Exhibit 99.1

The following presentations contain "forward-looking statements" within the meaning of

federal securities laws, including estimates of REVPAR, profit margins, earnings and the

number of lodging properties to be added in future years; expected investment spending;

anticipated results from synthetic fuel operations; and similar statements concerning future

events and expectations that are not historical facts. We caution you that these statements

are not guarantees of future performance and are subject to numerous risks and

uncertainties, including whether early indications of an economic recovery will continue;

supply and demand changes for hotel rooms, vacation ownership intervals, and corporate

housing; competitive conditions in the lodging industry; relationships with clients and

property owners; the availability of capital to finance growth and owner refurbishment of

existing hotels; the impact of recent privacy initiatives on our marketing of timeshares and

other products; and the risk that the Internal Revenue Service may not issue a satisfactory

private letter ruling in connection with the sale of the interest in our synthetic fuel business

or reject any of the tax credits produced; any of which could cause actual results to differ

materially from those expressed in or implied by the following. You can find more detailed

information about these and other risks and uncertainties in our periodic filings with the

SEC. These statements are made as of November 11, 2003, and we undertake no obligation

to publicly update or revise any forward-looking statement, whether as a result of new

information, future events or otherwise.

These presentations also include certain non-GAAP financial measures as defined by SEC

rules. As required by SEC rules, we have provided a reconciliation of those measures to the

most directly comparable GAAP measures at the end of the presentations and which is also

available on our investor relations website at www.marriott.com/investor and clicking on

"Reconciliations Required by Sarbanes Oxley."

Arne M. Sorenson

Executive Vice President

Chief Financial Officer

and President - Continental

European Lodging

Marriott International, Inc.

J.W. Marriott, Jr.

Chairman of the Board

and Chief Executive Officer

Marriott International, Inc.

Michael E. Jannini

Executive Vice President

Lodging Brand Management

Marriott International, Inc.

Marriott Lodging

2600+ Properties

First Choice Brand Preference

Distribution Channel Mastery

69 Countries

Broadest Portfolio

Largest Frequency Program

#1 Web Site

Deep Hospitality Culture

Premium Market Share

Largest Hotel Management Company

18 Lodging Brands

6

1995

2000

2005

2010

Operational

Excellence

Loyalty

Experience

Marriott Leadership

7

Operational Excellence

Brand Standards

Balanced Scorecard

Quality Assurance

At Your Service

Sleep Well Bed

High Speed Internet Access

8

Associates

Investors

Guests

Loyalty

9

Experience

TIME

Agriculture

Manufacturing

Service

Experience

10

FULL Service

High Room Rates

High Profit Margins

High REVPAR Premiums

System Obligations

High Value Travelers

More Complex

Well Differentiated

Defensible

Competence Requirements

Asset Appreciation

11

12

Simon F. Cooper

President and

Chief Operating Officer

The Ritz-Carlton

Hotel Company, L.L.C.

The Ritz-Carlton Hotel Company

Security Analyst

Meeting

November, 2003

14

Best in Class Service

J.D. Power Satisfaction Scores

Ritz-Carlton

Four Seasons

Luxury Average

Fairmont

Inter-Continental

880

839

835

823

778

Source: 2003 J.D. Power

15

Effects of Stay Elements on Ritz-Carlton Loyalty

Logistic Regression for Resort Hotels

Ritz –

Carlton

Loyalty

Provided Sense of Well-Being

Cleanliness of Hotel

18.5

12.4

17.9

Very Satisfied

Odds Ratio

Staff Genuinely Cares For You

10.6

Ability of Staff to Anticipate Needs

Feeling Wanted As Guest

7.8

Feel As If Guest In RC Home

7.3

16

Customer Engagement Levels

Rate Paid

= $246

Rate Paid

= $234

Rate Paid

= $227

Actively

Disengaged

11%

Not Engaged

15%

Engaged

29%

Fully

Engaged

45%

17

Employee Satisfaction

(1) “Satisfaction with Ritz-Carlton Hotel Company” from the Global Employee Satisfaction Survey.

Employee

Satisfaction (1)

Recognition

“Best Employer in Asia” (by the Asian Wall Street

Journal):

#1 The Portman Ritz-Carlton, Shanghai (#1 in China – second

consecutive win)

#3 The Ritz-Carlton Millenia Singapore (#2 in Singapore)

#8 The Ritz-Carlton Hong Kong (#1 in Hong Kong)

18

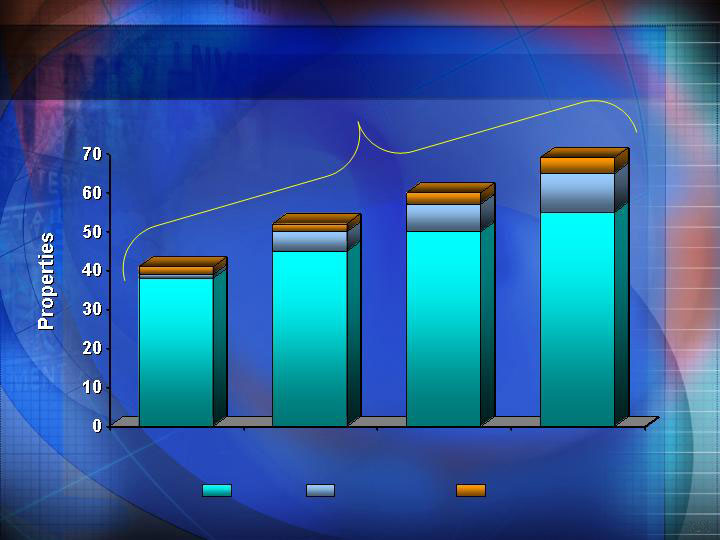

Worldwide Distribution

77% Growth

Hotels

Clubs

Residences

2000

2001

2002

2003E

41

52

60

69

19

Average Rates

Ritz-Carlton Domestic Hotels

12003 estimate as of 10/8/03

$250

$237

$233

$255

$231

$296

Comparable

Non-Comp

1

20

Average Cost per Key

Existing Hotels

New Development

Investment

per Room

$276K

Number

of Rooms

408

Investment

per Room

$391K

Number

of Rooms

302

21

Comparison to Four Seasons

U.S. Comparable House Profit Margin

= Ritz-Carlton

= Four Seasons

22

23

24

Sid S. Yu

Senior Vice President

Brand Management

Marriott International, Inc.

Marriott

Hotels & Resorts

Renaissance

Hotels & Resorts

New Heights

26

Marriott…Culture of Change

“Companies that don’t risk anything will

inevitably find themselves falling behind.

You can lead change or it can lead you.

The key is to manage risk productively.”

J.W. Marriott, Jr.

27

Takeaways

Business Clarity

… attract more consumers

... complementary values

Winning Brands

… shining star & getting

brighter

… emerging star

Business Clarity - - Consumer Needs

ACHIEVEMENT CONSUMER

peace of mind / trust

familiarity

comfort / dependability

ENJOYMENT/ STYLE CONSUMER

unique hotels

design / style

status

45% spending

55% spending

“ENJOYMENT” BRANDS

25% revenue

Renaissance

Westin

Hyatt

“ACHIEVEMENT” BRANDS

75% revenue

Marriott

Hilton

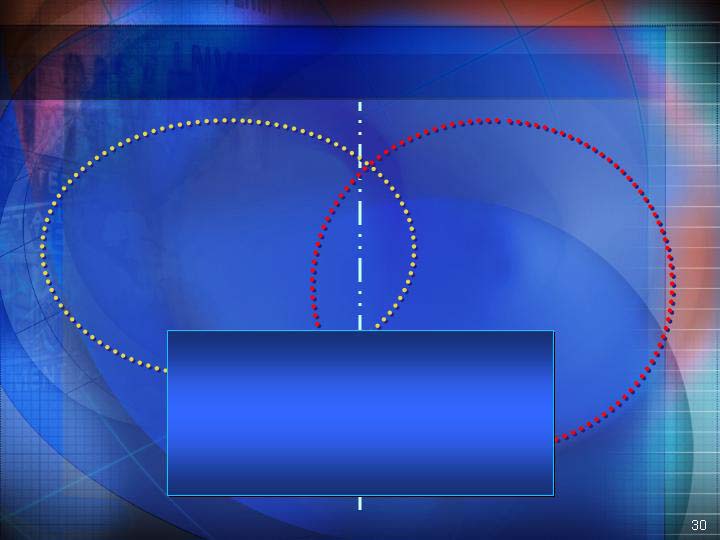

Business Clarity - Complementary Value

Achievement Oriented

Enjoyment Oriented

MARRIOTT

Hotels & Resorts

RENAISSANCE

Hotels & Resorts

NEW CONSUMERS … NOT CANNIBALIZATION

CROSS SELL UPSIDE

BUSINESS SYNERGIES

CONSUMER DIFFERENTIATION

> 50% did not use Marriott

> 70 % did not use RHR

Winning Brands

31

Marriott Hotels & Resorts

DEPARTURE POINT

…50 Years of Leadership

…Knowledge Leader

#1 Preference – Consumers

#1 Preference - Meeting

Planners

#1 Preference - Owners

REVPAR Premium

# 1 Distribution

Baltimore Waterfront

Source: Global Brand Tracking Study

(2003 Global Brand Tracking Study)

1st-Choice Preference

1st-Mention

Unaided Awareness

#1 Preference Leader - Consumers

(2002 Meeting Planner Satisfaction)

MHR

Hilton

RHR

Hyatt

Sheraton

#1

#1

#1

= Significant Improvement

= Significant Decline

= No change since 2001

Scale:

Penetration (U.S.)

