QuickLinks -- Click here to rapidly navigate through this documentExhibit 99

2004 ANNUAL REPORT

Waddell & Reed Financial, Inc.

Financial Highlights

| | 2004

| | 2003

| | % change

|

|---|

| Revenues from: (Dollar amounts in thousands, except per share data) | | | | | | | | |

| Investment management fees | | $ | 240,282 | | $ | 203,918 | | 18 |

| Underwriting and distribution fees | | | 187,273 | | | 176,586 | | 6 |

| Shareholder service fees | | | 76,522 | | | 70,678 | | 8 |

| | |

| |

| | |

| Revenue excluding investment and other income | | $ | 504,077 | | $ | 451,182 | | 12 |

Net income |

|

$ |

102,165 |

|

$ |

54,265 |

|

88 |

| | |

| |

| | |

Diluted earnings per share |

|

$ |

1.25 |

|

$ |

0.66 |

|

89 |

Dividend per share |

|

$ |

0.60 |

|

$ |

0.57 |

|

5 |

- 1.

- This includes special after-tax charges of $38.8 million, or $0.47 per diluted share. Net income excluding special charges was $93.0 million, or $1.13 per diluted share. See accompanying Form 10-K.

| | 2004

| | 2003

| | % change

| |

|---|

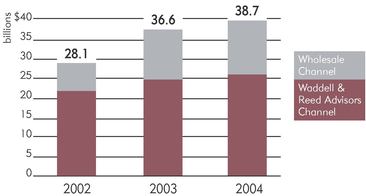

| Assets Under Management (millions) | | | | | | | | | |

| Waddell & Reed Advisors Channel | | | | | | | | | |

| | Equity funds | | $ | 20,580 | | $ | 19,418 | | 6 | |

| | Fixed income funds | | | 4,001 | | | 4,074 | | (2 | ) |

| | Money market funds | | | 716 | | | 845 | | (15 | ) |

| | |

| |

| | | |

| Sub total | | | 25,297 | | | 24,337 | | 4 | |

Wholesale Channel |

|

|

|

|

|

|

|

|

|

| | Equity funds | | $ | 12,347 | | $ | 11,172 | | 11 | |

| | Fixed income funds | | | 967 | | | 1,005 | | (4 | ) |

| | Money market funds | | | 47 | | | 59 | | (20 | ) |

| | |

| |

| | | |

| Sub total | | | 13,361 | | | 12,236 | | 9 | |

| | |

| |

| | | |

Total assets under management |

|

$ |

38,658 |

|

$ |

36,573 |

|

6 |

|

| | |

| |

| | | |

| S&P 500 Stock Index (year-end) | | $ | 1,211.9 | | $ | 1,111.9 | | 9 | |

| | |

| |

| | | |

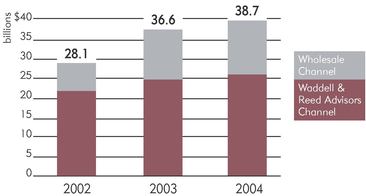

| Assets Under Management By Distribution Channel | | Sales By Distribution Channel |

| | | Gross sales of investment products reached $4.9 billion in 2004, segmented between our sales channels as follows: |

|

|

|

Profile of our Business

At the heart of Waddell & Reed is our asset management business. We act as investment manager to four mutual fund families comprising virtually all major asset classes and a broad range of investment styles. We distribute investment products in two channels: Advisors and Wholesale.

Advisors Channel

Our national network of proprietary financial advisors spans the United States. Financial advisors from Waddell & Reed assist clients in developing personal financial planning strategies for retirement, education, insurance and estates.

Wholesale Channel

Our Wholesale distribution channel encompasses the sale of our mutual funds in non-proprietary distribution channels, institutional asset management, and subadvisory services provided to other mutual fund families.

