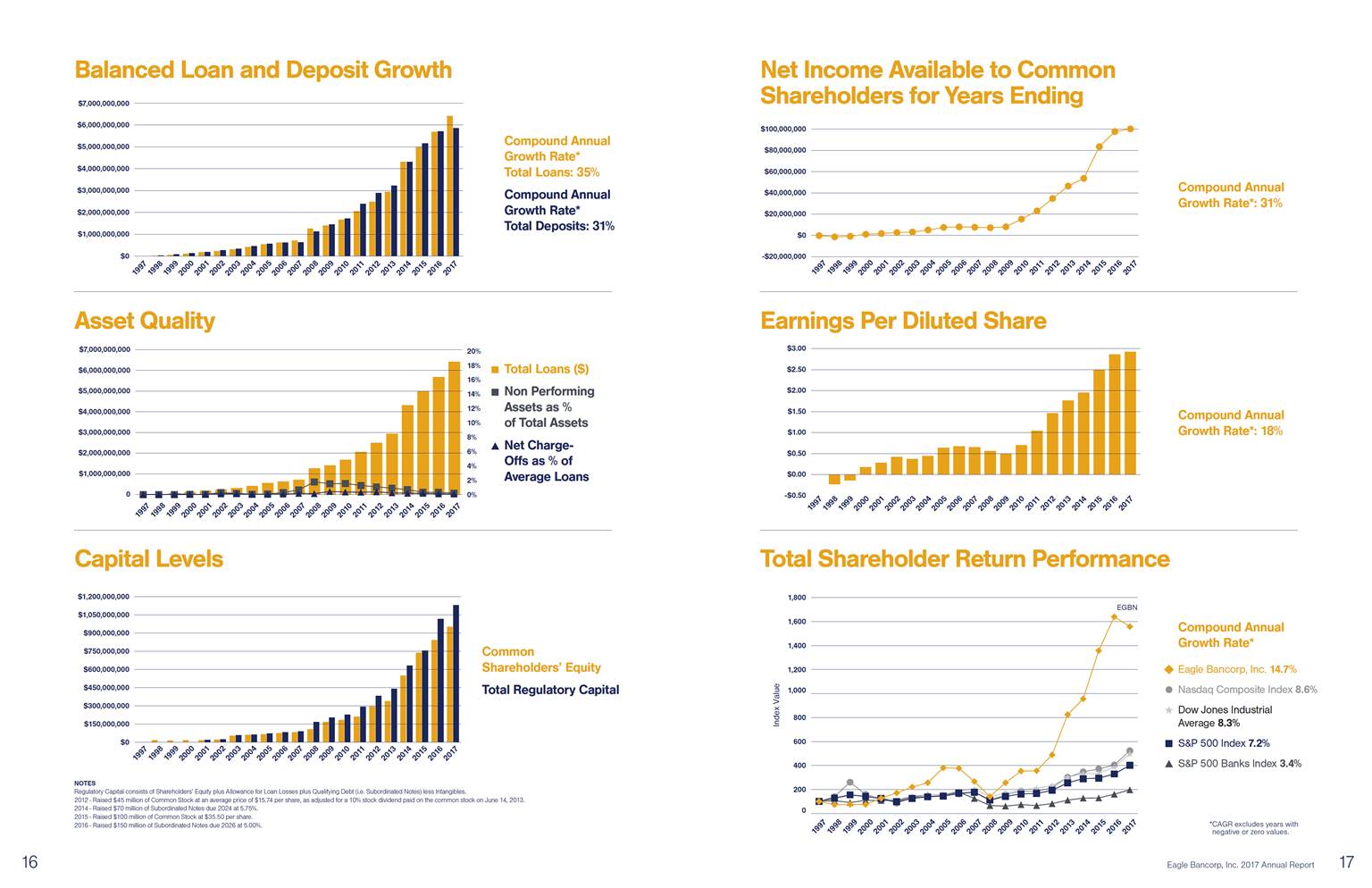

20 years: the long and the short Reflections of four employees who’ve been here all along. of it. Six-Year Summary of Selected Financial Data Years Ended December 31 Five-Year Compound Growth Rate 2017 2016 2015 2014 2013 2012 Securities Loans held for sale Loans Allowance for credit losses Intangible assets, net Total assets Deposits Borrowings Total liabilities Preferred shareholders’ equity Common shareholders’ equity Total shareholders’ equity Tangible common equity 1 $ 589,268 25,096 6,411,528 64,758 107,212 7,479,029 5,853,984 618,466 6,528,591 - 950,438 950,438 843,226 $ 538,108 51,629 5,677,893 59,074 107,419 6,890,096 5,716,114 285,390 6,047,297 - 842,799 842,799 735,380 $ 504,772 47,492 4,998,368 52,687 108,542 6,075,577 5,158,444 141,284 5,336,976 - 738,601 738,601 630,059 $ 404,903 44,317 4,312,399 46,075 109,908 5,246,684 4,310,768 279,224 4,625,925 71,900 548,859 620,759 438,951 $ 389,405 42,030 2,945,158 40,921 3,510 3,771,503 3,225,414 119,771 3,377,640 56,600 337,263 393,863 333,753 $310,514 226,923 2,493,095 37,492 3,785 3,409,441 2,897,222 140,638 3,059,465 56,600 293,376 349,976 289,591 14% -36% 21% 12% 95% 17% 15% 34% 16% - 27% 22% 24% “The time has gone by so quickly it doesn’t feel like 20 years. And I’d been in the banking business for nearly 20 years before starting with EagleBank. “I was taking a break from banking work, when I got a call from someone putting together the team for a new community bank. My previous banking boss had spoken highly of me—would I be interested? I had never worked at a startup, but I thought I’d meet the team and see what happened. Next thing you know, I was senior operations officer of EagleBank. “In those days, we all worked at a long table in a single office, with banker’s boxes for our files. I remember the day we completed our first loan. We had no vault, so we locked up the note in a metal box and put it in a filing cabinet. We were so proud of that first note! Interest income Interest expense Provision for credit losses Noninterest income Noninterest expense Income before taxes Income tax expense Net income Preferred dividends Net income available to common shareholders Total Revenue $ 324,034 40,147 8,971 29,372 118,552 185,736 85,504 100,232 - 100,232 313,259 $ 285,805 27,640 11,331 27,284 115,016 159,102 61,395 97,707 - 97,707 285,449 $ 253,180 19,238 14,638 26,628 110,716 135,216 51,049 84,167 601 83,566 260,570 $ 191,573 13,095 10,879 18,345 99,728 86,216 31,958 54,258 614 53,644 196,823 $ 157,294 12,504 9,602 24,716 84,579 75,325 28,318 47,007 566 46,441 169,506 $ 141,943 14,414 16,190 21,364 76,531 56,172 20,883 35,289 566 34,723 148,893 18% 23% -11% 7% 9% 27% 33% 23% - 24% 16% “Our first holiday party was all 20 of us at Ron’s house [CEO Ron Paul]. Everyone knew everyone, including their families. Now we get together in a hotel ballroom—hundreds of us. The larger the bank grows, the harder it is to keep that same family feeling. So the harder we try! Present at the creation (from left): Linda Lacy, Ron Paul, Susan Riel, Kai Hills, Olga Jean-Claude. “A lot of other things have changed over the years. Technology has made banking so different. Everything is automated, computerized, digital—and cybersecurity is now top-of-mind. “The opportunity to be part of the bank’s growth from the very beginning has been truly awesome! I have really enjoyed building long-term relationships with my clients and colleagues over the last 20 years, and hope to continue that well into the future.” Kai Hills SVP, C&I Commercial Deposit Officer Net income, basic Net income, diluted Book value Tangible book value 3 Common shares outstanding Weighted average common shares outstanding, basic Weighted average common shares outstanding, diluted $ 2.94 2.92 27.80 24.67 34,185,163 34,138,536 $ 2.91 2.86 24.77 21.61 $ 2.54 2.50 22.07 18.83 $ 2.01 1.95 18.21 14.56 30,139,396 $ 1.81 1.76 13.03 12.89 $ 1.50 1.46 11.62 11.47 14% 15% 19% 17% 6% 8% “But our culture is really the same: to work hard to do the best we can for each customer. Because banking is all about people: those we work with and those we serve. Always remembering that—I think that’s the real reason EagleBank has been so successful. 34,023,850 33,587,254 33,467,893 32,836,449 25,885,863 25,726,062 25,250,378 23,135,886 26,683,759 34,320,639 34,181,616 33,479,592 27,550,978 26,358,611 23,743,815 8% “It feels amazing—to have been here when we started in a single suite on the fifth floor, to now having 20 branches all over the region. It’s a journey I’m honored to be part of. I have met people from all walks of life, among my colleagues and all the people we assist every day. Building these long-lasting relationships, being part of a growing bank that has earned the trust and met the needs of its community—it’s been incredible.” Olga Jean-Claude Officer, Customer Service Representative, Silver Spring Branch “As a community bank, we still help lots of startups and small businesses. But we can now serve the lending needs of most any size company. We are a shining star in the industry. But there’s more to do, and we will continue to grow and continue to be the best bank in this market. Net interest margin Efficiency ratio 4 Return on average assets Return on average common equity CET1 capital (to risk weighted assets) 5 Total capital (to risk weighted assets) Tier 1 capital (to risk weighted assets) Tier 1 capital (to average assets) Tangible common equity