UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-08495

NATIONWIDE MUTUAL FUNDS

(Exact name of registrant as specified in charter)

1000 CONTINENTAL DRIVE, SUITE 400, KING OF PRUSSIA, PENNSYLVANIA 19406-2850

(Address of principal executive offices) (Zip code)

Eric E. Miller, Esq.

1000 Continental Drive

Suite 400

King of Prussia, Pennsylvania 19406-2850

(Name and address of agent for service)

Registrant’s telephone number, including area code: (610) 230-2839

Date of fiscal year end: July 31, 2014

Date of reporting period: August 1, 2013 through July 31, 2014

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than ten (10) days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR § 270.30e-1). The Commission may use the information provided on Form N-CSR in the Commission’s regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, D. C. 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Include a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR § 270.30e-1).

Annual Report

July 31, 2014

Nationwide Mutual Funds

Equity Funds

Nationwide Bailard Cognitive Value Fund

Nationwide Bailard International Equities Fund

Nationwide Bailard Technology & Science Fund

Nationwide Geneva Mid Cap Growth Fund

Nationwide Geneva Small Cap Growth Fund

Nationwide HighMark Balanced Fund

Nationwide HighMark Large Cap Core Equity Fund

Nationwide HighMark Large Cap Growth Fund

Nationwide HighMark Small Cap Core Fund

Nationwide HighMark Value Fund

Nationwide Ziegler Equity Income Fund

Nationwide Ziegler NYSE Arca Tech 100 Index Fund

Commentary in this report is provided by the portfolio manager(s) of each Fund as of the date of this report and is subject to change at any time based on market or other conditions.

Third-party information has been obtained from sources that Nationwide Fund Advisors (NFA), the investment adviser to the Funds, deems reliable. This report and the holdings provided are for informational purposes only and are not intended to be relied on as investment advice. Portfolio composition is accurate as of the date of this report and is subject to change at any time and without notice. NFA, one of its affiliated advisers or its employees may hold a position in the securities in this report.

Statement Regarding Availability of Quarterly Portfolio Holdings.

The Trust files complete schedules of portfolio holdings for each Fund with the Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year on Form N-Q. Additionally, the Trust files a schedule of portfolio holdings monthly for the Nationwide Money Market Fund on Form N-MFP. Forms N-Q and Forms N-MFP are available on the SEC’s website at http://www.sec.gov. Forms N-Q and Forms N-MFP may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330. The Trust also makes this information available to shareholders on nationwide.com/mutualfunds or upon request without charge.

Statement Regarding Availability of Proxy Voting Record.

Information regarding how the Funds voted proxies relating to portfolio securities held during the most recent 12-month period ended June 30 is available without charge, upon request, by calling 800-848-0920, and on the SEC’s website at http://www.sec.gov.

| | |

| Nationwide Funds® Annual Report | | |

Contents

Message to Shareholders

July 31, 2014

Dear Shareholder,

Watching children board a school bus can teach us a lot about human nature. As the red lights flash and the bus door slides open, some children rush to be first to climb up the steps. Others are hesitant, glancing back for reassurance. A few students freeze in fear, unable to proceed.

We understand that, like the students or anyone facing something daunting, investors vary in their approaches to financial planning. Whether you tend to climb right in, move tentatively or need support to move forward at all, please know that Nationwide Funds represent a range of products and investment strategies designed to suit all types of investors. We continually scan the investment universe seeking opportunities to expand our fund offerings to include potentially attractive asset classes. Our goal is to help provide the investment options you may need to prepare for and live in retirement. As a Nationwide Funds investor, you may be positioned for potential benefits from long-term investment solutions driven by tactical risk management and diversification.

Overall, most Nationwide Funds performed well during the one-year reporting period ended July 31, 2014. Broad U.S. stock market performance as measured by the S&P 500® Index grew 16.94% for the period, with all sectors reporting positive returns. The Barclays U.S. Aggregate Bond Index, a broad measurement of U.S. fixed-income investment performance, returned 3.97% for the one-year period.

Confucius reminds us that “Every journey starts with a single step.” By working with your financial advisor and investing with Nationwide Funds, you already have climbed that critical first step. We encourage you to stay true to your long-term plan no matter what your circumstances or investment temperament. Your advisor and Nationwide Funds are poised to help.

Sincerely,

Michael S. Spangler

President & CEO

Nationwide Funds

1

During the fiscal-year reporting period ended July 31, 2014, most asset classes produced a positive investment return. Domestic equities experienced a broad-based rally, with the S&P 500® Index delivering a 16.94% return, and nearly all sectors and capitalization ranges showing strong performance for the reporting period. International equities rose as well, with the MSCI Emerging Markets® Index recovering from a three-year period of underperformance versus developed markets to return 15.32% during the reporting period. Fixed-income returns were positive for the reporting period, primarily in the long-term and credit-sensitive segments.

In the United States, investment performance during the reporting period was affected positively by encouraging economic data and the anticipation of continued strong corporate earnings. While first-quarter gross domestic product (GDP) was disappointing, investors focused instead on an improving jobs picture and manufacturing data. Also supportive to equity and fixed-income returns were stable longer-term interest rates and the continuation of the accommodative Federal Reserve policy.

The S&P 500 Index produced positive performance in nine of the 12 months of the reporting period, including five of the last six months of the period. The weakest month was January 2014, registering -3.46%, but the brief downturn was more than offset by a 4.57% return in February 2014.

All sectors of the S&P 500 Index posted positive returns for the reporting period. The best-performing sectors for the S&P 500 Index during the reporting period were information technology, up 27.6%; materials, up 23.1%; and health care, up 20.9%. Technology and materials benefited from a strong earnings environment, and health care rallied in reaction to excitement surrounding new products. While all returns were positive, the sectors with the lowest returns included consumer staples, up 7.0%; telecommunication services, up 8.0%; and utilities, up 8.5%.

The strong performance in U.S. equities was broad based during the reporting period, with large-capitalization stocks outperforming small-cap stocks, and growth outperforming value.

U.S. economic activity showed volatility during the reporting period, with real GDP growing 4.5% and 3.5%, respectively, in the third and fourth quarters of calendar-year 2013, before shrinking by 2.1% in the first quarter of 2014 (constituting the worst result since the end of the economic recession in 2009) and then recovering to record 4.0% in the second quarter. Investors largely shrugged off the first-quarter 2014 stumble, blaming the weakness on the brutal winter weather’s effects on the economy. Expectations are for an acceleration of growth through the remainder of the year. Inflation remained well controlled throughout the reporting period, with the U.S. Consumer Price Index (CPI) and the core CPI (excluding the volatile food and energy categories) at roughly 2%. Despite job-creation levels coming in lower than during many past recoveries, the unemployment rate continued to decline during the reporting period, falling from 7.3% to 6.2%.

Throughout the reporting period, the performance of international stocks continued to be positive but weaker relative to U.S. stocks. Investors’ focus was on uncertainty surrounding Russia and Ukraine, along with sluggish European economic growth; worries about a U.S. tapering (reduction of accommodative policy involving asset purchases) depressed relative returns during the period. In Asia, stock performance was strong during the reporting period, with Japan returning 15.1% and Asia (excluding Japan) up 16.9%. Despite headline risks, emerging market stocks performed roughly in line with those of developed markets, reversing the trend of underperformance that had prevailed since the fourth quarter of 2010.

Performance in the fixed-income markets was driven by declining interest rates and falling

2

credit spreads during the reporting period. Long-term Treasury yields were relatively stable during the reporting period, with the 10-year Treasury yield falling from 2.58% to 2.56% during the period. Fixed-income returns were positive, as investors absorbed the news that the Fed will begin to taper (reduce) the quantitative easing (QE) program. Long-term and credit-sensitive bonds delivered the strongest performance during the reporting period.

| | | | |

| Index | | Fiscal Year

Total Return

(as of July 31, 2014) | |

| Barclays U.S. 1-3 Year Government/Credit Bond | | | 0.85% | |

| Barclays U.S. 10-20 Year Treasury Bond | | | 5.77% | |

| Barclays Emerging Markets USD Aggregate Bond | | | 8.85% | |

| Barclays Municipal Bond | | | 7.27% | |

| Barclays U.S. Aggregate Bond | | | 3.97% | |

| Barclays U.S. Corporate High Yield | | | 8.19% | |

| MSCI EAFE® | | | 15.07% | |

| MSCI Emerging Markets® | | | 15.32% | |

| MSCI World ex USA | | | 15.48% | |

| Russell 1000® Growth | | | 18.69% | |

| Russell 1000® Value | | | 15.47% | |

| Russell 2000® | | | 8.56% | |

| S&P 500® | | | 16.94% | |

3

| | |

| Fund Commentary | | Nationwide Bailard Cognitive Value Fund |

For the annual period ended July 31, 2014, the Nationwide Bailard Cognitive Value Fund (Class M) returned 10.38%* versus 8.18% for its benchmark, the Russell 2000® Value Index, and 11.87% for its former benchmark, the S&P SmallCap 600® Value Index.** For broader comparison, the median return for the Fund’s closest Lipper peer category of Small-Cap Value Funds (consisting of 289 funds as of July 31, 2014) was 10.27% for the same time period.

*Performance prior to the Fund’s inception on September 16, 2013, is based on the performance of the Fund’s predecessor fund.

**The Fund’s benchmark changed to the Russell 2000® Value Index effective February 3, 2014.

Bailard utilizes a proprietary multifactor model, the Behavioral Ranking Model (“BRM” or the “model”), to aid in portfolio construction. There are two primary determinants of the Fund’s relative performance. One is how well Bailard’s BRM is working, and the other is how successfully the model’s signals are translated into Fund performance.

For the reporting period, the model’s results were good, outperforming both the Fund’s benchmark and the average competitor, and winning eight out of the 12 months against each. For the earlier months of the reporting period, these good results were largely unrealized in actual Fund performance. For the latter months of the reporting period, actual results tended to be as good as or better than the model’s results.

Changes were made to the model in 2012 to improve performance, with implementation of those changes to the actual Fund taking place between the fall of 2013 and March of 2014. Throughout the modification process, realizable performance moved closer to actual BRM performance.

Ideally, the Fund would make no sector or subsector bets at all, as we believe that stock selection holds much greater potential for excess return, and that effort on the margin is better spent on improving stock selection than in attempting sector rotation. Unfortunately, the tracking error without making sector bets tends to max out at around 4.5%, which is below the

typical small-capitalization value managers’ 6.5% tracking error. As a result, we limit variance to 24 economic subsectors, allowing up to +/-2% deviation from the average small-cap value competitor’s weight in each. Stock selection then overweights or underweights each subsector, depending upon the abundance or scarcity of high BRM scores within. Because we are making sector bets by default and not conscious choice, the sectors that happen to outperform or underperform are strictly a byproduct of overall BRM efficacy and our ability to capture that in the portfolio.

For the reporting period, the Fund’s overweights in aerospace and defense and shipping were the largest contributors to Fund performance versus the Fund’s benchmark. The Fund’s holdings in Kimball International and Universal Insurance were the largest individual stocks contributing to Fund performance during the reporting period. In Kimball’s case this was due to positive earnings surprises, and in Universal’s case, due to a lack of hurricane activity.

For the reporting period, the Fund’s overweights in telecommunication services and electrical equipment were the largest detractors from Fund performance versus the Fund’s benchmark. The Fund’s holdings in Schweitzer-Mauduit International and Trans World Entertainment were the largest individual stocks detracting from Fund performance during the reporting period. In Schweitzer’s case this was due to sharply lower earnings expectations, and in Trans World’s case, due to a substantial decline in reported earnings.

Subadviser:

Bailard, Inc.

Portfolio Manager:

Thomas J. Mudge III

The Fund is subject to the risks of investing in equity securities and risks associated with investing in stocks of smaller companies. Value funds may underperform other funds that use different investing styles. The Fund may invest in more-aggressive investments such as derivatives (many of which create investment leverage and are highly volatile), exchange-traded funds (ETFs) (shareholders will bear additional costs) and foreign securities (which are volatile, harder to price and less liquid than U.S. securities). Please refer to the most recent prospectus for a more detailed explanation of the Fund’s principal risks.

A description of the benchmarks can be found on the Market Index Definitions page at the back of this book.

4

| | |

| Fund Overview | | Nationwide Bailard Cognitive Value Fund |

Objective

The Fund seeks long-term capital appreciation.

