwind for pro-cyclical and pro-inflation parts of the market (including commodities, value, and small-cap equities) when consumers resume normal activities. With COVID-19 cases down as vaccines roll out, consumers are expected to spend some of their surging incomes (and savings) on getaways. Longer term, we remain optimistic about consumer spending, abnormally high savings, the vaccine rollout, and continued fiscal stimulus driving economic growth. Markets are starting to shift focus from the growth and technology companies boosted by COVID-19 to the value and cyclical companies that the pandemic hurt.

That said, the pandemic accelerated the adoption of technology throughout our daily lives, and we believe many of these structural changes may remain indefinitely, offsetting some upside inflation risks. We believe technological growth is extremely important since it drives productivity growth, which, in turn, drives potential gross domestic product (GDP) growth, possibly increasing the headroom for non-inflationary real growth.

We are still in early stages of the global vaccination and COVID-19 reopening programs. Even if lockdowns are implemented again in some regions before a full reopening (especially in Europe), we think that investors will look through the short-term noise and buy potential dips in the reopening trade. While many of the developed markets face challenges the pandemic caused, the economic recovery in China continues. As business there returns to a new normal, we think the interest and attention of the global investor

3

Table of Contents

Portfolio management review

Delaware Strategic Allocation Fund

community is now focused on accessing what are viewed as growing opportunities in China.

We believe fixed income markets got a bit ahead of themselves about the speed and magnitude of recent yield increases. While the market seems to test the Fed’s willingness to tolerate higher inflation rates, we still believe that policy makers will remain accommodative. Within fixed income, we find that the appeal of investment grade credit has declined considerably, and we believe corporate spreads are already in their late-stage cycle. Low interest rates and high government spending are likely to persist, in our view, as policymakers attempt to mitigate the economic effects of pandemic control measures. We view the current fixed income backdrop as an opportunity to diversify out of low yielding cash and bonds.

The current economic environment is unprecedented as companies’ fundamentals may be affected most by vaccines, fiscal stimulus, and continued central bank support. As economies look to recover, nearly every sector faces significant financial hardship with market volatility lingering for longer than many have felt in some time. Investors globally must now grapple with anticipating and planning for what may come next. Nonetheless we remain positive on global growth and company earnings with the re-opening gaining traction.

We think a thoughtful, active management approach is needed given today’s increased political, economic, and market uncertainty. The Multi-Asset team’s decisions are taken collectively, and the weightings assigned to individual asset classes reflect our unique asset class ranking methodology, highlighted by our distinctive pairwise approach, which includes assessment of one asset class versus another on a head-to-head basis. Vigilant and continuous assessment of the current market environment may offer opportunities to take advantage of market dislocations and has the potential to achieve attractive risk-adjusted returns through an active focus on portfolio risk and diversification.

4

Table of Contents

| Performance summary | |

| Delaware Strategic Allocation Fund | March 31, 2021 (Unaudited) |

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 523-1918 or visiting delawarefunds.com/performance.

| Fund and benchmark performance1,2 | | Average annual total returns through March 31, 2021 |

| | 1 year | | 5 year | | 10 year | | Lifetime |

| Class A (Est. December 31, 1997) | | | | | | | | | |

| Excluding sales charge | | +35.37% | | +8.09% | �� | +6.39% | | +5.42% | |

| Including sales charge | | +27.54% | | +6.82% | | +5.76% | | +5.15% | |

| Class C (Est. December 31, 1997) | | | | | | | | | |

| Excluding sales charge | | +34.26% | | +7.26% | | +5.57% | | +4.64% | |

| Including sales charge | | +33.26% | | +7.26% | | +5.57% | | +4.64% | |

| Class R (Est. June 2, 2003) | | | | | | | | | |

| Excluding sales charge | | +34.94% | | +7.80% | | +6.10% | | +6.37% | |

| Including sales charge | | +34.94% | | +7.80% | | +6.10% | | +6.37% | |

| Institutional Class (Est. December 31, 1997) | | | | | | | | | |

| Excluding sales charge | | +35.54% | | +8.35% | | +6.63% | | +5.67% | |

| Including sales charge | | +35.54% | | +8.35% | | +6.63% | | +5.67% | |

| Bloomberg Barclays US Aggregate Index | | +0.71% | | +3.10% | | +3.44% | | +4.82% | * |

| S&P 500 Index | | +56.35% | | +16.29% | | +19.91% | | +8.27% | * |

| * | The benchmark lifetime returns are for Institutional Class share comparison only and are calculated using the last business day in the month of the Fund’s Institutional Class inception date. |

| 1 | Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares. |

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund and benchmark performance” table. Expenses for each class are listed on the “Fund expense ratios” table on page 7. Performance would have been lower had expense limitations not been in effect.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service (12b-1) fee.

Class A shares are sold with a maximum front-end sales charge of 5.75%, and have an annual 12b-1 fee of 0.25% of average daily net assets. In connection with the merger with Delaware Balanced Fund, the Board has adopted a formula for calculating 12b-1 plan fees for the Fund’s Class A shares. The Fund’s Class A shares are currently subject to a blended 12b-1 fee equal to the sum of: (i) 0.10% of average daily net assets representing shares acquired prior to June 1, 1992, and (ii) 0.25% of average daily net assets representing shares acquired on or after June 1, 1992. All Class A shares currently bear

5

Table of Contents

Performance summary

Delaware Strategic Allocation Fund

12b-1 fees at the same rate, the blended rate, currently 0.25% of average daily net assets, based on the formula described above. This method of calculating Class A 12b-1 fees may be discontinued at the sole discretion of the Board. Performance for Class A shares, excluding sales charges, assumes that no front-end sales charge applied.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual 12b-1 fee of 1.00% of average daily net assets. Performance for Class C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Class R shares are available only for certain retirement plan products. They are sold without a sales charge and have an annual 12b-1 fee of 0.50% of average daily net assets.

This Fund is subject to the same risks as the underlying investment styles in which it invests.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Fund may also be subject to prepayment risk, the risk that the principal of a bond that is held by a portfolio will be prepaid prior to maturity, at the time when interest rates are lower than what the bond was paying. A portfolio may then have to reinvest that money at a lower interest rate.

High yielding, non-investment-grade bonds (junk bonds) involve higher risk than investment grade bonds.

If and when the Fund invests in forward foreign currency contracts or uses other investments to hedge against currency risks, the Fund will be subject to special risks, including counterparty risk.

International investments entail risks including fluctuation in currency values, differences in accounting principles, or economic or political instability. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility, lower trading volume, and higher risk of market closures. In many emerging markets, there is substantially less publicly available information and the available information may be incomplete or misleading. Legal claims are generally more difficult to pursue.

Risk controls and asset allocation models do not promise any level of performance or guarantee against loss of principal.

Narrowly focused investments may exhibit higher volatility than investments in multiple industry sectors.

REIT investments are subject to many of the risks associated with direct real estate ownership, including changes in economic conditions, credit risk, and interest rate fluctuations.

The Fund may experience portfolio turnover in excess of 100%, which could result in higher transaction costs and tax liability.

IBOR risk is the risk that changes related to the use of the London interbank offered rate (LIBOR) or similar rates (such as EONIA) could have adverse impacts on financial instruments that reference these rates. The abandonment of these rates and transition to alternative rates could affect the value and liquidity of instruments that reference them and could affect investment strategy performance.

The disruptions caused by natural disasters, pandemics, or similar events could prevent the Fund from executing advantageous investment decisions in a timely manner and could negatively impact the Fund’s ability to achieve its investment objective and the value of the Fund’s investments.