- •

- We distribute our mutual fund families through strategic partners; The Legend Group, a Waddell & Reed subsidiary; and unaffiliated broker/dealers, 401(k) plans and registered investment advisors.

- •

- Through our Investment Management Division, several of our portfolio managers oversee investments for defined benefit plans, endowments and high net worth individuals. We also serve as subadvisor for various U.S., Canadian and offshore mutual funds.

Waddell & Reed's investment performance remains extremely competitive over the long term, illustrating a high level of consistency through a variety of market cycles.

Lipper Rankings(As of 12/31/04)*

| | 1 Year

| | 3 Years

| | 5 Years

|

|---|

| Percentage of Equity Funds ranked in: | | | | | | |

| (85% of assets under management) | | | | | | |

| | Top Quartile | | 36% | | 48% | | 54% |

| | Top Half | | 64% | | 74% | | 71% |

| | 1 Year

| | 3 Years

| | 5 Years

|

|---|

| Percentage of All Funds ranked in: | | | | | | |

| | Top Quartile | | 29% | | 38% | | 43% |

| | Top Half | | 59% | | 64% | | 65% |

- *

- Percentages are approximately the same on an asset weighted basis

Letter to Stockholders

Keith A. Tucker

Chairman of the Board & Chief Executive Officer

Henry J. Herrmann

President & Chief Investment Officer

To our stockholders,

By many measures, 2004 was an encouraging year for Waddell & Reed. Net income increased appreciably from 2003's adjusted net income; assets under management grew; mutual fund sales increased as the distribution of our funds broadened; and investment performance, already strong, ended 2004 in an even better position than at the prior year-end.

Nonetheless, Waddell & Reed's stock performance lagged that of its peers, as overall business momentum and organic growth fell short of our expectations and did not match that of our peers in the investment management business. For the year, earnings were $102 million, while our stock price increased 1.8 percent.

At the heart of Waddell & Reed is our investment management business. We act as investment adviser to four mutual fund families comprising virtually all major asset classes. As a distributor of investment products, we conduct our business through two channels: our Advisors channel, comprising more than 2,600 Waddell & Reed financial advisors; and our Wholesale channel, which includes the sale of our funds in non-proprietary distribution channels and our institutional business, through which we market managed accounts to defined benefit plans and serve as subadvisor on various mutual funds.

Advisors Channel

Throughout 2004, we focused on increasing advisor productivity. This brought meaningful benefit, as sales per advisor increased 20 percent over the previous year. However, growth overall in the Advisors channel did not meet our expectations for the year. Total retail investment sales increased just 1 percent from the prior year. As the year progressed, we achieved solid quarter-over-quarter sales growth in the third and fourth quarters, ending the year with good momentum.

Nonetheless, given the overall disappointing sales results for the channel, we have taken significant steps for improvement. We have introduced new sales leadership for the channel and will seek to rapidly reinvigorate our recruitment, training, sales and financial planning efforts. Although our two distribution channels remain discrete, we believe that both will benefit from our now common executive leadership and, in many instances, from common process and support.

Our number of advisors at year-end reached 2,623, giving Waddell & Reed a large and vibrant sales force marketing financial planning and investment products. We intend to aggressively build this sales force going forward, anticipating that it will have grown an additional 10 percent by the end of 2005. To further support our recruiting and retention efforts, we plan to enhance the quality of our field management, increase our recruiting resources and upgrade our product support and training efforts.

Today, and looking ahead, we remain confident that Waddell & Reed's advisors provide one of the industry's most complete lineups of financial planning services, built around mutual funds, annuities and insurance products. When complemented by the new sales leadership we've recently put in place, we believe our position is considerably strengthened for the coming years.

Wholesale Channel

Our Wholesale channel encompasses institutional asset management, the sale of our mutual funds in non-proprietary distribution channels and subadvisory services provided to other mutual fund families.

