Item 1. Reports to Stockholders

Annual report

Multi-asset mutual fund

Delaware Strategic Allocation Fund

March 31, 2020

Beginning on or about June 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your Fund’s shareholder reports will no longer be sent to you by mail, unless you specifically request them from the Fund or from your financial intermediary, such as a broker/dealer, bank, or insurance company. Instead, you will be notified by mail each time a report is posted on the website and provided with a link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you do not need to take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by signing up at delawarefunds.com/edelivery. If you own these shares through a financial intermediary, you may contact your financial intermediary.

You may elect to receive paper copies of all future shareholder reports free of charge. You can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by contacting us at 800523-1918. If you own these shares through a financial intermediary, you may contact your financial intermediary to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held with the Delaware Funds® by Macquarie or your financial intermediary.

Carefully consider the Fund’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Fund’s prospectus and its summary prospectus, which may be obtained by visiting delawarefunds.com/literature or calling 800523-1918. Investors should read the prospectus and the summary prospectus carefully before investing.

You can obtain shareholder reports and prospectuses online instead of in the mail.

Visit delawarefunds.com/edelivery.

Experience Delaware Funds®by Macquarie

Macquarie Investment Management (MIM) is a global asset manager with offices in the United States, Europe, Asia, and Australia. As active managers we prioritize autonomy and accountability at the investment team level in pursuit of opportunities that matter for clients. Delaware Funds is one of the longest-standing mutual fund families, with more than 80 years in existence.

If you are interested in learning more about creating an investment plan, contact your financial advisor.

You can learn more about Delaware Funds or obtain a prospectus for Delaware Strategic Allocation Fund at delawarefunds.com/literature.

Manage your account online

| ● | | Check your account balance and transactions |

| ● | | View statements and tax forms |

| ● | | Make purchases and redemptions |

Visit delawarefunds.com/account-access.

Macquarie Asset Management (MAM) offers a diverse range of products including securities investment management, infrastructure and real asset management, and fund and equity-based structured products. MIM is the marketing name for certain companies comprising the asset management division of Macquarie Group. This includes the following investment advisers: Macquarie Investment Management Business Trust (MIMBT), Macquarie Funds Management Hong Kong Limited, Macquarie Investment Management Austria Kapitalanlage AG, Macquarie Investment Management Global Limited, Macquarie Investment Management Europe Limited, Macquarie Capital Investment Management LLC, and Macquarie Investment Management Europe S.A.

The Fund is distributed byDelaware Distributors, L.P. (DDLP), an affiliate of MIMBT and Macquarie Group Limited.

Other than Macquarie Bank Limited (MBL), none of the entities noted are authorized deposit-taking institutions for the purposes of the Banking Act 1959 (Commonwealth of Australia). The obligations of these entities do not represent deposits or other liabilities of MBL. MBL does not guarantee or otherwise provide assurance in respect of the obligations of these entities, unless noted otherwise. The Fund is governed by US laws and regulations.

Unless otherwise noted, views expressed herein are current as of March 31, 2020, and subject to change for events occurring after such date.

The Fund is not FDIC insured and is not guaranteed. It is possible to lose the principal amount invested.

Advisory services provided by Delaware Management Company, a series of MIMBT, a US registered investment advisor.

All third-party marks cited are the property of their respective owners.

© 2020 Macquarie Management Holdings, Inc.

| | |

| Portfolio management review | | |

| Delaware Strategic Allocation Fund | | April 7, 2020 (Unaudited) |

| | | | | | | | |

| Performance preview (for the year ended March 31, 2020) | | | | | | | | |

| | | |

Delaware Strategic Allocation Fund (Institutional Class shares) | | | 1-year return | | | | -9.29 | % |

| | | |

Delaware Strategic Allocation Fund (Class A shares) | | | 1-year return | | | | -9.55 | % |

| | | |

Bloomberg Barclays US Aggregate Index (benchmark) | | | 1-year return | | | | +8.93 | % |

| | | |

S&P 500® Index (benchmark) | | | 1-year return | | | | -6.98 | % |

| | | |

Lipper Mixed-Asset Target Allocation Moderate Funds Average | | | 1-year return | | | | -6.32 | % |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Strategic Allocation Fund, please see the table on page 4. Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. Both Institutional Class shares and Class A shares reflect the reinvestment of all distributions.

The Lipper Mixed-Asset Target Allocation Moderate Funds Average compares funds that, by portfolio practice, maintain a mix of between 40% and 60% equity securities, with the remainder invested in bonds, cash, and cash equivalents.

Please see page 7 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Investment objective

The Fund seeks capital appreciation with current income as a secondary objective.

Economic backdrop

The period from April 1, 2019 to March 31, 2020 was mixed from a performance perspective. Prices of most risk assets had risen quite substantially up until theCOVID-19 outbreak. Market developments in the first quarter of 2020, and particularly March 2020, led to substantially falling prices of risk assets. In the equity markets, USsmall-cap equities underperformed US large caps, US value underperformed US growth, and US real estate investment trusts (REITs) underperformed the broad US equity market. Equities declined globally across all regions, including developed and emerging markets. In the fixed income markets, performance on an aggregate basis was positive, with US fixed income securities generating higher returns thannon-US fixed income securities. The price of many commodities declined even more than equity prices during the Fund’s fiscal year. Over the

12 months ended March 31, 2020, the spot price of West Texas Intermediate (WTI, Cushing) crude oil fell by nearlytwo-thirds, and the broadly diversified Bloomberg Commodity Index dropped by more than 20%. In contrast, the spot price of gold rose by almost 25%. (Source: Bloomberg.)

Within the Fund

For the fiscal year ended March 31, 2020, Delaware Strategic Allocation Fund underperformed its benchmarks, the Bloomberg Barclays US Aggregate Index and the S&P 500 Index. The Fund’s Institutional Class shares declined 9.29%. The Fund’s Class A shares fell 9.55% at net asset value and declined 14.77% at maximum offer price. These figures reflect all distributions reinvested. During the same period, the Bloomberg Barclays US Aggregate Index gained 8.93% and the S&P 500 Index declined 6.98%. For complete, annualized performance of Delaware Strategic Allocation Fund, please see the table on page 4.

1

Portfolio management review

Delaware Strategic Allocation Fund

The Fund’s negative return for the fiscal year ended March 31, 2020 was lower than that of the S&P 500 Index. This mainly stemmed from the fact that the Fund’s equity exposure was to a large extent allocated to international and emerging markets equities, which generally delivered lower returns than USlarge-cap equities for the12-month period. The Fund tends to hold a higher weight innon-US securities than most other asset allocation funds. Thus, when US markets are delivering higher total returns thannon-US markets, or when the US dollar is appreciating relative to other currencies, the Fund tends to struggle by comparison with its peers. Additionally, within US equities, the allocation tosmall-cap and real estate equities, which both underperformed the broad market, was unfavorable for the Fund during the12-month period.

A large portion of the Fund was invested in US fixed income securities, which had severalsub-sectors post significant gains, helping to dampen the negative effects of poor equity performance. During the fiscal year ended March 31, 2020, the Fund delivered returns that were lower than the average returns of its Lipper peer group, as shown on page 1.

Portfolio positioning

The Fund’s strategic policy weights reflect a commitment to seeking diversification across geographies and asset classes. At the beginning of April 2019, the Fund was positioned defensively relative to its strategic policy weights. In particular, the Fund was below its strategic policy weights in developed market equities – both US and international – while it held a tactical position in US real estate equities. The main overweight was in US fixed income securities. In broad terms, we maintained an underweight in US equity sectors and a tactical position in US REITs for the 12 months ended March 31, 2020. However, the extent of these active positions varied throughout

the fiscal period, along with other reallocations. At the beginning of the second quarter, we reduced the US fixed income allocation towards its strategic weight. In return, we increased the Fund’s allocation to international equities and maintained the overweight to emerging markets equities. In the third and fourth quarters of 2019, we chose to gradually reduce the active equity positions across all regions while establishing a small fixed income overweight. This changed inmid-December when we added to US equity exposure, which slightly overweighted equities overall relative to strategic policy weights. During the market selloff in March 2020 and immediately after theCOVID-19-related lockdowns in Italy, we decided to cut back equity investments to an underweight position. At the same time, we overweighted the allocation to US fixed income. We later again reduced this underweight to equities while we maintained a small underweight to equity overall.

As part of the oversight process, we periodically analyze the sources of the Fund’s active performance. Over the 12 months ended March 31, 2020, the Fund’s active positioning with respect to the strategic policy weights of different asset classes was disadvantageous to the Fund’s active performance, relative to its hypothetical returns at the strategic policy weights. Most of this underperformance occurred in the first quarter of 2020. In terms of asset allocation, the main detractor was the overweight credit and underweight duration allocation within the Fund’s fixed income sleeves. The underweight in US equities versus international and emerging markets during most of the Fund’s reporting period and the tactical addition of US REITs also detracted from active performance. In contrast, active positions in international equities, especially the underweight in March 2020, added to performance. In March 2020, the increased underweight of US equities likewise contributed to performance.

2

We periodically examine the contribution of derivatives to the Fund’s performance. Based on the available information, during the 12 months ended March 31, 2020, the Fund’s combination of futures, options, swaps, and currency positions had only a limited impact on performance. This limited impact detracted from the Fund’s performance for the fiscal year. As the Fund’s fiscal year ended, we sought to continue to deliver the potential benefits of diversification while actively managing risk. With these two

principles in mind, the Fund seeks to deliver returns that are derived from tactical asset allocation decisions as well as from active management of individual asset classes and investment styles. We manage the Fund based on the assumption that investors should keep a global perspective when evaluating potential investment opportunities, and therefore continue to include investment possibilities around the globe within the Fund.