6

Table of Contents

| 2 | The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Management Company has agreed to reimburse certain expenses and/or waive certain fees in order to prevent total annual fund operating expenses (excluding any 12b-1 fees, acquired fund fees and expenses, taxes, interest, short sale dividend and interest expenses, brokerage fees, certain insurance costs, and nonroutine expenses or costs, including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations (collectively, nonroutine expenses)) from exceeding 0.90% of the Fund’s average daily net assets from April 1, 2020 to March 31, 2021.* Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements. Please see the “Financial highlights” section in this report for the most recent expense ratios. |

| | | | | | | | Institutional |

| Fund expense ratios | | Class A | | Class C | | Class R | | Class |

| Total annual operating expenses | | | | | | | | |

| (without fee waivers) | | 1.18% | | 1.94% | | 1.44% | | 0.94% |

| Net expenses (including fee | | | | | | | | |

| waivers, if any) | | 1.14% | | 1.90% | | 1.40% | | 0.90% |

| Type of waiver | | Contractual | | Contractual | | Contractual | | Contractual |

| * | The aggregate contractual waiver period covering this report is from July 26, 2019 through July 29, 2021. |

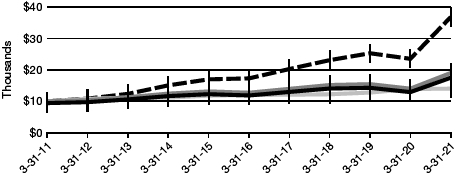

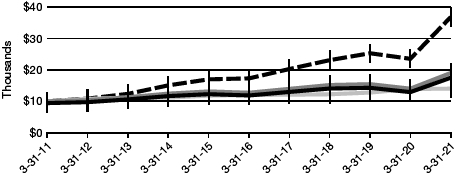

Performance of a $10,000 investment1

Average annual total returns from March 31, 2011 through March 31, 2021

| For period beginning March 31, 2011 through March 31, 2021 | | Starting value | | Ending value |

| S&P 500 Index | | | $10,000 | | | | $36,788 | |

| Delaware Strategic Allocation Fund – Institutional Class shares | | | $10,000 | | | | $19,005 | |

| Delaware Strategic Allocation Fund – Class A shares | | | $9,425 | | | | $17,500 | |

| Bloomberg Barclays US Aggregate Index | | | $10,000 | | | | $14,025 | |

7

Table of Contents

Performance summary

Delaware Strategic Allocation Fund

| 1 | The “Performance of a $10,000 investment” graph assumes $10,000 invested in Institutional Class and Class A shares of the Fund on March 31, 2011, and includes the effect of a 5.75% front-end sales charge (for Class A shares) and the reinvestment of all distributions. The graph does not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares. Expense limitations were in effect for some or all of the periods shown. Performance would have been lower had expense limitations not been in effect. Expenses are listed in the “Fund expense ratios” table on page 7. Please note additional details on pages 5 through 8. |

The graph also assumes $10,000 invested in the Bloomberg Barclays US Aggregate Index and the S&P 500 Index as of March 31, 2011.

The S&P 500 Index measures the performance of 500 mostly large-cap stocks weighted by market value, and is often used to represent performance of the US stock market.

The Bloomberg Barclays US Aggregate Index is a broad composite that tracks the investment grade domestic bond market.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance is not a guarantee of future results.

Performance of other Fund classes will vary due to different charges and expenses.

| | Nasdaq symbols | | CUSIPs |

| Class A | | DFBAX | | 245918503 |

| Class C | | DFBCX | | 245918701 |

| Class R | | DFBRX | | 245918834 |

| Institutional Class | | DFFIX | | 245918800 |

8

Table of Contents

Disclosure of Fund expenses

For the six-month period from October 1, 2020 to March 31, 2021 (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period from October 1, 2020 to March 31, 2021.

Actual expenses

The first section of the table shown, “Actual Fund return,” provides information about actual account values and actual expenses. You may use the information in this section of the table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second section of the table shown, “Hypothetical 5% return,” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The Fund’s expenses shown in the table reflect fee waivers in effect and assume reinvestment of all dividends and distributions.

9

Table of Contents

Disclosure of Fund expenses

For the six-month period from October 1, 2020 to March 31, 2021 (Unaudited)

Delaware Strategic Allocation Fund

Expense analysis of an investment of $1,000

| | Beginning | | Ending | | | | | | | Expenses |

| | Account Value | | Account Value | | Annualized | | Paid During Period |

| | 10/1/20 | | 3/31/21 | | Expense Ratio | | 10/1/20 to 3/31/21* |

| Actual Fund return† | | | | | | | | | | | | | | | | | | | | |

| Class A | | | $ | 1,000.00 | | | | $ | 1,145.30 | | | | 1.14 | % | | | | $ | 6.10 | |

| Class C | | | | 1,000.00 | | | | | 1,140.50 | | | | 1.90 | % | | | | | 10.14 | |

| Class R | | | | 1,000.00 | | | | | 1,142.60 | | | | 1.40 | % | | | | | 7.48 | |

| Institutional Class | | | | 1,000.00 | | | | | 1,145.60 | | | | 0.90 | % | | | | | 4.81 | |

| Hypothetical 5% return (5% return before expenses) | | | | | | | | | | | |

| Class A | | | $ | 1,000.00 | | | | $ | 1,019.25 | | | | 1.14 | % | | | | $ | 5.74 | |

| Class C | | | | 1,000.00 | | | | | 1,015.46 | | | | 1.90 | % | | | | | 9.55 | |

| Class R | | | | 1,000.00 | | | | | 1,017.95 | | | | 1.40 | % | | | | | 7.04 | |

| Institutional Class | | | | 1,000.00 | | | | | 1,020.44 | | | | 0.90 | % | | | | | 4.53 | |

| * | “Expenses Paid During Period” are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

| † | Because actual returns reflect only the most recent six-month period, the returns shown may differ significantly from fiscal year returns. |

In addition to the Fund’s expenses reflected above, the Fund also indirectly bears its portion of the fees and expenses of the investment companies, including exchange-traded funds (Underlying Funds) in which it invests. The table above does not reflect the expenses of the Underlying Funds.

10

Table of Contents

Security type / sector allocation, country

allocation and top 10 equity holdings |

| Delaware Strategic Allocation Fund | March 31, 2021 (Unaudited) |

Sector designations may be different from the sector designations presented in other Fund materials. The sector designations may represent the investment manager’s internal sector classifications.