Penetration (Int’l)

#1

1st Choice Preference

Provide Best Value

Provide Best Meeting

Services

#1

#1

Effective Promotion

of Meeting Services

#1 Meeting Planner Preference

Marriott #1 Among Owners As Managers for Future Hotels

(2003 Owner & Franchise Satisfaction Study)

What Manager would Owner Choose Tomorrow for Future Hotels?

#1 Preference Leader - Owners

Marriott

REVPAR

Index

REVPAR (Revenue per available room) index is for September 2003 YTD, for total

comparable U.S. hotels; data from Smith Travel

Consistent REVPAR Index Leader

Park Lane, UK

Next 50 Years of Leadership

DESTINATION

Take Industry Leadership to

New Heights

…Keep Brand Fresh

…Take Knowledge

to New Heights

…Further Expand & Grow

Keep Brand Fresh

warm & rich

Emphasize

Modern & Classic Sophistication

range of familiarity

progressive

residence

Keep Brand Fresh

MODERN COMFORTS

… amenities

… food & beverage

… consumer technology

Take Knowledge Leadership to New Heights

… expand definition of

service & relationships

… expand definition of

meeting excellence

5 YR CAGR % of Brand % Pipeline*

North America

International

Marriott Brand

* Rooms as of third quarter 2003, except for Pipeline, which is measured in units

Expand Marriott - Geography

42%

58%

100%

72%

28%

100%

+3%

+14%

+6%

DOWNTOWN

18% of Brand pipeline

CONVENTIONS

26% of Brand pipeline

Seattle Marriott Waterfront

Expand Marriott – Primary Locations

Expand Marriott – Line Extensions

JW MARRIOTT

4% of Brand pipeline

RESORTS

29% of Brand pipeline

JW Marriott Desert Ridge Resort

Drive Pricing Upside …

Line Extensions / Primary Locations

2003 Average Daily Rate*

JW Marriott

$176

Resorts

$165

Conventions

$158

Other Marriott Hotels

$120

*Estimated 2003, United States

Expanding The Leadership

“# 1

By Wide Margin”

… Business Week

October 2003

JW Marriott

Orlando Grande Lakes

Marriott

Miami South Beach

This Is Renaissance

46

This Is Renaissance

$2 billion

systemwide

sales

126 hotels

104% REVPAR

index

Strong guest

satisfaction

47

Strong Guest Satisfaction

Among users, RHR leads over other Enjoyment brands …

for Overall Opinion of Brands, Quality of Staff Service, and Distinctive.

Overall

Opinion

Quality of

Staff Service

Distinctive

2003 Global Brand Tracking

48

Renaissance

Top Upper Upscale Brand

Consumer Reports

Renaissance

#2 Upper Upscale Brand

JD Power

Top 5 Brands

Zagats

Strong Guest Satisfaction

49

Renaissance REVPAR Index

Renaissance

REVPAR

Index

Note: 2003 REVPAR Index for total comparable U.S. properties through September

savvy service

street f & b

expressive design

Three Pillars

Priorities For 2004 … Beyond

#2 REVPAR Index Leader

3 Pillars

Quality Growth

Renaissance Arts Hotel

Renaissance Hollywood

London Chancery Court

Renaissance Clubsport

2003 Zagats Survey

Renaissance Hotels & Resorts

“ Rapid expansion, well – liked, high – end

brand from Marriott

Pleasantly surprised … well appointed

room, conference facilities & dependable,

personal services

This chain gives a lot …”

Takeaways

Business Clarity

… attract more consumers

... complementary values

Winning Brands

… shining star &

getting brighter

… emerging star

Sid S. Yu

Senior Vice President

Brand Management

Simon F. Cooper

President and

Chief Operating Officer

The Ritz-Carlton Hotel

Company, L.L.C.

Brand Strategy Q&A

Michael E. Jannini

Executive Vice President

Lodging Brand Management

Moderator: Leeny K. Oberg

Vice President

Investor Relations

Amy C. McPherson

Senior Vice President

Global Revenue Management

Marriott International, Inc.

Global Rate

Integrity & Single

Image Inventory

Why & Why Now...

Changing and Complex Business

Environment

Eroding Customer Confidence in Rates

Inadequate Industry Response

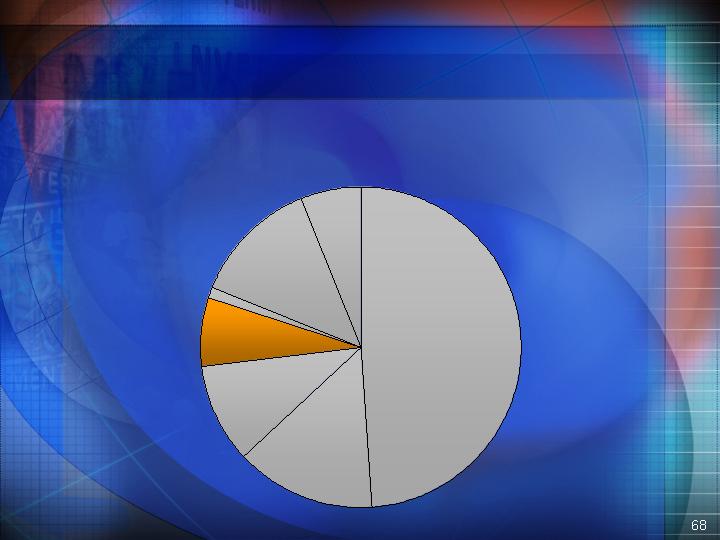

Sources of Roomnights

Roomnights by Channel

All Marriott Brands Worldwide

Year To Date 2003

Property

49%

Worldwide

Reservations/800#

14%

10%

Marriott.com

7%

Other Internet

1%

Major Travel Management

Companies-GDS

13%

Travel

Agents-GDS

6%

Area Reservation

Sales Offices

Global Rate Integrity and Single Image Inventory

Across All Channels

Single Image

Brand Standard

& Customer

Guarantee

Travel

Management

Company Pricing

Strategy

eChannel

Strategy

Our Vision...

Sources of Roomnights

Property

49%

10%

Marriott.com/

Brand Site

7%

Other Internet

1%

13%

Major Travel Management

Companies-GDS

Roomnights by Channel

All Marriott Brands Worldwide

Year To Date 2003

Worldwide

Reservations/800#

14%

Travel

Agents-GDS

6%

Area Reservation

Sales Offices

Sources of Roomnights

Property

49%

10%

Marriott.com

7%

Other Internet

1%

13%

Single Image

Brand Standard

Major Travel Management

Companies-GDS

Roomnights by Channel

All Marriott Brands Worldwide

Year To Date 2003

Worldwide

Reservations/800#

14%

Travel

Agents-GDS

6%

Area Reservation

Sales Offices

Sources of Roomnights

Property

49%

Marriott.com

7%

Other Internet

1%

13%

Major Travel Management

Companies-GDS

Roomnights by Channel

All Marriott Brands Worldwide

Year To Date 2003

Worldwide

Reservations/800#

14%

Travel

Agents-GDS

6%

10%

Area Reservation

Sales Offices

Sources of Roomnights

Property

49%

10%

Marriott.com

7%

Other Internet

1%

13%

Major Travel Management

Companies-GDS

Roomnights by Channel

All Marriott Brands Worldwide

Year To Date 2003

Worldwide

Reservations/800#

14%

Travel

Agents-GDS

6%

Area Reservation

Sales Offices

Sources of Roomnights

Property

49%

10%

7%

Other Internet

1%

13%

Area Reservation

Sales Offices

Marriott.com

Major Travel Management

Companies-GDS

Roomnights by Channel

All Marriott Brands Worldwide

Year To Date 2003

Worldwide

Reservations/800#

14%

Travel

Agents-GDS

6%

Sources of Roomnights

Property

49%

10%

7%

Other Internet

1%

13%

Marriott.com

Major Travel Management

Companies-GDS

Roomnights by Channel

All Marriott Brands Worldwide

Year To Date 2003

Worldwide

Reservations/800#

14%

Travel

Agents-GDS

6%

Area Reservation

Sales Offices

Marriott’s

Guarantee

Sources of Roomnights

Property

49%

10%

7%

Other Internet

1%

13%

Marriott.com

Major Travel Management

Companies-GDS

Roomnights by Channel

All Marriott Brands Worldwide

Year To Date 2003

Worldwide

Reservations/800#

14%

Travel

Agents-GDS

6%

Marriott’s

Guarantee

Area Reservation

Sales Offices

Mandates single image

inventory standard

“Sells the way the customer

wants to buy”

Strengthens customer

confidence and trust

Enhances competitive

advantage

Single Image

Brand Standard

& Customer

Guarantee

Travel

Management

Company Pricing

Strategy

eChannel

Strategy

Enables Marriott’s Look No

Further Best Rate Guarantee

Strengthens relationship and

fosters travel program compliance

Drives incremental revenue/profit

Enhances status as a preferred

supplier

Single Image Brand

Standard

& Customer

Guarantee

Travel

Management

Company Pricing

Strategy

eChannel

Strategy

Enables Marriott’s Look No

Further Best Rate Guarantee

Drives incremental revenue

Provides additional distribution

of rates

“Sells the way the customer

wants to buy”

Single Image Brand

Standard

& Customer

Guarantee

Travel

Management

Company Pricing

Strategy

eChannel

Strategy

Global Rate Integrity and Single Image Inventory

Across All Channels

Single Image

Brand Standard

& Customer

Guarantee

Travel

Management

Company Pricing

Strategy

eChannel

Strategy

Bruce W. Wolff

Senior Vice President

Distribution Sales and Strategy

Marriott International, Inc.

