UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________

Form 6-K

______________

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

October 8, 2020

Commission File Number 001-15244

CREDIT SUISSE GROUP AG

(Translation of registrant’s name into English)

Paradeplatz 8, 8001 Zurich, Switzerland

(Address of principal executive office)

______________

Commission File Number 001-33434

CREDIT SUISSE AG

(Translation of registrant’s name into English)

Paradeplatz 8, 8001 Zurich, Switzerland

(Address of principal executive office)

______________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

| Form 20-F ☒ | Form 40-F ☐ |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

This report on Form 6-K of Credit Suisse Group AG and Credit Suisse AG hereby incorporates by reference into the Registration Statement on Form F-3 (file no. 333-238458) and the Registration Statements on Form S-8 (file nos. 333-101259, 333-208152 and 333-217856) the slides no. 2 through 4, 8 and 10 through 11 of the “Presentation on historical financials under new reporting structure”.

David Mathers, Chief Financial OfficerOctober 8, 2020 Credit SuissePresentation on historical financialsunder new reporting structure

Disclaimer (1/2) 2 October 8, 2020 This material does not purport to contain all of the information that you may wish to consider. This material is not to be relied upon as such or used in substitution for the exercise of independent judgment. Cautionary statement regarding forward-looking statements This presentation contains forward-looking statements that involve inherent risks and uncertainties, and we might not be able to achieve the predictions, forecasts, projections and other outcomes we describe or imply in forward-looking statements. A number of important factors could cause results to differ materially from the plans, targets, goals, expectations, estimates and intentions we express in these forward-looking statements, including those we identify in "Risk factors” in our Annual Report on Form 20-F for the fiscal year ended December 31, 2019, in “Credit Suisse – Risk Factor” in our 1Q20 Financial Report published on May 7, 2020 and in the “Cautionary statement regarding forward-looking information" in our 2Q20 Financial Report published on July 30, 2020 and filed with the US Securities and Exchange Commission, and in other public filings and press releases. We do not intend to update these forward-looking statements. In particular, the terms “Estimate”, “Illustrative”, “Ambition”, “Objective”, “Outlook” and “Goal” are not intended to be viewed as targets or projections, nor are they considered to be Key Performance Indicators. All such estimates, illustrations, ambitions, objectives, outlooks and goals are subject to a large number of inherent risks, assumptions and uncertainties, many of which are completely outside of our control. These risks, assumptions and uncertainties include, but are not limited to, general market conditions, market volatility, interest rate volatility and levels, global and regional economic conditions, challenges and uncertainties resulting from the COVID-19 pandemic, political uncertainty, changes in tax policies, regulatory changes, changes in levels of client activity as a result of any of the foregoing and other factors. Accordingly, this information should not be relied on for any purpose. We do not intend to update these estimates, illustrations, ambitions, objectives, outlooks or goals. Statement regarding purpose and basis of presentationThe purpose of this presentation is to provide a preliminary unaudited restatement of previously published historical financial information reflecting the new divisional reporting structure and management responsibilities announced on July 30, 2020 and updates to certain calculations and allocations. The restated historical financial information in this presentation has not been reviewed by our independent public accountants, remains preliminary and is subject to further review in connection with the publication of the 3Q20 Financial Report, scheduled for October 29, 2020, and audit in connection with the publication of the 2020 Annual Report. In preparing this presentation, management has made estimates and assumptions that affect the numbers presented. Actual results may differ. Annualized numbers do not take into account variations in operating results, seasonality and other factors and may not be indicative of actual, full-year results. Figures throughout this presentation may also be subject to rounding adjustments. All opinions and views constitute judgments as of the date of writing without regard to the date on which the reader may receive or access the information. This information is subject to change at any time without notice and we do not intend to update this information.We may not achieve the benefits of our strategic initiativesWe may not achieve all of the expected benefits of our strategic initiatives. Factors beyond our control, including but not limited to the market and economic conditions (including macroeconomic and other challenges and uncertainties, for example, resulting from the COVID-19 pandemic), changes in laws, rules or regulations and other challenges discussed in our public filings, could limit our ability to achieve some or all of the expected benefits of these initiatives. Statement regarding non-GAAP financial measuresThis presentation also contains non-GAAP financial measures, including adjusted results as well as return on regulatory capital and return on tangible equity (which is based on tangible shareholders’ equity). Information needed to reconcile such non-GAAP financial measures to the most directly comparable measures under US GAAP can be found in this presentation in the Appendix, which is available on our website at www.credit-suisse.com.Our estimates, ambitions, objectives and targets often include metrics that are non-GAAP financial measures and are unaudited. A reconciliation of the estimates, ambitions, objectives and targets to the nearest GAAP measures is unavailable without unreasonable efforts. Adjusted results exclude goodwill impairment, major litigation provisions, real estate gains and other revenue and expense items included in our reported results, all of which are unavailable on a prospective basis. Return on tangible equity is based on tangible shareholders’ equity, a non-GAAP financial measure also known as tangible book value, which is calculated by deducting goodwill and other intangible assets from total shareholders’ equity as presented in our balance sheet, both of which are unavailable on a prospective basis. Return on regulatory capital (a non-GAAP financial measure) is calculated using income / (loss) after tax and assumes a tax rate of 25% and capital allocated based on the average of 10% of average RWA and 3.5% of average leverage exposure; the essential components of this calculation are unavailable on a prospective basis. Such estimates, ambitions, objectives and targets are calculated in a manner that is consistent with the accounting policies applied by us in preparing our financial statements.

