SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Under Rule 14a-12 |

ACCESS WORLDWIDE COMMUNICATIONS, INC.

(Name of Registrant as specified in its charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 25, 2005

Boca Raton, FL

April 22, 2005

To the Stockholders of

ACCESS WORLDWIDE COMMUNICATIONS, INC.

The Annual Meeting of the Stockholders of ACCESS WORLDWIDE COMMUNICATIONS, INC. will be held at the executive offices of the Company at 4950 Communication Avenue, Suite 300, Boca Raton, Florida 33431, at 11:00 a.m., local time, on Wednesday, May 25, 2005, to consider and act upon the following matters:

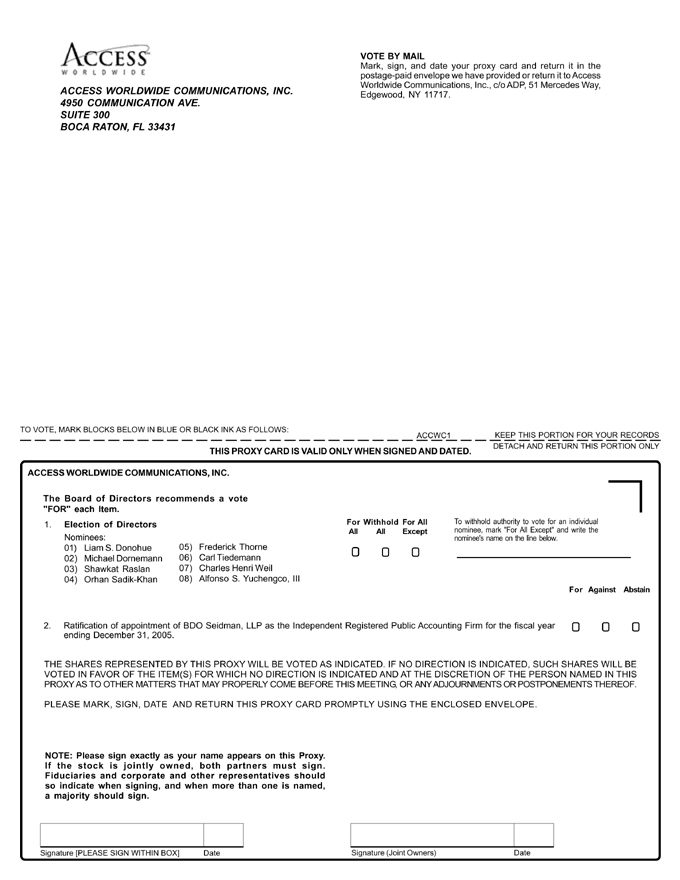

| | 1. | To elect eight directors, each to serve a one year term: |

| | 2. | To ratify the selection of BDO Seidman, LLP as the independent registered public accounting firm for the fiscal year ending December 31, 2005; and |

| | 3. | To transact such other business as may properly come before the meeting or any adjournment or adjournments thereof. |

The close of business April 1, 2005, has been fixed by the Board of Directors as the record date for the determination of stockholders entitled to notice of, and to vote at, the annual meeting.

|

| By Order of the Board of Directors, |

|

|

| Mark Wright |

| Secretary |

Whether or not you expect to attend the meeting, the Board of Directors urges you to promptly mark, sign and date the enclosed Proxy Card and mail it in the enclosed return envelope, which requires no postage if mailed in the United States, so that your vote can be recorded at the meeting if you do not attend personally.

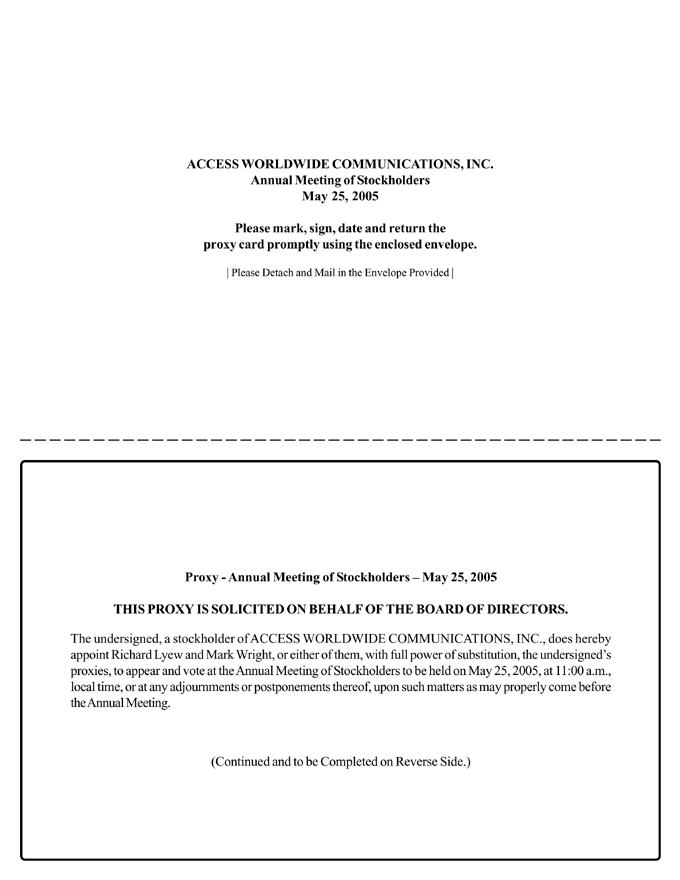

Access Worldwide Communications, Inc.

Proxy Statement

This Proxy Statement is provided in connection with the solicitation of proxies on behalf of the Board of Directors (the “Board”) of Access Worldwide Communications, Inc. (“Access Worldwide,” “Access,” “we,” “us,” “our,” or the “Company,” refers to Access Worldwide and/or, as the context requires, one or more of our subsidiaries) for use at the 2005 Annual Meeting of Stockholders (the “Meeting”) to be held on May 25, 2005, at 11:00 a.m., local time, at the Company’s executive offices, and at any adjournment or adjournments thereof, for the purposes set forth in such notice. The Company’s executive offices are located at 4950 Communication Avenue, Suite 300, Boca Raton, Florida 33431. This proxy statement and the accompanying proxy are first being mailed to the shareholders on or about April 22, 2005.

Holders of record of issued and outstanding shares of common stock, $0.01 par value per share (“Common Stock”), of the Company, as of April 1, 2005 (the “Record Date”), will be entitled to notice of, and to vote at, the Meeting as described below. On the Record Date, there were issued and outstanding 10,841,719 shares of Common Stock. The Company has no other class or series of Common Stock outstanding and entitled to vote at the Meeting. Each share of Common Stock is entitled to one vote with respect to each matter to be voted on at the Meeting.

The presence, in person or by proxy, of the holders of a majority of the outstanding shares of Common Stock entitled to vote at the Meeting is necessary to constitute a quorum at the Meeting or any adjournments thereof. Except as set forth below, abstentions and broker non-votes will be counted as present for the purpose of determining the presence of a quorum.

Common Stock represented by a properly executed proxy, if such proxy is received in time and not revoked, will be voted at the Meeting in accordance with the instructions indicated in such proxy. If no instructions are indicated, shares represented by proxy will be voted (i) “for” the election, as directors of the Company, of the eight nominees named in the proxy to serve until the 2006 annual meeting of stockholders, (ii) the selection of BDO Seidman, LLP as independent accountants for the fiscal year ending December 31, 2005 and (iii) in the discretion of the proxy holders as to any other matter which may properly be presented at the Meeting or any adjournment thereof.

Directors of the Company are elected by plurality vote. A “broker non-vote” refers to shares of Common Stock represented at the Meeting in person or by proxy by a broker or other nominee where such broker or other nominee (i) has not received voting instructions on a particular matter from the beneficial owners or persons entitled to vote and (ii) the broker or nominee does not have discretionary voting power on such matter. In the case of a broker non-vote or where a stockholder withholds authority from his/her proxy to vote, such shares will not be treated as “present” and “entitled to vote” on the matter and, thus, a broker non-vote or the withholding of a proxy’s authority will have no effect on the outcome of the vote on the matter.

Any proxy may be revoked at any time before it is exercised by written notice to the Secretary of the Company. The casting of a ballot at the Meeting by a stockholder, who may have previously given a proxy, will not have the effect of revoking that proxy unless the stockholder so notifies the Secretary of the Company in writing before voting the shares represented by the proxy.

