UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-08565 |

| |

| Exact name of registrant as specified in charter: | | Prudential Investment Portfolios 12 |

|

| (This Form N-CSR relates solely to the Registrant’s PGIM Global Real Estate Fund, PGIM Jennison Technology Fund, PGIM Jennison International Small-Mid Cap Opportunities Fund and PGIM Jennison NextGeneration Global Opportunities Fund (each a “Fund” and collectively the “Funds”)) |

| |

| Address of principal executive offices: | | 655 Broad Street, 17th Floor |

| | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Andrew R. French |

| | 655 Broad Street, 17th Floor |

| | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 10/31/2021 |

| |

| Date of reporting period: | | 10/31/2021 |

Item 1 – Reports to Stockholders

PGIM GLOBAL REAL ESTATE FUND

ANNUAL REPORT

OCTOBER 31, 2021

|

|

To enroll in e-delivery, go to pgim.com/investments/resource/edelivery |

Table of Contents

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

Mutual funds are distributed by Prudential Investment Management Services LLC (PIMS), member SIPC. PGIM Real Estate is a unit of PGIM, Inc. (PGIM), a registered investment adviser. PIMS and PGIM are Prudential Financial companies. © 2021 Prudential Financial, Inc. and its related entities. PGIM Real Estate, PGIM, and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

| | |

| 2 | | Visit our website at pgim.com/investments |

Letter from the President

| | |

| | Dear Shareholder: We hope you find the annual report for the PGIM Global Real Estate Fund informative and useful. The report covers performance for the 12-month period that ended October 31, 2021. The global economy and markets continued to recover throughout the period from the ongoing impact of the COVID-19 pandemic. The Federal Reserve slashed interest rates and kept them near zero to encourage borrowing. Congress passed stimulus bills worth several trillion dollars to help consumers and businesses. And several |

effective COVID-19 vaccines received regulatory approval. Those measures were enough to offset the fear of rising inflation and supply chain challenges that threatened to disrupt growth.

At the start of the period, stocks had recovered most of the steep losses they had suffered at the onset of the pandemic. Equities rallied as states reopened their economies but became more volatile as investors worried that a surge in COVID-19 infections would stall the recovery. However, rising corporate profits and economic growth, the resolution of the US presidential election, and the global rollout of approved vaccines lifted equity markets to record levels, helping stocks around the globe post gains for the full period.

Throughout this volatile period, investors sought safety in fixed income.

Investment-grade bonds in the US and the overall global bond market declined slightly during the period as the economy recovered, but emerging market debt rose. While the 10-year US Treasury yield hovered near record lows early in the period after a significant rally in interest rates, rates moved higher later on as investors began to focus on stronger economic growth and the prospects of higher inflation. The Fed also took several aggressive actions to keep the bond markets running smoothly, implementing many of the relief programs that proved to be successful in helping end the global financial crisis in 2008-09.

Regarding your investments with PGIM, we believe it is important to maintain a diversified portfolio of funds consistent with your tolerance for risk, time horizon, and financial goals. Your financial advisor can help you create a diversified investment plan that may include funds covering all the basic asset classes and that reflects your personal investor profile and risk tolerance. However, diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets.

At PGIM Investments, we consider it a great privilege and responsibility to help investors participate in opportunities across global markets while meeting their toughest investment challenges. PGIM is a top-10 global investment manager with more than $1.5 trillion in assets under management. This scale and investment expertise allow us to deliver actively managed funds and strategies to meet the needs of investors around the globe.

Thank you for choosing our family of funds.

Sincerely,

Stuart S. Parker, President

PGIM Global Real Estate Fund

December 15, 2021

| | | | |

PGIM Global Real Estate Fund | | | 3 | |

Your Fund’s Performance (unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at pgim.com/investments or by calling (800) 225-1852.

| | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns as of 10/31/21 | |

| | | One Year (%) | | Five Years (%) | | | Ten Years (%) | | | Since Inception (%) | |

| | | | |

| Class A | | | | | | | | | | | | | | |

| | | | |

| (with sales charges) | | 30.72 | | | 7.53 | | | | 7.60 | | | | — | |

| | | | |

| (without sales charges) | | 38.32 | | | 8.75 | | | | 8.21 | | | | — | |

| | | | |

| Class C | | | | | | | | | | | | | | |

| | | | |

| (with sales charges) | | 36.48 | | | 8.17 | | | | 7.53 | | | | — | |

| | | | |

| (without sales charges) | | 37.48 | | | 8.17 | | | | 7.53 | | | | — | |

| | | | |

| Class R | | | | | | | | | | | | | | |

| | | | |

| (without sales charges) | | 38.08 | | | 8.58 | | | | 8.02 | | | | — | |

| | | | |

| Class Z | | | | | | | | | | | | | | |

| | | | |

| (without sales charges) | | 38.87 | | | 9.26 | | | | 8.62 | | | | — | |

| | | | |

| Class R2 | | | | | | | | | | | | | | |

| | | | |

| (without sales charges) | | 38.33 | | | N/A | | | | N/A | | | | 8.85 (12/27/2017) | |

| | | | |

| Class R4 | | | | | | | | | | | | | | |

| | | | |

| (without sales charges) | | 38.68 | | | N/A | | | | N/A | | | | 9.13 (12/27/2017) | |

| | | | |

| Class R6 | | | | | | | | | | | | | | |

| | | | |

| (without sales charges) | | 39.05 | | | 9.40 | | | | N/A | | | | 8.03 (08/23/2013) | |

| | | | |

| FTSE EPRA/NAREIT Developed Index | | | | | | | | | | | | | | |

| | | | |

| | 42.12 | | | 7.00 | | | | 7.69 | | | | — | |

| | | | |

| S&P 500 Index | | | | | | | | | | | | | | |

| | | | |

| | | 42.90 | | | 18.92 | | | | 16.20 | | | | — | |

| | | | | | | | | | | | | | | |

| | | | | | | | |

|

| Average Annual Total Returns as of 10/31/21 Since Inception (%) |

| | | | | | | Class R2, Class R4 (12/27/2017) | | Class R6 (08/23/2013) |

| | | | |

| FTSE EPRA/NAREIT Developed Index | | | | | | 6.42 | | 7.07 |

| | |

S&P 500 Index | | 17.34 | | 15.77 |

Since Inception returns are provided for any share class with less than 10 fiscal years of returns. Since Inception returns for the Indexes are measured from the closest month-end to the class’ inception date.

| | |

| 4 | | Visit our website at pgim.com/investments |

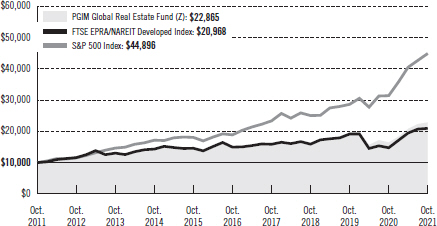

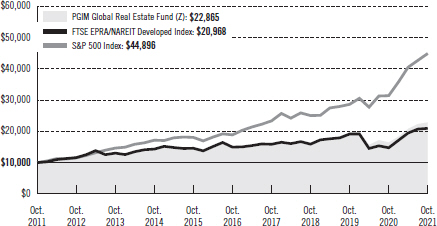

Growth of a $10,000 Investment (unaudited)

The graph compares a $10,000 investment in the Fund’s Class Z shares with a similar investment in the FTSE EPRA/NAREIT Developed Index and S&P 500 Index by portraying the initial account values at the beginning of the 10-year period for Class Z shares (October 31, 2011) and the account values at the end of the current fiscal year (October 31, 2021), as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted and (b) all dividends and distributions were reinvested. The line graph provides information for Class Z shares only. As indicated in the tables provided earlier, performance for other share classes will vary due to the differing fees and expenses applicable to each share class (as indicated in the following paragraphs). Without waiver of fees and/or expense reimbursements, if any, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

| | | | |

PGIM Global Real Estate Fund | | | 5 | |

Your Fund’s Performance (continued)

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. The average annual total returns take into account applicable sales charges, which are described for each share class in the table below.

| | | | | | | | | | | | | | |

| | | | | | | | |

| | | Class A | | Class C | | Class R | | Class Z | | Class R2 | | Class R4 | | Class R6 |

| | | | | | | | |

| Maximum initial sales charge | | 5.50% of the public offering price | | None | | None | | None | | None | | None | | None |

| Contingent deferred sales charge (CDSC) (as a percentage of the lower of the original purchase price or the net asset value at redemption) | | 1.00% on sales of $1 million or more made within 12 months of purchase | | 1.00% on sales made within 12 months of purchase | | None | | None | | None | | None | | None |

| Annual distribution or distribution and service (12b-1) fees (shown as a percentage of average daily net assets) | | 0.30% | | 1.00% | | 0.75% (0.50% currently) | | None | | 0.25% | | None | | None |

| Shareholder service fees | | None | | None | | None | | None | | 0.10%* | | 0.10%* | | None |

*Shareholder service fee reflects maximum allowable fees under a shareholder services plan.