3

Performance summary

| | |

Delaware Strategic Allocation Fund | | March 31, 2020 (Unaudited) |

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800523-1918 or visiting delawarefunds.com/performance.

| | | | | | | | | | | | | | | | |

| Fund and benchmark performance1,2 | | Average annual total returns through March 31, 2020 | |

| | | | |

| | | 1 year | | | 5 year | | | 10 year | | | Lifetime |

| | | | |

Class A (Est. Dec. 31, 1997) | | | | | | | | | | | | | | | | |

| | | | |

Excluding sales charge | | | -9.55 | % | | | +1.06 | % | | | +4.36 | % | | | +4.24% | |

| | | | |

Including sales charge | | | -14.77 | % | | | -0.13 | % | | | +3.74 | % | | | +3.97% | |

| | | | |

Class C (Est. Dec. 31, 1997) | | | | | | | | | | | | | | | | |

| | | | |

Excluding sales charge | | | -10.19 | % | | | +0.29 | % | | | +3.56 | % | | | +3.47% | |

| | | | |

Including sales charge | | | -11.03 | % | | | +0.29 | % | | | +3.56 | % | | | +3.47% | |

| | | | |

Class R (Est. June 2, 2003) | | | | | | | | | | | | | | | | |

| | | | |

Excluding sales charge | | | -9.74 | %* | | | +0.79 | % | | | +4.08 | % | | | +4.88% | |

| | | | |

Including sales charge | | | -9.74 | %* | | | +0.79 | % | | | +4.08 | % | | | +4.88% | |

| | | | |

Institutional Class (Est. Dec. 31, 1997) | | | | | | | | | | | | | | | | |

| | | | |

Excluding sales charge | | | -9.29 | % | | | +1.30 | % | | | +4.61 | % | | | +4.50% | |

| | | | |

Including sales charge | | | -9.29 | % | | | +1.30 | % | | | +4.61 | % | | | +4.50% | |

| | | | |

Bloomberg Barclays US Aggregate Index | | | +8.93 | % | | | +3.36 | % | | | +3.88 | % | | | +5.01%** | |

| | | | |

S&P 500 Index | | | -6.98 | % | | | +6.73 | % | | | +10.53 | % | | | +6.50%** | |

*Total return for the report period presented in the table differs from the return in “Financial highlights.” The total return presented in the above table is calculated based on the net asset value (NAV) at which shareholder transactions were processed. The total return presented in “Financial highlights” is calculated in the same manner but also takes into account certain adjustments that are necessary under US generally accepted accounting principles (US GAAP) required in the annual report.

**The benchmark lifetime return is for Institutional Class share comparison only and is calculated using the last business day in the month of the Fund’s Institutional Class inception date.

1Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund and benchmark performance” table. Expenses for each class are listed on the “Fund expense ratios” table on page 6. Performance would have been lower had expense limitations not been in effect.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service(12b-1) fee.

Class A shares are sold with a maximumfront-end sales charge of 5.75%, and have an annual12b-1 fee of 0.24% of average daily net assets. In connection with the merger with Delaware Balanced Fund, the Board has adopted a formula for calculating12b-1 plan fees for the Fund’s Class A shares. The Fund’s Class A shares are currently subject to a blended12b-1 fee equal to

4

the sum of: (i) 0.10% of average daily net assets representing shares acquired prior to June 1, 1992, and (ii) 0.25% of average daily net assets representing shares acquired on or after June 1, 1992. All Class A shares currently bear12b-1 fees at the same rate, the blended rate, currently 0.24% of average daily net assets, based on the formula described above. This method of calculating Class A12b-1 fees may be discontinued at the sole discretion of the Board. Performance for Class A shares, excluding sales charges, assumes that nofront-end sales charge applied.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual12b-1 fee of 1.00% of average daily net assets. Performance for Class C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Class R shares are available only for certain retirement plan products. They are sold without a sales charge and have an annual12b-1 fee of 0.50% of average daily net assets.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Fund may also be subject to prepayment risk, the risk that the principal of a bond that is held by a portfolio will be prepaid prior to maturity, at the time when interest rates are lower than what the bond was paying. A portfolio may then have to reinvest that money at a lower interest rate.

High yielding,non-investment-grade bonds (junk bonds) involve higher risk than investment grade bonds. The high yield secondary market is particularly susceptible to liquidity problems when institutional investors, such as mutual funds and certain other financial institutions, temporarily stop

buying bonds for regulatory, financial, or other reasons. In addition, a less liquid secondary market makes it more difficult for the Fund to obtain precise valuations of the high yield securities in its portfolio.

If and when the Fund invests in forward foreign currency contracts or uses other investments to hedge against currency risks, the Fund will be subject to special risks, including counterparty risk.

The Fund may invest in derivatives, which may involve additional expenses and are subject to risk, including the risk that an underlying security or securities index moves in the opposite direction from what the portfolio manager anticipated. A derivatives transaction depends upon the counterparties’ ability to fulfill their contractual obligations.

International investments entail risks not ordinarily associated with US investments including fluctuation in currency values, differences in accounting principles, or economic or political instability in other nations. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility and lower trading volume.

Risk controls and asset allocation models do not promise any level of performance or guarantee against loss of principal.

Narrowly focused investments may exhibit higher volatility than investments in multiple industry sectors.

Real estate investment trust (REIT) investments are subject to many of the risks associated with direct real estate ownership, including changes in economic conditions, credit risk, and interest rate fluctuations.

The Fund may experience portfolio turnover in excess of 100%, which could result in higher transaction costs and tax liability.

5

Performance summary

Delaware Strategic Allocation Fund

Interest payments on inflation-indexed debt securities will vary as the principal and/or interest is adjusted for inflation.

LIBOR risk is the risk that potential changes related to the use of the London interbank offered rate (LIBOR) could have adverse impacts on financial instruments which reference LIBOR. The potential abandonment of LIBOR could affect the value and liquidity of instruments which reference LIBOR.

The disruptions caused by natural disasters, pandemics, or similar events could prevent the Fund from executing advantageous investment decisions in a timely manner and could negatively impact the Fund’s ability to achieve its investment objective and the value of the Fund’s investments.

2The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Management Company has agreed to reimburse certain expenses and/or waive certain fees in order to prevent total annual fund operating expenses (excluding any12b-1 fees, acquired fund fees and expenses, taxes, interest, short sale and dividend and interest expenses, brokerage fees, certain insurance costs, and nonroutine expenses or costs, including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations (collectively, nonroutine expenses)) from exceeding 0.90% of the Fund’s average daily net assets from April 1, 2019 to March 31, 2020.* Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements. Please see the “Financial highlights” section in this report for the most recent expense ratios.

| | | | | | | | |

| Fund expense ratios | | Class A | | Class C | | Class R | | Institutional Class |

| | | | |

Total annual operating expenses | | 1.20% | | 1.96% | | 1.46% | | 0.96% |

(without fee waivers) | | | | | | | | |

Net expenses | | 1.14% | | 1.90% | | 1.40% | | 0.90% |

(including fee waivers, if any) | | | | | | | | |

Type of waiver | | Contractual | | Contractual | | Contractual | | Contractual |

*The aggregate contractual waiver period covering this report is from July 27, 2018 through July 29, 2020.

6

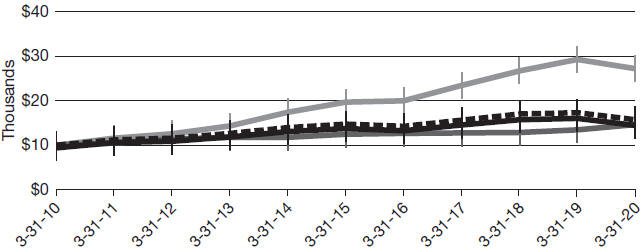

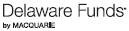

Performance of a $10,000 investment1

Average annual total returns from March 31, 2010 through March 31, 2020

| | | | | | | | |

| | | |

| For period beginning March 31, 2010 through March 31, 2020 | | Starting value | | | Ending value | |

| | |

S&P 500 Index S&P 500 Index

| | | $10,000 | | | | $27,211 | |

| | |

Delaware Strategic Allocation Fund — Institutional Class shares Delaware Strategic Allocation Fund — Institutional Class shares

| | | $10,000 | | | | $15,693 | |

| | |

Bloomberg Barclays US Aggregate Index Bloomberg Barclays US Aggregate Index

| | | $10,000 | | | | $14,638 | |

| | |

Delaware Strategic Allocation Fund — Class A shares Delaware Strategic Allocation Fund — Class A shares

| | | $9,425 | | | | $14,437 | |

1 The “Performance of a $10,000 investment” graph assumes $10,000 invested in Institutional Class and Class A shares of the Fund on March 31, 2010, and includes the effect of a 5.75%front-end sales charge (for Class A shares) and the reinvestment of all distributions. The graph does not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares. Expense limitations were in effect for some or all of the periods shown. Performance would have been lower had expense limitations not been in effect. Expenses are listed in the “Fund expense ratios” table on page 6. Please note additional details on pages 4 through 8.

The graph also assumes $10,000 invested in the Bloomberg Barclays US Aggregate Index and the S&P 500 Index as of March 31, 2010.

The S&P 500 Index measures the performance of 500 mostlylarge-cap stocks weighted by market value, and is often used to represent performance of the US stock market.

The Bloomberg Barclays US Aggregate Index is a broad composite that tracks the investment grade domestic bond market.

The Bloomberg Commodity Index, mentioned on page 1, is a highly liquid and diversified benchmark commodity price index. The index comprises 23 exchange-traded futures on physical commodities, representing 21 commodities that are weighted to account for economic significance and market liquidity.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.Past performance is not a guarantee of future results.

7

Performance summary

Delaware Strategic Allocation Fund

Performance of other Fund classes will vary due to

different charges and expenses.

| | | | | | |

| | | | |

| | | Nasdaq symbols | | CUSIPs | | |

Class A | | DFBAX | | 245918503 | | |

Class C | | DFBCX | | 245918701 | | |

Class R | | DFBRX | | 245918834 | | |

Institutional Class | | DFFIX | | 245918800 | | |

8

Disclosure of Fund expenses

For thesix-month period from October 1, 2019 to March 31, 2020 (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and service(12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entiresix-month period from Oct. 1, 2019 to March 31, 2020.

Actual expenses

The first section of the table shown, “Actual Fund return,” provides information about actual account values and actual expenses. You may use the information in this section of the table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second section of the table shown, “Hypothetical 5% return,” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The Fund’s expenses shown in the table reflect fee waivers in effect and assume reinvestment of all dividends and distributions.