1

PROPOSAL ONE

ELECTION OF DIRECTORS

The Board has nominated eight directors for election at the Meeting. Each director elected will serve until the next annual meeting of stockholders when his or her successor has been elected and qualified or until the director’s earlier resignation or removal. It is the intention of the persons named in the accompanying proxy to vote the shares represented thereby in favor of the election of each of the nominees named below unless otherwise instructed on such proxy. In case any of the nominees are unable or decline to serve, the persons named in the accompanying proxy reserve the right to vote the shares represented by such proxy for another person duly nominated by the Board in his stead or, if no other person is so nominated, to vote such shares for the remaining nominees. The Board has no reason to believe that any person named below will be unable or will decline to serve.The Board recommends a vote “FOR” the election of each of the nominees of the Board.

Michael Dornemann was appointed to the Board on June 22, 2004. Alfonso Yuchengco III was appointed to the Board on March 1, 2005.

Information concerning the nominees for election as directors is set forth below.

Liam S. Donohue, 37, has been a director of the Company since December 1996. Since 1998, Mr. Donohue has been a partner of DHM Arcadia Partners, a private equity fund investing in the for-profit education and training industry. From 1995 through 1998, Mr. Donohue was a principal of Foster Management Company, a private equity investment firm. In 1994, he was an Associate in the Salomon Brothers Corporate Finance Group in London. From 1989 to 1993, he was an Associate with Booz, Allen and Hamilton, Inc.’s International Environmental Management Practice and started Booz, Allen’s office in Budapest, Hungary.

Michael Dornemann, 59,has been a director of the Company since June of 2004. Mr. Dornemann is an entertainment & marketing executive that has more than 30 years of corporate development, strategic advisory, advertising and media experience. In 2001, he founded and is President of Dornemann & Co., LLC, a media consulting firm. Earlier in his career, Mr. Dornemann spent 18 years in the New York, Munich, and Luxemburg offices of media conglomerate Bertelsmann AG where he was an executive Board member for 16 years.

Shawkat Raslan, 53, has been Chairman of the Board, President and Chief Executive Officer of the Company since March 2002, and a director of the Company since May 1997. Since June 1983, Mr. Raslan has served as President and Chief Executive Officer of International Resources Holdings, Inc., an asset management and investment advisory service for international clients. Prior thereto, he served as Vice President of Trans Arabian Investment Bank in Bahrain from 1980 to 1983. From 1976 to 1980, Mr. Raslan was with Turner International, a construction management company. Mr. Raslan currently serves as a director of the Tiedemann Investment Group, Investor Select and CF Global.

Orhan Sadik-Khan, 75, has been a director of the Company since July 2002. Mr. Sadik-Khan is currently President of ADI Corporation, a management consulting firm and a director of Firecom, Inc., a fire-control business in New York. From 1986 to 2000, Mr. Sadik-Khan was a Managing Director of UBS PaineWebber, Inc., a wealth management company, and after his retirement he rejoined ADI Corporation which he had founded 25 years earlier. For 13 years, Mr. Sadik-Khan worked at Norton Simon, Inc., a multinational consumer products and services company, as Senior Vice President and Head of Corporate Development. Mr. Sadik-Khan was also a founding shareholder of Nextel Communications, Inc., a nationwide provider of mobile telecommunications services.

Frederick Thorne, 69, has been a director of the Company since August 2003. Since 2002, Mr. Thorne has been the Principal in Frederick Thorne, LLC, a consulting company. Prior to that, he held a number of positions with Harbor Capital Management Co., Inc., the investment firm he founded in 1979. He started Harbor Capital as President, CEO and Director, and became Chairman and Chief Investment Officer in 1993. He remained at this position until Harbor Capital was sold to Fortis Investment Management, a European based investment firm with global assets of $76.7 billion EUR. Previously, Mr. Thorne was President, Chief Executive Officer and Director of Phoenix Investment Counsel of Boston, Inc. Earlier in his career he was Chief Executive Officer and Director for John P. Chase, Inc. Mr. Thorne is a trustee, committee member or director for a number of colleges, organizations and institutes, including Bowdoin College, an independent, undergraduate liberal arts institution; the Massachusetts Eye and Ear Infirmary, a specialty hospital providing patient care for disorders of the eye, ear, nose, throat, head and neck; Northeast Health Systems, a network of hospitals, long-term care organizations, behavioral health services and clinicians; the World Peace Foundation, an operating foundation that advances the cause of peace; and the Pioneer Institute for Public Policy Research, an independent, non-partisan, privately funded research organization.

2

Carl Tiedemann, 78, has been a director of the Company since December 2002. Mr. Tiedemann has been the Chairman of the Tiedemann Investment Group, a private investment fund, since November 1980. Prior to founding Tiedemann Investment Group, Mr. Tiedemann had been with Donaldson, Lufkin & Jenrette, an investment bank and financial services provider, for eighteen years, serving as President (1975-1980) and Chairman of DLJ Securities (1966-1974), and remained as a Director of Donaldson, Lufkin & Jenrette until 1985. Mr. Tiedemann has served on the Board of Governors of the American Stock Exchange and on many committees of the Securities Industry Association.

Charles Henri Weil, 66, has been a director of the Company since August 2001. Mr. Weil has served as Chairman and Chief Executive Officer of Intergestion, an investment banking company based in France since 1989. From 1990 to 2000, Mr. Weil was also a self-employed financial consultant based in Paris, France. In addition to serving as a director of Access Worldwide, Mr. Weil serves as a director for Dawnay Day & Co. Ltd., an investment and advisory services company based in Great Britain, and Europeene de Distribution Luxembourg and Europeene des metaux Luxembourg, both industrial conglomerates located in Luxembourg.

Alfonso Yuchengco, III,46, has been a director of the Company since March of 2005. Mr. Yuchengco has extensive experience in the financial services and the Business Process Outsourcing (“BPO”) industry. He is currently a Partner of Argosy Advisers, a boutique financial advisory firm and Vice-Chairman of NeoIT Philippines, a joint venture with NeoIT, with a leading advisory firm on BPO in the US. Mr. Yuchengco was previously Executive Vice Chairman and CEO of Rizal Commercial Banking Corporation, the fifth largest private domestic bank in the Philippines. Prior to that, he served as President and CEO of the Yuchengco family office which has investments in consumer finance, construction, power generation, and banana plantations. He has also served as Chairman, Vice-Chairman or Director on the Board of several companies involved in various industries from credit cards, automotive manufacturing and distribution, education, real estate, pharmaceutical and memorial parks. Mr. Yuchengco was also responsible for setting up joint ventures in the Philippines with The Honda Motor Co. Ltd., Isuzu Motors Ltd., and the Government Investment Corporation of Singapore.

Board of Directors

The business and affairs of the Company are managed under the direction of the Board. The Board met five times during 2004.

Corporate Governance and Committees of the Board of Directors

On December 20, 2000, the Board approved Corporate Governance Guidelines for the Company. The Corporate Governance Guidelines set forth the role and functions of the Board, director qualifications and guidelines with respect to Board meetings and committees of the Board, among other things. The Corporate Governance Guidelines are available on the Company’s web site at www.accessww.com.

On December 9, 2003, the Board approved a Code of Business Conduct and Ethics (“Code”). The Code sets forth standards of conduct applicable to the Chief Executive Officer, Chief Financial Officer and senior financial officers to promote honest and ethical conduct, full, fair, accurate, timely and understandable disclosure, and compliance with governmental rules and regulations. The Code is available on the Company’s web site at www.accessww.com.

The Board has four standing committees to assist it in discharging its responsibilities: the Compensation Committee, the Audit Committee, the Capital and Finance Committee and the Nominating Committee.

The Compensation Committee reviews and makes recommendations regarding the compensation for executive officers and other key employees of the Company, including salaries and bonuses. There were changes to the membership of the Compensation Committee during the year. Frederick Thorne stepped down, and Michael Dornemann was nominated in his place. The present members consist of Carl Tiedemann (Chairman), Michael Dornemann, and Orhan Sadik-Khan. The members of the Compensation Committee are independent directors as defined under Rule 4200 of the Nasdaq Stock Market Inc.’s Marketplace Rules (“Nasdaq Rules”). The Compensation Committee has a stock option subcommittee (“Stock Option Subcommittee”) which administers the Company’s stock option plan (“Option Plan”) and determines the persons who are to receive awards, the number of shares subject to each award, and the exercise price. The members of the Stock Option Subcommittee are Messrs. Tiedemann (Chairman) and Sadik-Khan. The Compensation Committee and the Stock Option Subcommittee each met two times in 2004 and acted one time by written consent.

