UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED December 31, 2022 OR

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

Commission file number 001-03701

AVISTA CORPORATION

(Exact name of Registrant as specified in its charter)

| | |

WA | | 91-0462470 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer

Identification No.) |

1411 East Mission Avenue, Spokane, WA 99202-2600

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: 509-489-0500

Web site: http://www.avistacorp.com

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

Common Stock | | AVA | | NYSE |

Securities registered pursuant to Section 12(g) of the Act:

Title of Class

Preferred Stock, Cumulative, Without Par Value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days: Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | |

Large Accelerated Filer | ☒ | Accelerated Filer | ☐ |

Non-accelerated Filer | ☐ | Smaller reporting company | ☐ |

Emerging growth company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): Yes ☐ No ☒

The aggregate market value of the Registrant’s outstanding Common Stock, no par value (the only class of voting stock), held by non-affiliates is $3,175,189,328 based on the last reported sale price thereof on the consolidated tape on June 30, 2022.

As of January 31, 2023, 75,030,135 shares of Registrant’s Common Stock, no par value (the only class of common stock), were outstanding.

Documents Incorporated By Reference

| | |

Document | | Part of Form 10-K into Which Document is Incorporated |

Proxy Statement to be filed in connection with the annual meeting of shareholders to be held on May 11, 2023. Prior to such filing, the Proxy Statement was filed in connection with the annual meeting of shareholders held on May 12, 2022. | | Part III, Items 10, 11, 12, 13 and 14 |

AVISTA CORPORATION

INDEX

i

AVISTA CORPORATION

ii

AVISTA CORPORATION

* = not an applicable item in the 2022 calendar year for Avista Corp.

iii

AVISTA CORPORATION

ACRONYMS AND TERMS

(The following acronyms and terms are found in multiple locations within the document)

| | |

Acronym/Term | Meaning |

aMW | - | Average Megawatt - a measure of the average rate at which a particular generating source produces energy over a period of time |

AEL&P | - | Alaska Electric Light and Power Company, the primary operating subsidiary of AERC, which provides electric services in Juneau, Alaska |

AERC | - | Alaska Energy and Resources Company, the Company's wholly-owned subsidiary based in Juneau, Alaska |

AFUDC | - | Allowance for Funds Used During Construction; represents the cost of both the debt and equity funds used to finance utility plant additions during the construction period |

ASC | - | Accounting Standards Codification |

Avista Capital | - | Parent company to the Company’s non-utility businesses, with the exception of AJT Mining Properties, Inc., which is a subsidiary of AERC. |

Avista Corp. | - | Avista Corporation, the Company |

Avista Utilities | - | Operating division of Avista Corp. (not a subsidiary) comprising the regulated utility operations in Washington, Idaho, Oregon and Montana |

BPA | - | Bonneville Power Administration |

Capacity | - | The rate at which a particular generating source is capable of producing energy, measured in KW or MW |

Cabinet Gorge | - | The Cabinet Gorge Hydroelectric Generating Project, located on the Clark Fork River in Idaho |

CCRs | - | Coal Combustion Residuals, also termed coal combustion byproducts or coal ash |

CEIP | - | Clean Energy Implementation Plan, Washington |

CETA | - | Clean Energy Transformation Act, Washington |

CPP | - | Climate Protection Program, Oregon |

Colstrip | - | The coal-fired Colstrip Generating Plant in southeastern Montana |

Cooling degree days | - | The measure of the warmness of weather experienced, based on the extent to which the average of high and low temperatures for a day exceeds 65 degrees Fahrenheit (annual degree days above historic indicate warmer than average temperatures) |

Coyote Springs 2 | - | The natural gas-fired combined-cycle Coyote Springs 2 Generating Plant located near Boardman, Oregon |

COVID-19 | - | Coronavirus disease 2019, a respiratory illness that was declared a pandemic in March 2020 |

CT | - | Combustion turbine |

Deadband or ERM deadband | - | The first $4.0 million in annual power supply costs above or below the amount included in base retail rates in Washington under the ERM in the state of Washington |

Ecology | - | The State of Washington’s Department of Ecology |

EIM | - | Energy Imbalance Market |

Energy | - | The amount of electricity produced or consumed over a period of time, measured in KWh or MWh. Also, refers to natural gas consumed and is measured in dekatherms. |

EPA | - | Environmental Protection Agency |

ERM | - | The Energy Recovery Mechanism, a mechanism for accounting and rate recovery of certain power supply costs accepted by the utility commission in the state of Washington |

FCA | - | Fixed Cost Adjustment, the electric and natural gas decoupling mechanism in Idaho. |

iv

AVISTA CORPORATION

| | |

FERC | - | Federal Energy Regulatory Commission |

GAAP | - | Generally Accepted Accounting Principles |

GHG | - | Greenhouse gas |

GS | - | Generating station |

Heating degree days | - | The measure of the coldness of weather experienced, based on the extent to which the average of high and low temperatures for a day falls below 65 degrees Fahrenheit (annual degree days above historic indicate warmer than average temperatures) |

IPUC | - | Idaho Public Utilities Commission |

IRP | - | Integrated Resource Plan |

Jackson Prairie | - | Jackson Prairie Natural Gas Storage Project, an underground natural gas storage field located near Chehalis, Washington |

kV | - | Kilovolt (1000 volts): a measure of capacity on transmission lines |

KW, KWh | - | Kilowatt (1000 watts): a measure of generating output or capability. Kilowatt-hour (1000 watt hours): a measure of energy produced |

Lancaster Plant | - | A natural gas-fired combined cycle combustion turbine plant located in Idaho |

MPSC | - | Public Service Commission of the State of Montana |

MW, MWh | - | Megawatt: 1000 KW. Megawatt-hour: 1000 KWh |

NERC | - | North American Electricity Reliability Corporation |

NorthWestern | - | NorthWestern Corporation |

Noxon Rapids | - | The Noxon Rapids Hydroelectric Generating Project, located on the Clark Fork River in Montana |

OPUC | - | The Public Utility Commission of Oregon |

PCA | - | The Power Cost Adjustment mechanism, a procedure for accounting and rate recovery of certain power supply costs accepted by the utility commission in the state of Idaho |

PGA | - | Purchased Gas Adjustment |

PPA | - | Power Purchase Agreement |

PUD | - | Public Utility District |

RCA | - | The Regulatory Commission of Alaska |

REC | - | Renewable energy credit |

ROE | - | Return on equity |

ROR | - | Rate of return on rate base |

ROU | - | Right-of-use lease asset |

SEC | - | U.S. Securities and Exchange Commission |

Talen | - | Talen Montana, LLC, an indirect subsidiary of Talen Energy Corporation. |

Therm | - | Unit of measurement for natural gas; a therm is equal to approximately one hundred cubic feet (volume) or 100,000 BTUs (energy) |

WUTC | - | Washington Utilities and Transportation Commission |

v

AVISTA CORPORATION

Forward-Looking Statements

From time to time, we make forward-looking statements such as statements regarding projected or future:

•strategic goals and objectives;

•business environment; and

These statements are based upon underlying assumptions (many of which are based, in turn, upon further assumptions). Such statements are made both in our reports filed under the Securities Exchange Act of 1934, as amended (including this Annual Report on Form 10-K), and elsewhere. Forward-looking statements are all statements except those of historical fact including, without limitation, those that are identified by the use of words that include “will,” “may,” “could,” “should,” “intends,” “plans,” “seeks,” “anticipates,” “estimates,” “expects,” “forecasts,” “projects,” “predicts,” and similar expressions.

Forward-looking statements (including those made in this Annual Report on Form 10-K) are subject to a variety of risks, uncertainties and other factors. Most of these factors are beyond our control and may have a significant effect on our operations, results of operations, financial condition or cash flows, which could cause actual results to differ materially from those anticipated in our statements. Such risks, uncertainties and other factors include, among others:

Utility Regulatory Risk

•state and federal regulatory decisions or related judicial decisions that affect our ability to recover costs and earn a reasonable return including, but not limited to, disallowance or delay in the recovery of capital investments, operating costs, commodity costs, interest rate swap derivatives, the ordering of refunds to customers and discretion over allowed return on investment;

•the loss of regulatory accounting treatment, which could require the write-off of regulatory assets and the loss of regulatory deferral and recovery mechanisms;

Operational Risk

•political unrest and/or conflicts between foreign nation-states, which could disrupt the global, national and local economy, result in increases in operating and capital costs, impact energy commodity prices or our ability to access energy resources, create disruption in supply chains, disrupt, weaken or create volatility in capital markets, and increase cyber security risks. In addition, any of these factors could negatively impact our liquidity and limit our access to capital, among other implications;

•wildfires ignited, or allegedly ignited, by our equipment or facilities could cause significant loss of life and property or result in liability for resulting fire suppression costs, thereby causing serious operational and financial harm;

•severe weather or natural disasters, including, but not limited to, avalanches, wind storms, wildfires, earthquakes, extreme temperature events, snow and ice storms that could disrupt energy generation, transmission and distribution, as well as the availability and costs of fuel, materials, equipment, supplies and support services;

1

AVISTA CORPORATION

•explosions, fires, accidents, mechanical breakdowns or other incidents that could impair assets and may disrupt operations of any of our generation facilities, transmission, and electric and natural gas distribution systems or other operations and may require us to purchase replacement power or incur costs to repair our facilities;

•explosions, fires, accidents or other incidents arising from or allegedly arising from our operations that could cause injuries to the public or property damage;

•blackouts or disruptions of interconnected transmission systems (the regional power grid);

•terrorist attacks, cyberattacks or other malicious acts that could disrupt or cause damage to our utility assets or to the national or regional economy in general, including any effects of terrorism, cyberattacks, ransomware, or vandalism that damage or disrupt information technology systems;

•pandemics, which could disrupt our business, as well as the global, national and local economy, resulting in a decline in customer demand, deterioration in the creditworthiness of our customers, increases in operating and capital costs, workforce shortages, losses or disruptions in our workforce due to vaccine mandates, delays in capital projects, disruption in supply chains, and disruption, weakness and volatility in capital markets. In addition, any of these factors could negatively impact our liquidity and limit our access to capital, among other implications;

•work-force issues, including changes in collective bargaining unit agreements, strikes, work stoppages, the loss of key executives, availability of workers in a variety of skill areas, and our ability to recruit and retain employees;

•changes in the availability and price of purchased power, fuel and natural gas, as well as transmission capacity;

•increasing costs of insurance, more restrictive coverage terms and our ability to obtain insurance;

•delays or changes in construction costs, and/or our ability to obtain required permits and materials for present or prospective facilities;

•increasing health care costs and cost of health insurance provided to our employees and retirees;

•increasing operating costs, including effects of inflationary pressures;

•third party construction of buildings, billboard signs, towers or other structures within our rights of way, or placement of fuel containers within close proximity to our transformers or other equipment, including overbuilding atop natural gas distribution lines;

•the loss of key suppliers for materials or services or other disruptions to the supply chain;