9

Disclosure of Fund expenses

For thesix-month period from October 1, 2019 to March 31, 2020 (Unaudited)

Delaware Strategic Allocation Fund

Expense analysis of an investment of $1,000

| | | | | | | | | | | | | | | | | | | | |

| | | Beginning Account Value 10/1/19 | | Ending Account Value 3/31/20 | | Annualized Expense Ratio | | Expenses Paid During Period 10/1/19 to 3/31/20* |

| | | | |

Actual Fund return† | | | | | | | | | | | | | | | | | | | | |

Class A | | | | $1,000.00 | | | | | $885.20 | | | | | 1.12 | % | | | | $5.28 | |

Class C | | | | 1,000.00 | | | | | 881.50 | | | | | 1.88 | % | | | | 8.84 | |

Class R | | | | 1,000.00 | | | | | 883.60 | | | | | 1.38 | % | | | | 6.50 | |

Institutional Class | | | | 1,000.00 | | | | | 886.60 | | | | | 0.88 | % | | | | 4.15 | |

| | |

Hypothetical 5% return(5% return before expenses) | | | | | | | | | | | |

Class A | | | | $1,000.00 | | | | | $1,019.40 | | | | | 1.12 | % | | | | $5.65 | |

Class C | | | | 1,000.00 | | | | | 1,015.60 | | | | | 1.88 | % | | | | 9.47 | |

Class R | | | | 1,000.00 | | | | | 1,018.10 | | | | | 1.38 | % | | | | 6.96 | |

Institutional Class | | | | 1,000.00 | | | | | 1,020.60 | | | | | 0.88 | % | | | | 4.45 | |

*“Expenses Paid During Period” are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 183/366 (to reflect theone-half year period).

†Because actual returns reflect only the most recentsix-month period, the returns shown may differ significantly from fiscal year returns.

In addition to the Fund’s expenses reflected above, the Fund also indirectly bears its portion of the fees and expenses of the investment companies in which it invests (Underlying Funds), including exchange-traded funds. The table above does not reflect the expenses of the Underlying Funds.

10

Security type / sector allocation, top 10

equity holdings, and country allocation

| | |

Delaware Strategic Allocation Fund | | As of March 31, 2020 (Unaudited) |

Sector designations may be different than the sector designations presented in other Fund materials. The sector designations may represent the investment manager’s internal sector classifications.

| | | | | |

| Security type / sector | | Percentage of net assets |

| |

Common Stock | | | | 51.63 | % |

US Markets | | | | 25.29 | % |

Communication Services | | | | 2.39 | % |

Consumer Discretionary | | | | 2.03 | % |

Consumer Staples | | | | 1.06 | % |

Energy | | | | 0.51 | % |

Financials | | | | 3.14 | % |

Healthcare | | | | 4.45 | % |

Industrials | | | | 2.20 | % |

Information Technology | | | | 5.22 | % |

Materials | | | | 1.04 | % |

Real Estate | | | | 2.69 | % |

Utilities | | | | 0.56 | % |

Developed Markets | | | | 18.70 | % |

Communication Services | | | | 1.02 | % |

Consumer Discretionary | | | | 1.80 | % |

Consumer Staples | | | | 3.07 | % |

Energy | | | | 0.61 | % |

Financials | | | | 2.65 | % |

Healthcare | | | | 3.30 | % |

Industrials | | | | 2.70 | % |

Information Technology | | | | 1.24 | % |

Materials | | | | 1.35 | % |

Real Estate | | | | 0.53 | % |

Utilities | | | | 0.43 | % |

Emerging Markets | | | | 7.64 | % |

Communication Services | | | | 1.82 | % |

Consumer Discretionary | | | | 1.17 | % |

Consumer Staples | | | | 0.69 | % |

Energy | | | | 1.13 | % |

Financials | | | | 0.52 | % |

Healthcare | | | | 0.12 | % |

Industrials | | | | 0.00 | % |

Information Technology | | | | 1.97 | % |

Materials | | | | 0.17 | % |

Real Estate | | | | 0.03 | % |

Utilities | | | | 0.02 | % |

| |

Exchange-Traded Funds | | | | 5.38 | % |

11

Security type / sector allocation, top 10

equity holdings, and country allocation

Delaware Strategic Allocation Fund

| | | | | |

| Security type / sector | | Percentage of net assets |

Limited Partnership | | | | 0.01 | % |

Agency Asset-Backed Security | | | | 0.00 | % |

Agency Collateralized Mortgage Obligations | | | | 1.82 | % |

Agency Commercial Mortgage-Backed Securities | | | | 0.51 | % |

Agency Mortgage-Backed Securities | | | | 14.27 | % |

Collateralized Debt Obligations | | | | 0.61 | % |

Corporate Bonds | | | | 14.37 | % |

Banking | | | | 4.29 | % |

Basic Industry | | | | 0.81 | % |

Capital Goods | | | | 0.52 | % |

Communications. | | | | 2.01 | % |

Consumer Cyclical | | | | 0.42 | % |

ConsumerNon-Cyclical | | | | 1.14 | % |

Energy | | | | 1.06 | % |

Financials | | | | 0.46 | % |

Insurance | | | | 0.42 | % |

Real Estate | | | | 0.55 | % |

Technology | | | | 0.83 | % |

Transportation | | | | 0.08 | % |

Utilities | | | | 1.78 | % |

Loan Agreements | | | | 0.90 | % |

Municipal Bonds | | | | 0.46 | % |

Non-Agency Asset-Backed Securities | | | | 1.88 | % |

Non-Agency Collateralized Mortgage Obligations | | | | 1.42 | % |

Non-Agency Commercial Mortgage-Backed Securities | | | | 2.95 | % |

Sovereign Bond | | | | 0.01 | % |

Preferred Stock | | | | 0.55 | % |

Short-Term Investments | | | | 4.88 | % |

Total Value of Securities | | | | 101.65 | % |

Liabilities Net of Receivables and Other Assets | | | | (1.65 | %) |

Total Net Assets | | | | 100.00 | % |

12

Holdings are for informational purposes only and are subject to change at any time. They are not a recommendation to buy, sell, or hold any security.

| | | | | |

Top 10 equity holdings | | Percentage of net assets |

Microsoft | | | | 0.95 | % |

Reliance Industries GDR | | | | 0.66 | % |

Tencent Holdings | | | | 0.59 | % |

Samsung Electronics | | | | 0.58 | % |

Amazon.com | | | | 0.57 | % |

Alibaba Group Holding ADR | | | | 0.57 | % |

Roche Holding | | | | 0.56 | % |

Nestle | | | | 0.55 | % |

Taiwan Semiconductor Manufacturing | | | | 0.53 | % |

Alphabet Class A | | | | 0.50 | % |

| |

*Country / market | | Percentage of net assets |

US Markets | | | | 66.98 | % |

Developed Markets | | | | 21.59 | % |

Australia | | | | 1.70 | % |

Austria | | | | 0.11 | % |

Belgium | | | | 0.12 | % |

Canada | | | | 0.10 | % |

Cayman Islands | | | | 0.85 | % |

Denmark | | | | 0.51 | % |

Finland | | | | 0.18 | % |

France | | | | 2.42 | % |

Germany | | | | 1.38 | % |

Hong Kong | | | | 0.16 | % |

Ireland | | | | 0.27 | % |

Israel | | | | 0.32 | % |

Italy | | | | 0.23 | % |

Japan | | | | 5.56 | % |

Netherlands | | | | 1.24 | % |

Portugal | | | | 0.12 | % |

Singapore | | | | 0.51 | % |

Spain | | | | 0.73 | % |

Sweden | | | | 0.45 | % |

Switzerland | | | | 2.34 | % |

United Kingdom | | | | 2.29 | % |

13

Security type / sector allocation, top 10

equity holdings, and country allocation

Delaware Strategic Allocation Fund

| | | | | |

*Country / market | | Percentage of net assets |

Emerging Markets | | | | 8.20 | % |

Argentina | | | | 0.05 | % |

Brazil | | | | 0.67 | % |

Chile | | | | 0.06 | % |

China | | | | 2.68 | % |

Colombia | | | | 0.02 | % |

India | | | | 0.84 | % |

Indonesia | | | | 0.13 | % |

Malaysia | | | | 0.01 | % |

Mexico | | | | 0.48 | % |

Morocco | | | | 0.09 | % |

Peru | | | | 0.04 | % |

Republic of Korea | | | | 1.61 | % |

Russia | | | | 0.48 | % |

Taiwan | | | | 0.90 | % |

Turkey | | | | 0.14 | % |

Total | | | | 96.77 | % |

*Allocation includes all investments except for short-term investments.

