UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-08603

Name of Fund: BlackRock Debt Strategies Fund, Inc. (DSU)

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Debt Strategies Fund, Inc., 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800)882-0052, Option 4

Date of fiscal year end: 02/28/2020

Date of reporting period: 08/31/2019

Item 1 – Report to Stockholders

AUGUST 31, 2019

| | |

SEMI-ANNUAL REPORT (UNAUDITED) | |  |

BlackRock Debt Strategies Fund, Inc. (DSU)

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from BlackRock or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

You may elect to receive all future reports in paper free of charge. If you hold accounts directly with BlackRock, you can call Computershare at(800) 699-1236 to request that you continue receiving paper copies of your shareholder reports. If you hold accounts through a financial intermediary, you can follow the instructions included with this disclosure, if applicable, or contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. Please note that not all financial intermediaries may offer this service. Your election to receive reports in paper will apply to all funds advised by BlackRock Advisors, LLC or its affiliates, or all funds held with your financial intermediary, as applicable.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive electronic delivery of shareholder reports and other communications by contacting your financial intermediary, if you hold accounts through a financial intermediary. Please note that not all financial intermediaries may offer this service.

|

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

Supplemental Information (unaudited)

Section 19(a) Notices

The amounts and sources of distributions reported are estimates and are being provided pursuant to regulatory requirements and are not being provided for tax reporting purposes. The actual amounts and sources for tax reporting purposes will depend upon the Fund’s investment experience during the year and may be subject to changes based on tax regulations. Shareholders will receive a Form1099-DIV each calendar year that will inform them how to report these distributions for federal income tax purposes.

August 31, 2019

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Total Cumulative Distributions

for the Fiscal Period | | | % Breakdown of the Total Cumulative

Distributions for the Fiscal Period | |

| | | Net

Investment

Income | | | Net Realized

Capital Gains

Short Term | | | Net Realized

Capital Gains

Long Term | | | Return of

Capital | | | Total Per

Common

Share | | | Net

Investment

Income | | | Net Realized

Capital Gains

Short Term | | | Net Realized

Capital Gains

Long Term | | | Return of

Capital | | | Total Per

Common

Share | |

DSU | | $ | 0.411000 | | | $ | — | | | $ | — | | | $ | — | | | $ | 0.411000 | | | | 100 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 100 | % |

Section 19(a) notices for the Fund, as applicable, are available on the BlackRock website athttp://www.blackrock.com.

Section 19(b) Disclosure

On September 5, 2019, the Fund, acting pursuant to a U.S. Securities and Exchange Commission (“SEC”) exemptive order and with the approval of each Fund’s Board of Directors (the “Board”), adopted a managed distribution plan, consistent with its investment objectives and policies to support a level distribution of income, capital gains and/or return of capital (the “Plan”). In accordance with the Plan, starting in October 2019, the Fund will distribute a fixed amount of $0.0711 per share on a monthly basis.

The fixed amount distributed per share is subject to change at the discretion of the Board. Under its Plan, the Fund will distribute all available investment income to its shareholders as required by the Internal Revenue Code of 1986, as amended (the “Code”). If sufficient income (inclusive of net investment income and short-term capital gains) is not earned on a monthly basis, the Fund will distribute long-term capital gains and/or return of capital to shareholders in order to maintain a level distribution. Each monthly distribution to shareholders is expected to be at the fixed amount established by the Board; however, the Fund may make additional distributions from time to time, including additional capital gain distributions at the end of the taxable year, if required to meet requirements imposed by the Code and/or the Investment Company Act of 1940, as amended (the “1940 Act”).

Shareholders should not draw any conclusions about the Fund’s investment performance from the amount of these distributions or from the terms of the Plan. The Fund’s total return performance is presented in its financial highlights table.

The Board may amend, suspend or terminate the Plan at any time without prior notice to the Fund’s shareholders if it deems such actions to be in the best interests of the Fund or its shareholders. The suspension or termination of the Plan could have the effect of creating a trading discount (if the Fund’s stock is trading at or above net asset value) or widening an existing trading discount. The Fund is subject to risks that could have an adverse impact on its ability to maintain level distributions. Examples of potential risks include, but are not limited to, economic downturns impacting the markets, changes in interest rates, decreased market volatility, companies suspending or decreasing corporate dividend distributions and changes in the Code.

| | |

| 2 | | 2019 BLACKROCK SEMI-ANNUAL REPORTTO SHAREHOLDERS |

The Markets in Review

Dear Shareholder,

Investment performance in the 12 months ended August 31, 2019 was a tale of two markets. The first half of the reporting period was characterized by restrictive monetary policy, deteriorating economic growth, equity market volatility, and rising fear of an imminent recession. During the second half of the reporting period, stocks and bonds rebounded sharply, as restrained inflation and weak economic growth led the U.S. Federal Reserve (the “Fed”) to stop raising interest rates, which led to broad-based optimism that stimulative monetary policy could help forestall a recession.

After the dust settled, the U.S. equity and bond markets posted mixed returns while weathering significant volatility. Less volatile U.S. large cap equities and U.S. bonds advanced, while equities at the high end of the risk spectrum — emerging markets, international developed, and U.S. small cap — posted negative returns.

Fixed-income securities delivered strong returns with relatively low volatility, as interest rates declined (and bond prices rose). Longer-term U.S. Treasury yields declined further than short-term Treasury yields. This led to positive returns for U.S. Treasuries across the maturity spectrum and a substantial flattening of the yield curve. Investment grade and high yield corporate bonds also posted positive returns, as the credit fundamentals in corporate markets remained relatively solid.

In the U.S. equity market, volatility spiked in late 2018, as a wide range of risks were brought to bear on markets, ranging from rising interest rates and slowing global growth to heightened trade tensions and political turmoil. These risks manifested in a broad-basedsell-off in December, leading to the worst December performance on record since 1931.

Volatility also rose in emerging markets, as the rising U.S. dollar and higher interest rates in the U.S. disrupted economic growth abroad. U.S.-China trade relations and debt concerns adversely affected the Chinese stock market, particularly in mainland China, while Turkey and Argentina became embroiled in currency crises, largely due to hyperinflation in both countries. An economic slowdown in Europe and ongoing uncertainty about Brexit led to modest performance for European equities.

As equity performance faltered and global economic growth slowed, the Fed shifted to a more patient perspective on the economy in January 2019. The Fed left interest rates unchanged for six months, then lowered interest rates for the first time in 11 years in July 2019. Similarly, the European Central Bank and the Bank of Japan signaled a continuation of accommodative monetary policy, while China committed to looser credit conditions and an increase in fiscal spending.

The outpouring of global economic stimulus led to a sharp rally in risk assets throughout the world. Hopes continued to remain high thereafter, as the current economic expansion became the longest in U.S. history. Looking ahead, markets are pricing in additional rate cuts by the Fed over the next year, as investors anticipate a steady shift toward more stimulative monetary policy.

We expect a slowing expansion with additional room to run, as opposed to an economic recession. However, escalating trade tensions and the resulting disruptions in global supply chains have become the greatest risk to the global expansion.

We believe U.S. and emerging market equities remain relatively attractive. Within U.S. equities, companies with high-quality earnings and strong balance sheets offer the most attractive risk/rewardtrade-off. For bonds, U.S. Treasuries are likely to help buffer against volatility in risk assets, while income from other types of bonds can continue to offer steady returns.

In this environment, investors need to think globally, extend their scope across a broad array of asset classes, and be nimble as market conditions change. We encourage you to talk with your financial advisor and visitblackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| | | | |

| Total Returns as of August 31, 2019 |

| | | 6-month | | 12-month |

U.S. large cap equities

(S&P 500® Index) | | 6.15% | | 2.92% |

U.S. small cap equities

(Russell 2000® Index) | | (4.43) | | (12.89) |

International equities

(MSCI Europe, Australasia, Far East Index) | | 0.34 | | (3.26) |

Emerging market equities

(MSCI Emerging Markets Index) | | (4.68) | | (4.36) |

3-month Treasury bills

(ICE BofAML3-Month U.S. Treasury Bill Index) | | 1.25 | | 2.36 |

U.S. Treasury securities

(ICE BofAML10-Year U.S. Treasury Index) | | 12.18 | | 15.06 |

U.S. investment grade bonds

(Bloomberg Barclays U.S. Aggregate Bond Index) | | 8.02 | | 10.17 |

Tax-exempt municipal bonds

(S&P Municipal Bond Index) | | 5.92 | | 8.26 |

U.S. high yield bonds

(Bloomberg Barclays U.S. Corporate High Yield 2% Issuer Capped Index) | | 4.46 | | 6.56 |

| Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. |

| | | | |

| THIS PAGEISNOT PARTOF YOUR FUND REPORT | | | 3 | |

Table of Contents

| | |

| Fund Summary as of August 31, 2019 | | BlackRock Debt Strategies Fund, Inc. |

Fund Overview

BlackRock Debt Strategies Fund, Inc.’s (DSU) (the “Fund”) primary investment objective is to seek to provide current income by investing primarily in a diversified portfolio of U.S. companies’ debt instruments, including corporate loans, which are rated in the lower rating categories of the established rating services (BBB or lower by S&P Global Ratings or Baa or lower by Moody’s Investors Service, Inc. (“Moody’s”)) or unrated debt instruments, which are in the judgment of the investment adviser of equivalent quality. Corporate loans include senior and subordinated corporate loans, both secured and unsecured. The Fund may invest directly in debt instruments or synthetically through the use of derivatives. The Fund’s secondary investment objective is to provide capital appreciation.

No assurance can be given that the Fund’s investment objectives will be achieved.