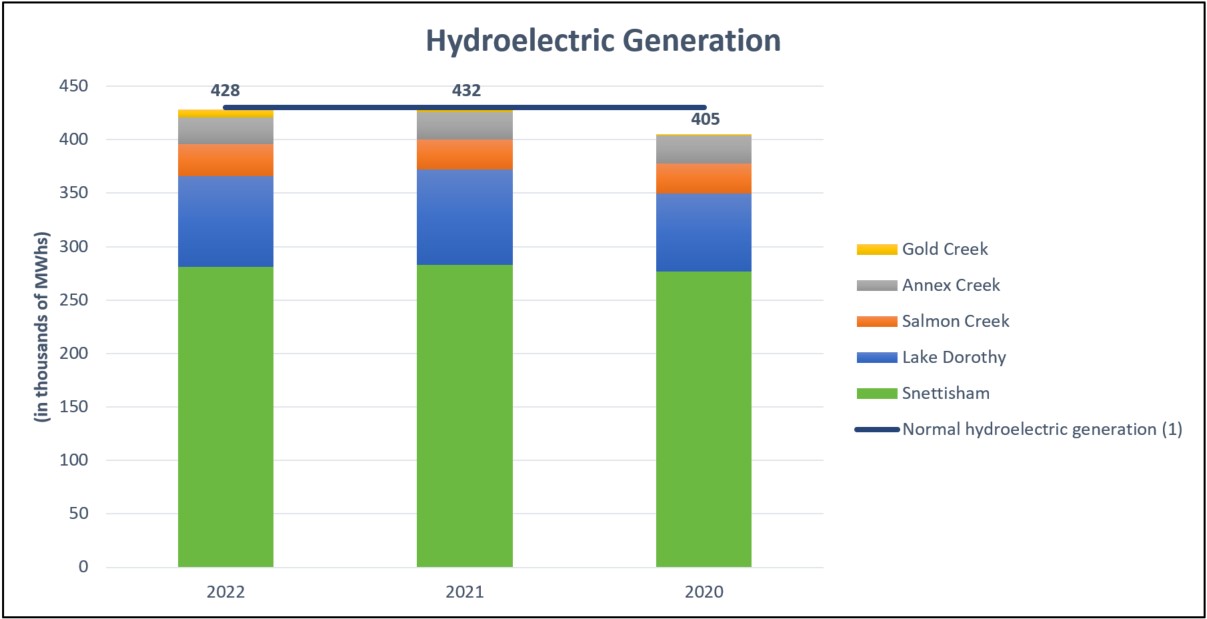

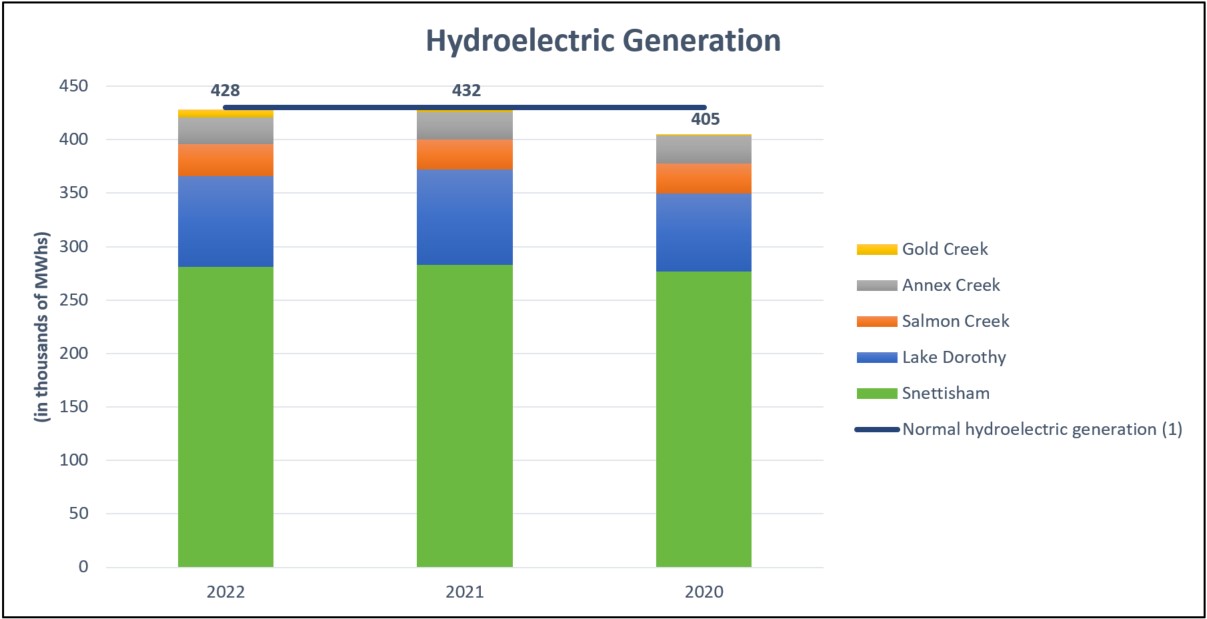

•adverse impacts to our Alaska electric utility (AEL&P) that could result from an extended outage of its hydroelectric generating resources or their inability to deliver energy, due to their lack of interconnectivity to any other electrical grids and the availability or cost of replacement power (diesel);

•changing river or reservoir regulation or operations at hydroelectric facilities not owned by us, which could impact our hydroelectric facilities downstream;

Climate Change Risk

•increasing frequency and intensity of severe weather or natural disasters resulting from climate change, that could disrupt energy generation, transmission and distribution, as well as the availability and costs of fuel, materials, equipment, supplies and support services;

•change in the use, availability or abundancy of water resources and/or rights needed for operation of our hydroelectric facilities, including impacts resulting from climate change;

2

AVISTA CORPORATION

Cyber and Technology Risk

•cyberattacks on the operating systems that are used in the operation of our electric generation, transmission and distribution facilities and our natural gas distribution facilities, and cyberattacks on such systems of other energy companies with which we are interconnected, which could damage or destroy facilities or systems or disrupt operations for extended periods of time and result in the incurrence of liabilities and costs;

•cyberattacks on the administrative systems that are used in the administration of our business, including customer billing and customer service, accounting, communications, compliance and other administrative functions, and cyberattacks on such systems of our vendors and other companies with which we do business, resulting in the disruption of business operations, the release of private information and the incurrence of liabilities and costs;

•changes in costs that impede our ability to implement new information technology systems or to operate and maintain current production technology;

•changes in technologies, possibly making some of the current technology we utilize obsolete or introducing new cyber security risks;

•insufficient technology skills, which could lead to the inability to develop, modify or maintain our information systems;

Strategic Risk

•growth or decline of our customer base due to new uses for our services or decline in existing services, including, but not limited to, the effect of the trend toward distributed generation at customer sites;

•the potential effects of negative publicity regarding our business practices, whether true or not, which could hurt our reputation and result in litigation or a decline in our common stock price;

•changes in our strategic business plans, which could be affected by any or all of the foregoing, including the entry into new businesses and/or the exit from existing businesses and the extent of our business development efforts where potential future business is uncertain;

•wholesale and retail competition including alternative energy sources, growth in customer-owned power resource technologies that displace utility-supplied energy or that may be sold back to the utility, and alternative energy suppliers and delivery arrangements;

•entering into or growth of non-regulated activities may increase earnings volatility;

•the risk of municipalization or other forms of service territory reduction;

External Mandates Risk

•changes in environmental laws, regulations, decisions and policies, including, but not limited to, regulatory responses to concerns regarding climate change, efforts to restore anadromous fish in areas currently blocked by dams, more stringent requirements related to air quality, water quality and waste management, present and potential environmental remediation costs and our compliance with these matters;

•the potential effects of initiatives, legislation or administrative rulemaking at the federal, state or local levels, including possible effects on our generating resources, prohibitions or restrictions on new or existing services, or restrictions on greenhouse gas emissions to mitigate concerns over global climate changes, including future limitations on the usage and distribution of natural gas;

•political pressures or regulatory practices that could constrain or place additional cost burdens on our distribution systems through accelerated adoption of distributed generation or electric-powered transportation or on our energy supply sources, such as campaigns to halt fossil fuel-fired power generation and opposition to other thermal generation, wind turbines or hydroelectric facilities;

3

AVISTA CORPORATION

•failure to identify changes in legislation, taxation and regulatory issues that could be detrimental or beneficial to our overall business;

•policy and/or legislative changes in various regulated areas, including, but not limited to, environmental regulation, healthcare regulations and import/export regulations;

Financial Risk

•weather conditions, which affect both energy demand and electric generating capability, including the impact of precipitation and temperature on hydroelectric resources, the impact of wind patterns on wind-generated power, weather-sensitive customer demand, and similar impacts on supply and demand in the wholesale energy markets;

•our ability to obtain financing through the issuance of debt and/or equity securities, which could be affected by various factors including our credit ratings, interest rates, other capital market conditions and global economic conditions;

•changes in interest rates that affect borrowing costs, our ability to effectively hedge interest rates for anticipated debt issuances, variable interest rate borrowing and the extent to which we recover interest costs through retail rates collected from customers;

•volatility in energy commodity markets that affect our ability to effectively hedge energy commodity risks, including cash flow impacts and requirements for collateral;

•changes in actuarial assumptions, interest rates and the actual return on plan assets for our pension and other postretirement benefit plans, which could affect future funding obligations, pension and other postretirement benefit expense and the related liabilities;

•the outcome of legal proceedings and other contingencies;

•economic conditions in our service areas, including the economy's effects on customer demand for utility services;

•economic conditions nationally may affect the valuation of our unregulated portfolio companies;

•declining energy demand related to customer energy efficiency, conservation measures and/or increased distributed generation;

•changes in the long-term climate and weather could materially affect, among other things, customer demand, the volume and timing of streamflows required for hydroelectric generation, costs of generation, transmission and distribution. Increased or new risks may arise from severe weather or natural disasters, including wildfires as well as their increased occurrence and intensity related to changes in climate;

•industry and geographic concentrations which could increase our exposure to credit risks due to counterparties, suppliers and customers being similarly affected by changing conditions;

•deterioration in the creditworthiness of our customers;

Energy Commodity Risk

•volatility and illiquidity in wholesale energy markets, including exchanges, the availability of willing buyers and sellers, changes in wholesale energy prices that could affect operating income, cash requirements to purchase electricity and natural gas, value received for wholesale sales, collateral required of us by individual counterparties and/or exchanges in wholesale energy transactions and credit risk to us from such transactions, and the market value of derivative assets and liabilities;

•default or nonperformance on the part of any parties from whom we purchase and/or sell capacity or energy;

•potential environmental regulations or lawsuits affecting our ability to utilize or resulting in the obsolescence of our power supply resources;

4

AVISTA CORPORATION

•explosions, fires, accidents, pipeline ruptures or other incidents that could limit energy supply to our facilities or our surrounding territory, which could result in a shortage of commodities in the market that could increase the cost of replacement commodities from other sources;

Compliance Risk

•changes in laws, regulations, decisions and policies at the federal, state or local levels, which could materially impact both our electric and gas operations and costs of operations; and

•the ability to comply with the terms of the licenses and permits for our hydroelectric or thermal generating facilities at cost-effective levels.