There were changes to the membership of the Audit Committee during the year. Mr. Liam Donohue stepped down, and Mr. Dornemann was nominated in his place. The present members of the Audit Committee are Messrs. Sadik-Khan (Chairman), Thorne and Dornemann. The Board has determined the members of the Audit Committee meet the

3

independence, education and experience requirements promulgated in accordance with the Sarbanes-Oxley Act of 2002 and the Nasdaq Rules. The Audit Committee acts as a liaison between the Board and the independent accountants and is responsible for annually appointing and if it deems necessary, terminating the Company’s relationship with the independent accountants. The Board has determined that Mr. Sadik-Khan is an “audit committee financial expert” within the meaning of Item 401(h) of Regulation S-K under the Securities Act of 1934, as amended. The Audit Committee reviews with the independent accountants the scope of their examination of the Company’s financial statements, the adequacy of internal accounting controls and otherwise performs the duties described in the Audit Committee charter. A copy of the Audit Committee Charter, as amended by the Board on April 1, 2003, is available on the Company’s web site at www.accessww.com. That amendment added provisions for compliance with the rules relating to audit committees under the Sarbanes-Oxley Act of 2002. The Audit Committee met six times in 2004 and did not act by written consent.

The members of the Capital and Finance Committee are Charles Henri Weil (Chairman) and Messrs. Donohue and Thorne. During the year, Mr. Tiedemann stepped down, and Mr. Thorne was nominated in his place. The Capital and Finance Committee reviews the financial condition of the Company so as to counsel the Board on the total financial resources, strength and capabilities of the Company and is authorized to explore and recommend various forms of financing and capital facilities. The Capital and Finance Committee is authorized to approve acquisitions of businesses having an aggregate purchase price of less than $1,000,000. The Capital and Finance Committee met one time during 2004.

The members of the Nominating Committee are Messrs. Tiedemann (Chairman), Donohue and Weil. During the year, Mr. Sadik-Khan stepped down, and Mr. Donohue was nominated in his place. All of the members of the Nominating Committee are independent directors as defined under Rule 4200 of the Nasdaq Rules. Pursuant to the Nominating Committee Charter enacted September 14, 2004, attached hereto as Annex 1, and available on the Company’s web site at www.accessww.com, The Nominating Committee is authorized to review, approve and recommend to the Board persons for election as directors. The Board, several months prior to the annual meeting of the stockholders, conducts a process of identifying and evaluating Board nominees. The Board initially looks to nominating its existing directors for re-election to the Board as appropriate or to other Director nominees proposed, as appropriate, by the members of the Board or business sources. In addition, the Nominating Committee will consider written nominations by stockholders, which are submitted to the Chairman of the Nominating Committee and addressed in care of the Corporate Secretary, Access Worldwide Communications, Inc., 4950 Communication Avenue, Suite 300, Boca Raton, Florida 33431 (see the section captioned “Stockholder Proposals and Nominations” contained herein). The Nominating Committee considers the candidate’s qualifications including education, work experience, knowledge of the Company’s industries, membership on other board of directors and civic activities. All candidates will be reviewed in the same manner, regardless of the source of recommendation. The Nominating Committee met two times in 2004 and acted by written consent on one occasion.

All of the then incumbent directors attended at least 89% of the Board of Directors meetings and 97% of the meetings of the committees and sub-committees on which they serve.

COMPENSATION OF DIRECTORS

Non-employee directors of the Company are compensated for their participation on the Board in the following manner: Each Director receives a fee of $4,000 for attending a Board meeting, $1,500 for attending a Board dinner, and $1,000 for attending a Board meeting telephonically. For each committee meeting attended, on a day other than the day of a full Board meeting, the committee members and the Chairman of the committee receive a fee of $500 and $1,000 respectively, whether in person or telephonically. The Audit Committee and Compensation Committee have fee schedules different from the other committees. The Audit Committee Chairman receives a fee of $2,000 per meeting, and the members $1,500 per meeting. Should the Chairman and members attend telephonically they receive fees of $1,500 and $1,000 respectively. The Compensation Committee Chairman receives a fee of $1,500 per meeting and the members $1,000 per meeting. Should the Chairman and members attend telephonically they receive fees of $1,000 and $500 respectively. The fees set forth above are paid both in cash and in shares (50% cash and 50% shares of Common Stock, valued on the day the meeting took place). New non-employee directors of the Company receive options to purchase 25,000 shares of Common Stock granted under the Company’s 1997 Stock Option Plan on the day they are elected or appointed to the Board. These stock options vest evenly over three years. Directors who are officers of the Company do not receive any additional compensation for serving on the Board. Directors are reimbursed for out-of-pocket expenses related to their duties.

4

EXECUTIVE OFFICERS

The Company’s executive officers and their ages are as follows:

| | | | |

Name

| | Age

| | Position

|

Shawkat Raslan | | 53 | | Chairman of the Board, President and Chief Executive Officer |

| | |

Richard Lyew | | 37 | | Executive Vice President, Chief Financial Officer, Treasurer |

| | |

Jared (Ted) Jordan | | 38 | | Senior Vice President and Chief Information Officer |

| | |

Guy Amato | | 42 | | President & CEO of TMS Professional Markets Group |

| | |

Georges André | | 40 | | President & CEO of TelAc Teleservices Group |

| | |

Stedman Stevens | | 46 | | President & CEO of AM Medica Communications Group |

Set forth below is information regarding the business experience of each of the Company’s executive officers. Information with respect to Mr. Raslan appears under “Proposal One—Election of Directors” on page two of this Proxy Statement.

In July 2004, Richard Lyew was elevated from Senior Vice President and Corporate Controller, to the position of Executive Vice President & CFO. Mr. Lyew joined Access Worldwide in May 1998 as Assistant Corporate Controller and was promoted the following year to Senior Vice President and Corporate Controller. Prior to joining Access Worldwide, Mr. Lyew spent more than six years in public accounting at PricewaterhouseCoopers LLP. He is a Certified Public Accountant licensed in the State of New York and a member of the American Institute of Certified Public Accountants.

Jared (Ted) Jordan is Senior Vice President of Access Worldwide and Chief Information Officer, a position he has held since January 2004. Earlier, Mr. Jordan became Senior Vice President, IT/IS when the Company underwent a leadership restructuring among the IT departments in April 2002 in order to integrate the various locations under a more efficient platform. Previously, Mr. Jordan was Executive Vice President, IT/IS for TelAc Teleservices Group (“TelAc”). Prior to joining TelAc, he was President of Jordan Computer Specialists, Inc., a software development and computer consulting company that he founded in 1992 that was purchased by Access Worldwide in 1997. Earlier in his career, Mr. Jordan was a Senior Associate at Ecosometrics, a research company specializing in urban development.

Guy Amato has served as Senior Vice President of Access Worldwide and President and Chief Executive Officer of TMS Professional Markets Group (“TMS”) since January 2004. Mr. Amato joined Access Worldwide in March 2002 as Senior Vice President, Sales & Marketing of TMS and was promoted to Executive Vice President of TMS in July 2003. He has more than 17 years of pharmaceutical and marketing experience. From June 2001 to March 2002, Mr. Amato was Sales Director at Wellpoint Pharmacy Management, Inc., a managed care organization. From November 2000 to May 2001, he worked at Parkstone Medical Inc., an e-Health software company, as Director of Marketing and Product Development. Earlier in his career, he worked at Glaxo Wellcome (prior to its merger with SmithKline Beecham) in sales, sales management, consumer marketing, professional marketing, and business analysis positions from April 1992 to November 2000.

Georges André has served as Senior Vice President of Access Worldwide since June 2001 and as President and Chief Executive Officer of TelAc since April 2001. From September 1999 until April 2001, Mr. André served as Senior Vice President of Client Services of TelAc. Mr. André was the Vice President of Operations at Iowave, Inc., a wireless broadband solutions company, from February 1999 through August 1999. Mr. André served as the Senior Vice President of Client Services and Operations for TelAc from July 1998 until January 1999 and as an Account Manager, Senior Account Manager and Vice President, Client Services, respectively, for TelAc, from February 1995 until July 1998, prior to TelAc being acquired by the Company.

J. Stedman Stevens joined Access Worldwide as President & CEO of AM Medica in September of 2004. Mr. Stevens has more than twenty years of experience in the pharmaceutical, hospital, physician marketing and consumer product sectors. From 2002 to 2004, Mr. Stevens was President & Chief Operating Officer of Pharmaceutical Research Plus, a patient recruitment and clinical trial support company. From 2001 to 2002, he was Chief Executive Officer & President of Blitz Research, a healthcare marketing company; and from 1999 to 2001, the Managing Director of the Colby Group’s Healthcare division.

5

EXECUTIVE COMPENSATION

The following table sets forth information for the fiscal years ended December 31, 2004, 2003 and 2002, concerning the compensation of (1) all persons who served as the Company’s Chief Executive Officer during 2004, (2) the four other most highly compensated executive officers of the Company whose total annual salary and bonus exceeded $100,000 during the year ended December 31, 2004 and who were executive officers as of December 31, 2004 and (3) individuals who would have been among the four other most highly compensated executive officers for 2004, but they were not serving as executive officers as of December 31, 2004 (collectively, the “Named Executive Officers”).

