UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

[ ] REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

[ X ]ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year endedDecember 31, 2010

OR

[ ]TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

[ ]SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF1934

Date of event requiring this shell company report _______

For the transition period from _______ to _______

Commission file number000-29578

GETTY COPPER INC.

(Exact name of Registrant as specified in its charter)

______________________________________

(Translation of Registrant’s name into English)

British Columbia, Canada

(Jurisdiction of incorporation or organization)

1000 Austin Avenue, Coquitlam, British Columbia, V3K 3P1, Canada

(Address of Principal executive offices)

Marilyn Young, (604) 931-3231, getty@telus.net, Fax: (604) 931-2814,

1000 Austin Avenue, Coquitlam, British Columbia, V3K 3P1, Canada

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| | | | |

| Title of each class | | Name of each exchange on which registered | |

| | | | |

| N/A | | N/A | |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Common Shares without Par Value

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

N/A

(Title of Class)

1

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

86,892,537 Common Shares

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

[ ] Yes [ X ] No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

[ ] Yes [ X ] No

Note — Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be file by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

[ X ] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

[ ] Yes [ ] No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated file?’ in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [ X ]

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

[ ] U.S. GAAP

[ ] International Financial Reporting Standards as issued by the International Accounting Standards Board

[ X ] Other

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

[ X ] Item 17 [ ] Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

[ ] Yes [ X ] No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

[ ] Yes [ ] No

2

GlossaryIn this Form 20-F, the following terms have the meanings set forth herein:

| |

| Assay | Quantitative test of minerals and ore by chemical and/or fire techniques. |

| Breccia | A coarse-grained clastic rock, composed of angular broken rock fragments held together by a mineral cement or in a fine-grained matrix. |

| Carbonate rock | A rock consisting chiefly of carbonate minerals, such as limestone or dolomite. |

| Clastic | Pertaining to a rock or sediment composed principally of broken fragments that are derived from pre-existing rocks or minerals and that have been transported some distance from their places of origin; also said of the texture of such a rock. |

| Cu | Used as the abbreviation for copper |

| Currency | All currency amounts are stated in Canadian dollars unless otherwise indicated. |

| Gangue | The valueless rock or mineral aggregates in an ore. |

| Igneous | Meaning a rock or mineral that solidified from molten or partly molten material. |

| Intrusive | A rock formed by the process of emplacement of magma in pre-existing rock. |

| Magma | Naturally occurring mobile rock material, generated within the earth and capable of intrusion and extrusion and from which igneous rocks are thought to have been derived through solidification and related processes. |

| Mineable Reserve | That portion of a mineral deposit which can be economically mined after taking into consideration cut-off grades, pit or mine plan, metallurgy and mill design and numerous economic factors such as metal prices and capital and operating costs. |

| Mineral Deposit | A deposit of mineralization which may or may not be ore, the determination of which requires a comprehensive feasibility study. A mineral deposit usually has been intersected by sufficient closely spaced drill holes and or underground sampling to support sufficient tonnage and average grade of metal(s) to warrant further exploration and development work. |

| Mineralized Material | A mineralized body which has been delineated by appropriately spaced drilling and/or underground sampling to support an estimate of size by tonnage and average grade of metals. Such a deposit does not qualify as “ore” or a reserve, which would require a comprehensive feasibility evaluation based upon unit cost, grade, recoveries, and other factors relating to engineering, legal, financial and economic feasibility. |

| Mo | Used as the abbreviation for molybdenum |

| Molybdenum | A hard, silvery metal used in steel and nickel alloys. |

| Ore | A mineral or aggregate of minerals more or less mixed with gangue which can be profitably mined given economic circumstances at the time. The Company does not hold any interest in properties where the mineralization has been determined to be ore. |

| Ounce (or oz.) | Meaning a troy ounce. There are 31.1034 grams to a troy ounce and there are 12 troy ounces to a troy pound, a common unit of measurement for precious metals. |

| Oxide | Mineral from which sulphur has been partially or completely removed by the action of surface water and oxygen. |

3

| |

| Porphyry | An igneous rock containing conspicuous crystals or phenocrysts in a fine-grained groundmass; type of mineral deposit in which ore minerals are widely disseminated, generally of low grade but large tonnage. |

| PFS | Means the Preliminary Feasibility Study of the Getty Property dated June 9, 2009 and as amended May 3, 2010, authored by West Coast Environmental and Engineering (WCE) of Ventura and Nevada City, California and filed at www.SEDAR.com |

| Pyrite | A very common iron sulphide mineral often associated with gold and other economic mineral deposits. |

| Robak | Robak Industries Ltd a company which is owned by the founder and director of the Company John Lepinski |

| Sulphide | Group of minerals consisting of metals combined with sulphur; common metallic ores. (or ”Sulfide”) |

| Tertiary | The period of geological time extending from 66 to 2 million years ago, which includes the Palaeogene and Neogene epochs. |

| TSX-V | TSX Venture exchange the stock exchange in Canada on which the Company’s shares are traded. |

| US (or United States) | Means the United States of America. |

| |

| B. | Certain Other Defined Terms |

| |

| Robak | Robak Industries Ltd a company which is owned by the founder and director of the Company John Lepinski |

| TSX-V | TSX Venture exchange the stock exchange in Canada on which the Company’s shares are traded. |

| US (or United States) | Means the United States of America. |

Conversion of metric units into imperial equivalents is as follows:

| | | | | | |

| Metric Units | | Multiply by | | Imperial Units | |

| Hectares | | 2.471 | | = acres | |

| Metres | | 3.281 | | = feet | |

| Kilometres | | 0.621 | | = miles (5,280 feet) | |

| Grams | | 0.032 | | = ounces (troy) | |

| Tonnes | | 1.102 | | = tons (short) (2,000 lbs.) | |

| Grams/tonne | | 0.029 | | = ounces (troy)/ton | |

FORWARD - LOOKING STATEMENTS

This annual report on Form 20-F, includes certain statements that may be “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Such forward-looking statements include any projections or estimates made by us and our management in connection with our business operations. These statements relate to future events or our future financial performance. In some cases you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of those terms or other comparable terminology. Although the Company believes the expectations expressed in its forward-looking statements are based on reasonable assumptions, such statements should not be in any way construed as guarantees of the ultimate size, quality or commercial feasibility of the Company’s mineral exploration projects or of the Company's future performance. Readers are cautioned not to place undue reliance on these statements, which speak only as of the date of this annual report. These statements are subject to risks and uncertainties that could cause results to differ materially from those contemplated in such forward-looking statements. Other risk factors that could cause the Company's actual results and performance to differ materially from those in forward-looking statements include adverse market prices for metals, the conclusions of detailed feasibility and technical analyses, lower than expected grades and quantities of resources, mining rates and metal recovery rates and the fact that necessary capital may not be available to the Company on terms acceptable to it or at all. The need for compliance with extensive environmental and socio-economic rules and practices and the requirement for the Company to obtain government permitting can cause a delay or even abandonment of a mineral project. The Company is subject to the specific risks inherent in the mining business as well as general economic and business conditions.

4

Please see Item 3.D “Risk Factors” as contained in this annual report on Form 20-F for additional information on risks and uncertainties relating to the forward-looking statements.

There can be no assurance that forward-looking statements referenced herein will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Also, many of the risk and uncertainty factors are beyond the control of the Company. Accordingly, readers should not place undue reliance on forward-looking statements contained in this annual report on Form 20-F. All forward-looking statements made herein, are qualified by this cautionary statement. Please consult the Company’s public filings at www.sedar.com and www.sec.gov for more detailed information concerning these matters.