Internet/Marriott.com

Opportunities

Marketer’s dream

Strengthens customer relationships

Powerful sales channel

Supports other Marriott International needs

Internet Concerns . . . . . .

Price transparency

Good for consumer

What are we doing?

Marriott’s rational pricing

Marriott’s Look No Further Best Rate Guarantee

Internet Concerns . . . . . .

Commoditization

Marriott product is not a commodity

Buying patterns demonstrate lodging not

commoditized

Information supports superior products

What are we doing?

Focus on brand equity

product, pricing, promotion, sales efforts

Enhance Marriott.com

Support customer buying patterns

reservations, Marriott.com, travel agents

Internet Concerns . . . . . .

Expensive intermediaries appearing

Rate integrity

Inventory integrity

Cost

What are we doing?

Enhance all channels, particularly Marriott.com

Travelweb

Best Rate Guarantee

Win-Win deals with e-intermediaries

Rita M. Cuddihy

Senior Vice President

Marketing

Marriott International, Inc.

Marriott Rewards

The world’s longest running and most

popular loyalty program

Over 19 million members

Recent accolades – top hotel loyalty program

Business Week

Business Travelers Magazine

7th consecutive year

Marriott Rewards Members are

Loyal to the Brand

% of Trip Share Given to Marriott Brands

12%

32%

54%

64%

79%

Non-

members

Members

Silver

Gold

Platinum

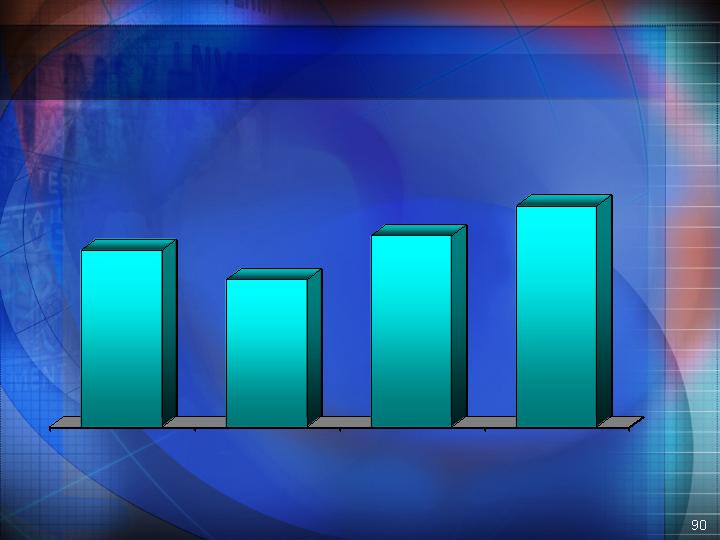

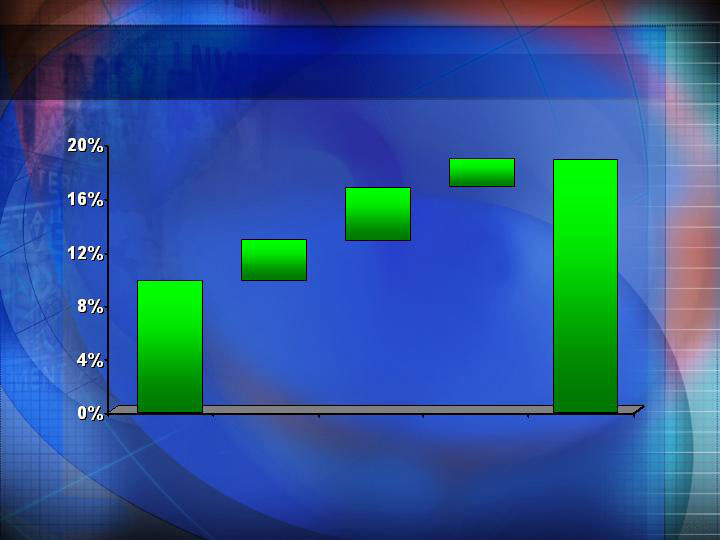

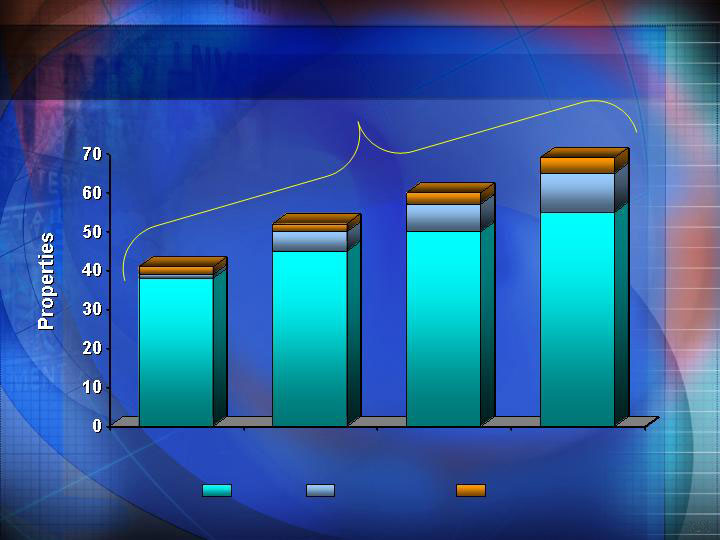

Marriott Rewards Active Members

Continue to Grow…

2000

2001

2002

2003E

Active members have made a paid stay within the past 12 months.

14% increase

1% increase

5% increase

And The Number Of Elite Members Has

Grown Even Faster

2000

2001

2002

2003E

Elite members have stayed at least 10 paid nights within a calendar year

23% increase

13% decrease

17% increase

Results in Strong Growth in Member Activity

2000

2001

2002

2003E

14% increase

4% increase

10% increase

Paid Nights

Marriott Rewards Service

Enhancements in 2003

Elite benefits applicable at all brands

Distinct 800 lines for Silver, Gold and

Platinum Elite members

Easy redemption with electronic certificates

Faster track to achieve Silver Elite status

Marriott Rewards Offers More…

Resorts

Onsite golf

Spas

… than any other program

November 20, 2003

20th Anniversary

Where Do We Go From Here?

Strengthening relationships

Focus on end-to-end customer experience

Guest recognition through enhanced

segmentation

Strengthening Relationships

Recognize “Our associates have the right

information at the right touchpoint so they

can recognize our guest.”

Differentiate “We understand our customers

and the value of our relationship.”

Anticipate “They don’t have to ask.”

Rewards “Rewards inspire repurchase and

increase share.”

Robert J. McCarthy

Executive Vice President

North American

Lodging Operations

Marriott International, Inc.

Operational Excellence

Our Associates…

…Are Our Most

VALUED ASSET!

100

Quality Assurance Program

Audits Performed by Certified

Third Party

Hotels Audited Twice a Year

Enforce Standards Compliance

at Every Hotel

101

Guest Satisfaction Survey

Reinforces Quality and

Consistency

Respond Quickly to Guest

Concerns

High Performers are Recognized

and Rewarded

Survey for Event Customers

102

Innovation in Products and Services

Piloting Check-in Check-out Kiosks

Wired for Business Survey Results:

83% would purchase Wired for Business

on additional stays

49% have purchased Wired for Business

on 5 or more stays

Wired for Business buyers would give

Marriott 16% more of their trips

103

Daily Basics Meetings

Global Communication Platform

Guests Feel Welcomed and

Appreciated

Associates are Recognized

and Acknowledged

for Contributions

104

At Your Service

Guest

At Your Service

Agent

105

At Your Service

Facilitates Guest Recognition

Identifies Guest Issues/Trends

Enables Issue Resolution

Creates Repeat Guest Profile

106

At Your Service

Intent to Return

Overall Satisfaction

Satisfaction with

Problem Resolution

Compared to

Brand Average

5.1% Better

Guest Satisfaction

Survey Questions

4.5% Better

2.5% Better

107

Hallmarks of Consistency

Setting High Brand Standards

Rigorous Quality Assurance

Program

Timely Guest Feedback

Innovation in Products and Services

Respect for the Individual

108

Amy C. McPherson

Senior Vice President

Global Revenue Management

Robert J. McCarthy

Executive Vice President

North American

Lodging Operations

Bruce W. Wolff

Senior Vice President

Distribution Sales

and Strategy

Rita M. Cuddihy

Senior Vice President

Marketing

Sales, Marketing & Operations Q&A

Moderator: Leeny K. Oberg

Vice President Investor Relations

Stephen P. Weisz

President

Marriott Vacation Club International

Marriott International, Inc.