Disclaimer (2/2) 3 October 8, 2020 Statement regarding capital, liquidity and leverageCredit Suisse is subject to the Basel III framework, as implemented in Switzerland, as well as Swiss legislation and regulations for systemically important banks (Swiss Requirements), which include capital, liquidity, leverage and large exposure requirements and rules for emergency plans designed to maintain systemically relevant functions in the event of threatened insolvency. Credit Suisse has adopted the Bank for International Settlements (BIS) leverage ratio framework, as issued by the Basel Committee on Banking Supervision (BCBS) and implemented in Switzerland by the Swiss Financial Market Supervisory Authority FINMA.References to phase-in and look-through included herein refer to Basel III capital requirements and Swiss Requirements. Phase-in reflects that, for the years 2014-2018, there was a five-year (20% per annum) phase-in of goodwill, other intangible assets and other capital deductions (e.g., certain deferred tax assets) and a phase-out of an adjustment for the accounting treatment of pension plans. For the years 2013-2022, there is a phase-out of certain capital instruments. Look-through assumes the full phase-in of goodwill and other intangible assets and other regulatory adjustments and the phase-out of certain capital instruments.Unless otherwise noted, leverage exposure is based on the BIS leverage ratio framework and consists of period-end balance sheet assets and prescribed regulatory adjustments. The tier 1 leverage ratio and CET1 leverage ratio are calculated as BIS tier 1 capital and CET1 capital, respectively, divided by period-end leverage exposure. Swiss leverage ratios are measured on the same period-end basis as the leverage exposure for the BIS leverage ratio.SourcesCertain material in this presentation has been prepared by Credit Suisse on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. Credit Suisse has not sought to independently verify information obtained from public and third-party sources and makes no representations or warranties as to accuracy, completeness or reliability of such information.

Overview of key changes 4 October 8, 2020 The creation of one global Investment Bank across GM, IBCM and APAC MarketsThe related formation of GTS (Global Trading Solutions), combining the success of ITS and APAC SolutionsThe launch of SRI (Sustainability, Research & Investment Solutions) capability, led at Executive Board level and combining Research1, IS&P2, IA&F3 and Marketing and BrandingRevised allocations, both corporate functions and funding costs, to align to the new organizational structure Principles of restatement Change in divisional and Group return on regulatory capital Usage of 25% tax rate (instead of 30%) for return on regulatory capital from 2020 onwards to align with our guidance for the 2021 Group tax rateRevert to an average rather than “worst of” definition of regulatory capital given the increased alignment of leverage exposure and RWA towards a 35% risk density in line with the calibration of “Too Big To Fail” Note: Effective as of August 1, 20201 Equity research across Global Markets and APAC 2 Investment Solutions & Products within IWM 3 Impact Advisory & Finance

High-level overview of changes to reporting units 5 October 8, 2020 Credit Suisse Swiss Universal Bank Private Clients Corporate & Institutional Clients InternationalWealthManagement Private Banking Asset Management AsiaPacific Wealth Management & Connected Markets Global Markets InvestmentBanking &Capital Markets CorporateCenter Credit Suisse Swiss Universal Bank Private Clients Corporate & Institutional Clients InternationalWealthManagement Private Banking Asset Management AsiaPacific InvestmentBank CorporateCenter From: To: Separate reporting unit