Our expectations, beliefs and projections are expressed in good faith. We believe they are reasonable based on, without limitation, an examination of historical operating trends, our records and other information available from third parties. There can be no assurance that our expectations, beliefs or projections will be achieved or accomplished. Furthermore, any forward-looking statement speaks only as of the date on which such statement is made. We undertake no obligation to update any forward-looking statement or statements to reflect events or circumstances that occur after the date on which such statement is made or to reflect the occurrence of unanticipated events. New risks, uncertainties and other factors emerge from time to time, and it is not possible for us to predict all such factors, nor can we assess the effect of each such factor on our business or the extent that any such factor or combination of factors may cause actual results to differ materially from those contained in any forward-looking statement.

Available Information

We file annual, quarterly and current reports and proxy statements with the SEC. The SEC maintains a website that contains these documents at www.sec.gov. We make annual, quarterly and current reports and proxy statements available on our website, https://investor.avistacorp.com, as soon as practicable after electronically filing these documents with the SEC. Except for SEC filings or portions thereof that are specifically referred to in this report, information contained on these websites is not part of this report.

5

AVISTA CORPORATION

PART I

ITEM 1. BUSINESS

COMPANY OVERVIEW

Avista Corp., incorporated in the territory of Washington in 1889, is primarily an electric and natural gas utility with certain other business ventures. Our mission is to improve our customers’ lives through innovative energy solutions, safely, responsibly and affordably. Our corporate headquarters is in Spokane, Washington, the second-largest city in Washington. Spokane serves as the business, transportation, medical, industrial and cultural hub of the Inland Northwest region (eastern Washington and northern Idaho). Regional services include government and higher education, medical services, retail trade and finance. Through our subsidiary AEL&P, we also provide electric utility services in Juneau, Alaska.

As of December 31, 2022, we have two reportable business segments as follows:

•Avista Utilities – an operating division of Avista Corp., comprising the regulated utility operations in Washington, Idaho, Oregon and Montana. Avista Utilities provides electric distribution and transmission, and natural gas distribution services in parts of eastern Washington and northern Idaho. Avista Utilities also provides natural gas distribution service in parts of northeastern and southwestern Oregon. Avista Utilities has electric generating facilities in Washington, Idaho, Oregon and Montana. Avista Utilities also supplies electricity to a small number of customers in Montana, most of whom are employees who operate Avista Utilities' Noxon Rapids generating facility. Avista Utilities also engages in wholesale purchases and sales of electricity and natural gas as an integral part of energy resource management and its load-serving obligation.

•AEL&P – a regulated utility providing electric services in Juneau, Alaska that is a wholly-owned subsidiary and the primary operating subsidiary of AERC.

We have other businesses, including venture fund investments, real estate investments, as well as certain other investments made by Avista Capital, which is a direct, wholly owned subsidiary of Avista Corp. These activities do not represent a reportable business segment and are conducted by various direct and indirect subsidiaries of Avista Corp.

Total Avista Corp. shareholders’ equity was $2.3 billion as of December 31, 2022, which includes a $149.9 million investment in Avista Capital and a $110.9 million investment in AERC.

See “Note 24 of the Notes to Consolidated Financial Statements” for information with respect to the operating performance of each business segment (and other subsidiaries).

Human Capital

Our approach to people is a critical strategy and the priorities for this strategy include, among other things:

•developing, retaining and attracting a diverse and skilled workforce,

•providing opportunities for continuous learning, development, career growth, and movement within the Company,

•supporting and rewarding our employees through competitive pay and benefits,

•encouraging and supporting a community-minded Company culture, and

•investing in the physical, emotional and financial health and safety of our employees.

The following is an overview of some of our key human capital initiatives intended to foster the overall well-being of our employees and other stakeholders, such as our customers and business partners.

Equity, Inclusion and Diversity

We strive to create a workplace culture that values trust and respect. Our culture guides our overall commitment to doing what is right, offering all employees the opportunity to enrich their lives and careers through challenging and meaningful work in an equal opportunity workplace surrounded by a supportive and inclusive environment. Foundational to this culture is active

6

AVISTA CORPORATION

engagement with and listening to our employees, customers and communities in order to help measure and inform our equity, inclusion, diversity, and racial and social justice practices. Our equity, inclusion, and diversity (EID) initiatives are focused on equity in our systems, employee recruitment, employee training and development, and employee engagement, including participation in employee resource groups. Employee resource groups are voluntary, employee-led groups that foster a diverse and inclusive workplace aligned with our organizational mission, values and goals and business practices. We sponsored four employee resource groups in 2022: Women of Avista, Veterans of Avista, Diversity Awareness, and Connections.

Additional employee-focused EID efforts include active engagement in employment system and practice reviews to uncover and correct systemic inequities and/or barriers for a more fulsome approach to EID. Projects include overhauling and updating all job descriptions ensuring equity among similar positions regardless of the department, a pay equity project and developing a robust inclusive recruiting initiative to address direct recruiting activities and processes, recruiting systems and future workforce pipeline development.

On December 31, 2022, Avista Utilities employed 1,767 with an employee profile of:

| | | | |

| | Women | | Under-Represented Groups (a) |

Bargaining Unit | | 3% | | 6% |

Non-bargaining Unit | | 44% | | 10% |

Executives (b) | | 14% | | 7% |

Overall | | 30% | | 9% |

(a)As defined by our Affirmative Action Plan and through employee self-identification.

(b)Executive is defined as vice president or higher.

Employee data represents all regular full-time and part-time employees, including temporary workers and student interns.

Bargaining Unit employees comprise 36 percent of Avista Utilities’ employees.

People Development, Retention and Attraction

We strive to hire and retain talented people who are innovative and skilled so that we can continue to provide safe, reliable and affordable service to our customers and advance our Company at the same time. Retention of our talented people is a focal strategy addressed through employee engagement efforts and the pay equity project. In 2022, we held our biennial employee experience survey and established an Employee Experience Core Team to prioritize initiatives focusing on enhancing our employee experience.

Continuous learning fosters collaboration and innovation among our employees and is embedded throughout the Company. Development opportunities are created to increase skill strength and prepare our employees at all levels to ensure they have the skills, knowledge and experience to perform today and well into the future. Keeping our workforce equipped to succeed is imperative in order to meet the emerging challenges that lay ahead. We develop training that is relevant, necessary and in demand for our organization. Training is delivered through instructor-led courses, self-service topics, computer-based learning modules, and field-based, hands-on workshop models that cover the range of our operations. Training programs include craft apprenticeship programs, engineering development programs, leadership development, communication skills, cross-functional learning and EID topics. We also provide opportunities for our employees to attend industry events and certification programs, courses or programs offered through energy-related organizations such as the Western Energy Institute, the American Gas Association and the Edison Electric Institute, as well as through our local colleges and universities.

Workplace Safety

Safety is an essential part of our mission. A variety of programs and initiatives are in place to help employees complete their work safely through heightened vigilance, hazard recognition, defensive strategies, lessons learned, human and organizational performance and other tools intended to ensure resilience in varying and unpredictable conditions. We work with our employees to reinforce personal responsibility regarding safety and health, and to implement measures to create and maintain a safe work environment.

7

AVISTA CORPORATION

Additional Information

Additional information highlighting the Company's commitments to corporate responsibility, including the Company’s commitments to our environment, our people, our customers and communities and ethical governance, is available on the Company’s website at www.avistacorp.com. Material on the Company’s website is not part of this report.

AVISTA UTILITIES

General

At the end of 2022, Avista Utilities supplied retail electric service to approximately 411,000 customers and retail natural gas service to approximately 377,000 customers across its service territory. Avista Utilities' service territory covers 30,000 square miles with a population of 1.7 million. See “Item 2. Properties” for further information on our utility assets. See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Economic Conditions and Utility Load Growth” for information on economic conditions in our service territory.

Electric Operations

General

Avista Utilities generates, transmits and distributes electricity, serving electric customers in eastern Washington and northern Idaho and a small number of customers in Montana, most of whom are employees who operate Avista Utilities' Noxon Rapids generating facility.

Avista Utilities generates electricity from facilities that we own and purchases capacity, energy and fuel for generation under long-term and short-term contracts to meet customer load obligations. We also sell electric capacity and energy, as well as surplus fuel in the wholesale market in connection with our resource optimization activities as described below.

As part of Avista Utilities' resource procurement and management operations in the electric business, we engage in an ongoing process of resource optimization, which involves the selection from available energy resources to serve our load obligations and the use of these resources to capture economic value through wholesale market transactions. These include sales and purchases of electric capacity and energy, fuel for electric generation, and derivative contracts related to capacity, energy, fuel and fuel transportation. Such transactions are part of the process of matching available resources with load obligations and hedging a portion of the related financial risks. In order to implement this process, we make continuing projections of:

•electric loads at various points in time (ranging from intra-hour to multiple years) based on, among other things, estimates of customer usage and weather, historical data, contract terms, and emerging trends and climate modeling results, and

•resource availability at these points in time based on, among other things, fuel choices and fuel markets, estimates of snowpack and streamflows, availability of generating units, historic and forward market information, contract terms and experience.

On the basis of these projections, we make purchases and sales of electric capacity and energy, fuel for electric generation, and related derivative contracts to match expected resources to expected electric load requirements and reduce our exposure to electricity (or fuel) market price changes. The process of resource optimization involves scheduling and dispatching available resources as well as the following:

•purchasing fuel for generation,

•when economical, selling fuel and substituting wholesale electric purchases, and

•other wholesale transactions to capture the value of generating resources, transmission contract rights and fuel delivery (transport) capacity contracts.

This optimization process includes entering into hedging transactions to manage risks. Transactions include both physical energy contracts and related derivative instruments, and the terms range from intra-hour up to multiple years.

8

AVISTA CORPORATION

Avista Utilities' generation assets are interconnected through the regional transmission system and are operated on a coordinated basis to enhance load-serving capability and reliability. We acquire both long-term and short-term transmission capacity to facilitate all of our energy and capacity transactions. We provide transmission and ancillary services in eastern Washington, northern Idaho and western Montana.

Electric Requirements

Avista Utilities' peak electric native load requirement for 2022 was 1,860 MW, which occurred on December 22, 2022. In 2021, our peak electric native load was 1,889 MW, which occurred during the summer, and in 2020, it was 1,721 MW, which occurred during the summer.

Electric Resources

Avista Utilities has a diverse electric resource mix of Company-owned and contracted hydroelectric, thermal and wind generation facilities, and other contracts for power purchases and exchanges. As of December 31, 2022, Avista Utilities' electric generation resource mix (including contracts for power purchases) was approximately 48 percent hydroelectric, 43 percent thermal and 9 percent other renewables. See “Item 2. Properties” for detailed information on Company-owned generating facilities.