Vacation Ownership

The Marriott Way

Ritz Carlton Aspen Member Lounge

1Source: American Resort Development Association

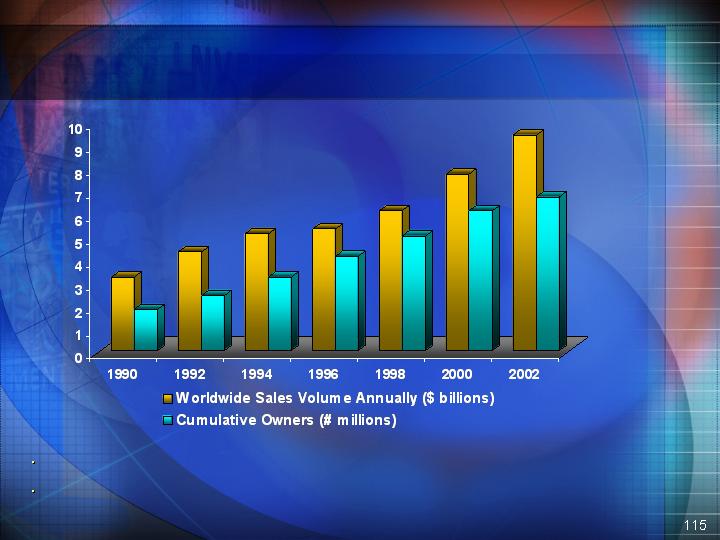

Vacation Ownership Industry

Began 40 years ago in Europe1

5,400 Vacation Ownership resorts in

over 100 countries1

Vacation Ownership is the purchase of

an interval of time in a resort or points

in a resort system.

Product ownership typically based on –

Deeded Real Estate (forever)

Right-to-use (specified number of years)

Points in a trust (trust owns real estate)

Typically sold in 1 week intervals (“timeshare”)

May be multiple weeks (“fractional” up to “quartershare”)

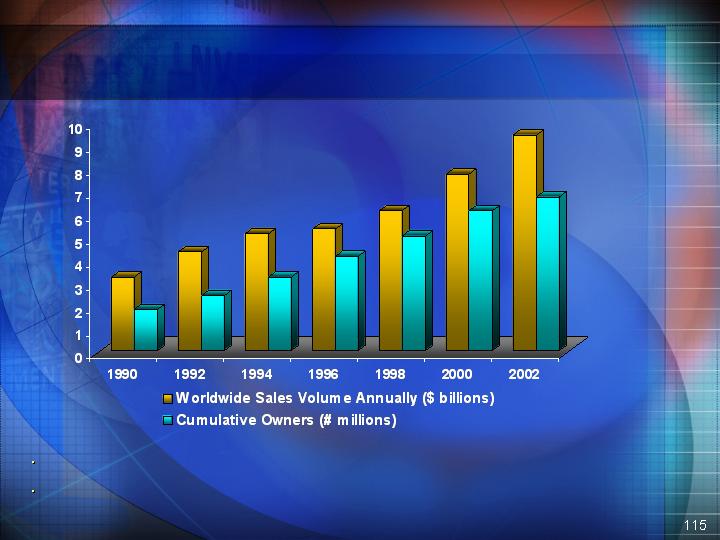

Vacation Ownership Industry

In 2002 $9.4 billion annual sales, 6.7 million cumulative owners

Since 1990, vacation ownership sales CAGR of 9.3%.

1 Source: ARDA - The Vacation Ownership Industry: Selected Characteristics 2003

Brands affiliated with Lodging companies

taking market share from other pure

Vacation Ownership brands

Improving consumer acceptance driving

industry growth

Continued market segmentation

More flexibility to use options and more “club”

benefits

Relationship marketing replacing telemarketing

Industry Trends

Average Price

$10K - $60K/

Week

$10K - $15K/

Week

$100K - $400K/

3 - 4 week

membership

$100K - $300K/

Fraction

Typical Customer

$75K - $200K+

household income

$50K - $90K

household income;

value conscious

$200K+ household

income; $3M+

net worth

$125K+ household

income; $1M+

net worth

Portfolio of Brands

% of Total 2002

Contract Sales

4%

11%

5%

80%

2002

1997

Source: Vacation Ownership World Magazine

(1) U. S. headquartered companies with Sales of $20 million or more in timeshares and/or fractional ownership interests

Marriott Vacation Ownership Brands

Remaining Industry

Marriott Vacation Ownership Sales

Market Share of US Based Companies1

What Does Marriott Vacation

Ownership Do for Marriott Lodging?

Increases MI brand loyalty as measured in

average roomnights per year from MVCI owners

Improves overall value of Marriott Rewards

system by providing highly-desirable

redemption locations

Drives improved results at hotels co-located

with Marriott Vacation Ownership projects, (ex.

Aruba, Kauai, Palm Springs, Orlando, Phuket)

Provides flexibility in deal negotiations

Marriott Vacation Ownership Priorities

Customer relationship management

Profitability and margins

Return on invested capital

How We Sell

Counselor sales approach

Marketing focus on:

In market leads

Affinity leads (Marriott Rewards)

Owner referrals

Prepared for do-not-call environment

Invested over $40 million in customer

relationship management (CRM) systems

CRM will enable us to learn from each

customer interaction and customize sales

approaches

*Excludes gain on sale of Interval International of $44M.

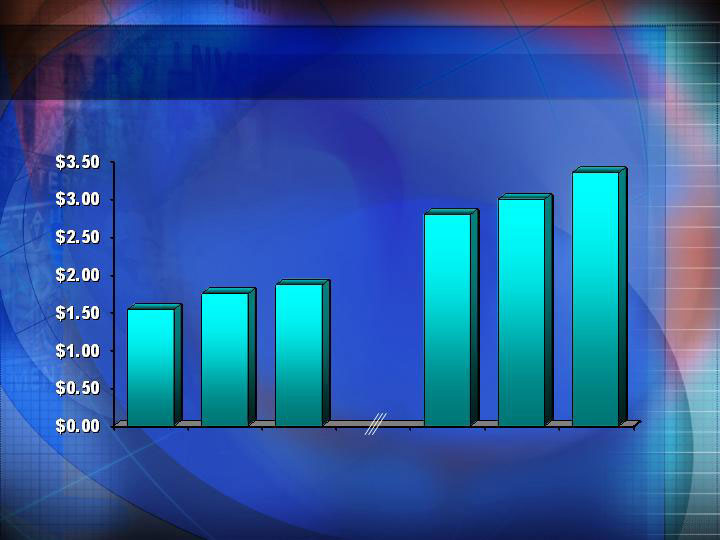

$60

$94

$138

$147

$139

$146 to

$148

$123

Marriott Vacation Ownership Results

$165 to

$175

($ in Millions)

122

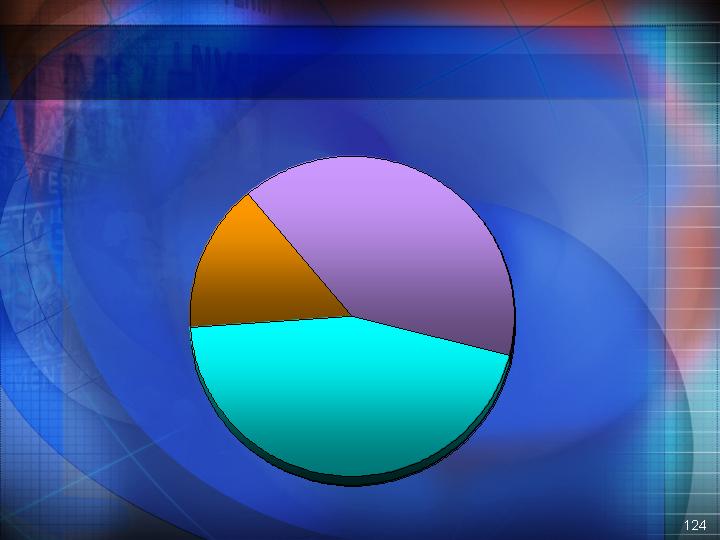

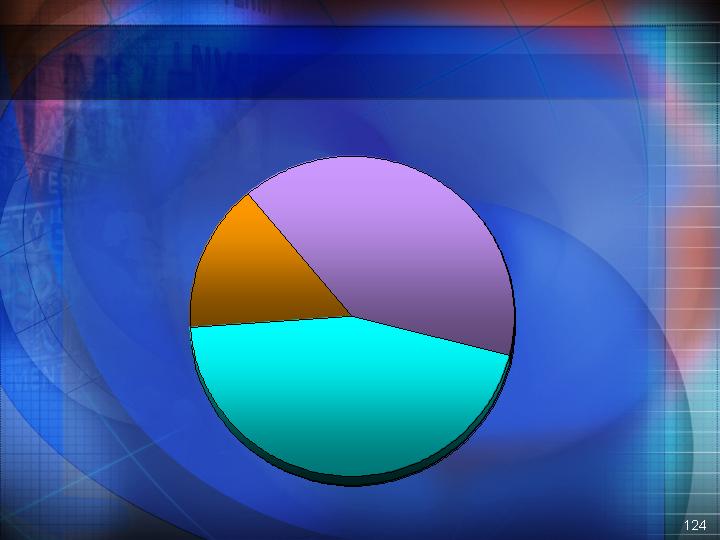

Financing

Profit Drivers

Sale of Vacation

Ownership Interests

Financing and Sales

of Vacation

Ownership Mortgages

Management Fees,

Rental Commissions

Development

Services

Profit Drivers

Development

40%

Financing

45%

Services

15%

Percentage of total timeshare profit in 2002

Note: Administrative costs are allocated pro-rata based on operating profit

Product costs

40% of sales price

Number of units:

Construction:

Sales life:

Project life sale

Project costs:

Typical MVCI Development Project

300 - 500

Phased units (30 – 60 units per phase)

