SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No, __ ) |

|

|

|

|

|

Filed by the Registrant [x]

|

|

Filed by a Party other than the Registrant [ ]

|

|

Check the appropriate box:

|

|

[ ] Preliminary Proxy Statement | [ ] | Confidential, For Use of the |

|

|

| | Commission Only (as permitted

by Rule 14a-6(e)(2) |

|

[x] Definitive Proxy Statement

|

|

[ ] Definitive Additional Materials

|

|

[ ] Soliciting Material Under Rule 14a-12

|

|

|

|

ACCESS WORLDWIDE COMMUNICATIONS, INC. |

|

(Name of Registrant as specified in its charter)

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

|

|

|

Payment of Filing Fee (Check the appropriate box): |

|

[x] No fee required. |

|

|

|

[ ] | Fee computed on table below per Exchange Act Rules 14a- 6(i)(1) and 0-11 |

|

|

|

(1) | Title of each class of securities to which transaction applies:

________________________________________________________________________________ |

|

|

|

(2) | Aggregate number of securities to which transaction applies:

________________________________________________________________________________ |

|

|

|

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11

(set forth the amount on which the filing fee is calculated and state how it was determined):

________________________________________________________________________________ |

|

|

|

(4) | Proposed maximum aggregate value of transaction:

________________________________________________________________________________ |

|

|

|

(5) | Total fee paid:

________________________________________________________________________________ |

|

| | |

[ ] | Fee paid previously with preliminary materials:

________________________________________________________________________________ |

|

|

|

|

[ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

|

|

|

|

(1) | Amount previously paid:

________________________________________________________________________________ |

|

|

|

|

(2) | Form, Schedule or Registration Statement No.:

________________________________________________________________________________ |

|

|

|

|

(3) | Filing Party:

________________________________________________________________________________ |

|

|

|

|

(4) | Date Filed:

________________________________________________________________________________ |

|

Access Worldwide Communications, Inc.

Notice of Annual Meeting of Stockholders

to be held on July 8, 2003

--------------------

To the Stockholders of

ACCESS WORLDWIDE COMMUNICATIONS, INC.:

The Annual Meeting of the Stockholders of ACCESS WORLDWIDE COMMUNICATIONS, INC. (the "Company") will be held at the executive offices of the Company at 4950 Communication Avenue, Suite 300, Boca Raton, Florida 33431, at 11:00 a.m., local time, on Tuesday, July 8, 2003, to consider and act upon the following matters:

| 1. | To elect six directors, each to serve a one year term; and |

| | |

| 2. | To transact such other business as may properly come before the meeting or any adjournment or adjournments thereof. |

The close of business on May 12, 2003, has been fixed by the Board of Directors as the record date for the determination of stockholders entitled to notice of, and to vote at, the annual meeting.

| By Order of the Board of Directors, |

|

|

|

|

| Richard Lyew |

| Secretary |

Whether or not you expect to attend the meeting, the Board of Directors urges you to promptly mark, sign and date the enclosed Proxy Card and mail it in the enclosed return envelope, which requires no postage if mailed in the United States, so that your vote can be recorded at the meeting if you do not attend personally.

Access Worldwide Communications, Inc.

----------------------

Proxy Statement

----------------------

This Proxy Statement is provided in connection with the solicitation of proxies on behalf of the Board of Directors (the "Board") of Access Worldwide Communications, Inc. (the "Company") for use at the 2003 Annual Meeting of Stockholders (the "Meeting") to be held on July 8, 2003, at 11:00 a.m., local time, at the Company's executive offices, and at any adjournment or adjournments thereof, for the purposes set forth in such notice. The Company's executive offices are located at 4950 Communication Avenue, Suite 300, Boca Raton, Florida 33431.

Holders of record of issued and outstanding shares of common stock, $.01 par value per share ("Common Stock"), of the Company, as of May 12, 2003 (the "Record Date"), will be entitled to notice of, and to vote at, the Meeting as described below. On the Record Date, there were issued and outstanding 9,740,001 shares of Common Stock. The Company has no other class or series of stock outstanding and entitled to vote at the Meeting. Each share of Common Stock is entitled to one vote with respect to each matter to be voted on at the Meeting.

The presence, in person or by proxy, of the holders of a majority of the outstanding shares of Common Stock entitled to vote at the Meeting is necessary to constitute a quorum at the Meeting or any adjournments thereof. Except as set forth below, abstentions and broker non-votes will be counted as present for the purpose of determining the presence of a quorum.

Common Stock represented by a properly executed proxy, if such proxy is received in time and not revoked, will be voted at the Meeting in accordance with the instructions indicated in such proxy. If no instructions are indicated, shares represented by proxy will be voted (i) "for" the election, as directors of the Company, of the six nominees named in the proxy to serve until the 2004 annual meeting of stockholders and (ii) in the discretion of the proxy holders as to any other matter which may properly be presented at the Annual Meeting.

Directors of the Company are elected by plurality vote. A "broker non-vote" refers to shares of Common Stock represented at the Meeting in person or by proxy by a broker or other nominee where such broker or other nominee (i) has not received voting instructions on a particular matter from the beneficial owners or persons entitled to vote and (ii) the broker or nominee does not have discretionary voting power on such matter. In the case of a broker non-vote or where a stockholder withholds authority from his/her proxy to vote, such shares will not be treated as "present" and "entitled to vote" on the matter and, thus, a broker non-vote or the withholding of a proxy's authority will have no effect on the outcome of the vote on the matter.

Any proxy may be revoked at any time before it is exercised by written notice to the Secretary of the Company. The casting of a ballot at the Meeting by a stockholder who may have previously given a proxy will not have the effect of revoking that proxy unless the stockholder so notifies the Secretary of the Company in writing before voting the shares represented by the proxy.

1

Proposal One

Election of Directors

The Board has nominated six directors for election at the Meeting. Each director elected will serve until the next annual meeting of stockholders when his or her successor has been elected and qualified or until the director's earlier resignation or removal. It is the intention of the persons named in the accompanying proxy to vote the shares represented thereby in favor of the election of each of the nominees named below unless otherwise instructed on such proxy. In case any of the nominees are unable or decline to serve, the persons named in the accompanying proxy reserve the right to vote the shares represented by such proxy for another person duly nominated by the Board of Directors in his stead or, if no other person is so nominated, to vote such shares for the remaining nominees. The Board of Directors has no reason to believe that any person named below will be unable or will decline to serve. The Board of Directors recommends a vote "FOR" the election of each of the nominees of the Board.

Information concerning the nominees for election as directors is set forth below.

Liam S. Donohue, 35, has been a director of the Company since December 1996. Since 1998, Mr. Donohue has been a partner of DHM Arcadia Partners, a private equity fund investing in the for-profit education and training industry. From 1995 through 1998, Mr. Donohue was a principal of Foster Management Company, a private equity investment firm. In 1994, he was an Associate in the Salomon Brothers Corporate Finance Group in London. From 1989 to 1993, he was an Associate with Booz, Allen and Hamilton, Inc.'s International Environmental Management Practice and started Booz, Allen's office in Budapest, Hungary.

Lee H. Edelstein, 55, has been President and Chief Executive Officer of the Company's TMS Professional Markets Group ("TMS Group") since March 2002, and a director of the Company since October 1997. Mr. Edelstein has been the President of LHE Consulting, Inc., a business consulting firm, since December 1998. From January 1997 until December 1998, Mr. Edelstein was President of TMS Group. In 1992, he founded TeleManagement Services, Inc. ("TMS"), a pharmaceutical and healthcare direct marketing and teleservices company acquired by the Company in January 1997. Prior to founding TMS, Mr. Edelstein worked for Goldline Laboratories, a division of IVAX Corp., a pharmaceutical company, for eleven years in various management positions including Operations Manager, Director of Marketing and Vice President of Marketing and Business Development.

