UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________________________________________________________

Form 10-K

(Mark One)

|

| |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED December 31, 2019 OR

|

| |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

Commission file number 001-03701

__________________________________________________________________________________________

|

|

| AVISTA CORPORATION |

| (Exact name of Registrant as specified in its charter) |

|

| | | | |

| WA | | 91-0462470 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer

Identification No.) |

1411 East Mission Avenue, Spokane, WA 99202-2600

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: 509-489-0500

Web site: http://www.avistacorp.com

Securities registered pursuant to Section 12(b) of the Act: |

| | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common Stock | AVA | NYSE |

Securities registered pursuant to Section 12(g) of the Act:

Title of Class

Preferred Stock, Cumulative, Without Par Value

__________________________________________________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days: Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | |

| Large Accelerated Filer | ☒ | Accelerated Filer | ☐ |

| Non-accelerated Filer | ☐ | Smaller reporting company | ☐ |

| Emerging growth company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): Yes ☐ No ☒

The aggregate market value of the Registrant’s outstanding Common Stock, no par value (the only class of voting stock), held by non-affiliates is $2,948,564,738 based on the last reported sale price thereof on the consolidated tape on June 30, 2019.

As of January 31, 2020, 67,208,604 shares of Registrant’s Common Stock, no par value (the only class of common stock), were outstanding.

__________________________________________________________________________________________

Documents Incorporated By Reference

|

| | |

| Document | | Part of Form 10-K into Which Document is Incorporated |

Proxy Statement to be filed in connection with the annual meeting of shareholders to be held on May 11, 2020. Prior to such filing, the Proxy Statement filed in connection with the annual meeting of shareholders held on May 9, 2019. | | Part III, Items 10, 11, 12, 13 and 14 |

INDEX

|

| | | | |

Item No. | | | Page No. | |

| | | | | |

| | | | | |

| | | | | |

| | | Part I | | |

| 1 | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| 1A. | | | | |

| 1B. | | | | |

| 2 | | | | |

| | | | | |

| | | | | |

| 3 | | | | |

| 4 | | | | * |

| | | Part II | | |

| 5 | | | | |

| 6 | | | | |

| 7 | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

|

| | | | |

| 9B. | | | | |

| | | Part III | | |

| 10. | | | | |

| 11. | | | | |

| 12. | | | | |

| 13. | | | | |

| 14. | | | | |

| | | Part IV | | |

| 15. | | | | |

| | | | | |

| | | | | |

* = not an applicable item in the 2019 calendar year for Avista Corp.

ACRONYMS AND TERMS

(The following acronyms and terms are found in multiple locations within the document)

|

| | |

| Acronym/Term | Meaning |

| aMW | - | Average Megawatt - a measure of the average rate at which a particular generating source produces energy over a period of time |

| AEL&P | - | Alaska Electric Light and Power Company, the primary operating subsidiary of AERC, which provides electric services in Juneau, Alaska |

| AERC | - | Alaska Energy and Resources Company, the Company's wholly-owned subsidiary based in Juneau, Alaska |

| AFUDC | - | Allowance for Funds Used During Construction; represents the cost of both the debt and equity funds used to finance utility plant additions during the construction period |

| AM&D | - | Advanced Manufacturing and Development, doing business as METALfx |

| ARAM | - | Average Rate Assumption Method |

| ASC | - | Accounting Standards Codification |

| ASU | - | Accounting Standards Update |

| Avista Capital | - | Parent company to the Company’s non-utility businesses, with the exception of AJT Mining Properties, Inc., which is a subsidiary of AERC. |

| Avista Corp. | - | Avista Corporation, the Company |

| Avista Utilities | - | Operating division of Avista Corp. (not a subsidiary) comprising the regulated utility operations in the Pacific Northwest |

| BPA | - | Bonneville Power Administration |

| Capacity | - | The rate at which a particular generating source is capable of producing energy, measured in KW or MW |

| Cabinet Gorge | - | The Cabinet Gorge Hydroelectric Generating Project, located on the Clark Fork River in Idaho |

| CETA | - | Clean Energy Transformation Act |

| Colstrip | - | The coal-fired Colstrip Generating Plant in southeastern Montana |

| Cooling degree days | - | The measure of the warmness of weather experienced, based on the extent to which the average of high and low temperatures for a day exceeds 65 degrees Fahrenheit (annual degree days above historic indicate warmer than average temperatures) |

| Coyote Springs 2 | - | The natural gas-fired combined-cycle Coyote Springs 2 Generating Plant located near Boardman, Oregon |

| CT | - | Combustion turbine |

| Deadband or ERM deadband | - | The first $4.0 million in annual power supply costs above or below the amount included in base retail rates in Washington under the ERM in the state of Washington |

| Ecology | - | The State of Washington’s Department of Ecology |

| EIM | - | Energy Imbalance Market |

| Energy | - | The amount of electricity produced or consumed over a period of time, measured in KWh or MWh. Also, refers to natural gas consumed and is measured in dekatherms. |

| EPA | - | Environmental Protection Agency |

| ERM | - | The Energy Recovery Mechanism, a mechanism for accounting and rate recovery of certain power supply costs accepted by the utility commission in the state of Washington |

| FASB | - | Financial Accounting Standards Board |

| FCA | - | Fixed Cost Adjustment, the electric and natural gas decoupling mechanism in Idaho. |

| FERC | - | Federal Energy Regulatory Commission |

| GAAP | - | Generally Accepted Accounting Principles |

| GHG | - | Greenhouse gas |

| GS | - | Generating station |

| Heating degree days | - | The measure of the coldness of weather experienced, based on the extent to which the average of high and low temperatures for a day falls below 65 degrees Fahrenheit (annual degree days above historic indicate warmer than average temperatures) |

| Hydro One | - | Hydro One Limited, based in Toronto, Ontario, Canada. |

|

| | |

| IPUC | - | Idaho Public Utilities Commission |

| IRP | - | Integrated Resource Plan |

| Jackson Prairie | - | Jackson Prairie Natural Gas Storage Project, an underground natural gas storage field located near Chehalis, Washington |

| Juneau | - | The City and Borough of Juneau, Alaska |

| kV | - | Kilovolt (1000 volts): a measure of capacity on transmission lines |

| KW, KWh | - | Kilowatt (1000 watts): a measure of generating output or capability. Kilowatt-hour (1000 watt hours): a measure of energy produced |

| Lancaster Plant | - | A natural gas-fired combined cycle combustion turbine plant located in Idaho |

| LNG | - | Liquefied Natural Gas |

| MPSC | - | Public Service Commission of the State of Montana |

| MW, MWh | - | Megawatt: 1000 KW. Megawatt-hour: 1000 KWh |

| NERC | - | North American Electricity Reliability Corporation |

| Noxon Rapids | - | The Noxon Rapids Hydroelectric Generating Project, located on the Clark Fork River in Montana |

| OPUC | - | The Public Utility Commission of Oregon |

| PCA | - | The Power Cost Adjustment mechanism, a procedure for accounting and rate recovery of certain power supply costs accepted by the utility commission in the state of Idaho |

| PGA | - | Purchased Gas Adjustment |

| PPA | - | Power Purchase Agreement |

| PSE | - | Puget Sound Energy |

| PUD | - | Public Utility District |

| RCA | - | The Regulatory Commission of Alaska |

| REC | - | Renewable energy credit |

| ROE | - | Return on equity |

| ROR | - | Rate of return on rate base |

| SEC | - | U.S. Securities and Exchange Commission |

| TCJA | - | The "Tax Cuts and Jobs Act," signed into law on December 22, 2017. |

| Therm | - | Unit of measurement for natural gas; a therm is equal to approximately one hundred cubic feet (volume) or 100,000 BTUs (energy) |

| Watt | - | Unit of measurement of electric power or capability; a watt is equal to the rate of work represented by a current of one ampere under a pressure of one volt |

| WUTC | - | Washington Utilities and Transportation Commission |

Forward-Looking Statements

From time to time, we make forward-looking statements such as statements regarding projected or future:

| |

| • | strategic goals and objectives; |

| |

| • | business environment; and |

These statements are based upon underlying assumptions (many of which are based, in turn, upon further assumptions). Such statements are made both in our reports filed under the Securities Exchange Act of 1934, as amended (including this Annual Report on Form 10-K), and elsewhere. Forward-looking statements are all statements except those of historical fact including, without limitation, those that are identified by the use of words that include “will,” “may,” “could,” “should,” “intends,” “plans,” “seeks,” “anticipates,” “estimates,” “expects,” “forecasts,” “projects,” “predicts,” and similar expressions.

Forward-looking statements (including those made in this Annual Report on Form 10-K) are subject to a variety of risks, uncertainties and other factors. Most of these factors are beyond our control and may have a significant effect on our operations, results of operations, financial condition or cash flows, which could cause actual results to differ materially from those anticipated in our statements. Such risks, uncertainties and other factors include, among others:

Utility Regulatory Risk

| |

| • | state and federal regulatory decisions or related judicial decisions that affect our ability to recover costs and earn a reasonable return including, but not limited to, disallowance or delay in the recovery of capital investments, operating costs, commodity costs, interest rate swap derivatives, the ordering of refunds to customers and discretion over allowed return on investment; |

| |

| • | the loss of regulatory accounting treatment, which could require the write-off of regulatory assets and the loss of regulatory deferral and recovery mechanisms; |

Operational Risk

| |

| • | wildfires ignited, or allegedly ignited, by Avista Corp. equipment or facilities could cause significant loss of life and property, thereby causing serious operational and financial harm to Avista Corp. and our customers; |

| |

| • | severe weather or natural disasters, including, but not limited to, avalanches, wind storms, wildfires, earthquakes, snow and ice storms, that can disrupt energy generation, transmission and distribution, as well as the availability and costs of fuel, materials, equipment, supplies and support services; |

| |

| • | explosions, fires, accidents, mechanical breakdowns or other incidents that could impair assets and may disrupt operations of any of our generation facilities, transmission, and electric and natural gas distribution systems or other operations and may require us to purchase replacement power or incur costs to repair our facilities; |

| |

| • | explosions, fires, accidents or other incidents arising from or allegedly arising from our operations that could cause injuries to the public or property damage; |

| |

| • | blackouts or disruptions of interconnected transmission systems (the regional power grid); |

| |

| • | terrorist attacks, cyberattacks or other malicious acts that could disrupt or cause damage to our utility assets or to the national or regional economy in general, including any effects of terrorism, cyberattacks, ransomware, or vandalism that damage or disrupt information technology systems; |

| |

| • | work-force issues, including changes in collective bargaining unit agreements, strikes, work stoppages, the loss of key executives, availability of workers in a variety of skill areas, and our ability to recruit and retain employees; |

| |

| • | increasing costs of insurance, more restrictive coverage terms and our ability to obtain insurance; |

| |

| • | delays or changes in construction costs, and/or our ability to obtain required permits and materials for present or prospective facilities; |

| |

| • | increasing health care costs and cost of health insurance provided to our employees and retirees; |

| |

| • | third party construction of buildings, billboard signs, towers or other structures within our rights of way, or placement of fuel containers within close proximity to our transformers or other equipment, including overbuild atop natural gas distribution lines; |

| |

| • | the loss of key suppliers for materials or services or other disruptions to the supply chain; |

| |

| • | adverse impacts to our Alaska electric utility that could result from an extended outage of its hydroelectric generating resources or their inability to deliver energy, due to their lack of interconnectivity to any other electrical grids and the availability or cost of replacement power (diesel); |

| |

| • | changing river regulation or operations at hydroelectric facilities not owned by us, which could impact our hydroelectric facilities downstream; |

| |

| • | change in the use, availability or abundancy of water resources and/or rights needed for operation of our hydroelectric facilities; |

Cyber and Technology Risk

| |

| • | cyberattacks on the operating systems that are used in the operation of our electric generation, transmission and distribution facilities and our natural gas distribution facilities, and cyberattacks on such systems of other energy companies with which we are interconnected, which could damage or destroy facilities or systems or disrupt operations for extended periods of time and result in the incurrence of liabilities and costs; |

| |

| • | cyberattacks on the administrative systems that are used in the administration of our business, including customer billing and customer service, accounting, communications, compliance and other administrative functions, and cyberattacks on such systems of our vendors and other companies with which we do business, which could result in the disruption of business operations, the release of private information and the incurrence of liabilities and costs; |

| |

| • | changes in costs that impede our ability to effectively implement new information technology systems or to operate and maintain current production technology; |

| |

| • | changes in technologies, possibly making some of the current technology we utilize obsolete or introducing new cyber security risks; |

| |

| • | insufficient technology skills, which could lead to the inability to develop, modify or maintain our information systems; |

Strategic Risk

| |

| • | growth or decline of our customer base due to new uses for our services or decline in existing services, including, but not limited to, the effect of the trend toward distributed generation at customer sites; |

| |

| • | the potential effects of negative publicity regarding our business practices, whether true or not, which could hurt our reputation and result in litigation or a decline in our common stock price; |

| |

| • | changes in our strategic business plans, which could be affected by any or all of the foregoing, including the entry into new businesses and/or the exit from existing businesses and the extent of our business development efforts where potential future business is uncertain; |

| |

| • | wholesale and retail competition including alternative energy sources, growth in customer-owned power resource technologies that displace utility-supplied energy or that may be sold back to the utility, and alternative energy suppliers and delivery arrangements; |

| |

| • | entering into or growth of non-regulated activities may increase earnings volatility; |

| |

| • | the risk of municipalization or other form of service territory reduction; |

External Mandates Risk

| |

| • | changes in environmental laws, regulations, decisions and policies, including present and potential environmental remediation costs and our compliance with these matters; |

| |

| • | the potential effects of initiatives, legislation or administrative rulemaking at the federal, state or local levels, including possible effects on our generating resources, prohibitions or restrictions on new or existing services, or restrictions on greenhouse gas emissions to mitigate concerns over global climate changes; |

| |

| • | political pressures or regulatory practices that could constrain or place additional cost burdens on our distribution systems through accelerated adoption of distributed generation or electric-powered transportation or on our energy supply sources, such as campaigns to halt fossil fuel fired power generation and opposition to other thermal generation, wind turbines or hydroelectric facilities; |

| |

| • | failure to identify changes in legislation, taxation and regulatory issues that could be detrimental or beneficial to our overall business; |

| |

| • | policy and/or legislative changes in various regulated areas, including, but not limited to, environmental regulation, healthcare regulations and import/export regulations; |

Financial Risk

| |

| • | weather conditions, which affect both energy demand and electric generating capability, including the impact of precipitation and temperature on hydroelectric resources, the impact of wind patterns on wind-generated power, weather-sensitive customer demand, and similar impacts on supply and demand in the wholesale energy markets; |

| |

| • | our ability to obtain financing through the issuance of debt and/or equity securities, which could be affected by various factors including our credit ratings, interest rates, other capital market conditions and global economic conditions; |

| |

| • | changes in interest rates that affect borrowing costs, our ability to effectively hedge interest rates for anticipated debt issuances, variable interest rate borrowing and the extent to which we recover interest costs through retail rates collected from customers; |

| |

| • | changes in actuarial assumptions, interest rates and the actual return on plan assets for our pension and other postretirement benefit plans, which could affect future funding obligations, pension and other postretirement benefit expense and the related liabilities; |

| |

| • | the outcome of legal proceedings and other contingencies; |

| |

| • | economic conditions in our service areas, including the economy's effects on customer demand for utility services; |

| |

| • | declining energy demand related to customer energy efficiency, conservation measures and/or increased distributed generation; |

| |

| • | changes in the long-term climate and weather could materially affect, among other things, customer demand, the volume and timing of streamflows required for hydroelectric generation, costs of generation, transmission and distribution. Increased or new risks may arise from severe weather or natural disasters, including wildfires; |

| |

| • | industry and geographic concentrations which could increase our exposure to credit risks due to counterparties, suppliers and customers being similarly affected by changing conditions; |

| |

| • | deterioration in the creditworthiness of our customers; |

Energy Commodity Risk

| |

| • | volatility and illiquidity in wholesale energy markets, including exchanges, the availability of willing buyers and sellers, changes in wholesale energy prices that could affect operating income, cash requirements to purchase electricity and natural gas, value received for wholesale sales, collateral required of us by individual counterparties and/or exchanges in wholesale energy transactions and credit risk to us from such transactions, and the market value of derivative assets and liabilities; |

| |

| • | default or nonperformance on the part of any parties from whom we purchase and/or sell capacity or energy; |

| |

| • | potential environmental regulations or lawsuits affecting our ability to utilize or resulting in the obsolescence of our power supply resources; |

| |

| • | explosions, fires, accidents, pipeline ruptures or other incidents that could limit energy supply to our facilities or our surrounding territory, which could result in a shortage of commodities in the market that could increase the cost of replacement commodities from other sources; |

Compliance Risk

| |

| • | changes in laws, regulations, decisions and policies at the federal, state or local levels, which could materially impact both our electric and gas operations and costs of operations; and |

| |

| • | the ability to comply with the terms of the licenses and permits for our hydroelectric or thermal generating facilities at cost-effective levels. |

Our expectations, beliefs and projections are expressed in good faith. We believe they are reasonable based on, without limitation, an examination of historical operating trends, our records and other information available from third parties. There can be no assurance that our expectations, beliefs or projections will be achieved or accomplished. Furthermore, any forward-looking statement speaks only as of the date on which such statement is made. We undertake no obligation to update any forward-looking statement or statements to reflect events or circumstances that occur after the date on which such statement is made or to reflect the occurrence of unanticipated events. New risks, uncertainties and other factors emerge from time to time, and it is not possible for us to predict all such factors, nor can we assess the effect of each such factor on our business or the extent that any such factor or combination of factors may cause actual results to differ materially from those contained in any forward-looking statement.