Benchmark Definitions

FTSE EPRA/NAREIT Developed Index—The Financial Times Stock Exchange European Public Real Estate Association/National Association of Real Estate Investment Trusts (FTSE EPRA/NAREIT) Developed Index reflects the stock performance of companies engaged in specific aspects of the major real estate markets/regions of the world.

S&P 500 Index*—The S&P 500 Index is an unmanaged index of over 500 stocks of large US public companies. It gives a broad look at how stock prices in the United States have performed.

*The S&P 500 Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by PGIM, Inc. and/or its affiliates. Copyright © 2021 S&P Dow Jones Indices LLC, a division of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of S&P Global and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC.

| | |

| 6 | | Visit our website at pgim.com/investments |

Investors cannot invest directly in an index. The returns for the Indexes would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes that may be paid by an investor.

Presentation of Fund Holdings as of 10/31/21

| | | | | | |

| | | |

Ten Largest Holdings | | Real Estate Sectors | | Country | | % of Net Assets |

| | | |

| Prologis, Inc. | | Industrial REITs | | United States | | 5.2% |

| | | |

| Welltower, Inc. | | Health Care REITs | | United States | | 4.2% |

| | | |

| Simon Property Group, Inc. | | Retail REITs | | United States | | 3.8% |

| | | |

| Equinix, Inc. | | Specialized REITs | | United States | | 3.1% |

| | | |

| Camden Property Trust | | Residential REITs | | United States | | 3.0% |

| | | |

| Essex Property Trust, Inc. | | Residential REITs | | United States | | 2.5% |

| | | |

| Equity Residential | | Residential REITs | | United States | | 2.5% |

| | | |

| Segro PLC | | Industrial REITs | | United Kingdom | | 2.4% |

| | | |

| Life Storage, Inc. | | Specialized REITs | | United States | | 2.2% |

| | | |

| Rexford Industrial Realty, Inc. | | Industrial REITs | | United States | | 2.0% |

Holdings reflect only long-term investments and are subject to change.

| | | | |

PGIM Global Real Estate Fund | | | 7 | |

Strategy and Performance Overview (unaudited)

How did the Fund perform?

The PGIM Global Real Estate Fund’s Class Z shares returned 38.87% in the 12-month reporting period that ended October 31, 2021, underperforming the 42.12% return of the FTSE EPRA/NAREIT Developed Index (the Index).

What were conditions like in the global real estate securities market?

| ● | Conditions in the US real estate investment trust (REIT) market during the reporting period can be characterized by a robust recovery in fundamentals following the devastating impact of the COVID-19 pandemic. After the US commercial real estate market experienced one of its worst years ever, Pfizer Inc. announced strong efficacy results for its COVID-19 vaccine in November 2020, which kicked off a massive recovery in fundamentals and stock valuations for the REIT sector. Overall, the US REIT market rallied more than 50% during the period, with some of the harder-hit sectors, such as strip malls and shopping malls, up more than 100%. A successful vaccination effort in the US, combined with record levels of government stimulus, resulted in a highly favorable operating environment for nearly every sector in the US REIT market. |

| ● | Europe’s US-dollar total return during the period was strongly positive at 33.8%, with COVID-19 vaccines helping the region’s economies start to recover from the pandemic. Europe was the second-best-performing global region during the period, ahead of Asia but trailing North America. The United Kingdom (UK) was the quickest country to implement a vaccination program, but other countries in continental Europe rolled out successful programs as well by the summer of 2021. Sweden was the best-performing European market during the period, as its economy benefited from a less-severe recession than other countries in the region. Sweden had resisted locking down its economy, and its companies enjoyed a strong profit rebound aided by record-low interest rates and higher leverage. France was the next-best performer, with its heavily discounted and dominant retail sector experiencing a strong bounce-back as the economy emerged from lockdown. The UK’s return exceeded the European average return for the period due to its early vaccine distribution and subsequent early emergence from lockdown. The weakest European markets during the period were Germany and Finland, both heavily dominated by the multifamily residential sector. Germany, the leading performer in Europe in 2020, lagged for most of 2021 as its residential sector struggled against regulation pressures and the headwind of anticipated interest rate tightening. |

| ● | Asia recovered moderately in 2021 as the market struggled to break out of numerous macro-economic, policy, and pandemic setbacks. In Japan, riskier sectors such as developers, hotel, and office REITs outperformed, benefiting from expectations of pandemic recovery. Despite numerous states of emergency, strong residential demand and relatively resilient office occupancy for the major developers helped solidify expectations of an earnings recovery. Hospitality JREITs (i.e., a REIT established in Japan) also outperformed during the period despite a slow recovery in their fundamentals. Japanese developers and REITs with a reopening tilt (i.e., hotel and office sectors) looked well-positioned for a strong recovery with the Liberal |

| | |

| 8 | | Visit our website at pgim.com/investments |

| | Democratic Party’s successful election and dwindling COVID-19 cases. Reopening was also a significant reason for outperformance in retail, office, and residential REITs in Australia. Residential REITs benefited from government subsidies for home purchases, while numerous retail tenants received mandated rent relief programs. Hong Kong commercial landlords also staged a meaningful recovery, as investors’ expectations reset from pandemic lockdowns to the eventual reopening of borders. Despite strong residential fundamentals in Hong Kong due to negative real interest rates and the lack of meaningful new supply, developers suffered from fears of the regulatory and policy tightening that affected numerous sectors in China. Investors also were concerned during the period about the financial distress of major Chinese developer China Evergrande Group, albeit these worries have abated somewhat due to some successful financing deals. In Singapore, domestic retail-centric REITs outperformed as the nation successfully vaccinated more than 80% of its population. |

What worked and didn’t work?

| ● | The Fund underperformed the Index during the reporting period. While North America outperformed, Europe and Asia underperformed on a relative basis, resulting in the Fund’s overall underperformance. |

| ● | Within North America, the US healthcare and net lease sectors made the most significant contribution to performance due to favorable security selection. Several other sectors also performed well, including data centers and storage. Data centers benefited due to an underweight position relative to the Index. Storage performed well due to positive stock selection. The specialty housing, office, and shopping centers sectors detracted from performance. |

| ● | Europe’s underperformance for the period was the result of weak stock picking in Sweden and Spain. An underweight exposure to France also negatively impacted the Fund. Strong stock selection in Belgium contributed to performance, as did a lack of exposure to Switzerland. |

| ● | The Asia Pacific region’s underperformance was driven by notably unfavorable stock selection in Hong Kong. |

Current outlook

| ● | PGIM Real Estate views the US REIT market as well positioned for the remainder of 2021 and into 2022. In PGIM Real Estate’s view, despite strong year-to-date performance, this market’s average implied capitalization rate (i.e., the rate of return expected to be generated on a real estate investment property) remains attractive at 4.5%, a roughly 310 basis points (bps) spread relative to the 10-year US Treasury yield. (One basis point equals 0.01%.) While this spread is consistent with the long-term average, given the current depressed net operating income (NOI) levels of most REITs, PGIM Real Estate expects this spread to compress much further before reverting to its long-term average. Despite some near-term disruption to NOI growth in certain sectors, PGIM Real Estate anticipates funds-from-operations per-share growth of 7.7% in 2021 and 9.7% in 2022 (Source: PGIM). In PGIM Real Estate’s view, the |

| | | | |

PGIM Global Real Estate Fund | | | 9 | |

Strategy and Performance Overview (continued)

| | recent improvement in REITs’ equity valuations has allowed many REITs to issue new equity for acquisitions and development. A favorable cost of capital and a faster pace of economies reopening bode well for PGIM Real Estate’s higher near-term earnings expectations. Capital markets continue to be active in the REIT sector, with the market already witnessing eight REIT takeovers in 2021 across a variety of sectors, representing both public-to-public and take-private transactions. Attractive debt and equity capital, combined with a multi-year recovery outlook in fundamentals, is likely to keep private equity interest focused on additional REIT market opportunities, in PGIM Real Estate’s view. PGIM Real Estate remains diligent in its value-based investment process, emphasizing individual stock selection and looking to capitalize on sectors expected to benefit from economic reopening. PGIM Real Estate has increased its overweight allocation to the retail sectors (malls and shopping centers) on the expectation that robust consumer spending will boost fundamentals in 2021 and 2022. PGIM Real Estate has further increased its underweight allocation to data centers, given a challenged internal growth outlook and full valuation, while adding to the storage sector given the strong operating environment and upward valuation revisions. Finally, the Fund remains underweight relative to the Index to the office sector, given a challenging long-term growth outlook. |