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | | | | | | |

| | | | | Annual Compensation

| | |

| | | | | | |

Name and Principal Position

| | Year

| | Salary ($)

| | Bonus ($)

| | | Other Annual Compensation ($)(1)

| | | Securities Underlying Options (#)

| | All Other Compensation ($)

| |

Shawkat Raslan Chairman, President and Chief Executive Officer | | 2004

2003

2002 | | $

| 162,500

150,000

109,404 | | $

| 100,000

35,000

— | (2)

| | $

| 9,600

8,667

14,450 |

(5) | | 117,173

150,000

150,000 | | $

| 12,501

11,688

6,673 | (3)

(4)

(6) |

| | | | | | |

John Hamerski(7) Executive Vice President and Chief Financial Officer | | 2004

2003

2002 | | $

| 180,000

180,000

180,000 | | $

| 35,000

35,000

27,500 |

(10) | | $

| 9,600

8,000

— |

| | —

10,000

35,000 | | $

| 9,131

8,941

8,284 | (8)

(9)

(11) |

| | | | | | |

Guy Amato Senior Vice President and President & Chief Executive Officer, TMS Professional Markets Group | | 2004

2003

2002 | | $

| 250,000

160,000

119,385 | |

| —

—

— |

| | $

| 9,600

70,949

33,940 |

(13)

(15) | | 15,000

4,000

30,000 | | $

| 12,530

11,313

6,673 | (12)

(14)

(16) |

| | | | | | |

Georges André Senior Vice President and President & Chief Executive Officer, TelAc Teleservices Group | | 2004

2003

2002 | | $

| 247,500

180,000

170,000 | | $

| 75,000

51,000

44,500 | (17)

| | $

| 9,600

8,000

— |

| | 45,000

20,000

40,000 | | $

| 12,530

11,945

9,470 | (18)

(19)

(20) |

| | | | | | |

Ted Jordan Senior Vice President and Chief Information Officer, Access Worldwide Communications | | 2004

2003

2002 | | $

| 185,000

175,000

175,000 | | $

| 15,000

20,000

17,500 | (21)

| |

| —

—

— |

| | 10,000

10,000

40,000 | | $

| 9,116

—

— | (22)

|

| (1) | Includes $7,200 to $9,600 car allowance where applicable. Except as set forth in this column, no “Other Annual Compensation” for the Named Executive Officers is reflected because the aggregate values of the perquisites and other personal benefits received by each of the Named Executive Officers for the indicated years were less than the required threshold for disclosure. |

| (2) | Mr. Raslan was awarded a $100,000 bonus which was distributed in shares of Access Worldwide Common Stock. |

| (3) | Includes $11,586 for medical and dental insurance, $144 for life insurance, $336 for short term disability, and $435 for long term disability. |

| (4) | Includes $9,781 for medical and dental insurance, $60 for life insurance, $465 for short term disability, and $1,382 for long term disability. |

| (5) | Mr. Raslan received $7,250 in Board fees prior to his appointment as an officer in March 2002. Subsequent to this appointment he received an automobile allowance of $7,200. |

| (6) | Includes $6,673 for medical and dental insurance paid by the Company. |

| (7) | Stepped down as Chief Financial Officer as of June 30, 2004. Compensated via severance arrangement through December 31, 2004. |

| (8) | Includes $8,129 for medical and dental insurance, $144 for life insurance, $336 for short term disability, and $522 for long term disability. |

| (9) | Includes $6,862 for medical and dental insurance, $165 for life insurance premiums, $597 of short-term disability insurance and $1,317 of long-term disability insurance paid by the Company. |

| (10) | Due to a typographical error, the 2002 Proxy Statement incorrectly listed the year of Mr. Hamerski’s bonuses. This error is corrected in the figures above. |

| (11) | Includes $6,242 for medical and dental insurance, $10 for life insurance premiums, $453 of short-term disability insurance and $1,579 of long-term disability insurance paid by the Company. |

6

| (12) | Includes $11,586 for medical and dental insurance, $144 for life insurance premiums, $336 of short-term disability insurance and $464 of long-term disability insurance paid by the Company. |

| (13) | Includes $66,564 in commissions and a car allowance of $4,385 paid by the Company. |

| (14) | Includes $9,781 for medical and dental insurance, $1,532 for life insurance premiums, short-term disability insurance and long-term disability insurance paid by the Company. |

| (15) | Includes $31,077 in commissions and a car allowance of $2,863 paid by the Company. |

| (16) | Includes $6,673 for medical insurance paid by the Company. |

| (17) | Bonus consists of $56,250 in cash and $18,750 in shares of Access Common Stock. |

| (18) | Includes $11,586 for medical and dental insurance, $144 for life insurance premiums, $336 of short-term disability insurance and $464 of long-term disability insurance paid by the Company. |

| (19) | Includes $9,781 for medical and dental insurance and $2,164 for life insurance premiums, short-term disability insurance and long-term disability insurance paid by the Company. |

| (20) | Includes $8,898 for medical insurance and $572 for life insurance premiums, short-term disability insurance and long-term disability insurance paid by the Company. |

| (21) | Bonus consists of $11,250 in cash and $3,750 in shares of Access Common Stock. |

| (22) | Includes $8,129 for medical and dental insurance, $144 for life insurance premiums, $336 of short-term disability insurance and $507 of long-term disability insurance paid by the Company. |

OPTION GRANTS IN 2004

The following table sets forth the grants of stock options to the Named Executive Officers during the year ended December 31, 2004. The amounts shown as potential realizable values are based on arbitrarily assumed annualized rates of stock price appreciation of five percent and ten percent over the exercise price of the options during the full terms of the options. Actual gains, if any, on option exercises and holdings of Common Stock are dependent on the future performance of the Common Stock and overall stock market conditions.

| | | | | | | | | | | | | | | | | | | |

| | | Individual Grants

| | Potential Realizable

Value At Assumed

Annual Rates of

Stock Price

Appreciation For

|

Name and Principal Position

| | Number of Securities Underlying Options Granted (#)

| | % of Total Options Granted to Employees

in 2004

| | | Exercise or Base Price

($/Sh)

| | Closing Price on Date of Issuance

($/Sh)

| | Expiration Date

| | 5%

| | 10%

|

Shawkat Raslan

Chairman, President and Chief Executive Officer | | 25,000 | | 11 | % | | $ | 0.61 | | $ | 0.61 | | 02/24/14 | | $ | 9,591 | | $ | 24,305 |

Richard Lyew

Executive Vice President and Chief Financial Officer | | 10,000 | | 4 | % | | | 0.61 | | | 0.61 | | 02/24/14 | | | 3,836 | | | 9,722 |

Guy Amato

President & Chief Executive Officer, TMS Professional Markets Group | | 15,000 | | 6 | % | | | 0.61 | | | 0.61 | | 02/24/14 | | | 5,754 | | | 14,583 |

Georges André

President & Chief Executive Officer, TelAc Teleservices Group | | 45,000 | | 19 | % | | | 0.61 | | | 0.61 | | 02/24/14 | | | 17,263 | | | 43,748 |

Steadman Stevens

President & Chief Executive Officer, AM Medica Communications Group | | 20,000 | | 9 | % | | | 0.90 | | | 0.90 | | 09/10/14 | | | 11,320 | | | 28,687 |

Jared (Ted) Jordan

Senior Vice President and Chief Information Officer | | 10,000 | | 4 | % | | | 0.61 | | | 0.61 | | 02/24/14 | | | 3,836 | | | 9,722 |

7

YEAR-END 2004 OPTION VALUES

The following table sets forth information regarding the number and year-end value of unexercised options to purchase Common Stock held at December 31, 2004 by each of the Named Executive Officers.

| | | | | |

Name and Principal Position

| | Number of Securities Underlying Unexercised Options at Fiscal Year-End(#) Exercisable/Unexercisable

| | Value of Unexercised In-the-

Money Options at Fiscal Year-End ($) Exercisable/Unexercisable

|

Shawkat Raslan

Chairman, President and Chief Executive Officer | | 116,250/235,000 | | $ | 97,650 /$176,400 |

| | |

Richard Lyew

Executive Vice President and Chief Financial Officer | | 7,700/ 26,300 | | $ | 3,780 /$21,840 |

| | |

Guy Amato

President & Chief Executive Officer, TMS Professional Markets Group | | 12,800/ 36,200 | | $ | 10,752/ $30,408 |

| | |

Georges André

President and President & Chief Executive Officer, TelAc Teleservices Group | | 23,200/ 85,300 | | $ | 16,800/ $71,400 |

| | |

J. Stedman Stevens

President and Chief Executive Officer, AM Medica Communications | | 00/20,000 | | $ | 0/$0 |

| | |

Jared (Ted) Jordan

Senior Vice President and Chief Operating Officer, AM Medica Communications Group | | 26,500 / 42,000 | | $ | 20,580/ $35,280 |

EMPLOYMENT ARRANGEMENTS

The Company entered into employment arrangements with the Named Executive Officers as described below. All of the employment arrangements provide for, among other things, (i) non-compete and non-disclosure agreements; (ii) the continuation of compensation payments to a disabled executive officer until such officer has been unable to perform the services required of him or her for the time set forth therein; and (iii) health insurance and other benefits.