Shawkat Raslan, 51, has been Chairman of the Board, President and Chief Executive Officer of the Company since March 2002, and a director of the Company since May 1997. Since June 1983, Mr. Raslan has served as President and Chief Executive Officer of International Resources Holdings, Inc., an asset management and investment advisory service for international clients. Prior thereto, he served as Vice President of Trans Arabian Investment Bank in Bahrain from 1980 to 1983. From 1976 to 1980, Mr. Raslan was a liaison officer and engineer for Turner International, a construction management company. Mr. Raslan currently serves as a director of the Tiedemann Investment Group and Integra, Inc., a managed behavioral healthcare services company ("Integra") where he also sits on the Audit Committee. Mr. Raslan is the managing partner of Prima Partners LP and Links Venture Partners LP.

2

Orhan Sadik-Khan, 73, has been a director of the Company since July 2002. Mr. Sadik-Khan is currently President of ADI Corporation, a management consulting firm and a director of Firecom, Inc., a fire-control business in New York. From 1986 to 2000, Mr. Sadik-Khan was a Managing Director of UBS PaineWebber, Inc., a wealth management company, and after his retirement he rejoined ADI Corporation which he had founded 25 years earlier. For 13 years, Mr. Sadik-Khan worked at Norton Simon, Inc., a multinational consumer products and services company, as Senior Vice President and Head of Corporate Development. Mr. Sadik-Khan was also a founding shareholder of Nextel Communications, Inc., a nationwide provider of mobile telecommunications services.

Carl Tiedemann, 76, has been a director of the Company since December 2002. Mr. Tiedemann has been the Chairman of the Tiedemann Investment Group, a private investment fund, since November 1980. Prior to founding Tiedemann Investment Group, Mr. Tiedemann had been with Donaldson, Lufkin & Jenrette, an investment bank and financial services provider, for eighteen years, serving as President (1975-1980) and Chairman of DLJ Securities (1966-1974), and remained as a Director of Donaldson, Lufkin & Jenrette until 1985. Mr. Tiedemann served on the Board of Governors of the American Stock Exchange and on many committees of the Securities Industry Association.

Charles Henri Weil, 64, has been a director of the Company since August 2001. Mr. Weil has served as Chairman and Chief Executive Officer of Intergestion, an investment banking company based in France since 1989. From 1990 to 2000, Mr. Weil was also a self-employed financial consultant based in Paris, France. In addition to serving as a director of Access Worldwide, Mr. Weil is a member of the Board of Directors of Integra. He also serves as a director for Dawnay Day & Co. Ltd., an investment and advisory services company based in Great Britain, and Europeenne de Distribution Luxembourg and Europeenne des metaux Luxembourg, both industrial conglomerates located in Luxembourg.

Board of Directors

The business and affairs of the Company are managed under the direction of the Board. The Board met seven times during 2002 and acted by written consent on six occasions.

Committees of the Board of Directors

The Board has four standing committees to assist it in discharging its responsibilities: the Compensation Committee, the Audit Committee, the Capital and Finance Committee and the Nominating Committee.

The Compensation Committee reviews and makes recommendations regarding the compensation for executive officers and other key employees of the Company, including salaries and bonuses. No member of the Compensation Committee is an officer of the Company. The members of the Compensation Committee are Orhan Sadik-Khan (Chairman), Carl Tiedemann and Charles Henri Weil. The Compensation Committee has a stock option subcommittee ("Stock Option Subcommittee") which administers the Company's stock option plan ("Option Plan") and determines the persons who are to receive awards, the number of shares subject to each award, and the exercise price. The members of the Stock Option Subcommittee are Messrs. Sadik-Khan and Weil. The Compensation Committee and the Stock Option Subcommittee each met once in 2002 and acted by written consent on four occasions and on three occasions, respectively.

3

The members of the Audit Committee are Messrs. Sadik-Khan (Chairman) and Tiedemann. The Board is currently actively searching for a third independent member to join this committee. The Audit Committee acts as a liaison between the Board and the independent accountants and is responsible for annually appointing and if it deems necessary, terminating the Company's independent accountants. The Audit Committee reviews with the independent accountants the scope of their examination of the Company's financial statements, the adequacy of internal accounting controls and otherwise performs the duties described in the Audit Committee charter. A copy of the Audit Committee Charter, as amended by the Board of Directors on April 1, 2003, is attached to this Proxy Statement as Annex A. That amendment added provisions for compliance with the new rules relating to audit committees under the Sarbanes-Oxley Act of 2002. The Audit Committee met six times in 2002 and acted by written consent on one occasion.

The members of the Capital and Finance Committee are Messrs. Weil (Chairman), Sadik-Khan, and Tiedemann. The Capital and Finance Committee reviews the financial condition of the Company so as to counsel the Board on the total financial resources, strength and capabilities of the Company and is authorized to explore and recommend various forms of financing and capital facilities. The Capital and Finance Committee is authorized to approve acquisitions of businesses having an aggregate purchase price of less than $1,000,000. The Capital and Finance Committee met twice in 2002.

The members of the Nominating Committee are Messrs. Tiedemann (Chairman), Sadik-Khan, and Weil. The Nominating Committee is authorized to review, approve and recommend to the Board persons for election as directors. In addition, the Nominating Committee will consider written nominations by stockholders, which are submitted to the Chairman of the Nominating Committee and addressed in care of the Secretary, Access Worldwide Communications, Inc., 4950 Communication Avenue, Suite 300, Boca Raton, Florida 33431. The Nominating Committee did not meet during 2002, instead any decisions relating to reviewing, approving and recommending persons for election as directors were made by the Board during 2002.

All of the then incumbent directors attended at least 75% of the Board of Directors meetings and meetings of the committees and sub-committees on which they serve.

COMPENSATION OF DIRECTORS

Non-employee directors of the Company receive an annual retainer of $15,000. In addition, non-employee directors of the Company receive fees of $1,000 for each meeting attended in person, $500 for each committee meeting attended on a day other than the day of a full Board of Directors meeting and $500 for each Board of Directors, committee or sub-committee meeting attended via teleconference. New non-employee directors of the Company receive options to purchase 10,000 shares of Common Stock granted under the Company's 1997 Stock Option Plan on the day they are elected or appointed to the Board, while existing non-employee directors receive options to purchase 5,000 shares of Common Stock granted under the Company's 1997 Stock Option Plan on each annual meeting date. These stock options vest evenly over three years. Directors who are officers of the Company do not receive any additional compensation for serving on the Board. Directors are reimbursed for out-of-pocket expenses related to their duties.

4

EXECUTIVE OFFICERS

The Company's executive officers and their ages are as follows:

Name | Age | Position |

| |

Shawkat Raslan | 51 | Chairman of the Board, President and Chief Executive Officer |

| |

Lee Edelstein | 55 | Director, President and Chief Executive Officer - TMS Professional Markets Group |

| |

John Hamerski | 52 | Executive Vice President and Chief Financial Officer |

| |

Georges André | 38 | Senior Vice President and President of TelAc Teleservices Group |

| |

Katherine Dietzen | 38 | Senior Vice President and Chief Operating Officer - AM Medica Communications Group |

| |

Richard Lyew | 34 | Senior Vice President and Corporate Controller |

Set forth below is information regarding the business experience of each of the Company's executive officers. Information with respect to Messrs. Edelstein and Raslan appears under "Proposal One - Election of Directors" on page two of this Proxy Statement.

John Hamerski has been Executive Vice President and Chief Financial Officer of Access Worldwide since July 2000. He joined the Company in November 1997 as Senior Vice President, Financial Planning and Analysis. From March 1995 until November 1997, he worked at Cadmus Communications Corporation, a printing and communications company, most recently as Vice President and Chief Financial Officer for Cadmus Interactive.

Georges André has served as Senior Vice President of the Company since June 2001 and as President of the Company's TelAc Teleservices Group ("TelAc") since April 2001. From September 1999 until April 2001, Mr. André served as Senior Vice President of Client Services of TelAc. Mr. André was the Vice President of Operations at Iowave, Inc., a wireless broadband solutions company, from February 1999 through August 1999. Mr. André served as the Senior Vice President of Client Services and Operations for TelAc from July 1998 until January 1999 and as an Account Manager, Senior Account Manager and Vice President, Client Services, respectively, for TelAc, from February 1995 until July 1998, prior to TelAc being acquired by the Company.