| ● | Europe began ending remaining lockdown measures during the period that had been implemented by many countries in the region, as COVID-19 vaccinations gained momentum across the continent. More than 80% of the UK’s adult population was fully vaccinated at the end of the period, and most countries in continental Europe have largely caught up with the UK. The UK ended all remaining social distancing measures in the middle of July 2021, and continental European countries followed. While the spread of the Delta variant remains a concern, the hope is that an expected increase in cases during the winter can be managed with high vaccination rates, including booster shots. The UK REIT sector is trading around a 9% discount to its one-year forward net asset value (NAV), and continental Europe trades on a slightly lower NAV discount of 6%. However, there are wide divergences across individual sub-sectors, with retail trading at the highest discount and industrial/logistics at a significant premium. The UK trades at a 3.9% implied capitalization rate, an approximately 300-bps spread to 10-year UK bonds, while the continent trades at a 4.0% rate, a 420-bps spread to German 10-year government yields. Dividend yields on offer are still attractive at 2.7% in the UK and 3.1% on the continent. PGIM Real Estate retains a careful stance on the retail sector, given the structural challenges it still faces and the price recovery already seen in many retail shares. PGIM Real Estate has a broadly neutral weight relative to the Index in the offices sector and retains a preference for industrial/logistics and alternatives. PGIM Real Estate is still cautious on the German residential sector following the uncertain outcome of Germany’s federal elections at the end of September 2021 and the impact this could have on future regulation of the residential rental market there. |

| ● | PGIM Real Estate believes Asia should witness a more sustained recovery heading into 2022. The COVID-19 pandemic has ushered in a period of unprecedented global |

| | |

| 10 | | Visit our website at pgim.com/investments |

| | monetary easing and fiscal stimulus as countries cope with the economic fallout. As Asia emerges from the depths of the Delta variant, there is optimism ahead with a focus now on reopening and recovery. Sectors that witnessed a significant contraction in demand (e.g., hospitality and retail) will likely see a gradual recovery in the coming months, in PGIM Real Estate’s view. Equity market investors are also looking beyond the Federal Reserve’s expected tapering of its monthly bond purchases as the Fed also considers when it might start raising interest rates. This is somewhat complicated by the current market focus on supply-chain disruption leading to stagflation concerns. In PGIM Real Estate’s view, the following themes could be in focus in the near term: (1) recovery from the COVID-19 pandemic, (2) stagflation concerns, (3) bond yield spike on inflation expectations, (4) recovery in retail and hospitality, and (5) US-China geopolitical relations. PGIM Real Estate remains positive on the Australian manufacturing housing and self-storage sectors, with demographic and market consolidation trends providing structural tailwinds. PGIM Real Estate has a slightly underweight allocation relative to the Index to Hong Kong with a preference toward non-discretionary retail, and an overweight allocation relative to the Index to Japanese developers with a preference for retail and hospitality exposures that are levered to a bigger COVID-19 recovery. PGIM Real Estate also has an overweight allocation relative to the Index to JREITs with a preference for hospitality and diversified companies that could benefit from easing COVID-19 restrictions, and an overweight to logistic JREITs given their consistent drive for accretive acquisition growth. In Singapore, PGIM Real Estate has an underweight relative to the Index allocation to developers given a lack of growth catalysts and its preference for recovery opportunities in other countries. For REITs, PGIM Real Estate favors logistic and suburban retail companies that offer resilient demand. Markets are improving but global reopening remains fraught with the risk of a subsequent wave of COVID-19 outbreaks amid growing economic and social marginalization. The effectiveness of incremental vaccine delivery via booster shots and childrens’ vaccinations likely will shape domestic recovery and determine when borders might reopen, in PGIM Real Estate’s view. At the same time, a strong recovery in the US could stoke inflationary pressures beyond what many economists currently say is a transitory trend, which could raise expectations for interest rate hikes. Supply-chain concerns could also hamper growth while creating an inflation spiral. Within PGIM Real Estate’s individual sector holdings, a sharp rise in long-term real interest rates could negatively impact regional REIT valuations. |

| | | | |

PGIM Global Real Estate Fund | | | 11 | |

Comments on Largest Holdings (unaudited)

5.2% Prologis Inc., Industrial REITs

Prologis is an owner, operator, and developer of industrial real estate, focusing on global and regional markets across the Americas, Europe, and Asia. The company also leases modern distribution facilities to customers, including manufacturers, retailers, transportation companies, third-party logistics providers, and other enterprises.

4.2% Welltower Inc., Healthcare REITs

Welltower invests in senior housing and healthcare real estate properties.

3.8% Simon Property Group, Retail REITs

Simon Property owns, develops, and manages retail real estate properties, including regional malls, outlet centers, community/lifestyle centers, and international properties.

3.1% Equinix Inc., Specialized REITs

Equinix invests in interconnected data centers. It focuses on developing network and cloud-neutral data center platforms.

3.0% Camden Property Trust, Residential REITs

Camden owns and operates multifamily apartment communities in the US.

| | |

| 12 | | Visit our website at pgim.com/investments |

Fees and Expenses (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 held through the six-month period ended October 31, 2021. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of PGIM funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information

| | | | |

PGIM Global Real Estate Fund | | | 13 | |

Fees and Expenses (continued)

provided in the expense table. Additional fees have the effect of reducing investment returns.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | |

| | | | |

PGIM Global Real Estate Fund

| | Beginning

Account Value May 1, 2021 | | Ending Account Value

October 31, 2021 | | Annualized Expense

Ratio Based on the Six-Month Period | | Expenses Paid

During the Six-Month Period* |

| | | | | |

| Class A | | Actual | | $1,000.00 | | $1,098.20 | | 1.29% | | $6.82 |

| | | | | |

| | Hypothetical | | $1,000.00 | | $1,018.70 | | 1.29% | | $6.56 |

| | | | | |

| Class C | | Actual | | $1,000.00 | | $1,094.80 | | 1.89% | | $9.98 |

| | | | | |

| | Hypothetical | | $1,000.00 | | $1,015.68 | | 1.89% | | $9.60 |

| | | | | |

| Class R | | Actual | | $1,000.00 | | $1,097.00 | | 1.47% | | $7.77 |

| | | | | |

| | Hypothetical | | $1,000.00 | | $1,017.80 | | 1.47% | | $7.48 |

| | | | | |

| Class Z | | Actual | | $1,000.00 | | $1,100.10 | | 0.91% | | $4.82 |

| | | | | |

| | Hypothetical | | $1,000.00 | | $1,020.62 | | 0.91% | | $4.63 |

| | | | | |

| Class R2 | | Actual | | $1,000.00 | | $1,097.70 | | 1.30% | | $6.87 |

| | | | | |

| | Hypothetical | | $1,000.00 | | $1,018.65 | | 1.30% | | $6.61 |

| | | | | |

| Class R4 | | Actual | | $1,000.00 | | $1,099.40 | | 1.05% | | $5.56 |

| | | | | |

| | Hypothetical | | $1,000.00 | | $1,019.91 | | 1.05% | | $5.35 |

| | | | | |

| Class R6 | | Actual | | $1,000.00 | | $1,100.70 | | 0.78% | | $4.13 |

| | | | | |

| | | Hypothetical | | $1,000.00

| | $1,021.27

| | 0.78%

| | $3.97

|

*Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended October 31, 2021, and divided by the 365 days in the Fund’s fiscal year ended October 31, 2021 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

| | |

| 14 | | Visit our website at pgim.com/investments |

Schedule of Investments

as of October 31, 2021

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

| LONG-TERM INVESTMENTS 99.8% | | | | | | |

| | |

| COMMON STOCKS | | | | | | |

| | |

| Australia 3.3% | | | | | | |

Ingenia Communities Group, REIT | | | 2,274,940 | | | $ | 11,155,374 | |

Mirvac Group, REIT | | | 5,336,157 | | | | 11,338,468 | |

National Storage REIT, REIT | | | 5,370,415 | | | | 9,673,439 | |

Stockland, REIT | | | 5,262,755 | | | | 18,059,629 | |

| | | | | | | | |

| | |

| | | | | | | 50,226,910 | |

| | |

| Belgium 2.0% | | | | | | |

Aedifica SA, REIT | | | 82,936 | | | | 11,058,077 | |

Shurgard Self Storage SA | | | 67,731 | | | | 4,179,362 | |

VGP NV | | | 61,377 | | | | 15,907,674 | |

| | | | | | | | |

| | |

| | | | | | | 31,145,113 | |

| | |

| Canada 3.2% | | | | | | |

Canadian Apartment Properties REIT, REIT | | | 197,251 | | | | 9,631,446 | |

InterRent Real Estate Investment Trust, REIT | | | 891,187 | | | | 13,055,285 | |