GTS overview 6 October 8, 2020 Integration of ITS and APAC Solutions to create a single hubGTS is a cross-divisional platform that provides innovative products and services to our Wealth Management-focused divisionsThis includes institutional solutions and is based on wholesale pricing sourced from the Investment BankGTS revenues, costs and capital are allocated to each of the Wealth Management-focused divisions and the Investment BankGTS is housed in the Investment Bank Corporate clients Institutional clients Wealth Management clients Swiss Universal Bank Asia Pacific International Wealth Management Investment Bank GTS

SRI overview 7 October 8, 2020 Sustainability Strategy, Advisory & FinanceDriving the sustainability strategy Securities ResearchThought leadership covering corporates and industries for wealth management and institutional clients InvestmentSolutions & ProductsEconomics, thematic views and sustainable investment solutions for wealth management and institutional clients Marketing&BrandingLeveraging client and market insights to drive divisional strategies Sustainability and insight creation globally under one roof Integrate and centralize Equity Research, Investment Solutions & Products, Impact Advisory & Finance/Sustainability and Marketing/Branding efforts under one roofProvide one single “House View” with Supertrends and sustainability at its coreIncrease connectivity of Research with CIO and the sustainability agenda; deliver market-leading thematic insights and content across public and private markets, leveraging dataDrive a globally consistent sustainability strategy SRI is a corporate function and provides services to all four divisions and the group overall; costs are allocated accordingly SRI capability at ExB level

Pro-forma 1H20 8 October 8, 2020 Old structure in CHF unless otherwise noted Rev: 2,776 mnPTI: 885 mnRWA: 46 bnLE: 106 bnRoRC1: 28% InternationalWealth Management Rev: 1,182 mn PTI: 208 mnRWA: 24 bnLE: 57 bnRoRC1: 11% Asia PacificWM&C Rev: 3,013 mnPTI: 1,276 mnRWA: 83 bnLE: 272 bnRoRC1: 19% Swiss Universal Bank New structure in CHF unless otherwise noted Rev: 941 mnPTI: 355 mnRWA: 13 bnLE: 54 bnRoRC1: 27% APAC Marketsin USD Rev: 3,668 mnPTI: 957 mnRWA: 65 bnLE: 265 bnRoRC1: 14% Global Marketsin USD Rev: 921 mnPTI: (180) mnRWA: 24 bnLE: 49 bnRoRC1: n.m. Investment Banking & Capital Marketsin USD Rev: (324) mnPTI: (704) mnRWA: 50 bnLE3: 52 bnRoRC1: n.m. Corporate Center Rev: 2,743 mnPTI: 849 mnRWA: 47 bnLE: 103 bnRoRC2: 32% InternationalWealth Management Rev: 1,643 mnPTI: 414 mnRWA: 29 bnLE: 79 bnRoRC2: 21% Asia Pacific Rev: 2,928 mnPTI: 1,187 mnRWA: 86 bnLE: 293 bnRoRC2: 19% Swiss Universal Bank Rev: 5,136 mn PTI: 1,037 mnRWA: 91 bnLE: 343 bnRoRC2: 14% Investment Bankin USD Rev: (286) mn PTI: (693) mnRWA: 52 bnLE3: 37 bnRoRC2: n.m. Corporate Center 1 Regulatory capital is calculated as the worst of 10% of RWA and 3.5% of leverage exposure. Return on regulatory capital (a non-GAAP financial measure) is calculated using income / (loss) after tax and assumes a taxrate of 30% and capital allocated based on the worst of 10% of average RWA and 3.5% of average leverage exposure 2 Regulatory capital is calculated as the average of 10% of RWA and 3.5% of leverage exposure. Return on regulatory capital (a non-GAAP financial measure) is calculated using income / (loss) after tax and assumes a tax rate of 25% and capital allocated based on the average of 10% of average RWA and 3.5% of average leverage exposure 3 Excludes CHF 104 bn of cash held at central banks, after adjusting for the dividend paid in 2Q20 and the planned dividend payment in 4Q20 as required by FINMA