Overall sales in the Wholesale channel lagged those of 2003, due primarily to a sales decrease in the institutional

business. On the other hand, sales of our mutual funds in non-proprietary channels increased sharply, due primarily to strong sales in the Ivy Funds family. Compounded annual growth in non-proprietary sales has increased 67 percent since the launch of the channel in July of 2003, and we expect continued growth in 2005. This growth has been propelled by a quality product line; meaningful penetration of key broker/dealer firms; and a growing, high-quality wholesaling effort.

We continue to leverage strategic alliances with three significant partners. Through our relationship with Mackenzie Financial Corporation in Canada, we act as subadvisor to selected Mackenzie Funds, and have access to long-term opportunities with other Mackenzie affiliates in the U.S. and Canada. Through Securian Financial Group, we gain vital distribution opportunities through its network of financial advisors, as well as institutional asset management opportunities. Our relationship with Nationwide Financial provides subadvisory opportunities and sales opportunities for the Ivy Funds.

We gained meaningful sales from our institutional business, through which we market to defined benefit pensions, endowments and high net worth individuals. We also actively market our subadvisory capabilities, focusing primarily on four major investment styles.

Investment Management

The center of our business remains our Investment Management Division, which has consistently produced results that are very competitive within the industry. Our portfolio managers engage in a collaborative process that blends their individual accountability with access to the ideas of their peers, supported by an intensive proprietary research capability. Our investment philosophy stresses controlling risk, emphasizing quality, and utilizing the expertise of our internal analysts and economists.

Our investment staff of 110 includes 26 portfolio managers, 18 analysts, three economists and eight traders. This team is augmented by seven subadvisors that manage products in the Ivy Funds and W&R Target Funds families. These subadvisors share Waddell & Reed's investment philosophy and the products they manage help to round out our total product line.

While the equity markets in 2004 remained volatile until near year-end, our investment results were again strong in comparison with our peers. For the year, 64 percent of our equity funds and 59 percent of all of our funds ranked in the top half of their Lipper peer groups. Results in early 2005 reflect ongoing improvement. Longer-term results also are impressive, as 65 percent of all of our funds rank within the top half of their Lipper peer groups over a five-year period, illustrating a high level of consistency through a variety of market cycles.

In the years to come, we intend to fully leverage the value of our business model, which we believe is unique in the industry. By offering highly competitive relative performance over the long term, through a broad range of investment products and distinct distribution channels, Waddell & Reed is positioned for growth and success. We believe that Waddell & Reed will continue to deliver value to clients and stockholders.

Sincerely,

| | |

/S/ KEITH A. TUCKER

Keith A. Tucker

Chairman of the Board & Chief Executive Officer |

|

|

|

/s/ HENRY J. HERRMANN

Henry J. Herrmann

President & Chief Investment Officer |

|

|

|

Officers and Directors

Keith A. Tucker

Chairman and Chief Executive Officer

Director

• 35 years industry experience

• 13 years with Waddell & Reed |

|

Thomas W. Butch

Senior Vice President and Chief Marketing Officer

• 23 years industry experience

• 5 years with Waddell & Reed |

Henry J. Herrmann

President and Chief Investment Officer

Director

• 42 years industry experience

• 33 years with Waddell & Reed |

|

Daniel P. Connealy

Senior Vice President and Chief Financial Officer

• 35 years industry experience

• 1 year with Waddell & Reed |

Alan W. Kosloff

Chairman, Kosloff & Partners, LLC

Director (since 2003)

• Audit Committee — Chairman

• Compensation Committee

• Nominating and Corporate Governance Committee |

|

Daniel C. Schulte

Senior Vice President, General Counsel and Assistant

Secretary

• 7 years industry experience

• 7 years with Waddell & Reed |

Dennis E. Logue

Dean, Michael B. Price College of Business,

University of Oklahoma

Director (since 2002)

• Audit Committee

• Nominating and Corporate Governance

• Committee — Chairman |

|

Michael D. Strohm

Senior Vice President and Chief Operations Officer

• 32 years industry experience

• 32 years with Waddell & Reed |

James M. Raines

President, James M. Raines and Co.

