UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08565

Strategic Partners Real

Estate Securities Fund

Exact name of registrant as specified in charter

Gateway Center 3,

100 Mulberry Street,

Newark, New Jersey 07102

Address of principal executive offices

Jonathan D. Shain

Gateway Center 3,

100 Mulberry Street,

Newark, New Jersey 07102

Name and address of agent for service

Registrant’s telephone number, including area code: 973-802-6469

Date of fiscal year end: 3/31/2004

Date of reporting period: 3/31/2004

Item 1 – Reports to Stockholders – [ INSERT REPORT ]

ANNUAL REPORT

MARCH 31, 2004

STRATEGIC PARTNERS

REAL ESTATE SECURITIES FUND

OBJECTIVE

High current income and long-term growth of capital

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

Dear Shareholder,

May 18, 2004

As the U.S. stock market slowed in 2004 following its particularly strong performance in 2003, some investors still seemed to be watching developments from the sidelines. Though the economy appears sound, given the unsettled global political climate and the potential for rising interest rates in the United States, we can understand why some investors may want to remain cautious. For those with long-term goals, a broadly diversified asset allocation can increase your chances of participating in economic growth.

We recommend that you develop a diversified asset allocation strategy in consultation with a financial professional who knows you and who understands your reasons for investing, the time you have to reach your goals, and the amount of risk you are comfortable assuming. Strategic Partners mutual funds offer a wide range of investment choices, and your financial professional can help you choose the appropriate funds to implement your strategy.

Whether you are investing for your retirement, your children’s education, or some other purpose, Strategic Partners mutual funds offer the resources and professional discipline of leading asset management firms. Our team of experienced analysts selects firms that are widely respected by institutional and individual investors. These firms have established track records in the specific asset classes and management styles they offer in Strategic Partners funds. Our analysts continue to monitor their performance and their adherence to the investment processes that earned them their reputations.

Thank you for your confidence in Strategic Partners mutual funds.

Sincerely,

Judy A. Rice, President

Strategic Partners Real Estate Securities Fund

| | |

| Strategic Partners Real Estate Securities Fund | | 1 |

Your Fund’s Performance

Fund objective

The investment objective of the Strategic Partners Real Estate Securities Fund (the Fund) is high current income and long-term growth of capital. There can be no assurance that the Fund will achieve its investment objective.

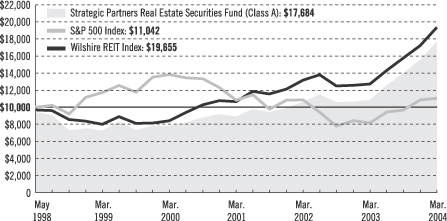

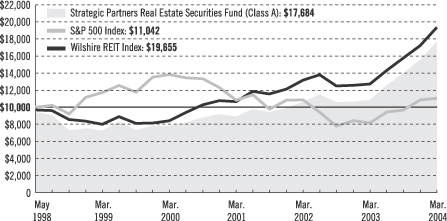

Performance data quoted represents past performance and is not indicative of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain current performance data to the most recent month-end by visiting our website at www.strategicpartners.com or by calling (800) 225-1852.

| | | | | | | | | |

|

| Cumulative Total Returns1 as of 3/31/04 | |

| | | One Year | | | Five Years | | | Since Inception2 | |

Class A | | 62.79 | % | | 143.94 | % | | 87.13 | % |

| |

Class B | | 61.62 | | | 134.89 | | | 79.04 | |

| |

Class C | | 61.62 | | | 134.89 | | | 79.04 | |

| |

Class Z | | 63.21 | | | 146.95 | | | 90.02 | |

| |

S&P 500 Index3 | | 35.10 | | | –5.86 | | | 10.42 | |

| |

Wilshire REIT Index4 | | 50.72 | | | 136.09 | | | 96.55 | |

| |

Lipper Real Estate Funds Avg.5 | | 51.23 | | | 125.12 | | | 84.86 | |

| |

| | | | | | | | | | |

| | | |

| Average Annual Total Returns1 as of 3/31/04 | | | | | | | | | |

| | | One Year | | | Five Years | | | Since Inception2 | |

Class A | | 53.84 | % | | 18.18 | % | | 10.13 | % |

| |

Class B | | 56.62 | | | 18.52 | | | 10.26 | |

| |

Class C | | 60.62 | | | 18.62 | | | 10.36 | |

| |

Class Z | | 63.21 | | | 19.82 | | | 11.48 | |

| |

S&P 500 Index3 | | 35.10 | | | –1.20 | | | 1.69 | |

| |

Wilshire REIT Index4 | | 50.72 | | | 18.75 | | | 12.10 | |

| |

Lipper Real Estate Funds Avg.5 | | 51.23 | | | 17.52 | | | 10.89 | |

| |

1Source: Prudential Investments LLC and Lipper Inc. The cumulative total returns do not take into account applicable sales charges. If reflected, the applicable sales charges would reduce the cumulative total returns performance quoted. The average annual total returns do take into account applicable sales charges. Without a distribution and service (12b-1) fee waiver of 0.05% for Class A shares, the returns would have been lower. Through March 14, 2004, the Fund charged a maximum front-end sales charge of 5% for Class A shares and a 12b-1 fee of up to 0.30% annually. Effective March 15, 2004, Class A shares are subject to a maximum front-end sales charge of 5.50% and a 12b-1 fee of up to 0.30% annually. Investors who purchase Class A shares in an amount of $1 million or more do not pay a front-end sales charge, but are subject to a contingent deferred sales charge (CDSC) of 1% for shares sold within 12 months of purchase. Class B shares are subject to a

| | |

| 2 | | Visit our website at www.strategicpartners.com |

declining CDSC of 5%, 4%, 3%, 2%, 1%, and 1% respectively for the first six years after purchase and a 12b-1 fee of 1% annually. Approximately seven years after purchase, Class B shares will automatically convert to Class A shares on a quarterly basis. Through February 1, 2004, Class C shares were subject to a front-end sales charge of 1%, a CDSC of 1% for shares redeemed within 18 months of purchase, and a 12b-1 fee of 1% annually. Class C shares purchased on or after February 2, 2004 are not subject to a front-end sales charge, the CDSC of 1% for Class C shares purchased on or after that date will apply for 12 months from the date of purchase, and the annual 12b-1 fee will remain 1%. Class Z shares are not subject to a 12b-1 fee. The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. 2Inception date: 5/5/98. 3The Standard & Poor’s 500 Composite Stock Price Index (S&P 500 Index) is an unmanaged index of 500 stocks of large U.S. companies. It gives a broad look at how U.S. stock prices have performed. 4The Wilshire REIT Index is an unmanaged, market capitalization-weighted index comprising publicly traded REITs. This Index does not include real estate operating companies like the Wilshire Real Estate Securities Index does. 5The Lipper Real Estate Funds Average (Lipper Average) represents returns based on the average return for all funds in the Lipper Real Estate Funds category for the periods noted. Funds in the Lipper Real Estate Funds category invest primarily in equity securities of domestic and foreign companies engaged in the real estate industry. Investors cannot invest directly in an index. The returns for the S&P 500 Index and the Wilshire REIT Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes. Returns for the Lipper Average reflect the deduction of operating expenses, but not sales charges or taxes.

| | | |

|

| Five Largest Holdings expressed as a percentage of net assets as of 3/31/04 | |

General Growth Properties, Inc./Retail—Malls | | 7.5 | % |

| |

Rouse Co./Diversified | | 6.4 | |

| |

Simon Property Group, Inc./Retail—Malls | | 6.0 | |

| |

ProLogis/Warehouses | | 5.9 | |

| |

Kimco Realty Corp./Retail—Shopping Centers | | 5.9 | |

| |

| Holdings are subject to change. | | | |

| | | |

|

| Five Largest Industries expressed as a percentage of net assets as of 3/31/04 | |

Diversified | | 16.5 | % |

| |

Retail—Shopping Centers | | 15.3 | |

| |

Retail—Malls | | 13.5 | |

| |

Specialty Finance | | 12.8 | |

| |

Warehouse | | 10.3 | |

| |

Industry weightings are subject to change.

| | |

| Strategic Partners Real Estate Securities Fund | | 3 |

Investment Adviser’s Report

Wellington Management Company, LLP

During the 12 months ended March 31, 2004, real estate investment trusts (REITs) continued to benefit from a heavy inflow of capital. We think that investors were attracted by REITs’ past strong performance and high dividend yields, and by expectations that they would be less volatile than other stocks. The robust growth of the U.S. economy and improving employment data helped the performance of REITs by mitigating concerns that operating fundamentals were weak in real estate. Performance was strong across the REIT subsectors, with specialty finance and home builders generating the strongest returns. Low interest rates fueled continued growth for housing and refinancing while strong consumer spending helped owners of retail malls.