Appendix 9 October 8, 2020

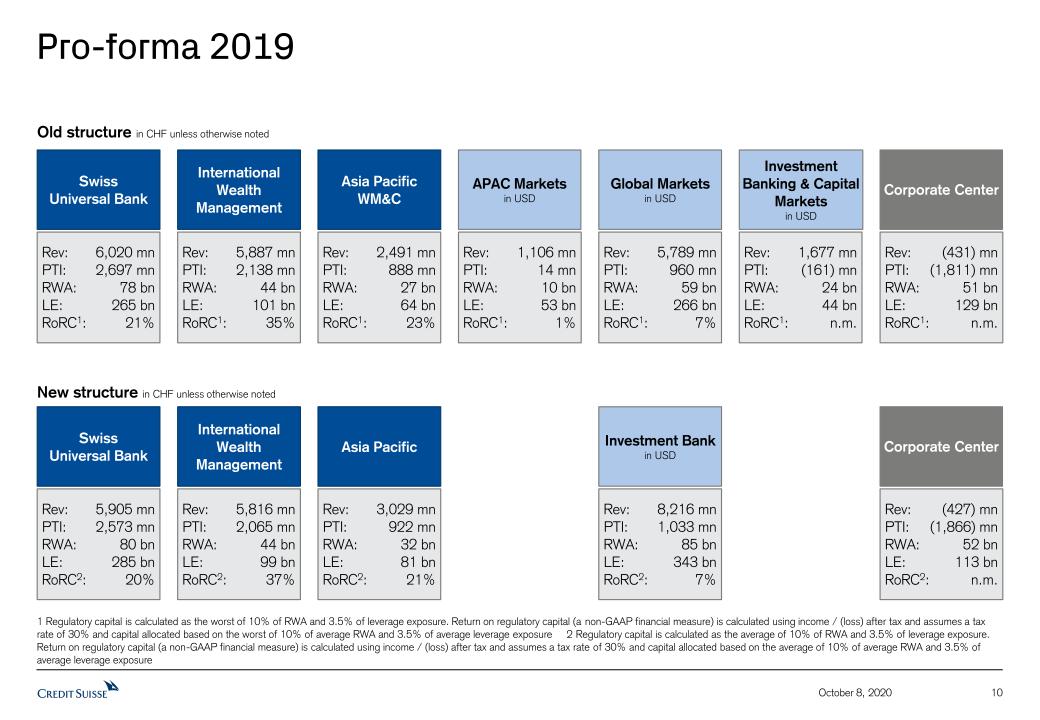

Pro-forma 2019 10 October 8, 2020 Old structure in CHF unless otherwise noted Rev: 5,887 mnPTI: 2,138 mnRWA: 44 bnLE: 101 bnRoRC1: 35% InternationalWealth Management Rev: 2,491 mn PTI: 888 mnRWA: 27 bnLE: 64 bnRoRC1: 23% Asia PacificWM&C Rev: 6,020 mnPTI: 2,697 mnRWA: 78 bnLE: 265 bnRoRC1: 21% Swiss Universal Bank New structure in CHF unless otherwise noted Rev: 1,106 mnPTI: 14 mnRWA: 10 bnLE: 53 bnRoRC1: 1% APAC Marketsin USD Rev: 5,789 mnPTI: 960 mnRWA: 59 bnLE: 266 bnRoRC1: 7% Global Marketsin USD Rev: 1,677 mnPTI: (161) mnRWA: 24 bnLE: 44 bnRoRC1: n.m. Investment Banking & Capital Marketsin USD Rev: (431) mnPTI: (1,811) mnRWA: 51 bnLE: 129 bnRoRC1: n.m. Corporate Center Rev: 5,816 mnPTI: 2,065 mnRWA: 44 bnLE: 99 bnRoRC2: 37% InternationalWealth Management Rev: 3,029 mnPTI: 922 mnRWA: 32 bnLE: 81 bnRoRC2: 21% Asia Pacific Rev: 5,905 mnPTI: 2,573 mnRWA: 80 bnLE: 285 bnRoRC2: 20% Swiss Universal Bank Rev: 8,216 mn PTI: 1,033 mnRWA: 85 bnLE: 343 bnRoRC2: 7% Investment Bankin USD Rev: (427) mn PTI: (1,866) mnRWA: 52 bnLE: 113 bnRoRC2: n.m. Corporate Center 1 Regulatory capital is calculated as the worst of 10% of RWA and 3.5% of leverage exposure. Return on regulatory capital (a non-GAAP financial measure) is calculated using income / (loss) after tax and assumes a taxrate of 30% and capital allocated based on the worst of 10% of average RWA and 3.5% of average leverage exposure 2 Regulatory capital is calculated as the average of 10% of RWA and 3.5% of leverage exposure. Return on regulatory capital (a non-GAAP financial measure) is calculated using income / (loss) after tax and assumes a tax rate of 30% and capital allocated based on the average of 10% of average RWA and 3.5% of average leverage exposure