Director (since 1998)

• Compensation Committee

• Nominating and Corporate Governance Committee |

|

John E. Sundeen, Jr.

Senior Vice President and Treasurer

• 21 years industry experience

• 21 years with Waddell & Reed |

Ronald C. Reimer

Director and Chairman, Network Trust

Director (since 2001)

• Audit Committee

• Nominating and Corporate Governance Committee |

|

Robert J. Williams, Jr.

Senior Vice President — Public Affairs

• 31 years industry experience

• 8 years with Waddell & Reed |

William L. Rogers

Managing Director, The Halifax Group

Director (since 1998)

• Nominating and Corporate Governance Committee |

|

Brent K. Bloss

Vice President and Assistant Treasurer

• 5 years industry experience

• 3 years with Waddell & Reed |

Jerry W. Walton

Chief Financial Officer, J.B. Hunt Transport Services, Inc.

Director (since 2000)

• Compensation Committee — Chairman

• Nominating and Corporate Governance Committee |

|

Wendy J. Hills

Vice President, Secretary and Associate General Counsel

• 7 years industry experience

• 7 years with Waddell & Reed |

|

|

Mark A. Schieber

Vice President, Controller and Principal Accounting Officer

• 24 years industry experience

• 24 years with Waddell & Reed |

Corporate Information

Annual Meeting of Stockholders

April 27, 2005 10:00 a.m.

Corporate Headquarters

Corporate Headquarters

Waddell & Reed Financial, Inc.

6300 Lamar Avenue

Overland Park, KS 66202

Stock Exchange Listing

Class A Common Stock

New York Stock Exchange Symbol: WDR

Transfer Agent & Registrar

EquiServe Trust Company, N.A.

P.O. Box 43069

Providence, RI 02940-3070

Toll Free Number: 877.498.8861

Hearing Impaired: 800.952.9245

www.equiserve.com

Independent Auditors

KPMG LLP

1000 Walnut, Suite 1600

Kansas City, MO 64106

Stockholder Inquiries

For general information regarding your Waddell & Reed Financial, Inc. stock, call 800.532.2757 or visit our website at www.waddell.com. For stock transfers, call 877.498.8861

Mutual Fund Information

For information regarding our mutual funds, please call 888.WADDELL or visit www.waddell.com or www.ivyfunds.com.

Dividend Reinvestment

Waddell & Reed Financial, Inc. maintains a dividend reinvestment plan for all holders of its common stock. Under the plan, stockholders may reinvest all or part of their dividends in additional shares of common stock. Participation is entirely voluntary. More information on the plan can be obtained from our Transfer Agent.

Stockholder and Analyst Resources

We believe that in today's digital world, the Internet allows us to disseminate our corporate information much more quickly and efficiently. In addition to the standard information typically found on corporate websites, such as general, corporate and stock information, access to archived press releases and SEC filings, and answers to frequently asked questions, we supply our stockholders and analysts with timely supplemental data including quarterly corporate presentations, access to live and archived webcasts, data tables and more. If you elect to request information alerts, we will send you an e-mail when new information is posted to our corporate website.

Any questions about corporate information can be directed to the attention of:

NYSE Section 303A Annual Written Affirmation

Waddell & Reed Financial, Inc. filed its Section 303A Annual Written Affirmation, including the Section 303A.12(a) CEO Certification, with the NYSE on May 21, 2004.

6300 Lamar Avenue · Overland Park, Kansas 66202

800.532.2757 · www.waddell.com

QuickLinks

Financial HighlightsProfile of our BusinessLetter to StockholdersKeith A. Tucker Chairman of the Board & Chief Executive Officer Henry J. Herrmann President & Chief Investment OfficerOfficers and DirectorsCorporate Information