14

Schedule of investments

| | |

| Delaware Strategic Allocation Fund | | March 31, 2020 |

| | | | | | | | |

| | | Number of shares | | | Value (US $) | |

Common Stock – 51.63% | | | | | | | | |

US Markets – 25.29% | | | | | | | | |

Communication Services – 2.39% | | | | | | | | |

Alphabet Class A † | | | 908 | | | $ | 1,055,051 | |

AT&T | | | 26,139 | | | | 761,952 | |

ATN International | | | 1,247 | | | | 73,211 | |

Century Communications =† | | | 25,000 | | | | 0 | |

Charter Communications Class A † | | | 947 | | | | 413,186 | |

Cinemark Holdings | | | 2,277 | | | | 23,203 | |

Comcast Class A | | | 20,396 | | | | 701,214 | |

Facebook Class A † | | | 1,409 | | | | 235,021 | |

Netflix † | | | 769 | | | | 288,759 | |

Nexstar Media Group Class A | | | 577 | | | | 33,310 | |

Take-Two Interactive Software † | | | 1,772 | | | | 210,177 | |

Verizon Communications | | | 9,300 | | | | 499,689 | |

Walt Disney | | | 7,092 | | | | 685,087 | |

Yelp † | | | 2,688 | | | | 48,465 | |

| | | | | | | | |

| | | | | | | 5,028,325 | |

| | | | | | | | |

Consumer Discretionary – 2.03% | | | | | | | | |

Amazon.com † | | | 617 | | | | 1,202,977 | |

American Eagle Outfitters | | | 6,665 | | | | 52,987 | |

Aramark | | | 3,263 | | | | 65,162 | |

BorgWarner | | | 2,256 | | | | 54,979 | |

Chegg † | | | 1,972 | | | | 70,558 | |

Chuy’s Holdings † | | | 1,645 | | | | 16,565 | |

Dollar Tree † | | | 6,400 | | | | 470,208 | |

Domino’s Pizza | | | 807 | | | | 261,524 | |

DR Horton | �� | | 1,550 | | | | 52,700 | |

Five Below † | | | 909 | | | | 63,975 | |

Home Depot | | | 2,052 | | | | 383,129 | |

Jack in the Box | | | 681 | | | | 23,869 | |

KB Home | | | 1,804 | | | | 32,652 | |

Lowe’s | | | 5,600 | | | | 481,880 | |

Malibu Boats Class A † | | | 2,051 | | | | 59,048 | |

NIKE Class B | | | 3,983 | | | | 329,553 | |

Starbucks | | | 3,221 | | | | 211,749 | |

Steven Madden | | | 3,790 | | | | 88,042 | |

Taylor Morrison Home † | | | 3,192 | | | | 35,112 | |

Tenneco Class A † | | | 1,245 | | | | 4,482 | |

Texas Roadhouse | | | 696 | | | | 28,745 | |

Toll Brothers | | | 2,972 | | | | 57,211 | |

Tractor Supply | | | 1,924 | | | | 162,674 | |

Wendy’s | | | 4,195 | | | | 62,422 | |

| | | | | | | | |

| | | | | | | 4,272,203 | |

| | | | | | | | |

15

Schedule of investments

Delaware Strategic Allocation Fund

| | | | | | | | |

| | | Number of shares | | | Value (US $) | |

Common Stock(continued) | | | | | | | | |

US Markets(continued) | | | | | | | | |

Consumer Staples – 1.06% | | | | | | | | |

Archer-Daniels-Midland | | | 14,600 | | | $ | 513,628 | |

BJ’s Wholesale Club Holdings † | | | 1,739 | | | | 44,292 | |

Casey’s General Stores | | | 1,067 | | | | 141,367 | |

Conagra Brands | | | 17,498 | | | | 513,391 | |

General Mills | | | 3,396 | | | | 179,207 | |

J&J Snack Foods | | | 677 | | | | 81,917 | |

Mondelez International Class A | | | 10,273 | | | | 514,472 | |

PepsiCo | | | 1,947 | | | | 233,835 | |

| | | | | | | | |

| | | | | | | 2,222,109 | |

| | | | | | | | |

Energy – 0.51% | | | | | | | | |

Chevron | | | 2,651 | | | | 192,091 | |

ConocoPhillips | | | 16,335 | | | | 503,118 | |

EOG Resources | | | 771 | | | | 27,694 | |

Marathon Oil | | | 31,807 | | | | 104,645 | |

Occidental Petroleum | | | 17,700 | | | | 204,966 | |

Patterson-UTI Energy | | | 3,762 | | | | 8,841 | |

PDC Energy † | | | 270 | | | | 1,677 | |

Pioneer Natural Resources | | | 537 | | | | 37,671 | |

| | | | | | | | |

| | | | | | | 1,080,703 | |

| | | | | | | | |

Financials – 3.14% | | | | | | | | |

Allstate | | | 5,500 | | | | 504,515 | |

American Equity Investment Life Holding | | | 4,646 | | | | 87,345 | |

American International Group | | | 15,400 | | | | 373,450 | |

Axis Capital Holdings | | | 1,789 | | | | 69,145 | |

Bank of New York Mellon | | | 15,100 | | | | 508,568 | |

BlackRock | | | 409 | | | | 179,948 | |

Bryn Mawr Bank | | | 1,543 | | | | 43,790 | |

Capital One Financial | | | 2,167 | | | | 109,260 | |

CenterState Bank | | | 5,384 | | | | 92,766 | |

Charles Schwab | | | 7,121 | | | | 239,408 | |

City Holding | | | 983 | | | | 65,399 | |

CME Group | | | 2,246 | | | | 388,356 | |

Comerica | | | 1,461 | | | | 42,866 | |

East West Bancorp | | | 2,989 | | | | 76,937 | |

Essent Group | | | 4,068 | | | | 107,151 | |

First Bancorp (North Carolina) | | | 2,206 | | | | 50,914 | |

First Financial Bancorp | | | 5,239 | | | | 78,113 | |

First Interstate BancSystem Class A | | | 2,358 | | | | 68,005 | |

Great Western Bancorp | | | 3,878 | | | | 79,421 | |

Hamilton Lane Class A | | | 1,171 | | | | 64,768 | |

Independent Bank | | | 1,299 | | | | 83,617 | |

16

| | | | | | | | |

| | | Number of shares | | | Value (US $) | |

Common Stock(continued) | | | | | | | | |

US Markets(continued) | | | | | | | | |

Financials(continued) | | | | | | | | |

Independent Bank Group | | | 2,141 | | | $ | 50,699 | |

Intercontinental Exchange | | | 1,699 | | | | 137,194 | |

JPMorgan Chase & Co. | | | 5,032 | | | | 453,031 | |

Kemper | | | 560 | | | | 41,647 | |

KeyCorp | | | 10,216 | | | | 105,940 | |

KKR & Co. Class A | | | 12,371 | | | | 290,347 | |

LendingTree † | | | 154 | | | | 28,242 | |

Marsh & McLennan | | | 5,700 | | | | 492,822 | |

MGIC Investment | | | 5,677 | | | | 36,049 | |

NMI Holdings Class A † | | | 1,528 | | | | 17,740 | |

Old National Bancorp | | | 6,413 | | | | 84,587 | |

Pacific Premier Bancorp | | | 1,139 | | | | 21,459 | |

Primerica | | | 321 | | | | 28,402 | |

Prudential Financial | | | 1,544 | | | | 80,504 | |

Raymond James Financial | | | 1,793 | | | | 113,318 | |

Reinsurance Group of America | | | 961 | | | | 80,859 | |

RLI | | | 178 | | | | 15,652 | |

Selective Insurance Group | | | 1,729 | | | | 85,931 | |

State Street | | | 1,827 | | | | 97,324 | |

Stifel Financial | | | 2,432 | | | | 100,393 | |

Travelers | | | 1,026 | | | | 101,933 | |

Truist Financial | | | 13,800 | | | | 425,592 | |

Umpqua Holdings | | | 5,064 | | | | 55,198 | |

United Community Banks | | | 3,195 | | | | 58,500 | |

US Bancorp | | | 3,436 | | | | 118,370 | |

Valley National Bancorp | | | 6,776 | | | | 49,533 | |

WesBanco | | | 2,805 | | | | 66,479 | |

WSFS Financial | | | 1,676 | | | | 41,766 | |

| | | | | | | | |

| | | | | | | 6,593,253 | |

| | | | | | | | |

Healthcare – 4.45% | | | | | | | | |

Abbott Laboratories | | | 9,356 | | | | 738,282 | |

Adamas Pharmaceuticals † | | | 2,801 | | | | 8,095 | |

Agios Pharmaceuticals † | | | 1,923 | | | | 68,228 | |

Becton Dickinson and Co. | | | 875 | | | | 201,049 | |

Brookdale Senior Living † | | | 28,642 | | | | 89,363 | |

Cardinal Health | | | 11,000 | | | | 527,340 | |

ChemoCentryx † | | | 736 | | | | 29,572 | |

Cigna | | | 4,413 | | | | 781,895 | |

CONMED | | | 1,377 | | | | 78,861 | |

CryoLife † | | | 3,589 | | | | 60,726 | |

CVS Health | | | 8,400 | | | | 498,372 | |

17

Schedule of investments

Delaware Strategic Allocation Fund

| | | | | | | | |

| | | Number of shares | | | Value (US $) | |

Common Stock(continued) | | | | | | | | |

US Markets(continued) | | | | | | | | |

Healthcare(continued) | | | | | | | | |

DexCom † | | | 668 | | | $ | 179,872 | |

Edwards Lifesciences † | | | 753 | | | | 142,031 | |

Exact Sciences † | | | 2,020 | | | | 117,160 | |

Gilead Sciences | | | 970 | | | | 72,517 | |

Illumina † | | | 984 | | | | 268,750 | |

Intercept Pharmaceuticals † | | | 1,190 | | | | 74,922 | |

Intuitive Surgical † | | | 204 | | | | 101,023 | |

IQVIA Holdings † | | | 3,627 | | | | 391,208 | |

Johnson & Johnson | | | 6,756 | | | | 885,914 | |

Ligand Pharmaceuticals Class B † | | | 1,152 | | | | 83,773 | |

Merck & Co. | | | 10,022 | | | | 771,093 | |

Merit Medical Systems † | | | 3,173 | | | | 99,156 | |

Natera † | | | 4,189 | | | | 125,084 | |

Neurocrine Biosciences † | | | 1,162 | | | | 100,571 | |

NuVasive † | | | 1,784 | | | | 90,377 | |

Pfizer | | | 23,086 | | | | 753,527 | |

Prestige Consumer Healthcare † | | | 3,234 | | | | 118,623 | |