7 years – 10 years

$300 - $500M

Marketing & sales costs

Commence approximately

12-18 months prior to first occupancy

Sales:

Development margin

45% of sales price

15% of sales price

Marriott Vacation Ownership

Consumer Financing

Propensity to finance is 45% to 48% of MVCI sales

Typical MVCI borrowing amount is $17,000

Typical borrowing rate is 12.5% to 12.8%

Credit guideline is credit score of over 600 for

automatic approval

Best-in-class servicing

Recycle defaulted inventory

Marriott Vacation Ownership

Mortgage Notes Sales

Normal part of capital recycle program

(2 note sales planned for 2003)

MVCI gets face amount of loan and splits

interest with investor

Gain represents present value of expected

future interest cash flows

Limited Marriott credit enhancement

Marriott Vacation Ownership

Services Income

Management fees of approximately $20M

in 2003; fee is typically 10% of annual

condo owners dues

Rental commissions

Ancillary business (food and beverage,

golf, spa)

2Excludes Interval International gain

Marriott Vacation Ownership ROIC1

1Earnings before interest and taxes divided by average invested capital

Typical MVCI Project

Year 1

Year 2

Year 3

Year 4

Year 5

Year 6

Year 7

Year 8

Year 9

Year 10

Year 11

Year 12

Invested capital project life to date

Annual contract sales

($ in Millions)

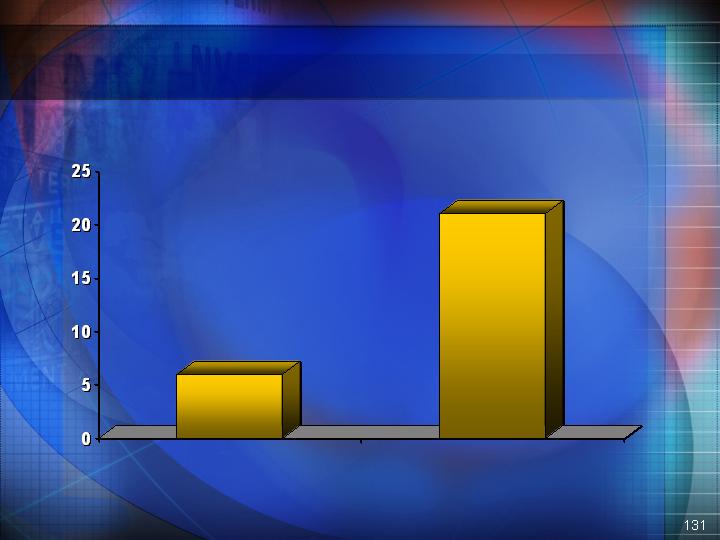

Marriott Vacation Ownership

Number of Projects With 5+ Years of Sales

2003

2006E

6

21

Marriott Vacation Ownership

ROIC Improvement

Maturing of long term inventory

Increase number of joint ventures. Joint venture

terms typically include:

Split of development risks and profits

Retention by MVCI of financing and

management profits

Non recourse financing

Increase number of marketing & sales agreements

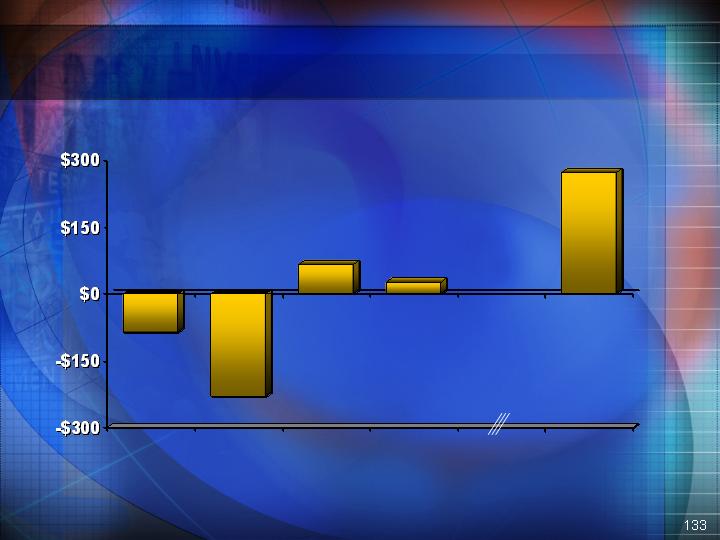

Marriott Vacation Ownership

Cash From Operations1

2000

$66

2001

2002

2003E

2006E

$26

$(86)

$(230)

$270

1Timeshare cash flow defined as after tax timeshare profit plus timeshare activity, net,

and depreciation and amortization.

($ in Millions)

Marriott Vacation Ownership

Profit Outlook

2000

$1391

2001

2003E

2004E

2006E

$146 to

$148

$138

$147

1Excluding gain on sale of Interval International investment

($ in Millions)

$165 to

$175

$280 to

$290

2002

Stephen P. Weisz

President

Marriott Vacation Club International

Marriott International, Inc.

Marriott Vacation Club Ownership Q&A

Moderator: Leeny K. Oberg

Vice President

Investor Relations

Joseph V. Cozza

Executive Director of Catering

New York Marriott Marquis

Marriott International, Inc.

George McNeill, CMC

Executive Chef

New York Marriott Marquis

Marriott International, Inc.

Kevin M. Kimball

Executive Vice President

Lodging Finance

Marriott International, Inc.

Lodging Growth

Sources of revenue

Property level margins

Worldwide rooms growth

Outlook

142

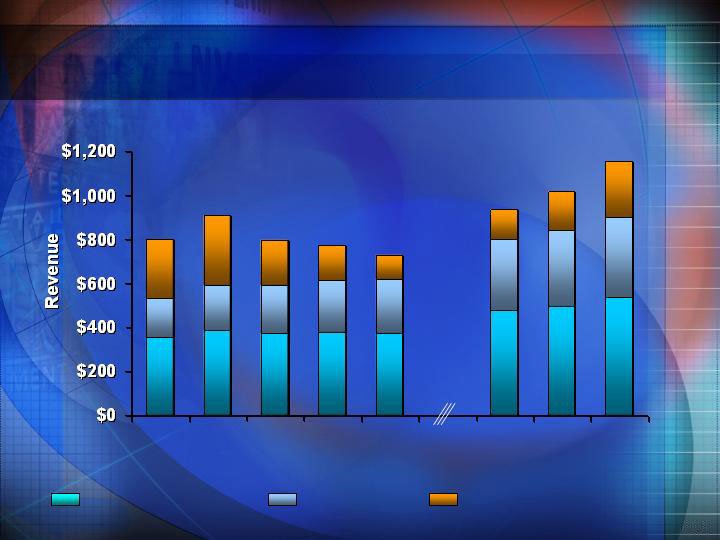

Lodging Fee Revenue

$800M

$907M

$794M

$773M

$725 to

$735M

Marriott Hotels & Resorts

REVPAR

Base Management Fees

Franchise Fees

Incentive Management Fees

143

($ in Millions)