CAUTIONARY NOTE REGARDING CERTAIN CANADIAN MINERAL DISCLOSURE STANDARDS

In Canada, an issuer is required to provide technical information with respect to mineralization, including reserves and resources, if any, on its mineral exploration properties in accordance with Canadian requirements, which differ significantly from the requirements of the SEC applicable to registration statements and reports filed by United States companies pursuant to the United States Securities Act of 1933, as amended (the “Securities Act”), or the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”). As such, information contained in this annual report concerning descriptions of mineralization under Canadian standards may not be comparable to similar information made public by United States companies subject to the reporting and disclosure requirements of the SEC. In particular, this annual report on Form 20-F includes the terms “mineral resource,” “measured mineral resource,” “indicated mineral resource” and “inferred mineral resource”. Investors are advised that these terms are defined in and required to be disclosed under Canadian rules by National Instrument 43-101 (“NI 43-101”). However, these terms are not defined terms under SEC Industry Guide 7 and are not permitted to be used in reports and registration statements filed with the SEC by U.S. domestic issuers. In addition, NI 43-101 permits disclosure of “contained ounces” of mineralization. In contrast, the SEC only permits issuers to report mineralization as in place tonnage and grade without reference to unit measures.

The definitions of proven and probable reserves used in NI 43-101 differ from the definitions in SEC Industry Guide 7. Under SEC Industry Guide 7 (under the Exchange Act), as interpreted by the staff of the SEC, mineralization may not be classified as a “reserve” for United States reporting purposes unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Among other things, all necessary permits would be required to be in hand or issuance imminent in order to classify mineralized material as reserves under the SEC standards.

United States investors are cautioned not to assume that any part or all of the mineral deposits identified as an “indicated mineral resource,” “measured mineral resource” or “inferred mineral resource” will ever be converted to reserves as defined in NI 43-101 or SEC Industry Guide 7. Further, “inferred mineral resources” have a great amount of uncertainty as to their existence and economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian securities legislation, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, or economic studies. U.S. investors are cautioned not to assume that part or all of an inferred mineral resource exists, or is economically or legally mineable.

5

T A B L E O F C O N T E N T S

| | |

| | | Page |

| Contents | |

| |

| ITEM 1 | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS | 7 |

| ITEM 2 | OFFER STATISTICS AND EXPECTED TIMETABLE | 7 |

| ITEM 3 | KEY INFORMATION | 7 |

| ITEM 4 | INFORMATION ON THE COMPANY | 12 |

| ITEM 5 | OPERATING AND FINANCIAL REVIEW AND PROSPECTS | 28 |

| ITEM 5.E | OFF-BALANCE SHEET ARRANGEMENTS | 31 |

| ITEM 5.F | TABULAR DISCLOSURE OF CONTRACTUAL OBLIGATIONS. | 31 |

| ITEM 6 | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | 32 |

| ITEM 7 | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | 35 |

| ITEM 8 | FINANCIAL INFORMATION | 36 |

| ITEM 9 | THE OFFER AND LISTING | 37 |

| ITEM 10 | ADDITIONAL INFORMATION | 38 |

| ITEM 11 | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 49 |

| ITEM 12 | DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | 49 |

| ITEM 13 | DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES | 50 |

| ITEM 14 | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | 50 |

| ITEM 15 | CONTROLS AND PROCEDURES | 50 |

| ITEM 16 | [RESERVED] | 50 |

| ITEM 16A | AUDIT COMMITTEE FINANCIAL EXPERT | 50 |

| ITEM 16B | CODE OF ETHICS | 51 |

| ITEM 16C | PRINCIPAL ACCOUNTANT FEES AND SERVICES | 51 |

| ITEM 16D | EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES | 51 |

| ITEM 16E | PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | 51 |

| ITEM 16F | CHANGES IN REGISTRANT’S CERTIFYING ACCOUNTANT | 51 |

| ITEM 16G | CORPORATE GOVERNACE | 51 |

| ITEM 17 | FINANCIAL STATEMENTS | 52 |

| ITEM 18 | FINANCIAL STATEMENTS | 52 |

| ITEM 19 | EXHIBITS | 53 |

6

PART 1

| |

| ITEM 1 | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable (this is an annual report on Form 20F).

| |

| ITEM 2 | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable (this is an annual report on Form 20F).

| |

| A. | Selected Financial Data |

The following constitutes selected financial data for Getty Copper Inc. (“Company”) for the last five fiscal years ended December 31, 2010, in Canadian dollars, presented in accordance with Canadian generally accepted accounting principles (“GAAP”) and United States GAAP, including a restatement of prior years’ figures due to a change in accounting policy with respect to exploration expenditures (see also the accompanying audited financial statements as of December 31, 2010 and for the previous year ended December 31, 2009).

| | | | | | | | | | | | | | | |

| (Cdn$) | | | | | | | | | | | | | | | |

| Balance Sheet Data | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| Total assets according to financial statements (CDN GAAP)(1) | | 5,116,337 | | | 4,888,733 | | | 5,236,527 | | $ | 4,898,678 | | $ | 4,572,683 | |

| Total Assets (US GAAP)(2) | | 543,800 | | | 470,115 | | | 884,264 | | $ | 911,546 | | $ | 696,528 | |

| Total liabilities | | 897,984 | | | 1,046,546 | | | 470,608 | | $ | 792,074 | | $ | 871,256 | |

| Share capital | | 22,064,202 | | | 21,409,542 | | | 21,409,542 | | $ | 19,924,370 | | $ | 18,014,384 | |

| Deficit (CDN GAAP) | $ | (19,078,279 | ) | $ | (18,771,380 | ) | $ | (17,687,410 | ) | $ | (17,390,686 | ) | $ | (15,173,683 | ) |

| Deficit (US GAAP) | $ | (27,415,748 | ) | $ | (26,954,930 | ) | $ | (25,804,605 | ) | $ | (25,142,750 | ) | $ | (22,814,770 | ) |

| | | | | | | | | | | | | | | |

| (Cdn$) | | | | | | | | | | | | | | | |

| Period End Balances (as at) | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| Working capital (deficiency) | | 147,528 | | | (3,534 | ) | | 358,634 | | $ | 59,974 | | $ | (329,618 | ) |

| Equipment, net | | 129,319 | | | 135,109 | | | 140,536 | | $ | 147,664 | | $ | 154,890 | |

| Mineral property interests (CDN GAAP) | | 4,572,537 | | | 4,418,618 | | | 4,352,263 | | $ | 3,987,132 | | $ | 3,876,155 | |

| Mineral property interests (US GAAP) | $ | - | | $ | - | | $ | - | | $ | - | | $ | - | |

| Shareholders’ equity | $ | 4,218,353 | | $ | 3,842,187 | | $ | 4,765,919 | | $ | 4,106,604 | | $ | 3,701,427 | |

| Share Capital (CDN GAAP) | | 22,064,202 | | | 21,409,542 | | | 21,409,542 | | $ | 19,924,370 | | $ | 18,014,384 | |

| Share Capital (US GAAP) | | 23,838,202 | | | 23,183,542 | | | 23,183,542 | | $ | 21,698,370 | | $ | 19,788,384 | |

| Number of outstanding Shares | | 86,892,537 | | | 80,892,537 | | | 80,892,537 | | | 67,638,907 | | | 49,078,657 | |

No cash or other dividends have been declared.

7

| | | | | | | | | | | | | | | | |

| (Cdn$) | | | | | | | | | | | | | | | | |

| Statement of Operations Data | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| Investment and Other Income | $ | 27,821 | | $ | 7,051 | | $ | 18,861 | | $ | 12,402 | | $ | 17,061 | |

| General and administrative expenses | $ | 334,720 | | $ | 1,091,021 | | $ | 315,585 | | $ | 1,333,086 | | $ | 1,153,971 | |

| Exploration Expenditure | $ | 153,919 | | $ | 66,355 | | $ | 365,131 | | $ | 110,977 | | $ | 367,916 | |

| Loss according to financial statements (CDN GAAP) | $ | (306,899 | ) | $ | (1,083,970 | ) | $ | (296,724 | ) | $ | (2,217,003 | ) | $ | (1,136,910 | ) |

| Loss according to financial statements (US GAAP) | $ | (460,818 | ) | $ | (1,150,325 | ) | $ | (661,855 | ) | $ | (2,327,980 | ) | $ | (1,504,826 | ) |

| Loss from continuing operations per Common Share | $ | (0.004 | ) | $ | (0.01 | ) | $ | (0.004 | ) | $ | (0.04 | ) | $ | (0.03 | ) |

| Loss per Share (US GAAP)(2) | $ | (0.006 | ) | $ | (0.014 | ) | $ | (0.009 | ) | $ | (0.04 | ) | $ | (0.04 | ) |

| Notes: |

| (1) | Under Canadian GAAP applicable to junior mining exploration companies, mineral exploration expenditures can be deferred on prospective properties until such time as it is determined that further exploration is not warranted, at which time the property costs are written off. The Company has expensed the exploration costs as incurred until December 31, 2003, which is consistent with U.S. GAAP, whereby all exploration expenditures are expensed until an independent feasibility study has determined that the property is capable of economic commercial production. Such costs will be deferred from January 2004 until such time as the company determines it if it has economically recoverable resources or until the exploration ceases and/or the mineral calms are abandoned. |

|

|

|

|

|

|

| (2) | Under Canadian GAAP, management incentive shares held in escrow are included in the calculation of loss per share. Under U.S. GAAP, shares held in escrow are excluded from the weighted average number of shares outstanding until such shares are released for trading. 187,500 shares were released from escrow during 2003.

Additionally, Statement of Financial Accounting Standards No.128: Earnings per Share (“SFAS 128”) replaces the presentation of primary earnings per share (“EPS”) with a presentation of both basic and diluted EPS for all entities with complex capital structures, including a reconciliation of each numerator and denominator. Basic EPS excludes dilutive securities and is computed by dividing income available to common stockholders by the weighted-average number of common shares outstanding for the year. Diluted EPS reflects the potential dilution that could occur if dilutive securities were converted into common stock and is computed similarly to fully diluted EPS pursuant to previous accounting pronouncements. SFAS 128 applies equally to loss per share presentations.

Stock options and warrants outstanding were not included in the computation of diluted loss per share as their inclusion would be antidilutive. |

|

|

|

|

|

|

|

|

|

|

|

See Item 17 of this annual report on Form 20-F for accompanying consolidated financial statements prepared in accordance with Canadian generally accepted accounting principles for further details.

Exchange Rates

Except as may be otherwise indicated, all dollar amounts are stated in Canadian dollars, the Company’s functional and reporting currency. The following tables set out the exchange rates published in the Federal Reserve Statistical Release for the conversion of Canadian dollars into one United States dollar. Averages are based on daily noon buying rates for cable transfers in New York City certified for customs purposes by the Federal Reserve Bank of New York

| | | | | | |

| | May 2011 | April 2011 | March 2011 | February 2011 | January 2011 | December 2010 |

| High | 0.9809 | 0.9689 | 0.9921 | 0.9955 | 1.0020 | 1.0176 |

| Low | 0.9489 | 0.9486 | 0.9686 | 0.9737 | 0.9864 | 1.0004 |

| Average for Period | 0.9680 | 0.9580 | 0.9766 | 0.9876 | 0.9939 | 1.0081 |

| | | | | |

| | 2010 | 2009 | 2008 | 2007 | 2006 |

| End of Period | 1.00 | 1.05 | 1.22 | 1.00 | 1.16 |

| Average for Period* | 1.03 | 1.14 | 1.07 | 1.07 | 1.13 |

| High for Period | 1.07 | 1.30 | 1.29 | 1.18 | 1.17 |

| Low for Period | 1.00 | 1.03 | 0.97 | 0.92 | 1.10 |

8

Note:

| |

| * | The average exchange rate for each period is based on the average of the exchange rates on the last day of each month in such period. |

On June 10, 2011, the exchange rate published in the Federal Reserve Statistical Release for the conversion of Canadian dollars into one United States dollar was US$1.00: Cdn$0.9769.

| |

| B. | Capitalization and Indebtedness |

Not applicable (this is an annual report only).

| |

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable (this is an annual report only).

Our securities are highly speculative and subject to a number of risks. You should not consider an investment in our securities unless you are capable of sustaining an economic loss of the entire investment. In addition to the other information presented in this annual report, the following risk factors should be given special consideration when evaluating an investment in the Company’s securities.

The Company requires additional financing to meet its planned commitments for the current fiscal year. Further financing will be required to meet the Company’s planned commitments for the year ending December 31, 2011. The exploration and development of the Company’s properties depend on the Company’s ability to obtain additional financing through equity financing or other means including a sale of an interest in its properties. The Company is currently pursuing financing opportunities to meet its administration costs. If the Company is unable to raise additional capital it will need to curtail its operations and the Company may be materially adversely affected.

The Company has no history of earnings and no foreseeable earnings. Although the Company has received a positive preliminary feasibility study, none of the properties in which the Company has an interest has been determined to be commercially feasible and hence none have any commercial production. The Company has no history of profits and has a substantial deficit. The Company receives no revenues from production or otherwise, and is entirely dependent on raising additional equity and loan financing. The Company has paid no dividends on its shares since incorporation and does not anticipate doing so in the foreseeable future. While the Company may receive funds from the exercise of outstanding share purchase warrants and stock options there are no assurances that this will occur.

The Company has not demonstrated that any mineralized material on its properties constitutes reserves as defined in SEC Industry Guide 7.The Company has no mineral producing properties, and the Company has not demonstrated that any mineralized material on its properties constitutes reserves under SEC Industry Guide 7. Although the mineralized material and mineralized deposit figures included herein have been carefully prepared by the Company, or, in some instances have been prepared, reviewed or verified by independent mining experts, these amounts are estimates only and no assurance can be given that any particular level of recovery of copper, molybdenum or other minerals from mineralized material will in fact be realized or that an identified mineralized deposit will ever qualify as a commercially mineable (or viable) reserve.

Estimates of mineralized deposits and production costs can also be affected by such factors as metals prices, availability of capital for development, permitting regulations and requirements, weather, environmental factors, unforeseen technical difficulties, unusual or unexpected geological formations and work interruptions. In addition, the grade of mineralization ultimately mined (if any) may differ from that indicated by drilling results.

Short term factors relating to mineralized material, such as the need for orderly development or the processing of new or different grades, may also have an adverse effect on mining operations and on the results of operations. There can be no assurance that copper, molybdenum and other minerals recovered in small scale laboratory tests will be duplicated in large scale tests under on-site conditions. Material changes in mineralized material, grades, stripping ratios or recovery rates may affect the economic viability of projects. Mineralized deposits are reported as general indicators of mine life and should not be interpreted as assurances of mine life or of the profitability of current or future operations.

The Company’s ability to obtain financing to fund its exploration activities and, if warranted, development of any of its properties, will be significantly affected by mineral prices. The ability of the Company to obtain financing to fund its exploration activities and, if warranted, development of any of its properties, will be significantly affected by changes in the market price of the metals for which it explores. The price of copper first collapsed during the recent financial crisis, then recovered in 2009 and 2010 as a result of improving economic conditions. Currently, the price of copper is approximately US$4.00 per pound.

9

Mineral prices are subject to fluctuation. The effect of these factors cannot accurately be predicted. The mining industry in general is intensely competitive and there is no assurance that, even if commercial quantities of mineral resource are discovered, a profitable market will exist for the sale of the same. Factors beyond the control of the Company may affect the marketability of any copper, molybdenum or any other materials discovered. The prices of copper and other minerals are affected by numerous factors beyond the control of the Company, including international economic and political trends, expectations of inflation, currency exchange fluctuations (specifically, Canadian dollars relative to other currencies), interest rates and global or regional consumption patterns, speculative activities and increased production due to improved mining and production methods. In addition, the world supplies of and demands for copper, molybdenum and other minerals can cause fluctuations in the price of such minerals

Development of any of the Company’s properties, if warranted, will be subject to potential delays and financing risks. Technical considerations, delays in obtaining governmental approvals, inability to obtain financing and other factors could cause delays in developing any of the Company’s properties that may in the future be determined to contain a commercially mineable ore-body. The Getty properties have been systematically explored for over 50 years and no production has ever been achieved.

If it is determined that a commercially mineable ore-body exists and it can be economically exploited, the Company will require significant additional financing in order to fund the costs of developing the Getty properties into commercial production, if warranted. The Company may have to seek additional funds through public and private share offerings, arrangements with corporate partners, or debt financing. There can be no assurance that the Company will be successful in its efforts to raise these required funds, or that it will be able to raise the funds on terms that do not result in high levels of dilution to shareholders.

Mineral exploration and mine development will be subject to hazards and risks that may delay development and production.

Hazards such as unusual or unexpected geological formations and other conditions are involved in mineral exploration and development, and the business of mining is subject to a variety of risks such as cave-ins and other accidents, flooding, environmental hazards, the discharge of toxic chemicals and other hazards. Such occurrences may delay development of the Getty Properties, delay production, increase production costs or result in liability.

The Company may become subject to liability for uninsurable hazards.The Company currently maintains only commercial general liability insurance coverage for its office premises, as well as property insurance covering certain office contents only. The Company does not maintain insurance coverage for risks involved in exploration, development or production on mineral properties, including fires, unexpected or unusual geological conditions, or natural disasters such as rock bursts or slides, floods or earthquakes. The Company also does not maintain insurance against any environmental risks. There is no guarantee that insurance coverage will be available to the Company if it decides to insure against these risks at economically viable premiums (if at all) or that, in the event of a claim, the level of insurance carried by the Company now or in the future is or will be adequate to cover the entire claim or liability. The Company’s business could be materially and adversely affected by claims for which it is not adequately insured.

Copper and molybdenum exploration is highly speculative, involves substantial expenditures, and is frequently non-productive.

Copper and molybdenum exploration involves a high degree of risk. Exploration projects are frequently unsuccessful. Few prospects that are explored are ultimately developed into producing mines. The Company cannot be certain that its copper exploration efforts will be successful. The success of copper and molybdenum exploration is dependent in part on the following factors:

unanticipated adverse geotechnical conditions;

incorrect data on which engineering assumptions are made;

costs of constructing and operating a mine in a specific environment;

cost of processing and refining;

availability of economic sources of power;

availability of qualified staff;

adequacy of water supply;

adequate access to the site including competing land uses (such as agriculture and illegal mining);

unanticipated transportation costs and shipping incidents and losses;

significant increases in the cost of diesel fuel, sulphuric acid or other major components of operating costs;

government regulations (including regulations relating to prices, royalties, duties, taxes, permitting, restrictions on production, quotas on exportation of minerals, as well as the costs of protection of the environment and agricultural lands);

fluctuations in copper and molybdenum prices;

accidents, labour actions and force majeure events;

the identification of potential copper mineralization based on superficial analysis;

10

availability of prospective land;

availability of government-granted exploration and exploitation permits;

the quality of our management and our geological and technical expertise; and

the funding available for exploration and development.

Substantial expenditures are required to determine if a project has economically mineable mineralization. It could take several years to establish reserves and to develop and construct mining and processing facilities. As a result of these uncertainties, the Company cannot guarantee that current and future exploration programs will result in the discovery of reserves and the development of a mine.

The Company faces intense competition.The Company operates in a competitive industry and compete with other more well established companies which have greater financial resources. The Company faces strong competition from other mining companies in connection with exploration and the acquisition of properties producing, or capable of producing precious metals. Many of these companies have greater financial resources, operational experience and technical capabilities than the Company. As a result of this competition, the Company may be unable to maintain or acquire attractive mining properties on terms it considers acceptable or at all. Consequently, the Company’s operations and financial condition could be materially adversely affected.

Changes in government regulations and the presence of unknown environmental hazards on the Company’s mineral properties may result in significant unanticipated delays, as well as significant compliance costs.Existing and possible future environmental legislation, regulations and actions could give rise to additional expense, capital expenditures, restrictions and delays in the activities of the Company, the extent of which cannot be predicted. Regulatory requirements and environmental standards are subject to constant evaluation and may be significantly increased, which could materially and adversely affect the business of the Company or its ability to develop its properties on an economically feasible basis. Before development and production can commence on any of its properties, the Company must obtain regulatory and environmental approvals. There is no assurance that such approvals will be obtained on a timely basis or at all. The cost of compliance with changes in governmental regulations has the potential to reduce the profitability of operations or preclude entirely the economic development of a property.

Mining is one of the most intensely regulated businesses in Canada. The period of time required to obtain environment assessments, consult with aboriginal peoples and other stakeholders as well as governments at the Canadian provincial and federal level can take 10 years or more. No assurance can be given that permitting of any mine on the Getty Properties will occur.

Future climate change regulations may result in significant compliance costs.A number of governments or governmental bodies have introduced or are contemplating regulatory changes in response to the potential impacts of climate change at the international, national, state, provincial and local levels. Where legislation is already in place to regulate emissions levels and energy efficiency, regulation is becoming more stringent.

The December 1997 Kyoto Protocol, which ends in 2012, established a set of greenhouse gas emission targets for developed countries that have ratified the Protocol, which include Argentina, Australia, Canada, Chile, Mexico and Peru. The Conference of Parties 15 (“COP15”) of the United Nations Framework Convention on Climate Change in Copenhagen, Denmark in December 2009 was held to determine the path forward after the Kyoto Protocol ends. COP15 resulted in the Copenhagen Accord (the “Accord”), a non-binding document calling for economy-wide emissions targets for 2020. Prior to the January 31, 2010 deadline, Canada, the United States, Australia, Mexico, Chile and Peru re-affirmed their commitments to the Accord.

The U.S. Congress and several U.S. states have initiated legislation regarding climate change that will affect energy prices and demand for carbon intensive products. In December 2009, the U.S. Environmental Protection Agency (the “EPA”) issued an endangerment finding under the U.S. Clean Air Act that current and projected concentrations of certain mixed greenhouse gases, including carbon dioxide, in the atmosphere threaten the public health and welfare. It is possible that proposed regulation may be promulgated in the U.S. to address the concerns raised by such endangerment finding. The EPA also began requiring that large emitters of greenhouse gases collect and report data with respect to their greenhouse gas emissions beginning on January 1, 2010.

Canada committed under the Accord to reducing its greenhouse gas emissions by 17% below 2005 levels by 2020, to be aligned with the emissions target and base year of the United States (with which the Canadian government has committed to implementing a North American cap and trade system). The Canadian federal government has not indicated how it will achieve greenhouse gas reduction and the commitments under the Accord are not binding. The Canadian federal government has publicly stated that it will delay implementing any specific federal greenhouse gas emissions legislation until after the U.S. implements its legislation so that Canadian greenhouse gas legislation is integrated and consistent with the U.S. legislation.

In British Columbia, the provincial government has announced a policy goal of reducing greenhouse gas emissions by at least 33% below current levels by 2020. In 2008, legislation was passed imposing carbon taxes on fuel effective July 2008, and cap and trade legislation was also passed with specific emission caps set by regulation. British Columbia is a member of the Western Climate

11

Initiative, which is a cooperative effort of U.S. states and Canadian provinces to design a comprehensive regional model cap and trade program. The provincial government has also recently introduced a reporting regulation that requires facilities emitting greater than 10,000 tonnes per year of carbon dioxide equivalent to register and report emissions annually for periods beginning on January 1, 2010; any facilities emitting greater than 25,000 tonnes per year are also subject to certain verification requirements.

Currently the greenhouse gas emissions legislation in the jurisdictions in which the Company operates do not result in material compliance costs for the Company’s current level of operations. Legislation and increased regulation regarding climate change could impose significant costs on us, our venture partners and our suppliers, including increased energy, capital equipment, environmental monitoring and reporting and other costs to comply with such regulations. Any adopted future climate change regulations could also negatively impact our ability to compete with companies situated in areas not subject to such limitations. Until the timing, scope and extent of any future regulation becomes known, we cannot predict the effect on our financial condition, operating performance and ability to compete. Furthermore, even without such regulation, increased awareness and any adverse publicity in the global marketplace about potential impacts on climate change by us or other companies in our industry could harm our reputation.

Our operations may be negatively impacted by climate change.The potential physical impacts of climate change on our operations are highly uncertain, and would be particular to the geographic circumstances in areas in which we operate. These may include changes in rainfall and storm patterns and intensities, water shortages, changing sea levels and changing temperatures. These impacts may adversely impact the cost, production and financial performance of our operations.

The Company’s Share Price is Volatile. Publicly quoted securities of junior resource issuers are subject to a relatively high degree of price volatility.

Likely PFIC status has consequences for U.S. investors. Potential investors who are U.S. taxpayers should be aware that the Company believes it was classified as a passive foreign investment company (“PFIC”) within the meaning of Section 1297 of the United States Internal Revenue Code for the tax year ended December 31, 2010, and may also have been a PFIC in prior and may also be a PFIC in subsequent years. If the Company is a PFIC for any year during a U.S. taxpayer’s holding period, then such U.S. taxpayer generally will be required to treat any so-called “excess distribution” received on its common shares, or any gain realized upon a disposition of common shares, as ordinary income and to pay an interest charge on a portion of such distribution or gain, unless the taxpayer makes a qualified electing fund (“QEF”) election or a mark-to-market election with respect to the shares of the Company. In certain circumstances, the sum of the tax and the interest charge may exceed the amount of the excess distribution received, or the amount of proceeds of disposition realized, by the taxpayer. A U.S. taxpayer who makes a QEF election generally must report on a current basis its share of the Company’s net capital gain and ordinary earnings for any year in which the Company is a PFIC, whether or not the Company distributes any amounts to its shareholders. A U.S. taxpayer who makes the mark-to-market election generally must include as ordinary income each year the excess of the fair market value of the common shares over the taxpayer’s tax basis therein. This paragraph is qualified in its entirety by the discussion below under the heading “Certain United States Federal Income Tax Considerations.” Each U.S. taxpayer should consult its own tax advisor regarding the PFIC rules and the U.S. federal income tax consequences of the acquisition, ownership, and disposition of common shares.

| |

| ITEM 4 | INFORMATION ON THE COMPANY |

SUMMARY

| |

A. | History and Development of the Company |

| |

1. | The legal name of the Company which is subject of this annual report on Form 20-F is Getty Copper Inc. |

| |

2. | The Company was incorporated on September 23, 1985 under theCanada Business Corporations Act. |

| |

3. | The registered office of the Company in British Columbia is located at 1500 - 1040 West Georgia Street Vancouver, British Columbia, Canada V6E 4H8. The head office and principal office of the Company in Canada is located at 1000 Austin Avenue, Coquitlam, British Columbia, Canada V3K 3P1. The Company’s Common Shares are listed for trading on the TSX-V under the symbol “GTC”. |

| |

4. | The Company was originally incorporated under the name Exxau Minerals Inc., pursuant to the Canada Business Corporations Act on September 23, 1985, with an authorized capital of an unlimited number of common shares without par value. The Company was organized for the purpose of engaging in the acquisition and exploration of natural resource properties. The Company became a reporting company in British Columbia on April 25, 1988. From 1985 through 1992, the Company concentrated its efforts on the acquisition and exploration of mineral resource properties. On September 3, 1992, the Company changed its name to Getty Copper Corp. |

12

| 5. | From 1993 to present the Company’s mineral exploration has been focused on a group of mineral properties located in the Highland Valley, British Columbia, Canada known as the Getty North and Getty South claims as well as some satellite properties collectively known at the “Getty Properties”. |

|

| 6. | The Company’s principal capital expenditures (there have been no material divestitures) over the three fiscal years ended December 31, 2010 are as follows: |

| | |

| Year | Exploration Deferred | Capital Assets |

| (i) Amounts Deferred (capitalized or invested) during the year |

| 2010 | 153,919 | NIL |

| 2009 | 66,355 | NIL |

| 2008 | 365,131 | NIL |

| (ii) Amounts Expensed as Exploration Expenses |

| 2010 | NIL | NIL |

| 2009 | NIL | NIL |

| 2008 | NIL | NIL |

History of Getty North Property:

Robak Industries Ltd. (“Robak”), a company owned and controlled by John Lepinski, and Masco Capital Inc. (“Masco”), a company controlled by John Lepinski, began negotiations in 1992 to acquire control of the Company in an effort to access the capital markets to develop its Getty North Property. The Company had no properties under exploration or development at that time.

In May 1993, the Company, pursuant to an arm’s length purchase and sale agreement to acquire the Getty North Property, issued 5,000,000 of its Common Shares to Robak and 5,000,000 of its Common Shares to Masco. See “Interests of Management in Certain Transactions.” The issuance of the 10,000,000 Common Shares (of which 9,216,984 were held in escrow until May 1999 ) resulted in a change in control of the Company.

The Company acquired the Getty North Property from Robak and Masco pursuant to an Agreement of Purchase and Sale dated June 30, 1992, as amended September 30, 1992, subject to a 1.5% net smelter return royalty reserved in favour of Robak. The Company issued into escrow 4,608,492 Common Shares to Robak and 4,608,492 Common Shares to Masco as consideration for the property, subject to the Company obtaining a valuation on the Getty North Property establishing a minimum value of Cdn $2,304,246 and approval by the then Vancouver Stock Exchange (“VSE”) which has evolved into the TSX-V. The shares were released to Robak and Masco from escrow after the Company obtained the required approval from the VSE on May 11, 1999. After the release of the escrow shares, title to the Getty North Property fully vested in the Company.

While there some old prospectors workings, there are no historical or existing mines on any of the Getty Properties.

History of Getty South Property, Getty Central Property, Getty Southwest Property:

In addition to the Getty Copper North Property and all Getty Copper Highland Valley Claims, the Company subsequently entered into a joint venture agreements to earn a 50% interest in the Getty South Property, the Getty Central Property and the Getty Southwest Property, (collectively, the “Getty Copper Project” or the “Getty Copper Highland Valley Project”). All of the mineral properties previously noted are subject to 1.5% net smelter royalties and the Getty South, Getty Central, Getty Southwest properties were subject to certain minimum exploration and development requirements. As a consequence of a Mineral Property Interest Sale Agreement dated November 8, 2002. (See Item 7.B of this annual report on Form 20-F), the Company purchased 100% of the Getty Central and Getty Southwest claims and 50% of the Getty South claims.” Since 1992, the Company has focused its efforts and resources on the acquisition and the exploration of the Getty Copper Project. See Item 4.D “Getty Copper Project” in this annual report on Form 20- F-The Company has no subsidiaries.

On March 7, 2003 the TSX- V accepted for filing documentation a mineral property agreement dated for reference November 8, 2002 between the Company and Robak Industries Ltd. (“Robak”), by which Robak has agreed to sell 100% interest in each of the Getty Central and the Getty Southwest and a 50% interest in the Getty South properties (the “New Getty Properties”) in consideration for 6 million Company shares (after the two old: one new share reverse split)) plus the below noted net smelter royalty (“NS”) and carried interest obligation. The Company has also agreed to pay 100% of the cost to place the Getty South property into production (the timing and extent of such costs to be in the registrant’s sole discretion), and is entitled to a priority recovery of any such carried costs before the parties revert to a 50:50 split of net income and loss.

13

In December 2004, Highland Valley Copper (“HVC”) terminated its participation in a joint venture signed on December 19, 2003. HVC spent $2.3 million dollars on line cutting, induced polarization surveys (IP), and diamond drilling. Only intrusive rocks and structures surrounding the Getty West Occurrence including the Transvaal property in which the Company formerly held an interest, exhibited significant copper mineralization and accompanying alteration. Here, sub-economic copper mineralization within hydrobrecciated Guichon and Bethlehem intrusives were encountered. The Cinder hill area contains a large tertiary volcanic center and is deeply covered with overburden. The Glossie Copper Occurrence was not tested during this program. Only weakly anomalous copper and zinc mineralization were encountered within silicified and metasomatized Nicola volcanics overlying weakly altered intrusives in the North Valley IP anomaly. However the drilling here was very wide spaced and the Company continues to review this work to determine if additional untested targets may exist in this area. The iron sulphide mineralized tertiary volcanics intersected in hole 2004-16 returned only very weakly anomalous copper.

The Company is engaged in the acquisition and exploration of natural resource properties. Since 1993, the Company has been conducting exploration for copper on approximately 200 square kilometers in Highland Valley, British Columbia, known collectively as the Getty Properties and comprised primarily of the Getty North, Getty South and satellite properties.

A recently conducted Titan 24 DC/IP Geophysical Survey by Quantec Geoscience Ltd. has successfully identified at least 39 geophysical anomalies of which 12 can be considered high priority drill targets. According to Quantec, in summary, “anomaly priorities are based on a combination of depth below surface, size of the chargeability anomaly, correlation between conductors with chargeability highs and trust in an anomaly (i.e. the anomaly can be followed over several lines and the HS-chargeability model shows a similar shaped anomaly). The number of the high priority targets is based on occurrences on each line.”

The Titan -24 DC/IP/MT geophysical survey was conducted over the Getty Copper’s Highland Valley property between November 20thand December 13thof 2010. A total of 12 lines of data were collected (23.2 line-km of direct current induced polarization (“DC/IP”) and 19.2 line-km Magnetotelluric (MT) data with a station spacing of 100 m. The survey geometry for the DC/IP component was a pole-dipole geometry. The line spacing was 250 m. and the lines were located in staggered fashion over the Getty North Deposit, the Getty South Deposit and the Getty West Zone, which is 1.4 km to the southwest of the Getty North Deposit.

The objective of the survey was to further delineate the geophysical signatures of the Getty North and Getty South deposits, and the Getty West Zone, as well as identify other anomalies and features of interest. The survey covered only a small percentage of the total Getty property surface area.

The survey confirmed by correlation with the past drill results the location of Getty North, and South Deposits, and revealed a large anomaly southwest of the Getty North deposit named the Getty West anomaly. Overall data quality was high. Several NNE-SSW striking faults were identified as narrow conductive features in both the DC and MT models, as well as breaks in the chargeability models. The survey produced an excellent correlation between mineralization shown in the drill holes targeting the Getty North and South deposits and the location of anomalies IP-07, IP-08 and IP-01 respectively.

Based on the recent Quantec program results and the previous 43 101 pre Feasibility study Getty is focused on a plan estimated at CDN$5 million to move the project forward toward feasibility, subject to financing being available. This is projected to include approximately 12,000 meters of drilling to expand the Getty North and Getty South reserves and resources while also delineating the exploration targets revealed by the Quantec work and previous studies. As well, confirmatory Geotechnical and Metallurgical programs will be undertaken. Also, environmental and permitting activities will be advanced and basic engineering in support of a feasibility study will be undertaken.

Summary of Survey Results:

14

The higher copper assays for the Getty South Deposit, correlate very well with the center of the chargeability anomaly. The chargeability anomaly suggests additional potential for copper mineralization at depth, which can be determined by extending the survey line in a possible second stage Titan 24 survey.

The Getty South Deposit anomalies are represented by a low resistivity, and a weak to moderate chargeability feature extending to approx. 350 m (1,150 ft.) below the surface which confirms the known deposit dimensions which is visible on all 4 short lines (250N-1000N). The chargeability anomaly could be open to depth, since the length of the survey lines (survey geometry) limits the depth of penetration at this location. The strongest response of the Getty South deposit is on line 500N, where the anomaly has an east-west length of approximately 350 m (1,148 ft.) located between 50 m (164 ft.) depth and the bottom of the model.

Quantec recommended to extend the lines over the Getty South Deposit in both the east and the west directions, to better image the Getty South IP anomaly with the full depth of penetration capability with the Titan-24 system. Several other lines can also be considered, since other smaller anomalies have been identified in this survey which are only covered by a single additional line due to the staggered nature of the line locations, filling in the gaps of data, can be considered to further study these single line anomalies.

The Getty West anomaly is a near surface structure of 320 m (1,050 feet) in east west direction. This feature is a weak to moderate chargeability & moderate-low resistivity and spans four (4) lines (L3000N-3750N).

There is further potential for the Getty West anomaly to be further extended south. Since the IP anomaly is not closed off by the southern most line. Additional lines of Titan-DC/IP and MT are also recommended to fill the gap between the Getty South and Getty north groups of lines.

Quantec also recommends to follow-up this survey with a borehole DC-IP survey is order to further delineate potential deposits and identify off-hole anomalies, due to the large number of available boreholes (provided the holes are still open).

The MT method could also be of use for further exploration of the Getty Properties, since many of chargeability anomalies appear to be related, or at least bound by an interpreted fault. One interpretation of the geophysical data suggests that the NW trending faults exert a strong control on mineralization. Drill hole data seem to confirm this interpretation.

West Coast Environmental and Engineering (“WCE”) of Ventura and Nevada City, California, completed a Preliminary Feasibility Study (the “PFS”) dated June 9, 2009 according to Canadian National Instrument 43-101 (Disclosure Standards for Mineral Projects). The Company caused the original PFS to be filed on the System for Electronic Document Analysis and Retrieval (commonly known as “SEDAR”) on July 9, 2009. In response to guidance received from technical staff at the British Columbia Securities Commission, the Company caused WCE to amend the PFS as of May 3, 2010. The amended and restated PFS was filed on SEDAR on May 25, 2010. SEDAR is the electronic document filing system maintained on behalf of the Canadian Securities Administrators to facilitate mandated continuous disclosure by public companies in Canada, and is accessible on the internet at http://www.sedar.com. The PFS is a pre-feasibility report and readers are reminded that its conclusions are broad in nature and remain subject to the requirements for detailed engineering in a (final) feasibility report prepared in accordance with industry and regulatory requirements.

The focus of the PFS was to evaluate the feasibility of a potential cathode copper and Molybdenum Trioxide production from the Getty North and Getty South oxide and sulphide resource zones. The PFS is intended to update the past work referred to above and includes possible development of both the copper and molybdenum oxide and sulphide resources. The oxide and sulphide resources of the Getty North Deposit would potentially be open-pit mined in conjunction with the Getty South oxide and sulphide resources.

The PFS was carried out by WCE under the direction of Mr. Craig Parkinson P.Geo, the Qualified Person responsible for this study. As the Getty North NI 43-101 compliant resource has been updated with molybdenum values, WCE reports that the processing plan is proposed to be altered to effectively accommodate the molybdenum resource. To facilitate effective recovery of the molybdenum resource, the option of dump and heap leaching of oxide ores has now been replaced by a flotation tailings leach system. This methodology is anticipated to allow maximum potential utilization of the updated Getty resources, and is analogous to other recent and successfully operating global hydrometallurgical production facilities.

15

Further, given the current global limited molybdenum roasting capacity, the Company is now investigating incremental added capacity in the hydrometallurgical pressure oxidation and metal recovery circuits for potential on-site custom processing of outside copper and molybdenum concentrates from other entities with available materials. In particular, the hydrometallurgical process plant evaluated for the Getty Project should allow treatment of much lower grade combined bulk copper and molybdenum concentrates, which could be a significant advantage over current molybdenum concentrate production and roasting practices.

The PFS proposals for producing copper concentrates and cathode copper may not be economically achievable even though the testing and planning to date indicate that the copper cathode could potentially be produced using the planned processes.

The PFS for copper molybdenum resources, for both Getty North and Getty South are as follows.

|

Cautionary Note to U.S. Investors Concerning Estimates of Measured and Indicated mineral resources The following table uses the term “indicated mineral resources”. We advise U.S. investors that while this term is recognized and required by Canadian securities regulations (under National Instrument 43-101Standards ofDisclosure for Mineral Projects), the SEC does not recognize it. U.S. investors are cautioned not to assume that any part or all of mineral deposits in this category will ever be converted into SEC defined reserves. See “Risk Factors”. |

| | | |

| | Indicated Mineral | |

| | Resources | |

| Deposit | (millions of tonnes) | Grade |

| | | Cu % | Mo % |

| North | 69.258 | 0.370 | 0.005 |

| South | 45.148 | 0.377 | No Data |

| Total | 114.406 | 0.373 | --- |

|

Cautionary Note to U.S. Investors Concerning Estimates of Inferred mineral resources The following table uses the term “inferred mineral resources”. We advise U.S. investors that while this term is recognized and required by Canadian regulations, the SEC does not recognize it. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of a mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of economic studies, except in rare cases. Mineral resources that are not mineral reserves do not have demonstrated economic viability. None of the following mineralization has been demonstrated to be ore nor is considered to be a mineral reserve. U.S. investors are cautioned not to assume that any part or all of an inferred mineral resource exists, or is economically or legally mineable. |

| | | |

| | Inferred Mineral | | |

| Deposit | Resources | Grade |

| | | Cu % | Mo % |

| North | 18.166 | 0.271 | 0.005 |

| South | 23.593 | 0.278 | No Data |

| Total | 41.759 | 0.275 | --- |

Total Getty Copper Project Life of Mine Cash Cost Per Pound of Copper are Approximately $ 2.03 USD/lb.

A summary of the updated copper and molybdenum Probable Mineral Reserve estimates determined independently by WCE in the PFS for both the Getty North and Getty South deposits are provided in the following table. These resources were computer modeled by Mr. Ed Switzer and vetted by the NI 43-101 Technical Report signatory QP's Mr. Craig Parkinson, Mr. Todd. As seen, a total of 86.561 million tonnes of Probable Mineral Reserves at a copper grade of 0.400 % Cu and a cutoff grade of 0.17 % Cu has been determined by Mr. Switzer.

16

|

Cautionary Note to U.S. Investors Concerning Estimates of Reserves The following table uses the term “probable reserves”. We advise U.S. investors that such mineral reserve estimates have been calculated in accordance with National Instrument 43-101Standards of Disclosure for MineralProjects, as required by Canadian securities regulatory authorities. For United States reporting purposes, SEC Industry Guide 7 (under the Exchange Act), as interpreted by the staff of the SEC, applies different standards in order to classify mineralization as a reserve. As a result, the definitions of probable reserves used in National Instrument 43-101 differ from the definition in SEC Industry Guide 7. Under SEC standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Among other things, all necessary permits would be required to be in hand or issuance imminent in order to classify mineralized material as reserves under the SEC standards. Accordingly, U.S. investors are cautioned that the probable reserve estimates presented in this annual report, while in compliance with Canadian standards and regulations, may not meet the requirements of reserve disclosure under SEC guidelines. |

Summary of Getty Probable Mineral Reserve Estimates.

| | | |

| | Probable Reserves | |

| Deposit | (millions of tonnes) | Grade |

| | | Cu % | Mo % |

| North | 49.691 | 0.397 | 0.005 |

| South | 36.870 | 0.405 | No Data |

| Total | 86.561 | 0.400 | --- |

The Company’s other identified potential mineral zones, known as North Valley; Glossie; Getty West, Northwest, Southwest, and Central; are all in the early stage of exploration and there is insufficient data to establish whether any resources may exist. The Company continues to seek additional properties worthy of exploration and development.

The price of copper first collapsed during the recent financial crisis, then recovered in 2009 and 2010 as a result of improving economic conditions. Currently, the price of copper is approximately US$4.00 per pound. There is no way to predict future metal prices and therefore current prices may not reflect future prices and this may have a bearing on the time frame that would be required to place any mineral deposit that may be located on the property into commercial production.

17

Certain Assumptions and Parameters Used in the Getty Project Mineral Resource and Reserve Estimates

| | |

| | | |

| | Cautionary Note to U.S. Investors Concerning Canadian Mineral Disclosure Standards | |

| | | |

| | This section refers to probable mineral reserve estimates that have been calculated in accordance with National Instrument 43-101Standards of Disclosure for Mineral Projects, as required by Canadian securities regulatory authorities. For United States reporting purposes, SEC Industry Guide 7 (under the Exchange Act), as interpreted by the staff of the SEC, applies different standards in order to classify mineralization as a reserve. As a result, the definition of probable reserves used National Instrument 43-101 differs from the definitions in the SEC Industry Guide 7. Under SEC standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Among other things, all necessary permits would be required to be in hand or issuance imminent in order to classify mineralized material as reserves under the SEC standards. Accordingly, U.S. investors are cautioned that the reserves presented in this annual report while in compliance with Canadian standards and regulations, may not meet the requirements of reserve disclosure under SEC guidelines. | |

| | | |

| | In addition, this section use the terms “indicated mineral resources” and “inferred mineral resources”. While these terms are recognized and required by Canadian regulations (under National Instrument 43-101), the SEC does not recognize them. United States investors are cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted to reserves. Further, “inferred mineral resources” have a great amount of uncertainty as to their existence and economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian securities legislation, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, or economic studies, except in rare cases. U.S. investors are cautioned not to assume that part or all of an inferred mineral resource exists, or is economically or legally mineable. | |

| | | |

The Getty Project mineral resource and reserve estimates are based on evaluations conducted in 2007 and February 2008. The key assumptions and parameters used in the Getty Project mineral resource and reserve estimates are as follows:

Specific gravity for: Getty North = 2.6 Getty South = 2.76;

Pit Slope = 52 degrees overall; Overall Stripping Ratio = 2.6 Waste to Ore

The strip ratio is 2.3 to 1 in the South, 2.8 to1 in the North.

Mining Cost = $1.45 CDN ($ 1.346 USD)/average per tonne both ore and waste;

Milling Cost = $11.76 CDN ($ 10.89 USD) /tonne ore;

General and Admin = $0.69 CDN ($0.64 USD)/tonne ore;

Copper Price = $3.55 CDN/lb ($ 3.29 USD/lb) using a 36-Month Trailing Average;

Molybdenum Price (MoO3) = $19.49 CDN/lb ($18.00 USD/lb) escalated to $24.19 CDN/lb ($22.35 USD/lb) by year 3 of the project life;

Copper Recovery = 91 %. Molybdenum Recovery = 50 %. (These metallurgical recoveries are based on multiple test results and industrial operating data).

The copper and molybdenum prices referred to immediately above are based on a 36-month trailing average analysis with an ending date of December 31, 2008. Due in part to the collapse in the price of copper during the recent financial crisis, and in response to guidance received from technical staff at the British Columbia Securities Commission, an updated economic analysis for the Getty Project was included in the amended and restated PFS completed in May 2010. Among other things, an updated base case for economic analysis was prepared using a copper price of CDN$3.24 ($2.99 USD) per pound. Although the amended and restated PFS included revised mineral resource and reserve estimates which are disclosed in this annual report, it was not deemed necessary to update the mineral resource and reserve estimates using new parameters - such as the lower copper price of CDN$3.24 ($2.99 USD) per pound - in part because copper prices recovered during late 2009 and early 2010 as a result of improving economic conditions.

The amendments made to the PFS dated June 9, 2009, which were incorporated into the amended and restated PFS completed as of May 3, 2010, took into account the following factors, among others:

Indicated and inferred mineral resources were originally bounded within the original pit boundaries. The amended and restated PFS updated the indicated and inferred mineral resource to include all mineralization that had reasonable prospects for economic extraction under favourable economic conditions, thus resulting in an increase in both the indicated and inferred mineral resources. The indicated mineral resource blocks within the preliminary pit design were designated as the probable mineral reserves.

18

There were no changes to the reserves estimated in the original PFS dated June 9, 2009.

The PFS dated June 9, 2009 used 60% of the 3 year trailing average and 40% of the 2 year forward average to project the copper metal price (US$3.29), and a deescalating molybdenum price based on a long term projected molybdenum prices (US$29.33 deescalating to US$14.75). Due to the precipitous drop in metal prices referred to above, the long term copper price was dropped to US$2.99 in preparing the base case for economic analysis included in the amended and restated PFS.

Molybdenum pricing was reviewed and updated to an escalating future price using a price starting at US$18.00 escalating to US$22.35.

In preparing the base case for economic analysis included in the amended and restated PFS, the cash flow analysis was reviewed and changed as appropriate due to the development of more accurate numbers in certain categories and the appropriate change in contingency for those numbers.

| |

| C. | Organizational Structure |

The Company is based in British Columbia, Canada. The Company operates directly and has no subsidiaries.

| |

| D. | Property, Plants and Equipment |

The Company owns land and a small office/storage building in Logan Lake, British Columbia. This property is encumbered by a first mortgage in the amount of $81,405 as of May 1, 2011. These premises are used for core storage, field offices and vehicle storage. No mining infrastructure exists on the Getty Property.

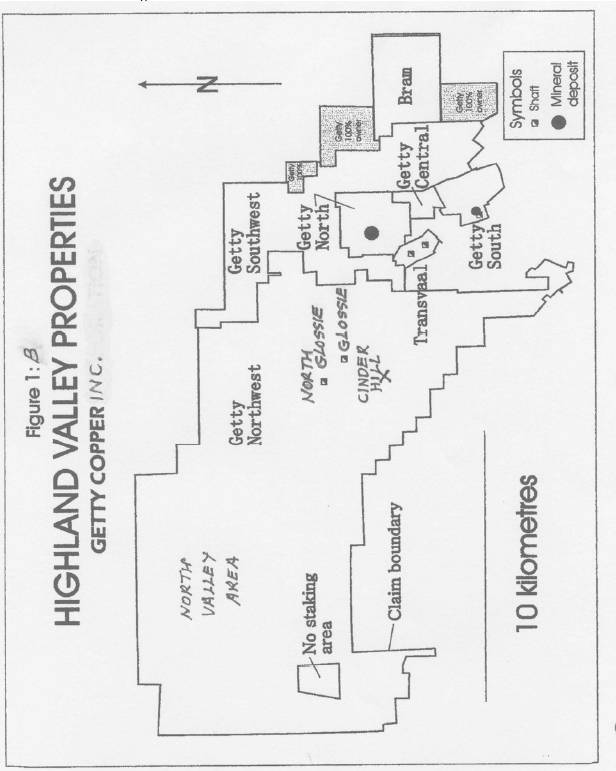

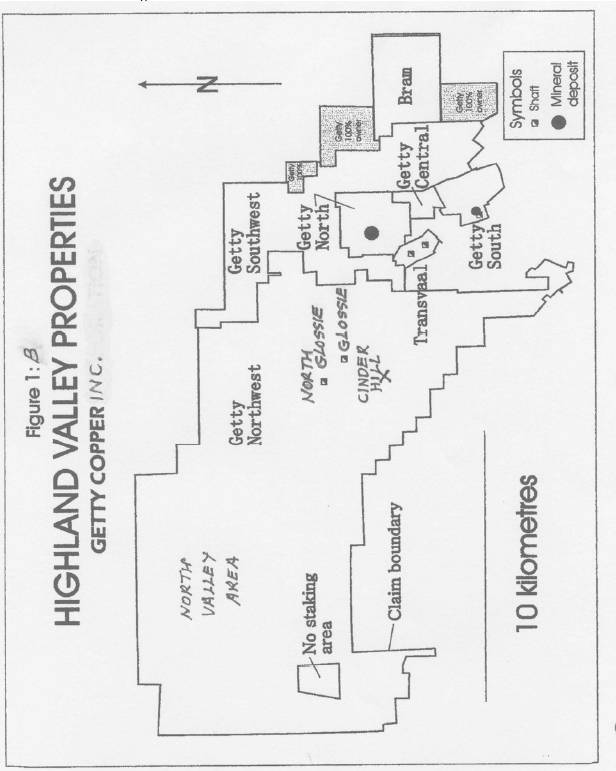

The Getty Copper Project

The Getty Copper Highland Valley Project consists of certain mineral interests in the following contiguous claim groups (collectively, the “Getty Properties”) each located in the Highland Valley, a historic copper producing area of the Kamloops Mining Division in British Columbia (the “Highland Valley”). A 1.5% NRS royalty interest payable to Robak Industries Ltd. (owned by a related party see item 7)

19

Figure 1A GETTY COPPER INC. PROPERTY LOCATION MAP

20

Figure 1B GETTY COPPER INC. HIGHLAND VALLEY PROPERTIES MAP

21

| | | | | |

| | Property | Claims | Hectares | Percentage of Interest | |

| | Getty North Property | 26 | 1,600 | 100% | |

| | Getty South Property | 22 | 336 | 50% | |

| | Getty Central Property | 5 | 205 | 100% | |

| | Getty Southwest Property | 24 | 6,199 | 100% | |

| | Getty Northwest Property | 32 | 18,566 | 100% | |

There are no existing mines on the Getty Properties, and the Company has no mineral producing properties at this time. All of the Company’s properties are exploration projects, and there is no assurance that a commercially viable deposit exists in any such properties until further exploration work and a comprehensive evaluation based upon unit cost, grade, tonnage recoveries and other factors conclude economic feasibility. The Getty Properties comprise 85 tenures and 24 crown granted claims totalling 26,906 hectares.

The following disclosure regarding accessibility, climate, local resources, infrastructure and physiography, history, geological setting, sampling and security of samples is common to all of the Getty Properties. Disclosure respecting exploration, drilling, mineral resource and exploration and development for each of the individual properties is included below.

Accessibility, Climate, Local Resources, Infrastructure and Physiography

The Getty Properties are easily accessible by the Bose Lake road, which branches off 10 kilometres from the property from the paved Bethlehem Mine road. Forestry and drill roads provide access to the claims. Logan Lake, the closest support community, is about 15 kilometres east of the Getty Copper Highland Valley Project.

The nearest domestic airport is located in Kamloops about an hour drive from the south end of the Properties. The major city of Vancouver, B.C. situated approximately 330 kilometres to the southwest by the Coquihalla Highway, provides access to an international airport and seaport.

The Getty Properties are located on and around Forge Mountain at an elevation between 1,450 to 1,900 metres. The topographic relief is moderate and the surface is covered by glacial deposits cut by recent stream channels. Small topographic highs are immediately underlain by glacial drift and Tertiary volcanic cover.

The climate is characteristic of the “dry belt” of the B.C. Interior Plateau and precipitation is about 23 centimeters annually. The seasonal climate conditions are generally moderate. Severe weather conditions can occur for isolated periods in the winter, although the snowfall is usually moderate and the summer temperatures are cool to warm. Mean temperatures are 14.1°C in July and -6.6°C in January, respectively. Mining activities are able to continue year round.

The Company believes that an established mining infrastructure and a skilled labour force are available in the Highland Valley area, as the region has a history of porphyry copper mining. The water supply in the region is limited; however, a previous operator in the Highland Valley area obtained a water supply for its mining operations from groundwater. A 500 kva power line transverses the property and telephone service and natural gas is available in Logan Lake and at the nearby adjacent mine. The Company believes that all necessary mining infrastructure such as water, power and access will be available at the anticipated future mine sites.

The town of Logan Lake is the nearest municipality to the Properties and is the current location of the Company’s site office. Logan Lake has a population of approximately 2,300. It is linked to Vancouver, 330 kilometres to the southwest, via the Coquihalla Highway.

22

History

The history of the Highland Valley copper district dates back to approximately 1896, when it was explored by prospecting, panning, trenching and drifting near high grade copper occurrences.

The following table is a breakdown of the Company’s deferred exploration and development costs on the Getty Properties to the dates indicated:

| | | | | | | | | | | | | | |

| | | | December 31, | | | | | | | | | |

| | Activity | | 2010 | | | 2009 | | | 2008 | | | 2007 | | |

| | Drilling | | 4,715,326 | | | 4,715,326 | | $ | 4,715,326 | | $ | 4,715,326 | | |

| | Environmental | | 254,456 | | | 254,456 | | | 254,456 | | | 254,456 | | |

| | Pre Feasibility Study | | 528,382 | | | 516,506 | | | 492,574 | | | 226,428 | | |