The Fund’s real estate benchmark, the Wilshire REIT Index (the Wilshire), had an impressive return over this reporting period. Even so, the Fund’s performance was substantially better. The Fund beat the Wilshire in each of its subsectors. It also profited from an overweight in specialty finance compared with the Wilshire, and underweights in the office space and multifamily subsectors. In addition, the Fund had positions in home-building companies such as Pulte Homes, which have been benefiting because low interest rates encouraged demand for homeownership. These companies are not represented in the Wilshire, and their sizable gains contributed to the Fund’s strong performance.

Specialty finance

Specialty finance—including all healthcare, mortgage, and net lease REITS—made the largest contribution to the Fund’s performance relative to the Wilshire. Specialty finance firms provide debt and equity financing to real estate entities. Specialty finance is less vulnerable to occupancy issues and high capital expenditure requirements than traditional real estate sectors. The Fund had a significant overweight in this high-performing area, as well as strong security selection.

Retail space

Consumer spending continued to be the primary factor in mall property performance, with foot traffic on the rise. Simon Property Group, General Growth Properties, and Rouse (see Comments on Largest Holdings for General Growth and Rouse) continued to contribute substantially to the Fund’s return. Retail space as a whole outperformed the overall real estate sector during this reporting period, and our slight overweight added to the Fund’s performance. Kimco Realty (see Comments on Largest Holdings) made the largest contribution to the Fund’s return in this group.

Lodging

Lodging is the most economically sensitive subsector in real estate. As most lodging companies tend to bear heavy debt burdens, their profitability is particularly

| | |

| 4 | | Visit our website at www.strategicpartners.com |

dependent on economic recovery. In addition to the strengthening economy, the weak dollar encouraged foreigners to visit the United States. Share prices improved as bookings increased, and our overweight helped the Fund.

Office

High vacancy rates from job outsourcing and the slow recovery of employment continued to affect this subsector. The Fund’s comparative performance benefited from a considerable underweight in offices. Its largest position in the subsector, however, was Boston Properties, which had strong returns over the reporting period. Boston Properties owns primarily Class A office buildings in markets with greater development constraints, such as midtown Manhattan, Washington D.C., and San Francisco. All of our office holdings contributed positively to Fund performance.

Multifamily

The Fund benefited from a substantial underweight in multifamily apartments. This sector competes with homeownership, which was favored by the low interest rates prevalent during the Fund’s reporting period. However, the rental environment is stabilizing, and could improve if employment prospects become more positive and interest rates look likely to tighten. While the multifamily subsector overall contributed positively to performance, the Fund’s holdings in Apartment and Investment Management Corporation negatively affected portfolio gains.

Warehouse

Although the warehouse subsector performed well helped by improving occupancy, it lagged all but the multifamily subsector. The Fund’s largest position was ProLogis (see Comments on Largest Holdings), which delivered strong returns and was among the largest contributors to the Fund’s overall performance.

Looking ahead

REIT shares made substantial advances despite weak real estate fundamentals. As a result, by the end of 2003 shares were expensive compared to the net asset value of REITs, and the margin that REIT dividends usually offer over the yield on corporate bonds was at historic lows. The sector’s stellar performance early in 2004 may well represent a peak in near-term valuations. REITs sold off sharply in the first half of April, which may lead to capital scarcity. We welcome the increased capital market discipline that this implies. As other investors pull back, the range of attractive investment opportunities for us has greatly increased.

The Portfolio of Investments following this report shows the size of the Fund’s positions at period-end.

| | |

| Strategic Partners Real Estate Securities Fund | | 5 |

Comments on Largest Holdings

Holdings expressed as a percentage of the Fund’s net assets as of 3/31/04.

| 7.5% | General Growth Properties, Inc./Retail—Malls |

General Growth is a real estate investment trust that is primarily engaged in the ownership, operation, management, leasing, acquisition, development, expansion, and financing of regional mall shopping centers in the United States. It has achieved strong operating margins, and has been one of the most successful REITs in deploying capital.

| 6.4% | Rouse Co./Diversified |

Rouse is a REIT engaged in the ownership, management, acquisition, and development of regional malls. It also has a significant community development portfolio. In addition to liking the regional mall business, we believe Rouse’s land development program in Las Vegas is significantly undervalued.

| 6.0% | Simon Property Group, Inc./Retail—Malls |

The largest shopping mall owner in the United States, Simon Property owns, develops, and manages more than 250 properties, primarily regional shopping malls and community shopping centers. It should continue to benefit from the stability of the mall sector and from its dominance in this area.

ProLogis operates a global network of warehouse and distribution properties, and is the largest owner of warehouse and distribution properties in Europe. We have a positive outlook on the warehouse and distribution market, and we are attracted to ProLogis’s development expertise and its unique business model, which enables the company to fund the expansion of its warehouse network through pension fund co-investment vehicles.

| 5.9% | Kimco Realty Corp./Retail—Shopping Centers |

Kimco Realty owns a portfolio of 400 neighborhood and community shopping centers. We are attracted to the stable cash flows characteristic of the sector, as well as to the company’s unique development and finance capabilities, which have historically led to investments producing high investment returns.

Holdings are subject to change.

| | |

| 6 | | Visit our website at www.strategicpartners.com |

ANNUAL REPORT

MARCH 31, 2004

STRATEGIC PARTNERS

REAL ESTATE SECURITIES FUND

PORTFOLIO OF INVESTMENTS

Portfolio of Investments

as of March 31, 2004

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | | |

LONG-TERM INVESTMENTS 97.4% | | | |

| |

COMMON STOCKS | | | |

| |

Diversified 16.5% | | | |

|

| 125,000 | | Hammerson PLC (United Kingdom) | | $ | 1,562,173 |

| 53,000 | | Newcastle Investment Holdings Corp.(a)(b) | | | 265,000 |

| 91,000 | | Rouse Co. (The) | | | 4,877,600 |

| 26,000 | | St. Joe Co. (The) | | | 1,057,940 |

| 20,972 | | Unibail | | | 2,191,950 |

| 43,200 | | Vornado Realty Trust | | | 2,612,736 |

| | | | |

|

|

| | | | | | 12,567,399 |

| |

Home Builder 1.5% | | | |

|

| 19,400 | | Standard Pacific Corp. | | | 1,164,000 |

| |

Lodging 9.0% | | | |

|

| 288,600 | | Host Marriott Corp.(b) | | | 3,688,308 |

| 60,052 | | Interstate Hotels & Resorts, Inc.(b) | | | 354,307 |

| 70,000 | | Starwood Hotels & Resorts Worldwide, Inc. | | | 2,835,000 |

| | | | |

|

|

| | | | | | 6,877,615 |

| |

Multi-Family 5.6% | | | |

|

| 56,400 | | Apartment Investment & Management Co. (Class A) | | | 1,753,476 |

| 47,100 | | Avalonbay Communities, Inc. | | | 2,523,618 |

| | | | |

|

|

| | | | | | 4,277,094 |

| |

Office 8.8% | | | |

|

| 62,200 | | Boston Properties, Inc. | | | 3,378,082 |

| 15,000 | | Dundee Real Estate Investment Trust | | | 285,904 |

| 41,100 | | Liberty Property Trust | | | 1,849,500 |

| 25,000 | | PS Business Parks, Inc. | | | 1,158,750 |

| | | | |

|

|

| | | | | | 6,672,236 |

| |

Retail-Malls 13.5% | | | |

|

| 163,200 | | General Growth Properties, Inc. | | | 5,736,480 |

| 77,700 | | Simon Property Group, Inc. | | | 4,540,788 |

| | | | |

|

|

| | | | | | 10,277,268 |

| |

Retail-Shopping Centers 15.3% | | | |

|

| 18,900 | | Acadia Realty Trust | | | 266,679 |

| 44,900 | | Chelsea Property Group, Inc. | | | 2,826,006 |

| 88,600 | | Kimco Realty Corp. | | | 4,516,828 |

See Notes to Financial Statements.