| Security type / sector | | Percentage of net assets |

| Common Stock | | | 58.07 | % | |

| US Markets | | | 27.09 | % | |

| Communication Services | | | 2.20 | % | |

| Consumer Discretionary | | | 3.06 | % | |

| Consumer Staples | | | 1.37 | % | |

| Energy | | | 0.62 | % | |

| Financials | | | 3.90 | % | |

| Healthcare | | | 4.29 | % | |

| Industrials | | | 3.59 | % | |

| Information Technology | | | 5.43 | % | |

| Materials | | | 1.17 | % | |

| Real Estate | | | 0.92 | % | |

| Utilities | | | 0.54 | % | |

| Developed Markets | | | 22.12 | % | |

| Communication Services | | | 0.89 | % | |

| Consumer Discretionary | | | 2.13 | % | |

| Consumer Staples | | | 2.41 | % | |

| Energy | | | 0.43 | % | |

| Financials | | | 4.34 | % | |

| Healthcare | | | 2.98 | % | |

| Industrials | | | 3.74 | % | |

| Information Technology | | | 2.04 | % | |

| Materials | | | 1.74 | % | |

| Real Estate | | | 0.57 | % | |

| Utilities | | | 0.85 | % | |

| Emerging Markets | | | 8.86 | % | |

| Communication Services | | | 1.96 | % | |

| Consumer Discretionary | | | 1.29 | % | |

| Consumer Staples | | | 0.53 | % | |

| Energy | | | 0.96 | % | |

| Financials | | | 0.54 | % | |

| Healthcare | | | 0.05 | % | |

| Information Technology | | | 3.18 | % | |

| Materials | | | 0.29 | % | |

11

Table of Contents

Security type / sector allocation, country

allocation and top 10 equity holdings

Delaware Strategic Allocation Fund

| Security type / sector | | Percentage of net assets |

| Real Estate | | | 0.02 | % | |

| Utilities | | | 0.04 | % | |

| Exchange-Traded Funds | | | 7.87 | % | |

| Agency Collateralized Mortgage Obligations | | | 0.70 | % | |

| Agency Commercial Mortgage-Backed Securities | | | 0.19 | % | |

| Agency Mortgage-Backed Securities | | | 9.98 | % | |

| Collateralized Debt Obligations | | | 1.23 | % | |

| Corporate Bonds | | | 9.16 | % | |

| Banking | | | 2.31 | % | |

| Basic Industry | | | 0.30 | % | |

| Capital Goods | | | 0.16 | % | |

| Communications | | | 1.96 | % | |

| Consumer Cyclical | | | 0.38 | % | |

| Consumer Non-Cyclical | | | 0.72 | % | |

| Energy | | | 0.83 | % | |

| Financials | | | 0.38 | % | |

| Real Estate | | | 0.21 | % | |

| Technology | | | 0.65 | % | |

| Transportation | | | 0.06 | % | |

| Utilities | | | 1.20 | % | |

| Loan Agreements | | | 1.02 | % | |

| Municipal Bonds | | | 0.31 | % | |

| Non-Agency Asset-Backed Securities | | | 0.60 | % | |

| Non-Agency Collateralized Mortgage Obligations | | | 0.94 | % | |

| Non-Agency Commercial Mortgage-Backed Securities | | | 1.31 | % | |

| Rights | | | 0.00 | % | |

| Sovereign Bonds | | | 3.56 | % | |

| Preferred Stock | | | 0.30 | % | |

| US Treasury Obligations | | | 2.34 | % | |

| Short-Term Investments | | | 2.56 | % | |

| Total Value of Securities | | | 100.14 | % | |

| Liabilities Net of Receivables and Other Assets | | | (0.14 | )% | |

| Total Net Assets | | | 100.00 | % | |

| | Percentage |

| Country/Market* | | of net assets |

| Developed Markets | | | 28.40 | % | |

| Australia | | | 2.34 | % | |

| Austria | | | 0.35 | % | |

| Belgium | | | 0.41 | % | |

12

Table of Contents

| | Percentage |

| Country/Market* | | of net assets |

| Canada | | | 0.19 | % | |

| Cayman Islands | | | 1.23 | % | |

| Denmark | | | 0.52 | % | |

| Finland | | | 0.22 | % | |

| France | | | 2.76 | % | |

| Germany | | | 2.75 | % | |

| Hong Kong | | | 0.49 | % | |

| Ireland | | | 0.31 | % | |

| Israel | | | 0.30 | % | |

| Italy | | | 0.75 | % | |

| Japan | | | 6.56 | % | |

| Netherlands | | | 1.46 | % | |

| Portugal | | | 0.10 | % | |

| Singapore | | | 0.61 | % | |

| South Africa | | | 0.15 | % | |

| Spain | | | 0.85 | % | |

| Sweden | | | 0.54 | % | |

| Switzerland | | | 2.20 | % | |

| United Kingdom | | | 3.26 | % | |

| United States | | | 0.05 | % | |

| Emerging Markets | | | 9.35 | % | |

| Argentina | | | 0.02 | % | |

| Brazil | | | 0.57 | % | |

| Chile | | | 0.08 | % | |

| China | | | 2.24 | % | |

| China/Hong Kong | | | 0.64 | % | |

| Colombia | | | 0.02 | % | |

| India | | | 0.76 | % | |

| Indonesia | | | 0.13 | % | |

| Malaysia | | | 0.00 | % | |

| Mexico | | | 0.35 | % | |

| Peru | | | 0.05 | % | |

| Philippines | | | 0.08 | % | |

| Republic of Korea | | | 2.14 | % | |

| Russia | | | 0.48 | % | |

| Taiwan | | | 1.67 | % | |

| Turkey | | | 0.12 | % | |

| US Markets | | | 59.83 | % | |

| Total | | | 97.58 | % | |

13

Table of Contents

Security type / sector allocation, country allocation and top 10 equity holdings

Delaware Strategic Allocation Fund

Holdings are for informational purposes only and are subject to change at any time. They are not a recommendation to buy, sell, or hold any security.