The Company entered into a two-year employment agreement with Shawkat Raslan, effective March 30, 2004, pursuant to which Mr. Raslan serves as President and Chief Executive Officer of the Company (and each of the Company’s wholly owned subsidiaries). From April 1, 2004, Mr. Raslan’s initial base salary is $150,000 per year. Beginning July 1, 2004, Mr. Raslan’s base salary increases to $175,000 per year, and he is entitled to receive merit increases in base salary as reasonably determined by the Compensation Committee of the Board of the Company, in its discretion. Mr. Raslan is eligible to receive an annual bonus of up to 50% of his base salary based on achievement of quantitative and qualitative goals as established by the Compensation Committee of the Board of the Company. Mr. Raslan is also entitled to an automobile allowance of $800 per month. In addition, pursuant and under the Company’s 1997 Stock Option Plan, as amended from time to time, Mr. Raslan was granted 25,000 stock options February of 2004. Under the employment agreement, Mr. Raslan’s employment may be terminated by the Company or Mr. Raslan for any reason after thirty days written notice. After such termination, the Company shall pay Mr. Raslan’s annual salary and all benefits accrued to such date of termination. In the event that Mr. Raslan’s employment is terminated by the Company, all stock options granted to him pursuant to the Company’s 1997 Stock Option Plan, or any successor thereto, shall become fully vested.

The Company entered into a three-year employment agreement, effective as of January 20, 2004, with Georges André pursuant to which Mr. André serves as Senior Vice President, Access Worldwide and President and Chief Executive Officer of the Company’s TelAc division, which provides for, among other things, Mr. André to receive an initial base salary of $250,000, plus an annual discretionary incentive bonus based upon the achievement of quantitative and qualitative goals established by the Chief Executive Officer of the Company. Mr. André is also entitled to an automobile allowance of $800 per month. If Mr. André’s employment is terminated by him for “Good Reason” within thirty (30) days after a change of control (as defined therein), with specified exceptions, he is entitled to receive (i) an amount equal to his then current annual base salary for a period of up to twelve (12) months and (ii) if a bonus has been awarded and

8

approved but not yet paid, then the bonus awarded is pro-rated through the date of such termination. “Good Reason” is defined as (a) a reduction in his annual base salary; or (b) a change in his duties and responsibilities which represent a substantial reduction of duties and responsibilities; or (c) the requirement by the Company that he work, without his consent, out of a location more than fifty (50) miles away from his then current workplace, other than reasonably required travel. If Mr. André’s employment is terminated by the Company without cause and he is not otherwise entitled to the termination payment described above, he is entitled to receive continuing payments of his then current annual base salary for a period of up to nine (9) months and if a bonus has been awarded and approved but not yet paid, then the bonus awarded is pro-rated through the date of such termination.

The Company entered into a three-year employment agreement, effective as of January 1, 2004, with Guy Amato pursuant to which Mr. Amato serves as Senior Vice President, Access Worldwide and President and Chief Executive Officer of the Company’s TMS Professional Markets Group, which provides for, among other things, Mr. Amato to receive an initial annual base salary of $250,000, plus an annual incentive bonus of up to 40% of his then current annual base salary based upon the achievement of quantitative and qualitative goals established by the Chief Executive Officer of the Company. In addition, Mr. Amato is eligible to receive merit increases in his annual base salary as determined by the Chief Executive Officer. Mr. Amato is also entitled to an automobile allowance of $800 per month. If Mr. Amato’s employment is terminated by him for “Good Reason” within ninety (90) days after a change of control (as defined therein), with specified exceptions, he is entitled to receive an amount equal to his then current annual base salary for a period of up to twelve (12) months. “Good Reason” is defined as (a) a reduction in his annual base salary; or (b) a change in his duties and responsibilities which represent a substantial reduction of duties and responsibilities; or (c) the requirement by the Company that he work, without his consent, out of a location more than fifty (50) miles away from his then current workplace, other than reasonably required travel. If Mr. Amato’s employment is terminated by the Company without cause and he is not otherwise entitled to the termination payment described above, he is entitled to receive continuing payments of his then current annual base salary for a period of up to nine (9) months.

The Company entered into a three-year employment agreement with J. Stedman Stevens effective as of September 10, 2004, pursuant to which Mrs. Stevens serves as President and Chief Executive Officer of the Company’s AM Medica Communications Group. Mr. Steven’s initial base salary is $250,000 per year, and he is entitled to receive merit based increases in base salary during the term of the agreement in amounts determined by the Chief Executive Officer, subject to the approval of the Board of the Company. Mr. Stevens is also eligible to receive a bonus of up to 40% of his base salary based on achievement of quantitative and qualitative goals established by the Chief Executive Officer and subject to the approval of the Board of the Company. In addition, Mr. Stevens was granted 20,000 stock options under and pursuant to the Company’s 1997 Stock Option Plan, as amended from time to time. Under the agreement, Mr. Steven’s employment may be terminated by the Company at any time for any reason the Company deems appropriate. If such termination is not due to death, disability, or “due cause” (as defined in the employment agreement), Mr. Stevens will be entitled to receive his annual salary until the earlier of (a) the expiration of the employment agreement or (b) nine (9) months following the date of such termination.

COMPENSATION COMMITTEE INTERLOCKS

AND INSIDER PARTICIPATION

Messrs. Sadik-Khan, Donohue, Thorne and Tiedemann served as members of the Compensation Committee from January 2004 up and until June 22, 2004. Beginning June 22, 2004 and continuing until year ended December 31, 2004, Messrs. Tiedemann, Dornemann, and Sadik-Khan served as members of the Compensation Committee. No member of the Compensation Committee was an officer or employee of the Company during 2004 or was formerly an officer of the Company. During the year ended December 31, 2004, none of the Company’s executive officers served on the Compensation Committee of any other entity, any of whose directors or executive officers served either on the Company’s Board or on the Company’s Compensation Committee.

9

PERFORMANCE GRAPH

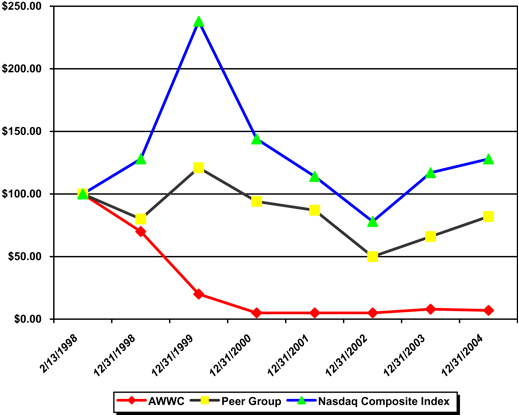

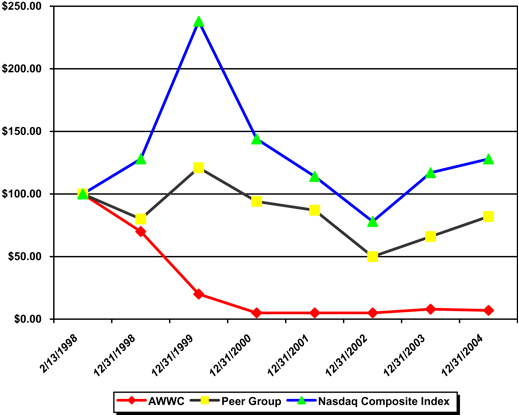

The Company’s Common Stock began trading on the Nasdaq National Market System on February 13, 1998 when its initial public offering commenced. Since July 17, 2001, the Company’s Common Stock has traded on the Over the Counter Bulletin Board. The following performance graph shows the total return to stockholders of an investment in the Company’s Common Stock as compared to an investment in (i) the Nasdaq Composite Index and (ii) a peer group made up of Catalina Marketing Corporation, Parexel International Corporation, SITEL Corporation and TeleTech Holdings (the “Peer Group”) for the period commencing February 13, 1998 and ending December 31, 2004. The data assumes that $100 was invested on February 13, 1998 in each of the Company’s Common Stock, the Nasdaq Composite Index and companies in the Peer Group Index (on a weighted market value basis) and that all dividends were reinvested. The Company has never paid any dividends.