PTC Therapeutics † | | | 1,531 | | | | 68,298 | |

Quidel † | | | 1,663 | | | | 162,658 | |

Repligen † | | | 1,652 | | | | 159,484 | |

Retrophin † | | | 6,152 | | | | 89,758 | |

Spectrum Pharmaceuticals † | | | 5,663 | | | | 13,195 | |

Supernus Pharmaceuticals † | | | 3,072 | | | | 55,265 | |

Tabula Rasa HealthCare † | | | 2,082 | | | | 108,868 | |

Teladoc Health † | | | 1,144 | | | | 177,331 | |

Thermo Fisher Scientific | | | 832 | | | | 235,955 | |

Ultragenyx Pharmaceutical † | | | 2,729 | | | | 121,249 | |

UnitedHealth Group | | | 1,385 | | | | 345,391 | |

Vanda Pharmaceuticals † | | | 6,084 | | | | 63,030 | |

Vertex Pharmaceuticals † | | | 850 | | | | 202,258 | |

Wright Medical Group † | | | 3,037 | | | | 87,010 | |

| | | | | | | | |

| | | | | | | 9,347,134 | |

| | | | | | | | |

Industrials – 2.20% | | | | | | | | |

ABM Industries | | | 3,041 | | | | 74,079 | |

Applied Industrial Technologies | | | 2,207 | | | | 100,904 | |

ASGN † | | | 1,901 | | | | 67,143 | |

Barnes Group | | | 1,333 | | | | 55,759 | |

BrightView Holdings † | | | 4,504 | | | | 49,814 | |

Casella Waste Systems Class A † | | | 1,599 | | | | 62,457 | |

Caterpillar | | | 2,853 | | | | 331,062 | |

18

| | | | | | | | |

| | | Number of shares | | | Value (US $) | |

Common Stock(continued) | | | | | | | | |

US Markets(continued) | | | | | | | | |

Industrials(continued) | | | | | | | | |

Columbus McKinnon | | | 2,945 | | | $ | 73,625 | |

Eaton | | | 1,751 | | | | 136,035 | |

Emerson Electric | | | 1,354 | | | | 64,518 | |

ESCO Technologies | | | 1,054 | | | | 80,009 | |

Federal Signal | | | 4,520 | | | | 123,306 | |

Gates Industrial † | | | 3,716 | | | | 27,424 | |

Honeywell International | | | 1,042 | | | | 139,409 | |

Hub Group Class A † | | | 1,702 | | | | 77,390 | |

Ingersoll Rand † | | | 873 | | | | 21,650 | |

Kadant | | | 1,112 | | | | 83,011 | |

Lockheed Martin | | | 520 | | | | 176,254 | |

MasTec † | | | 1,974 | | | | 64,609 | |

Mobile Mini | | | 2,591 | | | | 67,962 | |

MYR Group † | | | 2,673 | | | | 70,006 | |

Northrop Grumman | | | 1,600 | | | | 484,080 | |

Oshkosh | | | 1,326 | | | | 85,302 | |

Parker-Hannifin | | | 1,248 | | | | 161,903 | |

Raytheon | | | 3,400 | | | | 445,910 | |

Rexnord | | | 3,549 | | | | 80,456 | |

Rockwell Automation | | | 385 | | | | 58,100 | |

Southwest Airlines | | | 2,119 | | | | 75,458 | |

Tetra Tech | | | 1,757 | | | | 124,079 | |

Trane Technologies | | | 990 | | | | 81,764 | |

Uber Technologies † | | | 8,068 | | | | 225,259 | |

Union Pacific | | | 1,758 | | | | 247,948 | |

United Technologies | | | 2,301 | | | | 217,053 | |

US Ecology | | | 2,174 | | | | 66,090 | |

Waste Management | | | 2,986 | | | | 276,384 | |

Werner Enterprises | | | 1,577 | | | | 57,182 | |

| | | | | | | | |

| | | | | | | 4,633,394 | |

| | | | | | | | |

Information Technology – 5.22% | | | | | | | | |

Accenture Class A | | | 1,330 | | | | 217,136 | |

Adobe † | | | 1,322 | | | | 420,713 | |

Anixter International † | | | 540 | | | | 47,450 | |

Apple | | | 3,034 | | | | 771,516 | |

Applied Materials | | | 2,781 | | | | 127,425 | |

Arista Networks † | | | 871 | | | | 176,421 | |

Autodesk † | | | 1,761 | | | | 274,892 | |

Belden | | | 1,990 | | | | 71,799 | |

Blackbaud | | | 772 | | | | 42,885 | |

Box Class A † | | | 486 | | | | 6,823 | |

19

Schedule of investments

Delaware Strategic Allocation Fund

| | | | | | | | |

| | | Number of shares | | | Value (US $) | |

Common Stock(continued) | | | | | | | | |

US Markets(continued) | | | | | | | | |

Information Technology(continued) | | | | | | | | |

Broadcom | | | 2,855 | | | $ | 676,921 | |

Brooks Automation | | | 2,988 | | | | 91,134 | |

Cisco Systems | | | 18,543 | | | | 728,925 | |

Coupa Software † | | | 965 | | | | 134,839 | |

ExlService Holdings † | | | 1,686 | | | | 87,723 | |

II-VI † | | | 3,383 | | | | 96,416 | |

Intel | | | 14,518 | | | | 785,714 | |

Intuit | | | 270 | | | | 62,100 | |

J2 Global | | | 1,808 | | | | 135,329 | |

KBR | | | 1,952 | | | | 40,367 | |

MACOM Technology Solutions Holdings † | | | 763 | | | | 14,444 | |

Mastercard Class A | | | 1,334 | | | | 322,241 | |

MaxLinear † | | | 5,132 | | | | 59,890 | |

Microsoft | | | 12,680 | | | | 1,999,763 | |

Mimecast † | | | 1,510 | | | | 53,303 | |

NETGEAR † | | | 2,091 | | | | 47,758 | |

Oracle | | | 9,800 | | | | 473,634 | |

Paylocity Holding † | | | 435 | | | | 38,419 | |

PayPal Holdings † | | | 3,271 | | | | 313,166 | |

Plantronics | | | 720 | | | | 7,243 | |

PTC † | | | 1,587 | | | | 97,140 | |

Q2 Holdings † | | | 1,781 | | | | 105,186 | |

Rapid7 † | | | 2,849 | | | | 123,447 | |

salesforce.com † | | | 1,593 | | | | 229,360 | |

Semtech † | | | 2,537 | | | | 95,138 | |

ServiceNow † | | | 1,600 | | | | 458,528 | |

Silicon Laboratories † | | | 1,099 | | | | 93,866 | |

SS&C Technologies Holdings | | | 3,797 | | | | 166,385 | |

Texas Instruments | | | 1,250 | | | | 124,913 | |

Twilio Class A † | | | 1,596 | | | | 142,826 | |

Tyler Technologies † | | | 832 | | | | 246,738 | |

Visa Class A | | | 4,742 | | | | 764,031 | |

| | | | | | | | |

| | | | | | | 10,973,947 | |

| | | | | | | | |

Materials – 1.04% | | | | | | | | |

Balchem | | | 898 | | | | 88,651 | |

Ball | | | 6,529 | | | | 422,165 | |

Boise Cascade | | | 4,377 | | | | 104,085 | |

Coeur Mining † | | | 5,866 | | | | 18,830 | |

Corteva | | | 3,673 | | | | 86,315 | |

Dow | | | 1,908 | | | | 55,790 | |

DuPont de Nemours | | | 15,176 | | | | 517,502 | |

20

| | | | | | | | |

| | | Number of shares | | | Value (US $) | |

Common Stock(continued) | | | | | | | | |

US Markets(continued) | | | | | | | | |

Materials(continued) | | | | | | | | |

Eastman Chemical | | | 2,534 | | | $ | 118,034 | |

Ferro † | | | 3,518 | | | | 32,928 | |

Kaiser Aluminum | | | 1,447 | | | | 100,248 | |

Linde | | | 496 | | | | 85,808 | |

Minerals Technologies | | | 2,376 | | | | 86,154 | |

Neenah | | | 2,138 | | | | 92,212 | |

Quaker Chemical | | | 695 | | | | 87,765 | |

Reliance Steel & Aluminum | | | 650 | | | | 56,934 | |

Westrock | | | 5,169 | | | | 146,076 | |

Worthington Industries | | | 3,025 | | | | 79,406 | |

| | | | | | | | |

| | | | | | | 2,178,903 | |

| | | | | | | | |

Real Estate – 2.69% | | | | | | | | |

American Assets Trust | | | 2,220 | | | | 55,500 | |

American Tower | | | 1,023 | | | | 222,758 | |

Apartment Investment & Management Class A | | | 2,376 | | | | 83,516 | |

Armada Hoffler Properties | | | 4,536 | | | | 48,535 | |

AvalonBay Communities | | | 1,775 | | | | 261,227 | |

Boston Properties | | | 999 | | | | 92,138 | |

Brandywine Realty Trust | | | 8,736 | | | | 91,903 | |

Brixmor Property Group | | | 6,047 | | | | 57,447 | |

Camden Property Trust | | | 1,348 | | | | 106,816 | |

Cousins Properties | | | 2,452 | | | | 71,770 | |

Douglas Emmett | | | 4,725 | | | | 144,160 | |

EastGroup Properties | | | 977 | | | | 102,077 | |

Empire State Realty Trust Class A | | | 1,250 | | | | 11,200 | |

Equity LifeStyle Properties | | | 2,600 | | | | 149,448 | |

Equity Residential | | | 10,371 | | | | 639,994 | |

Essex Property Trust | | | 1,025 | | | | 225,746 | |

Extra Space Storage | | | 1,200 | | | | 114,912 | |

Federal Realty Investment Trust | | | 650 | | | | 48,497 | |

First Industrial Realty Trust | | | 9,191 | | | | 305,417 | |

Highwoods Properties | | | 2,650 | | | | 93,863 | |

Host Hotels & Resorts | | | 8,525 | | | | 94,116 | |

JBG SMITH Properties | | | 1,312 | | | | 41,761 | |

Kilroy Realty | | | 1,600 | | | | 101,920 | |

Kite Realty Group Trust | | | 5,921 | | | | 56,072 | |

Lexington Realty Trust | | | 12,353 | | | | 122,665 | |

Macerich | | | 1,400 | | | | 7,882 | |

Mack-Cali Realty | | | 3,975 | | | | 60,539 | |

Mid-America Apartment Communities | | | 1,218 | | | | 125,491 | |

National Retail Properties | | | 2,025 | | | | 65,185 | |

21

Schedule of investments

Delaware Strategic Allocation Fund

| | | | | | | | |

| | | Number of shares | | | Value (US $) | |

Common Stock(continued) | | | | | | | | |