5

Katherine Dietzen has been Senior Vice President of Access Worldwide and Chief Operating Officer of the Company's AM Medica Communications Group since November 2002. From October 2001, until her appointment as Chief Operating Officer, Mrs. Dietzen was Senior Vice President of Sales for AM Medica Communications Group. Previously, Mrs. Dietzen spent four years as Executive Vice President for NCM Publishers, Inc., a global producer of medical education programs.

Richard Lyew has been Senior Vice President and Corporate Controller of the Company since July 1999. He served as Assistant Corporate Controller of the Company from May 1998 until July 1999. From November 1996 until May 1998, Mr. Lyew was Acting Manager/Senior Associate at Price Waterhouse LLP (currently known as PricewaterhouseCoopers LLP). From July 1996 to November 1996, Mr. Lyew was Accounting Manager at Chase Manhattan Mortgage Corp., a division of Chase Manhattan Bank. Previously, Mr. Lyew spent five years at Coopers & Lybrand LLP (currently known as PricewaterhouseCoopers LLP), most recently as a Senior Associate. Mr. Lyew is licensed as a certified public accountant in the State of New York.

EXECUTIVE COMPENSATION

The following table sets forth information for the fiscal years ended December 31, 2002, 2001 and 2000, concerning the compensation of the (1) all persons who served as the Company's Chief Executive Officer during 2002, (2) the four other most highly compensated executive officers of the Company whose total annual salary and bonus exceeded $100,000 during the year ended December 31, 2002 and who were executive officers as of December 31, 2002 and (3) individuals who would have been among the four other most highly compensated executive officers for 2002, but they were not serving as executive officers as of December 31, 2002 (collectively, the "Named Executive Officers").

6

SUMMARY COMPENSATION TABLE

| | Annual Compensation | Long Term Compensation Award |

| | | | | | | | | | | | |

Name and Principal Position |

| Year |

| Salary ($) |

| Bonus ($) |

| Other Annual

Compensation

($)(1) |

| Securities

Underlying

Options (#) |

| All Other

Compensation

($) |

|

| |

Shawkat Raslan

Chairman, President and

Chief Executive Office (2) | | 2002

2001

2000 | | $109,404

- --

- -- | | --

- --

- -- | | $14,450(3)

- --

- -- | | 150,000

21,250

5,000 | | $6,673 (4)

- --

- -- |

| |

Michael Dinkins

Chairman, President and

Chief Executive Officer | | 2002

2001

2000 | | $79,500

318,000

309,000 | | $100,000

100,000

100,000 | | $238,500(5)

- --

- -- | | --

71,250

10,000 | | $13,325 (6)

14,183 (7)

1,450 (8) |

| |

John Hamerski

Executive Vice President

and Chief Financial Officer | | 2002

2001

2000 | | $180,000

180,000

147,500 | | $27,500(9)

50,000

20,000 | | --

- --

- -- | | 35,000

57,250

26,500 | | $8,284 (10)

9,107 (11)

505 (12) |

| |

Georges André

Senior Vice President and

President, TelAc

Teleservices Group> | | 2002

2001

2000 | | $170,000

170,000

152,000 | | $44,500

75,000

40,000 | | --

- --

- -- | | 40,000

- --

1,500 | | 9,470 (13)

10,328 (14)

- --

|

| |

Katherine Dietzen

Senior Vice President and

Chief Operating Officer -

AM Medica

Communications Group (15) | | 2002

2001

2000 | | $250,000

67,808

- -- | | $30,000

20,000

- -- | | --

- --

- -- | | 50,000

- --

- -- | | $14,454 (16)

4,818 (16)

- -- |

| |

Barbara Monaghan

Vice President,

AM Medica

Communications Group (17) | | 2002

2001

2000 | | $200,000

200,000

136,300 | | --

- --

- -- | | $207,091(18)

230,137(19)

139,678(19) | | --

3,850

1,500 | | --

- --

- -- |

________________

(1) | Except as set forth in this column, no "Other Annual Compensation" for the Named Executive Officers is reflected because the aggregate values of the perquisites and other personal benefits received by each of the Named Executive Officers for the indicated years were less than the required threshold for disclosure. |

| (2) | Mr. Raslan was appointed Chairman, President, and Chief Executive Officer in March 2002. |

| (3) | Mr. Raslan received $7,250 in Board fees prior to his appointment as an officer in March 2002. Subsequent to this appointment he received an automobile allowance of $7,200. |

7

| (4) | Includes $6,673 for medical insurance. |

(5) | In March 2002, Mr. Dinkins agreed to an amicable termination of his roles as the Chairman of the Board, President and Chief Executive Officer and received $238,500 in severance payments pursuant to his employment contract. |

(6) | Includes $8,898 of medical insurance, $690 of short term disability insurance and $3,737 of long term disability insurance paid by the Company. |

(7) | Includes $8,898 of medical insurance, $180 of life insurance premiums, $1,062 of short term disability insurance and $4,043 of long term disability insurance paid by the Company. |

(8) | Includes $928 of the Company's matching contributions under the 401(k) plan and $522 for life insurance premiums. |

(9) | Due to a typographical error, the 2002 Proxy Statement incorrectly listed the year of Mr. Hamerski's bonuses. This error is corrected in the figures above. |

(10) | Includes $6,242 for medical insurance, $10 for life insurance premiums, $453 of short term disability insurance and $1,579 of long term disability insurance paid by the Company. |

(11) | Includes $6,242 for medical insurance, $171 for life insurance premiums, $825 of short term disability insurance and $1,869 of long term disability insurance paid by the Company. |

(12) | Amount reflects payments for life insurance premiums. |

(13) | Includes $8,898 for medical insurance and $572 for short term disability insurance paid by the Company. |

(14) | Includes $8,898 for medical insurance, $180 for life insurance premiums, $944 for short term disability insurance and $306 for long term disability insurance paid by the Company. |

(15) | Mrs. Dietzen was appointed Chief Operating Officer of AM Medica Communications Group in November 2002. From October 2001, until her appointment as Chief Operating Officer, Mrs. Dietzen was Senior Vice President of Sales for AM Medica Communications Group. |

(16) | Amount reflects medical insurance paid by the Company. |

(17) | Ms. Monaghan was appointed Chief Operating Officer of AM Medica Communications Group in November 2000. In the fall of 2002, Ms. Monaghan voluntarily relinquished her position as Senior Vice President of the Company and ceased being an executive officer in November 2002. |

(18) | Includes $190,000 for commissions earned by Ms. Monaghan. |

(19) | Amount reflects commissions earned by Ms. Monaghan |

8

OPTION GRANTS IN 2002

The following table sets forth the grants of stock options to the Named Executive Officers during the year ended December 31, 2002. The amounts shown as potential realizable values are based on arbitrarily assumed annualized rates of stock price appreciation of five percent and ten percent over the exercise price of the options during the full terms of the options. Actual gains, if any, on option exercises and holdings of Common Stock are dependent on the future performance of the Common Stock and overall stock market conditions.

|

Individual Grants

| Potential Realizable Value At Assumed Annual Rates of Stock Price Appreciation For

Option Term |

Name and Principal Position | Number of

Securities

Underlying

Options

Granted (#) | % of Total

Options

Granted to

Employees

in 2002 | Exercise

or Base

Price

($/Sh) | Expiration

Date | 5% | 10% |

Shawkat Raslan

Chairman, President and

Chief Executive Officer |

150,000

|

23.3%

|

$0.500

|

4/1/12

|

$47,167

|

$119,531

|

Michael Dinkins

Chairman, President and

Chief Executive Officer |

0

|

0.0%

|

--

|

--

|

--

|

--

|

John Hamerski

Executive Vice President and

Chief Financial Officer |

10,000

|

1.6%

|

$0.460

|

3/1/12

|

2,893

|

7,331

|

John Hamerski

Executive Vice President and

Chief Financial Officer |

25,000

|

3.9%

|

$0.530

|

8/12/12

|

8,333

|

21,117

|

Georges André

Senior Vice President and

President, TelAc

Teleservices Group |

40,000

|

6.2%

|

$0.460

|

3/1/12

|

11,572

|

29,325

|

Katherine Dietzen

Senior Vice President and

Chief Operating Officer,

AM Medica

Communications Group |

50,000

|

7.8%

|

$0.335

|

11/7/12

|

10,534

|

26,695

|

Barbara Monaghan

Vice President,

AM Medica

Communications Group |

0

|

0.0%

|

--

|

--

|

--

|

--

|

9

YEAR-END 2002 OPTION VALUES

The following table sets forth information regarding the number and year-end value of unexercised options to purchase Common Stock held at December 31, 2002 by each of the Named Executive Officers.