COMPARISON OF CUMULATIVE TOTAL RETURN AMONG

THE NASDAQ COMPOSITE INDEX,

THE PEER GROUP INDEX, AND

ACCESS WORLDWIDE COMMUNICATIONS, INC.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2/13/1998

| | 12/31/1998

| | 12/31/1999

| | 12/31/2000

| | 12/31/2001

| | 12/31/2002

| | 12/31/2003

| | 12/31/2004

|

AWWC | | $ | 100 | | $ | 70 | | $ | 20 | | $ | 5 | | $ | 5 | | $ | 5 | | $ | 8 | | $ | 7 |

Peer Group | | $ | 100 | | $ | 80 | | $ | 121 | | $ | 94 | | $ | 87 | | $ | 50 | | $ | 66 | | $ | 82 |

Nasdaq Composite | | $ | 100 | | $ | 128 | | $ | 238 | | $ | 144 | | $ | 114 | | $ | 78 | | $ | 117 | | $ | 128 |

10

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Compensation Committee (the “Committee”) and the Stock Option Subcommittee, composed of three and two outside directors, respectively, are responsible for administering the Company’s executive compensation program.

The Company’s executive compensation program is intended to attract, motivate and retain key executives who are capable of leading the Company effectively and fostering its long-term growth. The compensation program for executives is comprised of base salary, annual incentives and long-term incentive awards. The Committee’s compensation philosophy is based upon the belief that success of the Company results from the coordinated efforts of all Company employees working as a team to achieve objectives of providing superior services to the Company’s clients and maximizing the Company’s value for the benefit of its stockholders.

The Committee reviews significant qualitative components in evaluating the individual performance of each executive officer. These components include such executive officer’s leadership, team building and motivation skills, adaptability to rapid change, and ability to assimilate new technical knowledge to meet the demands of the Company’s clients. In this qualitative evaluation, the Committee exercises its collective judgment as to the executive officer’s contributions to the growth and success of the Company during the prior year and the expected contributions of such executive officer in the future.

BASE SALARY. Base salary is determined by level of responsibility and individual performance as well as by the need to provide a competitive package that allows the Company to attract and retain key executives. After reviewing individual and Company performance, the Chief Executive Officer makes recommendations to the Committee concerning each executive officer’s base salary. The Committee reviews and, with any changes it deems appropriate, approves these recommendations.

EXECUTIVE BONUSES. Executive bonus payments are used to properly compensate for performance. Bonuses provide the opportunity for executive officers to earn as additional compensation, a percentage of the executive officer’s annual base salary by achieving the Company’s strategic and financial performance goals. The bonuses are based on the achievement of quantitative and qualitative goals which are established by the Chief Executive Officer and reviewed and approved by the Committee.

The key components in determining the amount of such bonuses include the financial performance of the Company and the progress of the Company in achieving its long-term strategic objectives. The judgment of each member of the Committee and the Chief Executive Officer, in the case of other executive officers, as to the impact of the individual or the support of the individual to his or her team on the financial performance and strategic progress of the Company also are considered. In order to further align the senior management team’s long-term interests with that of shareholders, the Compensation Committee issued shares of Access Worldwide’s Common Stock in lieu of all cash bonus payments for those individuals with bonuses over $10,000 (a minimum of 25% of the total value of the bonus payment was made in stock). In addition, eligible employees were given the option to have a greater ratio of shares to cash if they elected to do so. The Chief Executive Officer elected to receive 100% of his bonus in shares.

STOCK OPTIONS. The Option Plan is administered by the Stock Option Subcommittee. The Stock Option Subcommittee consists of two independent Board members who also are members of the Compensation Committee. Currently, the Stock Option Subcommittee consists of Carl Tiedemann (Chairman), and Orhan Sadik-Khan.

The Board and Stock Option Subcommittee believe that long-term incentive compensation in the form of stock options is the most effective way of making executive compensation dependent upon increases in shareholder value. In addition, the Stock Option Subcommittee believes that stock option grants are an effective means of attracting and retaining qualified key executives, an essential element in the Company’s highly regulated and client relationship-driven industry. The Company’s Option Plan provides the means through which executives can build an investment in Common Stock, which aligns such executive officers’ economic interest with the interest of stockholders.

All grants provide for a delayed vesting period and have a ten-year term. The Committee believes that stock options give the executive officers incentives throughout the term of the options to strive to operate the Company in a manner that directly affects the financial interests of the stockholders, both on a long-term, as well as a short-term basis.

In determining the number of options to grant to executive officers, the Committee considers the same factors as it does in determining the other components of compensation. The recommendation of the Chief Executive Officer is significant in determining awards to persons other than to himself.

11

DECISIONS REGARDING 2004 COMPENSATION. The 2004 year picked up where 2003 left off. The Company focused on building additional capacity for both TelAc and TMS here at home and abroad, and finalized the restructuring of AM Medica Communications Group. With respect to non-financial performance, management continued to implement its leadership model, which embodies principle-centered leadership that addresses clients, employees and the community.

Based on the foregoing, the Committee awarded bonuses for 2004 to those of the Named Executive Officers eligible for bonuses, which ranged from 17% to 86% of targeted bonus amounts.

During 2004, the compensation of Mr. Raslan, President and Chief Executive Officer of the Company, was based upon the Committee’s assessment of the Company’s financial performance as outlined above and its non-financial performance against criteria that were established at the beginning of fiscal year 2004.

DEDUCTIBILITY OF EXECUTIVE COMPENSATION. Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), limits the deductibility of compensation exceeding $1.0 million to the Company’s Chief Executive Officer and each of the four other most highly compensated executive officers. Qualifying performance-based compensation meeting the requirements promulgated by the Internal Revenue Service under section 162(m) will not be subject to the deduction limit. The Company intends to conform its executive compensation arrangements with such requirements.

The Committee believes that its compensation policies promote the goals of attracting, motivating, rewarding and retaining talented executive officers who will maximize value for the Company’s stockholders.

|

COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS |

|

| |

Carl Tiedemann, Chairman Orhan Sadik-Khan Michael Dornemann |

12

REPORT OF THE AUDIT COMMITTEE

The Securities and Exchange Commission (the “Commission”) rules require the Company to include in its proxy statement a report from the Audit Committee of the Company’s Board. The following report concerns the Audit Committee’s activities regarding oversight of the Company’s financial reporting and auditing process.

The Audit Committee is comprised of directors who meet the educational, experience, independence and other requirements for membership on the Audit Committee as may be determined from time to time by Nasdaq Rules, the Commission, and the federal securities laws of the United States, and it operates under a written charter adopted by the Board. The composition of the Audit Committee, the attributes of its members and the responsibilities of the committee, as reflected in its charter, are intended to be in accordance with applicable requirements for corporate audit committees. The Audit Committee reviews and assesses the adequacy of its charter on an annual basis.

As described more fully in its charter, the purpose of the Audit Committee is to assist the Board in its general oversight of the Company’s financial reporting, internal control and audit functions. The Company’s management is responsible for the preparation, presentation and integrity of the Company’s financial statements, accounting and financial reporting principles, internal controls and procedures designed to ensure compliance with accounting standards, applicable laws and regulations. BDO Seidman, LLP (“BDO”) the Company’s independent registered public accounting firm, is responsible for performing an independent audit of the consolidated financial statements in accordance with auditing standards generally accepted in the United States of America. The Audit Committee has ultimate authority and responsibility to select, evaluate, determine compensation for, and when appropriate, replace the Company’s independent auditor.

The Audit Committee members are not professional accountants or auditors, and their functions are not intended to duplicate or to certify the activities of management and the independent auditor. The Audit Committee serves a board-level oversight role, in which it provides advice, counsel and direction to management and the auditors on the basis of the information it receives, discussions with management and the auditors and the experience of the Audit Committee’s members in business, financial and accounting matters.

The Audit Committee has reviewed and discussed the consolidated financial statements with management and the independent auditors. Management represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States of America, and the independent auditor represented that its presentations included the matters required to be discussed in accordance with Statement on Auditing Standards (“SAS”) No. 61, “Communication with Audit Committees” as amended by SAS No. 90, “Audit Committee Communications.”

The Company’s independent auditor also provided the Audit Committee with the written disclosures required by Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees,” and the Audit Committee discussed with the independent auditor that firm’s independence.

Following the Audit Committee’s discussions with management and the independent auditor, the Audit Committee recommended that the Company’s Board include the audited consolidated financial statements in the Company’s annual report on Form 10-K for the year ended December 31, 2004.

|

AUDIT COMMITTEE OF THE BOARD OF DIRECTORS |

|

| |

Orhan Sadik-Khan, Chairman Michael Dornemann Frederick Thorne |

13

INDEPENDENT PUBLIC ACCOUNTANTS

The Audit Committee of the Company has selected BDO Seidman, LLP (“BDO”) to serve as the independent accountants for the Company for the year ended December 31, 2005. Representatives from BDO are expected to be present at the annual meeting and will have the opportunity to make a statement if they desire, and will be available to answer appropriate questions.