US Markets(continued) | | | | | | | | |

Real Estate(continued) | | | | | | | | |

Omega Healthcare Investors | | | 1,675 | | | $ | 44,455 | |

Pebblebrook Hotel Trust | | | 5,675 | | | | 61,801 | |

Physicians Realty Trust | | | 6,039 | | | | 84,184 | |

Prologis | | | 10,881 | | | | 874,506 | |

PS Business Parks | | | 725 | | | | 98,252 | |

Public Storage | | | 819 | | | | 162,662 | |

Regency Centers | | | 945 | | | | 36,316 | |

Retail Value | | | 448 | | | | 5,488 | |

RLJ Lodging Trust | | | 2,825 | | | | 21,809 | |

RPT Realty | | | 10,157 | | | | 61,247 | |

Sabra Health Care REIT | | | 200 | | | | 2,184 | |

Simon Property Group | | | 2,161 | | | | 118,552 | |

SITE Centers | | | 4,037 | | | | 21,033 | |

SL Green Realty | | | 1,875 | | | | 80,813 | |

Spirit MTA REIT =† | | | 677 | | | | 0 | |

Spirit Realty Capital | | | 1,405 | | | | 36,741 | |

Tanger Factory Outlet Centers | | | 2,750 | | | | 13,750 | |

Taubman Centers | | | 675 | | | | 28,269 | |

UDR | | | 4,200 | | | | 153,468 | |

Urban Edge Properties | | | 1,175 | | | | 10,352 | |

Ventas | | | 3,900 | | | | 104,520 | |

Welltower | | | 840 | | | | 38,455 | |

| | | | | | | | |

| | | | | | | 5,661,412 | |

| | | | | | | | |

Utilities – 0.56% | | | | | | | | |

Black Hills | | | 1,276 | | | | 81,702 | |

Edison International | | | 9,000 | | | | 493,110 | |

NorthWestern | | | 2,431 | | | | 145,447 | |

PPL | | | 4,371 | | | | 107,876 | |

South Jersey Industries | | | 6,271 | | | | 156,775 | |

Spire | | | 2,442 | | | | 181,880 | |

| | | | | | | | |

| | | | | | | 1,166,790 | |

| | | | | | | | |

Total US Markets(cost $42,942,116) | | | | | | | 53,158,173 | |

| | | | | | | | |

Developed Markets – 18.70%§ | | | | | | | | |

Communication Services – 1.02% | | | | | | | | |

Nippon Telegraph & Telephone | | | 22,260 | | | | 532,384 | |

NTT DOCOMO | | | 19,300 | | | | 603,571 | |

Publicis Groupe | | | 6,500 | | | | 185,763 | |

Telefonica | | | 58,600 | | | | 266,694 | |

Telenet Group Holding | | | 8,580 | | | | 257,646 | |

Toho | | | 9,900 | | | | 302,710 | |

| | | | | | | | |

| | | | | | | 2,148,768 | |

| | | | | | | | |

22

| | | | | | | | |

| | | Number of shares | | | Value (US $) | |

Common Stock(continued) | | | | | | | | |

Developed Markets§(continued) | | | | | | | | |

Consumer Discretionary – 1.80% | | | | | | | | |

Bandai Namco Holdings | | | 5,400 | | | $ | 261,918 | |

Cie Generale des Etablissements Michelin | | | 3,750 | | | | 328,443 | |

Honda Motor | | | 20,000 | | | | 447,529 | |

Industria de Diseno Textil | | | 15,500 | | | | 401,662 | |

LVMH Moet Hennessy Louis Vuitton | | | 600 | | | | 220,051 | |

Persimmon | | | 10,500 | | | | 248,206 | |

Sodexo | | | 3,990 | | | | 267,949 | |

Sony | | | 9,600 | | | | 568,642 | |

Stanley Electric | | | 12,500 | | | | 245,359 | |

Toyota Motor | | | 12,988 | | | | 782,721 | |

| | | | | | | | |

| | | | | | | 3,772,480 | |

| | | | | | | | |

Consumer Staples – 3.07% | | | | | | | | |

Asahi Group Holdings | | | 8,600 | | | | 279,012 | |

Beiersdorf | | | 3,800 | | | | 382,625 | |

British American Tobacco | | | 13,710 | | | | 467,035 | |

Chocoladefabriken Lindt & Spruengli | | | 40 | | | | 335,739 | |

Coles Group | | | 34,870 | | | | 324,746 | |

Danone | | | 6,870 | | | | 439,668 | |

Essity Class B | | | 11,200 | | | | 343,096 | |

Koninklijke Ahold Delhaize | | | 15,300 | | | | 356,438 | |

L’Oreal | | | 2,370 | | | | 613,382 | |

Matsumotokiyoshi Holdings | | | 7,000 | | | | 255,174 | |

Nestle | | | 11,260 | | | | 1,152,659 | |

Sundrug | | | 9,400 | | | | 301,216 | |

Suntory Beverage & Food | | | 10,000 | | | | 377,889 | |

Tate & Lyle | | | 32,230 | | | | 262,218 | |

WH Group 144A # | | | 300,000 | | | | 276,903 | |

Wm Morrison Supermarkets | | | 130,000 | | | | 284,005 | |

| | | | | | | | |

| | | | | | | 6,451,805 | |

| | | | | | | | |

Energy – 0.61% | | | | | | | | |

Galp Energia | | | 21,400 | | | | 244,734 | |

Royal Dutch Shell Class A | | | 24,370 | | | | 423,397 | |

Royal Dutch Shell Class B | | | 21,860 | | | | 366,681 | |

TOTAL | | | 6,700 | | | | 252,448 | |

| | | | | | | | |

| | | | | | | 1,287,260 | |

| | | | | | | | |

Financials – 2.65% | | | | | | | | |

Allianz | | | 2,860 | | | | 487,051 | |

Australia & New Zealand Banking Group | | | 33,520 | | | | 351,538 | |

Aviva | | | 75,000 | | | | 246,582 | |

Banco Bilbao Vizcaya Argentaria | | | 100,000 | | | | 309,655 | |

23

Schedule of investments

Delaware Strategic Allocation Fund

| | | | | | | | |

| | | Number of shares | | | Value (US $) | |

Common Stock(continued) | | | | | | | | |

Developed Markets§(continued) | | | | | | | | |

Financials(continued) | | | | | | | | |

Banco Espirito Santo Class R =† | | | 370,000 | | | $ | 0 | |

Bank LeumiLe-Israel | | | 63,000 | | | | 347,380 | |

Credit Suisse Group † | | | 41,000 | | | | 330,926 | |

Dai-ichi Life Holdings | | | 27,700 | | | | 328,941 | |

Daiwa Securities Group | | | 80,800 | | | | 312,235 | |

DBS Group Holdings | | | 29,600 | | | | 386,225 | |

Erste Group Bank † | | | 12,350 | | | | 226,100 | |

Investec | | | 59,000 | | | | 109,915 | |

Ninety One † | | | 29,500 | | | | 63,354 | |

Nordea Bank | | | 46,770 | | | | 263,100 | |

QBE Insurance Group | | | 46,000 | | | | 239,614 | |

Standard Chartered | | | 52,000 | | | | 287,497 | |

Swiss Life Holding | | | 960 | | | | 322,220 | |

UBS Group † | | | 35,320 | | | | 323,747 | |

UniCredit | | | 35,900 | | | | 277,744 | |

United Overseas Bank | | | 26,400 | | | | 362,209 | |

| | | | | | | | |

| | | | | | | 5,576,033 | |

| | | | | | | | |

Healthcare – 3.30% | | | | | | | | |

Alfresa Holdings | | | 20,000 | | | | 372,231 | |

Astellas Pharma | | | 32,000 | | | | 493,035 | |

BeiGene ADR † | | | 400 | | | | 49,244 | |

Daiichi Sankyo | | | 7,500 | | | | 515,075 | |

GlaxoSmithKline | | | 26,340 | | | | 494,248 | |

Koninklijke Philips | | | 13,450 | | | | 552,222 | |

Kyowa Kirin | | | 16,300 | | | | 364,297 | |

Novartis | | | 11,410 | | | | 941,312 | |

Novo Nordisk Class B | | | 11,580 | | | | 691,512 | |

Roche Holding | | | 3,630 | | | | 1,167,924 | |

Sanofi | | | 7,360 | | | | 637,191 | |

Smith & Nephew | | | 20,700 | | | | 364,662 | |

Sumitomo Dainippon Pharma | | | 22,200 | | | | 288,187 | |

| | | | | | | | |

| | | | | | | 6,931,140 | |

| | | | | | | | |

Industrials – 2.70% | | | | | | | | |

AGC | | | 10,400 | | | | 253,422 | |

Brenntag | | | 8,380 | | | | 304,463 | |

Deutsche Lufthansa | | | 17,620 | | | | 164,802 | |

East Japan Railway | | | 5,966 | | | | 451,450 | |

Intertek Group | | | 3,680 | | | | 215,004 | |

ITOCHU | | | 22,786 | | | | 471,548 | |

Japan Airlines | | | 10,400 | | | | 191,125 | |

24

| | | | | | | | |

| | | Number of shares | | | Value (US $) | |

Common Stock(continued) | | | | | | | | |

Developed Markets§(continued) | | | | | | | | |

Industrials(continued) | | | | | | | | |

Leonardo | | | 32,000 | | | $ | 211,557 | |

Meggitt | | | 29,590 | | | | 106,366 | |

Safran | | | 2,200 | | | | 194,914 | |

Schneider Electric | | | 5,960 | | | | 503,757 | |

Siemens | | | 4,560 | | | | 381,832 | |

Teleperformance | | | 1,870 | | | | 387,309 | |

Vestas Wind Systems | | | 4,750 | | | | 386,487 | |

Vinci | | | 5,780 | | | | 472,280 | |

Volvo Class B | | | 29,310 | | | | 348,377 | |

West Japan Railway | | | 5,000 | | | | 341,975 | |

Wolters Kluwer | | | 4,200 | | | | 297,293 | |

| | | | | | | | |

| | | | | | | 5,683,961 | |

| | | | | | | | |

Information Technology – 1.24% | | | | | | | | |

ASML Holding (New York Shares) | | | 2,660 | | | | 701,216 | |

Capgemini | | | 4,250 | | | | 355,140 | |

Nice † | | | 2,270 | | | | 328,232 | |

Omron | | | 7,600 | | | | 392,940 | |

Tokyo Electron | | | 2,700 | | | | 503,209 | |

Venture | | | 34,400 | | | | 327,697 | |

| | | | | | | | |

| | | | | | | 2,608,434 | |

| | | | | | | | |

Materials – 1.35% | | | | | | | | |

BlueScope Steel | | | 43,800 | | | | 229,316 | |

Covestro 144A # | | | 8,960 | | | | 271,920 | |

CRH | | | 15,000 | | | | 405,644 | |