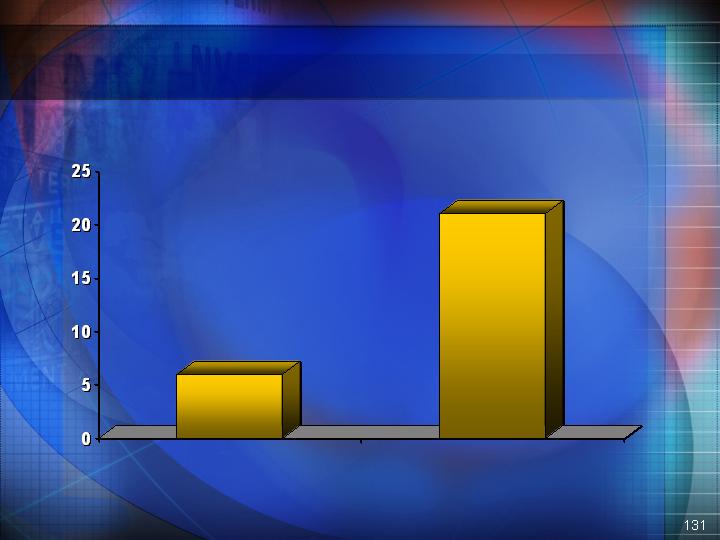

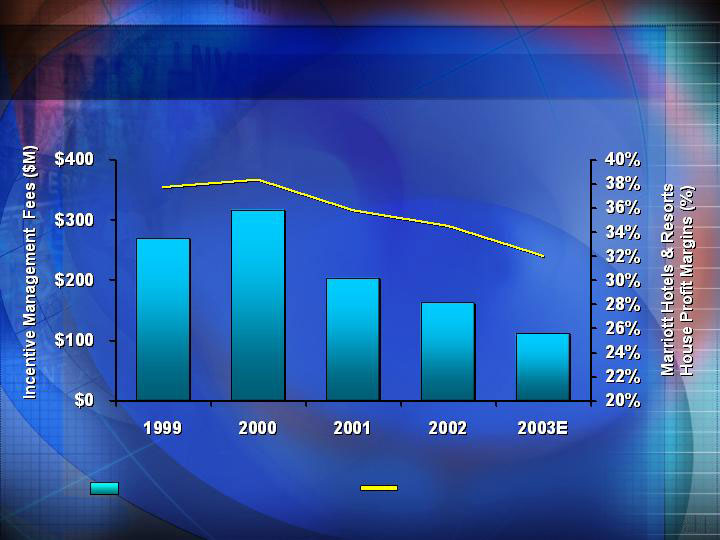

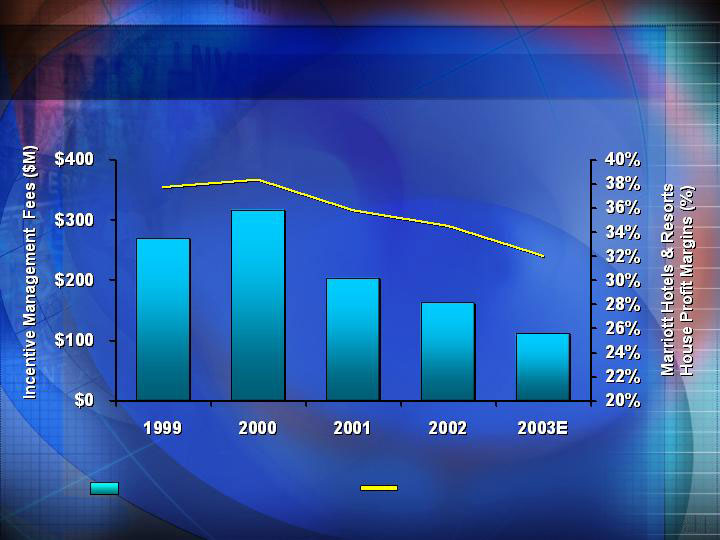

Marriott Hotels & Resorts REVPAR

Incentive Fees have fallen with Margins

Incentive management fees vs house profit margins

Incentive management fees

MHR house profit margin

144

U.S. Lodging Profit Contribution1

West

20%

South East

18%

South Central

13%

Mid Atlantic

18%

North East

14%

Mid West

17%

12003 YTD; full service, extended stay and select service segments.

Does not include MVCI or allocation of overhead

145

International Lodging Profit Contribution1

Central America

13%

Latin America

6%

Middle East &

Africa

11%

Continental Europe

29%

Asia Pacific

30%

United Kingdom

11%

12003 YTD; full service, extended stay and select service segments.

Does not include MVCI or allocation of overhead

146

Management and Franchise Contracts

Long-term

High renewal rates

147

International

U.S.

$100

Varies based on part of the world

3% of revenue

Current Typical Management Contract

35% House Profit

22% Net House Profit

3% of revenue in Europe &

Mideast; 1% to 3% of revenue

in Asia

10% to 11% of capital

Characteristics

Revenue per room

Base fee

Margins

Owners priority

15% to 25% of

Net House Profit

20 to 40 years

(including renewals)

Incentive fees

Term

Same or slightly lower in Europe;

Significantly higher in Asia

Similar in Europe;

Usually none in Asia

Similar in Europe;

Typically 8% of House Profit in Asia

Slightly less in Europe; 15 to

30 years (including renewals)

in Asia

148

Significant REVPAR Premiums1

1Smith Travel Research, September 2003 YTD; managed U.S. comparable hotels

Marriott

Renaissance

Residence

Inn

Courtyard

TownePlace

Suites

SpringHill

Suites

Ritz-Carlton

114

115

104

132

125

117

107

149

Property Level Revenue Sources

Marriott Hotels & Resorts1

Rooms

Food & beverage

Other

Total

2003 YTD

150

61%

32

7

100%

1As of Sept. year to date; 145 comparable managed North American hotels. “Other”

includes telephone, garage, gift shops, rents & commissions, golf & spa revenues

2003 YTD

% of Sales

Expenses

Wages & benefits

33%

Cost of sales & controllables

17

5

Utilities, repair and maintenance

Sales & marketing

Insurance, accidents, G&A and other

5

House Profit

5

35%

Base fee

Furniture, fixtures & equipment escrow

Real estate insurance, taxes & other

Net House Profit

3

5

5

22%

Property Level Margins

Marriott Hotels & Resorts

1As of Sept. year to date; 145 comparable managed North American hotels. “Other” includes telephone, garage,

gift shops, rents & commissions, golf & spa revenues

151

Focus on Profitability

Expense Items

Labor & benefits

Food & beverage

Telephone

Insurance

Labor scheduling

Procurement program

Wired for business

Systemwide insurance program

REVPAR increase of approximately 3% annually

should hold hotel margins flat from 2003 to 2006

Competitive Advantage

152

Labor Scheduling

Automated

Cross training

Citywide access

Highly skilled labor force

Higher associate satisfaction

Hours optimized

153

Procurement

154

Marriott Hotels & Resorts Occupancy Level Sensitivity

(1989-2000 for comparable managed properties)

3.0%

2.0%

6.8%

6.1%

Avg. REVPAR Growth

Avg. ADR Growth

Years when occupancy

was 72% to 75%

Years when occupancy

was above 75%

155

Marriott Hotels & Resorts

REVPAR versus House Profit Margin

MHR Comparable U.S. REVPAR

MHR House Profit Margin

156

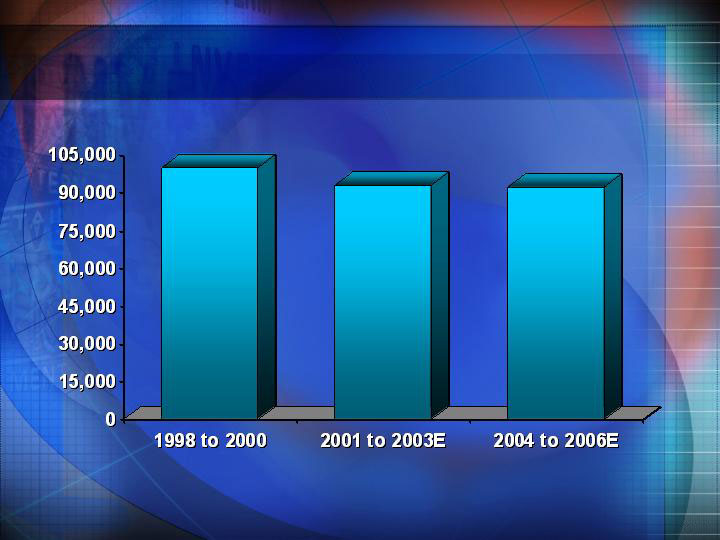

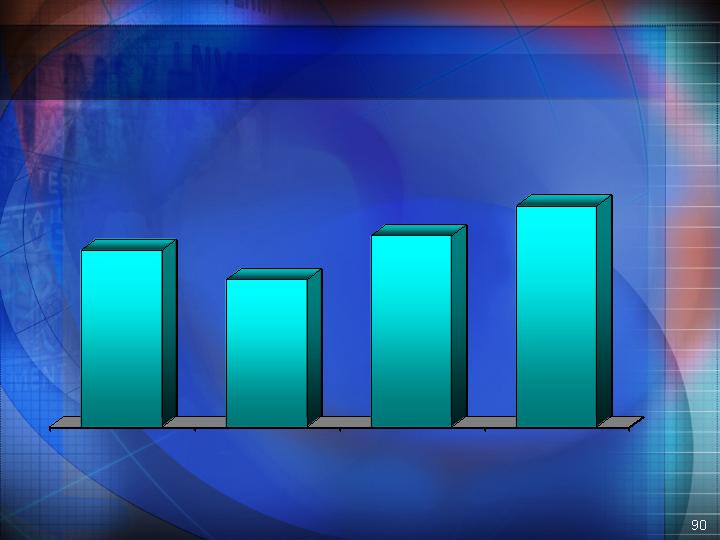

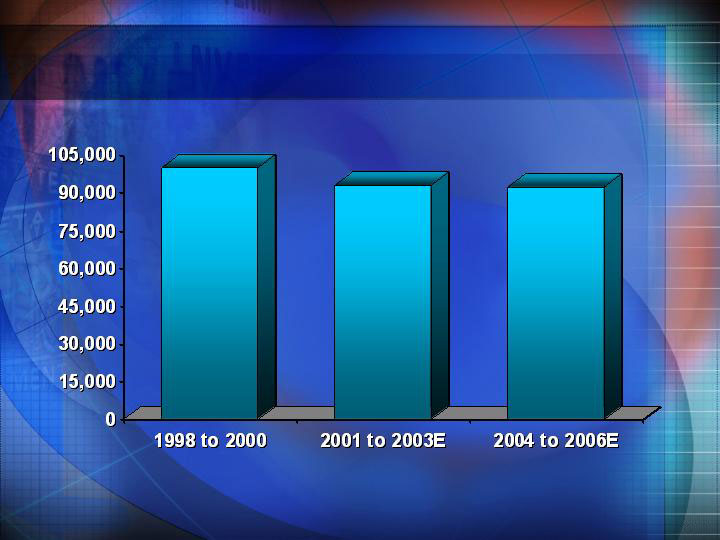

Gross Room Additions1

100,000

93,000

90,000 to

95,000

1Includes worldwide room additions for all lodging brands; does not include MVCI,

Ramada International or hotel deletions.