|

| Number of Securities Underlying

Unexercised Options at Fiscal Year-End

(#) |

| Value of Unexercised In-the-

Money Options at Fiscal Year-

End ($) |

Name and Principal Position

|

| Exercisable/

Unexercisable |

| Exercisable/

Unexercisable |

| |

Shawkat Raslan

Chairman, President and

Chief Executive Officer |

|

12,083/

164,167

|

|

--

|

| |

Michael Dinkins

Chairman, President and

Chief Executive Officer |

|

--/--

|

|

--

|

| |

John Hamerski

Executive Vice President and Chief

Financial Officer |

|

24,218/

96,532

|

|

--

|

| |

Georges André

Senior Vice President and

President, TelAc

Teleservices Group |

|

1,801/

41,699

|

|

--

|

| |

Katherine Dietzen

Senior Vice President and

Chief Operating Officer,

AM Medica

Communications Group |

|

--/50,000

|

|

--

|

| |

Barbara Monaghan

Vice President,

AM Medica

Communications Group |

|

1,284/

2,566

|

|

--

|

______________________ | | | | |

EMPLOYMENT ARRANGEMENTS

The Company entered into employment arrangements with the Named Executive Officers as described below. All of the employment arrangements provide for, among other things, (i) non-compete and non-disclosure agreements; (ii) the continuation of compensation payments to a disabled executive officer until such officer has been unable to perform the services required of him for the time set forth therein; and (iii) health insurance and other benefits.

10

The Company entered into a two-year employment agreement with Shawkat Raslan, effective March 30, 2002, pursuant to which Mr. Raslan serves as President and Chief Executive Officer of the Company (and each of the Company's wholly owned subsidiaries). Mr. Raslan's initial base salary is $150,000 per year, and he is entitled to receive merit increases in base salary as reasonably determined by the Compensation Committee of the Board of Directors of the Company, in its discretion. Mr. Raslan is eligible to receive an annual bonus of up to 50% of his base salary based on achievement of quantitative and qualitative goals as established by the Compensation Committee of the Board of Directors of the Company. Mr. Raslan is also entitled to an automobile allowance of $800 per month. In addition, pursuant and under the Company's 1997 Stock Option Plan, as amended from time to time, Mr. Raslan was granted 150,000 stock options per each year of the two-year term of the employment agreement, with the first 150,000 options earned and granted upon his appointment as Chief Executive Officer, and the second 150,000 options earned and granted on the first business day after January 1, 2003. Under the employment agreement, Mr. Raslan's employment may be terminated by the Company or Mr. Raslan for any reason after thirty days written notice. After such termination, the Company shall pay Mr. Raslan's annual salary and all benefits accrued to such date of termination. In the event that Mr. Raslan's employment is terminated by the Company, all stock options granted to him pursuant to the Company's 1997 Stock Option Plan, or any successor thereto, shall become fully vested.

The Company entered into a two-year employment agreement with Lee Edelstein effective March 4, 2002, and amended as of January 1, 2003, pursuant to which Mr. Edelstein serves as President and Chief Executive Officer of the Company's TMS Professional Markets Group. Pursuant to this amendment, Mr. Edelstein's employment term was extended until December 31, 2004 and Mr. Edelstein receives an additional expense allowance of $24,000 per year. Under the employment agreement, Mr. Edelstein is required to spend, together with his obligations under the consulting agreement with the Company described under "Certain Relationships and Related Party Transactions," below, a total of four days per month working for the Company. The agreement provides for an annual base salary of $100,000 and for Mr. Edelstein to be eligible for a bonus at the discretion of the Board of Directors of the Company. Mr. Edelstein is also entitled to an automobile allowance of $800 per month. Under the agreement, Mr. Edelstein's employment may be terminated by the Company at any time upon thirty (30) days' written notice upon which termination Mr. Edelstein would be entitled to receive all salary and other benefits accrued to the date of termination and any unpaid expense reimbursements. In the event Mr. Edelstein's employment is terminated by the Company, all options granted to him by the Company would become fully vested. Mr. Edelstein also has other arrangements with the Company as described below under "Certain Relationships and Related Party Transactions."

The Company entered into a three-year employment agreement, effective as of December 5, 2000, with John Hamerski, Executive Vice President and Chief Financial Officer, which provides for, among other things, Mr. Hamerski to receive an initial annual base salary of $180,000, plus an annual incentive bonus of up to 40% of his then current annual base salary based upon the achievement of quantitative and qualitative goals established by the Chief Executive Officer of the Company. In addition, Mr. Hamerski is eligible to receive merit increases in his annual base salary as determined by the Chief Executive Officer. Mr. Hamerski's current annual base salary is $180,000. If Mr. Hamerski's employment is terminated within two years after a change of control (as defined therein), with specified exceptions, he is entitled to receive (i) an amount equal to his then current annual base salary, and (ii) a bonus of 40% of his then current annual base salary, prorated to the date of termination; provided, that the target goals established by the Chief Executive Officer have been met or are reasonably on track to be met. If Mr. Hamerski's employment is terminated without cause and he is not otherwise entitled to the termination payment described above, he is entitled to receive continuing payments of his then current annual base salary for a period of one year.

11

The Company has an arrangement with Georges André, Senior Vice President and President of the Company's TelAc Teleservices Group ("TelAc"), whereby he receives an annual salary of $170,000 and a bonus of up to 30% of his base salary based on the performance of TelAc.

The Company entered into a three-year employment agreement with Katherine Dietzen effective as of November 7, 2002, pursuant to which Mrs. Dietzen serves as Chief Operating Officer of the Company's AM Medica Communications Group. Mrs. Dietzen's initial base salary is $250,000 per year, and she is entitled to receive merit based increases in base salary during the term of the agreement in amounts determined by the Chief Executive Officer, subject to the approval of the Board of Directors of the Company. Mrs. Dietzen is also eligible to receive a bonus of up to 30% of her base salary based on achievement of quantitative and qualitative goals established by the Chief Executive Officer and subject to the approval of the Board of Directors of the Company. In addition, Mrs. Dietzen was granted 50,000 stock options under and pursuant to the Company's 1997 Stock Option Plan, as amended from time to time. Under the agreement, Mrs. Dietzen's employment may be terminated by the Company at any time for any reason the Company deems appropriate. If such termination is not due to death, disability, or "due cause" (as defined in the employment agreement), Mrs. Dietzen will be entitled to receive her annual salary until the earlier of (a) the expiration of the employment agreement or (b) six months following the date of such termination.

The Company has entered into a five-year employment agreement effective as of April 12, 1999, with Barbara Monaghan, to be the Vice President and Client Services Director of AM Medica Communications Group, at an initial annual base salary of $200,000, subject to annual review, plus commission payments based on gross sales in an amount ranging from 2% to 5% of gross sales. In addition, under this agreement, Ms. Monaghan was granted an option to purchase 1,000 shares of Common Stock, which vests equally over five years, as well as additional options to purchase 4,000 shares of Common Stock annually thereafter. Under the agreement, if Ms. Monaghan's employment is terminated by the Company during the five-year term for any reason other than cause, Ms. Monaghan will be entitled to receive an amount equal to three months of her then current annual base salary plus an amount equal to two months of her then current annual base salary for each year of service with the Company, the total payments of which are not to exceed twelve months of her then current annual base salary. From November 2000 through November 2002, Ms. Monaghan assumed the duties of Chief Operating Officer of the AM Medica Communications Group. Upon relinquishing her position of Chief Operating Officer, she reassumed her duties as Client Services Director.