| Top 10 equity holdings | | Percentage of net assets |

| Taiwan Semiconductor Manufacturing | | 0.89% |

| Samsung Electronics | | 0.80% |

| Tencent Holdings | | 0.78% |

| SK Hynix | | 0.65% |

| Microsoft | | 0.64% |

| Reliance Industries GDR | | 0.60% |

| Nestle | | 0.57% |

| Alphabet Class A | | 0.56% |

| MediaTek | | 0.55% |

| Alibaba Group Holding ADR | | 0.55% |

| * | Allocation includes all investments except for short-term. |

14

Table of Contents

| Schedule of investments | |

| Delaware Strategic Allocation Fund | March 31, 2021 |

| | | Number of shares | | Value (US $) |

| Common Stock – 58.07% | | | | | |

| US Markets – 27.09% | | | | | |

| Communication Services - 2.20% | | | | | |

| | Alphabet Class A † | | 685 | | $ | 1,412,826 |

| AT&T | | 8,828 | | | 267,224 |

| ATN International | | 1,138 | | | 55,899 |

| Bumble Class A † | | 24 | | | 1,497 |

| Century Communications =,† | | 25,000 | | | 0 |

| Cinemark Holdings | | 5,876 | | | 119,929 |

| Comcast Class A | | 20,332 | | | 1,100,164 |

| Facebook Class A † | | 1,671 | | | 492,160 |

| Nexstar Media Group Class A | | 535 | | | 75,130 |

| Upwork † | | 1,145 | | | 51,262 |

| Verizon Communications | | 11,300 | | | 657,095 |

| Walt Disney † | | 6,476 | | | 1,194,951 |

| Yelp † | | 2,947 | | | 114,933 |

| | | | | | 5,543,070 |

| Consumer Discretionary – 3.06% | | | | | |

| Amazon.com † | | 407 | | | 1,259,291 |

| American Eagle Outfitters | | 9,193 | | | 268,803 |

| Aramark | | 3,898 | | | 147,266 |

| At Home Group † | | 2,748 | | | 78,868 |

| BorgWarner | | 3,454 | | | 160,128 |

| Brinker International | | 1,620 | | | 115,117 |

| Children’s Place † | | 799 | | | 55,690 |

| Chuy’s Holdings † | | 1,888 | | | 83,676 |

| Dana | | 5,089 | | | 123,815 |

| Dick’s Sporting Goods | | 1,375 | | | 104,706 |

| Dollar Tree † | | 6,000 | | | 686,760 |

| DR Horton | | 1,850 | | | 164,872 |

| Five Below † | | 1,319 | | | 251,652 |

| Hibbett Sports † | | 1,144 | | | 78,810 |

| Home Depot | | 1,866 | | | 569,597 |

| Jack in the Box | | 1,432 | | | 157,205 |

| KB Home | | 3,559 | | | 165,600 |

| La-Z-Boy | | 2,007 | | | 85,257 |

| Lowe’s | | 3,700 | | | 703,666 |

| Malibu Boats Class A † | | 2,025 | | | 161,352 |

| NIKE Class B | | 2,860 | | | 380,065 |

| Sonic Automotive Class A | | 959 | | | 47,538 |

| Starbucks | | 3,072 | | | 335,678 |

| Steven Madden | | 5,651 | | | 210,556 |

| Taylor Morrison Home † | | 5,385 | | | 165,912 |

| Texas Roadhouse † | | 3,828 | | | 367,258 |

15

Table of Contents

Schedule of investments

Delaware Strategic Allocation Fund

| | | Number of shares | | Value (US $) |

| Common Stock (continued) | | | | | |

| US Markets (continued) | | | | | |

| Consumer Discretionary (continued) | | | | | |

| | Toll Brothers | | 2,898 | | $ | 164,404 |

| Tractor Supply | | 1,943 | | | 344,067 |

| Waste Management | | 1,057 | | | 136,374 |

| Wendy’s | | 5,919 | | | 119,919 |

| | | | | | 7,693,902 |

| Consumer Staples – 1.37% | | | | | |

| Archer-Daniels-Midland | | 12,100 | | | 689,700 |

| BJ’s Wholesale Club Holdings † | | 3,748 | | | 168,135 |

| Casey’s General Stores | | 1,277 | | | 276,074 |

| Conagra Brands | | 17,798 | | | 669,205 |

| General Mills | | 3,113 | | | 190,889 |

| Helen of Troy † | | 789 | | | 166,211 |

| J & J Snack Foods | | 1,022 | | | 160,484 |

| Mondelez International Class A | | 11,273 | | | 659,809 |

| PepsiCo | | 2,324 | | | 328,730 |

| YETI Holdings † | | 2,018 | | | 145,720 |

| | | | | | 3,454,957 |

| Energy – 0.62% | | | | | |

| Chevron | | 4,449 | | | 466,211 |

| ConocoPhillips | | 16,507 | | | 874,376 |

| Earthstone Energy Class A † | | 2,438 | | | 17,431 |

| Patterson-UTI Energy | | 6,414 | | | 45,732 |

| PDC Energy † | | 4,811 | | | 165,498 |

| | | | | | 1,569,248 |

| Financials – 3.90% | | | | | |

| American Equity Investment Life Holding | | 2,803 | | | 88,379 |

| American International Group | | 15,200 | | | 702,392 |

| Axis Capital Holdings | | 2,824 | | | 139,986 |

| BlackRock | | 395 | | | 297,814 |

| Bryn Mawr Bank | | 1,304 | | | 59,345 |

| Capital One Financial | | 1,615 | | | 205,476 |

| City Holding | | 1,142 | | | 93,393 |

| Comerica | | 1,748 | | | 125,401 |

| Discover Financial Services | | 6,498 | | | 617,245 |

| East West Bancorp | | 3,568 | | | 263,318 |

| Enterprise Financial Services | | 1,049 | | | 51,862 |

| Essent Group | | 5,959 | | | 282,993 |

| First Bancorp (North Carolina) | | 2,344 | | | 101,964 |

| First Financial Bancorp | | 4,581 | | | 109,944 |

| First Foundation | | 1,235 | | | 28,973 |

16

Table of Contents

| | | Number of shares | | Value (US $) |

| Common Stock (continued) | | | | | |

| US Markets (continued) | | | | | |

| Financials (continued) | | | | | |

| | First Interstate BancSystem Class A | | 2,583 | | $ | 118,921 |

| Great Western Bancorp | | 2,717 | | | 82,298 |

| Hamilton Lane Class A | | 1,362 | | | 120,619 |

| Independent Bank | | 1,509 | | | 127,043 |

| Independent Bank Group | | 1,768 | | | 127,720 |

| Intercontinental Exchange | | 2,027 | | | 226,375 |

| JPMorgan Chase & Co. | | 5,016 | | | 763,586 |

| Kemper | | 651 | | | 51,898 |

| KeyCorp | | 8,909 | | | 178,002 |

| Lakeland Financial | | 360 | | | 24,908 |

| MetLife | | 11,813 | | | 718,112 |

| NMI Holdings Class A † | | 3,810 | | | 90,068 |

| Old National Bancorp | | 6,964 | | | 134,684 |

| Pacific Premier Bancorp | | 3,785 | | | 164,420 |

| Primerica | | 310 | | | 45,824 |

| Raymond James Financial | | 1,546 | | | 189,478 |

| Reinsurance Group of America | | 1,236 | | | 155,798 |

| RLI | | 741 | | | 82,673 |

| Selective Insurance Group | | 1,802 | | | 130,717 |

| South State | | 1,939 | | | 152,231 |

| State Street | | 2,611 | | | 219,350 |

| Stifel Financial | | 3,161 | | | 202,494 |

| Travelers | | 933 | | | 140,323 |

| Truist Financial | | 12,200 | | | 711,504 |

| Umpqua Holdings | | 5,885 | | | 103,282 |

| United Community Banks | | 4,283 | | | 146,136 |

| US Bancorp | | 17,586 | | | 972,682 |

| Valley National Bancorp | | 7,874 | | | 108,189 |

| Webster Financial | | 1,278 | | | 70,431 |

| WesBanco | | 3,260 | | | 117,556 |

| WSFS Financial | | 3,058 | | | 152,258 |

| | | | | | 9,798,065 |

| Healthcare – 4.29% | | | | | |

| Abbott Laboratories | | 2,816 | | | 337,469 |

| Agios Pharmaceuticals † | | 2,082 | | | 107,514 |

| Amicus Therapeutics † | | 10,659 | | | 105,311 |

| AtriCure † | | 1,415 | | | 92,711 |

| Becton Dickinson and Co. | | 930 | | | 226,129 |

| Blueprint Medicines † | | 1,462 | | | 142,150 |

| Cardinal Health | | 11,100 | | | 674,325 |

| Catalent † | | 1,251 | | | 131,743 |

17

Table of Contents

Schedule of investments

Delaware Strategic Allocation Fund

| | | Number of shares | | Value (US $) |

| Common Stock (continued) | | | | | |

| US Markets (continued) | | | | | |

| Healthcare (continued) | | | | | |

| | ChemoCentryx † | | 2,361 | | $ | 120,978 |

| Cigna | | 4,350 | | | 1,051,569 |

| CONMED | | 1,442 | | | 188,311 |

| CryoLife † | | 4,353 | | | 98,291 |

| CVS Health | | 8,600 | | | 646,978 |

| Dexcom † | | 530 | | | 190,477 |

| Edwards Lifesciences † | | 2,484 | | | 207,762 |

| Exact Sciences † | | 1,374 | | | 181,066 |