AUDIT FEES

The following table presents the aggregate fees billed to us by BDO for the audit of the Company’s annual financial statements for the fiscal years ended December 31, 2004 and 2003 and other services provided during those periods:

| | | | | | |

| | | BDO

|

Services Provided

| | Dec. 31, 2004(1)

| | Dec. 31, 2003(1)

|

Audit Fees | | $ | 157,500 | | $ | 144,050 |

Audit-Related Fees | | | 12,380 | | | — |

Tax Fees | | | — | | | — |

All Other Fees | | | — | | | 26,500 |

| (1) | $54,050 of the $144,050 Audit Fees for year ended December 31, 2003 were billed by PricewaterhouseCoopers, LLP, who was replaced by BDO during the year. Fees for audit services are fees associated with the audit of the Company’s annual financial statements (Form 10-K) and review of our quarterly financial statements (Form 10-Q) during and for the years ended December 31, 2004 and 2003. The $26,500 in All Other Fees for the year ended December 31, 2003 was rendered in connection with a review of the Company’s 401(k) plan. The $12,380 in Audit-Related Fees for the year ended December 31, 2004 was $7,880 and $4,500 from BDO and PwC respectively, for review of the Company’s Form S-3 filed with the Commission in August 2004. |

As previously reported in the Current Report on Form 8-K, filed with the Commission on December 12, 2003, PricewaterhouseCoopers LLP (“PwC”), the Company’s independent accountants for the majority of fiscal year ended 2003, informed us December 5, 2003, they were resigning as the independent accountants of the Company.

In connection with PwC’s audits of the Company’s financial statements as of and for the years ended December 31, 2002 and 2001, and through December 5, 2003, there were no disagreements with PwC on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure. Had any disagreements occurred that were not resolved to the satisfaction of PwC, PwC would have made reference thereto in their report on the financial statements of the Company as of and for the years ended December 31, 2002 and 2001.

A letter from PwC dated December 11, 2003, to the Securities and Exchange Commission regarding their resignation was attached as Exhibit 16 to the Company’s Form 8-K filed on December 12, 2003.

The PwC report dated March 14, 2003, which was previously included in the Annual Report on Form 10-K filed with the Commission on March 31, 2005, contained no adverse opinion or disclaimer of opinion and was not qualified or modified as to uncertainty, audit scope or accounting principle, except as to the eighth paragraph of Note 9, which is as of April 3, 2003, with respect to the Company’s financial statements as of December 31, 2002 and the year then ended, contained an explanatory paragraph which expressed substantial doubt regarding the Company’s ability to continue as a going concern.

On January 29, 2004, the Company, as approved by the Company’s Audit Committee, hired BDO as its independent auditor for the 2003 fiscal year. BDO succeeds PwC. During the Company’s years ended December 31, 2002 and 2003, and through January 29, 2004, the Company did not consult with BDO in respect to the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s consolidated financial statements, or any other matters or reportable events in Items 304(a)(2)(i) and (ii) of the Regulation S-K.

14

PRE-APPROVAL POLICIES & PROCEDURES

The Audit Committee pre-approves all fees to be paid to the independent public accountants in accordance with the Sarbanes-Oxley Act of 2002 and the rules and regulations promulgated in accordance therewith. Additionally, the Audit Committee has adopted a policy to pre-approve all audit and permissible non-audit services provided by the independent auditor. The Audit Committee will consider annually and, if appropriate, approve the scope of the audit services to be performed during the fiscal year as outlined in an engagement letter proposed by the independent auditor. For permissible non-audit services, the Audit Committee will approve in advance all services to be provided by the independent auditors in accordance with the Nasdaq Stock Rules, the Commission’s rules and regulations and the federal securities laws, and will determine the amount of compensation to be paid to the independent auditors for such auditing services. The Company will routinely inform the Audit Committee as to the extent of services provided by the independent auditor in accordance with this pre-approval policy and the fees incurred for the services performed to date.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act of 1934 requires the Company’s directors and executive officers, and persons who own more than ten percent of the Company’s Common Stock, to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in ownership of Common Stock. Officers, directors and greater than ten percent stockholders are required by Securities and Exchange Commission regulations to furnish the Company with copies of all Section 16(a) reports they file.

To the Company’s knowledge, based solely on a review of copies of such reports furnished and confirmations that no other reports were required during the year ended December 31, 2004, its directors, executive officers and greater than ten percent stockholders complied with all Section 16(a) filing requirements, except that through inadvertence, each of Liam Donohue and Shawkat Raslan filed a Form 5 after the filing deadline.

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

Agreements with Lee H. Edelstein

TLM Holdings Corp., a wholly-owned subsidiary of the Company (“TLM Holdings”), Lee H. Edelstein, who was President and Chief Executive Officer of the Company’s TMS Professional Markets Group (“TMS”) from March 2002 to December 31, 2003, and a director of the Company until May 28, 2004, and TeleManagement Services, Inc. (“TeleManagement”), which was then owned primarily by Mr. Edelstein, entered into an agreement dated January 1, 1997, as subsequently amended (the “TeleManagement Agreement”), whereby TLM Holdings purchased substantially all of the assets of TeleManagement. The purchase price for the assets was as follows: (i) $6,500,000 in cash, (ii) the issuance by TLM Holdings of a 6% subordinated promissory note (current interest rate is 10% due to a default under such note by TLM Holdings), in the principal amount of $1,300,000, which was subsequently assigned by TeleManagement to Mr. Edelstein, payable in the following manner: (i) all unpaid accrued interest is payable on January 15th of each year, commencing on January 15, 1998, until the note is paid in full, and (ii) the principal amount is payable in three equal installments of $433,334 on January 15, 1998, January 15, 1999 and on the date which is ten days following the date of the payment in full of all amounts owed by the Company to Bank of America, N.A. under the Company’s Credit Agreement with Bank of America, N.A.; and (iii) certain additional contingent payments of cash and common stock of TLM Holdings payable to Mr. Edelstein over a three-year period dependent upon the achievement of certain financial and operational goals. On June 23, 2003, a subordination agreement was entered into agreeing to extend the payment obligation of the Company and to subordinate Mr. Edelstein’s note to CapitalSource Finance LLC.

Mr. Edelstein entered into a consulting agreement, effective May 10, 1999, which has subsequently been amended twice, January 1, 2003 and January 1, 2004, with TLM Holdings (the “Edelstein Consulting Agreement”), to provide consulting services with respect to marketing and sales activities, and to support the executive management of TMS. The Edelstein Consulting Agreement provides among other things, (i) a term through December 31, 2005, (ii) the payment of $2,000 a month for the remainder of the term, and (iii) six (6%) percent commission on all Qualifying Sales as defined in the Edelstein Consulting Agreement throughout the remainder of the term, and (iv) the right of TLM Holdings to assign the Edelstein Consulting Agreement to the Company. Mr. Edelstein is also entitled to payment for his reasonable out-of-pocket expenses.

15

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of the Company’s Common Stock as of April 1, 2005, by: (1) each person known by the Company to be the beneficial owner of more than five percent (5%) of the outstanding shares of Common Stock (based on a review of filings with the Securities and Exchange Commission); (2) each Named Executive Officer; and (3) all of the Company’s current directors and executive officers as a group. Unless otherwise indicated, each shareholder has sole voting and investment power with respect to the indicated shares.

| | | | | | |

Name and Principal Position

| | Amount & Nature

of Beneficial

Ownership

(#)

| | | Percent of

Class

(%)

| |

Shawkat Raslan, Chairman, President and Chief Executive Officer | | 1,047,432 | (1) | | 9.47 | % |

| | |

Liam Donohue, Director | | 65,033 | (2) | | * | |

| | |

Michael Dornemann, Director | | 155,000 | | | 1.43 | % |

| | |

Orhan Sadik-Khan, Director | | 212,999 | (3) | | 1.96 | % |

| | |

Frederick Thorne, Director | | 93,333 | (4) | | * | |

| | |

Carl Tiedemann, Director | | 233,331 | (5) | | 2.15 | % |

| | |

Charles Henri Weil, Director | | 629,129 | (6) | | 5.76 | % |

| | |

Alfonso Yuchengco III, Director | | 192,900 | | | 1.78 | % |

| | |

Guy Amato, Senior Vice President and President & CEO, TMS Professional Markets Group | | 32,600 | (7) | | * | |

| | |

Georges André, Senior Vice President and President & CEO, TelAc Teleservices Group | | 92,969 | (8) | | * | |

| | |

J. Stedman Stevens, Senior Vice President and President & CEO, AM Medica Comm. Group | | 0 | | | * | |

| | |

Jared (Ted) Jordan, Senior Vice President & Chief Information Officer | | 53,326 | (9) | | * | |

| | |

Richard Lyew, Executive Vice President and Corporate Chief Financial Officer | | 25,746 | (10) | | * | |

| | |

All director and executive officers as a group (13 persons) | | 2,833,798 | | | 24.83 | % |

| | |

Ridfell Investments SA, Canelones 1090, Montevideo, Uruguay | | 994,500 | (11) | | 9.17 | % |

| | |

R&R Opportunity Fund L.P., 1250 Broadway, 14th Floor, New York, NY 10001 | | 691,033 | | | 6.37 | % |

| * | Indicates less than 1% percent. |

| (1) | Includes 181,250 shares and 33,000 shares of Common Stock issuable upon options and warrants presently exercisable, respectively. |

| (2) | Includes 56,333 shares and 5,000 shares of Common Stock issuable upon options and warrants presently exercisable, respectively. |

| (3) | Includes 17,999 shares of Common Stock issuable upon options presently exercisable. |

| (4) | Includes 8,333 shares and 50,000 shares of Common Stock issuable upon options and warrants presently exercisable, respectively. |

| (5) | Includes 23,331 shares of Common Stock issuable upon options presently exercisable. |

