Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File number: 811-08495

NATIONWIDE MUTUAL FUNDS

(Exact name of registrant as specified in charter)

1000 CONTINENTAL DRIVE, SUITE 400, KING OF PRUSSIA, PENNSYLVANIA 19406-2850

(Address of principal executive offices) (Zip code)

Eric E. Miller, Esq.

1000 Continental Drive

Suite 400

King of Prussia, Pennsylvania 19406-2850

(Name and address of agent for service)

Registrant’s telephone number, including area code: (610) 230-2839

Date of fiscal year end: June 30, 2013

Date of reporting period: July 1, 2012 through June 30, 2013

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than ten (10) days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 C.F.R. § 270.30e-1). The Commission may use the information provided on Form N-CSR in the Commission’s regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, D. C. 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Table of Contents

Item 1. Reports to Stockholders.

Include a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 C.F.R. § 270.30e-1).

Table of Contents

Nationwide Mutual Funds

AnnualReport

June 30, 2013

Equity Funds

Nationwide Global Equity Fund

Fixed-Income Funds

Nationwide High Yield Bond Fund

Table of Contents

Table of Contents

AnnualReport

June 30, 2013

| Contents | ||||

| 1 | Message to Shareholders | |||

| 5 | Summary of Market Environment | |||

| Equity Funds | ||||

| 6 | Nationwide Global Equity Fund | |||

| Fixed-Income Funds | ||||

| 21 | Nationwide High Yield Bond Fund | |||

| 40 | Notes to Financial Statements | |||

| 56 | Report of Independent Registered Public Accounting Firm | |||

| 57 | Supplemental Information | |||

| 58 | Management Information | |||

Commentary provided by Nationwide Fund Advisors, investment adviser to Nationwide Funds. All opinions and estimates included in this report constitute the Adviser’s judgment as of the date of this report and are subject to change without notice. Portfolio composition is accurate as of the date of this report and is subject to change at any time.

Statement Regarding Availability of Quarterly Portfolio Schedule.

The Nationwide Funds file complete schedules of portfolio holdings for each Fund with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q. Additionally, the Trust files a schedule of portfolio holdings monthly for the Nationwide Money Market Fund on Form N-MFP. Forms N-Q and Forms N-MFP are available on the Commission’s website at http://www.sec.gov. Forms N-Q and Forms N-MFP may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330. The Trust makes the information on Forms N-Q and Forms N-MFP available to shareholders on nationwide.com/mutualfunds or upon request without charge.

Statement Regarding Availability of Proxy Voting Record.

Information regarding how the Funds voted proxies relating to portfolio securities held during the most recent 12-month period ended June 30 is available without charge, upon request, by calling 800-848-0920, and on the Commission’s website at http://www.sec.gov.

|

Table of Contents

This page intentionally left blank

Table of Contents

June 30, 2013

Dear Shareholder,

Investing is like marriage. For the relationship to work, you must make an informed commitment and then honor it for better and for worse, through sickness and in health.

Today, most Americans understand that they are responsible for their own retirement and must make a commitment to prepare for the future. Yet, despite this awareness, many people still struggle with owning their financial futures. While hard at work to support their daily needs, they avoid making long-term plans. Their current obligations and a complex investment climate seem overwhelming, so they choose not to choose. Without a comprehensive long-term financial agenda, the future can be very uncertain.

As a Nationwide Mutual Funds shareholder, you can be confident that you and your financial advisor have selected a reliable partner to share your journey. We are dedicated to offering a solid diversified fund lineup, as well as innovative solutions, outcome-oriented products and the experience to guide your investments through market cycles.

Times have been difficult for investors. Healing from the economic downturn that began in 2008 is taking longer than we would like. Yet, while progress in the economy has been tepid, the stock market ended the reporting period on a tear, posting double-digit returns. Reflecting a broad-based view of economic recovery, the S&P 500® Index posted a return of 20.60% for the 12-month reporting period.

Headlines about the real and perceived potential effects of domestic and international political and economic challenges often cause investor unease and contribute to market volatility. During the past year, investors reacted to concerns about political and governmental issues such as the potential result of the U.S. presidential election, uncertainty about the looming fiscal cliff,

sequestration, costs related to the U.S. government health-care plan, the status of U.S. government debt and continued instability within the eurozone. Added to these were the human toll and the economic ramifications of Superstorm Sandy, the Sandy Hook Elementary School shootings and the Boston Marathon bombings; it is understandable why many investors remained skittish.

As we now know, the U.S. economy avoided falling off the fiscal cliff and has produced modestly encouraging economic indicators, including minor improvements in unemployment rates and the housing market. There are good reasons to be cautiously optimistic. Even at a slow pace, the more months with some good economic news and little or no bad news, the closer we will be to a sustainable recovery.

As we move forward, please keep in mind that periods of volatility and market downturns are a natural part of the economic cycle and should be expected. Long-term results are what matter most. We have more than 80 years of experience managing our customers’ assets through all types of markets.

We appreciate the commitment you have made to Nationwide Mutual Funds. We pride ourselves on keeping our promises and will continue to make your success our first priority.

Thank you.

Sincerely,

Michael S. Spangler

President & CEO

Nationwide Funds

1

Table of Contents

Important Disclosures

Investors should carefully consider a fund’s investment objectives, risks, fees, charges and expenses before investing any money. To obtain this and other information on Nationwide Funds, please call 1-800-848-0920 to request a summary prospectus and/or a prospectus, or download a summary prospectus and/or a prospectus at nationwide.com/mutualfunds. Please read it carefully before investing any money.

There is no assurance that the investment objective of any fund will be achieved.

This report and the holdings provided are for informational purposes only, do not constitute advice, and are not intended and should not be relied upon as an offer or recommendation with respect to the purchase or sale of any security. Portfolio composition is accurate as of the date of this report and is subject to change at any time and without notice. There is no assurance that any specific securities mentioned in this report will remain in the fund’s portfolio. A more recent listing of each fund’s portfolio holdings can be found on the Trust’s Internet site, nationwide.com/mutualfunds.

Investing in mutual funds involves risk, including the possible loss of principal.

The Funds’ Adviser or its employees may have a position in the securities named in this report.

Principal Risks

Nationwide Global Equity Fund — The Fund is subject to stock market risk. The Fund is subject to risks associated with investing in foreign securities. Funds that invest internationally involve risks not associated with investing solely in the United States, such as currency fluctuation, political risk, differences in accounting and limited availability of information, all of which are magnified in emerging markets. Funds that concentrate on specific countries may be subject to greater volatility than that of other mutual funds. The Fund is subject to risks associated with investing in preferred stock and stocks of smaller companies. The Fund also is subject to risks associated with investing in derivatives, including currency futures and forward foreign currency exchange contracts. Derivatives present default risks and may involve leverage, which can disproportionately increase losses and reduce opportunities for gains.

Nationwide High Yield Bond Fund — The Fund is subject to interest rate risk. The Fund is subject to credit and liquidity risks associated with the underlying bonds owned by the Fund. The Fund is subject to risks associated with investing in high-yield bonds and foreign securities. Funds that invest internationally involve risks not associated with investing solely in the United States, such as currency fluctuation, political risk, differences in accounting and limited availability of information, all of which are magnified in emerging markets. The Fund also is subject to prepayment and call risk, extension risk, and mortgage- and asset-backed securities risks to varying degrees. The Fund also is subject to risks associated with investing in derivatives, including currency futures and forward foreign currency exchange contracts. Derivatives present default risks and may involve leverage, which can disproportionately increase losses and reduce opportunities for gains.

The risks mentioned for each Fund above, as well as other risks, may be present during the time you hold shares of a Fund and may negatively affect the value of your investment.

Performance

PERFORMANCE SHOWN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS.

Performance shown is for Class A shares at NAV. Performance returns assume the reinvestment of all distributions. Returns for periods less than one year are not annualized. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. To obtain performance information current to the most recent month-end, which may be higher or lower than the performance shown, please call 1-800-848-0920 or go to nationwide.com/mutualfunds.

High double-digit returns are unusual and cannot be sustained.

Lipper Analytical Services, Inc. (Lipper) is an industry research firm whose rankings are based on total return performance and do not reflect the effect of sales charges. Each fund is ranked within a universe of funds similar in investment objective as determined by Lipper.

2

Table of Contents

Important Disclosures (Continued)

Market Indexes

Market index performance is provided by a third-party source Nationwide Funds Group deems to be reliable. Indexes are unmanaged and have been provided for comparison purposes only. No fees or expenses have been reflected. Individuals cannot invest directly in an index.

Barclays U.S. Aggregate Bond Index: An unmanaged, market value-weighted index of investment-grade, fixed-rate debt issues (including government, corporate, asset-backed, and mortgage-backed securities with maturities of one year or more) that is generally representative of the bond market as a whole.

Barclays U.S. Corporate High Yield 2% Issuer Cap Index: An unmanaged index that reflects the performance of fixed-rate, noninvestment-grade, U.S. dollar-denominated debt securities that are nonconvertible. The maximum exposure to any one issuer is limited to 2%, and the holdings must have at least one year to maturity, have a minimum of $150 million par value outstanding and be publicly issued with a maximum credit rating of Ba1 (including defaulted issues); gives a broad look at how high-yield (“junk”) bonds have performed.

BofA Merrill Lynch (BofAML) 1-10 Year US Corporate Index: An unmanaged index that is a subset of the BofA Merrill Lynch (BofAML) US Corporate Index; tracks the performance of all U.S. dollar-denominated, investment-grade, publicly issued debt securities with a remaining term to final maturity less than 10 years.

BofA Merrill Lynch (BofAML) 10+ Year US Corporate Index: An unmanaged index that is a subset of the BofA Merrill Lynch (BofAML) US Corporate Index; tracks the performance of all U.S. dollar-denominated, investment-grade, publicly issued debt securities with a remaining term to final maturity greater than or equal to 10 years.

BofA Merrill Lynch (BofAML) Mortgage Master Index: An unmanaged index that tracks the performance of U.S. dollar-denominated 30-year, 15-year and balloon pass-through mortgage securities having at least $150 million outstanding per generic production year.

BofA Merrill Lynch (BofAML) U.S. High Yield Cash Pay Constrained Index: An unmanaged, market-weighted index that measures the performance of U.S. dollar-denominated, below-investment-grade, fixed-rate, publicly issued, non-convertible, coupon-bearing

corporate debt with a remaining maturity of at least one year. Each issue represented must have an outstanding par value of at least $50 million, must be less than BBB/Baa3-rated but not in default, and is restricted to a maximum of 2% of the total index.

FTSE NAREIT® All Equity REITs Index: An unmanaged, free float-adjusted, market capitalization-weighted index of U.S. equity REITs; includes all tax-qualified REITs listed on the New York Stock Exchange (NYSE), the American Stock Exchange (AMEX) and the National Association of Securities Dealers Automated Quotations (NASDAQ) National Market that have more than 50% of their total assets in qualifying real estate assets other than mortgages secured by real property.

MSCI EAFE® Index: An unmanaged, free float-adjusted, market capitalization-weighted index that is designed to measure the performance of the stocks in developed markets outside the United States and Canada.

MSCI Emerging Markets® Index: An unmanaged, free float-adjusted, market capitalization-weighted index that is designed to measure the performance of the stocks in emerging-country markets.

MSCI World IndexSM Free: An unmanaged, free float-adjusted, market capitalization-weighted index that is designed to measure the performance of global developed-market equities. The “Free” suffix denotes an index with a somewhat different history but the same constituents and performance in relation to its counterpart index without the suffix.

Russell 2000® Total Return Index: An unmanaged index that measures the performance of the small-capitalization segment of the U.S. equity universe. The total return component indicates that all cash distributions, such as dividends, are reinvested in the index.

Russell Midcap® Total Return Index: An unmanaged index that measures the performance of the mid-capitalization segment of the U.S. equity universe. The total return component indicates that all cash distributions, such as dividends, are reinvested in the index.

S&P 500® Index: An unmanaged, market capitalization-weighted index of 500 stocks of leading large-cap U.S. companies in leading industries; gives a broad look at the U.S. equities market and those companies’ stock price performance.

3

Table of Contents

Important Disclosures (Continued)

Sales Charge and Fee Information

Nationwide Global Equity Fund

Class A shares have up to a 5.75% sales charge and a 0.25% 12b-1 fee. Total returns reflect a waiver of part of the Fund’s fees for certain periods since inception, without which returns would have been lower. Returns prior to the creation of Class A shares (11/19/12) are based on the performance of the Fund’s predecessor fund. Returns have been restated for sales charges but not for Class A shares’ fees. If these fees were reflected, performance would have been lower.

Nationwide High Yield Bond Fund

Class A shares have up to a 4.25% front-end sales charge and a 0.25% 12b-1 fee. Total returns reflect a waiver of part of the Fund’s fees for certain periods since inception, without which returns would have been lower. Returns prior to the creation of Class A shares (11/19/12) are based on the performance of the Fund’s predecessor fund. Returns have been restated for sales charges but not for Class A shares’ fees. If these fees were reflected, performance would have been lower.

About Nationwide Funds Group (NFG)

Commentary provided by NFG. Except where otherwise indicated, the views and opinions expressed herein are those of NFG as of the date noted, are subject to change at any time, and may not come to pass. Third-party information has been obtained from and is based on sources NFG deems to be reliable.

NFG comprises Nationwide Fund Advisors, Nationwide Fund Distributors LLC and Nationwide Fund Management LLC. Together they provide advisory, distribution and administration services, respectively, to Nationwide Funds.

Distributor

Nationwide Funds distributed by Nationwide Fund Distributors LLC (NFD), member FINRA, King of Prussia, Pa. NFD is not an affiliate of any subadviser discussed in this material.

Nationwide, the Nationwide framemark, Nationwide Funds, Nationwide Funds Group and On Your Side are service marks of Nationwide Mutual Insurance Company.

4

Table of Contents

June 30, 2013

In July 2012, the U.S. stock market gained slightly due to improvements in the domestic housing market and strong corporate earnings — with around 70% of the S&P 500® Index (S&P 500) beating analyst expectations. European Central Bank (ECB) President Mario Draghi and colleagues introduced an accommodative monetary policy called Outright Monetary Transactions, which allows the ECB to purchase unlimited bonds issued by the region’s most troubled governments. The domestic equity market finished the third quarter of 2012 strong, due mostly to a strong earnings season and positive jobs data, with the S&P 500 returning 6.35%.

In October 2012, the U.S. stock market declined, with the S&P 500 registering -1.85%. Superstorm Sandy had devastated a large portion of the East Coast and forced a weather-related shutdown of the U.S. markets. President Obama was re-elected in November for a second term, while Democrats retained control in the Senate and Republicans retained control of the House of Representatives. Immediately after the election, attention was once again focused on the so-called fiscal cliff. In December 2012, the expected effects of the fiscal cliff were mostly avoided, thanks to the permanent extension of the Bush-era tax cuts for many (but not all) taxpayers and a temporary postponement of the sequester. U.S. stock markets, as measured by the S&P 500, posted a positive return for December. Retail sales for the holiday season proved disappointing. The S&P 500 registered -0.38% for the fourth quarter of 2012.

The first quarter of 2013 saw Congress raise the payroll tax on earnings up to $113,700. The unemployment rate fell to 7.6%, which represented a four-year low, due to a combination of newly added jobs, but also evidence that unemployed workers were abandoning the job market. The island nation of Cyprus was close to financial collapse in the early part of the year, due to its banking system’s large exposure to Greek assets. During the first quarter of 2013, the S&P 500 returned 10.61%.

In the second quarter of 2013, U.S. equity markets posted positive returns but were dampened due to the Federal Open Market Committee’s (FOMC) June 19 policy meeting. In the meeting, the Federal Reserve outlined a potential plan for tapering the flow of assets in its quantitative easing program later this year and discontinuing it by mid-2014. This was mostly in line with expectations; however, the S&P 500 fell almost 4% on June 20 in reaction to this news. The news from the FOMC also sparked a sharp selloff in the fixed-income markets. In the eurozone, the economy posted its sixth

straight quarter of recession along with record high unemployment. As a result, the ECB cut interest rates by 25 basis points to 0.50%. The S&P 500 returned 2.91% for the quarter.

For the annual reporting period ended June 30, 2013, large-capitalization U.S. equities, as measured by the S&P 500, returned 20.60%. Mid-cap U.S. equities, as measured by the Russell Mid Cap Total Return Index, returned 25.41%, and small-cap U.S. equities, as measured by the Russell 2000® Total Return Index, returned 24.21%.

International stocks and emerging market stocks grew during the annual reporting period ended June 30, 2013. International stocks, as measured by the MSCI EAFE® Index, returned 18.62%. Emerging market stocks, as measured by the MSCI Emerging Markets® Index, returned 2.87%.

During the reporting period, the fixed-income markets were dominated by aggressive policy responses from central banks, slowing global growth and high unemployment. Unconventional monetary policy, both domestically and abroad, has sought to meet demand for money and encourage investors to shift into riskier assets in the hope that this activity will enable the private sector to grow. Interest rates remained at low levels, while large government deficits and future inflationary concerns remained an issue for investors. Investors began a bond selloff after the Fed indicated a tentative outline for tapering of its quantitative easing. The past 12 months have seen a mix of both risk-on and risk-off sentiment in the markets, and central bankers have battled volatility by adding liquidity. Strong overall performance of high-yield fixed-income securities and other riskier assets has indicated the effectiveness of central bank policy.

For the annual reporting period ended June 30, 2013, the U.S. bond market, as measured by the broad-based Barclays U.S. Aggregate Bond Index, registered -0.69%. On the corporate bond front, the Bank of America Merrill Lynch (BofAML) 1-10 Year U.S. Corporate Index returned 2.64%, while the BofAML 10+ Year U.S. Corporate Index registered -0.83% for the same time period. The high-yield market outperformed investment-grade bonds, with the Barclays U.S. Corporate High Yield 2% Issuer Cap Index returning 9.49% for the reporting period. Mortgage-related investments, as measured by the BofAML Mortgage Master Index, registered -1.15% for the same time period. The real estate market, as measured by the FTSE NAREIT® All Equity REITs Index, returned 10.21% for the reporting period.

5

Table of Contents

How did the Fund perform during the reporting period relative to its benchmark and its peer group?

For the annual period ended June 30, 2013, the Nationwide Global Equity Fund (Class A at NAV) returned 18.34% versus 18.58% for its benchmark, the MSCI World IndexSM Free. For broader comparison, the average return for the Fund’s closest Lipper peer category of Global Multi-Cap Core Funds (consisting of 132 funds as of June 30, 2013) was 17.33% for the same time period.

Which sectors and holdings/asset classes contributed the most to the Fund’s performance relative to its benchmark?

On a relative basis, when the Fund is compared with its benchmark, the MSCI World Index Free, during the reporting period the Fund’s top-performing sectors were materials, industrials and consumer staples, and its top-performing holdings were LyondellBassell Industries, Carrefour SA and Toyota Motor Corp.

During the reporting period, chemical company LyondellBassell benefited from increased demand and higher pricing for its key products, including ethylene. In addition, shares of Carrefour, a chain of French superstores (combination supermarket and department store), rose after the company implemented a strategic market repositioning, which led to better pricing and higher store sales. Toyota Motor also continued to grow, as vehicle sales in North America expanded along with consumer confidence. New model introductions for Toyota’s fuel-efficient vehicles were well received, sparking a greater rise in demand for Toyota versus that of most of its competitors.

Which sectors and holdings/asset classes detracted the most from the Fund’s performance relative to its benchmark?

The financials, health-care and consumer discretionary sectors detracted the most from the Fund’s performance relative to its benchmark for the reporting period. Fund holdings VeriFone Systems, Inc.; Petrominerales Ltd.; and Imperial Tobacco Group PLC were the greatest relative detractors from Fund performance.

VeriFone Systems missed earnings and revenue targets during the reporting period, as it did not successfully transition from a one-time sales business model to a service model. Shares of Petrominerales, a Latin American-focused oil and gas exploration and production company, fell as its production shrank along with weaker oil prices. Imperial Tobacco Group suffered from the adverse impact of new mandatory warning label requirements in certain markets, including Australia.

Did the Fund’s investments in derivatives negatively or positively affect the Fund’s performance relative to its benchmark?

The Fund held derivatives in the form of forward foreign currency exchange contracts during the reporting period. These contracts were selected on the basis of liquidity and trading efficiency. Holding them had a positive effect on the Fund’s relative performance.

Subadviser:

UBS Global Asset Management (Americas) Inc.

Portfolio Manager:

Nick Irish, ASIP

6

Table of Contents

| Fund Performance | Nationwide Global Equity Fund |

Average Annual Total Return

(For periods ended June 30, 2013)

| 1 Yr. | 5 Yr. | 10 Yr. | ||||||||||||

Class A1 | w/o SC2 | 18.34% | 3.00% | 6.11% | ||||||||||

w/SC3 | 11.86% | 1.84% | 5.51% | |||||||||||

Class C1 | w/o SC2 | 17.79% | 2.28% | 5.35% | ||||||||||

w/SC4 | 16.79% | 2.28% | 5.35% | |||||||||||

Institutional Service Class5,6 | 12.76% | – | – | |||||||||||

Institutional Class1,5,7 | 18.74% | 3.36% | 6.45% | |||||||||||

All figures showing the effect of a sales charge (SC) reflect the maximum charge possible, because it has the most significant effect on performance data.

| 1 | Total returns prior to the Fund’s inception on November 19, 2012 are based on the performance of the Fund’s predecessor fund. |

| 2 | These returns do not reflect the effects of SC. |

| 3 | A 5.75% front-end sales charge was deducted. |

| 4 | A 1.00% contingent deferred sales charge was deducted from the one year return because it is charged when you sell Class C shares within the first year after purchase. |

| 5 | Not subject to any SCs. |

| 6 | Since inception date of November 21, 2012. |

| 7 | Effective November 19, 2012, Class Y Shares were renamed Institutional Class Shares. |

Expense Ratios

| Gross Ratio* | Expense Ratio* | |||||||

Class A | 1.41 | % | 1.30 | % | ||||

Class C | 2.06 | % | 1.95 | % | ||||

Institutional Service Class | 1.31 | % | 1.20 | % | ||||

Institutional Class | 1.06 | % | 0.95 | % | ||||

| * | Current effective prospectus dated November 19, 2012. The difference between gross and net operating expenses reflects contractual waivers in place through February 28, 2014. Please see the Fund’s most recent prospectus for details. |

7

Table of Contents

Fund Performance (Continued) | ||

Performance of a $10,000 Investment

Investment return and principal value will fluctuate, and when redeemed, shares may be worth more or less than original cost. Past performance is no guarantee of future results and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investing in mutual funds involves market risk, including loss of principal. Performance returns assume the reinvestment of all distributions.

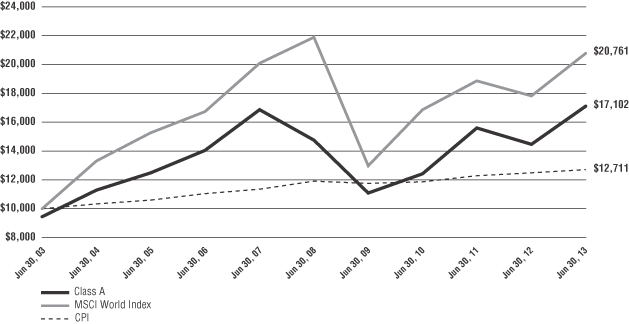

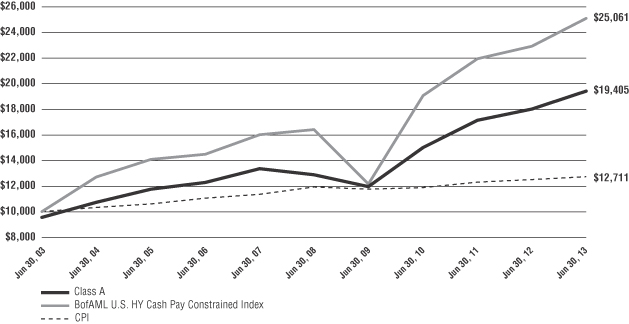

Comparative performance of $10,000 invested in Class A shares of the Nationwide Global Equity Fund versus the MSCI World Index SM Free(a) and the Consumer Price Index (CPI)(b) over the 10-year period ended 6/30/13. Performance prior to the Fund’s inception on 11/19/12 is based on the Fund’s predecessor fund. Unlike the Fund, the performance for these unmanaged indexes does not reflect any fees, expenses, or sales charges. One cannot invest directly in a market index.

| (a) | The MSCI World IndexSM Free is an unmanaged, free float-adjusted, market capitalization-weighted index that is designed to measure the performance of global developed-market equities. The “Free” suffix denotes an index with a somewhat different history but the same constituents and performance in relation to its counterpart index without the suffix. |

| (b) | Calculated by the U.S. Department of Labor’s Bureau of Labor Statistics, the CPI represents changes in prices of a basket of goods and services purchased for consumption by urban households. |

8

Table of Contents

Shareholder Expense Example | Nationwide Global Equity Fund |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) paid on purchase payments and redemption fees; and (2) ongoing costs, including investment advisory fees, administration fees, distribution fees and other Fund expenses. The examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. Per Securities and Exchange Commission (“SEC”) requirements, the examples assume that you had a $1,000 investment in the Class at the beginning of the reporting period (January 1, 2013) and continued to hold your shares at the end of the reporting period (June 30, 2013).

Actual Expenses

For each Class of the Fund in the table below, the first line provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid from January 1, 2013 through June 30, 2013. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line of each Class under the heading entitled

“Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Expenses for Comparison Purposes

The second line of each Class in the table below provides information about hypothetical account values and hypothetical expenses based on the Class’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period from January 1, 2013 through June 30, 2013. You may use this information to compare the ongoing costs of investing in the Class of the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges (loads) or redemption fees. If these transaction costs were included, your costs would have been higher. Therefore, the second line for each Class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. The examples also assume all dividends and distributions have been reinvested.

Schedule of Shareholder Expenses

Expense Analysis of a $1,000 Investment

June 30, 2013

| Nationwide Global Equity Fund | Beginning Account Value ($) 01/01/13 | Ending Account Value ($) 06/30/13 | Expenses Paid During Period ($) 01/01/13 -06/30/13a | Expense Ratio During Period (%) 01/01/13 - 06/30/13a | ||||||||||||||||

Class A Shares | Actual | 1,000.00 | 1,067.50 | 6.15 | 1.20 | |||||||||||||||

| Hypotheticalb | 1,000.00 | 1,018.84 | 6.01 | 1.20 | ||||||||||||||||

Class C Shares | Actual | 1,000.00 | 1,063.80 | 9.98 | 1.95 | |||||||||||||||

| Hypotheticalb | 1,000.00 | 1,015.12 | 9.74 | 1.95 | ||||||||||||||||

Institutional Service Class Shares | Actual | 1,000.00 | 1,069.00 | 5.18 | 1.01 | |||||||||||||||

| Hypotheticalb | 1,000.00 | 1,019.79 | 5.06 | 1.01 | ||||||||||||||||

Institutional Class Shares | Actual | 1,000.00 | 1,069.80 | 4.88 | 0.95 | |||||||||||||||

| Hypotheticalb | 1,000.00 | 1,020.08 | 4.76 | 0.95 | ||||||||||||||||

| a | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value from January 1, 2013 through June 30, 2013 multiplied to reflect one-half year period. The expense ratio presented represents a six-month, annualized ratio in accordance with Securities and Exchange Commission guidelines. |

| b | Represents the hypothetical 5% return before expenses. |

9

Table of Contents

Portfolio Summary

June 30, 2013 | Nationwide Global Equity Fund |

| Asset Allocation † | ||||

Common Stocks | 98.3 | % | ||

Mutual Fund | 1.3 | % | ||

Other assets in excess of liabilities | 0.4 | % | ||

|

| |||

| 100.0 | % | |||

| Top Industries †† | ||||

Commercial Banks | 10.2 | % | ||

Oil, Gas & Consumable Fuels | 8.2 | % | ||

Insurance | 5.8 | % | ||

Software | 4.4 | % | ||

Machinery | 4.2 | % | ||

Pharmaceuticals | 4.1 | % | ||

Food Products | 3.3 | % | ||

Internet Software & Services | 3.2 | % | ||

Diversified Financial Services | 3.1 | % | ||

Household Products | 3.0 | % | ||

Other Industries | 50.5 | % | ||

|

| |||

| 100.0 | % | |||

| Top Holdings †† | ||||

Google, Inc., Class A | 2.6 | % | ||

Toyota Motor Corp. | 2.1 | % | ||

BP PLC | 1.9 | % | ||

Thermo Fisher Scientific, Inc. | 1.8 | % | ||

HSBC Holdings PLC | 1.8 | % | ||

Microsoft Corp. | 1.8 | % | ||

Nestle SA | 1.7 | % | ||

Wells Fargo & Co. | 1.7 | % | ||

Procter & Gamble Co. (The) | 1.7 | % | ||

UnitedHealth Group, Inc. | 1.7 | % | ||

Other Holdings | 81.2 | % | ||

|

| |||

| 100.0 | % | |||

| Top Countries †† | ||||

United States | 36.5 | % | ||

Japan | 12.4 | % | ||

United Kingdom | 10.8 | % | ||

Switzerland | 5.3 | % | ||

Canada | 4.6 | % | ||

Netherlands | 3.8 | % | ||

Ireland | 3.1 | % | ||

Germany | 2.9 | % | ||

France | 2.7 | % | ||

China | 2.6 | % | ||

Other Countries | 15.3 | % | ||

|

| |||

| 100.0 | % | |||

| † | Percentages indicated are based upon net assets as of June 30, 2013. |

| †† | Percentages indicated are based upon total investments as of June 30, 2013. |

The accompanying notes are an integral part of these financial statements.

10

Table of Contents

Statement of Investments

June 30, 2013

Nationwide Global Equity Fund

| Common Stocks 98.3% | ||||||||||

| Shares | Market Value | |||||||||

| ||||||||||

AUSTRALIA 0.7% |

| |||||||||

Real Estate Investment Trusts (REITs) 0.7% |

| |||||||||

Westfield Group | 58,060 | $ | 608,099 | |||||||

|

| |||||||||

| ||||||||||

AUSTRIA 0.6% | ||||||||||

Real Estate Management & Development 0.6% |

| |||||||||

Immofinanz AG* | 131,663 | 491,299 | ||||||||

|

| |||||||||

| ||||||||||

BRAZIL 1.6% | ||||||||||

Information Technology Services 0.7% |

| |||||||||

Cielo SA | 24,480 | 613,714 | ||||||||

|

| |||||||||

Insurance 0.9% | ||||||||||

BB Seguridade Participacoes SA* | 98,322 | 772,881 | ||||||||

|

| |||||||||

| 1,386,595 | ||||||||||

|

| |||||||||

| ||||||||||

CANADA 4.5% | ||||||||||

Airlines 1.0% | ||||||||||

Westjet Airlines Ltd. | 40,400 | 865,083 | ||||||||

|

| |||||||||

Oil, Gas & Consumable Fuels 3.5% | ||||||||||

Canadian Oil Sands Ltd. | 30,500 | 564,643 | ||||||||

Gran Tierra Energy, Inc.* | 93,500 | 570,762 | ||||||||

Lightstream Resources Ltd. | 58,017 | 433,045 | ||||||||

Petrobank Energy & Resources Ltd.* | 54,400 | 24,828 | ||||||||

Petrominerales Ltd. | 46,500 | 265,285 | ||||||||

Shamaran Petroleum Corp.* | 985,000 | 337,168 | ||||||||

Suncor Energy, Inc. | 27,600 | 813,540 | ||||||||

|

| |||||||||

| 3,009,271 | ||||||||||

|

| |||||||||

| 3,874,354 | ||||||||||

|

| |||||||||

| ||||||||||

CHINA 2.6% | ||||||||||

Commercial Banks 1.6% | ||||||||||

China Construction Bank Corp., H Shares | 1,942,450 | 1,364,996 | ||||||||

|

| |||||||||

Electronic Equipment, Instruments & Components 1.0% |

| |||||||||

Hollysys Automation Technologies Ltd.* | 67,800 | 841,398 | ||||||||

|

| |||||||||

| 2,206,394 | ||||||||||

|

| |||||||||

| ||||||||||

FRANCE 2.7% |

| |||||||||

Electrical Equipment 1.1% |

| |||||||||

Schneider Electric SA | 13,124 | 953,153 | ||||||||

|

| |||||||||

Food & Staples Retailing 1.6% |

| |||||||||

Carrefour SA | 48,757 | 1,339,193 | ||||||||

|

| |||||||||

| 2,292,346 | ||||||||||

|

| |||||||||

| ||||||||||

GERMANY 2.9% |

| |||||||||

Multi-Utilities 0.7% |

| |||||||||

E.ON SE | 34,494 | 565,311 | ||||||||

|

| |||||||||

Pharmaceuticals 1.1% |

| |||||||||

Bayer AG REG | 9,228 | 982,510 | ||||||||

|

| |||||||||

Semiconductors & Semiconductor Equipment 1.1% |

| |||||||||

Infineon Technologies AG | 113,948 | 953,850 | ||||||||

|

| |||||||||

| 2,501,671 | ||||||||||

|

| |||||||||

|

|

|

|

| ||||||

| Common Stocks (continued) | ||||||||||

| Shares | Market Value | |||||||||

| ||||||||||

HONG KONG 2.4% |

| |||||||||

Insurance 1.5% |

| |||||||||

AIA Group Ltd. | 312,855 | $ | 1,318,058 | |||||||

|

| |||||||||

Wireless Telecommunication Services 0.9% |

| |||||||||

China Mobile Ltd. | 71,000 | 735,337 | ||||||||

|

| |||||||||

| 2,053,395 | ||||||||||

|

| |||||||||

| ||||||||||

INDONESIA 1.0% |

| |||||||||

Commercial Banks 1.0% |

| |||||||||

Bank Rakyat Indonesia Persero Tbk PT | 1,055,000 | 819,102 | ||||||||

|

| |||||||||

| ||||||||||

IRELAND 3.1% |

| |||||||||

Health Care Equipment & Supplies 0.9% |

| |||||||||

Covidien PLC | 12,604 | 792,035 | ||||||||

|

| |||||||||

Information Technology Services 0.9% |

| |||||||||

Accenture PLC, Class A | 10,500 | 755,580 | ||||||||

|

| |||||||||

Machinery 1.3% |

| |||||||||

Ingersoll-Rand PLC | 19,300 | 1,071,536 | ||||||||

|

| |||||||||

| 2,619,151 | ||||||||||

|

| |||||||||

| ||||||||||

ITALY 1.2% |

| |||||||||

Machinery 1.2% |

| |||||||||

Fiat Industrial SpA | 91,056 | 1,013,624 | ||||||||

|

| |||||||||

| ||||||||||

JAPAN 12.3% |

| |||||||||

Airlines 1.1% |

| |||||||||

Japan Airlines Co., Ltd. | 17,500 | 900,912 | ||||||||

|

| |||||||||

Auto Components 1.3% |

| |||||||||

Bridgestone Corp. | 32,000 | 1,091,207 | ||||||||

|

| |||||||||

Automobiles 2.1% |

| |||||||||

Toyota Motor Corp. | 30,500 | 1,839,695 | ||||||||

|

| |||||||||

Commercial Banks 1.4% |

| |||||||||

Mitsubishi UFJ Financial Group, Inc. | 191,400 | 1,182,061 | ||||||||

|

| |||||||||

Diversified Consumer Services 0.7% |

| |||||||||

Benesse Holdings, Inc. | 17,600 | 634,954 | ||||||||

|

| |||||||||

Diversified Financial Services 1.4% |

| |||||||||

ORIX Corp. | 91,300 | 1,245,946 | ||||||||

|

| |||||||||

Leisure Equipment & Products 0.9% |

| |||||||||

Sankyo Co., Ltd. | 15,400 | 727,703 | ||||||||

|

| |||||||||

Machinery 0.9% |

| |||||||||

THK Co., Ltd. | 36,800 | 772,175 | ||||||||

|

| |||||||||

Personal Products 1.3% |

| |||||||||

Shiseido Co., Ltd. | 73,200 | 1,089,130 | ||||||||

|

| |||||||||

Trading Companies & Distributors 1.2% |

| |||||||||

ITOCHU Corp. | 90,000 | 1,040,751 | ||||||||

|

| |||||||||

| 10,524,534 | ||||||||||

|

| |||||||||

| ||||||||||

NETHERLANDS 3.8% |

| |||||||||

Beverages 1.1% |

| |||||||||

Heineken NV | 14,840 | 944,590 | ||||||||

|

| |||||||||

11

Table of Contents

Statement of Investments (Continued)

June 30, 2013

Nationwide Global Equity Fund (Continued)

| Common Stocks (continued) | ||||||||||

| Shares | Market Value | |||||||||

|

|

|

|

| ||||||

NETHERLANDS (continued) |

| |||||||||

Chemicals 2.7% |

| |||||||||

Koninklijke DSM NV | 16,565 | $ | 1,079,929 | |||||||

LyondellBasell Industries NV, Class A | 18,325 | 1,214,214 | ||||||||

|

| |||||||||

| 2,294,143 | ||||||||||

|

| |||||||||

| 3,238,733 | ||||||||||

|

| |||||||||

| ||||||||||

NORWAY 1.2% |

| |||||||||

Diversified Telecommunication Services 1.2% |

| |||||||||

Telenor ASA | 51,317 | 1,019,310 | ||||||||

|

| |||||||||

| ||||||||||

RUSSIA 0.7% |

| |||||||||

Commercial Banks 0.7% |

| |||||||||

Sberbank of Russia(a) | 209,991 | 598,728 | ||||||||

|

| |||||||||

| ||||||||||

SOUTH AFRICA 1.3% |

| |||||||||

Media 1.3% |

| |||||||||

Naspers Ltd., Class N | 15,362 | 1,133,895 | ||||||||

|

| |||||||||

| ||||||||||

SOUTH KOREA 1.1% |

| |||||||||

Semiconductors & Semiconductor Equipment 1.1% |

| |||||||||

Samsung Electronics Co., Ltd. | 827 | 966,618 | ||||||||

|

| |||||||||

| ||||||||||

SPAIN 1.1% |

| |||||||||

Construction & Engineering 1.1% |

| |||||||||

Obrascon Huarte Lain SA | 26,998 | 917,377 | ||||||||

|

| |||||||||

| ||||||||||

SWEDEN 0.6% |

| |||||||||

Oil, Gas & Consumable Fuels 0.6% |

| |||||||||

Lundin Petroleum AB* | 25,636 | 507,046 | ||||||||

|

| |||||||||

| ||||||||||

SWITZERLAND 5.2% |

| |||||||||

Capital Markets 1.1% |

| |||||||||

Credit Suisse Group AG REG* | 35,821 | 948,328 | ||||||||

|

| |||||||||

Food Products 1.6% |

| |||||||||

Nestle SA REG | 21,186 | 1,390,235 | ||||||||

|

| |||||||||

Metals & Mining 0.9% |

| |||||||||

Glencore Xstrata PLC | 188,361 | 779,717 | ||||||||

|

| |||||||||

Pharmaceuticals 1.6% |

| |||||||||

Novartis AG REG | 19,218 | 1,361,221 | ||||||||

|

| |||||||||

| 4,479,501 | ||||||||||

|

| |||||||||

| ||||||||||

TAIWAN 1.0% |

| |||||||||

Electronic Equipment, Instruments & Components 1.0% |

| |||||||||

Hon Hai Precision Industry Co., Ltd. | 358,326 | 875,760 | ||||||||

|

| |||||||||

| ||||||||||

THAILAND 0.8% |

| |||||||||

Commercial Banks 0.8% |

| |||||||||

Kasikornbank PCL | 107,200 | 672,033 | ||||||||

|

| |||||||||

| ||||||||||

UNITED KINGDOM 10.8% |

| |||||||||

Beverages 1.1% |

| |||||||||

SABMiller PLC | 19,668 | 942,950 | ||||||||

|

| |||||||||

Capital Markets 1.1% |

| |||||||||

Aberdeen Asset Management PLC | 156,633 | 911,548 | ||||||||

|

| |||||||||

| Common Stocks (continued) | ||||||||||

| Shares | Market Value | |||||||||

| ||||||||||

UNITED KINGDOM (continued) |

| |||||||||

Commercial Banks 1.8% |

| |||||||||

HSBC Holdings PLC | 152,851 | $ | 1,582,337 | |||||||

|

| |||||||||

Insurance 0.8% |

| |||||||||

Direct Line Insurance Group PLC | 186,015 | 660,968 | ||||||||

|

| |||||||||

Metals & Mining 0.9% |

| |||||||||

Rio Tinto PLC | 19,139 | 778,363 | ||||||||

|

| |||||||||

Oil, Gas & Consumable Fuels 1.9% |

| |||||||||

BP PLC | 227,659 | 1,579,942 | ||||||||

|

| |||||||||

Real Estate Investment Trusts (REITs) 0.8% |

| |||||||||

Big Yellow Group PLC | 112,830 | 661,462 | ||||||||

|

| |||||||||

Tobacco 1.4% |

| |||||||||

Imperial Tobacco Group PLC | 34,467 | 1,195,130 | ||||||||

|

| |||||||||

Wireless Telecommunication Services 1.0% |

| |||||||||

Vodafone Group PLC | 301,539 | 864,114 | ||||||||

|

| |||||||||

| 9,176,814 | ||||||||||

|

| |||||||||

| ||||||||||

UNITED STATES 35.1% |

| |||||||||

Biotechnology 0.9% |

| |||||||||

Celgene Corp.* | 6,400 | 748,224 | ||||||||

|

| |||||||||

Building Products 1.3% |

| |||||||||

Owens Corning, Inc.* | 28,600 | 1,117,688 | ||||||||

|

| |||||||||

Commercial Banks 2.9% |

| |||||||||

PNC Financial Services Group, Inc. (The) | 14,300 | 1,042,756 | ||||||||

Wells Fargo & Co. | 33,700 | 1,390,799 | ||||||||

|

| |||||||||

| 2,433,555 | ||||||||||

|

| |||||||||

Commercial Services & Supplies 1.5% |

| |||||||||

Herman Miller, Inc. | 47,900 | 1,296,653 | ||||||||

|

| |||||||||

Diversified Financial Services 1.6% |

| |||||||||

JPMorgan Chase & Co. | 25,200 | 1,330,308 | ||||||||

|

| |||||||||

Food Products 1.6% |

| |||||||||

Hormel Foods Corp. | 34,900 | 1,346,442 | ||||||||

|

| |||||||||

Health Care Equipment & Supplies 1.0% |

| |||||||||

St. Jude Medical, Inc. | 18,800 | 857,844 | ||||||||

|

| |||||||||

Health Care Providers & Services 1.7% |

| |||||||||

UnitedHealth Group, Inc. | 22,100 | 1,447,108 | ||||||||

|

| |||||||||

Hotels, Restaurants & Leisure 1.1% |

| |||||||||

Royal Caribbean Cruises Ltd. | 27,900 | 930,186 | ||||||||

|

| |||||||||

Household Products 3.0% |

| |||||||||

Colgate-Palmolive Co. | 19,100 | 1,094,239 | ||||||||

Procter & Gamble Co. (The) | 18,800 | 1,447,412 | ||||||||

|

| |||||||||

| 2,541,651 | ||||||||||

|

| |||||||||

Information Technology Services 0.4% |

| |||||||||

VeriFone Systems, Inc.* | 20,100 | 337,881 | ||||||||

|

| |||||||||

Insurance 2.6% |

| |||||||||

Principal Financial Group, Inc. | 26,200 | 981,190 | ||||||||

Prudential Financial, Inc. | 16,400 | 1,197,692 | ||||||||

|

| |||||||||

| 2,178,882 | ||||||||||

|

| |||||||||

12

Table of Contents

Statement of Investments (Continued)

June 30, 2013

Nationwide Global Equity Fund (Continued)

| Common Stocks (continued) | ||||||||||

| Shares | Market Value | |||||||||

| ||||||||||

UNITED STATES (continued) |

| |||||||||

Internet Software & Services 3.1% |

| |||||||||

Facebook, Inc., Class A* | 22,091 | $ | 549,182 | |||||||

Google, Inc., Class A* | 2,460 | 2,165,710 | ||||||||

|

| |||||||||

| 2,714,892 | ||||||||||

|

| |||||||||

Life Sciences Tools & Services 1.8% |

| |||||||||

Thermo Fisher Scientific, Inc. | 18,200 | 1,540,266 | ||||||||

|

| |||||||||

Machinery 0.8% |

| |||||||||

Timken Co. | 11,800 | 664,104 | ||||||||

|

| |||||||||

Media 1.1% |

| |||||||||

Viacom, Inc., Class B | 13,500 | 918,675 | ||||||||

|

| |||||||||

Multi-Utilities 0.8% |

| |||||||||

MDU Resources Group, Inc. | 27,000 | 699,570 | ||||||||

|

| |||||||||

Oil, Gas & Consumable Fuels 2.1% |

| |||||||||

Hess Corp. | 14,300 | 950,807 | ||||||||

Occidental Petroleum Corp. | 9,600 | 856,608 | ||||||||

|

| |||||||||

| 1,807,415 | ||||||||||

|

| |||||||||

Pharmaceuticals 1.4% |

| |||||||||

AbbVie, Inc. | 29,000 | 1,198,860 | ||||||||

|

| |||||||||

Software 4.4% |

| |||||||||

Microsoft Corp. | 46,100 | 1,591,834 | ||||||||

Oracle Corp. | 36,100 | 1,108,992 | ||||||||

Symantec Corp. | 49,000 | 1,101,030 | ||||||||

|

| |||||||||

| 3,801,856 | ||||||||||

|

| |||||||||

| 29,912,060 | ||||||||||

|

| |||||||||

Total Common Stocks |

| 83,888,439 | ||||||||

|

| |||||||||

| Mutual Fund 1.3% | ||||||||||

Money Market Fund 1.3% |

| |||||||||

Fidelity Institutional Money Market Fund —Institutional Class, 0.12% (b) | 1,103,265 | 1,103,265 | ||||||||

|

| |||||||||

Total Mutual Fund |

| 1,103,265 | ||||||||

|

| |||||||||

Total Investments | 84,991,704 | |||||||||

Other assets in excess of liabilities — 0.4% |

| 362,352 | ||||||||

|

| |||||||||

NET ASSETS — 100.0% |

| $ | 85,354,056 | |||||||

|

| |||||||||

| * | Denotes a non-income producing security. |

| (a) | Fair Valued Security. |

| (b) | Represents 7-day effective yield as of June 30, 2013. |

| (c) | See notes to financial statements for tax unrealized appreciation/(depreciation) of securities. |

| AB | Stock Company |

| AG | Stock Corporation |

| ASA | Stock Corporation |

| Ltd. | Limited |

| NV | Public Traded Company |

| PCL | Public Company Limited |

| PLC | Public Limited Company |

| REG | Registered Shares |

| REIT | Real Estate Investment Trust |

| SA | Stock Company |

| SE | European Public Limited Liability Company |

| SpA | Limited Share Company |

| Tbk PT | State Owned Company |

13

Table of Contents

Statement of Investments (Continued)

June 30, 2013

Nationwide Global Equity Fund (Continued)

At June 30, 2013, the Fund’s open forward foreign currency contracts against the United States Dollar were as follows (Note 2):

| Currency | Counterparty | Delivery Date | Currency Delivered | Contract Value | Market Value | Unrealized Appreciation/ (Depreciation) | ||||||||||||||||

Short Contracts: | ||||||||||||||||||||||

| Brazilian Real | Credit Suisse International | 8/20/13 | (2,770,000 | ) | $ | (1,351,879 | ) | $ | (1,228,444 | ) | $ | 123,435 | ||||||||||

| British Pound | Goldman Sachs International | 8/20/13 | (2,035,000 | ) | (3,096,119 | ) | (3,094,075 | ) | 2,044 | |||||||||||||

| British Pound | Credit Suisse International | 8/20/13 | (240,000 | ) | (363,037 | ) | (364,903 | ) | (1,866 | ) | ||||||||||||

| Canadian Dollar | Goldman Sachs International | 8/20/13 | (2,400,000 | ) | (2,348,589 | ) | (2,279,249 | ) | 69,340 | |||||||||||||

| Chinese Yuan | Credit Suisse International | 8/20/13 | (14,465,000 | ) | (2,332,463 | ) | (2,346,887 | ) | (14,424 | ) | ||||||||||||

| Hong Kong Dollar | Morgan Stanley Co., Inc. | 8/20/13 | (1,795,000 | ) | (231,353 | ) | (231,477 | ) | (124 | ) | ||||||||||||

| Indian Rupee | Credit Suisse International | 8/20/13 | (95,350,000 | ) | (1,621,599 | ) | (1,590,258 | ) | 31,341 | |||||||||||||

| Indonesian Rupiah | Credit Suisse International | 8/20/13 | (8,177,600,000 | ) | (830,213 | ) | (819,191 | ) | 11,022 | |||||||||||||

| Japanese Yen | Credit Suisse International | 8/20/13 | (43,700,000 | ) | (439,560 | ) | (440,705 | ) | (1,145 | ) | ||||||||||||

| Japanese Yen | Credit Suisse International | 8/20/13 | (171,900,000 | ) | (1,676,349 | ) | (1,733,575 | ) | (57,226 | ) | ||||||||||||

| Korean Won | Credit Suisse International | 8/20/13 | (683,000,000 | ) | (607,651 | ) | (596,552 | ) | 11,099 | |||||||||||||

| Korean Won | Credit Suisse International | 8/20/13 | (481,000,000 | ) | (430,830 | ) | (420,119 | ) | 10,711 | |||||||||||||

| Norwegian Krone | Goldman Sachs International | 8/20/13 | (4,440,000 | ) | (756,441 | ) | (729,645 | ) | 26,796 | |||||||||||||

| South African Rand | Credit Suisse International | 8/20/13 | (8,370,000 | ) | (890,492 | ) | (840,525 | ) | 49,967 | |||||||||||||

| Swiss Franc | Goldman Sachs International | 8/20/13 | (1,545,000 | ) | (1,591,668 | ) | (1,636,427 | ) | (44,759 | ) | ||||||||||||

| Taiwan Dollar | Credit Suisse International | 8/20/13 | (25,900,000 | ) | (869,128 | ) | (864,554 | ) | 4,574 | |||||||||||||

| Thailand Baht | Credit Suisse International | 8/20/13 | (19,440,000 | ) | (650,777 | ) | (625,103 | ) | 25,674 | |||||||||||||

|

|

|

|

|

| |||||||||||||||||

| Total Short Contracts | $ | (20,088,148 | ) | $ | (19,841,689 | ) | $ | 246,459 | ||||||||||||||

|

|

|

|

|

| |||||||||||||||||

| Currency | Counterparty | Delivery Date | Currency Received | Contract Value | Market Value | Unrealized Appreciation/ (Depreciation) | ||||||||||||||||

Long Contracts: | ||||||||||||||||||||||

| Chinese Yuan | Credit Suisse International | 8/20/13 | 1,410,000 | $ | 228,027 | $ | 228,767 | $ | 740 | |||||||||||||

| Euro | Credit Suisse International | 8/20/13 | 645,000 | 858,715 | 839,745 | (18,970 | ) | |||||||||||||||

| Euro | Morgan Stanley Co., Inc. | 8/20/13 | 155,000 | 202,721 | 201,799 | (922 | ) | |||||||||||||||

| Euro | Morgan Stanley Co., Inc. | 8/20/13 | 835,000 | 1,076,388 | 1,087,112 | 10,724 | ||||||||||||||||

| Indian Rupee | Credit Suisse International | 8/20/13 | 95,350,000 | 1,711,849 | 1,590,257 | (121,592 | ) | |||||||||||||||

| Japanese Yen | Credit Suisse International | 8/20/13 | 53,000,000 | 549,479 | 534,494 | (14,985 | ) | |||||||||||||||

| Korean Won | Credit Suisse International | 8/20/13 | 108,000,000 | 95,372 | 94,330 | (1,042 | ) | |||||||||||||||

| Mexican Peso | Credit Suisse International | 8/20/13 | 10,770,000 | 876,180 | 827,414 | (48,766 | ) | |||||||||||||||

| Philippine Peso | Credit Suisse International | 8/20/13 | 33,550,000 | 815,607 | 776,072 | (39,535 | ) | |||||||||||||||

| Singapore Dollar | Goldman Sachs International | 8/20/13 | 780,000 | 625,980 | 615,437 | (10,543 | ) | |||||||||||||||

| Swedish Krona | Goldman Sachs International | 8/20/13 | 3,000,000 | 448,806 | 446,835 | (1,971 | ) | |||||||||||||||

|

|

|

|

|

| |||||||||||||||||

| Total Long Contracts | $ | 7,489,124 | $ | 7,242,262 | $ | (246,862 | ) | |||||||||||||||

|

|

|

|

|

| |||||||||||||||||

At June 30, 2013, the Fund’s open cross currency forward foreign currency contracts were as follows (Note 2):

| Counterparty | Delivery Date | Currency Received | Currency Delivered | Contract Value | Market Value | Unrealized Appreciation/ (Depreciation) | ||||||||||||||||

| Morgan Stanley Co., Inc. | 8/20/13 | 857,666 | Swiss Franc | (685,000) | Euro | $ | 891,822 | $ | 908,419 | $ | 16,597 | |||||||||||

|

|

|

|

|

| |||||||||||||||||

The accompanying notes are an integral part of these financial statements.

14

Table of Contents

Statement of Assets and Liabilities

June 30, 2013

| Nationwide Global Equity Fund | ||||||

Assets: | ||||||

Investments, at value (cost $75,794,174) | $ | 84,991,704 | ||||

Foreign currencies, at value (cost $103,712) | 103,403 | |||||

Dividends receivable | 195,629 | |||||

Receivable for investments sold | 87,668 | |||||

Receivable for capital shares issued | 21,243 | |||||

Reclaims receivable | 85,592 | |||||

Unrealized appreciation on forward foreign currency contracts (Note 2) | 394,064 | |||||

Prepaid expenses | 22,402 | |||||

|

| |||||

Total Assets | 85,901,705 | |||||

|

| |||||

Liabilities: | ||||||

Payable for investments purchased | 13,962 | |||||

Payable for capital shares redeemed | 24,175 | |||||

Cash overdraft (Note 2) | 13,968 | |||||

Unrealized depreciation on forward foreign currency contracts (Note 2) | 377,870 | |||||

Accrued expenses and other payables: | ||||||

Investment advisory fees | 14,749 | |||||

Fund administration fees | 9,567 | |||||

Distribution fees | 23,737 | |||||

Administrative servicing fees | 1,782 | |||||

Accounting and transfer agent fees | 25,785 | |||||

Custodian fees | 752 | |||||

Compliance program costs (Note 3) | 61 | |||||

Professional fees | 40,059 | |||||

Printing fees | 1,113 | |||||

Other | 69 | |||||

|

| |||||

Total Liabilities | 547,649 | |||||

|

| |||||

Net Assets | $ | 85,354,056 | ||||

|

| |||||

Represented by: | ||||||

Capital | $ | 101,424,787 | ||||

Accumulated undistributed net investment income | 1,261,113 | |||||

Accumulated net realized losses from investment, forward and foreign currency transactions | (26,545,293 | ) | ||||

Net unrealized appreciation/(depreciation) from investments | 9,197,530 | |||||

Net unrealized appreciation/(depreciation) from forward foreign currency contracts (Note 2) | 16,194 | |||||

Net unrealized appreciation/(depreciation) from translation of assets and liabilities denominated in foreign currencies | (275 | ) | ||||

|

| |||||

Net Assets | $ | 85,354,056 | ||||

|

| |||||

Net Assets: | ||||||

Class A Shares | $ | 50,709,673 | ||||

Class C Shares | 15,773,769 | |||||

Institutional Service Class Shares | 15,718 | |||||

Institutional Class Shares | 18,854,896 | |||||

|

| |||||

Total | $ | 85,354,056 | ||||

|

| |||||

15

Table of Contents

Statement of Assets and Liabilities (Continued)

June 30, 2013

| Nationwide Global Equity Fund | ||||||

Shares Outstanding (unlimited number of shares authorized): | ||||||

Class A Shares | 3,773,080 | |||||

Class C Shares | 1,228,943 | |||||

Institutional Service Class Shares | 1,140 | |||||

Institutional Class Shares | 1,366,792 | |||||

|

| |||||

Total | 6,369,955 | |||||

|

| |||||

Net asset value and redemption price per share (Net assets by class divided by shares outstanding by class, respectively): | ||||||

Class A Shares (a) | $ | 13.44 | ||||

Class C Shares (b) | $ | 12.84 | ||||

Institutional Service Class Shares | $ | 13.79 | ||||

Institutional Class Shares | $ | 13.80 | ||||

Maximum offering price per share (100%/(100%-maximum sales charge) of net asset value adjusted to the nearest cent): | ||||||

Class A Shares | $ | 14.26 | ||||

|

| |||||

Maximum Sales Charge: | ||||||

Class A Shares | 5.75 | % | ||||

|

| |||||

| (a) | For Class A Shares, the redemption price per share is reduced by 1.00% on sales of shares of original purchases of $1,000,000 or more or that were not subject to a front-end sales charge made within 18 months of the purchase date. |

| (b) | For Class C Shares, the redemption price per share is reduced by 1.00% for shares held less than one year. |

The accompanying notes are an integral part of these financial statements.

16

Table of Contents

Statement of Operations

For the Year Ended June 30, 2013

| Nationwide Global Equity Fund | ||||||

INVESTMENT INCOME: | ||||||

Dividend income | $ | 2,166,447 | ||||

Income from securities lending (Note 2) | 10,709 | |||||

Foreign tax withholding | (198,342 | ) | ||||

|

| |||||

Total Income | 1,978,814 | |||||

|

| |||||

EXPENSES: | ||||||

Investment advisory fees | 639,111 | |||||

Fund administration fees | 138,211 | |||||

Distribution fees Class A | 129,357 | |||||

Distribution fees Class C | 120,492 | |||||

Administrative servicing fees Class A | 5,030 | |||||

Administrative servicing fees Institutional Service Class (a) | 5 | |||||

Registration and filing fees | 50,936 | |||||

Professional fees | 89,329 | |||||

Printing fees | 38,069 | |||||

Trustee fees | 10,944 | |||||

Custodian fees | 29,019 | |||||

Accounting and transfer agent fees | 144,509 | |||||

Compliance program costs (Note 3) | 215 | |||||

Other | 9,940 | |||||

|

| |||||

Total expenses before earnings credit and expenses reimbursed | 1,405,167 | |||||

|

| |||||

Earnings credit (Note 5) | (19 | ) | ||||

Expenses reimbursed by adviser (Note 3) | (240,312 | ) | ||||

|

| |||||

Net Expenses | 1,164,836 | |||||

|

| |||||

NET INVESTMENT INCOME | 813,978 | |||||

|

| |||||

REALIZED/UNREALIZED GAINS (LOSSES) FROM INVESTMENTS: | ||||||

Net realized gains from investment transactions | 3,043,386 | |||||

Net realized gains from forward and foreign currency transactions (Note 2) | 732,528 | |||||

|

| |||||

Net realized gains from investment, forward and foreign currency transactions | 3,775,914 | |||||

|

| |||||

Net change in unrealized appreciation/(depreciation) from investments | 9,814,269 | |||||

Net change in unrealized appreciation/(depreciation) from forward foreign currency contracts (Note 2) | (65,086 | ) | ||||

Net change in unrealized appreciation/(depreciation) from translation of assets and liabilities denominated in foreign currencies | (35,308 | ) | ||||

|

| |||||

Net change in unrealized appreciation/(depreciation) from investments, forward foreign currency contracts, and translation of assets and liabilities denominated in foreign currencies | 9,713,875 | |||||

|

| |||||

Net realized/unrealized gains from investments, forward and foreign currency transactions, and translation of assets and liabilities denominated in foreign currencies | 13,489,789 | |||||

|

| |||||

CHANGE IN NET ASSETS RESULTING FROM OPERATIONS | $ | 14,303,767 | ||||

|

| |||||

| (a) | For the period from November 23, 2012 (commencement of operations) through June 30, 2013. |

The accompanying notes are an integral part of these financial statements.

17

Table of Contents

Statements of Changes in Net Assets

| Nationwide Global Equity Fund | ||||||||||||

| Year Ended June 30, 2013 | Year Ended June 30, 2012 | |||||||||||

Operations: | ||||||||||||

Net investment income | $ | 813,978 | $ | 744,985 | ||||||||

Net realized gains from investment, forward and foreign currency transactions | 3,775,914 | 74,783 | ||||||||||

Net change in unrealized appreciation/(depreciation) from investments, forward foreign currency contracts, and translation of assets and liabilities denominated in foreign currencies | 9,713,875 | (9,383,464 | ) | |||||||||

|

|

|

| |||||||||

Change in net assets resulting from operations | 14,303,767 | (8,563,696 | ) | |||||||||

|

|

|

| |||||||||

Distributions to Shareholders From: | ||||||||||||

Net investment income: | ||||||||||||

Class A | (1,581,927 | ) | (53,767 | ) | ||||||||

Class B (a) | – | – | ||||||||||

Class C | (393,807 | ) | – | |||||||||

Institutional Service Class (b) | – | – | ||||||||||

Institutional Class | (602,314 | ) | (102,576 | ) | ||||||||

|

|

|

| |||||||||

Change in net assets from shareholder distributions | (2,578,048 | ) | (156,343 | ) | ||||||||

|

|

|

| |||||||||

Change in net assets from capital transactions | (14,133,643 | ) | (15,381,872 | ) | ||||||||

|

|

|

| |||||||||

Change in net assets | (2,407,924 | ) | (24,101,911 | ) | ||||||||

|

|

|

| |||||||||

Net Assets: | ||||||||||||

Beginning of year | 87,761,980 | 111,863,891 | ||||||||||

|

|

|

| |||||||||

End of year | $ | 85,354,056 | $ | 87,761,980 | ||||||||

|

|

|

| |||||||||

Accumulated undistributed net investment income at end of year | $ | 1,261,113 | $ | 2,327,148 | ||||||||

|

|

|

| |||||||||

CAPITAL TRANSACTIONS: | ||||||||||||

Class A Shares | ||||||||||||

Proceeds from shares issued | $ | 1,647,375 | $ | 1,218,284 | ||||||||

Proceeds from shares issued from class conversion | – | 104,549 | ||||||||||

Dividends reinvested | 1,377,187 | 47,824 | ||||||||||

Cost of shares redeemed | (11,514,649 | ) | (11,351,274 | ) | ||||||||

|

|

|

| |||||||||

Total Class A Shares | (8,490,087 | ) | (9,980,617 | ) | ||||||||

|

|

|

| |||||||||

Class B Shares (a) | ||||||||||||

Proceeds from shares issued | – | – | ||||||||||

Proceeds from shares issued from class conversion | – | (104,549 | ) | |||||||||

Dividends reinvested | – | – | ||||||||||

Cost of shares redeemed | – | (490,312 | ) | |||||||||

|

|

|

| |||||||||

Total Class B Shares | – | (594,861 | ) | |||||||||

|

|

|

| |||||||||

Class C Shares | ||||||||||||

Proceeds from shares issued | 54,646 | 288,598 | ||||||||||

Dividends reinvested | 338,494 | – | ||||||||||

Cost of shares redeemed | (2,980,619 | ) | (3,389,757 | ) | ||||||||

|

|

|

| |||||||||

Total Class C Shares | (2,587,479 | ) | (3,101,159 | ) | ||||||||

|

|

|

| |||||||||

| (a) | Effective March 1, 2012, Class B Shares were converted to Class A shares. |

| (b) | For the period from November 23, 2012 (commencement of operations) through June 30, 2013. |

18

Table of Contents

Statements of Changes in Net Assets (Continued)

| Nationwide Global Equity Fund | ||||||||||||

| Year Ended June 30, 2013 | Year Ended June 30, 2012 | |||||||||||

CAPITAL TRANSACTIONS: (continued) | ||||||||||||

Institutional Service Class Shares (b) | ||||||||||||

Proceeds from shares issued | $ | 14,400 | $ | – | ||||||||

Dividends reinvested | – | – | ||||||||||

Cost of shares redeemed | – | – | ||||||||||

|

|

|

| |||||||||

Total Institutional Service Class Shares | 14,400 | – | ||||||||||

|

|

|

| |||||||||

Institutional Class Shares | ||||||||||||

Proceeds from shares issued | 2,594,053 | 693,702 | ||||||||||

Dividends reinvested | 598,460 | 102,029 | ||||||||||

Cost of shares redeemed | (6,262,990 | ) | (2,500,966 | ) | ||||||||

|

|

|

| |||||||||

Total Institutional Class Shares | (3,070,477 | ) | (1,705,235 | ) | ||||||||

|

|

|

| |||||||||

Change in net assets from capital transactions | $ | (14,133,643 | ) | $ | (15,381,872 | ) | ||||||

|

|

|

| |||||||||

SHARE TRANSACTIONS: | ||||||||||||

Class A Shares | ||||||||||||

Issued | 122,486 | 104,403 | ||||||||||

Issued in class conversion | – | 8,341 | ||||||||||

Reinvested | 116,218 | 4,482 | ||||||||||

Redeemed | (902,064 | ) | (981,905 | ) | ||||||||

|

|

|

| |||||||||

Total Class A Shares | (663,360 | ) | (864,679 | ) | ||||||||

|

|

|

| |||||||||

Class B Shares (a) | ||||||||||||

Issued | – | – | ||||||||||

Issued in class conversion | – | (8,565 | ) | |||||||||

Reinvested | – | – | ||||||||||

Redeemed | – | (39,769 | ) | |||||||||

|

|

|

| |||||||||

Total Class B Shares | – | (48,334 | ) | |||||||||

|

|

|

| |||||||||

Class C Shares | ||||||||||||

Issued | 4,604 | 27,117 | ||||||||||

Reinvested | 29,771 | – | ||||||||||

Redeemed | (244,236 | ) | (305,035 | ) | ||||||||

|

|

|

| |||||||||

Total Class C Shares | (209,861 | ) | (277,918 | ) | ||||||||

|

|

|

| |||||||||

Institutional Service Class Shares (b) | ||||||||||||

Issued | 1,140 | – | ||||||||||

Reinvested | – | – | ||||||||||

Redeemed | – | – | ||||||||||

|

|

|

| |||||||||

Total Institutional Service Class Shares | 1,140 | – | ||||||||||

|

|

|

| |||||||||

Institutional Class Shares | ||||||||||||

Issued | 185,079 | 54,195 | ||||||||||

Reinvested | 49,297 | 9,318 | ||||||||||

Redeemed | (498,699 | ) | (213,684 | ) | ||||||||

|

|

|

| |||||||||

Total Institutional Class Shares | (264,323 | ) | (150,171 | ) | ||||||||

|

|

|

| |||||||||

Total change in shares | (1,136,404 | ) | (1,341,102 | ) | ||||||||

|

|

|

| |||||||||

Amounts designated as “–” are zero or have been rounded to zero.

| (a) | Effective March 1, 2012, Class B Shares were converted to Class A shares. |

| (b) | For the period from November 23, 2012 (commencement of operations) through June 30, 2013. |

The accompanying notes are an integral part of these financial statements.

19

Table of Contents

Financial Highlights

Selected data for each share of capital outstanding throughout the periods indicated

Nationwide Global Equity Fund

| Operations | Distributions | Ratios/Supplemental Data | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net Asset Value, Beginning of Period | Net Investment Income (Loss) | Net Realized and Unrealized Gains (Losses) from Investments | Total from Operations | Net Investment Income | Total Distributions | Redemption Fees | Net Asset Value, End of Period | Total Return (a)(b)(c) | Net Assets at End of Period | Ratio of Expenses to Average Net Assets (d) | Ratio of Net Investment Income (Loss) to Average Net Assets (d) | Ratio of Expenses (Prior to Reimbursements) to Average Net Assets (d)(e) | Portfolio Turnover (f) | |||||||||||||||||||||||||||||||||||||||||||

| Class A Shares | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Year Ended June 30, 2013 (g) | $ | 11.73 | 0.13 | 1.97 | 2.10 | (0.39 | ) | (0.39 | ) | – | $ | 13.44 | 18.34% | $ | 50,709,673 | 1.32% | 1.00% | 1.61% | 28.88% | |||||||||||||||||||||||||||||||||||||

Year Ended June 30, 2012 (g) | $ | 12.67 | 0.10 | (1.03 | ) | (0.93 | ) | (0.01 | ) | (0.01 | ) | – | $ | 11.73 | (7.32% | ) | $ | 52,035,625 | 1.50% | 0.88% | 1.61% | 77.00% | ||||||||||||||||||||||||||||||||||

Year Ended June 30, 2011 (g) | $ | 10.36 | 0.03 | 2.61 | 2.64 | (0.33 | ) | (0.33 | ) | – | $ | 12.67 | 25.52% | $ | 67,171,855 | 1.50% | 0.26% | 1.53% | 83.00% | |||||||||||||||||||||||||||||||||||||

Year Ended June 30, 2010 (g) | $ | 9.46 | 0.05 | 1.12 | 1.17 | (0.27 | ) | (0.27 | ) | – | $ | 10.36 | 12.05% | $ | 64,979,350 | 1.50% | 0.47% | 1.55% | 83.00% | |||||||||||||||||||||||||||||||||||||

Year Ended June 30, 2009 (g) | $ | 13.54 | 0.10 | (3.57 | ) | (3.47 | ) | (0.61 | ) | (0.61 | ) | – | $ | 9.46 | (24.86% | ) | $ | 72,279,938 | 1.25% | 1.10% | 1.48% | 76.00% | ||||||||||||||||||||||||||||||||||

| Class C Shares | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Year Ended June 30, 2013 (g) | $ | 11.18 | 0.06 | 1.89 | 1.95 | (0.29 | ) | (0.29 | ) | – | $ | 12.84 | 17.79% | $ | 15,773,769 | 1.81% | 0.51% | 2.11% | 28.88% | |||||||||||||||||||||||||||||||||||||

Year Ended June 30, 2012 (g) | $ | 12.15 | 0.01 | (0.98 | ) | (0.97 | ) | – | – | – | $ | 11.18 | (7.98% | ) | $ | 16,081,624 | 2.25% | 0.12% | 2.40% | 77.00% | ||||||||||||||||||||||||||||||||||||

Year Ended June 30, 2011 (g) | $ | 9.94 | (0.06 | ) | 2.50 | 2.44 | (0.23 | ) | (0.23 | ) | – | $ | 12.15 | 24.48% | $ | 20,863,344 | 2.25% | (0.49% | ) | 2.32% | 83.00% | |||||||||||||||||||||||||||||||||||

Year Ended June 30, 2010 (g) | $ | 9.13 | (0.03 | ) | 1.07 | 1.04 | (0.23 | ) | (0.23 | ) | – | $ | 9.94 | 11.29% | $ | 20,499,132 | 2.25% | (0.28% | ) | 2.34% | 83.00% | |||||||||||||||||||||||||||||||||||

Year Ended June 30, 2009 (g) | $ | 13.05 | 0.03 | (3.44 | ) | (3.41 | ) | (0.51 | ) | (0.51 | ) | – | $ | 9.13 | (25.46% | ) | $ | 22,518,693 | 2.00% | 0.34% | 2.30% | 76.00% | ||||||||||||||||||||||||||||||||||

| Institutional Service Class Shares | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Period Ended June 30, 2013 (g)(h) | $ | 12.23 | 0.14 | 1.42 | 1.56 | – | – | – | $ | 13.79 | 12.76% | $ | 15,718 | 1.00% | 1.71% | 1.32% | 28.88% | |||||||||||||||||||||||||||||||||||||||

| Institutional Class Shares | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Year Ended June 30, 2013 (g) | $ | 12.04 | 0.16 | 2.04 | 2.20 | (0.44 | ) | (0.44 | ) | – | $ | 13.80 | 18.74% | $ | 18,854,896 | 1.07% | 1.24% | 1.31% | 28.88% | |||||||||||||||||||||||||||||||||||||

Year Ended June 30, 2012 (g) | $ | 13.04 | 0.14 | (1.08 | ) | (0.94 | ) | (0.06 | ) | (0.06 | ) | – | $ | 12.04 | (7.15% | ) | $ | 19,644,731 | 1.25% | 1.15% | 1.25% | 77.00% | ||||||||||||||||||||||||||||||||||

Year Ended June 30, 2011 (g) | $ | 10.65 | 0.08 | 2.68 | 2.76 | (0.37 | ) | (0.37 | ) | – | $ | 13.04 | 25.98% | $ | 23,230,312 | 1.15% | 0.62% | 1.15% | 83.00% | |||||||||||||||||||||||||||||||||||||

Year Ended June 30, 2010 (g) | $ | 9.69 | 0.08 | 1.16 | 1.24 | (0.28 | ) | (0.28 | ) | – | $ | 10.65 | 12.51% | $ | 25,227,375 | 1.15% | 0.67% | 1.15% | 83.00% | |||||||||||||||||||||||||||||||||||||

Year Ended June 30, 2009 (g) | $ | 13.84 | 0.13 | (3.63 | ) | (3.50 | ) | (0.65 | ) | (0.65 | ) | – | $ | 9.69 | (24.52% | ) | $ | 66,646,018 | 1.00% | 1.27% | 1.08% | 76.00% | ||||||||||||||||||||||||||||||||||

Amounts designated as “–” are zero or have been rounded to zero.

| (a) | Excludes sales charge. |

| (b) | Not annualized for periods less than one year. |

| (c) | Total returns prior to the Fund’s inception on November 19, 2012 are based on the performance of the Fund’s predecessor fund. |

| (d) | Annualized for periods less than one year. |

| (e) | During the period, certain fees may have been waived and/or reimbursed. If such waivers/reimbursements had not occurred, the ratios would have been as indicated. |

| (f) | Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing among the classes of shares. |

| (g) | Per share calculations were performed using average shares method. |

| (h) | For the period from November 23, 2012 (commencement of operations) through June 30, 2013. |

The accompanying notes are an integral part of these financial statements.

20

Table of Contents

Nationwide High Yield Bond Fund

How did the Fund perform during the reporting period relative to its benchmark and its peer group?

For the annual period ended June 30, 2013, the Nationwide High Yield Bond Fund (Class A at NAV) returned 7.82% versus 9.49% for its benchmark, the BofA Merrill Lynch (BofAML) U.S. High Yield Cash Pay Constrained Index. For broader comparison, the average return for the Fund’s closest Lipper peer category of High Yield Funds (consisting of 540 funds as of June 30, 2013) was 8.95% for the same time period.

Which sectors and holdings/asset classes contributed the most to the Fund’s performance relative to its benchmark?

Industries that contributed to relative Fund performance during the reporting period included gaming, energy and cable television. The gaming sector helped Fund performance due to the Fund’s good selection of issues and a broad relative overweight to the sector. The gaming sector posted strong performance at various times during the reporting period.