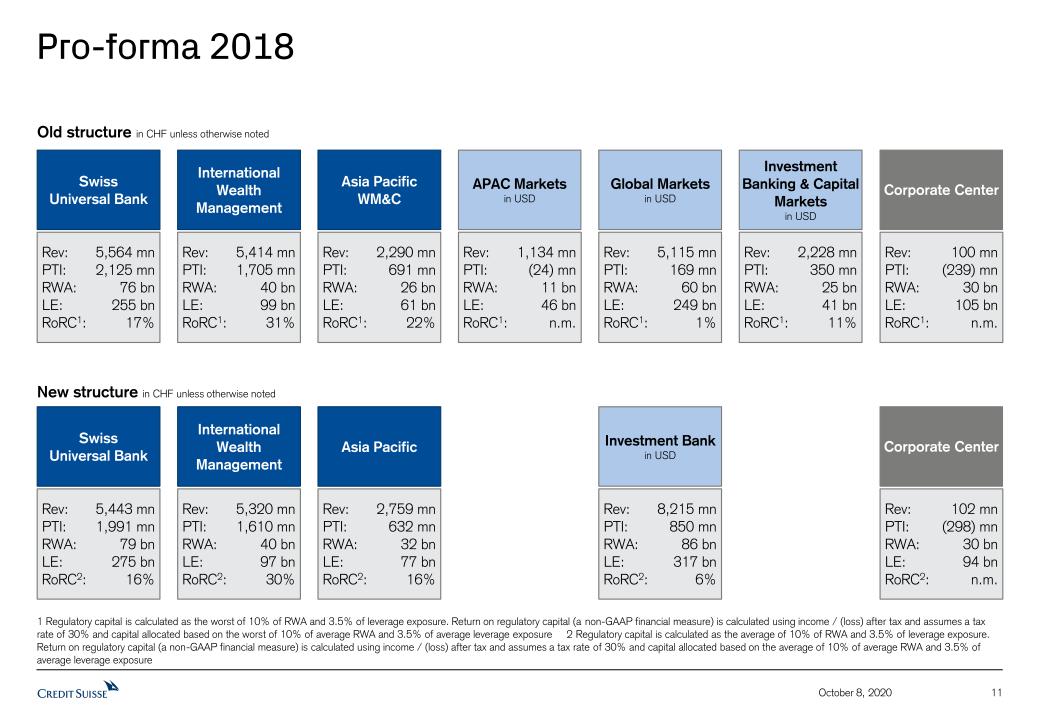

Pro-forma 2018 11 October 8, 2020 Old structure in CHF unless otherwise noted Rev: 5,414 mnPTI: 1,705 mnRWA: 40 bnLE: 99 bnRoRC1: 31% InternationalWealth Management Rev: 2,290 mn PTI: 691 mnRWA: 26 bnLE: 61 bnRoRC1: 22% Asia PacificWM&C Rev: 5,564 mnPTI: 2,125 mnRWA: 76 bnLE: 255 bnRoRC1: 17% Swiss Universal Bank New structure in CHF unless otherwise noted Rev: 1,134 mnPTI: (24) mnRWA: 11 bnLE: 46 bnRoRC1: n.m. APAC Marketsin USD Rev: 5,115 mnPTI: 169 mnRWA: 60 bnLE: 249 bnRoRC1: 1% Global Marketsin USD Rev: 2,228 mnPTI: 350 mnRWA: 25 bnLE: 41 bnRoRC1: 11% Investment Banking & Capital Marketsin USD Rev: 100 mnPTI: (239) mnRWA: 30 bnLE: 105 bnRoRC1: n.m. Corporate Center Rev: 5,320 mnPTI: 1,610 mnRWA: 40 bnLE: 97 bnRoRC2: 30% InternationalWealth Management Rev: 2,759 mnPTI: 632 mnRWA: 32 bnLE: 77 bnRoRC2: 16% Asia Pacific Rev: 5,443 mnPTI: 1,991 mnRWA: 79 bnLE: 275 bnRoRC2: 16% Swiss Universal Bank Rev: 8,215 mn PTI: 850 mnRWA: 86 bnLE: 317 bnRoRC2: 6% Investment Bankin USD Rev: 102 mn PTI: (298) mnRWA: 30 bnLE: 94 bnRoRC2: n.m. Corporate Center 1 Regulatory capital is calculated as the worst of 10% of RWA and 3.5% of leverage exposure. Return on regulatory capital (a non-GAAP financial measure) is calculated using income / (loss) after tax and assumes a taxrate of 30% and capital allocated based on the worst of 10% of average RWA and 3.5% of average leverage exposure 2 Regulatory capital is calculated as the average of 10% of RWA and 3.5% of leverage exposure. Return on regulatory capital (a non-GAAP financial measure) is calculated using income / (loss) after tax and assumes a tax rate of 30% and capital allocated based on the average of 10% of average RWA and 3.5% of average leverage exposure