In March 2002, Michael Dinkins resigned from his position as Chairman of the Board. The Company and Mr. Dinkins agreed to an amicable termination of his role as President and Chief Executive Officer, effective March 29, 2002. In connection with Mr. Dinkins' resignation from the Company, Mr. Dinkins agreed to receive his severance pay in an amount equal to 1.8 times his annual base salary for a period of 22 months (Mr. Dinkins' salary at the time of his resignation was $318,000) in addition to receiving various benefits for a period of 18 months following his termination; however, he voluntarily terminated certain benefits, including healthcare coverage, on October 1, 2002.

12

COMPENSATION COMMITTEE INTERLOCKS

AND INSIDER PARTICIPATION

Messrs. Sadik-Khan, Tiedemann and Weil served as members of the Compensation Committee throughout 2002. No member of the compensation committee was an officer or employee of the Company during 2002 or was formerly an officer of the Company. During the year ended December 31, 2002, none of the Company's executive officers served on the compensation committee of any other entity, any of whose directors or executive officers served either on the Company's Board of Directors or on the Company's Compensation Committee.

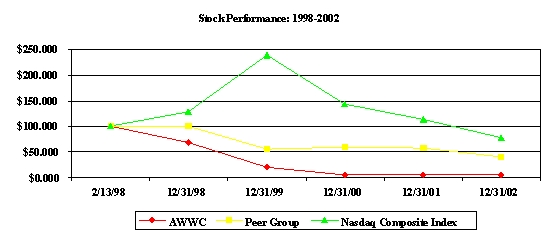

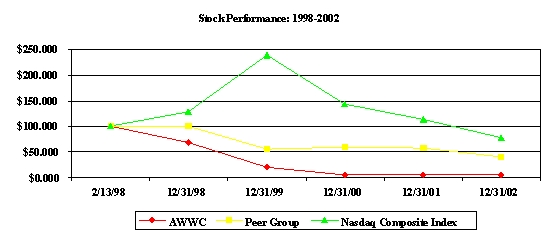

PERFORMANCE GRAPH

The Company's Common Stock began trading on the Nasdaq National Market System on February 13, 1998 when its initial public offering commenced. Since July 17, 2001, the Company's Common Stock has traded on the Over the Counter Bulletin Board. The following performance graph shows the total return to stockholders of an investment in the Company's Common Stock as compared to an investment in (i) the Nasdaq Composite Index and (ii) a peer group made up of Boron, LePore & Associates, Inc., Catalina Marketing Corporation, Parexel International Corporation, and Quintiles Transnational Corp (the "Peer Group") for the period commencing February 13, 1998 and ending December 31, 2002. The data assumes that $100 was invested on February 13, 1998 in each of the Company's Common Stock, the Nasdaq Composite Index and companies in the Peer Group Index (on a weighted market value basis) and that all dividends were reinvested. The Company has never paid any dividends.

COMPARISON OF CUMULATIVE TOTAL RETURN AMONG

THE NASDAQ COMPOSITE INDEX,

THE PEER GROUP INDEX,

AND ACCESS WORLDWIDE COMMUNICATIONS, INC

|

| 2/13/1998 |

| 12/31/1998 |

| 12/31/1999 |

| 12/31/2000 |

| 12/31/2001 |

| 12/31/2002 |

AWWC |

| $100.00 |

| $69.79 |

| $19.79 |

| $5.21 |

| $5.00 |

| $5.25 |

Peer Group |

| $100.00 |

| $100.42 |

| $55.95 |

| $60.09 |

| $58.45 |

| $41.05 |

Nasdaq Composite Index |

| $100.00 |

| $128.20 |

| $237.91 |

| $144.44 |

| $114.03 |

| $78.08 |

13

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Compensation Committee (the "Committee") and the Stock Option Subcommittee, composed of three and two outside directors, respectively, are responsible for administering the Company's executive compensation program.

The Company's executive compensation program is intended to attract, motivate and retain key executives who are capable of leading the Company effectively and fostering its long-term growth. The compensation program for executives is comprised of base salary, annual incentives and long-term incentive awards. The Committee's compensation philosophy is based upon the belief that success of the Company results from the coordinated efforts of all Company employees working as a team to achieve objectives of providing superior services to the Company's clients and maximizing the Company's value for the benefit of its stockholders.

The Committee reviews significant qualitative components in evaluating the individual performance of each executive officer. These components include such executive officer's leadership, team building and motivation skills, adaptability to rapid change, and ability to assimilate new technical knowledge to meet the demands of the Company's clients. In this qualitative evaluation, the Committee exercises its collective judgment as to the executive officer's contributions to the growth and success of the Company during the prior year and the expected contributions of such executive officer in the future.

BASE SALARY. Base salary is determined by level of responsibility and individual performance as well as by the need to provide a competitive package that allows the Company to attract and retain key executives. After reviewing individual and Company performance, the Chief Executive Officer makes recommendations to the Committee concerning each executive officer's base salary. The Committee reviews and, with any changes it deems appropriate, approves these recommendations. Only a limited number of executive officers received increases in base salary for 2002.

14

EXECUTIVE BONUSES. Executive bonus payments are used to properly compensate for performance. Bonuses provide the opportunity for executive officers to earn as additional compensation, a percentage of the executive officer's annual base salary by achieving the Company's strategic and financial performance goals. The bonuses are based on the achievement of quantitative and qualitative goals which are established by the Chief Executive Officer and reviewed and approved by the Committee.

The key components in determining the amount of such bonuses include the financial performance of the Company and the progress of the Company in achieving its long-term strategic objectives. The judgment of each member of the Committee and the Chief Executive Officer, in the case of other executive officers, as to the impact of the individual or the support of the individual to his or her team on the financial performance and strategic progress of the Company also are considered.

STOCK OPTIONS. The Option Plan is administered by the Stock Option Subcommittee. The Stock Option Subcommittee consists of two independent Board members who also are members of the Compensation Committee. Currently, the Stock Option Subcommittee consists of Orhan Sadik-Khan and Charles Henri Weil.

The Board of Directors and Stock Option Subcommittee believe that long-term incentive compensation in the form of stock options is the most effective way of making executive compensation dependent upon increases in shareholder value. In addition, the Stock Option Subcommittee believes that stock option grants are an effective means of attracting and retaining qualified key executives, an essential element in the Company's highly regulated and client relationship-driven industry. The Company's Option Plan provides the means through which executives can build an investment in Common Stock, which aligns such executive officers' economic interest with the interest of stockholders.

With the exception of the January 3, 2002 grant to Mr. Raslan, the exercise price of each option has been the market price of the Company's Common Stock on the date of grant. Mr. Raslan's January 3, 2002 grant, pursuant to his contract, was priced at the date of his appointment as President and Chief Executive Officer. The grants provide for a delayed vesting period and have a ten-year term. The Committee believes that stock options give the executive officers incentives throughout the term of the options to strive to operate the Company in a manner that directly affects the financial interests of the stockholders, both on a long-term, as well as a short-term basis.

In determining the number of options to grant to executive officers, the Committee considers the same factors as it does in determining the other components of compensation. The recommendation of the Chief Executive Officer is significant in determining awards to persons other than him.

DECISIONS REGARDING 2002 COMPENSATION. During 2002, the Company worked to position various operations for potential sale. The Company successfully disposed of two divisions in the first quarter of 2002 (the Phoenix Marketing Group and the Cultural Access Group). The Company's performance for the year 2002 included EBITDA substantially above that for 2001, on essentially the same level of revenue from continuing operations. The Company was also successful in retaining its key clients in 2002. With respect to non-financial performance, management continued to implement its leadership model, which embodies principle-centered leadership that addresses clients, employees and the community.

15

Based on the foregoing, the Committee awarded bonuses for 2002 to those of the Named Executive Officers eligible for bonuses, which ranged from 46% to 100% of targeted bonus amounts.

During 2002, the compensation of Mr. Raslan, President and Chief Executive Officer of the Company, was based upon the Committee's assessment of the Company's financial performance as outlined above and its non-financial performance against criteria that were established at the beginning of fiscal year 2002.