Summit Industrial Income REIT, REIT | | | 1,331,517 | | | | 25,433,954 | |

| | | | | | | | |

| | |

| | | | | | | 48,120,685 | |

| | |

| Finland 1.0% | | | | | | |

Kojamo OYJ | | | 680,026 | | | | 15,230,658 | |

| | |

| France 0.8% | | | | | | |

Klepierre SA, REIT* | | | 145,990 | | | | 3,478,809 | |

Unibail-Rodamco-Westfield, REIT* | | | 133,819 | | | | 9,568,409 | |

| | | | | | | | |

| | |

| | | | | | | 13,047,218 | |

| | |

| Germany 2.6% | | | | | | |

Aroundtown SA | | | 1,308,985 | | | | 9,098,307 | |

LEG Immobilien SE | | | 91,762 | | | | 13,692,471 | |

Vonovia SE | | | 268,382 | | | | 16,271,970 | |

| | | | | | | | |

| | |

| | | | | | | 39,062,748 | |

| | |

| Hong Kong 4.4% | | | | | | |

CK Asset Holdings Ltd. | | | 1,117,909 | | | | 6,910,896 | |

Link REIT, REIT | | | 2,459,446 | | | | 21,837,114 | |

Sun Hung Kai Properties Ltd. | | | 1,835,213 | | | | 24,395,979 | |

See Notes to Financial Statements.

| | | | |

PGIM Global Real Estate Fund | | | 15 | |

Schedule of Investments (continued)

as of October 31, 2021

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

| COMMON STOCKS (Continued) | | | | | | |

| | |

| Hong Kong (cont’d.) | | | | | | |

Swire Properties Ltd. | | | 3,308,108 | | | $ | 8,894,112 | |

Wharf Real Estate Investment Co. Ltd. | | | 960,277 | | | | 5,425,333 | |

| | | | | | | | |

| | |

| | | | | | | 67,463,434 | |

| | |

| Japan 10.5% | | | | | | |

Daiwa House REIT Investment Corp., REIT | | | 2,467 | | | | 7,090,803 | |

GLP J-REIT, REIT | | | 6,694 | | | | 10,931,740 | |

Invincible Investment Corp., REIT | | | 36,877 | | | | 14,608,505 | |

Japan Hotel REIT Investment Corp., REIT | | | 18,122 | | | | 10,971,105 | |

Mitsui Fudosan Co. Ltd. | | | 1,143,863 | | | | 26,137,978 | |

Mitsui Fudosan Logistics Park, Inc., REIT | | | 1,880 | | | | 9,997,268 | |

Nippon Building Fund, Inc., REIT | | | 3,258 | | | | 21,195,684 | |

Nippon Prologis REIT, Inc., REIT | | | 3,988 | | | | 13,317,012 | |

Nomura Real Estate Master Fund, Inc., REIT | | | 9,011 | | | | 13,488,959 | |

Seibu Holdings, Inc.* | | | 774,327 | | | | 8,450,985 | |

Sumitomo Realty & Development Co. Ltd. | | | 667,941 | | | | 24,158,135 | |

| | | | | | | | |

| | |

| | | | | | | 160,348,174 | |

| | |

| Singapore 2.7% | | | | | | |

CapitaLand Integrated Commercial Trust, REIT | | | 9,374,371 | | | | 14,963,985 | |

CapitaLand Investment Ltd.* | | | 1,777,809 | | | | 4,567,553 | |

Frasers Centrepoint Trust, REIT | | | 7,370,890 | | | | 13,172,636 | |

Mapletree Logistics Trust, REIT | | | 5,837,928 | | | | 8,766,451 | |

| | | | | | | | |

| | |

| | | | | | | 41,470,625 | |

| | |

| Spain 0.6% | | | | | | |

Inmobiliaria Colonial Socimi SA, REIT | | | 904,248 | | | | 8,793,722 | |

| | |

| Sweden 3.5% | | | | | | |

Castellum AB | | | 532,187 | | | | 14,166,593 | |

Fabege AB | | | 673,541 | | | | 11,393,996 | |

Pandox AB* | | | 921,772 | | | | 16,262,278 | |

Samhallsbyggnadsbolaget i Norden AB | | | 1,690,986 | | | | 11,357,170 | |

| | | | | | | | |

| | |

| | | | | | | 53,180,037 | |

| | |

| United Kingdom 5.6% | | | | | | |

Big Yellow Group PLC, REIT | | | 706,163 | | | | 14,338,445 | |

British Land Co. PLC (The), REIT | | | 1,280,508 | | | | 8,671,169 | |

Capital & Counties Properties PLC, REIT | | | 4,805,260 | | | | 10,871,397 | |

See Notes to Financial Statements.

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

| COMMON STOCKS (Continued) | | | | | | |

| | |

| United Kingdom (cont’d.) | | | | | | |

Segro PLC, REIT | | | 2,042,375 | | | $ | 36,156,674 | |

Tritax Big Box REIT PLC, REIT | | | 4,874,613 | | | | 15,018,777 | |

| | | | | | | | |

| | |

| | | | | | | 85,056,462 | |

| | |

| United States 59.6% | | | | | | |

Acadia Realty Trust, REIT | | | 732,276 | | | | 15,656,061 | |

Alexandria Real Estate Equities, Inc., REIT | | | 62,897 | | | | 12,839,794 | |

American Homes 4 Rent (Class A Stock), REIT | | | 438,695 | | | | 17,811,017 | |

Boston Properties, Inc., REIT | | | 225,184 | | | | 25,589,910 | |

Camden Property Trust, REIT | | | 277,619 | | | | 45,279,659 | |

Community Healthcare Trust, Inc., REIT | | | 249,796 | | | | 11,950,241 | |

CubeSmart, REIT | | | 262,251 | | | | 14,426,427 | |

CyrusOne, Inc., REIT | | | 25,678 | | | | 2,106,110 | |

Digital Realty Trust, Inc., REIT(a) | | | 187,954 | | | | 29,661,021 | |

Douglas Emmett, Inc., REIT | | | 171,376 | | | | 5,600,568 | |

Duke Realty Corp., REIT | | | 194,876 | | | | 10,959,826 | |

EPR Properties, REIT | | | 404,123 | | | | 20,291,016 | |

Equinix, Inc., REIT | | | 55,758 | | | | 46,673,349 | |

Equity Residential, REIT | | | 433,249 | | | | 37,432,714 | |

Essential Properties Realty Trust, Inc., REIT | | | 855,152 | | | | 25,474,978 | |

Essex Property Trust, Inc., REIT | | | 112,022 | | | | 38,079,638 | |

Extra Space Storage, Inc., REIT | | | 124,769 | | | | 24,625,657 | |

Federal Realty Investment Trust, REIT | | | 166,026 | | | | 19,981,229 | |

First Industrial Realty Trust, Inc., REIT | | | 196,053 | | | | 11,416,166 | |

Global Medical REIT, Inc., REIT | | | 1,118,434 | | | | 18,543,636 | |

Healthcare Trust of America, Inc. (Class A Stock), REIT | | | 358,544 | | | | 11,971,784 | |

Highwoods Properties, Inc., REIT | | | 152,504 | | | | 6,838,279 | |

Host Hotels & Resorts, Inc., REIT* | | | 981,468 | | | | 16,518,106 | |

Invitation Homes, Inc., REIT | | | 536,004 | | | | 22,110,165 | |

JBG SMITH Properties, REIT | | | 143,251 | | | | 4,134,224 | |

Kimco Realty Corp., REIT | | | 1,152,451 | | | | 26,045,393 | |

Life Storage, Inc., REIT | | | 255,256 | | | | 34,155,805 | |

MGM Growth Properties LLC (Class A Stock), REIT | | | 360,948 | | | | 14,214,132 | |

National Retail Properties, Inc., REIT | | | 132,130 | | | | 5,993,417 | |

NETSTREIT Corp., REIT | | | 211,114 | | | | 5,117,403 | |

Park Hotels & Resorts, Inc., REIT* | | | 567,468 | | | | 10,515,182 | |

Pebblebrook Hotel Trust, REIT | | | 477,994 | | | | 10,735,745 | |

Phillips Edison & Co., Inc., REIT | | | 264,930 | | | | 7,984,990 | |

Prologis, Inc., REIT | | | 548,944 | | | | 79,574,922 | |

Public Storage, REIT | | | 41,271 | | | | 13,709,401 | |

Rexford Industrial Realty, Inc., REIT | | | 445,189 | | | | 29,916,701 | |

Simon Property Group, Inc., REIT | | | 395,180 | | | | 57,925,484 | |

Spirit Realty Capital, Inc., REIT | | | 320,003 | | | | 15,657,747 | |

UDR, Inc., REIT | | | 490,218 | | | | 27,221,806 | |

See Notes to Financial Statements.