Highlights

| | Ÿ | | For the annual period ended July 31, 2014, the Nationwide Bailard Cognitive Value Fund (Class M) returned 10.38%, outperforming its benchmark by 2.20% and outperforming the Lipper peer category median by 0.11%. | |

| | Ÿ | | Bailard uses a proprietary quantitative model to aid in portfolio construction. Changes were made to the model in 2012 to improve performance, with implementation of those changes to the actual Fund taking place between the fall of 2013 and March of 2014. | |

| | Ÿ | | Ideally, the Fund would make no sector or subsector bets at all, as we believe that stock selection holds much greater potential for excess return, and that effort on the margin is better spent on improving stock selection than in attempting sector rotation. | |

Asset Allocation†

| | | | |

| Common Stocks | | | 95.1% | |

| Repurchase Agreement | | | 4.2% | |

| Exchange Traded Funds | | | 4.2% | |

| Mutual Fund | | | 0.5% | |

| Liabilities in excess of other assets | | | (4.0)% | |

| | | | 100.0% | |

Top Industries††

| | | | |

| Banks | | | 8.8% | |

| Insurance | | | 7.5% | |

| Real Estate Investment Trusts (REITs) | | | 5.9% | |

| Information Technology Services | | | 5.8% | |

| Electronic Equipment, Instruments & Components | | | 5.2% | |

| Machinery | | | 4.6% | |

| Equity Fund | | | 4.0% | |

| Electrical Equipment | | | 4.0% | |

| Chemicals | | | 3.9% | |

| Health Care Providers & Services | | | 3.8% | |

| Other Industries* | | | 46.5% | |

| | | | 100.0% | |

Top Holdings††

| | | | |

| A. Schulman, Inc. | | | 3.3% | |

| Benchmark Electronics, Inc. | | | 2.8% | |

| CSG Systems International, Inc. | | | 2.8% | |

| EnerSys | | | 2.8% | |

| Hanover Insurance Group, Inc. (The) | | | 2.6% | |

| National HealthCare Corp. | | | 2.5% | |

| Vanguard Small-Cap Value ETF | | | 2.4% | |

| Kimball International, Inc., Class B | | | 2.3% | |

| Warren Resources, Inc. | | | 2.2% | |

| Global Cash Access Holdings, Inc. | | | 2.1% | |

| Other Holdings* | | | 74.2% | |

| | | | 100.0% | |

| † | Percentages indicated are based upon net assets as of July 31, 2014. |

| †† | Percentages indicated are based upon total investments as of July 31, 2014. |

| * | For purposes of listing top industries and top holdings, the repurchase agreement is included as part of Other. |

5

| | |

| Fund Performance | | Nationwide Bailard Cognitive Value Fund |

Average Annual Total Return

(For periods ended July 31, 2014)

| | | | | | | | | | | | | | | | | | |

| | | | | 1 Yr. | | | 5 Yr. | | | 10 Yr. | | | Inception | |

| Class A1 | | w/o SC2 | | | 9.91% | | | | 16.53% | | | | 8.17% | | | | – | |

| | | w/ SC3 | | | 3.88% | | | | 15.22% | | | | 7.56% | | | | – | |

| Class C1 | | w/o SC2 | | | 9.25% | | | | 15.86% | | | | 7.52% | | | | – | |

| | | w/ SC4 | | | 8.25% | | | | 15.86% | | | | 7.52% | | | | – | |

| Class M1,5 | | | | | 10.38% | | | | 17.01% | | | | 8.61% | | | | – | |

| Institutional Service Class1,5,6 | | | | | 10.15% | | | | 16.89% | | | | 8.50% | | | | – | |

| Institutional Class5 | | | | | – | | | | – | | | | – | | | | 10.15% | 7* |

| Russell 2000® Value Index | | | | | 8.18% | | | | 15.83% | | | | 8.07% | | | | – | |

| S&P SmallCap 600 Value Index | | | | | 11.87% | | | | 17.85% | | | | 9.48% | | | | – | |

| CPI | | | | | 1.99% | | | | 2.04% | | | | 2.32% | | | | – | |

All figures showing the effect of a sales charge (SC) reflect the maximum charge possible, because it has the most significant effect on performance data.

| 1 | Total returns prior to the Fund’s inception on September 16, 2013 are based on the performance of the Fund’s predecessor fund. |

| 2 | These returns do not reflect the effects of SCs. |

| 3 | For the period from September 16, 2013 through July 31, 2014 a front-end sales charge of 5.75% was deducted. Prior to September 16, 2013, a front-end sales charge of 5.50% was deducted. |

| 4 | A 1.00% CDSC was deducted from the one year return because it is charged when you sell Class C shares within the first year after purchase. |

| 5 | Not subject to any SCs. |

| 6 | Effective September 16, 2013, Fiduciary Shares were renamed Institutional Service Class Shares. |

| 7 | Since inception date of September 18, 2013. |

Expense Ratios

| | | | | | | | |

| | | Gross

Expense

Ratio* | | | Net

Expense

Ratio* | |

| Class A | | | 1.54% | | | | 1.48% | |

| Class C | | | 2.04% | | | | 2.04% | |

| Class M | | | 1.04% | | | | 1.04% | |

| Institutional Service Class | | | 1.29% | | | | 1.23% | |

| Institutional Class | | | 1.04% | | | | 1.04% | |

| * | Current effective prospectus dated November 29, 2013 (as revised March 1, 2014). The difference between gross and net operating expenses reflects contractual waivers in place through November 30, 2015. Please see the Fund’s most recent prospectus for details. |