157

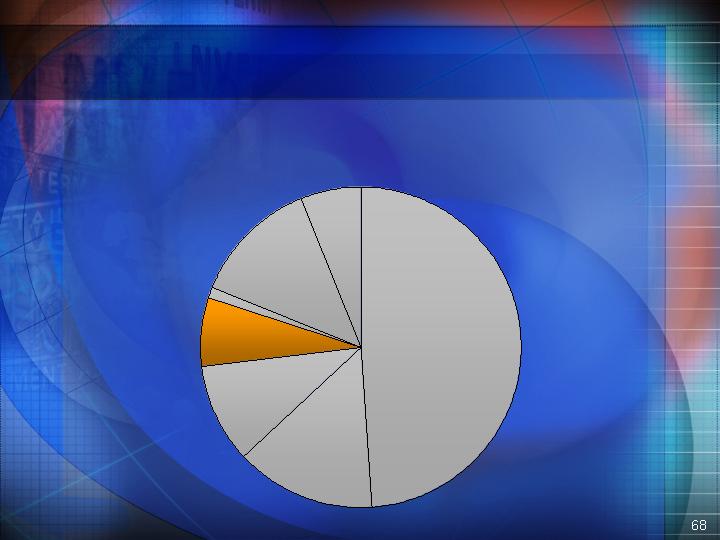

Gross Room Additions1

International

New Builds

15%

International

Conversions

5%

North

American

Conversions

21%

North

American

New Builds

59%

International

New Builds

17%

International

Conversions

10%

North

American

Conversions

20%

North

American

New Builds

53%

2001 to 2003E

2004 to 2006E

93,000

rooms opening

90,000 to 95,000

rooms opening

1Does not include Ramada International or MVCI

158

Increased Room Additions Outside The U.S.1

2001 to 2003E

2004 to 2006E

International

Full Service

New Builds

15%

International

Conversions

5%

North American

Full Service

Conversions

11%

North American

Full Service New Builds

20%

North

American

Limited Service

New Builds

39%

North American

Limited Service

Conversions

10%

International

Full Service

New Builds

17%

International

Conversions

10%

North American

Full Service

Conversions

16%

North American

Full Service New Builds

14%

North

American

Limited Service

New Builds

39%

North American

Limited Service

Conversions

4%

1Does not include Ramada International or MVCI

93,000 rooms opening

90,000 to 95,000

rooms opening

159

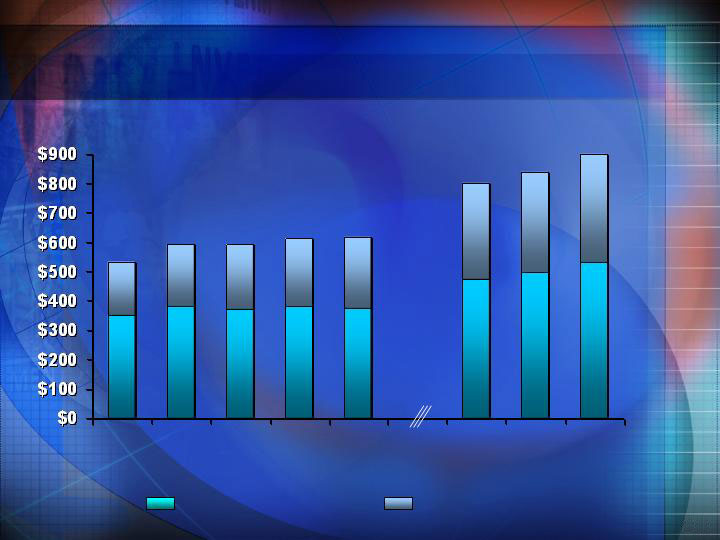

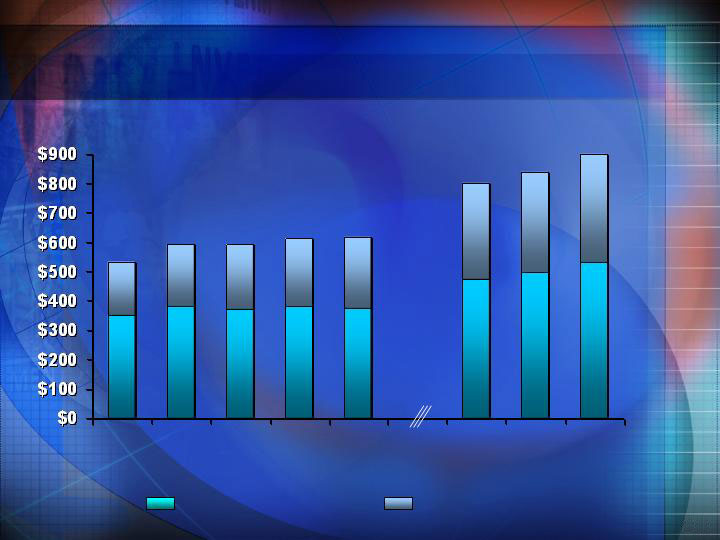

Base and Franchise Fee Recovery Scenarios

Base Management Fees

Franchise Fees

($ in Millions)

1999

2000

2001

2002

2003E

$532

$591

$592

$611

$617

$800

$840

$900

2006E

3% Annual

REVPAR

Growth

2006E

5% Annual

REVPAR

Growth

2006E

8% Annual

REVPAR

Growth

160

Incentive Management Fee Recovery Sensitivity

(based on 2003 year to date)

NHP More Than

30% Below

Owners Priority

Hotels Earning Incentive

Management Fees in 2003

845 Managed

Hotels

22%

13%

3%

8%

4%

50%

Net House Profit (NHP)

Less Than 5% Below

Owners Priority

NHP 5% to 10% Below

Owners Priority

NHP 10% to 20% Below

Owners Priority

NHP 20% to 30% Below

Owners Priority

161

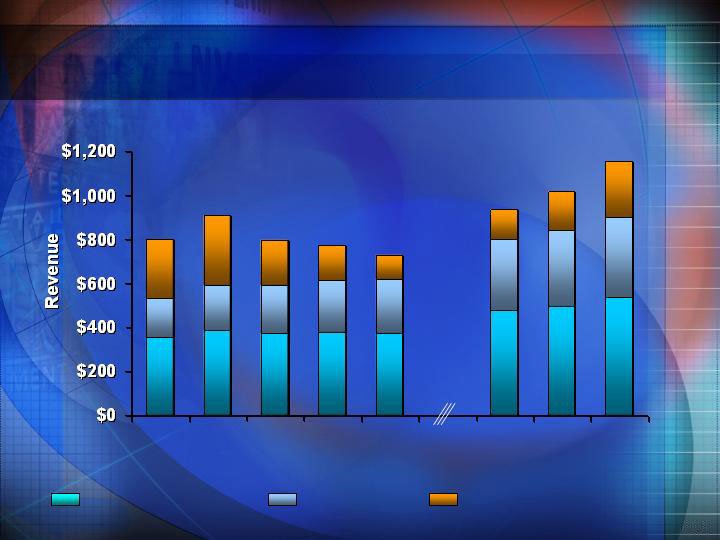

Lodging Fee Revenue Recovery Scenarios

Base Management Fees

Franchise Fees

Incentive Management Fees

($ in Millions)

1999

2000

2001

2002

2003E

$725 to

$735

$800

$907

$794

$773

$935

$1,015

$1,150

2006E

3% Annual

REVPAR

Growth

2006E

5% Annual

REVPAR

Growth

2006E

8% Annual

REVPAR

Growth

162

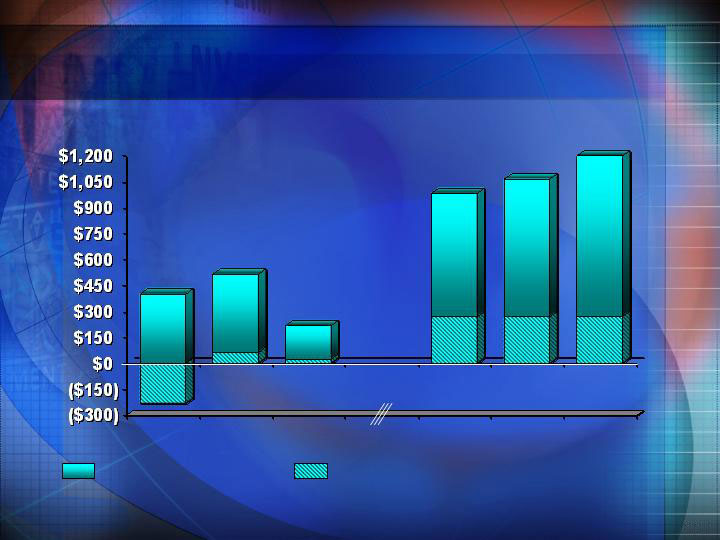

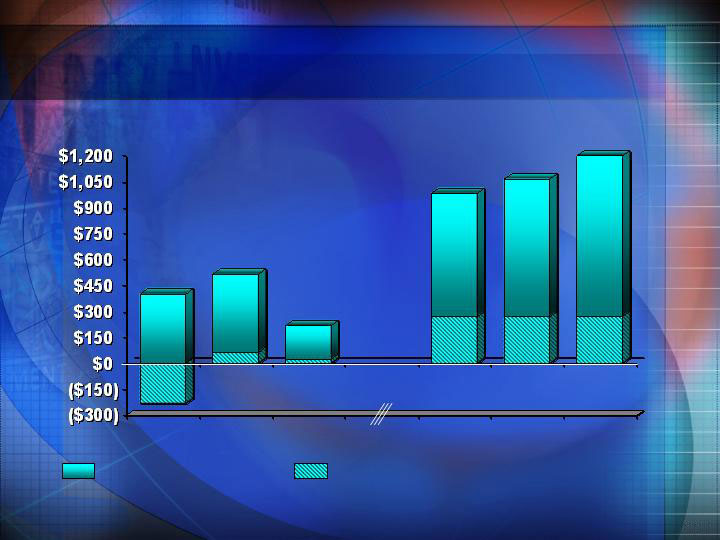

Core Lodging Results REVPAR Sensitivities

(Full Service, Select Service and Extended Stay segments)

($ in Millions)

Note: 2001 – 2002 adjusted for normalized operations

2000

2001

2002

2003E

2006E

3% Annual

REVPAR

Growth

2006E

5% Annual

REVPAR

Growth

2006E

8% Annual

REVPAR

Growth

$798

$607

$574

$545

$765

$845

$980

163

164

Carolyn B. Handlon

Executive Vice President

and Global Treasurer

Marriott International, Inc.