| GenMark Diagnostics † | | 5,226 | | | 124,901 |

| Halozyme Therapeutics † | | 3,878 | | | 161,674 |

| Insmed † | | 530 | | | 18,052 |

| Intercept Pharmaceuticals † | | 1,382 | | | 31,897 |

| Johnson & Johnson | | 6,852 | | | 1,126,126 |

| Ligand Pharmaceuticals † | | 913 | | | 139,187 |

| Merck & Co. | | 11,652 | | | 898,253 |

| Merit Medical Systems † | | 2,985 | | | 178,742 |

| Natera † | | 2,334 | | | 236,994 |

| Neurocrine Biosciences † | | 1,600 | | | 155,600 |

| NuVasive † | | 2,365 | | | 155,049 |

| Omnicell † | | 927 | | | 120,389 |

| Pfizer | | 7,891 | | | 285,891 |

| Prestige Consumer Healthcare † | | 3,304 | | | 145,640 |

| PTC Therapeutics † | | 2,333 | | | 110,467 |

| Quidel † | | 714 | | | 91,342 |

| Repligen † | | 634 | | | 123,256 |

| Shockwave Medical † | | 1,149 | | | 149,669 |

| Spectrum Pharmaceuticals † | | 7,749 | | | 25,262 |

| Supernus Pharmaceuticals † | | 3,871 | | | 101,343 |

| Tabula Rasa HealthCare † | | 2,663 | | | 122,631 |

| Teladoc Health † | | 724 | | | 131,587 |

| Thermo Fisher Scientific | | 703 | | | 320,835 |

| TransMedics Group † | | 1,900 | | | 78,831 |

| Travere Therapeutics † | | 5,599 | | | 139,807 |

| Ultragenyx Pharmaceutical † | | 1,772 | | | 201,760 |

| Vanda Pharmaceuticals † | | 6,978 | | | 104,810 |

| Vertex Pharmaceuticals † | | 1,108 | | | 238,098 |

| Viatris † | | 40,106 | | | 560,281 |

| | | | | | 10,781,158 |

| Industrials – 3.59% | | | | | |

| ABM Industries | | 2,832 | | | 144,460 |

| Allegiant Travel † | | 964 | | | 235,274 |

18

Table of Contents

| | | | Number of shares | | Value (US $) |

| Common Stock (continued) | | | | | |

| US Markets (continued) | | | | | |

| Industrials (continued) | | | | | |

| Ameresco Class A † | | 4,096 | | $ | 199,189 |

| Applied Industrial Technologies | | 1,762 | | | 160,642 |

| ASGN † | | 2,016 | | | 192,407 |

| Barnes Group | | 1,681 | | | 83,277 |

| BrightView Holdings † | | 5,800 | | | 97,846 |

| Carlisle | | 652 | | | 107,306 |

| Casella Waste Systems Class A † | | 1,146 | | | 72,851 |

| Caterpillar | | 3,188 | | | 739,202 |

| Columbus McKinnon | | 2,809 | | | 148,203 |

| Deere | | 314 | | | 117,480 |

| Eaton | | 1,154 | | | 159,575 |

| Emerson Electric | | 1,610 | | | 145,254 |

| ESCO Technologies | | 935 | | | 101,812 |

| Federal Signal | | 3,978 | | | 152,357 |

| Gates Industrial † | | 4,435 | | | 70,916 |

| Generac Holdings † | | 291 | | | 95,288 |

| Honeywell International | | 4,161 | | | 903,228 |

| Hub Group Class A † | | 2,372 | | | 159,588 |

| Ichor Holdings † | | 899 | | | 48,366 |

| Ingersoll Rand † | | 1,040 | | | 51,178 |

| Kadant | | 819 | | | 151,523 |

| Knight-Swift Transportation Holdings | | 2,413 | | | 116,041 |

| Lockheed Martin | | 411 | | | 151,865 |

| MasTec † | | 2,298 | | | 215,323 |

| MYR Group † | | 2,893 | | | 207,341 |

| Northrop Grumman | | 2,100 | | | 679,644 |

| Oshkosh | | 1,575 | | | 186,890 |

| Parker-Hannifin | | 1,138 | | | 358,959 |

| Quanta Services | | 1,291 | | | 113,582 |

| Raytheon Technologies | | 11,279 | | | 871,528 |

| Rexnord | | 3,507 | | | 165,145 |

| Rockwell Automation | | 462 | | | 122,633 |

| Southwest Airlines | | 2,468 | | | 150,696 |

| Tetra Tech | | 1,492 | | | 202,494 |

| Trane Technologies | | 1,690 | | | 279,796 |

| Union Pacific | | 1,402 | | | 309,015 |

| US Ecology † | | 2,689 | | | 111,970 |

| Werner Enterprises | | 2,362 | | | 111,416 |

| WESCO International † | | 2,175 | | | 188,203 |

| WillScot Mobile Mini Holdings † | | 5,737 | | | 159,202 |

| | | | | | 9,038,965 |

19

Table of Contents

Schedule of investments

Delaware Strategic Allocation Fund

| | | | Number of shares | | Value (US $) |

| Common Stock (continued) | | | | | |

| US Markets (continued) | | | | | |

| Information Technology – 5.43% | | | | | |

| Accenture Class A | | 1,348 | | $ | 372,385 |

| Activision Blizzard | | 766 | | | 71,238 |

| Adobe † | | 862 | | | 409,769 |

| Apple | | 10,921 | | | 1,334,000 |

| Bandwidth Class A † | | 338 | | | 42,838 |

| Blackline † | | 568 | | | 61,571 |

| Box Class A † | | 1,933 | | | 44,382 |

| Broadcom | | 2,153 | | | 998,260 |

| Brooks Automation | | 3,271 | | | 267,077 |

| Cisco Systems | | 19,168 | | | 991,177 |

| Cognizant Technology Solutions Class A | | 7,873 | | | 615,039 |

| ExlService Holdings † | | 1,846 | | | 166,435 |

| Fidelity National Information Services | | 4,631 | | | 651,165 |

| II-VI † | | 2,182 | | | 149,183 |

| Intel | | 5,488 | | | 351,232 |

| Intuit | | 526 | | | 201,490 |

| J2 Global † | | 1,634 | | | 195,851 |

| KBR | | 3,496 | | | 134,212 |

| MACOM Technology Solutions Holdings † | | 876 | | | 50,826 |

| MaxLinear † | | 3,856 | | | 131,413 |

| Microsoft | | 6,772 | | | 1,596,635 |

| Mimecast † | | 1,755 | | | 70,569 |

| Motorola Solutions | | 3,627 | | | 682,057 |

| NETGEAR † | | 1,994 | | | 81,953 |

| Oracle | | 10,200 | | | 715,734 |

| Plantronics † | | 310 | | | 12,062 |

| PTC † | | 1,894 | | | 260,709 |

| Q2 Holdings † | | 1,635 | | | 163,827 |

| Rapid7 † | | 2,463 | | | 183,764 |

| Roper Technologies | | 245 | | | 98,818 |

| salesforce.com † | | 1,451 | | | 307,423 |

| Semtech † | | 1,718 | | | 118,542 |

| ServiceNow † | | 513 | | | 256,557 |

| Silicon Laboratories † | | 960 | | | 135,427 |

| Sprout Social Class A † | | 850 | | | 49,096 |

| SS&C Technologies Holdings | | 4,109 | | | 287,096 |

| Texas Instruments | | 1,494 | | | 282,351 |

| Tyler Technologies † | | 908 | | | 385,473 |

| Uber Technologies † | | 1,445 | | | 78,767 |

20

Table of Contents

| | | | Number of shares | | Value (US $) |

| Common Stock (continued) | | | | | |

| US Markets (continued) | | | | | |

| Information Technology (continued) | | | | | |

| Varonis Systems † | | 1,992 | | $ | 102,269 |

| Visa Class A | | 2,634 | | | 557,697 |

| | | | | | 13,666,369 |

| Materials – 1.17% | | | | | |

| Balchem | | 700 | | | 87,787 |

| Boise Cascade | | 3,878 | | | 232,021 |

| Coeur Mining † | | 3,536 | | | 31,930 |

| Corteva | | 3,053 | | | 142,331 |

| Dow | | 2,287 | | | 146,231 |

| DuPont de Nemours | | 10,611 | | | 820,018 |

| Eastman Chemical | | 1,447 | | | 159,344 |

| Ferro † | | 5,615 | | | 94,669 |

| Kaiser Aluminum | | 1,399 | | | 154,590 |

| Minerals Technologies | | 2,504 | | | 188,601 |

| Neenah | | 2,356 | | | 121,051 |

| Quaker Chemical | | 586 | | | 142,849 |

| Reliance Steel & Aluminum | | 766 | | | 116,654 |

| Summit Materials Class A † | | 2,722 | | | 76,270 |

| Westrock | | 4,566 | | | 237,660 |

| Worthington Industries | | 2,797 | | | 187,651 |

| | | | | | 2,939,657 |

| Real Estate – 0.92% | | | | | |

| American Assets Trust | | 2,580 | | | 83,695 |

| American Tower | | 1,218 | | | 291,175 |

| Armada Hoffler Properties | | 5,663 | | | 71,014 |

| Brixmor Property Group | | 6,115 | | | 123,706 |

| Camden Property Trust | | 1,106 | | | 121,561 |

| Cousins Properties | | 1,508 | | | 53,308 |

| DiamondRock Hospitality † | | 7,045 | | | 72,564 |

| EastGroup Properties | | 948 | | | 135,829 |

| Equity Residential | | 10,045 | | | 719,523 |

| First Industrial Realty Trust | | 2,288 | | | 104,768 |

| Kite Realty Group Trust | | 5,527 | | | 106,616 |

| Lexington Realty Trust | | 7,713 | | | 85,691 |