| | | | |

PGIM Global Real Estate Fund | | | 17 | |

Schedule of Investments (continued)

as of October 31, 2021

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

| COMMON STOCKS (Continued) | | | | | | |

| | |

| United States (cont’d.) | | | | | | |

VICI Properties, Inc., REIT(a) | | | 285,473 | | | $ | 8,378,633 | |

Welltower, Inc., REIT | | | 794,500 | | | | 63,877,800 | |

| | | | | | | | |

| | |

| | | | | | | 906,996,136 | |

| | | | | | | | |

TOTAL LONG-TERM INVESTMENTS

(cost $1,194,747,687) | | | | | | | 1,520,141,922 | |

| | | | | | | | |

| | |

| SHORT-TERM INVESTMENTS 0.9% | | | | | | |

| | |

| AFFILIATED MUTUAL FUNDS | | | | | | |

PGIM Core Ultra Short Bond Fund(wa) | | | 3,308,653 | | | | 3,308,653 | |

PGIM Institutional Money Market Fund | | | | | | | | |

(cost $9,797,288; includes $9,796,810 of cash collateral for securities on loan)(b)(wa) | | | 9,803,170 | | | | 9,797,288 | |

| | | | | | | | |

| | |

TOTAL SHORT-TERM INVESTMENTS

(cost $13,105,941) | | | | | | | 13,105,941 | |

| | | | | | | | |

| | |

TOTAL INVESTMENTS 100.7%

(cost $1,207,853,628) | | | | | | | 1,533,247,863 | |

Liabilities in excess of other assets (0.7)% | | | | | | | (10,522,024 | ) |

| | | | | | | | |

| | |

NET ASSETS 100.0% | | | | | | $ | 1,522,725,839 | |

| | | | | | | | |

Below is a list of the abbreviation(s) used in the annual report:

LIBOR—London Interbank Offered Rate

REITs—Real Estate Investment Trust

| * | Non-income producing security. |

| (a) | All or a portion of security is on loan. The aggregate market value of such securities, including those sold and pending settlement, is $9,405,233; cash collateral of $9,796,810 (included in liabilities) was received with which the Fund purchased highly liquid short-term investments. In the event of significant appreciation in value of securities on loan on the last business day of the reporting period, the Fund may reflect a collateral value that is less than the market value of the loaned securities and such shortfall is remedied the following business day. |

| (b) | Represents security, or portion thereof, purchased with cash collateral received for securities on loan and includes dividend reinvestment. |

| (wa) | PGIM Investments LLC, the manager of the Fund, also serves as manager of the PGIM Core Ultra Short Bond Fund and PGIM Institutional Money Market Fund, if applicable. |

See Notes to Financial Statements.

Fair Value Measurements:

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

Level 1—unadjusted quoted prices generally in active markets for identical securities.

Level 2—quoted prices for similar securities, interest rates and yield curves, prepayment speeds, foreign currency exchange rates and other observable inputs.

Level 3—unobservable inputs for securities valued in accordance with Board approved fair valuation procedures.

The following is a summary of the inputs used as of October 31, 2021 in valuing such portfolio securities:

| | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

Investments in Securities | | | | | | | | | | | | |

Assets | | | | | | | | | | | | |

Long-Term Investments | | | | | | | | | | | | |

Common Stocks | | | | | | | | | | | | |

Australia | | $ | — | | | $ | 50,226,910 | | | $ | — | |

Belgium | | | — | | | | 31,145,113 | | | | — | |

Canada | | | 48,120,685 | | | | — | | | | — | |

Finland | | | — | | | | 15,230,658 | | | | — | |

France | | | — | | | | 13,047,218 | | | | — | |

Germany | | | — | | | | 39,062,748 | | | | — | |

Hong Kong | | | — | | | | 67,463,434 | | | | — | |

Japan | | | — | | | | 160,348,174 | | | | — | |

Singapore | | | — | | | | 41,470,625 | | | | — | |

Spain | | | — | | | | 8,793,722 | | | | — | |

Sweden | | | — | | | | 53,180,037 | | | | — | |

United Kingdom | | | — | | | | 85,056,462 | | | | — | |

United States | | | 906,996,136 | | | | — | | | | — | |

Short-Term Investments | | | | | | | | | | | | |

Affiliated Mutual Funds | | | 13,105,941 | | | | — | | | | — | |

| | | | | | | | | | | | |

Total | | $ | 968,222,762 | | | $ | 565,025,101 | | | $ | — | |

| | | | | | | | | | | | |

See Notes to Financial Statements.

| | | | |

PGIM Global Real Estate Fund | | | 19 | |

Schedule of Investments (continued)

as of October 31, 2021

Sector Classification:

The sector classification of investments and liabilities in excess of other assets shown as a percentage of net assets as of October 31, 2021 were as follows (unaudited):

| | | | |

Industrial REITs | | | 16.6 | % |

Specialized REITs | | | 15.0 | |

Retail REITs | | | 14.7 | |

Residential REITs | | | 14.7 | |

Real Estate Operating Companies | | | 9.4 | |

Health Care REITs | | | 7.7 | |

Office REITs | | | 5.7 | |

Diversified REITs | | | 5.7 | |

Diversified Real Estate Activities | | | 5.2 | |

Hotel & Resort REITs | | | 4.2 | |

| | | | |

Affiliated Mutual Funds (0.6% represents investments purchased with collateral from securities on loan) | | | 0.9 | % |

Railroads | | | 0.5 | |

Real Estate Development | | | 0.4 | |

| | | | |

| | | 100.7 | |

Liabilities in excess of other assets | | | (0.7 | ) |

| | | | |

| | | 100.0 | % |

| | | | |

Financial Instruments/Transactions—Summary of Offsetting and Netting Arrangements:

The Fund entered into financial instruments/transactions during the reporting period that are either offset in accordance with current requirements or are subject to enforceable master netting arrangements or similar agreements that permit offsetting. The information about offsetting and related netting arrangements for financial instruments/transactions where the legal right to set-off exists is presented in the summary below.

Offsetting of financial instrument/transaction assets and liabilities:

| | | | | | | | | | | | | | | |

Description | | Gross Market

Value of

Recognized

Assets/(Liabilities) | | Collateral

Pledged/(Received)(1) | | Net

Amount |

Securities on Loan | | | $ | 9,405,233 | | | | $ | (9,405,233 | ) | | | $ | — | |

| | | | | | | | | | | | | | | |

| (1) | Collateral amount disclosed by the Fund is limited to the market value of financial instruments/transactions. |

See Notes to Financial Statements.

Statement of Assets and Liabilities

as of October 31, 2021

| | | | |

Assets | | | | |

Investments at value, including securities on loan of $9,405,233: | | | | |

Unaffiliated investments (cost $1,194,747,687) | | $ | 1,520,141,922 | |

Affiliated investments (cost $13,105,941) | | | 13,105,941 | |

Foreign currency, at value (cost $33,259) | | | 33,205 | |

Receivable for investments sold | | | 17,501,632 | |

Receivable for Fund shares sold | | | 1,555,125 | |

Dividends receivable | | | 1,437,333 | |

Tax reclaim receivable | | | 792,525 | |

Prepaid expenses | | | 12,410 | |

| | | | |

Total Assets | | | 1,554,580,093 | |

| | | | |

| |

| Liabilities | | | |

Payable for Fund shares purchased | | | 20,778,175 | |

Payable to broker for collateral for securities on loan | | | 9,796,810 | |

Management fee payable | | | 958,669 | |

Accrued expenses and other liabilities | | | 246,221 | |

Distribution fee payable | | | 56,700 | |

Affiliated transfer agent fee payable | | | 12,369 | |

Payable for investments purchased | | | 3,533 | |

Trustees’ fees payable | | | 1,777 | |

| | | | |

Total Liabilities | | | 31,854,254 | |

| | | | |

| |

Net Assets | | $ | 1,522,725,839 | |

| | | | |

| | | | |

Net assets were comprised of: | | | | |

Shares of beneficial interest, at par | | $ | 55,231 | |

Paid-in capital in excess of par | | | 1,032,642,740 | |

Total distributable earnings (loss) | | | 490,027,868 | |

| | | | |

Net assets, October 31, 2021 | | $ | 1,522,725,839 | |

| | | | |

See Notes to Financial Statements.

| | | | |

PGIM Global Real Estate Fund | | | 21 | |

Statement of Assets and Liabilities

as of October 31, 2021

| | | | |

Class A | | | | |

Net asset value and redemption price per share,

($153,762,547 ÷ 5,603,518 shares of beneficial interest issued and outstanding) | | $ | 27.44 | |

Maximum sales charge (5.50% of offering price) | | | 1.60 | |

| | | | |

Maximum offering price to public | | $ | 29.04 | |

| | | | |

| |

| Class C | | | |

Net asset value, offering price and redemption price per share,

($14,756,142 ÷ 553,034 shares of beneficial interest issued and outstanding) | | $ | 26.68 | |

| | | | |

| |

| Class R | | | |

Net asset value, offering price and redemption price per share,

($14,415,189 ÷ 526,903 shares of beneficial interest issued and outstanding) | | $ | 27.36 | |

| | | | |

| |

| Class Z | | | |

Net asset value, offering price and redemption price per share,

($755,204,882 ÷ 27,362,579 shares of beneficial interest issued and outstanding) | | $ | 27.60 | |

| | | | |

| |

| Class R2 | | | |

Net asset value, offering price and redemption price per share,

($688,957 ÷ 25,014 shares of beneficial interest issued and outstanding) | | $ | 27.54 | |

| | | | |

| |

| Class R4 | | | |

Net asset value, offering price and redemption price per share,

($937,360 ÷ 34,007 shares of beneficial interest issued and outstanding) | | $ | 27.56 | |

| | | | |

| |

| Class R6 | | | |

Net asset value, offering price and redemption price per share,

($582,960,762 ÷ 21,126,359 shares of beneficial interest issued and outstanding) | | $ | 27.59 | |

| | | | |

See Notes to Financial Statements.

