UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM N-CSR/A

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File number: 811-08495

NATIONWIDE MUTUAL FUNDS

(Exact name of registrant as specified in charter)

1000 CONTINENTAL DRIVE, SUITE 400, KING OF PRUSSIA, PENNSYLVANIA 19406-2850

(Address of principal executive offices) (Zip code)

Eric E. Miller, Esq.

1000 Continental Drive

Suite 400

King of Prussia, Pennsylvania 19406-2850

(Name and address of agent for service)

Registrant’s telephone number, including area code: (610) 230-2839

Date of fiscal year end: October 31, 2013

Date of reporting period: November 1, 2012 through October 31, 2013

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than ten (10) days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 C.F.R. § 270.30e-1). The Commission may use the information provided on Form N-CSR in the Commission’s regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, D. C. 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Explanatory Note: This Form N-CSR/A for Nationwide Mutual Funds (the “Registrant”) is being filed solely to reflect a change in the information shown in the Performance of a $10,000 Investment for Nationwide Alternatives Allocation Fund, Nationwide Investor Destinations Aggressive Fund, Nationwide Investor Destinations Moderately Aggressive Fund, Nationwide Investor Destinations Moderate Fund, Nationwide Investor Destinations Moderately Conservative Fund and Nationwide Investor Destinations Conservative Fund within Item 1 “Reports to Stockholders” which were caused by a printer error. The annual reports for the other portfolios of the Registrant are contained in the Form N-CSR filed on December 30, 2013 (Accession Number 0001193125-13-487656) and are not amended or modified in any way by this Form N-CSR/A. Other than the aforementioned amendment, no other information or disclosures contained in the Registrant’s Form N-CSR filed on December 30, 2013 are being amended by this Form N-CSR/A.

Item 1. Reports to Stockholders.

Include a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 C.F.R. § 270.30e-1).

Annual Report

October 31, 2013

Nationwide Mutual Funds

Alternatives Allocation Fund

Nationwide Alternatives Allocation Fund

| Nationwide Funds® |

Commentary in this report is provided by the portfolio manager(s) of each Fund as of the date of this report and is subject to change at any time based on market or other conditions.

Third-party information has been obtained from sources that Nationwide Fund Advisors (NFA), the investment adviser to the Funds, deems reliable. This report and the holdings provided are for informational purposes only and are not intended to be relied on as investment advice. Portfolio composition is accurate as of the date of this report and is subject to change at any time and without notice. NFA, one of its affiliated advisers or its employees may hold a position in the securities in this report.

Statement Regarding Availability of Quarterly Portfolio Holdings

The Trust files complete schedules of portfolio holdings for each Fund with the Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year on Form N-Q. Additionally, the Trust files a schedule of portfolio holdings monthly for the Nationwide Money Market Fund on Form N-MFP. Forms N-Q and Forms N-MFP are available on the SEC’s website at http://www.sec.gov. Forms N-Q and Forms N-MFP may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330. The Trust also makes this information available to shareholders on nationwide.com/mutualfunds or upon request without charge.

Statement Regarding Availability of Proxy Voting Record

Information regarding how the Funds voted proxies relating to portfolio securities held during the most recent 12-month period ended June 30 is available without charge, upon request, by calling 800-848-0920, and on the SEC’s website at http://www.sec.gov.

| Nationwide Funds® Annual Report |

This page intentionally left blank

Nationwide Funds®

October 31, 2013

Dear Shareholder,

I am proud to report that Nationwide Financial has acquired 17 mutual funds through an agreement with HighMark Capital Management, Inc. and approval of its shareholders. This agreement is the latest step in the Nationwide Financial strategy to pursue Nationwide Funds growth.

Why is this important to you, a Nationwide Funds shareholder? By adding these HighMark Funds to the Nationwide Mutual Funds lineup, we continue to expand our selection of investment strategies. The transaction provides Nationwide Funds with approximately $3.6 billion in new mutual fund assets, enabling Nationwide to present a wider array of investment offerings. It also underscores our commitment to helping Americans, like you, prepare for and live in retirement.

During the 12-month reporting period ended October 31, 2013, broad U.S. stock market performance was predominantly positive, with the S&P 500® Index returning 27.18%. Yet despite recent encouraging returns, several years of economic volatility and uncertainty have left some investors distrustful of the markets and wary about their economic futures. In short, they have developed a fear of financial planning.

Nationwide Funds recently released the results of its in-depth investor sentiment survey conducted by Harris Interactive, titled Fear of Financial Planning. The study revealed that 26 percent of potential investors do not have a financial plan. Given that we live in an era when Americans are more responsible for their own financial security than ever before, we find this statistic troubling and are working to spread the word that financial planning is a necessity, not an option.

We encourage all of our shareholders to meet regularly with their financial advisors. An effective financial plan involves much more than just opening an investment account. It includes taking a macro-level view of your circumstances and making use of thoughtful, customized long-term analysis. An effective financial plan also contains contingencies to offset potential surprises and risks, specific action steps and defined milestones to help increase your confidence and measure success. Armed with a plan, you are never alone.

In his novel “The Hobbit,” author J.R.R. Tolkien wrote, “It does not do to leave a live dragon out of your calculations, if you live near him.” Since the beginning of the financial crisis, investors have been living close to a live dragon and have felt his heat. However, as every experienced dragon slayer knows, having a comprehensive plan of attack, a wide array of tools and a team of trusted experts by your side quiets fear and fortifies you to pursue victory.

Thank you for investing with Nationwide Funds.

Sincerely,

Michael S. Spangler

President & CEO

Nationwide Funds

1

| Economic Review |

During the fiscal year ended October 31, 2013, most asset classes reported strong performance. Domestic equities experienced a broad-based rally, with the S&P 500® Index delivering a 27.2% return, and with nearly all sectors and capitalization ranges delivering strong performance. International equities also were solid, with developed markets outperforming emerging markets. Fixed-income results were mixed, as credit-sensitive indexes showed positive returns, while rate-sensitive indexes were affected by rising Treasury yields.

Domestically, the reporting period was dominated by news from Washington. The main topics from November 2012 through January 2013 consisted of the national election for president and congressional control and a heated debate on the fiscal cliff. Concerns about the tapering (gradual reduction) of the Federal Reserve’s Quantitative Easing (“QE”) policy, the federal government shutdown and rhetoric in Congress related to raising the debt ceiling affected trading in August, September and October 2013.

The S&P 500 Index was up 10 of the 12 months of the fiscal year, including consecutively from November 2012 through May 2013.

The S&P 500 Index showed modest gains in November and December 2012 of 0.58% and 0.91%, respectively, despite the political uncertainty.

The first quarter of calendar-year 2013 saw a substantial rally, with the S&P 500 Index up 10.6% on relief over a conclusion to a contentious election season and the implementation of the federal spending cuts on March 1. The broad-based market’s strength continued in April and May, with the S&P 500 Index returning 1.9% and 2.3%, respectively, before the market became choppy for the remainder of the reporting period on a spike in interest rates. The equity and fixed-income markets reacted to comments from Federal Reserve Chairman Ben Bernanke suggesting a tapering of the Fed’s QE program

later in the year. Volatility increased materially, with substantial positive returns for the S&P 500 Index of 5.1% in July, 3.1% in September and 4.6% in October, somewhat offset by postings of -1.3% in June and -2.9% in August. A theme in the market during 2013 was “sell the rumor, buy the news,” as the market sold off modestly into the period of uncertainty, and rallied substantially as a conclusion was reached.

While gradually improving through the reporting period, U.S. economic activity was sluggish during the period, with GDP growth of 0.1%, 1.1%, 2.5% and 2.8% from calendar 4Q12 through calendar 3Q13. This was the primary impetus for the cautious approach by the Federal Reserve with regard to maintaining the QE program. Inflation remained well controlled during the reporting period, with the core Consumer Price Index (CPI) below 2% throughout the period, ending at 1.7% in October 2013. CPI, which includes the volatile food and energy categories, was actually lower than core CPI, averaging 1.6% and exiting September 2013 at 1.2%. Despite job-creation levels coming in lower than during many past recoveries, the unemployment rate continued to decline during the reporting period, falling from 7.9% to 7.2%, aided by the labor participation rate declining to 63.3% from 63.8% a year ago (the figure was more than 66% at the beginning of the 2008 recession).

The strong performance in domestic equities was broad based during the reporting period, with small-capitalization stocks outperforming large-cap stocks, and growth and value roughly equal. The best-performing sectors in the S&P 500 Index were consumer discretionary, with 40.5%, industrials, with 35.8% and health care, with 34.3%. Consumer discretionary and industrials benefited from improved profits and expanding valuations, and health care rose in reaction to excitement surrounding new products. The worst-performing sectors were utilities, with 9.5% and telecommunications, with 13.1%. Utilities and telecommunications were relatively impacted by rising rates, as the high dividends paid by these sectors were relatively less attractive.

2

| Economic Review (con’t.) |

The strong performance in domestic equities was broad based during the reporting period, with small-capitalization stocks outperforming large-cap stocks, and growth and value roughly equal.

International stocks were very strong at the start of the reporting period, as European shares rallied on hopes that the worst of the stress on the banking system was behind them. Asian shares rose in reaction to a U.S. rally and the prospect of additional stimulus from Japan’s Central Bank. In November and December 2012, international shares materially outperformed U.S. shares, with the MSCI ACWI ex USA Index outperforming the S&P 500 Index by nearly 4%. Throughout the year, the performance of international stocks continued to be positive but weaker relative to U.S. stocks. Europe was reminded of the fragile state of the banking systems of its weaker members, this time with Cyprus. Continued political tensions in Greece, sluggish economic growth and worries about a U.S. tapering depressed relative returns through mid-year, before the market rallied in response to stabilization of political and banking system risk. Asia was relatively strong throughout the year, primarily due to the prospect of renewed stimulus by Japan’s Central Bank and a beneficial exchange rate. Emerging market stocks lagged on concerns about China’s slowing economic growth as well as political tensions in Brazil, Turkey, North Korea and the Middle East, and steadily declining commodity prices.