| | |

| 8 | | Visit our website at www.strategicpartners.com |

| | | | | | |

| Shares | | Description | | Value (Note 1) | |

| 78,600 | | Regency Centers Corp. | | $ | 3,672,978 | |

| 12,700 | | Saul Centers, Inc. | | | 387,985 | |

| | | | |

|

|

|

| | | | | | 11,670,476 | |

| |

Self-Storage Facilities 4.1% | | | | |

| |

| 64,900 | | Public Storage, Inc. | | | 3,158,034 | |

| |

Specialty Finance 12.8% | | | | |

| |

| 85,540 | | iStar Financial, Inc. | | | 3,618,342 | |

| 22,700 | | RAIT Investment Trust | | | 670,785 | |

| 36,100 | | Medical Properties of America(b) | | | 361,000 | |

| 106,800 | | Ventas, Inc. | | | 2,934,864 | |

| 8,500 | | Realty Income Corp. | | | 379,525 | |

| 33,100 | | LNR Property Corp. | | | 1,771,843 | |

| | | | |

|

|

|

| | | | | | 9,736,359 | |

| | | | |

|

|

|

| |

Warehouse 10.3% | | | | |

| |

| 89,500 | | AMB Property Corp. | | | 3,326,715 | |

| 126,500 | | ProLogis | | | 4,537,555 | |

| | | | |

|

|

|

| | | | | | 7,864,270 | |

| | | | |

|

|

|

| | | Total long-term investments

(cost $52,333,898) | | | 74,264,751 | |

| | | | |

|

|

|

SHORT-TERM INVESTMENTS 3.7% | | | | |

| | |

Principal

Amount

(000)

| | | | | |

| |

Repurchase Agreement | | | | |

| |

| 2,855 | | State Street Bank & Trust Co. Repurchase Agreement,

dated 3/31/04, 0.10%, due 4/01/04(c)

(cost $2,855,000) | | | 2,855,000 | |

| | | | |

|

|

|

| | | Total Investments 101.1% (cost $55,188,898) | | | 77,119,751 | |

| | | Liabilities in excess of other assets (1.1%) | | | (846,576 | ) |

| | | | |

|

|

|

| | | Net Assets 100% | | $ | 76,273,175 | |

| | | | |

|

|

|

| (a) | Fair-valued security (Note 1). |

| (b) | Non-income producing security. |

| (c) | Repurchase price of $2,855,008. Collateralized by $2,660,000 U.S. Treasury Bonds with a rate of 10.375%, maturity date of 11/15/09, and aggregate market value, including accrued interest, of $2,916,518. |

See Notes to Financial Statements.

| | |

| Strategic Partners Real Estate Securities Fund | | 9 |

Statement of Assets and Liabilities

as of March 31, 2004

| | | | |

Assets | | | | |

| |

Investments, at value (cost $55,188,898) | | $ | 77,119,751 | |

Receivable for investments sold | | | 1,599,903 | |

Receivable for Fund shares sold | | | 219,570 | |

Dividends and interest receivable | | | 130,133 | |

Tax reclaim receivable | | | 2,652 | |

Other assets | | | 326 | |

| | |

|

|

|

Total assets | | | 79,072,335 | |

| | |

|

|

|

| |

Liabilities | | | | |

| |

Payable for investments purchased | | | 2,365,886 | |

Payable for Fund shares reacquired | | | 157,111 | |

Accrued expenses | | | 112,148 | |

Payable to custodian | | | 77,135 | |

Management fee payable | | | 46,268 | |

Distribution fee payable | | | 40,298 | |

Foreign withholding tax payable | | | 314 | |

| | |

|

|

|

Total liabilities | | | 2,799,160 | |

| | |

|

|

|

| |

Net Assets | | $ | 76,273,175 | |

| | |

|

|

|

| | | | | |

| |

Net assets were comprised of: | | | | |

Shares of beneficial interest, at par | | $ | 4,863 | |

Paid-in capital in excess of par | | | 75,186,860 | |

| | |

|

|

|

| | | | 75,191,723 | |

Undistributed net investment income | | | 41,744 | |

Accumulated net realized loss on investments | | | (20,892,043 | ) |

Net unrealized appreciation on investments | | | 21,931,751 | |

| | |

|

|

|

Net assets, March 31, 2004 | | $ | 76,273,175 | |

| | |

|

|

|

See Notes to Financial Statements.

| | |

| 10 | | Visit our website at www.strategicpartners.com |

| | | |

Class A | | | |

|

Net asset value and redemption price per share ($25,954,264 ÷ 1,651,606 shares of beneficial interest issued and outstanding) | | $ | 15.71 |

Maximum sales charge (5.5% of offering price) | | | .91 |

| | |

|

|

Maximum offering price to public | | $ | 16.62 |

| | |

|

|

| |

Class B | | | |

|

Net asset value, offering price and redemption price per share ($35,961,067 ÷ 2,297,167 shares of beneficial interest issued and outstanding) | | $ | 15.65 |

| | |

|

|

| |

Class C | | | |

|

Net asset value, offering price and redemption price per share ($6,851,675 ÷ 437,679 shares of beneficial interest issued and outstanding) | | $ | 15.65 |

| | |

|

|

| |

Class Z | | | |

|

Net asset value, offering price and redemption price per share

($7,506,169 ÷ 476,685 shares of beneficial interest issued and outstanding) | | $ | 15.75 |

| | |

|

|

See Notes to Financial Statements.

| | |

| Strategic Partners Real Estate Securities Fund | | 11 |

Statement of Operations

Year Ended March 31, 2004

| | | | |

Net Investment Income | | | | |

| |

Income | | | | |

Dividends (net of foreign withholding taxes of $7,338) | | $ | 1,744,593 | |

Interest | | | 3,630 | |

| | |

|

|

|

Total income | | | 1,748,223 | |

| | |

|

|

|

| |

Expenses | | | | |

Management fee | | | 408,473 | |

Distribution fee—Class A | | | 39,714 | |

Distribution fee—Class B | | | 301,955 | |

Distribution fee—Class C | | | 47,341 | |

Custodian’s fees and expenses | | | 133,000 | |

Transfer agent’s fees and expenses | | | 85,000 | |

Legal fees and expenses | | | 37,000 | |

Reports to shareholders | | | 18,000 | |

Audit fee | | | 17,000 | |

Registration fees | | | 11,000 | |

Trustees’ fees | | | 11,000 | |

Amortization of organizational expense | | | 2,461 | |

Miscellaneous | | | 3,214 | |

| | |

|

|

|

Total expenses | | | 1,115,158 | |

| | |

|

|

|

Net investment income | | | 633,065 | |

| | |

|

|

|

| |

Realized and Unrealized Gain (Loss) on Investments and Foreign Currency Transactions | | | | |

| |

Net realized gain (loss) on: | | | | |

Investment transactions | | | 4,537,908 | |

Foreign currency transactions | | | (4,240 | ) |

| | |

|

|

|

| | | | 4,533,668 | |

| | |

|

|

|

Net change in unrealized appreciation on: | | | | |

Investments | | | 21,047,029 | |

Foreign currencies | | | 898 | |

| | |

|

|

|

| | | | 21,047,927 | |

| | |

|

|

|

Net gain on investments | | | 25,581,595 | |

| | |

|

|

|

Net Increase in Net Assets Resulting From Operations | | $ | 26,214,660 | |

| | |

|

|

|

See Notes to Financial Statements.

| | |

| 12 | | Visit our website at www.strategicpartners.com |

Statement of Changes in Net Assets

| | | | | | | | |

| |

| | | Year Ended March 31,

| |

| | | 2004 | | | 2003 | |

Increase (Decrease) in Net Assets | | | | | | | | |

| |

Operations | | | | | | | | |

Net investment income | | $ | 633,065 | | | $ | 1,069,162 | |

Net realized gain on investments and foreign currency transactions | | | 4,533,668 | | | | 3,067,176 | |

Net change in unrealized appreciation (depreciation) on investments and foreign currencies | | | 21,047,927 | | | | (3,681,292 | ) |

| | |

|

|

| |

|

|

|

Net increase in net assets resulting from operations | | | 26,214,660 | | | | 455,046 | |

| | |

|

|

| |

|

|

|

Dividends and distributions (Note 1) | | | | | | | | |

Dividends from net investment income | | | | | | | | |

Class A | | | (258,161 | ) | | | (398,589 | ) |

Class B | | | (376,840 | ) | | | (751,391 | ) |

Class C | | | (56,241 | ) | | | (106,366 | ) |

Class Z | | | (52,132 | ) | | | (61,045 | ) |

| | |

|

|

| |

|

|

|

| | | | (743,374 | ) | | | (1,317,391 | ) |

| | |

|

|

| |

|

|

|

| | |

Fund share transactions (Net of share conversions) (Note 6) | | | | | | | | |

Net proceeds from shares sold | | | 26,824,919 | | | | 18,911,306 | |

Net asset value of shares issued in reinvestment of dividends and distributions | | | 635,174 | | | | 1,117,048 | |