LANXESS | | | 7,000 | | | | 278,628 | |

Rio Tinto | | | 12,470 | | | | 571,653 | |

Shin-Etsu Chemical | | | 4,700 | | | | 461,950 | |

South32 | | | 235,000 | | | | 259,419 | |

UPM-Kymmene | | | 13,460 | | | | 367,013 | |

| | | | | | | | |

| | | | | | | 2,845,543 | |

| | | | | | | | |

Real Estate – 0.53% | | | | | | | | |

Daito Trust Construction | | | 3,400 | | | | 315,736 | |

Grand City Properties | | | 14,660 | | | | 306,884 | |

Klepierre | | | 12,230 | | | | 233,123 | |

Mirvac Group | | | 204,620 | | | | 259,969 | |

| | | | | | | | |

| | | | | | | 1,115,712 | |

| | | | | | | | |

Utilities – 0.43% | | | | | | | | |

AusNet Services | | | 255,000 | | | | 267,753 | |

Centrica | | | 370,000 | | | | 174,341 | |

25

Schedule of investments

Delaware Strategic Allocation Fund

| | | | | | | | |

| | | Number of shares | | | Value (US $) | |

Common Stock(continued) | | | | | | | | |

Developed Markets§(continued) | | | | | | | | |

Utilities(continued) | | | | | | | | |

Tokyo Gas | | | 19,200 | | | $ | 452,415 | |

| | | | | | | | |

| | | | | | | 894,509 | |

| | | | | | | | |

Total Developed Markets(cost $42,831,705) | | | | | | | 39,315,645 | |

| | | | | | | | |

Emerging Markets – 7.64%@ | | | | | | | | |

Communication Services – 1.82% | | | | | | | | |

America Movil Class L ADR | | | 7,132 | | | | 84,015 | |

Baidu ADR † | | | 2,422 | | | | 244,113 | |

China Mobile | | | 39,715 | | | | 297,635 | |

China Mobile ADR | | | 3,222 | | | | 121,373 | |

Grupo Televisa ADR | | | 18,488 | | | | 107,230 | |

LG Uplus | | | 9,781 | | | | 85,929 | |

Mail.Ru Group GDR † | | | 3,427 | | | | 55,083 | |

Mobile TeleSystems PJSC ADR | | | 4,784 | | | | 36,358 | |

NAVER | | | 592 | | | | 82,308 | |

SINA † | | | 8,390 | | | | 267,138 | |

SK Telecom ADR | | | 42,555 | | | | 692,370 | |

Sohu.com ADR † | | | 9,774 | | | | 60,892 | |

Telefonica Brasil ADR | | | 10,600 | | | | 101,018 | |

Tencent Holdings | | | 24,900 | | | | 1,230,748 | |

Tencent Music Entertainment Group ADR † | | | 7 | | | | 70 | |

TIM Participacoes ADR | | | 9,082 | | | | 110,437 | |

Turkcell Iletisim Hizmetleri ADR | | | 14,390 | | | | 66,914 | |

Weibo ADR † | | | 1,972 | | | | 65,293 | |

Yandex Class A † | | | 3,272 | | | | 111,412 | |

| | | | | | | | |

| | | | | | | 3,820,336 | |

| | | | | | | | |

Consumer Discretionary – 1.17% | | | | | | | | |

Alibaba Group Holding ADR † | | | 6,138 | | | | 1,193,718 | |

Arcos Dorados Holdings Class A | | | 9,153 | | | | 30,571 | |

Astra International | | | 351,200 | | | | 83,498 | |

B2W Cia Digital † | | | 58,754 | | | | 541,056 | |

JD.com ADR † | | | 11,936 | | | | 483,408 | |

LG Electronics | | | 1,200 | | | | 47,182 | |

Trip.com Group ADR † | | | 3,331 | | | | 78,112 | |

| | | | | | | | |

| | | | | | | 2,457,545 | |

| | | | | | | | |

Consumer Staples – 0.69% | | | | | | | | |

Atacadao | | | 18,077 | | | | 71,110 | |

BRF ADR † | | | 28,163 | | | | 81,673 | |

China Mengniu Dairy † | | | 49,000 | | | | 168,987 | |

Cia Cervecerias Unidas ADR | | | 3,979 | | | | 53,239 | |

Coca-Cola Femsa ADR | | | 5,821 | | | | 234,179 | |

26

| | | | | | | | |

| | | Number of shares | | | Value (US $) | |

Common Stock(continued) | | | | | | | | |

Emerging Markets @(continued) | | | | | | | | |

Consumer Staples(continued) | | | | | | | | |

Fomento Economico Mexicano ADR | | | 1,138 | | | $ | 68,860 | |

Lotte Confectionery | | | 237 | | | | 20,334 | |

Tata Consumer Products | | | 14,985 | | | | 58,174 | |

Tingyi Cayman Islands Holding | | | 161,724 | | | | 262,936 | |

Tsingtao Brewery Class H | | | 50,000 | | | | 252,736 | |

Uni-President China Holdings | | | 183,600 | | | | 177,448 | |

| | | | | | | | |

| | | | | | | 1,449,676 | |

| | | | | | | | |

Energy – 1.13% | | | | | | | | |

China Petroleum & Chemical Class H | | | 276,200 | | | | 134,953 | |

CNOOC ADR | | | 1,297 | | | | 134,201 | |

Gazprom PJSC ADR | | | 56,767 | | | | 257,423 | |

LUKOIL PJSC ADR | | | 2,508 | | | | 148,373 | |

Petroleo Brasileiro ADR | | | 14,735 | | | | 81,043 | |

Reliance Industries GDR 144A # | | | 45,543 | | | | 1,394,868 | |

Rosneft Oil PJSC GDR | | | 53,962 | | | | 217,206 | |

| | | | | | | | |

| | | | | | | 2,368,067 | |

| | | | | | | | |

Financials – 0.52% | | | | | | | | |

Akbank T.A.S. † | | | 73,761 | | | | 61,936 | |

Banco Bradesco ADR | | | 22,725 | | | | 92,263 | |

Banco Santander Brasil ADR | | | 12,715 | | | | 65,737 | |

Banco Santander Mexico ADR | | | 33,819 | | | | 109,574 | |

Grupo Financiero Banorte Class O | | | 16,520 | | | | 45,265 | |

Itau Unibanco Holding ADR | | | 29,636 | | | | 133,066 | |

Ping An Insurance Group Co. of China Class H | | | 35,000 | | | | 341,819 | |

Samsung Life Insurance | | | 2,218 | | | | 77,625 | |

Sberbank of Russia PJSC | | | 68,513 | | | | 163,309 | |

| | | | | | | | |

| | | | | | | 1,090,594 | |

| | | | | | | | |

Healthcare – 0.12% | | | | | | | | |

Dr Reddy’s Laboratories | | | 4,481 | | | | 182,433 | |

Genscript Biotech † | | | 40,000 | | | | 64,025 | |

| | | | | | | | |

| | | | | | | 246,458 | |

| | | | | | | | |

Industrials – 0.00% | | | | | | | | |

Latam Airlines Group ADR | | | 3,308 | | | | 8,766 | |

| | | | | | | | |

| | | | | | | 8,766 | |

| | | | | | | | |

Information Technology – 1.97% | | | | | | | | |

Hon Hai Precision Industry | | | 150,582 | | | | 346,680 | |

MediaTek | | | 41,000 | | | | 440,062 | |

Samsung Electronics | | | 31,501 | | | | 1,224,807 | |

SK Hynix | | | 13,902 | | | | 939,832 | |

Taiwan Semiconductor Manufacturing | | | 123,069 | | | | 1,107,906 | |

27

Schedule of investments

Delaware Strategic Allocation Fund

| | | | | | | | |

| | | Number of shares | | | Value (US $) | |

Common Stock(continued) | | | | | | | | |

Emerging Markets @(continued) | | | | | | | | |

Information Technology(continued) | | | | | | | | |

WNS Holdings ADR † | | | 1,998 | | | $ | 85,874 | |

| | | | | | | | |

| | | | | | | 4,145,161 | |

| | | | | | | | |

Materials – 0.17% | | | | | | | | |

Cemex ADR | | | 13,862 | | | | 29,387 | |

Cia de Minas Buenaventura ADR | | | 12,628 | | | | 92,058 | |

Sociedad Quimica y Minera de Chile ADR | | | 3,027 | | | | 68,259 | |

Tata Chemicals | | | 13,145 | | | | 38,561 | |

Vale ADR † | | | 16,001 | | | | 132,648 | |

| | | | | | | | |

| | | | | | | 360,913 | |

| | | | | | | | |

Real Estate – 0.03% | | | | | | | | |

Etalon Group GDR 144A # | | | 20,100 | | | | 25,929 | |

IRSA Inversiones y Representaciones ADR † | | | 4,584 | | | | 15,952 | |

IRSA Propiedades Comerciales ADR | | | 192 | | | | 1,348 | |

UEM Sunrise † | | | 127,619 | | | | 11,594 | |

| | | | | | | | |

| | | | | | | 54,823 | |

| | | | | | | | |

Utilities – 0.02% | | | | | | | | |

Kunlun Energy | | | 86,000 | | | | 49,700 | |

| | | | | | | | |

| | | | | | | 49,700 | |

| | | | | | | | |

Total Emerging Markets(cost $14,834,472) | | | | | | | 16,052,039 | |

| | | | | | | | |

Total Common Stock(cost $100,608,293) | | | | | | | 108,525,857 | |

| | | | | | | | |

| | |

| | | | | | | | |

Exchange-Traded Funds – 5.38% | | | | | | | | |

iShares MSCI EAFE ETF | | | 3,770 | | | | 201,544 | |

iShares Russell 1000 Growth ETF | | | 51,490 | | | | 7,756,969 | |

Vanguard FTSE Developed Markets ETF | | | 930 | | | | 31,006 | |

Vanguard Mega Cap Growth ETF | | | 13,080 | | | | 1,662,206 | |

Vanguard Russell 1000 Growth ETF | | | 10,720 | | | | 1,658,170 | |

| | | | | | | | |

Total Exchange-Traded Funds(cost $9,617,552) | | | | | | | 11,309,895 | |

| | | | | | | | |

| | | | | | | | |

Limited Partnership – 0.01% | | | | | | | | |

Brookfield Property Partners | | | 3,983 | | | | 32,103 | |

| | | | | | | | |

Total Limited Partnership(cost $77,030) | | | | | | | 32,103 | |

| | | | | | | | |

28

| | | | | | | | |

| | | Principal amount° | | | Value (US $) | |

Agency Asset-Backed Security – 0.00% | | | | | | | | |

Fannie Mae REMIC Trust

Series2002-W11 AV1 1.967% (LIBOR01M + 0.34%, Floor 0.17%) 11/25/32● | | | 1,815 | | | $ | 1,778 | |