| National Storage Affiliates Trust | | 2,316 | | | 92,478 |

| Pebblebrook Hotel Trust | | 3,334 | | | 80,983 |

| Physicians Realty Trust | | 6,533 | | | 115,438 |

| RPT Realty | | 5,854 | | | 66,794 |

| Spirit MTA REIT =,† | | 677 | | | 0 |

| | | | | | 2,325,143 |

21

Table of Contents

Schedule of investments

Delaware Strategic Allocation Fund

| | | | Number of shares | | Value (US $) |

| Common Stock (continued) | | | | | |

| US Markets (continued) | | | | | |

| Utilities – 0.54% | | | | | |

| Black Hills | | 3,039 | | $ | 202,914 |

| Edison International | | 10,700 | | | 627,020 |

| NorthWestern | | 2,120 | | | 138,224 |

| South Jersey Industries | | 10,364 | | | 234,019 |

| Spire | | 2,065 | | | 152,583 |

| | | | | | 1,354,760 |

| Total US Markets (cost $39,150,520) | | | | | 68,165,294 |

| Developed Markets – 22.12%§ | | | | | |

| Communication Services – 0.89% | | | | | |

| Nippon Telegraph & Telephone | | 20,860 | | | 535,418 |

| PCCW | | 630,000 | | | 354,948 |

| Telefonica | | 64,432 | | | 288,410 |

| Telenet Group Holding | | 8,200 | | | 332,526 |

| Toho | | 6,400 | | | 259,526 |

| Vodafone Group | | 260,000 | | | 472,705 |

| | | | | | 2,243,533 |

| Consumer Discretionary – 2.13% | | | | | |

| Cie Generale des Etablissements Michelin | | 3,690 | | | 552,375 |

| Honda Motor | | 17,200 | | | 515,573 |

| Industria de Diseno Textil | | 11,790 | | | 388,514 |

| LVMH Moet Hennessy Louis Vuitton | | 640 | | | 426,375 |

| McDonald’s Holdings Co. Japan | | 7,700 | | | 354,662 |

| Persimmon | | 10,500 | | | 425,574 |

| Sony | | 8,000 | | | 837,751 |

| Stanley Electric | | 11,100 | | | 330,318 |

| Toyota Motor | | 11,888 | | | 925,058 |

| Wesfarmers | | 15,040 | | | 601,683 |

| | | | | | 5,357,883 |

| Consumer Staples – 2.41% | | | | | |

| Beiersdorf | | 3,170 | | | 334,943 |

| British American Tobacco | | 13,710 | | | 524,303 |

| Chocoladefabriken Lindt & Spruengli † | | 50 | | | 436,439 |

| Coles Group | | 29,430 | | | 357,880 |

| Essity Class B | | 11,200 | | | 353,821 |

| Koninklijke Ahold Delhaize | | 13,940 | | | 388,252 |

| L’Oreal | | 1,770 | | | 678,332 |

| Matsumotokiyoshi Holdings | | 7,000 | | | 311,673 |

| Nestle | | 12,780 | | | 1,424,372 |

| Sundrug | | 9,700 | | | 354,798 |

22

Table of Contents

| | | | Number of shares | | Value (US $) |

| Common Stock (continued) | | | | | |

| Developed Markets § (continued) | | | | | |

| Consumer Staples (continued) | | | | | |

| Suntory Beverage & Food | | 5,900 | | $ | 219,269 |

| Tate & Lyle | | 32,230 | | | 340,884 |

| Wm Morrison Supermarkets | | 130,000 | | | 326,983 |

| | | | | | 6,051,949 |

| Energy – 0.43% | | | | | |

| Galp Energia | | 21,400 | | | 248,950 |

| Royal Dutch Shell Class A | | 23,120 | | | 450,624 |

| Royal Dutch Shell Class B | | 20,740 | | | 381,705 |

| | | | | | 1,081,279 |

| Financials – 4.34% | | | | | |

| AIA Group | | 73,000 | | | 885,492 |

| Allianz | | 3,170 | | | 806,875 |

| Aviva | | 75,000 | | | 422,058 |

| Banco Bilbao Vizcaya Argentaria | | 100,000 | | | 519,037 |

| Banco Espirito Santo =,† | | 370,000 | | | 0 |

| Bank Leumi Le-Israel † | | 63,000 | | | 414,585 |

| BNP Paribas † | | 11,300 | | | 687,488 |

| Credit Suisse Group † | | 38,390 | | | 402,198 |

| Dai-ichi Life Holdings | | 17,300 | | | 297,174 |

| Daiwa Securities Group | | 74,100 | | | 382,864 |

| DBS Group Holdings | | 27,900 | | | 597,116 |

| Erste Group Bank † | | 12,890 | | | 437,158 |

| Investec | | 122,450 | | | 370,031 |

| KBC Group † | | 6,540 | | | 475,506 |

| Medibank | | 210,000 | | | 446,615 |

| Ninety One † | | 98,000 | | | 322,626 |

| Nordea Bank † | | 57,070 | | | 561,980 |

| QBE Insurance Group | | 34,193 | | | 249,844 |

| Sompo Holdings | | 10,100 | | | 386,942 |

| Standard Chartered | | 70,610 | | | 486,228 |

| Swiss Life Holding † | | 880 | | | 432,575 |

| UBS Group | | 35,320 | | | 546,906 |

| UniCredit † | | 27,150 | | | 286,963 |

| United Overseas Bank | | 26,400 | | | 506,922 |

| | | | | | 10,925,183 |

| Healthcare – 2.98% | | | | | |

| Alfresa Holdings | | 14,200 | | | 273,548 |

| Astellas Pharma | | 25,100 | | | 385,822 |

| AstraZeneca | | 8,800 | | | 879,183 |

| Daiichi Sankyo | | 11,700 | | | 340,777 |

23

Table of Contents

Schedule of investments

Delaware Strategic Allocation Fund

| | | Number of shares | | Value (US $) |

| Common Stock (continued) | | | | | |

| Developed Markets § (continued) | | | | | |

| Healthcare (continued) | | | | | |

| | GlaxoSmithKline | | 38,450 | | $ | 682,732 |

| Koninklijke Philips † | | 9,647 | | | 550,662 |

| Kyowa Kirin | | 9,700 | | | 289,971 |

| Nippon Shinyaku | | 4,700 | | | 349,343 |

| Novartis | | 11,740 | | | 1,003,269 |

| Novo Nordisk Class B | | 11,800 | | | 799,440 |

| Roche Holding | | 1,750 | | | 565,558 |

| Sanofi | | 7,290 | | | 720,252 |

| Smith & Nephew | | 19,790 | | | 375,953 |

| Sumitomo Dainippon Pharma | | 16,000 | | | 278,456 |

| | | | | | 7,494,966 |

| Industrials – 3.74% | | | | | |

| AGC | | 10,400 | | | 434,879 |

| ANDRITZ | | 10,140 | | | 455,908 |

| BAE Systems | | 71,400 | | | 497,082 |

| Brenntag | | 5,200 | | | 443,937 |

| Deutsche Lufthansa † | | 17,620 | | | 233,595 |

| Deutsche Post | | 10,630 | | | 582,402 |

| East Japan Railway | | 5,166 | | | 365,738 |

| Eiffage † | | 3,800 | | | 380,386 |

| Intertek Group | | 3,680 | | | 284,203 |

| ITOCHU | | 16,586 | | | 537,313 |

| Japan Airlines † | | 10,400 | | | 231,998 |

| Mitsubishi | | 20,700 | | | 585,153 |

| Miura | | 7,400 | | | 399,657 |

| Schneider Electric | | 4,250 | | | 649,163 |

| Siemens | | 4,940 | | | 811,039 |

| Teleperformance | | 750 | | | 273,356 |

| Vestas Wind Systems | | 2,250 | | | 461,830 |

| Vinci | | 5,040 | | | 516,333 |

| Volvo Class B † | | 21,990 | | | 556,205 |

| West Japan Railway | | 5,000 | | | 277,038 |

| Wolters Kluwer | | 4,870 | | | 423,303 |

| | | | | | 9,400,518 |

| Information Technology – 2.04% | | | | | |

| ASML Holding (New York Shares) | | 2,040 | | | 1,236,823 |

| Capgemini | | 2,580 | | | 439,010 |

| Computershare | | 35,100 | | | 400,969 |

| Nice † | | 1,560 | | | 336,909 |

| Obic | | 2,200 | | | 401,951 |

24

Table of Contents

| | | Number of shares | | Value (US $) |

| Common Stock (continued) | | | | | |

| Developed Markets § (continued) | | | | | |

| Information Technology (continued) | | | | | |

| | Omron | | 4,000 | | $ | 312,125 |

| SAP | | 7,070 | | | 865,745 |

| Tokyo Electron | | 1,700 | | | 718,383 |

| Venture | | 27,900 | | | 416,053 |

| | | | | | 5,127,968 |

| Materials – 1.74% | | | | | |

| BlueScope Steel | | 28,390 | | | 417,256 |

| Boliden | | 11,530 | | | 427,748 |

| Covestro 144A # | | 3,800 | | | 255,522 |

| CRH | | 12,400 | | | 581,223 |

| Givaudan † | | 140 | | | 539,470 |

| LANXESS | | 6,570 | | | 484,314 |

| Linde | | 507 | | | 142,031 |

| Rio Tinto | | 7,790 | | | 596,031 |

| Shin-Etsu Chemical | | 2,900 | | | 487,415 |

| South32 | | 209,460 | | | 447,058 |

| | | | | | 4,378,068 |

| Real Estate – 0.57% | | | | | |

| Daito Trust Construction | | 3,400 | | | 393,967 |

| Grand City Properties | | 10,190 | | | 255,248 |

| Klepierre | | 16,760 | | | 390,829 |