Available Information

We file annual, quarterly and current reports and proxy statements with the SEC. The SEC maintains a website that contains these documents at www.sec.gov. We make annual, quarterly and current reports and proxy statements available on our website, www.avistacorp.com, as soon as practicable after electronically filing these documents with the SEC. Except for SEC filings or portions thereof that are specifically referred to in this report, information contained on these websites is not part of this report.

PART I

ITEM 1. BUSINESS

COMPANY OVERVIEW

Avista Corp., incorporated in the territory of Washington in 1889, is primarily an electric and natural gas utility with certain other business ventures. As of December 31, 2019, we employed 1,796 people in our Pacific Northwest utility operations (Avista Utilities) and 124 people in our subsidiary businesses (including our Juneau, Alaska utility operations). Our corporate headquarters are in Spokane, Washington, the second-largest city in Washington. Spokane serves as the business, transportation, medical, industrial and cultural hub of the Inland Northwest region (eastern Washington and northern Idaho). Regional services include government and higher education, medical services, retail trade and finance. Through our subsidiary AEL&P, we also provide electric utility services in Juneau, Alaska.

As of December 31, 2019, we have two reportable business segments as follows:

| |

| • | Avista Utilities – an operating division of Avista Corp., comprising the regulated utility operations in the Pacific Northwest. Avista Utilities provides electric distribution and transmission, and natural gas distribution services in parts of eastern Washington and northern Idaho. Avista Utilities also provides natural gas distribution service in parts of northeastern and southwestern Oregon. Avista Utilities has electric generating facilities in Washington, Idaho, Oregon and Montana. Avista Utilities also supplies electricity to a small number of customers in Montana, most of whom are employees who operate Avista Utilities' Noxon Rapids generating facility. Avista Utilities also engages in wholesale purchases and sales of electricity and natural gas as an integral part of energy resource management and its load-serving obligation. |

| |

| • | AEL&P - a utility providing electric services in Juneau, Alaska that is a wholly-owned subsidiary and the primary operating subsidiary of AERC. |

We have other businesses, including venture fund investments, real estate investments, as well as certain other investments made by Avista Capital, which is a direct, wholly owned subsidiary of Avista Corp. These activities do not represent a reportable business segment and are conducted by various direct and indirect subsidiaries of Avista Corp. In April 2019, we sold our investment in METALfx, a custom sheet metal fabricator. See "Note 25 of the Notes to Consolidated Financial Statements" for further discussion of the sale.

Total Avista Corp. shareholders’ equity was $1,939.3 million as of December 31, 2019, which includes a $103.3 million investment in Avista Capital and a $103.8 million investment in AERC.

See “Item 6. Selected Financial Data” and “Note 23 of the Notes to Consolidated Financial Statements” for information with respect to the operating performance of each business segment (and other subsidiaries).

AVISTA UTILITIES

General

At the end of 2019, Avista Utilities supplied retail electric service to approximately 393,000 customers and retail natural gas service to approximately 361,000 customers across its service territory. Avista Utilities' service territory covers 30,000 square miles with a population of 1.7 million. See “Item 2. Properties” for further information on our utility assets. See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Economic Conditions and Utility Load Growth” for information on economic conditions in our service territory.

Electric Operations

General Avista Utilities generates, transmits and distributes electricity, serving electric customers in eastern Washington and northern Idaho and a small number of customers in Montana, most of whom are employees who operate Avista Utilities' Noxon Rapids generating facility.

Avista Utilities generates electricity from facilities that we own and purchases capacity, energy and fuel for generation under long-term and short-term contracts to meet customer load obligations. We also sell electric capacity and energy, as well as surplus fuel in the wholesale market in connection with our resource optimization activities as described below.

As part of Avista Utilities' resource procurement and management operations in the electric business, we engage in an ongoing process of resource optimization, which involves the selection from available energy resources to serve our load obligations and the use of these resources to capture economic value through wholesale market transactions. These include sales and purchases of electric capacity and energy, fuel for electric generation, and derivative contracts related to capacity, energy, fuel and fuel transportation. Such transactions are part of the process of matching available resources with load obligations and hedging a portion of the related financial risks. In order to implement this process, we make continuing projections of:

| |

| • | electric loads at various points in time (ranging from intra-hour to multiple years) based on, among other things, estimates of customer usage and weather, historical data and contract terms, and |

| |

| • | resource availability at these points in time based on, among other things, fuel choices and fuel markets, estimates of streamflows, availability of generating units, historic and forward market information, contract terms and experience. |

On the basis of these projections, we make purchases and sales of electric capacity and energy, fuel for electric generation, and related derivative contracts to match expected resources to expected electric load requirements and reduce our exposure to electricity (or fuel) market price changes. The process of resource optimization involves scheduling and dispatching available resources as well as the following:

| |

| • | purchasing fuel for generation, |

| |

| • | when economical, selling fuel and substituting wholesale electric purchases, and |

| |

| • | other wholesale transactions to capture the value of generating resources, transmission contract rights and fuel delivery (transport) capacity contracts. |

This optimization process includes entering into hedging transactions to manage risks. Transactions include both physical energy contracts and related derivative instruments, and the terms range from intra-hour up to multiple years.

Avista Utilities' generation assets are interconnected through the regional transmission system and are operated on a coordinated basis to enhance load-serving capability and reliability. We acquire both long-term and short-term transmission capacity to facilitate all of our energy and capacity transactions. We provide transmission and ancillary services in eastern Washington, northern Idaho and western Montana.

Electric Requirements

Avista Utilities' peak electric native load requirement for 2019 was 1,656 MW, which occurred on August 7, 2019. In 2018, our peak electric native load was 1,716 MW, which occurred during the summer, and in 2017, it was 1,681 MW, which occurred during the winter.

Electric Resources

Avista Utilities has a diverse electric resource mix of Company-owned and contracted hydroelectric, thermal and wind generation facilities, and other contracts for power purchases and exchanges. As of December 31, 2019, Avista Utilities' electric

generation resource mix (including contracts for power purchases) was approximately 51 percent hydroelectric, 45 percent thermal and 4 percent wind. See “Item 2. Properties” for detailed information on Company-owned generating facilities.

Hydroelectric Resources Avista Utilities owns and operates Noxon Rapids and Cabinet Gorge on the Clark Fork River and six smaller hydroelectric projects on the Spokane River. Hydroelectric generation is typically our lowest cost source per MWh of electric energy and the availability of hydroelectric generation has a significant effect on total power supply costs. Under normal streamflow and operating conditions, we estimate that we would be able to meet approximately one-half of our total average electric requirements (both retail and long-term wholesale) with the combination of our hydroelectric generation and long-term hydroelectric purchase contracts with certain PUDs in the state of Washington. Our estimate of normal annual hydroelectric generation for 2020 (including resources purchased under long-term hydroelectric contracts with certain PUDs) will be 586 aMW (or 5.2 million MWhs).