Cost of shares reacquired | | | (18,329,511 | ) | | | (22,372,903 | ) |

| | |

|

|

| |

|

|

|

Net increase (decrease) in net assets from Fund share transactions | | | 9,130,582 | | | | (2,344,549 | ) |

| | |

|

|

| |

|

|

|

Total increase (decrease) | | | 34,601,868 | | | | (3,206,894 | ) |

| | |

Net Assets | | | | | | | | |

| |

Beginning of year | | | 41,671,307 | | | | 44,878,201 | |

| | |

|

|

| |

|

|

|

End of year(a) | | $ | 76,273,175 | | | $ | 41,671,307 | |

| | |

|

|

| |

|

|

|

(a) Includes undistributed net investment income of: | | $ | 41,744 | | | $ | 159,575 | |

| | |

|

|

| |

|

|

|

See Notes to Financial Statements.

| | |

| Strategic Partners Real Estate Securities Fund | | 13 |

Notes to Financial Statements

Strategic Partners Real Estate Securities Fund, Inc. (the “Fund”), is registered under the Investment Company Act of 1940 as a nondiversified, open-end, management investment company. The Fund was established as a Delaware business trust on October 24, 1997. The Fund commenced investment operations on May 5, 1998. The investment objective of the Fund is high current income and long-term growth of capital. It seeks to achieve this objective by investing primarily in equity securities of real estate companies.

Note 1. Accounting Policies

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

Securities Valuation: Securities listed on a securities exchange are valued at the last sale price on such exchange on the day of valuation or, if there was no sale on such day, at the mean between the last reported bid and asked prices, or at the last bid price on such day in the absence of an asked price. Securities that are actively traded via Nasdaq, are valued at the official closing price provided by Nasdaq. Securities that are actively traded in the over-the-counter market, including listed securities for which the primary market is believed by Prudential Investments LLC (“PI” or “Manager”), in consultation with the subadviser, to be over-the-counter, are valued at market value using prices provided by an independent pricing agent or principal market maker. Options on securities and indices traded on an exchange are valued at the mean between the most recently quoted bid and asked prices on such exchange. Future contracts and options thereon traded on a commodities exchange or board of trade are valued at the last sale price at the close of trading on such exchange or board of trade or, if there was no sale on the applicable commodities exchange or board of trade on such day, at the mean between the most recently quoted bid and asked prices on such exchange or board of trade or at the last bid price in the absence of an asked price. Securities for which market quotations are not readily available, or for which pricing services does not provide a valuation methodology, or does not present fair value, or whose values have been affected by events occurring after the close of the security’s foreign market and before the Fund’s normal pricing time, are valued at fair value in accordance with Board of Trustees’ approved fair valuation procedures.

Short-term securities which mature in sixty days or less are valued at amortized cost, which approximates market value. The amortized cost method involves valuing a

| | |

| 14 | | Visit our website at www.strategicpartners.com |

security at its cost on the date of purchases and thereafter assuming a constant amortization to maturity of the difference between the principal amount due at maturity and cost. Short-term securities which mature in more than sixty days are valued at current market quotations.

Foreign Currency Translation: The books and records of the Series are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars on the following basis:

(i) market value of investment securities, other assets and liabilities—at the current rates of exchange;

(ii) purchases and sales of investment securities, income and expenses—at the rates of exchange prevailing on the respective dates of such transactions.

Although the net assets of the Fund are presented at the foreign exchange rates and market values at the close of the fiscal period, the Fund does not isolate that portion of the results of operations arising as a result of changes in the foreign exchange rates from the fluctuations arising from changes in the market prices of securities held at the end of the fiscal period. Similarly, the Fund does not isolate the effect of changes in foreign exchange rates from the fluctuations arising from changes in the market prices of portfolio securities sold during the fiscal period. Accordingly, realized foreign currency gains or losses are included in the reported net realized gains or losses on investment transactions.

Net realized gains or losses on foreign currency transactions represent net foreign exchange gains or losses from the holding of foreign currencies, currency gains or losses realized between the trade date and settlement date on securities transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent amounts actually received or paid. Net unrealized currency gains or losses from valuing foreign currency denominated assets and liabilities (other than investments) at period end exchange rates are reflected as a component of net unrealized appreciation (depreciation) on foreign currencies.

Foreign security and currency transactions may involve certain considerations and risks not typically associated with those of domestic origin as a result of, among other factors, the possibility of political and economic instability or the level of governmental supervision and regulation of foreign securities markets.

Repurchase Agreements: In connection with transactions in repurchase agreements with United States financial institutions, it is the Fund’s policy that its custodian or

| | |

| Strategic Partners Real Estate Securities Fund | | 15 |

Notes to Financial Statements

Cont’d

designated subcustodians, as the case may be under triparty repurchase agreements, take possession of the underlying collateral securities, the value of which exceeds the principal amount of the repurchase transaction, including accrued interest. To the extent that any repurchase transaction exceeds one business day, the value of collateral is marked to market on a daily basis to ensure adequacy of the collateral. If the seller defaults and the value of the collateral declines, or if bankruptcy proceedings are commenced with respect to the seller of the security, realization of the collateral by the Fund may be delayed or limited.

Securities Transactions and Net Investment Income: Securities transactions are recorded on the trade date. Realized and unrealized gains or loss from investments on sales of investments are calculated on the identified cost basis. Dividend income is recorded on the ex-dividend date. Interest income, including amortization of premium and accretion of discount on debt securities, as required, is recorded on the accrual basis. The Fund invests in real estate investment trusts (“REITS”), which report information on the source of their distributions annually. A portion of distributions received from REITS during the period is estimated to be capital gain and a portion is estimated to be return of capital and is recorded as a reduction of their costs. These estimates are adjusted when the actual source of distributions is disclosed by the REITS.

Net investment income or loss (other than distribution fees which are charged directly to the respective class) and unrealized and realized gains or losses are allocated daily to each class of shares based upon the relative proportion of net assets of each class at the beginning of the day.

Dividends and Distributions: The Fund expects to pay dividends of net investment income quarterly and distributions of net realized capital gains, if any, annually. Dividends and distributions to shareholders, which are determined in accordance with federal income tax regulations which may differ from generally accepted accounting principles, are recorded on the ex-dividend date. Permanent book/tax differences relating to income and gains are reclassified amongst undistributed net investment income, accumulated net realized gain or loss and paid-in capital in excess of par, as appropriate.

Taxes: It is the Fund’s policy to continue to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of

| | |

| 16 | | Visit our website at www.strategicpartners.com |

its taxable net income and capital gains, if any, to shareholders. Therefore, no federal income tax provision is required.

Withholding taxes on foreign dividends are recorded, net of reclaimable amounts, at the time the related income is earned.

Organization Expenses: Organization costs of approximately $108,700 are being amortized ratably over a period of sixty months from the date the Fund commenced investment operations.

Estimates: The preparation of the financial statements requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

Note 2. Agreements

The Fund has a management agreement with PI. Pursuant to this agreement, PI has responsibility for all investment advisory services and supervises the subadviser’s performance of such services. PI has a subadvisory agreement with Wellington Management Company, LLP (“Wellington” or “subadviser”). The subadvisory agreement provides that Wellington furnishes investment advisory services in connection with the management of the Fund. In connection therewith, Wellington is obligated to keep certain books and records of the Fund. PI continues to have responsibility for all investment advisory services pursuant to the management agreement and supervises Wellington’s performance of such services. PI pays for the services of Wellington, the cost of compensation of officers of the Fund, occupancy and certain clerical and bookkeeping costs of the Fund. The Fund bears all other costs and expenses.

The management fee paid to PI is computed daily and payable monthly at an annual rate of .75 of 1% of the Fund’s average daily net assets.

The Fund has a distribution agreement with Prudential Investment Management Services LLC (“PIMS”), which acts as the distributor of the Class A, Class B, Class C and Class Z shares of the Fund. The Fund compensates PIMS for distributing and servicing the Fund’s Class A, Class B and Class C shares, pursuant to a plan of distribution (the “Class A, B and C Plans”), regardless of expenses actually incurred by PIMS. The distribution fees are accrued daily and payable monthly. No distribution or service fees are paid to PIMS as distributor of the Class Z shares of the Fund.