| Mirvac Group | | 204,620 | | | 388,548 |

| | | | | | 1,428,592 |

| Utilities – 0.85% | | | | | |

| AusNet Services | | 195,880 | | | 273,013 |

| Centrica † | | 370,000 | | | 276,158 |

| E.ON | | 48,000 | | | 558,618 |

| Enel | | 70,990 | | | 707,042 |

| Tokyo Gas | | 14,900 | | | 331,373 |

| | | | | | 2,146,204 |

| Total Developed Markets (cost $45,594,284) | | | | | 55,636,143 |

| Emerging Markets - 8.86%@ | | | | | |

| Communication Services – 1.96% | | | | | |

| America Movil ADR Class L | | 6,429 | | | 87,306 |

| Baidu ADR † | | 2,422 | | | 526,906 |

| Grupo Televisa ADR † | | 18,488 | | | 163,804 |

| iQIYI ADR † | | 1,826 | | | 30,348 |

| LG Uplus | | 8,694 | | | 94,103 |

| Mail.Ru Group GDR † | | 3,046 | | | 69,753 |

25

Table of Contents

Schedule of investments

Delaware Strategic Allocation Fund

| | | Number of shares | | Value (US $) |

| Common Stock (continued) | | | | | |

| Emerging Markets @ (continued) | | | | | |

| Communication Services (continued) | | | | | |

| | NAVER | | 592 | | $ | 197,203 |

| SK Telecom ADR | | 42,555 | | | 1,158,773 |

| Sohu.com ADR † | | 8,688 | | | 136,575 |

| Telefonica Brasil ADR | | 9,422 | | | 74,151 |

| Tencent Holdings | | 24,900 | | | 1,953,795 |

| Tencent Music Entertainment Group ADR † | | 7 | | | 143 |

| TIM ADR | | 8,073 | | | 91,629 |

| Turkcell Iletisim Hizmetleri ADR | | 12,791 | | | 59,734 |

| Weibo ADR † | | 1,972 | | | 99,507 |

| Yandex Class A † | | 3,024 | | | 193,718 |

| | | | | | 4,937,448 |

| Consumer Discretionary – 1.29% | | | | | |

| Alibaba Group Holding ADR † | | 6,138 | | | 1,391,669 |

| Arcos Dorados Holdings Class A | | 8,245 | | | 41,967 |

| Astra International | | 312,200 | | | 113,381 |

| B2W Cia Digital † | | 40,090 | | | 433,475 |

| JD.com ADR † | | 11,936 | | | 1,006,563 |

| LG Electronics | | 1,067 | | | 141,418 |

| Trip.com Group ADR † | | 2,961 | | | 117,344 |

| | | | | | 3,245,817 |

| Consumer Staples – 0.53% | | | | | |

| BRF ADR † | | 25,034 | | | 112,403 |

| Cia Cervecerias Unidas ADR | | 3,537 | | | 62,499 |

| Coca-Cola Femsa ADR | | 5,174 | | | 239,039 |

| Fomento Economico Mexicano ADR | | 1,012 | | | 76,234 |

| Tata Consumer Products | | 13,320 | | | 116,396 |

| Tingyi Cayman Islands Holding | | 143,724 | | | 264,002 |

| Tsingtao Brewery Class H | | 29,400 | | | 260,565 |

| Uni-President China Holdings | | 163,600 | | | 199,078 |

| | | | | | 1,330,216 |

| Energy - 0.96% | | | | | |

| China Petroleum & Chemical Class H | | 246,200 | | | 131,111 |

| Gazprom PJSC ADR | | 50,460 | | | 300,943 |

| Petroleo Brasileiro ADR | | 13,098 | | | 111,071 |

| Reliance Industries GDR 144A # | | 27,156 | | | 1,501,727 |

| Rosneft Oil PJSC GDR | | 47,967 | | | 362,726 |

| | | | | | 2,407,578 |

| Financials – 0.54% | | | | | |

| Akbank TAS † | | 65,566 | | | 37,241 |

26

Table of Contents

| | | Number of shares | | Value (US $) |

| Common Stock (continued) | | | | | |

| Emerging Markets @ (continued) | | | | | |

| Financials (continued) | | | | | |

| | Banco Bradesco ADR | | 22,220 | | $ | 104,434 |

| Banco Santander Brasil ADR | | 11,302 | | | 79,679 |

| Banco Santander Mexico ADR † | | 30,062 | | | 165,341 |

| Grupo Financiero Banorte Class O † | | 14,685 | | | 82,803 |

| Itau Unibanco Holding ADR | | 29,636 | | | 146,995 |

| Ping An Insurance Group Co. of China Class H | | 31,000 | | | 369,052 |

| Samsung Life Insurance | | 1,972 | | | 136,084 |

| Sberbank of Russia PJSC = | | 60,901 | | | 233,793 |

| | | | | | 1,355,422 |

| Healthcare – 0.05% | | | | | |

| BeiGene ADR † | | 356 | | | 123,916 |

| Joinn Laboratories China Class H 144A #,† | | 100 | | | 1,729 |

| | | | | | 125,645 |

| Information Technology – 3.18% | | | | | |

| Hon Hai Precision Industry | | 133,582 | | | 580,527 |

| MediaTek | | 41,000 | | | 1,392,388 |

| Samsung Electronics | | 28,001 | | | 2,013,944 |

| SK Hynix | | 13,902 | | | 1,627,581 |

| Taiwan Semiconductor Manufacturing | | 109,069 | | | 2,243,840 |

| WNS Holdings ADR † | | 1,982 | | | 143,576 |

| Zhihu ADR † | | 500 | | | 4,055 |

| | | | | | 8,005,911 |

| Materials – 0.29% | | | | | |

| Cemex ADR † | | 12,322 | | | 85,884 |

| Cia de Minas Buenaventura ADR † | | 11,225 | | | 112,587 |

| Sociedad Quimica y Minera de Chile ADR | | 3,027 | | | 160,643 |

| Tata Chemicals | | 11,685 | | | 120,152 |

| Vale ADR | | 14,223 | | | 247,196 |

| | | | | | 726,462 |

| Real Estate – 0.02% | | | | | |

| Etalon Group GDR 144A #,† | | 20,100 | | | 32,461 |

| IRSA Inversiones y Representaciones ADR † | | 4,584 | | | 17,832 |

| IRSA Propiedades Comerciales ADR | | 221 | | | 2,177 |

| UEM Sunrise † | | 113,419 | | | 11,899 |

| | | | | | 64,369 |

27

Table of Contents

Schedule of investments

Delaware Strategic Allocation Fund

| | | Number of shares | | Value (US $) |

| Common Stock (continued) | | | | | |

| Emerging Markets @ (continued) | | | | | |

| Utilities – 0.04% | | | | | |

| | Kunlun Energy | | 86,000 | | $ | 90,380 |

| | | | | | 90,380 |

| Total Emerging Markets (cost $11,379,725) | | | | | 22,289,248 |

| Total Common Stock (cost $96,124,529) | | | | | 146,090,685 |

| | |

| Exchange-Traded Funds – 7.87% | | | | | |

| iShares MSCI EAFE ETF | | 12,350 | | | 936,994 |

| iShares Russell 1000 Growth ETF | | 51,170 | | | 12,436,357 |

| Vanguard FTSE Developed Markets ETF | | 21,500 | | | 1,055,865 |

| Vanguard Mega Cap Growth ETF | | 24,813 | | | 5,138,028 |

| Vanguard Russell 1000 Growth ETF | | 900 | | | 225,009 |

| Total Exchange-Traded Funds (cost $12,603,075) | | | | | 19,792,253 |

| | |

| | | Principal amount° | | | |

| Agency Collateralized Mortgage Obligations – 0.70% | | | | | |

| Fannie Mae REMICs | | | | | |

| Series 2013-44 DI 3.00% 5/25/33 Σ | | 411,123 | | | 44,209 |

| Freddie Mac REMICs | | | | | |

| Series 5092 WG 1.00% 4/25/31 = | | 330,000 | | | 331,908 |

| Freddie Mac Structured Agency Credit Risk REMIC | | | | | |

| Trust | | | | | |

| Series 2021-DNA1 M1 144A 0.667% (SOFR + | | | | | |

| 0.65%) 1/25/51 #,● | | 500,000 | | | 499,400 |

| Series 2021-HQA1 M1 144A 0.717% (SOFR + | | | | | |

| 0.70%) 8/25/33 #,● | | 400,000 | | | 399,502 |

| GNMA | | | | | |

| Series 2013-113 LY 3.00% 5/20/43 | | 450,000 | | | 476,162 |

| Series 2017-10 KZ 3.00% 1/20/47 | | 1,133 | | | 1,187 |

| Total Agency Collateralized Mortgage Obligations (cost $1,754,025) | | | | | 1,752,368 |

| |

| Agency Commercial Mortgage-Backed Securities – 0.19% | | | | | |

| Freddie Mac Multifamily Structured Pass Through | | | | | |

| Certificates | | | | | |

| Series K729 A2 3.136% 10/25/24 ◆ | | 100,000 | | | 107,725 |

| FREMF Mortgage Trust | | | | | |

| Series 2011-K15 B 144A 4.986% 8/25/44 #,● | | 20,000 | | | 20,198 |

| Series 2012-K22 B 144A 3.686% 8/25/45 #,● | | 145,000 | | | 150,644 |

28

Table of Contents

| | | | | Principal amount° | | Value (US $) |

| Agency Commercial Mortgage-Backed Securities (continued) | | | | | |

| FREMF Mortgage Trust | | | | | |

| | Series 2014-K717 B 144A 3.625% 11/25/47 #,● | | 140,000 | | $ | 141,472 |

| | Series 2014-K717 C 144A 3.625% 11/25/47 #,● | | 60,000 | | | 60,476 |

| Total Agency Commercial Mortgage-Backed Securities (cost $480,358) | | | | | 480,515 |