Performance in the fixed-income markets was driven by a sustained period of rising rates throughout most of the reporting period. Long-term Treasury yields rose meaningfully during the period, moving from a low of 1.70% in October 2012 to a high of 3.00% in September 2013 on anticipation of the tapering of Fed policy, but fell to 2.54% by the end of October as those concerns faded. The broadly based Barclays U.S. Aggregate Bond Index posted a total return of -1.1% for the reporting period. Long-duration benchmarks showed negative relative

performance, with the Barclays Long U.S. Treasury Index down 9.3%. A generally benign economic environment allowed a narrowing of most credit spreads, resulting in positive performance for high-yield and emerging market benchmarks. Municipal bonds performed largely in line with the broader index, as the positive impact from the gradual improvement in economic conditions was offset by a few high-profile events, such as the fears of a possible default of Puerto Rico, the third-largest municipal issuer behind California and New York.

| Index | Fiscal Year Total Return | |||

| S&P 500® | 27.18% | |||

| Russell 1000® Growth | 28.30% | |||

| Russell 1000® Value | 28.29% | |||

| Russell 2000® | 36.28% | |||

| MSCI World ex USA | 24.65% | |||

| MSCI Emerging Markets | 6.53% | |||

| Barclays U.S. Aggregate Bond | -1.08% | |||

| Barclays U.S. 10-20 Year Treasury Bond | -5.23% | |||

| Barclays U.S. 1-3 Year Government/Credit Bond | 0.77% | |||

| Barclays Municipal Bond | -1.72% | |||

| Barclays U.S. Corporate High Yield | 8.87% | |||

| Barclays Emerging Markets USD Aggregate Bond | -1.24% | |||

3

| Fund Commentary | Nationwide Alternatives Allocation Fund |

For the annual period ended October 31, 2013, the Nationwide Alternatives Allocation Fund (Institutional Class) returned 1.28% versus 10.34% for its composite benchmark, 50% Barclays Global Aggregate Bond Index and 50% MSCI All Country World IndexSM. For broader comparison, the average return for the Fund’s closest Lipper peer category of Global Flexible Portfolio Funds (consisting of 425 funds as of October 31, 2013) was 10.11% for the same time period.

The Fund is designed to provide investors with exposure to seven alternative asset classes with investment performance that may have a low correlation to the performance of more traditional asset classes (e.g., stocks of U.S. and international developed-country issuers and investment-grade bonds issued in the U.S.). These seven asset classes are global real estate stocks, emerging market stocks, emerging market bonds, international (developed market) bonds, U.S. high-yield bonds, U.S. Treasury Inflation-Protected Securities (TIPS) and commodities. The Fund seeks to achieve its objective by investing in a professionally selected mix of these different alternative asset classes that the Fund’s investment adviser believes offer the risk and return characteristics that may provide a complement to an investor’s investments in more traditional asset classes.

From a macroeconomic standpoint, the period was arguably dominated by statements from the U.S. Federal Reserve (Fed) supporting its pace of asset purchases to bolster the economy, then wavering on the subject, and eventually reaffirming its intent to support the economy by maintaining its current pace. Along the way, the Fund’s returns from these seven asset classes reacted sharply to each of these changes in direction and wound up mixed over the 12-month period. Double-digit returns were posted by the U.S. high-yield bond and global real estate sleeves, and smaller positive returns were generated by emerging market equities and international developed market bonds. U.S. high yield continued a string of strong quarterly returns (briefly interrupted in May and June) for this asset class as investors seeking higher bond yields and willing to trade higher credit risk for lower interest-rate risk have driven strong flows

into this class. Global real estate gained as commercial real estate markets in Europe rebounded strongly during the quarter while U.S. markets were slightly positive.

The Fund sleeves representing commodities, TIPS and emerging market debt posted negative returns. The commodities sleeve was adversely affected by, among other things, slackening demand for precious and industrial metals as slowing growth took hold in China, Brazil and other emerging market economies. Both TIPS and emerging market debt were adversely affected by the gradual rise in longer-term bond prices (as noted above). In the case of TIPS, inflation remained relatively low in the U.S., causing “real” yields (current yield minus current inflation level) to be negative and a disincentive to investment. In the case of emerging market debt, the slowing of inflows of foreign capital to many of these markets and the strengthening of the U.S. dollar against certain currencies further combined to reduce returns.

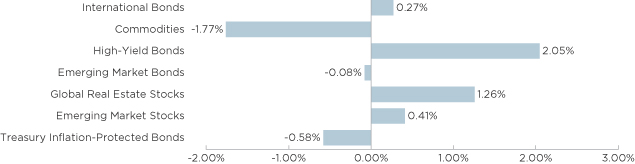

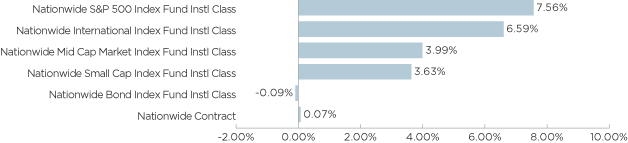

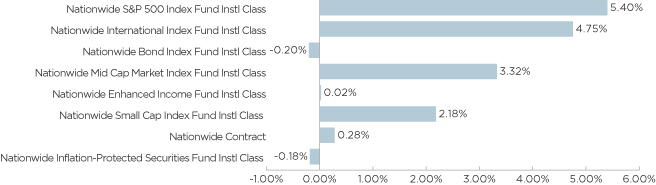

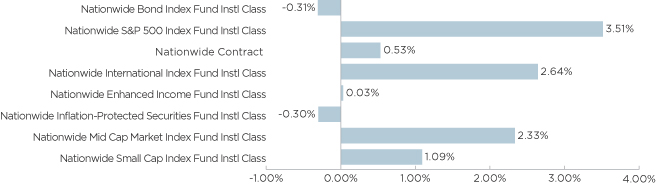

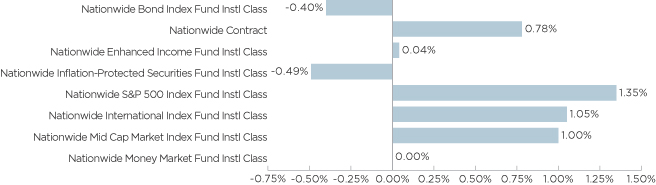

The returns from the Fund’s investments in the U.S. high-yield and global real estate sleeves, combined with their relatively significant allocations within the Fund, made them the largest contributors to the Fund’s return during the period, as shown in the chart below.

The negative returns from the Fund’s investments in the commodities and TIPS sleeves were the largest detractors from the Fund’s return during the period, as shown in the chart below.

Subadviser:

Goldman Sachs Asset Management, L.P.

Portfolio Managers:

Gary Chropuvka, Matthew Hoehn and Amna Qaiser

Asset allocation is the process of spreading assets across several different investment styles and asset classes. The Fund is designed to provide asset allocation across several types of alternative investments in an attempt to achieve performance that may have a low correlation to the performance of more traditional investments. The Fund consists of separate sleeves to represent the investments in each of the different asset classes. Each sleeve invests in securities and derivatives with the goal of matching the investment characteristics and performance of a specified asset class benchmark index.

4

| Fund Commentary (con’t) | Nationwide Alternatives Allocation Fund |

The Fund is subject to the risks of investing in fixed-income securities, including high-yield bonds. The Fund may invest in more aggressive investments such as foreign securities (which are volatile, harder to price and less liquid than U.S. securities) and real estate investment trusts (REITs) (which include possible declines in the value of real estate and the relative lack of liquidity associated with investments in real estate).

The Fund also invests in derivatives (many of which create investment leverage and are highly volatile). Substantially all of the Fund’s exposure to commodities will be through investing in commodity-linked notes, which are derivatives. Investing in commodities and commodity-linked investments may expose the Fund to increased volatility and decreased liquidity. Please refer to the summary prospectus for a more detailed explanation of the Fund’s principal risks.

The Fund is a nondiversified fund, which means that a relatively high percentage of the Fund’s assets may be invested in a limited number of issuers. The Fund is not intended to serve as a complete investment program. There is no assurance that the investment objective of the Fund will be achieved.

A description of the benchmarks can be found on the Market Index Definitions page at the back of this book.

Actual Asset Class Allocations

(as of October 31, 2013)

| International Bonds | 24% | |||

| Commodities | 17% | |||

| High-Yield Bonds | 15% | |||

| Emerging Market Bonds | 15% | |||

| Global Real Estate Stocks | 11% | |||

| Emerging Market Stocks | 10% | |||

| Treasury Inflation-Protected Securities | 8% | |||

| 100% |

Asset class allocations are stated as a percentage of the Fund’s total net assets. Allocations may change over time in order for the Fund to meet its objective or due to market and/or economic conditions.

Contributions of Underlying Asset Classes to Fund Performance

(For the year ended October 31, 2013)

The contribution of underlying asset classes to Fund performance is based on target asset class allocations through the reporting period. Nationwide Fund Advisors (NFA), the investment adviser to the Fund, applies a long-term investment horizon with respect to the Fund, and allocation changes are not likely to be made in response to short-term market conditions. NFA may add or delete asset classes or change allocations at any time and without notice. For more information, refer to the Fund’s prospectus.

5

| Fund Overview | Nationwide Alternatives Allocation Fund |

Objective

The Fund seeks to provide total return.

Highlights

| Ÿ | International bonds, high-yield bonds, global real estate stocks and emerging market stocks contributed positively to overall Fund performance over the one-year period. |

| Ÿ | TIPS, emerging market bonds and commodities detracted from overall Fund performance over the one-year period. |

| Ÿ | High-yield bonds and global real estate stocks both posted double-digit positive returns and contributed the most to the Fund’s overall performance. |

Asset Allocation†

| Mutual Fund | 41.6% | |||

| U.S. Treasury Note | 32.2% | |||

| Common Stocks | 12.3% | |||

| U.S. Treasury Bonds | 7.0% | |||

| Commodity-Linked Notes | 4.8% | |||

| Purchased Options | 0.1% | |||

| Other assets in excess of liabilities | 2.0% | |||

| 100.0% |

Top Industries††

| Real Estate Investment Trusts (REITs) | 10.2% | |||

| Real Estate Management & Development | 2.3% | |||

| Other Industries | 87.5% | |||

| 100.0% |

Top Holdings††

| Fidelity Institutional Money Market Fund — Institutional Class | 42.4% | |||

| U.S. Treasury Note, 3.13%, 05/15/19 | 32.9% | |||

| JPMorgan Chase Bank, NA Commodity Note | 3.5% | |||

| Bank of America Corp. Commodity Note | 0.9% | |||

| Simon Property Group, Inc. | 0.7% | |||

| Mitsui Fudosan Co., Ltd. | 0.4% | |||

| Unibail-Rodamco SE | 0.4% | |||

| U.S. Treasury Inflation Indexed Bonds, 0.13%, 04/15/17 | 0.4% | |||

| Public Storage | 0.4% | |||

| Brookfield Asset Management, Inc., Class A | 0.3% | |||

| Other Holdings | 17.7% | |||

| 100.0% |

Top Countries††

| United States | 93.9% | |||

| Japan | 1.1% | |||

| United Kingdom | 0.9% | |||

| Australia | 0.8% | |||

| France | 0.7% | |||

| Canada | 0.5% | |||

| Hong Kong | 0.5% | |||

| Singapore | 0.5% | |||

| Liechtenstein | 0.2% | |||

| Netherlands | 0.1% | |||

| Other Countries | 0.8% | |||

| 100.0% |

| † | Percentages indicated are based upon net assets as of October 31, 2013. |

| †† | Percentages indicated are based upon total investments as of October 31, 2013. |

6

| Fund Performance | Nationwide Alternatives Allocation Fund |

Average Annual Total Return

| (For periods ended October 31, 2013) | 1 Yr. | Inception5 | ||||||||

| Class A | w/o SC1 | 1.07% | (0.69)% | |||||||

| w/SC2 | (3.21)% | (2.56)% | ||||||||

| Class C | w/o SC1 | 0.31% | (1.38)% | |||||||

| w/SC3 | (0.69)% | (1.38)% | ||||||||

| Institutional Service Class4 | 1.38% | (0.38)% | ||||||||

| Institutional Class4 | 1.28% | (0.42)% | ||||||||

All figures showing the effect of a sales charge (SC) reflect the maximum charge possible, because it has the most significant effect on performance data.

| 1 | These returns do not reflect the effects of SCs. |

| 2 | Prior to October 29, 2013, a 4.25% front-end sales charge was deducted. Effective October 29, 2013, a 2.25% front-end sales charge was deducted. |

| 3 | A 1.00% contingent deferred sales charge was deducted from the one year return because it is charged when you sell Class C shares within the first year after purchase. |

| 4 | Not subject to any SCs. |

| 5 | Since inception date of July 25, 2011. |

Expense Ratios

| Gross Expense Ratio* | Net Expense Ratio* | |||||

| Class A | 1.16% | 0.97% | ||||

| Class C | 1.66% | 1.47% | ||||

| Institutional Service Class | 0.91% | 0.72% | ||||

| Institutional Class | 0.66% | 0.47% | ||||

* Current effective prospectus dated March 1, 2013. The difference between gross and net operating expenses reflects contractual waivers in place through February 28, 2014. Please see the Fund's most recent prospectus for details.