October 8, 2020 12 Update on strategic initiatives and structural refinements(1/5) As per 2Q20 Earnings presentation

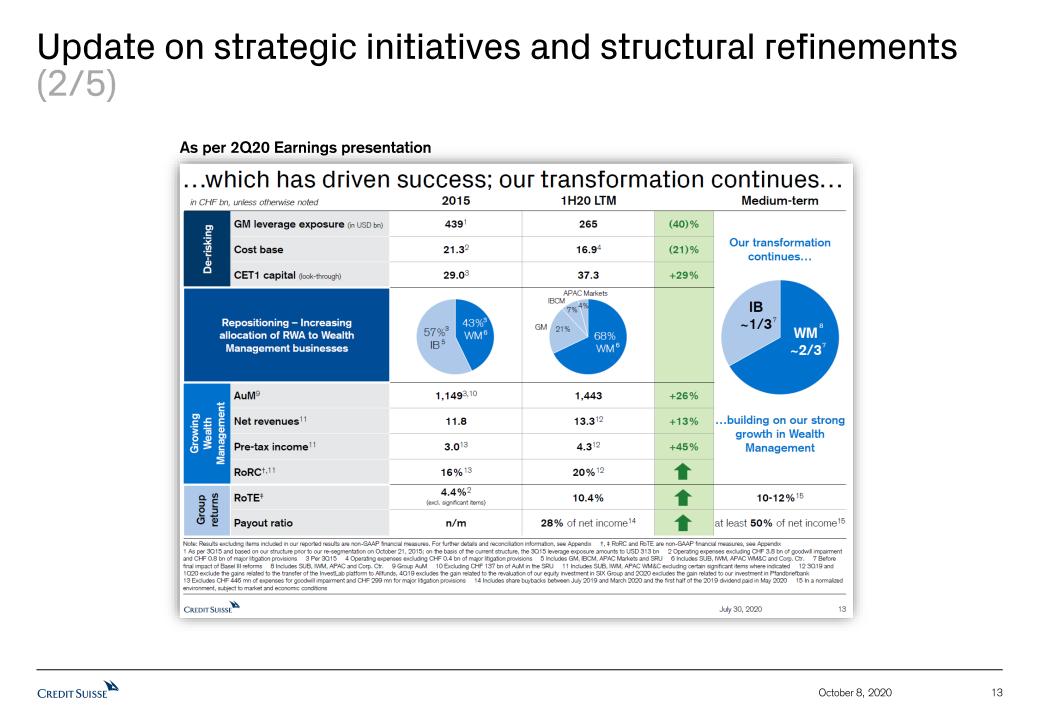

October 8, 2020 13 Update on strategic initiatives and structural refinements(2/5) As per 2Q20 Earnings presentation

14 October 8, 2020 Update on strategic initiatives and structural refinements(3/5) As per 2Q20 Earnings presentation

October 8, 2020 15 Update on strategic initiatives and structural refinements(4/5) As per 2Q20 Earnings presentation

October 8, 2020 16 Update on strategic initiatives and structural refinements(5/5) As per 2Q20 Earnings presentation

17 Reconciliation of significant items (1/2) Results excluding the significant items noted below are non-GAAP financial measures. Management believes that these provide a useful presentation of our operating results for purposes of assessing our Group and divisional performance, on a basis that excludes items that management does not consider representative of our underlying performance. Provided below is a reconciliation to the most directly comparable US GAAP measures. October 8, 2020 1 SUB, IWM and APAC WM&C Group in CHF mn 1H20 LTM 2015 Total operating expenses reported 17,296 25,895 Goodwill impairment - (3,797) Major litigation provisions (433) (820) Cost base 16,863 21,278 Wealth Management1 SUB IWM APAC WM&C in CHF mn 1H20 LTM 2015 1H20 LTM 2015 1H20 LTM 2015 1H20 LTM 2015 Net revenues reported 14,549 11,779 6,178 5,721 5,877 4,552 2,494 1,506 o/w related to InvestLab transfer 595 - 123 - 349 - 123 - o/w related to SIX revaluation 498 - 306 - 192 - - - o/w Pfandbriefbank gain 134 - 134 - - - - - Net revenues excl. one-offs 13,322 11,779 5,615 5,721 5,336 4,552 2,371 1,506 Provision for credit losses 538 174 225 138 104 5 209 31 Total operating expenses reported 8,476 9,375 3,184 3,908 3,717 3,824 1,575 1,643 Pre-tax income reported 5,535 2,230 2,769 1,675 2,056 723 710 (168) o/w Goodwill impairment (2015) - (446) - - - - - (446) o/w Major litigation (2015) - (299) - (25) - (268) - (6) Pre-tax income excl. one-offs, goodwill impairment and major litigation 4,308 2,975 2,206 1,700 1,515 991 587 284