Pursuant to the Class A, B and C Plans, the Fund compensates PIMS for distribution-related activities at an annual rate of up to .30 of 1%, 1% and 1%, of the average

| | |

| Strategic Partners Real Estate Securities Fund | | 17 |

Notes to Financial Statements

Cont’d

daily net assets of the Class A, B and C shares, respectively. For the year ended March 31, 2004, PIMS has contractually agreed to limit such fees to .25% of 1% of the average daily net assets of the Class A shares.

PIMS has advised the Fund that it received approximately $74,800 and $4,600 in front-end sales charges resulting from sales of Class A and Class C shares, respectively, during the year ended March 31, 2004. From these fees, PIMS paid such sales charges to dealers, which in turn paid commissions to salespersons and incurred other distribution costs.

PIMS has advised the Fund that for the year ended March 31, 2004, it received approximately $53,300 and $1,900 in contingent deferred sales charges imposed upon certain redemptions by Class B and Class C shareholders, respectively.

PI and PIMS are indirect, wholly-owned subsidiaries of Prudential Financial, Inc. (“Prudential”).

The Fund, along with other affiliated registered investment companies (the “Funds”), is a party to a syndicated credit agreement (“SCA”) with a group of banks. For the year ended March 31, 2004, the SCA provides for a commitment of $800 million and allows the Funds to increase the commitment to $1 billion, if necessary. Interest on any borrowings under the SCA will be incurred at market rates. The Funds pay a commitment fee of .08 of 1% of the unused portion of the SCA. The commitment fee is accrued daily and paid quarterly and is allocated to the Funds pro rata, based on net assets. The purpose of the SCA is to serve as an alternative source of funding for capital share redemptions. The expiration date of the SCA was April 30, 2004. Effective May 1, 2004, the commitment will be reduced to $500 million. All other terms and conditions will remain the same. The expiration of the renewed SCA will be October 29, 2004. The fund did not borrow any amounts pursuant to the SCA during the year ended March 31, 2004.

Note 3. Other Transactions with Affiliates

Prudential Mutual Fund Services LLC (“PMFS”), an affiliate of PI and an indirect, wholly-owned subsidiary of Prudential, serves as the Fund’s transfer agent. During the year ended March 31, 2004, the Fund incurred fees of approximately $66,400 for the services of PMFS. As of March 31, 2004, approximately $6,400 of such fees were due

| | |

| 18 | | Visit our website at www.strategicpartners.com |

to PMFS. Transfer agent fees and expenses in the Statement of Operations include certain out-of-pocket expenses paid to non-affiliates, where applicable.

The Fund pays networking fees to affiliated and unaffiliated broker/dealers. These networking fees are payments made to broker/dealers that clear mutual fund transactions through a national clearing system. The Fund incurred approximately $10,200 in total networking fees, of which the amount relating to the services of Wachovia Securities, LLC (“Wachovia”) and Prudential Securities, Inc. (“PSI”), affiliates of PI, was approximately $9,500 for the year ended March 31, 2004. Effective July 1, 2003 Prudential and Wachovia Corp. formed a joint venture (“Wachovia Securities, LLC”) whereby Prudential and Wachovia Corp. combined their brokerage business with Prudential holding a minority interest. Prior to July 1, 2003, PSI was an indirect, wholly-owned subsidiary of Prudential. As of March 31, 2004, approximately $1,000 of such fees were due to Wachovia. These amounts are included in the transfer agent’s fees and expenses in the Statement of Operations.

For the period of July 1, 2003 to March 31, 2004, Wachovia earned $470 in brokerage commissions from portfolio transactions executed on behalf of the Fund.

Note 4. Portfolio Securities

Purchases and sales of investment securities, other than short-term investments, for the year ended March 31, 2004 aggregated $42,789,492 and $34,538,928, respectively.

Note 5. Distributions and Tax Information

In order to present undistributed net investment income (loss) and accumulated net realized gains (losses) on the Statement of Assets and Liabilities that more closely represent their tax character, certain adjustments have been made to paid-in-capital in excess of par, undistributed net investment income (loss) and accumulated net realized gain (loss) on investments. For the year ended March 31, 2004, the adjustments were to decrease accumulated net realized loss by $4,240, decrease undistributed net investment income by $7,522, and decrease paid-in-capital in excess of par by $3,282 for foreign currencies, certain expenses not deductible for tax purposes and redemptions utilized as distributions. Net investment income, net realized gains and net assets were not affected by this change date.

For the years ended March 31, 2004 and March 31, 2003, the tax character of dividends paid by the Fund was $749,117 and $1,317,391, respectively, from ordinary income.

| | |

| Strategic Partners Real Estate Securities Fund | | 19 |

Notes to Financial Statements

Cont’d

For the years ended March 31, 2004 and March 31, 2003, the Fund had undistributed ordinary income on a tax basis of $41,744 and $159,575, respectively.

For federal income tax purposes, the Fund had a capital loss carryforward as of March 31, 2004, of approximately $20,544,000 of which $18,400,000 expires in 2008 and $2,144,000 expires in 2009. Accordingly, no capital gains distributions are expected to be paid to shareholders until future net gains have been realized in excess of such carryforward.

The United States federal income tax basis of the Fund’s investments and the net unrealized appreciation as of March 31, 2004 were as follows:

| | | | | | | | |

Tax Basis

| | Appreciation

| | Depreciation

| | Other Cost Basis

Adjustments

| | Total

Net Unrealized Appreciation

|

| $55,536,766 | | $22,053,525 | | $470,540 | | $898 | | $21,583,883 |

The difference between book basis and tax basis was attributable to deferred losses on wash sales.

Note 6. Capital

The Fund offers Class A, Class B, Class C and Class Z shares. Class A shares are sold with a front-end sales charge of up to 5.5%. Prior to March 15, 2004, Class A shares were sold with a front-end sales charge of 5%. Effective March 15, 2004, all investors who purchase Class A shares in an amount of $1 million or more and sell these shares within 12 months of purchase are subject to a contingent deferred sales charge (CDSC) of 1%, including investors who purchase their shares through broker-dealers affiliated with Prudential. Class B shares are sold with a contingent deferred sales charge which declines from 5% to zero depending on the period of time the shares are held. Prior to February 2, 2004, Class C shares were sold with a front-end sales charge of 1% and a contingent deferred sales charge of 1% during the first 18 months. Class C shares purchased on or after February 2, 2004 are not subject to an initial sales charge and the contingent deferred sales charge (CDSC) for Class C shares will be 12 months from the date of purchase. Class B shares automatically convert to Class A shares on a quarterly basis approximately seven years after purchase. A special exchange privilege is also available for shareholders who qualified to purchase Class A shares at net asset value. Class Z shares are not subject to any sales or redemption charge and are offered exclusively for sale to a limited group of investors.

| | |

| 20 | | Visit our website at www.strategicpartners.com |

There is an unlimited number of shares of beneficial interest, $.001 par value per share, divided into four classes, designated Class A, Class B, Class C and Class Z.

At March 31, 2004, Prudential owns 1 share of each Class A, Class B, Class C and Class Z.

| | | | | | | |

Class A

| | Shares

| | | Amount

| |

Year ended March 31, 2004: | | | | | | | |

Shares sold | | 1,001,362 | | | $ | 13,259,775 | |

Shares issued in reinvestment of dividends | | 19,338 | | | | 221,931 | |

Shares reacquired | | (530,737 | ) | | | (6,563,602 | ) |

| | |

|

| |

|

|

|

Net increase (decrease) in shares outstanding before conversion | | 489,963 | | | | 6,918,104 | |

Shares issued upon conversion from Class B | | 36,097 | | | | 479,841 | |

| | |

|

| |

|

|

|

Net increase (decrease) in shares outstanding | | 526,060 | | | $ | 7,397,945 | |

| | |

|

| |

|

|

|

Year ended March 31, 2003: | | | | | | | |

Shares sold | | 720,377 | | | $ | 7,051,194 | |

Shares issued in reinvestment of dividends | | 35,963 | | | | 346,610 | |

Shares reacquired | | (784,287 | ) | | | (7,543,928 | ) |

| | |

|

| |

|

|

|

Net increase (decrease) in shares outstanding before conversion | | (27,947 | ) | | | (146,124 | ) |