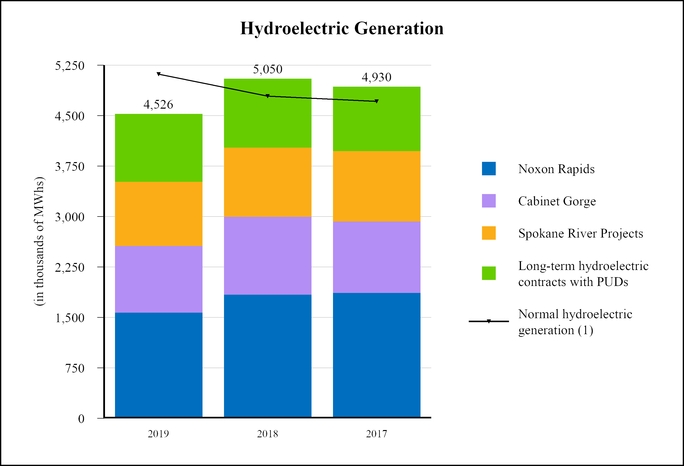

The following graph shows Avista Utilities' hydroelectric generation (in thousands of MWhs) during the year ended December 31:

| |

| (1) | "Normal" hydroelectric generation is determined by reference to the effect of upstream dam regulation on median natural water flow. Natural water flow is the flow of the rivers without the influence of dams, whereas regulated water flow takes into account any water flow changes from upstream dams due to releasing or holding back water. The calculation of "normal" varies annually due to the timing of upstream dam regulation throughout the year, as well as changes in PUD contracts. |

Thermal Resources Avista Utilities owns the following thermal generating resources:

| |

| • | the combined cycle natural gas-fired CT, known as Coyote Springs 2, located near Boardman, Oregon, |

| |

| • | a 15 percent interest in units 3 & 4 of the Colstrip GS, a coal-fired boiler generating facility located in southeastern Montana, |

| |

| • | a wood waste-fired boiler generating facility known as the Kettle Falls GS in northeastern Washington, |

| |

| • | a two-unit natural gas-fired CT generating facility, located in northeastern Spokane (Northeast CT), |

| |

| • | a two-unit natural gas-fired CT generating facility in northern Idaho (Rathdrum CT), and |

| |

| • | two small natural gas-fired generating facilities (Boulder Park GS and Kettle Falls CT). |

Coyote Springs 2, which is operated by Portland General Electric Company, is supplied with natural gas under a combination of term contracts and spot market purchases, including transportation agreements with bilateral renewal rights.

Colstrip, which is operated by Talen Montana, is supplied with fuel from adjacent coal reserves under coal supply and transportation agreements. A new contract for coal supply was negotiated with the coal mine operator that extends through December 31, 2025. See “Item 7. Management's Discussion and Analysis – Environmental Issues and Contingencies" for discussion regarding environmental and other issues surrounding Colstrip.

The primary fuel for the Kettle Falls GS is wood waste generated as a by-product and delivered by trucks from forest industry operations within 100 miles of the plant. A combination of long-term contracts and spot purchases has provided, and is expected to meet, fuel requirements for the Kettle Falls GS.

The Northeast CT, Rathdrum CT, Boulder Park GS and Kettle Falls CT generating units are primarily used to meet peaking electric requirements. We also operate these facilities when marginal costs are below prevailing wholesale electric prices. These generating facilities have access to natural gas supplies that are adequate to meet their respective operating needs.

See "Item 2. Properties - Avista Utilities - Generation Properties" for the nameplate rating and present generating capabilities of the above thermal resources.

We have the exclusive rights to all the capacity of the Lancaster Plant, a 270 MW natural gas-fired combined cycle combustion turbine plant located in northern Idaho, owned by an unrelated third-party. All of the output from the Lancaster Plant is contracted to us through 2026 under a PPA. Under the terms of the PPA, we make the dispatch decisions, provide all natural gas fuel and receive all of the electric energy output from the Lancaster Plant; therefore, we consider this plant in our baseload resources. See "Note 6 of the Notes to Consolidated Financial Statements" for further discussion of this PPA.

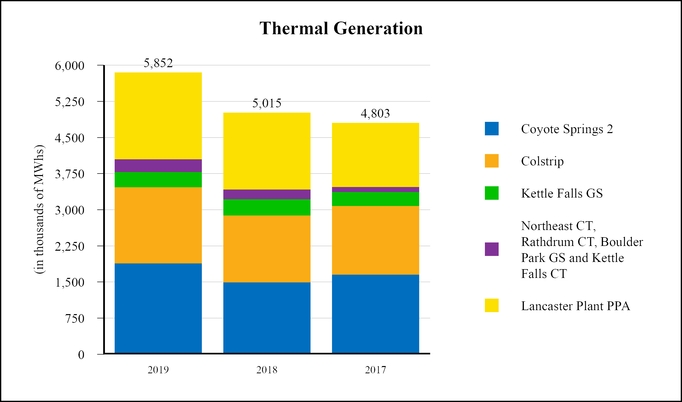

The following graph shows Avista Utilities' thermal generation (in thousands of MWhs) during the year ended December 31:

Wind Resources We have exclusive rights to all the capacity of Palouse Wind, a wind generation project developed, owned and managed by an unrelated third-party and located in Whitman County, Washington. The PPA expires in 2042 and requires us to acquire all of the power and renewable attributes produced by the project at a fixed price per MWh with a fixed escalation of

the price over the term of the agreement. The project has a nameplate capacity of 105 MW. Generation from Palouse Wind was 302,136 MWhs in 2019, 327,172 MWhs in 2018 and 300,380 MWhs in 2017. We have an annual option to purchase the wind project beginning in December 2022. The purchase price is a fixed price per KW of in-service capacity with a fixed decline in the price per KW over the remaining 20-year term of the PPA. Under the terms of the PPA, we do not have any input into the day-to-day operation of the project, including maintenance decisions. All such rights are held by the owner.

In March 2019, we signed a PPA with Clearway Energy Group (Clearway) to purchase all of the power generated from the Rattlesnake Flat Wind project in Adams County, Washington. The facility has a nameplate capacity of 144 MW and is expected to generate approximately 50 aMW annually. The PPA is a 20-year agreement with deliveries expected to begin in 2020. The PPA provides Avista Corp. with additional renewable energy, capacity and environmental attributes. Under the terms of the PPA, we do not have any input into the day-to-day operation of the project, including maintenance decisions. All such rights are held by the owner.

Solar Resources We have exclusive rights to all the capacity of the Lind Solar Farm, a solar generation project developed, owned and managed by an unrelated third-party and located in Lind, Washington. The PPA expires in 2038 and requires us to acquire all the power and renewable attributes produced by the project at a fixed price per MWh. The project has a nameplate capacity of 28 MW. The facility became operational in the fourth quarter of 2018 and generated 42,346 and 584 MWhs in 2019 and 2018, respectively. Under the terms of the PPA, we do not have any input into the day-to-day operation of the project, including maintenance decisions. All such rights are held by the owner. In addition to the Lind Solar Farm, we also own a community solar array located in Spokane Valley, Washington with a nameplate capacity of 0.4 MW. The community solar array generated 561 and 538 MWhs during 2019 and 2018, respectively.

Other Purchases, Exchanges and Sales In addition to the resources described above, we purchase and sell power under various long-term contracts, and we also enter into short-term purchases and sales. Further, pursuant to The Public Utility Regulatory Policies Act of 1978, as amended, we are required to purchase generation from qualifying facilities. This includes, among other resources, hydroelectric projects, cogeneration projects and wind generation projects at rates approved by the WUTC and the IPUC.

See “Avista Utilities Electric Operating Statistics – Electric Operations” below for annual quantities of purchased power, wholesale power sales and power from exchanges in 2019, 2018 and 2017. See “Electric Operations” above for additional information with respect to the use of wholesale purchases and sales as part of our resource optimization process and also see "Future Resource Needs" below for the magnitude of these power purchase and sales contracts in future periods.

Hydroelectric Licenses

Avista Corp. is a licensee under the Federal Power Act (FPA) as administered by the FERC, which includes regulation of hydroelectric generation resources. Excluding the Little Falls Hydroelectric Generating Project (Little Falls), our other seven hydroelectric plants are regulated by the FERC through two project licenses. The licensed projects are subject to the provisions of Part I of the FPA. These provisions include payment for headwater benefits, condemnation of licensed projects upon payment of just compensation, and take-over by the federal government of such projects after the expiration of the license upon payment of the lesser of “net investment” or “fair value” of the project, in either case, plus severance damages. In the unlikely event that a take-over occurs, it could lead to either the decommissioning of the hydroelectric project or offering the project to another party (likely through sale and transfer of the license).

Cabinet Gorge and Noxon Rapids are under one 45-year FERC license issued in 2001. See “Item 7. Management's Discussion and Analysis – Environmental Issues and Contingencies" for discussion of dissolved atmospheric gas levels that exceed state of Idaho and federal numeric water quality standards downstream of Cabinet Gorge during periods when we must divert excess river flows over the spillway, as well as our mitigation plans and efforts.