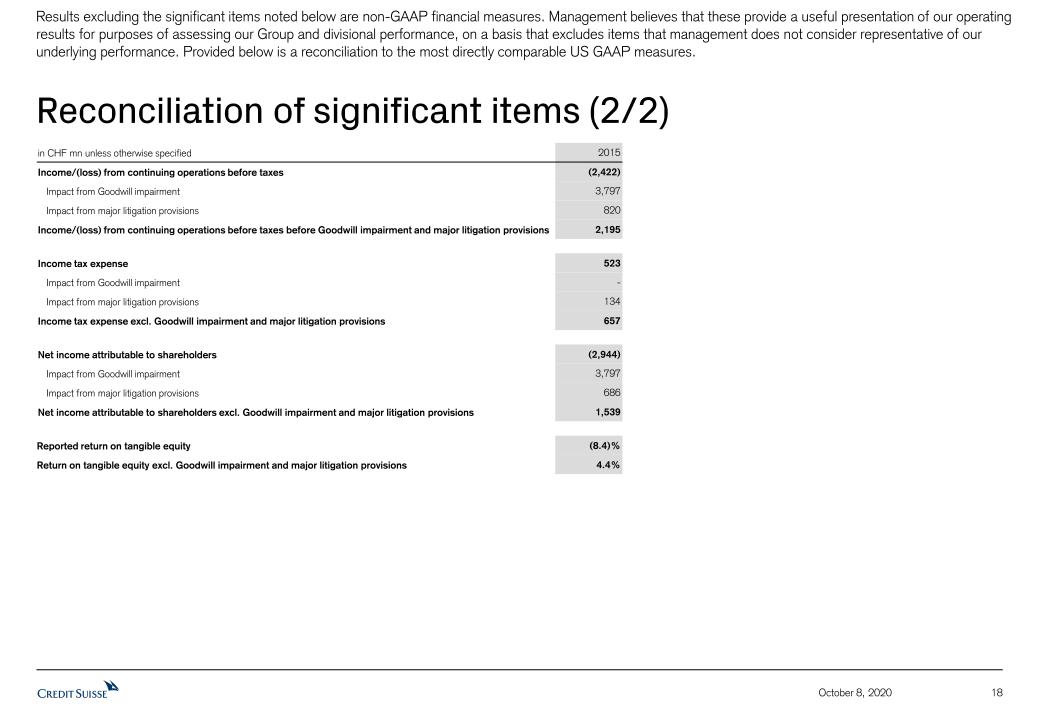

18 October 8, 2020 Reconciliation of significant items (2/2) Results excluding the significant items noted below are non-GAAP financial measures. Management believes that these provide a useful presentation of our operating results for purposes of assessing our Group and divisional performance, on a basis that excludes items that management does not consider representative of our underlying performance. Provided below is a reconciliation to the most directly comparable US GAAP measures. in CHF mn unless otherwise specified 2015 Income/(loss) from continuing operations before taxes (2,422) Impact from Goodwill impairment 3,797 Impact from major litigation provisions 820 Income/(loss) from continuing operations before taxes before Goodwill impairment and major litigation provisions 2,195 Income tax expense 523 Impact from Goodwill impairment - Impact from major litigation provisions 134 Income tax expense excl. Goodwill impairment and major litigation provisions 657 Net income attributable to shareholders (2,944) Impact from Goodwill impairment 3,797 Impact from major litigation provisions 686 Net income attributable to shareholders excl. Goodwill impairment and major litigation provisions 1,539 Reported return on tangible equity (8.4)% Return on tangible equity excl. Goodwill impairment and major litigation provisions 4.4%