7

| Fund Performance (cont.) | Nationwide Alternatives Allocation Fund |

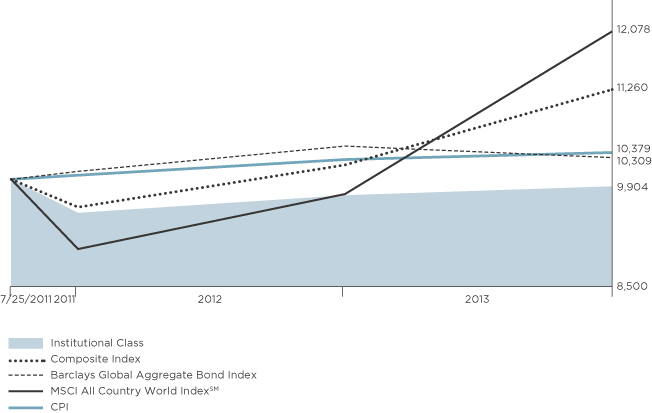

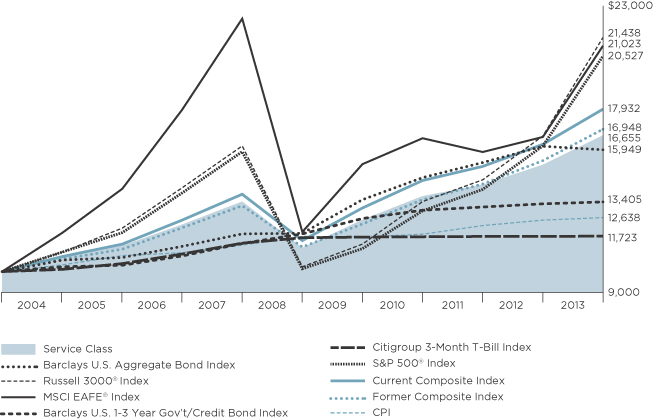

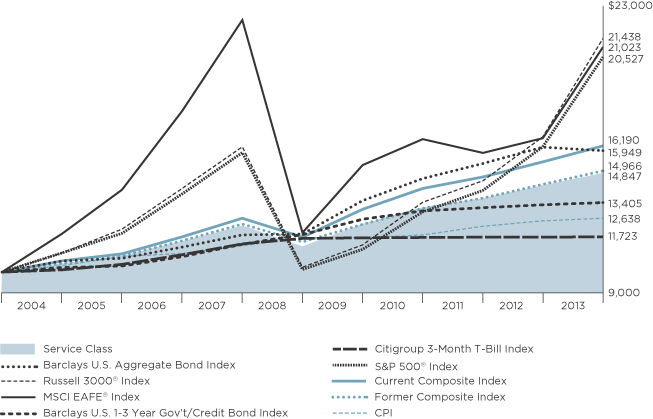

Performance of a $10,000 Investment

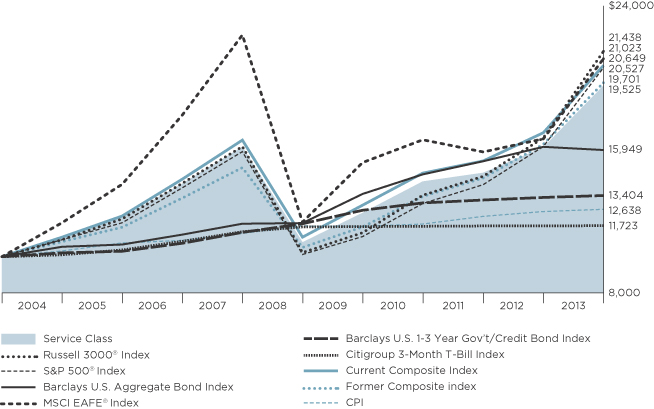

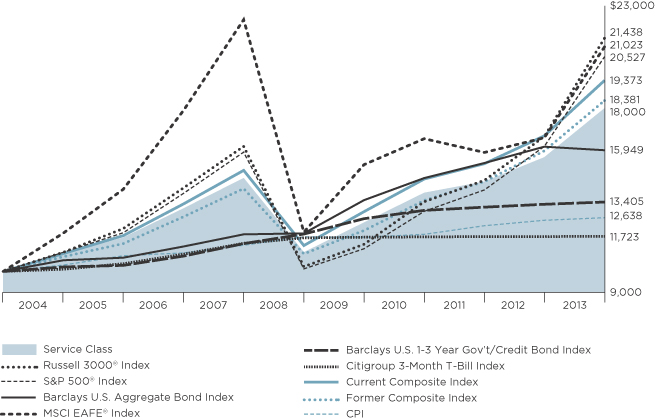

Investment return and principal value will fluctuate, and when redeemed, shares may be worth more or less than original cost. Past performance is no guarantee of future results and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investing in mutual funds involves market risk, including loss of principal. Performance returns assume the reinvestment of all distributions.

Comparative performance of $10,000 invested in Institutional Class shares of the Nationwide Alternatives Allocation Fund from inception through 10/31/13 versus the Barclays Global Aggregate Bond Index, the MSCI All Country World IndexSM, the Composite Index* and the Consumer Price Index (CPI) from 8/1/11 through 10/31/13. Unlike the Fund, the returns for these unmanaged indexes do not reflect any fees, expenses, or sales charges. Investors cannot invest directly in market indexes. A description of the benchmarks can be found on the Market Index Definitions page at the back of this book.

| * | The Composite Index is an unmanaged, hypothetical representation of the performance of each of the Fund’s asset classes according to its respective weighting. The Composite Index comprises 50% Barclays Global Aggregate Bond Index and 50% MSCI All Country World Index. |

8

| Shareholder Expense Example | Nationwide Alternatives Allocation Fund |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) paid on purchase payments and redemption fees; and (2) ongoing costs, including investment advisory fees, administration fees, distribution fees and other Fund expenses. The examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. Per Securities and Exchange Commission (“SEC”) requirements, the examples assume that you had a $1,000 investment in the Class at the beginning of the reporting period (May 1, 2013) and continued to hold your shares at the end of the reporting period (October 31, 2013).

Actual Expenses

For each Class of the Fund in the table below, the first line provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid from May 1, 2013 through October 31, 2013. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line of each Class under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Expenses for Comparison Purposes

The second line of each Class in the table below provides information about hypothetical account values and hypothetical expenses based on the Class’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period from May 1, 2013 through October 31, 2013. You may use this information to compare the ongoing costs of investing in the Class of the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges (loads) or redemption fees. If these transaction costs were included, your costs would have been higher. Therefore, the second line for each Class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. The examples also assume all dividends and distributions are reinvested.

Schedule of Shareholder Expenses

Expense Analysis of a $1,000 Investment

Nationwide Alternatives October 31, 2013 | Beginning Account Value ($) 05/01/13 | Ending Account Value ($) 10/31/13 | Expenses Paid During Period ($) 05/01/13 - 10/31/13 | Expense Ratio During Period (%) 05/01/13 - 10/31/13 | ||||||||

| Class A Shares | Actual | a | 1,000.00 | 971.30 | 3.53 | 0.71 | ||||||

| Hypothetical | a,b | 1,000.00 | 1,021.63 | 3.62 | 0.71 | |||||||

| Class C Shares | Actual | a | 1,000.00 | 968.00 | 6.94 | 1.40 | ||||||

| Hypothetical | a,b | 1,000.00 | 1,018.15 | 7.12 | 1.40 | |||||||

| Institutional Service Class Shares | Actual | a | 1,000.00 | 973.30 | 1.99 | 0.40 | ||||||

| Hypothetical | a,b | 1,000.00 | 1,023.19 | 2.04 | 0.40 | |||||||

| Institutional Class Shares | Actual | a | 1,000.00 | 971.30 | 1.99 | 0.40 | ||||||

| Hypothetical | a,b | 1,000.00 | 1,023.19 | 2.04 | 0.40 | |||||||

| a | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value from May 1, 2013 through October 31, 2013 multiplied to reflect one-half year period. The expense ratio presented represents a six-month, annualized ratio in accordance with Securities and Exchange Commission guidelines. |