6

| | |

| Fund Performance (con’t.) | | Nationwide Bailard Cognitive Value Fund |

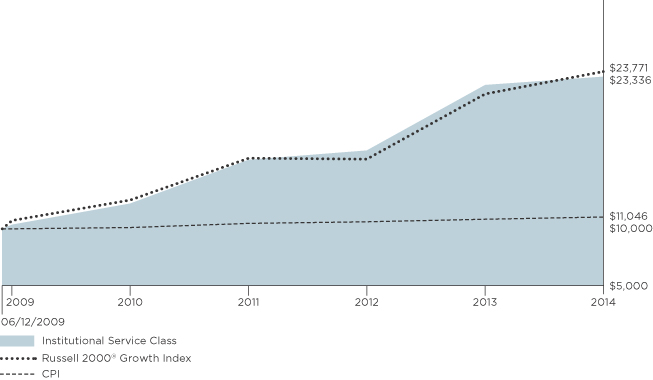

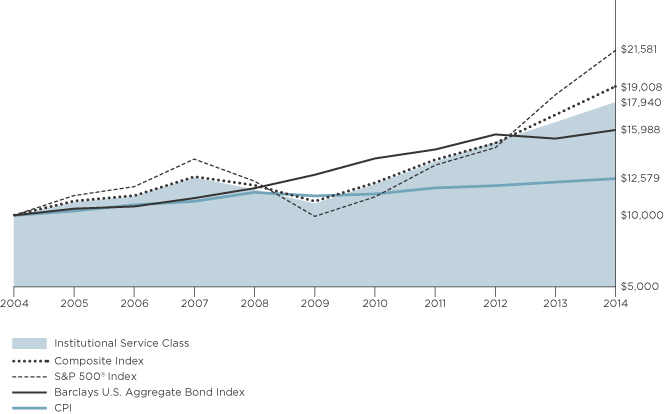

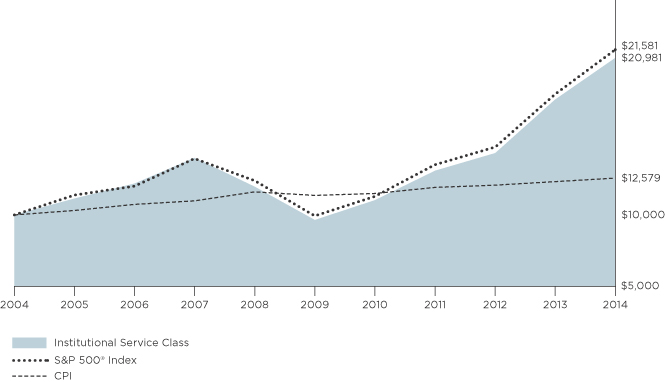

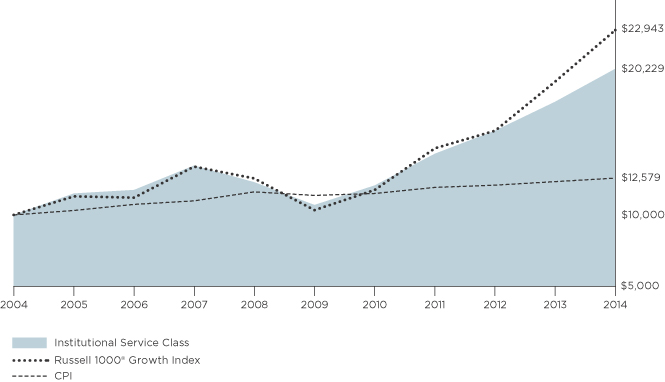

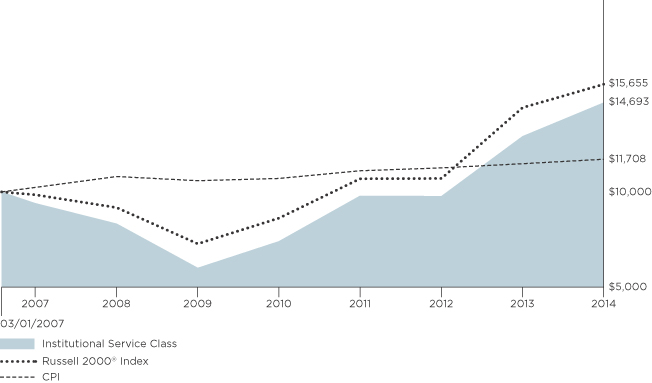

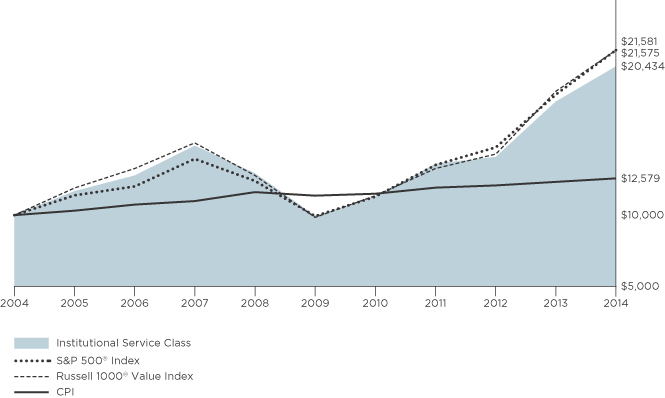

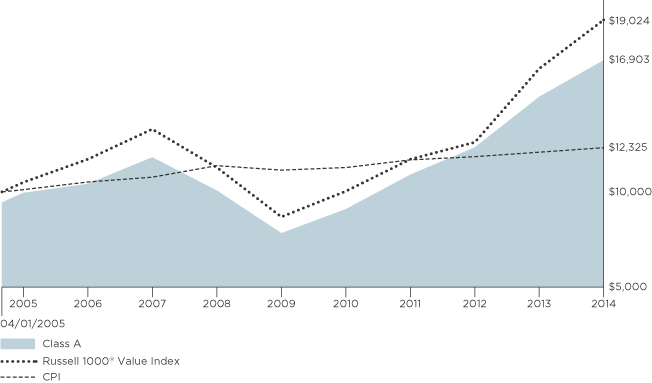

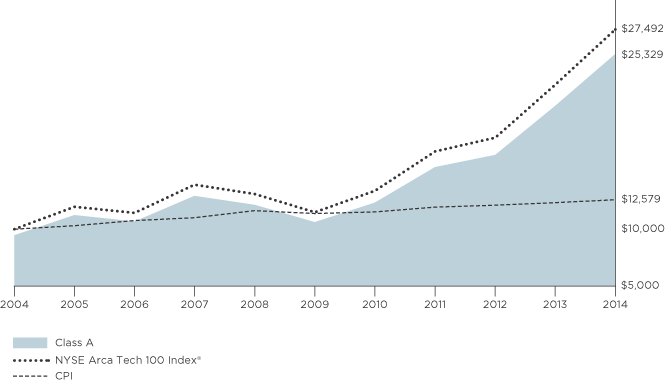

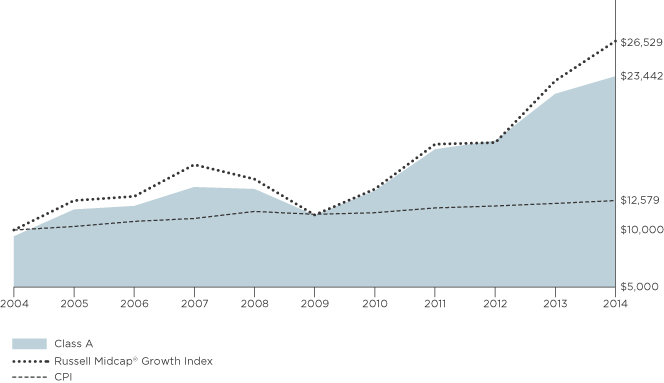

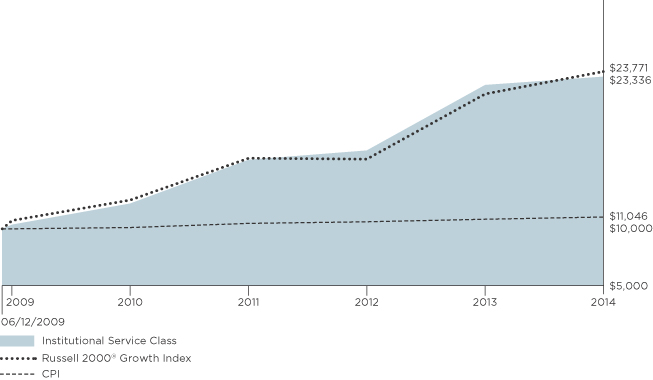

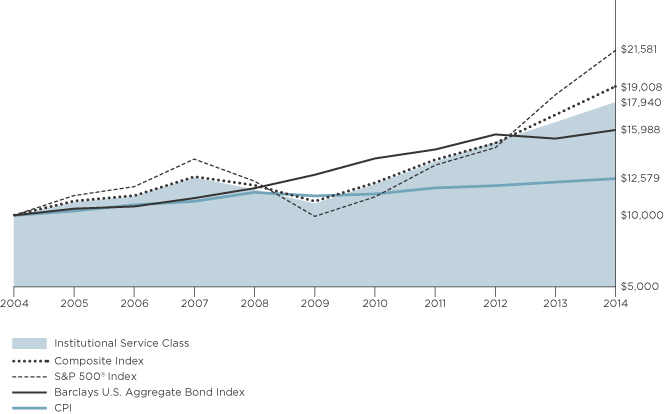

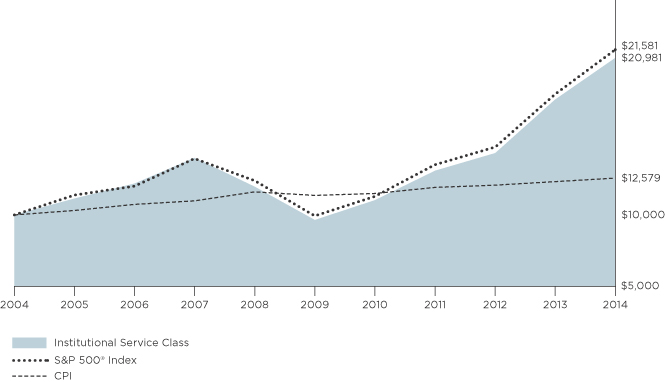

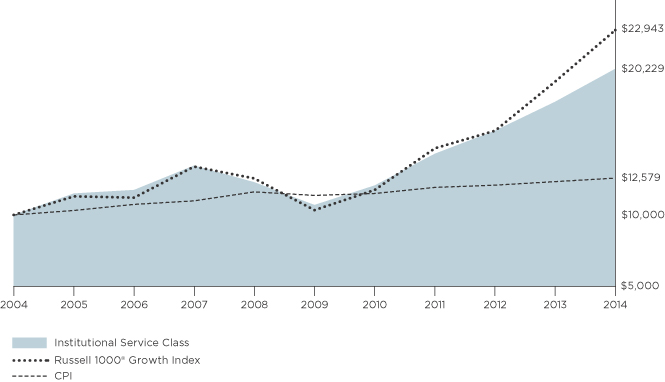

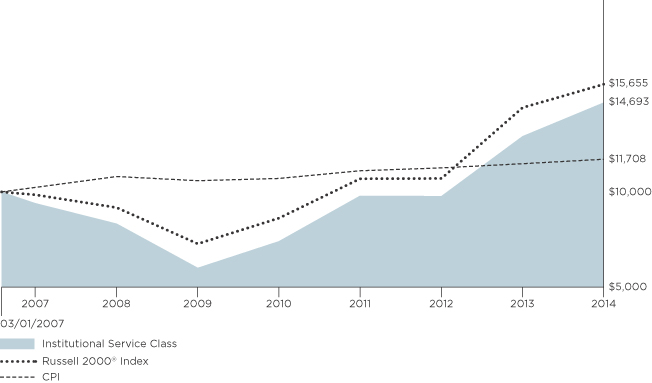

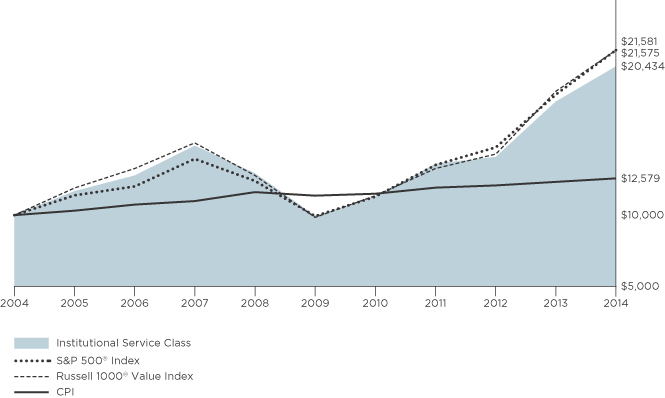

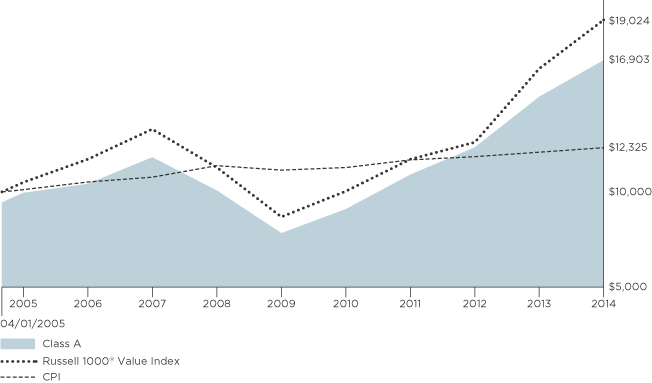

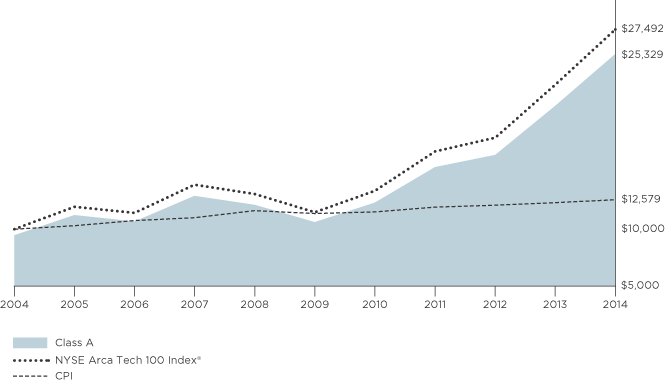

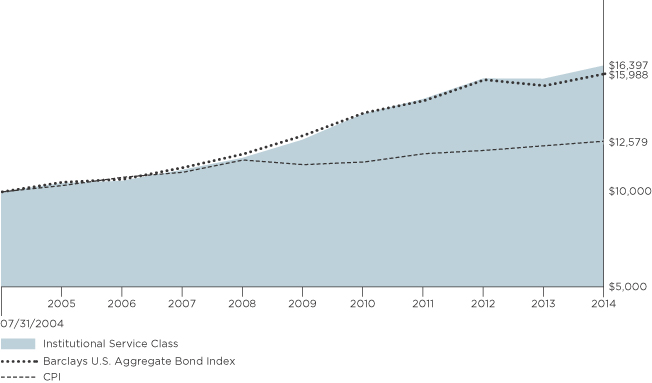

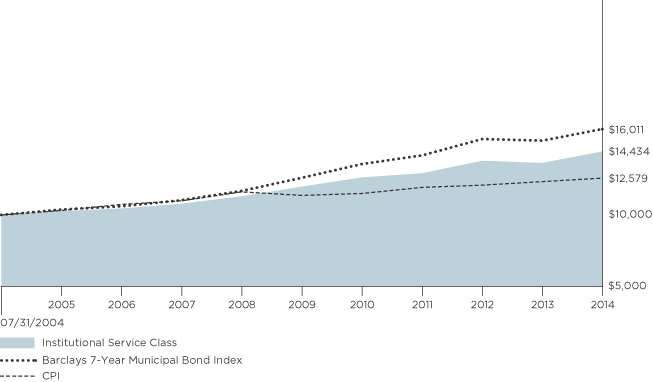

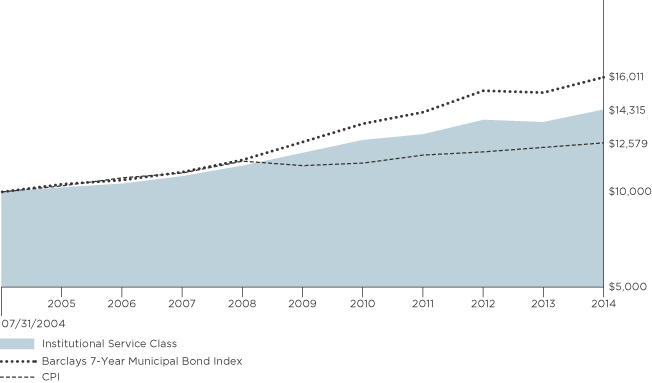

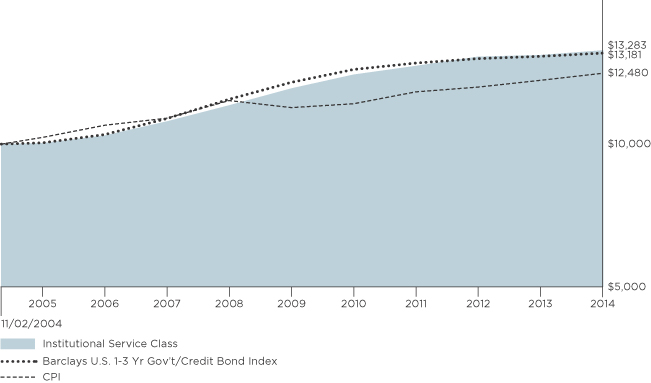

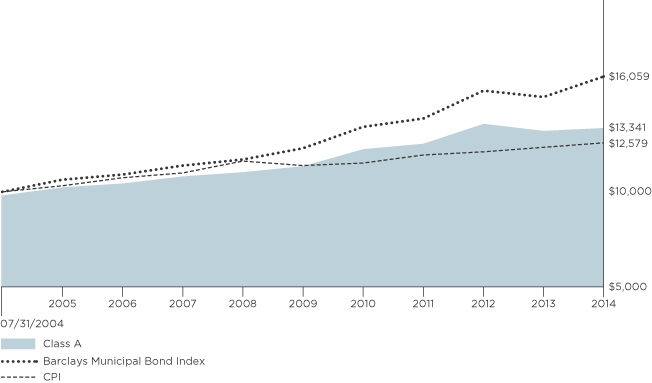

Performance of a $10,000 Investment

Investment return and principal value will fluctuate, and when redeemed, shares may be worth more or less than original cost. Past performance is no guarantee of future results and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investing in mutual funds involves market risk, including loss of principal. Performance returns assume the reinvestment of all distributions.