DEDUCTIBILITY OF EXECUTIVE COMPENSATION. Section 162(m) of the Internal Revenue Code of 1986, as amended (the "Code"), limits the deductibility of compensation exceeding $1.0 million to the Company's Chief Executive Officer and each of the four other most highly compensated executive officers. Qualifying performance-based compensation meeting the requirements promulgated by the Internal Revenue Service under section 162(m) will not be subject to the deduction limit. The Company intends to conform its executive compensation arrangements with such requirements.

The Committee believes that its compensation policies promote the goals of attracting, motivating, rewarding and retaining talented executive officers who will maximize value for the Company's stockholders.

| COMPENSATION COMMITTEE |

| OF THE BOARD OF DIRECTORS |

|

|

| Orhan Sadik-Khan, Chairman |

| Carl Tiedemann |

| Charles Henri Weil |

|

|

REPORT OF THE AUDIT COMMITTEE

The Securities and Exchange Commission (the "Commission") rules require the Company to include in its proxy statement a report from the Audit Committee of the Company's Board of Directors. The following report concerns the Audit Committee's activities regarding oversight of the Company's financial reporting and auditing process.

The Audit Committee is comprised solely of directors who meet the educational, experience, independence and other requirements for membership on the Audit Committee as may be determined from time to time by Nasdaq Stock Market, Inc. ("Nasdaq"), the Commission, and the federal securities laws of the United States, and it operates under a written charter adopted by the Board of Directors, a copy of which is attached to this proxy statement as Annex A. The composition of the Audit Committee, the attributes of its members and the responsibilities of the committee, as reflected in its charter, are intended to be in accordance with applicable requirements for corporate audit committees. The Audit Committee reviews and assesses the adequacy of its charter on an annual basis.

16

As described more fully in its charter, the purpose of the Audit Committee is to assist the Board of Directors in its general oversight of the Company's financial reporting, internal control and audit functions. The Company's management is responsible for the preparation, presentation and integrity of the Company's financial statements, accounting and financial reporting principles, internal controls and procedures designed to ensure compliance with accounting standards, applicable laws and regulations. PricewaterhouseCoopers LLP, ("PWC") the Company's independent auditing firm, is responsible for performing an independent audit of the consolidated financial statements in accordance with auditing standards generally accepted in the United States of America. The Audit Committee has ultimate authority and responsibility to select, evaluate, determine compensation for, and when appropriate, replace the Company's independent auditor.

The Audit Committee members are not professional accountants or auditors, and their functions are not intended to duplicate or to certify the activities of management and the independent auditor. The Audit Committee serves a board-level oversight role, in which it provides advice, counsel and direction to management and the auditors on the basis of the information it receives, discussions with management and the auditors and the experience of the Audit Committee's members in business, financial and accounting matters.

The Audit Committee has reviewed and discussed the consolidated financial statements with management and the independent auditors, Management represented to the Audit Committee that the Company's consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States of America, and the independent auditor represented that its presentations included the matters required to be discussed in accordance with Statement on Auditing Standards ("SAS") No. 61, "Communication with Audit Committees" as amended by SAS No. 90, "Audit Committee Communications."

The Company's independent auditor also provided the Audit Committee with the written disclosures required by Independence Standards Board Standard No. 1, "Independence Discussions with Audit Committees," and the Audit Committee discussed with the independent auditor that firm's independence.

Following the Audit Committee's discussions with management and the independent auditor, the Audit Committee recommended that the Company's Board of Directors include the audited consolidated financial statements in the Company's annual report on Form 10-K for the year ended December 31, 2002.

17

| | AUDIT COMMITTEE |

| | OF THE BOARD OF DIRECTORS |

| |

| |

| | Orhan Sadik-Khan, Chairman |

| | Carl Tiedemann |

| |

Independent Certified Public Accountants' Fees

The aggregate fees billed to the Company for the year ended December 31, 2002, by our principal accounting firm, PWC, are as follows:

Audit Fees: The aggregate fees for professional services rendered by PWC in connection with the audit of our annual financial statements (Form 10-K) and reviews of our quarterly financial statements (Forms 10-Q) for the year ended December 31, 2002, were $140,000.

Financial Information Systems Design and Implementation Fees: There were no fees billed by PWC for services rendered in connection with financial information systems design and implementation for the fiscal year ended December 31, 2002.

All Other Fees: There were no other fees billed by PWC for services rendered during the fiscal year ended December 31, 2002.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act of 1934 requires the Company's directors and executive officers, and persons who own more than ten percent of the Company's Common Stock, to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in ownership of Common Stock. Officers, directors and greater than ten percent stockholders are required by Securities and Exchange Commission regulations to furnish the Company with copies of all Section 16(a) reports they file.

To the Company's knowledge, based solely on a review of copies of such reports furnished and confirmations that no other reports were required during the year ended December 31, 2002, its directors, executive officers and greater than ten percent stockholders complied with all Section 16(a) filing requirements except that, through inadvertence, Orhan Sadik-Khan filed a Form 3 after the filing deadline.

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

Agreements with Liam S. Donohue

The Company entered into a consulting agreement dated July 1, 2002 with Liam S. Donohue (the "Donohue Consulting Agreement"). Pursuant to the Donohue Consulting Agreement, Mr. Donohue provides consulting services to the Company's AM Medica Communications Group ("AMM") and serves as the Interim President and CEO of AMM, reporting directly to the Chief Executive Officer of the Company. The Donohue Consulting Agreement provides for, among other things, (i) that either party may terminate the Agreement upon 30 days written notice and (ii) a monthly consulting fee of $10,000 payable to Mr. Donohue.

18

Additionally, Mr. Donohue is a principal of Fairfield Partners ("Fairfield"). On May 10, 2002, the Company entered into an advisory services agreement with Fairfield to act as an exclusive financial advisor to the Company in connection with a possible sale or other material business transaction involving AMM. On June 28, 2002 the advisory services agreement with Fairfield was canceled. A total of $75,000 of advisory services fees were paid over the life of this agreement.

Agreements with Lee H. Edelstein

TLM Holdings Corp., a wholly-owned subsidiary of the Company ("TLM Holdings"), Lee H. Edelstein, President and Chief Executive Officer of the Company's TMS Professional Markets Group ("TMS") since March 2002, and a director of the Company, and TeleManagement Services, Inc. ("TeleManagement"), which was then owned primarily by Mr. Edelstein, entered into an agreement dated January 1, 1997, as subsequently amended (the "TeleManagement Agreement"), whereby TLM Holdings purchased substantially all of the assets of TeleManagement. The purchase price for the assets was as follows: (i) $6,500,000 in cash, (ii) the issuance by TLM Holdings of a 6% convertible subordinated promissory note (current interest rate is 10% due to a default under such note by TLM Holdings), in the principal amount of $1,300,000, which was subsequently assigned by TeleManagement to Mr. Edelstein, payable in the following manner: (i) all unpaid accrued interest is payable on January 15th of each year, commencing on January 15, 1998, until the note is paid in full, and (ii) the principal amount is payable in three equal installments of $433,334 on January 15, 1998, January 15, 1999 and on the date which is ten days following the date of the payment in full of all amounts owed by the Company to Bank of America, N.A. under the Company's Credit Agreement with Bank of America, N.A.; and (iii) certain additional contingent payments of cash and common stock of TLM Holdings payable to Mr. Edelstein over a three-year period dependent upon the achievement of certain financial and operational goals.

Mr. Edelstein entered into a consulting agreement, effective May 10, 1999 and amended effective as of January 1, 2003, with TLM Holdings (the "Edelstein Consulting Agreement"), to provide consulting services with respect to marketing and sales activities, and to support the executive management of TMS. The Edelstein Consulting Agreement provides for, among other things, (i) a term through December 31, 2004, (ii) Mr. Edelstein to devote 20% of his business time (not less than four days per month) to provide the required services, (iii) the payment of (a) $75,000 annually (through March 3, 2002), (b) $12,917 per month from March 4, 2002 through December 31, 2002 and (c) $10,917 per month thereafter until the termination of the Agreement and (iv) the right of TLM Holdings to assign the Edelstein Consulting Agreement to the Company.