Statement of Operations

Year Ended October 31, 2021

| | | | | | | |

Net Investment Income (Loss) | | | | | | | |

Income | | | | | | | |

Unaffiliated dividend income (net of $1,313,309 foreign withholding tax) | | | $ | 31,099,363 | | | |

Income from securities lending, net (including affiliated income of $9,169) | | | | 24,838 | | | |

Affiliated dividend income | | | | 6,656 | | | |

| | | | | | | |

Total income | | | | 31,130,857 | | | |

| | | | | | | |

| | |

Expenses | | | | | | | |

Management fee | | | | 10,162,529 | | | |

Distribution fee(a) | | | | 713,964 | | | |

Shareholder servicing fees(a) | | | | 1,115 | | | |

Transfer agent’s fees and expenses (including affiliated expense of $74,437)(a) | | | | 1,300,242 | | | |

Custodian and accounting fees | | | | 204,074 | | | |

Registration fees(a) | | | | 82,972 | | | |

Shareholders’ reports | | | | 60,611 | | | |

Audit fee | | | | 31,003 | | | |

Legal fees and expenses | | | | 24,823 | | | |

Trustees’ fees | | | | 24,790 | | | |

Miscellaneous | | | | 76,296 | | | |

| | | | | | | |

Total expenses | | | | 12,682,419 | | | |

Less: Fee waiver and/or expense reimbursement(a) | | | | (11,230 | ) | | |

Distribution fee waiver(a) | | | | (35,247 | ) | | |

| | | | | | | |

Net expenses | | | | 12,635,942 | | | |

| | | | | | | |

Net investment income (loss) | | | | 18,494,915 | | | |

| | | | | | | |

| | |

| Realized And Unrealized Gain (Loss) On Investment And Foreign Currency Transactions | | | | |

Net realized gain (loss) on: | | | | | | | |

Investment transactions (including affiliated of $(6,153)) | | | | 212,331,693 | | | |

Foreign currency transactions | | | | (134,017 | ) | | |

| | | | | | | |

| | | | 212,197,676 | | | |

| | | | | | | |

Net change in unrealized appreciation (depreciation) on: | | | | | | | |

Investments (including affiliated of $(3,881)) | | | | 196,493,954 | | | |

Foreign currencies | | | | (76,637 | ) | | |

| | | | | | | |

| | | | 196,417,317 | | | |

| | | | | | | |

Net gain (loss) on investment and foreign currency transactions | | | | 408,614,993 | | | |

| | | | | | | |

Net Increase (Decrease) In Net Assets Resulting From Operations | | | $ | 427,109,908 | | | |

| | | | | | | |

| (a) | Class specific expenses and waivers were as follows: |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Class A | | | Class C | | | Class R | | | Class Z | | | Class R2 | | | Class R4 | | | Class R6 | |

| | | | | | | |

Distribution fee | | | 422,423 | | | | 184,688 | | | | 105,742 | | | | — | | | | 1,111 | | | | — | | | | — | |

Shareholder servicing fees | | | — | | | | — | | | | — | | | | — | | | | 350 | | | | 765 | | | | — | |

Transfer agent’s fees and expenses | | | 300,167 | | | | 21,263 | | | | 28,429 | | | | 938,541 | | | | 887 | | | | 1,362 | | | | 9,593 | |

Registration fees | | | 14,518 | | | | 9,011 | | | | 5,038 | | | | 24,608 | | | | 5,038 | | | | 6,288 | | | | 18,471 | |

Fee waiver and/or expense reimbursement | | | — | | | | — | | | | — | | | | — | | | | (5,072 | ) | | | (6,158 | ) | | | — | |

Distribution fee waiver | | | — | | | | — | | | | (35,247 | ) | | | — | | | | — | | | | — | | | | — | |

See Notes to Financial Statements.

| | | | |

PGIM Global Real Estate Fund | | | 23 | |

Statements of Changes in Net Assets

| | | | | | | | |

| |

| | | Year Ended

October 31, | |

| | |

| | | 2021 | | | 2020 | |

| | |

Increase (Decrease) in Net Assets | | | | | | | | |

Operations | | | | | | | | |

Net investment income (loss) | | $ | 18,494,915 | | | $ | 25,311,827 | |

Net realized gain (loss) on investment and foreign currency transactions | | | 212,197,676 | | | | 24,430,338 | |

Net change in unrealized appreciation (depreciation) on investments and foreign currencies | | | 196,417,317 | | | | (320,056,808 | ) |

| | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | 427,109,908 | | | | (270,314,643 | ) |

| | | | | | | | |

Dividends and Distributions | | | | | | | | |

Distributions from distributable earnings | | | | | | | | |

Class A | | | (1,508,193 | ) | | | (17,767,151 | ) |

Class B | | | — | | | | (380,431 | ) |

Class C | | | (98,634 | ) | | | (5,500,197 | ) |

Class R | | | (109,922 | ) | | | (2,023,130 | ) |

Class Z | | | (9,707,872 | ) | | | (109,591,519 | ) |

Class R2 | | | (4,645 | ) | | | (25,361 | ) |

Class R4 | | | (10,595 | ) | | | (73,643 | ) |

Class R6 | | | (7,316,802 | ) | | | (47,655,645 | ) |

| | | | | | | | |

| | | (18,756,663 | ) | | | (183,017,077 | ) |

| | | | | | | | |

Tax return of capital distributions | | | | | | | | |

Class A | | | — | | | | (1,511,005 | ) |

Class B | | | — | | | | (32,353 | ) |

Class C | | | — | | | | (467,764 | ) |

Class R | | | — | | | | (172,057 | ) |

Class Z | | | — | | | | (9,320,197 | ) |

Class R2 | | | — | | | | (2,157 | ) |

Class R4 | | | — | | | | (6,263 | ) |

Class R6 | | | — | | | | (4,052,869 | ) |

| | | | | | | | |

| | | — | | | | (15,564,665 | ) |

| | | | | | | | |

Fund share transactions (Net of share conversions) | | | | | | | | |

Net proceeds from shares sold | | | 312,798,775 | | | | 321,462,855 | |

Net asset value of shares issued in reinvestment of dividends and distributions | | | 17,101,728 | | | | 173,255,496 | |

Cost of shares purchased | | | (367,662,340 | ) | | | (590,994,288 | ) |

| | | | | | | | |

Net increase (decrease) in net assets from Fund share transactions | | | (37,761,837 | ) | | | (96,275,937 | ) |

| | | | | | | | |

Total increase (decrease) | | | 370,591,408 | | | | (565,172,322 | ) |

| | |

Net Assets: | | | | | | | | |

Beginning of year | | | 1,152,134,431 | | | | 1,717,306,753 | |

| | | | | | | | |

End of year | | | $1,522,725,839 | | | | $1,152,134,431 | |

| | | | | | | | |

See Notes to Financial Statements.