Fund Information

| | |

Symbol on New York Stock Exchange (“NYSE”) | | DSU |

Initial Offering Date | | March 27, 1998 |

Current Distribution Rate on Closing Market Price as of August 31, 2019 ($10.70)(a) | | 7.68% |

Current Monthly Distribution per Common Share(b) | | $0.0685 |

Current Annualized Distribution per Common Share(b) | | $0.8220 |

Leverage as of August 31, 2019(c) | | 30% |

| | (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. Past performance does not guarantee future results. | |

| | (b) | The monthly distribution per Common Share, declared on October 1, 2019 was increased to $0.0711 per share. The current distribution rate on closing market price, current monthly distribution per Common Share, and current annualized distribution per Common Share do not reflect the new distribution rate. The new distribution rate is not constant and is subject to change in the future. | |

| | (c) | Represents bank borrowings outstanding as a percentage of total managed assets, which is the total assets of the Fund (including any assets attributable to borrowings) minus the sum of liabilities (other than borrowings representing financial leverage). Does not reflect derivatives or other instruments that may give rise to economic leverage. For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging and Derivative Financial Instruments on page 7. | |

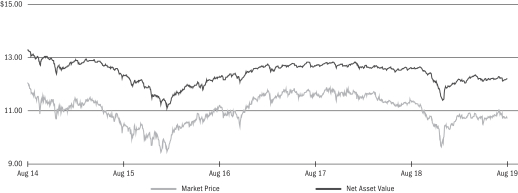

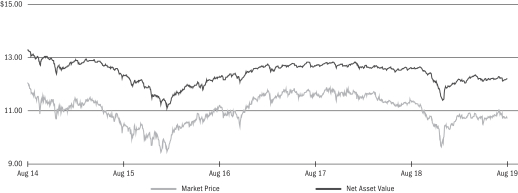

Market Price and Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

| | | 08/31/19 | | | 02/28/19 | | | Change | | | High | | | Low | |

Market Price | | $ | 10.70 | | | $ | 10.78 | | | | (0.74 | )% | | $ | 11.02 | | | $ | 10.46 | |

Net Asset Value | | | 12.18 | | | | 12.16 | | | | 0.16 | | | | 12.32 | | | | 12.03 | |

Market Price and Net Asset Value History For the Past Five Years

| | |

| Fund Summary as of August 31, 2019 (continued) | | BlackRock Debt Strategies Fund, Inc. |

Performance and Portfolio Management Commentary

Returns for the period ended August 31, 2019 were as follows:

| | | | | | | | | | | | | | | | | | | | |

| | | 6-Month

Total Returns | | | | | | Average Annual Total Returns | |

| | | | | | 1 Year | | | 3 Years | | | 5 Years | |

Fund at NAV(a)(b) | | | 4.04 | % | | | | | | | 4.56 | % | | | 7.36 | % | | | 5.76 | % |

Fund at Market Price(a)(b) | | | 3.10 | | | | | | | | 1.90 | | | | 6.13 | | | | 5.08 | |

Reference Benchmark(c) | | | 3.25 | | | | | | | | 4.95 | | | | 5.42 | | | | 4.32 | |

Bloomberg Barclays U.S. Corporate High Yield 2% Issuer Capped Index(d) | | | 4.46 | | | | | | | | 6.56 | | | | 6.17 | | | | 4.86 | |

S&P/LSTA Leveraged Loan Index(e) | | | 2.03 | | | | | | | | 3.33 | | | | 4.66 | | | | 3.76 | |

| | (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. Performance results reflect the Fund’s use of leverage. | |

| | (b) | The Fund’s discount to NAV widened during the period, which accounts for the difference between performance based on market price and performance based on NAV. | |

| | (c) | The Reference Benchmark is comprised of the Bloomberg Barclays U.S. Corporate High Yield 2% Issuer Capped Index (50%) and the S&P/LSTA Leveraged Loan Index (50%). The Reference Benchmark’s index content and weightings may have varied over past periods. | |

| | (d) | An unmanaged index comprised of issuers that meet the following criteria: at least $150 million par value outstanding; maximum credit rating of Ba1; at least one year to maturity; and no issuer represents more than 2% of the index. | |

| | (e) | An unmanaged market value-weighted index designed to measure the performance of the U.S. leveraged loan market based upon market weightings, spreads and interest payments. | |

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Past performance is not indicative of future results.

DSU is presenting the Reference Benchmark to accompany fund performance. The Reference Benchmark is presented for informational purposes only, as the Fund is actively managed and does not seek to track or replicate the performance of the Reference Benchmark or any other index. The portfolio investments of the Fund may differ substantially from the securities that comprise the indices within the Reference Benchmark, which may cause the Fund’s performance to differ materially from that of the Reference Benchmark. The Fund employs leverage as part of its investment strategy, which may change over time at the discretion of BlackRock Advisors, LLC (the “Manager”) as market and other conditions warrant. In contrast, the Reference Benchmark is not adjusted for leverage. Therefore, leverage generally may result in the Fund outperforming the Reference Benchmark in rising markets and underperforming in declining markets. The Board considers additional factors to evaluate the Fund’s performance, such as the performance of the Fund relative to a peer group of funds, a leverage-adjusted benchmark and/or other information provided by the Manager.

More information about the historical performance can be found in the “Closed End Funds” section ofhttp://www.blackrock.com.

The following discussion relates to the Fund’s absolute performance based on NAV:

What factors influenced performance?

For the semi-annual period, the Fund’s positioning within floating rate loan interests (“bank loans”) made the largest contribution to the Fund’s return, followed by holdings in high yield bonds. Sector positioning within technology, chemicals and consumer cyclical services represented the three largest contributors, though holdings in most sectors added to Fund performance given strong overall market performance. All credit rating segments were positive throughout the period, withB-rated credits the largest contributors, followed byBB-rated issues.

During the period, the Fund’s equity holdings modestly weighed on Fund performance from an asset allocation perspective, followed by holdings in high yield credit default swaps. From a sector perspective, the Fund’s modest exposure to oil field services, independent energy and integrated energy issues detracted from the Fund’s return, as energy-related sectors came under pressure during the period.

Describe recent portfolio activity.

The Fund added to its bank loan positioning relative to both high yield bonds and collateralized loan obligations (“CLOs”) over the period. This brought the Fund’s total loan exposure to approximately 80% of the portfolio, with high yield bonds at approximately 17% and no exposure to CLOs by period end. Sector expressions remained broadly consistent over the past several quarters, though single-name positioning is arguably more important to portfolio performance. The Fund’stop-five issuer positions comprised approximately 8.5% of portfolio assets at the close of the period.

Describe portfolio positioning at period end.

At period end, bank loans remained the largest allocation in the portfolio, with high yield bonds also representing a meaningful position. The Fund’s largest positions were within the technology, consumer cyclical services and health care sectors. By contrast, the Fund had less exposure to communications names — specifically within wirelines and cable — as well as less exposure to retailers and home construction. Within energy, the Fund emphasized higher quality issuers within the independent energy sector, and approached more cyclical names within oil field services with caution. The Fund’s core positioning remained betweenBB-rated andB-rated issues, with a higher allocation toB-rated names at period end. The Fund also held a smallCCC-rated allocation.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| 6 | | 2019 BLACKROCK SEMI-ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Fund Summary as of August 31, 2019 (continued) | | BlackRock Debt Strategies Fund, Inc. |

Overview of the Fund’s Total Investments

PORTFOLIO COMPOSITION

| | | | | | | | |

| | | 08/31/19 | | | 02/28/19 | |

Floating Rate Loan Interests | | | 79 | % | | | 70 | % |

Corporate Bonds | | | 17 | | | | 26 | |

Investment Companies | | | 3 | | | | 1 | |

Preferred Securities | | | 1 | | | | 1 | |

Asset-Backed Securities | | | — | | | | 2 | |

Other | | | — | (a) | | | — | (a) |

| | (a) | Includes a less than 1% holding in each of the following investment types: Common Stocks, Options Purchased, Other Interests and Warrants. | |

CREDIT QUALITY ALLOCATION (b)

| | | | | | | | |

| | | 08/31/19 | | | 02/28/19 | |

BBB/Baa | | | 7 | % | | | 9 | % |

BB/Ba | | | 31 | | | | 33 | |

B | | | 56 | | | | 50 | |

CCC/Caa | | | 3 | | | | 5 | |

N/R | | | 3 | | | | 3 | |

| | (b) | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. | |

The Benefits and Risks of Leveraging

The Fund may utilize leverage to seek to enhance the distribution rate on, and net asset value (“NAV”) of, its common shares (“Common Shares”). However, there is no guarantee that these objectives can be achieved in all interest rate environments.

In general, the concept of leveraging is based on the premise that the financing cost of leverage, which is based on short-term interest rates, is normally lower than the income earned by the Fund on its longer-term portfolio investments purchased with the proceeds from leverage. To the extent that the total assets of the Fund (including the assets obtained from leverage) are invested in higher-yielding portfolio investments, the Fund’s shareholders benefit from the incremental net income. The interest earned on securities purchased with the proceeds from leverage (after paying the leverage costs) is paid to shareholders in the form of dividends, and the value of these portfolio holdings (less the leverage liability) is reflected in the per share NAV.

To illustrate these concepts, assume the Fund’s capitalization is $100 million and it utilizes leverage for an additional $30 million, creating a total value of $130 million available for investment in longer-term income securities. If prevailing short-term interest rates are 3% and longer-term interest rates are 6%, the yield curve has a strongly positive slope. In this case, the Fund’s financing costs on the $30 million of proceeds obtained from leverage are based on the lower short-term interest rates. At the same time, the securities purchased by the Fund with the proceeds from leverage earn income based on longer-term interest rates. In this case, the Fund’s financing cost of leverage is significantly lower than the income earned on the Fund’s longer-term investments acquired from such leverage proceeds, and therefore the holders of Common Shares (“Common Shareholders”) are the beneficiaries of the incremental net income.

However, in order to benefit shareholders, the return on assets purchased with leverage proceeds must exceed the ongoing costs associated with the leverage. If interest and other costs of leverage exceed the Fund’s return on assets purchased with leverage proceeds, income to shareholders is lower than if the Fund had not used leverage. Furthermore, the value of the Fund’s portfolio investments generally varies inversely with the direction of long-term interest rates, although other factors can influence the value of portfolio investments. In contrast, the value of the Fund’s obligations under its leverage arrangement generally does not fluctuate in relation to interest rates. As a result, changes in interest rates can influence the Fund’s NAVs positively or negatively. Changes in the future direction of interest rates are very difficult to predict accurately, and there is no assurance that the Fund’s intended leveraging strategy will be successful.

The use of leverage also generally causes greater changes in the Fund’s NAV, market price and dividend rates than comparable portfolios without leverage. In a declining market, leverage is likely to cause a greater decline in the NAV and market price of the Fund’s shares than if the Fund were not leveraged. In addition, the Fund may be required to sell portfolio securities at inopportune times or at distressed values in order to comply with regulatory requirements applicable to the use of leverage or as required by the terms of leverage instruments, which may cause the Fund to incur losses. The use of leverage may limit the Fund’s ability to invest in certain types of securities or use certain types of hedging strategies. The Fund incurs expenses in connection with the use of leverage, all of which are borne by shareholders and may reduce income to the shareholders. Moreover, to the extent the calculation of the Fund’s investment advisory fees includes assets purchased with the proceeds of leverage, the investment advisory fees payable to the Fund’s investment adviser will be higher than if the Fund did not use leverage.

The Fund may utilize leverage through a credit facility as described in the Notes to Financial Statements.

Under the Investment Company Act of 1940, as amended (the “1940 Act”), the Fund is permitted to issue debt up to 331⁄3% of its total managed assets. The Fund may voluntarily elect to limit its leverage to less than the maximum amount permitted under the 1940 Act. In addition, the Fund may also be subject to certain asset coverage, leverage or portfolio composition requirements imposed by its credit facility, which may be more stringent than those imposed by the 1940 Act.