Hydroelectric Resources

Avista Utilities owns and operates Noxon Rapids and Cabinet Gorge on the Clark Fork River and six smaller hydroelectric projects on the Spokane River. Hydroelectric generation is typically our lowest cost source per MWh of electric energy and the availability of hydroelectric generation has a significant effect on total power supply costs. Under normal streamflow and operating conditions, we estimate that we would be able to meet approximately one-half of our total average electric requirements (both retail and long-term wholesale) with the combination of our hydroelectric generation and long-term hydroelectric purchase contracts with certain PUDs in the state of Washington. Our estimate of normal annual hydroelectric generation for 2023 (including resources purchased under long-term hydroelectric contracts with certain PUDs) is 573.5 aMW (or 5.0 million MWhs).

See “Item 2. Properties - Avista Utilities - Generation Properties” for the present generating capabilities of the above hydroelectric resources.

9

AVISTA CORPORATION

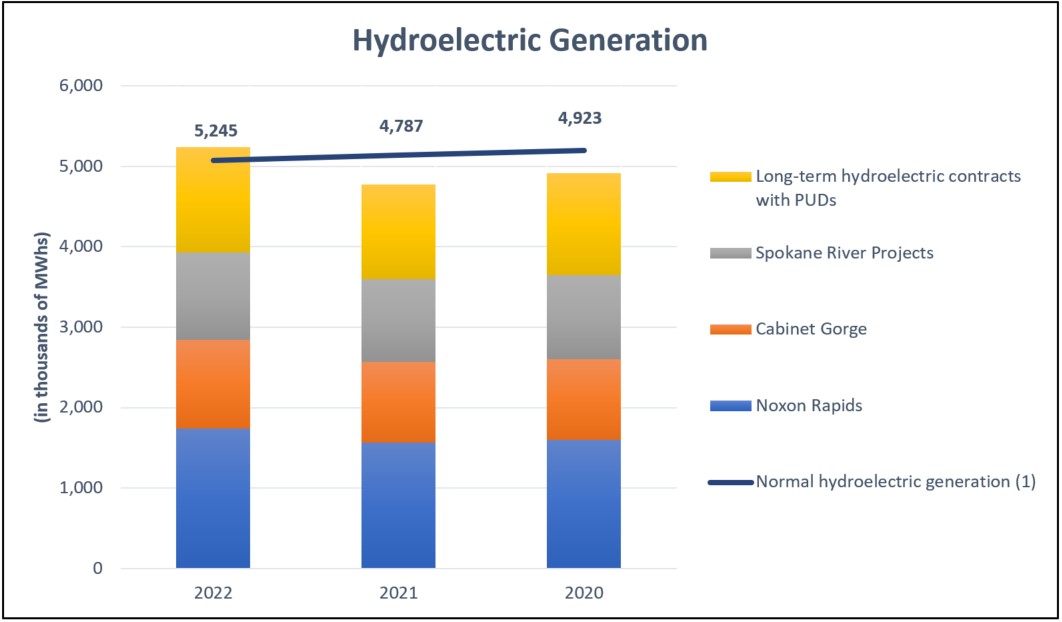

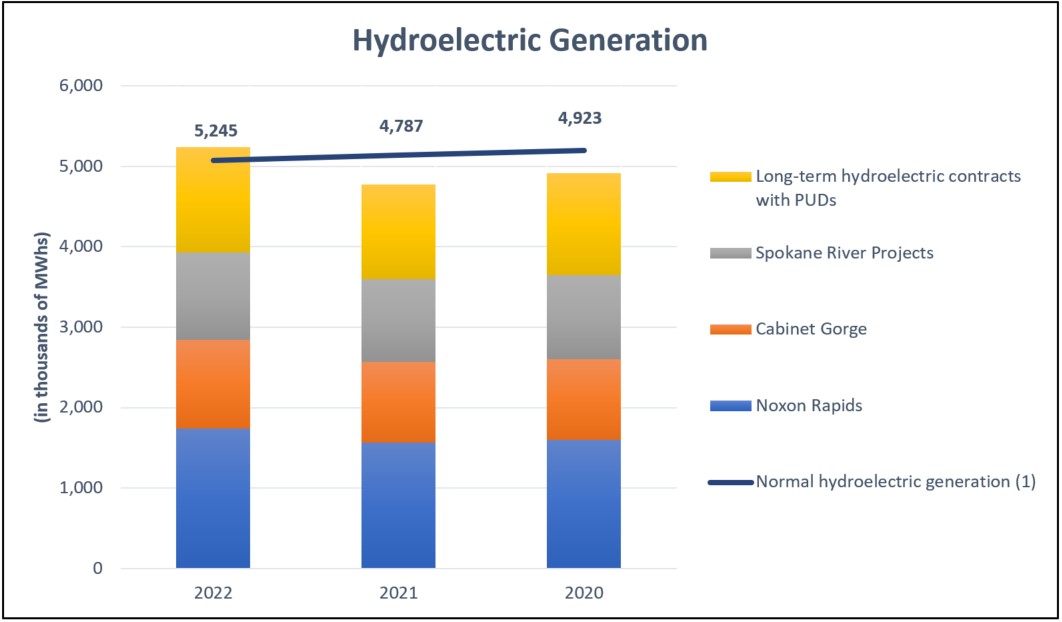

The following graph shows Avista Utilities' hydroelectric generation (in thousands of MWhs) during the year ended December 31:

(1)“Normal” hydroelectric generation is determined by reference to the effect of upstream dam regulation on median natural water flow. Natural water flow is the flow of the rivers without the influence of dams, whereas regulated water flow takes into account any water flow changes from upstream dams due to releasing or holding back water. The calculation of “normal” varies annually due to the timing of upstream dam regulation throughout the year, as well as changes in PUD contracts.

Thermal Resources

Avista Utilities owns the following thermal generating resources:

•the combined cycle natural gas-fired CT, known as Coyote Springs 2, located near Boardman, Oregon,

•a 15 percent interest in Units 3 and 4 of Colstrip, a coal-fired boiler generating facility located in southeastern Montana. We have an agreement with NorthWestern to transfer our ownership at the end of 2025; see “Note 22 of the Notes to Consolidated Financial Statements” for discussion of our Colstrip transaction with NorthWestern,

•a wood waste-fired boiler generating facility known as the Kettle Falls GS in northeastern Washington,

•a two-unit natural gas-fired CT generating facility in northeastern Spokane (Northeast CT),

•a two-unit natural gas-fired CT generating facility in northern Idaho (Rathdrum CT), and

•two small natural gas-fired generating facilities (Boulder Park GS and Kettle Falls CT).

Coyote Springs 2, which is operated by Portland General Electric Company, is supplied with natural gas under a combination of term contracts and spot market purchases, including transportation agreements with bilateral renewal rights.

Colstrip, which is operated by Talen Montana, is supplied with fuel from adjacent coal reserves under coal supply and transportation agreements. Several of the co-owners of Colstrip, including us, have a coal contract that runs through December

10

AVISTA CORPORATION

31, 2025. See “Item 7. Management's Discussion and Analysis – Colstrip” for discussion regarding environmental and other issues surrounding Colstrip.

The primary fuel for the Kettle Falls GS is wood waste generated as a by-product and delivered by trucks from forest industry operations within 100 miles of the plant. A combination of long-term contracts and spot purchases has provided, and is expected to meet, fuel requirements for the Kettle Falls GS.

The Northeast CT, Rathdrum CT, Boulder Park GS and Kettle Falls CT generating units are primarily used to meet peaking electric requirements. We also operate these facilities when marginal costs are below prevailing wholesale electric prices. These generating facilities have access to natural gas supplies that are adequate to meet their respective operating needs.

See “Item 2. Properties - Avista Utilities - Generation Properties” for the present generating capabilities of the above thermal resources.

The Lancaster Plant is a 270 MW natural gas-fired combined cycle combustion turbine plant located in northern Idaho, owned by an unrelated third-party. All of the output from the Lancaster Plant is contracted to us through October 31, 2026 under a PPA. Under the terms of the PPA, we make the dispatch decisions, provide all natural gas fuel and receive all of the electric energy output. Therefore, we consider the Lancaster Plant to be a baseload resource. See “Note 6 of the Notes to Consolidated Financial Statements” for further discussion of this PPA.

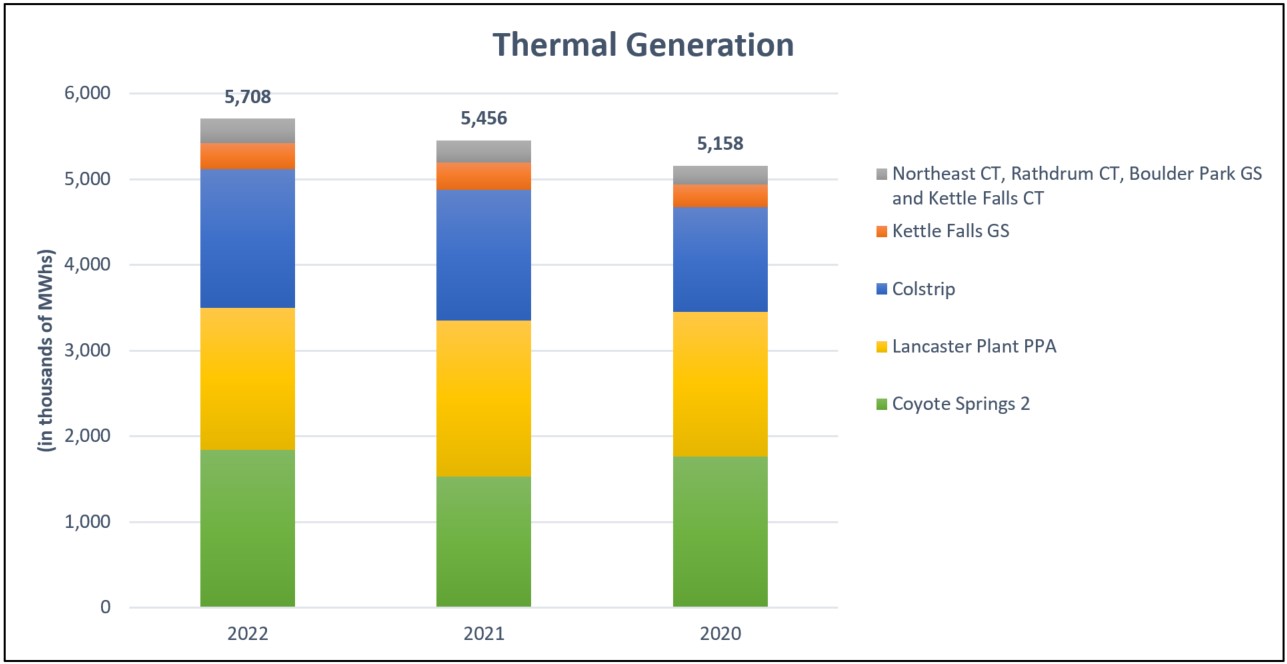

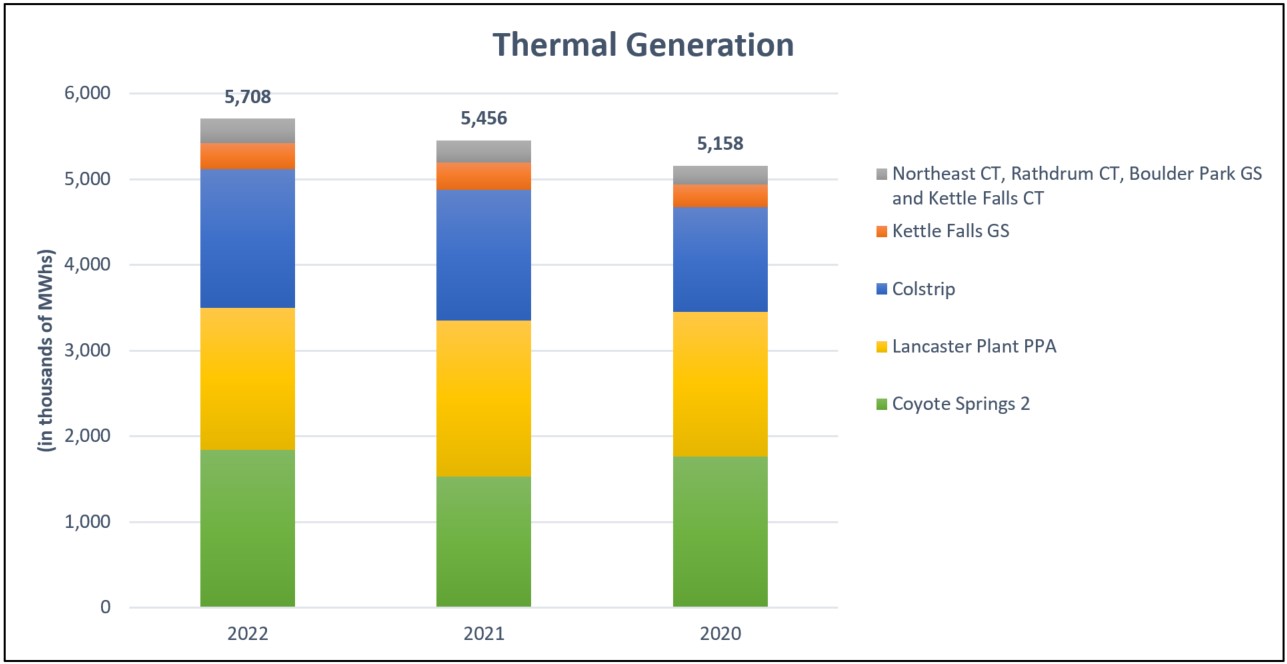

The following graph shows Avista Utilities' thermal generation (in thousands of MWhs) during the year ended December 31:

Wind Resources

We have exclusive rights to all the capacity of Palouse Wind, a wind generation project developed, owned and managed by an unrelated third-party and located in Whitman County, Washington. The PPA expires in 2042 and requires us to acquire all of the power and renewable attributes produced by the project at a fixed price per MWh with a fixed escalation of the price over the term of the agreement. The project has a nameplate capacity of 105 MW. Generation from Palouse Wind was 315,410 MWhs in 2022, 360,783 MWhs in 2021 and 370,142 MWhs in 2020. We have an annual option to purchase the wind project, which we have not exercised. The purchase price is a fixed price per KW of in-service capacity with a fixed decline in the price per KW over the remaining 20-year term of the PPA. Under the terms of the PPA, we do not have any input into the day-to-day operation of the project, including maintenance decisions. All such rights are held by the owner.

11

AVISTA CORPORATION

We have exclusive rights to all of the capacity of Rattlesnake Flat Wind project developed, owned and managed by an unrelated third party and located in Adams County, Washington. The facility has a nameplate capacity of 144 MW. The PPA is a 20-year agreement that began in December 2020 and requires us to acquire all of the power and renewable attributes produced by the project at a fixed price per MWh with a fixed escalation of the price over the term of the agreement. Generation from Rattlesnake Flat Wind was 363,533 MWhs in 2022 and 423,510 MWhs in 2021. Under the terms of the PPA, we do not have any input into the day-to-day operation of the project, including maintenance decisions. All such rights are held by the owner.

Solar Resources

We have exclusive rights to all the capacity of the Lind Solar Farm, a solar generation project developed, owned and managed by an unrelated third-party and located in Lind, Washington. The PPA expires in 2038 and requires us to acquire all the power and renewable attributes produced by the project at a fixed price per MWh. The project has a nameplate capacity of 28 MW. The facility generated 34,809 MWhs in 2022, 43,328 MWhs in 2021, and 45,281 MWhs in 2020. Under the terms of the PPA, we do not have any input into the day-to-day operation of the project, including maintenance decisions. All such rights are held by the owner.

Other Purchases, Exchanges and Sales

In addition to the resources described above, we purchase and sell power under various long-term contracts, and we also enter into short-term purchases and sales. Further, pursuant to The Public Utility Regulatory Policies Act of 1978, as amended, we are required to purchase generation from qualifying facilities. This includes, among other resources, hydroelectric projects, cogeneration projects and wind generation projects at rates approved by the WUTC and the IPUC.

See “Avista Utilities Electric Operating Statistics – Electric Operations” below for annual quantities of purchased power, wholesale power sales and power from exchanges in 2022, 2021 and 2020. See “Electric Operations” above for additional information with respect to the use of wholesale purchases and sales as part of our resource optimization process and also see “Future Resource Needs” below for the magnitude of these power purchase and sales contracts in future periods.

Avista Corp. understands that there are many coal-fired electric generating stations throughout the western United States that are scheduled for retirement in the next several years. Depending upon a variety of factors, these retirements could have an impact upon the availability and price of purchased power in, and the dynamics of, the market in which we conduct our wholesale purchases and sales. After December 31, 2025, we are prohibited by Clean Energy Transformation Act (CETA) from using energy produced by coal-fired plants to serve our retail customers in Washington. In order to comply, we entered into an agreement with NorthWestern to transfer our interest in Colstrip at the end of 2025. To the extent necessary, we will obtain energy produced by other resources. See “Item 7. Management's Discussion and Analysis – Environmental Matters and Contingencies – Climate Change – Washington Legislation and Regulatory Actions – Clean Energy Transformation Act” and “Colstrip.”

Hydroelectric Licenses

Avista Corp. is a licensee under the Federal Power Act (FPA) as administered by the FERC, which includes regulation of hydroelectric generation resources. Excluding the Little Falls Hydroelectric Generating Project (Little Falls), our other seven hydroelectric plants are regulated by the FERC through two project licenses. The licensed projects are subject to the provisions of Part I of the FPA. These provisions include payment for headwater benefits, condemnation of licensed projects upon payment of just compensation, and take-over by the federal government of such projects after the expiration of the license upon payment of the lesser of “net investment” or “fair value” of the project, in either case, plus severance damages. In the unlikely event that a take-over occurs, it could lead to either the decommissioning of the hydroelectric project or offering the project to another party (likely through sale and transfer of the license).

Cabinet Gorge and Noxon Rapids are under one 45-year FERC license expiring in 2046. This license embodies a settlement agreement relating to project operations and resource protection and mitigation efforts over the license term. See “Item 7. Management's Discussion and Analysis – Environmental Issues and Contingencies” for discussion of dissolved atmospheric gas levels that exceed the state of Idaho and federal numeric water quality standards downstream of Cabinet Gorge during

12

AVISTA CORPORATION

periods when we must divert excess river flows over the spillway, as well as efforts related to bull trout, a threatened species under the Endangered Species Act.

Five of our six hydroelectric projects on the Spokane River (Long Lake, Nine Mile, Upper Falls, Monroe Street and Post Falls) are under one 50-year FERC license expiring in 2059 and are referred to collectively as the Spokane River Project. The license includes numerous natural and cultural resource protection measures that are subject to ongoing regulatory interpretation. The sixth, Little Falls, is operated under separate Congressional authority and is not licensed by the FERC. It is the subject of a 50-year agreement with the Spokane Tribe, signed in 1994.

Future Resource Needs

Avista Utilities has operational strategies to provide sufficient resources to meet our energy requirements under a range of operating conditions. These operational strategies consider the amount of energy needed, which varies widely because of the factors that influence demand over intra-hour, hourly, daily, monthly and annual durations. Our average hourly load was 1,142 aMW in 2022, 1,113 aMW in 2021 and 1,064 aMW in 2020.

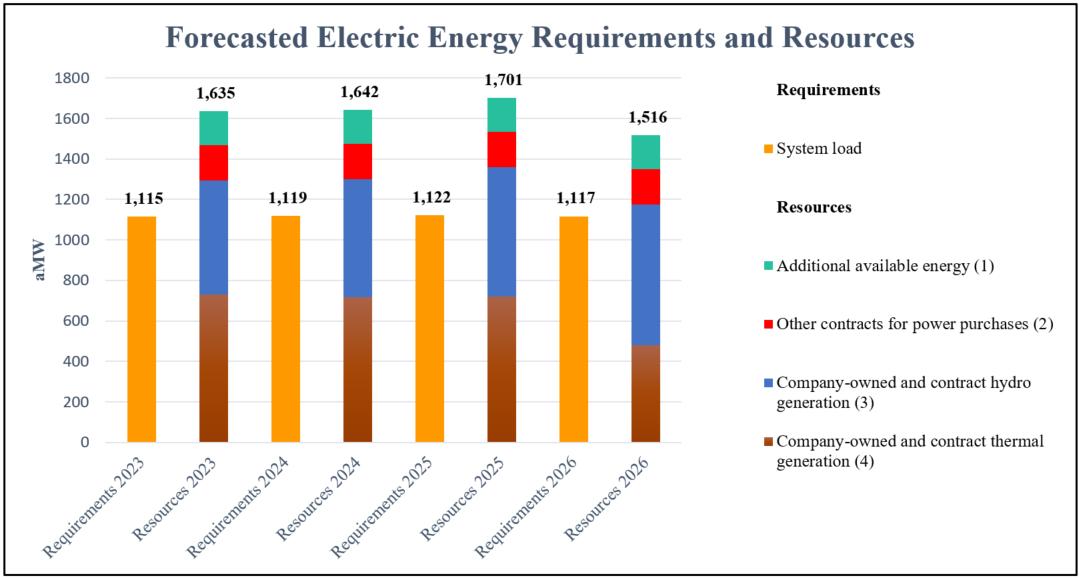

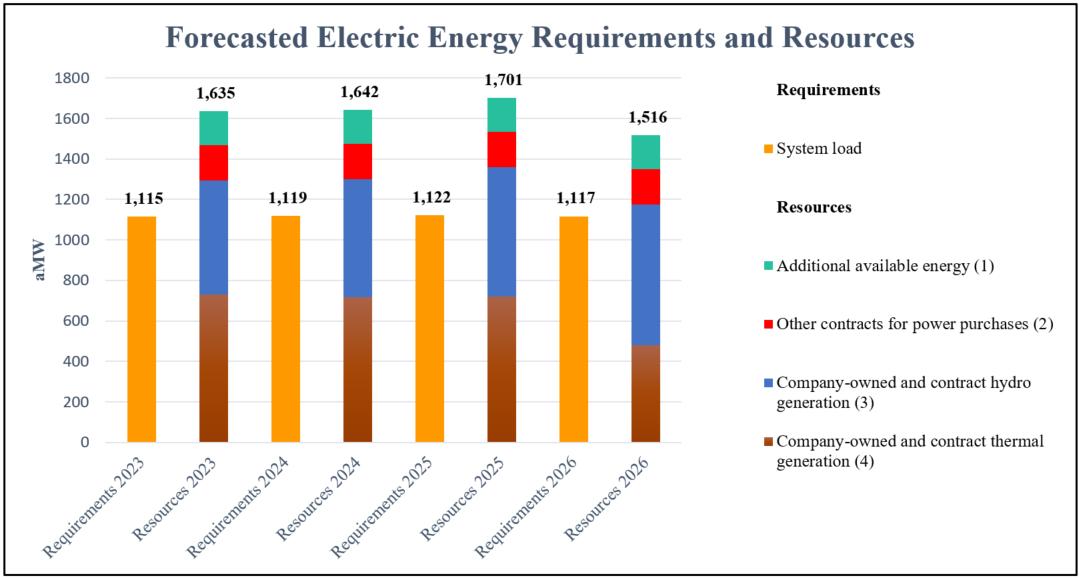

The following graph shows our forecast of our average annual energy requirements and our available resources for 2023 through 2026:

(1)The combined maximum capacity of Boulder Park GS, Kettle Falls CT, Northeast CT and Rathdrum CT is 278 MW, with estimated available energy production as indicated for each year.

(2)Other contracts for power purchases includes power purchase agreements for solar and wind energy.

(3)The forecast assumes near normal hydroelectric generation.

(4)Includes the Lancaster Plant PPA (current PPA through October 31, 2026). Excludes Boulder Park GS, Kettle Falls CT, Northeast CT and Rathdrum CT, as these are considered peaking facilities and are generally not used to meet our base load requirements.

We are required to file an Integrated Resource Plan (IRP) or Washington Progress Report with the WUTC and IPUC every two years. The WUTC and IPUC review the IRP and give the public the opportunity to comment. The WUTC and IPUC do not approve or disapprove of the content in the IRP; rather, they acknowledge that the IRP was prepared in accordance with applicable standards if that is the case. The IRP details projected growth in demand for energy and the new resources needed to

13

AVISTA CORPORATION

serve customers over the next 20 years. We regard the IRP as a tool for resource evaluation, rather than an acquisition plan for a particular project.

In April 2021, we filed our 2021 Electric IRP with the WUTC and the IPUC. Later that same month, we filed an amended Electric IRP to include the results of the 2020 Renewable Request for Proposal (RFP). We plan to file the 2023 Electric IRP in June 2023.

Highlights of the amended 2021 Electric IRP include the following expectations and/or assumptions:

•We have adequate resources between owned and contractually controlled generation, when combined with conservation and market purchases, to meet customer demand through October 2026. Our first long-term capacity deficit, net of energy efficiency, begins in October 2026 and is 247 MW by January 2027.

•New renewable energy, energy storage, demand response, energy efficiency, and upgrades to existing hydropower and biomass plants are integral to our plan.

•We anticipate customer load growth of 0.3 percent per year.

•Assumes Colstrip will exit the portfolio by 2025 (see “Item 7. Management’s Discussion and Analysis of Financial Condition – Environmental Issues and Contingencies” and “Note 22 of the Notes to Consolidated Financial Statements” for further discussion of Colstrip in relation to the Washington CETA).

•New natural gas-fired peaking units are the most economic means to meet the capacity shortfall in 2027 since long-term energy storage is not yet available at a cost effective price.

•Demand response programs begin in 2025 and grow to 72 MW by 2045.

•Our first new renewable resource identified in the IRP is in 2025, as a wind project located in Montana. Actual resource selection will be determined by a future RFP.

The resource strategy embodied in the IRP is intended to move us closer to achieving our corporate clean electricity goal to provide customers with 100 percent net clean electricity by 2027. Net clean energy is defined as either 100 percent non-carbon emitting resources or investing in or acquiring carbon offsets to net-out emissions created from carbon emitting resources. The addition of natural gas peaking units in 2027 would require us to purchase carbon offsets to obtain our net clean electricity goal.

We are subject to the Washington State Energy Independence Act, which requires us to obtain a portion of our electricity from qualifying renewable resources or through purchase of RECs and acquiring all cost effective conservation measures. Future generation resource decisions will be affected by legislation for restrictions on greenhouse gas emissions and renewable energy requirements.

See “Item 7. Management’s Discussion and Analysis of Financial Condition – Environmental Issues and Contingencies” and “Colstrip” for information related to existing and proposed laws and regulations, and issues relating to Colstrip.

Additional generating resources that we will require will either be owned by us or be owned by other parties who will sell the capacity and energy to us under PPAs. The decision as to ownership will be made as to each project at the appropriate time and will depend on, among other things, the type of project and the related economics, including tax and ratemaking treatment.

Request for Proposal for Energy and Capacity

In February 2022, we issued an All-Source Request for Proposal from energy project owners and developers, seeking approximately 196 MWs of winter capacity and 190 MWs of summer capacity. After reviewing the bids received, several projects were selected for further contract negotiations. Contracts already signed include a 23 year PPA for 145 MWs peak from seven irrigation hydro generation projects that will ramp in between 2023 and 2030 and a 30 year PPA for 98 MWs of wind starting in 2026. Negotiations for additional PPAs are on-going.

14

AVISTA CORPORATION

Clean Energy Goals

In April 2019, we announced a goal to serve our customers with 100 percent clean electricity by 2045 and to have a carbon-neutral supply of electricity by the end of 2027. To help achieve our goals and add to our clean electricity portfolio, in the last three years, we have implemented renewable energy projects on behalf of our customers including entering into PPAs for the Solar Select project (28 MW) in Lind, Washington and the Rattlesnake Flat Wind project (144 MW) in Adams County, Washington. We also entered into two power purchase contracts with Chelan County Public Utility District for a percentage share of the output of their Rocky Reach and Rock Island hydro projects for 22 years starting in 2024 (88-264 MW). These resources are in addition to our existing clean hydroelectric generation, biomass generation, and additional wind and solar projects.

To achieve our clean energy goals, we expect energy storage and other technologies, which are either not currently available or are not cost-effective under the lowest reasonable cost regulatory standard, will advance such that it will allow us to meet our goals while also maintaining reliability and affordability for our customers. If the required technology is not available or not affordable in the future, we may not meet our goals in the desired timeframe. Meeting our clean energy goals may also require accommodation from regulatory agencies insofar as we may need to acquire emission offsets to meet our goals. See the discussion in Item 1 under “Electric Resources” for more information on our existing clean electricity sources and efforts to achieve these goals. See “Item 7. Management’s Discussion and Analysis of Financial Condition – Environmental Issues and Contingencies” for further discussion on clean energy, including applicable regulations.

Wildfire Resiliency Plan

We are implementing additional measures to enhance our ability to mitigate the potential for, and impact of, wildfires within our service territories. Building on prevention and response strategies that have been in place for many years, in 2020 we created a comprehensive 10-year Wildfire Resiliency Plan that includes improved defense strategies and operating practices for a more resilient system. This plan will be periodically updated and informed by observed experience as well as changes in observed landscape and climatic conditions.

We developed the Wildfire Resiliency Plan through a series of internal workshops, industry research and engagement with state and local fire agencies. Improvements to infrastructure and operational practices were identified as key components to the plan. These key components are categorized into the following categories: grid hardening, vegetation management, situational awareness, operations and emergency response, and worker and public safety.

We expect to spend approximately $330 million implementing the plan components over the life of the 10-year plan that began in 2020. The IPUC and WUTC approved deferral of certain costs of the wildfire resiliency plan, and we will seek recovery of those deferred costs in future rate filings.

See “Note 22 of the Notes to Consolidated Financial Statements” for further discussion on wildfires.

Natural Gas Operations

General

Avista Utilities provides natural gas distribution services to retail customers in parts of eastern Washington, northern Idaho, and northeastern and southwestern Oregon.

Market prices for natural gas, like other commodities, can be volatile. Our natural gas procurement strategy is to provide a reliable supply to our customers with some level of price certainty. We procure natural gas from various supply basins and over varying time periods. The resulting portfolio is a diversified mix of forward fixed price purchases, index and spot market purchases, and utilizing physical and financial derivative instruments. We also use natural gas storage to support high demand periods and the procurement of natural gas when prices may be lower. Securing prices throughout the year and even into subsequent years provides a level of price certainty and can mitigate price volatility to customers between years.

Weather is a key component of our natural gas customer load. This load is highly variable and daily natural gas loads can differ significantly from the monthly forecasted load projections. We make continuing projections of our natural gas loads and assess

15

AVISTA CORPORATION

available natural gas resources. On the basis of these projections, we plan and execute a series of transactions to hedge a portion of our customers' projected natural gas requirements through forward market transactions and derivative instruments. These transactions may extend for multiple years into the future. We also leave a portion of our natural gas supply requirements unhedged for purchase in the short-term spot markets.

Our purchase of natural gas supply is governed by our procurement plan and is reviewed and approved annually by the Risk Management Committee (RMC), which is comprised of certain officers and other management personnel. Once approval is received, the plan is implemented and monitored by our gas supply and risk management groups.

The plan’s progress is also presented to the WUTC and IPUC staff in semi-annual meetings, and updates are given to the OPUC staff quarterly. The RMC is provided with an update on plan results and changes in their monthly meetings. These activities provide transparency for the natural gas supply procurement plan. Any material changes to the plan are documented and communicated to RMC members.

As part of the process of balancing natural gas retail load requirements with resources, we engage in the wholesale purchase and sale of natural gas. We plan for sufficient natural gas delivery capacity to serve our retail customers for a theoretical peak day event. We generally have more pipeline and storage capacity than what is needed during periods other than a peak day. We optimize our natural gas resources by using market opportunities to generate economic value that helps mitigate fixed costs. Wholesale sales are delivered through wholesale market facilities outside of our natural gas distribution system. Natural gas resource optimization activities include, but are not limited to:

•wholesale market sales of surplus natural gas supplies,

•purchases and sales of natural gas to optimize use of pipeline and storage capacity, and

•participation in the transportation capacity release market.

We also provide distribution transportation service to qualified, large commercial and industrial natural gas customers who purchase natural gas through third-party marketers. For these customers, we receive their purchased natural gas from such third-party marketers into our distribution system and deliver it to the customers’ premises. These customers generally pay the same rates as other customers in the same class, without any charge for the cost of the natural gas delivered.

Optimization transactions that we engage in throughout the year are included in our annual purchased gas cost adjustment filings with the various commissions and are subject to review for prudence during this process.

Clean Energy Goals

In April 2021, we announced an aspirational goal to reduce carbon emissions for natural gas 30 percent by 2030 and 100 percent by 2045. Examples of carbon emissions reduction strategies include the following:

•Diversify or transition from fossil fuel-based natural gas to renewable natural gas,

•Reduce natural gas consumption via conservation, energy efficiency and new technologies, and

•Purchase carbon offsets as necessary.

Achieving the carbon emission reductions for the natural gas system will involve various pathways. The initial primary pathways include renewable natural gas (RNG), energy efficiency, customer voluntary RNG and carbon offset programs. See “Item 7. Management’s Discussion and Analysis of Financial Condition – Environmental Issues and Contingencies” for further discussion on clean energy, including applicable regulations.

Natural Gas Supply

Avista Utilities purchases all of its natural gas in wholesale markets. We are connected to multiple supply basins in the western United States and Canada through firm capacity transportation rights on six different pipeline networks. Access to this diverse portfolio of natural gas resources allows us to make natural gas procurement decisions that benefit our natural gas customers.

16

AVISTA CORPORATION

These interstate pipeline transportation rights provide the capacity to serve approximately 25 percent of peak natural gas customer demands from domestic sources and 75 percent from Canadian sourced supply. Natural gas prices in the Pacific Northwest are affected by global energy markets, as well as supply and demand factors in other regions of the United States and Canada. Future prices and delivery constraints may cause our resource mix to vary.

Natural Gas Storage

Avista Utilities owns a one-third interest in Jackson Prairie, an underground aquifer natural gas storage field located near Chehalis, Washington. Jackson Prairie has a total peak day deliverability of 12 million therms, with a total working natural gas capacity of 256 million therms. As an owner, our share is one-third of the peak day deliverability and total working capacity. We also contract for additional storage capacity and delivery at Jackson Prairie from Northwest Pipeline for a portion of their one-third share of the storage project.

We optimize our natural gas storage capacity throughout the year by executing transactions that capture favorable market price spreads. Natural gas buyers identify opportunities to purchase lower cost natural gas in the immediate term to inject into storage, and then sell the gas in a forward market to be withdrawn at a later time. The reverse of this type of transaction also occurs. These transactions lock in incremental value for customers. Jackson Prairie is also used as a variable peaking resource, and to protect from extreme daily price volatility during cold weather or other events affecting the market. See "Executive Level Summary" for discussion on market volatility in December 2022 and the impacts to our business.

Future Resource Needs

In April 2021, we filed our 2021 Natural Gas IRP with the WUTC, the IPUC and the OPUC. The IRP details projected growth in demand for energy and the new resources needed to serve customers over the next 20 years. We regard the IRP as a tool for resource evaluation, rather than an acquisition plan for a particular project. The IPUC and OPUC have formally acknowledged our IRP; the WUTC is still processing the IRP.

Highlights of the 2021 natural gas IRP include the following expectations and/or assumptions:

•We anticipate having sufficient natural gas resources during the 20-year planning horizon.

•Due to expected carbon legislation at the state levels through a cap and reduce mechanism (Oregon) and a cap and invest mechanism (Washington), we expect our retail natural gas rates to include a carbon price adder in Oregon and Washington, but not in Idaho.

•Regional supply constraints are beginning to increase in their likelihood causing prices to act in a more volatile fashion. This volatility in pricing paired with supply side resource availability has made our procurement plan an increasingly important piece to manage customer rates, diversity of supply and peak day demand.

•Liquefied natural gas exports, power generation and exports to Mexico will continue to add demand for natural gas.

•We expect lower use per customer and an increased amount of demand side management (DSM). The combination of low-priced natural gas in addition to carbon fees or other programs has led to a higher potential for DSM measures.

•We view renewable natural gas and low carbon fuels as an important component of our corporate environment strategy and decarbonization goals.

We will monitor these assumptions on an on-going basis and adjust our resource requirements accordingly.

We are required to file a natural gas IRP every two years and we anticipate our next IRP to be filed in April 2023.

Request for Proposals for Renewable Natural Gas Resources

In October 2022, we issued a Request for Proposals seeking renewable natural gas resources for our customers over the long term to reach aspirational goals to reduce emissions and comply with local regulations. See “Item 7. Management’s Discussion

17

AVISTA CORPORATION

and Analysis of Financial Condition – Environmental Issues and Contingencies” for further discussion on clean energy, including applicable regulations.

Bids in response to the Request for Proposal were submitted through December 2022. We are evaluating bids.

Utility Regulation

General

As a public utility, Avista Corp. is subject to regulation by state utility commissions for retail electric and natural gas rates, accounting, the issuance of securities and other matters. The retail electric and natural gas operations are subject to the jurisdiction of the WUTC, IPUC, OPUC and MPSC. Approval of the issuance of securities is not required from the MPSC. We are also subject to the jurisdiction of the FERC for licensing of hydroelectric generation resources, and for electric transmission services and wholesale sales.

Since Avista Corp. is a “holding company” (in addition to being itself an operating utility), we are also subject to the jurisdiction of the FERC under the Public Utility Holding Company Act of 2005, which imposes certain reporting and record-keeping requirements on Avista Corp. and its subsidiaries. We and our subsidiaries are required to make books and records available to the FERC and the state utility commissions. In addition, upon the request of any jurisdictional state utility commission, the FERC would have the authority to review assignment of costs of non-power goods and administrative services among us and our subsidiaries. The FERC has the authority generally to require that rates subject to its jurisdiction be just and reasonable and in this context would continue to be able to, among other things, review transactions of an affiliated company.

Our rates for retail electric and natural gas services (other than specially negotiated retail rates for industrial or large commercial customers, which are subject to regulatory review and approval) are generally determined on a “cost of service” basis.

Retail rates are designed to provide an opportunity to recover allowable operating expenses and earn a return of and a reasonable return on “rate base.” Rate base is generally determined by reference to the original cost (net of accumulated depreciation) of utility plant in service, subject to various adjustments for deferred income taxes and other items. Over time, rate base is increased by additions to utility plant in service and reduced by depreciation and write-offs as authorized by the utility commissions. Our operating expenses and rate base are allocated or directly assigned to five regulatory jurisdictions: electric in Washington and Idaho, and natural gas in Washington, Idaho and Oregon. In general, requests for new retail rates are made on the basis of revenues, operating expenses and net investment for a test year that ended prior to the date of the request, subject to possible adjustments, which differ among the various jurisdictions, designed to reflect the expected revenues, operating expenses and net investment during the period new retail rates will be in effect. The retail rates approved by the state commissions in a rate proceeding may not provide sufficient revenues to provide recovery of costs and a reasonable return on investment for a number of reasons, including, but not limited to, ongoing capital expenditures and unexpected changes in revenues and expenses following the time new retail rates are requested in the rate proceeding (known as “regulatory lag”), the denial by the commission of recovery, or timely recovery, of certain expenses or investment and the limitation by the commission of the authorized return on investment. In 2021, Washington enacted a multi-year rate plan and performance-based rate making regulations, and our 2022 general rate cases were our first filed under these new regulations. See “Item 7. Management’s Discussion and Analysis – Regulatory Matters – General Rate Cases” for further information.

Our rates for wholesale electric sales and electric transmission services, as well as certain natural gas transportation services, are based on either “cost of service” principles or market-based rates as set forth by the FERC. See “Notes 1, 13 and 23 of the Notes to Consolidated Financial Statements” for additional information about regulation, depreciation and deferred income taxes.

General Rate Cases

Avista Utilities regularly reviews the need for electric and natural gas rate changes in each state in which we provide service. See “Item 7. Management’s Discussion and Analysis – Regulatory Matters – General Rate Cases” for information on general rate case activity.

18

AVISTA CORPORATION

Power Cost Deferrals

Avista Utilities defers the recognition in the income statement of certain power supply costs that vary from the level currently recovered from our retail customers as authorized by the WUTC and the IPUC. See “Item 7. Management’s Discussion and Analysis – Regulatory Matters – Power Cost Deferrals and Recovery Mechanisms” and “Note 23 of the Notes to Consolidated Financial Statements” for information on power cost deferrals and recovery mechanisms.

Purchased Gas Adjustments (PGA)

Under established regulatory practices in each state, Avista Utilities defers the recognition in the income statement of the natural gas costs that vary from the level currently recovered from our retail customers as authorized by each of our jurisdictions. See “Item 7. Management’s Discussion and Analysis – Regulatory Matters – Purchased Gas Adjustments” and “Note 23 of the Notes to Consolidated Financial Statements” for information on natural gas cost deferrals and recovery mechanisms.

Decoupling Mechanisms

Decoupling (also known as FCA in Idaho) is a mechanism designed to sever the link between a utility's revenues and consumers' energy usage. In each of its jurisdictions, Avista Utilities' electric and natural gas revenues are adjusted so as to be based on the number of customers in certain customer rate classes and assumed “normal” usage, rather than being based on actual usage. The difference between revenues based on the number of customers and “normal” sales and revenues based on actual usage is deferred and either surcharged or rebated to customers beginning in the following year. See “Item 7. Management’s Discussion and Analysis – Regulatory Matters – Decoupling and Earnings Sharing Mechanisms” and “Note 23 of the Notes to Consolidated Financial Statements” for further discussion of these mechanisms.

Federal Laws Related to Wholesale Competition

Federal law promotes practices that foster competition in the electric wholesale energy market. The FERC requires electric utilities to transmit power and energy to or for wholesale purchasers and sellers, and requires electric utilities to enhance or construct transmission facilities to create additional transmission capacity for the purpose of providing these services. Public utilities (through subsidiaries or affiliates) and other entities may participate in the development of independent electric generating plants for sales to wholesale customers.

Public utilities operating under the FPA are required to provide open and non-discriminatory access to their transmission systems to third parties and establish an Open Access Same-Time Information System to provide an electronic means by which transmission customers can obtain information about available transmission capacity and purchase transmission access. The FERC also requires each public utility subject to the rules to operate its transmission and wholesale power merchant operating functions separately and to comply with standards of conduct designed to ensure that all wholesale users, including the public utility’s power merchant operations, have equal access to the public utility’s transmission system. Our compliance with these standards has not had any substantive impact on the operation, maintenance and marketing of our transmission system or our ability to provide service to customers.

See “Item 7. Management’s Discussion and Analysis – Competition” for further information.

Regional Transmission Planning

Beginning with FERC Order No. 888 and continuing with subsequent rulemakings and policies, the FERC has encouraged better coordination and operational consistency aimed to capture efficiencies that might otherwise be gained through the formation of a Regional Transmission Organization or an independent system operator (ISO).

The Company meets its FERC requirements to coordinate transmission planning activities with other regional entities through NorthernGrid. Launched January 1, 2020, NorthernGrid is an association of all major transmission providers throughout the Pacific Northwest and Intermountain West, with facilities in California, Idaho, Montana, Oregon, Utah, Washington and Wyoming. Through its participation in NorthernGrid, the Company is able to meet the regional transmission planning requirements of FERC Order Nos. 890 and 1000, and their follow-on orders. NorthernGrid and its members also work with

19

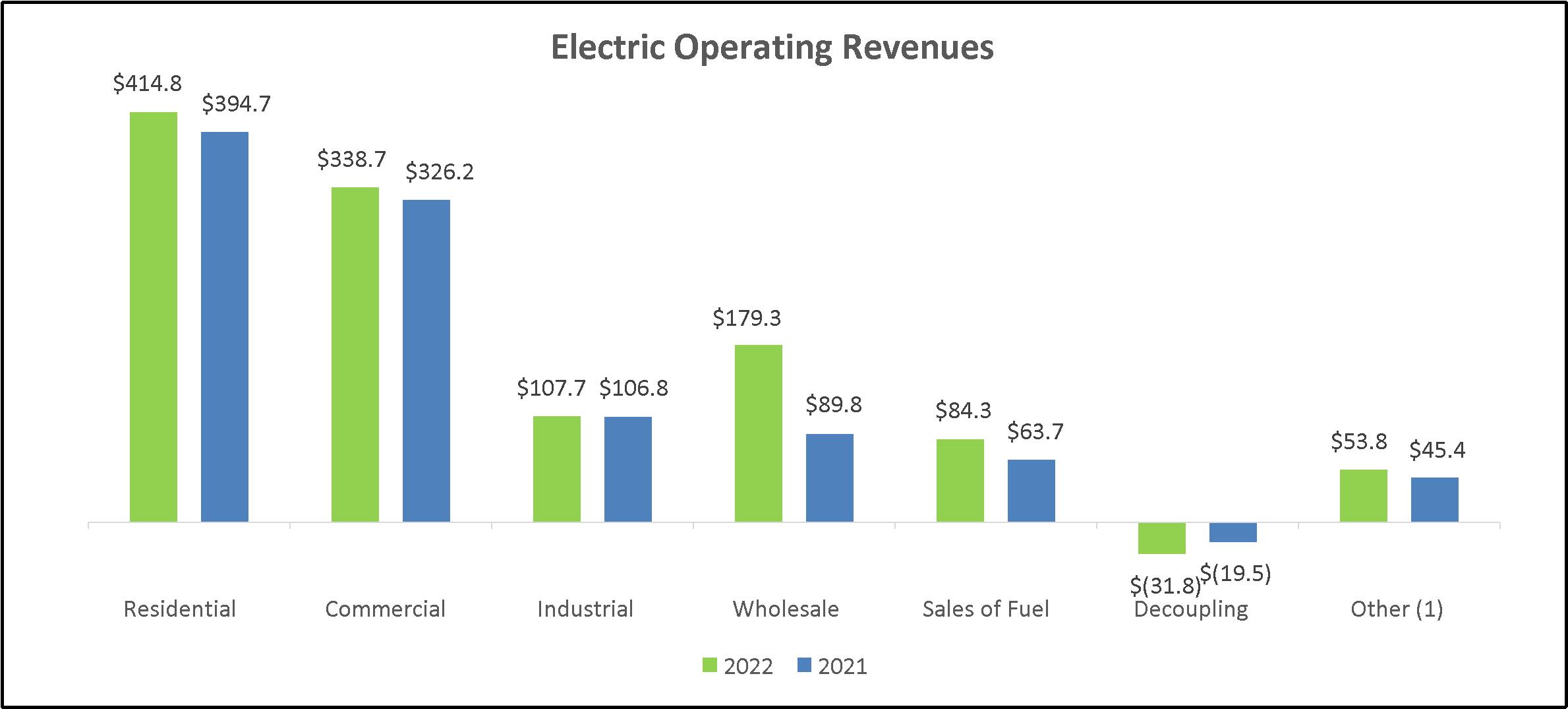

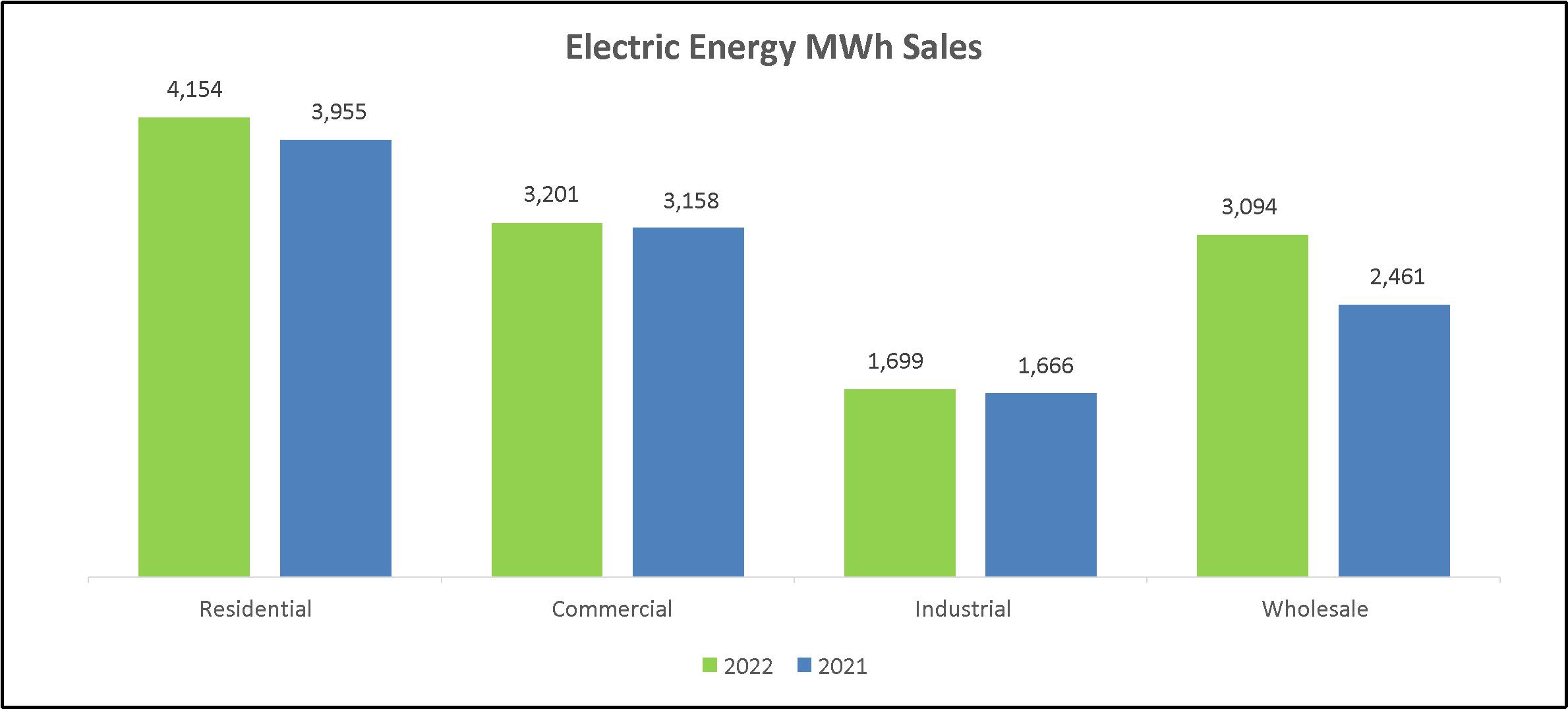

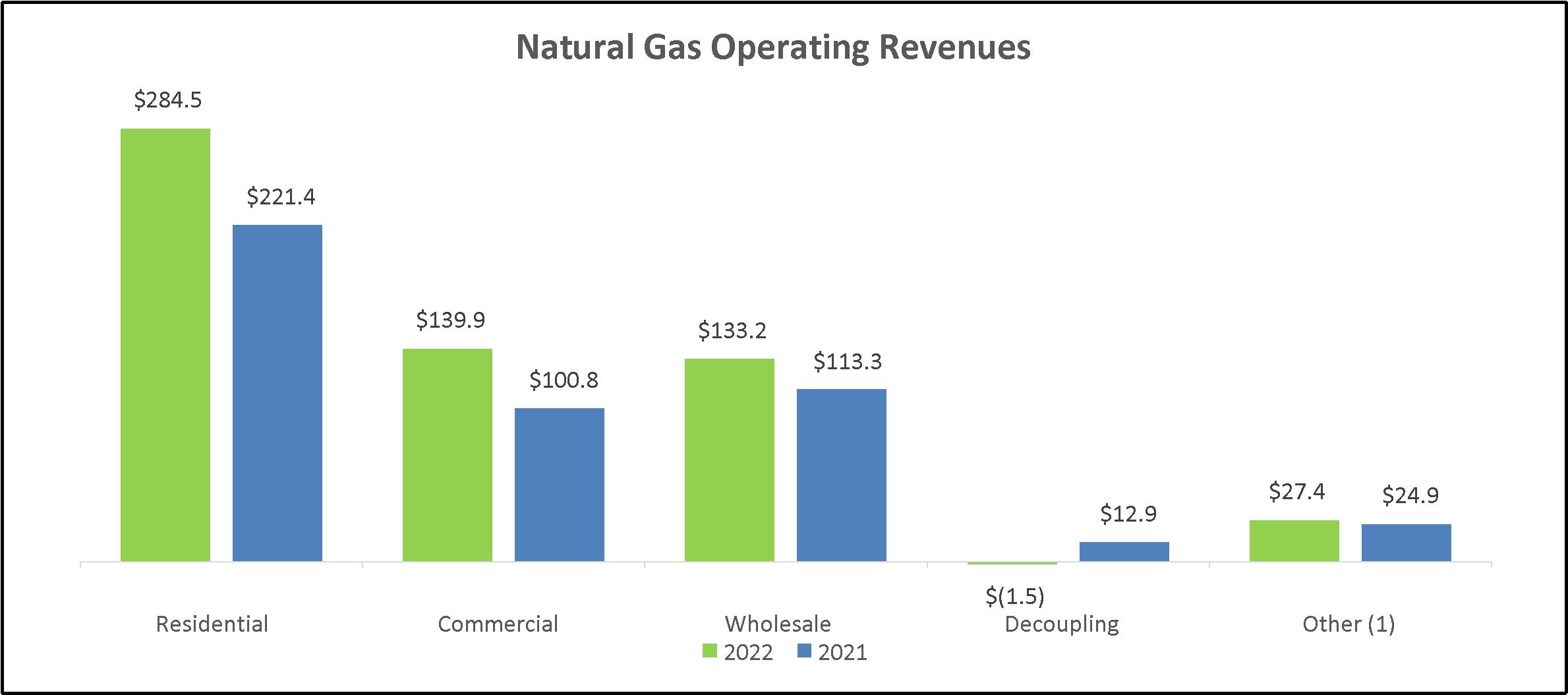

AVISTA CORPORATION