Notes 19 October 8, 2020 General notesThroughout the presentation rounding differences may occurUnless otherwise noted, all CET1 ratio, risk-weighted assets and leverage exposure figures shown in this presentation are as of the end of the respective period and, for periods prior to 2019, on a “look-through” basisSpecific notes† Prior to 3Q20, regulatory capital was calculated as the worst of 10% of RWA and 3.5% of leverage exposure and return on regulatory capital (a non-GAAP financial measure) was calculated using income / (loss) after tax and assumed a tax rate of 30%. In 3Q20, we updated our calculation approach, following which regulatory capital is calculated as the average of 10% of RWA and 3.5% of leverage exposure and return on regulatory capital (a non-GAAP financial measure) is calculated using income / (loss) after tax and assumes a tax rate of 30% for periods prior to 2020 and 25% from 2020 onward. For the Investment Bank division, return on regulatory capital is based on US dollar denominated numbers. Adjusted return on regulatory capital is calculated using adjusted results, applying the same methodology to calculate return on regulatory capital.‡ Return on tangible equity is based on tangible shareholders’ equity, a non-GAAP financial measure, which is calculated by deducting goodwill and other intangible assets from total shareholders’ equity as presented in our balance sheet. Management believes that return on tangible equity is meaningful as it is a measure used and relied upon by industry analysts and investors to assess valuations and capital adequacy. For end-4Q15, tangible shareholders’ equity excluded goodwill of CHF 4,808 mn and other intangible assets of CHF 196 mn from total shareholders’ equity of CHF 44,382 mn as presented in our balance sheet. For end-3Q19, tangible shareholders’ equity excluded goodwill of CHF 4,760 mn and other intangible assets of CHF 219 mn from total shareholders’ equity of CHF 45,150 mn as presented in our balance sheet. For end-4Q19, tangible shareholders’ equity excluded goodwill of CHF 4,663 mn and other intangible assets of CHF 291 mn from total shareholders’ equity of CHF 43,644 mn as presented in our balance sheet. For end-1Q20, tangible shareholders’ equity excluded goodwill of CHF 4,604 mn and other intangible assets of CHF 279 mn from total shareholders’ equity of CHF 48,675 mn as presented in our balance sheet. For end-2Q20, tangible shareholders’ equity excluded goodwill of CHF 4,676 mn and other intangible assets of CHF 273 mn from total shareholders’ equity of CHF 46,535 mn as presented in our balance sheet.AbbreviationsAPAC = Asia Pacific; AuM = Assets under Management; BCBS = Basel Committee on Banking Supervision; BIS = Bank for International Settlements; CCO = Chief Compliance Officer; CET1 = Common Equity Tier 1; CIO = Chief Investment Office; Corp Ctr. = Corporate Center; COVID-19 = Coronavirus disease 2019; CRCO = Group Chief Risk and Compliance Officer; CRO = Chief Risk Officer; EMEA = Europe, Middle East and Africa; ESG = Environmental, Social and Governance; ExB = Executive Board; excl. = excluding; FINMA = Swiss Financial Market Supervisory Authority; GAAP = Generally Accepted Accounting Principles; GM = Global Markets; GTS = Global Trading Solutions; IA&F = Impact Advisory & Finance; IB = Investment Bank; IBCM = Investment Banking & Capital Markets; IS&P = Investment Solutions & Products; ITS = International Trading Solutions; IWM = International Wealth Management; JV = Joint Venture; LE = Leverage Exposure; LTM = Last Twelve Months; M&A = Mergers & Acquisitions; p.a. = per annum; PB = Private Banking; PTI = Pre-tax income; Rev = revenues; RoRC = Return on Regulatory Capital; RoTE = Return on Tangible Equity; RWA = Risk-weighted assets; SIX = Swiss Infrastructure and Exchange; SRI = Sustainability, Research & Investment Solutions; SRU = Strategic Resolution Unit; SUB = Swiss Universal Bank; U/HNW = (Ultra) High Net Worth; U/HNWI = (Ultra) High Net Worth Individuals; WM = Wealth Management; WM&C = Wealth Management & Connected

October 8, 2020 20

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the undersigned, thereunto duly authorized.

| CREDIT SUISSE GROUP AG and CREDIT SUISSE AG | ||

| (Registrants) | ||

| By: | /s/ Flavio Lardelli | |

| Flavio Lardelli | ||

| Director | ||

| /s/ Annina Müller | ||

| Annina Müller | ||

| Date: October 8, 2020 | Vice President |