Welcome to Our 2022 Annual Meeting Exhibit 99.199.1

Statement Regarding Forward-Looking Information This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are not historical facts and may include expressions about Management’s strategies and Management’s expectations about financial results, new and existing programs and products, investments, relationships, opportunities and market conditions. These statements may be identified by such forward-looking terminology as “expect,” “look,” “believe,” “anticipate,” “may,” or similar statements or variations of such terms. Actual results may differ materially from such forward-looking statements. Factors that may cause actual results to differ materially from those contemplated by such forward-looking statements include, but are not limited to: 1) inflation and our ability to successfully grow our business and implement our strategic plan, including our ability to generate revenues to offset the increased personnel and other costs related to the strategic plan; 2) the current or anticipated impact of military conflict, terrorism or other geopolitical events; the impact of anticipated higher operating expenses in 2022 and beyond; 3) our ability to successfully integrate wealth management firm acquisitions; 4) our ability to manage our growth; 5) our ability to successfully integrate our expanded employee base; 6) an unexpected decline in the economy, in particular in our New Jersey and New York market areas; 7) declines in our net interest margin caused by the interest rate environment (including the shape of the yield curve) and our highly competitive market; 8) declines in the value in our investment portfolio; 9) impact on our business from a pandemic event on our business, operations, customers, allowance for loan losses, and capital levels; 10) higher than expected increases in our allowance for loan and lease losses; 11) higher than expected increases in loan and lease losses or in the level of nonperforming loans; 12) changes in interest rates; 13) a decline in real estate values within our market areas; 14) legislative and regulatory actions (including the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act, Basel III and related regulations) that may result in increased compliance costs; 15) changes in monetary policy by the Federal Reserve Board; 16) changes to tax or accounting matters; 17) successful cyberattacks against our IT infrastructure and that of our IT providers; 18) higher than expected FDIC insurance premiums; 19) adverse weather conditions; 20) our ability to successfully generate business in new geographic markets; 21) a reduction in our lower-cost funding sources; 22) our ability to adapt to technological changes; 23) claims and litigation pertaining to fiduciary responsibility, environmental laws and other matters; 24) our ability to retain key employees; 25) demands for loans and deposits in our market areas; 26) adverse changes in securities markets and 27) other unexpected material adverse changes in our operations or earnings. Further, given its ongoing and dynamic nature, it is difficult to predict the continued impact of the COVID-19 outbreak on our business. The extent of such impact will depend on future developments, which are highly uncertain, including when the coronavirus can be controlled and abated. As the result of the COVID-19 pandemic and the related adverse local and national economic consequences, we could be subject to any of the following risks, any of which could have a material, adverse effect on our business, financial condition, liquidity, and results of operations: 1) demand for our products and services may decline, making it difficult to grow assets and income; 2) if the economy worsens, loan delinquencies, problem assets, and foreclosures may increase, resulting in increased charges and reduced income; 3) collateral for loans, especially real estate, may decline in value, which could cause loan losses to increase; 4) our allowance for loan losses may increase if borrowers experience financial difficulties, which will adversely affect our net income; 5) the net worth and liquidity of loan guarantors may decline, impairing their ability to honor commitments to us; 6) a material decrease in net income or a net loss over several quarters could result in the elimination or a decrease in the rate of our quarterly cash dividend; 7) our wealth management revenues may decline with continuing market turmoil; 8) our cyber security risks are increased as the result of an increase in the number of employees working remotely; and 9) FDIC premiums may increase if the agency experience additional resolution costs. The Company undertakes no duty to update any forward-looking statement to conform the statement to actual results or changes in the Company’s expectations. Although we believe that the expectations reflected in the forward-looking statements are reasonable, the Company cannot guarantee future results, levels of activity, performance or achievements. 2

2021 was a record year: revenue up 11%; pretax income before provision for loan losses up 31%; net income up 116%. Peapack Private Wealth Management had a record year as income grew $12MM or 30% and ended the year at $11.1B in AUM/AUA. Total fee income grew $17MM or 31% (excluding PPP gains) to a record $71MM. Mortgage banking fee income totaled only $2MM and is not a material source of revenue. Effectively deployed excess liquidity (net loans up 15% excluding PPP). Core deposits grew 14% or $594MM and comprise 89% of total deposits. Continued to expand Net Interest Margin, up 21 bps from Q4 2020 to Q4 2021. Well positioned for rate hikes (40% of loans re-price within 90 days; 52% re-price within 1 year). Favorable asset-sensitivity profile relative to NJ peers (#1 out of 14). Repurchased 895K shares of stock; announced an additional 5% program. ABA Best Banks To Work For four years in a row. Investment grade ratings from Moody’s and Kroll. 2021: A Year In Review 3

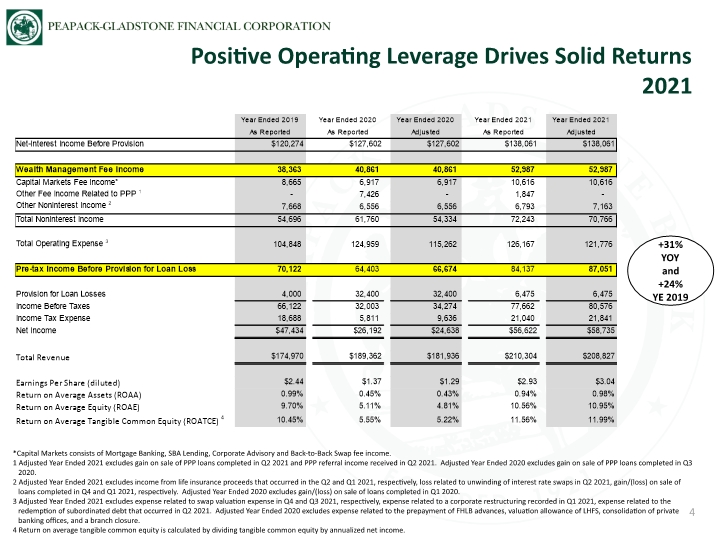

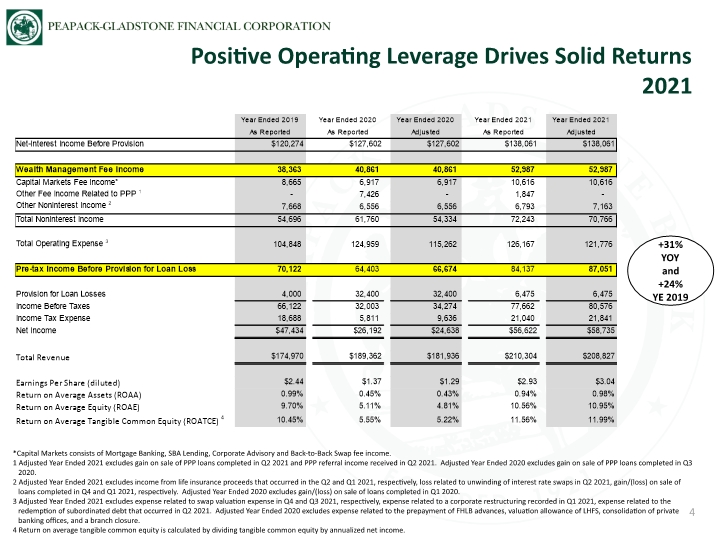

Positive Operating Leverage Drives Solid Returns 2021 4 *Capital Markets consists of Mortgage Banking, SBA Lending, Corporate Advisory and Back-to-Back Swap fee income. 1 Adjusted Year Ended 2021 excludes gain on sale of PPP loans completed in Q2 2021 and PPP referral income received in Q2 2021. Adjusted Year Ended 2020 excludes gain on sale of PPP loans completed in Q3 2020. 2 Adjusted Year Ended 2021 excludes income from life insurance proceeds that occurred in the Q2 and Q1 2021, respectively, loss related to unwinding of interest rate swaps in Q2 2021, gain/(loss) on sale of loans completed in Q4 and Q1 2021, respectively. Adjusted Year Ended 2020 excludes gain/(loss) on sale of loans completed in Q1 2020. 3 Adjusted Year Ended 2021 excludes expense related to swap valuation expense in Q4 and Q3 2021, respectively, expense related to a corporate restructuring recorded in Q1 2021, expense related to the redemption of subordinated debt that occurred in Q2 2021. Adjusted Year Ended 2020 excludes expense related to the prepayment of FHLB advances, valuation allowance of LHFS, consolidation of private banking offices, and a branch closure. 4 Return on average tangible common equity is calculated by dividing tangible common equity by annualized net income. +31% YOY and +24% YE 2019

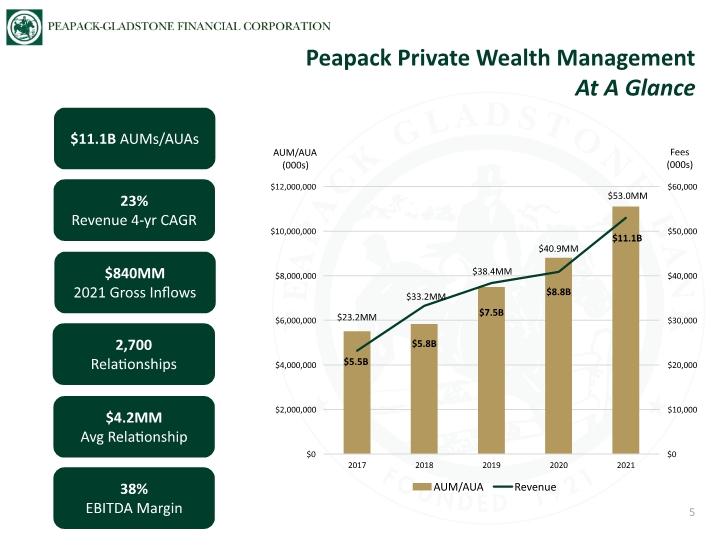

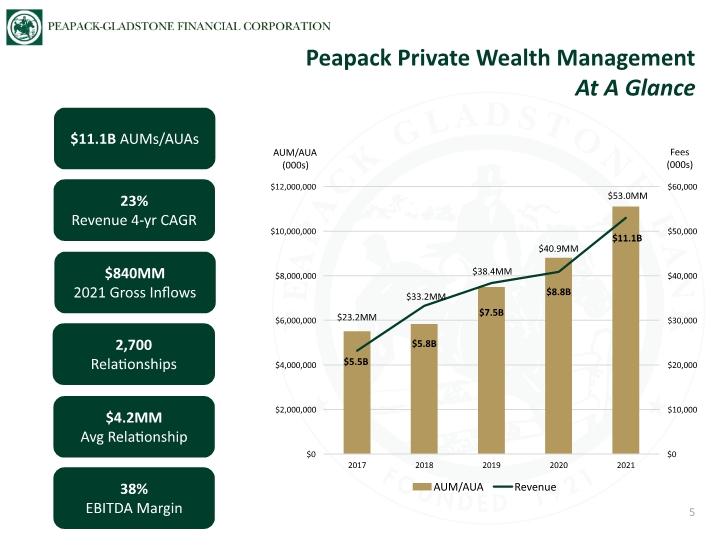

AUM/AUA (000s) Fees (000s) Peapack Private Wealth Management At A Glance 5 $11.1B AUMs/AUAs 38% EBITDA Margin 2,700 Relationships 23% Revenue 4-yr CAGR $4.2MM Avg Relationship $840MM 2021 Gross Inflows

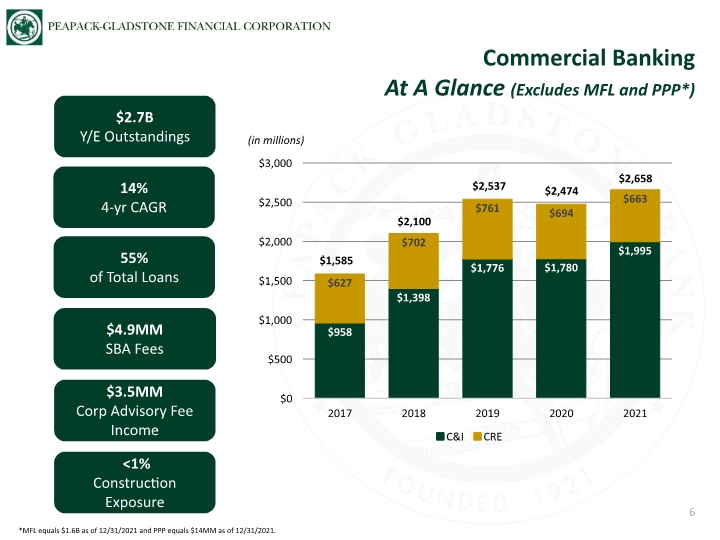

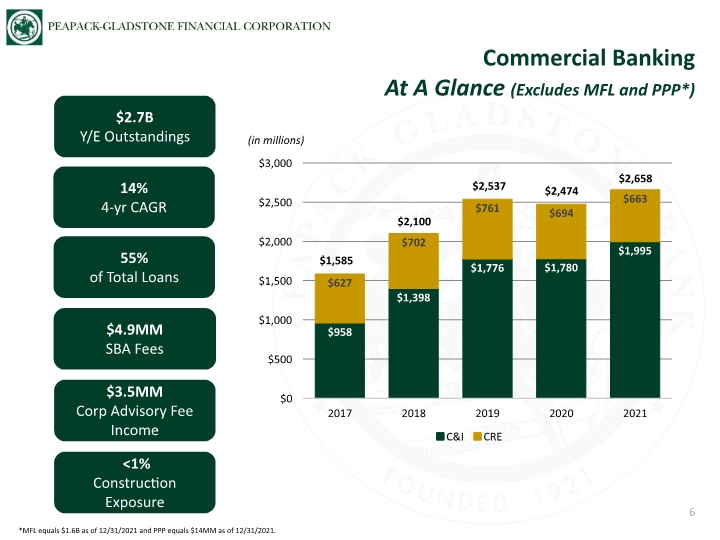

Commercial Banking At A Glance (Excludes MFL and PPP*) 6 $2.7B Y/E Outstandings <1% Construction Exposure $4.9MM SBA Fees 55% of Total Loans $3.5MM Corp Advisory Fee Income (in millions) $1,585 14% 4-yr CAGR *MFL equals $1.6B as of 12/31/2021 and PPP equals $14MM as of 12/31/2021. $2,100 $2,474 $2,658 $2,537

NIM (as reported) (%) 7 Net Interest Margin Improved in 2021 and Will Expand with Rising Rates 1-Month Libor @ Period End 0.144% 0.111% 0.101% 0.080% 0.101% Net Interest Income expected to benefit 2% in Year 1 and 8.5% in Year 2 from a +200 bps rate increase (assumes 45% deposit beta). 38% of loans reprice within 3 months, 50% reprice within a year.

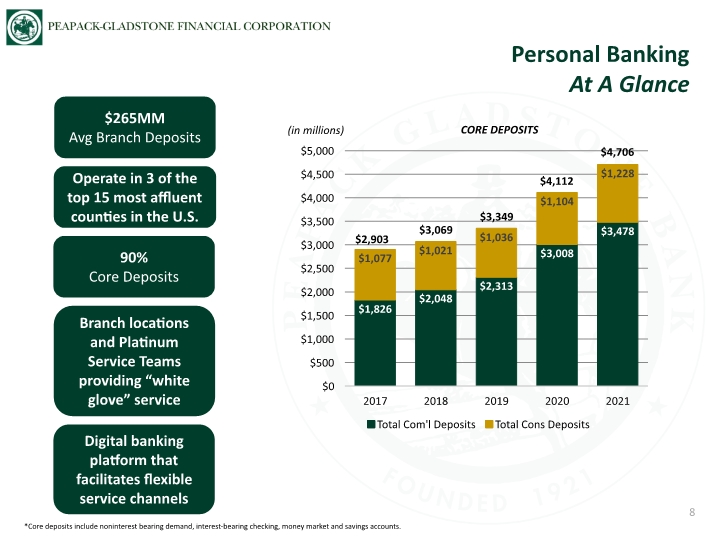

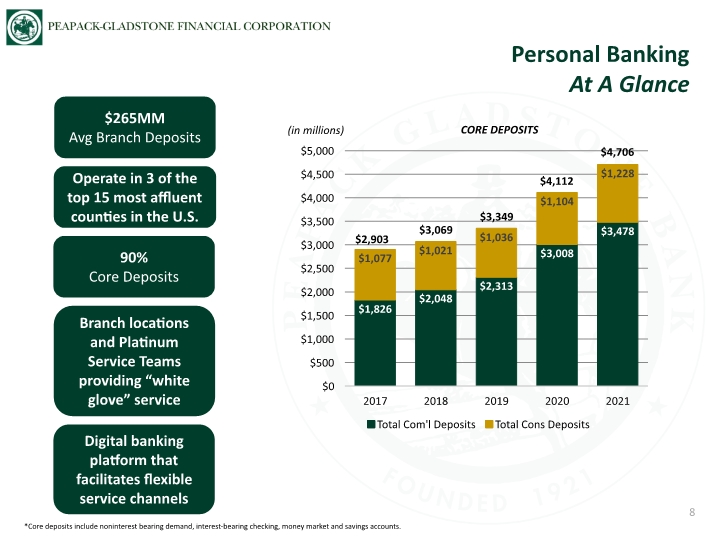

8 $265MM Avg Branch Deposits Operate in 3 of the top 15 most affluent counties in the U.S. Branch locations and Platinum Service Teams providing “white glove” service Digital banking platform that facilitates flexible service channels 90% Core Deposits Personal Banking At A Glance $2,903 $3,069 $3,349 $4,112 $4,706 (in millions) *Core deposits include noninterest bearing demand, interest-bearing checking, money market and savings accounts. CORE DEPOSITS

Adjusted: EPS $1.02; ROA 1.25%; ROE 14.19%; ROTE 15.58%. Net interest margin up 23 bps linked quarter. Positioned positively for additional rate hikes – 38% of loans reprice within 3 months and 50% within 1 year. Loans increased $305MM or 6.3% during the quarter. Growth partially funded through a balance sheet repositioning strategy – benefit future NIM 4 bps. C&I loan/lease balances comprise 40% of total loans. Strong asset quality. 30-89 day past dues were only $600K. Capital markets fees totaled $4.7MM ($11.7MM for trailing 12 months). Mortgage banking fees nominal percent of total revenue. Wealth Management fees totaled $14.8MM, up 6% linked quarter and 22% YOY. AUM/AUA totaled $10.7B at quarter end. Gross client inflows totaled $350MM for the quarter. Core deposits grew to 90% of total deposits. 300,000 shares repurchased at a cost of $11.2MM. Q1 2022 Highlights 9

10 PGC’s Valuation vs. Wealth Management Peers Indicates Significant Upside Share Price Potential Note: Pricing data as of 04/19/2022; TBV as reported for the period ended 12/31/2021 and not pro forma for pending acquisitions. Wealth Management Institutions: UVSP – Univest Financial Corp., CATC – Cambridge Bancorp, WASH – Washington Trust Bancorp, and TMP - Tompkins Financial Corporation. Source: S&P Global Market Intelligence Price/TBV

Current TBV multiple lags wealth management peers providing potential share price appreciation. $10.7B AUM/AUA ($59MM annualized revenue) wealth management business with significant value. Wealth management, commercial banking and capital markets activities provide diverse and stable revenue streams over time. Total fee income 35% of total revenue for Q1 2022. Attractive geographic franchise. Operates in three of the top 15 wealthiest counties in the U.S. Highly efficient branch network with average deposits per branch of $269MM. Positioned to benefit from rate increases. Core deposits totaled 90% of total deposits at quarter end. Strong asset quality. 30-89 day past dues were only $600K at quarter end. Proven management team – track record of building a successful wealth management business and a full-service commercial bank including corporate advisory services. Investment grade ratings from both Moody’s and Kroll. ABA Best Banks To Work For four years in a row. Compelling Investment Considerations 11

Q&A 2022 Annual Meeting