| | | | | | | |

| Agency Mortgage-Backed Securities – 9.98% | | | | | |

| Fannie Mae S.F. 30 yr | | | | | |

| | 2.00% 12/1/50 | | 65,172 | | | 65,134 |

| | 2.00% 1/1/51 | | 24,827 | | | 24,815 |

| | 2.00% 2/1/51 | | 1,183,188 | | | 1,182,148 |

| | 2.50% 7/1/50 | | 489,292 | | | 504,279 |

| | 2.50% 10/1/50 | | 842,870 | | | 867,182 |

| | 2.50% 11/1/50 | | 539,128 | | | 553,855 |

| | 2.50% 2/1/51 | | 1,569,744 | | | 1,612,323 |

| | 3.00% 12/1/46 | | 831,961 | | | 876,922 |

| | 3.00% 1/1/47 | | 277,402 | | | 293,516 |

| | 3.00% 11/1/49 | | 389,922 | | | 413,221 |

| | 3.00% 3/1/50 | | 319,878 | | | 338,414 |

| | 3.00% 7/1/50 | | 127,511 | | | 133,703 |

| | 3.00% 8/1/50 | | 425,334 | | | 450,942 |

| | 3.50% 7/1/47 | | 121,550 | | | 130,618 |

| | 3.50% 11/1/48 | | 66,888 | | | 70,747 |

| | 3.50% 3/1/50 | | 30,846 | | | 32,650 |

| | 3.50% 7/1/50 | | 479,628 | | | 513,731 |

| | 3.50% 9/1/50 | | 830,457 | | | 906,661 |

| | 4.00% 10/1/48 | | 515,207 | | | 567,315 |

| | 4.50% 4/1/44 | | 48,759 | | | 54,962 |

| | 4.50% 10/1/45 | | 291,336 | | | 323,837 |

| | 4.50% 5/1/46 | | 395,672 | | | 445,195 |

| | 4.50% 9/1/48 | | 1,050,891 | | | 1,160,541 |

| | 4.50% 9/1/49 | | 417,651 | | | 461,062 |

| | 5.00% 7/1/47 | | 626,843 | | | 728,517 |

| | 5.00% 8/1/49 | | 1,382,623 | | | 1,564,121 |

| | 5.50% 5/1/44 | | 2,381,365 | | | 2,786,966 |

| | 6.00% 10/1/38 | | 580,906 | | | 694,271 |

| | 6.00% 6/1/41 | | 29,004 | | | 34,646 |

| | 6.00% 7/1/41 | | 987,466 | | | 1,180,473 |

| | 6.00% 1/1/42 | | 35,303 | | | 42,176 |

| Fannie Mae S.F. 30 yr TBA | | | | | |

| | 2.00% 4/1/51 | | 1,452,000 | | | 1,449,278 |

| | 2.50% 4/1/51 | | 1,026,000 | | | 1,052,852 |

29

Table of Contents

Schedule of investments

Delaware Strategic Allocation Fund

| | | | | Principal amount° | | Value (US $) |

| Agency Mortgage-Backed Securities (continued) | | | | | |

| Freddie Mac S.F. 30 yr | | | | | |

| | 2.00% 11/1/50 | | 549,750 | | $ | 549,773 |

| | 2.00% 12/1/50 | | 112,601 | | | 111,488 |

| | 2.00% 4/1/51 | | 73,000 | | | 72,277 |

| | 2.50% 11/1/50 | | 214,588 | | | 221,181 |

| | 2.50% 2/1/51 | | 1,052,182 | | | 1,089,360 |

| | 3.00% 7/1/50 | | 596,593 | | | 622,621 |

| | 3.00% 12/1/50 | | 573,465 | | | 609,654 |

| | 4.50% 8/1/48 | | 150,699 | | | 165,444 |

| | 4.50% 1/1/49 | | 55,040 | | | 61,498 |

| | 5.50% 9/1/41 | | 35,287 | | | 41,414 |

| GNMA II S.F. 30 yr | | | | | |

| | 5.50% 5/20/37 | | 10,395 | | | 11,858 |

| | 6.50% 6/20/39 | | 21,486 | | | 25,265 |

| Total Agency Mortgage-Backed Securities (cost $24,990,629) | | | | | 25,098,906 |

| | | | | | | |

| Collateralized Debt Obligations – 1.23% | | | | | |

| Cedar Funding IX CLO | | | | | |

| | Series 2018-9A A1 144A 1.204% (LIBOR03M + | | | | | |

| | 0.98%, Floor 0.98%) 4/20/31 #,● | | 250,000 | | | 250,185 |

| Galaxy XXI CLO | | | | | |

| | Series 2015-21A AR 144A 1.244% (LIBOR03M + | | | | | |

| | 1.02%) 4/20/31 #,● | | 600,000 | | | 600,474 |

| Neuberger Berman Loan Advisers CLO 36 | | | | | |

| | Series 2020-36A A1R 144A 1.474% (LIBOR03M + | | | | | |

| | 1.25%, Floor 1.25%) 4/20/33 #,● | | 250,000 | | | 249,937 |

| Northwoods Capital XV | | | | | |

| | Series 2017-15A A 144A 1.487% (LIBOR03M + | | | | | |

| | 1.30%) 6/20/29 #,● | | 248,335 | | | 248,754 |

| Octagon Investment Partners 33 | | | | | |

| | Series 2017-1A A1 144A 1.414% (LIBOR03M + | | | | | |

| | 1.19%) 1/20/31 #,● | | 250,000 | | | 250,268 |

| Octagon Investment Partners 48 | | | | | |

| | Series 2020-3A A 144A 1.732% (LIBOR03M + | | | | | |

| | 1.50%, Floor 1.50%) 10/20/31 #,● | | 250,000 | | | 250,631 |

| Park Avenue Institutional Advisers CLO | | | | | |

| | Series 2021-1A A1A 144A 1.595% (LIBOR03M + | | | | | |

| | 1.39%, Floor 1.39%) 1/20/34 #,● | | 250,000 | | | 249,934 |

| Signal Peak CLO 5 | | | | | |

| | Series 2018-5A A 144A 1.328% (LIBOR03M + | | | | | |

| | 1.11%, Floor 1.11%) 4/25/31 #,● | | 250,000 | | | 250,437 |

| Sound Point CLO XXI | | | | | |

| | Series 2018-3A A1A 144A 1.395% (LIBOR03M + | | | | | |

| | 1.18%, Floor 1.18%) 10/26/31 #,● | | 250,000 | | | 250,427 |

30

Table of Contents

| | | | | Principal amount° | | Value (US $) |

| Collateralized Debt Obligations (continued) | | | | | |

| Venture 34 CLO | | | | | |

| | Series 2018-34A A 144A 1.471% (LIBOR03M + | | | | | |

| | 1.23%, Floor 1.23%) 10/15/31 #,● | | 250,000 | | $ | 250,427 |

| Venture 42 CLO | | | | | |

| | Series 2021-42A A1A 144A 1.13% (LIBOR03M + | | | | | |

| | 1.13%, Floor 1.13%) 4/15/34 #,● | | 250,000 | | | 249,937 |

| Total Collateralized Debt Obligations (cost $3,088,285) | | | | | 3,101,411 |

| | | | | | | |

| Corporate Bonds – 9.16% | | | | | |

| Banking – 2.31% | | | | | |

| Banco Santander 2.706% 6/27/24 | | 200,000 | | | 211,129 |

| Bank of America | | | | | |

| | 1.658% 3/11/27 µ | | 105,000 | | | 105,392 |

| | 1.898% 7/23/31 µ | | 115,000 | | | 108,115 |

| | 2.676% 6/19/41 µ | | 125,000 | | | 117,282 |

| | 2.831% 10/24/51 µ | | 20,000 | | | 18,397 |

| | 3.458% 3/15/25 µ | | 215,000 | | | 230,958 |

| Bank of Montreal 1.850% 5/1/25 | | 210,000 | | | 215,382 |

| BBVA USA 3.875% 4/10/25 | | 250,000 | | | 273,299 |

| Citizens Financial Group 2.850% 7/27/26 | | 345,000 | | | 366,283 |

| Credit Suisse Group 144A 5.100% 1/24/30 #,µ,ψ | | 200,000 | | | 193,300 |

| Goldman Sachs Group | | | | | |

| | 1.992% 1/27/32 µ | | 65,000 | | | 61,742 |

| | 2.600% 2/7/30 | | 70,000 | | | 70,906 |

| | 3.500% 4/1/25 | | 40,000 | | | 43,352 |

| JPMorgan Chase & Co. | | | | | |

| | 1.040% 2/4/27 µ | | 40,000 | | | 39,032 |

| | 1.953% 2/4/32 µ | | 45,000 | | | 42,687 |

| | 2.522% 4/22/31 µ | | 80,000 | | | 79,896 |

| | 3.109% 4/22/41 µ | | 45,000 | | | 44,841 |

| | 3.702% 5/6/30 µ | | 400,000 | | | 436,292 |

| | 4.023% 12/5/24 µ | | 75,000 | | | 81,400 |

| | 4.600% 2/1/25 µ,ψ | | 30,000 | | | 30,375 |

| | 5.000% 8/1/24 µ,ψ | | 50,000 | | | 51,727 |

| KeyBank 3.400% 5/20/26 | | 500,000 | | | 539,761 |

| Morgan Stanley | | | | | |

| | 1.413% (LIBOR03M + 1.22%) 5/8/24 ● | | 650,000 | | | 660,359 |

| | 1.794% 2/13/32 µ | | 5,000 | | | 4,671 |

| | 2.750% 5/19/22 | | 200,000 | | | 205,445 |

| | 5.000% 11/24/25 | | 30,000 | | | 34,515 |

| PNC Bank 2.700% 11/1/22 | | 250,000 | | | 258,785 |

| PNC Financial Services Group 2.600% 7/23/26 | | 175,000 | | | 185,000 |

31

Table of Contents

Schedule of investments

Delaware Strategic Allocation Fund

| | | | | Principal amount° | | Value (US $) |

| Corporate Bonds (continued) | | | | | |

| Banking (continued) | | | | | |

| Regions Financial 3.800% 8/14/23 | | 80,000 | | $ | 85,846 |

| Santander UK 144A 5.000% 11/7/23 # | | 90,000 | | | 98,646 |

| State Street 3.300% 12/16/24 | | 260,000 | | | 283,711 |

| SVB Financial Group | | | | | |

| | 1.800% 2/2/31 | | 45,000 | | | 41,583 |

| | 4.100% 2/15/31 µ,ψ | | 135,000 | | | 135,422 |