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

| Class A Shares | |

| | | Year Ended October 31, | |

| | | 2021 | | | 2020 | | | 2019 | | | 2018 | | | 2017 | |

| Per Share Operating Performance(a): | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Year | | | $20.05 | | | | $27.31 | | | | $22.97 | | | | $24.07 | | | | $23.41 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.25 | | | | 0.31 | | | | 0.36 | | | | 0.42 | | | | 0.31 | |

| Net realized and unrealized gain (loss) on investment and foreign currency transactions | | | 7.41 | | | | (4.45 | ) | | | 4.87 | | | | (0.36 | ) | | | 1.21 | |

| Total from investment operations | | | 7.66 | | | | (4.14 | ) | | | 5.23 | | | | 0.06 | | | | 1.52 | |

| Less Dividends and Distributions: | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.27 | ) | | | (0.88 | ) | | | (0.51 | ) | | | (0.74 | ) | | | (0.57 | ) |

| Tax return of capital distributions | | | - | | | | (0.25 | ) | | | - | | | | - | | | | - | |

| Distributions from net realized gains | | | - | | | | (1.99 | ) | | | (0.38 | ) | | | (0.42 | ) | | | (0.29 | ) |

| Total dividends and distributions | | | (0.27 | ) | | | (3.12 | ) | | | (0.89 | ) | | | (1.16 | ) | | | (0.86 | ) |

| Net asset value, end of year | | | $27.44 | | | | $20.05 | | | | $27.31 | | | | $22.97 | | | | $24.07 | |

| Total Return(b): | | | 38.32 | % | | | (16.64 | )% | | | 23.50 | % | | | 0.11 | % | | | 6.72 | % |

| |

| Ratios/Supplemental Data: | |

| Net assets, end of year (000) | | | $153,763 | | | | $122,346 | | | | $169,987 | | | | $161,591 | | | | $283,167 | |

| Average net assets (000) | | | $140,808 | | | | $139,599 | | | | $160,416 | | | | $231,191 | | | | $376,991 | |

| Ratios to average net assets(c)(d): | | | | | | | | | | | | | | | | | | | | |

| Expenses after waivers and/or expense reimbursement | | | 1.30 | % | | | 1.42 | % | | | 1.50 | % | | | 1.46 | % | | | 1.27 | % |

| Expenses before waivers and/or expense reimbursement | | | 1.30 | % | | | 1.42 | % | | | 1.50 | % | | | 1.46 | % | | | 1.27 | % |

| Net investment income (loss) | | | 1.00 | % | | | 1.40 | % | | | 1.43 | % | | | 1.79 | % | | | 1.33 | % |

| Portfolio turnover rate(e) | | | 149 | % | | | 158 | % | | | 82 | % | | | 57 | % | | | 66 | % |

| (a) | Calculated based on average shares outstanding during the year. |

| (b) | Total return does not consider the effects of sales loads. Total return is calculated assuming a purchase of a share on the first day and a sale on the last day of each year reported and includes reinvestment of dividends and distributions, if any. Total returns may reflect adjustments to conform to GAAP. |

| (c) | Does not include expenses of the underlying funds in which the Fund invests. |

| (d) | Effective November 1, 2017, class specific expenses include transfer agent fees and expenses and registration fees, which are charged to their respective share class. |

| (e) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short-term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

See Notes to Financial Statements.

| | | | |

PGIM Global Real Estate Fund | | | 25 | |

Financial Highlights (continued)

| | | | | | | | | | | | | | | | | | | | |

| Class C Shares | |

| | | Year Ended October 31, | |

| | | 2021 | | | 2020 | | | 2019 | | | 2018 | | | 2017 | |

| Per Share Operating Performance(a): | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Year | | | $19.51 | | | | $26.69 | | | | $22.46 | | | | $23.57 | | | | $22.98 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.10 | | | | 0.19 | | | | 0.25 | | | | 0.30 | | | | 0.15 | |

| Net realized and unrealized gain (loss) on investment and foreign currency transactions | | | 7.20 | | | | (4.34 | ) | | | 4.77 | | | | (0.35 | ) | | | 1.18 | |

| Total from investment operations | | | 7.30 | | | | (4.15 | ) | | | 5.02 | | | | (0.05 | ) | | | 1.33 | |

| Less Dividends and Distributions: | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.13 | ) | | | (0.79 | ) | | | (0.41 | ) | | | (0.64 | ) | | | (0.45 | ) |

| Tax return of capital distributions | | | - | | | | (0.25 | ) | | | - | | | | - | | | | - | |

| Distributions from net realized gains | | | - | | | | (1.99 | ) | | | (0.38 | ) | | | (0.42 | ) | | | (0.29 | ) |

| Total dividends and distributions | | | (0.13 | ) | | | (3.03 | ) | | | (0.79 | ) | | | (1.06 | ) | | | (0.74 | ) |

| Net asset value, end of year | | | $26.68 | | | | $19.51 | | | | $26.69 | | | | $22.46 | | | | $23.57 | |

| Total Return(b): | | | 37.48 | % | | | (17.11 | )% | | | 23.05 | % | | | (0.36 | )% | | | 5.99 | % |

| |

| Ratios/Supplemental Data: | |

| Net assets, end of year (000) | | | $14,756 | | | | $23,586 | | | | $54,343 | | | | $67,679 | | | | $96,562 | |

| Average net assets (000) | | | $18,469 | | | | $38,807 | | | | $62,207 | | | | $82,784 | | | | $116,225 | |

| Ratios to average net assets(c)(d): | | | | | | | | | | | | | | | | | | | | |

| Expenses after waivers and/or expense reimbursement | | | 1.95 | % | | | 1.95 | % | | | 1.91 | % | | | 1.92 | % | | | 1.97 | % |

| Expenses before waivers and/or expense reimbursement | | | 1.95 | % | | | 1.95 | % | | | 1.91 | % | | | 1.92 | % | | | 1.97 | % |

| Net investment income (loss) | | | 0.41 | % | | | 0.90 | % | | | 1.05 | % | | | 1.29 | % | | | 0.67 | % |

| Portfolio turnover rate(e) | | | 149 | % | | | 158 | % | | | 82 | % | | | 57 | % | | | 66 | % |

| (a) | Calculated based on average shares outstanding during the year. |

| (b) | Total return does not consider the effects of sales loads. Total return is calculated assuming a purchase of a share on the first day and a sale on the last day of each year reported and includes reinvestment of dividends and distributions, if any. Total returns may reflect adjustments to conform to GAAP. |

| (c) | Does not include expenses of the underlying funds in which the Fund invests. |

| (d) | Effective November 1, 2017, class specific expenses include transfer agent fees and expenses and registration fees, which are charged to their respective share class. |

| (e) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short-term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | | | | | |

| Class R Shares | |

| | | Year Ended October 31, | |

| | | 2021 | | | 2020 | | | 2019 | | | 2018 | | | 2017 | |

| Per Share Operating Performance(a): | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Year | | | $19.97 | | | | $27.24 | | | | $22.90 | | | | $24.01 | | | | $23.36 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.20 | | | | 0.27 | | | | 0.33 | | | | 0.40 | | | | 0.27 | |

| Net realized and unrealized gain (loss) on investment and foreign currency transactions | | | 7.38 | | | | (4.44 | ) | | | 4.88 | | | | (0.38 | ) | | | 1.21 | |

| Total from investment operations | | | 7.58 | | | | (4.17 | ) | | | 5.21 | | | | 0.02 | | | | 1.48 | |

| Less Dividends and Distributions: | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.19 | ) | | | (0.86 | ) | | | (0.49 | ) | | | (0.71 | ) | | | (0.54 | ) |

| Tax return of capital distributions | | | - | | | | (0.25 | ) | | | - | | | | - | | | | - | |

| Distributions from net realized gains | | | - | | | | (1.99 | ) | | | (0.38 | ) | | | (0.42 | ) | | | (0.29 | ) |

| Total dividends and distributions | | | (0.19 | ) | | | (3.10 | ) | | | (0.87 | ) | | | (1.13 | ) | | | (0.83 | ) |

| Net asset value, end of year | | | $27.36 | | | | $19.97 | | | | $27.24 | | | | $22.90 | | | | $24.01 | |

| Total Return(b): | | | 38.08 | % | | | (16.82 | )% | | | 23.45 | % | | | (0.06 | )% | | | 6.52 | % |

| | |

| Ratios/Supplemental Data: | |

| Net assets, end of year (000) | | | $14,415 | | | | $12,562 | | | | $19,815 | | | | $19,864 | | | | $33,346 | |

| Average net assets (000) | | | $14,099 | | | | $15,354 | | | | $19,694 | | | | $24,550 | | | | $33,336 | |

| Ratios to average net assets(c)(d): | | | | | | | | | | | | | | | | | | | | |

Expenses after waivers and/or expense reimbursement | | | 1.52 | % | | | 1.58 | % | | | 1.58 | % | | | 1.60 | % | | | 1.47 | % |

| Expenses before waivers and/or expense reimbursement | | | 1.77 | % | | | 1.83 | % | | | 1.83 | % | | | 1.85 | % | | | 1.72 | % |

| Net investment income (loss) | | | 0.80 | % | | | 1.25 | % | | | 1.35 | % | | | 1.70 | % | | | 1.15 | % |

| Portfolio turnover rate(e) | | | 149 | % | | | 158 | % | | | 82 | % | | | 57 | % | | | 66 | % |

| (a) | Calculated based on average shares outstanding during the year. |

| (b) | Total return is calculated assuming a purchase of a share on the first day and a sale on the last day of each year reported and includes reinvestment of dividends and distributions, if any. Total returns may reflect adjustments to conform to GAAP. |

| (c) | Does not include expenses of the underlying funds in which the Fund invests. |

| (d) | Effective November 1, 2017, class specific expenses include transfer agent fees and expenses and registration fees, which are charged to their respective share class. |

| (e) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short-term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