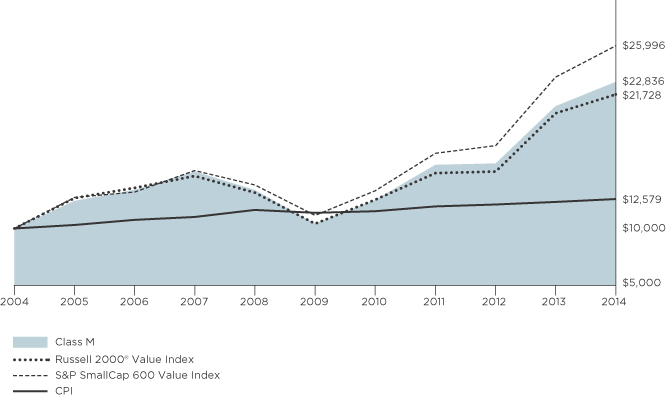

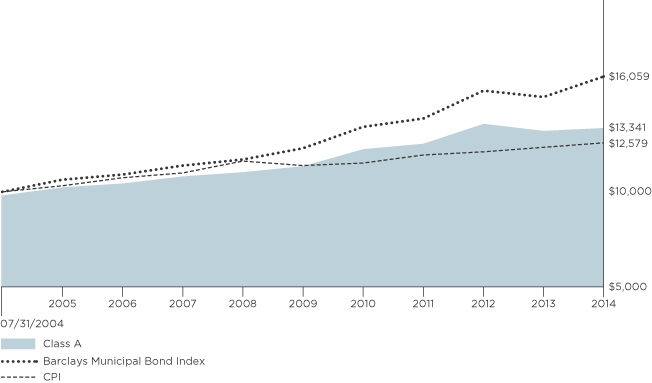

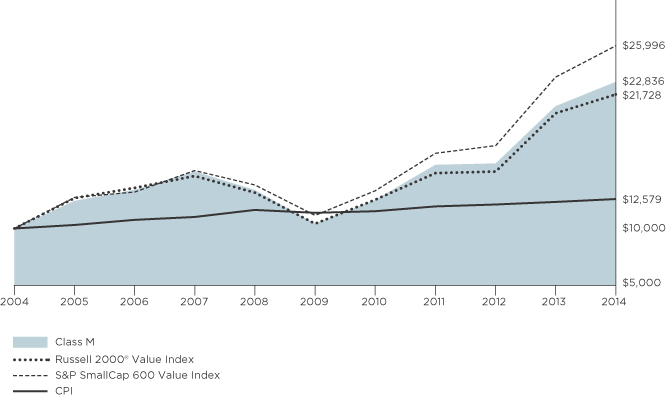

Comparative performance of $10,000 invested in Class M shares of the Nationwide Bailard Cognitive Value Fund versus the Russell 2000® Value Index (current benchmark), the S&P SmallCap 600 Value Index (former benchmark) and the Consumer Price Index (CPI) over the 10-year period ended 7/31/14. Fund performance prior to the Fund’s inception on 9/16/13 is based on the Fund’s predecessor fund. Unlike the Fund, the performance for these unmanaged indexes does not reflect any fees, expenses, or sales charges. One cannot invest directly in a market index. A description of the benchmarks can be found on the Market Index Definitions page at the back of this book.

7

| | |

| Shareholder Expense Example | | Nationwide Bailard Cognitive Value Fund |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) paid on purchase payments and redemption fees; and (2) ongoing costs, including investment advisory fees, administration fees, distribution fees and other Fund expenses. The examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. Per Securities and Exchange Commission (“SEC”) requirements, the examples assume that you had a $1,000 investment in the Class at the beginning of the reporting period February 1, 2014 and continued to hold your shares at the end of the reporting period July 31, 2014.

Actual Expenses

For each Class of the Fund in the table below, the first line provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid from February 1, 2014 through July 31, 2014. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line of each Class under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Expenses for Comparison Purposes

The second line of each Class in the table below provides information about hypothetical account values and hypothetical expenses based on the Class’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period from February 1, 2014 through July 31, 2014. You may use this information to compare the ongoing costs of investing in the Class of the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges (loads) or redemption fees. If these transaction costs were included, your costs would have been higher. Therefore, the second line for each Class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. The examples also assume all dividends and distributions are reinvested.

Schedule of Shareholder Expenses

Expense Analysis of a $1,000 Investment

| | | | | | | | | | | | |

Nationwide Bailard Cognitive

Value Fund July 31, 2014 | | | Beginning

Account Value ($)

02/01/14 | | Ending

Account Value ($)

07/31/14 | | Expenses Paid

During Period ($)

02/01/14 - 07/31/14 | | Expense Ratio

During Period (%)

02/01/14 - 07/31/14 |

| Class A Shares | | | Actual | (a) | | 1,000.00 | | 1,062.60 | | 6.55 | | 1.28 |

| | | | Hypothetical | (a)(b) | | 1,000.00 | | 1,018.45 | | 6.41 | | 1.28 |

| Class C Shares | | | Actual | (a) | | 1,000.00 | | 1,058.60 | | 10.21 | | 2.00 |

| | | | Hypothetical | (a)(b) | | 1,000.00 | | 1,014.88 | | 9.99 | | 2.00 |

| Class M Shares | | | Actual | (a) | | 1,000.00 | | 1,064.50 | | 5.07 | | 0.99 |

| | | | Hypothetical | (a)(b) | | 1,000.00 | | 1,019.89 | | 4.96 | | 0.99 |

| Institutional Service Class Shares(c) | | | Actual | (a) | | 1,000.00 | | 1,063.90 | | 5.32 | | 1.04 |

| | | | Hypothetical | (a)(b) | | 1,000.00 | | 1,019.64 | | 5.21 | | 1.04 |

| Institutional Class Shares | | | Actual | (a) | | 1,000.00 | | 1,063.70 | | 5.12 | | 1.00 |

| | | | Hypothetical | (a)(b) | | 1,000.00 | | 1,019.84 | | 5.01 | | 1.00 |

| (a) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value from February 1, 2014 through July 31, 2014 multiplied to reflect one-half year period. The expense ratio presented represents a six-month, annualized ratio in accordance with Securities and Exchange Commission guidelines. |

| (b) | Represents the hypothetical 5% return before expenses. |

| (c) | Effective September 16, 2013, Fiduciary Shares were renamed Institutional Service Class Shares. |

8

Statement of Investments

July 31, 2014

Nationwide Bailard Cognitive Value Fund

| | | | | | | | | | |

| | | Common Stocks 95.1% | |

| | | |

| | | | | Shares | | | Market

Value | |

| | | |

| | | | | | | | | | |

| | Aerospace & Defense 0.9% | |

| | Engility Holdings, Inc.* | | | 28,100 | | | $ | 971,136 | |

| | | | | | | | | | |

| | | |

| | Airlines 1.4% | |

| | JetBlue Airways Corp.* (a) | | | 136,100 | | | | 1,458,992 | |

| | | | | | | | | | |

| | | |

| | Auto Components 1.4% | |

| | Modine Manufacturing Co.* | | | 106,500 | | | | 1,466,505 | |

| | | | | | | | | | |

| | | |

| | Banks 9.2% | |

| | Associated Banc-Corp. | | | 52,700 | | | | 944,384 | |

| | Central Pacific Financial Corp. | | | 74,800 | | | | 1,338,920 | |

| | Financial Institutions, Inc. | | | 5,007 | | | | 111,155 | |

| | First Busey Corp. | | | 226,698 | | | | 1,258,174 | |

| | First Interstate BancSystem, Inc. | | | 66,921 | | | | 1,746,638 | |

| | German American Bancorp, Inc. | | | 9,700 | | | | 250,745 | |

| | MainSource Financial Group, Inc. | | | 116,969 | | | | 1,910,104 | |

| | MidSouth Bancorp, Inc. | | | 16,800 | | | | 327,600 | |

| | Northrim BanCorp, Inc. | | | 55,491 | | | | 1,359,530 | |

| | Suffolk Bancorp* | | | 7,400 | | | | 149,850 | |

| | | | | | | | | | |

| | | | | | | | | 9,397,100 | |

| | | | | | | | | | |

| | | |

| | Building Products 1.1% | |

| | A.O. Smith Corp. | | | 13,400 | | | | 625,780 | |

| | Alpha Pro Tech Ltd.* | | | 90,800 | | | | 185,232 | |

| | Simpson Manufacturing Co., Inc. | | | 8,800 | | | | 267,608 | |

| | | | | | | | | | |

| | | | | | | | | 1,078,620 | |

| | | | | | | | | | |

| | | |

| | Capital Markets 1.5% | |

| | FBR & Co.* | | | 54,200 | | | | 1,515,432 | |

| | | | | | | | | | |

| | | |

| | Chemicals 4.1% | |

| | A. Schulman, Inc. | | | 88,100 | | | | 3,501,094 | |

| | Minerals Technologies, Inc. | | | 12,000 | | | | 696,840 | |

| | | | | | | | | | |

| | | | | | | | | 4,197,934 | |

| | | | | | | | | | |

| | | |

| | Commercial Services & Supplies 2.7% | |

| | Brady Corp., Class A | | | 11,600 | | | | 303,340 | |

| | Kimball International, Inc., Class B | | | 153,918 | | | | 2,427,287 | |

| | | | | | | | | | |

| | | | | | | | | 2,730,627 | |

| | | | | | | | | | |

| | | |

| | Communications Equipment 0.8% | |

| | Comtech Telecommunications Corp. | | | 9,100 | | | | 307,580 | |

| | Polycom, Inc.* | | | 38,800 | | | | 497,416 | |

| | | | | | | | | | |

| | | | | | | | | 804,996 | |

| | | | | | | | | | |

| | | |

| | Construction & Engineering 1.3% | |

| | MYR Group, Inc.* | | | 55,800 | | | | 1,384,398 | |

| | | | | | | | | | |

| | | |

| | Distributors 1.1% | |

| | Weyco Group, Inc. | | | 45,200 | | | | 1,173,392 | |

| | | | | | | | | | |

| | | |

| | Electric Utilities 3.2% | |

| | Empire District Electric Co. (The) (a) | | | 12,900 | | | | 316,179 | |

| | PNM Resources, Inc. | | | 45,500 | | | | 1,167,075 | |

| | | | | | | | | | |

| | | Common Stocks (continued) | |

| | | |

| | | | | Shares | | | Market

Value | |

| | | |

| | | | | | | | | | |

| | Electric Utilities (continued) | |

| | Portland General Electric Co. | | | 23,200 | | | $ | 740,776 | |

| | UIL Holdings Corp. | | | 30,800 | | | | 1,081,388 | |

| | | | | | | | | | |

| | | | | | | | | 3,305,418 | |

| | | | | | | | | | |

| | | |

| | Electrical Equipment 4.1% | |

| | EnerSys | | | 46,400 | | | | 2,943,152 | |

| | SL Industries, Inc.* | | | 35,403 | | | | 1,280,881 | |

| | | | | | | | | | |

| | | | | | | | | 4,224,033 | |

| | | | | | | | | | |

| | | |

| | Electronic Equipment, Instruments & Components 5.4% | |

| | Benchmark Electronics, Inc.* | | | 125,100 | | | | 3,021,165 | |

| | Insight Enterprises, Inc.* | | | 16,000 | | | | 420,320 | |

| | Sanmina Corp.* | | | 72,600 | | | | 1,690,854 | |

| | Vishay Intertechnology, Inc. | | | 30,300 | | | | 446,319 | |

| | | | | | | | | | |

| | | | | | | | | 5,578,658 | |

| | | | | | | | | | |

| | | |

| | Energy Equipment & Services 3.4% | |

| | Bolt Technology Corp. | | | 73,300 | | | | 1,251,231 | |

| | ION Geophysical Corp.* | | | 30,000 | | | | 112,500 | |

| | Matrix Service Co.* | | | 80,100 | | | | 2,150,685 | |

| | | | | | | | | | |

| | | | | | | | | 3,514,416 | |

| | | | | | | | | | |

| | | |

| | Gas Utilities 0.7% | |

| | Gas Natural, Inc. | | | 52,700 | | | | 679,303 | |

| | | | | | | | | | |

| | | |

| | Health Care Equipment & Supplies 0.9% | |

| | CONMED Corp. | | | 8,600 | | | | 335,400 | |

| | Digirad Corp. | | | 91,600 | | | | 302,280 | |

| | Kewaunee Scientific Corp. | | | 15,925 | | | | 286,968 | |

| | | | | | | | | | |

| | | | | | | | | 924,648 | |

| | | | | | | | | | |

| | | |

| | Health Care Providers & Services 4.0% | |

| | InfuSystems Holdings, Inc.* (a) | | | 297,500 | | | | 827,050 | |

| | Kindred Healthcare, Inc. | | | 17,870 | | | | 427,093 | |

| | National HealthCare Corp. | | | 48,400 | | | | 2,660,064 | |

| | PharMerica Corp.* | | | 7,100 | | | | 191,629 | |

| | | | | | | | | | |

| | | | | | | | | 4,105,836 | |

| | | | | | | | | | |

| | | |

| | Hotels, Restaurants & Leisure 1.1% | |

| | Marriott Vacations Worldwide Corp.* | | | 12,300 | | | | 707,865 | |

| | Texas Roadhouse, Inc. | | | 6,100 | | | | 151,768 | |

| | Wendy’s Co. (The) | | | 37,200 | | | | 303,180 | |

| | | | | | | | | | |

| | | | | | | | | 1,162,813 | |

| | | | | | | | | | |

| | | |

| | Household Durables 0.5% | |

| | Helen of Troy Ltd.* | | | 8,700 | | | | 466,581 | |

| | | | | | | | | | |

| | | |

| | Information Technology Services 6.0% | |

| | CSG Systems International, Inc. | | | 113,800 | | | | 2,963,352 | |

| | Global Cash Access Holdings, Inc.* | | | 265,100 | | | | 2,218,887 | |

| | NCI, Inc., Class A* | | | 106,400 | | | | 955,472 | |

| | | | | | | | | | |

| | | | | | | | | 6,137,711 | |

| | | | | | | | | | |

9

Statement of Investments (Continued)

July 31, 2014

Nationwide Bailard Cognitive Value Fund (Continued)

| | | | | | | | | | |

| | | Common Stocks (continued) | |

| | | |

| | | | | Shares | | | Market

Value | |

| | | |

| | | | | | | | | | |

| | Insurance 7.8% | |

| | Argo Group International Holdings Ltd. | | | 8,800 | | | $ | 438,328 | |

| | Aspen Insurance Holdings Ltd. | | | 23,550 | | | | 942,235 | |

| | First Acceptance Corp.* | | | 88,700 | | | | 204,897 | |

| | Hanover Insurance Group, Inc. (The) | | | 48,138 | | | | 2,782,858 | |

| | HCI Group, Inc. | | | 21,238 | | | | 847,396 | |

| | Montpelier Re Holdings Ltd. | | | 33,400 | | | | 986,302 | |

| | Symetra Financial Corp. | | | 41,600 | | | | 948,480 | |

| | United Insurance Holdings Corp. | | | 33,800 | | | | 490,776 | |

| | Universal Insurance Holdings, Inc. | | | 26,230 | | | | 316,334 | |

| | | | | | | | | | |

| | | | | | | | | 7,957,606 | |

| | | | | | | | | | |

| | | |

| | Life Sciences Tools & Services 1.1% | |

| | Albany Molecular Research, Inc.* | | | 22,300 | | | | 424,592 | |

| | Nordion, Inc.* | | | 57,600 | | | | 746,496 | |

| | | | | | | | | | |

| | | | | | | | | 1,171,088 | |

| | | | | | | | | | |

| | | |

| | Machinery 4.8% | |

| | Hurco Cos., Inc. | | | 17,300 | | | | 555,503 | |

| | Kadant, Inc. | | | 40,900 | | | | 1,559,926 | |

| | LS Starrett Co. (The), Class A | | | 38,943 | | | | 581,808 | |

| | MFRI, Inc.* | | | 152,806 | | | | 1,682,394 | |

| | Standex International Corp. | | | 7,500 | | | | 494,625 | |

| | | | | | | | | | |

| | | | | | | | | 4,874,256 | |

| | | | | | | | | | |

| | | |

| | Media 0.4% | |

| | Meredith Corp. | | | 8,200 | | | | 376,544 | |

| | | | | | | | | | |

| | | |

| | Metals & Mining 1.4% | |

| | Century Aluminum Co.* | | | 25,700 | | | | 483,160 | |

| | Commercial Metals Co. | | | 23,800 | | | | 410,312 | |

| | Steel Dynamics, Inc. | | | 23,900 | | | | 506,919 | |

| | | | | | | | | | |

| | | | | | | | | 1,400,391 | |

| | | | | | | | | | |

| | | |

| | Oil, Gas & Consumable Fuels 3.6% | |

| | Adams Resources & Energy, Inc. | | | 20,300 | | | | 1,326,402 | |

| | Warren Resources, Inc.* | | | 404,587 | | | | 2,383,017 | |

| | | | | | | | | | |

| | | | | | | | | 3,709,419 | |

| | | | | | | | | | |

| | | |

| | Paper & Forest Products 0.4% | |

| | Neenah Paper, Inc. | | | 8,200 | | | | 406,884 | |

| | | | | | | | | | |

| | | |

| | Professional Services 1.4% | |

| | VSE Corp. | | | 24,129 | | | | 1,437,365 | |

| | | | | | | | | | |

| | | |

| | Real Estate Investment Trusts (REITs) 6.1% | |

| | DCT Industrial Trust, Inc. | | | 45,800 | | | | 358,614 | |

| | DuPont Fabros Technology, Inc. | | | 40,500 | | | | 1,110,105 | |

| | Franklin Street Properties Corp. | | | 64,400 | | | | 781,816 | |

| | Monmouth Real Estate Investment Corp. | | | 27,100 | | | | 278,588 | |

| | One Liberty Properties, Inc. | | | 46,000 | | | | 953,120 | |

| | Post Properties, Inc. | | | 20,300 | | | | 1,100,260 | |

| | Urstadt Biddle Properties, Inc., Class A | | | 22,700 | | | | 465,123 | |

| | | | | | | | | | |

| | | Common Stocks (continued) | |

| | | |

| | | | | Shares | | | Market

Value | |

| | | |

| | | | | | | | | | |

| | Real Estate Investment Trusts (REITs) (continued) | |

| | Winthrop Realty Trust | | | 81,103 | | | $ | 1,222,222 | |

| | | | | | | | | | |

| | | | | | | | | 6,269,848 | |

| | | | | | | | | | |

| | | |

| | Road & Rail 0.2% | |

| | ArcBest Corp. | | | 6,000 | | | | 190,380 | |

| | | | | | | | | | |

| | | |

| | Semiconductors & Semiconductor Equipment 2.0% | |

| | ASM International NV, NYRS-NL | | | 10,300 | | | | 389,752 | |

| | International Rectifier Corp.* | | | 68,300 | | | | 1,696,572 | |

| | | | | | | | | | |

| | | | | | | | | 2,086,324 | |

| | | | | | | | | | |

| | | |

| | Software 0.5% | |

| | Perfect World Co., Ltd., ADR-CN | | | 24,900 | | | | 483,807 | |

| | | | | | | | | | |

| | | |

| | Specialty Retail 3.1% | |

| | Aaron’s, Inc. | | | 24,300 | | | | 641,034 | |

| | Brown Shoe Co., Inc. | | | 22,500 | | | | 634,275 | |

| | Citi Trends, Inc.* | | | 62,000 | | | | 1,249,300 | |

| | Zumiez, Inc.* | | | 23,500 | | | | 654,475 | |

| | | | | | | | | | |

| | | | | | | | | 3,179,084 | |

| | | | | | | | | | |

| | | |

| | Technology Hardware, Storage & Peripherals 1.9% | |

| | Lexmark International, Inc., Class A | | | 40,300 | | | | 1,935,609 | |

| | | | | | | | | | |

| | | |

| | Textiles, Apparel & Luxury Goods 1.1% | |

| | Crown Crafts, Inc. | | | 143,000 | | | | 1,108,250 | |

| | | | | | | | | | |

| | | |

| | Thrifts & Mortgage Finance 2.4% | |

| | First Defiance Financial Corp. | | | 34,100 | | | | 921,041 | |

| | WSFS Financial Corp. | | | 22,240 | | | | 1,592,162 | |

| | | | | | | | | | |

| | | | | | | | | 2,513,203 | |

| | | | | | | | | | |

| | | |

| | Wireless Telecommunication Services 2.1% | |

| | Spok Holdings, Inc. | | | 142,900 | | | | 2,139,213 | |

| | | | | | | | | | |

| | |

| | Total Common Stocks

(cost $92,547,617) | | | | 97,517,820 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | Exchange Traded Funds 4.2% | |

| | Equity Funds 4.2% | |

| | iShares Russell 2000 Value ETF (a) | | | 17,900 | | | | 1,725,023 | |

| | Vanguard Small-Cap Value ETF (a) | | | 25,300 | | | | 2,541,385 | |

| | | | | | | | | | |

| | | | | | | | | 4,266,408 | |

| | | | | | | | | | |

| | |

| | Total Exchange Traded Funds

(cost $3,781,057) | | | | 4,266,408 | |

| | | | | | | | | | |

| | | | | | | | | | |

10

Statement of Investments (Continued)

July 31, 2014

Nationwide Bailard Cognitive Value Fund (Continued)

| | | | | | | | | | |

| | | Mutual Fund 0.5% | |

| | | |

| | | | | Shares | | | Market

Value | |

| | | |

| | | | | | | | | | |

| | Money Market Fund 0.5% | |

| | Fidelity Institutional Money Market Fund - Institutional Class, 0.09% (b)(c) | | | 470,456 | | | $ | 470,456 | |

| | | | | | | | | | |

| | |

| | Total Mutual Fund (cost $470,456) | | | | 470,456 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | Repurchase Agreement 4.2% | |

| | | |

| | | | | Principal

Amount | | | | |

| | | |

| | Royal Bank of Canada, 0.06%, dated 07/31/14, due 08/01/14, repurchase price $4,344,551, collateralized by a U.S. Treasury Note, 0.63%, maturing 09/30/17; total market value $4,433,236. (c) | | $ | 4,344,544 | | | | 4,344,544 | |

| | | | | | | | | | |

| | |

| | Total Repurchase Agreement

(cost $4,344,544) | | | | 4,344,544 | |

| | | | | | | | | | |

| | |

| | Total Investments

(cost $101,143,674) (d) — 104.0% | | | | 106,599,228 | |

| | | |

| | Liabilities in excess of other assets — (4.0%) | | | | | | | (4,071,435 | ) |

| | | | | | | | | | |

| | |

| | NET ASSETS — 100.0% | | | $ | 102,527,793 | |

| | | | | | | | | | |

| | * | Denotes a non-income producing security. |

| | (a) | The security or a portion of this security is on loan at July 31, 2014. The total value of securities on loan at July 31, 2014 was $4,711,266. |

| | (b) | Represents 7-day effective yield as of July 31, 2014. |

| | (c) | Security or a portion of the security was purchased with cash collateral held from securities on loan. The total value of securities purchased with cash collateral as of July 31, 2014 was $4,815,000. |

| | (d) | See notes to financial statements for tax cost and unrealized appreciation/(depreciation) of securities. |

| | ADR | American Depositary Receipt |

| | NYRS | New York Registry Shares |

| | REIT | Real Estate Investment Trust |

The accompanying notes are an integral part of these financial statements.

11

Statement of Assets and Liabilities

July 31, 2014

| | | | | | |

| | | Nationwide Bailard Cognitive

Value Fund |

Assets: | | | | | | |

Investments, at value *(cost $96,799,130) | | $ | 102,254,684 | | | |

Repurchase agreement, at value (cost $4,344,544) | | | 4,344,544 | | | |

| | | | | | |

Total Investments, at value (total cost $101,143,674) | | | 106,599,228 | | | |

| | | | | | |

Cash | | | 1,103,472 | | | |

Dividends receivable | | | 65,307 | | | |

Security lending income receivable | | | 4,639 | | | |

Receivable for investments sold | | | 402,836 | | | |

Receivable for capital shares issued | | | 43,856 | | | |

Prepaid expenses | | | 16,776 | | | |

| | | | | | |

Total Assets | | | 108,236,114 | | | |

| | | | | | |

Liabilities: | | | | | | |

Payable for investments purchased | | | 459,510 | | | |

Payable for capital shares redeemed | | | 306,917 | | | |

Payable upon return of securities loaned (Note 2) | | | 4,815,000 | | | |

Accrued expenses and other payables: | | | | | | |

Investment advisory fees | | | 68,732 | | | |

Fund administration fees | | | 9,745 | | | |

Distribution fees | | | 11,397 | | | |

Administrative servicing fees | | | 1,338 | | | |

Accounting and transfer agent fees | | | 2,637 | | | |

Trustee fees | | | 257 | | | |

Custodian fees | | | 447 | | | |

Compliance program costs (Note 3) | | | 1,352 | | | |

Professional fees | | | 22,970 | | | |

Printing fees | | | 4,427 | | | |

Other | | | 3,592 | | | |

| | | | | | |

Total Liabilities | | | 5,708,321 | | | |

| | | | | | |

Net Assets | | $ | 102,527,793 | | | |

| | | | | | |

| | |

Represented by: | | | | | | |

Capital | | $ | 89,353,813 | | | |

Accumulated undistributed net investment income | | | 102,851 | | | |

Accumulated net realized gains from investments | | | 7,615,575 | | | |

Net unrealized appreciation/(depreciation) from investments | | | 5,455,554 | | | |

| | | | | | |

Net Assets | | $ | 102,527,793 | | | |

| | | | | | |

Net Assets: | | | | | | |

Class A Shares | | $ | 1,102,616 | | | |

Class C Shares | | | 12,501,150 | | | |

Class M Shares | | | 88,479,981 | | | |

Institutional Service Class Shares | | | 433,029 | | | |

Institutional Class Shares | | | 11,017 | | | |

| | | | | | |

Total | | $ | 102,527,793 | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| * | Includes value of securities on loan of $4,711,266 (Note 2). |

12

Statement of Assets and Liabilities (Continued)

July 31, 2014

| | | | | | |

| | | Nationwide

Bailard Cognitive

Value Fund |

Shares Outstanding (unlimited number of shares authorized): | | | | | | |

Class A Shares | | | 83,307 | | | |

Class C Shares | | | 988,336 | | | |

Class M Shares | | | 6,705,048 | | | |

Institutional Service Class Shares | | | 32,766 | | | |

Institutional Class Shares | | | 835 | | | |

| | | | | | |

Total | | | 7,810,292 | | | |

| | | | | | |

Net asset value and redemption price per share (Net assets by class divided by shares outstanding by class, respectively): | | | | | | |

Class A Shares (a) | | $ | 13.24 | | | |

Class C Shares (b) | | $ | 12.65 | | | |

Class M Shares | | $ | 13.20 | | | |

Institutional Service Class Shares | | $ | 13.22 | | | |

Institutional Class Shares | | $ | 13.19 | | | |

Maximum offering price per share (100%/(100%-maximum sales charge) of net asset value adjusted to the nearest cent): | | | | | | |

Class A Shares | | $ | 14.05 | | | |

| | | | | | |

Maximum Sales Charge: | | | | | | |

Class A Shares | | | 5.75 | % | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | | |

| (a) | For Class A Shares, the redemption price per share is reduced by 1.00% on sales of shares of original purchases of $1,000,000 or more or that were not subject to a front-end sales charge made within 18 months of the purchase date. |

| (b) | For Class C Shares, the redemption price per share is reduced by 1.00% for shares held less than one year. |

The accompanying notes are an integral part of these financial statements.

13

Statement of Operations

For the Year Ended July 31, 2014

| | | | | | |

| | | Nationwide

Bailard Cognitive

Value Fund |

INVESTMENT INCOME: | | | | | | |

Dividend income | | $ | 1,930,085 | | | |

Interest income | | | 39 | | | |

Income from securities lending (Note 2) | | | 19,165 | | | |

Foreign tax withholding | | | (2,728 | ) | | |

| | | | | | |

Total Income | | | 1,946,561 | | | |

| | | | | | |

EXPENSES: | | | | | | |

Investment advisory fees | | | 788,408 | | | |

Fund administration fees | | | 130,275 | | | |

Distribution fees Class A | | | 2,822 | | | |

Distribution fees Class C | | | 104,128 | | | |

Administrative servicing fees Class A | | | 1,422 | | | |

Administrative servicing fees Class C | | | 324 | | | |

Administrative servicing fees Institutional Service Class (a) | | | 1,939 | | | |

Registration and filing fees | | | 56,519 | | | |

Professional fees | | | 34,026 | | | |

Printing fees | | | 15,605 | | | |

Trustee fees | | | 2,672 | | | |

Custodian fees | | | 4,123 | | | |

Accounting and transfer agent fees | | | 9,849 | | | |

Compliance program costs (Note 3) | | | 1,748 | | | |

Other | | | 12,913 | | | |

| | | | | | |

Total expenses before earnings credit, fees waived, and expenses reimbursed | | | 1,166,773 | | | |

| | | | | | |

Earnings credit (Note 5) | | | (150 | ) | | |

Administrative servicing fees voluntarily waived — Class A (Note 3) | | | (141 | ) | | |

Administrative servicing fees voluntarily waived — Institutional Service Class (Note 3) (a) | | | (235 | ) | | |

Expenses reimbursed by adviser (Note 3) | | | (3,943 | ) | | |

| | | | | | |

Net Expenses | | | 1,162,304 | | | |

| | | | | | |

NET INVESTMENT INCOME | | | 784,257 | | | |

| | | | | | |

REALIZED/UNREALIZED GAINS (LOSSES) FROM INVESTMENTS: | | | | | | |

Net realized gains from investment transactions | | | 10,481,797 | | | |

Net change in unrealized appreciation/(depreciation) from investments | | | (922,140 | ) | | |

| | | | | | |

Net realized/unrealized gains from investments | | | 9,559,657 | | | |

| | | | | | |

CHANGE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 10,343,914 | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | | |

| (a) | Effective September 16, 2013, Fiduciary Shares were renamed Institutional Service Class Shares. |

The accompanying notes are an integral part of these financial statements.

14

Statements of Changes in Net Assets

| | | | | | | | | | | | |

| | | Nationwide Bailard Cognitive Value Fund |

| | | Year Ended

July 31, 2014 | | Year Ended

July 31, 2013 |

Operations: | | | | | | | | | | | | |

Net investment income | | $ | 784,257 | | | | | $ | 1,330,136 | | | |

Net realized gains from investments | | | 10,481,797 | | | | | | 22,104,698 | | | |

Net change in unrealized appreciation/(depreciation) from investments | | | (922,140 | ) | | | | | 1,516,351 | | | |

| | | | | | | | | |

Change in net assets resulting from operations | | | 10,343,914 | | | | | | 24,951,185 | | | |

| | | | | | | | | |

| | | | |

Distributions to Shareholders From: | | | | | | | | | | | | |

Net investment income: | | | | | | | | | | | | |

Class A | | | (8,779 | ) | | | | | (5,466 | ) | | |

Class C | | | (142,234 | ) | | | | | (1,418 | ) | | |

Class M | | | (1,159,326 | ) | | | | | (975,185 | ) | | |

Institutional Service Class (a) | | | (12,903 | ) | | | | | (35,776 | ) | | |

Institutional Class | | | (129 | )(b) | | | | | – | | | |

Net realized gains: | | | | | | | | | | | | |

Class A | | | (204,658 | ) | | | | | – | | | |

Class C | | | (2,644,093 | ) | | | | | – | | | |

Class M | | | (17,530,044 | ) | | | | | – | | | |

Institutional Service Class (a) | | | (246,368 | ) | | | | | – | | | |

Institutional Class | | | (1,945 | )(b) | | | | | – | | | |

| | | | | | | | | |

Change in net assets from shareholder distributions | | | (21,950,479 | ) | | | | | (1,017,845 | ) | | |

| | | | | | | | | |

Change in net assets from capital transactions | | | 17,352,778 | | | | | | (9,217,565 | ) | | |

| | | | | | | | | |

Change in net assets | | | 5,746,213 | | | | | | 14,715,775 | | | |

| | | | | | | | | |

| | | | |

Net Assets: | | | | | | | | | | | | |

Beginning of year | | | 96,781,580 | | | | | | 82,065,805 | | | |

| | | | | | | | | |

End of year | | $ | 102,527,793 | | | | | $ | 96,781,580 | | | |

| | | | | | | | | |

Accumulated undistributed net investment income at end of year | | $ | 102,851 | | | | | $ | 509,622 | | | |

| | | | | | | | | |

| | | | |

CAPITAL TRANSACTIONS: | | | | | | | | | | | | |

Class A Shares (Note 12) | | | | | | | | | | | | |

Proceeds from shares issued | | $ | 316,147 | | | | | $ | 493,322 | (c) | | |

Dividends reinvested | | | 187,155 | | | | | | 4,699 | | | |

Cost of shares redeemed | | | (413,516 | ) | | | | | (205,914 | ) | | |

| | | | | | | | | |

Total Class A Shares | | | 89,786 | | | | | | 292,107 | | | |

| | | | | | | | | |

Class C Shares (Note 12) | | | | | | | | | | | | |

Proceeds from shares issued | | | 15,698,391 | | | | | | 125,270 | (c) | | |

Dividends reinvested | | | 2,776,516 | | | | | | 1,190 | | | |

Cost of shares redeemed | | | (4,562,217 | ) | | | | | (102,342 | ) | | |

| | | | | | | | | |

Total Class C Shares | | | 13,912,690 | | | | | | 24,118 | | | |

| | | | | | | | | |

Class M Shares (Note 12) | | | | | | | | | | | | |

Proceeds from shares issued | | | 7,493,203 | | | | | | 6,055,974 | (c) | | |

Dividends reinvested | | | 16,892,388 | | | | | | 866,070 | | | |

Cost of shares redeemed | | | (19,651,113 | ) | | | | | (12,514,797 | ) | | |

| | | | | | | | | |

Total Class M Shares | | | 4,734,478 | | | | | | (5,592,753 | ) | | |

| | | | | | | | | |

| | | | | | | | | | | | |

| (a) | Effective September 16, 2013, Fiduciary Shares were renamed Institutional Service Class Shares. |

| (b) | For the period from September 19, 2013 (commencement of operations) through July 31, 2014. |

| (c) | Includes redemption fees. See Note 4 for further information. |

15

Statements of Changes in Net Assets (Continued)

| | | | | | | | | | | | |

| | | Nationwide Bailard Cognitive Value Fund |

| | | Year Ended

July 31, 2014 | | Year Ended

July 31, 2013 |

CAPITAL TRANSACTIONS: (continued) | | | | | | | | | | | | |

Institutional Service Class Shares (Note 12)(a) | | | | | | | | | | | | |

Proceeds from shares issued | | $ | 64,180 | | | | | $ | 1,303,454 | (c) | | |

Dividends reinvested | | | 234,018 | | | | | | 30,635 | | | |

Cost of shares redeemed | | | (1,694,448 | ) | | | | | (5,275,126 | ) | | |

| | | | | | | | | |

Total Institutional Service Class Shares | | | (1,396,250 | ) | | | | | (3,941,037 | ) | | |

| | | | | | | | | |

Institutional Class Shares | | | | | | | | | | | | |

Proceeds from shares issued | | | 10,000 | (b) | | | | | – | | | |

Dividends reinvested | | | 2,074 | (b) | | | | | – | | | |

Cost of shares redeemed | | | – | (b) | | | | | – | | | |

| | | | | | | | | |

Total Institutional Class Shares | | | 12,074 | (b) | | | | | – | | | |

| | | | | | | | | |

Change in net assets from capital transactions | | $ | 17,352,778 | | | | | $ | (9,217,565 | ) | | |

| | | | | | | | | |

SHARE TRANSACTIONS: | | | | | | | | | | | | |

Class A Shares (Note 12) | | | | | | | | | | | | |

Issued | | | 23,095 | | | | | | 36,204 | | | |

Reinvested | | | 15,020 | | | | | | 383 | | | |

Redeemed | | | (29,775 | ) | | | | | (15,249 | ) | | |

| | | | | | | | | |

Total Class A Shares | | | 8,340 | | | | | | 21,338 | | | |

| | | | | | | | | |

Class C Shares (Note 12) | | | | | | | | | | | | |

Issued | | | 1,069,693 | | | | | | 9,595 | | | |

Reinvested | | | 232,150 | | | | | | 100 | | | |

Redeemed | | | (351,995 | ) | | | | | (7,810 | ) | | |

| | | | | | | | | |

Total Class C Shares | | | 949,848 | | | | | | 1,885 | | | |

| | | | | | | | | |

Class M Shares (Note 12) | | | | | | | | | | | | |

Issued | | | 548,913 | | | | | | 455,168 | | | |

Reinvested | | | 1,360,746 | | | | | | 70,873 | | | |

Redeemed | | | (1,436,347 | ) | | | | | (922,037 | ) | | |

| | | | | | | | | |

Total Class M Shares | | | 473,312 | | | | | | (395,996 | ) | | |

| | | | | | | | | |

Institutional Service Class Shares (Note 12)(a) | | | | | | | | | | | | |

Issued | | | 5,024 | | | | | | 98,683 | | | |

Reinvested | | | 18,826 | | | | | | 2,507 | | | |

Redeemed | | | (120,659 | ) | | | | | (412,288 | ) | | |

| | | | | | | | | |

Total Institutional Service Class Shares | | | (96,809 | ) | | | | | (311,098 | ) | | |

| | | | | | | | | |

Institutional Class Shares | | | | | | | | | | | | |

Issued | | | 668 | (b) | | | | | – | | | |

Reinvested | | | 167 | (b) | | | | | – | | | |

Redeemed | | | – | (b) | | | | | – | | | |

| | | | | | | | | |

Total Institutional Class Shares | | | 835 | (b) | | | | | – | | | |

| | | | | | | | | |

Total change in shares | | | 1,335,526 | | | | | | (683,871 | ) | | |

| | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | |

Amounts designated as “–” are zero or have been rounded to zero.

| (a) | Effective September 16, 2013, Fiduciary Shares were renamed Institutional Service Class Shares. |

| (b) | For the period from September 19, 2013 (commencement of operations) through July 31, 2014. |

| (c) | Includes redemption fees. See Note 4 for further information. |

The accompanying notes are an integral part of these financial statements.

16

Financial Highlights

Selected data for each share of capital outstanding throughout the periods indicated

Nationwide Bailard Cognitive Value Fund

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Operations | | | Distributions | | | | | | Ratios/Supplemental Data | |

| | | Net Asset

Value,

Beginning

of Period | | | Net

Investment

Income

(Loss) | | | Net Realized

and

Unrealized

Gains

(Losses)

from

Investments | | | Total from

Operations | | | Net

Investment

Income | | | Net

Realized

Gains | | | Total

Distributions | | | Redemption

Fees | | | Net Asset

Value, End

of Period | | | Total

Return (a)(b)(c) | | | Net Assets

at End of

Period | | | Ratio of

Expenses

to Average

Net Assets (d) | | | Ratio of Net

Investment

Income (Loss)

to Average

Net Assets (d) | | | Ratio of Expenses

(Prior to

Reimbursements)

to Average

Net Assets (d)(e) | | | Portfolio

Turnover (f) | |

| Class A Shares | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year Ended July 31, 2014 (g) | | $ | 14.97 | | | | 0.06 | | | | 1.24 | | | | 1.30 | | | | (0.12 | ) | | | (2.91 | ) | | | (3.03 | ) | | | – | | | $ | 13.24 | | | | 10.00% | (h) | | $ | 1,102,616 | | | | 1.37% | | | | 0.46% | | | | 1.38% | | | | 286.05% | |

Year Ended July 31, 2013 (g) | | $ | 11.48 | | | | 0.14 | | | | 3.45 | | | | 3.59 | | | | (0.10 | ) | | | – | | | | (0.10 | ) | | | – | | | $ | 14.97 | | | | 31.48% | | | $ | 1,122,377 | | | | 1.47% | | | | 1.09% | | | | 1.58% | | | | 339.00% | |

Year Ended July 31, 2012 (g) | | $ | 11.51 | | | | 0.03 | | | | (0.01 | ) | | | 0.02 | | | | (0.05 | ) | | | – | | | | (0.05 | ) | | | – | | | $ | 11.48 | | | | 0.21% | | | $ | 615,772 | | | | 1.47% | | | | 0.23% | | | | 1.60% | | | | 268.00% | |

Year Ended July 31, 2011 (g) | | $ | 9.37 | | | | 0.07 | | | | 2.19 | | | | 2.26 | | | | (0.12 | ) | | | – | | | | (0.12 | ) | | | – | | | $ | 11.51 | | | | 24.05% | | | $ | 961,056 | | | | 1.47% | | | | 0.60% | | | | 1.58% | | | | 216.00% | |

Year Ended July 31, 2010 (g) | | $ | 7.89 | | | | 0.03 | | | | 1.50 | (i) | | | 1.53 | | | | (0.05 | ) | | | – | | | | (0.05 | ) | | | – | | | $ | 9.37 | | | | 19.60% | (i) | | $ | 654,681 | | | | 1.45% | | | | 0.34% | | | | 1.58% | | | | 152.00% | |

| | | | | | | | | | | | | | | |

| Class C Shares | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year Ended July 31, 2014 (g) | | $ | 14.55 | | | | (0.02 | ) | | | 1.19 | | | | 1.17 | | | | (0.16 | ) | | | (2.91 | ) | | | (3.07 | ) | | | – | | | $ | 12.65 | | | | 9.25% | | | $ | 12,501,150 | | | | 1.99% | | | | (0.14% | ) | | | 1.99% | | | | 286.05% | |

Year Ended July 31, 2013 (g) | | $ | 11.17 | | | | 0.06 | | | | 3.36 | | | | 3.42 | | | | (0.04 | ) | | | – | | | | (0.04 | ) | | | – | | | $ | 14.55 | | | | 30.67% | | | $ | 559,903 | | | | 2.07% | | | | 0.49% | | | | 2.08% | | | | 339.00% | |

Year Ended July 31, 2012 (g) | | $ | 11.20 | | | | (0.04 | ) | | | 0.01 | | | | (0.03 | ) | | | – | | | | – | | | | – | | | | – | | | $ | 11.17 | | | | (0.27% | ) | | $ | 408,689 | | | | 2.07% | | | | (0.37% | ) | | | 2.10% | | | | 268.00% | |

Year Ended July 31, 2011 (g) | | $ | 9.11 | | | | – | | | | 2.12 | | | | 2.12 | | | | (0.03 | ) | | | – | | | | (0.03 | ) | | | – | | | $ | 11.20 | | | | 23.30% | | | $ | 567,831 | | | | 2.07% | | | | – | | | | 2.08% | | | | 216.00% | |

Year Ended July 31, 2010 (g) | | $ | 7.68 | | | | (0.02 | ) | | | 1.47 | (i) | | | 1.45 | | | | (0.02 | ) | | | – | | | | (0.02 | ) | | | – | | | $ | 9.11 | | | | 18.92% | (i) | | $ | 520,057 | | | | 2.05% | | | | (0.26% | ) | | | 2.08% | | | | 152.00% | |

| | | | | | | | | | | | | | | |

| Class M Shares | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year Ended July 31, 2014 (g) | | $ | 14.95 | | | | 0.12 | | | | 1.23 | | | | 1.35 | | | | (0.19 | ) | | | (2.91 | ) | | | (3.10 | ) | | | – | | | $ | 13.20 | | | | 10.38% | | | $ | 88,479,981 | | | | 1.00% | | | | 0.85% | | | | 1.01% | | | | 286.05% | |

Year Ended July 31, 2013 (g) | | $ | 11.47 | | | | 0.19 | | | | 3.44 | | | | 3.63 | | | | (0.15 | ) | | | – | | | | (0.15 | ) | | | – | | | $ | 14.95 | | | | 31.94% | | | $ | 93,162,527 | | | | 1.07% | | | | 1.49% | | | | 1.08% | | | | 339.00% | |

Year Ended July 31, 2012 (g) | | $ | 11.51 | | | | 0.07 | | | | – | | | | 0.07 | | | | (0.11 | ) | | | – | | | | (0.11 | ) | | | – | | | $ | 11.47 | | | | 0.71% | | | $ | 75,990,508 | | | | 1.07% | | | | 0.63% | | | | 1.10% | | | | 268.00% | |

Year Ended July 31, 2011 (g) | | $ | 9.37 | | | | 0.11 | | | | 2.18 | | | | 2.29 | | | | (0.15 | ) | | | – | | | | (0.15 | ) | | | – | | | $ | 11.51 | | | | 24.54% | | | $ | 87,921,410 | | | | 1.07% | | | | 1.00% | | | | 1.08% | | | | 216.00% | |

Year Ended July 31, 2010 (g) | | $ | 7.87 | | | | 0.06 | | | | 1.51 | (i) | | | 1.57 | | | | (0.07 | ) | | | – | | | | (0.07 | ) | | | – | | | $ | 9.37 | | | | 20.08% | (i) | | $ | 70,390,248 | | | | 1.05% | | | | 0.74% | | | | 1.08% | | | | 152.00% | |

| | | | | | | | | | | | | | | |

| Institutional Service Class Shares (j) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year Ended July 31, 2014 (g) | | $ | 14.95 | | | | 0.10 | | | | 1.23 | | | | 1.33 | | | | (0.15 | ) | | | (2.91 | ) | | | (3.06 | ) | | | – | | | $ | 13.22 | | | | 10.23% | (h) | | $ | 433,029 | | | | 1.14% | | | | 0.75% | | | | 1.16% | | | | 286.05% | |

Year Ended July 31, 2013 (g) | | $ | 11.46 | | | | 0.18 | | | | 3.45 | | | | 3.63 | | | | (0.14 | ) | | | – | | | | (0.14 | ) | | | – | | | $ | 14.95 | | | | 31.93% | | | $ | 1,936,773 | | | | 1.14% | | | | 1.42% | | | | 1.33% | | | | 339.00% | |

Year Ended July 31, 2012 (g) | | $ | 11.50 | | | | 0.06 | | | | – | | | | 0.06 | | | | (0.10 | ) | | | – | | | | (0.10 | ) | | | – | | | $ | 11.46 | | | | 0.60% | | | $ | 5,050,836 | | | | 1.16% | | | | 0.54% | | | | 1.35% | | | | 268.00% | |

Year Ended July 31, 2011 (g) | | $ | 9.36 | | | | 0.09 | | | | 2.19 | | | | 2.28 | | | | (0.14 | ) | | | – | | | | (0.14 | ) | | | – | | | $ | 11.50 | | | | 24.32% | | | $ | 5,075,223 | | | | 1.21% | | | | 0.86% | | | | 1.33% | | | | 216.00% | |

Year Ended July 31, 2010 (g) | | $ | 7.87 | | | | 0.06 | | | | 1.50 | (i) | | | 1.56 | | | | (0.07 | ) | | | – | | | | (0.07 | ) | | | – | | | $ | 9.36 | | | | 20.06% | (i) | | $ | 2,230,226 | | | | 1.13% | | | | 0.66% | | | | 1.33% | | | | 152.00% | |

| | | | | | | | | | | | | | | |

| Institutional Class Shares | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Period Ended July 31, 2014 (g)(k) | | $ | 14.97 | | | | 0.09 | | | | 1.23 | | | | 1.32 | | | | (0.19 | ) | | | (2.91 | ) | | | (3.10 | ) | | | – | | | $ | 13.19 | | | | 10.15% | | | $ | 11,017 | | | | 0.99% | | | | 0.76% | | | | 0.99% | | | | 286.05% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amounts designated as “–” are zero or have been rounded to zero.

| (a) | Excludes sales charge. |

| (b) | Not annualized for periods less than one year. |

| (c) | Total returns prior to the Fund’s inception date on September 16, 2013 are based on the perfomance of the Fund’s predecessor fund. |

| (d) | Annualized for periods less than one year. |

| (e) | During the period, certain fees may have been waived and/or reimbursed. If such waivers/reimbursements had not occurred, the ratios would have been as indicated. |

| (f) | Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing among the classes of shares. |

| (g) | Per share calculations were performed using average shares method. |

| (h) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

| (i) | Includes payment by affiliates of $0.001 per share. The effects of such payments did not affect the amount shown as total return for the period. |

| (j) | Effective September 16, 2013, Fiduciary Shares were renamed Institutional Service Class Shares. |

| (k) | For the period from September 19, 2013 (commencement of operations) through July 31, 2014. Total return is calculated based on inception date of September 18, 2013 through July 31, 2014. |

The accompanying notes are an integral part of these financial statements.

17

| | |

| Fund Commentary | | Nationwide Bailard International Equities Fund |

For the annual period ended July 31, 2014, the Nationwide Bailard International Equities Fund (Class M) returned 16.42%* versus 15.07% for its benchmark, the MSCI EAFE® Index, and 15.91% for its former benchmark, the MSCI ACWI ex USA.** For broader comparison, the median return for the Fund’s closest Lipper peer category of International Multi-Cap Core Funds (consisting of 379 funds as of July 31, 2014) was 12.67% for the same time period.

*Performance prior to the Fund’s inception on September 16, 2013, is based on the performance of the Fund’s predecessor fund.