| b | Represents the hypothetical 5% return before expenses. |

9

Statement of Investments

October 31, 2013

Nationwide Alternatives Allocation Fund

| Common Stocks 12.3% | ||||||||||

| Shares | Market Value | |||||||||

| ||||||||||

Real Estate Investment Trusts (REITs) 10.0% |

| |||||||||

Acadia Realty Trust | 2,888 | $ | 77,023 | |||||||

Activia Properties, Inc. | 20 | 174,415 | ||||||||

Alexandria Real Estate Equities, Inc. | 9,363 | 615,898 | ||||||||

American Campus Communities, Inc. | 13,287 | 459,199 | ||||||||

Apartment Investment & Management Co., Class A | 17,018 | 476,164 | ||||||||

Artis Real Estate Investment Trust | 4,300 | 59,470 | ||||||||

Ascendas Real Estate Investment Trust | 286,000 | 543,782 | ||||||||

Ashford Hospitality Trust, Inc. | 7,913 | 103,344 | ||||||||

Associated Estates Realty Corp. | 4,262 | 65,379 | ||||||||

AvalonBay Communities, Inc. | 14,670 | 1,834,483 | ||||||||

Befimmo SCA Sicafi | 655 | 46,938 | ||||||||

Beni Stabili SpA | 45,913 | 31,430 | ||||||||

Big Yellow Group PLC | 3,258 | 24,401 | ||||||||

BioMed Realty Trust, Inc. | 25,010 | 498,199 | ||||||||

Boardwalk Real Estate Investment Trust | 2,700 | 153,587 | ||||||||

Boston Properties, Inc. | 18,485 | 1,913,198 | ||||||||

Brandywine Realty Trust | 25,270 | 359,592 | ||||||||

BRE Properties, Inc. | 8,254 | 450,751 | ||||||||

British Land Co. PLC | 126,134 | 1,257,987 | ||||||||

BWP Trust | 10,844 | 23,603 | ||||||||

Calloway Real Estate Investment Trust | 7,500 | 180,550 | ||||||||

Cambridge Industrial Trust | 32,641 | 18,362 | ||||||||

Camden Property Trust | 9,502 | 610,028 | ||||||||

Canadian Apartment Properties REIT | 4,400 | 90,857 | ||||||||

Canadian Real Estate Investment Trust | 3,900 | 158,858 | ||||||||

CapitaCommercial Trust | 289,000 | 341,971 | ||||||||

Capital Property Fund | 153,134 | 163,117 | ||||||||

CapitaMall Trust | 328,000 | 532,736 | ||||||||

CBL & Associates Properties, Inc. | 24,562 | 486,573 | ||||||||

Cedar Realty Trust, Inc. | 11,852 | 67,675 | ||||||||

CFS Retail Property Trust Group | 285,031 | 557,833 | ||||||||

Champion REIT | 95,000 | 42,341 | ||||||||

Charter Hall Retail REIT | 17,463 | 66,673 | ||||||||

Chartwell Retirement Residences | 7,100 | 72,999 | ||||||||

Cofinimmo | 2,500 | 301,966 | ||||||||

Commonwealth Property Office Fund | 286,575 | 324,221 | ||||||||

CommonWealth REIT | 12,753 | 310,791 | ||||||||

Corio NV | 12,347 | 537,471 | ||||||||

Corporate Office Properties Trust | 14,151 | 348,115 | ||||||||

Cousins Properties, Inc. | 20,989 | 237,805 | ||||||||

CubeSmart | 13,580 | 248,107 | ||||||||

Daiwa Office Investment Corp. | 23 | 101,874 | ||||||||

DCT Industrial Trust, Inc. | 38,778 | 300,530 | ||||||||

DDR Corp. | 29,775 | 504,686 | ||||||||

Derwent London PLC | 7,967 | 319,800 | ||||||||

Dexus Property Group | 646,419 | 662,465 | ||||||||

DiamondRock Hospitality Co. | 21,689 | 247,038 | ||||||||

Digital Realty Trust, Inc. | 15,395 | 733,726 | ||||||||

Douglas Emmett, Inc. | 14,931 | 372,230 | ||||||||

Duke Realty Corp. | 43,631 | 722,966 | ||||||||

DuPont Fabros Technology, Inc. | 7,388 | 183,592 | ||||||||

EastGroup Properties, Inc. | 3,537 | 225,165 | ||||||||

| Common Stocks (continued) | ||||||||||

| Shares | Market Value | |||||||||

| ||||||||||

Real Estate Investment Trusts (REITs) (continued) |

| |||||||||

Education Realty Trust, Inc. | 9,171 | $ | 83,823 | |||||||

Equity Lifestyle Properties, Inc. | 7,582 | 288,040 | ||||||||

Equity One, Inc. | 8,726 | 210,384 | ||||||||

Equity Residential | 40,695 | 2,130,790 | ||||||||

Essex Property Trust, Inc. | 3,874 | 623,714 | ||||||||

Eurocommercial Properties NV | 4,452 | 189,163 | ||||||||

Extra Space Storage, Inc. | 11,761 | 540,888 | ||||||||

Federal Realty Investment Trust | 6,872 | 711,939 | ||||||||

FelCor Lodging Trust, Inc. * | 10,364 | 69,646 | ||||||||

First Industrial Realty Trust, Inc. | 15,659 | 282,958 | ||||||||

First Potomac Realty Trust | 5,002 | 61,475 | ||||||||

Fonciere des Regions | 5,972 | 511,446 | ||||||||

Fountainhead Property Trust | 132,152 | 101,683 | ||||||||

Franklin Street Properties Corp. | 5,685 | 75,042 | ||||||||

Frasers Commercial Trust | 12,000 | 12,443 | ||||||||

Frontier Real Estate Investment Corp. | 25 | 249,796 | ||||||||

Fukuoka REIT Co. | 7 | 57,755 | ||||||||

Gecina SA | 3,586 | 478,537 | ||||||||

General Growth Properties, Inc. | 66,244 | 1,406,360 | ||||||||

Glimcher Realty Trust | 21,997 | 225,469 | ||||||||

Goodman Group | 189,972 | 907,874 | ||||||||

Goodman Property Trust | 1,658 | 1,409 | ||||||||

GPT Group | 189,331 | 659,873 | ||||||||

Great Portland Estates PLC | 50,827 | 466,411 | ||||||||

Growthpoint Properties Ltd. | 189,125 | 480,924 | ||||||||

H&R Real Estate Investment Trust | 17,980 | 372,482 | ||||||||

Hammerson PLC | 90,288 | 765,076 | ||||||||

HCP, Inc. | 55,327 | 2,296,071 | ||||||||

Health Care REIT, Inc. | 35,133 | 2,278,375 | ||||||||

Healthcare Realty Trust, Inc. | 11,626 | 279,140 | ||||||||

Hersha Hospitality Trust | 23,541 | 133,477 | ||||||||

Highwoods Properties, Inc. | 10,692 | 412,711 | ||||||||

Home Properties, Inc. | 5,581 | 336,590 | ||||||||

Hospitality Properties Trust | 19,552 | 574,438 | ||||||||

Host Hotels & Resorts, Inc. | 91,833 | 1,703,502 | ||||||||

Inland Real Estate Corp. | 3,592 | 38,398 | ||||||||

Intu Properties PLC | 62,801 | 346,366 | ||||||||

Investa Office Fund | 101,504 | 297,984 | ||||||||

Is Gayrimenkul Yatirim Ortakligi AS | 10,765 | 7,746 | ||||||||

Japan Excellent, Inc. | 22 | 136,014 | ||||||||

Japan Prime Realty Investment Corp. | 87 | 289,113 | ||||||||

Japan Real Estate Investment Corp. | 74 | 845,443 | ||||||||

Japan Retail Fund Investment Corp. | 246 | 498,229 | ||||||||

Kenedix Realty Investment Corp. | 27 | 121,290 | ||||||||

Kilroy Realty Corp. | 9,632 | 512,037 | ||||||||

Kimco Realty Corp. | 46,852 | 1,006,381 | ||||||||

Kite Realty Group Trust | 6,060 | 38,784 | ||||||||

Kiwi Income Property Trust | 4,998 | 4,518 | ||||||||

KLCC Property Holdings Bhd | 3,600 | 7,358 | ||||||||

Klepierre | 9,678 | 434,070 | ||||||||

Land Securities Group PLC | 94,012 | 1,490,290 | ||||||||

LaSalle Hotel Properties | 13,324 | 413,710 | ||||||||

Liberty Property Trust | 19,134 | 711,593 | ||||||||

10

Statement of Investments (Continued)

October 31, 2013

Nationwide Alternatives Allocation Fund (Continued)

| Common Stocks (continued) | ||||||||||

| Shares | Market Value | |||||||||

| ||||||||||

Real Estate Investment Trusts (REITs) (continued) |

| |||||||||

Link REIT (The) | 256,000 | $ | 1,287,845 | |||||||

LTC Properties, Inc. | 6,580 | 259,581 | ||||||||

Macerich Co. (The) | 16,612 | 983,597 | ||||||||

Mack-Cali Realty Corp. | 10,340 | 212,590 | ||||||||

Mapletree Logistics Trust | 134,000 | 117,996 | ||||||||

Mercialys SA | 1,601 | 34,541 | ||||||||

Mid-America Apartment Communities, Inc. | 7,700 | 511,280 | ||||||||

Mori Hills REIT Investment Corp. | 25 | 175,451 | ||||||||

MORI TRUST Sogo Reit, Inc. | 18 | 160,085 | ||||||||

Nippon Building Fund, Inc. | 86 | 1,063,897 | ||||||||

Nomura Real Estate Office Fund, Inc. | 43 | 212,420 | ||||||||

Orix JREIT, Inc. | 161 | 200,778 | ||||||||

Parkway Properties, Inc. | 2,946 | 53,352 | ||||||||

Pebblebrook Hotel Trust | 4,134 | 124,847 | ||||||||

Pennsylvania Real Estate Investment Trust | 12,470 | 226,081 | ||||||||

Piedmont Office Realty Trust, Inc., Class A | 14,272 | 263,747 | ||||||||

Post Properties, Inc. | 5,622 | 257,150 | ||||||||

Premier Investment Corp. | 16 | 65,534 | ||||||||

Prologis, Inc. | 59,982 | 2,396,281 | ||||||||

PS Business Parks, Inc. | 847 | 69,022 | ||||||||

Public Storage | 17,013 | 2,840,661 | ||||||||

Ramco-Gershenson Properties Trust | 7,583 | 123,300 | ||||||||

Regency Centers Corp. | 12,435 | 642,392 | ||||||||

RioCan Real Estate Investment Trust | 19,000 | 463,770 | ||||||||

Rouse Properties, Inc. | 5,476 | 110,725 | ||||||||

SA Corporate Real Estate Fund | 334,984 | 133,810 | ||||||||

Segro PLC | 91,294 | 478,156 | ||||||||

Senior Housing Properties Trust | 22,486 | 554,055 | ||||||||

Shaftesbury PLC | 19,702 | 187,604 | ||||||||

Simon Property Group, Inc. | 37,144 | 5,740,605 | ||||||||

SL Green Realty Corp. | 11,098 | 1,049,538 | ||||||||

Sovran Self Storage, Inc. | 3,326 | 254,406 | ||||||||

Starhill Global REIT | 13,000 | 8,467 | ||||||||

Sun Communities, Inc. | 6,056 | 269,916 | ||||||||

Sunstone Hotel Investors, Inc. | 25,168 | 333,476 | ||||||||

Suntec Real Estate Investment Trust | 337,000 | 463,841 | ||||||||

Sycom Property Fund | 2,648 | 6,990 | ||||||||

Tanger Factory Outlet Centers | 9,396 | 327,451 | ||||||||

Taubman Centers, Inc. | 7,905 | 520,070 | ||||||||

Tokyu REIT, Inc. | 21 | 129,757 | ||||||||

Top REIT, Inc. | 10 | 46,664 | ||||||||

UDR, Inc. | 27,841 | 690,735 | ||||||||

Unibail-Rodamco SE | 12,009 | 3,137,582 | ||||||||

United Urban Investment Corp. | 289 | 441,082 | ||||||||

Universal Health Realty Income Trust | 3,195 | 140,324 | ||||||||

Vastned Retail NV | 3,099 | 143,212 | ||||||||

Ventas, Inc. | 35,586 | 2,321,631 | ||||||||

Vornado Realty Trust | 21,434 | 1,908,912 | ||||||||

Washington Real Estate Investment Trust | 6,967 | 182,605 | ||||||||

Weingarten Realty Investors | 14,778 | 468,906 | ||||||||

Wereldhave NV | 1,762 | 136,908 | ||||||||

| Common Stocks (continued) | ||||||||||

| Shares | Market Value | |||||||||

| ||||||||||

Real Estate Investment Trusts (REITs) (continued) |

| |||||||||

Westfield Group | 240,403 | $ | 2,460,164 | |||||||

Westfield Retail Trust | 322,403 | 940,621 | ||||||||

Workspace Group PLC | 3,876 | 30,415 | ||||||||

|

| |||||||||

| 82,785,818 | ||||||||||

|

| |||||||||

| ||||||||||

Real Estate Management & Development 2.3% |

| |||||||||

Aeon Mall Co., Ltd. | 13,730 | 389,945 | ||||||||

Atrium European Real Estate Ltd. | 5,530 | 33,082 | ||||||||

Ayala Land, Inc. | 654,400 | 445,496 | ||||||||

BR Malls Participacoes SA | 62,000 | 600,571 | ||||||||

Brookfield Asset Management, Inc., Class A | 69,900 | 2,767,441 | ||||||||

Brookfield Office Properties, Inc. | 29,400 | 549,285 | ||||||||

CA Immobilien Anlagen AG * | 6,666 | 101,371 | ||||||||

Capital & Counties Properties PLC | 73,316 | 407,764 | ||||||||

CapitaLand Ltd. | 341,000 | 854,373 | ||||||||

Castellum AB | 23,796 | 365,382 | ||||||||

Central Pattana PCL | 158,900 | 244,401 | ||||||||

Daibiru Corp. | 14,700 | 187,331 | ||||||||

Echo Investment SA * | 13,101 | 29,578 | ||||||||

Fabege AB | 20,886 | 240,314 | ||||||||

First Capital Realty, Inc. | 5,400 | 93,846 | ||||||||

Forest City Enterprises, Inc., Class A * | 18,558 | 375,985 | ||||||||

Global Logistic Properties Ltd. | 381,000 | 945,758 | ||||||||

Grainger PLC | 13,715 | 42,830 | ||||||||

GuocoLand Ltd. | 11,000 | 19,916 | ||||||||

Hang Lung Group Ltd. | 83,000 | 439,072 | ||||||||

Hang Lung Properties Ltd. | 266,000 | 875,972 | ||||||||

Heiwa Real Estate Co., Ltd. | 9,300 | 168,448 | ||||||||

Hongkong Land Holdings Ltd. | 137,000 | 844,596 | ||||||||

Hulic Co., Ltd. | 38,900 | 618,989 | ||||||||

Hysan Development Co., Ltd. | 62,342 | 291,624 | ||||||||

Immofinanz AG * | 131,707 | 576,822 | ||||||||

Kerry Properties Ltd. | 70,000 | 303,558 | ||||||||

Kungsleden AB | 17,608 | 129,332 | ||||||||

Mitsui Fudosan Co., Ltd. | 107,000 | 3,544,472 | ||||||||

NTT Urban Development Corp. | 19,600 | 250,201 | ||||||||

PSP Swiss Property AG * | 4,276 | 367,517 | ||||||||

Robinsons Land Corp. | 52,700 | 27,645 | ||||||||

SM Prime Holdings, Inc. | 894,875 | 396,408 | ||||||||

Swiss Prime Site AG * | 6,670 | 505,041 | ||||||||

Tokyu Fudosan Holdings Corp. * | 51,700 | 507,904 | ||||||||

Wheelock & Co., Ltd. | 107,000 | 546,055 | ||||||||

|

| |||||||||

| 19,088,325 | ||||||||||

|

| |||||||||

Total Common Stocks |

| 101,874,143 | ||||||||

|

| |||||||||

11

Statement of Investments (Continued)

October 31, 2013

Nationwide Alternatives Allocation Fund (Continued)

| U.S. Treasury Bonds 7.0% | ||||||||||

| Principal Amount† | Market Value | |||||||||

| ||||||||||

U.S. Treasury Inflation Indexed Bonds | ||||||||||

0.13%, 04/15/16 (a) | $ | 2,392,000 | $ | 2,602,977 | ||||||

0.13%, 04/15/17 (a) | 2,770,000 | 2,949,424 | ||||||||

0.13%, 04/15/18 | 2,120,000 | 2,218,976 | ||||||||

0.13%, 01/15/22 (a) | 2,575,000 | 2,639,180 | ||||||||

0.13%, 07/15/22 (a) | 2,557,000 | 2,574,109 | ||||||||

0.13%, 01/15/23 | 2,557,000 | 2,532,156 | ||||||||

0.38%, 07/15/23 | 936,000 | 940,220 | ||||||||

0.50%, 04/15/15 | 1,324,000 | 1,457,898 | ||||||||

0.63%, 07/15/21 (a) | 2,235,300 | 2,423,542 | ||||||||

0.63%, 02/15/43 | 997,000 | 840,041 | ||||||||

0.75%, 02/15/42 | 1,441,000 | 1,288,497 | ||||||||

1.13%, 01/15/21 (a) | 2,287,000 | 2,641,879 | ||||||||

1.25%, 07/15/20 (a) | 2,019,000 | 2,379,009 | ||||||||

1.38%, 07/15/18 | 934,000 | 1,116,345 | ||||||||

1.38%, 01/15/20 | 1,183,000 | 1,408,595 | ||||||||

1.63%, 01/15/15 | 1,185,000 | 1,495,886 | ||||||||

1.63%, 01/15/18 | 1,023,000 | 1,258,761 | ||||||||

1.75%, 01/15/28 | 974,000 | 1,221,914 | ||||||||

1.88%, 07/15/15 | 1,060,000 | 1,341,845 | ||||||||

1.88%, 07/15/19 | 946,000 | 1,178,517 | ||||||||

2.00%, 01/15/16 | 1,060,000 | 1,334,349 | ||||||||

2.00%, 01/15/26 | 1,247,000 | 1,699,700 | ||||||||

2.12%, 02/15/40 | 946,000 | 1,221,008 | ||||||||

2.13%, 01/15/19 | 920,000 | 1,141,539 | ||||||||

2.13%, 02/15/41 | 1,496,000 | 1,908,500 | ||||||||

2.38%, 01/15/17 | 1,075,000 | 1,383,458 | ||||||||

2.38%, 01/15/25 | 1,746,000 | 2,592,850 | ||||||||

2.38%, 01/15/27 | 1,028,000 | 1,437,349 | ||||||||

2.50%, 07/15/16 | 1,248,000 | 1,594,329 | ||||||||

2.50%, 01/15/29 | 882,000 | 1,185,963 | ||||||||

2.63%, 07/15/17 | 873,000 | 1,119,660 | ||||||||

3.38%, 04/15/32 | 313,000 | 579,637 | ||||||||

3.63%, 04/15/28 | 1,045,000 | 2,093,555 | ||||||||

3.88%, 04/15/29 | 1,215,000 | 2,485,052 | ||||||||

|

| |||||||||

Total U.S. Treasury Bonds | 58,286,720 | |||||||||

|

| |||||||||

| U.S. Treasury Note 32.2% | ||||||||||

U.S. Treasury Note, | 245,766,000 | 267,347,327 | ||||||||

|

| |||||||||

Total U.S. Treasury Note |

| 267,347,327 | ||||||||

|

| |||||||||

| Commodity-Linked Notes 4.8% | ||||||||||

Bank of America Corp. | 9,800,000 | 7,500,215 | ||||||||

| Commodity-Linked Notes (continued) | ||||||||||

| Principal Amount | Market Value | |||||||||

| ||||||||||

JPMorgan Chase Bank, NA | $ | 300,000 | $ | 234,009 | ||||||

JPMorgan Chase Bank, NA | 440,00 | 352,960 | ||||||||

JPMorgan Chase Bank, NA | 250,000 | 219,455 | ||||||||

JPMorgan Chase Bank, NA | 290,000 | 289,141 | ||||||||

JPMorgan Chase Bank, NA | 29,970,000 | 28,367,548 | ||||||||

JPMorgan Chase Bank, NA | 1,720,000 | 1,694,530 | ||||||||

UBS AG Commodity Note, | 250,000 | 188,246 | ||||||||

UBS AG Commodity Note, | 250,000 | 219,513 | ||||||||

12

Statement of Investments (Continued)

October 31, 2013

Nationwide Alternatives Allocation Fund (Continued)

| Commodity-Linked Notes (continued) | ||||||||||

| Principal Amount | Market Value | |||||||||

| ||||||||||

UBS AG Commodity Note, | $ | 450,000 | $ | 436,061 | ||||||

UBS AG Commodity Note, | 250,000 | 231,808 | ||||||||

UBS AG Commodity Note, | 330,000 | 346,737 | ||||||||

|

| |||||||||

Total Commodity-Linked Notes |

| 40,080,223 | ||||||||

|

| |||||||||

| Purchased Options 0.1% | ||||||||||

| Number of Contracts | ||||||||||

|

|

| ||||||||

Call Options 0.1% |

| |||||||||

KOSPI 200 Index, | 83 | 245,308 | ||||||||

KOSPI 200 Index, | 3 | 10,569 | ||||||||

KOSPI 200 Index, | 33 | 155,286 | ||||||||

KOSPI 200 Index, | 1 | 3,852 | ||||||||

SET50 Index, | 4 | 7,316 | ||||||||

SET50 Index, | 32 | 47,835 | ||||||||

SET50 Index, | 76 | 134,906 | ||||||||

|

| |||||||||

Total Purchased Options |

| 605,072 | ||||||||

|

| |||||||||

| Mutual Fund 41.6% | ||||||||||

| Shares | Market Value | |||||||||

|

|

|

|

| ||||||

Money Market Fund 41.6% | ||||||||||

Fidelity Institutional Money Market Fund — Institutional Class, | 345,109,370 | $ | 345,109,370 | |||||||

|

| |||||||||

Total Mutual Fund |

| 345,109,370 | ||||||||

|

| |||||||||

Total Investments |

| 813,302,855 | ||||||||

Other assets in excess of |

| 16,801,380 | ||||||||

|

| |||||||||

NET ASSETS — 100.0% |

| $ | 830,104,235 | |||||||

|

| |||||||||

* Denotes a non-income producing security. |

† Principal amounts are not adjusted for inflation. |

(a) Security or a portion of the security was used to cover the margin requirement for futures contracts. |

(b) Variable Rate Security. The rate reflected in the Statement of Investments is the rate in effect on October 31, 2013. The maturity date represents the actual maturity date. |

(c) Security is linked to the Dow Jones-UBS Commodity Index 3 Month Forward Total Return. Security does not guarantee any return of principal at maturity but instead, will pay at maturity or upon exchange, an amount based on the closing value of the Dow Jones-UBS Commodity Index 3 Month Forward Total Return. Although these instruments are primarily debt obligations, they indirectly provide exposure to changes in the value of the underlying commodities. Holders of the security have the right to exchange these notes at any time. |

(d) Rule 144A, Section 4(2), or other security which is restricted as to sale to institutional investors. These securities were deemed liquid pursuant to procedures approved by the Board of Trustees. The aggregate value of these securities at October 31, 2013 was $40,080,223 which represents 4.83% of net assets. |

(e) Represents 7-day effective yield as of October 31, 2013. |

(f) See notes to financial statements for tax unrealized appreciation/(depreciation) of securities. |

AB Stock Company |

AG Stock Corporation |

AS Stock Corporation |

Bhd Public Limited Company |

13

Statement of Investments (Continued)

October 31, 2013

Nationwide Alternatives Allocation Fund (Continued)

KOSPI Korean Composite Stock Price Index |

KRW South Korean Won |

LIBOR London Interbank Offered Rate |

Ltd. Limited |

NA National Association |

NV Public Traded Company |

PCL Public Company Limited |

PLC Public Limited Company |

REIT Real Estate Investment Trust |

SA Stock Company |

SCA Limited partnership with share capital |

SE European Public Limited Liability Company |

SET Stock Exchange of Thailand |

SpA Limited Share Company |

THB Thailand Baht |

At October 31, 2013, the Fund’s open written options contracts were as follows:

Put Options

| Number of contracts | Description | Counterparty | Expiration Date | Premiums Paid/(Received) | Value at October 31, 2013 | Unrealized Appreciation/ (Depreciation) | ||||||||||||||

| 83 | KOSPI 200 Index (Strike Price KRW 265.53) | Credit Suisse International | 12/12/13 | $ | — | $ | (158,670 | ) | $ | (158,670 | ) | |||||||||

| 3 | KOSPI 200 Index (Strike Price KRW 263.70) | Credit Suisse International | 12/12/13 | — | (4,863 | ) | (4,863 | ) | ||||||||||||

| 33 | KOSPI 200 Index (Strike Price KRW 260.25) | Credit Suisse International | 12/12/13 | — | (39,036 | ) | (39,036 | ) | ||||||||||||

| 1 | KOSPI 200 Index (Strike Price KRW 262.70) | Credit Suisse International | 12/12/13 | — | (1,480 | ) | (1,480 | ) | ||||||||||||

| 4 | SET50 Index (Strike Price THB 969.50) | Credit Suisse International | 12/27/13 | — | (4,604 | ) | (4,604 | ) | ||||||||||||

| 76 | SET50 Index (Strike Price THB 972.25) | Credit Suisse International | 12/27/13 | — | (90,081 | ) | (90,081 | ) | ||||||||||||

| 32 | SET50 Index (Strike Price THB 987.37) | Credit Suisse International | 12/27/13 | — | (44,442 | ) | (44,442 | ) | ||||||||||||

|

|

|

|

|

| |||||||||||||||

| $ | — | $ | (343,176 | ) | $ | (343,176 | ) | |||||||||||||

|

|

|

|

|

| |||||||||||||||

Amounts designated as “—” are zero or have been rounded to zero.

At October 31, 2013, the Fund’s open swap contracts were as follows:

Credit default swaps on sovereign issues — sell protection1

| Counterparty | Reference Entity | Fixed Annual Rate Paid by Fund | Notional Amount2 | Implied Credit Spread as of October 31, 20133 | Termination Date | Upfront Premium (Received)/ Paid4 | Unrealized Appreciation/ (Depreciation) | |||||||||||||||||||

| Bank of America Corp. | Federal Republic of Brazil | 1.00 | % | $ | 3,600,000 | 1.487 | % | 12/20/17 | $ | (11,443 | ) | $ | (54,464 | ) | ||||||||||||

| Bank of America Corp. | Republic of Colombia | 1.00 | 100,000 | 0.955 | 06/20/17 | (1,586 | ) | 1,862 | ||||||||||||||||||

| Bank of America Corp. | Republic of Indonesia | 1.00 | 3,600,000 | 1.382 | 06/20/17 | (111,871 | ) | 67,416 | ||||||||||||||||||

14

Statement of Investments (Continued)

October 31, 2013

Nationwide Alternatives Allocation Fund (Continued)

Credit default swaps on sovereign issues — sell protection1 (continued)

| Counterparty | Reference Entity | Fixed Annual Rate Paid by Fund | Notional Amount2 | Implied Credit Spread as of October 31, 20133 | Termination Date | Upfront Premium (Received)/ Paid4 | Unrealized Appreciation/ (Depreciation) | |||||||||||||||||||

| Bank of America Corp. | Republic of Indonesia | 1.00 | % | $ | 1,400,000 | 1.523 | % | 12/20/17 | $ | (27,060 | ) | $ | (438 | ) | ||||||||||||

| Bank of America Corp. | Republic of Philippines | 1.00 | 1,000,000 | 0.597 | 06/20/17 | (22,968 | ) | 38,632 | ||||||||||||||||||

| Bank of America Corp. | Republic of Philippines | 1.00 | 500,000 | 0.688 | 12/20/17 | (5,078 | ) | 12,012 | ||||||||||||||||||

| Credit Suisse International | Republic of Colombia | 1.00 | 100,000 | 0.850 | 12/20/16 | (2,873 | ) | 3,456 | ||||||||||||||||||

| Credit Suisse International | Republic of Colombia | 1.00 | 9,100,000 | 1.242 | 12/20/18 | (140,999 | ) | 43,085 | ||||||||||||||||||

| Credit Suisse International | Republic of Indonesia | 1.00 | 200,000 | 1.195 | 12/20/16 | (5,834 | ) | 4,863 | ||||||||||||||||||

| Credit Suisse International | Republic of Indonesia | 1.00 | 200,000 | 1.295 | 03/20/17 | (6,541 | ) | 4,823 | ||||||||||||||||||

| Credit Suisse International | Republic of Indonesia | 1.00 | 100,000 | 1.295 | 03/20/17 | (2,156 | ) | 1,298 | ||||||||||||||||||

| Credit Suisse International | Republic of Panama | 1.00 | 100,000 | 0.790 | 09/20/16 | (55 | ) | 774 | ||||||||||||||||||

| Credit Suisse International | Republic of Panama | 1.00 | 3,100,000 | 1.181 | 12/20/18 | (48,033 | ) | 24,052 | ||||||||||||||||||

| Credit Suisse International | Republic of Peru | 1.00 | 500,000 | 0.861 | 09/20/16 | (6,063 | ) | 8,642 | ||||||||||||||||||

| Credit Suisse International | Republic of Peru | 1.00 | 100,000 | 0.861 | 09/20/16 | (684 | ) | 1,200 | ||||||||||||||||||

| Credit Suisse International | Republic of Peru | 1.00 | 1,200,000 | 0.998 | 06/20/17 | (25,919 | ) | 27,411 | ||||||||||||||||||

| Credit Suisse International | Republic of Peru | 1.00 | 5,000,000 | 1.282 | 12/20/18 | (110,834 | ) | 47,390 | ||||||||||||||||||

| Credit Suisse International | Republic of Philippines | 1.00 | 200,000 | 0.448 | 09/20/16 | (3,222 | ) | 6,637 | ||||||||||||||||||

| Credit Suisse International | Republic of Philippines | 1.00 | 200,000 | 0.478 | 12/20/16 | (8,899 | ) | 12,397 | ||||||||||||||||||

| Credit Suisse International | Republic of Turkey | 1.00 | 1,800,000 | 1.363 | 09/20/16 | (78,529 | ) | 62,054 | ||||||||||||||||||

| Credit Suisse International | Republic of Turkey | 1.00 | 100,000 | 1.363 | 09/20/16 | (2,392 | ) | 1,478 | ||||||||||||||||||

| Credit Suisse International | Republic of Turkey | 1.00 | 600,000 | 1.452 | 03/20/17 | (27,246 | ) | 18,993 | ||||||||||||||||||

| Credit Suisse International | Republic of Venezuela | 5.00 | 1,200,000 | 9.476 | 09/20/16 | (214,200 | ) | 89,741 | ||||||||||||||||||

| Credit Suisse International | Republic of Venezuela | 5.00 | 100,000 | 9.476 | 09/20/16 | (9,811 | ) | (561 | ) | |||||||||||||||||

| Credit Suisse International | Republic of Venezuela | 5.00 | 100,000 | 9.499 | 12/20/16 | (11,217 | ) | 35 | ||||||||||||||||||

| Credit Suisse International | Republic of Venezuela | 5.00 | 200,000 | 9.545 | 03/20/17 | (13,883 | ) | (10,169 | ) | |||||||||||||||||

| Credit Suisse International | Russia Foreign Bond | 1.00 | 1,500,000 | 1.097 | 09/20/16 | (33,229 | ) | 30,834 | ||||||||||||||||||

| Credit Suisse International | Russia Foreign Bond | 1.00 | 100,000 | 1.097 | 09/20/16 | (1,161 | ) | 1,002 | ||||||||||||||||||

| Deutsche Bank AG | Federal Republic of Brazil | 1.00 | 1,100,000 | 1.191 | 09/20/16 | (7,230 | ) | 2,519 | ||||||||||||||||||

| Deutsche Bank AG | Federal Republic of Brazil | 1.00 | 100,000 | 1.191 | 09/20/16 | (414 | ) | (14 | ) | |||||||||||||||||

| Deutsche Bank AG | Federal Republic of Brazil | 1.00 | 4,100,000 | 1.382 | 06/20/17 | (80,281 | ) | 29,416 | ||||||||||||||||||

| Deutsche Bank AG | Federal Republic of Brazil | 1.00 | 16,800,000 | 1.727 | 12/20/18 | (593,078 | ) | 19,386 | ||||||||||||||||||

| Deutsche Bank AG | Republic of Indonesia | 1.00 | 11,500,000 | 1.909 | 12/20/18 | (809,756 | ) | 321,182 | ||||||||||||||||||

| Deutsche Bank AG | Republic of Panama | 1.00 | 800,000 | 0.790 | 09/20/16 | (1,173 | ) | 6,921 | ||||||||||||||||||

| Deutsche Bank AG | Republic of Peru | 1.00 | 2,400,000 | 1.076 | 12/20/17 | 0 | (4,580 | ) | ||||||||||||||||||

| Deutsche Bank AG | Republic of Philippines | 1.00 | 14,300,000 | 0.933 | 12/20/18 | (151,164 | ) | 215,584 | ||||||||||||||||||

| Deutsche Bank AG | Republic of Turkey | 1.00 | 200,000 | 1.452 | 03/20/17 | (11,436 | ) | 8,685 | ||||||||||||||||||

| Deutsche Bank AG | Republic of Turkey | 1.00 | 2,300,000 | 1.599 | 12/20/17 | (56,487 | ) | 4,287 | ||||||||||||||||||

| Deutsche Bank AG | Republic of Turkey | 1.00 | 22,100,000 | 1.854 | 12/20/18 | (1,201,298 | ) | 315,594 | ||||||||||||||||||

| Deutsche Bank AG | Republic of Venezuela | 5.00 | 3,600,000 | 9.585 | 06/20/17 | (331,416 | ) | (131,402 | ) | |||||||||||||||||

| Deutsche Bank AG | Republic of Venezuela | 5.00 | 900,000 | 9.650 | 12/20/17 | (80,879 | ) | (48,816 | ) | |||||||||||||||||

| Deutsche Bank AG | Republic of Venezuela | 5.00 | 23,000,000 | 9.771 | 12/20/18 | (3,597,035 | ) | (373,257 | ) | |||||||||||||||||

| Deutsche Bank AG | Russia Foreign Bond | 1.00 | 200,000 | 1.205 | 03/20/17 | (10,753 | ) | 9,620 | ||||||||||||||||||

| Deutsche Bank AG | Russia Foreign Bond | 1.00 | 2,200,000 | 1.265 | 06/20/17 | (97,329 | ) | 79,156 | ||||||||||||||||||

| Deutsche Bank AG | Russia Foreign Bond | 1.00 | 600,000 | 1.361 | 12/20/17 | (11,285 | ) | 3,288 | ||||||||||||||||||

| Deutsche Bank AG | Russia Foreign Bond | 1.00 | 14,700,000 | 1.616 | 12/20/18 | (505,193 | ) | 80,748 | ||||||||||||||||||

| Deutsche Bank AG | United Mexican States | 1.00 | 3,900,000 | 0.754 | 06/20/17 | (57,876 | ) | 96,886 | ||||||||||||||||||

| Deutsche Bank AG | United Mexican States | 1.00 | 21,700,000 | 1.047 | 12/20/18 | (210,863 | ) | 185,701 | ||||||||||||||||||

| UBS AG | Federal Republic of Brazil | 1.00 | 300,000 | 1.318 | 03/20/17 | (5,689 | ) | 2,876 | ||||||||||||||||||

| UBS AG | Republic of Indonesia | 1.00 | 1,100,000 | 1.133 | 09/20/16 | (18,400 | ) | 15,522 | ||||||||||||||||||

| UBS AG | Republic of Indonesia | 1.00 | 100,000 | 1.133 | 09/20/16 | (970 | ) | 709 | ||||||||||||||||||

| UBS AG | Republic of Panama | 1.00 | 100,000 | 0.790 | 09/20/16 | (1,014 | ) | 1,733 | ||||||||||||||||||

| UBS AG | Republic of Panama | 1.00 | 500,000 | 0.875 | 03/20/17 | (7,617 | ) | 10,286 | ||||||||||||||||||

15

Statement of Investments (Continued)

October 31, 2013

Nationwide Alternatives Allocation Fund (Continued)

Credit default swaps on sovereign issues — sell protection1 (continued)

| Counterparty | Reference Entity | Fixed Annual Rate Paid by Fund | Notional Amount2 | Implied Credit Spread as of October 31, 20133 | Termination Date | Upfront Premium (Received)/ Paid4 | Unrealized Appreciation/ (Depreciation) | |||||||||||||||||||

| UBS AG | Republic of Panama | 1.00 | % | $ | 1,900,000 | 0.924 | % | 06/20/17 | $ | (30,833 | ) | $ | 38,245 | |||||||||||||

| UBS AG | Republic of Peru | 1.00 | 300,000 | 0.894 | 12/20/16 | (3,826 | ) | 5,161 | ||||||||||||||||||

| UBS AG | Republic of Peru | 1.00 | 100,000 | 0.949 | 03/20/17 | (2,266 | ) | 2,552 | ||||||||||||||||||

| UBS AG | Republic of Philippines | 1.00 | 600,000 | 0.448 | 09/20/16 | (9,754 | ) | 20,000 | ||||||||||||||||||

| UBS AG | Republic of Philippines | 1.00 | 100,000 | 0.448 | 09/20/16 | (884 | ) | 2,592 | ||||||||||||||||||

| UBS AG | Republic of Turkey | 1.00 | 100,000 | 1.363 | 09/20/16 | (2,745 | ) | 1,830 | ||||||||||||||||||

| UBS AG | Republic of Turkey | 1.00 | 4,100,000 | 1.508 | 06/20/17 | (201,009 | ) | 132,187 | ||||||||||||||||||

| UBS AG | Russia Foreign Bond | 1.00 | 300,000 | 1.138 | 12/20/16 | (9,236 | ) | 8,308 | ||||||||||||||||||

|

|

|

| |||||||||||||||||||||||

| $ | (9,042,975 | ) | $ | 1,507,360 | ||||||||||||||||||||||

|

|

|

| |||||||||||||||||||||||

Centrally cleared credit default swaps on credit indices — sell protection1

| Reference Entity | Fixed Annual Rate Paid by Fund | Notional Amount2 | Implied Credit Spread as of October 31, 20133 | Termination Date | Upfront Premium (Received)/ Paid4 | Unrealized Appreciation/ (Depreciation) | ||||||||||||||||||

| Markit CDX North America High Yield Index Series 20 | 5.00 | % | $ | 116,220,000 | 3.534 | % | 12/20/18 | $ | 5,578,102 | $ | 2,725,090 | |||||||||||||

|

|

|

| |||||||||||||||||||||

| $ | 5,578,102 | $ | 2,725,090 | |||||||||||||||||||||

|

|

|

| |||||||||||||||||||||

CDX Credit Default Swap Index

| 1 | The Fund, as a seller of credit protection, receives periodic payments and any upfront premium from the protection buyer, and is obligated to make a contingent payment, upon occurrence of a credit event with respect to an underlying reference obligation, as defined under the terms of each individual swap contract. |

| 2 | The notional amount is the maximum amount that a seller of a credit default swap would be obligated to pay and a buyer of credit protection would receive, upon occurrence of a credit event. |

| 3 | Implied credit spreads are an indication of the seller’s performance risk, related to the likelihood of a credit event occurring that would require a seller to make a payment to a buyer. Implied credit spreads are used to determine the value of swap contracts and reflect the cost of buying/selling protection, which may include upfront payments made to enter into the contract. Therefore, higher spreads would indicate a greater likelihood that a seller will be obligated to perform (i.e., make payment) under the swap contract. Increasing values, in absolute terms and relative notional amounts, are also indicative of greater performance risk. Implied credit spreads for credit default swaps on credit indices are linked to the weighted average spread across the underlying reference obligations included in a particular index. |

| 4 | Upfront premiums generally related to payments received at the initiation of the agreement to compensate the differences between the stated terms of the swap agreement and current market conditions (credit spreads, interest rates and other relevant factors). |

At October 31, 2013, the Fund has $120,000 and $11,540,000 segregated as collateral with Bank of America Corp. and Deutsche Bank AG, respectively, for open credit default swap contracts.

Equity Swaps

| Counterparty | Reference Entity | Termination Date | Notional Amount | Unrealized Appreciation/ (Depreciation) | ||||||||||||

| Credit Suisse International | Bovespa Index | 12/18/13 | BRL | 25,218,276 | $ | 237,414 | ||||||||||

| Credit Suisse International | FTSE KLCI Index | 11/29/13 | MYR | 16,679,636 | (43,257 | ) | ||||||||||

| Credit Suisse International | ISE 30 Index | 12/31/13 | TRY | 4,551,097 | (38,428 | ) | ||||||||||

| Credit Suisse International | RTS Index | 12/16/13 | $ | 5,701,827 | 213,833 | |||||||||||

| Credit Suisse International | WIG20 Index | 12/20/13 | PLN | 3,849,921 | 65,327 | |||||||||||

|

| |||||||||||||||

| $ | 434,889 | |||||||||||||||

|

| |||||||||||||||

16

Statement of Investments (Continued)

October 31, 2013

Nationwide Alternatives Allocation Fund (Continued)

BRL Brazilian Real |

FTSE Financial Times Stock Exchange |

ISE Istanbul Stock Exchange |

KLCI Kuala Lumpur Composite Index |

MYR Malaysia Ringgit |

PLN Poland Zloty |

RTS Russian Trading System |

TRY Turkish Lira |

WIG Warsaw Stock Exchange |

At October 31, 2013, the Fund has $2,120,000 segregated as collateral with Credit Suisse International for open written options, credit default swaps, and equity swaps contracts.

At October 31, 2013, the Fund’s open futures contracts were as follows (Note 2):

| Number of Contracts | Long Contracts | Expiration | Notional Value Covered by Contracts | Unrealized Appreciation/ (Depreciation) | ||||||||||||

| 49 | Australian 10 Year Bond Future | 12/16/13 | $ | 5,396,819 | $ | 411 | ||||||||||

| 54 | Canadian 10 Year Bond Future | 12/18/13 | 6,802,762 | 120,130 | ||||||||||||

| 1,005 | EURO-BOBL Future | 12/06/13 | 170,963,058 | 1,764,761 | ||||||||||||

| 170 | FTSE/JSE Top 40 Future | 12/19/13 | 6,921,081 | 168,729 | ||||||||||||

| 263 | H-Shares Index Future | 11/28/13 | 18,041,603 | 794,785 | ||||||||||||

| 34 | Japan 10 Year Bond Treasury Future | 12/11/13 | 50,161,497 | 440,512 | ||||||||||||

| 62 | Long GILT Future | 12/27/13 | 11,060,445 | 126,982 | ||||||||||||

| 180 | Mexican Bolsa Index Future | 12/20/13 | 5,654,433 | (27,829 | ) | |||||||||||

| 353 | MSCI Taiwan Index Future | 11/28/13 | 10,515,870 | 12,532 | ||||||||||||

| 476 | SGX S&P CNX Nifty Future | 11/28/13 | 6,019,496 | 93,684 | ||||||||||||

|

|

|

| |||||||||||||

| $ | 291,537,064 | $ | 3,494,697 | |||||||||||||

|

|

|

| |||||||||||||

BOBL Bundesobligationen (Federal Republic of Germany) |

CNX CRISIL NSE Index |

FTSE Financial Times Stock Exchange |

GILT Government Index-Linked Treasury |

JSE Johannesburg Stock Exchange |

SGX Singapore Exchange |

At October 31, 2013, the Fund’s open forward foreign currency contracts against the United States Dollar were as follows (Note 2):

| Currency | Counterparty | Delivery Date | Currency Delivered | Contract Value | Market Value | Unrealized Appreciation/ (Depreciation) | ||||||||||||||||

Short Contracts: | ||||||||||||||||||||||

| Brazilian Real | UBS AG | 11/04/13 | (23,600,000 | ) | $ | (10,781,179 | ) | $ | (10,534,774 | ) | $ | 246,405 | ||||||||||

| Turkish Lira | UBS AG | 12/18/13 | (100,000 | ) | (48,400 | ) | (49,705 | ) | (1,305 | ) | ||||||||||||

|

|

|

|

|

| |||||||||||||||||

| Total Short Contracts | $ | (10,829,579 | ) | $ | (10,584,479 | ) | $ | 245,100 | ||||||||||||||

|

|

|

|

|

| |||||||||||||||||

17

Statement of Investments (Continued)

October 31, 2013

Nationwide Alternatives Allocation Fund (Continued)

| Currency | Counterparty | Delivery Date | Currency Received | Contract Value | Market Value | Unrealized Appreciation/ (Depreciation) | ||||||||||||||||

Long Contracts: | ||||||||||||||||||||||

| Brazilian Real | UBS AG | 11/04/13 | 600,000 | $ | 270,819 | $ | 267,833 | $ | (2,986 | ) | ||||||||||||

| Brazilian Real | UBS AG | 11/04/13 | 16,600,000 | 7,309,234 | 7,410,053 | 100,819 | ||||||||||||||||

| Brazilian Real | UBS AG | 11/04/13 | 6,400,000 | 2,877,116 | 2,856,888 | (20,228 | ) | |||||||||||||||

| Brazilian Real | UBS AG | 12/03/13 | 23,600,000 | 10,708,776 | 10,461,167 | (247,609 | ) | |||||||||||||||

| Czech Republic Koruna | UBS AG | 12/18/13 | 2,200,000 | 115,907 | 115,802 | (105 | ) | |||||||||||||||

| Czech Republic Koruna | UBS AG | 12/18/13 | 2,200,000 | 117,122 | 115,802 | (1,320 | ) | |||||||||||||||

| Hong Kong Dollar | UBS AG | 12/18/13 | 40,700,000 | 5,249,495 | 5,250,177 | 682 | ||||||||||||||||

| Hong Kong Dollar | UBS AG | 12/18/13 | 3,000,000 | 386,956 | 386,991 | 35 | ||||||||||||||||

| Hong Kong Dollar | UBS AG | 12/18/13 | 107,400,000 | 13,853,149 | 13,854,275 | 1,126 | ||||||||||||||||

| Hungarian Forint | UBS AG | 12/18/13 | 39,200,000 | 176,992 | 179,522 | 2,530 | ||||||||||||||||

| Hungarian Forint | UBS AG | 12/18/13 | 19,600,000 | 85,806 | 89,761 | 3,955 | ||||||||||||||||

| Indian Rupee | UBS AG | 12/18/13 | 96,800,000 | 1,449,536 | 1,558,930 | 109,394 | ||||||||||||||||

| Indian Rupee | UBS AG | 12/18/13 | 8,800,000 | 140,340 | 141,721 | 1,381 | ||||||||||||||||

| Indian Rupee | UBS AG | 12/18/13 | 237,600,000 | 3,690,301 | 3,826,464 | 136,163 | ||||||||||||||||

| Korean Won | UBS AG | 12/18/13 | 3,935,400,000 | 3,611,784 | 3,698,005 | 86,221 | ||||||||||||||||

| Korean Won | UBS AG | 12/18/13 | 10,869,200,000 | 10,072,468 | 10,213,537 | 141,069 | ||||||||||||||||

| Korean Won | UBS AG | 12/18/13 | 281,100,000 | 257,961 | 264,143 | 6,182 | ||||||||||||||||

| Korean Won | UBS AG | 12/18/13 | 562,200,000 | 522,182 | 528,286 | 6,104 | ||||||||||||||||

| Malaysian Ringgit | UBS AG | 12/18/13 | 300,000 | 94,212 | 94,777 | 565 | ||||||||||||||||

| Malaysian Ringgit | UBS AG | 12/18/13 | 300,000 | 91,127 | 94,777 | 3,650 | ||||||||||||||||

| Malaysian Ringgit | UBS AG | 12/18/13 | 8,700,000 | 2,675,277 | 2,748,532 | 73,255 | ||||||||||||||||

| Malaysian Ringgit | UBS AG | 12/18/13 | 3,300,000 | 997,612 | 1,042,547 | 44,935 | ||||||||||||||||

| Mexican Peso | UBS AG | 12/18/13 | 2,200,000 | 166,965 | 168,020 | 1,055 | ||||||||||||||||

| Mexican Peso | UBS AG | 12/18/13 | 48,400,000 | 3,661,950 | 3,696,433 | 34,483 | ||||||||||||||||

| Mexican Peso | UBS AG | 12/18/13 | 1,100,000 | 83,366 | 84,010 | 644 | ||||||||||||||||

| Mexican Peso | UBS AG | 12/18/13 | 17,600,000 | 1,327,521 | 1,344,158 | 16,637 | ||||||||||||||||

| Polish Zlotych | UBS AG | 12/18/13 | 3,000,000 | 957,426 | 971,184 | 13,758 | ||||||||||||||||

| Polish Zlotych | UBS AG | 12/18/13 | 1,200,000 | 370,356 | 388,474 | 18,118 | ||||||||||||||||

| South African Rand | UBS AG | 12/18/13 | 1,400,000 | 138,686 | 138,524 | (162 | ) | |||||||||||||||

| South African Rand | UBS AG | 12/18/13 | 48,300,000 | 4,738,313 | 4,779,073 | 40,760 | ||||||||||||||||

| South African Rand | UBS AG | 12/18/13 | 1,400,000 | 138,279 | 138,524 | 245 | ||||||||||||||||

| South African Rand | UBS AG | 12/18/13 | 16,800,000 | 1,658,538 | 1,662,286 | 3,748 | ||||||||||||||||

| Taiwan Dollar | UBS AG | 12/18/13 | 3,300,000 | 112,841 | 112,433 | (408 | ) | |||||||||||||||

| Taiwan Dollar | UBS AG | 12/18/13 | 3,300,000 | 111,993 | 112,433 | 440 | ||||||||||||||||

| Taiwan Dollar | UBS AG | 12/18/13 | 85,800,000 | 2,909,215 | 2,923,270 | 14,055 | ||||||||||||||||

| Taiwan Dollar | UBS AG | 12/18/13 | 231,000,000 | 7,851,801 | 7,870,341 | 18,540 | ||||||||||||||||

| Thailand Baht | UBS AG | 12/18/13 | 59,500,000 | 1,896,717 | 1,906,243 | 9,526 | ||||||||||||||||

| Thailand Baht | UBS AG | 12/18/13 | 24,500,000 | 755,939 | 784,923 | 28,984 | ||||||||||||||||

| Turkish Lira | UBS AG | 12/18/13 | 1,000,000 | 484,174 | 497,050 | 12,876 | ||||||||||||||||

| Turkish Lira | UBS AG | 12/18/13 | 2,500,000 | 1,214,447 | 1,242,624 | 28,177 | ||||||||||||||||

| Turkish Lira | UBS AG | 12/18/13 | 100,000 | 49,478 | 49,705 | 227 | ||||||||||||||||

|

|

|

|

|

| |||||||||||||||||

| Total Long Contracts | $93,382,177 | $ | 94,069,698 | $ | 687,521 | |||||||||||||||||

|

|

|

|

|

| |||||||||||||||||

The accompanying notes are an integral part of these financial statements.

18

Statement of Assets and Liabilities

October 31, 2013

Nationwide Alternatives Allocation Fund | ||||||

Assets: | ||||||

Investments, at value (cost $812,664,232) | $ | 813,302,855 | ||||

Cash | 136,202 | |||||

Restricted cash, collateral for open written options, credit default swaps, and equity swaps contracts | 13,780,000 | |||||

Foreign currencies, at value (cost $467,676) | 464,647 | |||||

Interest and dividends receivable | 3,876,307 | |||||

Receivable for investments sold | 1,643 | |||||

Receivable for capital shares issued | 9,477 | |||||

Reclaims receivable | 4,947 | |||||

Swaps contracts, at value (Note 2) | 685,803 | |||||

Receivable for variation margin on swap contracts | 6,029,348 | |||||

Unrealized appreciation on forward foreign currency contracts (Note 2) | 1,206,744 | |||||

Prepaid expenses | 26,057 | |||||

|

| |||||

Total Assets | 839,524,030 | |||||

|

| |||||

Liabilities: | ||||||

Payable for investments purchased | 6,606 | |||||

Payable for capital shares redeemed | 280,917 | |||||

Payable for variation margin on futures contracts | 1,297 | |||||

Cash collateral due to broker for open swap contracts | 410,000 | |||||

Written options, at value (premiums $0)(Note 2) | 343,176 | |||||

Swap contracts, at value (Note 2) | 7,786,529 | |||||

Unrealized depreciation on forward foreign currency contracts (Note 2) | 274,123 | |||||

Accrued expenses and other payables: | ||||||

Investment advisory fees | 235,992 | |||||

Fund administration fees | 22,998 | |||||

Distribution fees | 669 | |||||

Administrative servicing fees | 102 | |||||

Accounting and transfer agent fees | 1,877 | |||||

Trustee fees | 568 | |||||

Deferred capital gain country tax | 3,523 | |||||

Custodian fees | 2,500 | |||||

Compliance program costs (Note 3) | 3 | |||||

Professional fees | 39,204 | |||||

Printing fees | 8,125 | |||||

Other | 1,586 | |||||

|

| |||||

Total Liabilities | 9,419,795 | |||||

|

| |||||

Net Assets | $ | 830,104,235 | ||||

|

| |||||

Represented by: | ||||||

Capital | $ | 823,971,768 | ||||

Accumulated distributions in excess of net investment income | 1,997,205 | |||||

Accumulated net realized losses from investment, futures, forward and foreign currency, written option, and swap transactions | (5,194,627 | ) | ||||

Net unrealized appreciation/(depreciation) from investments† | 635,100 | |||||

Net unrealized appreciation/(depreciation) from futures contracts (Note 2) | 3,494,697 | |||||

Net unrealized appreciation/(depreciation) from forward foreign currency contracts (Note 2) | 932,621 | |||||

Net unrealized appreciation/(depreciation) from translation of assets and liabilities denominated in foreign currencies | (56,692 | ) | ||||

Net unrealized appreciation/(depreciation) from written options (Note 2) | (343,176 | ) | ||||

Net unrealized appreciation/(depreciation) from swap contracts (Note 2) | 4,667,339 | |||||

|

| |||||

Net Assets | $ | 830,104,235 | ||||

|

| |||||

| † | Net of $3,523 of deferred capital gain country tax. |

19

Statement of Assets and Liabilities (Continued)

October 31, 2013

Nationwide Alternatives Allocation Fund | ||||||

Net Assets: | ||||||

Class A Shares | $ | 1,237,486 | ||||

Class C Shares | 492,813 | |||||

Institutional Service Class Shares | 82,618 | |||||

Institutional Class Shares | 828,291,318 | |||||

|

| |||||

Total | $ | 830,104,235 | ||||

|

| |||||

Shares Outstanding (unlimited number of shares authorized): | ||||||

Class A Shares | 126,306 | |||||

Class C Shares | 50,876 | |||||

Institutional Service Class Shares | 8,408 | |||||

Institutional Class Shares | 84,314,017 | |||||

|

| |||||

Total | 84,499,607 | |||||

|

| |||||

Net asset value and redemption price per share (Net assets by class divided by shares outstanding by class, respectively): | ||||||

Class A Shares(a) | $ | 9.80 | ||||

Class C Shares(b) | $ | 9.69 | ||||

Institutional Service Class Shares | $ | 9.83 | ||||

Institutional Class Shares | $ | 9.82 | ||||

Maximum offering price per share (100%/(100%-maximum sales charge) of net asset value adjusted to the nearest cent): | ||||||

Class A Shares | $ | 10.03 | ||||

|

| |||||

Maximum Sales Charge: | ||||||

Class A Shares | 2.25 | % | ||||

|

| |||||