See Notes to Financial Statements.

| | | | |

PGIM Global Real Estate Fund | | | 27 | |

Financial Highlights (continued)

| | | | | | | | | | | | | | | | | | | | |

| Class Z Shares | |

| | | Year Ended October 31, | |

| | | 2021 | | | 2020 | | | 2019 | | | 2018 | | | 2017 | |

| Per Share Operating Performance(a): | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Year | | | $20.15 | | | | $27.45 | | | | $23.07 | | | | $24.17 | | | | $23.50 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.34 | | | | 0.42 | | | | 0.50 | | | | 0.55 | | | | 0.39 | |

| Net realized and unrealized gain (loss) on investment and foreign currency transactions | | | 7.46 | | | | (4.48 | ) | | | 4.92 | | | | (0.36 | ) | | | 1.21 | |

| Total from investment operations | | | 7.80 | | | | (4.06 | ) | | | 5.42 | | | | 0.19 | | | | 1.60 | |

| Less Dividends and Distributions: | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.35 | ) | | | (1.00 | ) | | | (0.66 | ) | | | (0.87 | ) | | | (0.64 | ) |

| Tax return of capital distributions | | | - | | | | (0.25 | ) | | | - | | | | - | | | | - | |

| Distributions from net realized gains | | | - | | | | (1.99 | ) | | | (0.38 | ) | | | (0.42 | ) | | | (0.29 | ) |

| Total dividends and distributions | | | (0.35 | ) | | | (3.24 | ) | | | (1.04 | ) | | | (1.29 | ) | | | (0.93 | ) |

| Net asset value, end of year | | | $27.60 | | | | $20.15 | | | | $27.45 | | | | $23.07 | | | | $24.17 | |

| Total Return(b): | | | 38.87 | % | | | (16.26 | )% | | | 24.27 | % | | | 0.64 | % | | | 7.05 | % |

| | |

| Ratios/Supplemental Data: | |

| Net assets, end of year (000) | | | $755,205 | | | | $609,899 | | | | $1,030,064 | | | | $974,596 | | | | $1,473,514 | |

| Average net assets (000) | | | $696,648 | | | | $794,641 | | | | $971,722 | | | | $1,175,745 | | | | $1,747,768 | |

| Ratios to average net assets(c)(d): | | | | | | | | | | | | | | | | | | | | |

| Expenses after waivers and/or expense reimbursement | | | 0.92 | % | | | 0.94 | % | | | 0.92 | % | | | 0.93 | % | | | 0.97 | % |

| Expenses before waivers and/or expense reimbursement | | | 0.92 | % | | | 0.94 | % | | | 0.92 | % | | | 0.93 | % | | | 0.97 | % |

| Net investment income (loss) | | | 1.38 | % | | | 1.90 | % | | | 2.01 | % | | | 2.32 | % | | | 1.65 | % |

| Portfolio turnover rate(e) | | | 149 | % | | | 158 | % | | | 82 | % | | | 57 | % | | | 66 | % |

| (a) | Calculated based on average shares outstanding during the year. |

| (b) | Total return is calculated assuming a purchase of a share on the first day and a sale on the last day of each year reported and includes reinvestment of dividends and distributions, if any. Total returns may reflect adjustments to conform to GAAP. |

| (c) | Does not include expenses of the underlying funds in which the Fund invests. |

| (d) | Effective November 1, 2017, class specific expenses include transfer agent fees and expenses and registration fees, which are charged to their respective share class. |

| (e) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short-term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class R2 Shares | | |

| | | Year Ended October 31, | | | | December 27, 2017(a) through October 31, 2018 | | |

| | | 2021 | | 2020 | | 2019 | | |

| Per Share Operating Performance(b): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | | | | $20.11 | | | | | $27.40 | | | | | $23.05 | | | | | | | | | | $24.10 | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | | 0.25 | | | | | 0.32 | | | | | 0.34 | | | | | | | | | | 0.24 | | | | | | |

| Net realized and unrealized gain (loss) on investment and foreign currency transactions | | | | 7.43 | | | | | (4.45 | ) | | | | 4.97 | | | | | | | | | | (0.96 | ) | | | | | |

| Total from investment operations | | | | 7.68 | | | | | (4.13 | ) | | | | 5.31 | | | | | | | | | | (0.72 | ) | | | | | |

| Less Dividends and Distributions: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | | (0.25 | ) | | | | (0.92 | ) | | | | (0.58 | ) | | | | | | | | | (0.33 | ) | | | | | |

| Tax return of capital distributions | | | | - | | | | | (0.25 | ) | | | | - | | | | | | | | | | - | | | | | | |

| Distributions from net realized gains | | | | - | | | | | (1.99 | ) | | | | (0.38 | ) | | | | | | | | | - | | | | | | |

| Total dividends and distributions | | | | (0.25 | ) | | | | (3.16 | ) | | | | (0.96 | ) | | | | | | | | | (0.33 | ) | | | | | |

| Net asset value, end of period | | | | $27.54 | | | | | $20.11 | | | | | $27.40 | | | | | | | | | | $23.05 | | | | | | |

| Total Return(c) : | | | | 38.33 | % | | | | (16.56 | )% | | | | 23.77 | % | | | | | | | | | (3.01 | )% | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data: | | | | | | | | | | | | |

| Net assets, end of period (000) | | | | $689 | | | | | $237 | | | | | $222 | | | | | | | | | | $10 | | | | | | |

| Average net assets (000) | | | | $444 | | | | | $223 | | | | | $69 | | | | | | | | | | $10 | | | | | | |

| Ratios to average net assets(d): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Expenses after waivers and/or expense reimbursement | | | | 1.30 | % | | | | 1.30 | % | | | | 1.30 | % | | | | | | | | | 1.30 | %(e) | | | | | |

| Expenses before waivers and/or expense reimbursement | | | | 2.44 | % | | | | 7.86 | % | | | | 19.11 | % | | | | | | | | | 209.91 | %(e) | | | | | |

| Net investment income (loss) | | | | 0.97 | % | | | | 1.48 | % | | | | 1.28 | % | | | | | | | | | 1.22 | %(e) | | | | | |

| Portfolio turnover rate(f) | | | | 149 | % | | | | 158 | % | | | | 82 | % | | | | | | | | | 57 | % | | | | | |

| (a) | Commencement of offering. |

| (b) | Calculated based on average shares outstanding during the period. |

| (c) | Total return is calculated assuming a purchase of a share on the first day and a sale on the last day of each period reported and includes reinvestment of dividends and distributions, if any. Total returns may reflect adjustments to conform to GAAP. Total returns for periods less than one full year are not annualized. |

| (d) | Does not include expenses of the underlying funds in which the Fund invests. |

| (f) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short-term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

See Notes to Financial Statements.

| | | | |

PGIM Global Real Estate Fund | | | 29 | |

Financial Highlights (continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class R4 Shares | | |

| | | Year Ended October 31, | | | | December 27, 2017(a) through October 31, 2018 | | |

| | | | | | | | | | |

| | | 2021 | | 2020 | | 2019 | | | | | | |

| | | | | | | | | | |

| Per Share Operating Performance(b): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | | | | $20.12 | | | | | $27.41 | | | | | $23.06 | | | | | | | | | | $24.10 | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | | 0.31 | | | | | 0.39 | | | | | 0.47 | | | | | | | | | | (0.27 | ) | | | | | |

| Net realized and unrealized gain (loss) on investment and foreign currency transactions | | | | 7.44 | | | | | (4.47 | ) | | | | 4.90 | | | | | | | | | | (0.39 | ) | | | | | |

| Total from investment operations | | | | 7.75 | | | | | (4.08 | ) | | | | 5.37 | | | | | | | | | | (0.66 | ) | | | | | |

| Less Dividends and Distributions: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | | (0.31 | ) | | | | (0.97 | ) | | | | (0.64 | ) | | | | | | | | | (0.38 | ) | | | | | |

| Tax return of capital distributions | | | | - | | | | | (0.25 | ) | | | | - | | | | | | | | | | - | | | | | | |

| Distributions from net realized gains | | | | - | | | | | (1.99 | ) | | | | (0.38 | ) | | | | | | | | | - | | | | | | |

| Total dividends and distributions | | | | (0.31 | ) | | | | (3.21 | ) | | | | (1.02 | ) | | | | | | | | | (0.38 | ) | | | | | |

| Net asset value, end of period | | | | $27.56 | | | | | $20.12 | | | | | $27.41 | | | | | | | | | | $23.06 | | | | | | |

| Total Return(c): | | | | 38.68 | % | | | | (16.35 | )% | | | | 24.08 | % | | | | | | | | | (2.77 | )% | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |