Figure 1B GETTY COPPER INC. HIGHLAND VALLEY PROPERTIES MAP

20

| | | |

| Property | Claims | Hectares | Percentage of Interest |

| Getty North Property | 26 | 1,600 | 100% |

| Getty South Property | 22 | 336 | 50% |

| Getty Central Property | 3 | 205 | 100% |

| Getty Southwest Property | 24 | 6,199 | 100% |

| Getty Northwest Property | 28 | 18,605 | 100% |

There are no existing mines on the Registrant’s Properties, and the Registrant has no mineral producing properties at this time. All of the Registrant’s properties are exploration projects, and there is no assurance that a commercially viable deposit exists in any such properties until further exploration work and a comprehensive evaluation based upon unit cost, grade, tonnage recoveries and other factors conclude economic feasibility. The Getty Properties comprise 81 tenures and 24 crown granted claims totalling 26,609 hectares.

The following disclosure regarding accessibility, climate, local resources, infrastructure and physiography, history, geological setting, sampling and security of samples is common to all of the Getty Properties. Disclosure respecting exploration, drilling, mineral resource and exploration and development for each of the individual properties is included below.

Accessibility, Climate, Local Resources, Infrastructure and Physiography

The Properties are easily accessible by the Bose Lake road, which branches off 10 kilometres from the property from the paved Bethlehem Mine road. Forestry and drill roads provide access to the claims. Logan Lake, the closest support community, is about 15 kilometres east of the Getty Copper Highland Valley Project.

The nearest domestic airport is located in Kamloops about an hour drive from the south end of the Properties. The major city of Vancouver, B.C. situated approximately 330 kilometres to the southwest by the Coquihalla Highway, provides access to an international airport and seaport.

The Getty Properties are located on and around Forge Mountain at an elevation between 1,450 to 1,900 metres. The topographic relief is moderate and the surface is covered by glacial deposits cut by recent stream channels. Small topographic highs are immediately underlain by glacial drift and Tertiary volcanic cover.

The climate is characteristic of the “dry belt” of the B.C. Interior Plateau and precipitation is about 23 centimeters annually. The seasonal climate conditions are generally moderate. Severe weather conditions can occur for isolated periods in the winter, although the snowfall is usually moderate and the summer temperatures are cool to warm. Mean temperatures are 14.1°C in July and -6.6°C in January, respectively. Mining activities are able to continue year round.

The Registrant believes that an established mining infrastructure and a skilled labour force are available in the Highland Valley area, as the region has a history of porphyry copper mining. The water supply in the region is limited; however, a previous operator in the Highland Valley area obtained a water supply for its mining operations from groundwater. A 500 kva power line transverses the property and telephone service and natural gas is available in Logan Lake and at the nearby adjacent mine. The Registrant believes that all necessary mining infrastructure such as water, power and access will be available at the anticipated future mine sites.

The town of Logan Lake is the nearest municipality to the Properties and is the current location of the Registrant’s site office. Logan Lake has a population of approximately 2,300. It is linked to Vancouver, 330 kilometres to the southwest, via the Coquihalla Highway.

History

The history of the Highland Valley copper district dates back to approximately 1896, when it was explored by prospecting, panning, trenching and drifting near high grade copper occurrences.

The following table is a breakdown of the Registrant’s deferred exploration and development costs on the Getty Properties to the dates indicated:

21

| | | | | | | | | | | | |

| December 31, |

| Activity | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| Drilling | | 4,715,326 | | | 4,715,326 | | $ | 4,715,326 | | $ | 4,715,326 | |

| Environmental | | 254,456 | | | 254,456 | | | 254,456 | | | 254,456 | |

| Pre Feasibility Study | | 516,506 | | | 492,574 | | | 226,428 | | | 166,709 | |

| Geoscience | | 3,118,740 | | | 3,116,258 | | | 3,073,793 | | | 2,986,698 | |

| Metallurgy | | 987,113 | | | 987,113 | | | 987,113 | | | 1,059,514 | |

| Assay | | 624,667 | | | 624,642 | | | 624,094 | | | 623,775 | |

| Other Costs | | 2,036,183 | | | 1,996,267 | | | 1,940,295 | | | 1,904,050 | |

| | | | | | | | | | | | |

| Provision forimpairment | | (9,514,843 | ) | | (9,514,843 | ) | | (9,514,843 | ) | | (9,514,843 | ) |

| Totals | $ | 2,738,148 | | $ | 2,671,793 | | $ | 2,306,662 | | $ | 2,195,685 | |

Geological Setting

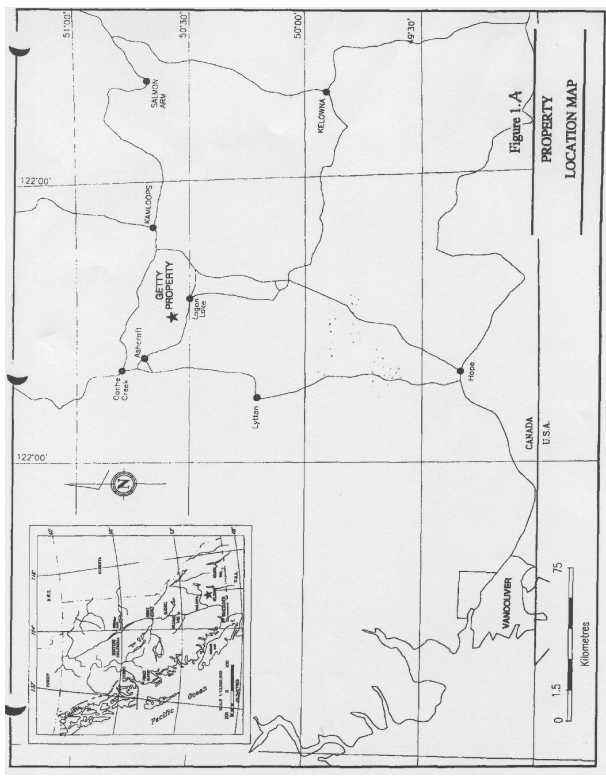

The Getty Properties mineral tenure is comprised of 210 square kms of contiguous mineral claims located in the Highland Valley, British Columbia’s premier copper producing area, approximately 200 km northeast of Vancouver (Figure 1). The local area contains excellent transportation and power infrastructure, a large pool of experienced mining and support personnel, and a mining based economy.

The Registrant’s mineral tenure contains favourable Guichon Creek Batholith geology and adjoins to the south with the large Cu-Mo mining and milling operations of the Highland Valley Copper Partnership (HVC) owned by Teck Cominco (97.5%) and Highmont Mining (2.5%).

The Registrant‘s claims span the entire width of favourable Guichon Creek Batholith geology immediately to the north of HVC’s holdings. The Registrant’s most advanced projects, the Getty North and Getty South deposits which were the subject of the PFS, are located in the eastern part of the property in the same geological and structural setting as the Bethlehem Mine located five to eight km to the south.

Sampling and Analysis

Drill core is mechanically split along its long axis. One half of the core is submitted for preparation and analysis, and the other half is geologically catalogued and stored on the site.

All assays and analyses are performed by Eco-Tech Laboratories in Kamloops, British Columbia, where they also store the samples they test for future reference.

Security of Samples

Drill core samples are stored in the Registrant’s alarmed office and warehouse facility.

22

Planned exploration for 2010

The Registrant currently does not have plans to explore the Getty Properties in 2010 as it can not do so unless it raises funding or finds a joint venture partner for the project.

Exploration

Prior to the acquisition of the Getty North Property by the Registrant from Robak and Masco, Robak held the Getty North Property for approximately two decades. During that period, in excess of $350,000 was spent on exploration work on the property consisting of silt and soil sampling, trenching and bulk sampling. Since the date of the Registrant’s acquisition of the Getty North Property to December 31, 2009, the Registrant has completed $8,783,459 of exploration work on the property, consisting of aerial photographic surveys and base map production, diamond drilling, geological mapping, assaying, induced polarization and magnetics geophysical surveys, soil geochemical surveys, metallurgical testing, and resource calculations.

The following table is a brief summary of documented drilling:

Getty North

Summary of Drilling

| | | | |

| Period | Company | Type | Holes | Metres |

| 1956-1957 | Northlodge Copper

Beaverlodge Diamond Uranium-Farwest

Tungsten Group | Diamond | 27 | 2,995 |

| 1957-1959 | Kennecott Copper | Diamond | 2 | 345 |

| 1964-1965 | North Pacific Mines | Diamond | 8 | 2,349 |

| | | Percussion | 17 | 806 |

| 1965-1966 | Canex Aerial Exploration

(Now known as Placer-Dome) | Diamond | 16 | 2,015 |

| 1967 | Isaac Schulman Syndicate | Diamond | 4 | 846 |

| 1968-1969 | Noranda Exploration | Diamond | 7 | 957 |

| 1970 | North Pacific Mines | Percussion | 25 | 1,149 |

| 1971-1972 | Getty Mining Pacific | Percussion | 16 | 1,765 |

| | | Diamond | 3 | 635 |

| 1972-1973 | Quintana Minerals | Percussion | 16 | 2,004 |

| 1993 | Getty Copper Corp. | Diamond | 5 | 557.9 |

| 1995 | Getty Copper Corp. | Diamond | 33 | 7,652.6 |

| 1996 | Getty Copper Corp. | Diamond | 41 | 10,691.5 |

| 1997 | Getty Copper Corp. | Diamond | 64 | 17,444.5 |

| 2004 | Getty Copper Inc. | Diamond | 16 | 4,711.6 |

Also in 2004, the Registrant completed $979,963 of exploration in the Getty North area. A 980 metric tonne bulk sample of oxidized material was removed from the Getty North deposit and stored near the Getty South deposit. A 10-hole diamond drill program tested areas southeast of the Getty North deposit with only locally anomalous copper results being obtained. A combined line cutting, IP, multi-element geochemical soil sampling and drilling program was carried out on the Getty North Extension target immediately northeast of the Getty North deposit. The surveys produced weak copper, lead, gold, and molybdenum anomalies and weak to moderate IP anomalies that when drilled returned locally weakly anomalous copper in altered and sheared intrusive rocks.

23

In 1997, the Registrant undertook a $3 million program of drilling and sampling on the Getty North Property. As of December 31, 1997, the Registrant had completed 64 diamond drill holes totalling 17,444.5 metres (57,235.4 ft). These holes were systematically drilled on sections 30 metres apart to provide the density of data points required for an independent mineral deposit update.

The Registrant, in 2006, embarked on a metallurgy test program of its copper sulphide and copper oxide samples at SGS Lakefield Research Limited in Lakefield, Ontario. The test program determined the leach parameters and optimum chemistry for leaching copper from Getty’s resource samples which had been forwarded to Lakefield. Additionally the Registrant contracted with Innovat Limited of Ontario to test the viability of using Innovat’s proprietary continuous vat leaching system to extract copper from the samples provided to Lakefield. The pilot plant testing confirmed the viability of the Innovat continuous vat leaching system and the Issuer negotiated a non-exclusive license to commercially exploit the technology, however, the Registrant is no longer pursuing this exclusive agreement with Innovat, and is reviewing another method.

During 2008 and until July 2009 the first version of the PFS was completed. and after receipt of comments from technical staff at the British Columbia securities commission it was amended and refilled at www.SEDAR.com where it can be downloaded

This annual report on Form 20-F may include the terms "mineral resource," "indicated mineral resource" and "inferred mineral resource". Investors are advised that these terms are defined in and required to be disclosed under Canadian rules by National Instrument 43-101 (“NI 43-101”). However, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. "Inferred mineral resources" have a great amount of uncertainty as to their existence and economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable.

Mineralization

The Getty North deposit is situated in the north central portion of the Guichon Batholith, an area the Registrant believes has a favourable structural trend of copper deposits. The Registrant believes the deposit is predominantly hosted by quartz diorite of the Guichon variety cut by dykes and breccia zones. Sericite, chlorite and carbonate associated with copper mineralization overprints the protolith mineral assemblage.

Cross sections 30 meters apart based on extensive drilling (132 holes from 1993 to 1997) were used in the resource calculation, and over 200 holes were used in geological interpretation. These sections show that the mineralization occurs in a shape similar to an inverted “horseshoe” containing a central zone of lower grade mineralization. The Getty North deposit displays continuity in a north northwest direction for a distance of at least 300 metres, ranging from 50 to over 150 meters wide in an east northeast-west southwest direction. Intrusive contacts and faulting, as seen in drill core, both control and displace mineralization, and dip steeply to the southwest.

In the central and north portions of the deposit a well-developed zone of oxidation occurs to a depth of more than 100 metres. In this area, oxidation of the primary sulphides is generally complete. Copper mineralization in the oxidized zone consists of chrysocolla, malachite, azurite, cuprite, copper manganese oxides, native copper and chalcocite. Primary sulphides generally occur below the oxidized zone and consist of, in order of abundance, pyrite, chalcopyrite, bornite, chalcocite and molybdenite.

Approximately 15% of the Getty North deposit is covered by unmineralized tertiary volcanic rock, varying in thickness from 2 metres to 70 metres.

Reserves

In May 2010, West Coast Environmental and Engineering (WCE) updated the July 2009 PFS which covers the Getty North and Getty South deposits. Both the 2009 and updated 2010 PFS documents were filed on www.SEDAR.com as technical reports forming part of Getty’s continuous disclosure record. WCE is a consulting engineering firm comprised of independent, qualified technical personnel with multiple disciplines who are professionally registered and certified in their respective disciplines in Canada and/or the USA. The purpose of the PFS was to provide estimates of copper and molybdenum resources and probable reserves in accordance with Canadian mining disclosure standards within the Getty North and South deposits, prepare preliminary mining and processing plans, and perform an economic analysis to determine the feasibility of the project on a 100 % project basis (meaning the PFS includes 100 % of the Getty South claims although they are only 50 % owned by Getty the other 50% bei ng owned by Robak).

24

The updated copper and molybdenum Indicated and Inferred Mineral Resource estimates determined independently by WCE in the PFS for the Getty North deposits. These resources were modeled by Mr. Ed Switzer using MineSight software to meet NI 43 101 Technical Report requirements and vetted by responsible “qualified person” (QP- as defined in NI 43-101) Mr. Craig Parkinson and Mr. Todd Fayram the second QP for the PFS. A total of 49.691 Probable Reserves at 0.397% Cu. and 69.258 million tonnes of Indicated Resources at an average copper grade of 0.37 % Cu, 0.005 Mo% and an additional 18.166 million tonnes of Inferred Resources at a copper grade of 0.271 % Cu, 0.005 Mo% have been determined by WCE in the PFS. The inferred resources were not used for purposes of the PFS calculations of NPV and reserves

The Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards state, in part, that a mineral resource is an occurrence of natural solid material in the Earth’s crust in such form, quantity, and quality (grade) that the material has a reasonable prospect for economic extraction. The location, quantity, grade, continuity, and geologic characteristics of the Getty North mineral resource are known and have been adequately interpreted from the available geologic evidence, data, and analytical test results. The Getty North mineral resource has a reasonable prospect for economic extraction by modern surface and underground mining methods given the current metal prices and economic conditions. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

The sulphide copper is proposed to be treated using conventional milling and flotation as is done worldwide to produce copper concentrates. Any copper concentrate that might be produced is proposed to be pressure leached on site with industrially proven, low temperature-pressure oxidation autoclaving followed by solvent extraction and electro-winning (SX/EW) to produce high quality cathode copper metal. Pressure oxidation of copper concentrates is a rapidly emerging industrially applied and environmentally sound technology. The proposed pressure oxidation facility at the Getty property would be based on this proven industrial technology. It would potentially offer the advantages of a large-scale application of the technical and financial advantages of low pressures and temperatures assuming that the planned study is positive. However, at this time there can be no assurance that the proposed preliminary-feasibility study will indicate that the quality of the present resources wi ll be upgraded to the status of reserves, or that the planned processes will be able to produce cathode copper material as proposed. The above plans for producing copper concentrates and cathode copper may not be economically achievable even though the testing and planning to date indicate that the copper cathode could potentially be produced using the planned processes.

No operational mines exist on the Getty South Property, and any existing historical workings have been sealed as required under British Columbia law.

Exploration History

The property was acquired by Trojan Exploration Limited in 1955 and was explored by Trojan Consolidated Mines Limited by surface and underground methods. Recovery of copper values by diamond drilling at that time was poor. Approximately one million dollars was spent on exploration during the period 1955 to 1973. The following work was performed by previous operators before the Registrant acquired the property: Surface diamond drilling - 15,556 metres; Underground diamond drilling - 1158 metres; Percussion drilling - 319 metres; Underground drifting - 1719 metres; Two compartment shaft - 49.1 metres; and Surface trenching - 396 metres.

In 1992, an independent consultant performed a mineral deposit estimate based on physical work completed on the Getty South Property prior to the Registrant’s acquisition of the property. In 1996, the Registrant undertook a thirteen diamond drill-hole program aggregating 3236 meters of drilling that provided assay results that were lower than anticipated, and the Registrant had determined that the drilling completed at that time was not reliable for determining grade.

As part of a systematic assessment of the grade and extent of near-surface oxide/sulphide-copper mineralization at the Getty South deposit, a program of surface trenching consisting of 13 trenches totalling approximately 1572 metres in aggregate length was completed as of December 31, 1997. The assay results to date indicate that significant concentrations of copper, mostly as leachable oxide copper, occur over an area measuring approximately 240 metres by 40 metres. Additionally, significant results were obtained approximately 200 metres to the south.

The Registrant has completed initial exploration work of its own on the Getty South Property, including aerial photographic surveys and base map production, drilling, trenching, assaying, geophysical, geochemical and geological work, at a cost of $1,243,904 to December 31, 2009.

In May 2010, West Coast Environmental and Engineering (WCE) updated the July 2009 PFS which covers the Getty North and Getty South deposits. Both the 2009 and updated 2010 PFS documents were filed on www.SEDAR.com as technical reports forming part of Getty’s continuous disclosure record. WCE is a consulting engineering firm comprised of independent, qualified technical personnel with multiple disciplines who are professionally registered and certified in their respective disciplines in Canada and/or the USA. The purpose of the PFS was to provide estimates of copper and molybdenum resources and probable reserves in accordance with Canadian mining disclosure standards within the Getty North and South deposits, prepare preliminary mining and processing plans, and perform an economic analysis to determine the feasibility of the project on a 100 % project basis (meaning the PFS includes 100 % of the Getty South claims although they are only 50 % owned by Getty the other 50% bei ng owned by Robak).

25

The updated copper Indicated and Inferred Mineral Resource estimates determined independently by WCE in the PFS for the Getty South deposits. These resources were modeled by Mr. Ed Switzer using MineSight software to meet NI 43 101 Technical Report requirements and vetted by responsible “qualified person” (QP- as defined in NI 43-101) Mr. Craig Parkinson and Mr. Todd Fayram the second QP for the PFS. A total 36.870 million tonnes at 0.405 Cu% and 45.148 million tonnes of Indicated Mineral Resources at an average copper grade of 0.377 % Cu and an additional 23.593 million tonnes of Inferred Resources at a copper grade of 0.278 % Cu have been determined by WCE in the PFS. The inferred mineral resources were not used for purposes of the PFS calculations of NPV and reserves

This annual report on Form 20-F may include the terms "mineral resource," "indicated mineral resource" and "inferred mineral resource". Investors are advised that these terms are defined in and required to be disclosed under Canadian rules by National Instrument 43-101 (“NI 43-101”). However, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. "Inferred mineral resources" have a great amount of uncertainty as to their existence and economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable.

Mineralization

The Getty South deposit is hosted within a breccia zone measuring approximately 600 metres from north to south, and 300 metres in width, which intrudes Guichon variety quartz diorite of the Guichon Creek Batholith. This breccia body is one of several which occur within a well-defined northerly trending structural zone of faulting and minor intrusions (dykes) that extends for 9 kilometres from the JA deposit through the Bethlehem ore bodies and on through to the Getty North deposit. The breccia body consists of fragments of quartz diorite and dacite porphyry set in a matrix of finely broken and crushed rock and secondary minerals such as quartz and tourmaline. Mineralization in the form of specular hematite, chalcopyrite and secondary copper minerals, such as malachite, azurite, chrysocolla, cuprite and native copper occurs mostly between rock fragments and along structurally controlled veinlets and crush zones.

Drilling

The Getty South deposit has been less thoroughly drill tested than the Getty North deposit, but has been explored by one underground level comprising a 45-metre shaft, approximately 1775 metres of drifting and crosscutting and approximately 1477 metres of underground diamond and percussion drilling. Although 15,550 metres of surface drilling were completed by previous operators, it is reportedly of poor quality and thus is not a reliable base for calculating the copper mineral resource. During 1996, the Registrant completed an initial 13-hole reconnaissance large diameter diamond drilling program totalling 3236.2 metres that returned copper results lower than anticipated. Previous engineering reports concluded that diamond drilling results based on poor recovery have proven unreliable when compared with underground development sampling, and that diamond and percussion drilling results to date do not match the overall grades returned from the currently interpreted areas of miner alization from the underground muck and bulk samples. Closely spaced large diameter diamond or reverse–circulation (RC) drilling has been recommended as a better method to determine the grade of near surface mineralization in the breccia deposit Reopening the underground workings are being considered.

Underground development

The Getty South has been developed by a 45 meter (150 foot) vertical shaft and over 1500 meters of horizontal development and at least one raise. Development took place in at least four campaigns from 1957 to 1974. Development took place primarily to test the highest grade known mineralized zones. Resource estimates were based primarily on the muck and bulk sample grades with additional data from mineralized and geological information derived from the drilling and 1997 trenching results.

Planned Exploration for 2010.

Subject to financing the Registrant intends to carry out any exploration and metallurgical work recommendations provided in the preliminary feasibility study.

| |

| (c) | Getty Central Property |

The Registrant has completed initial exploration work of its own on the Getty Central, including aerial photographic surveys and base map production, geochemical soil sampling, prospecting, geophysical surveys and geological work, at costs to December 31, 2009 of $57,587 for the Getty Central Property.

26

Exploration

The Getty Central Property is in the early exploration stage, and there is insufficient data to establish whether proven or probable reserves exist on the property. There are no existing mines on the property. No exploration expenditures are planned in 2010.

| |

| (d) | Getty Southwest Property |

Exploration

The Registrant has completed initial exploration work of its own on the Southwest Property including aerial photographic surveys and base map production, geochemical soil sampling, prospecting, geophysical surveys and geological work, at costs to December 31, 2009 of $392,788.

The Getty Southwest Property is in the early exploration stage, and there is insufficient data to establish whether proven or probable reserves exist on the property. There are no existing mines on the property. No exploration expenditures are planned in 2010.

Drilling

In 2004, HVC completed 6 diamond drill holes following up geological and IP targets. No potentially economic mineralization was encountered. Part of a large post mineral Eocene volcanic center was defined.

| |

| (e) | Getty Northwest Property |

The Getty Northwest Property is comprised of 142 mineral claims acquired by the Registrant by staking. These claims are subject to a 1.5% net smelter return royalty reserved in favour of Robak..

The Getty Northwest Property is in the early exploration stage, and there is insufficient data to establish whether proven or probable reserves exist on the property. There are no existing mines on the property. The Registrant has not planned any exploration on the property for 2008, and any plans to develop a new mine on the property would be based on a full-scale feasibility study, if any, to determine the commercial feasibility of a mining operation on the property.

Exploration History

The Registrant has completed initial exploration work of its own on the Getty Northwest Property, including aerial photographic surveys and base map production, drilling, geochemical soil sampling, prospecting, geophysical surveys and geological mapping, at a cost to December 31, 2009 of $1,775,253. HVC in 2004 completed a large line cutting and IP program over the area.

Drilling

During 1996, one exploratory diamond drill hole 254.4 metres (834 ft) deep was drilled, but no significant results were obtained. In 2004, HVC completed eight diamond drill holes following up the IP program. Only locally weakly anomalous copper and zinc results were obtained usually in hornfelsed volcanic rocks overlying the intrusive rocks. HVC also completed one drill hole 500 meters east of the Glossie mineral occurrence in which a thick sequence of Eocene volcanics was intersected. Pyritized sections returned weakly anomalous gold.

Planned Exploration for 2010

Subject to financing the Registrant intends to carry out any exploration and metallurgical work recommendations provided in the preliminary feasibility study.

| |

| ITEM 4A | UNRESOLVED STAFF COMMENTS |

Not applicable.

| |

| ITEM 5 | OPERATING AND FINANCIAL REVIEW AND PROSPECTS |

Critical Accounting Policies

Under Canadian generally accepted accounting principles, corporate/administrative expenses are written off yearly and exploration and property acquisition expenses deferred (or capitalized). Such acquisition and exploration costs are written off where the Registrant seeks to abandon a property due to exploration program results which appear to warrant abandonment or when it appears the deferred costs may not be recoverable. Acquisition costs and exploration expenditures are financed through a combination of cash and common share issuances.

27

Convergence to international Financial Reporting Standards (“IFRS”)

In February 2008, the CICA announced that Canadian GAAP for publicly accountable enterprises will be replaced by International Financial Reporting Standards (“IFRS”) for fiscal years beginning on or after January 1, 2011. Companies will be required to provide IFRS comparative information for the previous fiscal year. The transition date of January 1, 2011 will require the restatement for comparative purposes, amounts reported by the Company for the year ended December 31, 2011, for which the current and comparative information will be prepared under IFRS.

The Company has commenced its IFRS conversion project in 2008. The Company’s IFRS project consists of three phases – scoping, evaluation and design, and implementation and review. The Company has commenced the scoping phase of the project, which consists of project initiation and awareness, identification of high-level differences between Canadian GAAP and IFRS and project planning and resourcing. The Company has completed a high level scoping exercise and has prepared a preliminary comparison of financial statement areas that will be impacted by the conversion.

A detailed assessment of the impact of adopting IFRS on the Company’s consolidated financial statements, accounting policies, information technology and data systems, internal controls over financial reporting, disclosure controls and procedures, and the various covenants and capital requirements and business activities has not been completed. The impact on such elements will depend on the particular circumstances prevailing at the adoption date and the IFRS accounting policy choices made by the Company. The Company has not completed its quantification of the effects of adopting IFRS. The financial performance and financial position as disclosed in our Canadian GAAP financial statements may be significantly different when presented in accordance with IFRS.

Overview

The Registrant is currently an expenditure-based organization whose business strategy is to acquire, explore and conduct detailed engineering and economic analysis of mineral deposits which have large tonnage and multi-year operation potential. None of the Registrant’s currently held or to be acquired mineral deposits currently hosts a mineral resource that can be said to be economic at current metals prices.

The Registrant’s financial statements are prepared on the basis that it will continue as a going concern. Given that the Registrant has no source of significant revenue this assumption is always subject to the further assumption that there will continue to be investment interest in funding large tonnage metal deposits which are not known to be economic in the current environment. The Registrant can give no assurance that it will continue to be able to raise sufficient funds and should it be unable to continue to do so, may be unable to realize on the carrying value of its resource project and the net realizable value could be materially less than the Registrant’s liabilities with a potential for total loss to the Registrant shareholders.

The Registrant does not believe that it is significantly impacted by the effects of inflation and the Canadian dollar has fluctuated in a relatively narrow band to the United States dollar (US$1.00: Cdn$0.97 to $1.29) during these three years. The Registrant has not been materially affected by government economic, fiscal, monetary or political policies and the outlook for the Registrant’s assets primarily relate to the outlook for copper. For information relating to the historical prices for copper and gold, see “Trend Information” below.

Operating Results – Fiscal 2009 Compared with Fiscal 2008

At December 31, 2009, the registrant had working capital deficit of ($3,534) compared to working capital of $358,634 at December 31, 2008. During the year ending December 31, 2009, the decrease in working capital is due to general and administration expenses as well as the recognition of an indemnity payable to a director. See Item 7B. The Company has no source of revenue other than funds raised through the issuance of stock, through private placement. Current liabilities at December 31, 2009 decreased to $338,540 from $385,094 at December 31, 2008.

Net deferred exploration expenditures incurred during the year ended December 31, 2009 $66,355 compared to $365,131 spent during the year ended December 31, 2008. See Note 5 of the annual financial statements.

Shareholder equity decrease to $3,842,187 during the year ending December 31, 2009 from $4,765,919 December 31, 2008, due to expenditures. The Registrant has no source of income, other than interest earned on funds held in a term deposit.

The Registrant earned $7,051 in interest income for the year ending December 31, 2009 compared to $16,618 at December 31, 2008. The decrease is due to a depletion of funds spent on expenditures.

28

Operating Results – Fiscal 2008 Compared with Fiscal 2007

At December 31, 2008, the registrant had working capital of $358,634 compared to working capital of $59,974 at December 31, 2007. During the year ending December 31, 2008, the increase in working capital is a result of funds raised through the issuance of stock, through private placement and exercising of warrants. Current liabilities at December 31, 2008 decreased to $385,094 from $703,908 at December 31, 2007, due to a decrease in legal expenses, as many of these issues have been settled.

Net deferred exploration expenditures incurred during the year ended December 31, 2008, $365,131 compared to $110,977 spent during the year ended December 31, 2007. See Note 5 of the annual financial statements.

Shareholder equity increased to $4,765,919 during the year ended December 31, 2008 from $4,106,604 December 31, 2007 due to private placements and the exercising of warrants, the Registrant has no source of income other than interest earned on funds held in a term deposit.

The Registrant earned $16,618 in interest income for the year ending December 31, 2008 compared to $10,138 at December 31, 2007.

During the year ended December 31, 2008 the Registrant earned $2,243 rental income for a road usage. During the previous year ending December 31, 2007, the Registrant earned $2,264 for a portion of office space located in Logan Lake, British Columbia.

| |

| B. | LIQUIDITY AND CAPITAL RESOURCES |

On January 18, 2006, the registrant completed a private placement of 5,000,000 units. Each unit consisted of one share valued at $0.10 and one-half share purchase warrant certificates, exercisable for one year at a price of $0.125 in the first six months and $0.15 in the second six months. . These warrants were extended to January 16, 2008 at a price of $0.15. As of May 12, 2008 125,000 warrants were exercised, leaving a balance of 2,375,000 whole warrants to expire unexercised.

On July 7, 2006, the Company completed a private placement and issued 10,000,000 units at $0.11 for gross proceeds of $1,100,000. Each unit is comprised of one common share and one common share half-warrant, entitling the holder of each whole share purchase warrant to purchase an additional one common share of the Company for a period of 6 months (expiry date was extended to July 7, 2008 from January 7, 2007) at a price of $0.15. No finder’s fees or commissions were paid. Proceeds from the private placement were used to fund the Company’s exploration and development programs, to pay ongoing legal expenses and for general working capital. As of May 20, 2008, 22,750 warrants were exercised, leaving a balance of 4,977,250 whole warrants.

On May 1, 2007, the TSX Venture Exchange accepted for filing the company’s proposal to issued 4,937,500 shares at a deemed value of 10 cents per share to settle outstanding debt for $493,750.

On May 7, 2007 the TSX Venture Exchange accepted the Company’s non-brokered private placement of 13,000,000 units for gross proceeds of $1,300,000. Each unit, at a price of $0.10, is comprised of one common share and one half-share purchase warrant, each whole share purchase warrant entitles the holder to purchase one additional common share at an exercise price of $0.15 per share until May 7, 2008. At the expiration date, these warrants were unexercised. All securities issued were subject to a four-month hold period from the date of closing.

On January 10, 2008, the Company closed a non-brokered private placement for 10,000,000 shares at $0.10 per share, for proceeds of $1,000,000. The TSX Venture Exchange accepted this private placement on January 10, 2008. All Securities issued will be subject to a four-month hold period expiring on May 11, 2008.

During the year ending December 31, 2008, 3,253,630 warrants were exercised at $0.15 each for 3,253,630 common shares raising $488,044.50. These warrants were from the July 7, 2006 private placement, the balance of the warrants expired July 8, 2008. As of February 28, 2010, 80,892,537 shares were outstanding.

Possible Unavailability of Additional Financing.

The Registrant is currently pursuing financing opportunities to meet its administration costs. If the Registrant is unable to raise additional capital it will need to curtail its operations and the Registrant may be materially adversely affected.

Overview

Historically the Registrant’s sole source of funding was the sale of equity securities for cash primarily through private placements to sophisticated investors and institutions. The Registrant has no assurance of continued access to significant equity funding.

29

Fiscal 2009 Compared with Fiscal 2008

As at March 31, 2010, the Registrant’s cash and short term investments was $ 205,624 .

The Registrant’s cash and short-term investments at December 31, 2009 were $294,722 compared to $716,313 at December 31, 2008. The decrease is due to exploration spending during the year and administrative and legal expenses, as well as $50,000 cash was paid out ($600,000 plus interest remain payable) during the year ending December 31, 2009 upon the execution of a definitive agreement to indemnify a director for legal costs in connection with a 2002 mineral property interest sale agreement and the action s of certain former directors. See Item 7 B. Aside from cash and short-term investments, the Registrant has no material unused sources of liquidity.

Fiscal 2008 Compared with Fiscal 2007

As at March 31, 2009, the Registrant’s cash and short term investments was $ 622,558 .

The Registrant’s cash and short-term investments at December 31, 2008 were $716,313 compared to $755,929 at December 31, 2007. The decrease is due to exploration spending during the year and administrative and legal expenses, the decrease is minimized because of a private placement and the exercising of warrants in 2008. Aside from cash and short-term investments, the Registrant has no material unused sources of liquidity.

Financial Instruments

The Registrant financed its activities from 1985 through 2009 primarily through the issuance of equity shares through private and public distributions. Certain of these financings were structured as “flow through” to provide a Canadian income tax incentive to make the securities more attractive. TheIncome Tax Act(Canada) provides certain incentives to encourage exploration on Canadian resource properties including the deductibility of a defined class of “Canadian Exploration Expenses” and “Canadian Development Expenses” which provide deductible pools of resource expenditures deductible against other sources of income. The Registrant keeps its financial instruments denominated in Canadian dollars and does not engage in any hedging operations with respect to currency or in-situ minerals. Funds which are currently excess to the Registrant’s needs are invested in government of Canada or like debt obligations and other short term near cash investments pending the need for the funds.

The Registrant does not have any material commitments for capital expenditures and accordingly can remain relatively flexible in gearing its activities to the availability of funds. As of the fiscal 2009 year end, the Registrant estimates that the cost of maintaining its corporate administrative activities at approximately $20,000 exclusive of legal fees per month. Accordingly, the Registrant’s management estimate that a minimum of $240,000 will be needed to maintain its corporate status and assets over the ensuing two-year period and the Registrant has current working capital deficit at March 31, 2010 of ($73,585) which is not adequate to ensure continued viability over this period of time.

| |

| C. | RESEARCH AND DEVELOPMENT |

The Registrant is a resource expenditure based corporation and accordingly does not have a program of intellectual property development or patenting or licensing issues.

As a mineral exploration company, the Registrant’s activities are somewhat cyclical as metals prices have traditionally been cyclical in nature. The basic trend through the last few years for metal prices has been positive. Copper is a commodity metal used extensively in the housing, electrical and automotive industries and accordingly, demand for copper varies directly with general economic conditions. Copper demand from developing economies is expected to remain relatively strong.

| |

| E. | OFF-BALANCE SHEET ARRANGEMENTS |

Not Applicable

| |

| F. | TABULAR DISCLOSURE OF CONTRACTUAL OBLIGATIONS |

The Registrant is committed to make monthly payments of $3,000 to related parties for management fees and rent.

| | | |

| | Total | less than a year | 1-3 years |

| Rent | $6,000 | -- | $6,000 |

| Management Fees | $30,000 | -- | $30,000 |

| Consulting Fees | $30,000US$ | -- | $30,000US$ |

30

The Registrant has a mortgage payable which is secured by a first charge on land and building and requires monthly payments of $756 including interest at 7.5% per annum, and is repayable on October 1, 2012.

Principal repayments required are as follows:

| | | |

| 2010 | $ | 2,856 | |

| 2011 | | 3,074 | |

| 2012 | | 3,308 | |

| 2013 | | 76,276 | |

| |

| ITEM 6 | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES |

| |

| A. | Directors and Senior Management as of June 1, 2010 |

| | | |

| Name, Position andPlace of Residence | Period a Director of the Issuer | Shares BeneficiallyOwned or Controlled(1) | Percentage of SharesOutstanding |

Corby G. Anderson PhD CEng

President, CEO, COO, Director

Butte, Montana, USA | June 12, 2006 to date | 325,000 Shares | 0.4% |

John B. Lepinski

Managing Director

Coquitlam, British Columbia | June 30, 1992 to date | 19,924,877 Shares | 24.6% |

Donald R. Willoughby FCA

Chief Financial Officer, Director

Vancouver, British Columbia | June 30, 1992 to date | 395,000 Shares | 0.5% |

Robert H. Peterson

Director

Boise, Idaho, USA | August 16, 2007 to date | 10,000 Shares | 0.01% |

Charles Mitchell, LLB

Director

Edmonton, Alberta | November 30, 2004 to date | NIL | 0% |

Edward Leung, CGA

Director

Vancouver, British Columbia | January 26, 2005 to date | NIL | 0% |

Dennis Milburn, CA

Director

Langley, British Columbia | May 20, 2008 to date | NIL | 0% |

Notes:

| |

| (1) | The information as to shares beneficially owned or controlled is furnished by the respective directors as of June 1, 2010. |

Occupation of Current Management and directors of Getty

CORBY ANDERSON – President, CEO, COO, Director. Dr. Corby Anderson CEng FIChemE, is the President of Allihies Engineering Incorporated.

JOHN B. LEPINSKI – Managing Director. John B. Lepinski is owner manager of a liquor distribution business and has forty years experience in mining related enterprises. He is also the principle shareholder, director and officer of several private companies and has served as a director of other public companies during the past twenty years.

31

DONALD R. WILLOUGHBY, FCA – Chief Financial Officer and Director. Mr. Willoughby is a Fellow Chartered Accountant . He is also a shareholder, director and officer of several private companies and has served as a director of other public companies during the past fifteen years.

ROBERT H. PETERSON – Director, Mr. Robert H. Peterson has a Bachelor of Science degree in Electrical Engineering. He has also completed the Management Program for Executives and has received an Alfred P. Sloan Fellowship Award in M.S. Management. Mr. Peterson has over 40 years of experience in the mining sector.

CHARLES MITCHELL, LLB, BA- Director, Mr. Charles Mitchell has a Bachelor of Law and Bachelor of Arts degrees and is a lawyer for Rogers Oil & Gas Inc.

EDWARD LEUNG, CGA – Director, Mr. Edward Leung is a certified general account and has over 25 years experience in the accounting and finance sector. Mr. Leung has a Bachelor of Business Administration degree.

DENNIS MILBURN, CA – Director. Mr. Dennis Milburn is a chartered accountant and has more than 40 years experience in the resource sector.

During the Registrant’s financial year ended December 31, 2009, the aggregate remuneration paid or payable to the Registrant’s directors and senior officers or companies or professional firms with which the directors or officers are associated, for rent, accounting, legal services, geological consulting fees by a director was $89,000.

Dr. Corby Anderson, President and director of the Registrant, and Mr. Donald R. Willoughby, Chief Financial Officer and a director of the Registrant, are each a “Named Executive Officer” of the Registrant for the purposes of the following disclosure.

The compensation paid any Named Executive Officers during the Registrant’s three most recently completed financial years is as set out below:

| | | | | | | | |

| | | Annual Compensation | Long Term Compensation | |

| | | | | | Awards | Payouts | |

Name and

Principal

Position | Year | Salary

($) | Bonus

($) | Other Annual

Compensation

($) | Securities

Under

Options

Granted

(#) | Restricted

Shares or

Restricted

Share

Units

($) | LTIP

Payouts

($) | All Other

Compensation

($) |

Dr. Corby

Anderson,

President

since July

20, 2007 | 2009 | Nil | Nil | Nil | Nil | Nil | Nil | $35,9171 |

| 2008 | Nil | Nil | Nil | Nil | Nil | Nil | $32,3811 |

Donald

Willoughby,

CFO | 2009 | Nil | Nil | Nil | Nil | Nil | Nil | $17,0832 |

| 2008 | Nil | Nil | Nil | Nil | Nil | Nil | $17,9762 |

John

Lepinski,

Managing

Director, | 2009 | Nil | Nil | Nil | Nil | Nil | Nil | $36,0003 |

| 2008 | Nil | Nil | Nil | Nil | Nil | Nil | $36,0003 |

| 1. | Consulting fees paid to Allihies Engineering Inc., a company controlled by Corby Anderson. |

| 2. | Fees paid to a professional accounting firm, of which Mr. Willoughby’s professional corporation is associated |

| 3. | This amount represents the $2,500 per month billed by Freeways Properties Inc. a company controlled by John Lepinski, for management fees and $500 per month billed by Deborah Resources Ltd. , a company controlled by John B Lepinski for office rental. |

32

Termination of Employment, Change in Responsibilities and Employment Contracts

There are no compensatory plans or arrangements with respect to the Named Executive Officers resulting from the resignation, retirement or any other termination of employment of the officer’s employment or from a change of the Named Executive Officer’s responsibilities following a change in control.

There are no arrangements under which directors were compensated by the Registrant during the financial year ended December 31, 2009 for their services in their capacity as directors and consultants except as herein disclosed. An accounting firm in which a director of the Registrant is associated charged the Registrant $17,083 (2008 - $17,976) for accounting fees related to tax filings, quarterly report review and other professional accounting related matters. A Company controlled by the current president, Dr. Corby G Anderson billed the Company $35,917 (2008 $32,381) for consulting services. For the year ending December 31, 2009, the Company also paid $6,000 office rent and $30,000 management fees to companies controlled by the managing director.

All directors were re-elected at the June 10, 2009 annual general meeting and have a term of office expiring at the next annual general meeting of the Registrant to be held on June 24, 2010 and it is anticipated that all existing directors will be re-elected at that meeting. All officers have a term of office lasting until their removal or replacement by the Board of Directors.

At the June 10, 2009 directors meeting, Messrs. Leung CGA, Mitchell LLB, and Peterson, all independent directors, were appointed to the Registrant’s Audit Committee. The Board also appointed Messrs. Milburn CA, Willoughby FCA and Anderson PhD.CEng to the Nominating and Corporate Governance Committee. All Board committees are reviewed annually by the directors of the Registrant at the first meeting of the Board held after the Registrant’s annual general meeting. The primary function of the Audit Committee is to review the financial statements of the Registrant before they are submitted to the board for approval. The Audit Committee is also available to assist the Board if required with matters relating to the appointment of the Registrant’s auditor and the overall scope and results of the audit, internal financial controls, and financial information for publication for various purposes. The Registrant has no remuneration committee.

At December 31, 2009, 2008 and 2007 the Registrant had one direct employee.

As of December 31, 2009 an aggregate of 3,325,000 Shares have been reserved for issuance pursuant to the following director, executive officer and service provider stock options: At the annual general meeting held June 25, 2007, the shareholders passed a resolution increasing the number of reserved shares under the Plan to 6,700,000.

| | | | | |

| (a) Incentive Options | | | | | |

| Option holder | Number of

Shares | | Exercise Price

per Share(1) | Date of Grant

(m/d/y) | Expiry Date

(m/d/y) |

| Donald Willoughby FCA, CFP | 275,000 | $ | 0.10 | 8/18/2009 | 08/14/2014 |

| John Lepinski | 400,000 | $ | 0.10 | 8/18/2009 | 08/14/2014 |

| Edward Leung CGA | 250,000 | $ | 0.10 | 8/18/2009 | 08/14/2014 |

| Charles Mitchell LLB | 250,000 | $ | 0.10 | 8/18/2009 | 08/14/2014 |

| Dr. Corby G. Anderson CEng FIChemE | 1,250,000 | $ | 0.10 | 8/18/2009 | 08/14/2014 |

| Robert Peterson | 250,000 | $ | 0.10 | 8/18/2009 | 08/14/2014 |

| Dennis Milburn CA | 250,000 | $ | 0.10 | 8/18/2009 | 08/14/2014 |

| Marilyn Young | 150,000 | $ | 0.10 | 8/18/2009 | 08/14/2014 |

Notes:

| |

| (1) | As of June 21, 2010 no options were exercised. |

Securities Held By Insiders

As at June 21, 2010 the directors and officers of the Registrant and their affiliate companies held as a group, directly and indirectly, own or control an aggregate of 20,514,877 common shares (25.5%) and hold 3,175,000 options .

33

Material Terms of the Registrant’s Stock Option Plan (The “Plan”)

Eligible Optionees

Under the policies of TSX V, to be eligible for the issuance of a stock option under the Plan an Optionee must either be a director, officer, employee, consultant or an employee of a company providing management or other services to the Registrant at the time the option is granted.

Options may be granted only to an individual or to a company that is wholly-owned by individuals eligible for an option grant. If the option is granted to a company, that company must provide the TSX V with an undertaking that it will not permit any transfer of its shares, nor issue further shares, to any other individual or entity as long as the incentive stock option remains in effect without the consent of the TSX V.

Material Terms of the Plan

The following is a summary of the material terms of the Plan:

| (a) | all options granted under the Plan are non-assignable and non-transferable and for a period of up to 10 years; |

| (b) | for stock options granted to employees or service providers (inclusive of management company employees), the Registrant is required to represent that the proposed Optionee is a bona fide employee or service provider (inclusive of a management company employee), as the case may be, of the Registrant.; |

| (c) | if an Optionee ceases to be employed by the Registrant or to provide services to the Registrant (other than as a result of termination with cause) or ceases to act as a director or officer of the Registrant or a subsidiary of the Registrant, any option held by such Optionee may be exercised within 90 days after the date such Optionee ceases to be employed as an officer or director or, as the case may be, or within 30 days if the Optionee is engaged in investor relations activities and ceases to be employed to provide investor relations activities; |

| (d) | the minimum exercise price of an option granted under the Plan must not be less than the closing price for the Registrant’s common shares as traded on the TSX V on the last trading day before the date that the option is granted less allowable discounts as permitted by the TSX V of up to 25%; and |

| (e) | no Optionee can be granted an option or options to purchase more than 5% of the outstanding listed shares of the Registrant in a one year period. |

| | | |

| | 1. | Vesting of options is at the discretion of the board of directors and will be subject to a) and b). |

| | 2. | Options granted to Consultants retained by the Registrant pursuant to a short term contract or for a specific projects with a finite term, will be subject to such vesting provisions determined by the board of directors of the Registrant at the time of the Option Commitment is made, subject to Regulatory Approval. |

The Registrant will obtain "disinterested" shareholders' approval (described below) if:

| (a) | the number of options granted to Insiders of the Registrant exceeds 10% of the Registrant’s outstanding listed shares; or |

| (b) | the aggregate number of options granted to Insiders of the Registrant within a one year period exceeds 10% of the Registrant’s outstanding listed shares; or |

| (c) | the number of options granted to any one Insider and such Insider’s associates within a one year period exceeds 5% of the Registrant’s outstanding listed shares; or |

| (d) | the Registrant is decreasing the exercise price of options previously granted to Insiders. |

Disinterested Shareholder Approval

If options are granted by the Registrant under the Plan, which trigger the requirement for disinterested shareholder approval (“DSA Options”), the DSA Options need to be presented to shareholders of the Registrant for approval at an annual general or special meeting of the Registrant. No DSA Options can be exercised by the Optionee until disinterested shareholder approval has been obtained.

“Disinterested shareholder approval” means the approval by a majority of the votes cast by all shareholders of the Registrant at the shareholders’ meeting excluding votes attached to listed shares beneficially owned by "Insiders" of the Registrant (generally officers and directors) to whom the DSA Options have been granted under the Plan and Associates of those Insiders.

At the June 25, 2007 annual general meeting shareholders approved a resolution increasing the number of shares in the Registrant’s fixed share option plan to 6,700,000. The amendment to the Registrant’s fixed share option plan had been previously approved by the TSX Venture Exchange.

34

| |

| ITEM 7 | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS |

To the extent that the following information is known to the Registrant or can be ascertained from public filings, the following shareholders beneficially own more than 5 % of the Registrant’s voting securities as of May 17, 2010:

John Lepinski 19,924,877 24.6%

Ralph Berezan 15,533,410 19.2%

Lisa Lepinski 7,827,523 9.6% (daughter of John Lepinski)

Brent Lepinski 6,094,363 7.5% (son of John Lepinski)

Tara Hamaoka 4,158,117 5.1% (daughter of John Lepinski)

The Registrant’s securities are recorded on the books of its transfer agent in registered form, however, the majority of such shares are registered in the name of intermediaries such as brokerage houses and clearing houses on behalf of their respective brokerage clients, and the Registrant does not have knowledge or access to information about of the beneficial owners thereof. To the best of its knowledge, the Registrant is not directly or indirectly owned or controlled by a corporation or foreign government. As of December 31, 2009, the Registrant had unlimited authorized common shares without par value of which 80,892,537 (May 31, 2010: 80,892,537)

The Registrant’s major shareholders do not have voting rights different from other holders of the Registrant’s common shares.

Under the British ColumbiaSecurities Act,insiders (generally officers, directors, holders of 10% or more of the Registrant’s shares) are required to file insider reports of changes in their ownership within 5 days of the date of trade.. Insider reports can be viewed online at www.SEDI.ca.

As of May 31, 2010 there were 56 registered shareholders of record holding a total of 80,892,537 common shares of the Registrant. To the best of the Registrant’s knowledge there were 39 registered shareholders of record with registered addresses in Canada, 11 shareholders of record with registered addresses in the United States and 6 shareholders of record with registered addresses in other countries holding approximately 78,919,268 (97.6%)- 1,970,144 (2.4%) and 3,125 (0.004%) of the outstanding common shares, respectively. Shares registered in intermediaries were assumed to be held by residents of the same country in which the clearing house was located.

| |

| B. | Related Party Transactions |

No director or senior officer, and no associate or affiliate of the foregoing persons, and no insider has or has had any material interest, direct or indirect, in any other transactions, or in any other proposed transaction, which in either such case has materially affected or will materially affect the Registrant or its predecessors during the year ended December 31, 2009.

On December 9, 2002, the Registrant held a Special Meeting whereby the shareholders approved an ordinary resolution of disinterested shareholders authorizing the directors to conclude a proposed mineral property interest sale agreement (MPISA) agreement between the Registrant and Robak Industries Ltd., a holding company of director John Lepinski to acquire the Getty South property (as to 50%) and 100 % of the Southwest and Central mineral claims (each subject to a 1.5% NSR) for a total of 6 million (post-reversed-split) fully paid common shares having a deemed value of C$0,20 or $1,200,000. The transaction received TSX V approval on March 7, 2003 and details of the transaction can be reviewed in the management proxy circular prepared for the December 9, 2002 meeting which is publicly accessible at www.sedar.com.

In 2004, the Board of Directors considered acquiring the remaining 50% of Getty South from Robak. The board commissioned a valuation of the Robak interest from the same party who carried out the 2002 valuation. In 2004 the valuator presented information about his 2002 report that caused the board to re-examine the 2002 transaction. A committee of the whole of the directors, with the exception of John Lepinski, as an independent review committee, initiated a thorough review of the historical geological data of the Getty South Property. To date the board has received nothing that would suggest that the Getty South acquisition should be rescinded.

In April, 2009, the Company reached a settlement with one of its directors, to indemnify him for approximately 88% of legal expenses incurred during 2004 to 2007 in connection with his prosecution of legal actions against former directors who were alleged to have improperly attempted to impugn for ulterior reasons the 2002 “MPISA described above. The settlement was premised on the fact that the director's legal actions were of benefit to the Company in the conduct of its own litigation in defence of the MPISA. The settlement provides that the director will be entitled to receive $650,000 by way of a secured debenture for $600,000 payable January 2, 2012 and bearing interest at 6%, plus $50,000 cash upon execution of a definitive agreement. The payment must be accelerated in the event the Company completes a financing of $2 million or more or in certain customary events of default (failure to maintain the properties, insolvency etc).

35

| |

| C. | Interests of Experts and Counsel |

Not applicable.

| |

| ITEM 8 | FINANCIAL INFORMATION |

| |

| A. | Financial Statements and Other Financial Information |

The Registrant’s annual audited financial statements for fiscal years ended December 31, 2009 , 2008 and 2007 can be found under Item 17 of this annual report on Form 20-F.

Legal Proceedings

There are no legal or arbitration proceedings involving the Registrant, including those relating to bankruptcy, receivership or similar proceedings and those involving any third party, which may have, or have had in the recent past, significant effects on the Registrant’s financial position. This includes governmental proceedings pending or known to be contemplated.

Dividend Policy

The Registrant has not paid any dividends on its outstanding common shares since its incorporation and does not anticipate that it will do so in the foreseeable future. All funds of the Registrant are being retained for exploration of its Projects.

There have been no significant changes to the accompanying financial statements since December 31, 2009, except as disclosed herein.

| |

| ITEM 9 | THE OFFER AND LISTING |

[The Registrant’s authorized capital consists of an unlimited number of common shares without par value. There are no restrictions on the transferability of the Registrant’s common shares imposed by its constituting documents.

The common shares entitle their holders to: (i) vote at all meetings of our shareholders except meetings at which only holders of specified classes of shares are entitled to vote, having one vote per common share, (ii) receive dividends at the discretion of our board of directors; and (iii) receive our remaining property on liquidation, dissolution or winding up.]

| |

| A. | Offer and Listing Details |

The following information provides the price history of the Registrant’s common shares that are listed on the TSX-V

| | | | | |

| | High | Low | | High | Low |

| | ($) | ($) | | ($) | ($) |

| Annual | | | By Quarter | | |

| Fiscal Year 2009 | 0.07 | 0.015 | Fiscal 2008 | | |

| Fiscal Year 2008 | 0.16 | 0.015 | First Quarter | 0.105 | 0.075 |

| Fiscal Year 2007 | 0.40 | 0.075 | Second Quarter | 0.175 | 0.07 |

| Fiscal Year 2006 | 0.145 | 0.085 | Third Quarter | 0.16 | 0.06 |

| Fiscal Year 2005 | 0.19 | 0.07 | Fourth Quarter | 0.055 | 0.015 |

| | | | | | |

| Monthly | | | Fiscal 2009 | | |

| | | | First Quarter | 0.035 | 0.02 |

| January, 2010 | 0.00 | 0.00 | Second Quarter | 0.045 | 0.015 |

| February, 2010 | 0.00 | 0.00 | Third Quarter | 0.055 | 0.025 |

| March, 2010 | 0.00 | 0.00 | Fourth Quarter | 0.035 | 0.025 |

| April, 2010 | 0.00 | 0.00 | | | |

| May, 2010 | 0.00 | 0.00 | Fiscal 2010 | | |

| | | | First Quarter | 0.0 | 0.0 |

36

During the period November 24, 2009 to June 9, 2010, the Registrant’s common shares listed on the TSX V were under a cease trade while the British Columbia Securities Commission reviewed the Registrant’s Pre-feasibility study dated June 9, 2009 and filed on Sedar, July 22, 2009. An amended Pre-feasibility was completed May 3. 2010 and filed on Sedar on May 25, 2010. The Registrant resumed trading its common shares on the TSX V on June 9, 2010.

Not applicable.

The Registrant’s securities are not listed on any other stock exchange or regulated market other than the TSX-V. The registrant’s shares did not trade from November 2009 to June 6,2010 pending resolution of technical comments of the British Columbia Securities Commission on the PFS.

Not applicable.

Not applicable.

Not applicable.

| |

| ITEM 10 | ADDITIONAL INFORMATION |

Not applicable.

| |

| B. | Articles of Incorporation |

The Registrant’s Articles of Incorporation are registered with Industry Canada under Certificate No. 197635-1 under theCanada Business Corporations Act(“CBCA”).

Objects and Purposes

The Registrant’s Restated Articles of Incorporation do not specify objects or purposes.

Directors Powers and Limitations

The Registrant’s By-laws specify that there will be a minimum of three and a maximum of seven directors. Directors automatically retire at the commencement of each annual meeting subject to being re-elected.

Although the Registrant’s directors and officers have various fiduciary obligations to the Registrant, situations may arise where the interests of the directors and officers could conflict with those of the Registrant. The potential conflicts of interest arise as a result of common ownership and certain common directors, officers, and personnel of the Registrant and their associates and affiliates. These conflicts are normally resolved in accordance with the CBCA (in the case of the Registrant) which requires disclosures of conflicts at meetings of the directors held for the purposes, inter alia, of acquiring assets or dealing in assets in which directors have an interest. These directors are then prevented from voting on any resolution passed by the Board with respect to any such acquisition or dealing.

The CBCA, however, provides that directors who have an interest in the transaction or matter can vote on any resolution if the contract they are approving is an arrangement by way of security for money lent or obligations undertaken by the director for the benefit of the Registrant, relating to the remuneration of the director, relating to indemnities or insurance for directors or a contract with an affiliate.

The directors and officers of the Registrant are both by statute and at common law, required to act fairly and in the best interest of the Registrant and are not permitted to breach this fiduciary duty for their own benefit.

37

While the Registrant does not anticipate making any loans to directors, officers or affiliates, if such a need should arise, no future loans will be made to such persons absent a bona fide, and independent business purpose.

Shareholders’ Meetings

Under the CBCA, the Registrant’s directors must call an annual meeting of shareholders not later than 15 months after holding the last preceding annual meeting and may at any time call a special meeting of shareholders.

For the purpose of determining shareholders entitled to receive notice of a meeting of shareholders, the directors may fix in advance a date as the record date for such determination, but such record date shall not proceed by more than 50 days or by less than 21 days the date on which the meeting is to be held.

Under the CBCA, notice of the time and place of a meeting of shareholders shall be sent not less than 21 days nor more than 50 days before the meeting to each shareholder entitled to vote at the meeting. A National Policy Statement of the Canadian Securities Regulators extends the date by which notice must be given to shareholders. Under that National Policy Statement an advance notice of annual meeting must be published 60 days before the date of such annual meeting. As well, the National Policy Statement requires that meeting materials be sent to registered holders approximately 35 days before the meeting date, so that such registered holders can forward the materials to beneficial holders.

Common Shares

The holders of Common Shares are entitled to one vote for each share on all matters submitted to a vote of shareholders. There is no cumulative voting with respect to the election of directors. Accordingly, holders of a majority of the shares entitled to vote in any election of directors may elect all of the directors standing for election. Subject to preferences that may be applicable to any then outstanding Preferred Shares, the holders of Common Shares are entitled to receive such dividends, if any, as may be declared by the Board of Directors from time to time out of legally available funds. Upon liquidation, dissolution or winding up of the Registrant, the holders of Common Shares are entitled to share rateably in all assets of the Registrant that are legally available for distribution, after payment of all debts and other liabilities. The holders of Common Shares have no redemption or conversion rights. The rights, preferences and privileges of holders of Common Shares ar e subject to the rights of the holders of shares of any series of Preferred Shares that the Registrant may issue in the future.

Redemption

The Registrant has no redeemable securities authorized or issued.

Pre-emptive Rights

There are no pre-emptive rights applicable to the Registrant which provide a right to any person to participate in offerings of the Registrant’s securities

Liquidation

All common shares of the Registrant participate rateably in any available assets in the event of a winding up or other liquidation.

No Limitation on Foreign Ownership

There are no limitations under the Registrant’s Articles or in the CBCA or under any other Canadian law on the right of persons who are not citizens of Canada to hold or vote common shares. (See also “Exchange Controls” – below.)

Dividends

Dividends may be declared by the Board out of available assets and are paid rateably to holders of common shares. No dividend may be paid if the Registrant is, or would thereby become, insolvent.

Voting Rights

Each Registrant share is entitled to one vote on matters to which common shares ordinarily vote including the election of directors, appointment of auditors and approval of corporate changes and other matters requiring shareholder approval.

38

Change in Control

The Registrant has not implemented any shareholders’ rights or other “poison pill” protection against possible take-overs. The Registrant does not have any agreements which are triggered by a take-over or other change of control. There are no provisions in its articles triggered by or affected by a change in outstanding shares which gives rise to a change in control.

Share Ownership Reporting

The articles of the Registrant do not require disclosure of share ownership. Share ownership of director nominees must be reported annually in proxy materials sent to the Registrant’s shareholders. There are no requirements under British Columbia corporate law to report ownership of shares of the Registrant but the British Columbia Securities Act requires disclosure of trading by insiders including holders of 10% of voting shares within 5 days of the trade. Controlling shareholders (generally those in excess of 20% of outstanding shares) must provide seven days advance notice of share sales. Insider reports can be viewed on-line at www.sedi.ca.

The Registrant is not subject to any material agreements except:

a) settlement agreement with John Lepinski under which $650,000 is owed to Mr Lepinski and is due January, 2011

b) the mortgage on the Registrant’s Logan lake building.

The Registrant is a Canadian Company. There is no law or governmental decree or regulation in Canada that restricts the export or import of capital, or affects the remittance of dividends, interest or other payments to a non-resident holder of Common Shares, other than withholding tax requirements. Any such remittances to United States residents are generally subject to withholding tax. See “Taxation”, below.

There is no limitation imposed by the laws of Canada or by the charter or other constituent documents of the Registrant on the right of a non-resident to hold or vote the Common Shares, other than as provided in theInvestment Canada Act(Canada) (the “Investment Act”). The following discussion summarizes the material features of theInvestment Actfor a non-resident who proposes to acquire a controlling number of Common Shares. It is general only, it is not a substitute for independent advice from an investor’s own advisor, and it does not anticipate statutory or regulatory amendments. The Registrant does not believe theInvestment Actwill have any affect on it or on its non-Canadian shareholders due to a number of factors including the nature of its operations and the Registrant’s relatively small capitalization.

TheInvestment Actgenerally prohibits implementation of a reviewable investment by an individual, government or agency thereof, corporation, partnership, trust or joint venture (each an “entity”) that is not a “Canadian” as defined in theInvestment Act(a “non-Canadian”), unless after review the Director of Investments appointed by the minister responsible for the Investment Act is satisfied that the investment is likely to be of net benefit to Canada. The size and nature of a proposed transaction may give rise to an obligation to notify the Director to seek an advance ruling. An investment in the Common Shares by a non-Canadian other than a “WTO Investor” (as that term is defined in the Investment Act and which term includes entities which are nationals of or are controlled by nationals of member states of the World Trade Organization) when the Registrant was not controlled by a WTO Investor, would be reviewable under the Investment Act if it was an investment to acquire control of the Registrant and the value of the assets of the Registrant, as determined in accordance with the regulations promulgated under the Investment Act, was $5 million or more, or if an order for review was made by the federal cabinet on the grounds that the investment related to Canada’s cultural heritage or national identity, regardless of the value of the assets of the Registrant. An investment in the Common Shares by a WTO Investor, or by a non-Canadian when the Registrant was controlled by a WTO Investor, would be reviewable under the Investment Act if it was an investment to acquire control of the Registrant and the value of the assets of the Registrant, as determined in accordance with the regulations promulgated under the Investment Act, was not less than a specified amount, which for 2001 exceeds Cdn$192 million. A non-Canadian would acquire control of the Registrant for the purposes of the Investment Act if the non-Canadian acquired a m ajority of the Common Shares. The acquisition of less than a majority but one-third or more of the Common Shares would be presumed to be an acquisition of control of the Registrant unless it could be established that, on the acquisition, the Registrant was not controlled in fact by the acquirer through the ownership of the Common Shares.

The foregoing assumes the Registrant will not engage in the production of uranium or own an interest in a producing uranium property in Canada, or provide any financial service or transportation service, as the rules governing these businesses are different.

Certain transactions relating to the Common Shares would be exempt from theInvestment Act, including

| a) | an acquisition of the Common Shares by a person in the ordinary course of that person’s business as a trader or dealer in securities, |

39

| | b) | an acquisition of control of the Registrant in connection with the realization of security granted for a loan or other financial assistance and not for a purpose related to the provisions of theInvestment Act, and |

| | | |

| | c) | an acquisition of control of the Registrant by reason of an amalgamation, merger, consolidation or corporate reorganization following which the ultimate direct or indirect control in fact of the Registrant, through the ownership of the Common Shares, remained unchanged. |

| | |

Certain Canadian Federal Income Tax Consequences