| | | | | | | | |

Total Agency Asset-Backed Security(cost $1,816) | | | | | | | 1,778 | |

| | | | | | | | |

| | | | | | | | |

Agency Collateralized Mortgage Obligations – 1.82% | | | | | | | | |

Fannie Mae REMICs | | | | | | | | |

Series2013-4 PL 2.00% 2/25/43 | | | 26,000 | | | | 26,975 | |

Series2013-44 DI 3.00% 5/25/33S | | | 550,379 | | | | 53,511 | |

Series2013-71 ZA 3.50% 7/25/43 | | | 107,615 | | | | 115,757 | |

Series2015-89 EZ 3.00% 12/25/45 | | | 97,923 | | | | 99,340 | |

Series2016-61 ML 3.00% 9/25/46 | | | 21,000 | | | | 22,998 | |

Series2016-80 JZ 3.00% 11/25/46 | | | 53,174 | | | | 56,491 | |

Series2016-101 ZP 3.50% 1/25/47 | | | 36,969 | | | | 42,585 | |

Series2017-40 GZ 3.50% 5/25/47 | | | 167,204 | | | | 187,804 | |

Series2017-67 BZ 3.00% 9/25/47 | | | 6,483 | | | | 7,047 | |

Series2017-94 CZ 3.50% 11/25/47 | | | 189,335 | | | | 212,214 | |

Series2017-99 DZ 3.50% 12/25/47 | | | 118,261 | | | | 133,094 | |

Freddie Mac REMICs | | | | | | | | |

Series 4015 MY 3.50% 3/15/42 | | | 30,000 | | | | 33,102 | |

Series 4197 LZ 4.00% 4/15/43 | | | 217,490 | | | | 244,203 | |

Series 4210 Z 3.00% 5/15/43 | | | 92,536 | | | | 91,989 | |

Series 4487 ZC 3.50% 6/15/45 | | | 875,029 | | | | 1,005,229 | |

Series 4531 PZ 3.50% 11/15/45 | | | 180,345 | | | | 195,767 | |

Series 4625 PZ 3.00% 6/15/46 | | | 1,108 | | | | 1,193 | |

Series 4629 KB 3.00% 11/15/46 | | | 390,000 | | | | 424,739 | |

Series 4657 JZ 3.50% 2/15/47 | | | 5,569 | | | | 6,392 | |

GNMA | | | | | | | | |

Series2013-113 LY 3.00% 5/20/43 | | | 450,000 | | | | 489,184 | |

Series2016-160 VZ 2.50% 11/20/46 | | | 58,688 | | | | 59,492 | |

Series2017-10 KZ 3.00% 1/20/47 | | | 1,100 | | | | 1,112 | |

Series2017-19 AY 3.00% 2/20/47 | | | 15,000 | | | | 16,699 | |

Series2017-36 ZC 3.00% 3/20/47 | | | 66,737 | | | | 72,231 | |

Series2017-52 LE 3.00% 1/16/47 | | | 188,000 | | | | 211,393 | |

Series2017-56 GZ 3.50% 4/20/47 | | | 4,429 | | | | 5,233 | |

Series2017-56 JZ 3.00% 4/20/47 | | | 6,548 | | | | 7,167 | |

Series2018-34 TY 3.50% 3/20/48 | | | 10,000 | | | | 10,878 | |

| | | | | | | | |

Total Agency Collateralized Mortgage Obligations(cost $3,438,166) | | | | | | | 3,833,819 | |

| | | | | | | | |

| | | | | | | | |

Agency Commercial Mortgage-Backed Securities – 0.51% | | | | | | | | |

FREMF Mortgage Trust | | | | | | | | |

Series2011-K11 B 144A 4.418% 12/25/48 #● | | | 500,000 | | | | 500,046 | |

Series2011-K15 B 144A 4.961% 8/25/44 #● | | | 20,000 | | | | 19,951 | |

29

Schedule of investments

Delaware Strategic Allocation Fund

| | | | | | | | |

| | | Principal amount° | | | Value (US $) | |

Agency Commercial Mortgage-Backed Securities(continued) | | | | | | | | |

FREMF Mortgage Trust | | | | | | | | |

Series2012-K22 B 144A 3.687% 8/25/45 #● | | | 145,000 | | | $ | 143,601 | |

Series 2013-K713 B 144A 3.492% 4/25/46 #● | | | 9,230 | | | | 9,208 | |

Series 2013-K713 C 144A 3.492% 4/25/46 #● | | | 210,000 | | | | 209,494 | |

Series 2014-K717 B 144A 3.63% 11/25/47 #● | | | 140,000 | | | | 139,029 | |

Series 2014-K717 C 144A 3.63% 11/25/47 #● | | | 60,000 | | | | 59,713 | |

| | | | | | | | |

Total Agency Commercial Mortgage-Backed Securities(cost $1,118,195) | | | | | | | 1,081,042 | |

| | | | | | | | |

| | | | | | | | |

Agency Mortgage-Backed Securities – 14.27% | | | | | | | | |

Fannie Mae S.F. 30 yr | | | | | | | | |

3.00% 12/1/46 | | | 1,301,441 | | | | 1,373,065 | |

3.00% 9/1/47 | | | 825,323 | | | | 869,646 | |

3.00% 4/1/48 | | | 103,950 | | | | 109,012 | |

3.00% 11/1/48 | | | 96,635 | | | | 101,909 | |

3.00% 10/1/49 | | | 351,199 | | | | 368,275 | |

3.00% 11/1/49 | | | 228,718 | | | | 239,774 | |

3.00% 12/1/49 | | | 181,720 | | | | 191,227 | |

3.00% 1/1/50 | | | 1,980,615 | | | | 2,076,274 | |

3.50% 11/1/48 | | | 136,742 | | | | 144,754 | |

3.50% 6/1/49 | | | 327,644 | | | | 346,357 | |

3.50% 11/1/49 | | | 679,192 | | | | 717,532 | |

3.50% 12/1/49 | | | 936,729 | | | | 1,000,439 | |

3.50% 2/1/50 | | | 1,584,638 | | | | 1,674,597 | |

3.50% 3/1/50 | | | 42,930 | | | | 45,776 | |

4.00% 4/1/48 | | | 354,991 | | | | 380,716 | |

4.00% 10/1/48 | | | 669,883 | | | | 728,718 | |

4.50% 4/1/44 | | | 65,184 | | | | 72,231 | |

4.50% 2/1/46 | | | 428,524 | | | | 469,373 | |

4.50% 5/1/46 | | | 33,502 | | | | 36,680 | |

4.50% 11/1/47 | | | 39,962 | | | | 43,778 | |

4.50% 4/1/48 | | | 74,388 | | | | 81,448 | |

4.50% 9/1/48 | | | 1,537,327 | | | | 1,667,093 | |

4.50% 1/1/49 | | | 297,346 | | | | 325,609 | |

4.50% 11/1/49 | | | 758,211 | | | | 815,267 | |

5.00% 7/1/47 | | | 1,149,700 | | | | 1,275,412 | |

5.00% 9/1/48 | | | 404,955 | | | | 437,079 | |

5.00% 8/1/49 | | | 2,011,802 | | | | 2,229,896 | |

5.50% 2/1/34 | | | 39,499 | | | | 45,098 | |

5.50% 9/1/34 | | | 54,542 | | | | 61,200 | |

5.50% 5/1/44 | | | 3,438,891 | | | | 3,893,363 | |

6.00% 10/1/38 | | | 695,186 | | | | 799,721 | |

6.00% 6/1/41 | | | 54,454 | | | | 62,676 | |

6.00% 7/1/41 | | | 2,006,423 | | | | 2,308,816 | |

30

| | | | | | | | |

| | | Principal amount° | | | Value (US $) | |

Agency Mortgage-Backed Securities(continued) | | | | | | | | |

Fannie Mae S.F. 30 yr

6.00% 1/1/42 | | | 44,457 | | | $ | 51,136 | |

Fannie Mae S.F. 30 yr TBA | | | | | | | | |

4.00% 4/1/50 | | | 279,000 | | | | 297,892 | |

5.00% 4/1/50 | | | 1,620,000 | | | | 1,749,284 | |

Freddie Mac ARM

2.599% (LIBOR12M + 1.63%,

Cap 7.60%, Floor 1.63%) 10/1/46● | | | 96,702 | | | | 98,344 | |

Freddie Mac S.F. 30 yr | | | | | | | | |

3.00% 11/1/49 | | | 182,635 | | | | 191,515 | |

3.00% 12/1/49 | | | 52,632 | | | | 55,207 | |

3.00% 1/1/50 | | | 91,478 | | | | 96,179 | |

4.00% 10/1/47 | | | 354,483 | | | | 381,737 | |

4.50% 8/1/48 | | | 663,125 | | | | 717,670 | |

5.00% 7/1/45 | | | 187,324 | | | | 207,759 | |

5.50% 6/1/35 | | | 31,057 | | | | 35,110 | |

5.50% 7/1/37 | | | 46,473 | | | | 52,665 | |

5.50% 8/1/37 | | | 40,111 | | | | 45,344 | |

5.50% 10/1/37 | | | 39,682 | | | | 44,967 | |