Derivative Financial Instruments

The Fund may invest in various derivative financial instruments. These instruments are used to obtain exposure to a security, commodity, index, market, and/or other assets without owning or taking physical custody of securities, commodities and/or other referenced assets or to manage market, equity, credit, interest rate, foreign currency exchange rate, commodity and/or other risks. Derivative financial instruments may give rise to a form of economic leverage and involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the instrument. The Fund’s successful use of a derivative financial instrument depends on the investment adviser’s ability to predict pertinent market movements accurately, which cannot be assured. The use of these instruments may result in losses greater than if they had not been used, may limit the amount of appreciation the Fund can realize on an investment and/or may result in lower distributions paid to shareholders. The Fund’s investments in these instruments, if any, are discussed in detail in the Notes to Financial Statements.

| | |

| 8 | | 2019 BLACKROCK SEMI-ANNUAL REPORTTO SHAREHOLDERS |

| | |

Schedule of Investments (unaudited) August 31, 2019 | | BlackRock Debt Strategies Fund, Inc. (DSU) (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Security | | | Shares | | | Value | |

|

Common Stocks — 0.1% | |

|

Diversified Financial Services — 0.1% | |

Kcad Holdings I Ltd.(a)(b) | | | | | | | 1,075,282,733 | | | $ | 752,698 | |

| | | | | | | | |

|

| Health Care Management Services — 0.0% | |

New Millennium HoldCo, Inc.(b) | | | | | | | 10,718 | | | | 161 | |

| | | | | | | | |

|

| Media — 0.0% | |

Adelphia Communications Corp., Class A(a)(b)(c) | | | | | | | 400,000 | | | | 4 | |

Adelphia Recovery Trust(b) | | | | | | | 396,568 | | | | 40 | |

| | | | | | | | |

| | | | | | | | | | | 44 | |

|

| Metals & Mining — 0.0% | |

Ameriforge Group, Inc. | | | | | | | 1,664 | | | | 91,520 | |

Preferred Proppants LLC(a) | | | | | | | 14,576 | | | | 32,796 | |

| | | | | | | | |

| | | | | | | | | | | 124,316 | |

|

| Semiconductors & Semiconductor Equipment — 0.0% | |

SunPower Corp.(b) | | | | | | | 1,707 | | | | 21,372 | |

| | | | | | | | |

|

| Software — 0.0% | |

Avaya Holdings Corp.(b) | | | | | | | 37 | | | | 522 | |

| | | | | | | | |

| |

Total Common Stocks — 0.1%

(Cost — $12,497,578) | | | | 899,113 | |

| | | | | | | | |

| | | |

| | | | | | Par

(000) | | | | |

|

Corporate Bonds — 24.9% | |

|

Aerospace & Defense — 1.2% | |

Arconic, Inc., 5.13%, 10/01/24 | | | USD | | | | 753 | | | | 802,432 | |

BBA US Holdings, Inc., 5.38%, 05/01/26(d) | | | | | | | 42 | | | | 43,890 | |

Bombardier, Inc.(d): | | | | | | | | | | | | |

6.13%, 01/15/23 | | | | | | | 664 | | | | 660,680 | |

7.50%, 12/01/24 | | | | | | | 402 | | | | 400,533 | |

7.50%, 03/15/25 | | | | | | | 414 | | | | 403,132 | |

7.88%, 04/15/27 | | | | | | | 122 | | | | 118,188 | |

TransDigm UK Holdings PLC, 6.88%, 05/15/26 | | | | | | | 293 | | | | 306,917 | |

TransDigm, Inc.: | | | | | | | | | | | | |

6.50%, 05/15/25 | | | | | | | 184 | | | | 191,820 | |

6.25%, 03/15/26(d) | | | | | | | 4,263 | | | | 4,598,626 | |

| | | | | | | | |

| | | | | | | | | | | 7,526,218 | |

|

| Air Freight & Logistics — 0.0% | |

XPO Logistics, Inc., 6.75%, 08/15/24(d) | | | | | | | 19 | | | | 20,473 | |

| | | | | | | | |

|

| Airlines — 0.1% | |

US Airways Pass-Through Trust, Series2013-1, Class B, 5.38%, 05/15/21 | | | | | | | 408 | | | | 425,684 | |

| | | | | | | | |

|

| Auto Components — 0.3% | |

Allison Transmission, Inc., 5.88%, 06/01/29(d) | | | | | | | 315 | | | | 337,837 | |

GKN Holdings Ltd., 4.63%, 05/12/32 | | | GBP | | | | 100 | | | | 124,787 | |

Icahn Enterprises LP/Icahn Enterprises Finance Corp.: | | | | | | | | | | | | |

6.38%, 12/15/25 | | | USD | | | | 379 | | | | 401,266 | |

6.25%, 05/15/26(d) | | | | | | | 243 | | | | 253,631 | |

IHO Verwaltungs GmbH, (3.63% Cash 4.38% PIK), 3.63%, 05/15/25(e) | | | EUR | | | | 100 | | | | 112,378 | |

NM Holdings Co. LLC, Series B, 9.50%, 07/01/05(a)(b)(c) | | | USD | | | | 5,125 | | | | — | |

Panther BF Aggregator 2 LP/Panther Finance Co., Inc.: | | | | | | | | | | | | |

4.38%, 05/15/26 | | | EUR | | | | 134 | | | | 150,218 | |

6.25%, 05/15/26(d)(f) | | | USD | | | | 45 | | | | 46,687 | |

Tesla, Inc., 5.30%, 08/15/25(d) | | | | | | | 168 | | | | 149,940 | |

| | | | | | | | | | | | |

| Security | | | | | Par

(000) | | | Value | |

|

| Auto Components (continued) | |

Venture Holdings Co. LLC, 12.00%, 06/01/09(a)(b)(c) | | | USD | | | | 5,150 | | | $ | — | |

| | | | | | | | |

| | | | | | | | | | | 1,576,744 | |

|

| Banks — 0.0% | |

Allied Irish Banks PLC (5 year EUR Swap + 3.95%), 4.13%, 11/26/25(g) | | | EUR | | | | 100 | | | | 114,439 | |

Banco Espirito Santo SA(b)(c): | | | | | | | | | | | | |

2.63%, 05/08/17 | | | | | | | 100 | | | | 23,080 | |

4.75%, 01/15/18 | | | | | | | 200 | | | | 46,160 | |

4.00%, 01/21/19 | | | | | | | 100 | | | | 23,080 | |

| | | | | | | | |

| | | | | | | | | | | 206,759 | |

|

| Building Products — 0.2% | |

Beacon Roofing Supply, Inc., 4.88%, 11/01/25(d) | | | USD | | | | 35 | | | | 34,519 | |

CPG Merger Sub LLC, 8.00%, 10/01/21(d) | | | | | | | 446 | | | | 446,557 | |

Masonite International Corp., 5.38%, 02/01/28(d) | | | | | | | 198 | | | | 208,890 | |

Standard Industries, Inc.(d): | | | | | | | | | | | | |

5.50%, 02/15/23 | | | | | | | 4 | | | | 4,100 | |

5.38%, 11/15/24 | | | | | | | 550 | | | | 565,812 | |

6.00%, 10/15/25 | | | | | | | 238 | | | | 250,198 | |

| | | | | | | | |

| | | | | | | | | | | 1,510,076 | |

|

| Capital Markets — 0.0% | |

LABL Escrow Issuer LLC, 6.75%, 07/15/26(d) | | | | | | | 154 | | | | 158,235 | |

| | | | | | | | |

|

| Chemicals — 0.5% | |

Alpha 3 BV/Alpha US Bidco, Inc., 6.25%, 02/01/25(d) | | | | | | | 1,030 | | | | 1,022,275 | |

Axalta Coating Systems LLC, 4.88%, 08/15/24(d) | | | | | | | 440 | | | | 455,444 | |

Blue Cube Spinco LLC: | | | | | | | | | | | | |

9.75%, 10/15/23 | | | | | | | 313 | | | | 343,518 | |

10.00%, 10/15/25 | | | | | | | 355 | | | | 398,487 | |

GCP Applied Technologies, Inc., 5.50%, 04/15/26(d) | | | | | | | 134 | | | | 137,015 | |

PQ Corp., 5.75%, 12/15/25(d) | | | | | | | 507 | | | | 519,675 | |

| | | | | | | | |

| | | | | | | | | | | 2,876,414 | |

|

| Commercial Services & Supplies — 0.2% | |

ADT Security Corp.: | | | | | | | | | | | | |

3.50%, 07/15/22 | | | | | | | 32 | | | | 32,080 | |

4.88%, 07/15/32(d) | | | | | | | 583 | | | | 507,939 | |

Core & Main LP, 6.13%, 08/15/25(d) | | | | | | | 391 | | | | 396,865 | |

GFL Environmental, Inc., 8.50%, 05/01/27(d) | | | | | | | 231 | | | | 252,945 | |

| | | | | | | | |

| | | | | | | | | | | 1,189,829 | |

|

| Communications Equipment — 0.5% | |

ViaSat, Inc., 5.63%, 04/15/27(d) | | | | | | | 558 | | | | 592,875 | |

Zayo Group LLC/Zayo Capital, Inc.: | | | | | | | | | | | | |

6.00%, 04/01/23 | | | | | | | 1,311 | | | | 1,352,139 | |

6.38%, 05/15/25 | | | | | | | 92 | | | | 94,645 | |

5.75%, 01/15/27(d) | | | | | | | 1,187 | | | | 1,210,740 | |

| | | | | | | | |

| | | | | | | | | | | 3,250,399 | |

|

| Construction & Engineering — 0.1% | |

Brand Industrial Services, Inc., 8.50%, 07/15/25(d) | | | | | | | 224 | | | | 197,400 | |

SRS Distribution, Inc., 8.25%, 07/01/26(d) | | | | | | | 196 | | | | 192,080 | |

| | | | | | | | |

| | | | | | | | | | | 389,480 | |

|

| Construction Materials — 0.2% | |

HD Supply, Inc., 5.38%, 10/15/26(d) | | | | | | | 895 | | | | 953,354 | |

Williams Scotsman International, Inc., 6.88%, 08/15/23(d) | | | | | | | 531 | | | | 556,222 | |

| | | | | | | | |

| | | | | | | | | | | 1,509,576 | |

|

| Consumer Discretionary — 0.1% | |

Dun & Bradstreet Corp., 6.88%, 08/15/26(d) | | | | | | | 463 | | | | 501,776 | |

ServiceMaster Co. LLC, 5.13%, 11/15/24(d) | | | | | | | 134 | | | | 140,651 | |

| | | | | | | | |

| | | | | | | | | | | 642,427 | |

| | | | |

| SCHEDULE OF INVESTMENTS | | | 9 | |

| | |

Schedule of Investments (unaudited) (continued) August 31, 2019 | | BlackRock Debt Strategies Fund, Inc. (DSU) (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Security | | | | | Par

(000) | | | Value | |

|

| Consumer Finance — 0.8% | |

Ally Financial, Inc.: | | | | | | | | | | | | |

3.88%, 05/21/24 | | | USD | | | | 158 | | | $ | 166,493 | |

8.00%, 11/01/31 | | | | | | | 709 | | | | 990,827 | |

Mulhacen Pte Ltd., (6.5% Cash or 7.25% PIK), 6.50%, 08/01/23(e) | | | EUR | | | | 100 | | | | 88,129 | |