19

Agreements with Ann M. Holmes

The Company, Ann M. Holmes and AM Medica Communications, Ltd., which was then owned primarily by Ms. Holmes ("AM Medica") entered into an agreement dated October 24, 1998, ("AM Medica Agreement"), whereby the Company purchased all of the issued and outstanding shares of AM Medica. The purchase price for the shares was as follows: (i) $20,000,000 in cash, (ii) the issuance by the Company of a 6.5% subordinated promissory note in the original principal amount of $5,500,000, as amended to decrease the principal amount to $5,219,000, payable in the following manner: (a) consecutive monthly payments of $150,000 payable on the first day of each month, (b) two additional payments of $250,000 each, payable on May 25, 2000 and October 25, 2000, and (c) the remaining principal amount and any outstanding accrued and unpaid interest thereon, payable on October 1, 2003; and (iii) certain additional contingent payments of cash and common stock of the Company payable to Ms. Holmes over a three-year period dependent upon the achievement of certain financial and operational goals. In 2002, Ms. Holmes received payments of $1,800,000 pursuant to the Subordinated Promissory Note.

Additionally, effective February 14, 2001, as amended, effective April 1, 2002, the Company entered into an agreement with Ms. Holmes whereby Ms. Holmes is to provide consulting services and support to AM Medica (the "Holmes Consulting Agreement"). The Holmes Consulting Agreement provides for, among other things, (i) a term through May 31, 2003 and (ii) a monthly consulting fee payable to Ms. Holmes of $15,000 through December 31, 2002, and $10,000 through May 31, 2003.

20

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of the Company's Common Stock as of March 31, 2003, by (1) each person known by the Company to be the beneficial owner of more than five percent (5%) of the outstanding shares of Common Stock (based on a review of filings with the Securities and Exchange Commission); (2) each Named Executive Officer; and (3) all of the Company's current directors and executive officers as a group. Unless otherwise indicated, each shareholder has sole voting and investment power with respect to the indicated shares.

Name and Principal Position |

| Amount & Nature of

Beneficial

Ownership

(#) |

| Percent of

Class

(%) |

Shawkat Raslan, Chairman, President and

Chief Executive Officer (1) | | 241,083 | | 2.4752% |

| |

Michael Dinkins, Chairman, President and

Chief Executive Officer (2) | | 7,000 | | * |

| |

Liam Donohue, Director (3) | | 12,033 | | * |

| |

Lee Edelstein, Director, President and Chief Executive Officer, TMS

Professional Markets Group (4) | |

192,766

| |

1.9791%

|

| |

Orhan Sadik-Khan, Director | | 70,000 | | * |

| |

Carl Tiedemann, Director | | 35,000 | | * |

| |

Charles Henri Weil (5) (6 | | 554,463 | | 5.6926% |

| |

John Hamerski, Executive Vice President and Chief Financial

Officer (7) | |

43,618

| |

*

|

| |

Georges André, President, TelAc Teleservices Group (8) | | 32,903 | | * |

| |

Katherine Dietzen, Chief Operating Officer, AM Medica

Communications Group | |

--

| |

--

|

| |

Barbara Monaghan, Vice President, AM Medica Communications Group (9) (10) | |

2,566

| |

*

|

| |

Richard Lyew, Senior Vice President and Corporate

Controller (11) (12) | | 2,567 | | * |

| |

All directors and executive officers as a group (10 persons) | | 1,184,433 | | 12.1605% |

| |

Ridfell Investments SA, Canelones 1090, Montevideo, Uruguay (13) | | 494,500 | | 5.0770% |

| |

R&R Opportunity Fund L.P., 1250 Broadway, 14th Floor, New

York, NY 10001 | |

679,000

| |

6.9713%

|

| ______________ |

* | Indicates less than 1% percent. |

| (1) | Includes 12,083 shares of Common Stock issuable upon options presently exercisable. |

| (2) | In March 2002, Mr. Dinkins resigned from his position as Chairman of the Board. In addition, the Company and Mr. Dinkins agreed to an amicable termination of his role as President and Chief Executive Officer, effective March 29, 2002. |

| (3) | Includes 8,333 shares of Common Stock issuable upon options presently exercisable. |

21

| (4) | Includes 1,750 shares of Common Stock issuable upon options presently exercisable. |

| (5) | Includes 3,333 shares of Common Stock issuable upon options presently exercisable. |

| (6) | According to a Schedule 13-D, dated September 17, 1999, filed by Compania Financiera Tassarina, S.A. ("Compania"), Compania has sole voting power and no dispositive power over all 551,130 shares and Charles Henri Weil has no voting power and sole dispositive power over all 551,130 shares. |

| (7) | Includes 26,518 shares of Common Stock issuable upon options presently exercisable. |

| (8) | Includes 10,101 shares of Common Stock issuable upon options presently exercisable. |

| (9) | In the fall of 2002, Ms. Monoghan voluntarily relinquished her position as Senior Vice President, Access Worldwide and Chief Operating Officer, AM Medica. |

| (10) | Includes 2,566 shares of Common Stock issuable upon options presently exercisable. |

| (11) | Includes 200 shares owned by Mr. Lyew's wife. |

| (12) | Includes 2,267 shares of Common Stock issuable upon options presently exercisable. |

| (13) | This ownership is listed per the October 3, 2002 report from our transfer agent. To the best of the Company's knowledge Ridfell has never filed any documents with the SEC. |

INDEPENDENT PUBLIC ACCOUNTANTS

The Audit Committee of the Company has selected PWC to serve as the independent accountants for the Company for the year ended December 31, 2003. PWC has examined the financial statements of the Company since before the Company's initial public offering on February 13, 1998.

Representatives from PWC are expected to be present at the annual meeting and will have the opportunity to make a statement if they desire, and will be available to answer appropriate questions.

OTHER MATTERS

The Board of Directors does not know of any other matters which may be brought forth at the Meeting. However, if any such other matters are properly presented for action, it is the intention of the persons named in the accompanying form of proxy to vote the shares represented thereby in accordance with their judgment on such matters.

SOLICITATION OF PROXY

The proxy accompanying this Proxy Statement is being solicited on behalf of the Company's Board of Directors. Officers, directors and certain employees of the Company, none of whom will receive any additional compensation for their services, may solicit proxies. Also, the Company has retained The Altman Group, Inc., a proxy solicitation firm, to solicit proxies at an estimated cost of $4,000, plus reasonable expenses. Such solicitations may be made personally, or by mail, facsimile, telephone, telegraph, messenger or via the Internet. The Company will pay all of the cost of solicitation of proxies. The Company also will pay persons holding shares of Common Stock in their names or in the name of nominees, but not owning such shares beneficially, such as brokerage houses, banks, and other fiduciaries, for the expense of forwarding solicitation materials to their principals.

STOCKHOLDER PROPOSALS

The deadline for submission of stockholder proposals pursuant to Rule 14a-8 of the Exchange Act for inclusion in our proxy statement for the 2004 Annual Meeting of Stockholders is March 8, 2004. Additionally, the Company must receive notice of any stockholder proposal to be submitted at the 2004 Annual Meeting of Stockholders (but not required to be included in our proxy statement) by July 8, 2004, or such proposal will be considered untimely pursuant to Rule 14a-4 and 14a-5(e) under the Exchange Act and the persons named in the proxies solicited by management may exercise discretionary voting authority with respect to such proposal.

22

ANNEX A

ACCESS WORLDWIDE COMMUNICATIONS, INC.

Audit Committee Charter

There shall be established a committee of the Board of Directors (the "Board") of Access Worldwide Communications, Inc. (the "Corporation") to be known as the Audit Committee (the "Committee").