Five of our six hydroelectric projects on the Spokane River (Long Lake, Nine Mile, Upper Falls, Monroe Street and Post Falls) are under one 50-year FERC license issued in 2009 and are referred to collectively as the Spokane River Project. The sixth, Little Falls, is operated under separate Congressional authority and is not licensed by the FERC.

Future Resource Needs

Avista Utilities has operational strategies to provide sufficient resources to meet our energy requirements under a range of operating conditions. These operational strategies consider the amount of energy needed, which varies widely because of the factors that influence demand over intra-hour, hourly, daily, monthly and annual durations. Our average hourly load was 1,081 aMW in 2019, 1,034 aMW in 2018 and 1,070 aMW in 2017.

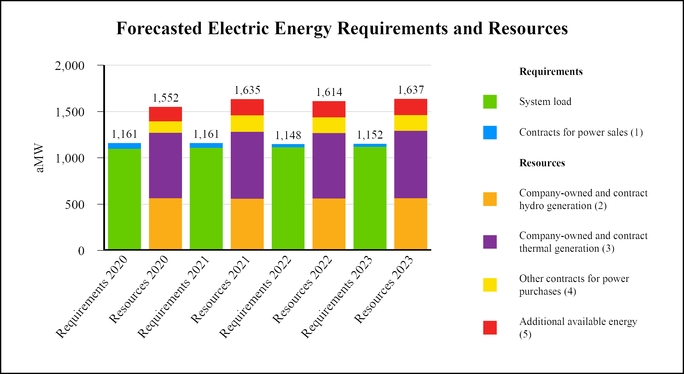

The following graph shows our forecast of our average annual energy requirements and our available resources for 2020 through 2023:

| |

| (1) | The contracts for power sales decrease due to certain contracts expiring in each of these years. We are evaluating the future plan for the additional resources made available due to the expiration of these contracts. |

| |

| (2) | The forecast assumes near normal hydroelectric generation. |

| |

| (3) | Includes the Lancaster Plant PPA. Excludes Boulder Park GS, Kettle Falls CT, Northeast CT and Rathdrum CT, as these are considered peaking facilities and are generally not used to meet our base load requirements. |

| |

| (4) | Other contracts for power purchases includes power purchase agreements for solar and wind energy. |

| |

| (5) | The combined maximum capacity of Boulder Park GS, Kettle Falls CT, Northeast CT and Rathdrum CT is 278 MW, with estimated available energy production as indicated for each year. |

In August 2017, we filed our 2017 Electric IRP with the WUTC and the IPUC. The WUTC and IPUC review the IRPs and give the public the opportunity to comment. The WUTC and IPUC do not approve or disapprove of the content in the IRPs; rather they acknowledge that the IRPs were prepared in accordance with applicable standards if that is the case. The IRP details projected growth in demand for energy and the new resources needed to serve customers over the next 20 years. We regard the IRP as a tool for resource evaluation, rather than an acquisition plan for a particular project.

We are required to file an electric IRP every two years. We filed petitions with the WUTC and IPUC in January 2019 to extend the current electric IRP from August 31, 2019 to February 28, 2020 because of the uncertainty created by new clean energy laws in Washington. The WUTC and IPUC approved our petitions. Subsequent to these approvals, the WUTC issued an order extending the deadline to file the IRP until April 2021. We will file an IRP in Idaho on February 28, 2020. Our resource strategy includes additional clean energy resources and potential for existing resource retirements. This plan is subject to change in the 2021 IRP due to rulemaking in Washington State to implement the Clean Energy Transformation Act.

Highlights of the 2020 IRP include the following expectations and/or assumptions:

| |

| • | Models the clean energy requirements of CETA in Washington State. |

| |

| • | Optimizing a resource portfolio for 25 years instead of 20 years. |

| |

| • | Assumes Colstrip exits the portfolio in 2025, and then studies the cost impacts of extending the project to 2035 for servicing loads outside of Washington. |

| |

| • | Assumes the Northeast CT retires in 2035. |

| |

| • | A cap and trade greenhouse gas emissions cap applies in modeling Oregon. |

| |

| • | Uses a full demand response (DR) potential assessment for potential DR programs for both residential and commercial/industrial customers. |

| |

| • | Includes social cost of carbon costs, using the 2.5 percent discount rate proscribed in CETA, for Washington's share of resource emissions and market purchases for new resource acquisitions, DR programs, and energy efficiency. |

| |

| • | Includes cost of upstream greenhouse gas emissions from the natural gas-fired projects at the social cost of carbon for Washington share of resources. |

| |

| • | Modeled wind, solar, pumped hydro storage, nuclear, and geothermal as purchase power agreements; whereas previous IRPs assumed these resources would be modeled as an owned resource. |

| |

| • | Modeled several energy storage options in this IRP including pumped hydro storage, lithium-ion, vanadium flow, zinc bromide flow, liquid air, and hydrogen all with varying energy durations. The previous IRP modeled storage generically. |

We are subject to the Washington State Energy Independence Act, which requires us to obtain a portion of our electricity from qualifying renewable resources or through purchase of RECs and acquiring all cost effective conservation measures. Future generation resource decisions will be affected by legislation for restrictions on greenhouse gas emissions and renewable energy requirements.

See “Item 7. Management’s Discussion and Analysis of Financial Condition – Environmental Issues and Contingencies” for information related to existing laws, as well as potential legislation that could influence our future electric resource mix.

Natural Gas Operations

General Avista Utilities provides natural gas distribution services to retail customers in parts of eastern Washington, northern Idaho, and northeastern and southwestern Oregon.

Market prices for natural gas, like other commodities, can be volatile. Our natural gas procurement strategy is to provide a reliable supply to our customers with some level of price certainty. We procure natural gas from various supply basins and over varying time periods. The resulting portfolio is a diversified mix of forward fixed price purchases, index and spot market purchases, and utilizing physical and financial derivative instruments. We also use natural gas storage to support high demand periods and to procure natural gas when prices may be lower. Securing prices throughout the year and even into subsequent years provides a level of price certainty and can mitigate price volatility to customers between years.

Weather is a key component of our natural gas customer load. This load is highly variable and daily natural gas loads can differ significantly from the monthly forecasted load projections. We make continuing projections of our natural gas loads and assess available natural gas resources. On the basis of these projections, we plan and execute a series of transactions to hedge a portion of our customers' projected natural gas requirements through forward market transactions and derivative instruments. These transactions may extend for multiple years into the future. We also leave a portion of our natural gas supply requirements unhedged for purchase in the short-term spot markets.

Our purchase of natural gas supply is governed by our procurement plan and is reviewed and approved annually by the Risk Management Committee (RMC), which is comprised of certain officers and other management personnel. Once approval is received, the plan is implemented and monitored by our gas supply and risk management groups.

The plan’s progress is also presented to the WUTC and IPUC staff in semi-annual meetings, and updates are given to the OPUC staff quarterly. The RMC is provided with an update on plan results and changes in their monthly meetings. These activities provide transparency for the natural gas supply procurement plan. Any material changes to the plan are documented and communicated to RMC members.

As part of the process of balancing natural gas retail load requirements with resources, we engage in the wholesale purchase and sale of natural gas. We plan for sufficient natural gas delivery capacity to serve our retail customers for a theoretical peak day event. We generally have more pipeline and storage capacity than what is needed during periods other than a peak day. We optimize our natural gas resources by using market opportunities to generate economic value that helps mitigate fixed costs. Wholesale sales are delivered through wholesale market facilities outside of our natural gas distribution system. Natural gas resource optimization activities include, but are not limited to:

| |

| • | wholesale market sales of surplus natural gas supplies, |

| |

| • | purchases and sales of natural gas to optimize use of pipeline and storage capacity, and |

| |

| • | participation in the transportation capacity release market. |

We also provide distribution transportation service to qualified, large commercial and industrial natural gas customers who purchase natural gas through third-party marketers. For these customers, we receive their purchased natural gas from such third-party marketers into our distribution system and deliver it to the customers’ premise.

Optimization transactions that we engage in throughout the year are included in our annual purchased gas cost adjustment filings with the various commissions and are subject to review for prudence during this process.