Navient Corp.: | | | | | | | | | | | | |

6.63%, 07/26/21 | | | USD | | | | 177 | | | | 189,390 | |

5.50%, 01/25/23 | | | | | | | 267 | | | | 280,430 | |

7.25%, 09/25/23 | | | | | | | 10 | | | | 11,100 | |

6.13%, 03/25/24 | | | | | | | 96 | | | | 101,880 | |

5.88%, 10/25/24 | | | | | | | 278 | | | | 292,453 | |

Refinitiv US Holdings, Inc.: | | | | | | | | | | | | |

4.50%, 05/15/26 | | | EUR | | | | 100 | | | | 118,968 | |

4.50%, 05/15/26(d) | | | | | | | 855 | | | | 1,017,174 | |

Springleaf Finance Corp., 7.13%, 03/15/26 | | | USD | | | | 321 | | | | 366,101 | |

Verscend Escrow Corp., 9.75%, 08/15/26(d) | | | | | | | 977 | | | | 1,045,957 | |

| | | | | | | | |

| | | | | | | | | | | 4,668,902 | |

|

| Containers & Packaging — 0.5% | |

Ardagh Packaging Finance PLC/Ardagh Holdings USA, Inc.: | | | | | | | | | | | | |

4.13%, 08/15/26(d) | | | | | | | 200 | | | | 202,246 | |

4.75%, 07/15/27 | | | GBP | | | | 100 | | | | 122,948 | |

Berry Global, Inc., 4.88%, 07/15/26(d) | | | USD | | | | 338 | | | | 354,900 | |

BWAY Holding Co., 4.75%, 04/15/24 | | | EUR | | | | 100 | | | | 113,532 | |

Crown Americas LLC/Crown Americas Capital Corp., 4.25%, 09/30/26 | | | USD | | | | 107 | | | | 111,013 | |

Reynolds Group Issuer, Inc./Reynolds Group Issuer LLC/Reynolds Group Issuer Lu(d): | | | | | | | | | | | | |

5.13%, 07/15/23 | | | | | | | 165 | | | | 169,628 | |

7.00%, 07/15/24 | | | | | | | 467 | | | | 482,761 | |

Trivium Packaging Finance BV(d): | | | | | | | | | | | | |

5.50%, 08/15/26 | | | | | | | 548 | | | | 579,510 | |

8.50%, 08/15/27 | | | | | | | 954 | | | | 1,025,550 | |

| | | | | | | | |

| | | | | | | | | | | 3,162,088 | |

|

| Diversified Consumer Services — 0.3% | |

APX Group, Inc.: | | | | | | | | | | | | |

8.75%, 12/01/20 | | | | | | | 215 | | | | 204,250 | |

7.88%, 12/01/22 | | | | | | | 216 | | | | 205,470 | |

Ascend Learning LLC, 6.88%, 08/01/25(d) | | | | | | | 490 | | | | 507,762 | |

Laureate Education, Inc., 8.25%, 05/01/25(d) | | | | | | | 119 | | | | 129,561 | |

Prime Security Services Borrower LLC/Prime Finance, Inc.(d): | | | | | | | | | | | | |

5.25%, 04/15/24 | | | | | | | 186 | | | | 192,122 | |

5.75%, 04/15/26 | | | | | | | 116 | | | | 120,930 | |

Service Corp. International, 5.13%, 06/01/29 | | | | | | | 220 | | | | 235,400 | |

| | | | | | | | |

| | | | | | | | | | | 1,595,495 | |

|

| Diversified Financial Services — 0.4% | |

Allied Universal Holdco LLC/Allied Universal Finance Corp., 6.63%, 07/15/26(d) | | | | | | | 800 | | | | 850,000 | |

Barclays PLC(5 year EUR Swap + 2.45%), 2.63%, 11/11/25(g) | | | EUR | | | | 100 | | | | 111,391 | |

Cabot Financial Luxembourg II SA (3 mo. Euribor + 6.38%), 6.38%, 06/14/24(h) | | | | | | | 100 | | | | 113,321 | |

F-BrasileSpA/F-Brasile US LLC, Series XR, 7.38%, 08/15/26(d) | | | USD | | | | 200 | | | | 203,000 | |

Intrum AB, 2.75%, 07/15/22 | | | EUR | | | | 100 | | | | 111,738 | |

LHC3 PLC, (4.13% Cash or 4.88% PIK), 4.13%, 08/15/24(e) | | | | | | | 100 | | | | 113,477 | |

Tempo Acquisition LLC/Tempo Acquisition Finance Corp., 6.75%, 06/01/25(d) | | | USD | | | | 491 | | | | 504,404 | |

UniCredit SpA (5 year EUR Swap + 4.32%), 4.38%, 01/03/27(g) | | | EUR | | | | 100 | | | | 118,154 | |

| | | | | | | | |

| | | | | | | | | | | 2,125,485 | |

| | | | | | | | | | | | |

| Security | | | | | Par

(000) | | | Value | |

|

| Diversified Telecommunication Services — 0.4% | |

CenturyLink, Inc.: | | | | | | | | | | | | |

5.63%, 04/01/25 | | | USD | | | | 216 | | | $ | 220,860 | |

Series P, 7.60%, 09/15/39 | | | | | | | 132 | | | | 126,720 | |

Series U, 7.65%, 03/15/42 | | | | | | | 132 | | | | 126,060 | |

Embarq Corp., 8.00%, 06/01/36 | | | | | | | 623 | | | | 610,764 | |

Level 3 Financing, Inc., 5.25%, 03/15/26 | | | | | | | 62 | | | | 64,635 | |

SoftBank Group Corp.: | | | | | | | | | | | | |

4.00%, 04/20/23 | | | EUR | | | | 100 | | | | 119,768 | |

4.00%, 09/19/29 | | | | | | | 100 | | | | 119,290 | |

Telecom Italia Capital SA: | | | | | | | | | | | | |

6.38%, 11/15/33 | | | USD | | | | 58 | | | | 61,335 | |

6.00%, 09/30/34 | | | | | | | 195 | | | | 199,875 | |

7.20%, 07/18/36 | | | | | | | 14 | | | | 15,610 | |

7.72%, 06/04/38 | | | | | | | 51 | | | | 58,905 | |

Telecom Italia SpA: | | | | | | | | | | | | |

5.30%, 05/30/24(d) | | | | | | | 788 | | | | 843,160 | |

2.75%, 04/15/25 | | | EUR | | | | 100 | | | | 115,267 | |

| | | | | | | | |

| | | | | | | | | | | 2,682,249 | |

|

| Electric Utilities — 0.1% | |

AES Corp., 5.50%, 04/15/25 | | | USD | | | | 8 | | | | 8,350 | |

NextEra Energy Operating Partners LP(d): | | | | | | | | | | | | |

4.25%, 07/15/24 | | | | | | | 393 | | | | 403,807 | |

4.50%, 09/15/27 | | | | | | | 173 | | | | 177,758 | |

| | | | | | | | |

| | | | | | | | | | | 589,915 | |

|

| Electronic Equipment, Instruments & Components — 0.1% | |

CDW LLC/CDW Finance Corp., 5.50%, 12/01/24 | | | | | | | 185 | | | | 201,419 | |

Vertiv Group Corp., 9.25%, 10/15/24(d) | | | | | | | 618 | | | | 584,010 | |

| | | | | | | | |

| | | | | | | | | | | 785,429 | |

|

| Energy Equipment & Services — 0.2% | |

Archrock Partners LP/Archrock Partners Finance Corp., 6.88%, 04/01/27(d) | | | | | | | 107 | | | | 112,082 | |

Gates Global LLC/Gates Global Co., 6.00%, 07/15/22(d) | | | | | | | 160 | | | | 159,200 | |

USA Compression Partners LP/USA Compression Finance Corp.: | | | | | | | | | | | | |

6.88%, 04/01/26 | | | | | | | 344 | | | | 352,600 | |

6.88%, 09/01/27(d) | | | | | | | 362 | | | | 372,346 | |

| | | | | | | | |

| | | | | | | | | | | 996,228 | |

|

| Environmental, Maintenance, & Security Service — 0.2% | |

Advanced Disposal Services, Inc., 5.63%, 11/15/24(d) | | | | | | | 107 | | | | 112,082 | |

GFL Environmental, Inc., 7.00%, 06/01/26(d) | | | | | | | 242 | | | | 251,075 | |

Tervita Corp., 7.63%, 12/01/21(d) | | | | | | | 380 | | | | 385,700 | |

Waste Pro USA, Inc., 5.50%, 02/15/26(d) | | | | | | | 156 | | | | 162,240 | |

| | | | | | | | |

| | | | | | | | | | | 911,097 | |

|

| Equity Real Estate Investment Trusts (REITs) — 0.6% | |

Brookfield Property REIT, Inc./BPR Cumulus LLC/BPR Nimbus LLC/GGSI Sellco LL, 5.75%, 05/15/26(d) | | | | | | | 128 | | | | 134,720 | |

GLP Capital LP/GLP Financing II, Inc.: | | | | | | | | | | | | |

5.25%, 06/01/25 | | | | | | | 90 | | | | 98,953 | |

5.38%, 04/15/26 | | | | | | | 80 | | | | 87,813 | |

Iron Mountain, Inc., 4.88%, 09/15/27(d) | | | | | | | 302 | | | | 310,118 | |

Marriott Ownership Resorts, Inc./ILG LLC, 6.50%, 09/15/26 | | | | | | | 80 | | | | 86,336 | |

MGM Growth Properties Operating Partnership LP/MGP FinanceCo-Issuer, Inc.: | | | | | | | | | | | | |

4.50%, 09/01/26 | | | | | | | 655 | | | | 686,113 | |

4.50%, 01/15/28 | | | | | | | 697 | | | | 712,682 | |

MPT Operating Partnership LP/MPT Finance Corp., 4.63%, 08/01/29 | | | | | | | 329 | | | | 342,160 | |

| | |

| 10 | | 2019 BLACKROCK SEMI-ANNUAL REPORTTO SHAREHOLDERS |

| | |

Schedule of Investments (unaudited) (continued) August 31, 2019 | | BlackRock Debt Strategies Fund, Inc. (DSU) (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Security | | | | | Par

(000) | | | Value | |

|

| Equity Real Estate Investment Trusts (REITs) (continued) | |

SBA Communications Corp., 4.88%, 09/01/24 | | | USD | | | | 950 | | | $ | 983,250 | |

VICI Properties 1 LLC/VICI FC, Inc., 8.00%, 10/15/23 | | | | | | | 99 | | | | 108,351 | |

| | | | | | | | |

| | | | | | | | | | | 3,550,496 | |

|

| Food & Staples Retailing — 0.1% | |

Albertsons Cos. LLC/Safeway, Inc./New Albertson’s, Inc./Albertson’s LLC, 6.63%, 06/15/24 | | | | | | | 58 | | | | 60,755 | |

Albertsons Cos. LLC/Safeway, Inc./New Albertsons LP/Albertson’s LLC, 5.88%, 02/15/28(d) | | | | | | | 271 | | | | 285,596 | |

B&M European Value Retail SA, 4.13%, 02/01/22 | | | GBP | | | | 100 | | | | 123,314 | |

Post Holdings, Inc., 5.50%, 12/15/29(d) | | | USD | | | | 183 | | | | 193,469 | |