**The Fund’s benchmark changed to the MSCI EAFE® Index effective February 3, 2014.

The Fund operates from the top down, with a strategy that focuses first on country selection, followed by stock selection within each individual market. During the reporting period, country selection was neutral to slightly negative while stock selection was a positive contributor to Fund performance versus the benchmark.

During the reporting period, added value for the Fund in the area of country selection came from overweighting the Fund’s investments in selected emerging and developed markets. The reporting period was punctuated by two distinct periods. During the first six months, developed markets performed very well while emerging markets struggled; the reverse was true during the latter half of the reporting period. In the initial period, concerns about tapering (reduction) of bond purchases by the U.S. Federal Reserve and uncertainty about policies in Japan that were intended to weaken that country’s currency led to fears of both competitive currency devaluations in Asia and risk to a range of emerging markets (termed the “Fragile Five” consisting of Turkey, Brazil, India, South Africa and Indonesia). Due to large current account deficits, the Fragile Five were considered most dependent on foreign capital. In the latter half of the reporting period, concerns about continuing weakness in Europe led to talk of deflation, bringing the yield on 10-year Swiss government debt below that of Japan. Alternatively, investors discounted their fears of financial risk around emerging markets

(even as political risk cropped up in a diverse range of markets, including Thailand, Russia, Turkey and Argentina) and began to recognize the compelling relative value in many of these countries.

Beneficial country choices for the Fund during the reporting period included overweight positions in Finland, India, and Argentina and an underweight position in Switzerland. While Japanese companies produced great earnings during this period, Japanese shares failed to follow suit. The combination, though, of overweighting the market while hedging a portion of the currency risk did result in a slight net benefit for the Fund as the yen declined from 98 to 103 in relation to the U.S. dollar during the reporting period.

Results for the Fund on the stock selection side during the reporting period were strongest in Japan and across much of developed Europe (France, the U.K., Spain, and Switzerland), where portfolio holdings far outperformed the index. Within each market, the Fund’s sector weights are generally held in line with the index, and sector selection is not pursued as an investment strategy. Notable individual stocks held by the Fund that outperformed during the reporting period included printer and watch maker Seiko Epson in Japan, computer peripheral company Logitech International in Switzerland, banks Credit Agricole in France and Bankinter in Spain, auto parts supplier Valeo in France, and retailer W.H. Smith in the U.K.

Country selection decisions that did not help Fund results during the reporting period included a couple of “misses” in high-flying developed markets (underweights in Italy, Denmark and Australia) as well as overweight exposures to disappointing emerging markets Hungary and Russia.

Points of weakness for stock selection in the Fund during the reporting period were Netherlands, Italy, Hong Kong and India, where Fund holdings failed to keep up with the respective MSCI country indexes. The benefits of the Fund’s strong returns in the large developed markets outweighed the negative results from the Fund’s investments in these relatively smaller markets.

18

| | |

| Fund Commentary (con’t.) | | Nationwide Bailard International Equities Fund |

The most notable individual stock detractor from Fund performance during the reporting period was a name not held by the Fund, Nokia in Finland, which rose mightily on a generous bid by Microsoft for its handset business. Other detractors from Fund performance included an exposure to PostNL, the Dutch mail service, and an overweight to Hong Kong developer New World Development.

During the reporting period, the Fund entered into financial futures contracts to enable the Fund to more closely approximate the performance of its benchmark or for tactical hedging purposes. The Fund entered into forward foreign currency contracts in connection with planned purchases or sales of securities denominated in a foreign currency and/or to hedge the U.S. dollar value of portfolio securities denominated in a foreign currency.

Subadviser:

Bailard, Inc.

Portfolio Managers:

Anthony Craddock, Peter M. Hill and Eric P. Leve

The Fund is subject to the risks of investing in equity securities and risks associated with investing in foreign securities, such as currency fluctuation, political risk, differences in accounting and limited availability of information, all of which are magnified in emerging markets. The Fund may invest in more-aggressive investments such as derivatives (many of which create investment leverage and are highly volatile) and exchange-traded funds (ETFs) (shareholders will bear additional costs). High double-digit returns are unusual and cannot be sustained. Please refer to the most recent prospectus for a more detailed explanation of the Fund’s principal risks.

A description of the benchmarks can be found on the Market Index Definitions page at the back of this book.

19

| | |

| Fund Overview | | Nationwide Bailard International Equities Fund |

Objective

The Fund seeks long-term capital appreciation.

Highlights

| | Ÿ | | For the annual period ended July 31, 2014, the Nationwide Bailard International Equities Fund (Class M) returned 16.42%, outperforming its benchmark by 1.35% and the Lipper peer category median by 3.75%. | |

| | Ÿ | | During the reporting period, country selection was neutral to slightly negative while stock selection was a positive contributor to Fund performance versus the benchmark. | |

| | Ÿ | | Beneficial country choices for the Fund during the reporting period included overweight positions in Finland, India, and Argentina and an underweight position in Switzerland. While Japanese companies produced great earnings during this period, Japanese shares failed to follow suit. | |

Asset Allocation†

| | | | |

| Common Stocks | | | 96.4% | |

| Repurchase Agreement | | | 1.7% | |

| Exchange Traded Fund | | | 1.4% | |

| Mutual Fund | | | 0.2% | |

| Other assets in excess of liabilities | | | 0.3% | |

| | | | 100.0% | |

Top Industries††

| | | | |

| Banks | | | 12.4% | |

| Oil, Gas & Consumable Fuels | | | 7.8% | |

| Pharmaceuticals | | | 6.1% | |

| Insurance | | | 5.7% | |

| Diversified Telecommunication Services | | | 4.1% | |

| Food Products | | | 3.5% | |

| Capital Markets | | | 3.5% | |

| Auto Components | | | 3.2% | |

| Construction & Engineering | | | 3.2% | |

| Wireless Telecommunication Services | | | 2.9% | |

| Other Industries* | | | 47.6% | |

| | | | 100.0% | |

Top Holdings††

| | | | |

| Seiko Epson Corp. | | | 2.0% | |

| Sumitomo Mitsui Financial Group, Inc. | | | 1.9% | |

| Unilever PLC | | | 1.8% | |

| Market Vectors Russia ETF | | | 1.4% | |

| Vinci SA | | | 1.3% | |

| Credit Agricole SA | | | 1.3% | |

| BT Group PLC | | | 1.1% | |

| Bayer AG | | | 1.1% | |

| Deutsche Post AG | | | 1.1% | |

| AstraZeneca PLC | | | 1.1% | |

| Other Holdings* | | | 85.9% | |

| | | | 100.0% | |

| † | Percentages indicated are based upon net assets as of July 31, 2014. |

| †† | Percentages indicated are based upon total investments as of July 31, 2014. |

| * | For purposes of listing top industries, top holdings and top countries, the repurchase agreement is included as part of Other. |

20

| | |

| Fund Performance | | Nationwide Bailard International Equities Fund |

Average Annual Total Return

(For periods ended July 31, 2014)

| | | | | | | | | | | | | | | | | | |

| | | | | 1 Yr. | | | 5 Yr. | | | 10 Yr. | | | Inception | |

| Class A1 | | w/o SC2 | | | 15.92% | | | | 9.30% | | | | 7.99% | | | | – | |

| | | w/ SC3 | | | 9.56% | | | | 8.06% | | | | 7.39% | | | | – | |

| Class C1 | | w/o SC2 | | | 15.12% | | | | 8.59% | | | | 7.27% | | | | – | |

| | | w/ SC4 | | | 14.12% | | | | 8.59% | | | | 7.27% | | | | – | |

| Class M1,5 | | | | | 16.42% | | | | 9.67% | | | | 8.36% | | | | – | |

| Institutional Service Class1,5,6 | | | | | 16.13% | | | | 9.48% | | | | 8.20% | | | | – | |

| Institutional Class5 | | | | | – | | | | – | | | | – | | | | 8.78% | 7* |

| MSCI EAFE Index | | | | | 15.07% | | | | 9.40% | | | | 7.07% | | | | – | |

| MSCI ACWI ex USA | | | | | 15.48% | | | | 9.29% | | | | 7.32% | | | | – | |

| CPI | | | | | 1.99% | | | | 2.04% | | | | 2.32% | | | | – | |

All figures showing the effect of a sales charge (SC) reflect the maximum charge possible, because it has the most significant effect on performance data.

| 1 | Total returns prior to the Fund’s inception on September 16, 2013 are based on the performance of the Fund’s predecessor fund. |

| 2 | These returns do not reflect the effects of SCs. |

| 3 | For the period from September 16, 2013 through July 31, 2014 a front-end sales charge of 5.75% was deducted. Prior to September 16, 2013, a front-end sales charge of 5.50% was deducted. |

| 4 | A 1.00% CDSC was deducted from the one year return because it is charged when you sell Class C shares within the first year after purchase. |

| 5 | Not subject to any SCs. |

| 6 | Effective September 16, 2013, Fiduciary Shares were renamed Institutional Service Class Shares. |

| 7 | Since inception date of September 18, 2013. |

Expense Ratios

| | | | |

| | | Expense Ratio* | |

| Class A | | | 1.42% | |

| Class C | | | 2.01% | |

| Class M | | | 0.92% | |

| Institutional Service Class | | | 1.17% | |

| Institutional Class | | | 0.92% | |

| * | Current effective prospectus dated November 29, 2013 (as revised March 1, 2014). Please see the Fund’s most recent prospectus for details. |

21

| | |

| Fund Performance (con’t.) | | Nationwide Bailard International Equities Fund |

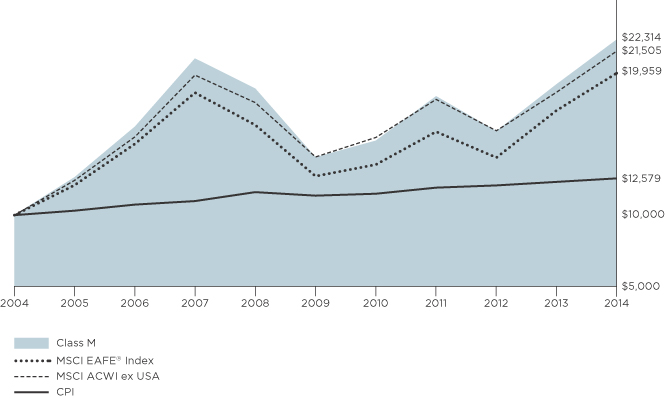

Performance of a $10,000 Investment

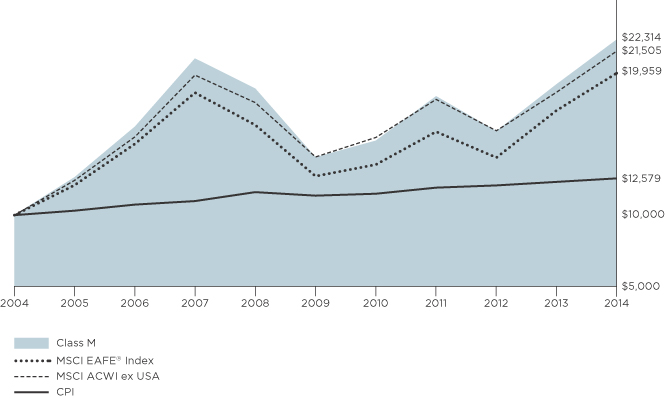

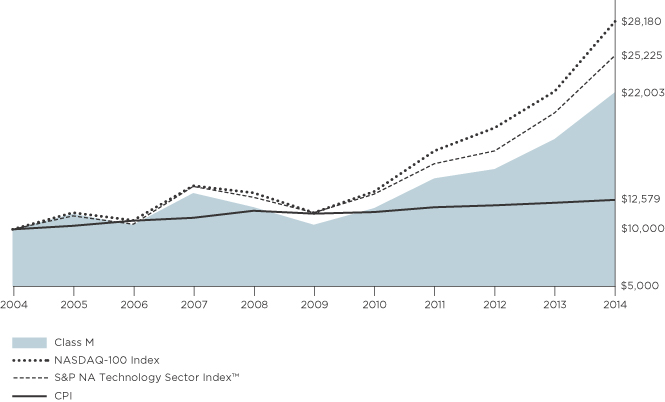

Investment return and principal value will fluctuate, and when redeemed, shares may be worth more or less than original cost. Past performance is no guarantee of future results and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investing in mutual funds involves market risk, including loss of principal. Performance returns assume the reinvestment of all distributions.