Discussion Topics

Marriott’s financial strengths

How we invest our capital

Improving return on invested capital

Meaningful earnings per share growth

166

REVPAR

premium

Strong returns

to owners &

franchisees

Capital

recycling

Financial

flexibility

Increased

distribution/

market share

Brand

equity

Strong

Cash flow

Growing

Earnings

Higher

Return on

Invested

Capital

Our Business Model

167

Financial Strength and Stability

Broad geographic distribution

Brand diversification

Length of contracts

Strong balance sheet and cash flow

Management/franchise business model

168

Solid Investment Grade

Income from continuing

operations

EBITDA1

Debt at 9/12/03

2003 Latest

4 Quarters

($ in Millions)

1Includes pre-tax operating losses of $127 million from our synthetic fuel operations, before syn-fuel

depreciation expense of $10 million. The operating losses are more than offset by the tax credits

generated by this business, which reduce our income tax expense

$422

$648

$1,678

169

Investment Philosophy

Focus on management and franchise contracts

Invest where expected returns exceed cost of capital

Minimal real estate ownership

Selective real estate development or temporary

ownership to enhance management agreement

Recycle capital

170

Investment Process

Set aggregate commitment levels through

budget and long range planning process

Evaluate investments using rigorous criteria;

net present value, earnings per share and

return on invested capital

Remain investment grade credit

Monitor and analyze post audit results

171

Marriott International Capital Recycling

Typical Holding Time

Timeshare resort units

3 years

Timeshare consumer notes

6 months or less

Lodging senior and

mezzanine debt

5 years

Lodging new build

Lodging acquisitions

12 to 18 months for Limited Service;

2 to 3 years Full Service

3 to 12 months

Lodging new build

172

Lodging Notes Receivable and Guarantees1

Lodging notes receivable

Lodging guarantees in effect

Total

$915

503

$1,418

At 9/12/03

$944

549

$1,493

($ in Millions)

1The above numbers do not include $800 million and $200 million of loans and

guarantees primarily related to timeshare mortgage notes and Senior Living

Services at 9/12/03 and 1/03/03, respectively.

At 1/03/03

173

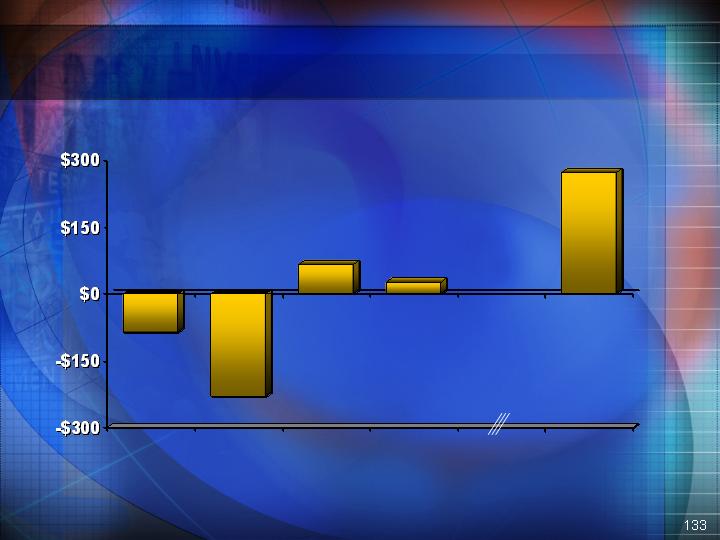

Guarantee and Loan Loss Provisions

Guarantee and loan loss

provisions

$90

2001

2002

$30

2003

$10

3Q YTD

($ in Millions)

174

Lodging Results Provide Attractive Upside1

($ in Millions)

1Adjusted to reflect normalized operations

2000

2001

2002

2003E

2006E

3% Annual

REVPAR

Growth

$936

$690 to

$700

Approx.

$1,050

Approx.

$1,130

Approx.

$1,270

$7561

$7131

2006E

5% Annual

REVPAR

Growth

2006E

8% Annual

REVPAR

Growth

Core lodging

Timeshare

175

Cash From Operations1

2001

$403

$516

$220

2002

2003E

$990

2006E

3% Annual

REVPAR

Growth

2006E

5% Annual

REVPAR

Growth

2006E

8% Annual

REVPAR

Growth

$1,070

$1,200

($ in Millions)

1Timeshare business’s impact on cash flow defined as after tax timeshare profit plus timeshare activity, net, and depreciation and

amortization.

Core lodging and other

Timeshare

176

Estimated Free Cash Flow

Net cash flow from operations1

2004E to 2006E

2004E investment spending

2005E to 2006E

investment spending

2004E to 2006E dispositions,

note sales & collections

Free cash flow

$2,700

($500)

$1,500 to $2,000

$1,000 to $1,500

1Assumes average of 3%, 5% & 8% annual REVPAR growth scenarios and includes

MVCI timeshare development

($1,000 to $2,000)

($ in Millions)

177

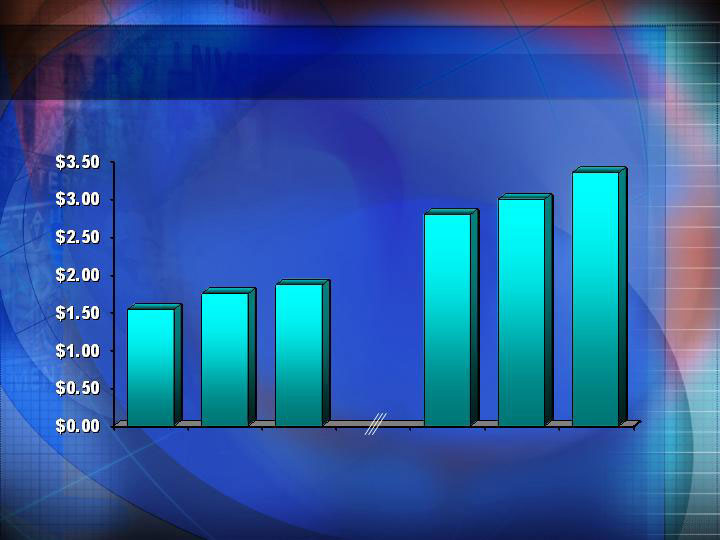

EPS Sensitivity to REVPAR1

($ per share)

1From continuing operations and normalized for 2001 and 2002; assumes contribution from synthetic

fuel of $0.40 in 2003 and $0.38 in 2006

2001

2002

2003E

$2.80

$3.00

$3.35

$1.75

$1.86 to

$1.88

$1.54

2006E

3% Annual

REVPAR

Growth

2006E

5% Annual

REVPAR

Growth

2006E

8% Annual

REVPAR

Growth

178

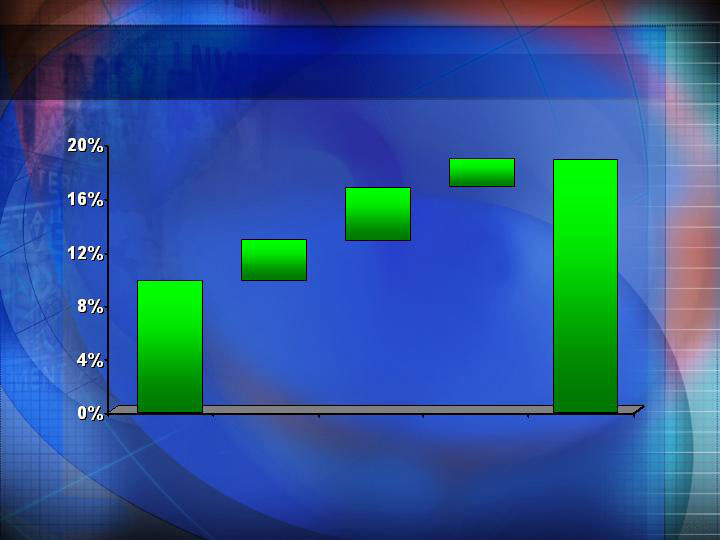

EPS Growth Drivers 2003E to 2006E1

Assuming 3% to 6% REVPAR Growth Annually

Base and

Franchise

Fees

9% to 11%

5%

17% to 22%

Incentive

Management

Fees

Operating

Leverage and

Net Interest Income

Total

EPS

MVCI

2%

1% to 4%

1Does not include earnings from synthetic fuel

179

180

Edwin D. Fuller

President and

Managing Director

Marriott Lodging - International

William J. Shaw

President and

Chief Operating Officer

John W. Marriott III

Executive Vice President

Lodging

James M. Sullivan

Executive Vice President

Lodging Development

Arne M. Sorenson

Executive Vice President,

Chief Financial Officer and President

Continental European Lodging

Leadership Q&A

Moderator: Laura E. Paugh

Senior Vice President

Investor Relations