Natural Gas Supply Avista Utilities purchases all of its natural gas in wholesale markets. We are connected to multiple supply basins in the western United States and Canada through firm capacity transportation rights on six different pipeline networks. Access to this diverse portfolio of natural gas resources allows us to make natural gas procurement decisions that benefit our natural gas customers. These interstate pipeline transportation rights provide the capacity to serve approximately 25 percent of peak natural gas customer demands from domestic sources and 75 percent from Canadian sourced supply. Natural gas prices in the Pacific Northwest are affected by global energy markets, as well as supply and demand factors in other regions of the United States and Canada. Future prices and delivery constraints may cause our resource mix to vary.

Natural Gas Storage Avista Utilities owns a one-third interest in Jackson Prairie, an underground aquifer natural gas storage field located near Chehalis, Washington. Jackson Prairie has a total peak day deliverability of 12 million therms, with a total working natural gas capacity of 256 million therms. As an owner, our share is one-third of the peak day deliverability and total working capacity. We also contract for additional storage capacity and delivery at Jackson Prairie from Northwest Pipeline for a portion of their one-third share of the storage project.

We optimize our natural gas storage capacity throughout the year by executing transactions that capture favorable market price spreads. Natural gas buyers identify opportunities to purchase lower cost natural gas in the immediate term to inject into storage, and then sell the gas in a forward market to be withdrawn at a later time. The reverse of this type of transaction also occurs. These transactions lock in incremental value for customers. Jackson Prairie is also used as a variable peaking resource, and to protect from extreme daily price volatility during cold weather or other events affecting the market.

Future Resource Needs In August 2018, we filed our 2018 Natural Gas IRP with the WUTC, the IPUC and the OPUC. The IRP details projected growth in demand for energy and the new resources needed to serve customers over the next 20 years. We regard the IRP as a tool for resource evaluation, rather than an acquisition plan for a particular project.

Highlights of the 2018 natural gas IRP include the following expectations and/or assumptions:

| |

| • | We will need no additional natural gas transportation resources during the 20-year planning horizon in Washington, Idaho, or Oregon. |

| |

| • | Due to expected carbon legislation at the state levels through a cap and trade mechanism (Oregon) or a fee mechanism (Washington), we expect natural gas prices to include a carbon price adder in Oregon and Washington, but not in Idaho. |

| |

| • | North American supplies of natural gas will continue to be abundant led by shale gas development. |

| |

| • | Customer growth in our service territory will increase slightly compared to the 2016 IRP. There will be increasing interest from customers to utilize natural gas for heating due to its abundant supply and consequent low cost. |

| |

| • | We anticipate that any increased demand for natural gas regionally will primarily come from power generation as natural gas is increasingly being used to back up solar and wind technology, and also to replace retired coal plants. There is also potential for increased usage in other markets, such as LNG exports or exports to Mexico. |

| |

| • | Slightly higher customer growth will continue to be offset by lower use per customer and an increased amount of demand side management (DSM). The combination of low-priced natural gas in addition to carbon fees or other programs has led to a higher potential for DSM measures as compared to the previous three IRPs. |

| |

| • | The availability of natural gas in North America will continue to change global LNG dynamics. Existing and new LNG facilities will look to export low cost North American natural gas to the higher-priced foreign markets. This could alter the price of natural gas and/or transportation in U.S. markets, constrain existing pipeline networks, stimulate development of new pipeline resources and change flows of natural gas across North America. |

We will monitor these assumptions on an on-going basis and adjust our resource requirements accordingly.

We are required to file a natural gas IRP every two years, with the next IRP expected to be filed during the third quarter of 2020. Our resource strategy in our 2020 IRP may change from the 2018 IRP based on market, legislative and regulatory developments.

Regulatory Issues

General As a public utility, Avista Corp. is subject to regulation by state utility commissions for prices, accounting, the issuance of securities and other matters. The retail electric and natural gas operations are subject to the jurisdiction of the WUTC, IPUC, OPUC and MPSC. Approval of the issuance of securities is not required from the MPSC. We are also subject to the jurisdiction of the FERC for licensing of hydroelectric generation resources, and for electric transmission services and wholesale sales.

Since Avista Corp. is a “holding company” (in addition to being itself an operating utility), we are also subject to the jurisdiction of the FERC under the Public Utility Holding Company Act of 2005, which imposes certain reporting and other requirements. We, and all of our subsidiaries (whether or not engaged in any energy related business), are required to maintain books, accounts and other records in accordance with the FERC regulations and to make them available to the FERC and the state utility commissions. In addition, upon the request of any jurisdictional state utility commission, the FERC would have the authority to review assignment of costs of non-power goods and administrative services among us and our subsidiaries. The FERC has the authority generally to require that rates subject to its jurisdiction be just and reasonable and in this context would continue to be able to, among other things, review transactions of any affiliated company.

Our rates for retail electric and natural gas services (other than specially negotiated retail rates for industrial or large commercial customers, which are subject to regulatory review and approval) are generally determined on a “cost of service” basis.

Rates are designed to provide an opportunity for us to recover allowable operating expenses and earn a return of and a reasonable return on “rate base.” Rate base is generally determined by reference to the original cost (net of accumulated depreciation) of utility plant in service, subject to various adjustments for deferred income taxes and other items. Over time, rate base is increased by additions to utility plant in service and reduced by depreciation and retirement of utility plant and write-offs as authorized by the utility commissions. Our operating expenses and rate base are allocated or directly assigned to five regulatory jurisdictions: electric in Washington and Idaho, and natural gas in Washington, Idaho and Oregon. In general, requests for new retail rates are made on the basis of revenues, operating expenses and net investment for a test year that ended prior to the date of the request, subject to possible adjustments, which differ among the various jurisdictions, designed to reflect the expected revenues, operating expenses and net investment during the period new retail rates will be in effect. The retail rates approved by the state commissions in a rate proceeding may not provide sufficient revenues to provide recovery of costs and a reasonable return on investment for a number of reasons, including, but not limited to, ongoing capital expenditures and unexpected changes in revenues and expenses following the time new retail rates are requested in the rate proceeding, the denial by the commission of recovery, or timely recovery, of certain expenses or investment and the limitation by the commission of the authorized return on investment.

Our rates for wholesale electric and natural gas transmission services are based on either “cost of service” principles or market-based rates as set forth by the FERC. See “Notes 1, 12 and 22 of the Notes to Consolidated Financial Statements” for additional information about regulation, depreciation and deferred income taxes.

General Rate Cases Avista Utilities regularly reviews the need for electric and natural gas rate changes in each state in which we provide service. See “Item 7. Management’s Discussion and Analysis – Regulatory Matters – General Rate Cases” for information on general rate case activity.

Power Cost Deferrals Avista Utilities defers the recognition in the income statement of certain power supply costs that vary from the level currently recovered from our retail customers as authorized by the WUTC and the IPUC. See “Item 7. Management’s Discussion and Analysis – Regulatory Matters – Power Cost Deferrals and Recovery Mechanisms” and “Note 22 of the Notes to Consolidated Financial Statements” for information on power cost deferrals and recovery mechanisms in Washington and Idaho.

Purchased Gas Adjustments (PGA) Under established regulatory practices in each state, Avista Utilities defers the recognition in the income statement of the natural gas costs that vary from the level currently recovered from our retail customers as authorized by each of our jurisdictions. See “Item 7. Management’s Discussion and Analysis – Regulatory Matters – Purchased Gas Adjustments” and “Note 22 of the Notes to Consolidated Financial Statements” for information on natural gas cost deferrals and recovery mechanisms in Washington, Idaho and Oregon.

Decoupling Mechanisms Decoupling (also known as FCA in Idaho) is a mechanism designed to sever the link between a utility's revenues and consumers' energy usage. In each of its jurisdictions, Avista Utilities' electric and natural gas revenues are adjusted so as to be based on the number of customers in certain customer rate classes and assumed "normal" usage, rather than being based on actual usage. The difference between revenues based on the number of customers and "normal" sales and revenues based on actual usage is deferred and either surcharged or rebated to customers beginning in the following year. See “Item 7. Management’s Discussion and Analysis – Regulatory Matters – Decoupling and Earnings Sharing Mechanisms” for further discussion of these mechanisms.

Federal Laws Related to Wholesale Competition

Federal law promotes practices that foster competition in the electric wholesale energy market. The FERC requires electric utilities to transmit power and energy to or for wholesale purchasers and sellers, and requires electric utilities to enhance or construct transmission facilities to create additional transmission capacity for the purpose of providing these services. Public utilities (through subsidiaries or affiliates) and other entities may participate in the development of independent electric generating plants for sales to wholesale customers.

Public utilities operating under the FPA are required to provide open and non-discriminatory access to their transmission systems to third parties and establish an Open Access Same-Time Information System to provide an electronic means by which transmission customers can obtain information about available transmission capacity and purchase transmission access. The FERC also requires each public utility subject to the rules to operate its transmission and wholesale power merchant operating functions separately and to comply with standards of conduct designed to ensure that all wholesale users, including the public utility’s power merchant operations, have equal access to the public utility’s transmission system. Our compliance with these standards has not had any substantive impact on the operation, maintenance and marketing of our transmission system or our ability to provide service to customers.

See “Item 7. Management’s Discussion and Analysis – Competition” for further information.

Regional Transmission Planning

Beginning with FERC Order No. 888 and continuing with subsequent rulemakings and policies, the FERC has encouraged better coordination and operational consistency aimed to capture efficiencies that might otherwise be gained through the formation of a Regional Transmission Organization or an independent system operator (ISO).

The Company currently meets its FERC requirements to coordinate transmission planning activities with other regional entities through ColumbiaGrid. ColumbiaGrid is a Washington nonprofit membership corporation with an independent board formed to improve the operational efficiency, reliability, and planned expansion of the transmission grid in the Pacific Northwest. We became a member of ColumbiaGrid in 2006 during its formation. ColumbiaGrid is not an ISO, but fills the role of facilitating the regional transmission planning requirements of FERC Order Nos. 890 and 1000, and their follow-on orders, for its members. ColumbiaGrid and its members also work with other western organizations, including WestConnect and the Northern Tier Transmission Group (NTTG), to address broader interregional planning.

Certain ColumbiaGrid members, including Avista Corp. and BPA (ColumbiaGrid’s largest funding member), and the members of NTTG have been working to develop a combined single regional planning organization for the Pacific Northwest region, NorthernGrid. These parties have attained FERC acceptance of the NorthernGrid Funding Agreement and continue to work toward FERC acceptance of the NorthernGrid structure and transitioning coordinated transmission planning activities from ColumbiaGrid and NTTG to NorthernGrid by December 31, 2020. Neither the costs nor requirements of participating in either of these regional transmission planning organizations are expected to materially impact the Company’s operations or financial performance.

Regional Energy Markets

The California Independent System Operator (CAISO) operates the Western Energy Imbalance Market (EIM) in the western United States. Most investor-owned utilities in the Pacific Northwest are either participants in the Western EIM or plan to integrate into the market in the near future. The Company has announced its decision to participate in the Western EIM and is slated to commence EIM operations by April 2022. The decision to join the Western EIM is based on a number of factors, including the amount of expected variable generating resources the Company will need to integrate within its balancing authority area in the foreseeable future, and the expected costs and benefits associated with joining the Western EIM.

Reliability Standards

Among its other provisions, the U.S. Energy Policy Act provides for the implementation of mandatory reliability standards and authorizes the FERC to assess penalties for non-compliance with these standards and other FERC regulations.

The FERC certified the NERC as the single Electric Reliability Organization authorized to establish and enforce reliability standards and delegate authority to regional entities for the purpose of establishing and enforcing reliability standards. The FERC approves NERC Reliability Standards, including western region standards that make up the set of legally enforceable standards for the United States bulk electric system. The first of these reliability standards became effective in 2007. From time to time new standards are developed or existing standards are updated, revised, consolidated or eliminated pursuant to an industry-involved process. We are required to self-certify our compliance with these standards on an annual basis and undergo regularly scheduled periodic reviews by the NERC and its regional entity, the Western Electricity Coordinating Council (WECC). Failure to comply with NERC reliability standards could result in financial penalties of up to approximately $1.3 million per day per violation. We have a robust internal compliance program in place to manage compliance activities and mitigate the risk of potential noncompliance with these standards. We do not expect the costs associated with compliance with these standards to have a material impact on our financial results.

As both a balancing authority and transmission operator, the Company must operate under the oversight of a reliability coordinator per NERC reliability standards. The California ISO’s RC West is the reliability coordinator of record for 41 balancing authorities and transmission operators in the Western Interconnection, including Avista Corp. RC West oversees grid compliance with federal and regional grid standards, and can determine measures to prevent or mitigate system emergencies in day-ahead or real-time operations.

Vulnerability to Cyberattack

The energy sector, particularly electric and natural gas utility companies in the United States and abroad, have become the subject of cyberattacks and ransomware attacks with increased frequency. The Company’s administrative and operating networks are targeted by hackers on a regular basis.

A successful attack on the Company’s administrative networks could compromise the security and privacy of data, including operating, financial and personal information. A successful attack on the Company’s operating networks could impair the operation of the Company’s electric and/or natural gas utility facilities, possibly resulting in the inability to provide electric and/or natural gas service for extended periods of time.

The Company continually reinforces and updates its defensive systems and is in compliance with NERC’s reliability standards. See “Reliability Standards," "Item 1A. Risk Factors – Cyber and Technology Risk Factors” and “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Enterprise Risk Management – Cyber and Technology Risks” for further information.

AVISTA UTILITIES ELECTRIC OPERATING STATISTICS

|

| | | | | | | | | | | |

| | Years Ended December 31, |

| | 2019 | | 2018 | | 2017 |

| ELECTRIC OPERATIONS | | | | | |

| OPERATING REVENUES (Dollars in Thousands): | | | | | |

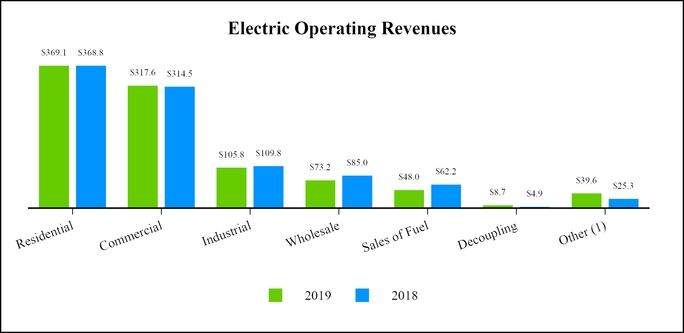

| Residential | $ | 369,102 |

| | $ | 368,753 |

| | $ | 381,682 |

|

| Commercial | 317,589 |

| | 314,532 |

| | 311,593 |

|

| Industrial | 105,802 |

| | 109,846 |

| | 110,982 |

|

| Public street and highway lighting | 7,448 |

| | 7,539 |

| | 7,484 |

|

| Total retail | 799,941 |

| | 800,670 |

| | 811,741 |

|

| Wholesale | 73,232 |

| | 84,956 |

| | 81,512 |

|

| Sales of fuel | 48,040 |

| | 62,219 |

| | 64,925 |

|

| Other | 28,995 |

| | 29,301 |

| | 31,614 |

|

| Alternative revenue programs | 8,699 |

| | 4,870 |

| | (8,220 | ) |

| Deferrals and amortizations for rate refunds to customers | 3,141 |

| | (11,477 | ) | | (1,182 | ) |

| Total electric operating revenues | $ | 962,048 |

| | $ | 970,539 |

| | $ | 980,390 |

|

| ENERGY SALES (Thousands of MWhs): | | | | | |

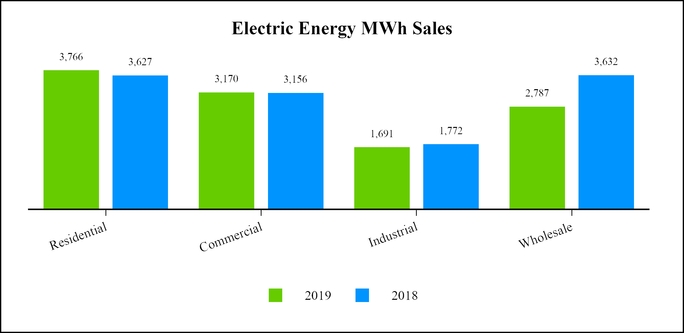

| Residential | 3,766 |

| | 3,627 |

| | 3,840 |

|

| Commercial | 3,170 |

| | 3,156 |

| | 3,222 |

|

| Industrial | 1,691 |

| | 1,772 |

| | 1,815 |

|

| Public street and highway lighting | 18 |

| | 18 |

| | 20 |

|

| Total retail | 8,645 |

| | 8,573 |

| | 8,897 |

|

| Wholesale | 2,787 |

| | 3,632 |

| | 2,881 |

|

| Total electric energy sales | 11,432 |

| | 12,205 |

| | 11,778 |

|

| ENERGY RESOURCES (Thousands of MWhs): | | | | | |

| Hydro generation (from Company facilities) | 3,520 |

| | 4,029 |

| | 3,978 |

|

| Thermal generation (from Company facilities) | 4,054 |

| | 3,424 |

| | 3,476 |

|

| Purchased power | 4,833 |

| | 5,349 |

| | 4,809 |

|

| Power exchanges | (504 | ) | | (109 | ) | | (6 | ) |

| Total power resources | 11,903 |

| | 12,693 |

| | 12,257 |

|

| Energy losses and Company use | (471 | ) | | (488 | ) | | (479 | ) |

| Total energy resources (net of losses) | 11,432 |

| | 12,205 |

| | 11,778 |

|

| NUMBER OF RETAIL CUSTOMERS (Average for Period): | | | | | |

| Residential | 345,064 |

| | 340,308 |

| | 334,848 |

|

| Commercial | 42,930 |

| | 42,618 |

| | 42,154 |

|

| Industrial | 1,305 |

| | 1,318 |

| | 1,328 |

|

| Public street and highway lighting | 612 |

| | 594 |

| | 569 |

|

| Total electric retail customers | 389,911 |

| | 384,838 |

| | 378,899 |

|

| RESIDENTIAL SERVICE AVERAGES: | | | | | |

| Annual use per customer (KWh) | 10,914 |

| | 10,658 |

| | 11,469 |

|

| Revenue per KWh (in cents) | 9.80 |

| | 10.17 |

| | 9.94 |

|

| Annual revenue per customer | $ | 1,069.66 |

| | $ | 1,083.58 |

| | $ | 1,139.87 |

|

| AVERAGE HOURLY LOAD (aMW) | 1,081 |

| | 1,034 |

| | 1,070 |

|

AVISTA UTILITIES ELECTRIC OPERATING STATISTICS

|

| | | | | | | | |

| | Years Ended December 31, |

| | 2019 | | 2018 | | 2017 |

| RETAIL NATIVE LOAD at time of system peak (MW): | | | | | |

| Winter | 1,577 |

| | 1,555 |

| | 1,681 |

|

| Summer | 1,656 |

| | 1,716 |

| | 1,596 |

|

| COOLING DEGREE DAYS: (1) | | | | | |

| Spokane, WA | | | | | |

| Actual | 488 |

| | 517 |

| | 743 |

|

| Historical average | 531 |

| | 544 |

| | 529 |

|

| % of average | 92 | % | | 95 | % | | 140 | % |

| HEATING DEGREE DAYS: (2) | | | | | |

| Spokane, WA | | | | | |

| Actual | 6,817 |

| | 6,159 |

| | 6,783 |

|

| Historical average | 6,613 |

| | 6,593 |

| | 6,578 |

|

| % of average | 103 | % | | 93 | % | | 103 | % |

| |

| (1) | Cooling degree days are the measure of the warmness of weather experienced, based on the extent to which the average of high and low temperatures for a day exceeds 65 degrees Fahrenheit (annual degree days above historical average indicate warmer than average temperatures). |

| |

| (2) | Heating degree days are the measure of the coldness of weather experienced, based on the extent to which the average of high and low temperatures for a day falls below 65 degrees Fahrenheit (annual degree days below historical averages indicate warmer than average temperatures). |

AVISTA UTILITIES NATURAL GAS OPERATING STATISTICS

|

| | | | | | | | | | | |

| | Years Ended December 31, |

| | 2019 | | 2018 | | 2017 |

| NATURAL GAS OPERATIONS | | | | | |

| OPERATING REVENUES (Dollars in Thousands): | | | | | |

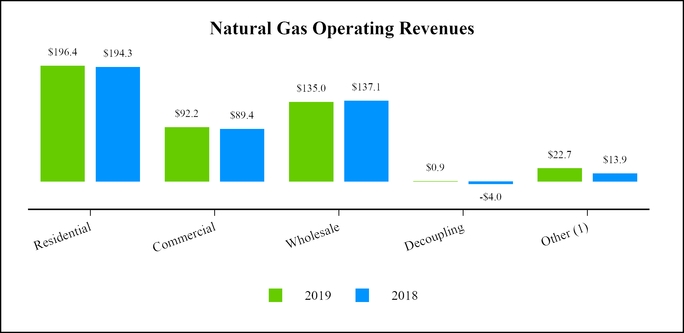

| Residential | $ | 196,430 |

| | $ | 194,340 |

| | $ | 220,176 |

|

| Commercial | 92,168 |

| | 89,341 |

| | 104,240 |

|

| Interruptible | 2,257 |

| | 1,886 |

| | 1,901 |

|

| Industrial | 3,006 |

| | 2,867 |

| | 3,756 |

|

| Total retail | 293,861 |

| | 288,434 |

| | 330,073 |

|

| Wholesale | 135,039 |

| | 137,070 |

| | 142,722 |

|

| Transportation | 8,674 |

| | 9,103 |

| | 9,208 |

|

| Other | 7,375 |

| | 6,824 |

| | 6,411 |

|

| Alternative revenue programs | 915 |

| | (3,962 | ) | | (11,374 | ) |

| Deferrals and amortizations for rate refunds to customers | 1,368 |

| | (6,764 | ) | | (2,392 | ) |

| Total natural gas operating revenues | $ | 447,232 |

| | $ | 430,705 |

| | $ | 474,648 |

|

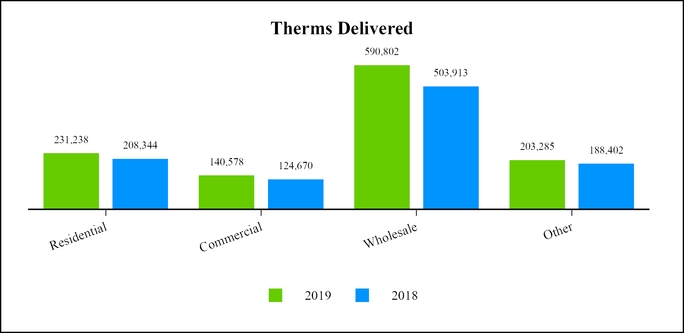

| THERMS DELIVERED (Thousands of Therms): | | | | | |

| Residential | 231,238 |

| | 208,344 |

| | 221,982 |

|

| Commercial | 140,578 |

| | 124,670 |

| | 133,343 |

|

| Interruptible | 9,138 |

| | 5,750 |

| | 5,465 |

|

| Industrial | 6,212 |

| | 5,801 |

| | 6,340 |

|

| Total retail | 387,166 |

| | 344,565 |

| | 367,130 |

|

| Wholesale | 590,802 |

| | 503,913 |

| | 545,348 |

|

| Transportation | 187,514 |

| | 176,439 |

| | 186,222 |

|

| Interdepartmental and Company use | 421 |

| | 412 |

| | 441 |

|

| Total therms delivered | 1,165,903 |

| | 1,025,329 |

| | 1,099,141 |

|

| NUMBER OF RETAIL CUSTOMERS (Average for Period): | | | | | |

| Residential | 321,343 |

| | 314,800 |

| | 307,375 |

|

| Commercial | 35,804 |

| | 35,488 |

| | 35,192 |

|

| Interruptible | 45 |

| | 39 |

| | 37 |

|

| Industrial | 241 |

| | 246 |

| | 251 |

|

| Total natural gas retail customers | 357,433 |

| | 350,573 |

| | 342,855 |

|

| RESIDENTIAL SERVICE AVERAGES: | | | | | |

| Annual use per customer (therms) | 720 |

| | 662 |

| | 722 |

|

| Revenue per therm (in dollars) | $ | 0.85 |

| | $ | 0.93 |

| | $ | 0.99 |

|

| Annual revenue per customer | $ | 611.28 |

| | $ | 617.35 |

| | $ | 716.31 |

|

| HEATING DEGREE DAYS: (1) | | | | | |

| Spokane, WA | | | | | |

| Actual | 6,817 |

| | 6,159 |

| | 6,783 |

|

| Historical average | 6,613 |

| | 6,593 |

| | 6,578 |

|

| % of average | 103 | % | | 93 | % | | 103 | % |

| Medford, OR | | | | | |

| Actual | 4,439 |

| | 4,155 |

| | 4,254 |

|

| Historical average | 4,291 |

| | 4,297 |

| | 4,305 |

|

| % of average | 103 | % | | 97 | % | | 99 | % |

| |