16

| (6) | Includes 27,999 shares and 50,000 shares of Common Stock issuable upon options and warrants presently exercisable, respectively. According to a Schedule 13-D, dated September 17, 1999, filed by Compania Financiera Tassarina, S.A. (“Compania”), Compania has sole voting power and no dispositive power over all 551,130 shares and Charles Henri Weil has no voting power and sole dispositive power over all 551,130 shares. |

| (7) | Includes 22,600 shares of Common Stock issuable upon options presently exercisable. |

| (8) | Includes 44,500 shares of Common Stock issuable upon options presently exercisable. |

| (9) | Includes 38,500 shares of Common Stock issuable upon options presently exercisable. |

| (10) | Includes 14,000 shares of Common Stock issuable upon options presently exercisable. |

| (11) | This ownership is listed per the April 1, 2005 report from the Company’s transfer agent (500,000 shares) and the Non-Objecting Beneficial Shareowner list (494,500 shares). To the best of the Company’s knowledge Ridfell has never filed any documents with the SEC. |

PROPOSAL TWO

RATIFICATION OF INDEPENDENT AUDITORS

The Board has selected BDO Seidman, LLP to serve as independent auditors for the Company for the fiscal year ending December 31, 2005. Such firm has examined the financial statements of the Company since year end 2003. Although it is not required to do so, the Board is submitting its selection of the Company’s auditors for ratification at the Meeting in order to ascertain the views of stockholders regarding such selection. If the selection is not ratified, the Board will reconsider its selection.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE COMPANY’S STOCKHOLDERS VOTE “FOR” RATIFICATION OF THE SELECTION OF BDO SEIDMAN LLP TO EXAMINE THE CONSOLIDATED FINANCIAL STATEMENTS OF THE COMPANY AND ITS SUBSIDIARIES FOR THE FISCAL YEAR ENDING DECEMBER 31, 2005.

It is the intention of the persons named in the accompanying form of proxy to vote the shares represented thereby in favor of such ratification unless otherwise instructed in such proxy.

A representative of BDO Seidman LLP will be present at the Meeting and will have the opportunity to make a statement if such representative desires to do so, and will be available to respond to appropriate questions.

OTHER MATTERS

The Board does not know of any other matters which may be brought forth at the Meeting. However, if any such other matters are properly presented for action, it is the intention of the persons named in the accompanying form of proxy to vote the shares represented thereby in accordance with their judgment on such matters.

SOLICITATION OF PROXY

The proxy accompanying this Proxy Statement is being solicited on behalf of the Company’s Board of Directors. Officers, directors and certain employees of the Company, none of whom will receive any additional compensation for their services, may solicit proxies. Such solicitations may be made personally, or by mail, facsimile, telephone, telegraph, messenger or via the Internet. The Company will pay all of the cost of solicitation of proxies. The Company also will pay persons holding shares of Common Stock in their names or in the name of nominees, but not owning such shares beneficially, such as brokerage houses, banks, and other fiduciaries, for the expense of forwarding solicitation materials to their principals.

17

STOCKHOLDER PROPOSALS AND NOMINATIONS

Any stockholder who wishes to present a proposal for action at the next annual meeting of stockholders, presently scheduled for May 2006, or wishes to nominate a director candidate for the Board, must submit such proposal or nomination in writing to the Corporate Secretary of Access Worldwide Communications, Inc., 4950 Communication Avenue, Suite 300, Boca Raton, Florida 33431. The proposal or nomination should comply with the time period and information requirements set forth in the by-laws relating to shareholder business or shareholder nominations, respectively. Shareholders interested in submitting a proposal for inclusion in the proxy statement for the 2006 annual meeting of shareholders may do so by following the procedures prescribed in SEC Rule 14a-8. To be eligible for inclusion, the Corporate Secretary at the above address must receive shareholder proposals no later than January 28, 2006.

STOCKHOLDER COMMUNICATION WITH BOARD OF DIRECTORS

Any stockholder who wishes to communicate with the Board, a committee of the Board, the non-management directors as a group or any member of the Board, may send correspondence to the Corporate Secretary of Access Worldwide Communications, Inc., 4950 Communication Avenue, Suite 300, Boca Raton, Florida 33431. The Corporate Secretary will compile and submit on a periodic basis all stockholder correspondence to the entire Board, or if and when designated in the communication, to a committee of the Board, the non-management directors as a group or an individual member. The independent members of the Board have approved this process.

DELIVERY OF DOCUMENTS TO

SECURITY HOLDERS SHARING AN ADDRESS

If instructed by shareholders, only one proxy statement is being delivered to multiple security holders sharing an address. The Company shall deliver promptly upon written or oral request a separate copy of the information statement to a security holder at a shared address to which a single copy of the documents was delivered. A security holder can notify the Company that the security holder wishes to receive a separate copy of the information statement by sending a written request to Access Worldwide Communications, Inc., Attn: Investor Relations, 4950 Communication Avenue, Suite 300, Boca Raton, Florida 33431 or by calling the Company at 571-438-6140 and requesting a copy of the proxy statement. A security holder may utilize the same address and telephone number to request either separate copies or a single copy for a single address for all future proxy statements and annual reports. A copy of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2004 is being provided to each stockholder simultaneously with delivery of this Proxy Statement. Additional copies of the Company’s Annual Report on Form 10-K, filed with the Securities and Exchange Commission, may be obtained by writing Access Worldwide Communications, Inc., Attn: Investor Relations, 4950 Communication Avenue, Suite 300, Boca Raton, Florida 33431 or by calling the Company at 571-438-6140.

18

Appendix A

ACCESS WORLDWIDE COMMUNICATIONS, INC.

NOMINATING COMMITTEE CHARTER

September 14, 2004

Organization

There shall be a committee of the Board of Directors of Access Worldwide Communications, Inc. (the “Corporation”) to be known as the Nominating Committee. The Nominating Committee shall be composed of at least three directors who are “independent” in accordance with The Nasdaq Stock Market Marketplace Rules for determining the independence of directors (subject to any Nasdaq exceptions), and otherwise meet The Nasdaq Stock Market Marketplace Rules requirements for the membership of the Nominating Committee. The Nominating Committee members shall be free of any relationship that, in the opinion of the Board of Directors, would interfere with their exercise of independent judgment as a Nominating Committee member.

Statement of Purpose

The purpose of the Nominating Committee shall be to solicit, consider, recommend and nominate candidates to serve on the Board of Directors of the Corporation under criteria adopted by it from time to time.

Responsibilities of Nominating Committee

| 1) | Establish an agenda for the ensuing year. Hold such regular meetings as may be necessary and such special meetings as may be called by the Chairman of the Nominating Committee or at the request of the Board of Directors. |

| 2) | Review the powers and duties of the Nominating Committee and report and make recommendations to the Board of Directors on these responsibilities. |

| 3) | Periodically review, at least once a year, whether any steps should be taken to improve the effectiveness of the Nominating Committee and/or the Board of Directors. Review and consider, among other things, the following: |

| | a) | the composition and experience base of the members of the Nominating Committee; |

| | b) | whether the size of the Board of Directors should be expanded or contracted; and |

| | c) | what types of experience, areas of expertise or other skills should be added to the Board of Directors. |

| 4) | In connection with the Nominating Committee’s annual process of recommending to the Board of Directors a slate of directors for election or re-election, the Nominating Committee will consider and review the direct and indirect relationships of members of the Board of Directors with the Corporation or its management and assist the Board of Directors with its determination of independence of its members. |

| 5) | Solicit suggestions for director candidates from management, shareholders and other sources. Consider and accept nominations for candidates to serve as directors. In performing this |

A-1