Shares issued upon conversion from Class B | | 27,626 | | | | 274,022 | |

| | |

|

| |

|

|

|

Net increase (decrease) in shares outstanding | | (321 | ) | | $ | 127,898 | |

| | |

|

| |

|

|

|

Class B

| | | | | | |

Year ended March 31, 2004: | | | | | | | |

Shares sold | | 397,793 | | | $ | 5,007,352 | |

Shares issued in reinvestment of dividends | | 27,360 | | | | 311,318 | |

Shares reacquired | | (645,096 | ) | | | (7,992,963 | ) |

| | |

|

| |

|

|

|

Net increase (decrease) in shares outstanding before conversion | | (219,943 | ) | | | (2,674,293 | ) |

Shares reacquired upon conversion from Class A | | (36,185 | ) | | | (479,841 | ) |

| | |

|

| |

|

|

|

Net increase (decrease) in shares outstanding | | (256,128 | ) | | $ | (3,154,134 | ) |

| | |

|

| |

|

|

|

Year ended March 31, 2003: | | | | | | | |

Shares sold | | 728,086 | | | $ | 7,188,231 | |

Shares issued in reinvestment of dividends | | 63,891 | | | | 616,151 | |

Shares reacquired | | (1,061,355 | ) | | | (10,341,123 | ) |

| | |

|

| |

|

|

|

Net increase (decrease) in shares outstanding before conversion | | (269,378 | ) | | | (2,536,741 | ) |

Shares reacquired upon conversion from Class A | | (27,665 | ) | | | (274,022 | ) |

| | |

|

| |

|

|

|

Net increase (decrease) in shares outstanding | | (297,043 | ) | | $ | (2,810,763 | ) |

| | |

|

| |

|

|

|

Class C

| | | | | | |

Year ended March 31, 2004: | | | | | | | |

Shares sold | | 208,265 | | | $ | 2,751,417 | |

Shares issued in reinvestment of dividends | | 4,506 | | | | 51,369 | |

Shares reacquired | | (146,029 | ) | | | (1,801,285 | ) |

| | |

|

| |

|

|

|

Net increase (decrease) in shares outstanding | | 66,742 | | | $ | 1,001,501 | |

| | |

|

| |

|

|

|

Year ended March 31, 2003: | | | | | | | |

Shares sold | | 135,638 | | | $ | 1,326,702 | |

Shares issued in reinvestment of dividends | | 10,007 | | | | 96,488 | |

Shares reacquired | | (188,554 | ) | | | (1,823,267 | ) |

| | |

|

| |

|

|

|

Net increase (decrease) in shares outstanding | | (42,909 | ) | | $ | (400,077 | ) |

| | |

|

| |

|

|

|

| | |

| Strategic Partners Real Estate Securities Fund | | 21 |

Notes to Financial Statements

Cont’d

| | | | | | | |

Class Z

| | Shares

| | | Amount

| |

Year ended March 31, 2004: | | | | | | | |

Shares sold | | 442,671 | | | $ | 5,806,375 | |

Shares issued in reinvestment of dividends | | 4,358 | | | | 50,556 | |

Shares reacquired | | (161,624 | ) | | | (1,971,661 | ) |

| | |

|

| |

|

|

|

Net increase (decrease) in shares outstanding | | 285,405 | | | $ | 3,885,270 | |

| | |

|

| |

|

|

|

Year ended March 31, 2003: | | | | | | | |

Shares sold | | 343,421 | | | $ | 3,345,179 | |

Shares issued in reinvestment of dividends | | 6,049 | | | | 57,799 | |

Shares reacquired | | (276,329 | ) | | | (2,664,585 | ) |

| | |

|

| |

|

|

|

Net increase (decrease) in shares outstanding | | 73,141 | | | $ | 738,393 | |

| | |

|

| |

|

|

|

Note 7. Change in Independent Auditors

PricewaterhouseCoopers LLP was previously the independent auditors for the Fund. The decision to change the independent auditors was approved by the Audit Committee and by the Board of Trustees in a meeting held on November 18, 2003, resulting in KPMG LLP’s appointment as independent auditors of the Fund.

The reports on the financial statements of the Fund audited by PricewaterhouseCoopers LLP through the year ended March 31, 2003 did not contain an adverse opinion or disclaimer of opinion, and were not qualified or modified as to uncertainty, audit scope or accounting principles. There were no disagreements between the Fund and PricewaterhouseCoopers LLP on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures.

Note 8. Subsequent Events

On April 8, 2004 the Board of Trustees of the Fund declared the following dividends per share, payable on April 13, 2004 to shareholders of record on April 12, 2004.

| | | | | | | | | |

| | | |

| | | Class A

| | Class B

and C

| | Class Z

|

Ordinary Income | | $ | 0.03 | | $ | 0.01 | | $ | 0.04 |

| | |

| 22 | | Visit our website at www.strategicpartners.com |

Financial Highlights

| | |

|

| MARCH 31, 2004 | | ANNUAL REPORT |

Real Estate Securities Fund

Financial Highlights

| | | | |

| |

| | | Class A

| |

| | | Year Ended

March 31, 2004 | |

| |

Per Share Operating Performance: | | | | |

Net Asset Value, Beginning Of Year | | $ | 9.84 | |

| | |

|

|

|

Income from investment operations | | | | |

Net investment income | | | .16 | |

Net realized and unrealized gain (loss) on investment and foreign currency transactions | | | 5.93 | |

| | |

|

|

|

Total from investment operations | | | 6.09 | |

| | |

|

|

|

Less Distributions: | | | | |

Dividends from net investment income | | | (.22 | ) |

Distributions in excess of net investment income | | | — | |

Tax return of capital distributions | | | — | |

| | |

|

|

|

Total distributions | | | (.22 | ) |

| | |

|

|

|

Net asset value, end of year | | $ | 15.71 | |

| | |

|

|

|

Total Return(a): | | | 62.79 | % |

Ratios/Supplemental Data: | | | | |

Net assets, end of year (000) | | $ | 25,954 | |

Average net assets (000) | | $ | 15,886 | |

Ratios to average net assets: | | | | |

Expenses, including distribution and service (12b-1) fees(d) | | | 1.58 | % |

Expenses, excluding distribution and service (12b-1) fees | | | 1.33 | % |

Net investment income | | | 1.53 | % |

For Class A, B, C and Z shares: | | | | |

Portfolio turnover | | | 65 | % |

| (a) | Total return does not consider the effects of sales loads. Total return is calculated assuming a purchase of shares on the first day and a sale on the last day of each year reported and includes reinvestment of dividends and distributions. |

| (b) | Less than $.005 per share. |

| (c) | Based on average shares outstanding during the year. |

| (d) | The Distributor of the Fund contractually agreed to limit its distribution and service (12b-1) fees to .25 of 1% of the average net assets for the Class A shares. |

See Notes to Financial Statements.

| | |

| 24 | | Visit our website at www.strategicpartners.com |

| | | | | | | | | | | | | | |

|

| Class A | |

|

| Year Ended March 31, | |

|

| 2003 | | | 2002 | | | 2001 | | | 2000 | |

| |

| | | | | | | | | | | | | | | |

| $ | 9.97 | | | $ | 8.71 | | | $ | 7.79 | | | $ | 7.46 | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | | | | | | | | | |

| | .29 | (c) | | | .31 | (c) | | | .28 | (c) | | | .15 | (c) |

| | (.08 | ) | | | 1.30 | | | | .82 | | | | .42 | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | .21 | | | | 1.61 | | | | 1.10 | | | | .57 | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | | | | | | | | | |

| | (.34 | ) | | | (.35 | ) | | | (.18 | ) | | | (.21 | ) |

| | — | | | | — | | | | — | | | | — | (b) |

| | — | | | | — | | | | — | | | | (.03 | ) |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | (.34 | ) | | | (.35 | ) | | | (.18 | ) | | | (.24 | ) |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| $ | 9.84 | | | $ | 9.97 | | | $ | 8.71 | | | $ | 7.79 | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | 2.27 | % | | | 19.00 | % | | | 14.28 | % | | | 7.74 | % |

| | | | | | | | | | | | | | | |

| $ | 11,073 | | | $ | 11,225 | | | $ | 15,103 | | | $ | 16,545 | |

| $ | 11,248 | | | $ | 12,433 | | | $ | 16,271 | | | $ | 19,631 | |

| | | | | | | | | | | | | | | |

| | 1.79 | % | | | 1.93 | % | | | 1.87 | % | | | 1.70 | % |

| | 1.54 | % | | | 1.68 | % | | | 1.62 | % | | | 1.45 | % |

| | 2.97 | % | | | 3.43 | % | | | 3.27 | % | | | 1.93 | % |

| | | | | | | | | | | | | | | |

| | 92 | % | | | 110 | % | | | 62 | % | | | 54 | % |

See Notes to Financial Statements.

| | |

| Strategic Partners Real Estate Securities Fund | | 25 |

Financial Highlights

Cont’d

| | | | |

| |

| | | Class B

| |

| | | Year Ended

March 31, 2004 | |

| |

Per Share Operating Performance: | | | | |

Net Asset Value, Beginning Of Year | | $ | 9.82 | |

| | |

|

|

|

Income from investment operations | | | | |

Net investment income | | | .12 | |

Net realized and unrealized gain (loss) on investment and foreign currency transactions | | | 5.86 | |

| | |

|

|

|

Total from investment operations | | | 5.98 | |

| | |

|

|

|

Less Distributions: | | | | |

Dividends from net investment income | | | (.15 | ) |

Distributions in excess of net investment income | | | — | |

Tax return of capital distributions | | | — | |

| | |

|

|

|

Total distributions | | | (.15 | ) |

| | |

|

|

|

Net asset value, end of year | | $ | 15.65 | |

| | |

|

|

|

Total Return(a): | | | 61.62 | % |

Ratios/Supplemental Data: | | | | |

Net assets, end of year (000) | | $ | 35,961 | |

Average net assets (000) | | $ | 30,195 | |

Ratios to average net assets: | | | | |

Expenses, including distribution and service (12b-1) fees | | | 2.33 | % |

Expenses, excluding distribution and service (12b-1) fees | | | 1.33 | % |

Net investment income | | | .97 | % |

| (a) | Total return does not consider the effects of sales loads. Total return is calculated assuming a purchase of shares on the first day and a sale on the last day of each year reported and includes reinvestment of dividends and distributions. |

| (b) | Less than $.005 per share. |

| (c) | Based on average shares outstanding during the year. |

See Notes to Financial Statements

| | |

| 26 | | Visit our website at www.strategicpartners.com |

| | | | | | | | | | | | | | |

|

| Class B | |

|

| Year Ended March 31, | |

|

| 2003 | | | 2002 | | | 2001 | | | 2000 | |

| |

| | | | | | | | | | | | | | | |

| $ | 9.95 | | | $ | 8.69 | | | $ | 7.78 | | | $ | 7.45 | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | | | | | | | | | |

| | .22 | (c) | | | .24 | (c) | | | .21 | (c) | | | .09 | (c) |

| | (.08 | ) | | | 1.30 | | | | .82 | | | | .42 | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | .14 | | | | 1.54 | | | | 1.03 | | | | .51 | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | | | | | | | | | |

| | (.27 | ) | | | (.28 | ) | | | (.12 | ) | | | (.15 | ) |

| | — | | | | — | | | | — | | | | — | (b) |

| | — | | | | — | | | | — | | | | (.03 | ) |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | (.27 | ) | | | (.28 | ) | | | (.12 | ) | | | (.18 | ) |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| $ | 9.82 | | | $ | 9.95 | | | $ | 8.69 | | | $ | 7.78 | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | 1.47 | % | | | 18.14 | % | | | 13.35 | % | | | 6.96 | % |

| | | | | | | | | | | | | | | |

| $ | 25,072 | | | $ | 28,357 | | | $ | 28,118 | | | $ | 33,616 | |

| $ | 26,955 | | | $ | 27,939 | | | $ | 30,747 | | | $ | 47,271 | |

| | | | | | | | | | | | | | | |

| | 2.54 | % | | | 2.68 | % | | | 2.62 | % | | | 2.45 | % |

| | 1.54 | % | | | 1.68 | % | | | 1.62 | % | | | 1.45 | % |

| | 2.20 | % | | | 2.67 | % | | | 2.49 | % | | | 1.16 | % |

See Notes to Financial Statements.

| | |

| Strategic Partners Real Estate Securities Fund | | 27 |

Financial Highlights

Cont’d

| | | | |

| |

| | | Class C

| |

| | | Year Ended

March 31, 2004 | |

| |

Per Share Operating Performance: | | | | |

Net Asset Value, Beginning Of Year | | $ | 9.82 | |

| | |

|

|

|

Income from investment operations | | | | |

Net investment income | | | .12 | |

Net realized and unrealized gain (loss) on investment and foreign currency transactions | | | 5.86 | |

| | |

|

|

|

Total from investment operations | | | 5.98 | |

| | |

|

|

|

Less Distributions: | | | | |

Dividends from net investment income | | | (.15 | ) |

Distributions in excess of net investment income | | | — | |

Tax return of capital distributions | | | — | |

| | |

|

|

|

Total distributions | | | (.15 | ) |

| | |

|

|

|

Net asset value, end of year | | $ | 15.65 | |

| | |

|

|

|

Total Return(a): | | | 61.62 | % |

Ratios/Supplemental Data: | | | | |

Net assets, end of year (000) | | $ | 6,852 | |

Average net assets (000) | | $ | 4,734 | |

Ratios to average net assets: | | | | |

Expenses, including distribution and service (12b-1) fees | | | 2.33 | % |

Expenses, excluding distribution and service (12b-1) fees | | | 1.33 | % |

Net investment income | | | .87 | % |

| (a) | Total return does not consider the effects of sales loads. Total return is calculated assuming a purchase of shares on the first day and a sale on the last day of each year reported and includes reinvestment of dividends and distributions. |

| (b) | Less than $.005 per share. |

| (c) | Based on average shares outstanding during the year. |

See Notes to Financial Statements

| | |

| 28 | | Visit our website at www.strategicpartners.com |

| | | | | | | | | | | | | | |

|

| Class C | |

|

| Year Ended March 31, | |

|

| 2003 | | | 2002 | | | 2001 | | | 2000 | |

| |

| | | | | | | | | | | | | | | |

| $ | 9.95 | | | $ | 8.69 | | | $ | 7.78 | | | $ | 7.45 | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | | | | | | | | | |

| | .22 | (c) | | | .25 | (c) | | | .21 | (c) | | | .09 | (c) |

| | (.08 | ) | | | 1.29 | | | | .82 | | | | .42 | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | .14 | | | | 1.54 | | | | 1.03 | | | | .51 | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | | | | | | | | | |

| | (.27 | ) | | | (.28 | ) | | | (.12 | ) | | | (.15 | ) |

| | — | | | | — | | | | — | | | | — | (b) |

| | — | | | | — | | | | — | | | | (.03 | ) |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | (.27 | ) | | | (.28 | ) | | | (.12 | ) | | | (.18 | ) |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| $ | 9.82 | | | $ | 9.95 | | | $ | 8.69 | | | $ | 7.78 | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | 1.47 | % | | | 18.14 | % | | | 13.35 | % | | | 6.96 | % |

| | | | | | | | | | | | | | | |

| $ | 3,642 | | | $ | 4,117 | | | $ | 4,750 | | | $ | 5,162 | |

| $ | 3,891 | | | $ | 4,390 | | | $ | 5,096 | | | $ | 8,215 | |

| | | | | | | | | | | | | | | |

| | 2.54 | % | | | 2.68 | % | | | 2.62 | % | | | 2.45 | % |

| | 1.54 | % | | | 1.68 | % | | | 1.62 | % | | | 1.45 | % |

| | 2.24 | % | | | 2.72 | % | | | 2.52 | % | | | 1.12 | % |

See Notes to Financial Statements.

| | |

| Strategic Partners Real Estate Securities Fund | | 29 |

Financial Highlights

Cont’d

| | | | |

| |

| | | Class Z

| |

| | | Year Ended

March 31, 2004 | |

| |

Per Share Operating Performance: | | | | |

Net Asset Value, Beginning Of Year | | $ | 9.85 | |

| | |

|

|

|

Income from investment operations | | | | |

Net investment income | | | .18 | |

Net realized and unrealized gain (loss) on investment and foreign currency transactions | | | 5.96 | |

| | |

|

|

|

Total from investment operations | | | 6.14 | |

| | |

|

|

|

Less Distributions: | | | | |

Dividends from net investment income | | | (.24 | ) |

Distributions in excess of net investment income | | | — | |

Tax return of capital distributions | | | — | |

| | |

|

|

|

Total distributions | | | (.24 | ) |

| | |

|

|

|

Net asset value, end of year | | $ | 15.75 | |

| | |

|

|

|

Total Return(a): | | | 63.21 | % |

Ratios/Supplemental Data: | | | | |

Net assets, end of year (000) | | $ | 7,506 | |

Average net assets (000) | | $ | 3,648 | |

Ratios to average net assets: | | | | |

Expenses, including distribution and service (12b-1) fees | | | 1.33 | % |

Expenses, excluding distribution and service (12b-1) fees | | | 1.33 | % |

Net investment income | | | 1.52 | % |

| (a) | Total return does not consider the effects of sales loads. Total return is calculated assuming a purchase of shares on the first day and a sale on the last day of each year reported and includes reinvestment of dividends and distributions. |

| (b) | Less than $.005 per share. |

| (c) | Based on average shares outstanding during the year. |

See Notes to Financial Statements

| | |

| 30 | | Visit our website at www.strategicpartners.com |

| | | | | | | | | | | | | | |

|

| Class Z | |

|

| Year Ended March 31, | |

|

| 2003 | | | 2002 | | | 2001 | | | 2000 | |

| |

| | | | | | | | | | | | | | | |

| $ | 9.98 | | | $ | 8.72 | | | $ | 7.80 | | | $ | 7.47 | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | | | | | | | | | |

| | .31 | (c) | | | .33 | (c) | | | .29 | (c) | | | .18 | (c) |

| | (.07 | ) | | | 1.30 | | | | .83 | | | | .41 | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | .24 | | | | 1.63 | | | | 1.12 | | | | .59 | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | | | | | | | | | |

| | (.37 | ) | | | (.37 | ) | | | (.20 | ) | | | (.23 | ) |

| | — | | | | — | | | | — | | | | — | (b) |

| | — | | | | — | | | | — | | | | (.03 | ) |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | (.37 | ) | | | (.37 | ) | | | (.20 | ) | | | (.26 | ) |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| $ | 9.85 | | | $ | 9.98 | | | $ | 8.72 | | | $ | 7.80 | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | 2.52 | % | | | 19.29 | % | | | 14.54 | % | | | 8.02 | % |

| | | | | | | | | | | | | | | |

| $ | 1,884 | | | $ | 1,179 | | | $ | 1,045 | | | $ | 1,746 | |

| $ | 1,722 | | | $ | 988 | | | $ | 1,376 | | | $ | 1,482 | |

| | | | | | | | | | | | | | | |

| | 1.54 | % | | | 1.68 | % | | | 1.62 | % | | | 1.45 | % |

| | 1.54 | % | | | 1.68 | % | | | 1.62 | % | | | 1.45 | % |

| | 3.17 | % | | | 3.70 | % | | | 3.43 | % | | | 2.32 | % |

See Notes to Financial Statements.

| | |

| Strategic Partners Real Estate Securities Fund | | 31 |

Report of Independent Registered Public Accounting Firm

The Board of Trustees and Shareholders of

Strategic Partners Real Estate Securities Fund

We have audited the accompanying statement of assets and liabilities of the Strategic Partners Real Estate Securities Fund, (the “Fund”) formerly known as the Prudential Real Estate Securities Fund, including the portfolio of investments, as of March 31, 2004, and the related statement of operations, the statement of changes in net assets, and the financial highlights for the year then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit. The statement of changes in net assets and the financial highlights for the years presented through March 31, 2003, were audited by other auditors, whose report dated, May 15, 2003, expressed an unqualified opinion thereon.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of March 31, 2004 by correspondence with the custodian and brokers. As to securities purchased or sold but not yet received or delivered, we performed other appropriate auditing procedures. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Strategic Partners Real Estate Securities Fund as of March 31, 2004 and the results of its operations, the changes in its net assets, and the financial highlights for the year then ended, in conformity with accounting principles generally accepted in the United States of America.

New York, New York

May 18, 2004

| | |

| 32 | | Visit our website at www.strategicpartners.com |

Strategic Partners Real Estate Securities Fund

Federal Income Tax Information (Unaudited)

We are required by the Internal Revenue Code to advise you within 60 days of the Fund’s fiscal year end (March 31, 2004) as to the federal tax status of dividends paid by the Fund during such fiscal year. Accordingly, we are advising you that in the fiscal year ended March 31, 2004, dividends were paid of $.216, $.153, $.153 and $.236 per share (representing net investment income for Class A, B, C and Z shares respectively), which are taxable as ordinary income. The Fund utilized redemptions as distributions in the amount of $.0012 of ordinary income for each class of shares.

We wish to advise you that the corporate dividends received deduction for the Fund is 24%. Only funds that invest in U.S. equity securities are entitled to pass-through a corporate dividends received deduction.

In January 2004, you were advised on IRS Form 1099 DIV or substitute 1099 DIV as to the federal tax status of the dividends received by you in calendar year 2003.

| | |

| Strategic Partners Real Estate Securities Fund | | 33 |

Management of the Fund

(Unaudited)

Information pertaining to the Trustees of the Fund is set forth below. Trustees who are not deemed to be “interested persons” of the Fund, as defined in the 1940 Act are referred to as “Independent Trustees.” Trustees who are deemed to be “interested persons” of the Fund are referred to as “Interested Trustees.” “Fund Complex”† consists of the Fund and any other investment companies managed by Prudential Investments LLC (the Manager or PI).

Independent Trustees(2)

David E.A. Carson (69), Trustee since 2003(3) Oversees 89 portfolios in Fund complex

Principal occupations (last 5 years): Director (January 2000 to May 2000), Chairman (January 1999 to December 1999), Chairman and Chief Executive Officer (January 1998 to December 1998) and President, Chairman and Chief Executive Officer (1983-1997) of People’s Bank.

Other Directorships held:(4) Director of United Illuminating and UIL Holdings (utility company), since 1993.

Robert E. La Blanc (70), Trustee since 2001(3) Oversees 97 portfolios in Fund complex

Principal occupations (last 5 years): President (since 1981) of Robert E. La Blanc Associates, Inc. (telecommunications); formerly General Partner at Salomon Brothers and Vice-Chairman of Continental Telecom; Trustee of Manhattan College.

Other Directorships held:(4) Director of Storage Technology Corporation (technology) (since 1979), Chartered Semiconductor Manufacturing, Ltd. (since 1998); Titan Corporation (electronics) (since 1995), Computer Associates International, Inc. (software company) (since 2002); FiberNet Telecom Group, Inc. (telecom company) (since 2003); Director (since April 1999) of the High Yield Plus Fund, Inc.

Douglas H. McCorkindale (64), Trustee since 2003(3) Oversees 90 portfolios in Fund complex

Principal occupations (last 5 years): Chairman (since February 2001), Chief Executive Officer (since June 2000) and President (since September 1997) of Gannett Co. Inc. (publishing and media); formerly Vice Chairman (March 1984-May 2000) of Gannett Co., Inc.

Other Directorships held:(4) Director of Gannett Co. Inc., Director of Continental Airlines, Inc. (since May 1993); Director of Lockheed Martin Corp. (aerospace and defense) (since May 2001); Director of The High Yield Plus Fund, Inc. (since 1996).

Richard A. Redeker (60), Trustee since 2003(3) Oversees 91 portfolios in Fund complex

Principal occupations (last 5 years): Management Consultant; Director of Invesmart, Inc. (since 2001) and Director of Penn Tank Lines, Inc. (since 1999).

Other Directorships held:(4) None.

| | |

| 34 | | Visit our website at www.strategicpartners.com |

Robin B. Smith (64), Trustee since 1997(3) Oversees 96 portfolios in Fund complex

Principal occupations (last 5 years): Chairman of the Board (since January 2003) of Publishers Clearing House (direct marketing); formerly Chairman and Chief Executive Officer (August 1996-January 2003) of Publishers Clearing House.

Other Directorships held:(4) Director of BellSouth Corporation (since 1992).

Stephen D. Stoneburn (60), Trustee since 2001(3) Oversees 94 portfolios in Fund complex

Principal occupations (last 5 years): President and Chief Executive Officer (since June 1996) of Quadrant Media Corp. (a publishing company); formerly President (June 1995-June 1996) of Argus Integrated Media, Inc.; Senior Vice President and Managing Director (January 1993-1995) of Cowles Business Media and Senior Vice President of Fairchild Publications, Inc. (1975-1989).

Other Directorships held:(4) None

Clay T. Whitehead (65), Trustee since 1997(3) Oversees 95 portfolios in Fund complex

Principal occupations (last 5 years): President (since 1983) of National Exchange Inc. (new business development firm).

Other Directorships held:(4) Director (since 2000) of the High Yield Plus Fund, Inc.

Interested Trustees(1)

Judy A. Rice (56), President since 2003 and Trustee since 2000(3) Oversees 94 portfolios in Fund complex