ratio 4.15% 37.84% 1.41% 11.06% 11.23% 15.02% 11.23% 11.45% 11.44% 4.16% 40.29% 1.52% 12.27% 10.80% 14.89% 10.80% 10.72% 10.84% 4.33% 42.49% 1.49% 12.32% 10.68% 12.75% 10.68% 10.90% 10.56% 4.44% 50.67% 1.31% 13.50% - 12.97% 10.39% 10.69% 8.54% 4.30% 49.90% 1.37% 14.60% - 13.01% 11.53% 10.93% 8.86% 4.32% 51.40% 1.18% 14.14% - 12.20% 10.80% 10.44% 8.50% “Because we have great people—starting with Ron Paul. He’s a real Type A: very driven, very demanding, always ready to roll up his sleeves and work as hard as anyone. Unlike a lot of Type A’s, though, Ron’s not afraid to show his caring side. And that sets the tone for everyone here. “When the bank opened, I never expected to be working here 20 years later, much less with some of the very same people who started EagleBank. Susan Riel has been my mentor. She has shown me what works, why we value being flexible, what it takes to meet each customer’s needs. I have worked at EagleBank longer than anywhere else in my career, and I still truly enjoy working with this dedicated team. I’ve made so many lifetime memories here.” Linda Lacy SVP, Applications Manager Nonperforming assets and loans 90+ past due Nonperforming assets and loans 90+ past due to total assets Nonperforming loans to total loans Allowance for credit losses to loans Allowance for credit losses to nonperforming loans Net charge-offs Net charge-offs to average loans $ 14,632 $ 20,569 $ 19,091 $ 35,667 $ 33,927 $ 35,983 “You know, it’s hard to excel at something you don’t love. At EagleBank, we all work hard because we love what we do. That’s what keeps me going. 0.20% 0.21% 1.01% 489.20% 3,286 0.06% 0.30% 0.31% 1.04% 330.49% 4,945 0.09% 0.31% 0.26% 1.05% 397.95% 8,026 0.17% 0.68% 0.52% 1.07% 205.30% 5,724 0.17% 0.90% 0.84% 1.39% 165.66% 6,173 0.23% 1.06% 1.23% 1.50% 122.19% 8,351 0.37% “I have been fortunate in my career. It has been a great journey.” Susan Riel SEVP and Chief Operating Officer $ $ $ $ $ $ 1 Tangible common shareholders’ equity, a non-GAAP financial measure, is defined as total common shareholders’ equity reduced by goodwill and other intangible assets. 2 Presented giving retroactive effect to a 10% stock dividend paid on the common stock on June 14, 2013. 3 Tangible book value per common share, a non-GAAP financial measure, is defined as tangible common shareholders’ equity divided by total common shares outstanding. 4 Computed by dividing noninterest expense by the sum of net interest income and noninterest income. 14 5 Not applicable to fiscal years prior to 2015. 15 Eagle Bancorp, Inc. 2017 Annual Report ASSET QUALITY (dollars in thousands) RATIOS PER COMMON SHARE DATA 2 STATEMENT OF OPERATIONS (dollars in thousands) BALANCE SHEET - PERIOD END (dollars in thousands)