Tesco Corporate Treasury Services PLC, 2.50%, 05/02/25 | | | GBP | | | | 100 | | | | 124,723 | |

| | | | | | | | |

| | | | | | | | | | | 787,857 | |

|

| Food Products — 0.5% | |

Chobani LLC/Chobani Finance Corp., Inc., 7.50%, 04/15/25(d) | | | USD | | | | 479 | | | | 441,878 | |

JBS USA LUX SA/JBS USA Finance, Inc.(d): | | | | | | | | | | | | |

5.88%, 07/15/24 | | | | | | | 59 | | | | 60,742 | |

5.75%, 06/15/25 | | | | | | | 834 | | | | 867,881 | |

6.75%, 02/15/28 | | | | | | | 43 | | | | 47,542 | |

JBS USA LUX SA/JBS USA Food Co./JBS USA Finance, Inc.(d): | | | | | | | | | | | | |

6.50%, 04/15/29 | | | | | | | 755 | | | | 836,162 | |

5.50%, 01/15/30 | | | | | | | 436 | | | | 462,160 | |

Simmons Foods, Inc., 7.75%, 01/15/24(d) | | | | | | | 174 | | | | 187,920 | |

| | | | | | | | |

| | | | | | | | | | | 2,904,285 | |

|

| Health Care Equipment & Supplies — 0.6% | |

Avantor, Inc.(d): | | | | | | | | | | | | |

6.00%, 10/01/24 | | | | | | | 1,377 | | | | 1,476,832 | |

9.00%, 10/01/25 | | | | | | | 631 | | | | 709,875 | |

Ortho-Clinical Diagnostics, Inc./Ortho-Clinical Diagnostics SA, 6.63%, 05/15/22(d) | | | | | | | 1,654 | | | | 1,596,110 | |

Teleflex, Inc., 4.63%, 11/15/27 | | | | | | | 12 | | | | 12,689 | |

| | | | | | | | |

| | | | | | | | | | | 3,795,506 | |

|

| Health Care Providers & Services — 1.4% | |

AHP Health Partners, Inc., 9.75%, 07/15/26(d) | | | | | | | 200 | | | | 214,825 | |

Centene Corp., 5.38%, 06/01/26(d) | | | | | | | 576 | | | | 615,773 | |

CHS/Community Health Systems, Inc., 8.63%, 01/15/24(d) | | | | | | | 599 | | | | 599,000 | |

Encompass Health Corp., 5.75%, 11/01/24 | | | | | | | 109 | | | | 110,363 | |

Envision Healthcare Crop., 8.75%, 10/15/26(d) | | | | | | | 262 | | | | 142,790 | |

HCA, Inc.: | | | | | | | | | | | | |

5.38%, 02/01/25 | | | | | | | 221 | | | | 245,310 | |

5.38%, 09/01/26 | | | | | | | 80 | | | | 89,200 | |

5.63%, 09/01/28 | | | | | | | 736 | | | | 837,430 | |

Molina Healthcare, Inc., 5.38%, 11/15/22 | | | | | | | 176 | | | | 188,107 | |

MPH Acquisition Holdings LLC, 7.13%, 06/01/24(d) | | | | | | | 410 | | | | 366,462 | |

NVA Holdings, Inc., 6.88%, 04/01/26 | | | | | | | 65 | | | | 69,407 | |

Polaris Intermediate Corp., (8.50% Cash), 8.50%, 12/01/22(d)(e) | | | | | | | 649 | | | | 545,160 | |

Sotera Health Holdings LLC, 6.50%, 05/15/23(d) | | | | | | | 106 | | | | 107,855 | |

Surgery Center Holdings, Inc., 10.00%, 04/15/27(d) | | | | | | | 193 | | | | 184,797 | |

Team Health Holdings, Inc., 6.38%, 02/01/25(d) | | | | | | | 348 | | | | 233,160 | |

Tenet Healthcare Corp.: | | | | | | | | | | | | |

8.13%, 04/01/22 | | | | | | | 1,183 | | | | 1,274,564 | |

4.63%, 09/01/24(d) | | | | | | | 272 | | | | 280,160 | |

4.88%, 01/01/26(d) | | | | | | | 1,083 | | | | 1,112,891 | |

5.13%, 11/01/27(d) | | | | | | | 724 | | | | 748,435 | |

| | | | | | | | | | | | |

| Security | | | | | Par

(000) | | | Value | |

|

| Health Care Providers & Services (continued) | |

WellCare Health Plans, Inc.: | | | | | | | | | | | | |

5.25%, 04/01/25 | | | USD | | | | 354 | | | $ | 370,656 | |

5.38%, 08/15/26(d) | | | | | | | 117 | | | | 124,751 | |

| | | | | | | | |

| | | | | | | | | | | 8,461,096 | |

|

| Health Care Technology — 0.2% | |

Change Healthcare Holdings LLC/Change Healthcare Finance, Inc., 5.75%, 03/01/25(d) | | | | | | | 229 | | | | 230,479 | |

IQVIA, Inc.(d): | | | | | | | | | | | | |

5.00%, 10/15/26 | | | | | | | 200 | | | | 211,000 | |

5.00%, 05/15/27 | | | | | | | 535 | | | | 565,094 | |

| | | | | | | | |

| | | | | | | | | | | 1,006,573 | |

|

| Hotels, Restaurants & Leisure — 1.0% | |

1011778 BC ULC/New Red Finance, Inc.(d): | | | | | | | | | | | | |

4.25%, 05/15/24 | | | | | | | 65 | | | | 67,097 | |

5.00%, 10/15/25 | | | | | | | 1,001 | | | | 1,033,532 | |

Cedar Fair LP, 5.25%, 07/15/29(d) | | | | | | | 176 | | | | 190,960 | |

Cirsa Finance International Sarl, 7.88%, 12/20/23(d) | | | | | | | 200 | | | | 211,300 | |

Eldorado Resorts, Inc., 6.00%, 09/15/26 | | | | | | | 124 | | | | 135,625 | |

Golden Nugget, Inc., 6.75%, 10/15/24(d) | | | | | | | 991 | | | | 1,013,297 | |

Hilton Domestic Operating Co., Inc.: | | | | | | | | | | | | |

4.25%, 09/01/24 | | | | | | | 42 | | | | 42,840 | |

5.13%, 05/01/26 | | | | | | | 100 | | | | 105,550 | |

4.88%, 01/15/30(d) | | | | | | | 785 | | | | 839,950 | |

IRB Holding Corp., 6.75%, 02/15/26(d) | | | | | | | 138 | | | | 138,690 | |

Lions Gate Capital Holdings LLC(d): | | | | | | | | | | | | |

6.38%, 02/01/24 | | | | | | | 26 | | | | 27,461 | |

5.88%, 11/01/24 | | | | | | | 86 | | | | 89,440 | |

MGM Resorts International, 7.75%, 03/15/22 | | | | | | | 308 | | | | 345,801 | |

Sabre GLBL, Inc., 5.25%, 11/15/23(d) | | | | | | | 221 | | | | 227,077 | |

Scientific Games International, Inc.(d): | | | | | | | | | | | | |

5.00%, 10/15/25 | | | | | | | 211 | | | | 218,014 | |

8.25%, 03/15/26 | | | | | | | 1,113 | | | | 1,179,780 | |

Station Casinos LLC, 5.00%, 10/01/25(d) | | | | | | | 99 | | | | 100,990 | |

Stonegate Pub Co. Financing PLC (3 mo. LIBOR GBP + 4.38%), 5.16%, 03/15/22(h) | | | GBP | | | | 100 | | | | 122,229 | |

Wyndham Destinations, Inc., 5.75%, 04/01/27 | | | USD | | | | 141 | | | | 150,518 | |

Yum! Brands, Inc., 5.35%, 11/01/43 | | | | | | | 14 | | | | 13,300 | |

| | | | | | | | |

| | | | | | | | | | | 6,253,451 | |

|

| Household Durables — 0.2% | |

Algeco Global Finance PLC, 8.00%, 02/15/23(d) | | | | | | | 300 | | | | 300,225 | |

Brookfield Residential Properties, Inc./Brookfield Residential US Corp., 6.13%, 07/01/22(d) | | | | | | | 7 | | | | 7,096 | |

Lennar Corp.: | | | | | | | | | | | | |

6.63%, 05/01/20 | | | | | | | 130 | | | | 133,484 | |

4.88%, 12/15/23 | | | | | | | 265 | | | | 284,213 | |

5.25%, 06/01/26 | | | | | | | 143 | | | | 155,691 | |

Mattamy Group Corp., 6.50%, 10/01/25(d) | | | | | | | 90 | | | | 95,400 | |

Tempur Sealy International, Inc., 5.50%, 06/15/26 | | | | | | | 2 | | | | 2,090 | |

| | | | | | | | |

| | | | | | | | | | | 978,199 | |

|

| Independent Power and Renewable Electricity Producers — 0.5% | |

Calpine Corp.: | | | | | | | | | | | | |

5.38%, 01/15/23 | | | | | | | 1,138 | | | | 1,153,556 | |

5.75%, 01/15/25 | | | | | | | 31 | | | | 31,465 | |

5.25%, 06/01/26(d) | | | | | | | 468 | | | | 473,850 | |

Clearway Energy Operating LLC: | | | | | | | | | | | | |

5.38%, 08/15/24 | | | | | | | 222 | | | | 227,550 | |

5.75%, 10/15/25(d) | | | | | | | 241 | | | | 251,247 | |

NRG Energy, Inc.: | | | | | | | | | | | | |

6.63%, 01/15/27 | | | | | | | 455 | | | | 491,400 | |

5.75%, 01/15/28 | | | | | | | 31 | | | | 33,403 | |

5.25%, 06/15/29(d) | | | | | | | 406 | | | | 433,230 | |

| | | | |

| SCHEDULE OF INVESTMENTS | | | 11 | |

| | |

Schedule of Investments (unaudited) (continued) August 31, 2019 | | BlackRock Debt Strategies Fund, Inc. (DSU) (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Security | | | | | Par

(000) | | | Value | |

|

| Independent Power and Renewable Electricity Producers (continued) | |

TerraForm Power Operating LLC, 5.00%, 01/31/28(d) | | | USD | | | | 139 | | | $ | 144,737 | |

| | | | | | | | |

| | | | | | | | | | | 3,240,438 | |

|

| Industrial Conglomerates — 0.4% | |

Project Spring, (Aquired 05/09/19, cost $2,248,690), 10.00%, 06/30/24(a)(d)(i) | | | | | | | 2,314 | | | | 2,325,571 | |

| | | | | | | | |

| | | |

| Insurance — 0.3% | | | | | | | | | |

Alliant Holdings Intermediate LLC/Alliant HoldingsCo-Issuer, 8.25%, 08/01/23(d) | | | | | | | 989 | | | | 1,010,016 | |

Caisse Nationale de Reassurance Mutuelle Agricole Groupama, 6.00%, 01/23/27 | | | EUR | | | | 100 | | | | 141,006 | |

HUB International Ltd., 7.00%, 05/01/26(d) | | | USD | | | | 943 | | | | 957,145 | |

| | | | | | | | |

| | | | | | | | | | | 2,108,167 | |

|

| Interactive Media & Services — 0.3% | |

Go Daddy Operating Co. LLC/GD Finance Co., Inc., 5.25%, 12/01/27(d) | | | | | | | 230 | | | | 242,650 | |

Netflix, Inc.: | | | | | | | | | | | | |

4.88%, 04/15/28 | | | | | | | 213 | | | | 222,851 | |

5.88%, 11/15/28 | | | | | | | 141 | | | | 157,744 | |

3.88%, 11/15/29 | | | EUR | | | | 149 | | | | 176,942 | |

5.38%, 11/15/29(d) | | | USD | | | | 344 | | | | 374,100 | |

Symantec Corp., 5.00%, 04/15/25(d) | | | | | | | 115 | | | | 115,758 | |

Uber Technologies, Inc.(d): | | | | | | | | | | | | |

7.50%, 11/01/23 | | | | | | | 325 | | | | 339,625 | |

8.00%, 11/01/26 | | | | | | | 86 | | | | 90,461 | |

United Group BV, 4.38%, 07/01/22 | | | EUR | | | | 126 | | | | 141,590 | |

| | | | | | | | |

| | | | | | | | | | | 1,861,721 | |

|

| IT Services — 0.4% | |

Banff Merger Sub, Inc.: | | | | | | | | | | | | |

8.38%, 09/01/26 | | | | | | | 100 | | | | 98,914 | |

9.75%, 09/01/26(d) | | | USD | | | | 1,298 | | | | 1,181,180 | |

Harland Clarke Holdings Corp., 8.38%, 08/15/22(d) | | | | | | | 712 | | | | 564,260 | |

Outfront Media Capital LLC/Outfront Media Capital Corp., 5.00%, 08/15/27(d) | | | | | | | 568 | | | | 587,170 | |

Xerox Corp.: | | | | | | | | | | | | |

4.80%, 03/01/35 | | | | | | | 300 | | | | 260,250 | |

6.75%, 12/15/39 | | | | | | | 4 | | | | 4,038 | |

| | | | | | | | |

| | | | | | | | | | | 2,695,812 | |

|

| Machinery — 0.3% | |

Colfax Corp.(d): | | | | | | | | | | | | |

6.00%, 02/15/24 | | | | | | | 434 | | | | 462,752 | |

6.38%, 02/15/26 | | | | | | | 226 | | | | 245,775 | |

RBS Global, Inc./Rexnord LLC, 4.88%, 12/15/25(d) | | | | | | | 205 | | | | 211,150 | |

SPX FLOW, Inc., 5.88%, 08/15/26(d) | | | | | | | 209 | | | | 220,495 | |

Titan Acquisition Ltd./TitanCo-Borrower LLC, 7.75%, 04/15/26(d) | | | | | | | 699 | | | | 632,595 | |

| | | | | | | | |

| | | | | | | | | | | 1,772,767 | |

|

| Media — 4.2% | |

Altice Financing SA(d): | | | | | | | | | | | | |

6.63%, 02/15/23 | | | | | | | 1,051 | | | | 1,083,844 | |

7.50%, 05/15/26 | | | | | | | 200 | | | | 213,000 | |

Altice France SA: | | | | | | | | | | | | |

6.25%, 05/15/24(d) | | | | | | | 200 | | | | 206,184 | |

7.38%, 05/01/26(d) | | | | | | | 1,139 | | | | 1,215,882 | |

5.88%, 02/01/27 | | | EUR | | | | 100 | | | | 121,582 | |

8.13%, 02/01/27(d) | | | USD | | | | 534 | | | | 588,735 | |

Altice Luxembourg SA(d): | | | | | | | | | | | | |

7.75%, 05/15/22 | | | | | | | 304 | | | | 311,760 | |

7.63%, 02/15/25 | | | | | | | 940 | | | | 971,725 | |

10.50%, 05/15/27 | | | | | | | 761 | | | | 827,587 | |

| | | | | | | | | | | | |

| Security | | | | | Par

(000) | | | Value | |

|

| Media (continued) | |

AMC Networks, Inc., 4.75%, 08/01/25 | | | USD | | | | 121 | | | $ | 123,571 | |

CCO Holdings LLC/CCO Holdings Capital Corp.(d): | | | | | | | | | | | | |

4.00%, 03/01/23 | | | | | | | 79 | | | | 79,790 | |

5.13%, 05/01/27 | | | | | | | 1,033 | | | | 1,092,387 | |

5.00%, 02/01/28 | | | | | | | 211 | | | | 221,550 | |

5.38%, 06/01/29 | | | | | | | 1,344 | | | | 1,436,400 | |

Clear Channel International BV, 8.75%, 12/15/20(d) | | | | | | | 162 | | | | 165,543 | |

Clear Channel Worldwide Holdings, Inc.: | | | | | | | | | | | | |

6.50%, 11/15/22 | | | | | | | 910 | | | | 929,720 | |

9.25%, 02/15/24(d) | | | | | | | 1,035 | | | | 1,134,619 | |

5.13%, 08/15/27(d) | | | | | | | 1,341 | | | | 1,403,021 | |

Series B, 6.50%, 11/15/22 | | | | | | | 1,823 | | | | 1,862,504 | |

CSC Holdings LLC: | | | | | | | | | | | | |

5.25%, 06/01/24 | | | | | | | 344 | | | | 368,080 | |

7.75%, 07/15/25(d) | | | | | | | 462 | | | | 496,072 | |

10.88%, 10/15/25(d) | | | | | | | 1,357 | | | | 1,540,195 | |

5.50%, 05/15/26(d) | | | | | | | 390 | | | | 412,425 | |

6.50%, 02/01/29(d) | | | | | | | 288 | | | | 322,740 | |

Series 144S, 5.13%, 12/15/21(d) | | | | | | | 378 | | | | 378,473 | |

Diamond Sports Group LLC/Diamond Sports Finance Co., 5.38%, 08/15/26(d) | | | | | | | 518 | | | | 543,900 | |

DISH DBS Corp.: | | | | | | | | | | | | |

6.75%, 06/01/21 | | | | | | | 10 | | | | 10,533 | |

5.88%, 07/15/22 | | | | | | | 1,322 | | | | 1,368,270 | |

eircom Finance DAC, 3.50%, 05/15/26 | | | EUR | | | | 100 | | | | 117,324 | |

Entertainment One Ltd., 4.63%, 07/15/26 | | | GBP | | | | 100 | | | | 132,376 | |

Gray Television, Inc., 7.00%, 05/15/27(d) | | | USD | | | | 196 | | | | 214,316 | |

Hughes Satellite Systems Corp., 5.25%, 08/01/26 | | | | | | | 105 | | | | 111,300 | |

iHeartCommunications, Inc.: | | | | | | | | | | | | |

6.38%, 05/01/26 | | | | | | | 124 | | | | 133,428 | |

5.25%, 08/15/27(d) | | | | | | | 235 | | | | 247,086 | |

Intelsat Jackson Holdings SA: | | | | | | | | | | | | |

5.50%, 08/01/23 | | | | | | | 272 | | | | 247,520 | |

8.50%, 10/15/24(d) | | | | | | | 927 | | | | 920,047 | |

9.75%, 07/15/25(d) | | | | | | | 754 | | | | 773,792 | |

MDC Partners, Inc., 6.50%, 05/01/24(d) | | | | | | | 201 | | | | 182,910 | |

Radiate Holdco LLC/Radiate Finance, Inc., 6.63%, 02/15/25(d) | | | | | | | 252 | | | | 250,110 | |

Sirius XM Radio, Inc.(d): | | | | | | | | | | | | |

4.63%, 07/15/24 | | | | | | | 116 | | | | 121,075 | |

5.50%, 07/01/29 | | | | | | | 369 | | | | 402,103 | |

Telenet Finance VI Luxembourg SCA, 4.88%, 07/15/27 | | | EUR | | | | 70 | | | | 84,434 | |

Telesat Canada/Telesat LLC, 8.88%, 11/15/24(d) | | | USD | | | | 117 | | | | 126,579 | |

Tribune Media Co., 5.88%, 07/15/22 | | | | | | | 189 | | | | 191,776 | |

Univision Communications, Inc.(d): | | | | | | | | | | | | |

5.13%, 05/15/23 | | | | | | | 22 | | | | 21,725 | |

5.13%, 02/15/25 | | | | | | | 166 | | | | 160,172 | |

Videotron Ltd., 5.13%, 04/15/27(d) | | | | | | | 50 | | | | 52,625 | |

Virgin Media Finance PLC, 5.75%, 01/15/25(d) | | | | | | | 722 | | | | 750,671 | |

Virgin Media Secured Finance PLC, 4.88%, 01/15/27 | | | GBP | | | | 100 | | | | 126,993 | |

WMG Acquisition Corp., 4.13%, 11/01/24 | | | EUR | | | | 90 | | | | 102,504 | |

Ziggo Bond Co. BV, 6.00%, 01/15/27(d) | | | USD | | | | 309 | | | | 322,133 | |

Ziggo BV, 5.50%, 01/15/27(d) | | | | | | | 188 | | | | 198,331 | |

| | | | | | | | |

| | | | | | | | | | | 25,421,422 | |

|

| Metals & Mining — 0.9% | |

Big River Steel LLC/BRS Finance Corp., 7.25%, 09/01/25(d) | | | | | | | 317 | | | | 335,227 | |

Constellium SE(d): | | | | | | | | | | | | |

6.63%, 03/01/25 | | | | | | | 300 | | | | 314,063 | |

5.88%, 02/15/26 | | | | | | | 1,176 | | | | 1,225,980 | |

| | |

| 12 | | 2019 BLACKROCK SEMI-ANNUAL REPORTTO SHAREHOLDERS |

| | |

Schedule of Investments (unaudited) (continued) August 31, 2019 | | BlackRock Debt Strategies Fund, Inc. (DSU) (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Security | | | | | Par

(000) | | | Value | |

|

| Metals & Mining (continued) | |

Freeport-McMoRan, Inc.: | | | | | | | | | | | | |

3.88%, 03/15/23 | | | USD | | | | 646 | | | $ | 652,718 | |

5.45%, 03/15/43 | | | | | | | 1,772 | | | | 1,616,950 | |

Grinding Media,Inc./Moly-Cop AltaSteel Ltd., 7.38%, 12/15/23(d) | | | | | | | 309 | | | | 293,164 | |

Novelis Corp.(d): | | | | | | | | | | | | |

6.25%, 08/15/24 | | | | | | | 682 | | | | 714,395 | |

5.88%, 09/30/26 | | | | | | | 251 | | | | 265,119 | |

Steel Dynamics, Inc.: | | | | | | | | | | | | |

5.50%, 10/01/24 | | | | | | | 138 | | | | 142,209 | |

4.13%, 09/15/25 | | | | | | | 51 | | | | 51,383 | |

thyssenkrupp AG, 2.88%, 02/22/24 | | | EUR | | | | 64 | | | | 72,864 | |

| | | | | | | | |

| | | | | | | | | | | 5,684,072 | |

|

| Oil, Gas & Consumable Fuels — 3.1% | |

Aker BP ASA, 4.75%, 06/15/24(d) | | | USD | | | | 233 | | | | 238,242 | |

Antero Resources Corp., 5.38%, 11/01/21 | | | | | | | 42 | | | | 40,793 | |

Ascent Resources Utica Holdings LLC/ARU Finance Corp., 10.00%, 04/01/22(d) | | | | | | | 324 | | | | 324,810 | |

Callon Petroleum Co., Series WI, 6.38%, 07/01/26 | | | | | | | 42 | | | | 40,740 | |

Carrizo Oil & Gas, Inc.: | | | | | | | | | | | | |

6.25%, 04/15/23 | | | | | | | 129 | | | | 123,389 | |

8.25%, 07/15/25 | | | | | | | 281 | | | | 272,570 | |

Cheniere Corpus Christi Holdings LLC: | | | | | | | | | | | | |

7.00%, 06/30/24 | | | | | | | 502 | | | | 579,182 | |

5.88%, 03/31/25 | | | | | | | 588 | | | | 655,620 | |

5.13%, 06/30/27 | | | | | | | 493 | | | | 544,149 | |

Cheniere Energy Partners LP: | | | | | | | | | | | | |

5.63%, 10/01/26 | | | | | | | 743 | | | | 783,865 | |

Series WI, 5.25%, 10/01/25 | | | | | | | 12 | | | | 12,405 | |

Chesapeake Energy Corp.: | | | | | | | | | | | | |

4.88%, 04/15/22 | | | | | | | 378 | | | | 313,267 | |

5.75%, 03/15/23 | | | | | | | 38 | | | | 30,400 | |

7.00%, 10/01/24 | | | | | | | 170 | | | | 129,625 | |

8.00%, 06/15/27 | | | | | | | 58 | | | | 41,906 | |

CNX Resources Corp., 5.88%, 04/15/22 | | | | | | | 1,522 | | | | 1,472,535 | |

CONSOL Energy, Inc., 11.00%, 11/15/25(d) | | | | | | | 573 | | | | 590,190 | |

Covey Park Energy LLC/Covey Park Finance Corp., 7.50%, 05/15/25(d) | | | | | | | 221 | | | | 156,910 | |

Crestwood Midstream Partners LP/Crestwood Midstream Finance Corp., 5.63%, 05/01/27(d) | | | | | | | 365 | | | | 364,883 | |

CrownRock LP/CrownRock Finance, Inc., 5.63%, 10/15/25(d) | | | | | | | 625 | | | | 618,750 | |

DCP Midstream Operating LP: | | | | | | | | | | | | |

5.38%, 07/15/25 | | | | | | | 22 | | | | 23,265 | |

5.13%, 05/15/29 | | | | | | | 137 | | | | 140,432 | |

6.45%, 11/03/36(d) | | | | | | | 250 | | | | 261,875 | |

6.75%, 09/15/37(d) | | | | | | | 226 | | | | 237,300 | |

eG Global Finance PLC: | | | | | | | | | | | | |

4.38%, 02/07/25 | | | EUR | | | | 111 | | | | 118,487 | |

6.75%, 02/07/25(d) | | | USD | | | | 303 | | | | 292,395 | |

Endeavor Energy Resources LP/EER Finance, Inc.(d): | | | | | | | | | | | | |

5.50%, 01/30/26 | | | | | | | 368 | | | | 382,260 | |

5.75%, 01/30/28 | | | | | | | 307 | | | | 321,582 | |

EnLink Midstream Partners LP: | | | | | | | | | | | | |

4.40%, 04/01/24 | | | | | | | 136 | | | | 134,640 | |

4.85%, 07/15/26 | | | | | | | 42 | | | | 41,160 | |

5.60%, 04/01/44 | | | | | | | 249 | | | | 210,405 | |

5.05%, 04/01/45 | | | | | | | 157 | | | | 129,525 | |

5.45%, 06/01/47 | | | | | | | 5 | | | | 4,225 | |

Extraction Oil & Gas, Inc., 7.38%, 05/15/24(d) | | | | | | | 314 | | | | 235,500 | |

Indigo Natural Resources LLC, 6.88%, 02/15/26(d) | | | | | | | 311 | | | | 256,575 | |

Matador Resources Co., 5.88%, 09/15/26 | | | | | | | 320 | | | | 310,000 | |

| | | | | | | | | | | | |

| Security | | | | | Par

(000) | | | Value | |

|

| Oil, Gas & Consumable Fuels (continued) | |

MEG Energy Corp.(d): | | | | | | | | | | | | |

6.38%, 01/30/23 | | | USD | | | | 37 | | | $ | 34,965 | |

7.00%, 03/31/24 | | | | | | | 31 | | | | 29,489 | |

6.50%, 01/15/25 | | | | | | | 637 | | | | 640,185 | |

Murphy Oil Corp., 5.75%, 08/15/25 | | | | | | | 105 | | | | 106,281 | |

Nabors Industries, Inc., 4.63%, 09/15/21 | | | | | | | 447 | | | | 425,767 | |

NGPL PipeCo LLC, 7.77%, 12/15/37(d) | | | | | | | 341 | | | | 444,589 | |

Noble Holding International Ltd.: | | | | | | | | | | | | |

7.75%, 01/15/24 | | | | | | | 20 | | | | 13,300 | |

7.88%, 02/01/26(d) | | | | | | | 184 | | | | 148,580 | |

Northern Oil and Gas, Inc., (8.50% Cash or 1.00% PIK), 9.50%, 05/15/23(e) | | | | | | | 35 | | | | 35,868 | |

NuStar Logistics LP, 6.00%, 06/01/26 | | | | | | | 124 | | | | 132,990 | |

Parsley Energy LLC/Parsley Finance Corp.(d): | | | | | | | | | | | | |

6.25%, 06/01/24 | | | | | | | 132 | | | | 136,950 | |

5.38%, 01/15/25 | | | | | | | 76 | | | | 77,520 | |

5.63%, 10/15/27 | | | | | | | 558 | | | | 574,740 | |

PDC Energy, Inc.: | | | | | | | | | | | | |

6.13%, 09/15/24 | | | | | | | 66 | | | | 65,835 | |

5.75%, 05/15/26 | | | | | | | 9 | | | | 8,797 | |

QEP Resources, Inc.: | | | | | | | | | | | | |

5.38%, 10/01/22 | | | | | | | 634 | | | | 570,600 | |

5.25%, 05/01/23 | | | | | | | 91 | | | | 79,625 | |

5.63%, 03/01/26 | | | | | | | 36 | | | | 29,160 | |

Range Resources Corp., 4.88%, 05/15/25 | | | | | | | 64 | | | | 52,480 | |

Rowan Cos., Inc., 4.88%, 06/01/22 | | | | | | | 599 | | | | 488,185 | |

SM Energy Co.: | | | | | | | | | | | | |

6.13%, 11/15/22 | | | | | | | 40 | | | | 37,200 | |

5.00%, 01/15/24 | | | | | | | 453 | | | | 396,375 | |

5.63%, 06/01/25 | | | | | | | 29 | | | | 24,650 | |

6.75%, 09/15/26 | | | | | | | 12 | | | | 10,200 | |

Southwestern Energy Co.: | | | | | | | | | | | | |

6.20%, 01/23/25 | | | | | | | 195 | | | | 170,625 | |

7.75%, 10/01/27 | | | | | | | 71 | | | | 61,770 | |

SRC Energy, Inc., 6.25%, 12/01/25 | | | | | | | 29 | | | | 28,746 | |

Sunoco LP/Sunoco Finance Corp.,: | | | | | | | | | | | | |

5.50%, 02/15/26 | | | | | | | 57 | | | | 59,138 | |

5.88%, 03/15/28 | | | | | | | 151 | | | | 157,040 | |

Tallgrass Energy Partners LP/Tallgrass Energy Finance Corp.(d): | | | | | | | | | | | | |

5.50%, 09/15/24 | | | | | | | 62 | | | | 60,450 | |

5.50%, 01/15/28 | | | | | | | 453 | | | | 426,386 | |

Targa Resources Partners LP/Targa Resources Partners Finance Corp.: | | | | | | | | | | | | |

5.13%, 02/01/25 | | | | | | | 75 | | | | 76,875 | |

5.38%, 02/01/27 | | | | | | | 17 | | | | 17,541 | |

6.50%, 07/15/27(d) | | | | | | | 165 | | | | 179,025 | |

6.88%, 01/15/29(d) | | | | | | | 533 | | | | 588,965 | |

Transocean Pontus Ltd., 6.13%, 08/01/25(d) | | | | | | | 85 | | | | 86,628 | |

Transocean Poseidon Ltd., 6.88%, 02/01/27(d) | | | | | | | 249 | | | | 259,894 | |

Transocean, Inc.: | | | | | | | | | | | | |

8.38%, 12/15/21 | | | | | | | 99 | | | | 102,341 | |

9.00%, 07/15/23(d) | | | | | | | 504 | | | | 521,000 | |

7.25%, 11/01/25(d) | | | | | | | 260 | | | | 236,600 | |

WPX Energy, Inc., 8.25%, 08/01/23 | | | | | | | 456 | | | | 507,300 | |

| | | | | | | | |

| | | | | | | | | | | 18,538,512 | |

|

| Paper & Forest Products — 0.0% | |

International Paper Co., 7.30%, 11/15/39 | | | | | | | 5 | | | | 6,987 | |

| | | | | | | | |

|

| Personal Products — 0.0% | |

Coty, Inc., 6.50%, 04/15/26(d) | | | | | | | 31 | | | | 29,295 | |

| | | | | | | | |

| | | | |

| SCHEDULE OF INVESTMENTS | | | 13 | |

| | |

Schedule of Investments (unaudited) (continued) August 31, 2019 | | BlackRock Debt Strategies Fund, Inc. (DSU) (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Security | | | | | Par

(000) | | | Value | |

|

| Pharmaceuticals — 1.1% | |

Bausch Health Americas, Inc.(d): | | | | | | | | | | | | |

8.50%, 01/31/27 | | | USD | | | | 708 | | | $ | 785,866 | |

9.25%, 04/01/26 | | | | | | | 304 | | | | 344,280 | |

Bausch Health Cos., Inc.: | | | | | | | | | | | | |

4.50%, 05/15/23 | | | EUR | | | | 340 | | | | 378,348 | |

7.00%, 03/15/24(d) | | | USD | | | | 606 | | | | 640,033 | |

6.13%, 04/15/25(d) | | | | | | | 3 | | | | 3,090 | |

5.50%, 11/01/25(d) | | | | | | | 830 | | | | 870,446 | |

9.00%, 12/15/25(d) | | | | | | | 457 | | | | 512,411 | |

7.00%, 01/15/28(d) | | | | | | | 337 | | | | 353,152 | |

Catalent Pharma Solutions, Inc., 5.00%, 07/15/27(d) | | | | | | | 205 | | | | 214,760 | |

Charles River Laboratories International, Inc., 5.50%, 04/01/26(d) | | | | | | | 381 | | | | 407,632 | |

Eagle Holding Co. II LLC(d)(e): | | | | | | | | | | | | |

(7.63% Cash or 8.38% PIK), 7.63%, 05/15/22 | | | | | | | 114 | | | | 115,140 | |

(7.75% Cash), 7.75%, 05/15/22 | | | USD | | | | 262 | | | | 264,947 | |

Elanco Animal Health, Inc., 4.90%, 08/28/28 | | | | | | | 250 | | | | 272,430 | |

Jaguar Holding Co. II/Pharmaceutical Product Development LLC, 6.38%, 08/01/23(d) | | | | | | | 928 | | | | 958,160 | |

MEDNAX, Inc., 5.25%, 12/01/23(d) | | | | | | | 122 | | | | 122,610 | |

Rossini Sarl, 6.75%, 10/30/25 | | | EUR | | | | 168 | | | | 201,684 | |

Synlab Unsecured Bondco PLC, 8.25%, 07/01/23 | | | | | | | 100 | | | | 114,567 | |

| | | | | | | | |

| | | | | | | | | | | 6,559,556 | |

|

| Professional Services — 0.0% | |

Dun & Bradstreet Corp., 10.25%, 02/15/27(d) | | | USD | | | | 165 | | | | 180,263 | |

| | | | | | | | |

| | | |

| Real Estate Management & Development — 0.1% | | | | | | | | | |

ADLER Real Estate AG, 2.13%, 02/06/24 | | | EUR | | | | 100 | | | | 115,076 | |

Greystar Real Estate Partners LLC, 5.75%, 12/01/25(d) | | | USD | | | | 218 | | | | 223,526 | |

Unique Pub Finance Co. PLC, Series A4, 5.66%, 06/30/27 | | | GBP | | | | 51 | | | | 68,983 | |

| | | | | | | | |

| | | | | | | | | | | 407,585 | |

|

| Road & Rail — 0.3% | |

Avis Budget Finance PLC, 4.75%, 01/30/26 | | | EUR | | | | 100 | | | | 117,873 | |

Herc Holdings, Inc., 5.50%, 07/15/27(d) | | | USD | | | | 335 | | | | 346,725 | |

Hertz Corp., 7.63%, 06/01/22(d) | | | | | | | 474 | | | | 493,576 | |

Hertz Holdings Netherlands BV, 5.50%, 03/30/23 | | | EUR | | | | 100 | | | | 115,568 | |

United Rentals North America, Inc.: | | | | | | | | | | | | |

5.50%, 07/15/25 | | | USD | | | | 2 | | | | 2,085 | |

4.63%, 10/15/25 | | | | | | | 141 | | | | 145,011 | |

5.88%, 09/15/26 | | | | | | | 137 | | | | 146,933 | |

5.50%, 05/15/27 | | | | | | | 324 | | | | 347,655 | |

5.25%, 01/15/30 | | | | | | | 66 | | | | 70,538 | |

| | | | | | | | |

| | | | | | | | | | | 1,785,964 | |

|

| Semiconductors & Semiconductor Equipment — 0.0% | |

Sensata Technologies BV, 5.00%, 10/01/25(d) | | | | | | | 47 | | | | 49,820 | |

| | | | | | | | |

|

| Software — 1.2% | |

CDK Global, Inc.: | | | | | | | | | | | | |

4.88%, 06/01/27 | | | | | | | 505 | | | | 521,786 | |

5.25%, 05/15/29(d) | | | | | | | 105 | | | | 108,413 | |

Genesys Telecommunications Laboratories,

Inc./Greeneden Lux 3 Sarl/Greeneden US Ho,

10.00%, 11/30/24(d) | | | | | | | 579 | | | | 625,320 | |

Infor US, Inc., 6.50%, 05/15/22 | | | | | | | 1,223 | | | | 1,242,874 | |

MSCI, Inc., 4.75%, 08/01/26(d) | | | | | | | 77 | | | | 80,561 | |

Nuance Communications, Inc.,

6.00%, 07/01/24 | | | | | | | 169 | | | | 175,760 | |

RP Crown Parent LLC, 7.38%, 10/15/24(d) | | | | | | | 602 | | | | 627,410 | |

Solera LLC/Solera Finance, Inc.,

10.50%, 03/01/24(d) | | | | | | | 981 | | | | 1,039,860 | |

| | | | | | | | | | | | |

| Security | | | | | Par

(000) | | | Value | |

|

| Software (continued) | |

SS&C Technologies, Inc., 5.50%, 09/30/27(d) | | | USD | | | | 1,377 | | | $ | 1,445,850 | |

TIBCO Software, Inc., 11.38%, 12/01/21(d) | | | | | | | 871 | | | | 914,550 | |

Veritas US, Inc./Veritas Bermuda Ltd.,

7.50%, 02/01/23(d) | | | | | | | 369 | | | | 365,310 | |

| | | | | | | | |

| | | | | | | | | | | 7,147,694 | |

|

| Specialty Retail — 0.2% | |

Asbury Automotive Group, Inc.,

6.00%, 12/15/24 | | | | | | | 396 | | | | 409,365 | |

Group 1 Automotive, Inc., 5.25%, 12/15/23(d) | | | | | | | 69 | | | | 70,725 | |

IAA, Inc., 5.50%, 06/15/27(d) | | | | | | | 367 | | | | 390,855 | |

PetSmart, Inc., 7.13%, 03/15/23(d) | | | | | | | 133 | | | | 123,690 | |

| | | | | | | | |

| | | | | | | | | | | 994,635 | |

|

| Technology Hardware, Storage & Peripherals — 0.1% | |

NCR Corp.(d): | | | | | | | | | | | | |

5.75%, 09/01/27 | | | | | | | 159 | | | | 167,913 | |

6.13%, 09/01/29 | | | | | | | 159 | | | | 168,758 | |

Western Digital Corp., 4.75%, 02/15/26 | | | | | | | 306 | | | | 313,176 | |

| | | | | | | | |

| | | | | | | | | | | 649,847 | |

|

| Textiles, Apparel & Luxury Goods — 0.0% | |

William Carter Co., 5.63%, 03/15/27(d) | | | | | | | 162 | | | | 172,527 | |

| | | | | | | | |

|

| Thrifts & Mortgage Finance — 0.1% | |

Nationstar Mortgage Holdings, Inc.(d): | | | | | | | | | | | | |

8.13%, 07/15/23 | | | | | | | 174 | | | | 180,191 | |

9.13%, 07/15/26 | | | | | | | 139 | | | | 146,992 | |

| | | | | | | | |

| | | | | | | | | | | 327,183 | |

|

| Utilities — 0.1% | |

Orano SA, 3.38%, 04/23/26 | | | EUR | | | | 100 | | | | 119,863 | |

Vistra Operations Co. LLC(d): | | | | | | | | | | | | |

5.63%, 02/15/27 | | | USD | | | | 99 | | | | 104,816 | |

5.00%, 07/31/27 | | | | | | | 177 | | | | 182,753 | |

| | | | | | | | |

| | | | | | | | | | | 407,432 | |

|

| Wireless Telecommunication Services — 0.3% | |

Sprint Capital Corp.: | | | | | | | | | | | | |

6.88%, 11/15/28 | | | | | | | 47 | | | | 52,111 | |

8.75%, 03/15/32 | | | | | | | 293 | | | | 366,977 | |

Sprint Corp.: | | | | | | | | | | | | |

7.88%, 09/15/23 | | | | | | | 492 | | | | 553,500 | |

7.13%, 06/15/24 | | | | | | | 460 | | | | 508,512 | |

7.63%, 02/15/25 | | | | | | | 89 | | | | 99,569 | |

7.63%, 03/01/26 | | | | | | | 90 | | | | 101,137 | |

| | | | | | | | |

| | | | | | | | | | | 1,681,806 | |

| | | | | | | | |

| |

Total Corporate Bonds — 24.9%

(Cost — $155,592,526) | | | | 150,585,741 | |

| | | | | | | | |

|

Floating Rate Loan Interests(h) — 114.5% | |

|

Aerospace & Defense — 2.2% | |

1199169 B.C. Unlimited Liability Co., 2019 Term Loan B2, (3 mo. LIBOR + 4.00%), 6.33%, 04/06/26 | | | | | | | 1,965 | | | | 1,963,444 | |

Atlantic Aviation FBO, Inc., 2018 Term Loan B,

(1 mo. LIBOR + 3.75%), 5.87%, 12/06/25(a) | | | | | | | 1,368 | | | | 1,374,966 | |

Dynasty Acquisition Co., Inc., 2019 Term Loan B1,

(3 mo. LIBOR + 4.00%), 6.33%, 04/06/26 | | | | | | | 3,655 | | | | 3,652,006 | |

MRO Holdings, Inc., 2019 Term Loan B, (3 mo.

LIBOR + 5.00%), 7.48%, 06/04/26 | | | | | | | 1,245 | | | | 1,233,334 | |

Nordam Group Inc, The, Term Loan B, (6 mo.

LIBOR + 5.50%), 7.88%, 04/09/26(a) | | | | | | | 790 | | | | 788,045 | |

TransDigm, Inc., 2018 Term Loan F, (3 mo.

LIBOR + 2.50%), 4.83%, 06/09/23 | | | | | | | 4,526 | | | | 4,490,161 | |

| | | | | | | | |

| | | | | | | | | | | 13,501,956 | |

| | |

| 14 | | 2019 BLACKROCK SEMI-ANNUAL REPORTTO SHAREHOLDERS |

| | |

Schedule of Investments (unaudited) (continued) August 31, 2019 | | BlackRock Debt Strategies Fund, Inc. (DSU) (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Security | | | | | Par

(000) | | | Value | |

|

| Air Freight & Logistics — 0.9% | |

Avolon TLB Borrower 1 (US) LLC, Term Loan B3, (1 mo. LIBOR + 1.75%), 3.92%, 01/15/25 | | | USD | | | | 1,980 | | | $ | 1,982,913 | |

WestJet Airlines Ltd., Term Loan B, 08/06/26(j) | | | | | | | 3,671 | | | | 3,679,040 | |

| | | | | | | | |

| | | | | | | | | | | 5,661,953 | |

|

| Airlines — 0.9% | |

Allegiant Travel Co., Term Loan B, (3 mo.

LIBOR + 4.50%), 6.71%, 02/05/24 | | | | | | | 1,776 | | | | 1,777,194 | |

American Airlines, Inc.: | | | | | | | | | | | | |

2017 Incremental Term Loan, (1mo. LIBOR + 2.00%), 4.20%, 12/14/23 | | | | | | | 2,125 | | | $ | 2,115,367 | |

Repriced TL B due 2023, (1 mo.

LIBOR + 2.00%), 4.12%, 04/28/23 | | | | | | | 1,257 | | | | 1,251,844 | |

| | | | | | | | |

| | | | | | | | | | | 5,144,405 | |

|

| Auto Components — 1.2% | |

Adient US LLC, Term Loan B, (3 mo. LIBOR + 4.25%), 6.46%, 05/06/24 | | | | | | | 448 | | | | 434,491 | |

Panther BF Aggregator 2 LP, USD Term Loan B,

(1 mo. LIBOR + 3.50%),