The Committee shall be composed of, two directors until April 1, 2004 when at least, three directors appointed by the Board at the recommendation of the Corporation's Nominating Committee, each of whom (1) are educated and experienced in financial matters, (2) are independent of the management of the Corporation, (3) are free of any relationship that, in the opinion of the Board, would interfere with their exercise of independent judgment as a Committee member and (4) otherwise meet the educational, experience, independence and other requirements for membership on the Committee as may be determined from time to time by Nasdaq Stock Market, Inc. ("Nasdaq"), the Securities and Exchange Commission (the "Commission"), and the federal securities laws of the United States. In addition, starting April 1, 2004, at least one Committee member shall be a "financial expert" as such term is defined under the rules and regulations of Nasdaq and the Commission and under the federal securities laws.

The primary purpose of the Committee shall be to assist the Board in fulfilling its responsibilities to oversee management activities related to internal controls, disclosure controls, accounting and financial reporting policies and auditing practices, and to review the independence of the Corporation's independent auditors and the objectivity of its internal auditors. In fulfilling its responsibilities, the Committee shall maintain free and open communication among the Corporation's directors, its independent auditors, its internal auditors and its management.

The Committee shall meet at least twice a year with the Corporation's management, including the Chief Executive Officer, the Chief Financial Officer, the Corporate Controller, the Disclosure Committee, the internal auditors and the independent auditors in separate executive sessions.

In performing its oversight role, the Committee shall have the authority and discretion to retain independent legal, accounting or other consultants at its discretion and at the Corporation's expense.

It shall be the responsibility of the Audit Committee to:

Committee Management |

|

|

|

1) | Review and assess the adequacy of this Audit Committee Charter annually and propose amendments to this Charter and submit such proposed amendments for Board approval. |

|

|

|

2) | Maintain the independence, education and experience requirements of Nasdaq, the Commission and the federal securities laws of the United States, each as may be determined from time to time. |

|

|

|

|

3) | Establish an agenda for each ensuing year and hold such regular meetings as may be necessary and such special meetings as may be called by the Chairman of the Committee or at the request of the independent auditors. |

|

23

4) | Submit the minutes of all meetings of the Committee to, or discuss the matters discussed at each Committee meeting with, the Board. |

|

|

|

5) | Consider such other matters in relation to the financial affairs of the Corporation and its accounts, and in relation to the external audit of the Corporation as the Committee may, in its discretion, determine to be advisable. |

|

|

|

Management of Relationship with Independent Auditors |

|

|

|

6) | Appoint, determine funding for, and oversee the independent auditors to audit the financial statements of the Corporation and its divisions and subsidiaries. Supervise the work of the independent auditors and resolve any disagreements between management and the independent auditors. Meet with the independent auditors and financial management of the Corporation to review the scope of the proposed audit for the current year and the audit procedures to be utilized, and at the conclusion thereof review such audit, including any comments or recommendations of the independent auditors. |

|

|

|

|

7) | Receive and review (i) the independent auditors formal written statement delineating all relationships between the independent auditors and the Corporation, consistent with Independence Standards Board Standard 1, Independence Discussions with Audit Committees, and (ii) any other certifications or documentation necessary to ensure that the independent auditors meet the independence standard required by law. Review all such documentation with the independent auditors, and if so determined by the Audit Committee, take or recommend that the full Board take appropriate action to oversee the independence of the independent auditors. |

|

|

|

|

8) | Receive and review timely reports from the independent auditors regarding: (i) all critical accounting policies and practices to be employed; (ii) all alternative treatments of financial information within generally accepted accounting principles in the United States of America that have been discussed with management officials of the Corporation, ramifications of the use of such alternative disclosures and treatments, and the treatment preferred by the independent auditors; and (iii) other material written communications between the independent auditors and the management of the Corporation, such as any management letter or schedule of unadjusted differences. |

|

|

|

|

9) | Review the following with management and the independent auditors: |

|

|

|

|

| a) | the Corporation's annual financial statements and related disclosures contained in the Form 10-K, including the Corporation's disclosure under the Management's Discussion and Analysis of Financial Condition and Results of Operations (including quality of financial reporting decisions and judgments); |

|

|

|

|

|

| b) | the audit of the annual financial statements and the independent auditors' report thereon; |

|

|

|

|

|

| c) | any significant changes required in the independent auditors' audit plan; |

|

|

|

|

|

| d) | any significant difficulties or disputes encountered during the audit; |

|

24

| | e) | critical accounting policies' disclosure for inclusion in the Form 10-K; and |

| | | |

| | f) | recommendation to the Board of Directors that the audited annual financial statements be included in the Corporation's Annual Report on Form 10-K. |

| | | |

10) | Review with management and the independent auditor the Corporation's quarterly financial statements prior to the filing of its Form 10-Q. |

| | |

11) | Discuss with the independent auditors any other matters required to be discussed by Statement on Auditing Standards No. 61 relating to the conduct of the audit. |

| | |

12) | Approve, in advance, all auditing services to be provided by the independent auditors in accordance with Nasdaq rules and regulations, the Commission's rules and regulations and the federal securities laws. Determine the amount of compensation to be paid to the independent auditors for such auditing services. |

| | |

13) | Approve, in advance, any non-audit services to be provided by the independent auditors in accordance with Nasdaq rules and regulations, the Commission's rules and regulations and the federal securities laws. Determine the amount of compensation to be paid to the independent auditors for such non-audit services. |

| | |

Develop Controls to Insure the Integrity of the Financial Statements and Quality of Disclosure |

| |

14) | Review with management and the independent accountants significant risks and exposures, and the steps management has taken to minimize the risks or exposures. |

| | |

15 ) | Review with management and the Disclosure Committee the adequacy of the Corporation's system of internal controls and disclosure controls. |

| | |

16) | On a quarterly basis, discuss the following with management and the Disclosure Committee and the independent auditors, if applicable: |

| | |

| | a) | all significant deficiencies in the design or operation of internal controls and disclosure controls, which could adversely affect the Corporation's ability to record, process, summarize and report financial data and any material weaknesses in internal controls and disclosure controls; and |

| | | |

| | b) | any fraud, whether or not material, that involves management or other employees who have a significant role in the Corporation's internal controls and disclosure controls. |

| | | |

17) | Establish procedures for: (i) the receipt, retention and treatment of complaints received by the Corporation regarding accounting, internal accounting controls or auditing matters; (ii) the confidential, anonymous submission by employees of the Corporation of concerns regarding questionable accounting or auditing matters; and (iii) the receipt and treatment of any evidence of a violation of the securities laws or breach of fiduciary duty brought to the Committee's attention by the Corporation's external securities counsel. |

| | |

18) | Prepare the Audit Committee Report for inclusion in the Proxy Statement for the Corporation's Annual Meeting. |

25

Proxy - Annual Meeting of Stockholders - July 8, 2003

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS.

The undersigned, a stockholder of ACCESS WORLDWIDE COMMUNICATIONS, INC., does hereby appoint John Hamerski and Richard Lyew, or either of them, with full power of substitution, the undersigned's proxies, to appear and vote at the Annual Meeting of Stockholders to be held July 8, 2003, at 11:00 a.m., local time, or at any adjournments thereof, upon such matters as may properly come before the Meeting.

(Continued and to be Completed on Reverse Side.)

ACCESS WORLDWIDE COMMUNICATIONS, INC.

Annual Meeting of Stockholders

July 8, 2003

Please mark, date and return the

proxy card promptly using the enclosed envelope.

| Please Detach and Mail in the Envelope Provided |

________________________________________________

A [X] | Please mark your

votes as in this

example. |

|

|

| | | |

| | | |

| | | |

| | | |

| | | | |

| | FOR | | WITHHOLD

AUTHORITY

to vote for

nominees listed | | |

| | | | | Nominees: | Liam S. Donohue |

| 1. | Election of

Directors. | [ ] | [ ] | | Lee H. Edelstein

Shawkat Raslan

Orhan Sadik-Khan

Carl Tiedemann

Charles Henri Weil |

| | | | | |

| | | | | |

| | | | | |

(INSTRUCTIONS: TO WITHHOLD AUTHORITY TO VOTE FOR AN INDIVIDUAL NOMINEE, WRITE THAT NOMINEE'S NAME IN THE SPACE PROVIDED BELOW.)

The Board of Directors recommends a vote "FOR" each Item.